Supplemental Operating and Financial Data

For the Quarter Ended September 30, 2018

About the Company

TIER REIT, Inc. is a publicly traded (NYSE: TIER), self-managed, Dallas-based real estate investment trust focused on owning quality, well-managed commercial office properties in dynamic markets throughout the U.S. TIER REIT’s vision is to be the premier owner and operator of best-in-class office properties in TIER1 submarkets, which are primarily higher density and amenity-rich locations within select, high-growth metropolitan areas that offer a walkable experience to various amenities. Our mission is to provide unparalleled, TIER ONE Property Services to our tenants and outsized total return through stock price appreciation and dividend growth to our stockholders.

As of September 30, 2018, we owned interests in 18 operating office properties with approximately 6.7 million rentable square feet and three development properties that will consist of approximately 989,000 rentable square feet. As of September 30, 2018, our operating properties are located in six markets throughout the United States.

|

| | |

| Board of Directors | | Executive Officers and Senior Management |

| Richard I. Gilchrist | | Scott W. Fordham |

| Chairman of the Board and Independent Director | | Chief Executive Officer and Director |

| | | |

| Scott W. Fordham | | Dallas E. Lucas |

| Chief Executive Officer and Director | | President and Chief Operating Officer |

| | | |

| R. Kent Griffin, Jr. | | James E. Sharp |

| Independent Director | | Chief Financial Officer and Treasurer |

| | | |

| Thomas M. Herzog | | William J. Reister |

| Independent Director | | Chief Investment Officer and Executive Vice President |

| | | |

| Dennis J. Martin | | Telisa Webb Schelin |

| Independent Director | | Chief Legal Officer, Executive Vice President, and Secretary |

| | | |

| Gregory J. Whyte | | Hannah Q. Wrenn |

| Independent Director | | Chief Accounting Officer |

| | | |

| | | R. Heath Johnson |

| | | Managing Director - Asset Management |

| | | |

| | | Dean R. Hook |

| | | Senior Vice President - Information Technology and Property Management |

| | |

| | | |

|

| | | | | | |

| Company Information | | |

| Corporate Headquarters | | Website | | Trading Information | | Investor inquiries should be directed to: |

| 5950 Sherry Lane, Suite 700 | | www.tierreit.com | | Trading Symbol: TIER | | Scott A. McLaughlin |

| Dallas, Texas 75225 | | | | New York Stock Exchange | | Senior Vice President - Investor Relations |

| | | | | | | at 972.483.2400 or ir@tierreit.com |

| | | | | | | |

| | | | | | | |

|

| | | | | | | | |

| Research Coverage | | | | | | |

| BMO Capital | | Janney Montgomery Scott | | JMP Securities | | J.P. Morgan Securities | | Robert W. Baird & Co. |

| John Kim | | Robert Stevenson | | Mitch Germain | | Anthony Paolone | | David Rodgers |

| 212.885.4115 | | 646.840.3217 | | 212.906.3546 | | 212.622.6682 | | 216.737.7341 |

Supplemental Operating and Financial Data

For the Quarter Ended September 30, 2018

Table of Contents

|

| | |

| Overview and Highlights | |

| Overview | 1 |

|

| Financial Highlights | 2-3 |

|

| Consolidated Balance Sheets | 4 |

|

| Consolidated Statements of Operations | 5 |

|

| Calculations of FFO and Additional Information | 6 |

|

| Calculations of EBITDAre | 7 |

|

| Unconsolidated Entities Financial Summary | 8 |

|

| Same Store Analysis | 9 |

|

| Schedule of Properties Owned | 10 |

|

| Portfolio Analysis | 11 |

|

| Components of Net Asset Value | 12 |

|

| Significant Tenants | 13 |

|

| Industry Diversification | 14 |

|

| | |

| Leasing | |

| Leasing Activity | 15-16 |

|

| Lease Expirations | 17-18 |

|

| Occupancy Trends | 19 |

|

| | |

| Capital Expenditures | |

| Leasing Cost Summary | 20 |

|

| Development, Leasing, and Capital Expenditures Summary | 21 |

|

| | |

| Other Information | |

| Potential Future Development and Redevelopment Sites | 22 |

|

| Summary of Development Activity | 23 |

|

| Properties Under Development | 24-27 |

|

| Acquisition and Disposition Activities | 28 |

|

| Summary of Financing | 29 |

|

| Principal Payments by Year | 30 |

|

| Definitions of Non-GAAP Financial Measures | 31-32 |

|

Forward-Looking Statements

This supplemental operating and financial data report contains forward-looking statements within the meaning of the federal securities laws relating to the business and financial outlook of TIER REIT, Inc. that are based on current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Statements contained herein may be impacted by a number of risks and uncertainties, including the company’s ability to rent space on favorable terms, its ability to address debt maturities and fund its capital requirements, its intentions to acquire, develop, or sell certain properties, the value of its assets, its anticipated capital expenditures, and other matters. Words such as “may,” "will," “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “outlook,” “would,” “could,” “should,” “objectives,” “strategies,” “opportunities,” “goals,” “position,” “future,” “vision,” “mission,” “strive,” “project” and variations of these words and similar expressions are intended to identify forward-looking statements. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this document, as well as other factors described in the Risk Factors section of TIER REIT, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2017. Forward-looking statements in this document speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events.

Overview

For the Quarter Ended September 30, 2018

| |

| • | Occupancy at September 30, 2018, was 90.1%, reflecting an increase of 70 basis points from June 30, 2018. |

| |

| • | 120,000 square feet leased - 26,000 square feet of renewals, 19,000 square feet of expansions, and 75,000 square feet of new leasing. |

| |

| • | During the third quarter of 2018, we received $0.7 million in business interruption insurance proceeds related to rent abatements provided in previous periods as a result of Hurricane Harvey. We anticipate we will receive additional business interruption insurance proceeds in subsequent quarters. |

| |

| • | Plaza at MetroCenter was held for sale as of September 30, 2018, and was sold on October 31, 2018, for a contract purchase price of $51.3 million. |

| |

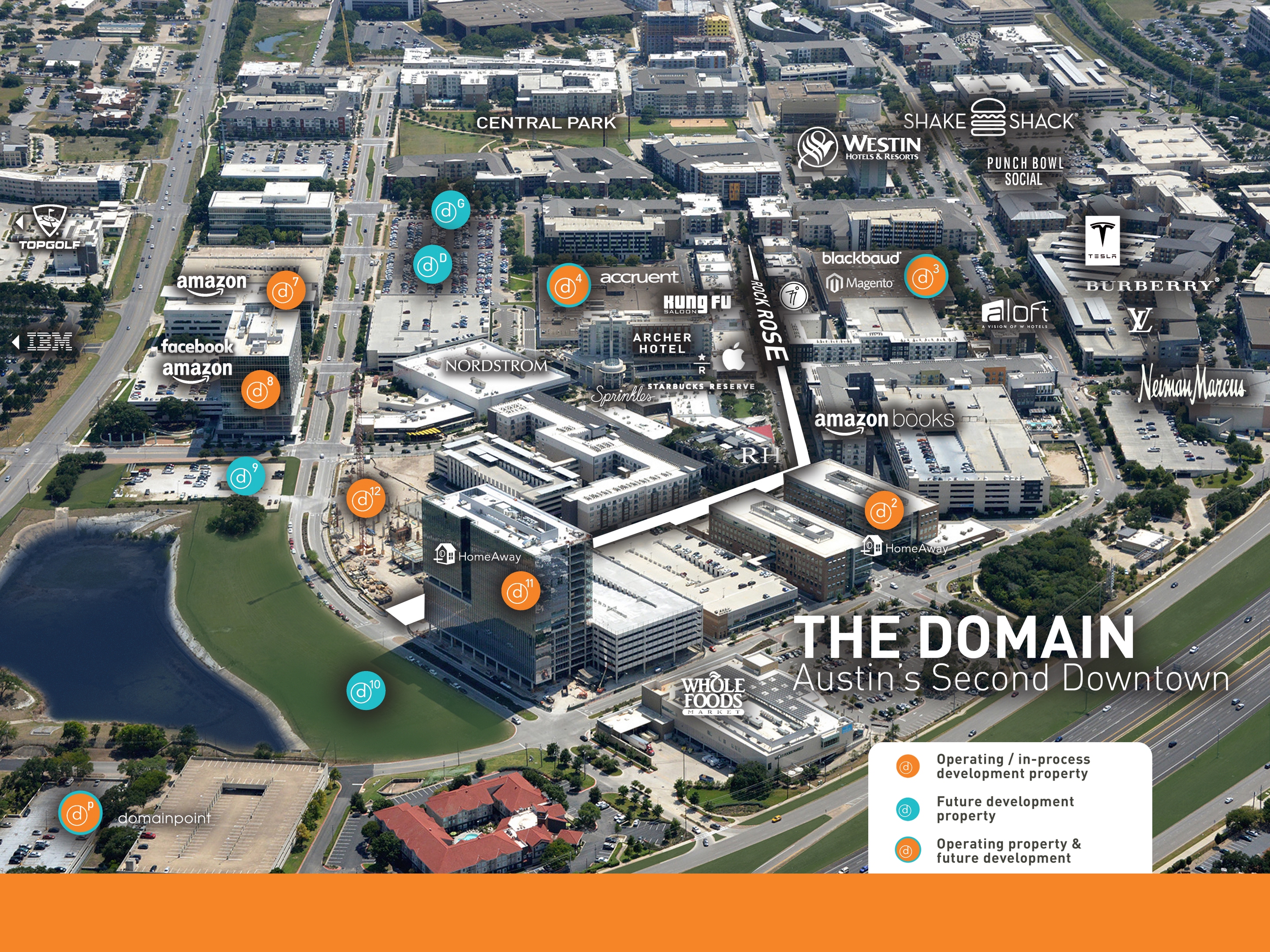

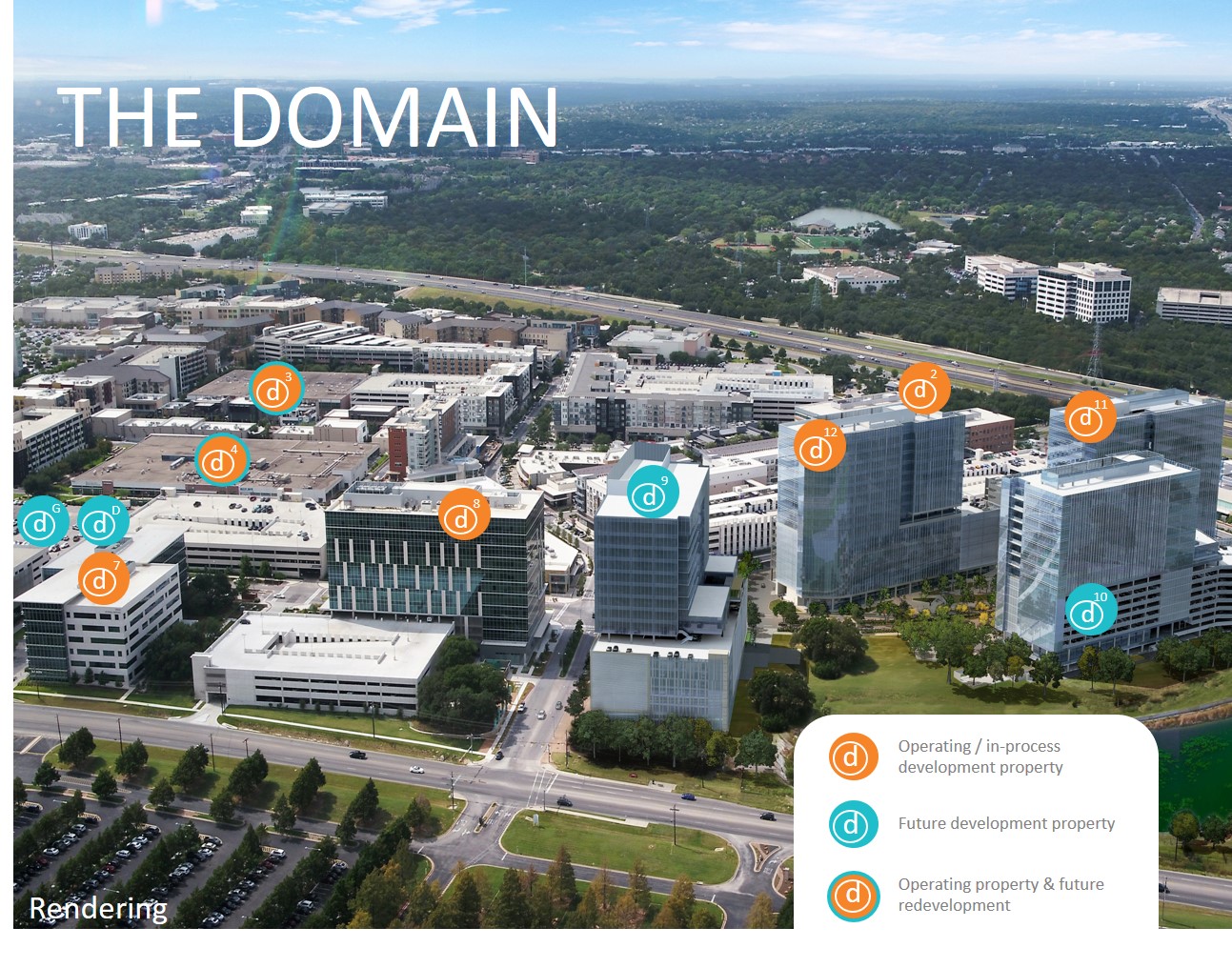

| • | During the third quarter of 2018, we pre-leased 100% of Domain 12. Domain 12 is a development property containing 320,000 rentable square feet located in Austin, Texas. |

| |

| • | On August 3, 2018, our board of directors authorized a distribution of $0.18 per share of common stock for the third quarter of 2018, that was paid on September 28, 2018. |

| |

| • | On August 15, 2018, we entered into three forward interest rate swaps for a combined notional value of $250.0 million with a maturity date of December 31, 2024. These become effective on October 31, 2019, upon the maturity of two of our outstanding interest rate swaps with a combined notional value of $250.0 million. |

| |

| • | On August 21, 2018, we paid off the $89.7 million loan secured by Domain 8 without penalty. The loan was scheduled to mature in June 2020. |

| |

| • | On August 27, 2018, ownership of Fifth Third Center, located in Columbus, Ohio, was conveyed to the associated lender pursuant to a foreclosure. The transaction was accounted for as a full settlement of the outstanding debt and related interest. As a result, we recognized a gain on troubled debt restructuring of $31.0 million. We recorded an asset impairment loss of $3.4 million related to the disposition of the property. |

| |

| • | In August 2018, we established an additional $125.0 million ATM program for a total of $250.0 million when combined with our May 2017 ATM Program. During the three months ended September 30, 2018, we issued 4,916,095 shares of common stock under our ATM Programs, for proceeds of $114.1 million, net of commissions and issuance costs. Subsequent to September 30, 2018, we issued 130,172 additional shares for net proceeds of $3.1 million, resulting in total net proceeds for the year of $138.0 million. |

| |

| • | Development on Domain 10 commenced in October 2018. Domain 10 will contain 300,000 rentable square feet and is located in Austin, Texas, adjacent to our other Domain properties. |

| |

| • | On November 2, 2018, our board of directors authorized a distribution of $0.18 per share of common stock for the fourth quarter of 2018, that will be paid on December 27, 2018. |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 1 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights |

| (in thousands, except per share data, effective rent data, percentages, and number of properties) |

| | | | | | | | | | | | | | | |

| | 30-Sep-18 | | 30-Sep-17 | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| Portfolio Summary: | | | | | | | | | | | | | | |

| Total operating office properties | 18 |

| | 20 |

| | | 18 |

| | 18 |

| | 18 |

| | 20 |

| | 20 |

|

| Rentable square feet (100%) (operating properties) | 6,657 |

| | 7,405 |

| | | 6,657 |

| | 6,657 |

| | 6,657 |

| | 7,405 |

| | 7,405 |

|

| Rentable square feet (own %) (operating properties) | 6,633 |

| | 7,260 |

| | | 6,633 |

| | 6,633 |

| | 6,633 |

| | 7,260 |

| | 7,260 |

|

| Occupancy % | 90.1 | % | | 88.3 | % | | | 90.1 | % | | 89.4 | % | | 89.4 | % | | 89.1 | % | | 88.3 | % |

| Executed % SF leased | 90.4 | % | | 89.0 | % | | | 90.4 | % | | 89.8 | % | | 89.6 | % | | 89.7 | % | | 89.0 | % |

| Economic % SF leased | 86.2 | % | | 82.4 | % | | | 86.2 | % | | 85.3 | % | | 86.1 | % | | 84.4 | % | | 82.4 | % |

| Average effective rent/square foot | $ | 32.89 |

| | $ | 29.58 |

| | | $ | 32.89 |

| | $ | 32.60 |

| | $ | 32.55 |

| | $ | 30.33 |

| | $ | 29.58 |

|

| | | | | | | | | | | | | | | |

| | Nine Months Ended | | | Three Months Ended |

| | 30-Sep-18 | | 30-Sep-17 | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| Financial Results: | | | | | | | | | | | | | | |

| Revenue | $ | 162,965 |

| | $ | 161,835 |

| | | $ | 54,832 |

| | $ | 53,990 |

| | $ | 54,143 |

| | $ | 54,626 |

| | $ | 50,920 |

|

| Property related expenses | (38,812 | ) | | (41,790 | ) | | | (13,262 | ) | | (12,395 | ) | | (13,155 | ) | | (14,131 | ) | | (13,170 | ) |

| Real estate taxes | (27,057 | ) | | (25,752 | ) | | | (9,229 | ) | | (9,074 | ) | | (8,754 | ) | | (8,512 | ) | | (8,439 | ) |

| Property management fees | (262 | ) | | (181 | ) | | | (80 | ) | | (97 | ) | | (85 | ) | | (51 | ) | | (49 | ) |

| NOI | $ | 96,834 |

| | $ | 94,112 |

| | | $ | 32,261 |

| | $ | 32,424 |

| | $ | 32,149 |

| | $ | 31,932 |

| | $ | 29,262 |

|

| Base rent | $ | 106,433 |

| | $ | 116,002 |

| | | $ | 35,759 |

| | $ | 35,556 |

| | $ | 35,118 |

| | $ | 34,122 |

| | $ | 36,002 |

|

| Free rent | $ | (4,298 | ) | | $ | (8,040 | ) | | | $ | (1,218 | ) | | $ | (1,776 | ) | | $ | (1,304 | ) | | $ | (1,570 | ) | | $ | (2,288 | ) |

| Net income (loss) attributable to common stockholders | $ | 22,758 |

| | $ | 94,161 |

| | | $ | 22,645 |

| | $ | (8,277 | ) | | $ | 8,390 |

| | $ | (9,875 | ) | | $ | (8,041 | ) |

| Diluted income (loss) per common share (1) | $ | 0.46 |

| | $ | 1.95 |

| | | $ | 0.43 |

| | $ | (0.17 | ) | | $ | 0.17 |

| | $ | (0.21 | ) | | $ | (0.17 | ) |

| FFO attributable to common stockholders | $ | 79,371 |

| | $ | 52,918 |

| | | $ | 50,678 |

| | $ | 18,804 |

| | $ | 9,889 |

| | $ | 19,020 |

| | $ | 15,885 |

|

| Diluted FFO per common share | $ | 1.59 |

| | $ | 1.10 |

| | | $ | 0.96 |

| | $ | 0.39 |

| | $ | 0.20 |

| | $ | 0.39 |

| | $ | 0.33 |

|

| FFO attributable to common stockholders, excluding certain items | $ | 59,085 |

| | $ | 55,748 |

| | | $ | 20,070 |

| | $ | 19,521 |

| | $ | 19,494 |

| | $ | 19,374 |

| | $ | 16,508 |

|

| Diluted FFO, excluding certain items, per common share | $ | 1.18 |

| | $ | 1.16 |

| | | $ | 0.38 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.34 |

|

| Adjusted EBITDAre | $ | 82,969 |

| | $ | 81,865 |

| | | $ | 26,407 |

| | $ | 28,359 |

| | $ | 28,203 |

| | $ | 26,321 |

| | $ | 26,181 |

|

| | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic | 49,092 |

| | 47,532 |

| | | 51,900 |

| | 47,684 |

| | 47,645 |

| | 47,554 |

| | 47,550 |

|

| Weighted average common shares outstanding - diluted | 49,950 |

| | 47,956 |

| | | 52,617 |

| | 48,534 |

| | 48,300 |

| | 48,207 |

| | 48,160 |

|

| | | | | | | | | | | | | | | |

| Selected Additional Trend Information: | | | | | | | | | | | | | | |

| Renewal % based on square feet | 67 | % | | 73 | % | | | 61 | % | | 74 | % | | 64 | % | | 30 | % | | 83 | % |

| Distributions declared on common shares | $ | 26,925 |

| | $ | 25,829 |

| | | $ | 9,671 |

| | $ | 8,628 |

| | $ | 8,626 |

| | $ | 8,612 |

| | $ | 8,612 |

|

| Annualized distribution yield (2) | 3.0 | % | | 3.7 | % | | | 3.0 | % | | 3.0 | % | | 3.9 | % | | 3.5 | % | | 3.7 | % |

_______________________________

(1) In periods of net loss from continuing operations there are no dilutive securities and diluted loss per common share is calculated using weighted average common shares outstanding - basic as the denominator.

(2) Based on the closing price of our common stock as of the last day of the associated period.

Notes:

Occupancy % represents the total square footage subject to commenced leases as of the reporting date as a percentage of the total rentable square feet (at our ownership interest).

Executed % SF leased represents the total square footage subject to commenced leases plus the square footage for currently vacant space that is subject to executed leases that have not commenced as of the reporting date as a percentage of the total rentable square feet (at our ownership interest).

Economic % SF leased represents the total square footage subject to commenced leases as of the reporting date adjusted to exclude the square footage associated with leases receiving rental abatements as a percentage of the total rentable square feet (at our ownership interest).

Average effective rent represents 12 times the sum of the monthly contractual amounts for base rent and the pro rata budgeted operating expense reimbursements, as of period end, related to leases in place as of period end, as reduced for free rent and excluding any scheduled future rent increases, as adjusted for our ownership interest, divided by the total square footage under commenced leases at period end.

This section includes non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Quantitative reconciliations of the differences between the non-GAAP financial measures presented and the most directly comparable GAAP financial measures are shown on pages 6-7. A description of the non-GAAP financial measures we present and a statement of the reasons why management believes the non-GAAP measures provide useful information to investors about the Company’s financial condition and results of operations can be found on pages 31-32.

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 2 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights (continued) |

| (in thousands, except stock prices, percentages, and ratios) |

| | | | | | | |

| | 30-Sep-18 | | 30-Sep-17 | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| Selected Balance Sheet Items: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total book value of real estate | $ | 1,386,255 |

| | $ | 1,325,536 |

| | | $ | 1,386,255 |

| | $ | 1,434,814 |

| | $ | 1,430,355 |

| | $ | 1,275,953 |

| | $ | 1,325,536 |

|

| | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 5,192 |

| | $ | 10,959 |

| | | $ | 5,192 |

| | $ | 8,359 |

| | $ | 10,183 |

| | $ | 13,800 |

| | $ | 10,959 |

|

| | | | | | | | | | | | | | | |

Unconsolidated cash and cash equivalents (at ownership %) | $ | 550 |

| | $ | 2,495 |

| | | $ | 550 |

| | $ | 327 |

| | $ | 282 |

| | $ | 1,435 |

| | $ | 2,495 |

|

| | | | | | | | | | | | | | | |

| Restricted cash | $ | 10,232 |

| | $ | 13,323 |

| | | $ | 10,232 |

| | $ | 14,086 |

| | $ | 12,565 |

| | $ | 8,510 |

| | $ | 13,323 |

|

| | | | | | | | | | | | | | | |

| Total assets | $ | 1,662,342 |

| | $ | 1,581,288 |

| | | $ | 1,662,342 |

| | $ | 1,696,121 |

| | $ | 1,688,999 |

| | $ | 1,581,138 |

| | $ | 1,581,288 |

|

| | | | | | | | | | | | | | | |

| Mortgage debt | $ | 142,162 |

| | $ | 191,694 |

| | | $ | 142,162 |

| | $ | 280,311 |

| | $ | 280,689 |

| | $ | 191,339 |

| | $ | 191,694 |

|

| | | | | | | | | | | | | | | |

| Revolving credit facility and term loans | $ | 591,000 |

| | $ | 598,000 |

| | | $ | 591,000 |

| | $ | 608,000 |

| | $ | 612,000 |

| | $ | 610,000 |

| | $ | 598,000 |

|

| | | | | | | | | | | | | | | |

| Unconsolidated debt (at ownership %) | $ | 26,137 |

| | $ | 43,572 |

| | | $ | 26,137 |

| | $ | 21,248 |

| | $ | 16,239 |

| | $ | 52,377 |

| | $ | 43,572 |

|

| | | | | | | | | | | | | | | |

| Total liabilities | $ | 836,797 |

| | $ | 889,465 |

| | | $ | 836,797 |

| | $ | 1,001,531 |

| | $ | 1,001,439 |

| | $ | 903,567 |

| | $ | 889,465 |

|

| | | | | | | | | | | | | | | |

| Capitalization: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Shares of common stock outstanding | 53,491 |

| | 47,552 |

| | | 53,491 |

| | 48,575 |

| | 47,656 |

| | 47,623 |

| | 47,552 |

|

| | | | | | | | | | | | | | | |

| Restricted stock units outstanding | 351 |

| | 228 |

| | | 351 |

| | 351 |

| | 356 |

| | 228 |

| | 228 |

|

| | | | | | | | | | | | | | | |

| Shares of restricted stock outstanding | 260 |

| | 291 |

| | | 260 |

| | 260 |

| | 265 |

| | 181 |

| | 291 |

|

| | | | | | | | | | | | | | | |

| | 54,102 |

| | 48,071 |

| | | 54,102 |

| | 49,186 |

| | 48,277 |

| | 48,032 |

| | 48,071 |

|

| | | | | | | | | | | | | | | |

| High stock price | $ | 24.98 |

| | $ | 19.50 |

| | | $ | 24.98 |

| | $ | 24.22 |

| | $ | 20.51 |

| | $ | 20.72 |

| | $ | 19.50 |

|

| | | | | | | | | | | | | | | |

| Low stock price | $ | 17.04 |

| | $ | 15.96 |

| | | $ | 22.66 |

| | $ | 18.06 |

| | $ | 17.04 |

| | $ | 18.83 |

| | $ | 16.67 |

|

| | | | | | | | | | | | | | | |

| Average closing stock price | $ | 21.18 |

| | $ | 17.81 |

| | | $ | 23.67 |

| | $ | 20.81 |

| | $ | 19.01 |

| | $ | 19.71 |

| | $ | 18.39 |

|

| | | | | | | | | | | | | | | |

| Closing stock price | $ | 24.10 |

| | $ | 19.30 |

| | | $ | 24.10 |

| | $ | 23.78 |

| | $ | 18.48 |

| | $ | 20.39 |

| | $ | 19.30 |

|

| | | | | | | | | | | | | | | |

| Market capitalization (1) | $ | 1,303,858 |

| | $ | 927,770 |

| | | $ | 1,303,858 |

| | $ | 1,169,643 |

| | $ | 892,159 |

| | $ | 979,372 |

| | $ | 927,770 |

|

| | | | | | | | | | | | | | | |

| Total debt (2) | $ | 759,299 |

| | $ | 833,266 |

| | | $ | 759,299 |

| | $ | 909,559 |

| | $ | 908,928 |

| | $ | 853,716 |

| | $ | 833,266 |

|

| | | | | | | | | | | | | | | |

| Net debt (3) | $ | 753,557 |

| | $ | 819,812 |

| | | $ | 753,557 |

| | $ | 900,873 |

| | $ | 898,463 |

| | $ | 838,481 |

| | $ | 819,812 |

|

| | | | | | | | | | | | | | | |

| Total capitalization | $ | 2,063,157 |

| | $ | 1,761,036 |

| | | $ | 2,063,157 |

| | $ | 2,079,202 |

| | $ | 1,801,087 |

| | $ | 1,833,088 |

| | $ | 1,761,036 |

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Nine Months Ended | | | Three Months Ended |

| | 30-Sep-18 | | 30-Sep-17 | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| Ratios: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| NOI margin % (4) | 59.4 | % | | 58.2 | % | | | 58.8 | % | | 60.1 | % | | 59.4 | % | | 58.5 | % | | 57.5 | % |

| | | | | | | | | | | | | | | |

| Normalized fixed charge coverage (5) | 3.02 |

| | 2.99 |

| | | 3.06 |

| | 3.00 |

| | 3.00 |

| | 2.83 |

| | 2.86 |

|

| | | | | | | | | | | | | | | |

| Normalized interest coverage (5) | 3.13 |

| | 3.12 |

| | | 3.14 |

| | 3.12 |

| | 3.13 |

| | 2.94 |

| | 2.97 |

|

| | | | | | | | | | | | | | | |

| Net debt/adjusted annualized estimated full period EBITDAre from properties owned at period end (5) | N/A |

| | N/A |

| | | 7.15x |

| | 7.94x |

| | 8.34x |

| | 7.96x |

| | 7.83x |

|

| | | | | | | | | | | | | | | |

| Net debt/adjusted annualized estimated full period EBITDAre from properties owned at period end, including development properties (5) (6) | N/A |

| | N/A |

| | | 6.22x |

| | 7.13x |

| | 7.67x |

| | 7.47x |

| | 7.45x |

|

| | | | | | | | | | | | | | | |

| |

| (1) Market capitalization is equal to outstanding shares (common stock, restricted stock, and restricted stock units, as if converted) times the closing price of our common stock as of the last day of the associated period. |

| (2) Includes book value of mortgage debt, the revolving credit facility and term loans, and unconsolidated debt (at ownership %). |

| (3) Total debt less cash and cash equivalents and unconsolidated cash and cash equivalents (at ownership %). |

| (4) NOI margin % is equal to NOI divided by revenue. |

| (5) See page 7 for more detailed information. |

| (6) Includes estimated stabilized NOI for development properties, to the extent of percentage of completion of the respective developments based on spend to date. |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 3 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

| (in thousands, except share and per share data) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| Assets | | | | | | | | | | | |

| | Real estate | | | | | | | | | | |

| | Land | | $ | 150,473 |

| | $ | 156,517 |

| | $ | 156,577 |

| | $ | 139,951 |

| | $ | 140,959 |

|

| | Land held for development | | 45,059 |

| | 45,059 |

| | 45,059 |

| | 45,059 |

| | 45,059 |

|

| | Buildings and improvements, net | | 1,097,613 |

| | 1,160,273 |

| | 1,177,433 |

| | 1,061,418 |

| | 1,122,072 |

|

| | Real estate under development | | 93,110 |

| | 72,965 |

| | 51,286 |

| | 29,525 |

| | 17,446 |

|

| | Total real estate | | 1,386,255 |

| | 1,434,814 |

| | 1,430,355 |

| | 1,275,953 |

| | 1,325,536 |

|

| | | | | | | | | | | | |

| | Cash and cash equivalents | | 5,192 |

| | 8,359 |

| | 10,183 |

| | 13,800 |

| | 10,959 |

|

| | Restricted cash | | 10,232 |

| | 14,086 |

| | 12,565 |

| | 8,510 |

| | 13,323 |

|

| | Accounts receivable, net | | 69,592 |

| | 80,755 |

| | 76,385 |

| | 81,129 |

| | 82,737 |

|

| | Prepaid expenses and other assets | | 19,357 |

| | 17,124 |

| | 14,238 |

| | 28,112 |

| | 20,115 |

|

| | Investments in unconsolidated entities | | 32,112 |

| | 31,714 |

| | 31,314 |

| | 31,852 |

| | 33,977 |

|

| | Deferred financing fees, net | | 2,985 |

| | 3,211 |

| | 3,426 |

| | 1,387 |

| | 1,735 |

|

| | Acquired above-market leases, net | | 20 |

| | 180 |

| | 288 |

| | 419 |

| | 543 |

|

| | Other lease intangibles, net | | 103,511 |

| | 105,878 |

| | 110,245 |

| | 86,628 |

| | 90,547 |

|

| | Other intangible assets, net | | — |

| | — |

| | — |

| | — |

| | 1,816 |

|

| | Assets associated with real estate held for sale | | 33,086 |

| | — |

| | — |

| | 53,348 |

| | — |

|

| Total assets | | $ | 1,662,342 |

| | $ | 1,696,121 |

| | $ | 1,688,999 |

| | $ | 1,581,138 |

| | $ | 1,581,288 |

|

| | | | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| | Mortgage debt | | $ | 142,162 |

| | $ | 280,311 |

| | $ | 280,689 |

| | $ | 191,339 |

| | $ | 191,694 |

|

| | Unsecured term loans | | 575,000 |

| | 575,000 |

| | 575,000 |

| | 575,000 |

| | 575,000 |

|

| | Unsecured revolving credit facility | | 16,000 |

| | 33,000 |

| | 37,000 |

| | 35,000 |

| | 23,000 |

|

| | Unamortized debt issuance costs | | (2,029 | ) | | (2,051 | ) | | (2,156 | ) | | (6,801 | ) | | (7,308 | ) |

| | Total notes payable, net | | 731,133 |

| | 886,260 |

| | 890,533 |

| | 794,538 |

| | 782,386 |

|

| | | | | | | | | | | | | | |

| | Accounts payable and accrued liabilities | | 74,560 |

| | 82,816 |

| | 76,144 |

| | 81,166 |

| | 78,174 |

|

| | Acquired below-market leases, net | | 24,312 |

| | 25,910 |

| | 27,684 |

| | 17,942 |

| | 19,462 |

|

| | Other liabilities | | 6,471 |

| | 6,545 |

| | 7,078 |

| | 7,567 |

| | 9,443 |

|

| | Obligations associated with real estate held for sale | | 321 |

| | — |

| | — |

| | 2,354 |

| | — |

|

| Total liabilities | | 836,797 |

| | 1,001,531 |

| | 1,001,439 |

| | 903,567 |

| | 889,465 |

|

| Commitments and contingencies | | | | | | | | | | |

| | | | | | | | | | | |

| Equity | | | | | | | | | | |

| | Preferred stock | | — |

| | — |

| | — |

| | — |

| | — |

|

| | Convertible stock | | — |

| | — |

| | — |

| | — |

| | — |

|

| | Common stock | | 5 |

| | 5 |

| | 5 |

| | 5 |

| | 5 |

|

| | Additional paid-in capital | | 2,747,825 |

| | 2,632,635 |

| | 2,610,288 |

| | 2,609,540 |

| | 2,609,361 |

|

| | Cumulative distributions and net loss attributable to common stockholders | | (1,940,492 | ) | | (1,953,466 | ) | | (1,936,561 | ) | | (1,936,960 | ) | | (1,918,473 | ) |

| | Accumulated other comprehensive income | | 15,262 |

| | 12,462 |

| | 10,479 |

| | 4,218 |

| | 257 |

|

| | Stockholders’ equity | | 822,600 |

| | 691,636 |

| | 684,211 |

| | 676,803 |

| | 691,150 |

|

| | Noncontrolling interests | | 2,945 |

| | 2,954 |

| | 3,349 |

| | 768 |

| | 673 |

|

| Total equity | | 825,545 |

| | 694,590 |

| | 687,560 |

| | 677,571 |

| | 691,823 |

|

| Total liabilities and equity | | $ | 1,662,342 |

| | $ | 1,696,121 |

| | $ | 1,688,999 |

| | $ | 1,581,138 |

| | $ | 1,581,288 |

|

| | | | | | | | | | | | |

| Common stock, number of shares issued and outstanding | | 53,490,819 |

| | 48,574,724 |

| | 47,655,669 |

| | 47,623,324 |

| | 47,552,014 |

|

| | | | | | | | | | | | | | |

| |

| |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 4 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated Statements of Operations |

| | (in thousands, except share and per share amounts) |

| | | | | | | | |

| | | | | | | | |

| | | Nine Months Ended | | | Three Months Ended |

| | | 30-Sep-18 | | 30-Sep-17 | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| Revenue | | | | | | | | | | | | | | |

| | Rental income | $ | 155,599 |

| | $ | 152,186 |

| | | $ | 52,570 |

| | $ | 51,088 |

| | $ | 51,941 |

| | $ | 52,362 |

| | $ | 47,333 |

|

| | Straight-line rent and lease incentive revenue | 1,906 |

| | 6,334 |

| | | 453 |

| | 862 |

| | 591 |

| | 978 |

| | 2,280 |

|

| | Above- and below-market rent amortization | 4,474 |

| | 2,863 |

| | | 1,533 |

| | 1,665 |

| | 1,276 |

| | 1,032 |

| | 1,075 |

|

| | Lease termination fees | 986 |

| | 452 |

| | | 276 |

| | 375 |

| | 335 |

| | 254 |

| | 232 |

|

| | Total revenue | 162,965 |

| | 161,835 |

| | | 54,832 |

| | 53,990 |

| | 54,143 |

| | 54,626 |

| | 50,920 |

|

| Expenses | | | | | | | | | | | | | | |

| | Property related expenses | 38,812 |

| | 41,790 |

| | | 13,262 |

| | 12,395 |

| | 13,155 |

| | 14,131 |

| | 13,170 |

|

| | Real estate taxes | 27,057 |

| | 25,752 |

| | | 9,229 |

| | 9,074 |

| | 8,754 |

| | 8,512 |

| | 8,439 |

|

| | Property management fees | 262 |

| | 181 |

| | | 80 |

| | 97 |

| | 85 |

| | 51 |

| | 49 |

|

| | Total property operating expenses | 66,131 |

| | 67,723 |

| | | 22,571 |

| | 21,566 |

| | 21,994 |

| | 22,694 |

| | 21,658 |

|

| | Interest expense | 22,498 |

| | 22,851 |

| | | 6,782 |

| | 8,011 |

| | 7,705 |

| | 7,534 |

| | 7,516 |

|

| | Interest rate hedge ineffectiveness expense (income) | — |

| | 9 |

| | | — |

| | — |

| | — |

| | (262 | ) | | 8 |

|

| | Amortization of deferred financing costs | 1,121 |

| | 2,561 |

| | | 359 |

| | 358 |

| | 404 |

| | 883 |

| | 882 |

|

| | Total interest expense | 23,619 |

| | 25,421 |

| | | 7,141 |

| | 8,369 |

| | 8,109 |

| | 8,155 |

| | 8,406 |

|

| | Asset impairment losses | 3,418 |

| | — |

| | | 3,418 |

| | — |

| | — |

| | 5,250 |

| | — |

|

| | General and administrative | 16,008 |

| | 16,490 |

| | | 5,128 |

| | 5,377 |

| | 5,503 |

| | 4,956 |

| | 5,157 |

|

| | Real estate depreciation and amortization | 76,281 |

| | 70,641 |

| | | 24,770 |

| | 27,011 |

| | 24,500 |

| | 23,655 |

| | 23,653 |

|

| | Depreciation and amortization - non-real estate assets | 303 |

| | 325 |

| | | 64 |

| | 123 |

| | 116 |

| | 133 |

| | 132 |

|

| | Total expenses | 185,760 |

| | 180,600 |

| | | 63,092 |

| | 62,446 |

| | 60,222 |

| | 64,843 |

| | 59,006 |

|

| | Interest and other income | 644 |

| | 1,271 |

| | | 49 |

| | 550 |

| | 45 |

| | 88 |

| | 170 |

|

| | Loss on early extinguishment of debt | (8,988 | ) | | (545 | ) | | | — |

| | — |

| | (8,988 | ) | | — |

| | — |

|

| | Gain on troubled debt restructuring | 31,006 |

| | — |

| | | 31,006 |

| | — |

| | — |

| | — |

| | — |

|

| Income (loss) before income taxes, equity in operations | | | | | | | | | | | | | | |

| | of investments, and gains (losses) | (133 | ) | | (18,039 | ) | | | 22,795 |

| | (7,906 | ) | | (15,022 | ) | | (10,129 | ) | | (7,916 | ) |

| | Provision for income taxes | (637 | ) | | (297 | ) | | | (228 | ) | | (214 | ) | | (195 | ) | | (171 | ) | | (202 | ) |

| | Equity in operations of investments | 287 |

| | 6,367 |

| | | — |

| | — |

| | 287 |

| | 32 |

| | 67 |

|

| Income (loss) before gains (losses) | (483 | ) | | (11,969 | ) | | | 22,567 |

| | (8,120 | ) | | (14,930 | ) | | (10,268 | ) | | (8,051 | ) |

| Gain (loss) on sale of assets | 11,924 |

| | 92,012 |

| | | — |

| | (90 | ) | | 12,014 |

| | 384 |

| | — |

|

| Gain (loss) on remeasurement of investment in unconsolidated entities | 11,090 |

| | 14,168 |

| | | — |

| | (152 | ) | | 11,242 |

| | — |

| | — |

|

| Net income (loss) | 22,531 |

| | 94,211 |

| | | 22,567 |

| | (8,362 | ) | | 8,326 |

| | (9,884 | ) | | (8,051 | ) |

| | Noncontrolling interests | 227 |

| | (50 | ) | | | 78 |

| | 85 |

| | 64 |

| | 9 |

| | 10 |

|

| Net income (loss) attributable to common stockholders | $ | 22,758 |

| | $ | 94,161 |

| | | $ | 22,645 |

| | $ | (8,277 | ) | | $ | 8,390 |

| | $ | (9,875 | ) | | $ | (8,041 | ) |

| | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic | 49,091,962 |

| | 47,532,432 |

| | | 51,899,779 |

| | 47,684,152 |

| | 47,645,050 |

| | 47,553,564 |

| | 47,549,635 |

|

| Weighted average common shares outstanding - diluted (1) | 49,950,441 |

| | 47,956,167 |

| | | 52,616,570 |

| | 47,684,152 |

| | 48,299,882 |

| | 47,553,564 |

| | 47,549,635 |

|

| | | | | | | | | | | | | | | | |

| Basic income (loss) per common share | $ | 0.46 |

| | $ | 1.97 |

| | | $ | 0.43 |

| | $ | (0.17 | ) | | $ | 0.18 |

| | $ | (0.21 | ) | | $ | (0.17 | ) |

| Diluted income (loss) per common share (1) | $ | 0.46 |

| | $ | 1.95 |

| | | $ | 0.43 |

| | $ | (0.17 | ) | | $ | 0.17 |

| | $ | (0.21 | ) | | $ | (0.17 | ) |

| | | | | | | | | | | | | | | | |

| Distributions declared per common share | $ | 0.54 |

| | $ | 0.54 |

| | | $ | 0.18 |

| | $ | 0.18 |

| | $ | 0.18 |

| | $ | 0.18 |

| | $ | 0.18 |

|

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| (1) | In periods of net loss there are no dilutive securities and diluted loss per common share is calculated using weighted average common shares outstanding - basic as the denominator. |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 5 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Calculations of FFO and Additional Information |

| (in thousands, except per share data) |

| | | | | | | | |

| | | | | | | | |

| | | Nine Months Ended | | | Three Months Ended |

| | 30-Sep-18 | | 30-Sep-17 | | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 22,531 |

| | $ | 94,211 |

| | | $ | 22,567 |

| | $ | (8,362 | ) | | $ | 8,326 |

| | $ | (9,884 | ) | | $ | (8,051 | ) |

| Noncontrolling interests | 227 |

| | (50 | ) | | | 78 |

| | 85 |

| | 64 |

| | 9 |

| | 10 |

|

| Net income (loss) attributable to common stockholders | 22,758 |

| | 94,161 |

| | | 22,645 |

| | (8,277 | ) | | 8,390 |

| | (9,875 | ) | | (8,041 | ) |

| Adjustments (1): | | | | | | | | | | | | | | |

| | Real estate depreciation and amortization from consolidated properties | 76,281 |

| | 70,641 |

| | | 24,770 |

| | 27,011 |

| | 24,500 |

| | 23,655 |

| | 23,653 |

|

| | Real estate depreciation and amortization from unconsolidated properties | 391 |

| | 986 |

| | | — |

| | — |

| | 391 |

| | 391 |

| | 289 |

|

| | Real estate depreciation and amortization - noncontrolling interest | (1,759 | ) | | — |

| | | (544 | ) | | (782 | ) | | (433 | ) | | — |

| | — |

|

| | Impairment of depreciable real estate assets | 3,418 |

| | — |

| | | 3,418 |

| | — |

| | — |

| | 5,250 |

| | — |

|

| | Loss (gain) on sale of depreciable real estate | (11,924 | ) | | (98,725 | ) | | | — |

| | 90 |

| | (12,014 | ) | | (384 | ) | | — |

|

| | Loss (gain) on remeasurement of investment in unconsolidated entities | (11,090 | ) | | (14,168 | ) | | | — |

| | 152 |

| | (11,242 | ) | | — |

| | — |

|

| | Noncontrolling interests | 1,296 |

| | 23 |

| | | 389 |

| | 610 |

| | 297 |

| | (17 | ) | | (16 | ) |

| FFO attributable to common stockholders | 79,371 |

| | 52,918 |

| | | 50,678 |

| | 18,804 |

| | 9,889 |

| | 19,020 |

| | 15,885 |

|

| | | | | | | | | | | | | | | |

| Adjustments (1): | | | | | | | | | | | | | | |

| | Severance charges | 127 |

| | 451 |

| | | — |

| | 108 |

| | 19 |

| | — |

| | — |

|

| | Interest rate hedge ineffectiveness expense (income) (2) | — |

| | 9 |

| | | — |

| | — |

| | — |

| | (262 | ) | | 8 |

|

| | Loss on early extinguishment of debt | 8,988 |

| | 545 |

| | | — |

| | — |

| | 8,988 |

| | — |

| | — |

|

| | Gain on troubled debt restructuring | (31,006 | ) | | — |

| | | (31,006 | ) | | — |

| | — |

| | — |

| | — |

|

| | Default interest (3) | 1,599 |

| | 1,827 |

| | | 388 |

| | 609 |

| | 602 |

| | 616 |

| | 616 |

|

| | Noncontrolling interests | 6 |

| | (2 | ) | | | 10 |

| | — |

| | (4 | ) | | — |

| | (1 | ) |

| FFO attributable to common stockholders, excluding certain items | $ | 59,085 |

| | $ | 55,748 |

| | | $ | 20,070 |

| | $ | 19,521 |

| | $ | 19,494 |

| | $ | 19,374 |

| | $ | 16,508 |

|

| | | | | | | | | | | | | | | |

| Recurring capital expenditures (1) | $ | (11,781 | ) | | $ | (22,022 | ) | | | $ | (3,252 | ) | | $ | (2,337 | ) | | $ | (6,192 | ) | | $ | (6,109 | ) | | $ | (10,271 | ) |

| Straight-line rent adjustments (1) | $ | (3,283 | ) | | $ | (8,655 | ) | | | $ | (769 | ) | | $ | (1,165 | ) | | $ | (1,349 | ) | | $ | (2,088 | ) | | $ | (3,757 | ) |

| Above- and below-market rent amortization (1) | $ | (4,382 | ) | | $ | (2,865 | ) | | | $ | (1,503 | ) | | $ | (1,634 | ) | | $ | (1,245 | ) | | $ | (1,032 | ) | | $ | (1,075 | ) |

| Amortization of deferred financing costs (1) | $ | 1,153 |

| | $ | 2,724 |

| | | $ | 359 |

| | $ | 358 |

| | $ | 436 |

| | $ | 915 |

| | $ | 918 |

|

| Amortization of restricted shares and units | $ | 3,370 |

| | $ | 3,010 |

| | | $ | 1,206 |

| | $ | 1,164 |

| | $ | 1,000 |

| | $ | 1,071 |

| | $ | 1,077 |

|

| Depreciation and amortization - non-real estate assets | $ | 303 |

| | $ | 325 |

| | | $ | 64 |

| | $ | 123 |

| | $ | 116 |

| | $ | 133 |

| | $ | 132 |

|

| | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic | 49,092 |

| | 47,532 |

| | | 51,900 |

| | 47,684 |

| | 47,645 |

| | 47,554 |

| | 47,550 |

|

| Weighted average common shares outstanding - diluted | 49,950 |

| | 47,956 |

| | | 52,617 |

| | 48,534 |

| | 48,300 |

| | 48,207 |

| | 48,160 |

|

| | | | | | | | | | | | | | | |

| Diluted FFO per common share | $ | 1.59 |

| | $ | 1.10 |

| | | $ | 0.96 |

| | $ | 0.39 |

| | $ | 0.20 |

| | $ | 0.39 |

| | $ | 0.33 |

|

| Diluted FFO, excluding certain items, per common share | $ | 1.18 |

| | $ | 1.16 |

| | | $ | 0.38 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.34 |

|

| | | | | | | | | | | | | | | | |

| We provided rent abatements to tenants at the Eldridge Properties as a result of Hurricane Harvey through the second quarter of 2018. These rent abatements were offset by business interruption insurance proceeds, net of a deductible and estimated saved expenses as detailed below: |

| Rent abatements | $ | (4,683 | ) | | $ | (1,921 | ) | | | $ | — |

| | $ | (775 | ) | | $ | (3,908 | ) | | $ | (5,116 | ) | | $ | (1,921 | ) |

| Business interruption insurance proceeds, net | $ | 4,414 |

| | $ | — |

| | | $ | 719 |

| | $ | 358 |

| | $ | 3,337 |

| | $ | 6,221 |

| | $ | — |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | |

| (1) Includes our pro rata share of consolidated and unconsolidated amounts, including for our period of ownership of properties sold. |

| (2) Interest rate swaps are adjusted to fair value through other comprehensive income (loss). However, because our interest rate swaps do not have a LIBOR floor while the hedged debt is subject to a LIBOR floor, the portion of the change in fair value of our interest rate swaps attributable to this mismatch is reclassified to interest rate hedge ineffectiveness expense (income) within “interest expense” on our consolidated statements of operations. We adopted new accounting guidance on January 1, 2018, that eliminates the requirement to separately measure and report hedge ineffectiveness expense (income). |

| (3) We had a non-recourse loan in default that subjected us to incur default interest at a rate that was 500 basis points higher than the stated interest rate. The ownership of this property was conveyed to the lender in August 2018. |

| | | | | | | | | | | | | | | | |

| For additional information regarding the non-GAAP measures, see pages 31-32. |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 6 |

|

| | | | | | | | | | | | | | | | | | | | |

| Calculations of EBITDAre |

| (in thousands, except ratios) |

| | | |

| | | Three Months Ended |

| | | 30-Sep-18 | | 30-Jun-18 | | 31-Mar-18 | | 31-Dec-17 | | 30-Sep-17 |

| | | | | | | | | | | |

| Net income (loss) | $ | 22,567 |

| | $ | (8,362 | ) | | $ | 8,326 |

| | $ | (9,884 | ) | | $ | (8,051 | ) |

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | | | | | | | | | | |

| | Interest expense: | | | | | | | | | |

| | Interest expense - consolidated | 6,782 |

| | 8,011 |

| | 7,705 |

| | 7,534 |

| | 7,516 |

|

| | Interest expense - unconsolidated entities | — |

| | — |

| | 360 |

| | 338 |

| | 335 |

|

| | Interest rate hedge ineffectiveness expense (income) (1) | — |

| | — |

| | — |

| | (262 | ) | | 8 |

|

| | Amortization of deferred financing costs - consolidated | 359 |

| | 358 |

| | 404 |

| | 883 |

| | 882 |

|

| | Amortization of deferred financing costs - unconsolidated entities | — |

| | — |

| | 32 |

| | 32 |

| | 36 |

|

| | Total interest expense | 7,141 |

| | 8,369 |

| | 8,501 |

| | 8,525 |

| | 8,777 |

|

| | | | | | | | | | | |

| | Tax provision - consolidated | 228 |

| | 214 |

| | 195 |

| | 171 |

| | 202 |

|

| | Tax provision - unconsolidated entities | — |

| | — |

| | 14 |

| | 1 |

| | — |

|

| | Depreciation and amortization - consolidated | 24,834 |

| | 27,134 |

| | 24,616 |

| | 23,788 |

| | 23,785 |

|

| | Depreciation and amortization - unconsolidated entities | — |

| | — |

| | 391 |

| | 391 |

| | 289 |

|

| | Asset impairment losses | 3,418 |

| | — |

| | — |

| | 5,250 |

| | — |

|

| | Loss (gain) on sale of real estate | — |

| | 90 |

| | (12,014 | ) | | (384 | ) | | — |

|

| | Loss (gain) on remeasurement of investment in unconsolidated entities | — |

| | 152 |

| | (11,242 | ) | | — |

| | — |

|

| EBITDAre | 58,188 |

| | 27,597 |

| | 18,787 |

| | 27,858 |

| | 25,002 |

|

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | Loss on early extinguishment of debt | — |

| | — |

| | 8,988 |

| | — |

| | — |

|

| | Gain on troubled debt restructuring | (31,006 | ) | | — |

| | — |

| | — |

| | — |

|

| | Non-cash write-off (recoveries), net of tenant receivables | (56 | ) | | 237 |

| | — |

| | 19 |

| | (742 | ) |

| | Rent abatements (recoveries), net, due to Hurricane Harvey (2) | (719 | ) | | 417 |

| | 409 |

| | (1,556 | ) | | 1,921 |

|

| | Severance charges | — |

| | 108 |

| | 19 |

| | — |

| | — |

|

| Adjusted EBITDAre | 26,407 |

| | 28,359 |

| | 28,203 |

| | 26,321 |

| | 26,181 |

|

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | EBITDAre from properties disposed before period end | (61 | ) | | (4 | ) | | (2,504 | ) | | 5 |

| | 11 |

|

| | Full quarter EBITDAre adjustment for acquired properties | — |

| | — |

| | 1,223 |

| | — |

| | — |

|

Adjusted estimated full period EBITDAre from properties owned at period end | $ | 26,346 |

| | $ | 28,355 |

| | $ | 26,922 |

| | $ | 26,326 |

| | $ | 26,192 |

|

| | | | | | | | | | | |

| Fixed charges | | | | | | | | | |

| | Interest expense | $ | 7,141 |

| | $ | 8,369 |

| | $ | 8,501 |

| | $ | 8,525 |

| | $ | 8,777 |

|

| | Interest rate hedge ineffectiveness (expense) income (1) | — |

| | — |

| | — |

| | 262 |

| | (8 | ) |

| | Default interest expense (3) | (388 | ) | | (609 | ) | | (602 | ) | | (616 | ) | | (616 | ) |

| | Capitalized interest incurred (4) | 1,644 |

| | 1,318 |

| | 1,103 |

| | 782 |

| | 653 |

|

| | Normalized interest expense | 8,397 |

| | 9,078 |

| | 9,002 |

| | 8,953 |

| | 8,806 |

|

| | Principal payments (excludes debt payoff) | 239 |

| | 378 |

| | 384 |

| | 355 |

| | 349 |

|

| Normalized fixed charges | $ | 8,636 |

| | $ | 9,456 |

| | $ | 9,386 |

| | $ | 9,308 |

| | $ | 9,155 |

|

| | | | | | | | | | | |

| Normalized interest coverage (5) | 3.14 |

| | 3.12 |

| | 3.13 |

| | 2.94 |

| | 2.97 |

|

| Normalized fixed charge coverage (5) | 3.06 |

| | 3.00 |

| | 3.00 |

| | 2.83 |

| | 2.86 |

|

| | | | | | | | | | | |

| |

| (1) | Interest rate swaps are adjusted to fair value through other comprehensive income (loss). However, because our interest rate swaps do not have a LIBOR floor while the hedged debt is subject to a LIBOR floor, the portion of the change in fair value of our interest rate swaps attributable to this mismatch is reclassified to interest rate hedge ineffectiveness expense (income). We adopted new accounting guidance on January 1, 2018, that eliminates the requirement to separately measure and report hedge ineffectiveness expense (income). |

| |

| (2) | Reflects rent abatements, net of business interruption insurance recoveries and an insurance deductible, following Hurricane Harvey. |

| |

| (3) | We had a non-recourse loan in default that subjected us to incur default interest at a rate that was 500 basis points higher than the stated interest rate. The ownership of this property was conveyed to the lender in August 2018. |

(4) Excludes capitalized interest funded from construction loans.

(5) Normalized interest coverage is equal to adjusted EBITDAre divided by normalized interest expense. Normalized fixed charge coverage is equal to adjusted EBITDAre divided by normalized fixed charges.

For additional information regarding the non-GAAP measures, see pages 31-32.

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 7 |

|

| | | | |

| Unconsolidated Entities Financial Summary |

| at TIER REIT Ownership Share |

| As of and for the Quarter Ended September 30, 2018 |

| (dollars in thousands) |

| | | |

| | | |

| | | Third + Shoal |

| Ownership % during the period | 47.50% |

| Ownership % at period end | 47.50% |

| | |

| Balance Sheet Information | |

| Real estate book value | $ | 53,683 |

|

| Accumulated depreciation and amortization | (433 | ) |

| Real estate book value after depreciation and amortization | $ | 53,250 |

|

| | |

| Cash and cash equivalents | $ | 550 |

|

| Assets | $ | 56,846 |

|

| Mortgage debt | $ | 26,137 |

|

| Company’s equity interest in investment | $ | 25,919 |

|

| Basis differences | 6,193 |

|

| Carrying value of the Company’s investment | $ | 32,112 |

|

| ________________________________ | |

| Notes: |

| Investments in unconsolidated entities consist of our noncontrolling interest in properties accounted for using the equity method. Multiplying each financial statement line item by the associated ownership percentage and adding those amounts to consolidated totals may not accurately depict the legal and economic implications of holding a noncontrolling interest in an investee entity. |

| | |

| Third + Shoal is a development property. |

| |

(Third + Shoal interior rendering)

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 8 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Analysis |

| (in thousands, except property count and percentages) |

| | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended | |

| Same Store NOI: | 30-Sep-18 | | 30-Sep-17 | | Favorable/ (Unfavorable) | | 30-Sep-18 | | 30-Sep-17 | | Favorable/ (Unfavorable) | |

| Same Store Revenue: | | | | | | | | | | | | |

| Rental revenue (1) | $ | 46,592 |

| | $ | 42,113 |

| | $ | 4,479 |

| | $ | 128,281 |

| | $ | 122,945 |

| | $ | 5,336 |

| |

| Less: Lease termination fees | (276 | ) | | (177 | ) | | (99 | ) | | (986 | ) | | (207 | ) | | (779 | ) | |

| | 46,316 |

| | 41,936 |

| | 4,380 |

| 10.4 | % | 127,295 |

| | 122,738 |

| | 4,557 |

| 3.7 | % |

| Same Store Expenses: | | | | | | | | | | | | |

Property operating expenses

(less tenant improvement demolition costs) | 11,103 |

| | 9,568 |

| | (1,535 | ) | (16.0 | )% | 31,320 |

| | 29,046 |

| | (2,274 | ) | (7.8 | )% |

| Real estate taxes | 7,856 |

| | 7,684 |

| | (172 | ) | (2.2 | )% | 21,680 |

| | 21,697 |

| | 17 |

| 0.1 | % |

| Property management fees | 25 |

| | 25 |

| | — |

| — | % | 76 |

| | 66 |

| | (10 | ) | (15.2 | )% |

| Property expenses | 18,984 |

| | 17,277 |

| | (1,707 | ) | (9.9 | )% | 53,076 |

| | 50,809 |

| | (2,267 | ) | (4.5 | )% |

| Same Store NOI - consolidated properties | 27,332 |

| | 24,659 |

| | 2,673 |

| 10.8 | % | 74,219 |

| | 71,929 |

| | 2,290 |

| 3.2 | % |

Same Store NOI - unconsolidated properties

(at ownership %) | 1,272 |

| | 728 |

| | 544 |

| 74.7 | % | — |

| | — |

| | — |

| — | % |

| Same Store NOI | $ | 28,604 |

| | $ | 25,387 |

| | $ | 3,217 |

| 12.7 | % | $ | 74,219 |

| | $ | 71,929 |

| | $ | 2,290 |

| 3.2 | % |

| | | | | | | | | | | | | |

| Same Store Cash NOI: | | | | | | | | | | | | |

| Same Store NOI | $ | 27,332 |

| | $ | 24,659 |

| | $ | 2,673 |

| | $ | 74,219 |

| | $ | 71,929 |

| | $ | 2,290 |

| |

| Less: | | | | | | | | | | | | |

| Straight-line rent revenue adjustment | 288 |

| | (2,085 | ) | | 2,373 |

| | 222 |

| | (4,528 | ) | | 4,750 |

| |

| Above- and below-market rent amortization | (1,052 | ) | | (1,156 | ) | | 104 |

| | (2,859 | ) | | (2,922 | ) | | 63 |

| |

| Same Store Cash NOI - consolidated properties | 26,568 |

| | 21,418 |

| | 5,150 |

| 24.0 | % | 71,582 |

| | 64,479 |

| | 7,103 |

| 11.0 | % |

| Same Store Cash NOI - unconsolidated properties (at ownership %) | 840 |

| | (283 | ) | | 1,123 |

| (396.8 | )% | — |

| | — |

| | — |

| — | % |

| Same Store Cash NOI | $ | 27,408 |

| | $ | 21,135 |

| | $ | 6,273 |

| 29.7 | % | $ | 71,582 |

| | $ | 64,479 |

| | $ | 7,103 |

| 11.0 | % |

| | | | | | | | | | | | | |

Same Store occupancy % at period end

(% owned) | 89.7 | % | | 88.6 | % | | | | 88.9 | % | | 87.7 | % | | | |

| | | | | | | | | | | | | |

| Same Store operating properties | 16 |

| | | | | | 14 |

| | | | | |

| Same Store rentable square feet (% owned) | 5,911 |

| | | | | | 5,446 |

| | | | | |

| | | | | | | | | | | | | |

| Reconciliation of net income (loss) to Same Store NOI and Same Store Cash NOI: | | | | | | | |

| Net income (loss) | $ | 22,567 |

| | $ | (8,051 | ) | | | | $ | 22,531 |

| | $ | 94,211 |

| | | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | 7,141 |

| | 8,406 |

| | | | 23,619 |

| | 25,421 |

| | | |

| Asset impairment losses | 3,418 |

| | — |

| | | | 3,418 |

| | — |

| | | |

| Tenant improvement demolition costs | 36 |

| | 127 |

| | | | 170 |

| | 242 |

| | | |

| General and administrative | 5,128 |

| | 5,157 |

| | | | 16,008 |

| | 16,490 |

| | | |

| Real estate depreciation and amortization | 24,834 |

| | 23,785 |

| | | | 76,584 |

| | 70,966 |

| | | |

| Interest and other income | (49 | ) | | (170 | ) | | | | (644 | ) | | (1,271 | ) | | | |

| Loss on early extinguishment of debt | — |

| | — |

| | | | 8,988 |

| | 545 |

| | | |

| Gain on troubled debt restructuring | (31,006 | ) | | — |

| | | | (31,006 | ) | | — |

| | | |

| Provision for income taxes | 228 |

| | 202 |

| | | | 637 |

| | 297 |

| | | |

| Equity in operations of investments | — |

| | (67 | ) | | | | (287 | ) | | (6,367 | ) | | | |

| Gain on sale of assets | — |

| | — |

| | | | (11,924 | ) | | (92,012 | ) | | | |

| Gain on remeasurement of investment in unconsolidated entities | — |

| | — |

| | | | (11,090 | ) | | (14,168 | ) | | | |

| Net operating income of non-same store properties | (4,689 | ) | | (4,553 | ) | | | | (21,799 | ) | | (22,218 | ) | | | |

| Lease termination fees | (276 | ) | | (177 | ) | | | | (986 | ) | | (207 | ) | | | |

Same Store NOI of unconsolidated properties

(at ownership %) | 1,272 |

| | 728 |

| | | | — |

| | — |

| | | |

| Same Store NOI | 28,604 |

| | 25,387 |

| | | | 74,219 |

| | 71,929 |

| | | |

| Straight-line rent revenue adjustment | 288 |

| | (2,085 | ) | | | | 222 |

| | (4,528 | ) | | | |

| Above- and below-market rent amortization | (1,052 | ) | | (1,156 | ) | | | | (2,859 | ) | | (2,922 | ) | | | |

| Cash NOI adjustments for unconsolidated properties (at ownership %) | (432 | ) | | (1,011 | ) | | | | — |

| | — |

| | | |

| Same Store Cash NOI | $ | 27,408 |

| | $ | 21,135 |

| | | | $ | 71,582 |

| | $ | 64,479 |

| | | |

| | | | | | | | | | | | | | |

| Our Domain 2 and Domain 7 properties (two properties in which we acquired full ownership in January 2017) are reflected above as consolidated and at 100% ownership in all periods presented. Our Domain 8 property is reflected as unconsolidated and at the prior year ownership percentage of 50% for the three-month comparison periods presented above. Domain 8 became operational in the third quarter of 2017 and we acquired full ownership on March 30, 2018. Legacy Union One was acquired in June 2017, and is included in the three-month comparison periods presented above. For additional information regarding the non-GAAP measures, see pages 30-31. |

| (1) We provided rent abatements to tenants at the Eldridge Properties as a result of Hurricane Harvey through the second quarter of 2018. These rent abatements were offset by business interruption insurance proceeds, net of a deductible and estimated saved expenses. See page 6 for details. The timing difference of rent abatements provided and business interruption insurance proceeds received for the Eldridge Properties was a significant driver to the increase in Same Store NOI and Same Store Cash NOI. Excluding the Eldridge Properties, Same Store NOI and Same Store Cash NOI increase over prior year same periods would be as follows: |

| Increase in Same Store NOI (excluding Eldridge Properties) | |

|

| 3.0 | % | | | | |

|

| 2.4 | % |

| Increase in Same Store Cash NOI (excluding Eldridge Properties) | |

|

| 18.1 | % | | | | |

|

| 11.7 | % |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 9 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Schedule of Properties Owned |

| as of September 30, 2018 |

| (in thousands, except $/RSF and percentages) |

| | | | | | | | | | | | | | | | | | | |

| | | | | Rentable SF (100%) | | Rentable SF (own %) | | | | Average Effective Rent (own %) | | Average Effective Rent $/RSF (own %) | | Average

Adjusted

Effective Rent

$/RSF

(own %) | | Estimated Market Rent $/RSF (own %) | | | | % Average Effective Rent (own %) |

| | | | | | | Occupancy % (own %) | | | | | | % of NRA (own %) | |

| Property (% owned, if not 100%) | | Location | | | | | | | | | |

| Terrace Office Park | | Austin, TX | | 619 |

| | 619 |

| | 91.4 | % | | $ | 23,100 |

| | $ | 40.81 |

| | $ | 41.83 |

| | $ | 45.76 |

| | 9.3 | % | | 11.8 | % |

| Domain 2 | | Austin, TX | | 115 |

| | 115 |

| | 100.0 | % | | 5,124 |

| | $ | 44.56 |

| | $ | 44.56 |

| | $ | 49.50 |

| | 1.7 | % | | 2.6 | % |

| Domain 3 | | Austin, TX | | 179 |

| | 179 |

| | 100.0 | % | | 6,180 |

| | $ | 34.53 |

| | $ | 37.21 |

| | $ | 43.65 |

| | 2.7 | % | | 3.1 | % |

| Domain 4 | | Austin, TX | | 153 |

| | 153 |

| | 100.0 | % | | 5,124 |

| | $ | 33.49 |

| | $ | 37.10 |

| | $ | 41.03 |

| | 2.3 | % | | 2.6 | % |

| Domain 7 | | Austin, TX | | 222 |

| | 222 |

| | 100.0 | % | | 10,092 |

| | $ | 45.46 |

| | $ | 45.46 |

| | $ | 49.28 |

| | 3.3 | % | | 5.1 | % |

| Domain 8 | | Austin, TX | | 291 |

| | 291 |

| | 100.0 | % | | 11,040 |

| | $ | 37.94 |

| | $ | 47.05 |

| | $ | 48.60 |

| | 4.4 | % | | 5.6 | % |

| Domain Point (90%) | | Austin, TX | | 240 |

| | 216 |

| | 90.5 | % | | 6,714 |

| | $ | 34.34 |

| | $ | 34.34 |

| | $ | 43.60 |

| | 3.3 | % | | 3.4 | % |

| Austin | | | | 1,819 |

| | 1,795 |

| | 95.9 | % | | 67,374 |

| | $ | 39.14 |

| | $ | 41.61 |

| | $ | 46.06 |

| | 27.1 | % | | 34.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| 5950 Sherry Lane | | Dallas, TX | | 197 |

| | 197 |

| | 92.9 | % | | 7,440 |

| | $ | 40.66 |

| | $ | 41.38 |

| | $ | 42.28 |

| | 3.0 | % | | 3.8 | % |

| Burnett Plaza | | Fort Worth, TX | | 1,025 |

| | 1,025 |

| | 85.3 | % | | 20,832 |

| | $ | 23.84 |

| | $ | 24.25 |

| | $ | 25.00 |

| | 15.5 | % | | 10.6 | % |

| Legacy Union One | | Plano, TX | | 319 |

| | 319 |

| | 100.0 | % | | 12,262 |

| | $ | 38.44 |

| | $ | 38.44 |

| | $ | 41.25 |

| | 4.8 | % | | 6.2 | % |

| Dallas/Fort Worth | | | | 1,541 |

| | 1,541 |

| | 89.3 | % | | 40,534 |

| | $ | 29.46 |

| | $ | 29.82 |

| | $ | 31.07 |

| | 23.2 | % | | 20.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

| One BriarLake Plaza | | Houston, TX | | 502 |

| | 502 |

| | 89.2 | % | | 18,732 |

| | $ | 41.81 |

| | $ | 43.47 |

| | $ | 43.41 |

| | 7.6 | % | | 9.5 | % |

| Two BriarLake Plaza | | Houston, TX | | 333 |

| | 333 |

| | 85.6 | % | | 9,732 |

| | $ | 34.15 |

| | $ | 42.40 |

| | $ | 42.86 |

| | 5.0 | % | | 5.0 | % |

| One & Two Eldridge Place | | Houston, TX | | 519 |

| | 519 |

| | 70.7 | % | | 12,012 |

| | $ | 32.73 |

| | $ | 33.42 |

| | $ | 35.20 |

| | 7.8 | % | | 6.1 | % |

| Three Eldridge Place | | Houston, TX | | 305 |

| | 305 |

| | 71.1 | % | | 9,372 |

| | $ | 43.19 |

| | $ | 43.74 |

| | $ | 38.05 |

| | 4.6 | % | | 4.8 | % |

| Houston | | | | 1,659 |

| | 1,659 |

| | 79.4 | % | | 49,848 |

| | $ | 37.85 |

| | $ | 40.48 |

| | $ | 40.12 |

| | 25.0 | % | | 25.4 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Bank of America Plaza | | Charlotte, NC | | 891 |

| | 891 |

| | 96.0 | % | | 22,824 |

| | $ | 26.69 |

| | $ | 26.96 |

| | $ | 32.50 |

| | 13.4 | % | | 11.6 | % |

| Charlotte | | | | 891 |

| | 891 |

| | 96.0 | % | | 22,824 |

| | $ | 26.69 |

| | $ | 26.96 |

| | $ | 32.50 |

| | 13.4 | % | | 11.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Plaza at MetroCenter (1) | | Nashville, TN | | 361 |

| | 361 |

| | 92.0 | % | | 6,168 |

| | $ | 18.58 |

| | $ | 18.83 |

| | $ | 20.00 |

| | 5.5 | % | | 3.1 | % |

| Nashville | | | | 361 |

| | 361 |

| | 92.0 | % | | 6,168 |

| | $ | 18.58 |

| | $ | 18.83 |

| | $ | 20.00 |

| | 5.5 | % | | 3.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Woodcrest (2) | | Cherry Hill, NJ | | 386 |

| | 386 |

| | 97.2 | % | | 9,816 |

| | $ | 26.18 |

| | $ | 26.18 |

| | $ | 20.74 |

| | 5.8 | % | | 5.0 | % |

| Other | | 386 |

| | 386 |

| | 97.2 | % | | 9,816 |

| | $ | 26.18 |

| | $ | 26.18 |

| | $ | 20.74 |

| | 5.8 | % | | 5.0 | % |

| Total operating office properties | | 6,657 |

| | 6,633 |

| | 90.1 | % | | $ | 196,564 |

| | $ | 32.89 |

| | $ | 34.32 |

| | $ | 36.32 |

| | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Development Properties | | | | | | Leased % | | | | | | | | | | | | |

| Domain 11 | | Austin, TX | | 324 |

| | 324 |

| | 98.0 | % | | | | | | | | | | | | |

| Domain 12 | | Austin, TX | | 320 |

| | 320 |

| | 100.0 | % | | | | | | | | | | | | |

| Third + Shoal (47.5%) | | Austin, TX | | 345 |

| | 164 |

| | 99.7 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| (1) This property is classified as held for sale as of September 30, 2018. |

| (2) Includes two properties. |

| |

| |

Average effective rent represents 12 times the sum of the monthly contractual amounts for base rent and the pro rata budgeted operating expense reimbursements, as of period end, related to leases in place as of period end, as reduced for free rent and excluding any scheduled future rent increases, as adjusted for our ownership interest, divided by the total square footage under commenced leases at period end. |

Average adjusted effective rent represents 12 times the sum of the monthly contractual amounts for base rent and the pro rata budgeted operating expense reimbursements, as of period end, related to leases in place as of period end, excluding any scheduled future rent increases, as adjusted for our ownership interest, divided by the total square footage under commenced leases at period end. |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 10 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio Analysis |

| For the Three Months Ended and |

| as of September 30, 2018 |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Number of Properties | | Number of Buildings | | Net Rentable Area (000’s) | | Commenced % SF Leased | | % of NRA | | NOI ($000’s) (1) | | % of NOI | |

| Market | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Austin | | 7 |

| | 11 |

| | 1,795 |

| | 95.9 | % | | 27.1 | % | | $ | 11,489 |

| | 35.7 | % | |

| Dallas/Fort Worth | | 3 |

| | 3 |

| | 1,541 |

| | 89.3 | % | | 23.2 | % | | 6,450 |

| | 20.0 | % | |

| Houston | | 4 |

| | 5 |

| | 1,659 |

| | 79.4 | % | | 25.0 | % | | 7,487 |

| | 23.3 | % | |

| Charlotte | | 1 |

| | 1 |

| | 891 |

| | 96.0 | % | | 13.4 | % | | 4,805 |

| | 14.9 | % | |

| Nashville | | 1 |

| | 2 |

| | 361 |

| | 92.0 | % | | 5.5 | % | | 937 |

| | 2.9 | % | |

| Other | | 2 |

| | 2 |

| | 386 |

| | 97.2 | % | | 5.8 | % | | 1,030 |

| | 3.2 | % | |

| | | | | | | | | | | | | | | | |

| Total | | 18 |

| | 24 |

| | 6,633 |

| | 90.1 | % | | 100.0 | % | | 32,198 |

| | 100.0 | % | |

| | | | | | | | | | | | | | | | |

| Reconciliation to NOI (Consolidated): | | | | | | |

| Plus NOI from noncontrolling interest | | 126 |

| | | |

| Plus NOI from disposed properties | | (63 | ) | | | |

| NOI (Consolidated) | | | | | | | | | | | | $ | 32,261 |

| | | |

| | | | | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | | | | |

| Analysis relates to operating properties owned at the end of the most recent period only. | |

| Amounts reflect TIER REIT’s ownership %. | | | |

| NOI is a non-GAAP performance measure. A calculation of NOI is presented on page 2. | |

| | |

| (1) NOI in Houston reflects approximately $0.7 million of business interruption insurance proceeds received in the third quarter of 2018 related to rent abatements provided to tenants at the Eldridge Properties in previous periods as a result of Hurricane Harvey. We anticipate we will receive additional business interruption insurance proceeds in subsequent quarters. | |

| | |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 11 |

|

| | | | | | |

| Components of Net Asset Value |

| (in thousands, except percentages) |

| |

| | | | | Annualized Three Months Ended |

| | | | | 30-Sep-18 |

| Consolidated total revenue | | | $ | 219,328 |

|

| | Less: | | | |

| | GAAP rent adjustments | | (7,944 | ) |

| | Lease termination fees | | (1,104 | ) |

| | | | | 210,280 |

|

| Consolidated total property operating expenses | | (90,284 | ) |

| Adjusted cash NOI | | 119,996 |

|

| | Adjustments: | | | |

| | Adjusted cash NOI from sold properties, at ownership share | | 20 |

|

| | Adjusted cash NOI from noncontrolling interest in consolidated assets | (375 | ) |

| | Adjusted cash NOI attributed to business interruption insurance proceeds in excess of abatements during the period at the Eldridge Properties (2) | (2,585 | ) |

| | Incremental pro forma stabilized adjusted cash NOI from executed leases at Domain 8, Domain 11, Domain 12, and Third + Shoal at ownership share | 31,343 |

|

| Total adjusted cash NOI at ownership share (3) | | | $ | 148,399 |

|

| | | | | |

| | | | | 30-Sep-18 |

| Cost basis of land and development properties, at ownership share (4) | | $ | 36,426 |

|

| | | |

| Other tangible assets | | |

| | Cash and cash equivalents | | $ | 5,192 |

|

| | Restricted cash | | 10,232 |

|

| | Accounts receivable, net (excluding $50,878 of straight-line rent receivable and $12,132 of insurance receivable) (5) | 6,582 |

|

| | Prepaid expenses and other assets | | 19,357 |

|

| Total other tangible assets | | $ | 41,363 |

|

| | | | |

| Liabilities | | | |

| | Mortgage debt | | $ | 142,162 |

|

| | Unsecured term loans and revolving credit facility | | 591,000 |

|

| | Accrued and other liabilities | | 81,031 |

|

| | Ownership share of unconsolidated mortgage debt | | 26,137 |

|

| | Remaining estimated cost to complete Domain 11, Domain 12, and Third + Shoal, at ownership share | 142,370 |

|

| Total liabilities | | $ | 982,700 |

|

| | | |

| Total common shares, restricted stock, and restricted stock units outstanding | | 54,102 |

|

| | | | | |

| | | | |

| (1) | Includes Domain 9, Domain 10, Domain 11, Legacy Union Two, Legacy Union Three, and Domain Blocks D & G at ownership share. |

| (2) | We received approximately $0.7 million of business interruption insurance proceeds during the quarter. |

| (3) | Comprised of adjusted cash NOI as detailed in the table below. |

|

| | | | | |

| Market | Adjusted Cash NOI | % |

| Austin | $ | 69,768 |

| 47 | % |

| Dallas | 24,356 |

| 17 | % |

| Houston | 28,447 |

| 19 | % |

| Charlotte | 17,240 |

| 12 | % |

| Nashville | 3,396 |

| 2 | % |

| Other | 5,192 |

| 3 | % |

| | | |

| Total | $ | 148,399 |

| 100 | % |

|

| | | | | |

| (4) | Includes Domain 9, Domain 10, Legacy Union Two, Legacy Union Three, and Domain Blocks D & G at ownership share. |

| (5) | Excludes insurance receivable expected to be recovered for the write-off of net book value of hurricane-damaged assets. |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 12 |

|

| | | | | | | | | | | | | | | | |

| Significant Tenants |

| September 30, 2018 |

| (in thousands, except percentages and years) |

| |

| |

| | Annualized

Gross Rental

Revenues | | Percentage of Annualized

Gross Rental

Revenues | | | | Percentage of Square Feet Leased | | Weighted Average Remaining Term (Years) | | |

| | | | Square Feet Leased | | | | Moody’s / S&P Credit Rating |

| Tenant | | | | | |

| Encana Oil & Gas (USA) Inc. | $ | 12,265 |

| | 6 | % | | 319 |

| | 5 | % | | 8.8 | | Ba1 / BBB- |

| Amazon | 11,297 |

| | 6 | % | | 246 |

| | 4 | % | | 7.2 | | Baa1 / AA- |

| Amoco | 9,498 |

| | 5 | % | | 217 |

| | 4 | % | | 0.5 | | A1 / A- |

| Bank of America | 8,931 |

| | 4 | % | | 388 |

| | 6 | % | | 1.9 | | A3 / A- |

| Apache Corporation | 8,671 |

| | 4 | % | | 210 |

| | 4 | % | | 6.1 | | Baa3 / BBB |

| GM Financial | 8,306 |

| | 4 | % | | 326 |

| | 5 | % | | 7.4 | | Baa3 / BBB |

| Samsung Engineering America Inc. | 7,206 |

| | 4 | % | | 161 |

| | 3 | % | | 6.8 | | NR |

| McDermott, Inc. | 5,504 |

| | 3 | % | | 169 |

| | 3 | % | | 1.8 | | NR / B+ |

| GSA | 5,284 |

| | 3 | % | | 226 |

| | 4 | % | | 5.1 | | U.S. Government |

| HomeAway | 5,128 |

| | 3 | % | | 115 |

| | 2 | % | | 7.4 | | Ba1 / BBB |

| Facebook, Inc. | 4,847 |

| | 2 | % | | 102 |

| | 2 | % | | 7.1 | | NR |

| Blackbaud, Inc. | 4,753 |

| | 2 | % | | 133 |

| | 2 | % | | 5.0 | | NR |

| Time Warner Cable Inc. | 4,072 |

| | 2 | % | | 112 |

| | 2 | % | | 2.3 | | NR |

| Conduent Incorporated | 4,020 |

| | 2 | % | | 151 |

| | 3 | % | | 1.9 | | Ba3 / BB |

| SCOR Global Life | 3,696 |

| | 2 | % | | 140 |

| | 2 | % | | 9.8 | | NR / AA- |

| Total of largest 15 tenants | $ | 103,478 |

| | 50 | % | | 3,015 |

| | 50 | % | | 5.2 | | |

| Total all tenants | $ | 205,095 |

| | | | 5,977 |

| | | | 5.3 | | |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | | | | | | | | | | | |

| The above tables set forth the Company’s 15 largest tenants including subsidiaries for the operating properties as of the date noted above, based upon annualized gross rents plus estimated operating cost recoveries in place at the end of the above noted period. |

| As annualized rental revenue is not derived from the historical GAAP results, historical results may differ from those set forth above. |

| Amounts reflect TIER REIT’s ownership %. | | | | | |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 13 |

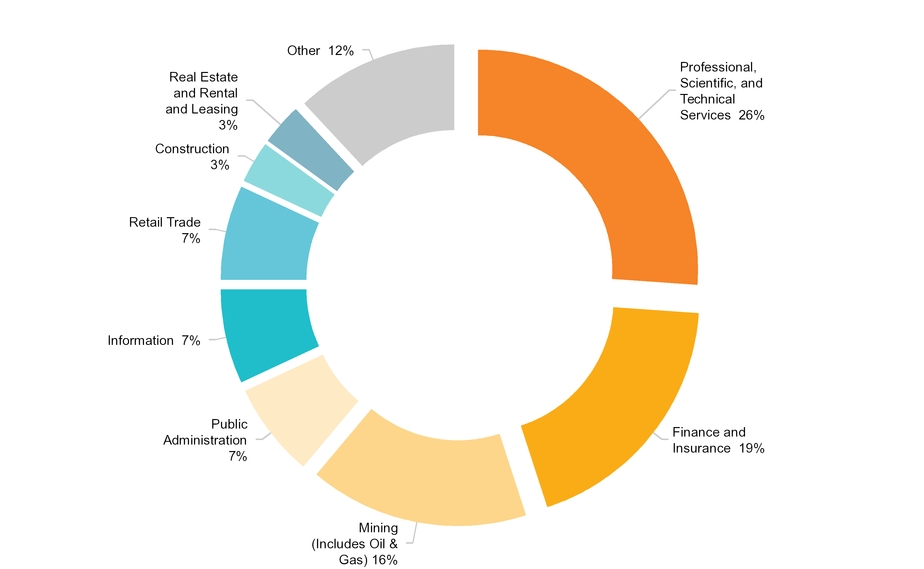

Industry Diversification (by square feet)

As of September 30, 2018

|

| |

| Notes: |

| | |

| The Company’s tenants are classified according to the U.S. Government’s North American Industrial Classification System (NAICS). | |

| Amounts reflect TIER REIT’s ownership %. | |

| “Other” includes 12 industry classifications. | |

|

| | |

Supplemental Operating and Financial Data | | 3Q’18 Page 14 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Leasing Activity Summary |

| For the Three Months Ended |

| September 30, 2018 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |