UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM S-1

Registration Statement Under The Securities Act Of 1933

___________________

EARLYDETECT INC.

(Exact name of registrant as specified in its charter)

Nevada (State or jurisdiction of incorporation or organization) | | 2835 (Primary Standard Industrial Classification Code Number) | | 88-0368729 (IRS Employer Identification No.) |

| | | | | |

| | | 2082 Michelson Dr., Suite 212 Irvine, CA 92612 (949) 553-1127 (Address and telephone number of principal executive offices and principal place of business) | | |

Charles A. Strongo

Chief Executive Officer

2082 Michelson Dr., Suite 212

Irvine, CA 92612

(949) 553-1127

(Name, address and telephone number for agent for service)

Copies of all communications to:

Raymond A. Lee, Esq. Chris Y. Chen, Esq. Greenberg Traurig, LLP 650 Town Center Drive, Suite 1700 Costa Mesa, CA 92626 (714) 708-6500 | | David S. Cooper, Esq. Daniel H. Kolber, Esq. Baker, Donelson, Bearman, Caldwell & Berkowitz, P.C. 3414 Peachtree Road, Suite 1600 Atlanta, GA 30326 (404) 577-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | Amount to be registered | | Proposed offering price per share | | Proposed maximum aggregate offering price | | Amount of registration fee | |

| Common stock, par value $0.001 per share | | | 3,050,000(1 | ) | $ | 10.00(2 | ) | $ | 30,500,000(2 | ) | $ | 936.35 | |

| | | | | | | | | | | | | | |

| Common stock, par value $0.001 per share | | | 3,555,206(3 | ) | $ | 10.00(4 | ) | $ | 35,552,060(4 | ) | $ | 1,091.45 | |

| | (1) | Includes 50,000 shares issued to the underwriters as part of compensation in connection with the offering. |

| | (2) | The registration fee for securities to be offered by the Registrant is based on the offering price and such estimate is solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

| | (3) | This Registration Statement also covers the resale under a separate resale prospectus (the “Resale Prospectus”) by selling stockholders of the Registrant of up to 3,555,206 shares of common stock previously issued to such selling stockholders as named in the Resale Prospectus. |

| | (4) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains a prospectus to be used in connection with the initial public offering of up to 3,000,000 shares of the Registrant's common stock through the underwriters named on the cover page of that prospectus (the "IPO Prospectus"). In addition, the Registrant registering on this Registration Statement for the resale of up to 3,555,206 shares of its common stock held by selling stockholders. Consequently, this Registration Statement contains a second prospectus to cover these possible resales (the "Resale Prospectus") by certain of the Registrant's stockholders named on the Resale Prospectus (the "Selling Stockholders"). The IPO Prospectus and the Resale Prospectus are substantively identical, except for the following principal points:

| · | they contain different outside and inside front covers; |

| · | they contain different Offering sections in the Prospectus Summary section beginning on page 6; |

| · | they contain different Use of Proceeds sections on page 16; |

| · | the Capitalization section is deleted from the Resale Prospectus on page 17; |

| · | the Dilution section is deleted from the Resale Prospectus on page 17; |

| · | a Selling Stockholder section is included in the Resale Prospectus beginning on page 41A; |

| · | references in the IPO Prospectus to the Resale Prospectus is deleted from the Resale Prospectus; |

| · | the Shares Eligible for Future Sale section is deleted from the Resale Prospectus on page 42; |

| · | the Certain Material U.S. Federal Income Tax Consequences to Non-US Holders section is deleted from the Resale Prospectus on page 43; |

| · | the Underwriting section from the IPO Prospectus on page 46 is deleted from the Resale Prospectus and a Plan of Distribution is inserted in its place; |

| · | the Legal Matters section in the Resale Prospectus on page 49 deletes the reference to counsel for the underwriters that is contained in the IPO Prospectus; and |

| · | the outside back cover of the IPO Prospectus is deleted from the Resale Prospectus. |

The Registrant has included in this Registration Statement, after the financial statements, alternate pages to reflect the foregoing differences.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE HAVE FILED A REGISTRATION STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION RELATING TO THIS OFFERING. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT BECOMES EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROSPECTUS

3,000,000 Shares

Maximum offering of 3,000,000 shares

Minimum offering of 1,000,000 shares

Common Stock

$10.00 per Share

EARLYDETECT INC.

[LOGO]

______________

This is a public offering of 3,000,000 shares of common stock by EarlyDETECT Inc. We are offering through our underwriters on a best efforts basis a minimum of 1,000,000 shares and up to a maximum of 3,000,000 shares of our common stock. The offering period shall commence on the effective date of this prospectus until the earlier of: December 31, 2007 or the date we have sold all of the shares we are offering or such other date as may be agreed upon by our underwriters and us.

Until the closing of the offering, all proceeds received from this offering will be placed into a non interest-bearing escrow account at [_____________] and will not be released until at least the minimum offering of 1,000,000 shares of common stock are subscribed for and paid for. If the minimum offering is not reached within ___ days from the date of this Prospectus (unless we extend it with the consent of the underwriters for up to ___ additional days), all funds placed in the escrow account will be promptly returned without interest. Purchasers of our common stock will have no right to the return of their funds during the term of the escrow. The termination date for the maximum offering is ___ days from the date of this Prospectus. See “Underwriting.”

We anticipate that the initial public offering price of our common stock will be $10.00 per share. Assuming an initial public offering price of $10.00 per share, the aggregate purchase price of the common stock offered hereby would be $10,000,000 for the minimum offering and $30,000,000 for the maximum offering.

EarlyDETECT Inc. is a Nevada corporation that was formed on September 19, 1996 under the name “Advance Medical Systems Inc.” and on June 25, 2002 changed its name to “EarlyDETECT Inc.” This is an initial public offering of our common stock and prior to this offering there has been no public market for our securities. EarlyDETECT Inc. (“EDI”) is an early stage company that has not generated any net revenues. Our products are currently available for purchase at certain retail chain outlets and elsewhere as more fully explained herein. We need money from this offering in order to increase our manufacturing, marketing, and sales effort among other uses.

We are applying to have our common stock quoted for trading on the Nasdaq Capital Market under the symbol “ERLY”. There can be no guarantee that we will be successful in having our stock listed thereon although we believe we will meet the Nasdaq Capital Market minimum listing requirements.

See the Risk Factors listed under “Risk Factors” beginning on page 8.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| | | Public Offering Price | | Proceeds to Us(1) | |

| Per share | | $ | | | $ | | |

| Minimum offering | | $ | | | $ | | |

| Maximum offering | | $ | | | $ | | |

(1) The expenses of this offering will include an aggregate of 11% of the gross proceeds from the offering payable to the underwriters, including commission and non-accountable marketing expense allowance. Such fees and expenses range from $1,100,000 for the minimum offering to $3,300,000 for the maximum offering. In addition, we have issued to the underwriters 50,000 shares of common stock and a warrant to purchase that number of common stock equal to 10% of the number of shares sold in the offering.

The date of this Prospectus is ________________, 2007

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other then the date on the front of this prospectus.

| Prospectus Summary | | 1 |

| Selected Financial Data | | 7 |

| Risk Factors | | 8 |

| Cautionary Statement Concerning Forward-Looking Information | | 15 |

| Use of Proceeds | | 16 |

| Dividend Policy | | 16 |

| Capitalization | | 17 |

| Dilution | | 17 |

| Description of Business | | 18 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 26 |

| Legal Proceedings | | 33 |

| Management | | 34 |

| Related Party Transactions | | 40 |

| Security Ownership of Certain Beneficial Owners and Management | | 40 |

| Description of Capital Stock | | 42 |

| Shares Eligible for Future Sale | | 42 |

| Certain Material United States Federal Income Tax Consequences to Non-U.S. Holders | | 43 |

| Underwriting | | 46 |

| Legal Matters | | 47 |

| Experts | | 47 |

| Where You Can Find More Information | | 47 |

| Index To Financial Information | | 48 |

Until [_____________], 2007 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully together with our consolidated financial statements and the related notes appearing elsewhere in this prospectus before making an investment decision. This prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Rick Factors” and other sections of the prospectus.

In this prospectus, the words “EarlyDETECT,” “EDI,” “company,” “we,” “our,” “ours” and “us” refer only to EarlyDETECT Inc. and our wholly owned subsidiaries, unless the context indicates otherwise. The following summary contains basic information about this offering. You should read carefully this entire prospectus, including the “Risk Factors,” financial information and related notes, as well as the documents we have incorporated by reference into this prospectus before making an investment decision.

Company Background and Products

Our company was incorporated in the State of Nevada on September 19, 1996 under the name “Advance Medical Systems Inc.” and, on June 25, 2002, we changed our name to “EarlyDETECT Inc.” Our company was founded to develop, manufacture and market in vitro diagnostic (IVD) tests for over-the-counter (OTC or consumer), and point-of-care (POC or professional) use markets. At our inception we tried to market our products outside the United States, primarily Canada. In 2004, we stopped all our marketing and sales efforts in Canada, and we decided to sell in the United States the 20 products we now offer. Our company currently manufactures and markets a range of diagnostic test kits for consumer use through over-the-counter (OTC) sales, and for use by health care professionals, generally located at medical clinics, physician offices and hospitals known as Points-of-Care (POC), in the United States. These test kits are known as in vitro diagnostic test kits or “IVD” products.

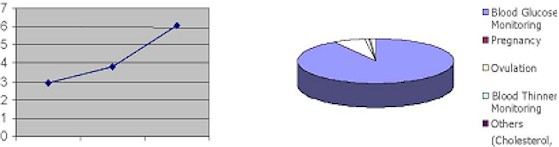

We believe that based on publicly available information that worldwide sales of at-home healthcare-related diagnostic kits have increased from $2.9 billion in 1999 to more than $6 billion in 2006 and is continuing to grow annually.

Currently we market 20 products consisting of ten OTC products and ten POC products in the U.S. Two of the 20 products are assembled and packaged differently and are sold in both the OTC and POC markets. Of the ten POC products, we manufacture three of them and the remaining 18 products we repackage and add certain components depending on the products. With respect to the products we do not manufacture directly, we buy components from various FDA inspected and registered facilities located throughout the U.S. that have met certain requirements in order to be designated as GMP facilities. GMP means good manufacturing practices. These components are delivered to our facility located in San Diego, California (the “San Diego Facility”) where they are repackaged, assembled, labeled and inserted in their final containers. Some of the components used in our products do not need to be manufactured at FDA inspected and registered facilities. Examples of such components are lance sets to puncture skin, bandages and alcohol. At the San Diego Facility, we also insert in each package pre-printed instructions. We use different labels depending on whether a product is destined for the OTC or POC markets. We obtain the cardboard packaging that our final products are placed in from a single supplier. We manufacture our own labels. We discuss our products in greater detail below.

Our OTC distribution channels consist of large chains and smaller retail outlets. We sell directly to the large chains by shipping our products to their respective distribution centers. We sell our products to smaller retail outlets either directly or through a middleman distributor, ANDA Distributors, who distributes to approximately 16,000 stores of which approximately 200 stores currently carry at least one of our OTC products. In addition, approximately 200 small retailers purchase our products directly from us. We also sell our products on the Internet through two websites: Drugstore.com and Amazon.com. Currently we do not sell our products directly to the public because we do not want to compete with our retail outlets.

We sell at least one of the products from our line of OTC products to the following large chain stores, which include drug stores, mass merchandisers, and food stores (some stores do not carry our entire line of OTC products) as set forth in the table below. With the exception of Wal-Mart, we do not sell in all of the stores of each of the retail chains.

EarlyDETECT Distributor Channels |

| | | | |

| Name of Distribution Outlet | Products Carried by Each Distribution Outlet | Number of Stores in Each Distribution Outlet Carrying Product | Location |

| | | | |

| Albertson (including Save-On) | Glucose | 490 | CA, NV, OR, NM, AZ, and UT |

| Hyvee | Entire Line | 495 | Midwest |

| Meijer | Entire Line | 365 | Midwest |

| Circle K | Pregnancy | 195 | CA and NV |

| Big Lots | Pregnancy | 200 | CA |

| PathMark | Entire Line | 125 | Northeast |

| General Nutrition | Colorectal, Glucose, Cholesterol | 120 | Nationwide |

| Wal-Mart | Colorectal | 1,985 | Nationwide |

In addition to our activities relating to the sales of our 20 products, we are engaged in certain research and development activities in two broad areas: to increase our IVD products line and to continue our attempts to develop two bio-pharmaceutical products. These two products are our H5N1 Avian Flu vaccine for birds and our SB15 compound to treat certain anxiety-related diseases and disorders. Neither of these two products are currently generating any revenue. However, we intend to devote approximately eight percent of the proceeds from this offering to our research and development activities devoted to these two bio-pharmaceutical products and approximately two percent of the proceeds from this offering to enhance our existing IVD product line. There can be no assurance that our research and development efforts will be successful in producing commercially viable products or in improving our existing IVD product line.

We have never been profitable. Since our inception, we have generated aggregate revenues of $1,202,315, of which $763,809 was generated prior to 2004. Since the end of our most recent fiscal year ending August 31, 2006 through the nine months ending May 31, 2007 we have lost $30,325,571 on sales of $287,291. We have suffered significant losses since our inception and these losses have increased yearly with the most significant increase occurring from fiscal year 2005 (a net loss of $5,652,135) to fiscal year 2006 (a net loss of $20,062,078). Our loss of $30,325,571 since August 31, 2006 is primarily attributed to acquisition costs and offsets associated with our acquisitions of Sherman Biotech and Pan Probe Biotech.

We currently manufacture (including repackaging and assembling) and market 20 products for consumer and professional markets in the United States. Except for our DNA Paternity Test, all of our products are sold pursuant to U.S. Food and Drug Administration regulations that apply to screening tests known as Class I and Class II FDA 510(K) tests. See the EarlyDETECT Product List Information Table on page 4. All of our products are designed to provide instant or rapid test results using simple and sanitary testing devices. The results of our IVD tests are designed to be easily read by consumers. Our products do not require refrigeration. Our IVD test kits are packaged individually for the retail market and in bulk for professional channels.

Of our 20 products, ten are sold in the OTC market primarily through large retail chains or smaller retail outlets and ten are sold in the POC market primarily to health clinics, physician offices, correctional institutions, and hospitals. Our products are available through the Internet. We consider our glucose tests as two separate products because we sell it in both the OTC and POC markets with some slight variation. The same holds true for our urinary tract infection tests. When we say we manufacture products we mean that we either combine and repackage components from FDA regulated third party vendors or, we manufacture at least one of the components in the test kit ourselves. Currently, we directly manufacture three POC test kits as follows: pregnancy, menopause, and drugs-of-abuse. The vast majority of our products are sold in packages that carry our EarlyDETECT name and logo, with respect to which we own the trademark. We also sell certain of our products under a different trademark that we own - LiveSURE. Currently, we are selling LiveSURE branded products only to the Big Lots retail chain. The retail prices to the consumer of our OTC products generally range from approximately $9.95 to approximately $19.95 per kit. We sells our POC products by the case of 25 or 50 kits to a case. We charge our POC purchasers per case a range of approximately $5.00 to $265.00 and we charge our wholesale purchasers per kit a range of approximately $3.25 to approximately $180.

The following describes our product line.

EarlyDETECT Pregnancy Wand Test (OTC) and EarlyDETECT Cassette Test (POC): This test series uses simplified technology. It is used by consumers in their home (OTC) and by the professional market (POC) to determine pregnancy. We believe that of all consumer IVD tests on the market sold by us or our competitors, the pregnancy test is the most popular. We know of at least five other companies who compete with us regarding this product.

EarlyDETECT Ovulation Wand Test (OTC) and EarlyDETECT Ovulation Cassette Test (POC): This test series predicts the onset of ovulation. Ovulation tests are widely used by women trying to conceive. We know of at least four other companies who compete with us regarding this product.

EarlyDETECT Menopause Wand Test (OTC) and EarlyDETECT Menopause Cassette Test (POC): This test series is a simple urine-based test to determine if menopause has occurred. This test shows if there is a “high constant” level of follicle-stimulating hormone, indicating that menopause has taken place.

EarlyDETECT Drugs-of-Abuse Cup Test (OTC) and EarlyDETECT Drugs-of-Abuse Dipstick Multipanel Test (POC): This test series detects the presence of metabolites of cocaine, marijuana, methamphetamines, amphetamines, benzodiazepines, PCP, and opiates in urine. The tests are sold to a variety of markets such as parents, governmental agencies, schools, and employers. Our tests are completed onsite within ten minutes.

EarlyDETECT Glucose Test (same product for OTC and POC markets with different packages): This test indicates the apparent presence of diabetes or hypoglycemia. EarlyDETECT Cholesterol Test (OTC) and EarlyDETECT Cholesterol Colormetric Test (POC): This test series determines the levels of cholesterol in whole blood which assists in combating the treat of heart disease.

Early DETECT Cholesterol Test (OTC) and EarlyDETECT Cholesterol Test Colormetric Test (POC): This test series determines the levels of cholesterol in whole blood which assists in combating the threat of heart disease.

EarlyDETECT Urinary Tract Infection Test (same product for OTC and POC markets with different packages): This test determines nitrates in urine, a symptom of urinary tract infection in men and women.

EarlyDETECT Breast Self-Examination Pad (OTC only): This highly sensitive pad is used by women to self-examine their breasts on a routine basis, for the early detection of breast lumps. It reduces the friction of skin against skin, making lumps easier to feel. The test includes a six-minute video demonstrating the correct method of breast self-examination and stressing the need for early detection and treatment of breast cancer.

EarlyDETECT DNA Paternity Test (OTC only): This test is a swab test. A sample is swabbed from the mouth of the mother, father, and child and the sample is sent to an independent unaffiliated lab for testing and analysis of DNA match.

EarlyDETECT Colorectal Test (OTC only): In their early stages, colorectal diseases such as cancer, ulcers, hemorrhoids, polyps, colitis, diverticulitis, and fissures often do not show visible symptoms. This test detects unseen blood and thereby serves as an early warning signal for disease. A tissue is thrown in the toilet and the patient then sees if the tissue changes color thus indicating the presence of blood. We know of only one other competitor offering this type of product.

EarlyDETECT Mononucleosis Test (POC only): This test is an antibody rapid diagnostic test, which indicates mononucleosis using whole blood samples.

EarlyDETECT Strep A Test (POC only): This test is a rapid diagnostic test using reagents added to a swab containing a throat mucus sample.

EarlyDETECT Influenza Test (POC only): This test is a diagnostic test, which indicates antibodies of influenza using whole blood samples.

EarlyDETECT H-Pylori Test (POC only): This ten-minute test determines the presence of the Helicobacter-Pylori bacteria in the digestive system.

EarlyDETECT Fecal Occult Blood (POC only): This test adds reagents to a stool sample to determine the existence of blood in the stool.

EarlyDETECT Product List Information |

| |

| Name of Product | FDA Class Designation (I, II, III) | 510 (K) Number | Over the Counter “OTC” | Point of Care “POC”(1) | Dates |

| | | | | | |

| Pregnancy Wand Test | II | K050546 | x | | 5-20-05 |

| Cassette Test | II | K020968 | | x | 7-15-02 |

| Ovulation Wand Test | I | K983113 | x | | 11-18-98 |

| Ovulation Cassette Test | I | K951538 | | x | 7-11-95 |

| Menopause Wand Test | I | K030058 | x | | 7-30-03 |

| Menopause Cassette Test | I | K030058 | | x | 7-30-03 |

| Drugs-of-Abuse Cup Test | II | K992748 | x | | 9-2-99 |

| Drugs-of-Abuse Dipstick Multipanel Test | II | K990325 | | x | 7-14-99 |

| Glucose Test | II | K943503 | x | x | 7-23-96 |

| Cholesterol Test | II | K943279 | x | | 5/01/95 |

| Cholesterol Colorimetric Test | I | K864159/0 | | x | 6-10-88 |

| Urinary Tract Infection Test | II | K990873 | x | x | 9-1-99 |

| Breast Self-Examination Pad | II | K991469 | x | x | 7-20-99 |

| DNA Paternity Test | | | x | | |

| Colorectal Test | II | K850431/A | x | | 6-17-85 |

| Mononucleosis Test | II | K042272 | | x | 2-23-05 |

| Strep A Test | I | K924007 | | x | 4-6-93 |

| Influenza Test | I | K991633 | | x | 9-24-99 |

| H-Pylori Test | I | K024350 | | x | 4-3-03 |

| Fecal Occult Blood | II | K063673 | | x | 3-5-07 |

________

(1) Our Glucose Test, Urinary Tract Infection Test, and Breast Self-Examination Pad are the same products for OTC and POC markets, and we include them as part of our ten OTC products but do not double-count them in our ten POC products.

In addition to the products described above, we are engaged in certain research and development activities with the objective of developing and marketing two bio-pharmaceutical drugs - an H5N1 Avian Flu vaccine for birds and a compound we call SB15 that might be used to treat anxiety related diseases and disorders. Neither of these products are ready to be marketed although we believe that the prospects for their development justifies spending approximately 8% of the proceeds from this offering to continue our research and development efforts. As of May 31, 2007 we spent approximately $75,000 and approximately $60,000 for research and development on the H5N1 Avian Bird Flu vaccine and the SB15 compound, respectively. We intend to devote approximately 2% of the proceeds from this offering to continue our research and development activities to improve our existing OTC and POC products lines by enhancing existing products and by adding new products. Currently of the 20 products that we now market we repackage or assemble components from third party vendors with respect to 17 of the products and manufacture three of the products ourselves. To the extent that we have the capacity to manufacture products directly as opposed or repackaging them or assembling them from others our operating margins should improve. Therefore, we intend to devote approximately 5% of the proceeds from this offering for the purpose of enabling us to manufacture products directly. There can be no assurances that we will be successful in manufacturing any or all of our products that we currently repackage or assemble.

On July 26, 2005, we purchased all the issued and outstanding shares of Pan Probe Biotech, Inc., a California corporation (“Pan Probe”), for an aggregate purchase price of $16,000,000 consisting of 2,500,000 shares of EDI common stock (approximately 15% of EDI’s then issued and outstanding shares) valued at $12,500,000 ($5.00 per share) and an EDI note in the amount of $3,500,000 of which $3,500,000 is outstanding and which we intend to retire from the proceeds of this offering. We now operate Pan Probe as a wholly owned subsidiary. We purchased Pan Probe primarily because it employed Dr. Shujie Cui as its lead scientist and because of its leasehold interest in an FDA inspected and registered Class II (which includes Class I products such as our products) approximately 8,800 square foot diagnostic laboratory and plant to manufacture our products. This facility is located at 7936 Trade St., San Diego, CA. We maintain Pan Probe’s Class II status by ensuring it meets FDA Good Manufacturing Practices (GMP’s). The FDA is expected to inspect Pan Probe at least every two years. Dr. Shujie Cui is now our Chief Science Officer. The three POC test products we manufacture directly (pregnancy - cassette, menopause - cassette and drugs-of-abuse) requires us to produce certain reagents and anti-bodies which we do at our Pan Probe facility.

On August 31, 2006, we acquired all the issued and outstanding shares of Sherman Biotech, Inc., a Delaware corporation (“Sherman Biotech”), for an aggregate purchase price of $15,000,000 in shares of our common stock. We now operate Sherman Biotech as a wholly owned subsidiary. We purchased Sherman Biotech primarily because of its knowledge and trade secrets related to its development of a compound known as SB15 which we intend to continue developing with the objective of marketing a commercially viable product that could be used for the treatment of anxiety-related diseases and disorders such as autism and Fragile X Syndrome also known as FXS. There can be no assurances we will be successful in developing SB15.

Our principal executive offices are located at 2082 Michelson Dr., Suite 212, Irvine, California 92612. Our telephone number is (949) 553-1127 and our fax number is (949) 752-6195. Our website address is www.earlydetect.com. The information on, or accessible through, our website is not part of this prospectus.

EarlyDETECT™ and LiveSURE™ are our trademarks. This prospectus also contains trademarks and tradenames of other companies not affiliated with us.

This Offering

| Securities offered | | A minimum of 1,000,000 shares of common stock and a maximum of 3,000,000 shares of common stock. |

| | | |

| Common stock outstanding after this offering if the maximum amount is fully subscribed based on 22,437,099 shares outstanding as of August 1, 2007 | | 25,437,099 |

| | | |

| Use of proceeds | | The principal purposes of this offering are to increase our marketing and sales efforts with respect to our existing line of 20 products, fund our development activities so we can directly manufacture more than our current number of three products instead of repackaging them from components obtained from others, fund the use and operations of a laboratory and manufacturing facility for the purpose of developing two biopharmaceutical products - H5N1 Bird Flu vaccine and SB15 compound, repay certain outstanding loans and increase our working capital and funding for general corporate purposes, including marketing and increasing inventory. See “Use of Proceeds” beginning on page 16. |

| | | |

| Risk Factors | | The securities offered by this prospectus involve a high degree of risk and should be considered speculative. Investors who cannot afford to lose their entire investment should not purchase the securities. See “Risk Factors” beginning on page 8. |

| | | |

| Dividend policy | | We do not anticipate declaring or paying any regular cash dividends on our common stock in the foreseeable future. Any payment of cash dividends on our common stock in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements, financial condition, future prospects, contractual restrictions and other factors deemed relevant by our Board of Directors. |

| | | |

| Proposed Nasdaq Capital Market symbol | | ERLY |

We have 22,437,099 shares of common stock outstanding as of August 1, 2007. Unless the context indicates otherwise, all share and per-share common stock information in this prospectus assumes a public offering price of $10.00 per share.

SELECTED FINANCIAL DATA

The following table summarizes historical financial data regarding our business and should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus. The summary information as of August 31, 2006, 2005, 2004, 2003, and 2002 has been derived from our financial statements.

Statement of Operations Data

| | | 8/31/06 | | 8/31/05 | | 8/31/04 | | 8/31/03 | | 8/31/02 | |

| | | | | | | | | | | | |

| Total Revenues | | $ | 118,404 | | $ | 32,813 | | $ | -- | | $ | -- | | $ | (16 | ) |

| Cost of Sales | | | 1,414,416 | | | 216,233 | | | 324,864 | | | 324,864 | | | 1,470 | |

| Operating Expenses | | | | | | | | | | | | | | | | |

| Compensation, professional and consulting fees | | | 9,350,013 | | | 5,200,036 | | | 3,127,723 | | | -- | | | 69,465 | |

| Rent | | | 94,755 | | | 28,104 | | | 40,848 | | | 40,848 | | | 4,800 | |

| Other General and Administrative | | | 393,474 | | | 143,175 | | | 178,441 | | | 3,296,681 | | | 807,553 | |

| Deprec., Amort., Impairment | | | 8,690,543 | | | 66,069 | | | 7,325 | | | 7,294 | | | 989 | |

| Other Expense (Interest, net) | | | 237,281 | | | 31,331 | | | -- | | | -- | | | -- | |

| Income (Loss) from Operations | | | (20,062,078 | ) | | (5,652,135 | ) | | (3,679,201 | ) | | (3,669,687 | ) | | (884,293 | ) |

| Net Income (Loss) | | | (20,062,078 | ) | | (5,652,135 | ) | | (3,679,201 | ) | | (3,669,687 | ) | | (884,293 | ) |

Balance Sheet Data

| | | 8/31/06 | | 8/31/05 | | 8/31/04 | | 8/31/03 | | 8/31/02 | |

| | | | | | | | | | | | |

| Cash and Cash Equivalents | | | | | | | | $ | | | $ | - | | | | |

| Accounts Receivable | | | 5,256 | | | - | | | - | | | 4,043 | | | - | |

| Inventory | | | 3,330,209 | | | 4,598,540 | | | - | | | 203,728 | | | 16,062 | |

| Fixed Assets | | | 4,686,012 | | | 5,172,955 | | | 20,502 | | | 27,211 | | | 19,958 | |

| Other Assets (Patents, Goodwill) | | | 13,432,020 | | | 6,559,581 | | | 370 | | | 400 | | | 930,201 | |

| Total Assets | | | 21,507,366 | | | 16,401,352 | | | 20,872 | | | 235,382 | | | 975,529 | |

| Total Liabilities | | | 6,205,636 | | | 5,926,898 | | | 2,113,064 | | | 1,676,941 | | | 854,931 | |

| Total Stockholders’ Equity | | | 15,301,730 | | | 10,474,454 | | | (2,092,192 | ) | | (1,441,559 | ) | | 120,598 | |

An investment in our securities is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this prospectus, including the consolidated financial statements and notes thereto of our company, before deciding to invest in our securities. The risks described below are not the only ones facing our company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our company. If any of the following risks occur, our business, financial condition and results of operations and the value of our common stock could be materially and adversely affected and you could lose all or part of your investment.

RISKS RELATED TO OUR COMPANY

We have a history of significant net operating losses and may never achieve profitability.

We have a history of significant net operating losses. For the year ended August 31, 2006, we had a net loss of approximately $20,062,078, and for the year ended August 31, 2005, we had a net loss of approximately $5,652,135. For the nine month period ended May 31, 2007, we had total revenues of $287,291 and a net loss of approximately $30,325,571. We cannot assure you that we will ever achieve profitability. Even if we do achieve profitability, we cannot assure you that we will be able to sustain or increase profitability on a quarterly or annual basis in the future. Revenues and profits, if any, will depend upon various factors, including whether we will be able to successfully implement our sales, marketing, and advertising strategies. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us. In addition, an inability to achieve profitability could have a detrimental effect on the long term capital appreciation of our common stock.

Our independent auditors have expressed a reservation as to whether we can continue as a going concern.

Our independent auditors’ report on our financial statements included in this registration statement states that our recurring losses and lack of revenue generation to date raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability to raise additional capital or generate revenues to sustain our operations. There is no guarantee that we will be able to raise enough capital or generate revenues to sustain our operations.

There can be no assurance that we will be able to generate or secure sufficient funding to successfully execute our business plan. Currently, we only have approximately $12,000 in cash and we continue to incur significant losses.

The working capital requirements associated with our business plan will continue to be significant. The primary requirements are for sales, marketing, and advertising efforts. We estimate that we will need to spend approximately $8,000,000 per year for the next two years to execute our business plan. We will need to raise additional capital in the next twelve months to fully implement our sales, marketing, and advertising strategy. If we do not have sufficient cash from operations, funds available under credit facilities and/or the ability to raise cash through the sale of debt and/or equity securities, or if we cannot issue our capital stock on terms suitable to us, we will be unable to pursue our business strategy, which could have a material adverse effect on our ability to increase our company’s revenue and net income (or reduce our net loss, as applicable) and on our company’s financial condition and results of operations.

If we are unable to attract and retain qualified personnel with experience in the in vitro diagnostics industry, our business could suffer.

Our current and future success depends in part on our ability to identify, attract, assimilate, hire, train and motivate professional, highly-skilled scientific and technical personnel for our research, development and engineering efforts, as well as managerial, and sales and marketing personnel with experience in the in vitro diagnostics industry. If we fail to attract and retain the necessary technical, managerial, and sales and marketing personnel, we may not develop a sufficient customer base to adequately develop our proposed operations, and, as a result, could have a material adverse effect on our company.

Our company’s operations are dependent on the continued efforts of our Board of Directors and our executive officers, including Charles A. Strongo, our President, Chief Executive Officer, and Director, and Richard Johnson, our Chief Financial Officer. If either of these individuals becomes unwilling or unable to continue their employment or association with us, our business could be affected materially and adversely. Furthermore, there can be no assurance that our management team will be successful in managing the operations of the company or be able to effectively implement our business strategy. Failure of our management group to successfully manage the operation of our company or to effectively implement our business strategy could have a material adverse effect on our company’s financial condition and results of operations. We have no key man life insurance on any of our executives.

Our executive officers and certain key personnel are critical to our business and have limited experience in running a public company.

As a public company, we will be highly dependent on the expertise of our senior management, particularly our Chief Executive Officer and Chief Financial Officer. Our senior management team has not acted in their current capacities for a public company. Consequently, their focus and attention may be diverted while they familiarize themselves with the requirements of managing a public company.

We currently have existing material weaknesses in our internal control over financial reporting. If we are unable to improve and maintain the quality of our system of internal control over financial reporting, any deficiencies could materially and adversely affect our ability to report timely and accurate financial information about us.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes−Oxley Act, as well as rules subsequently implemented by the Securities and Exchange Commission and the NASDAQ Stock Market, have imposed various new requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations have increased our legal and financial compliance costs and will make some activities more time consuming and costly. For example, we expect these rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to incur substantial costs to maintain the same or similar coverage.

We are responsible for establishing and maintaining effective disclosure controls and procedures and adequate internal control over financial reporting, in each case as prescribed by applicable SEC rules and regulations. Together, these elements are intended to provide reasonable (but not absolute) assurance regarding the reliability of our financial reporting. Management has determined that our disclosure controls and procedures were not effective and that we have material weaknesses in our internal control over financial reporting. Since the time we determined that our disclosure controls and procedures were not effective and identified the material weaknesses in our internal control over financial reporting, we have devoted significant time to developing remedial measures to address these deficiencies. Although we believe that these measures have strengthened our disclosure controls and procedures and our internal control over financial reporting, we cannot be certain that they will ensure that we maintain effective disclosure controls and procedures or adequate internal control over our financial reporting in future periods. Any failure to maintain such effective disclosure controls and procedures or adequate internal control over financing reporting could adversely impact our ability to report our financial results on a timely and accurate basis. If we are no longer able to report our financial results on a timely and accurate basis, we may erode our investors’ understanding of and confidence in our financial reporting, as well as face severe consequences from regulatory authorities, either of which may have a material adverse affect on our business and a negative effect on the trading price of our stock.

If the markets for our products do not develop and expand as we anticipate, demand for our products may decline, which would negatively impact our results of operations and financial performance.

The markets for our products are characterized by rapidly changing technologies, evolving industry standards and frequent new product introductions. Our success is expected to depend, in substantial part, on the timely and successful introduction of new products, upgrades of current products to comply with emerging industry standards, our ability to acquire technologies needed to remain competitive and our ability to address competing technologies and products. In addition, the following factors related to our products and the markets for them could have an adverse impact on our results of operations and financial performance:

• The inability to maintain a favorable mix of products;

• The anticipated level of demand for our products by our customers does not continue. While this demand has been increasing in recent quarters, there is no assurance that this upward trend can be sustained. A leveling or declining demand or an unanticipated change in market demand for products based on a specific technology would adversely affect our ability to sustain recent operating and financial performance; and

• The inability to continue to develop new product lines to address our customers’ diverse needs and the several market segments in which we participate. This requires a high level of innovation, as well as the accurate anticipation of technological and market trends.

Changes in our manufacturing processes or those of our contractors and suppliers could significantly reduce our manufacturing yields and product reliability.

The manufacture of our products involves highly complex and precise processes, requiring production in highly controlled, arid clean environments. In some cases, existing manufacturing techniques, which involve substantial manual labor, may be insufficient to achieve the volume or cost targets of our customers. We will need to develop new manufacturing processes and techniques to achieve targeted volume and cost levels. While we continue to devote substantial efforts to the improvement of our manufacturing techniques and processes, we may not achieve manufacturing volumes and cost levels in our manufacturing activities that will fully satisfy customer demands.

We may experience difficulties that may delay or prevent our development, introduction or marketing of new or enhanced products.

We intend to continue to invest in product and technology development. The development of new or enhanced products is a complex and uncertain process. We may experience research and development, manufacturing, marketing and other difficulties that could delay or prevent our development, introduction or marketing of new products or enhancements. We cannot be certain that:

• any of the products under development will prove to be effective in clinical trials;

• we will be able to obtain, in a timely manner or at all, regulatory approval to market any of our products that are in development or contemplated;

• any of such products can be manufactured at acceptable cost and with appropriate quality; or

• any such products, if and when approved, can be successfully marketed.

The factors listed above, as well as manufacturing or distribution problems, or other factors beyond our control, could delay new product launches. In addition, we cannot assure you that the market will accept these products. Accordingly, there is no assurance that our overall revenues will increase if and when new products are launched.

We rely on certain suppliers for raw materials and other products and fluctuations in the availability and price of such products and services may interfere with our ability to meet our customers’ needs.

Difficulty in obtaining raw materials and components for our products could affect our ability to achieve anticipated production levels. For some of our products we are dependent on a small number of suppliers of finished products and of critical raw materials and components and our ability to obtain, enter into and maintain contracts with these suppliers. We cannot assure you that we will be able to obtain, enter into or maintain all such contracts in the future. On occasion, we have been forced to redesign portions of products when a supplier of critical raw materials or components terminated its contract or no longer made the materials or components available. If we are unable to achieve anticipated production levels and meet our customers needs, our operating results could be adversely affected. In addition, our results of operations may be significantly impacted by unanticipated increases in the costs of labor, raw materials, freight, utilities and other items needed to develop, manufacture and maintain our products and operate our business.

Increases in demand for our products could require us to expend considerable resources to meet the demand or harm our customer relationships if we are unable to meet demand.

If we experience significant or unexpected increases in the demand for our products, we and our suppliers may not be able to meet that demand without expending additional capital resources. These capital resources could involve the cost of new machinery or even the cost of new manufacturing facilities. This would increase our capital costs, which could adversely affect our earnings. Our suppliers may be unable or unwilling to expend the necessary capital resources or otherwise expand their capacity. In addition, new manufacturing equipment or facilities may be required to meet required FDA standards before they can be used to manufacture our products. To the extent we are unable to obtain or are delayed in meeting such standards, our ability to meet the demand for our products could be adversely affected.

If we or our suppliers are unable to develop necessary manufacturing capabilities in a timely manner, our net sales could be adversely affected. Failure to cost-effectively increase production volumes, if required, or lower than anticipated yields or production problems encountered as a result of changes that we or our suppliers make in our manufacturing processes to meet increased demand, could result in shipment delays or interruptions and increased manufacturing costs, which could also have a material adverse effect on our revenues and profitability.

Our inability to meet customer demand for our products could also harm our customer relationships and impair our reputation within the industry. This, in turn, could have a material adverse effect on our business and prospects.

Recently there has been an increase of bogus home diagnostic tests sold on the Internet that could result in loss of confidence in legitimate home diagnostic tests such as our products.

The FDA and Federal Trade Commission have warned the public to be beware of bogus home diagnostic tests sold on the Internet and elsewhere as a result of an increase of sales of such products on the Internet. If people are fooled by such products and there is widespread media attention to this problem, people may not trust legitimate home diagnostic tests including our products. In addition, there have been media reports of deaths due to inaccurate readings from IVD home test kits either because the tests were defective or the kits were not properly read. Additional problems of this nature could erode public confidence in our products which could have a material adverse effect on our business and prospects. See “Specific Risks Related To Our Products” immediately following this paragraph.

There can be no assurance that our new distributor will be able to satisfy certain minimum purchase requirements.

While our distributor, Winwheel Bullion, LLC, agreed to purchase a minimum of $60 million of sales per year for the first 18 months of the distributor agreement and $90 million per year for every year after in exchange for certain distribution rights, there is no assurance that Winwheel Bullion will be able to satisfy such minimum purchase requirements. Our agreement with Winwheel Bullion is recent, and we do not have any relationship or history with the company prior to entering into the agreement in July 2007. While management believes that Winwheel Bullion is financially sound, we have not been provided with a letter of credit or other guarantees of their financial ability to satisfy such minimum purchase requirements.

SPECIFIC RISKS RELATED TO OUR PRODUCTS

Self-testing diagnostic and monitoring devices present numerous inherent risks, some of which are described below. There may be risks in addition to these. The misuse or misinterpretation of results from our products designed to monitor chronic illnesses or diagnose serious or potentially fatal disease could result in serious problems for the consumer including death. Any of the following risks could result in materially adverse consequences to our income and financial status.

Consumers may not carefully read the test-kit labels and instructions.

If consumers of our products do not correctly follow the instructions they may get false readings. In addition, although the home test kits are designed to be an adjunct to visits to their doctors, not a replacement, the use of our products could have the result of causing people to avoid going to the doctor, with potential consequences to their health. For example, if the consumer does not hold the instrument correctly in our ovulation predictor product, the numbers can be misread.

Users of our products may forego important pre- and post-test counseling.

The convenience and low cost of our products may preclude the user from using the services of a health-care professional who could provide necessary information, interpretation and advice because such a professional is equipped to evaluate the user’s entire health picture rather than just evaluating the patient based on a single test. In addition, a person could engage in self-destructive conduct as a result of receiving potentially bad news of illness, infection, or pregnancy at home.

Our products are not 100% accurate.

No IVD testing products, including ours, is always accurate. Our products could result in false positive test results (incorrectly indicating the presence of a condition) or false negative results (incorrectly failing to identify a condition that is present). For example, it is possible that our Influenza test kit could show a negative result when used on an Influenza-positive sample.

The accuracy of our products may deteriorate over time or when exposed to extreme temperatures.

If a purchaser of our products stores them in a place where they are exposed to extreme temperatures, the products may not result in an accurate reading. In addition, if the consumer fails to check the test-kit expiration dates, the chemicals in an outdated test may not work correctly. In addition, if the specimens are not properly collected, stored or shipped, the results may be inaccurate. For example, urine samples taken too early or too late in the day or after certain foods have been consumed may result in false readings.

RISKS RELATED TO OUR INDUSTRY

We face intense competition in our business. We expect that we will face additional competition from existing competitors, such as Inverness Medical Innovations, Beckman Coulter, Abbott Laboratories, Bayer, Church & Dwight, Johnson & Johnson, and Roche and from a number of companies that may enter our markets. Since some of the markets in which we compete are characterized by rapid growth and rapid technology changes, smaller niche and start-up companies may become our principal competitors in the future. We must invest in research and development, expand our manufacturing and marketing capabilities, and continue to improve customer service and support in order to remain competitive. While we expect to undertake the investment and effort in each of these areas, we cannot assure that we will be able to maintain or improve our competitive position. There can be no assurance that we will be able to compete successfully with such entities in the future.

Many of our competitors and potential competitors have superior resources, which could place us at a cost and price disadvantage. Thus, we may never realize revenues sufficient to sustain our operations, and we may fail in our business and cease operations.

Many of our competitors and potential competitors may have significant competitive advantages, including greater market presence, name recognition, superior financial, technological and personnel resources, superior services and marketing capabilities, and superior manufacturing capabilities. Some of these competitors are household names such as Abbott Laboratories, Bayer, Church & Dwight, Johnson & Johnson, and Roche. As a result, some of our competitors and potential competitors could raise capital at a lower cost than we can, and they may be able to adapt more swiftly to new or emerging technologies and changes in customer requirements, take advantage of acquisitions and other opportunities more readily, and devote greater resources to the development, marketing, and sale of products than we can. Market consolidation may create additional or stronger competitors and may intensify competition. Also, our competitors’ and potential competitors’ greater brand-name recognition may require us to price our services at lower levels in order to win business. Our competitors’ and potential competitors’ financial advantages may give them the ability to reduce their prices for an extended period of time if they so choose.

Technological advances and regulatory changes may erode revenues that could be derived from our proposed operations, which could increase competition and put downward pressure on prices for our proposed products.

New technologies and regulatory changes, particularly those relating to pharmaceutical and biotech products, if any, could impair our prospects, put downward pressure on prices for our in vitro diagnostics products, and adversely affect our operating results. In addition, the competition in our market from the existing developers and manufacturers of in vitro diagnostics products with technologically advanced processes may place downward pressure on prices for such products, which can adversely affect our operating results. In addition, we could face competition from other companies we have not yet identified or which may later enter into the market with technologically advanced processes. If we are not able to compete effectively with these industry participants, our operating results would be adversely affected.

If we deliver products with defects, our credibility may be harmed, market acceptance of our products may decrease and we may be exposed to liability in excess of our product liability insurance coverage.

The manufacturing and marketing of consumer and professional diagnostic products involve an inherent risk of product liability claims. In addition, our product development and production are extremely complex and could expose our products to defects. Any defects could harm our credibility and decrease market acceptance of our products. Potential product liability claims may exceed the amount of our insurance coverage or may be excluded from coverage under the terms of the policy. In the event that we are held liable for a claim for which we are not indemnified, or for damages exceeding the limits of our insurance coverage, that claim could materially damage our business and our financial condition.

The need to obtain regulatory approvals and respond to changes in regulatory requirements could adversely affect our business.

Many of our proposed and existing products are subject to regulation by the FDA and other governmental or public health agencies. In particular, we are subject to strict governmental controls on the development, manufacture, labeling, distribution and marketing of our products. In addition, we are often required to obtain approval or registration with foreign governments or regulatory bodies before we can import and sell our products in foreign countries.

The process of obtaining required approvals or clearances from governmental or public health agencies can involve lengthy and detailed laboratory testing, human clinical trials, sampling activities and other costly, time- consuming procedures. These approvals can require the submission of a large amount of clinical data which may require significant time to obtain. It is also possible that a product will not perform at a level needed to generate the clinical data required to obtain an approval or clearance. The submission of an application to the FDA or other regulatory authority does not guarantee that an approval or clearance to market the product will be received. Each authority may impose its own requirements and delay or refuse to grant approval or clearance, even though a product has been approved in another country or by another agency.

Moreover, the approval or clearance process for a new product can be complex and lengthy. This time span increases our costs to develop new products as well as the risk that we will not succeed in introducing or selling them in the United States or other countries.

Failure to comply with FDA or other regulatory requirements may require us to suspend production of our products or institute a recall which could result in higher costs and a loss of revenues.

We can manufacture and sell many of our products, both in the United States and internationally, only if we comply with regulations of government agencies such as the FDA. We have implemented quality assurance and other systems that are intended to comply with applicable regulations.

Although we believe that we have adequate processes in place to ensure compliance with these requirements, the FDA or other regulatory bodies could force us to stop manufacturing or selling our products if it concludes that we are out of compliance with applicable regulations. The FDA and other regulatory bodies could also require us to recall products if we fail to comply with applicable regulations, which could force us to stop manufacturing such products. Such actions by the FDA could adversely affect our revenues.

Our success depends on our ability to protect our proprietary technology.

The diagnostics industry places considerable importance on obtaining patent, trademark and trade secret protection, as well as other intellectual property rights, for new technologies, products and processes. Our success depends, in part, on our ability to develop and maintain a strong intellectual property portfolio or obtain licenses to patents for products and technologies both in the United States and in other countries. Currently, we own no patents for any of our products.

As appropriate, we intend to file patent applications and obtain patent protection for our proprietary technology. These patent applications and patents will cover, as applicable, compositions of matter for our products, methods of making those products, methods of using those products and apparatus relating to the use or manufacture of those products. We will also rely on trade secrets, know-how and continuing technological advancements to protect our proprietary technology.

We do not currently have any confidentiality agreements with our employees, consultants, advisors and collaborators. However, in the future we intend to adopt a policy that would require such persons and entities to enter into such agreements with us. When we do this, these parties may not honor these agreements and we may not be able to successfully protect our rights to unpatented trade secrets and know-how. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets and know-how.

Some of our current employees, including scientific and management personnel, were previously employed by competing companies. Although we encourage and expect all of our employees to abide by any confidentiality agreement with a prior employer, competing companies may allege trade secret violations and similar claims against us.

We may collaborate with universities and governmental research organizations which, as a result, may acquire part of the rights to any inventions or technical information derived from collaboration with them.

To facilitate development and commercialization of a proprietary technology base, we may need to obtain licenses to patents or other proprietary rights from other parties. Obtaining and maintaining such licenses may require the payment of substantial amounts. In addition, if we are unable to obtain these types of licenses, our product development and commercialization efforts may be delayed or precluded.

We may incur substantial costs and be required to expend substantial resources in asserting or protecting our intellectual property rights, or in defending suits against us related to intellectual property rights. Disputes regarding intellectual property rights could substantially delay product development or commercialization activities. Disputes regarding intellectual property rights might include state, federal or foreign court litigation, as well as patent interference, patent reexamination, patent reissue, or trademark opposition proceedings in the United States Patent and Trademark Office. Opposition or revocation proceedings could be instituted in a foreign patent office. An adverse decision in any proceeding regarding intellectual property rights could result in the loss or limitation of our rights to a patent, an invention or trademark.

Failure to sell the minimum number of shares will result in the failure of this offering and your investment will be returned to you without interest.

We may not be able to sell the minimum amount of shares required to close this offering. Until the minimum offering of 1,000,000 shares of common stock are subscribed for and paid for, all proceeds received from this offering will be placed in escrow at [_______________] and will not be released to us until the minimum offering is met. If the minimum offering is not reached within the prescribed time, all funds placed in the escrow account will be promptly returned without interest.

After this offering, our executive officers, directors and principal shareholders will have the ability to control all matters submitted to our shareholders for approval.

When this offering is completed, our executive officers, directors and shareholders who owned more than 5% of our outstanding common stock before this offering will, in the aggregate, beneficially own shares representing [_____]% of our common stock assuming such persons do not purchase any shares of our common stock in this offering. As a result, if these shareholders were to choose to act together, they would be able to control all matters submitted to our shareholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, will control the election of directors and approval of any merger, consolidation, sale of all or substantially all of our assets or other business combination or reorganization. This concentration of voting power could delay or prevent an acquisition of us on terms that other shareholders may desire. The interests of this group of shareholders may not always coincide with your interests or the interests of other shareholders and they may act in a manner that advances their best interests and not necessarily those of other shareholders, including obtaining a premium value for their common stock, and might affect the prevailing market price for our common stock.

If securities or industry analysts do not publish research or reports about our business, or publish negative reports about our business, our stock price and trading volume could decline.

The trading market for our common stock may depend on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over these analysts. If one or more of the analysts who cover us downgrade our stock or change their opinion of our stock, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

A significant portion of our total outstanding shares of common stock is restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares of common stock intend to sell shares, could reduce the market price of our common stock. After this offering, we will have [_______________] outstanding shares of common stock based on the number of shares outstanding as of [_______________], 2007. Of these shares, [_______________] may be resold in the public market immediately and the remaining [_______________] shares are currently restricted under securities laws or as a result of lock-up agreements described in the “Underwriting” section of this prospectus but will be able to be resold after the offering as described in the “Shares Eligible for Future Sale” section of this prospectus.

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

The initial public offering price will be substantially higher than the tangible book value per share of shares of our common stock based on the total value of our tangible assets less our total liabilities immediately following this offering. Therefore, if you purchase shares of our common stock in this offering, you will experience immediate and substantial dilution of approximately $9.16 per share in the price you pay for shares of our common stock as compared to its tangible book value, assuming an initial public offering price of $10.00 per share. To the extent outstanding options to purchase shares of common stock are exercised, there will be further dilution. For further information on this calculation, see “Dilution” elsewhere in this prospectus.

We have broad discretion in the use of net proceeds from this offering and may not use them effectively.

Although we currently intend to use the net proceeds from this offering in the manner described in “Use of Proceeds” elsewhere in this prospectus, we will have broad discretion in the application of the net proceeds. Our failure to apply these funds effectively could affect our ability to continue to develop and eventually to manufacture and sell our products.

There currently is no public trading market for our securities, and an active market may not develop or, if developed, be sustained. If a public trading market does not develop, you may not be able to sell any of your securities.

There is currently no public trading market for our common stock, and we can provide no assurance that an active market will develop or be sustained. It is intended that the our common stock will initially be quoted for trading on the NASDAQ Capital Market. If an active public trading market for our securities does not develop or is not sustained, it may be difficult or impossible for you to resell your shares at any price. Even if a public market does develop, the market price could decline below the amount you paid for your shares.

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A prolonged decline in the price of our common stock could result in the reduction in our ability to raise capital through the sale of equity securities. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and would have a significant negative effect on our business plans and operations, including our ability to develop new products and continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

We have never declared or paid any cash dividends on our capital stock and do not intend to pay dividends in the foreseeable future. We intend to invest our future earnings, if any, to fund our growth. Therefore, you may not receive any funds without selling your shares.

This prospectus contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Reference is made in particular to the description of our plans and objectives for future operations, assumptions underlying such plans and objectives, and other forward-looking statements included in this prospectus. Such statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management’s current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning product development, capital expenditures, earnings, litigation, regulatory matters, markets for products and services, liquidity and capital resources and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, changes in consumer demand, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, and other circumstances affecting anticipated revenues and costs, as more fully disclosed in our discussion of risk factors beginning on page 8.

We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Additional factors that could cause such results to differ materially from those described in the forward-looking statements are set forth in connection with the forward-looking statements.

USE OF PROCEEDS

We estimate that, at a price of $10.00 per share, the gross proceeds from the sale of all of the shares in this offering will be $10,000,000, if the minimum amount of 1,000,000 shares is sold, and $30,000,000, if the maximum amount of 3,000,000 shares is sold. We expect our offering expenses, including commissions and fees payable to the underwriters, filing fees, legal and accounting fees, printing, and other expenses, to range from approximately [______________] for the minimum offering to [______________] for the maximum offering. After deducting the offering expenses, we expect to receive net proceeds ranging from approximately [______________] for the minimum offering to [______________] for the maximum offering.

The following table sets forth the estimated use of proceeds from this offering assuming the $10,000,000 minimum offering and the $30,000,000 maximum offering, in order of priority in which the proceeds will be used for the purposes stated:

| | | | Assuming Minimum Offering | | | % | | | Assuming Maximum Offering | | | % |

| | | | | | | | | | | | | |

| Gross Proceeds | | $ | 10,000,000 | | | | | $ | 30,000,000 | | | |

| | | | | | | | | | | | | |

| Offering Expenses | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Proceeds | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Marketing | | | | | | 70 | | | | | | 80 |

| Product Inventory | | | | | | 5 | | | | | | 2 |

| Lab, Manufacturing and Warehousing Facility, Office | | | | | | 5 | | | | | | 3 |

| Research & Development / Regulatory Approvals | | | | | | 10 | | | | | | 10 |

| Contractual Loan Payment | | | | | | 5 | | | | | | 2 |

| Working capital and other general corporate purposes | | | | | | 5 | | | | | | 3 |

We may receive additional proceeds of $__________________ if the underwriters’ warrants are fully exercised, assuming the sale of the maximum amount at the offering price of $10.00 per share. We cannot estimate how many, if any, warrants will be exercised. The foregoing information is an estimate based on our current business plan. We may find it necessary or advisable to re-allocate portions of the net proceeds reserved for one category of uses to another, and we will have broad discretion in doing so.