Supplemental Operating and Financial Data

For the Quarter Ended September 30, 2015

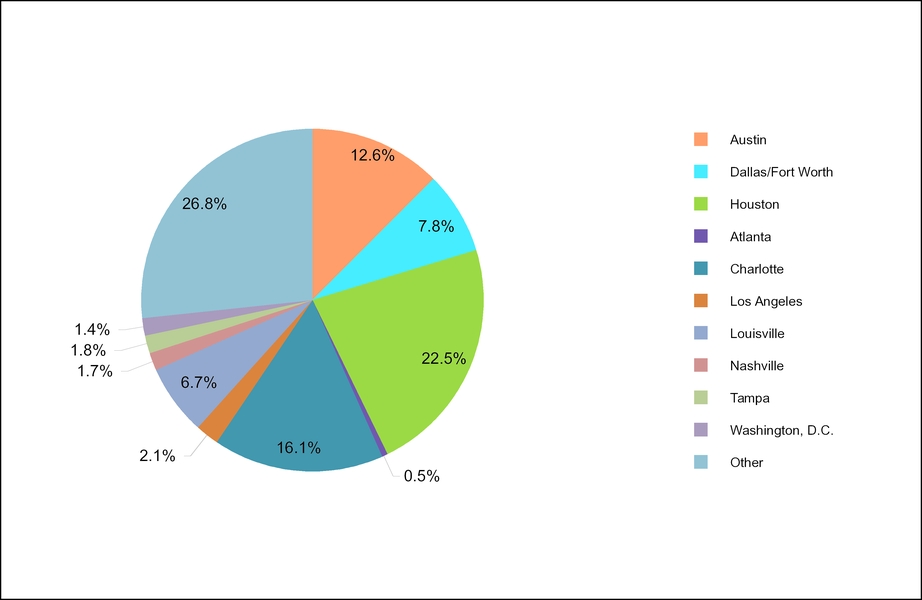

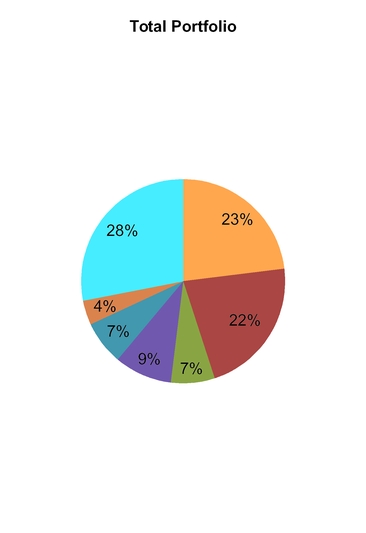

About the Company

TIER REIT, Inc. is a self-managed, Dallas-based real estate investment trust whose goal is to maximize total return to stockholders through the combination of stock appreciation and income derived from a sustainable distribution. TIER’s investment strategy is to acquire, develop, and operate a portfolio of best-in-class office properties in select U.S. markets that consistently lead the nation in population and office-using employment growth. As of September 30, 2015, we owned interests in 35 operating office properties, one recently developed non-operating office property and one retail property, located in 16 markets throughout the United States with a total of 13.0 million rentable square feet.

Senior Management

|

| | |

| Scott W. Fordham | | Chief Executive Officer and President |

| Dallas E. Lucas | | Chief Financial Officer and Treasurer |

| William J. Reister | | Chief Investment Officer and Executive Vice President |

| Telisa Webb Schelin | | Chief Legal Officer, Executive Vice President and Secretary |

| James E. Sharp | | Chief Accounting Officer and Executive Vice President |

| R. Heath Johnson | | Managing Director - Asset Management |

| Dean R. Hook | | Senior Vice President - Information Systems |

Where to Get More Information: |

| | |

| Kelly Sargent | | Vice President - Investor Relations |

By Phone:

(972) 483-2400

By Email:

ir@tierreit.com

By Mail:

5950 Sherry Lane, Suite 700

Dallas, Texas 75225

Website:

www.tierreit.com

Supplemental Operating and Financial Data

For the Quarter Ended September 30, 2015

Table of Contents

|

| | |

| Overview and Highlights | |

| Overview | 1 |

|

| Financial Highlights | 2-3 |

|

| Consolidated Balance Sheets | 4 |

|

| Consolidated Statements of Operations | 5 |

|

| Consolidated Statements of Discontinued Operations | 6 |

|

| Calculation of FFO and FAD | 7 |

|

| Calculation of EBITDA | 8 |

|

| Non Wholly-Owned Entities Financial Summary | 9 |

|

| Same Store Analysis | 10 |

|

| Schedule of Properties Owned | 11 |

|

| Net Operating Income by Market | 12 |

|

| Components of Net Asset Value | 13 |

|

| Selected Non-Stabilized Properties | 14 |

|

| Significant Tenants | 15 |

|

| Industry Diversification | 16 |

|

| | |

| Leasing | |

| Leasing Activity | 17-18 |

|

| Lease Expirations | 19-20 |

|

| Occupancy Trends | 21 |

|

| | |

| Capital Expenditures | |

| Leasing Cost Summary | 22 |

|

| Leasing Cost Trend Analysis | 23 |

|

| Development, Leasing, and Capital Expenditures Summary | 24 |

|

| | |

| Other Information | |

| Potential Future Development Sites | 25 |

|

| Properties Under Development | 26 |

|

| Acquisition and Disposition Activities | 27 |

|

| Summary of Financing | 28 |

|

| Principal Payments by Year | 29 |

|

| Definitions of Non-GAAP Financial Measures | 30-31 |

|

Forward Looking Statements

This supplemental operating and financial data report contains forward-looking statements relating to the business and financial outlook of TIER REIT, Inc. that are based on current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Statements contained herein may be impacted by a number of risks and uncertainties, including the company’s ability to rent space on favorable terms, its ability to address debt maturities and fund its capital requirements, the value of its assets, its anticipated capital expenditures, and other matters. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this document, as well as other factors described in the Risk Factors section of TIER REIT, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2014, and subsequent Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. Forward-looking statements in this document speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events.

Overview

For the Quarter Ended September 30, 2015

Quarterly Highlights and Financial Results

| |

| • | FFO attributable to common stockholders, excluding certain items for the third quarter of 2015 was $20.7 million, or $0.42 per diluted share, as compared to $18.0 million, or $0.36 per diluted share, for the third quarter of 2014, a 15.0% increase of $2.7 million, or $0.06 per diluted share |

| |

| • | FFO attributable to common stockholders for the third quarter of 2015 was $18.9 million, or $0.39 per diluted share, as compared to $17.1 million, or $0.34 per diluted share, for the third quarter of 2014, a 10.5% increase of $1.8 million, or $0.05 per diluted share |

| |

| • | Same Store GAAP NOI for the third quarter of 2015 was $35.86 million, as compared to $32.54 million for the third quarter of 2014, an increase of $3.32 million, or 10.2% |

| |

| • | Same Store Cash NOI for the third quarter of 2015 was $32.72 million, as compared to $31.19 million for the third quarter 2014, an increase of $1.53 million, or 4.9% |

| |

| • | Net loss attributable to common stockholders was $13.8 million, or $0.28 per diluted share, as compared to a net loss attributable to common stockholders of $16.4 million, or $0.33 per diluted share for the third quarter of 2014 |

Property Results

| |

| • | Occupancy at September 30, 2015, was 89.4%, an increase of 40 basis points from June 30, 2015 |

| |

| • | Leased 338,000 square feet - 175,000 square feet of renewals, 41,000 square feet of expansion space, and 122,000 square feet of new leasing |

Real Estate Activities

| |

| • | Acquired various interests in real estate, both existing operating properties and unimproved land located in Austin, Texas (“The Domain”), for a contract purchase price of $201.1 million, which after applying purchase credits received, equates to $198.2 million total consideration paid. The acquisition includes two wholly-owned office buildings, interests in two additional office buildings, and various tracts of land. The acquisition also included $22.0 million for parcels of land zoned for residential development and a deposit of $15.0 million for an interest in a multifamily residential property |

| |

| • | During the quarter, we sold the parcels of land zoned for residential development acquired as part of The Domain for $22.0 million, and subsequent to quarter end we completed the acquisition of the interest in the multifamily residential property for $15.0 million and concurrently sold it for $15.0 million |

Capital Market Activities

| |

| • | Paid off $42.0 million CMBS loan secured by our Loop Central property |

| |

| • | On July 23, 2015, we listed our common stock on the NYSE under the ticker symbol “TIER” |

| |

| • | In connection with the NYSE listing, we completed a $50.0 million tender offer on August 19, 2015, with 2,631,578 shares tendered and accepted at $19.00 per share |

| |

| • | Authorized distributions of $0.18 per share of common stock on July 30, 2015, which was paid on October 8, 2015 |

| |

| • | Reduced weighted average borrowings costs on our overall borrowings by 29 basis points to 4.14% |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 1 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights |

| (in thousands, except per share data, effective rent data, and number of properties) |

| | | | | | | | | | | | | | | |

| | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| Portfolio Summary: | | | | | | | | | | | | | | |

| (at our ownership %, unless otherwise noted) | | | | | | | | | | | | | | |

| Total operating office properties | 35 |

| | 37 |

| | | 35 |

| | 31 |

| | 34 |

| | 37 |

| | 37 |

|

| Rentable square feet (100%) (operating properties) | 12,615 |

| | 15,291 |

| | | 12,615 |

| | 11,946 |

| | 13,624 |

| | 14,304 |

| | 15,291 |

|

| Rentable square feet (own %) (operating properties) | 10,918 |

| | 14,154 |

| | | 10,918 |

| | 10,418 |

| | 12,487 |

| | 13,167 |

| | 14,154 |

|

| Occupancy % | 89 | % | | 87 | % | | | 89 | % | | 89 | % | | 88 | % | | 88 | % | | 87 | % |

| Executed % SF leased | 90 | % | | 89 | % | | | 90 | % | | 89 | % | | 90 | % | | 89 | % | | 89 | % |

| Economic % SF leased | 84 | % | | 82 | % | | | 84 | % | | 82 | % | | 82 | % | | 82 | % | | 82 | % |

| Average effective rent/square feet | $ | 25.50 |

| | $ | 26.13 |

| | | $ | 25.50 |

| | $ | 24.94 |

| | $ | 25.95 |

| | $ | 26.02 |

| | $ | 26.13 |

|

| | | | | | | | | | | | | | | |

| | Nine Months Ended | | | Three Months Ended |

| | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| Financial Results: | | | | | | | | | | | | | | |

| Revenue | $ | 215,280 |

| | $ | 213,451 |

| | | $ | 69,423 |

| | $ | 70,038 |

| | $ | 75,819 |

| | $ | 74,616 |

| | $ | 72,157 |

|

| Base rent | $ | 155,610 |

| | $ | 157,484 |

| | | $ | 47,351 |

| | $ | 51,336 |

| | $ | 56,923 |

| | $ | 54,771 |

| | $ | 53,141 |

|

| Free rent | $ | (14,256 | ) | | $ | (7,369 | ) | | | $ | (3,718 | ) | | $ | (5,365 | ) | | $ | (5,173 | ) | | $ | (3,717 | ) | | $ | (2,284 | ) |

| NOI | $ | 111,643 |

| | $ | 104,345 |

| | | $ | 38,121 |

| | $ | 36,858 |

| | $ | 36,664 |

| | $ | 38,116 |

| | $ | 36,192 |

|

| Net income (loss) attributable to common stockholders | $ | (20,892 | ) | | $ | (63,248 | ) | | | $ | (13,849 | ) | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) |

| Diluted earnings (loss) per common share (1) (2) | $ | (0.42 | ) | | $ | (1.27 | ) | | | $ | (0.28 | ) | | $ | (0.02 | ) | | $ | (0.12 | ) | | $ | 0.92 |

| | $ | (0.33 | ) |

| FFO attributable to common stockholders | $ | 17,736 |

| | $ | 50,607 |

| | | $ | 18,883 |

| | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

|

| Diluted FFO per common share (1) (2) | $ | 0.36 |

| | $ | 1.01 |

| | | $ | 0.39 |

| | $ | (0.36 | ) | | $ | 0.34 |

| | $ | 0.06 |

| | $ | 0.34 |

|

| FFO attributable to common stockholders, excluding certain items | $ | 55,362 |

| | $ | 51,556 |

| | | $ | 20,737 |

| | $ | 17,181 |

| | $ | 17,444 |

| | $ | 19,815 |

| | $ | 18,020 |

|

| Diluted FFO, excluding certain items per common share (2) | $ | 1.11 |

| | $ | 1.03 |

| | | $ | 0.42 |

| | $ | 0.34 |

| | $ | 0.35 |

| | $ | 0.40 |

| | $ | 0.36 |

|

| FAD attributable to common stockholders | $ | 4,334 |

| | $ | (2,034 | ) | | | $ | 3,954 |

| | $ | (1,176 | ) | | $ | 1,556 |

| | $ | (2,656 | ) | | $ | 1,958 |

|

| FAD per common share (2) | $ | 0.09 |

| | $ | (0.04 | ) | | | $ | 0.08 |

| | $ | (0.02 | ) | | $ | 0.03 |

| | $ | (0.05 | ) | | $ | 0.04 |

|

| Normalized EBITDA | $ | 106,263 |

| | $ | 117,543 |

| | | $ | 35,752 |

| | $ | 33,439 |

| | $ | 37,072 |

| | $ | 41,294 |

| | $ | 40,094 |

|

| Weighted average common shares outstanding - basic (2) | 49,539 |

| | 49,875 |

| | | 48,843 |

| | 49,893 |

| | 49,891 |

| | 49,877 |

| | 49,877 |

|

| Weighted average common shares outstanding - diluted (2) | 49,725 |

| | 49,995 |

| | | 49,034 |

| | 50,085 |

| | 50,066 |

| | 49,996 |

| | 49,996 |

|

| | | | | | | | | | | | | | | |

| Selected Additional Trend Information: | | | | | | | | | | | | | | |

| Renewal % based on square feet | 78 | % | | 63 | % | | | 69 | % | | 83 | % | | 74 | % | | 89 | % | | 75 | % |

| Distributions declared on common shares | $ | 17,550 |

| | $ | — |

| | | $ | 8,539 |

| | $ | 9,011 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Annualized distribution yield (3) | N/A |

| | N/A |

| | | 4.9 | % | | N/A |

| | N/A |

| | N/A |

| | N/A |

|

(1) In periods of net loss from continuing operations or negative FFO or FAD attributable to common stockholders there are no dilutive securities and diluted earnings (loss) per common share or diluted FFO or FAD per common share is calculated using weighted average common shares outstanding - basic as the denominator.

(2) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015.

(3) Based on the closing price of our common stock as of our most recent quarter end. For distributions declared prior to the July 23, 2015, listing of our stock no stock price is available.

Occupancy % represents the total square footage subject to commenced leases as of the reporting date as a percentage of the total rentable square feet (at our ownership interest).

Executed % SF leased represents the total square footage subject to commenced leases plus the square footage for currently vacant space that is subject to executed leases that have not commenced as of the reporting date as a percentage of the total rentable square feet (at our ownership interest).

Economic % SF leased represents the total square footage subject to commenced leases as of the reporting date adjusted to exclude the square footage associated with leases receiving rental abatements as a percentage of the total rentable square feet (at our ownership interest).

Average effective rent represents 12 times the sum of the monthly contractual amounts for base rent and the pro rata budgeted operating expense reimbursements, as of period end, related to leases in place as of period end, as reduced for free rent and excluding any scheduled future rent increases, as adjusted for our ownership interest.

This section includes non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with GAAP. Quantitative reconciliations of the differences between the non-GAAP financial measures presented and the most directly comparable GAAP financial measures are shown on pages 7-8. A description of the non-GAAP financial measures we present and a statement of the reasons why management believes the non-GAAP measures provide useful information to investors about the Company’s financial condition and results of operations can be found on pages 30-31.

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 2 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights (continued) |

| (in thousands) |

| | | | | | | |

| | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| Selected Balance Sheet Items: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total book value of real estate (1) | $ | 1,590,422 |

| | $ | 2,008,569 |

| | | $ | 1,590,422 |

| | $ | 1,488,373 |

| | $ | 1,609,953 |

| | $ | 1,768,766 |

| | $ | 2,008,569 |

|

| | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 7,769 |

| | $ | 923 |

| | | $ | 7,769 |

| | $ | 153,158 |

| | $ | 5,764 |

| | $ | 31,442 |

| | $ | 923 |

|

| | | | | | | | | | | | | | | |

| Unconsolidated cash and cash equivalents (at ownership %) | $ | 6,293 |

| | $ | 3,621 |

| | | $ | 6,293 |

| | $ | 3,368 |

| | $ | 2,480 |

| | $ | 3,355 |

| | $ | 3,621 |

|

| | | | | | | | | | | | | | | |

| Restricted cash | $ | 16,615 |

| | $ | 49,654 |

| | | $ | 16,615 |

| | $ | 29,620 |

| | $ | 32,761 |

| | $ | 35,324 |

| | $ | 49,654 |

|

| | | | | | | | | | | | | | | |

| Total assets | $ | 1,906,755 |

| | $ | 2,340,502 |

| | | $ | 1,906,755 |

| | $ | 1,919,743 |

| | $ | 2,116,165 |

| | $ | 2,211,183 |

| | $ | 2,340,502 |

|

| | | | | | | | | | | | | | | |

| Mortgage notes payable (1) | $ | 463,629 |

| | $ | 1,445,017 |

| | | $ | 463,629 |

| | $ | 505,224 |

| | $ | 903,475 |

| | $ | 1,069,085 |

| | $ | 1,445,017 |

|

| | | | | | | | | | | | | | | |

| Revolving credit facility and term loans | $ | 626,000 |

| | $ | 20,000 |

| | | $ | 626,000 |

| | $ | 525,000 |

| | $ | 221,000 |

| | $ | 125,000 |

| | $ | 20,000 |

|

| | | | | | | | | | | | | | | |

| Notes payable classified as held for sale | $ | — |

| | $ | — |

| | | $ | — |

| | $ | — |

| | $ | 96,824 |

| | $ | 97,257 |

| | $ | — |

|

| | | | | | | | | | | | | | | |

| Unconsolidated debt (at ownership %) | $ | 90,909 |

| | $ | 60,625 |

| | | $ | 90,909 |

| | $ | 72,392 |

| | $ | 59,870 |

| | $ | 60,253 |

| | $ | 60,625 |

|

| | | | | | | | | | | | | | | |

| Total liabilities | $ | 1,216,646 |

| | $ | 1,599,724 |

| | | $ | 1,216,646 |

| | $ | 1,144,786 |

| | $ | 1,338,198 |

| | $ | 1,423,023 |

| | $ | 1,599,724 |

|

| | | | | | | | | | | | | | | |

| Common stock outstanding (5) | 47,242 |

| | 49,877 |

| | | 47,242 |

| | 49,872 |

| | 49,901 |

| | 49,877 |

| | 49,877 |

|

| | | | | | | | | | | | | | | |

| OP units and vested restricted stock units outstanding (5) | 82 |

| | 78 |

| | | 82 |

| | 76 |

| | 78 |

| | 78 |

| | 78 |

|

| | | | | | | | | | | | | | | |

| Restricted stock outstanding (5) | 189 |

| | 119 |

| | | 189 |

| | 192 |

| | 192 |

| | 119 |

| | 119 |

|

| | | | | | | | | | | | | | | |

| Capitalization: |

| |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Market capitalization (2) | $ | 696,609 |

| | $ | 1,258,883 |

| | | $ | 696,609 |

| | $ | 1,342,602 |

| | $ | 1,343,444 |

| | $ | 1,342,808 |

| | $ | 1,258,883 |

|

| | | | | | | | | | | | | | | |

| Total debt (3) | $ | 1,180,538 |

| | $ | 1,525,642 |

| | | $ | 1,180,538 |

| | $ | 1,102,616 |

| | $ | 1,281,169 |

| | $ | 1,351,595 |

| | $ | 1,525,642 |

|

| | | | | | | | | | | | | | | |

| Net debt (4) | $ | 1,166,476 |

| | $ | 1,521,098 |

| | | $ | 1,166,476 |

| | $ | 946,090 |

| | $ | 1,272,925 |

| | $ | 1,316,798 |

| | $ | 1,521,098 |

|

| | | | | | | | | | | | | | | |

| Total capitalization | $ | 1,877,147 |

| | $ | 2,784,525 |

| | | $ | 1,877,147 |

| | $ | 2,445,218 |

| | $ | 2,624,613 |

| | $ | 2,694,403 |

| | $ | 2,784,525 |

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Nine Months Ended | | | Three Months Ended |

| | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| Ratios: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| NOI margin % | 51.9 | % | | 48.9 | % | | | 54.9 | % | | 52.6 | % | | 48.4 | % | | 51.1 | % | | 50.2 | % |

| | | | | | | | | | | | | | | |

| Normalized fixed charge coverage | 1.93 |

| | 1.44 |

| | | 2.35 |

| | 1.78 |

| | 1.76 |

| | 1.54 |

| | 1.46 |

|

| | | | | | | | | | | | | | | |

| Normalized interest coverage | 2.23 |

| | 1.76 |

| | | 2.68 |

| | 2.05 |

| | 2.06 |

| | 1.90 |

| | 1.79 |

|

| | | | | | | | | | | | | | | |

| Net debt/normalized annualized estimated full period EBITDA from properties owned at period end | N/A |

| | N/A |

| | | 8.02x |

| | 7.75x |

| | 8.94x |

| | 8.43x |

| | 9.56x |

|

| | | | | | | | | | | | | | | |

| (1) Excludes book value of real estate and notes payable classified as held for sale. | | | |

| (2) Market capitalization is equal to outstanding shares (common stock, OP units, and vested restricted stock units, as if converted) times the closing price of our common stock as of the most recent quarter end ($14.72 per share). Prior to the July 23, 2015, listing of our common stock stock the price used was the estimated stock value, $25.20 per share through October 2014 or $26.88 per share beginning in November 2014, as reported in Quarterly Reports on Form 10-Q filed on November 5, 2013, and November 3, 2014, respectively and reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

| (3) Includes book value of mortgage notes payable, the revolving credit facility and term loans, notes payable classified as held for sale, and unconsolidated debt (at ownership %). |

| (4) Total debt less cash and cash equivalents and unconsolidated cash and cash equivalents (at ownership %). |

| (5) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 3 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

| (in thousands, except share and per share data) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| Assets | | | | | | | | | | | |

| | Real estate | | | | | | | | | | |

| | Land | | $ | 184,318 |

| | $ | 167,231 |

| | $ | 249,030 |

| | $ | 286,430 |

| | $ | 318,058 |

|

| | Land held for development | | 44,834 |

| | 6,377 |

| | — |

| | — |

| | — |

|

| | Buildings and improvements, net | | 1,361,270 |

| | 1,314,765 |

| | 1,360,923 |

| | 1,482,336 |

| | 1,690,511 |

|

| | Total real estate | | 1,590,422 |

| | 1,488,373 |

| | 1,609,953 |

| | 1,768,766 |

| | 2,008,569 |

|

| | | | | | | | | | | | | | |

| | Cash and cash equivalents | | 7,769 |

| | 153,158 |

| | 5,764 |

| | 31,442 |

| | 923 |

|

| | Restricted cash | | 16,615 |

| | 29,620 |

| | 32,761 |

| | 35,324 |

| | 49,654 |

|

| | Accounts receivable, net | | 74,817 |

| | 71,877 |

| | 75,466 |

| | 83,380 |

| | 100,601 |

|

| | Prepaid expenses and other assets | | 22,875 |

| | 31,890 |

| | 7,222 |

| | 7,129 |

| | 8,033 |

|

| | Investments in unconsolidated entities | | 85,377 |

| | 44,780 |

| | 39,422 |

| | 39,885 |

| | 41,420 |

|

| | Deferred financing fees, net | | 12,826 |

| | 13,292 |

| | 10,690 |

| | 10,783 |

| | 7,130 |

|

| | Acquired above-market leases, net | | 1,518 |

| | 1,619 |

| | 163 |

| | 2,019 |

| | 4,442 |

|

| | Other lease intangibles, net | | 84,351 |

| | 74,850 |

| | 77,480 |

| | 92,671 |

| | 117,556 |

|

| | Other intangible assets, net | | 10,185 |

| | 10,284 |

| | 2,114 |

| | 2,144 |

| | 2,174 |

|

| | Assets associated with real estate held for sale | | — |

| | — |

| | 255,130 |

| | 137,640 |

| | — |

|

| Total assets | | $ | 1,906,755 |

| | $ | 1,919,743 |

| | $ | 2,116,165 |

| | $ | 2,211,183 |

| | $ | 2,340,502 |

|

| | | | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | |

| | Notes payable | | $ | 463,620 |

| | $ | 505,196 |

| | $ | 903,688 |

| | $ | 1,069,323 |

| | $ | 1,445,018 |

|

| | Term loans | | 525,000 |

| | 525,000 |

| | 125,000 |

| | 125,000 |

| | — |

|

| | Revolving credit facility | | 101,000 |

| | — |

| | 96,000 |

| | — |

| | 20,000 |

|

| | Unamortized mark to market premium (discount) | | 9 |

| | 28 |

| | (213 | ) | | (238 | ) | | (1 | ) |

| | Total notes payable | | 1,089,629 |

| | 1,030,224 |

| | 1,124,475 |

| | 1,194,085 |

| | 1,465,017 |

|

| | | | | | | | | | | | | | |

| | Accounts payable | | 1,477 |

| | 2,192 |

| | 1,118 |

| | 2,790 |

| | 5,543 |

|

| | Payables to related parties | | 302 |

| | 794 |

| | 2,257 |

| | 2,041 |

| | 1,820 |

|

| | Accrued liabilities | | 72,719 |

| | 64,794 |

| | 65,713 |

| | 77,375 |

| | 86,174 |

|

| | Acquired below-market leases, net | | 13,321 |

| | 12,773 |

| | 14,381 |

| | 16,984 |

| | 19,618 |

|

| | Deferred tax liabilities | | 1,386 |

| | 2,507 |

| | 2,551 |

| | 2,880 |

| | 760 |

|

| | Other liabilities | | 29,256 |

| | 22,474 |

| | 23,246 |

| | 18,525 |

| | 20,792 |

|

| | Distributions payable | | 8,556 |

| | 9,028 |

| | — |

| | — |

| | — |

|

| | Obligations associated with real estate held for sale | | — |

| | — |

| | 104,457 |

| | 108,343 |

| | — |

|

| Total liabilities | | 1,216,646 |

| | 1,144,786 |

| | 1,338,198 |

| | 1,423,023 |

| | 1,599,724 |

|

| Commitments and contingencies | | | | | | | | | | |

| Series A Convertible Preferred Stock | | 2,700 |

| | 4,626 |

| | 4,626 |

| | 4,626 |

| | 2,700 |

|

| Equity: | | | | | | | | | | |

| | Preferred stock | | — |

| | — |

| | — |

| | — |

| | — |

|

| | Convertible stock | | — |

| | — |

| | — |

| | — |

| | — |

|

| | Common stock, $.0001 par value per share, 382,499,000 shares authorized (1) | 5 |

| | 5 |

| | 5 |

| | 5 |

| | 5 |

|

| | Additional paid-in capital (1) | | 2,598,333 |

| | 2,645,825 |

| | 2,646,147 |

| | 2,645,927 |

| | 2,647,535 |

|

| | Cumulative distributions and net loss attributable to common stockholders | (1,902,927 | ) | | (1,878,611 | ) | | (1,868,447 | ) | | (1,862,555 | ) | | (1,910,287 | ) |

| | Accumulated other comprehensive income (loss) | | (10,148 | ) | | 799 |

| | (5,336 | ) | | (788 | ) | | — |

|

| | Stockholders’ equity | | 685,263 |

| | 768,018 |

| | 772,369 |

| | 782,589 |

| | 737,253 |

|

| | Noncontrolling interests | | 2,146 |

| | 2,313 |

| | 972 |

| | 945 |

| | 825 |

|

| Total equity | | 687,409 |

| | 770,331 |

| | 773,341 |

| | 783,534 |

| | 738,078 |

|

| Total liabilities and equity | | $ | 1,906,755 |

| | $ | 1,919,743 |

| | $ | 2,116,165 |

| | $ | 2,211,183 |

| | $ | 2,340,502 |

|

| | | | | | | | | | | | |

| Common stock, number of shares issued and outstanding (1) | | 47,241,851 |

| | 49,871,776 |

| | 49,901,013 |

| | 49,877,350 |

| | 49,877,350 |

|

| | | | | | | | | | | | | | |

| (1) All periods have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 4 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated Statements of Operations |

| | (in thousands, except share and per share amounts) |

| | | | | | | | |

| | | | | | | | |

| | | Nine Months Ended | | | Three Months Ended |

| | | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| Revenue | | | | | | | | | | | | | | |

| | Rental income | $ | 198,351 |

| | $ | 205,510 |

| | | $ | 62,794 |

| | $ | 63,953 |

| | $ | 71,604 |

| | $ | 69,973 |

| | $ | 69,857 |

|

| | Straight-line rent revenue adjustment | 8,692 |

| | 3,712 |

| | | 2,062 |

| | 4,339 |

| | 2,291 |

| | 2,618 |

| | 772 |

|

| | Lease incentives | 963 |

| | 266 |

| | | 485 |

| | 286 |

| | 192 |

| | 528 |

| | 77 |

|

| | Above- and below-market rent amortization | 4,586 |

| | 2,348 |

| | | 2,064 |

| | 1,335 |

| | 1,187 |

| | 955 |

| | 532 |

|

| | Lease termination fees | 2,688 |

| | 1,615 |

| | | 2,018 |

| | 125 |

| | 545 |

| | 542 |

| | 919 |

|

| | Total revenue | 215,280 |

| | 213,451 |

| | | 69,423 |

| | 70,038 |

| | 75,819 |

| | 74,616 |

| | 72,157 |

|

| Expenses | | | | | | | | | | | | | | |

| | Property related expenses | 67,346 |

| | 71,098 |

| | | 21,290 |

| | 20,877 |

| | 25,179 |

| | 24,358 |

| | 22,464 |

|

| | Real estate taxes | 31,512 |

| | 31,528 |

| | | 9,670 |

| | 10,198 |

| | 11,644 |

| | 9,944 |

| | 11,272 |

|

| | Property management fees | 4,779 |

| | 6,480 |

| | | 342 |

| | 2,105 |

| | 2,332 |

| | 2,198 |

| | 2,229 |

|

| | Total property operating expenses | 103,637 |

| | 109,106 |

| | | 31,302 |

| | 33,180 |

| | 39,155 |

| | 36,500 |

| | 35,965 |

|

| | Interest expense | 42,116 |

| | 48,273 |

| | | 11,884 |

| | 14,591 |

| | 15,641 |

| | 16,390 |

| | 16,033 |

|

| | Amortization of deferred financing costs | 2,721 |

| | 1,790 |

| | | 914 |

| | 899 |

| | 908 |

| | 782 |

| | 654 |

|

| | Amortization of mark to market | (90 | ) | | 57 |

| | | (33 | ) | | (30 | ) | | (27 | ) | | 82 |

| | 19 |

|

| | Total interest expense | 44,747 |

| | 50,120 |

| | | 12,765 |

| | 15,460 |

| | 16,522 |

| | 17,254 |

| | 16,706 |

|

| | General and administrative | 17,171 |

| | 12,793 |

| | | 6,378 |

| | 5,412 |

| | 5,381 |

| | 4,695 |

| | 4,147 |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,301 |

| | — |

| | | 101 |

| | 10,200 |

| | — |

| | — |

| | — |

|

| | Tender offer and listing costs | 5,553 |

| | — |

| | | 2,562 |

| | 2,488 |

| | 503 |

| | 104 |

| | — |

|

| | Amortization of restricted shares and units | 1,604 |

| | 1,034 |

| | | 505 |

| | 564 |

| | 535 |

| | 363 |

| | 369 |

|

| | Straight-line rent expense adjustment | (81 | ) | | (15 | ) | | | (67 | ) | | (7 | ) | | (7 | ) | | (6 | ) | | (5 | ) |

| | Acquisition expense | 1,459 |

| | 4 |

| | | 644 |

| | 813 |

| | 2 |

| | 86 |

| | 4 |

|

| | Asset impairment losses | 132 |

| | 8,225 |

| | | — |

| | — |

| | 132 |

| | 4,940 |

| | — |

|

| | Real estate depreciation and amortization | 92,320 |

| | 87,988 |

| | | 31,217 |

| | 31,081 |

| | 30,022 |

| | 31,682 |

| | 29,885 |

|

| | Depreciation and amortization - non-real estate assets | 229 |

| | — |

| | | 229 |

| | — |

| | — |

| | — |

| | — |

|

| | Total expenses | 277,072 |

| | 269,255 |

| | | 85,636 |

| | 99,191 |

| | 92,245 |

| | 95,618 |

| | 87,071 |

|

| | Interest and other income | 553 |

| | 432 |

| | | 267 |

| | 141 |

| | 145 |

| | 81 |

| | 88 |

|

| | Loss on early extinguishment of debt | (21,478 | ) | | — |

| | | (30 | ) | | (21,412 | ) | | (36 | ) | | (426 | ) | | — |

|

| Loss from continuing operations before income taxes, equity | | | | | | | | | | | | | | |

| | in operations of investments, and gain (loss) on sale of assets | (82,717 | ) | | (55,372 | ) | | | (15,976 | ) | | (50,424 | ) | | (16,317 | ) | | (21,347 | ) | | (14,826 | ) |

| | Benefit (provision) for income taxes | (1,298 | ) | | (45 | ) | | | (36 | ) | | (1,338 | ) | | 76 |

| | 73 |

| | (36 | ) |

| | Equity in operations of investments | 153 |

| | 1,314 |

| | | (159 | ) | | 69 |

| | 243 |

| | 522 |

| | 431 |

|

| Loss from continuing operations before gain (loss) on sale of assets | (83,862 | ) | | (54,103 | ) | | | (16,171 | ) | | (51,693 | ) | | (15,998 | ) | | (20,752 | ) | | (14,431 | ) |

| Discontinued operations: | | | | | | | | | | | | | | |

| | Income (loss) from discontinued operations | 1,390 |

| | (13,260 | ) | | | 21 |

| | (121 | ) | | 1,490 |

| | (17,634 | ) | | (5,975 | ) |

| | Gain on sale of discontinued operations | 15,086 |

| | 4,026 |

| | | 403 |

| | 6,077 |

| | 8,606 |

| | 86,195 |

| | 4,026 |

|

| Discontinued operations | 16,476 |

| | (9,234 | ) | | | 424 |

| | 5,956 |

| | 10,096 |

| | 68,561 |

| | (1,949 | ) |

| Gain (loss) on sale of assets | 44,479 |

| | — |

| | | (85 | ) | | 44,564 |

| | — |

| | — |

| | — |

|

| Net income (loss) | (22,907 | ) | | (63,337 | ) | | | (15,832 | ) | | (1,173 | ) | | (5,902 | ) | | 47,809 |

| | (16,380 | ) |

| | Noncontrolling interests - continuing operations | 118 |

| | 91 |

| | | 58 |

| | 33 |

| | 27 |

| | 41 |

| | 34 |

|

| | Noncontrolling interests - discontinued operations | (29 | ) | | (2 | ) | | | (1 | ) | | (11 | ) | | (17 | ) | | (118 | ) | | (9 | ) |

| | Dilution (accretion) of Series A Convertible Preferred Stock | 1,926 |

| | — |

| | | 1,926 |

| | — |

| | — |

| | (1,926 | ) | | — |

|

| Net income (loss) attributable to common stockholders | $ | (20,892 | ) | | $ | (63,248 | ) | | | $ | (13,849 | ) | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) |

| | | | | | | | | | | | | | | |

| Basic and diluted weighted average common shares outstanding (1) | 49,538,652 |

| | 49,875,410 |

| | | 48,842,711 |

| | 49,893,330 |

| | 49,891,436 |

| | 49,877,350 |

| | 49,877,350 |

|

| Basic and diluted earnings (loss) per common share: | | | | | | | | | | | | | | |

| | Continuing operations (1) | $ | (0.75 | ) | | $ | (1.08 | ) | | | $ | (0.29 | ) | | $ | (0.14 | ) | | $ | (0.32 | ) | | $ | (0.45 | ) | | $ | (0.29 | ) |

| | Discontinued operations (1) | 0.33 |

| | (0.19 | ) | | | 0.01 |

| | 0.12 |

| | 0.20 |

| | 1.37 |

| | (0.04 | ) |

| Basic and diluted earnings (loss) per common share (1) | $ | (0.42 | ) | | $ | (1.27 | ) | | | $ | (0.28 | ) | | $ | (0.02 | ) | | $ | (0.12 | ) | | $ | 0.92 |

| | $ | (0.33 | ) |

| | | | | | | |

| Distributions declared per common share (1) | $ | 0.36 |

| | $ | — |

| | | $ | 0.18 |

| | $ | 0.18 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| | | | | | | |

| Net income (loss) attributable to common stockholders: | | | | | | |

| | Continuing operations | $ | (37,339 | ) | | $ | (54,012 | ) | | | $ | (14,272 | ) | | $ | (7,096 | ) | | $ | (15,971 | ) | | $ | (22,637 | ) | | $ | (14,397 | ) |

| | Discontinued operations | 16,447 |

| | (9,236 | ) | | | 423 |

| | 5,945 |

| | 10,079 |

| | 68,443 |

| | (1,958 | ) |

| Net income (loss) attributable to common stockholders | $ | (20,892 | ) | | $ | (63,248 | ) | | | $ | (13,849 | ) | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) |

| | | | | | | | | | | | | | | | |

| (1) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 5 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Discontinued Operations |

| (in thousands) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Nine Months Ended | | | Three Months Ended |

| | | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | |

| | Rental income | $ | 4,138 |

| | $ | 39,882 |

| | | $ | 27 |

| | $ | (92 | ) | | $ | 4,203 |

| | $ | 11,358 |

| | $ | 12,946 |

|

| | Straight-line rent revenue adjustment | 455 |

| | (417 | ) | | | — |

| | (32 | ) | | 487 |

| | 454 |

| | (406 | ) |

| | Lease incentives | — |

| | (316 | ) | | | — |

| | — |

| | — |

| | (102 | ) | | (109 | ) |

| | Above- and below-market rent amortization | — |

| | 642 |

| | | — |

| | — |

| | — |

| | 188 |

| | 195 |

|

| | Lease termination fees | — |

| | 355 |

| | | — |

| | — |

| | — |

| | 149 |

| | 116 |

|

| | Total revenue | 4,593 |

| | 40,146 |

| | | 27 |

| | (124 | ) | | 4,690 |

| | 12,047 |

| | 12,742 |

|

| | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | |

| | Property related expenses | 1,729 |

| | 12,654 |

| | | 6 |

| | 22 |

| | 1,701 |

| | 3,909 |

| | 4,295 |

|

| | Real estate taxes | 633 |

| | 7,040 |

| | | — |

| | (83 | ) | | 716 |

| | 2,334 |

| | 2,171 |

|

| | Property management fees | 121 |

| | 1,190 |

| | | — |

| | 14 |

| | 107 |

| | 309 |

| | 374 |

|

| | Total property operating expenses | 2,483 |

| | 20,884 |

| | | 6 |

| | (47 | ) | | 2,524 |

| | 6,552 |

| | 6,840 |

|

| | | | | | | | | | | | | | | | |

| | Interest expense | 707 |

| | 13,269 |

| | | — |

| | 44 |

| | 663 |

| | 3,362 |

| | 4,455 |

|

| | Amortization of deferred financing costs | 14 |

| | 300 |

| | | — |

| | — |

| | 14 |

| | 75 |

| | 113 |

|

| | Amortization of mark to market | (1 | ) | | 2 |

| | | — |

| | — |

| | (1 | ) | | — |

| | 1 |

|

| | Total interest expense | 720 |

| | 13,571 |

| | | — |

| | 44 |

| | 676 |

| | 3,437 |

| | 4,569 |

|

| | | | | | | | | | | | | | | | |

| | Real estate depreciation and amortization | — |

| | 17,999 |

| | | — |

| | — |

| | — |

| | 5,499 |

| | 6,360 |

|

| Total expenses | 3,203 |

| | 52,454 |

| | | 6 |

| | (3 | ) | | 3,200 |

| | 15,488 |

| | 17,769 |

|

| | | | | | | | | | | | | | | | |

| | Interest and other income (expense) | — |

| | (6 | ) | | | — |

| | — |

| | — |

| | (3 | ) | | (2 | ) |

| | Loss on early extinguishment of debt | — |

| | (946 | ) | | | — |

| | — |

| | — |

| | (14,190 | ) | | (946 | ) |

| | Income (loss) from discontinued operations | 1,390 |

| | (13,260 | ) | | | 21 |

| | (121 | ) | | 1,490 |

| | (17,634 | ) | | (5,975 | ) |

| | Gain on sale of discontinued operations | 15,086 |

| | 4,026 |

| | | 403 |

| | 6,077 |

| | 8,606 |

| | 86,195 |

| | 4,026 |

|

| Discontinued operations | $ | 16,476 |

| | $ | (9,234 | ) | | | $ | 424 |

| | $ | 5,956 |

| | $ | 10,096 |

| | $ | 68,561 |

| | $ | (1,949 | ) |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 6 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Calculation of FFO and FAD |

| (in thousands, except per share data) |

| | | | | | | | |

| | | | | | | | |

| | | Nine Months Ended | | | Three Months Ended |

| Funds from operations (FFO) | 30-Sep-15 | | 30-Sep-14 | | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| | | | | | | | | | | | | | | | |

| Net income (loss) | $ | (22,907 | ) | | $ | (63,337 | ) | | | $ | (15,832 | ) | | $ | (1,173 | ) | | $ | (5,902 | ) | | $ | 47,809 |

| | $ | (16,380 | ) |

| Net (income) loss attributable to noncontrolling interests | 89 |

| | 89 |

| | | 57 |

| | 22 |

| | 10 |

| | (77 | ) | | 25 |

|

| Dilution (accretion) of Series A Convertible Preferred Stock | 1,926 |

| | — |

| | | 1,926 |

| | — |

| | — |

| | (1,926 | ) | | — |

|

| Adjustments (1): | | | | | | | | | | | | | | |

| | Real estate depreciation and amortization - consolidated | 92,320 |

| | 105,987 |

| | | 31,217 |

| | 31,081 |

| | 30,022 |

| | 37,181 |

| | 36,245 |

|

| | Real estate depreciation and amortization - unconsolidated joint ventures | 4,558 |

| | 3,854 |

| | | 1,904 |

| | 1,367 |

| | 1,287 |

| | 1,307 |

| | 1,275 |

|

| | Real estate depreciation and amortization - noncontrolling interest | (10 | ) | | — |

| | | (10 | ) | | — |

| | — |

| | — |

| | — |

|

| | Impairment of depreciable real estate assets | 132 |

| | 8,225 |

| | | — |

| | — |

| | 132 |

| | 4,940 |

| | — |

|

| | Gain on sale of depreciable real estate | (59,565 | ) | | (4,026 | ) | | | (318 | ) | | (50,641 | ) | | (8,606 | ) | | (86,195 | ) | | (4,026 | ) |

| | Taxes associated with sale of depreciable real estate | 1,259 |

| | — |

| | | (5 | ) | | 1,264 |

| | — |

| | — |

| | — |

|

| | Noncontrolling interests (OP units & vested restricted stock units) share of above adjustments | (66 | ) | | (185 | ) | | | (56 | ) | | 29 |

| | (39 | ) | | 68 |

| | (68 | ) |

| FFO attributable to common stockholders | $ | 17,736 |

| | $ | 50,607 |

| | | $ | 18,883 |

| | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

|

| | | | | | | | | | | | | | | |

| FFO, excluding certain items | | | | | | | | | | | | | | |

| FFO attributable to common stockholders | $ | 17,736 |

| | $ | 50,607 |

| | | $ | 18,883 |

| | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

|

| Adjustments (1): | | | | | | | | | | | | | | |

| | Acquisition expenses | 1,837 |

| | 4 |

| | | 642 |

| | 1,193 |

| | 2 |

| | 86 |

| | 4 |

|

| | Tender offer and listing costs | 5,553 |

| | — |

| | | 2,562 |

| | 2,488 |

| | 503 |

| | 104 |

| | — |

|

| | Loss on early extinguishment of debt | 21,575 |

| | 946 |

| | | 127 |

| | 21,412 |

| | 36 |

| | 14,616 |

| | 946 |

|

| | Non-cash default interest (2) | 355 |

| | — |

| | | 355 |

| | — |

| | — |

| | — |

| | — |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,301 |

| | — |

| | | 101 |

| | 10,200 |

| | — |

| | — |

| | — |

|

| | Noncontrolling interests (OP units & vested restricted stock units) share of above adjustments | (69 | ) | | (1 | ) | | | (7 | ) | | (61 | ) | | (1 | ) | | (24 | ) | | (1 | ) |

| | Accretion (dilution) of Series A Convertible Preferred Stock | (1,926 | ) | | — |

| | | (1,926 | ) | | — |

| | — |

| | 1,926 |

| | — |

|

| FFO attributable to common stock holders, excluding certain items | $ | 55,362 |

| | $ | 51,556 |

| | | $ | 20,737 |

| | $ | 17,181 |

| | $ | 17,444 |

| | $ | 19,815 |

| | $ | 18,020 |

|

| | | | | | | | | | | | | | | |

| Funds available for distribution (FAD) | | | | | | | | | | | | | | |

| FFO attributable to common stock holders | $ | 17,736 |

| | $ | 50,607 |

| | | $ | 18,883 |

| | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

|

| Adjustments (1): | | | | | | | | | | | | | | |

| | Recurring capital expenditures | (41,109 | ) | | (49,883 | ) | | | (13,795 | ) | | (14,067 | ) | | (13,247 | ) | | (19,468 | ) | | (16,056 | ) |

| | Straight-line rent adjustments | (9,744 | ) | | (3,822 | ) | | | (2,525 | ) | | (4,369 | ) | | (2,850 | ) | | (3,141 | ) | | (411 | ) |

| | Above- and below-market rent amortization | (4,861 | ) | | (3,287 | ) | | | (2,139 | ) | | (1,433 | ) | | (1,289 | ) | | (1,244 | ) | | (827 | ) |

| | Amortization of deferred financing fees and mark to market | 2,764 |

| | 2,282 |

| | | 930 |

| | 898 |

| | 936 |

| | 982 |

| | 831 |

|

| | Amortization of restricted shares and units | 1,604 |

| | 1,034 |

| | | 505 |

| | 564 |

| | 535 |

| | 363 |

| | 369 |

|

| | Acquisition expenses | 1,837 |

| | 4 |

| | | 642 |

| | 1,193 |

| | 2 |

| | 86 |

| | 4 |

|

| | Tender offer and listing costs | 5,553 |

| | — |

| | | 2,562 |

| | 2,488 |

| | 503 |

| | 104 |

| | — |

|

| | Loss on early extinguishment of debt | 21,575 |

| | 946 |

| | | 127 |

| | 21,412 |

| | 36 |

| | 14,616 |

| | 946 |

|

| | Default interest | 355 |

| | — |

| | | 355 |

| | — |

| | — |

| | — |

| | — |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,301 |

| | — |

| | | 101 |

| | 10,200 |

| | — |

| | — |

| | — |

|

| | Depreciation and amortization - non-real estate assets | 229 |

| | — |

| | | 229 |

| | — |

| | — |

| | — |

| | — |

|

| | Noncontrolling interests (OP units & vested restricted stock units) share of above adjustments | 20 |

| | 85 |

| | | 5 |

| | (11 | ) | | 26 |

| | 13 |

| | 31 |

|

| | Accretion (dilution) of Series A Convertible Preferred Stock | (1,926 | ) | | — |

| | | (1,926 | ) | | — |

| | — |

| | 1,926 |

| | — |

|

| FAD attributable to common stockholders | $ | 4,334 |

| | $ | (2,034 | ) | | | $ | 3,954 |

| | $ | (1,176 | ) | | $ | 1,556 |

| | $ | (2,656 | ) | | $ | 1,958 |

|

| | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic (3) | 49,539 |

| | 49,875 |

| | | 48,843 |

| | 49,893 |

| | 49,891 |

| | 49,877 |

| | 49,877 |

|

| Weighted average common shares outstanding - diluted (3) | 49,725 |

| | 49,995 |

| | | 49,034 |

| | 50,085 |

| | 50,066 |

| | 49,996 |

| | 49,996 |

|

| | | | | | | | | | | | | | | |

| Diluted FFO per common share (3) (4) | $ | 0.36 |

| | $ | 1.01 |

| | | $ | 0.39 |

| | $ | (0.36 | ) | | $ | 0.34 |

| | $ | 0.06 |

| | $ | 0.34 |

|

| Diluted FFO, excluding certain items per common share (3) (4) | $ | 1.11 |

| | $ | 1.03 |

| | | $ | 0.42 |

| | $ | 0.34 |

| | $ | 0.35 |

| | $ | 0.40 |

| | $ | 0.36 |

|

| Diluted FAD per common share (3) (4) | $ | 0.09 |

| | $ | (0.04 | ) | | | $ | 0.08 |

| | $ | (0.02 | ) | | $ | 0.03 |

| | $ | (0.05 | ) | | $ | 0.04 |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| (1) Adjustments represent our pro rata share of consolidated and unconsolidated amounts, including discontinued operations. |

| (2) As of September 30, 2015, we had a non-recourse loan in default which subjects us to incur default interest at a rate that is 500 basis points higher than the stated interest rate. Based on our previous experience, we anticipate that when ownership of the property is conveyed to the lender, this default interest will be forgiven. |

| (3) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

| (4) There are no dilutive securities for purposes of calculating diluted FFO per common share and diluted FAD per common share when FFO attributable to common stockholders or FAD attributable to common stockholders is negative. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 7 |

|

| | | | | | | | | | | | | | | | | | | | |

| Calculation of EBITDA |

| (in thousands, except fixed charge coverage) |

| | | |

| | | Three Months Ended |

| | | 30-Sep-15 | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 |

| | | | | | | | | | | |

| Net income (loss) attributable to common stockholders | $ | (13,849 | ) | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) |

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | | | | | | | | | | |

| | Noncontrolling interests (OP units & vested restricted stock units) | (27 | ) | | (1 | ) | | (10 | ) | | 77 |

| | (36 | ) |

| | Dilution (accretion) of Series A Convertible Preferred Stock | (1,926 | ) | | — |

| | — |

| | 1,926 |

| | — |

|

| | | | | | | | | | | |

| | Interest expense - consolidated (including discontinued operations) | 11,884 |

| | 14,635 |

| | 16,304 |

| | 19,752 |

| | 20,488 |

|

| | Interest expense - unconsolidated entities | 1,437 |

| | 617 |

| | 615 |

| | 631 |

| | 635 |

|

| | Amortization of deferred financing costs - consolidated (including discontinued operations) | 914 |

| | 899 |

| | 922 |

| | 857 |

| | 767 |

|

| | Amortization of deferred financing costs - unconsolidated entities | 48 |

| | 13 |

| | 13 |

| | 13 |

| | 13 |

|

| | Mark to market - consolidated (including discontinued operations) | (33 | ) | | (30 | ) | | (28 | ) | | 82 |

| | 20 |

|

| | Mark to market - unconsolidated entities | 1 |

| | 16 |

| | 17 |

| | 18 |

| | 19 |

|

| | Total interest expense | 14,251 |

| | 16,150 |

| | 17,843 |

| | 21,353 |

| | 21,942 |

|

| | | | | | | | | | | |

| | Tax (benefit) provision - consolidated (including discontinued operations) | 36 |

| | 1,338 |

| | (76 | ) | | (73 | ) | | 36 |

|

| | Tax (benefit) provision - unconsolidated entities | 1 |

| | 1 |

| | 2 |

| | 3 |

| | (1 | ) |

| | | | | | | | | | | |

| | Depreciation and amortization - consolidated (including discontinued operations) | 31,446 |

| | 31,081 |

| | 30,022 |

| | 37,181 |

| | 36,245 |

|

| | Depreciation and amortization - unconsolidated entities | 1,904 |

| | 1,367 |

| | 1,287 |

| | 1,307 |

| | 1,275 |

|

| | | | | | | | | | | |

| | Impairment losses | — |

| | — |

| | 132 |

| | 4,940 |

| | — |

|

| | Gain on sale of real estate | (318 | ) | | (50,641 | ) | | (8,606 | ) | | (86,195 | ) | | (4,026 | ) |

| | Loss on early extinguishment of debt | 127 |

| | 21,412 |

| | 36 |

| | 14,616 |

| | 946 |

|

| EBITDA | 31,645 |

| | 19,556 |

| | 34,738 |

| | 40,941 |

| | 40,026 |

|

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | Costs incurred in connection with listing activities | 2,562 |

| | 2,488 |

| | 503 |

| | 104 |

| | — |

|

| | Acquisition expenses | 642 |

| | 1,193 |

| | 2 |

| | 86 |

| | 4 |

|

| | Non-cash write-off of tenant receivables | 802 |

| | 2 |

| | 1,829 |

| | 163 |

| | 64 |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 101 |

| | 10,200 |

| | — |

| | — |

| | — |

|

| Normalized EBITDA | 35,752 |

| | 33,439 |

| | 37,072 |

| | 41,294 |

| | 40,094 |

|

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | EBITDA from properties disposed before period end | (42 | ) | | (2,933 | ) | | (1,488 | ) | | (2,974 | ) | | (336 | ) |

| | Full quarter adjustment for acquired properties | 656 |

| | — |

| | — |

| | 723 |

| | — |

|

| Normalized estimated full period EBITDA from properties owned at period end | $ | 36,366 |

| | $ | 30,506 |

| | $ | 35,584 |

| | $ | 39,043 |

| | $ | 39,758 |

|

| | | | | | | | | | | |

| Fixed charges | | | | | | | | | |

| | Interest expense | $ | 14,251 |

| | $ | 16,150 |

| | $ | 17,843 |

| | $ | 21,353 |

| | $ | 21,942 |

|

| | Non-cash default interest (1) | (355 | ) | | — |

| | — |

| | — |

| | — |

|

| | Interest expense related to participating mortgage (2) | (660 | ) | | — |

| | — |

| | — |

| | — |

|

| | Capitalized interest incurred (3) | 119 |

| | 132 |

| | 176 |

| | 338 |

| | 428 |

|

| | Normalized interest expense | 13,355 |

| | 16,282 |

| | 18,019 |

| | 21,691 |

| | 22,370 |

|

| | Principal payments (excludes debt payoff) | 1,876 |

| | 2,498 |

| | 3,059 |

| | 5,038 |

| | 5,026 |

|

| Fixed charges | $ | 15,231 |

| | $ | 18,780 |

| | $ | 21,078 |

| | $ | 26,729 |

| | $ | 27,396 |

|

| | | | | | | | | | | |

| Normalized interest coverage | 2.68 |

| | 2.05 |

| | 2.06 |

| | 1.90 |

| | 1.79 |

|

| Normalized fixed charge coverage | 2.35 |

| | 1.78 |

| | 1.76 |

| | 1.54 |

| | 1.46 |

|

______________________

(1) As of September 30, 2015, we had a non-recourse loan in default which subjects us to incur default interest at a rate that is 500 basis points higher than the stated interest rate. Based on our previous experience, we anticipate that when ownership of the property is conveyed to the lender, this default interest will be forgiven.

(2) Represents an estimate of the portion of the Paces West B note that will be repaid based on achievement of certain investment return thresholds which is included in interest expense- unconsolidated entities above.

(3) Excludes capitalized interest funded from Two BriarLake Plaza construction loan.

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 8 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non Wholly-Owned Entities Financial Summary |

| As of and for the Quarter Ended September 30, 2015 |

| (dollars in thousands) |

| | | | | | | | | |

| | | Unconsolidated Entities at | | Consolidated Entities at |

| | | TIER REIT Ownership Share | | TIER REIT Ownership Share |

| | | Paces West | | Wanamaker Building | | 1325 G Street | | Colorado Building | | Domain 2 & 7 (1) | | Domain 8 (1) | | | | Legacy Land | | Third + Shoal | | |

| Ownership % during the period | 10.00% | | 60.00% | | 10.00% | | 10.00% | | 49.84% | | 50.00% | | | | 95.00% | | 95.00% | | |

| Ownership % at period end | 10.00% | | 60.00% | | 10.00% | | 10.00% | | 49.84% | | 50.00% | | Total | | 95.00% | | 95.00% | | Total |

| Results of Operations | | | | | | | | | | | | | | | | | | | |

| Rental income | $ | 306 |

| | $ | 3,679 |

| | $ | 202 |

| | $ | 105 |

| | $ | 829 |

| | $ | — |

| | $ | 5,121 |

| | — |

| | 180 |

| | 180 |

|

| Straight-line rent revenue adjustment | 19 |

| | 31 |

| | 116 |

| | 58 |

| | 172 |

| | — |

| | 396 |

| | — |

| | — |

| | — |

|

| Above- and below-market rent amortization | — |

| | 101 |

| | (18 | ) | | (12 | ) | | 4 |

| | — |

| | 75 |

| | — |

| | — |

| | — |

|

| Other income | 1 |

| | 39 |

| | 38 |

| | — |

| | — |

| | — |

| | 78 |

| | — |

| | — |

| | — |

|

| | Total revenue | 326 |

| | 3,850 |

| | 338 |

| | 151 |

| | 1,005 |

| | — |

| | 5,670 |

| | — |

| | 180 |

| | 180 |

|

| | | | | | | | | | | | | | | | | | | | | |

| Property related expenses | 92 |

| | 1,211 |

| | 77 |

| | 41 |

| | 279 |

| | — |

| | 1,700 |

| | 3 |

| | 364 |

| | 367 |

|

| Real estate taxes | 23 |

| | 380 |

| | 66 |

| | 22 |

| | 109 |

| | — |

| | 600 |

| | 19 |

| | 40 |

| | 59 |

|

| Property management fees | 9 |

| | 113 |

| | 7 |

| | 3 |

| | 25 |

| | — |

| | 157 |

| | — |

| | 56 |

| | 56 |

|

| | NOI | 202 |

| | 2,146 |

| | 188 |

| | 85 |

| | 592 |

| | — |

| | 3,213 |

| | (22 | ) | | (280 | ) | | (302 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | 750 |

| | 529 |

| | 47 |

| | 17 |

| | 94 |

| | — |

| | 1,437 |

| | — |

| | — |

| | — |

|

| Amortization of deferred financing costs | 3 |

| | 20 |

| | 6 |

| | 2 |

| | 28 |

| | — |

| | 59 |

| | — |

| | — |

| | — |

|

| Amortization of mark to market | — |

| | 1 |

| | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Asset management fees | — |

| | — |

| | 3 |

| | 2 |

| | — |

| | — |

| | 5 |

| | — |

| | — |

| | — |

|

| Real estate depreciation and amortization | 132 |

| | 1,178 |

| | 191 |

| | 86 |

| | 317 |

| | — |

| | 1,904 |

| | — |

| | 188 |

| | 188 |

|

| Interest income and other expense | — |

| | 5 |

| | — |

| | — |

| | — |

| | — |

| | 5 |

| | — |

| | — |

| | — |

|

| Acquisition expenses | — |

| | — |

| | 1 |

| | 1 |

| | — |

| | — |

| | 2 |

| | — |

| | 75 |

| | 75 |

|

| Loss on early extinguishment of debt | — |

| | 97 |

| | — |

| | — |

| | — |

| | — |

| | 97 |

| | — |

| | — |

| | — |

|

| Provision for income taxes | — |

| | 1 |

| | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| | Net income (loss) | (683 | ) | | 315 |

| | (60 | ) | | (23 | ) | | 153 |

| | — |

| | (298 | ) | | (22 | ) | | (543 | ) | | (565 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Intercompany eliminations | | | | | | | | | | | | | | | | | | | |

| Eliminate amortization of deferred financing costs | — |

| | 11 |

| | — |

| | — |

| | — |

| | — |

| | 11 |

| | — |

| | — |

| | — |

|

| Eliminate property management fees | 7 |

| | 113 |

| | 5 |

| | 3 |

| | — |

| | — |

| | 128 |

| | — |

| | — |

| | — |

|

| | Adjusted net income (loss) | (676 | ) | | 439 |

| | (55 | ) | | (20 | ) | | 153 |

| | — |

| | (159 | ) | | (22 | ) | | (543 | ) | | (565 | ) |

| Adjustments: | | | | | | | | | | | | | | | | | | | |

| | Real estate depreciation and amortization | 132 |

| | 1,178 |

| | 191 |

| | 86 |

| | 317 |

| | — |

| | 1,904 |

| | — |

| | 188 |

| | 188 |

|

| Funds from operations | $ | (544 | ) | | $ | 1,617 |

| | $ | 136 |

| | $ | 66 |

| | $ | 470 |

| | $ | — |

| | $ | 1,745 |

| | $ | (22 | ) | | $ | (355 | ) | | $ | (377 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Information | | | | | | | | | | | | | | | | | | | |

| Real estate book value (2) | $ | 6,787 |

| | $ | 101,079 |

| | $ | 12,531 |

| | $ | 3,692 |

| | $ | 43,632 |

| | $ | 6,780 |

| | $ | 174,501 |

| | 6,061 |

| | 10,042 |

| | 16,103 |

|

| Accumulated depreciation | (747 | ) | | (23,530 | ) | | (71 | ) | | (14 | ) | | (800 | ) | | — |

| | (25,162 | ) | | — |

| | (188 | ) | | (188 | ) |

| Real estate book value after depreciation | $ | 6,040 |

| | $ | 77,549 |

| | $ | 12,460 |

| | $ | 3,678 |

| | $ | 42,832 |

| | $ | 6,780 |

| | $ | 149,339 |

| | $ | 6,061 |

| | $ | 9,854 |

| | $ | 15,915 |

|

| | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 91 |

| | $ | 2,696 |

| | $ | 231 |

| | $ | 366 |

| | $ | 1,825 |

| | $ | 1,084 |

| | $ | 6,293 |

| | $ | 147 |

| | $ | 1,229 |

| | $ | 1,376 |

|

| Assets | $ | 8,134 |

| | $ | 98,742 |

| | $ | 15,900 |

| | $ | 5,181 |

| | $ | 50,531 |

| | $ | 11,212 |

| | $ | 189,700 |

| | $ | 6,207 |

| | $ | 11,187 |

| | $ | 17,394 |

|

| Debt | $ | 7,160 |

| | $ | 51,462 |

| | $ | 9,500 |

| | $ | 3,400 |

| | $ | 18,818 |

| | $ | — |

| | $ | 90,340 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Equity | $ | 647 |

| | $ | 38,304 |

| | $ | 4,480 |

| | $ | 1,007 |

| | $ | 26,937 |

| | $ | 14,002 |

| | $ | 85,377 |

| | $ | 6,152 |

| | $ | 10,947 |

| | $ | 17,099 |

|

| ________________________________ |

| (1) | Reflects our ownership share of the operating results for the period from acquisition or formation through September 30, 2015. Domain 2 & 7 were acquired on July 23, 2015. Domain 8 was formed on August 28, 2015. |

| (2) | Third + Shoal real estate book value includes $7.7 million for a ground lease intangible. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 9 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Analysis |

| (in thousands, except property count) |

| | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended | |

| Same Store GAAP NOI: | 30-Sep-15 | | 30-Sep-14 | | Favorable/ (Unfavorable) | | 30-Sep-15 | | 30-Sep-14 | | Favorable/ (Unfavorable) | |

| Revenues: | | | | | | | | | | | | |

| Total revenue | $ | 63,394 |

| | $ | 60,331 |

| | $ | 3,063 |

| | $ | 184,362 |

| | $ | 177,520 |

| | $ | 6,842 |

| |

| Less: Lease termination fees | (2,018 | ) | | (919 | ) | | (1,099 | ) | | (2,688 | ) | | (1,616 | ) | | (1,072 | ) | |

| | | 61,376 |

| | 59,412 |

| | 1,964 |

| 3.3 | % | 181,674 |

| | 175,904 |

| | 5,770 |

| 3.3 | % |

| Expenses: | | | | | | | | | | | | |

| Property operating expenses (less tenant improvement demolition costs) | 19,282 |

| | 17,930 |

| | (1,352 | ) | (7.5 | )% | 56,586 |

| | 55,397 |

| | (1,189 | ) | (2.1 | )% |

| Real estate taxes | 8,731 |

| | 9,638 |

| | 907 |

| 9.4 | % | 27,112 |

| | 26,989 |

| | (123 | ) | (0.5 | )% |

| Property management fees | 256 |

| | 1,871 |

| | 1,615 |

| 86.3 | % | 4,080 |

| | 5,448 |

| | 1,368 |

| 25.1 | % |

| Property expenses | 28,269 |

| | 29,439 |

| | 1,170 |

| 4.0 | % | 87,778 |

| | 87,834 |

| | 56 |

| 0.1 | % |

| Same Store GAAP NOI - consolidated properties | 33,107 |

| | 29,973 |

| | 3,134 |

| 10.5 | % | 93,896 |

| | 88,070 |

| | 5,826 |

| 6.6 | % |

| Same Store GAAP NOI - unconsolidated properties (at ownership %) | 2,750 |

| | 2,571 |

| | 179 |

| 7.0 | % | 7,888 |

| | 7,839 |

| | 49 |

| 0.6 | % |

| Same Store GAAP NOI | $ | 35,857 |

| | $ | 32,544 |

| | $ | 3,313 |

| 10.2 | % | $ | 101,784 |

| | $ | 95,909 |

| | $ | 5,875 |

| 6.1 | % |

| | | | | | | | | | | | | |

| Same Store Cash NOI: | | | | | | | | | | | | |

| Less: | | | | | | | | | | | | |

| Straight-line rent adjustments | (1,368 | ) | | (618 | ) | | (750 | ) | | (4,337 | ) | | (2,684 | ) | | (1,653 | ) | |

| Above- and below-market rent amortization | (1,476 | ) | | (572 | ) | | (904 | ) | | (3,750 | ) | | (2,467 | ) | | (1,283 | ) | |

| Same Store Cash NOI - consolidated properties | 30,263 |

| | 28,783 |

| | 1,480 |

| 5.1 | % | 85,809 |

| | 82,919 |

| | 2,890 |

| 3.5 | % |

| Same Store Cash NOI - unconsolidated properties (at ownership %) | 2,455 |

| | 2,408 |

| | 47 |

| | 7,088 |

| | 6,986 |

| | 102 |

| |

| Same Store Cash NOI | $ | 32,718 |

| | $ | 31,191 |

| | $ | 1,527 |

| 4.9 | % | $ | 92,897 |

| | $ | 89,905 |

| | $ | 2,992 |

| 3.3 | % |

| | | | | | | | | | | | | | |

| Occupancy % at period end (% owned) | 89.2 | % | | 87.5 | % | | | | 89.2 | % | | 87.5 | % | | | |

| | | | | | | | | | | | | | |

| Operating properties | 30 |

| | | | | | 30 |

| | | | | |

| Rentable square feet (% owned) | 10,221 |

| | | | | | 10,221 |

| | | | | |

| | | | | | | | | | | | | | |

| Reconciliation of Same Store GAAP NOI and Same Store Cash NOI reconciliation: | | | | | | | | | | | | |

| Net loss | $ | (15,832 | ) | | $ | (16,380 | ) | | | | $ | (22,907 | ) | | $ | (63,337 | ) | | | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | 12,765 |

| | 16,706 |

| | | | 44,747 |

| | 50,120 |

| | | |

| Asset impairment losses | — |

| | — |

| | | | 132 |

| | 8,225 |

| | | |

| Tenant improvement demolition costs | 106 |

| | 244 |

| | | | 312 |

| | 1,424 |

| | | |

| General and administrative | 6,378 |

| | 4,147 |

| | | | 17,171 |

| | 12,793 |

| | | |

| BHT Advisors termination fee and HPT Management buyout fee | 101 |

| | — |

| | | | 10,301 |

| | — |

| | | |

| Tender offer and listing costs | 2,562 |

| | — |

| | | | 5,553 |

| | — |

| | | |

| Amortization of restricted shares and units | 505 |

| | 369 |

| | | | 1,604 |

| | 1,034 |

| | | |

| Straight-line rent expense adjustment | (67 | ) | | (5 | ) | | | | (81 | ) | | (15 | ) | | | |

| Acquisition expense | 644 |

| | 4 |

| | | | 1,459 |

| | 4 |

| | | |

| Real estate depreciation and amortization | 31,217 |

| | 29,885 |

| | | | 92,320 |

| | 87,988 |

| | | |

| Depreciation and amortization of non-real estate assets | 229 |

| | — |

| | | | 229 |

| | — |

| | | |

| Interest and other income | (267 | ) | | (88 | ) | | | | (553 | ) | | (432 | ) | | | |

| Loss on early extinguishment of debt | 30 |

| | — |

| | | | 21,478 |

| | — |

| | | |

| Provision for income taxes | 36 |

| | 36 |

| | | | 1,298 |

| | 45 |

| | | |

| Equity in operations of investments | 159 |

| | (431 | ) | | | | (153 | ) | | (1,314 | ) | | | |

| (Income) loss from discontinued operations | (21 | ) | | 5,975 |

| | | | (1,390 | ) | | 13,260 |

| | | |

| Gain on sale of discontinued operations | (403 | ) | | (4,026 | ) | | | | (15,086 | ) | | (4,026 | ) | | | |

| Gain (loss) on sale of assets | 85 |

| | — |

| | | | (44,479 | ) | | — |

| | | |

| Net operating income of non-same store properties | (3,102 | ) | | (5,544 | ) | | | | (15,371 | ) | | (16,083 | ) | | | |

| Lease termination fees | (2,018 | ) | | (919 | ) | | | | (2,688 | ) | | (1,616 | ) | | | |

| Same store GAAP NOI of unconsolidated properties (at ownership %) | 2,750 |

| | 2,571 |

| | | | 7,888 |

| | 7,839 |

| | | |

| Same Store GAAP NOI | 35,857 |

| | 32,544 |

| | | | 101,784 |

| | 95,909 |

| | | |

| Straight-line rent revenue adjustment | (1,368 | ) | | (618 | ) | | | | (4,337 | ) | | (2,684 | ) | | | |

| Above- and below-market rent amortization | (1,476 | ) | | (572 | ) | | | | (3,750 | ) | | (2,467 | ) | | | |

| Cash NOI adjustments for unconsolidated properties (at ownership %) | (295 | ) | | (163 | ) | | | | (800 | ) | | (853 | ) | | | |

| Same Store Cash NOI | $ | 32,718 |

| | $ | 31,191 |

| | | | $ | 92,897 |

| | $ | 89,905 |

| | | |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 3rd Quarter Page 10 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Schedule of Properties Owned |

| as of September 30, 2015 |

| (in thousands, except average effective rent $/RSF) |

| | | | | | | | | | | | | | | |

| | | | | Rentable SF (100%) | | Rentable SF (own %) | | | | Average Effective Rent | | Average Effective Rent $/RSF | | | | % Average Effective Rent (own %) |

| | | | | | | Occupancy % | | | | % of NRA (own %) | |

| Property (% owned, if not 100%) | | Location | | | | | | | |

| Terrace Office Park | | Austin, TX | | 619 |

| | 619 |

| | 93.9 | % | | $ | 21,155 |

| | $ | 36.38 |

| | 5.7 | % | | 8.5 | % |

| Domain 3 | | Austin, TX | | 179 |

| | 179 |

| | 100.0 | % | | 5,644 |

| | $ | 31.53 |

| | 1.6 | % | | 2.3 | % |

| Domain 4 | | Austin, TX | | 153 |

| | 153 |

| | 100.0 | % | | 3,686 |

| | $ | 24.09 |

| | 1.4 | % | | 1.5 | % |

| Domain 7 (49.84%) | | Austin, TX | | 222 |

| | 111 |

| | 80.2 | % | | 3,034 |

| | $ | 34.75 |

| | 1.0 | % | | 1.2 | % |

| Domain 2 (49.84%) | | Austin, TX | | 115 |

| | 57 |

| | 100.0 | % | | 1,750 |

| | $ | 30.61 |

| | 0.5 | % | | 0.7 | % |

| Austin | | | | 1,288 |

| | 1,119 |

| | 94.6 | % | | 35,269 |

| | $ | 33.30 |

| | 10.2 | % | | 14.2 | % |

| | | | | | | | | | | | | | | | | |

| 5950 Sherry Lane | | Dallas, TX | | 197 |

| | 197 |

| | 84.8 | % | | 5,219 |

| | $ | 31.19 |

| | 1.8 | % | | 2.1 | % |

| Burnett Plaza | | Fort Worth, TX | | 1,025 |

| | 1,025 |

| | 87.3 | % | | 18,164 |

| | $ | 20.30 |

| | 9.4 | % | | 7.3 | % |

| Centreport Office Center | | Fort Worth, TX | | 133 |

| | 133 |

| | 100.0 | % | | 2,503 |

| | $ | 18.78 |

| | 1.2 | % | | 1.0 | % |

| Dallas/Fort Worth | | | | 1,355 |

| | 1,355 |

| | 88.2 | % | | 25,886 |

| | $ | 21.66 |

| | 12.4 | % | | 10.4 | % |

| | | | | | | | | | | | | | | | | |

| Loop Central | | Houston, TX | | 575 |

| | 575 |

| | 94.3 | % | | 12,690 |

| | $ | 23.40 |

| | 5.3 | % | | 5.1 | % |

| One & Two Eldridge Place | | Houston, TX | | 519 |

| | 519 |

| | 95.4 | % | | 16,435 |

| | $ | 33.21 |

| | 4.8 | % | | 6.6 | % |

| One BriarLake Plaza | | Houston, TX | | 502 |

| | 502 |

| | 96.8 | % | | 21,479 |

| | $ | 44.19 |

| | 4.6 | % | | 8.6 | % |

| Three Eldridge Place | | Houston, TX | | 305 |

| | 305 |

| | 80.3 | % | | 9,985 |

| | $ | 40.72 |

| | 2.8 | % | | 4.0 | % |

| Houston | | | | 1,901 |

| | 1,901 |

| | 93.0 | % | | 60,589 |

| | $ | 34.27 |

| | 17.4 | % | | 24.4 | % |

| | | | | | | | | | | | | | | | | |

| Paces West (10%) | | Atlanta, GA | | 646 |

| | 65 |

| | 83.1 | % | | 1,185 |

| | $ | 21.77 |

| | 0.6 | % | | 0.5 | % |

| Atlanta | | | | 646 |

| | 65 |

| | 83.1 | % | | 1,185 |

| | $ | 21.77 |

| | 0.6 | % | | 0.5 | % |

| | | | | | | | | | | | | | | | | |

| Bank of America Plaza | | Charlotte, NC | | 891 |

| | 891 |

| | 86.4 | % | | 17,672 |

| | $ | 22.96 |

| | 8.2 | % | | 7.1 | % |

| Charlotte | | | | 891 |

| | 891 |

| | 86.4 | % | | 17,672 |

| | $ | 22.96 |

| | 8.2 | % | | 7.1 | % |

| | | | | | | | | | | | | | | | | |

| Buena Vista Plaza | | Burbank, CA | | 115 |

| | 115 |

| | 100.0 | % | | 211 |

| | $ | 1.83 |

| | 1.1 | % | | 0.1 | % |

| Los Angeles | | | | 115 |

| | 115 |

| | 100.0 | % | | 211 |

| | $ | 1.83 |

| | 1.1 | % | | 0.1 | % |

| | | | | | | | | | | | | | | | | |

| Forum Office Park | | Louisville, KY | | 328 |

| | 328 |

| | 98.2 | % | | 5,813 |

| | $ | 18.06 |

| | 3.0 | % | | 2.3 | % |

| Hurstbourne Place | | Louisville, KY | | 235 |

| | 235 |

| | 91.5 | % | | 3,835 |

| | $ | 17.83 |

| | 2.2 | % | | 1.5 | % |

| One Oxmoor Place | | Louisville, KY | | 135 |

| | 135 |

| | 97.0 | % | | 2,904 |

| | $ | 22.09 |

| | 1.2 | % | | 1.2 | % |

| Hurstbourne Park | | Louisville, KY | | 104 |

| | 104 |

| | 99.0 | % | | 2,189 |

| | $ | 21.28 |

| | 1.0 | % | | 0.9 | % |

| Steeplechase Place | | Louisville, KY | | 77 |

| | 77 |

| | 90.9 | % | | 1,173 |

| | $ | 16.77 |

| | 0.7 | % | | 0.5 | % |

| Lakeview | | Louisville, KY | | 76 |

| | 76 |

| | 93.4 | % | | 1,394 |

| | $ | 19.77 |

| | 0.7 | % | | 0.6 | % |

| Hunnington | | Louisville, KY | | 62 |

| | 62 |

| | 87.1 | % | | 912 |

| | $ | 16.77 |

| | 0.6 | % | | 0.4 | % |

| Louisville | | | | 1,017 |

| | 1,017 |

| | 95.0 | % | | 18,220 |

| | $ | 18.86 |

| | 9.3 | % | | 7.3 | % |

| | | | | | | | | | | | | | | | | |

| Plaza at MetroCenter | | Nashville, TN | | 361 |

| | 361 |

| | 92.8 | % | | 5,910 |

| | $ | 17.65 |

| | 3.3 | % | | 2.4 | % |

| Nashville | | | | 361 |

| | 361 |

| | 92.8 | % | | 5,910 |

| | $ | 17.65 |

| | 3.3 | % | | 2.4 | % |

| | | | | | | | | | | | | | | | | |

| 5104 Eisenhower Blvd. | | Tampa, FL | | 130 |

| | 130 |

| | 100.0 | % | | 3,350 |

| | $ | 25.75 |

| | 1.2 | % | | 1.3 | % |

| Tampa | | | | 130 |

| | 130 |

| | 100.0 | % | | 3,350 |

| | $ | 25.75 |