UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21137 |

Nuveen Preferred & Income Securities Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: January 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

31 January 2022

Nuveen Closed-End Funds

| JPC | Nuveen Preferred & Income Opportunities Fund | |

| JPI | Nuveen Preferred and Income Term Fund | |

| JPS | Nuveen Preferred & Income Securities Fund | |

| JPT | Nuveen Preferred and Income Fund (formerly Nuveen Preferred and Income 2022 Term Fund) | |

| NPFD | Nuveen Variable Rate Preferred & Income Fund |

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will not be sent to you by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences”. Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Semiannual Report

Life is Complex

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your email!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial professional or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 9 | ||||

| 12 | ||||

| 22 | ||||

| 23 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 62 | ||||

| 64 | ||||

| 70 | ||||

| 85 | ||||

| 87 | ||||

| 88 | ||||

| 91 | ||||

3

Chair’s Letter to Shareholders

Dear Shareholders,

In February, the world witnessed Russia invade Ukraine. The scale of the humanitarian crisis and economic shock caused by these events cannot yet be quantified, and our thoughts remain with all those affected.

Given the fluidity of the situation, market uncertainty is currently high. Conditions were already challenging prior to the invasion, with inflation lingering at multi-decade highs, interest rates expected to continue rising, economic growth moderating from the post-pandemic recovery, and weakening performance across equity markets and some bond market segments. The Russia-Ukraine conflict has accelerated these trends in the short term. The spike in geopolitical risks led to surging prices for oil and other hard and soft commodities, driving both inflation and recession risks higher. The U.S. Federal Reserve (Fed) and other central banks now face an even more difficult task of slowing inflation without stifling economic growth. At their March 2022 meeting, Fed officials announced a quarter percentage point increase to the short-term interest rate, raising it from near zero for the first time since the pandemic was declared two years ago.

In the meantime, while markets will likely continue fluctuating with the daily headlines, we encourage investors to keep a long-term perspective. To learn more about how well your portfolio is aligned to your time horizon, risk tolerance and investment goals, consider reviewing it with your financial professional.

On behalf of the other members of the Nuveen Fund Board, I look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

March 23, 2022

4

For Shareholders of

Nuveen Preferred & Income Opportunities Fund (JPC)

Nuveen Preferred and Income Term Fund (JPI)

Nuveen Preferred & Income Securities Fund (JPS)

Nuveen Preferred and Income Fund (JPT)

Nuveen Variable Rate Preferred & Income Fund (NPFD)

Portfolio Manager Commentaries in Semiannual Reports

Beginning with this semiannual shareholder report, the Funds will include portfolio manager commentary only in their annual shareholder reports. For the Funds’ most recent annual portfolio manager discussion, please refer to the Portfolio Managers’ Comments section of the Funds’ July 31, 2021 annual shareholder report.

For current information on your Fund’s investment objectives, portfolio management team and average annual total returns please refer to the Fund’s website at www.nuveen.com.

For changes that occurred to your Fund both during and subsequent to this reporting period, please refer to the Notes to Financial Statements section of this report.

For average annual total returns as of the end of this reporting period, please refer to the Performance Overview and Holding Summaries section within this report.

Fund Restructuring for Nuveen Preferred and Income Fund (JPT)

Events that occurred during the current reporting period

On January 19, 2022, shareholders of Nuveen Preferred and Income Fund (JPT) approved a proposal to restructure the fund (the “restructuring”). The restructuring allowed shareholders the opportunity to maintain their investment in JPT and its exposure to a leveraged strategy focused on preferred and other income producing securities in lieu of the scheduled termination of the fund. The effectiveness of the restructuring was contingent on the success of the fund’s tender offer.

On January 20, 2022, JPT conducted a tender offer, which allowed shareholders to offer up to 100% of their shares for repurchase for cash at a price per share equal to 100% of the net asset value (“NAV”) per share determined on the date the tender offer expired.

Events that occurred subsequent to the current reporting period

JPT’s tender offer expired on February 17, 2022. In the tender offer 2,454,617 shares were tendered, representing approximately 36% of JPT’s common shares outstanding. Properly tendered shares were repurchased $23.2613 per share, which was the NAV of the fund as of the close of ordinary trading on the New York Stock Exchange on February 17, 2022.

As a result of the successful completion of the tender offer, the restructuring of the JPT was completed and on February 28, 2022 the following changes became effective.

| • | JPT’s declaration of trust was amended to eliminate the term structure of the fund. |

| • | JPT’s investment policies were amended to permit investment in contingent capital securities (CoCos). |

| • | JPT’s use of leverage is expected to increase from current levels. |

5

Important Notices (continued)

| • | JPT’s name changed to Nuveen Preferred and Income Fund. |

| • | Nuveen Fund Advisors, LLC, the investment adviser to the fund, will waive 50% of the fund’s net management fees beginning February 8, 2022 and continuing over the first year following the elimination of the term structure. |

More details about JPT’s restructuring is available on www.nuveen.com/cef.

Additional Market Disruption Risk

In late February 2022, Russia launched a large scale military attack on Ukraine. The invasion significantly amplified already existing geopolitical tensions among Russia, Ukraine, Europe, NATO and the West, including the U.S. In response to the military action by Russia, various countries, including the U.S., the United Kingdom, and European Union issued broad-ranging economic sanctions against Russia. Such sanctions included, among other things, a prohibition on doing business with certain Russian companies, large financial institutions, officials and oligarchs; a commitment by certain countries and the European Union to remove selected Russian banks from the Society for Worldwide Interbank Financial Telecommunications (“SWIFT”), the electronic banking network that connects banks globally; and restrictive measures to prevent the Russian Central Bank from undermining the impact of the sanctions.

Additional sanctions may be imposed in the future. Such sanctions (and any future sanctions) and other actions against Russia may adversely impact, among other things, the Russian economy and various sectors of the economy, including but not limited to, financials, energy, metals and mining, engineering and defense and defense-related materials sectors; resulting in a decline in the value and liquidity of Russian securities; resulting in boycotts, tariffs, and purchasing and financing restrictions on Russia’s government, companies and certain individuals; weaken the value of the ruble; downgrade the country’s credit rating; freeze Russian securities and/or funds invested in prohibited assets and impair the ability to trade in Russian securities and/or other assets; and have other adverse consequences on the Russian government, economy, companies and region. Further, several large corporations and U.S. states have announced plans to divest interests or otherwise curtail business dealings with certain Russian businesses.

The ramifications of the hostilities and sanctions, however, may not be limited to Russia and Russian companies but may spill over to and negatively impact other regional and global economic markets (including Europe and the United States), companies in other countries (particularly those that have done business with Russia) and on various sectors, industries and markets for securities and commodities globally, such as oil and natural gas. Accordingly, the actions discussed above and the potential for a wider conflict could increase financial market volatility, cause severe negative effects on regional and global economic markets, industries, and companies and have a negative effect on your Fund’s investments and performance beyond any direct exposure to Russian issuers or those of adjoining geographic regions. In addition, Russia may take retaliatory actions and other countermeasures, including cyberattacks and espionage against other countries and companies around the world, which may negatively impact such countries and the companies in which your Fund invests.

The extent and duration of the military action or future escalation of such hostilities, the extent and impact of existing and future sanctions, market disruptions and volatility, and the result of any diplomatic negotiations cannot be predicted. These and any related events could have a significant impact on Fund performance and the value of an investment in the Fund, particularly with respect to Russian exposure.

6

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through bank borrowings as well as the use of reverse repurchase agreements for JPC, JPI JPS and NPFD. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that a Fund pays on its leveraging instruments are lower than the interest the Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage. This has been particularly true in the recent market environment where short-term rates have been low by historical standards.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value. All this will make the shares’ total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term tax-exempt interest rates. While fund leverage expenses are somewhat higher than their all-time lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

The Funds’ use of leverage had a negative impact on total return performance during this reporting period.

JPC, JPI and JPS continued to use interest rate swap contracts to partially hedge the interest cost of leverage. During the period, these interest rate swaps had a positive impact on the overall fund performance of JPC, JPI and JPS.

As of January 31, 2022, the Funds’ percentages of leverage are as shown in the accompanying table.

| JPC | JPI | JPS | JPT | NPFD | ||||||||||||||||

Effective Leverage* | 37.42 | % | 35.31 | % | 37.20 | % | 22.27 | % | 34.50 | % | ||||||||||

Regulatory Leverage* | 32.13 | % | 29.97 | % | 31.05 | % | 22.27 | % | 24.71 | % | ||||||||||

| * | Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of the Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

7

Fund Leverage (continued)

THE FUNDS’ LEVERAGE

Bank Borrowings

As noted previously, the Funds employ leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown in the accompanying table.

| Current Reporting Period | Subsequent to the Close of the Reporting Period | |||||||||||||||||||||||||||||||||||

Fund | Outstanding | Draws | Paydowns | Outstanding | Average Balance Outstanding | Draws | Paydowns | Outstanding Balance as of March 23, 2022 | ||||||||||||||||||||||||||||

JPC | $ | 462,700,000 | $ | 10,700,000 | $ | — | $ | 473,400,000 | $ | 470,192,120 | $ | — | $ | (40,000,000 | ) | $ | 433,400,000 | |||||||||||||||||||

JPI | $ | 234,800,000 | $ | 1,200,000 | $ | — | $ | 236,000,000 | $ | 235,060,870 | $ | — | $ | (5,000,000 | ) | $ | 231,000.000 | |||||||||||||||||||

JPS | $ | 873,300,000 | $ | — | $ | — | $ | 873,300,000 | $ | 873,300,000 | $ | — | $ | (59,000,000 | ) | $ | 814,300,000 | |||||||||||||||||||

JPT | $ | 47,000,000 | $ | — | $ | — | $ | 47,000,000 | $ | 47,000,000 | $ | — | $ | — | $ | 47,000,000 | ||||||||||||||||||||

NPFD | $ | — | $ | 193,200,000 | $ | — | $ | 193,200,000 | $ | 166,533,333 | * | $ | 12,000,000 | $ | (1,600,000 | ) | $ | 203,600,000 | ||||||||||||||||||

| * | For the period January 11, 2022 (initial draw) through January 31, 2022. |

Refer to Notes to Financial Statements, Note 8 – Fund Leverage for further details.

Reverse Repurchase Agreements

As noted previously, JPC, JPI, JPS and NPFD used reverse repurchase agreements, in which the Funds sell to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Funds’ transactions in reverse repurchase agreements are as shown in the accompanying table.

| Current Reporting Period | Subsequent to the Close of the Reporting Period | |||||||||||||||||||||||||||||||||||

Fund | Outstanding | Sales | Purchases | Outstanding | Average Balance Outstanding | Sales | Purchases | Outstanding Balance as of March 23, 2022 | ||||||||||||||||||||||||||||

JPC | $ | 121,000,000 | $ | 7,000,000 | $ | (3,500,000 | ) | $ | 124,500,000 | $ | 124,274,457 | $ | — | $ | (22,400,000 | ) | $ | 102,100,000 | ||||||||||||||||||

JPI | $ | 56,500,000 | $ | 9,100,000 | $ | (600,000 | ) | $ | 65,000,000 | $ | 63,853,804 | $ | — | $ | — | $ | 65,000,000 | |||||||||||||||||||

JPS | $ | 275,000,000 | $ | — | $ | — | $ | 275,000,000 | $ | 275,000,000 | $ | — | $ | — | $ | 275,000,000 | ||||||||||||||||||||

NPFD | $ | — | $ | 120,000,000 | $ | (3,200,000 | ) | $ | 116,800,000 | $ | 102,577,778 | ** | $ | — | $ | (8,398,000 | ) | $ | 108,402,000 | |||||||||||||||||

| ** | For the period January 5, 2022 (initial purchase of reverse repurchase agreements) through January 31, 2022. |

Refer to Notes to Financial Statements, Note 8 – Fund Leverage for further details.

8

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of January 31, 2022. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| Per Common Share Amounts | ||||||||||||||||

| Monthly Distributions (Ex-Dividend Date) | JPC | JPI | JPS | JPT | ||||||||||||

August 2021 | $ | 0.0530 | $ | 0.1305 | $ | 0.0505 | $ | 0.1185 | ||||||||

September | 0.0530 | 0.1305 | 0.0505 | 0.1185 | ||||||||||||

October | 0.0530 | 0.1305 | 0.0505 | 0.1185 | ||||||||||||

November | 0.0530 | 0.1305 | 0.0505 | 0.1185 | ||||||||||||

December | 0.0530 | 0.1305 | 0.0505 | 0.1185 | ||||||||||||

January 2022 | 0.0530 | 0.1305 | 0.0505 | 0.1185 | ||||||||||||

Total Distributions | $ | 0.3180 | $ | 0.7830 | $ | 0.3030 | $ | 0.7110 | ||||||||

Current Distribution Rate* | 6.92 | % | 6.46 | % | 6.47 | % | 5.96 | % | ||||||||

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes. |

NPFD declared its first distribution of $0.1380 during January 2022, for shareholders of record on February 15, 2022 and payable on March 1, 2022 (subsequent to the end of the reporting period). Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed-end fund resource page, which is at https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

9

Common Share Information (continued)

COMMON SHARE EQUITY SHELF PROGRAMS

During the current reporting period, JPC and JPS were authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (Shelf Offering). Under these programs, JPC and JPS, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per common share. The maximum aggregate offering under these Shelf Offerings, are as shown in the accompanying table.

| JPC | JPS | |||||||

Maximum aggregate offering | Unlimited | Unlimited | ||||||

During the current reporting period, JPS and JPC sold common shares through their Shelf Offerings at a weighted average premium to its NAV per common share as shown in the accompanying table.

| JPC | JPS | |||||||

Common shares sold through shelf offering | 1,185,860 | 921,252 | ||||||

Weighted average premium to NAV per common share sold | 1.18 | % | 1.16 | % | ||||

Refer to Notes to Financial Statements, Note 5 – Fund Shares for further details of Shelf Offerings and each Fund’s transactions.

COMMON SHARE REPURCHASES

During August 2021, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing JPC, JPI, JPS and JPT to repurchase an aggregate of up to approximately 10% of its outstanding common shares. NPFD is currently not authorized to repurchase its common shares.

During the current reporting period, the Funds did not repurchase any of their outstanding common shares. As of January 31, 2022 (and since the inception of the Funds’ repurchase programs), each Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| JPC | JPI | JPS | JPT | |||||||||||||

Common shares cumulatively repurchased and retired | 2,826,100 | 0 | 38,000 | 0 | ||||||||||||

Common shares authorized for repurchase | 10,380,000 | 2,275,000 | 20,475,000 | 680,000 | ||||||||||||

OTHER COMMON SHARE INFORMATION

As of January 31, 2022, the Funds’ common share prices were trading at a premium/(discount) to their common share NAV and trading at an average premium/(discount) to NAV during the current reporting period, as follows.

| JPC | JPI | JPS | JPT | NPFD | ||||||||||||||||

Common share NAV | $ | 9.52 | $ | 24.21 | $ | 9.43 | $ | 23.96 | $ | 24.36 | ||||||||||

Common share price | $ | 9.19 | $ | 24.25 | $ | 9.28 | $ | 23.87 | $ | 24.78 | ||||||||||

Premium/(Discount) to NAV | (3.47 | )% | 0.17 | % | (1.59 | )% | (0.38 | )% | 1.72 | % | ||||||||||

Average premium/(discount) to NAV | (0.53 | )% | 1.19 | % | (0.46 | )% | 0.26 | % | 2.40 | % | ||||||||||

10

THIS PAGE INTENTIONALLY LEFT BLANK

11

| JPC | Nuveen Preferred & Income Opportunities Fund Performance Overview and Holding Summaries as of January 31, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2022*

| Cumulative | Average Annual | |||||||||||||||

| 6-Month | 1-Year | 5-Year | 10-Year | |||||||||||||

| JPC at Common Share NAV | (0.76)% | 5.48% | 5.64% | 8.14% | ||||||||||||

| JPC at Common Share Price | (5.03)% | 7.02% | 6.03% | 9.08% | ||||||||||||

| ICE BofA U.S. All Capital Securities Index | (2.31)% | 1.63% | 5.86% | 6.81% | ||||||||||||

| JPC Blended Benchmark | (2.48)% | 1.21% | 5.79% | 6.14% | ||||||||||||

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment. Performance for indexes that were created after the Fund’s inception are linked to the Fund’s previous benchmark.

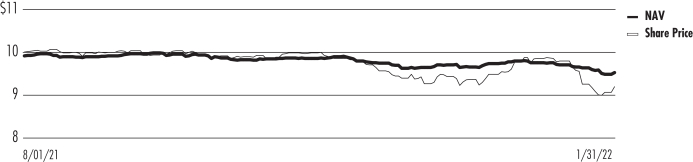

Daily Common Share NAV and Share Price

| * | For purposes of Fund performance, relative results are measured against the JPC Blended Benchmark. The JPC Blended Benchmark consists of: 1) 50% ICE BofA Fixed Rate Preferred Securities Index, 2) 30% ICE BofA U.S. All Capital Securities Index and 3) 20% ICE USD Contingent Capital Index (CDLR). Prior to December 31, 2013: 1) 82.5% ICE BofA Fixed Rate Preferred Securities Index and 2) 17.5% Bloomberg Capital Securities Index. Refer to the Glossary of Terms Used in this Report for further details on the Fund’s Blended Benchmark compositions. |

12

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| $1,000 Par (or similar) Institutional Preferred | 80.5% | |||

| $25 Par (or similar) Retail Preferred | 34.2% | |||

| Contingent Capital Securities | 30.7% | |||

| Corporate Bonds | 8.3% | |||

| Convertible Preferred Securities | 4.1% | |||

| Common Stocks | 0.4% | |||

| Repurchase Agreements | 1.5% | |||

| Other Assets Less Liabilities | 0.1% | |||

Net Assets Plus Borrowings and Reverse Repurchase Agreements | 159.8% | |||

| Borrowings | (47.3)% | |||

| Reverse Repurchase Agreements | (12.5)% | |||

Net Assets | 100% |

Portfolio Composition

(% of total investments)

| Banks | 41.0% | |||

| Insurance | 14.3% | |||

| Capital Markets | 9.6% | |||

| Food Products | 5.2% | |||

| Diversified Financial Services | 3.8% | |||

| Electric Utilities | 3.6% | |||

| Multi-Utilities | 2.7% | |||

| Other2 | 18.8% | |||

| Repurchase Agreements | 1.0% | |||

Total | 100% |

Country Allocation1

(% of total investments)

| United States | 73.3% | |||

| United Kingdom | 8.0% | |||

| Switzerland | 4.1% | |||

| France | 3.4% | |||

| Canada | 3.1% | |||

| Spain | 1.3% | |||

| Australia | 1.3% | |||

| Netherlands | 1.1% | |||

| Germany | 1.0% | |||

| Italy | 0.9% | |||

| Ireland | 0.7% | |||

| Other | 1.8% | |||

Total | 100% |

Top Five Issuers

(% of total long-term

investments)

| Citigroup Inc | 3.4% | |||

| JPMorgan Chase & Co | 3.2% | |||

| Bank of America Corp | 2.9% | |||

| Wells Fargo & Co | 2.9% | |||

| Land O’ Lakes Inc | 2.8% |

Portfolio Credit Quality

(% of total long-term fixed-income investments)

| A | 0.1% | |||

| BBB | 57.8% | |||

| BB or Lower | 36.8% | |||

| N/R (not rated) | 5.3% | |||

Total | 100% |

| 1 | Includes 1.3% (as a percentage of total investments) in emerging market countries. |

| 2 | See the Portfolio of Investments for the remaining industries comprising “Other” and not listed in the Portfolio Composition above. |

13

| JPI | Nuveen Preferred and Income Term Fund Performance Overview and Holding Summaries as of January 31, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2022*

| Cumulative | Average Annual | |||||||||||||||

| 6-Month | 1-Year | 5-Year | Since Inception | |||||||||||||

| JPI at Common Share NAV | (1.57)% | 5.19% | 6.74% | 7.94% | ||||||||||||

| JPI at Common Share Price | (4.71)% | 6.60% | 7.54% | 7.79% | ||||||||||||

| ICE BofA U.S. All Capital Securities Index | (2.31)% | 1.63% | 5.86% | 6.65% | ||||||||||||

| JPI Blended Benchmark | (2.01)% | 1.86% | 6.38% | 5.98% | ||||||||||||

Since inception returns are from 7/26/12. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

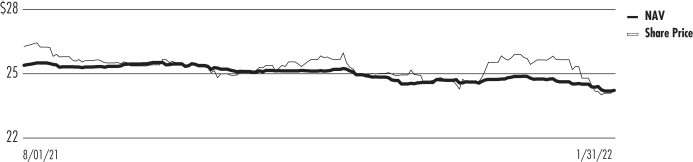

Daily Common Share NAV and Share Price

| * | For purposes of Fund performance, relative results are measured against the JPI Blended Benchmark. The JPI Blended Benchmark consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index (CDLR). Prior to December 31, 2013: 1) 65% ICE BofA Fixed Rate Preferred Securities Index and 2) 35% Bloomberg Capital Securities Index. Refer to the Glossary of Terms Used in this Report for further details on the Fund’s Blended Benchmark compositions. |

14

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| $1,000 Par (or similar) Institutional Preferred | 72.7% | |||

| Contingent Capital Securities | 51.9% | |||

| $25 Par (or similar) Retail Preferred | 28.2% | |||

| Corporate Bonds | 0.7% | |||

| Repurchase Agreements | 0.2% | |||

| Other Assets Less Liabilities | 0.9% | |||

Net Assets Plus Borrowings and Reverse Repurchase Agreements | 154.6% | |||

| Borrowings | (42.8)% | |||

| Reverse Repurchase Agreements | (11.8)% | |||

Net Assets | 100% |

Portfolio Composition

(% of total investments)

| Banks | 48.0% | |||

| Insurance | 14.6% | |||

| Capital Markets | 12.1% | |||

| Diversified Financial Services | 4.8% | |||

| Food Products | 4.7% | |||

| Other2 | 15.7% | |||

| Repurchase Agreements | 0.1% | |||

Total | 100% |

Country Allocation1

(% of total investments)

| United States | 58.0% | |||

| United Kingdom | 12.8% | |||

| Switzerland | 7.2% | |||

| France | 6.0% | |||

| Spain | 2.3% | |||

| Australia | 2.2% | |||

| Canada | 2.0% | |||

| Netherlands | 1.9% | |||

| Germany | 1.7% | |||

| Italy | 1.5% | |||

| Ireland | 1.2% | |||

| Other | 3.2% | |||

Total | 100% |

Top Five Issuers

(% of total long-term

investments)

| UBS Group AG | 3.7% | |||

| HSBC Holdings PLC | 3.6% | |||

| Credit Suisse Group AG | 3.5% | |||

| Citigroup Inc | 3.2% | |||

| Barclays PLC | 3.1% |

Portfolio Credit Quality

(% of total long-term fixed-income

investments)

| A | 0.2% | |||

| BBB | 61.2% | |||

| BB or Lower | 36.2% | |||

| N/R (not rated) | 2.4% | |||

Total | 100% |

| 1 | Includes 2.1% (as a percentage of total investments) in emerging market countries. |

| 2 | See the Portfolio of Investments for the remaining industries comprising “Other” and not listed in the Portfolio Composition above. |

15

| JPS | Nuveen Preferred & Income Securities Fund Performance Overview and Holding Summaries as of January 31, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2022*

| Cumulative | Average Annual | |||||||||||||||

| 6-Month | 1-Year | 5-Year | 10-Year | |||||||||||||

| JPS at Common Share NAV | (1.84)% | 3.42% | 6.51% | 8.41% | ||||||||||||

| JPS at Common Share Price | (4.43)% | 5.75% | 6.54% | 8.64% | ||||||||||||

| ICE BofA U.S. All Capital Securities Index | (2.31)% | 1.63% | 5.86% | 6.48% | ||||||||||||

| JPS Blended Benchmark | (2.01)% | 1.86% | 6.38% | 6.78% | ||||||||||||

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment. Performance for indexes that were created after the Fund’s inception are linked to the Fund’s previous benchmark.

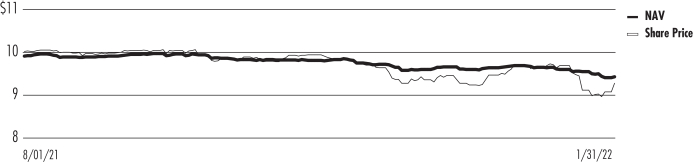

Daily Common Share NAV and Share Price

| * | For purposes of Fund performance, relative results are measured against the JPS Blended Benchmark. The JPS Blended Benchmark consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index (CDLR). Prior to December 31, 2013: 1) 55% ICE BofA Fixed Rate Preferred Securities Index and 2) 45% Bloomberg Capital Securities Tier-1 Index. Refer to the Glossary of Terms Used in this Report for further details on the Fund’s Blended Benchmark compositions. |

16

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| $1,000 Par (or similar) Institutional Preferred | 79.1% | |||

| Contingent Capital Securities | 54.8% | |||

| $25 Par (or similar) Retail Preferred | 16.7% | |||

| Corporate Bonds | 4.5% | |||

| Convertible Preferred Securities | 1.8% | |||

| Investment Companies | 1.1% | |||

| Repurchase Agreements | 1.1% | |||

| Other Assets Less Liabilities | 0.1% | |||

Net Assets Plus Borrowings and Reverse Repurchase Agreements | 159.2% | |||

| Borrowings | (45.0)% | |||

| Reverse Repurchase Agreements | (14.2)% | |||

Net Assets | 100% |

Portfolio Composition

(% of total investments)

| Banks | 52.0% | |||

| Insurance | 15.5% | |||

| Capital Markets | 14.0% | |||

| Electric Utilities | 3.9% | |||

| Other2 | 13.2% | |||

| Repurchase Agreements | 0.7% | |||

| Investment Companies | 0.7% | |||

Total | 100% |

Country Allocation1

(% of total investments)

| United States | 52.8% | |||

| United Kingdom | 13.4% | |||

| France | 10.0% | |||

| Switzerland | 8.1% | |||

| Finland | 2.8% | |||

| Canada | 2.2% | |||

| Spain | 2.0% | |||

| Norway | 1.8% | |||

| Netherlands | 1.2% | |||

| Australia | 1.2% | |||

| Japan | 1.2% | |||

| Other | 3.3% | |||

Total | 100% |

Top Five Issuers

(% of total long-term

investments)

| Barclays PLC | 4.1% | |||

| UBS Group AG | 3.4% | |||

| Wells Fargo & Co | 3.3% | |||

| BNP Paribas SA | 3.2% | |||

| Societe Generale SA | 3.2% |

Portfolio Credit Quality

(% of total long-term fixed-income investments)

| A | 7.1% | |||

| BBB | 79.2% | |||

| BB or Lower | 13.7% | |||

Total | 100% |

| 1 | Includes 0.0% (as a percentage of total investments) in emerging market countries. |

| 2 | See the Portfolio of Investments for the remaining industries comprising “Other” and not listed in the Portfolio Composition above. |

17

| JPT | Nuveen Preferred and Income Fund Performance Overview and Holding Summaries as of January 31, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2022*

| Cumulative | Average Annual | |||||||||||||||

| 6-Month | 1-Year | 5-Year | Since Inception | |||||||||||||

| JPT at Common Share NAV | (1.51)% | 4.06% | 5.55% | 5.49% | ||||||||||||

| JPT at Common Share Price | (3.46)% | 2.79% | 5.25% | 5.15% | ||||||||||||

| ICE BofA U.S. All Capital Securities Index | (2.31)% | 1.63% | 5.86% | 5.90% | ||||||||||||

Since inception returns are from 1/26/17. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

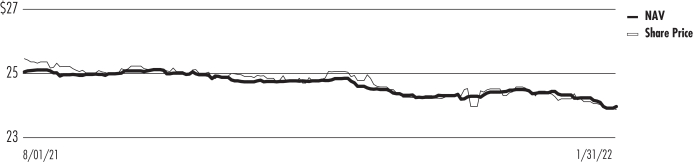

Daily Common Share NAV and Share Price

| * | For purposes of Fund performance, relative results are measured against the ICE BofA U.S. All Capital Securities Index. |

18

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

$1,000 Par (or similar) Institutional Preferred | 93.6% | |||

$25 Par (or similar) Retail Preferred | 32.6% | |||

Corporate Bonds | 1.3% | |||

Repurchase Agreements | 0.4% | |||

Other Assets Less Liabilities | 0.8% | |||

Net Assets Plus Borrowings | 128.7% | |||

Borrowings | (28.7)% | |||

Net Assets | 100% |

Portfolio Composition

(% of total investments)

Banks | 32.0% | |||

Insurance | 23.7% | |||

Capital Markets | 7.1% | |||

Food Products | 7.0% | |||

Diversified Financial Services | 6.9% | |||

Oil, Gas & Consumable Fuels | 4.4% | |||

Other2 | 18.5% | |||

Repurchase Agreements | 0.4% | |||

Total | 100% |

Country Allocation1

(% of total investments)

United States | 83.1% | |||

Canada | 3.7% | |||

United Kingdom | 2.8% | |||

Ireland | 2.8% | |||

Bermuda | 2.3% | |||

Australia | 2.3% | |||

France | 1.6% | |||

Other | 1.4% | |||

Total | 100% |

Top Five Issuers

(% of total long- term investments)

Citigroup Inc | 4.2% | |||

JPMorgan Chase & Co | 3.8% | |||

Wells Fargo & Co | 3.4% | |||

Land O’ Lakes Inc | 3.3% | |||

Bank of America Corp | 3.1% |

Portfolio Credit Quality

(% of total long-term

fixed-income investments)

| A | 1.1% | |||

| BBB | 60.7% | |||

| BB or Lower | 35.1% | |||

| N/R (not rated) | 3.1% | |||

Total | 100% |

| 1 | Includes 2.8% (as a percentage of total investments) in emerging market countries. |

| 2 | See the Portfolio of Investments for the remaining industries comprising “Other” and not listed in the Portfolio Composition above. |

19

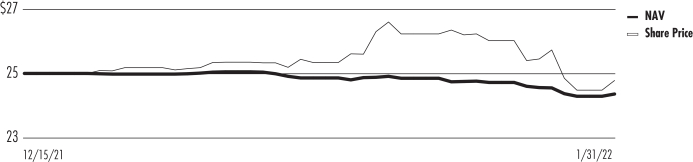

| NPFD | Nuveen Variable Rate Preferred & Income Fund Performance Overview and Holding Summaries as of January 31, 2022 |

Refer to Glossary of Terms Used in this Report for further definition of terms used in this section.

Cumulative Total Returns as of January 31, 2022*

| Since Inception | ||||

| NPFD at Common Share NAV | (2.56)% | |||

| NPFD at Common Share Price | (0.88)% | |||

| ICE Variable Rate Preferred & Hybrid Securities Index | (0.73)% | |||

| NPFD Blended Benchmark | (0.83)% | |||

Since inception returns are from 12/15/2021. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

| * | For purposes of Fund performance, relative results are measured against the NPFD Blended Benchmark. The NPFD Blended Benchmark consists of: 1) 80% ICE Variable Rate Preferred & Hybrid Securities Index and 2) 20% ICE USD Contingent Capital Index (CDLR). |

20

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

$1,000 Par (or similar) Institutional Preferred | 94.1% | |||

Contingent Capital Securities | 30.6% | |||

$25 Par (or similar) Retail Preferred | 24.2% | |||

Repurchase Agreements | 0.5% | |||

Other Assets Less Liabilities | 3.3% | |||

Net Assets Plus Borrowings and Reverse Repurchase Agreements | 152.7% | |||

Borrowings | (32.8)% | |||

Reverse Repurchase Agreements | (19.9)% | |||

Net Assets | 100% |

Portfolio Composition

(% of total investments)

Banks | 45.3% | |||

Insurance | 13.6% | |||

Capital Markets | 12.6% | |||

Oil, Gas & Consumable Fuels | 5.1% | |||

Trading Companies & Distributors | 3.6% | |||

Electric Utilities | 3.3% | |||

Other2 | 16.2% | |||

| Repurchase Agreements | 0.3% | |||

Total | 100% |

Country Allocation1

(% of total investments)

United States | 66.5% | |||

United Kingdom | 9.0% | |||

Canada | 4.7% | |||

Switzerland | 4.5% | |||

France | 3.8% | |||

Ireland | 2.2% | |||

Australia | 2.1% | |||

Spain | 1.4% | |||

Netherlands | 1.2% | |||

Italy | 1.2% | |||

Other | 3.4% | |||

Total | 100% |

Top Five Issuers

(% of total long- term investments)

Citigroup Inc | 4.8% | |||

JPMorgan Chase & Co | 4.4% | |||

Wells Fargo & Co | 3.8% | |||

Bank of America Corp | 3.3% | |||

Goldman Sachs Group Inc | 3.0% |

Portfolio Credit Quality

(% of total long-term

fixed-income investments)

| A | 0.2% | |||

| BBB | 63.8% | |||

| BB or Lower | 33.5% | |||

| N/R (not rated) | 2.5% | |||

Total | 100% |

| 1 | Includes 1.8% (as a percentage of total investments) in emerging market countries. |

| 2 | See the Portfolio of Investments for the remaining industries comprising “Other” and not listed in the Portfolio Composition above. |

21

A special meeting of shareholders was held on December 17, 2021 for JPT. The meeting was held virtually due to public health concerns regarding the ongoing COVID-19 pandemic; at this meeting shareholders were asked to approve an amendment to the Fund’s Declaration of Trust. The meeting was subsequently adjourned to January 19, 2022 in order to seek additional shareholder participation.

| JPT | ||||

| Common Shares | ||||

To approve an amendment to the Fund’s Declaration of Trust | ||||

For | 3,462,697 | |||

Against | 299,684 | |||

Abstain | 186,995 | |||

Total | 3,949,376 | |||

22

| JPC | Nuveen Preferred & Income

Portfolio of Investments January 31, 2022 | |

| (Unaudited) |

| Principal Amount (000)/ Shares | Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

LONG-TERM INVESTMENTS – 158.2% (99.0% of Total Investments) |

| |||||||||||||||||||

$1,000 PAR (OR SIMILAR) INSTITUTIONAL PREFERRED – 80.5% (50.4% of Total Investments) |

| |||||||||||||||||||

Auto Components – 1.1% |

| |||||||||||||||||||

| $ | 3,625 | Adient US LLC, 144A | 9.000% | 4/15/25 | BB- | $ | 3,841,412 | |||||||||||||

| 6,600 | American Axle & Manufacturing Inc, (3) | 6.500% | 4/01/27 | B+ | 6,798,000 | |||||||||||||||

Total Auto Components | 10,639,412 | |||||||||||||||||||

| Automobiles – 3.1% | ||||||||||||||||||||

| 7,485 | General Motors Financial Co Inc | 5.700% | N/A (4) | BB+ | 8,411,643 | |||||||||||||||

| 9,140 | General Motors Financial Co Inc, (3) | 5.750% | N/A (4) | BB+ | 9,645,442 | |||||||||||||||

| 11,750 | General Motors Financial Co Inc, (3), (5) | 6.500% | N/A (4) | BB+ | 12,807,500 | |||||||||||||||

Total Automobiles | 30,864,585 | |||||||||||||||||||

| Banks – 32.1% | ||||||||||||||||||||

| 3,685 | Bank of America Corp | 4.375% | N/A (4) | BBB+ | 3,639,306 | |||||||||||||||

| 3,540 | Bank of America Corp | 6.250% | N/A (4) | BBB+ | 3,752,400 | |||||||||||||||

| 27,985 | Bank of America Corp, (3), (5), (6) | 6.500% | N/A (4) | BBB+ | 30,117,457 | |||||||||||||||

| 5,560 | Bank of America Corp, (3) | 6.300% | N/A (4) | BBB+ | 6,088,200 | |||||||||||||||

| 1,415 | Bank of America Corp | 6.100% | N/A (4) | BBB+ | 1,525,243 | |||||||||||||||

| 1,820 | Citigroup Inc | 4.150% | N/A (4) | BBB- | 1,775,810 | |||||||||||||||

| 16,055 | Citigroup Inc, (3) | 6.250% | N/A (4) | BBB- | 17,740,775 | |||||||||||||||

| 6,290 | Citigroup Inc, (3) | 5.000% | N/A (4) | BBB- | 6,360,071 | |||||||||||||||

| 9,981 | Citigroup Inc | 5.950% | N/A (4) | BBB- | 10,529,955 | |||||||||||||||

| 7,145 | Citigroup Inc | 6.300% | N/A (4) | BBB- | 7,347,204 | |||||||||||||||

| 2,215 | Citizens Financial Group Inc, (3) | 4.000% | N/A (4) | BB+ | 2,173,469 | |||||||||||||||

| 1,685 | Citizens Financial Group Inc | 6.375% | N/A (4) | BB+ | 1,727,125 | |||||||||||||||

| 3,150 | CoBank ACB, (3) | 6.250% | N/A (4) | BBB+ | 3,449,250 | |||||||||||||||

| 2,420 | Farm Credit Bank of Texas, 144A, (3) | 5.700% | N/A (4) | Baa1 | 2,571,250 | |||||||||||||||

| 1,900 | Fifth Third Bancorp, (3) | 4.500% | N/A (4) | Baa3 | 1,957,000 | |||||||||||||||

| 14,985 | First Citizens BancShares Inc/NC | 5.800% | N/A (4) | N/R | 15,546,937 | |||||||||||||||

| 910 | Goldman Sachs Group Inc/The | 4.400% | N/A (4) | BB+ | 889,525 | |||||||||||||||

| 925 | Goldman Sachs Group Inc/The | 3.800% | N/A (4) | BBB- | 889,656 | |||||||||||||||

| 2,314 | HSBC Capital Funding Dollar 1 LP, 144A | 10.176% | N/A (4) | BBB | 3,748,680 | |||||||||||||||

| 3,025 | Huntington Bancshares Inc/OH, (3) | 5.700% | N/A (4) | Baa3 | 3,040,125 | |||||||||||||||

| 5,525 | Huntington Bancshares Inc/OH | 5.625% | N/A (4) | Baa3 | 6,203,028 | |||||||||||||||

| 2,660 | JPMorgan Chase & Co, (3) | 6.100% | N/A (4) | BBB+ | 2,822,925 | |||||||||||||||

| 33,555 | JPMorgan Chase & Co, (3) | 6.750% | N/A (4) | BBB+ | 35,927,338 | |||||||||||||||

| 4,665 | JPMorgan Chase & Co | 3.650% | N/A (4) | BBB+ | 4,484,791 | |||||||||||||||

| 7,275 | JPMorgan Chase & Co | 5.000% | N/A (4) | BBB+ | 7,402,313 | |||||||||||||||

| 2,485 | KeyCorp | 5.000% | N/A (4) | Baa3 | 2,615,463 | |||||||||||||||

| 12,655 | �� | Lloyds Bank PLC, 144A | 12.000% | N/A (4) | Baa3 | 12,655,000 | ||||||||||||||

| 1,440 | M&T Bank Corp, (3) | 3.500% | N/A (4) | Baa2 | 1,353,758 | |||||||||||||||

| 1,880 | M&T Bank Corp | 5.125% | N/A (4) | Baa2 | 1,997,848 | |||||||||||||||

| 6,970 | M&T Bank Corp, (3) | 6.450% | N/A (4) | Baa2 | 7,325,121 | |||||||||||||||

| 2,222 | PNC Financial Services Group Inc/The | 5.000% | N/A (4) | Baa2 | 2,310,880 | |||||||||||||||

| 1,710 | PNC Financial Services Group Inc/The | 3.400% | N/A (4) | Baa2 | 1,611,658 | |||||||||||||||

| 21,977 | PNC Financial Services Group Inc/The, (3-Month LIBOR reference rate + 3.678% spread), (3), (7) | 3.804% | N/A (4) | Baa2 | 22,130,950 | |||||||||||||||

| 8,290 | Regions Financial Corp | 5.750% | N/A (4) | BB+ | 8,912,496 | |||||||||||||||

| 785 | SVB Financial Group | 4.700% | N/A (4) | Baa2 | 779,270 | |||||||||||||||

| 875 | SVB Financial Group | 4.100% | N/A (4) | Baa2 | 826,193 | |||||||||||||||

| 3,690 | SVB Financial Group | 4.000% | N/A (4) | Baa2 | 3,586,570 | |||||||||||||||

| 10,155 | Truist Financial Corp, (5) | 4.800% | N/A (4) | Baa2 | 10,358,100 | |||||||||||||||

| 2,690 | Truist Financial Corp | 5.100% | N/A (4) | Baa2 | 2,918,650 | |||||||||||||||

| 1,930 | Truist Financial Corp | 5.050% | N/A (4) | Baa2 | 1,910,700 | |||||||||||||||

23

| JPC | Nuveen Preferred & Income Opportunities Fund (continued) | |

| Portfolio of Investments January 31, 2022 | ||

| (Unaudited) | ||

| Principal Amount (000)/ Shares | Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Banks (continued) | ||||||||||||||||||||

| $ | 9,458 | Truist Financial Corp, (5) | 4.950% | N/A (4) | Baa2 | $ | 10,010,536 | |||||||||||||

| 1,385 | Wells Fargo & Co, (3) | 7.950% | 11/15/29 | Baa1 | 1,848,155 | |||||||||||||||

| 7,780 | Wells Fargo & Co, (3) | 3.900% | N/A (4) | Baa2 | 7,705,701 | |||||||||||||||

| 20,134 | Wells Fargo & Co, (3), (5) | 5.875% | N/A (4) | Baa2 | 21,524,252 | |||||||||||||||

| 3,490 | Wells Fargo & Co | 5.900% | N/A (4) | Baa2 | 3,577,250 | |||||||||||||||

| 11,196 | Zions Bancorp NA, (5) | 7.200% | N/A (4) | BB+ | 11,847,160 | |||||||||||||||

| 1,105 | Zions Bancorp NA | 5.800% | N/A (4) | BB+ | 1,126,609 | |||||||||||||||

Total Banks | 320,642,153 | |||||||||||||||||||

| Capital Markets – 3.3% | ||||||||||||||||||||

| 2,040 | Bank of New York Mellon Corp/The | 4.700% | N/A (4) | Baa1 | 2,149,650 | |||||||||||||||

| 2,250 | Charles Schwab Corp/The, (3) | 4.000% | N/A (4) | BBB | 2,222,843 | |||||||||||||||

| 4,325 | Charles Schwab Corp/The | 7.000% | N/A (4) | BBB | 4,352,031 | |||||||||||||||

| 11,935 | Charles Schwab Corp/The | 5.375% | N/A (4) | BBB | 12,818,190 | |||||||||||||||

| 5,069 | Goldman Sachs Group Inc/The | 5.500% | N/A (4) | BBB- | 5,316,621 | |||||||||||||||

| 1,555 | Goldman Sachs Group Inc/The | 4.125% | N/A (4) | BBB- | 1,518,069 | |||||||||||||||

| 4,411 | Goldman Sachs Group Inc/The | 5.300% | N/A (4) | BBB- | 4,730,797 | |||||||||||||||

Total Capital Markets | 33,108,201 | |||||||||||||||||||

| Communications Equipment – 0.2% | ||||||||||||||||||||

| 2,315 | Vodafone Group PLC, (3) | 4.125% | 6/04/81 | BB+ | 2,205,084 | |||||||||||||||

| Consumer Finance – 3.5% | ||||||||||||||||||||

| 14,134 | Ally Financial Inc, (3) | 4.700% | N/A (4) | Ba2 | 13,973,579 | |||||||||||||||

| 6,365 | Ally Financial Inc | 4.700% | N/A (4) | Ba2 | 6,301,350 | |||||||||||||||

| 3,335 | American Express Co | 3.550% | N/A (4) | Baa2 | 3,193,262 | |||||||||||||||

| 3,215 | Capital One Financial Corp | 3.950% | N/A (4) | Baa3 | 3,142,663 | |||||||||||||||

| 8,120 | Discover Financial Services, (3) | 6.125% | N/A (4) | Ba2 | 8,761,967 | |||||||||||||||

Total Consumer Finance | 35,372,821 | |||||||||||||||||||

| Diversified Financial Services – 4.4% | ||||||||||||||||||||

| 9,325 | American AgCredit Corp, 144A, (3) | 5.250% | N/A (4) | BB+ | 9,511,500 | |||||||||||||||

| 2,590 | Capital Farm Credit ACA, 144A, (3) | 5.000% | N/A (4) | BB | 2,654,750 | |||||||||||||||

| 13,000 | Compeer Financial ACA, 144A, (3), (9) | 6.750% | N/A (4) | BB+ | 13,104,000 | |||||||||||||||

| 1,100 | Compeer Financial ACA, 144A | 4.875% | N/A (4) | BB+ | 1,116,500 | |||||||||||||||

| 3,670 | Equitable Holdings Inc | 4.950% | N/A (4) | BBB- | 3,770,925 | |||||||||||||||

| 13,001 | Voya Financial Inc, (3) | 6.125% | N/A (4) | BBB- | 13,456,035 | |||||||||||||||

Total Diversified Financial Services | 43,613,710 | |||||||||||||||||||

| Electric Utilities – 4.6% | ||||||||||||||||||||

| 2,070 | American Electric Power Co Inc | 3.875% | 2/15/62 | BBB- | 2,030,551 | |||||||||||||||

| 5,880 | Edison International, (3) | 5.000% | N/A (4) | BB+ | 5,857,538 | |||||||||||||||

| 1,200 | Edison International, (3) | 5.375% | N/A (4) | BB+ | 1,217,250 | |||||||||||||||

| 1,565 | Electricite de France SA, 144A, (3) | 5.250% | N/A (4) | Baa3 | 1,590,431 | |||||||||||||||

| 21,680 | Emera Inc, (3) | 6.750% | 6/15/76 | BB+ | 24,444,200 | |||||||||||||||

| 7,475 | NextEra Energy Capital Holdings Inc, (3) | 5.650% | 5/01/79 | BBB | 8,307,373 | |||||||||||||||

| 2,165 | Southern Co/The, (6) | 4.000% | 1/15/51 | BBB- | 2,181,259 | |||||||||||||||

Total Electric Utilities | 45,628,602 | |||||||||||||||||||

| Food Products – 4.6% | ||||||||||||||||||||

| 2,145 | Dairy Farmers of America Inc, 144A | 7.125% | N/A (4) | BB+ | 2,236,162 | |||||||||||||||

| 3,860 | Land O’ Lakes Inc, 144A, (3) | 7.250% | N/A (4) | BB | 4,159,150 | |||||||||||||||

| 29,460 | Land O’ Lakes Inc, 144A, (3) | 8.000% | N/A (4) | BB | 31,632,675 | |||||||||||||||

| 7,435 | Land O’ Lakes Inc, 144A, (3) | 7.000% | N/A (4) | BB | 7,881,100 | |||||||||||||||

Total Food Products | 45,909,087 | |||||||||||||||||||

| Health Care Providers & Services – 0.5% | ||||||||||||||||||||

| 4,900 | Tenet Healthcare Corp, 144A, (3) | 7.500% | 4/01/25 | B+ | 5,104,683 | |||||||||||||||

| Independent Power & Renewable Electricity Producers – 1.6% | ||||||||||||||||||||

| 1,350 | AES Andes SA, 144A, (3) | 7.125% | 3/26/79 | BB | 1,380,443 | |||||||||||||||

24

| Principal Amount (000)/ Shares | Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Independent Power & Renewable Electricity Producers (continued) | ||||||||||||||||||||

| $ | 2,775 | AES Andes SA, 144A | 6.350% | 10/07/79 | BB | $ | 2,822,716 | |||||||||||||

| 8,525 | Vistra Corp, 144A | 8.000% | N/A (4) | Ba3 | 8,844,687 | |||||||||||||||

| 2,815 | Vistra Corp, 144A | 7.000% | N/A (4) | Ba3 | 2,800,925 | |||||||||||||||

Total Independent Power & Renewable Electricity Producers | 15,848,771 | |||||||||||||||||||

| Industrial Conglomerates – 0.9% | ||||||||||||||||||||

| 9,026 | General Electric Co, (3-Month LIBOR reference rate + 3.330% spread), (3), (7) | 3.533% | N/A (4) | BBB- | 8,822,915 | |||||||||||||||

| Insurance – 13.1% | ||||||||||||||||||||

| 1,615 | Aegon NV | 5.500% | 4/11/48 | BBB | 1,816,270 | |||||||||||||||

| 1,550 | American International Group Inc, (6) | 5.750% | 4/01/48 | BBB- | 1,690,384 | |||||||||||||||

| 9,409 | Assurant Inc | 7.000% | 3/27/48 | BB+ | 10,655,692 | |||||||||||||||

| 11,519 | Assured Guaranty Municipal Holdings Inc, 144A, (6) | 6.400% | 12/15/66 | BBB+ | 12,651,080 | |||||||||||||||

| 2,465 | AXIS Specialty Finance LLC | 4.900% | 1/15/40 | BBB | 2,568,062 | |||||||||||||||

| 2,395 | Enstar Finance LLC | 5.750% | 9/01/40 | BB+ | 2,478,754 | |||||||||||||||

| 5,720 | Enstar Finance LLC | 5.500% | 1/15/42 | BB+ | 5,640,608 | |||||||||||||||

| 1,485 | Legal & General Group PLC, Reg S | 5.250% | 3/21/47 | A3 | 1,579,298 | |||||||||||||||

| 5,075 | Markel Corp | 6.000% | N/A (4) | BBB- | 5,417,563 | |||||||||||||||

| 11,660 | MetLife Capital Trust IV, 144A, (3) | 7.875% | 12/15/37 | BBB | 15,536,950 | |||||||||||||||

| 8,088 | MetLife Inc, 144A, (6) | 9.250% | 4/08/38 | BBB | 11,952,431 | |||||||||||||||

| 2,275 | MetLife Inc | 3.850% | N/A (4) | BBB | 2,292,063 | |||||||||||||||

| 1,430 | MetLife Inc | 5.875% | N/A (4) | BBB | 1,577,639 | |||||||||||||||

| 575 | Nationwide Financial Services Capital Trust | 7.899% | 3/01/37 | Baa2 | 718,797 | |||||||||||||||

| 9,550 | Nationwide Financial Services Inc, (3), (6) | 6.750% | 5/15/37 | Baa2 | 11,245,125 | |||||||||||||||

| 2,485 | PartnerRe Finance B LLC, (6) | 4.500% | 10/01/50 | Baa1 | 2,546,280 | |||||||||||||||

| 5,065 | Provident Financing Trust I | 7.405% | 3/15/38 | BB+ | 6,191,962 | |||||||||||||||

| 745 | Prudential Financial Inc, (6) | 3.700% | 10/01/50 | BBB+ | 729,301 | |||||||||||||||

| 9,055 | QBE Insurance Group Ltd, 144A | 7.500% | 11/24/43 | Baa1 | 9,802,037 | |||||||||||||||

| 1,215 | QBE Insurance Group Ltd, Reg S | 6.750% | 12/02/44 | BBB | 1,319,842 | |||||||||||||||

| 2,960 | QBE Insurance Group Ltd, 144A, (3) | 5.875% | N/A (4) | Baa2 | 3,130,200 | |||||||||||||||

| 9,700 | SBL Holdings Inc, 144A | 6.500% | N/A (4) | BB | 9,215,000 | |||||||||||||||

| 10,685 | SBL Holdings Inc, 144A | 7.000% | N/A (4) | BB | 10,524,725 | |||||||||||||||

Total Insurance | 131,280,063 | |||||||||||||||||||

| Multi-Utilities – 2.5% | ||||||||||||||||||||

| 2,125 | Algonquin Power & Utilities Corp | 4.750% | 1/18/82 | BB+ | 2,099,556 | |||||||||||||||

| 6,420 | CenterPoint Energy Inc | 6.125% | N/A (4) | BBB- | 6,565,156 | |||||||||||||||

| 850 | CMS Energy Corp, (6) | 4.750% | 6/01/50 | BBB- | 898,620 | |||||||||||||||

| 3,400 | Dominion Energy Inc | 4.350% | N/A (4) | BBB- | 3,425,500 | |||||||||||||||

| 1,320 | NiSource Inc | 5.650% | N/A (4) | BBB- | 1,343,100 | |||||||||||||||

| 3,005 | Sempra Energy | 4.125% | 4/01/52 | BBB- | 2,925,679 | |||||||||||||||

| 7,280 | Sempra Energy | 4.875% | N/A (4) | BBB- | 7,614,516 | |||||||||||||||

Total Multi-Utilities | 24,872,127 | |||||||||||||||||||

| Oil, Gas & Consumable Fuels – 1.8% | ||||||||||||||||||||

| 1,540 | Enbridge Inc, (3) | 6.000% | 1/15/77 | BBB- | 1,634,147 | |||||||||||||||

| 800 | Enbridge Inc | 5.500% | 7/15/77 | BBB- | 816,138 | |||||||||||||||

| 3,765 | Enbridge Inc | 5.750% | 7/15/80 | BBB- | 4,122,675 | |||||||||||||||

| 1,705 | Energy Transfer LP | 6.500% | N/A (4) | BB | 1,743,891 | |||||||||||||||

| 1,735 | MPLX LP | 6.875% | N/A (4) | BB+ | 1,726,325 | |||||||||||||||

| 6,450 | Transcanada Trust, (3) | 5.875% | 8/15/76 | BBB | 6,888,600 | |||||||||||||||

| 1,400 | Transcanada Trust | 5.500% | 9/15/79 | BBB | 1,470,000 | |||||||||||||||

Total Oil, Gas & Consumable Fuels | 18,401,776 | |||||||||||||||||||

| Trading Companies & Distributors – 2.2% | ||||||||||||||||||||

| 7,560 | AerCap Global Aviation Trust, 144A | 6.500% | 6/15/45 | BB+ | 8,092,753 | |||||||||||||||

| 3,205 | AerCap Holdings NV | 5.875% | 10/10/79 | BB+ | 3,251,472 | |||||||||||||||

| 2,180 | Air Lease Corp, (3) | 4.650% | N/A (4) | BB+ | 2,196,830 | |||||||||||||||

| 1,960 | ILFC E-Capital Trust I, 144A | 3.370% | 12/21/65 | B+ | 1,631,700 | |||||||||||||||

25

| JPC | Nuveen Preferred & Income Opportunities Fund (continued) | |

| Portfolio of Investments January 31, 2022 | ||

| (Unaudited) | ||

| Principal Amount (000)/ Shares | Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Trading Companies & Distributors (continued) | ||||||||||||||||||||

| $ | 8,474 | ILFC E-Capital Trust I, 144A | 3.620% | 12/21/65 | BB+ | $ | 7,351,195 | |||||||||||||

Total Trading Companies & Distributors | 22,523,950 | |||||||||||||||||||

| U.S. Agency – 0.6% | ||||||||||||||||||||

| 5,835 | Farm Credit Bank of Texas, 144A, (3) | 6.200% | N/A (4) | BBB+ | 6,258,038 | |||||||||||||||

| Wireless Telecommunication Services – 0.4% | ||||||||||||||||||||

| 3,285 | Vodafone Group PLC | 7.000% | 4/04/79 | BB+ | 3,775,638 | |||||||||||||||

Total $1,000 Par (or similar) Institutional Preferred (cost $766,961,950) |

| 804,871,616 | ||||||||||||||||||

| Shares | Description (1) | Coupon | Ratings (2) | Value | ||||||||||||||||

$25 PAR (OR SIMILAR) RETAIL PREFERRED – 34.2% (21.4% of Total Investments) |

| |||||||||||||||||||

| Banks – 9.1% | ||||||||||||||||||||

| 63,000 | Bank of America Corp | 4.375% | BBB+ | $ | 1,489,320 | |||||||||||||||

| 389,931 | Citigroup Inc, (5) | 7.125% | BBB- | 10,457,949 | ||||||||||||||||

| 127,675 | CoBank ACB, (8) | 6.250% | BBB+ | 13,252,665 | ||||||||||||||||

| 93,724 | CoBank ACB, (8) | 6.200% | BBB+ | 10,098,761 | ||||||||||||||||

| 165,500 | Farm Credit Bank of Texas, 144A, (3), (8) | 6.750% | Baa1 | 17,046,500 | ||||||||||||||||

| 236,981 | Fifth Third Bancorp, (3) | 6.625% | Baa3 | 6,495,650 | ||||||||||||||||

| 178,757 | FNB Corp/PA, (3) | 7.250% | Ba1 | 4,853,253 | ||||||||||||||||

| 138,275 | KeyCorp | 6.125% | Baa3 | 3,975,406 | ||||||||||||||||

| 72,962 | People’s United Financial Inc | 5.625% | BB+ | 2,000,618 | ||||||||||||||||

| 247,561 | Regions Financial Corp, (3) | 6.375% | BB+ | 6,941,610 | ||||||||||||||||

| 61,900 | Regions Financial Corp | 5.700% | BB+ | 1,648,397 | ||||||||||||||||

| 91,115 | Synovus Financial Corp | 5.875% | BB- | 2,434,593 | ||||||||||||||||

| 66,100 | Truist Financial Corp | 4.750% | Baa2 | 1,680,262 | ||||||||||||||||

| 68,200 | Wells Fargo & Co | 4.750% | Baa2 | 1,694,088 | ||||||||||||||||

| 187,400 | Western Alliance Bancorp, (3) | 4.250% | Ba1 | 4,726,228 | ||||||||||||||||

| 91,847 | Wintrust Financial Corp | 6.875% | BB | 2,546,917 | ||||||||||||||||

Total Banks | 91,342,217 | |||||||||||||||||||

| Capital Markets – 4.5% | ||||||||||||||||||||

| 79,169 | Charles Schwab Corp/The | 5.950% | BBB | 2,036,227 | ||||||||||||||||

| 33,793 | Goldman Sachs Group Inc/The | 5.500% | BB+ | 884,363 | ||||||||||||||||

| 741,766 | Morgan Stanley, (3), (5) | 7.125% | Baa3 | 20,087,023 | ||||||||||||||||

| 110,293 | Morgan Stanley | 6.875% | Baa3 | 2,991,146 | ||||||||||||||||

| 209,211 | Morgan Stanley | 5.850% | Baa3 | 5,774,224 | ||||||||||||||||

| 100,352 | Morgan Stanley | 6.375% | Baa3 | 2,735,595 | ||||||||||||||||

| 276,907 | Stifel Financial Corp, (3) | 6.250% | BB- | 7,205,120 | ||||||||||||||||

| 130,906 | Stifel Financial Corp, (3) | 6.125% | BB- | 3,385,229 | ||||||||||||||||

Total Capital Markets | 45,098,927 | |||||||||||||||||||

| Consumer Finance – 0.7% | ||||||||||||||||||||

| 84,573 | Capital One Financial Corp, (3) | 5.000% | Baa3 | 2,120,245 | ||||||||||||||||

| 204,314 | Synchrony Financial, (3) | 5.625% | BB- | 5,310,121 | ||||||||||||||||

Total Consumer Finance | 7,430,366 | |||||||||||||||||||

| Diversified Financial Services – 1.7% | ||||||||||||||||||||

| 74,600 | AgriBank FCB, (8) | 6.875% | BBB+ | 7,944,900 | ||||||||||||||||

| 114,400 | Equitable Holdings Inc | 5.250% | BBB- | 2,932,072 | ||||||||||||||||

| 204,839 | Voya Financial Inc | 5.350% | BBB- | 5,868,637 | ||||||||||||||||

Total Diversified Financial Services | 16,745,609 | |||||||||||||||||||

| Diversified Telecommunication Services – 0.8% | ||||||||||||||||||||

| 52,800 | AT&T Inc, (3) | 4.750% | BBB- | 1,297,296 | ||||||||||||||||

| 259,100 | Qwest Corp | 6.750% | BBB- | 6,573,367 | ||||||||||||||||

Total Diversified Telecommunication Services | 7,870,663 | |||||||||||||||||||

26

| Shares | Description (1) | Coupon | Ratings (2) | Value | ||||||||||||||||

| Electric Utilities – 0.3% | ||||||||||||||||||||

| 100,000 | Duke Energy Corp, (3) | 5.750% | BBB- | $ | 2,673,000 | |||||||||||||||

| Equity Real Estate Investment Trust – 1.2% | ||||||||||||||||||||

| 142,800 | Pebblebrook Hotel Trust | 6.375% | N/R | 3,571,428 | ||||||||||||||||

| 132,500 | Pebblebrook Hotel Trust | 5.700% | N/R | 3,113,750 | ||||||||||||||||

| 66,300 | Summit Hotel Properties Inc | 5.875% | N/R | 1,630,980 | ||||||||||||||||

| 138,800 | Sunstone Hotel Investors Inc | 6.125% | N/R | 3,472,776 | ||||||||||||||||

Total Equity Real Estate Investment Trust | 11,788,934 | |||||||||||||||||||

| Food Products – 3.7% | ||||||||||||||||||||

| 295,811 | CHS Inc, (3) | 7.875% | N/R | 8,134,803 | ||||||||||||||||

| 487,106 | CHS Inc | 7.100% | N/R | 13,322,349 | ||||||||||||||||

| 468,864 | CHS Inc | 6.750% | N/R | 12,771,855 | ||||||||||||||||

| 23,900 | Dairy Farmers of America Inc, 144A, (5), (8), (9) | 7.875% | BB+ | 2,413,900 | ||||||||||||||||

Total Food Products | 36,642,907 | |||||||||||||||||||

| Insurance – 8.4% | ||||||||||||||||||||

| 274,600 | American Equity Investment Life Holding Co | 5.950% | BB | 7,359,280 | ||||||||||||||||

| 137,600 | American Equity Investment Life Holding Co | 6.625% | BB | 3,784,000 | ||||||||||||||||

| 302,283 | Argo Group US Inc, (3) | 6.500% | BBB- | 7,756,582 | ||||||||||||||||

| 249,028 | Aspen Insurance Holdings Ltd | 5.950% | BB+ | 6,721,266 | ||||||||||||||||

| 66,100 | Aspen Insurance Holdings Ltd | 5.625% | BB+ | 1,693,482 | ||||||||||||||||

| 48,200 | Assurant Inc | 5.250% | BB+ | 1,226,208 | ||||||||||||||||

| 411,533 | Athene Holding Ltd, (3) | 6.350% | BBB | 11,444,733 | ||||||||||||||||

| 370,852 | Athene Holding Ltd | 6.375% | BBB | 10,061,215 | ||||||||||||||||

| 63,400 | Delphi Financial Group Inc, (8), (9) | 3.346% | BBB | 1,378,950 | ||||||||||||||||

| 459,098 | Enstar Group Ltd, (3) | 7.000% | BB+ | 12,840,971 | ||||||||||||||||

| 255,780 | Hartford Financial Services Group Inc/The, (3) | 7.875% | Baa2 | 6,514,716 | ||||||||||||||||

| 219,645 | Maiden Holdings North America Ltd | 7.750% | N/R | 4,821,010 | ||||||||||||||||

| 113,445 | Reinsurance Group of America Inc, (3) | 6.200% | BBB+ | 2,932,553 | ||||||||||||||||

| 157,800 | Reinsurance Group of America Inc | 5.750% | BBB+ | 4,541,484 | ||||||||||||||||

| 46,100 | Selective Insurance Group Inc | 4.600% | BBB- | 1,101,790 | ||||||||||||||||

Total Insurance | 84,178,240 | |||||||||||||||||||

| Multi-Utilities – 0.7% | ||||||||||||||||||||

| 271,210 | Algonquin Power & Utilities Corp | 6.200% | BB+ | 7,252,156 | ||||||||||||||||

| Oil, Gas & Consumable Fuels – 1.2% | ||||||||||||||||||||

| 35,700 | Energy Transfer LP | 7.600% | BB | 888,930 | ||||||||||||||||

| 167,226 | NuStar Energy LP | 6.969% | B2 | 4,115,432 | ||||||||||||||||

| 148,751 | NuStar Energy LP | 7.625% | B2 | 3,269,547 | ||||||||||||||||

| 127,137 | NuStar Logistics LP | 6.975% | B | 3,205,124 | ||||||||||||||||

Total Oil, Gas & Consumable Fuels | 11,479,033 | |||||||||||||||||||

| Thrifts & Mortgage Finance – 1.1% | ||||||||||||||||||||

| 75,580 | Federal Agricultural Mortgage Corp | 6.000% | N/R | 2,023,276 | ||||||||||||||||

| 337,570 | New York Community Bancorp Inc, (3) | 6.375% | Ba2 | 9,354,065 | ||||||||||||||||

Total Thrifts & Mortgage Finance | 11,377,341 | |||||||||||||||||||

| Trading Companies & Distributors – 0.3% | ||||||||||||||||||||

| 124,215 | Air Lease Corp | 6.150% | BB+ | 3,259,402 | ||||||||||||||||

| Wireless Telecommunication Services – 0.5% | ||||||||||||||||||||

| 177,000 | United States Cellular Corp | 6.250% | BB+ | 4,543,590 | ||||||||||||||||

Total $25 Par (or similar) Retail Preferred (cost $330,762,660) | 341,682,385 | |||||||||||||||||||

| Principal Amount (000) | Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

CONTINGENT CAPITAL SECURITIES – 30.7% (19.3% of Total Investments) (10) |

| |||||||||||||||||||

| Banks – 23.3% | ||||||||||||||||||||

| $ | 2,025 | Australia & New Zealand Banking Group Ltd/United Kingdom, 144A, (3) | 6.750% | N/A (4) | Baa2 | $ | 2,257,875 | |||||||||||||

27

| JPC | Nuveen Preferred & Income Opportunities Fund (continued) | |

| Portfolio of Investments January 31, 2022 | ||

| (Unaudited) | ||

| Principal Amount (000) | Description (1) | Coupon | Maturity | Ratings (2) | Value | |||||||||||||||

| Banks – 23.3% (continued) | ||||||||||||||||||||

| $ | 3,805 | Banco Bilbao Vizcaya Argentaria SA, (3) | 6.125% | N/A (4) | Ba2 | $ | 3,904,881 | |||||||||||||

| 5,975 | Banco Bilbao Vizcaya Argentaria SA | 6.500% | N/A (4) | Ba2 | 6,206,531 | |||||||||||||||

| 1,400 | Banco Mercantil del Norte SA/Grand Cayman, 144A | 7.500% | N/A (4) | Ba2 | 1,424,500 | |||||||||||||||

| 3,120 | Banco Mercantil del Norte SA/Grand Cayman, 144A, (3) | 7.625% | N/A (4) | Ba2 | 3,186,830 | |||||||||||||||

| 5,600 | Banco Santander SA, Reg S, (3) | 7.500% | N/A (4) | Ba1 | 5,949,104 | |||||||||||||||

| 4,905 | Banco Santander SA | 4.750% | N/A (4) | Ba1 | 4,713,705 | |||||||||||||||

| 9,910 | Barclays PLC | 8.000% | N/A (4) | BBB- | 10,799,125 | |||||||||||||||

| 8,865 | Barclays PLC | 7.750% | N/A (4) | BBB- | 9,419,063 | |||||||||||||||

| 6,440 | Barclays PLC | 6.125% | N/A (4) | BBB- | 6,848,618 | |||||||||||||||

| 1,600 | Barclays PLC | 4.375% | N/A (4) | BBB- | 1,510,560 | |||||||||||||||

| 1,000 | BNP Paribas SA, 144A | 7.000% | N/A (4) | BBB | 1,132,500 | |||||||||||||||

| 10,495 | BNP Paribas SA, 144A, (5) | 7.375% | N/A (4) | BBB | 11,736,558 | |||||||||||||||

| 8,145 | BNP Paribas SA, 144A | 6.625% | N/A (4) | BBB | 8,590,532 | |||||||||||||||

| 2,165 | Credit Agricole SA, 144A | 4.750% | N/A (4) | BBB | 2,124,406 | |||||||||||||||

| 5,985 | Credit Agricole SA, 144A | 7.875% | N/A (4) | BBB | 6,486,244 | |||||||||||||||

| 7,445 | Credit Agricole SA, 144A | 8.125% | N/A (4) | BBB | 8,612,004 | |||||||||||||||

| 5,100 | Credit Suisse Group AG, 144A | 5.250% | N/A (4) | BB+ | 5,085,720 | |||||||||||||||

| 1,815 | Danske Bank A/S, Reg S | 6.125% | N/A (4) | BBB- | 1,878,561 | |||||||||||||||

| 1,840 | Danske Bank A/S, Reg S | 4.375% | N/A (4) | BBB- | 1,775,600 | |||||||||||||||

| 1,600 | Danske Bank A/S, Reg S, (3) | 7.000% | N/A (4) | BBB- | 1,716,992 | |||||||||||||||

| 4,010 | HSBC Holdings PLC, (3) | 6.375% | N/A (4) | BBB | 4,210,500 | |||||||||||||||

| 15,344 | HSBC Holdings PLC, (5) | 6.375% | N/A (4) | BBB | 16,221,984 | |||||||||||||||

| 11,850 | HSBC Holdings PLC, (3) | 6.000% | N/A (4) | BBB | 12,509,215 | |||||||||||||||

| 6,130 | ING Groep NV, Reg S | 6.750% | N/A (4) | BBB | 6,520,788 | |||||||||||||||

| 3,210 | ING Groep NV | 6.500% | N/A (4) | BBB | 3,434,700 | |||||||||||||||

| 5,280 | ING Groep NV | 5.750% | N/A (4) | BBB | 5,550,600 | |||||||||||||||

| 7,590 | Intesa Sanpaolo SpA, 144A, (3) | 7.700% | N/A (4) | BB- | 8,330,025 | |||||||||||||||

| 11,565 | Lloyds Banking Group PLC, (3) | 7.500% | N/A (4) | Baa3 | 12,550,107 | |||||||||||||||

| 6,995 | Lloyds Banking Group PLC | 7.500% | N/A (4) | Baa3 | 7,759,728 | |||||||||||||||

| 3,350 | Macquarie Bank Ltd/London, 144A | 6.125% | N/A (4) | BB+ | 3,504,938 | |||||||||||||||

| 6,385 | NatWest Group PLC | 8.000% | N/A (4) | BBB- | 7,191,106 | |||||||||||||||

| 5,405 | NatWest Group PLC, (3) | 6.000% | N/A (4) | BBB- | 5,692,006 | |||||||||||||||

| 3,985 | Nordea Bank Abp, 144A | 6.625% | N/A (4) | BBB+ | 4,420,879 | |||||||||||||||

| 1,975 | Societe Generale SA, 144A | 8.000% | N/A (4) | BB | 2,230,387 | |||||||||||||||

| 6,536 | Societe Generale SA, 144A | 7.875% | N/A (4) | BB+ | 7,000,710 | |||||||||||||||

| 2,066 | Societe Generale SA, 144A, (3) | 6.750% | N/A (4) | BB | 2,200,290 | |||||||||||||||

| 2,820 | Societe Generale SA, 144A | 4.750% | N/A (4) | BB+ | 2,785,906 | |||||||||||||||

| 4,845 | Standard Chartered PLC, 144A | 4.300% | N/A (4) | BBB- | 4,530,075 | |||||||||||||||

| 2,010 | Standard Chartered PLC, 144A | 7.750% | N/A (4) | BBB- | 2,115,364 | |||||||||||||||

| 3,120 | Standard Chartered PLC, 144A | 6.000% | N/A (4) | BBB- | 3,260,400 | |||||||||||||||

| 5,060 | UniCredit SpA, Reg S | 8.000% | N/A (4) | BB- | 5,477,450 | |||||||||||||||

| 218,766 | Total Banks | 232,857,067 | ||||||||||||||||||

| Capital Markets – 7.4% | ||||||||||||||||||||

| 2,090 | Credit Suisse Group AG, 144A | 6.375% | N/A (4) | BB+ | 2,181,438 | |||||||||||||||

| 10,229 | Credit Suisse Group AG, 144A, (3) | 7.250% | N/A (4) | BB+ | 10,932,244 | |||||||||||||||

| 3,925 | Credit Suisse Group AG, 144A | 7.500% | N/A (4) | BB+ | 4,183,030 | |||||||||||||||

| 8,750 | Credit Suisse Group AG, 144A | 7.500% | N/A (4) | BB+ | 9,105,600 | |||||||||||||||

| 14,020 | Deutsche Bank AG, (3) | 6.000% | N/A (4) | BB- | 14,125,150 | |||||||||||||||

| 10,095 | UBS Group AG, Reg S, (3) | 7.000% | N/A (4) | BBB | 10,970,741 | |||||||||||||||

| 1,640 | UBS Group AG, Reg S | 5.125% | N/A (4) | BBB | 1,693,457 | |||||||||||||||

| 7,950 | UBS Group AG, 144A, (3) | 7.000% | N/A (4) | BBB | 8,402,196 | |||||||||||||||

| 6,455 | UBS Group AG, Reg S, (3) | 6.875% | N/A (4) | BBB | 7,011,382 | |||||||||||||||

| 1,715 | UBS Group AG, 144A | 4.875% | N/A (4) | BBB | 1,712,599 | |||||||||||||||

| 4,590 | UBS Group AG, 144A | 3.875% | N/A (4) | BBB | 4,407,547 | |||||||||||||||