Exhibit 99.2 OFFICE BROUGHT TO LIFE Property Portfolio 2018

WHO IS TIER REIT? Our Company TIER REIT, Inc. is a publicly traded (NYSE: TIER), self-managed, Dallas-based real estate investment trust focused on owning quality, well-managed commercial office properties in dynamic markets throughout the U.S. We leverage our expertise, long- term focus and strategic use of technology to deliver value to our stockholders and exceptional working environments to our tenants and employees. Our submarket focus is more than our strategy, it’s also our brand. We define TIER1 Our Strategy submarkets as primarily higher Our strategy is straightforward. TIER REIT’s vision density and amenity-rich is to be the premier owner and operator of best-in- locations in proximity to execu- class office properties in submarkets within tive housing that we expect will disproportionately benefit from select, high-growth metropolitan areas that offer employment growth and de- a walkable experience to various amenities. Our mand for premier office space. mission is to provide unparalleled, Property Services to our tenants and outsized total return through stock price appreciation and dividend growth to our stockholders. Our Leadership Our commitment to provide operational excellence and Our leadership brings a valuable combination outstanding customer service is of industry knowledge, strategic foresight and more than just our job, it’s our transaction experience to every situation. We rely pledge. Each TIER REIT team on our expertise to create a blueprint for success member promises to go beyond throughout market cycles, and our team continually expectations to provide property services explores creative solutions to offer real value. From to the very best of our abilities. analyzing market data while making investment decisions to improving existing properties for maximum tenant satisfaction, count on our team of experts to deliver prudent allocation of capital. 2

OUR FOCUS As of 1Q’18 We focus on vibrant cities with local GDP and population growth above the national average. We then identify amenity-rich submarkets that appeal to dynamic corporate users and highly educated, in-demand employees. 18 Operating Office Properties As of 1Q’18, we operate in six markets across the U.S., with the primary focus on our seven target growth markets of Austin, Dallas, Houston, Charlotte, Nashville, Atlanta and Denver. submarkets are, by definition,dynamic , and are based on our close monitoring of current, as Million6 Square.7 Feet well as projected, office-using population and rent of High-Quality, growth trends. Class A Office Space Submarkets Shown in Italics Current Market Locations Target Growth Markets Denver CBD/LoDo Cherry Creek Platte River Nashville CBD West End Dallas The Gulch Charlotte Preston Center Uptown Plano Legacy SouthPark Uptown Atlanta Midtown Austin Buckhead CBD The Domain Houston Southwest Westchase The Galleria Katy Freeway West 3

TARGET GROWTH MARKET AUSTIN 4

LIVE.WORK.PLAY – IN AUSTIN AUSTIN is among the best places in the nation today to live, work and play. Combined with its strong demographic trends and favorable office market fundamentals, it’s no surprise the “Live Music Capital of the World” tops the charts on TIER REIT’s list. The University of Texas at Austin is an engine for the city’s burgeoning tech and biotech businesses, while the Texas capital ensures a pro- business government policy that continues to fuel economic growth. Austin offers an attractive lifestyle to the highly educated and evolving workforce. According to Costar: 31% 3X Diversified Austin has achieved the highest total Over the past 10 years, Austin has a highly diversified economy, with every sector employment growth and office-using Austin’s population has except energy contributing to job growth. Low business employment growth in the nation since the grown at a pace nearly costs, a deep pool of talent, state economic incentives and recession ended. Employment is more than 3 times faster than high quality of life have led to firms such as Apple, Facebook, 31% above its previous peak. the national average Amazon, Oracle, Expedia and Google increasing their (2.8% v. 1.0%). presence in Austin. In addition to its “Silicon Hills” economy, Austin has a dense concentration of public sector employees and rapidly growing education and medical sectors. AUSTIN 5

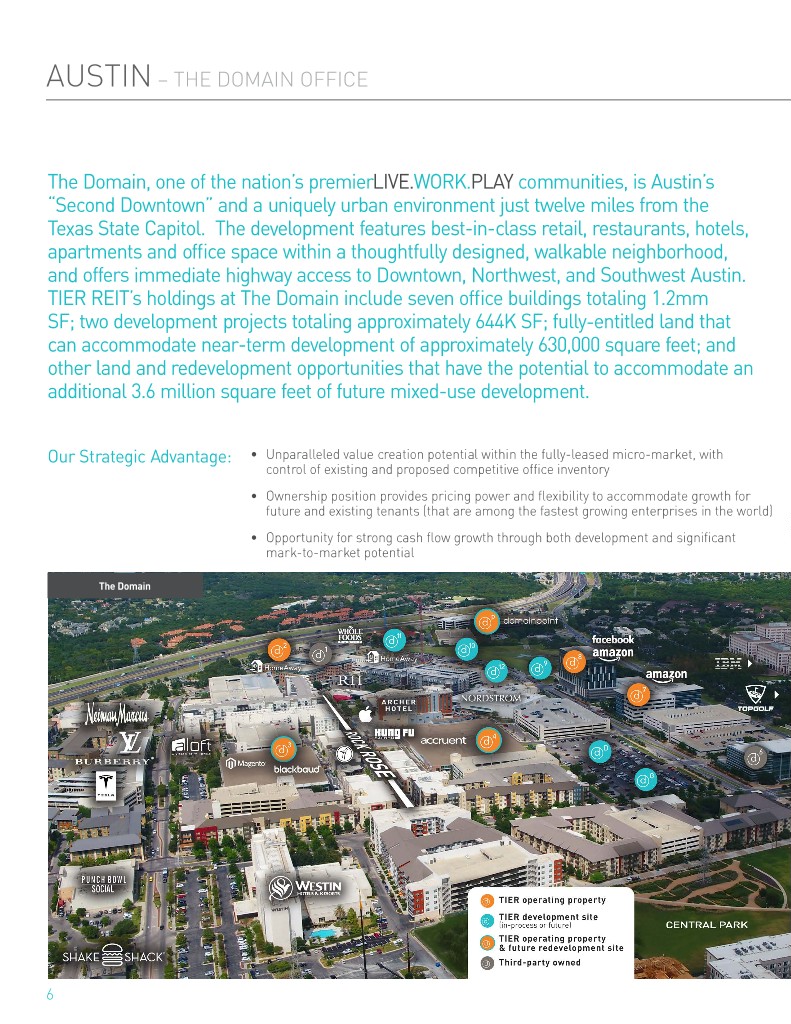

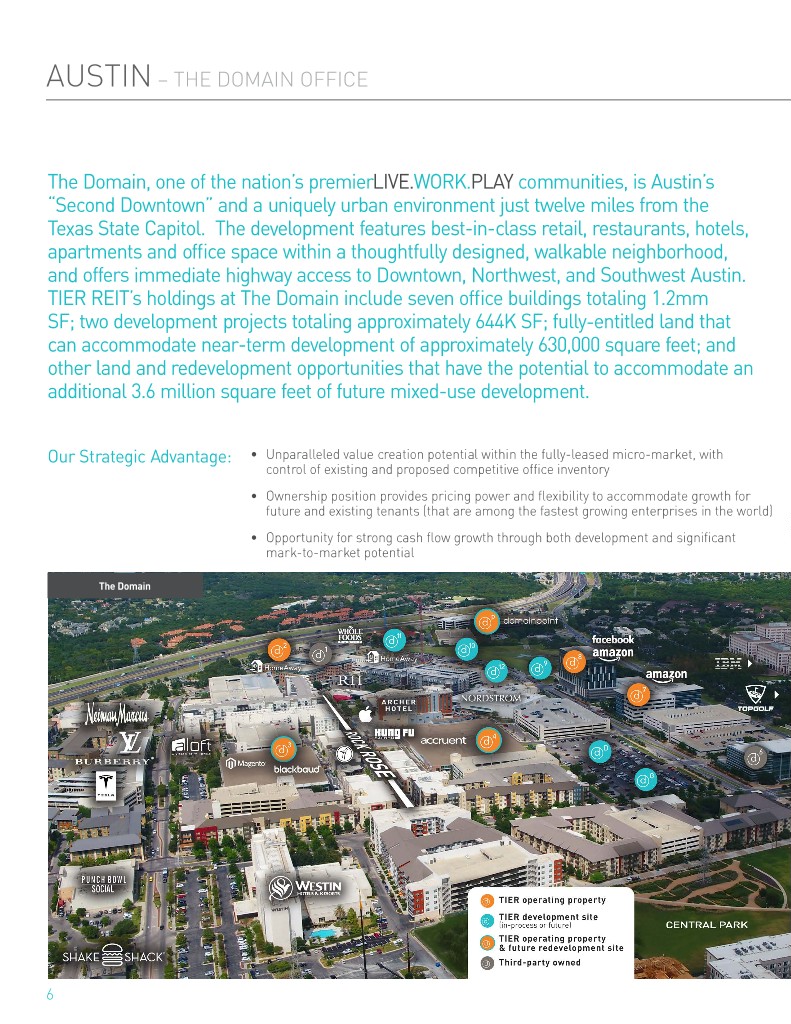

AUSTIN – THE DOMAIN OFFICE The Domain, one of the nation’s premierLIVE. WORK.PLAY communities, is Austin’s “Second Downtown” and a uniquely urban environment just twelve miles from the Texas State Capitol. The development features best-in-class retail, restaurants, hotels, apartments and office space within a thoughtfully designed, walkable neighborhood, and offers immediate highway access to Downtown, Northwest, and Southwest Austin. TIER REIT’s holdings at The Domain include seven office buildings totaling 1.2mm SF; two development projects totaling approximately 644K SF; fully-entitled land that can accommodate near-term development of approximately 630,000 square feet; and other land and redevelopment opportunities that have the potential to accommodate an additional 3.6 million square feet of future mixed-use development. Our Strategic Advantage: • Unparalleled value creation potential within the fully-leased micro-market, with control of existing and proposed competitive office inventory • Ownership position provides pricing power and flexibility to accommodate growth for future and existing tenants (that are among the fastest growing enterprises in the world) • Opportunity for strong cash flow growth through both development and significant mark-to-market potential The Domain 6

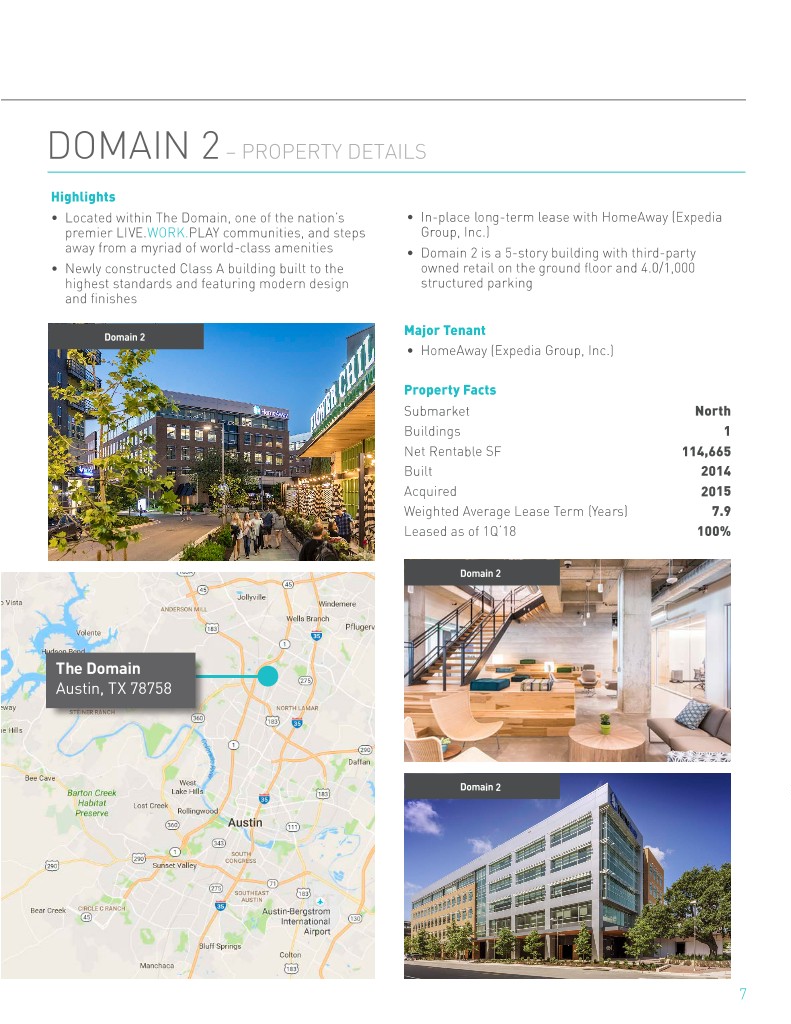

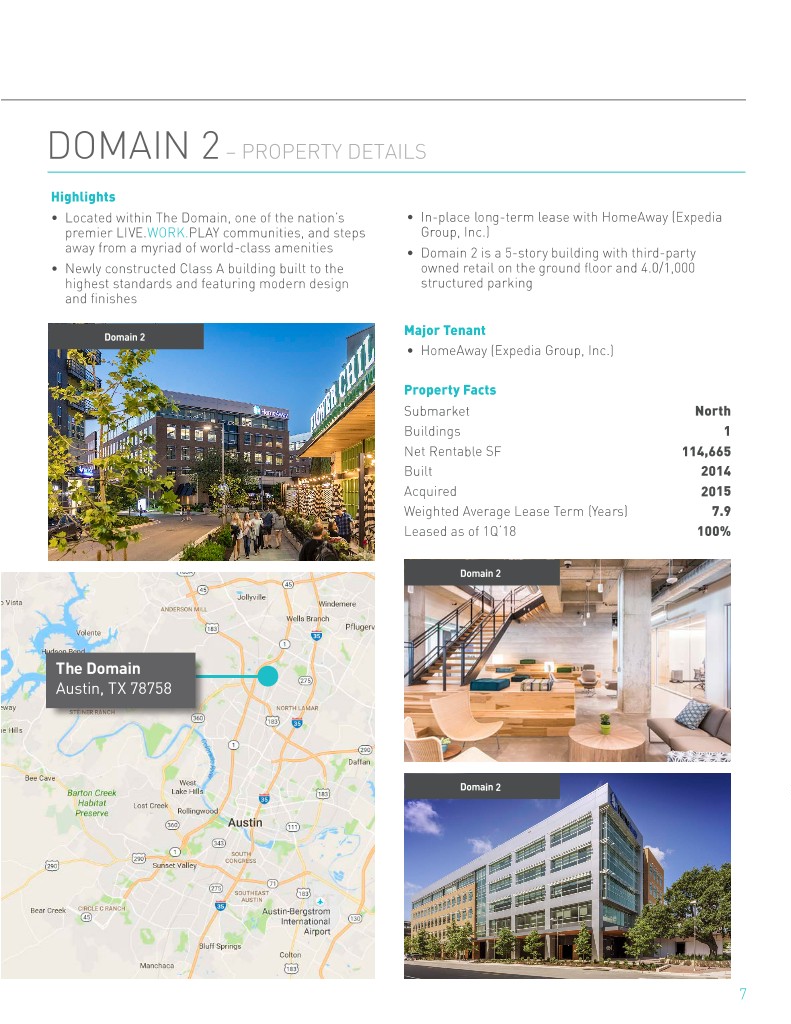

AUSTIN – THE DOMAIN OFFICE DOMAIN 2 – PROPERTY DETAILS Highlights • Located within The Domain, one of the nation’s • In-place long-term lease with HomeAway (Expedia premier LIVE.WORK.PLAY communities, and steps Group, Inc.) away from a myriad of world-class amenities • Domain 2 is a 5-story building with third-party • Newly constructed Class A building built to the owned retail on the ground floor and 4.0/1,000 highest standards and featuring modern design structured parking and finishes Domain 2 Major Tenant • HomeAway (Expedia Group, Inc.) Property Facts Submarket North Buildings 1 Net Rentable SF 114,665 Built 2014 Acquired 2015 Weighted Average Lease Term (Years) 7.9 Leased as of 1Q‘18 100% Domain 2 The Domain Austin, TX 78758 Domain 2 7

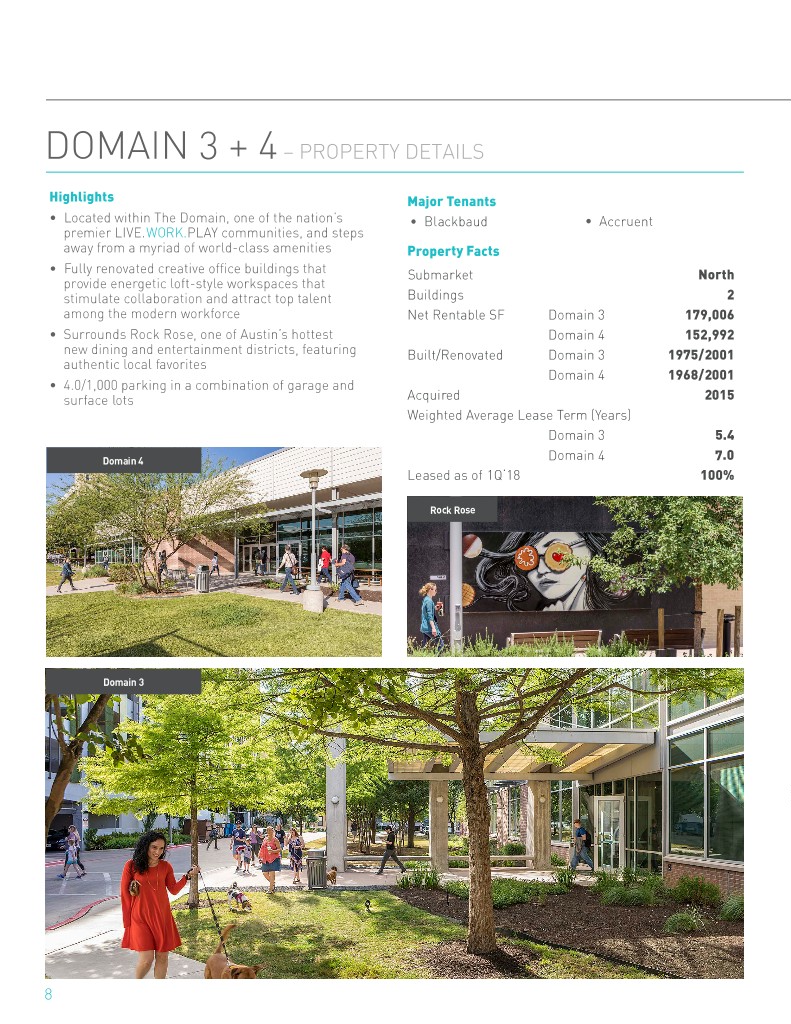

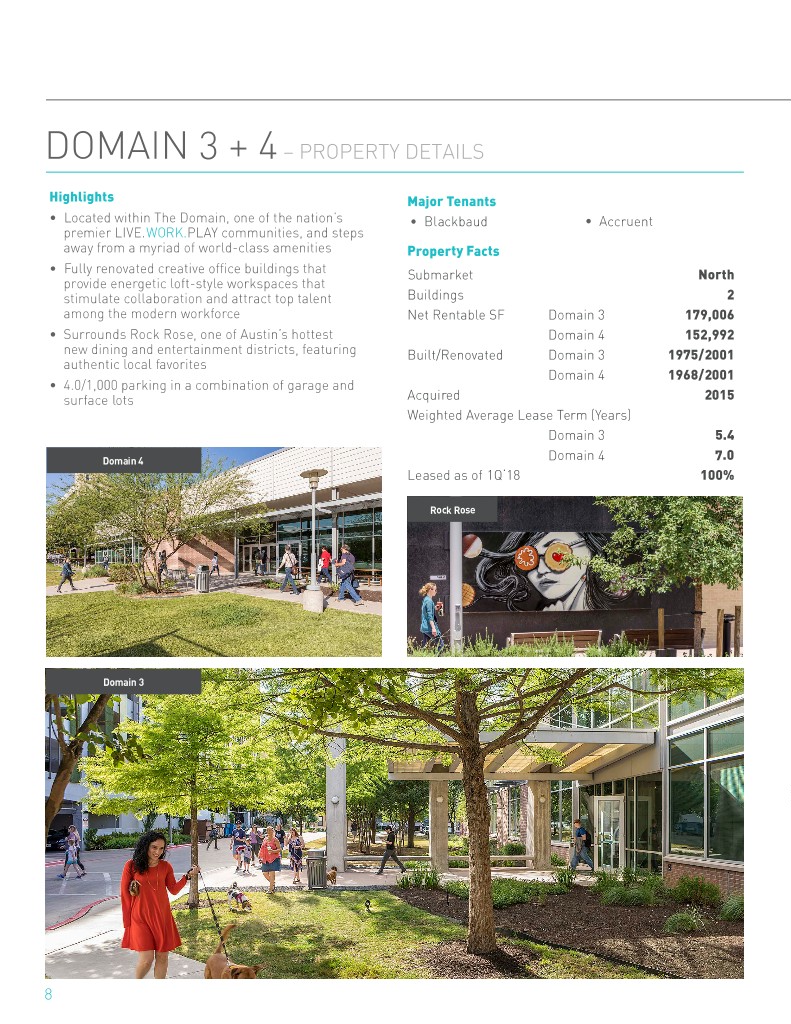

DOMAIN 3 + 4 – PROPERTY DETAILS Highlights Major Tenants • Located within The Domain, one of the nation’s • Blackbaud • Accruent premier LIVE.WORK.PLAY communities, and steps away from a myriad of world-class amenities Property Facts • Fully renovated creative office buildings that Submarket North provide energetic loft-style workspaces that stimulate collaboration and attract top talent Buildings 2 among the modern workforce Net Rentable SF Domain 3 179,006 • Surrounds Rock Rose, one of Austin’s hottest Domain 4 152,992 new dining and entertainment districts, featuring Built/Renovated Domain 3 1975/2001 authentic local favorites Domain 4 1968/2001 • 4.0/1,000 parking in a combination of garage and surface lots Acquired 2015 Weighted Average Lease Term (Years) Domain 3 5.4 Domain 4 Domain 4 7.0 Leased as of 1Q‘18 100% Rock Rose Domain 3 8

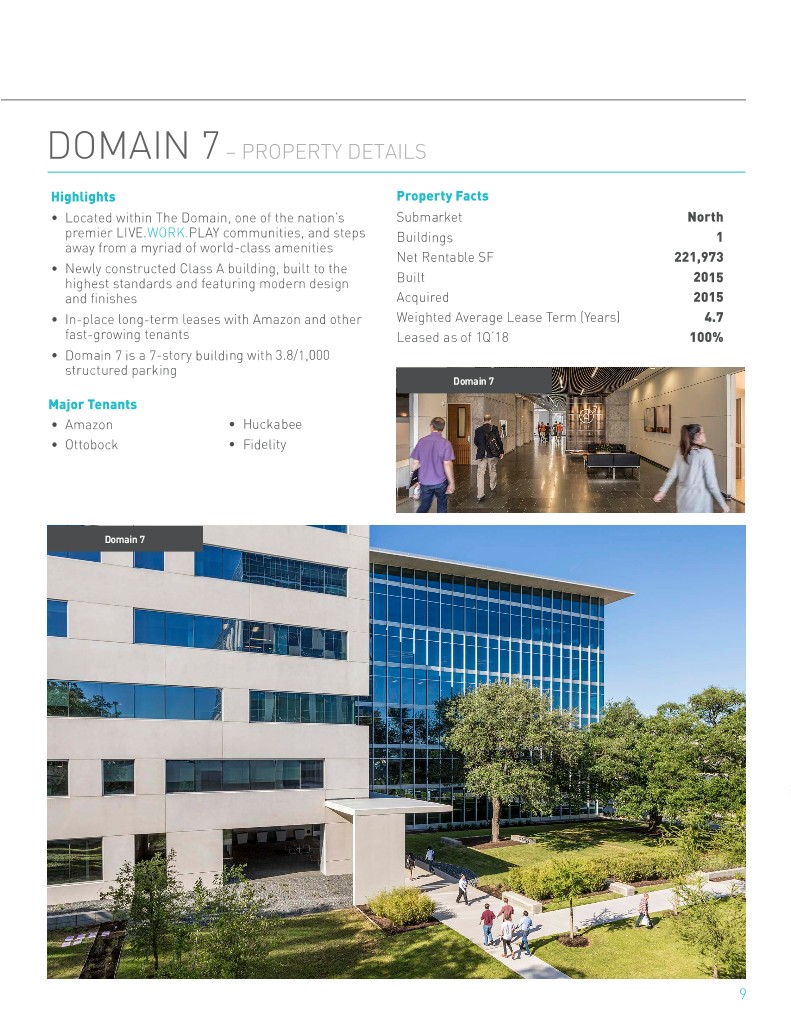

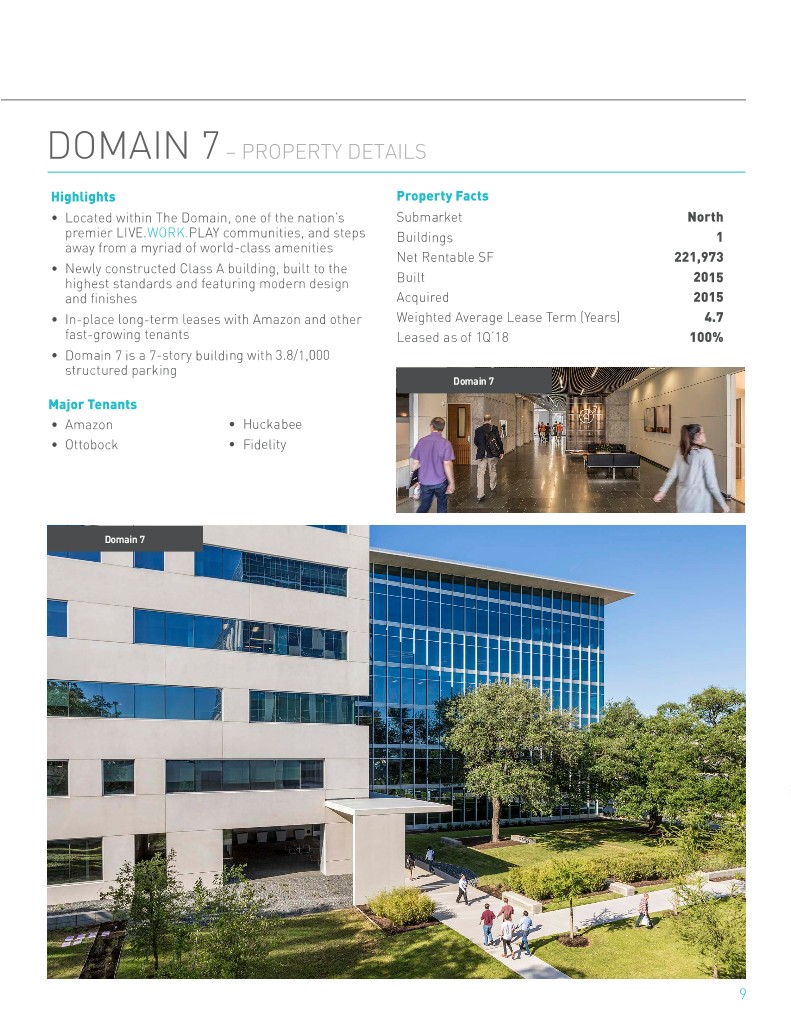

DOMAIN 7 – PROPERTY DETAILS Highlights Property Facts • Located within The Domain, one of the nation’s Submarket North premier LIVE.WORK.PLAY communities, and steps Buildings 1 away from a myriad of world-class amenities Net Rentable SF 221,973 • Newly constructed Class A building, built to the 2015 highest standards and featuring modern design Built and finishes Acquired 2015 • In-place long-term leases with Amazon and other Weighted Average Lease Term (Years) 4.7 fast-growing tenants Leased as of 1Q‘18 100% • Domain 7 is a 7-story building with 3.8/1,000 structured parking Domain 7 Major Tenants • Amazon • Huckabee • Ottobock • Fidelity Domain 7 9

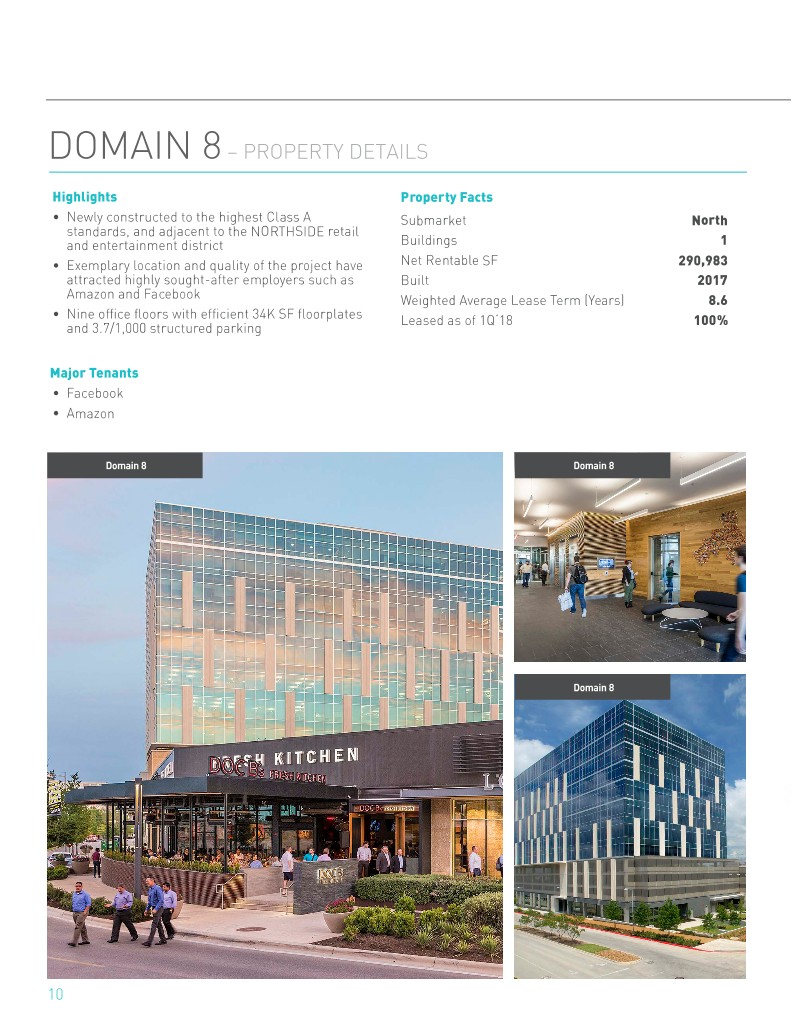

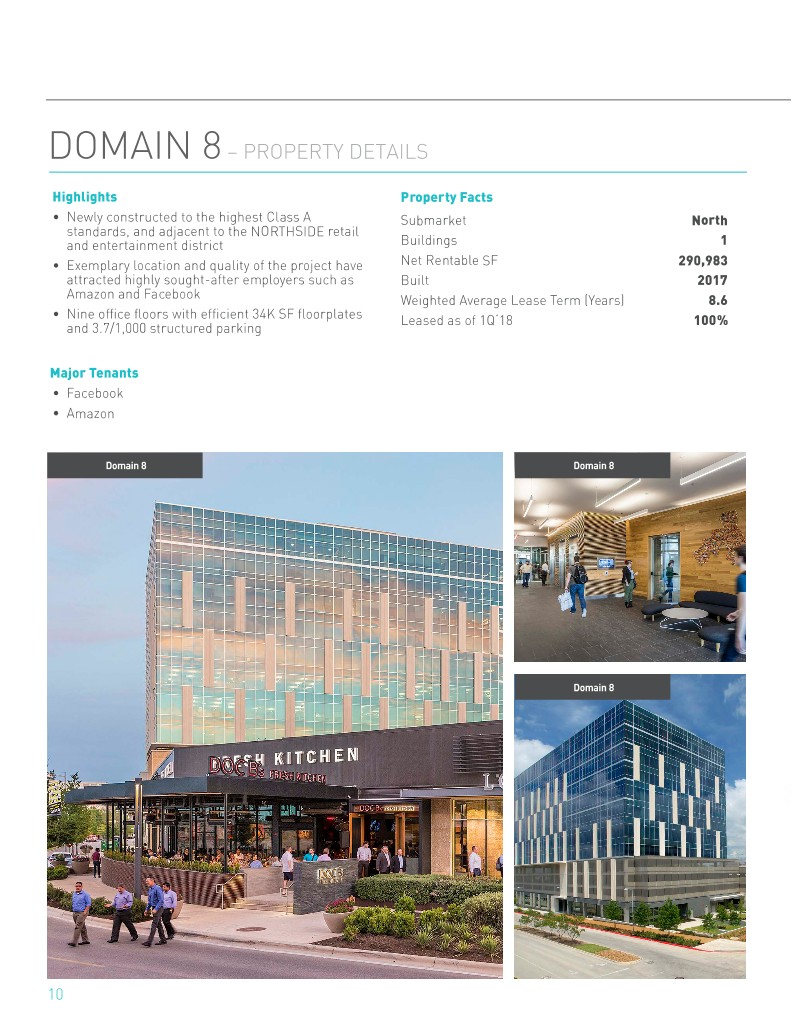

DOMAIN 8 – PROPERTY DETAILS Highlights Property Facts • Newly constructed to the highest Class A Submarket North standards, and adjacent to the NORTHSIDE retail and entertainment district Buildings 1 • Exemplary location and quality of the project have Net Rentable SF 290,983 attracted highly sought-after employers such as Built 2017 Amazon and Facebook Weighted Average Lease Term (Years) 8.6 • Nine office floors with efficient 34K SF floorplates Leased as of 1Q‘18 100% and 3.7/1,000 structured parking Major Tenants • Facebook • Amazon Domain 8 Domain 8 Domain 8 10

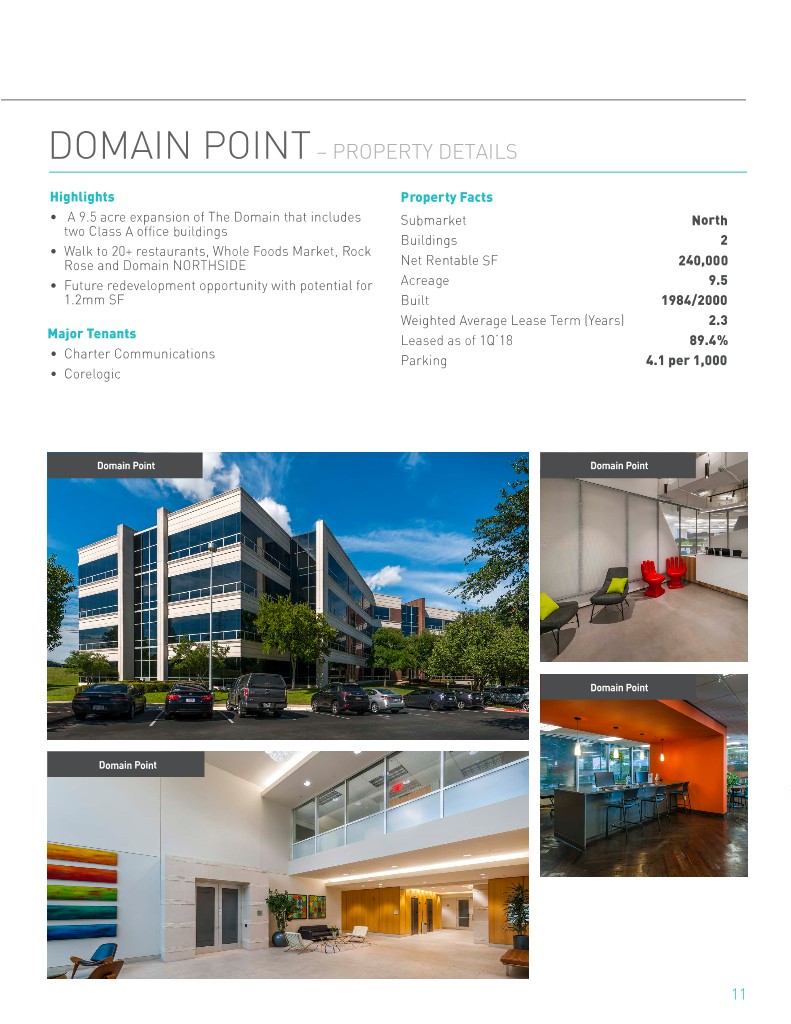

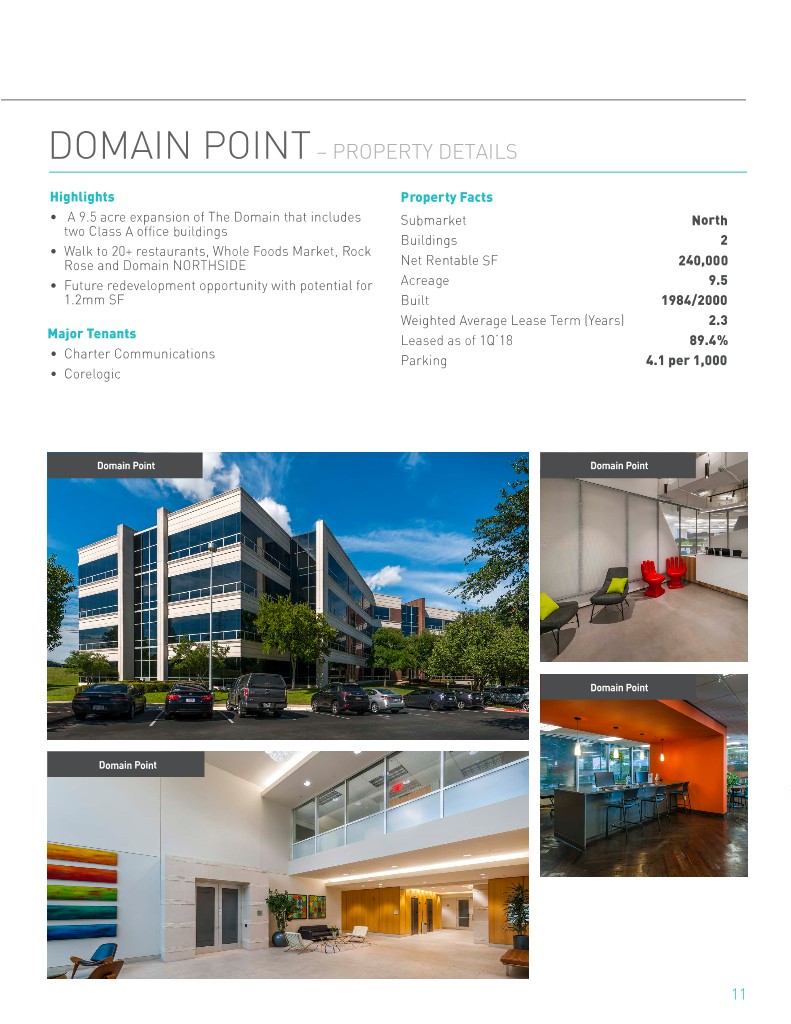

DOMAIN POINT – PROPERTY DETAILS Highlights Property Facts • A 9.5 acre expansion of The Domain that includes Submarket North two Class A office buildings Buildings 2 • Walk to 20+ restaurants, Whole Foods Market, Rock Rose and Domain NORTHSIDE Net Rentable SF 240,000 • Future redevelopment opportunity with potential for Acreage 9.5 1.2mm SF Built 1984/2000 Weighted Average Lease Term (Years) 2.3 Major Tenants Leased as of 1Q‘18 89.4% • Charter Communications Parking 4.1 per 1,000 • Corelogic Domain Point Domain Point Domain Point Domain Point 11

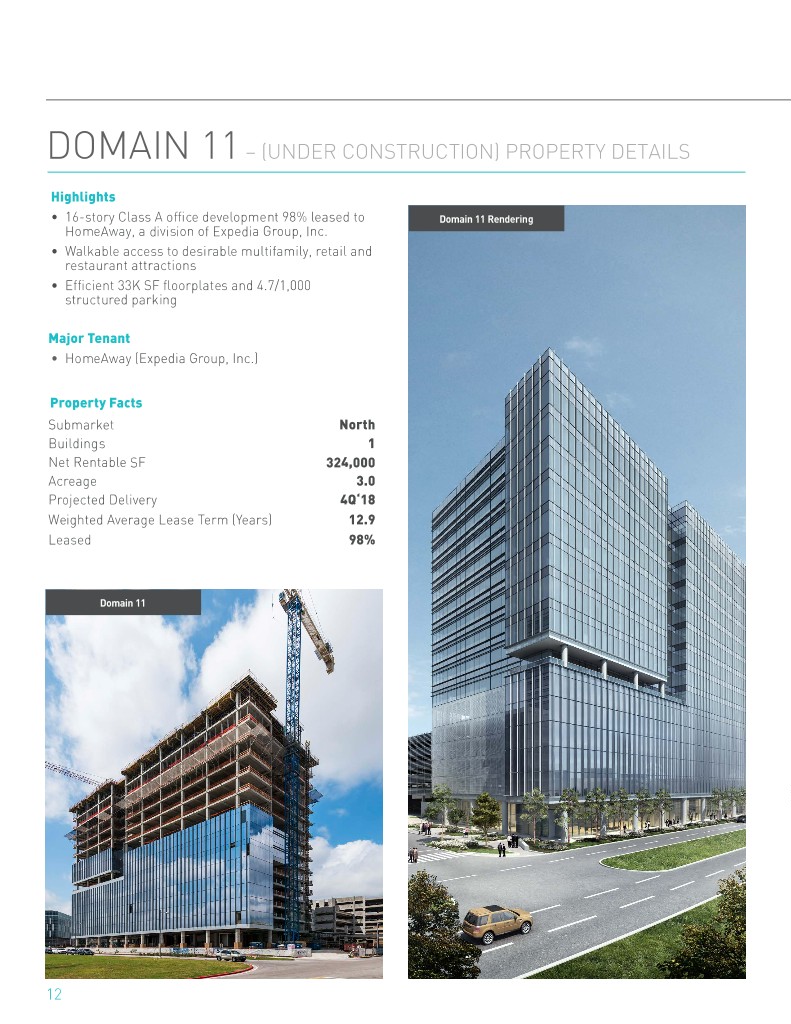

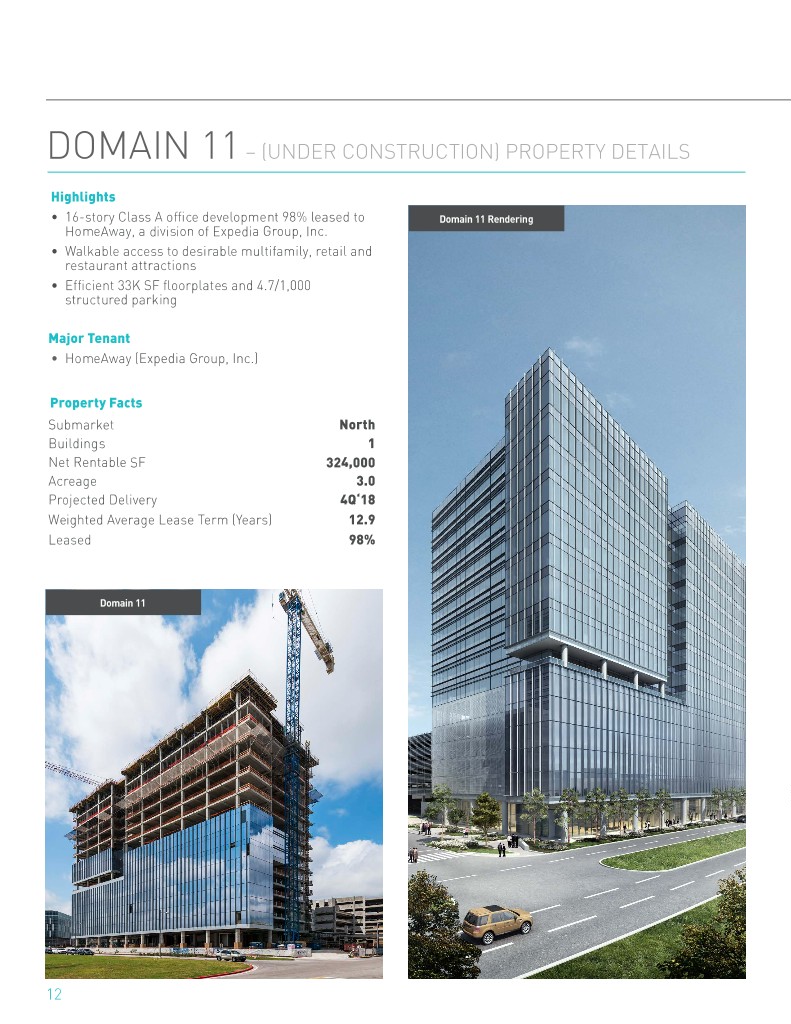

DOMAIN 11 – (UNDER CONSTRUCTION) PROPERTY DETAILS Highlights • 16-story Class A office development 98% leased to Domain 11 Rendering HomeAway, a division of Expedia Group, Inc. • Walkable access to desirable multifamily, retail and restaurant attractions • Efficient 33K SF floorplates and 4.7/1,000 structured parking Major Tenant • HomeAway (Expedia Group, Inc.) Property Facts Submarket North Buildings 1 Net Rentable SF 324,000 Acreage 3.0 Projected Delivery 4Q‘18 Weighted Average Lease Term (Years) 12.9 Leased 98% Domain 11 12

DOMAIN 12 – (UNDER CONSTRUCTION) PROPERTY DETAILS Highlights Property Facts • 17-story Class A office development that will offer a new level of amenities, quality and prestige Submarket North • Walkable access to desirable multifamily, retail and Buildings 1 restaurant attractions Net Rentable SF 320,000 • Efficient 33K SF floorplates and 3.74/1,000 Acreage 3.2 structured parking Projected Delivery 4Q’19 Domain 12 Rendering 13

DOMAIN 9 – FUTURE DEVELOPMENT DETAILS Highlights Property Facts • Fully-designed and entitled 18-story Class A Submarket North proposed office development that will offer premier amenities, quality and prestige Buildings 1 • Strong tenant demand in this highly sought- Net Rentable SF 330,000 after LIVE.WORK.PLAY community may enable Acreage 3.1 development at very accretive yields \ • Walkable access to desirable multifamily, retail and restaurant attractions • Efficient 33K SF floorplates and 3.7/1,000 structured parking Domain 9 Rendering 14

DOMAIN 10 – FUTURE DEVELOPMENT DETAILS Highlights Property Facts • Fully-designed and entitled 16-story Class A proposed office development that will offer premier Submarket North amenities, quality and prestige Buildings 1 • Strong tenant demand in this highly sought- Net Rentable SF 300,000 after LIVE.WORK.PLAY community may enable Acreage 3.1 development at very accretive yields • Walkable access to desirable multifamily, retail and restaurant attractions • Efficient 33K SF floorplates and 3.8/1,000 structured parking Domain 10 Rendering 15

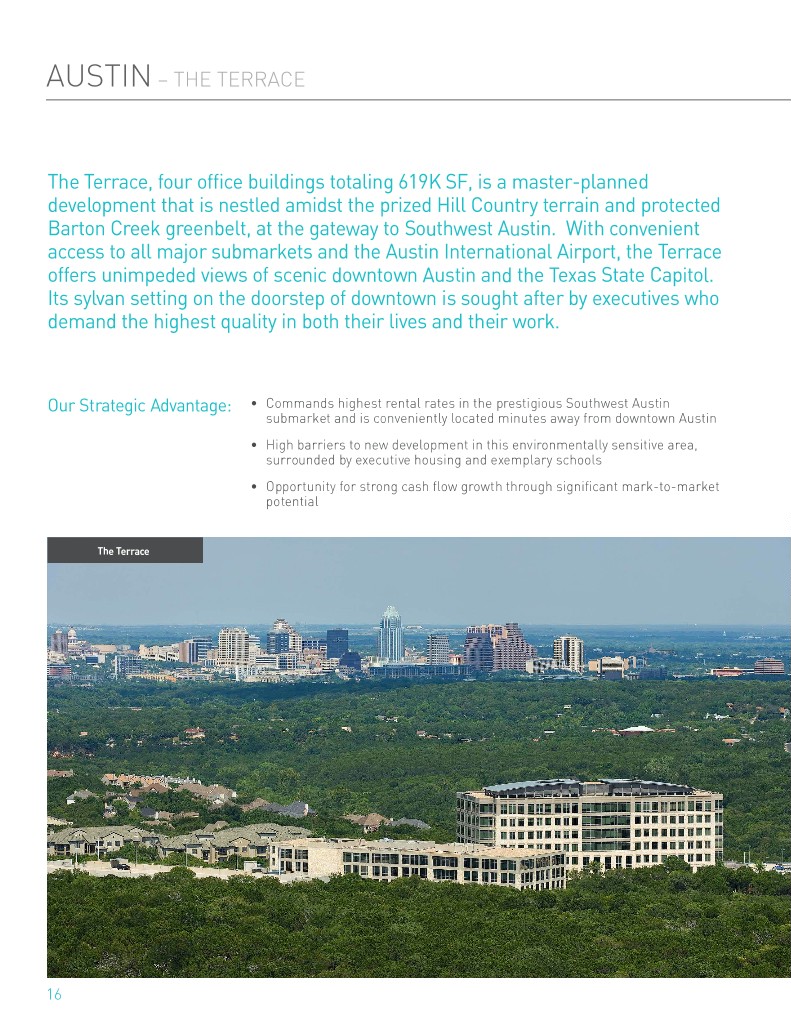

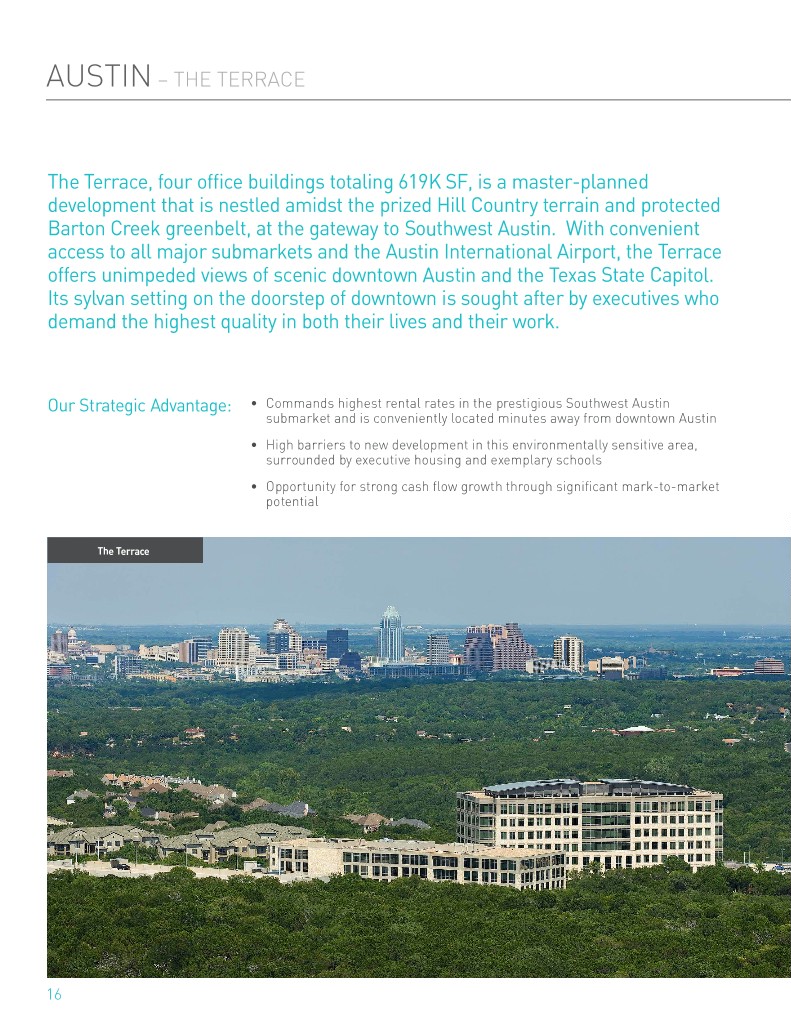

AUSTIN – THE TERRACE The Terrace, four office buildings totaling 619K SF, is a master-planned development that is nestled amidst the prized Hill Country terrain and protected Barton Creek greenbelt, at the gateway to Southwest Austin. With convenient access to all major submarkets and the Austin International Airport, the Terrace offers unimpeded views of scenic downtown Austin and the Texas State Capitol. Its sylvan setting on the doorstep of downtown is sought after by executives who demand the highest quality in both their lives and their work. Our Strategic Advantage: • Commands highest rental rates in the prestigious Southwest Austin submarket and is conveniently located minutes away from downtown Austin • High barriers to new development in this environmentally sensitive area, surrounded by executive housing and exemplary schools • Opportunity for strong cash flow growth through significant mark-to-market potential The Terrace 16

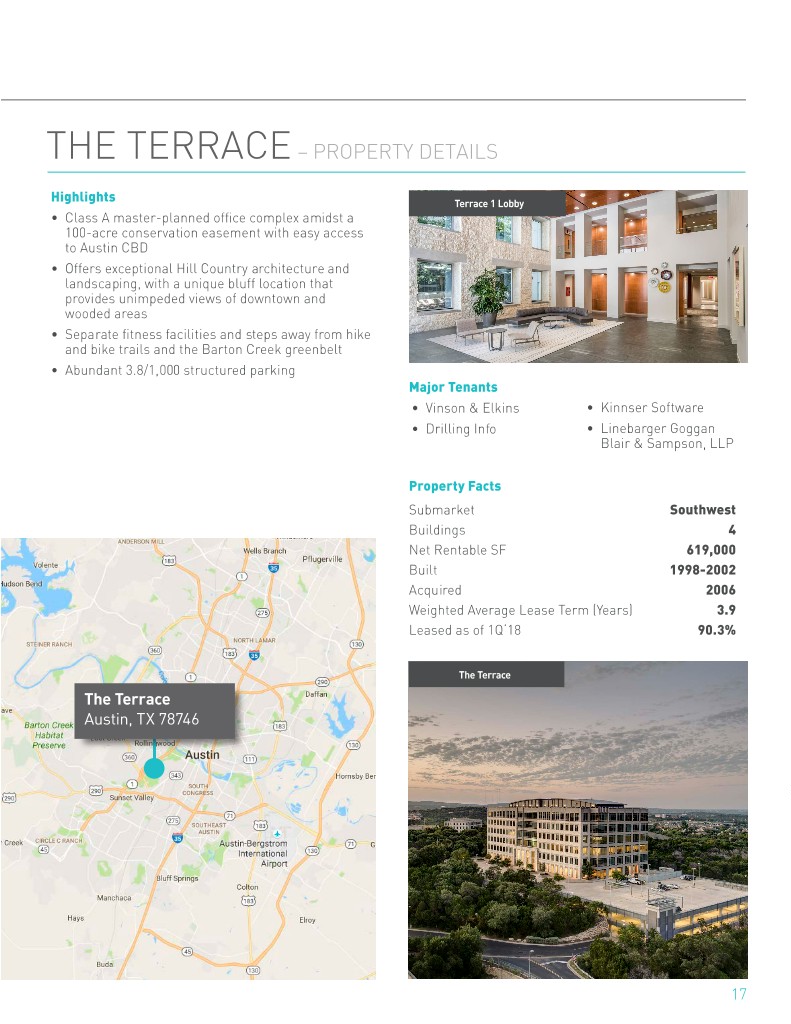

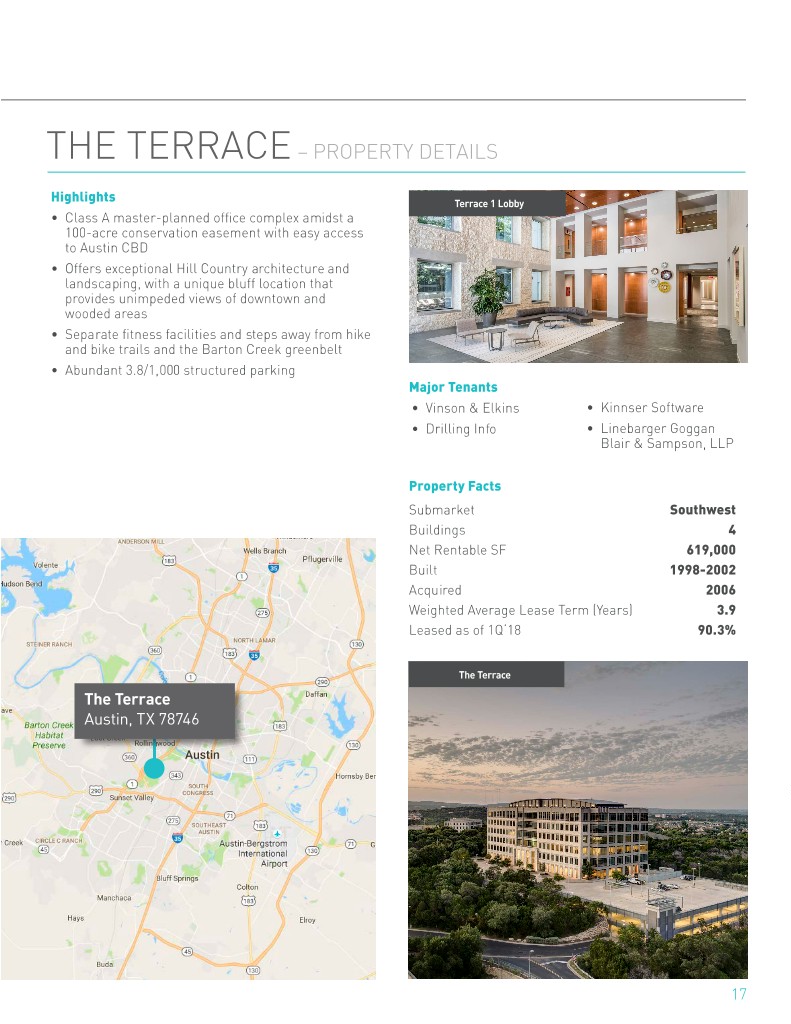

AUSTIN – THE TERRACE THE TERRACE – PROPERTY DETAILS Highlights Terrace 1 Lobby • Class A master-planned office complex amidst a 100-acre conservation easement with easy access to Austin CBD • Offers exceptional Hill Country architecture and landscaping, with a unique bluff location that provides unimpeded views of downtown and wooded areas • Separate fitness facilities and steps away from hike and bike trails and the Barton Creek greenbelt • Abundant 3.8/1,000 structured parking Major Tenants • Vinson & Elkins • Kinnser Software • Drilling Info • Linebarger Goggan Blair & Sampson, LLP Property Facts Submarket Southwest Buildings 4 Net Rentable SF 619,000 Built 1998-2002 Acquired 2006 Weighted Average Lease Term (Years) 3.9 Leased as of 1Q‘18 90.3% The Terrace The Terrace Austin, TX 78746 17

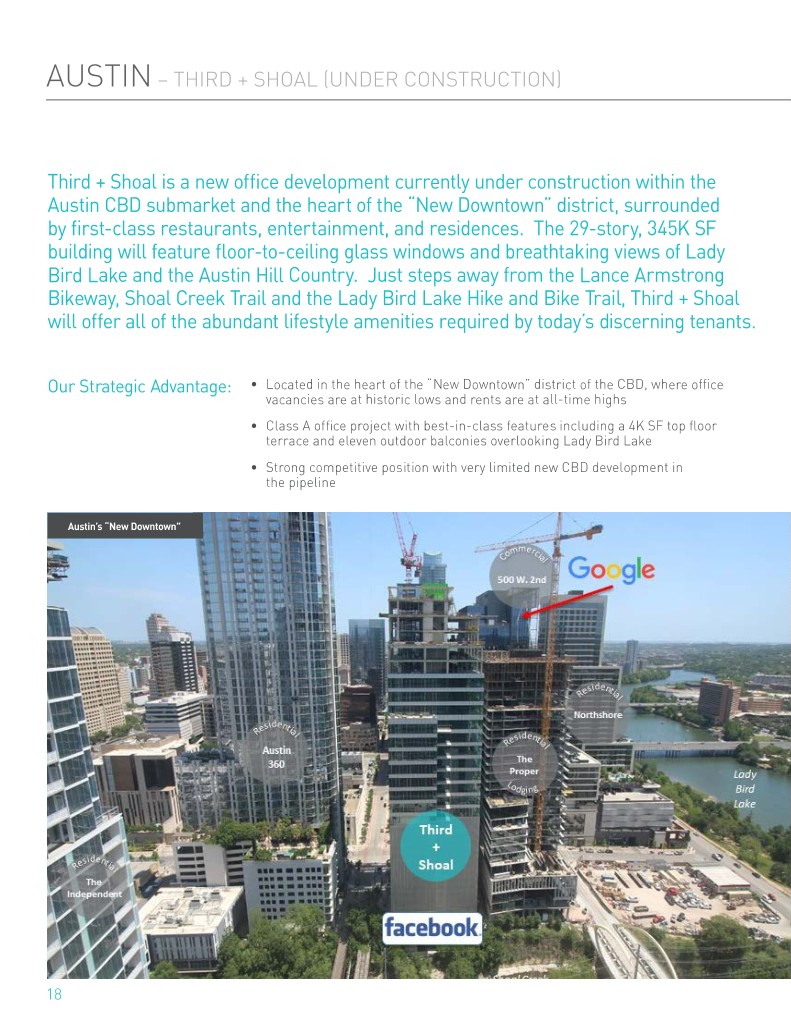

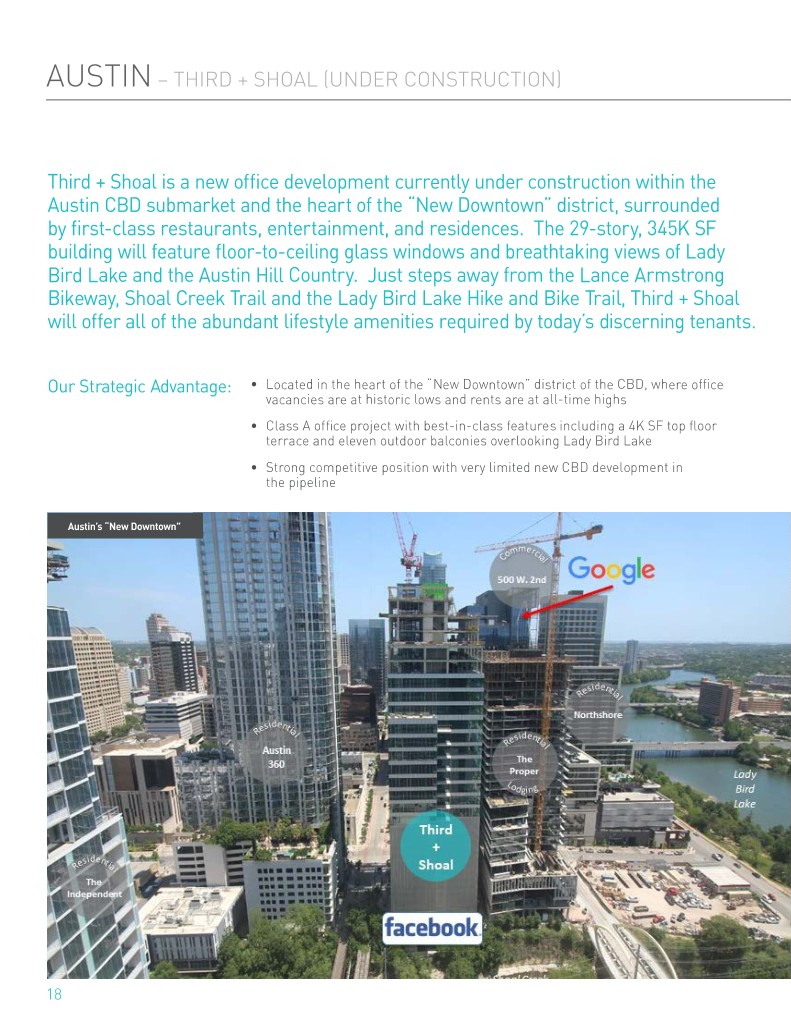

AUSTIN – THIRD + SHOAL (UNDER CONSTRUCTION) Third + Shoal is a new office development currently under construction within the Austin CBD submarket and the heart of the “New Downtown” district, surrounded by first-class restaurants, entertainment, and residences. The 29-story, 345K SF building will feature floor-to-ceiling glass windows and breathtaking views of Lady Bird Lake and the Austin Hill Country. Just steps away from the Lance Armstrong Bikeway, Shoal Creek Trail and the Lady Bird Lake Hike and Bike Trail, Third + Shoal will offer all of the abundant lifestyle amenities required by today’s discerning tenants. Our Strategic Advantage: • Located in the heart of the “New Downtown” district of the CBD, where office vacancies are at historic lows and rents are at all-time highs • Class A office project with best-in-class features including a 4K SF top floor terrace and eleven outdoor balconies overlooking Lady Bird Lake • Strong competitive position with very limited new CBD development in the pipeline Austin’s “New Downtown” 18

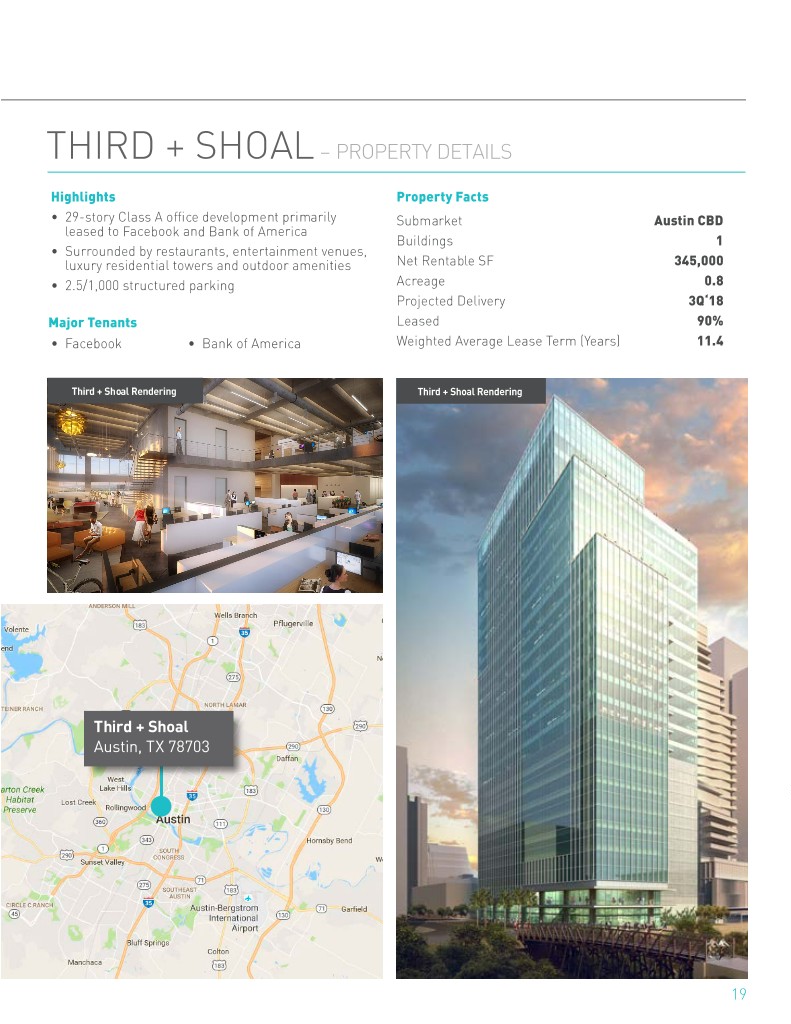

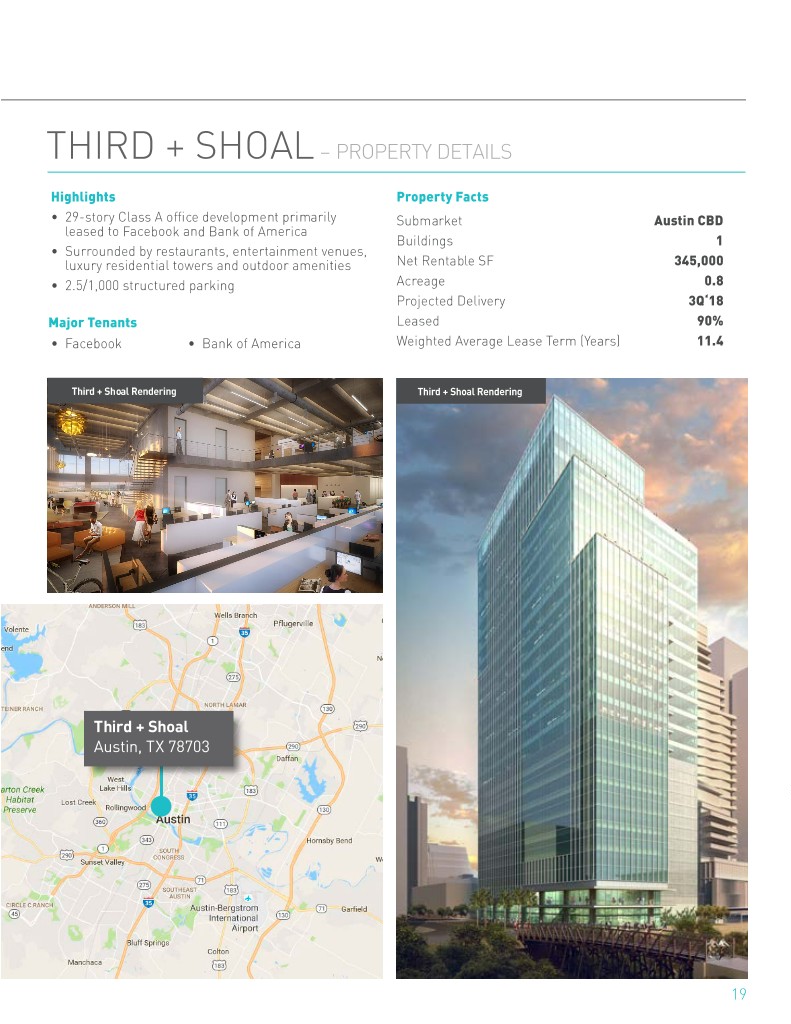

AUSTIN – THIRD + SHOAL (UNDER CONSTRUCTION) THIRD + SHOAL – PROPERTY DETAILS Highlights Property Facts • 29-story Class A office development primarily Submarket Austin CBD leased to Facebook and Bank of America Buildings 1 • Surrounded by restaurants, entertainment venues, luxury residential towers and outdoor amenities Net Rentable SF 345,000 • 2.5/1,000 structured parking Acreage 0.8 Projected Delivery 3Q‘18 Major Tenants Leased 90% • Facebook • Bank of America Weighted Average Lease Term (Years) 11.4 Third + Shoal Rendering Third + Shoal Rendering Third + Shoal Austin, TX 78703 19

TARGET GROWTH MARKET DALLAS- FORT WORTH 20

LIVE.WORK.PLAY – IN DALLAS-FORT WORTH Everything’s bigger in Texas, and Dallas-Fort Worth is at the epicenter of it all. Riding high in the saddle of business friendliness, low taxes and a central location, the DFW area attracts both corporate relocations and one new person just about every four minutes. Nearly two dozen Fortune 500 companies, twelve four-year universities, a world-class transportation infrastructure, and a highly-educated DALLAS- population all mean Dallas earns a big star among the nation’s great cities. FORT WORTH According to Costar: 90,000+ 2X Headquarters DFW has added over 90,000 jobs each Over the past 10 years DFW Airport, a central location, generous state and of the last three years, with annual DFW population has local incentives and a highly-educated employment employment growth significantly expanded at a pace base continue to draw major corporate relocations outpacing the nation. almost double including Toyota, State Farm, Charles Schwab and the national average Liberty Mutual. It is home to one of the largest (1.9% v. 1.0%). concentrations of corporate headquarters in the U.S. 21

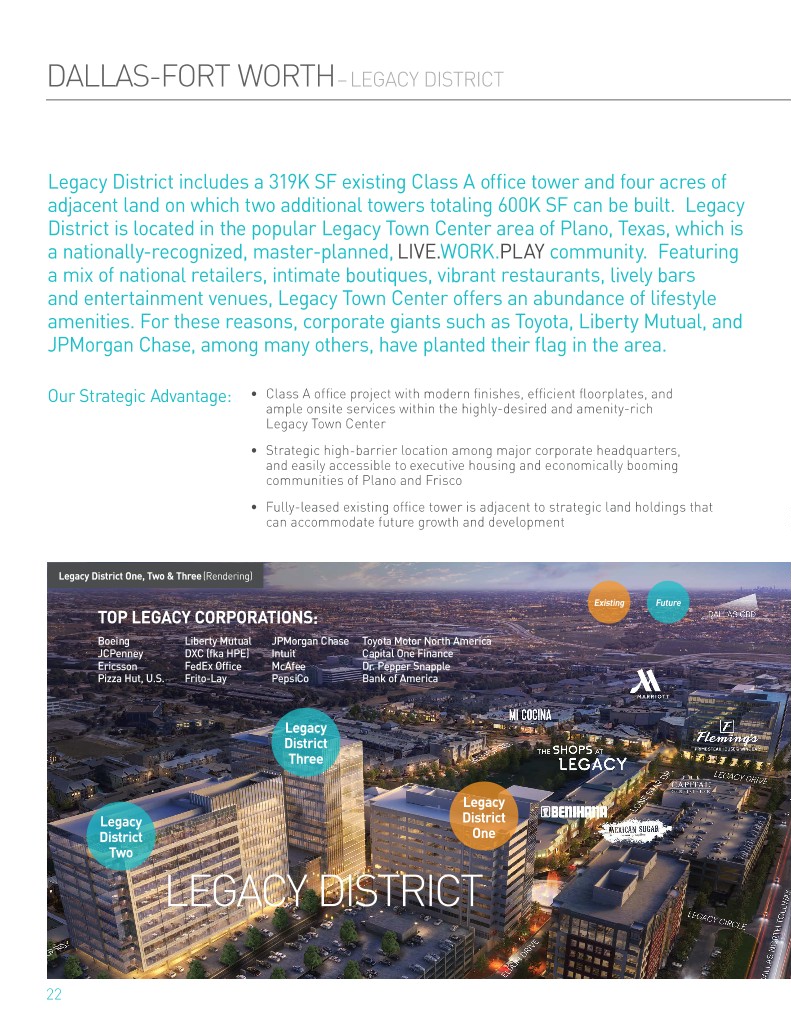

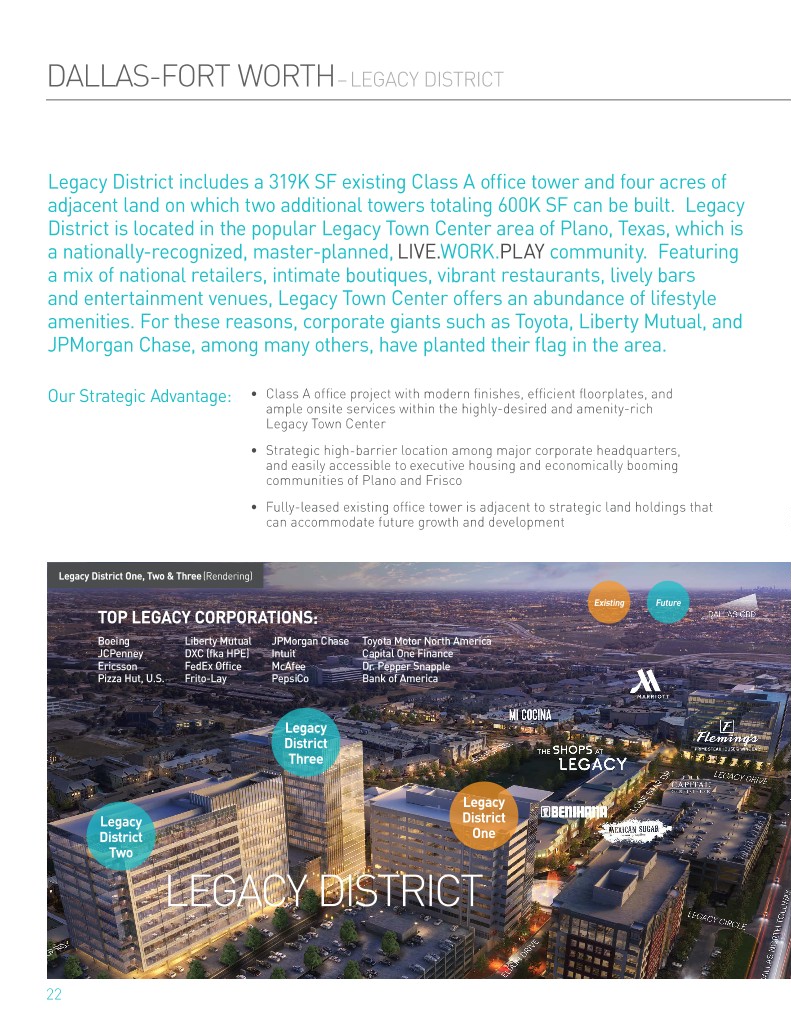

DALLAS-FORT WORTH – LEGACY DISTRICT Legacy District includes a 319K SF existing Class A office tower and four acres of adjacent land on which two additional towers totaling 600K SF can be built. Legacy District is located in the popular Legacy Town Center area of Plano, Texas, which is a nationally-recognized, master-planned, LIVE.WORK.PLAY community. Featuring a mix of national retailers, intimate boutiques, vibrant restaurants, lively bars and entertainment venues, Legacy Town Center offers an abundance of lifestyle amenities. For these reasons, corporate giants such as Toyota, Liberty Mutual, and JPMorgan Chase, among many others, have planted their flag in the area. Our Strategic Advantage: • Class A office project with modern finishes, efficient floorplates, and ample onsite services within the highly-desired and amenity-rich Legacy Town Center • Strategic high-barrier location among major corporate headquarters, and easily accessible to executive housing and economically booming communities of Plano and Frisco • Fully-leased existing office tower is adjacent to strategic land holdings that can accommodate future growth and development Legacy District One, Two & Three (Rendering) Existing Future TOP LEGACY CORPORATIONS: Boeing Liberty Mutual JPMorgan Chase Toyota Motor North America JCPenney DXC (fka HPE) Intuit Capital One Finance Ericsson FedEx Office McAfee Dr. Pepper Snapple Pizza Hut, U.S. Frito-Lay PepsiCo Bank of America Legacy District Three Legacy Legacy District District One Two LEGACY DISTRICT 22

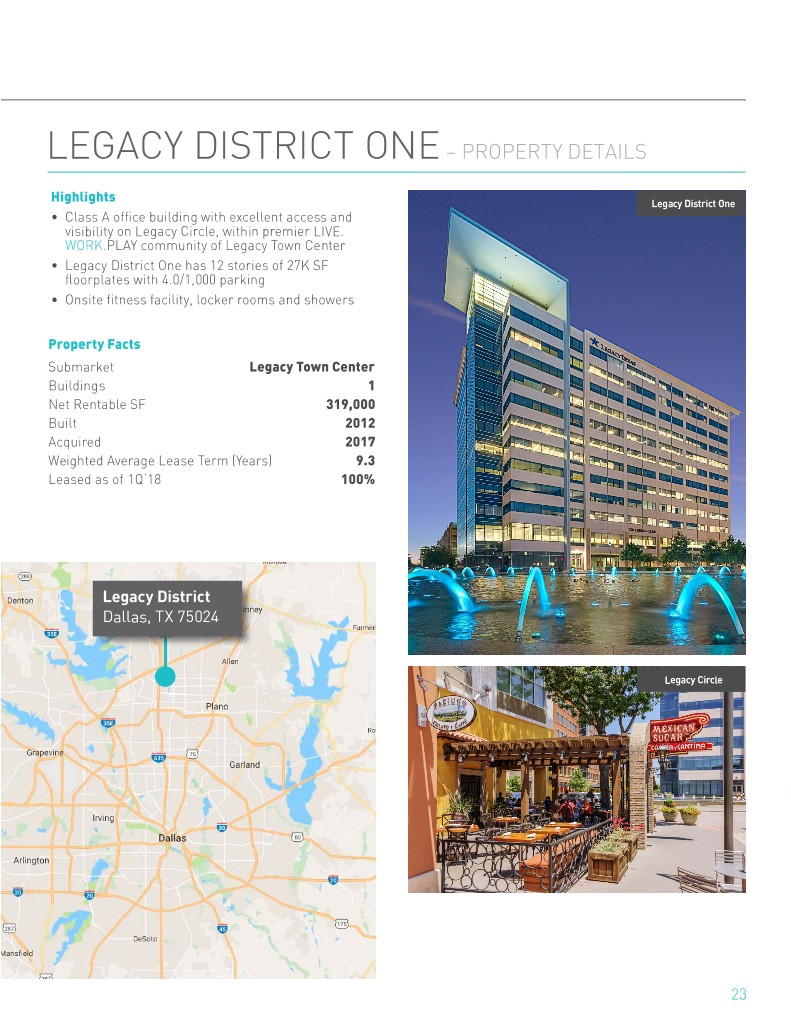

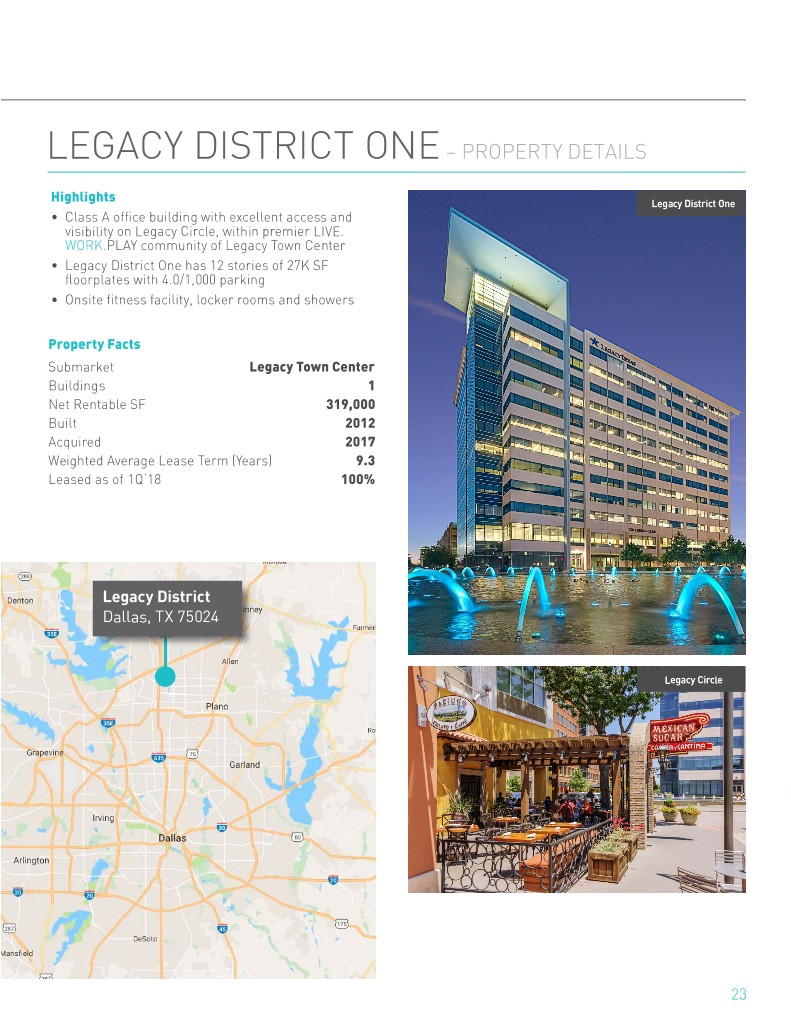

DALLAS-FORT WORTH – LEGACY DISTRICT LEGACY DISTRICT ONE – PROPERTY DETAILS Highlights Legacy District One • Class A office building with excellent access and visibility on Legacy Circle, within premier LIVE. WORK.PLAY community of Legacy Town Center • Legacy District One has 12 stories of 27K SF floorplates with 4.0/1,000 parking • Onsite fitness facility, locker rooms and showers Property Facts Submarket Legacy Town Center Buildings 1 Net Rentable SF 319,000 Built 2012 Acquired 2017 Weighted Average Lease Term (Years) 9.3 Leased as of 1Q‘18 100% Legacy District Dallas, TX 75024 Legacy Circle 23

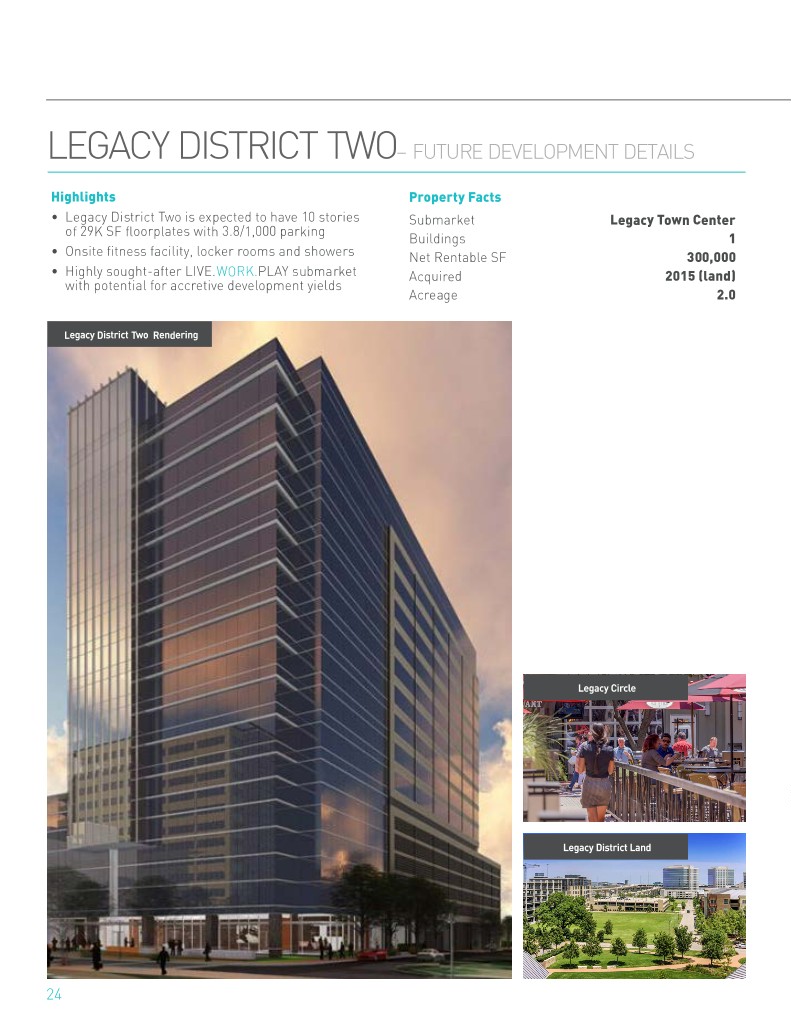

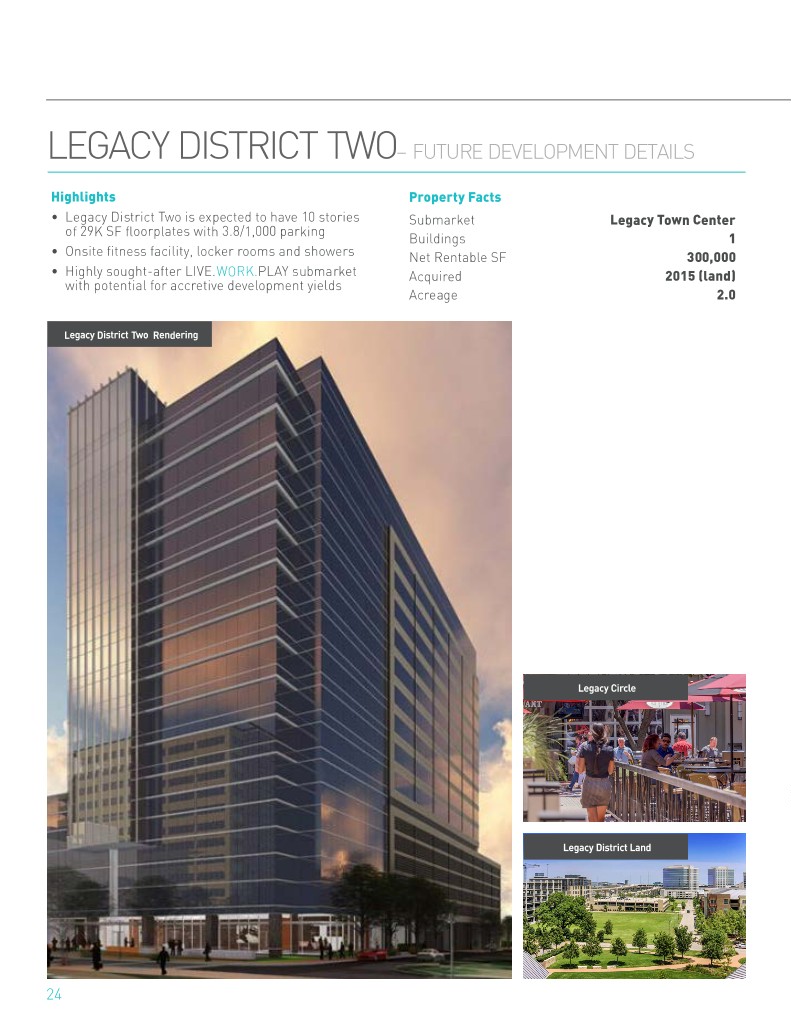

LEGACY DISTRICT TWO – FUTURE DEVELOPMENT DETAILS Highlights Property Facts • Legacy District Two is expected to have 10 stories Submarket Legacy Town Center of 29K SF floorplates with 3.8/1,000 parking Buildings 1 • Onsite fitness facility, locker rooms and showers Net Rentable SF 300,000 • Highly sought-after LIVE.WORK.PLAY submarket Acquired 2015 (land) with potential for accretive development yields Acreage 2.0 Legacy District Two Rendering Legacy Circle Legacy District Land 24

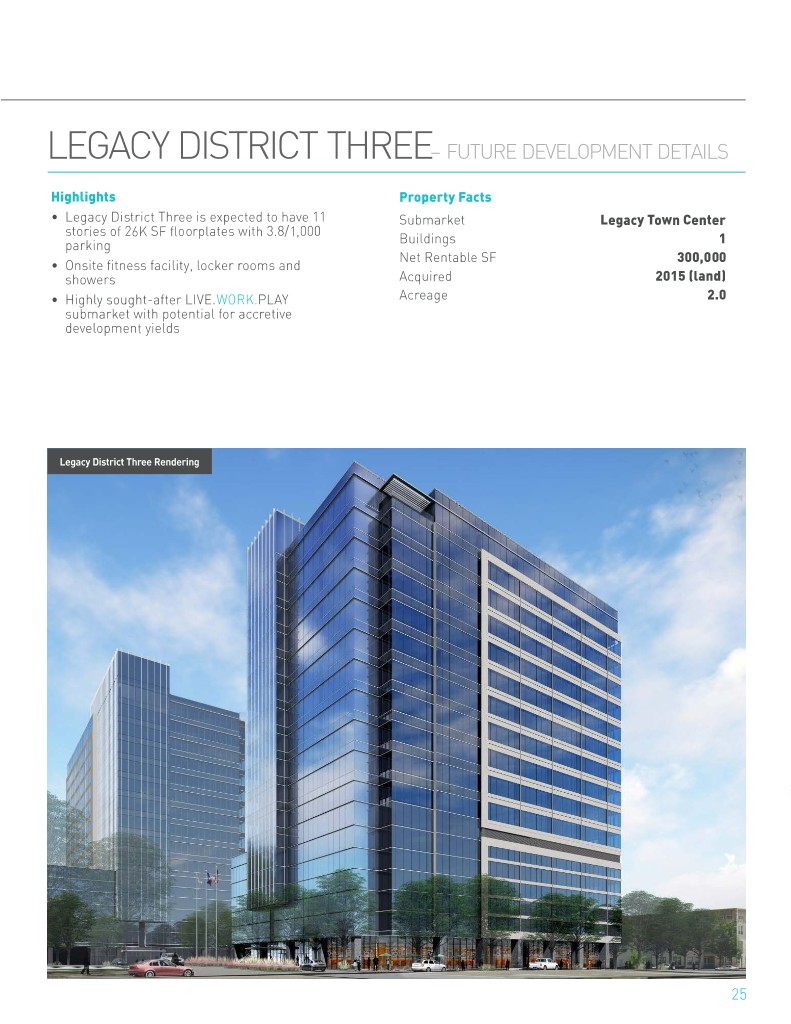

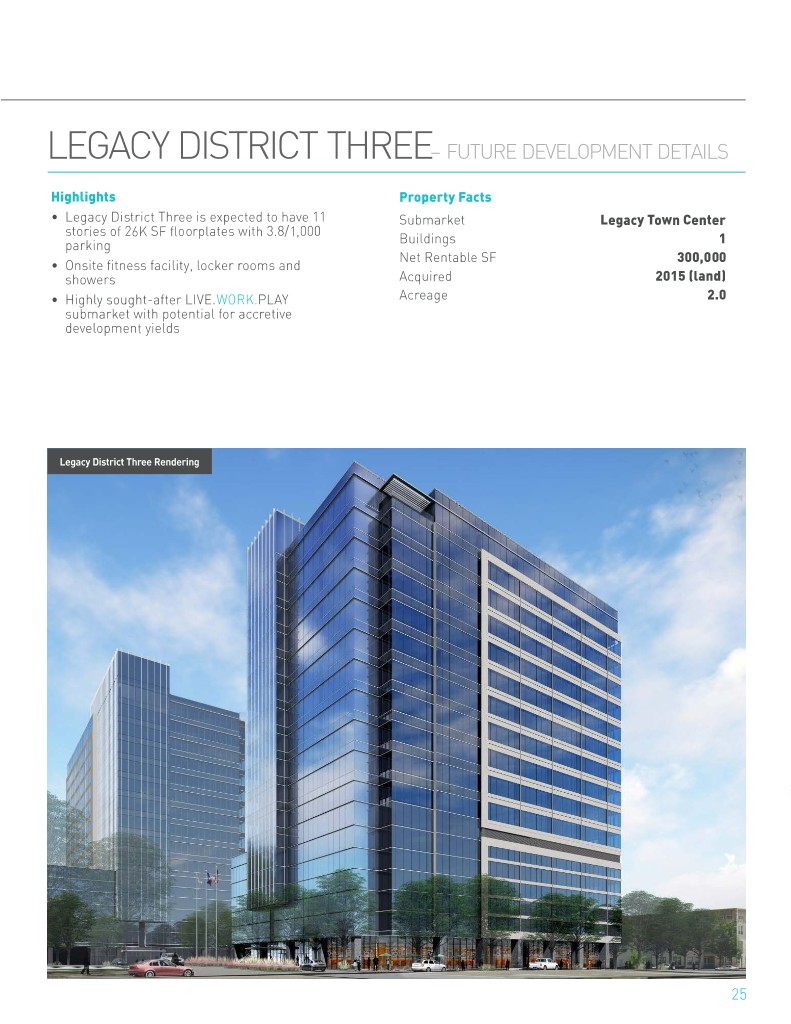

LEGACY DISTRICT TWO – FUTURE DEVELOPMENT DETAILS LEGACY DISTRICT THREE – FUTURE DEVELOPMENT DETAILS Highlights Property Facts • Legacy District Three is expected to have 11 Submarket Legacy Town Center stories of 26K SF floorplates with 3.8/1,000 1 parking Buildings Net Rentable SF 300,000 • Onsite fitness facility, locker rooms and showers Acquired 2015 (land) • Highly sought-after LIVE.WORK.PLAY Acreage 2.0 submarket with potential for accretive development yields Legacy District Three Rendering 25

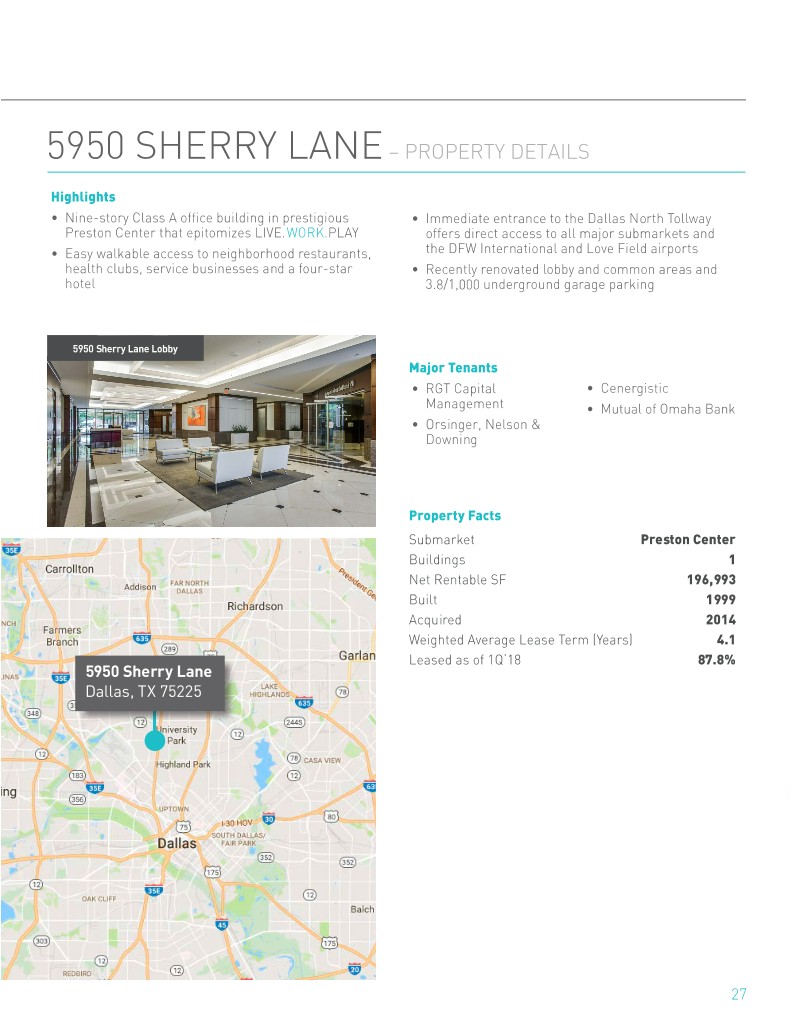

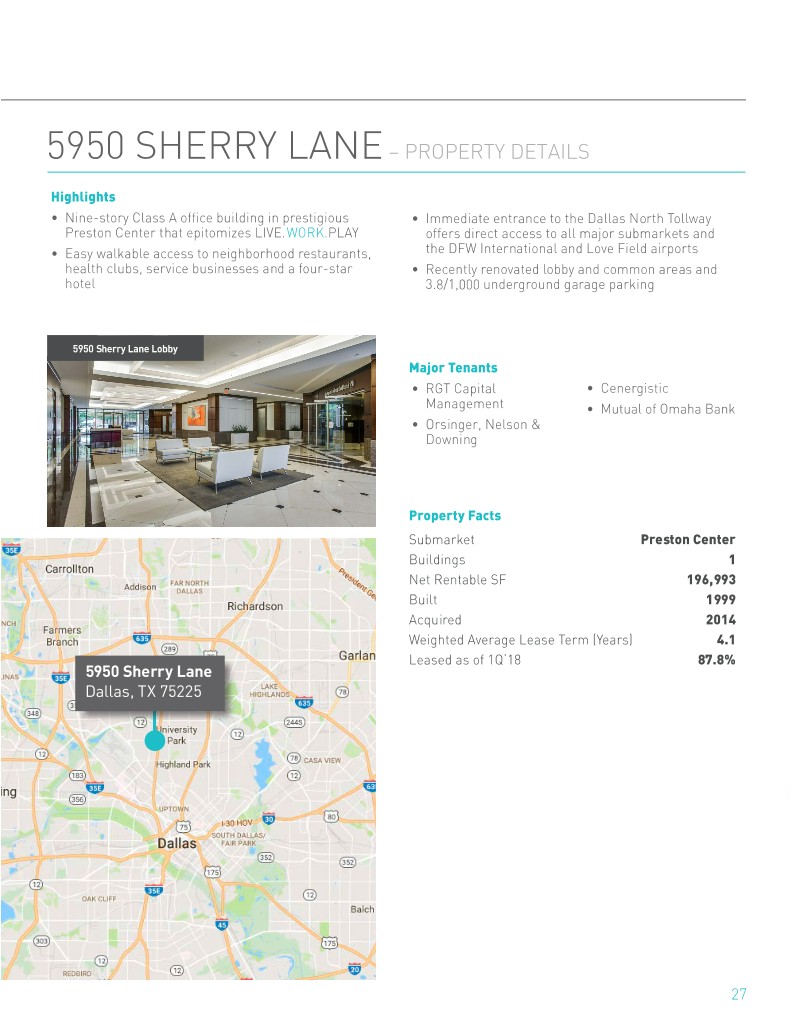

DALLAS-FORT WORTH – 5950 SHERRY LANE 5950 Sherry Lane, a 200K SF Class A office property, is located in the Preston Center submarket. With direct access to the Dallas North Tollway at the northwest corner of the Park Cities, the building enjoys convenient access to CBD, Uptown and Plano Legacy submarkets. As one of the most prestigious submarkets in Dallas, Preston Center is flanked by executive housing and abundant walkable amenities that epitomize LIVE.WORK.PLAY. Our Strategic Advantage: • Transformative $2mm renovation completed in 2016 has repositioned the property to best-in-class status among existing office buildings • High barriers to entry in Preston Center due to limited development sites and active neighborhood involvement • Opportunity for strong cash flow growth through lease up and favorable existing submarket fundamentals 5950 Sherry Lane 26

DALLAS-FORT WORTH – 5950 SHERRY LANE 5950 SHERRY LANE – PROPERTY DETAILS Highlights • Nine-story Class A office building in prestigious • Immediate entrance to the Dallas North Tollway Preston Center that epitomizes LIVE.WORK.PLAY offers direct access to all major submarkets and • Easy walkable access to neighborhood restaurants, the DFW International and Love Field airports health clubs, service businesses and a four-star • Recently renovated lobby and common areas and hotel 3.8/1,000 underground garage parking 5950 Sherry Lane Lobby Major Tenants • RGT Capital • Cenergistic Management • Mutual of Omaha Bank • Orsinger, Nelson & Downing Property Facts Submarket Preston Center Buildings 1 Net Rentable SF 196,993 Built 1999 Acquired 2014 Weighted Average Lease Term (Years) 4.1 Leased as of 1Q‘18 87.8% 5950 Sherry Lane Dallas, TX 75225 27

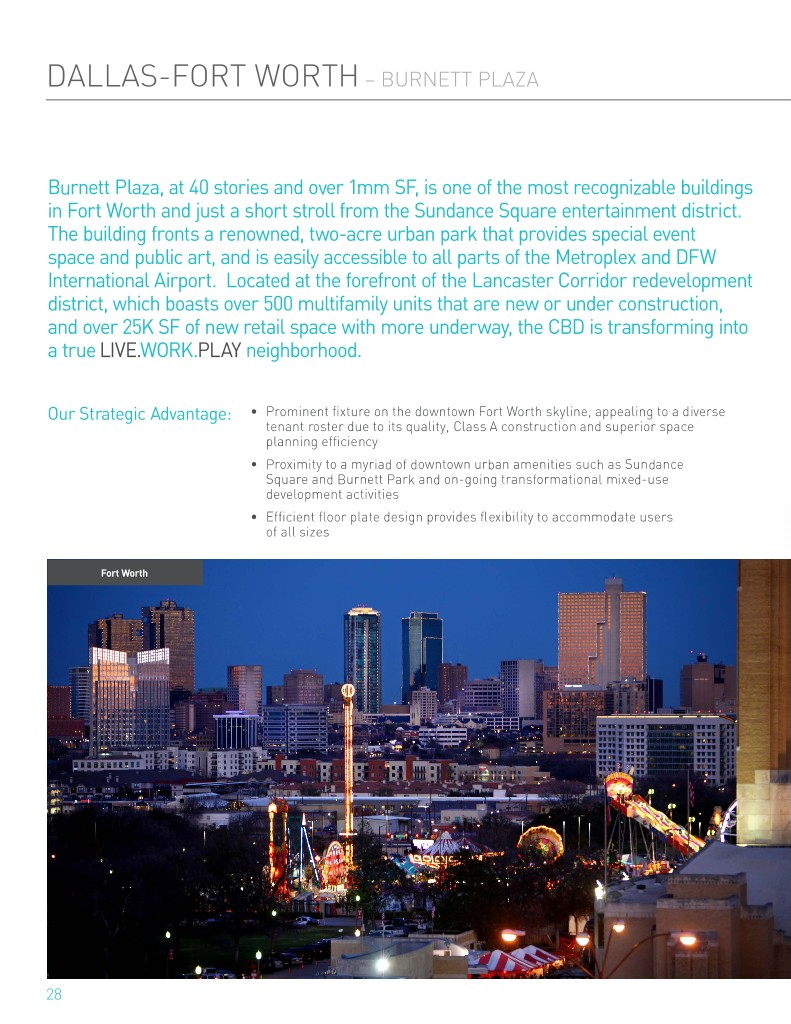

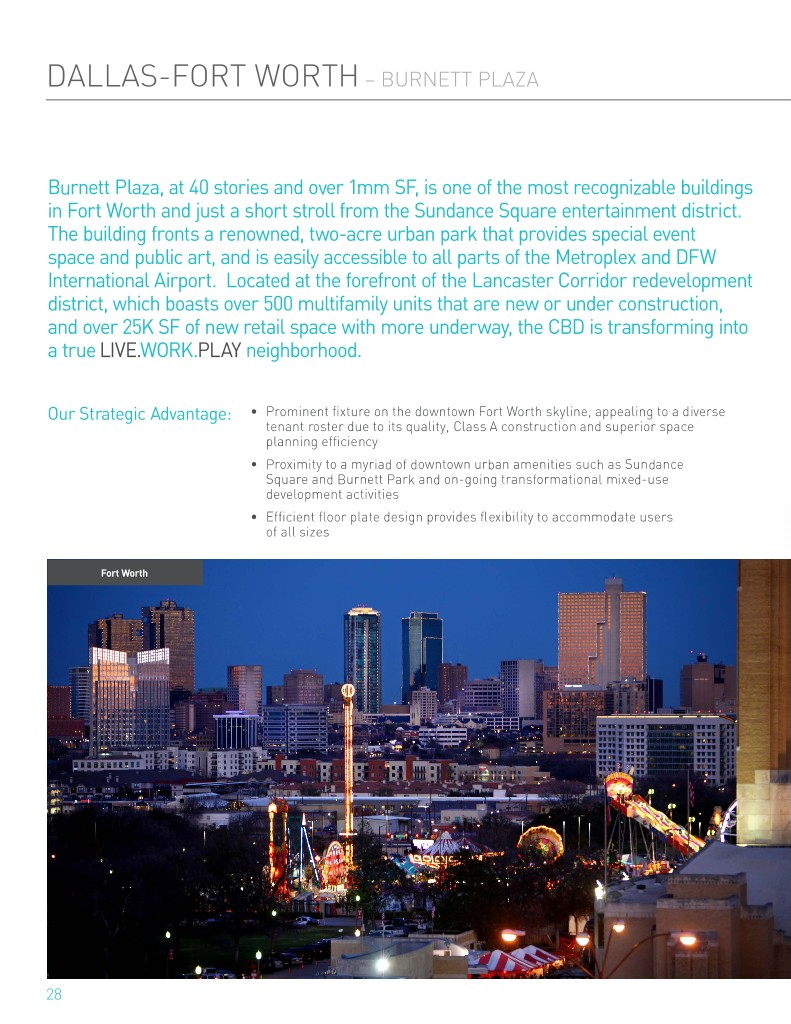

DALLAS-FORT WORTH – BURNETT PLAZA Burnett Plaza, at 40 stories and over 1mm SF, is one of the most recognizable buildings in Fort Worth and just a short stroll from the Sundance Square entertainment district. The building fronts a renowned, two-acre urban park that provides special event space and public art, and is easily accessible to all parts of the Metroplex and DFW International Airport. Located at the forefront of the Lancaster Corridor redevelopment district, which boasts over 500 multifamily units that are new or under construction, and over 25K SF of new retail space with more underway, the CBD is transforming into a true LIVE.WORK.PLAY neighborhood. Our Strategic Advantage: • Prominent fixture on the downtown Fort Worth skyline, appealing to a diverse tenant roster due to its quality, Class A construction and superior space planning efficiency • Proximity to a myriad of downtown urban amenities such as Sundance Square and Burnett Park and on-going transformational mixed-use development activities • Efficient floor plate design provides flexibility to accommodate users of all sizes Fort Worth 28

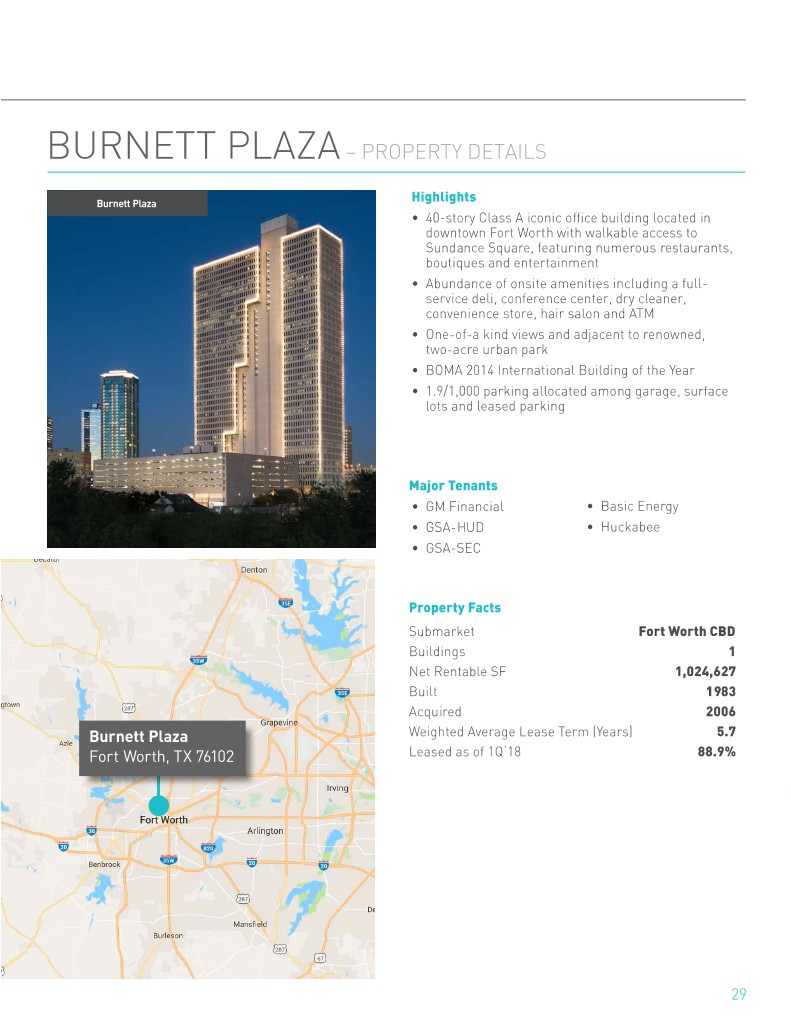

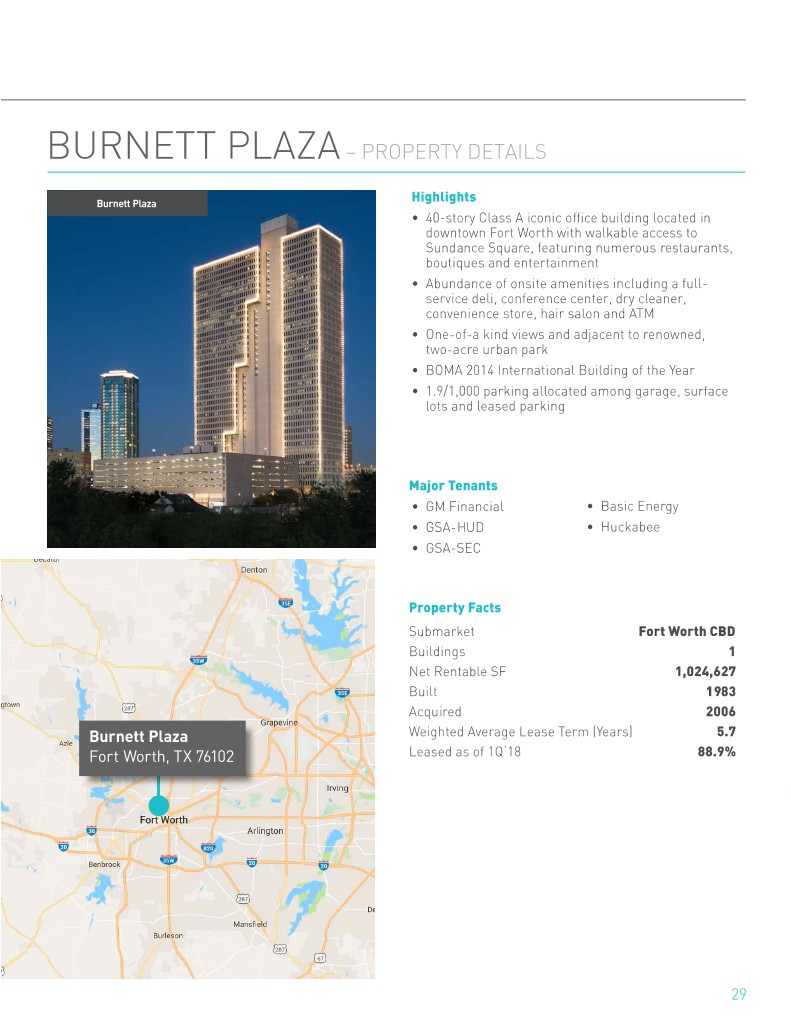

DALLAS-FORT WORTH – BURNETT PLAZA BURNETT PLAZA – PROPERTY DETAILS Burnett Plaza Highlights • 40-story Class A iconic office building located in downtown Fort Worth with walkable access to Sundance Square, featuring numerous restaurants, boutiques and entertainment • Abundance of onsite amenities including a full- service deli, conference center, dry cleaner, convenience store, hair salon and ATM • One-of-a kind views and adjacent to renowned, two-acre urban park • BOMA 2014 International Building of the Year • 1.9/1,000 parking allocated among garage, surface lots and leased parking Major Tenants • GM Financial • Basic Energy • GSA-HUD • Huckabee • GSA-SEC Property Facts Submarket Fort Worth CBD Buildings 1 Net Rentable SF 1,024,627 Built 1983 Acquired 2006 Burnett Plaza Weighted Average Lease Term (Years) 5.7 Fort Worth, TX 76102 Leased as of 1Q‘18 88.9% 29

TARGET GROWTH MARKET HOUSTON 30

LIVE.WORK.PLAY – IN HOUSTON HOUSTON is the nation’s 4th most populous city and boasts one of the most robust and dynamic economies in the U.S. From 2010 to 2014, Houston added more than 450K jobs, and in spite of the recent energy downturn, the city has sustained positive year-over-year job growth. No longer just a “big oil” town, Houston has a highly-diversified, international economy, and is one of the world’s best places to live, work and build a business. The Space City boasts championship-quality professional sports teams, an acclaimed culinary and HOUSTON cultural scene, and world renowned parks and urban green spaces. According to Costar: 18 2X Diversified 35 companies in the Over the past 10 years, the The Houston metro has continued to diversify from an oil & gas focus Fortune 1000 and Houston population has since the ‘80s. Health care in particular has continued to provide high- 18 in the Fortune 500 expanded at a pace more than paying jobs throughout the metro. The Texas Medical Center is the largest double the national average medical complex in the world and eighth-largest business district in the US (2.2% v. 1.0%). encompassing more than 50mm developed square feet. Additionally, the Port of Houston is the largest Gulf Coast container port and has ranked 1st in import tonnage and 2nd in total tonnage for over 23 years. 31

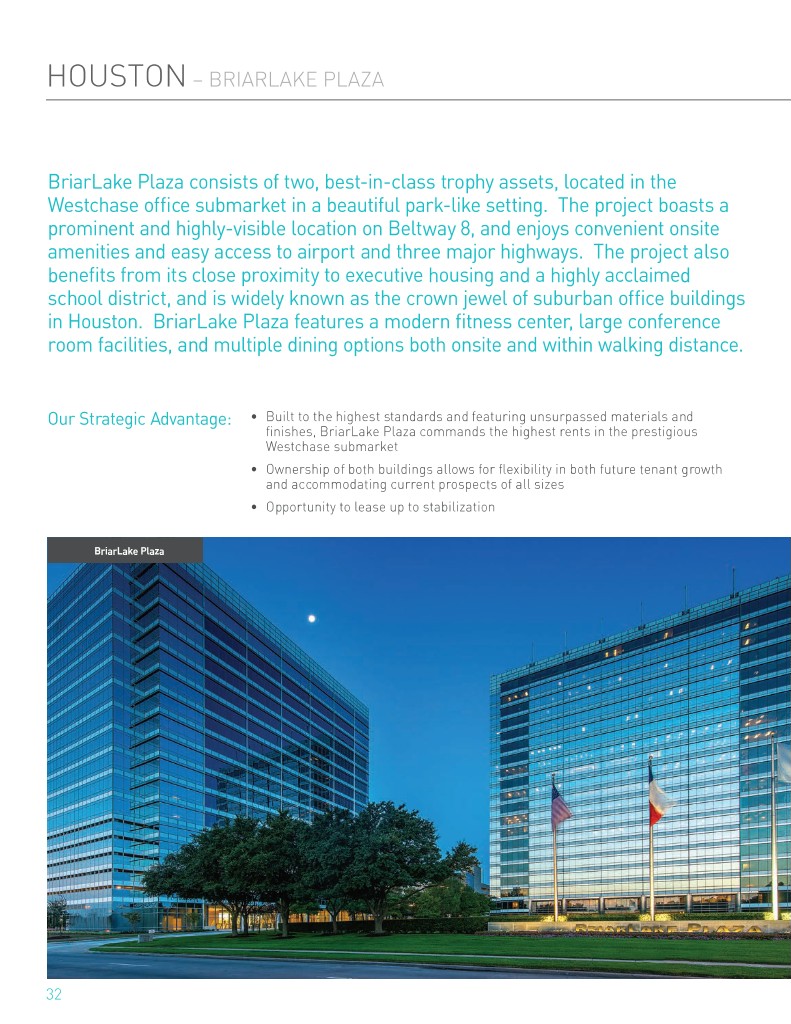

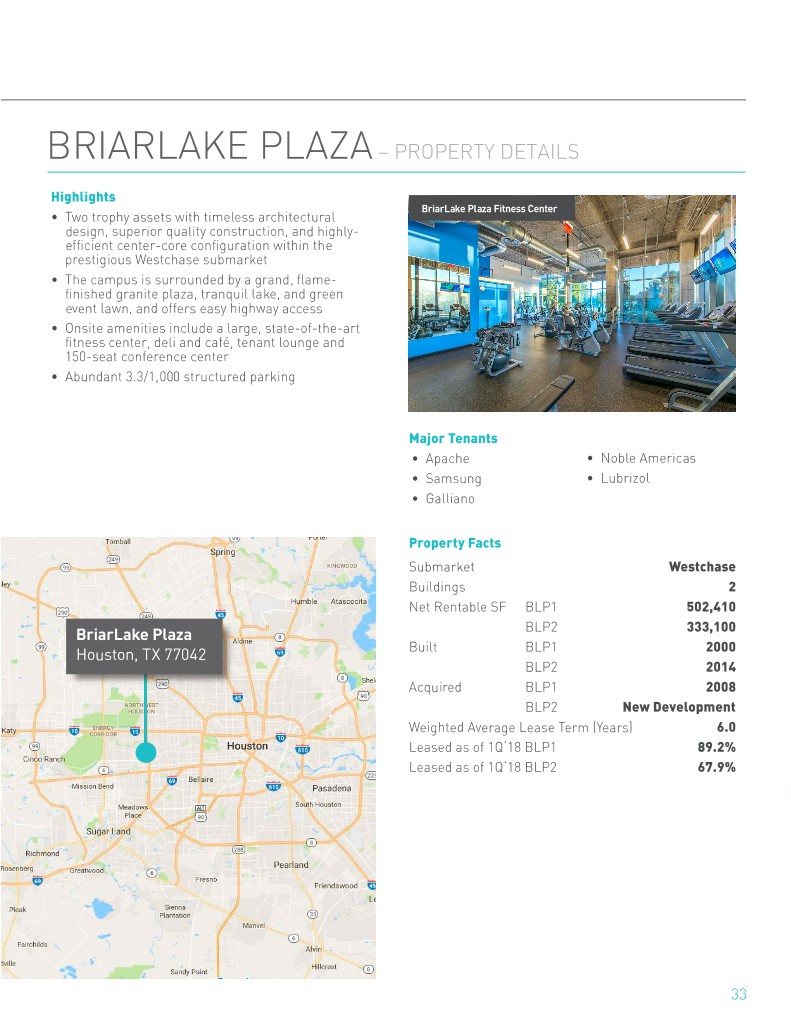

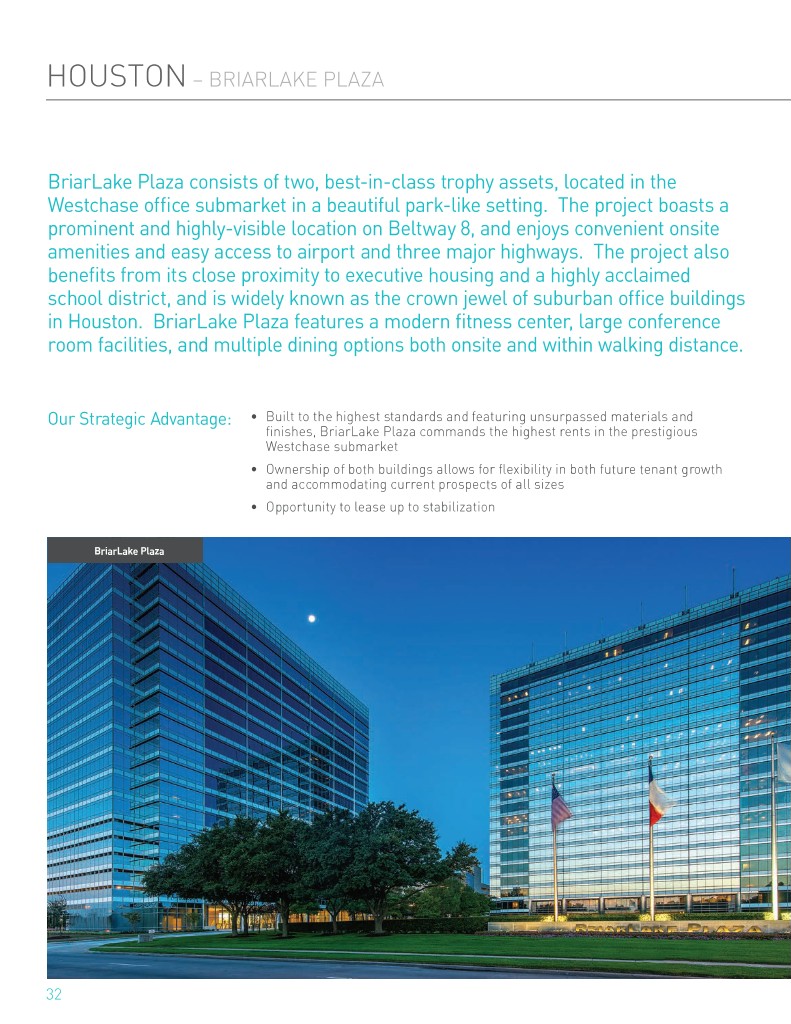

HOUSTON – BRIARLAKE PLAZA BriarLake Plaza consists of two, best-in-class trophy assets, located in the Westchase office submarket in a beautiful park-like setting. The project boasts a prominent and highly-visible location on Beltway 8, and enjoys convenient onsite amenities and easy access to airport and three major highways. The project also benefits from its close proximity to executive housing and a highly acclaimed school district, and is widely known as the crown jewel of suburban office buildings in Houston. BriarLake Plaza features a modern fitness center, large conference room facilities, and multiple dining options both onsite and within walking distance. Our Strategic Advantage: • Built to the highest standards and featuring unsurpassed materials and finishes, BriarLake Plaza commands the highest rents in the prestigious Westchase submarket • Ownership of both buildings allows for flexibility in both future tenant growth and accommodating current prospects of all sizes • Opportunity to lease up to stabilization BriarLake Plaza 32

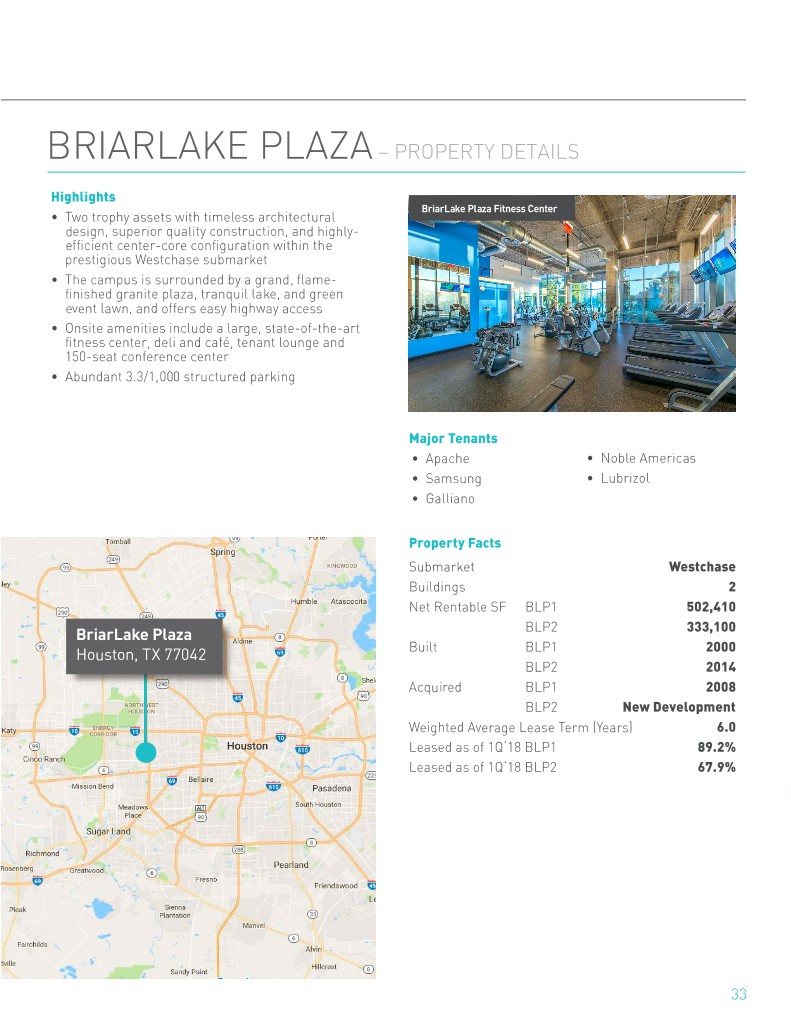

HOUSTON – BRIARLAKE PLAZA BRIARLAKE PLAZA – PROPERTY DETAILS Highlights BriarLake Plaza Fitness Center • Two trophy assets with timeless architectural design, superior quality construction, and highly- efficient center-core configuration within the prestigious Westchase submarket • The campus is surrounded by a grand, flame- finished granite plaza, tranquil lake, and green event lawn, and offers easy highway access • Onsite amenities include a large, state-of-the-art fitness center, deli and café, tenant lounge and 150-seat conference center • Abundant 3.3/1,000 structured parking Major Tenants • Apache • Noble Americas • Samsung • Lubrizol • Galliano Property Facts Submarket Westchase Buildings 2 Net Rentable SF BLP1 502,410 BriarLake Plaza BLP2 333,100 2000 Houston, TX 77042 Built BLP1 BLP2 2014 Acquired BLP1 2008 BLP2 New Development Weighted Average Lease Term (Years) 6.0 Leased as of 1Q‘18 BLP1 89.2% Leased as of 1Q‘18 BLP2 67.9% 33

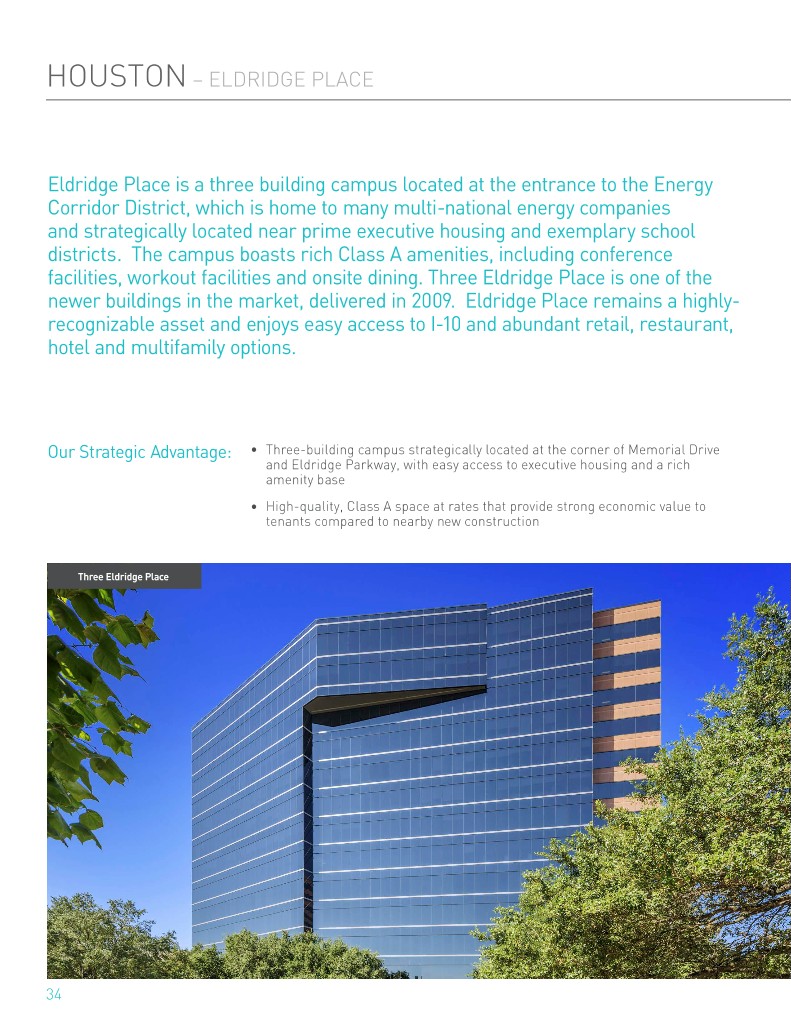

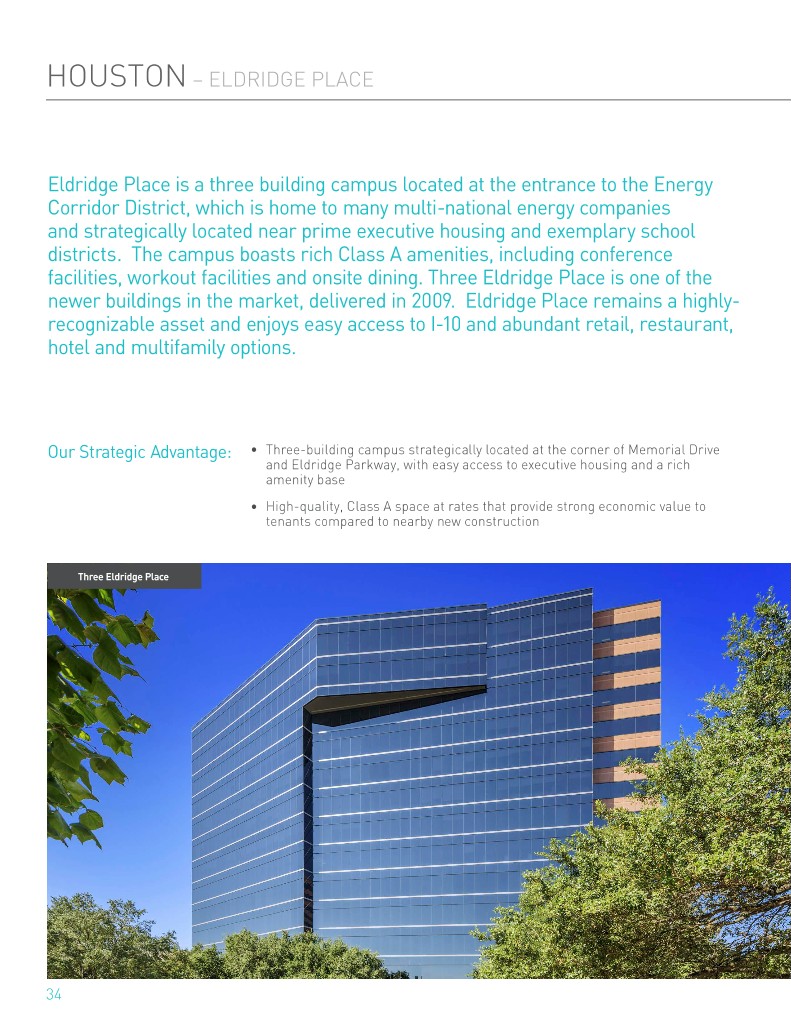

HOUSTON – ELDRIDGE PLACE Eldridge Place is a three building campus located at the entrance to the Energy Corridor District, which is home to many multi-national energy companies and strategically located near prime executive housing and exemplary school districts. The campus boasts rich Class A amenities, including conference facilities, workout facilities and onsite dining. Three Eldridge Place is one of the newer buildings in the market, delivered in 2009. Eldridge Place remains a highly- recognizable asset and enjoys easy access to I-10 and abundant retail, restaurant, hotel and multifamily options. Our Strategic Advantage: • Three-building campus strategically located at the corner of Memorial Drive and Eldridge Parkway, with easy access to executive housing and a rich amenity base • High-quality, Class A space at rates that provide strong economic value to tenants compared to nearby new construction Three Eldridge Place 34

HOUSTON – ELDRIDGE PLACE ELDRIDGE PLACE – PROPERTY DETAILS Highlights Property Facts • Three-building Class A campus with easy access Submarket Katy Freeway West to adjacent parks, hike and bike trails and green space Buildings 3 • Onsite fitness center, conference room, and deli Net Rentable SF 824,632 • Abundant 3.1/1,000 structured parking Built EP1 & EP2 1984-1986 EP3 2009 Major Tenants Acquired EP1 & EP2 2006 • BP Amoco • SM Energy EP3 New Development • McDermott Inc. • Marubeni Oil & Gas Weighted Average Lease Term (Years) 2.4 Leased as of 1Q‘18 EP1 and EP2 72.1% Leased as of 1Q‘18 EP3 71.1% One & Two Eldridge Place Eldridge Place Houston, TX 77079 35

TARGET GROWTH MARKET CHARLOTTE 36

LIVE.WORK.PLAY – IN CHARLOTTE The Queen City is a royal venue for high-growth tenants and employees. Its pro- business attitude has a long and rich pedigree among banking and finance, but more recently, has been winning accolades as a “top tech momentum market” according to CBRE. As the 16th largest city within the U.S. with a convenient, central East Coast location, Charlotte is indeed in the center of it all when it comes to a diverse and highly-educated population, world-class airport and vibrant culture. It’s no surprise that over a third of Charlotte’s regional economy is CHARLOTTE crowned with headquarters operations. According to Costar: 8.6% growth 2X Destination The Charlotte office market continues to perform well, Over the past 10 years, Charlotte remains a major destination for with 8.6% year-over-year rent growth as of 3.31.18. Charlotte’s population retirees, young professionals, and others drawn has expanded at a pace to the eclectic atmosphere and opportunities two times faster than of the Queen City. The flow of high-quality jobs, the national average. affordable living costs and above-average job growth should continue to attract new residents. 37

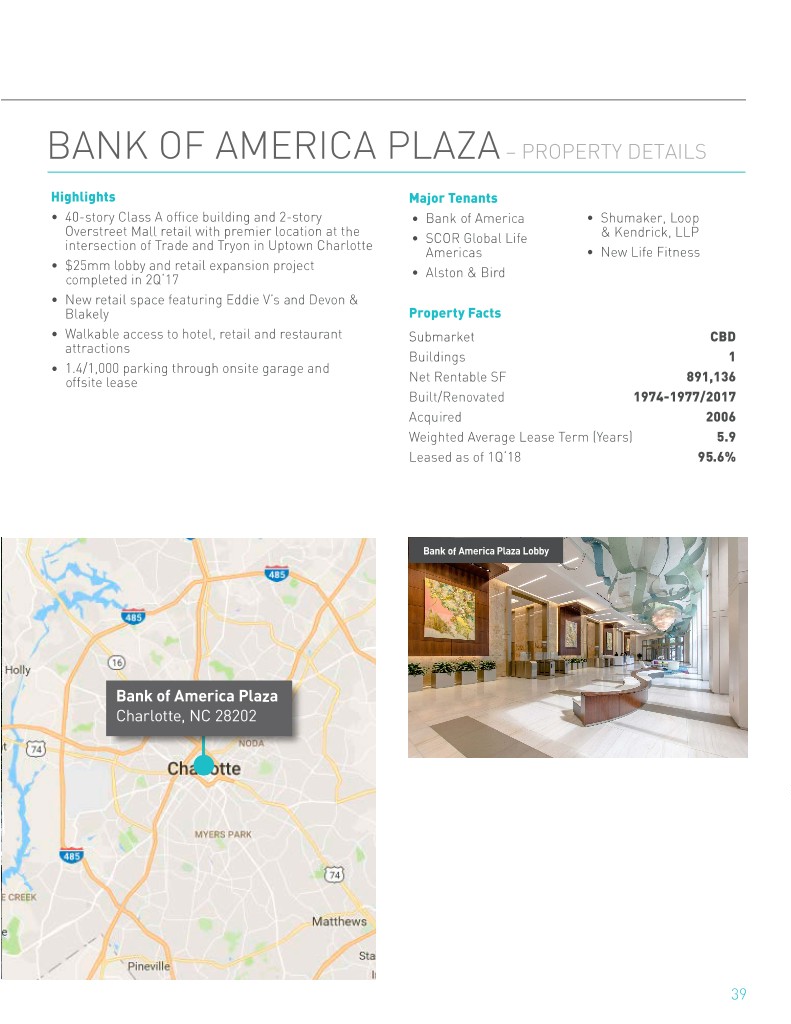

CHARLOTTE – BANK OF AMERICA PLAZA Bank of America Plaza is located at the intersection of Trade and Tryon in the heart of Charlotte’s premier Uptown submarket. Directly across from Bank of America’s headquarters and with a diverse, high-credit tenant roster, Bank of America Plaza is a fixture on the Charlotte skyline. As a result of a $25 million renovation, the building has retained its market-leading status among existing trophy buildings. The renovation has energized this premier location with several new restaurants, including Essex Bar & Bistro, Eddie V’s Prime Seafood, and Devon & Blakely, along with a completely redesigned ground floor including a modern lobby with contemporary finishes and artwork. Our Strategic Advantage: • Iconic skyline presence and “Main and Main” location in the heart of Uptown Charlotte • Ability to significantly increase long-term cash flow from mark-to-market opportunities • Highly-amenitized location with connection to the Overstreet Mall and Omni Hotel, and walkable to all major sports, entertainment and cultural attractions in Uptown Bank of America Plaza Bank of America Plaza 38

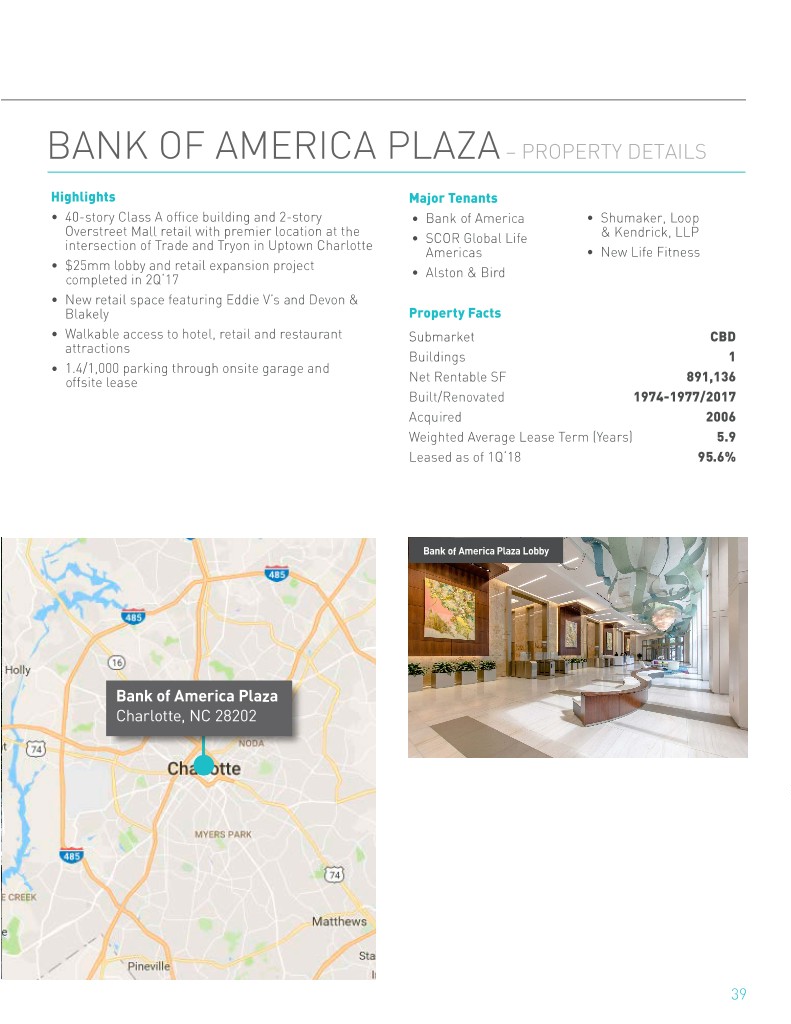

CHARLOTTE – BANK OF AMERICA PLAZA BANK OF AMERICA PLAZA – PROPERTY DETAILS Highlights Major Tenants • 40-story Class A office building and 2-story • Bank of America • Shumaker, Loop Overstreet Mall retail with premier location at the • SCOR Global Life & Kendrick, LLP intersection of Trade and Tryon in Uptown Charlotte Americas • New Life Fitness • $25mm lobby and retail expansion project • Alston & Bird completed in 2Q‘17 • New retail space featuring Eddie V’s and Devon & Blakely Property Facts • Walkable access to hotel, retail and restaurant Submarket CBD attractions Buildings 1 • 1.4/1,000 parking through onsite garage and offsite lease Net Rentable SF 891,136 Built/Renovated 1974-1977/2017 Acquired 2006 Weighted Average Lease Term (Years) 5.9 Leased as of 1Q‘18 95.6% Bank of America Plaza Lobby Bank of America Plaza Charlotte, NC 28202 39

TARGET GROWTH MARKET NASHVILLE 40

LIVE.WORK.PLAY – IN NASHVILLE The Music Capital in the heart of Tennessee is the largest metro area in the five- state region. Many corporate giants call Nashville home, in addition to serving as a national hub for the creative class and hosting the strongest concentration of the music industry in America. Nashville boasts a diverse economy, low costs of living and doing business, a creative culture and a well-educated population, which together make Nashville among the nation’s best locations for relocating, NASHVILLE expanding and startup companies. According to Costar: 44% More 2X 200+ Nashville has nearly 44% more office workers now than Over the past 10 years Per the Chamber of Commerce, over the at the height of the last cycle, making for the second Nashville’s population past two years, more than 200 companies strongest office-job recovery in the national index has expanded at a pace have either relocated to or expanded in markets, behind Austin. almost double the national the Nashville metro. average (1.8% v. 1.0%). 41

NASHVILLE – METROCENTER MetroCenter is ideally situated just thirteen blocks from the Central Business District. It is one of Nashville’s first master-planned office developments and has traditionally been home to a majority of the federal and state agencies in the city. TIER REIT’s investment includes a three-building complex that is considered a top- of-market asset within the submarket. Our Strategic Advantage: • Best-in-class asset for the MetroCenter submarket • Fully-developed submarket with high barriers to entry • Strategic location that attracts long-term, stable federal and state tenants Plaza at MetroCenter Atrium Lobby 42

NASHVILLE – METROCENTER METROCENTER – PROPERTY DETAILS Highlights Property Facts • Class A office campus located just thirteen blocks Submarket MetroCenter from the CBD and located in the largest master- Buildings 3 planned business community in Nashville Net Rentable SF 361,000 • Distinguished architectural design, beautiful landscape, elegant fountains, expansive boulevards, Built 1985 and serene lake views Acquired 2007 • Located within one mile of major interstate Weighted Average Lease Term (Years) 9.6 junctions and minutes from the Nashville Metropolitan Airport, West End and the CBD Leased as of 1Q‘18 90.3% • 3.3/1,000 surface parking Major Tenants • State of Tennessee Dept. • Brown & Caldwell of Human Services • RR Donnelley & Sons • State of Tennessee Dept. • Ensafe, Inc. of Children’s Services Plaza at MetroCenter MetroCenter Nashville, TN 37228 Fountain Pool 43

tierreit.com Investor + Relations TIER REIT, Inc. 5950 Sherry Lane, Suite 700 InvestorDallas, TX 75225 Information 972.483.2400 Please visit our website at www.tierreit.com/ir to sign up for press releases, conference call information and other timely communications. Sustainable + Responsible TIER REIT believes that high-performing, sustainably-operated buildings are not just good for our environment and communities, but they also create economic value for our tenants, stockholders and employees. 11 Our portfolio of high-quality and environmentally-designed and operated Number of LEED certified properties are among the best managed in the industry. TIER REIT is office buildings as of 1Q’18 a leader in BOMA 360 designations, and a significant portion of our portfolio is Energy Star labeled or LEED certified. Our efforts have earned us a prestigious “Green Star” in the Global Real Estate Sustainability Benchmark for the past several years, while the Association of Energy Engineers, in which our head of engineering serves as a Fellow Member, named TIER REIT the winner of the 2017 Corporate Energy Management award (Region IV). We are proud of the accomplishments we have made and our commitment to healthy, sustainable and environmental best practices throughout our business operations. Forward-Looking Statements This document contains forward-looking statements relating to the business and financial outlook of TIER REIT that are based on our current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this document. Such factors include those described in the Risk Factors section of our most recent Form 10-K. Forward-looking statements in this document speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events. We claim the safe harbor protection for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The modeling, projections, analyses, and other forward-looking information prepared by CoStar Portfolio Strategy, LLC (“CoStar”) and presented herein are based on financial and other information from public and proprietary sources, as well as various assumptions concerning future events and circumstances that are speculative, uncertain and subject to change without notice. Actual results and events may differ materially from the projections presented. All CoStar materials set forth herein (“CoStar Materials”) speak only as of the date referenced and may have materially changed since such date. CoStar does not purport that the CoStar Materials herein are comprehensive, and, while they are believed to be accurate, the CoStar Materials are not guaranteed to be free from error, omission or misstatement. CoStar has no obligation to update any of the CoStar Materials included in this document. All CoStar Materials are provided “as is,” without any guarantees, representations or warranties of any kind, including implied warranties of merchantability, non-infringement, title and fitness for a particular purpose. To the maximum extent permitted by law, CoStar disclaims any and all liability in the event any CoStar Materials prove to be inaccurate, incomplete or unreliable. CoStar does not sponsor, endorse, offer or promote an investment in the securities of TIER REIT, Inc. You should not construe any of the CoStar Materials as investment, tax, accounting or legal advice. 5.2018