Fourth Quarter and Full Year 2016 Earnings Presentation Exhibit 99.2

2 Important Notice This presentation contains “forward looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the control of Ares Management, L.P. (“Ares”), including those listed in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”). Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and Ares assumes no obligation to update or revise any such forward-looking statements. Certain information discussed in this presentation was derived from third party sources and has not been independently verified and, accordingly, Ares makes no representation or warranty in respect of this information. The following slides contain summaries of certain financial and statistical information about Ares. The information contained in this presentation is summary information that is intended to be considered in the context of Ares’ SEC filings and other public announcements that Ares may make, by press release or otherwise, from time to time. Ares undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this presentation. In addition, this presentation contains information about Ares, its affiliated funds and certain of their respective personnel and affiliates, and their respective historical performance. You should not view information related to the past performance of Ares and its affiliated funds, as indicative of future results. Certain information set forth herein includes estimates and targets and involves significant elements of subjective judgment and analysis. Further, such information, unless otherwise stated, is before giving effect to management and incentive fees and deductions for taxes. No representations are made as to the accuracy of such estimates or targets or that all assumptions relating to such estimates or targets have been considered or stated or that such estimates or targets will be realized. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of Ares. Management uses certain non-GAAP financial measures, including assets under management, fee paying assets under management, economic net income and distributable earnings, to evaluate Ares’ performance and that of its business segments. Management believes that these measures provide investors with a greater understanding of Ares’ business and that investors should review the same supplemental non-GAAP financial measures that management uses to analyze Ares’ performance. The measures described herein represent those non-GAAP measures used by management, in each case, before giving effect to the consolidation of certain funds that the company consolidates with its results in accordance with GAAP. These measures should be considered in addition to, and not in lieu of, Ares’ financial statements prepared in accordance with GAAP. The definitions and reconciliations of these measures to the most directly comparable GAAP measures, as well as an explanation of why we use these measures, are included in the Appendix. Amounts and percentages may reflect rounding adjustments and consequently totals may not appear to sum.

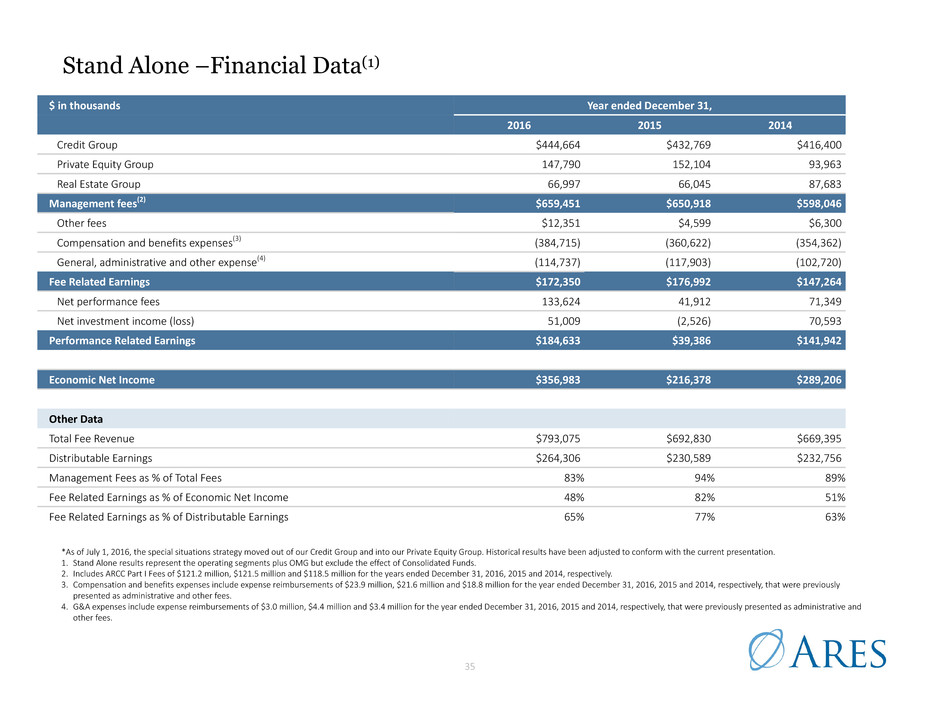

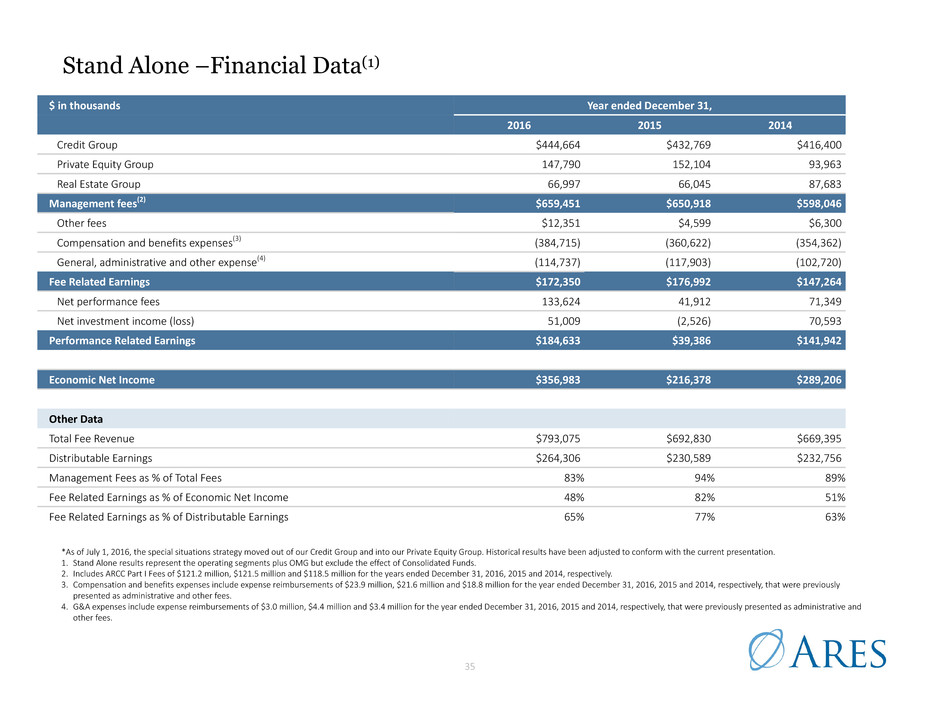

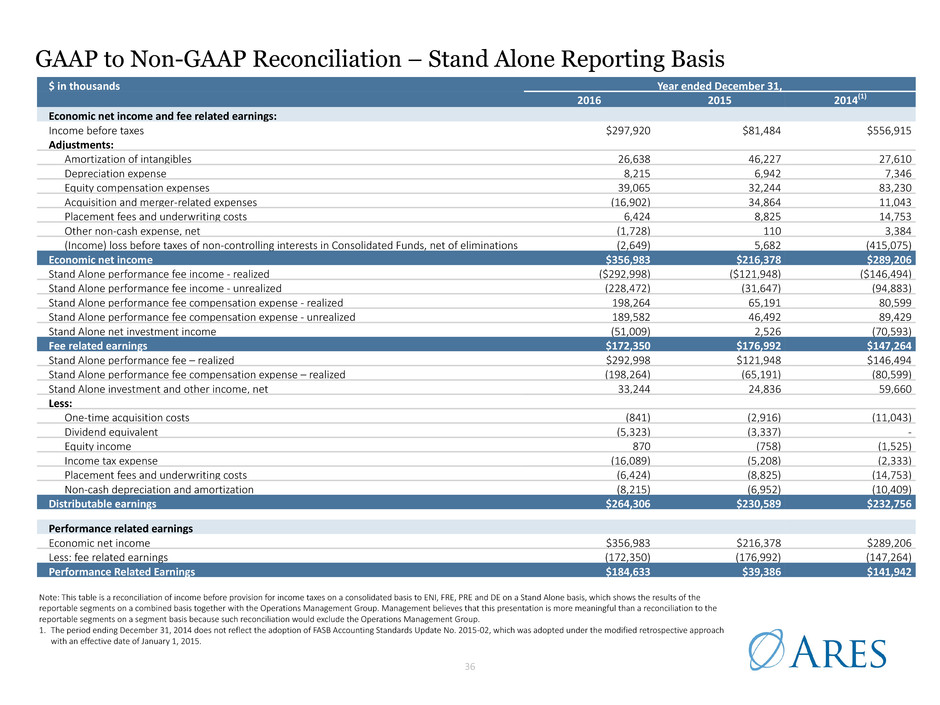

3 Fourth Quarter and Year Ended 2016 Highlights 1. Net inflows represents gross commitments less redemptions. 2. Includes ARCC Part I Fees of $30.3 million and $121.2 million for the three months and year ended December 31, 2016, respectively. Difference between GAAP and Stand Alone management fees represents $3.9 million and $17.4 million from Consolidated Funds that is eliminated upon consolidation for Q4-16 and FY 2016, respectively. 3. Total pro forma units of 214,208,695 includes the sum of common units, Ares Operating Group Units that are exchangeable for common units on a one-for-one basis and the dilutive effects of the Company’s equity- based awards. Please refer to slides 19 and 33 in this presentation for further information. After-tax Economic Net Income per unit is net of the preferred unit distribution. 4. After-tax Distributable Earnings per common unit is net of the preferred unit distribution. 5. Payable on March 24, 2017 to unitholders of record as of March 10, 2017. Assets Under Management • Total Assets Under Management of $95.3 billion; or $98.9 billion pro forma for Ares Capital's ("ARCC") acquisition of American Capital, Ltd. ("ACAS") which closed on January 3, 2017 • Total Fee Paying AUM of $60.6 billion • Available Capital of $23.2 billion • AUM Not Yet Earning Fees of $18.0 billion • Raised $2.1 billion and $13.9 billion in gross new capital with net inflows of $1.6 billion and $12.0 billion(1) for the quarter and year ended December 31, 2016, respectively • Capital deployment of $2.8 billion and $10.2 billion for the quarter and year ended December 31, 2016, respectively, of which $1.3 billion and $6.7 billion was related to our drawdown funds for these periods Financial Results Distributable Earnings and Common Distributions • Q4-16 and FY 2016 GAAP net income attributable to Ares Management, L.P. of $34.0 million and $111.8 million, respectively • Q4-16 and FY 2016 GAAP basic earnings per common unit of $0.35 and $1.22 and diluted earnings per common unit of $0.34 and $1.20, respectively • Q4-16 and FY 2016 GAAP management fees of $161.5 million and $642.1 million, respectively(2) • Q4-16 and FY 2016 Stand Alone management fees of $165.4 million and $659.5 million, respectively(2) • Q4-16 and FY 2016 Fee Related Earnings of $48.4 million and $172.4 million, respectively • Q4-16 and FY 2016 Performance Related Earnings of $65.4 million and $184.6 million, respectively • Q4-16 and FY 2016 Economic Net Income of $113.8 million and $357.0 million, respectively, and Q4-16 and FY 2016 after-tax Economic Net Income of $0.44 per unit and $1.42 per unit, respectively(3) • Q4-16 and FY 2016 Distributable Earnings of $79.5 million and $264.3 million, respectively • Q4-16 and FY 2016 After-tax Distributable Earnings of $0.31 per common unit and $1.00 per common unit, respectively(4) • Declared Q4-16 distribution of $0.28 per common unit, bringing full year distribution to $0.91 per common unit(5)

4 Recent Developments since Quarter End ARCC's Acquisition of ACAS On January 3, 2017, in conjunction with ARCC's acquisition of ACAS, we increased our assets under management by approximately $3.6 billion. The acquisition will increase our FPAUM by an estimated $3 billion based on pro forma September 30, 2016 portfolio values (including asset sales through October 31, 2016), subject to adjustment for subsequent asset sales and fair value changes. Although the initial value of the acquired portfolio has not yet been determined, we began earning management fees on the acquired portfolio on January 3, 2017. In conjunction with the acquisition, we provided financial support of $275 million and agreed to waive up to $100 million of ARCC Part I fees to facilitate the transaction. The proper tax treatment of the support payment made by the Company is unclear and subject to final determination. We believe the outcome could range from an immediate tax deduction of $275 million in 2017 or amortizing the amount over a prescribed life, typically 15 years. The outcome of such determination may materially affect the net taxable income of the Company and the amount of distributions to our common unitholders. First Closing for Junior Capital Private Direct Lending Fund On February 21, 2017, we held a first closing of over $1 billion on our first junior capital private direct lending fund. Credit Facility Extension On February 24, 2017, we amended our Credit Facility to, among other things, increase the size from $1.03 billion to $1.04 billion and extend the facility’s maturity from April 2019 to February 2022. Based on our current credit agency ratings, the stated interest rate was reduced to LIBOR plus 1.50% from LIBOR plus 1.75% and the unused commitment fee was reduced to 0.20% from 0.25%. ACOF V Pending Activation We expect to activate management fees on our Ares Corporate Opportunity Fund V in conjunction with the closing of that fund’s first investment which we anticipate to occur in the first quarter.

5 Gross New Capital Commitments – Fourth Quarter and Full Year 2016(1) 1. Represents gross new commitments during Q4-16 and full year 2016, including equity and debt commitments and gross inflows into our open-ended managed accounts and sub-advised accounts. $ in millions Q4 2016 FY 2016 Comments Credit Group U.S. CLOs $614 $1,831 Closed three new U.S. CLOs in 2016 High Yield 134 1,664 New and additional equity commitments to high yield mandates Ares Capital Europe III ("ACE III") — 1,225 New commitments bringing total equity and debt commitments to $4.0 billion Senior Direct Lending Program, LLC ("SDLP") 314 1,155 New debt commitments of $1.1 billion and new equity commitments of $44 million Structured Credit 103 908 New and additional equity commitments to various funds Ares Capital Corporation ("ARCC") — 600 New debt commitments (3.625% Notes due 2022) Ares European CLO VIII 439 439 Closed new European CLO Other U.S. Direct Lending — 1,410 New and additional equity and debt commitments to various funds Other Credit Funds 339 1,323 New and additional equity and debt commitments to various funds Total Credit Group $1,944 $10,555 Private Equity Group Ares Corporate Opportunities Fund V ("ACOF V") $— $2,154 Final equity commitments bringing total commitments to $7.85 billion Fifth Power and Infrastructure Strategy 120 130 Additional equity commitments Other Private Equity Funds 30 30 New equity commitments to corporate PE strategy in Asia Total Private Equity Group $150 $2,314 Real Estate Group U.S. and E.U. Equity $38 $826 New and additional equity commitments and co-investments ACRE — 225 Additional debt commitments Other Real Estate Debt 15 15 Additional equity commitments Total Real Estate Group $53 $1,066 Total $2,147 $13,935 #679FD1 #49749B #225070 #1E3154 #75B8F4 #DBE6EF #A7D1EA #ACACAC #828282 #D2D2D2

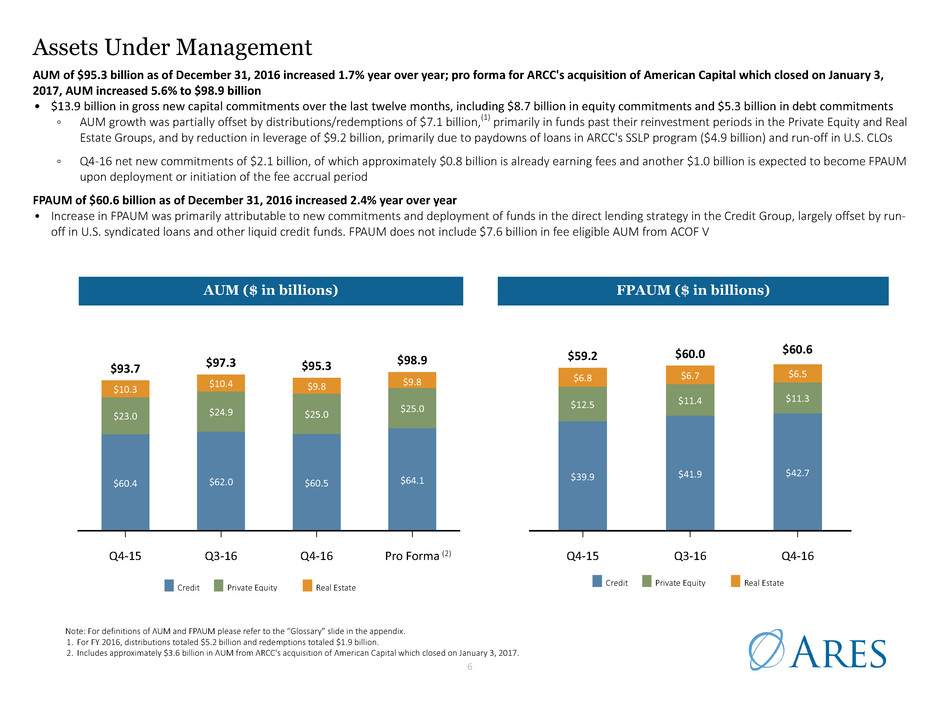

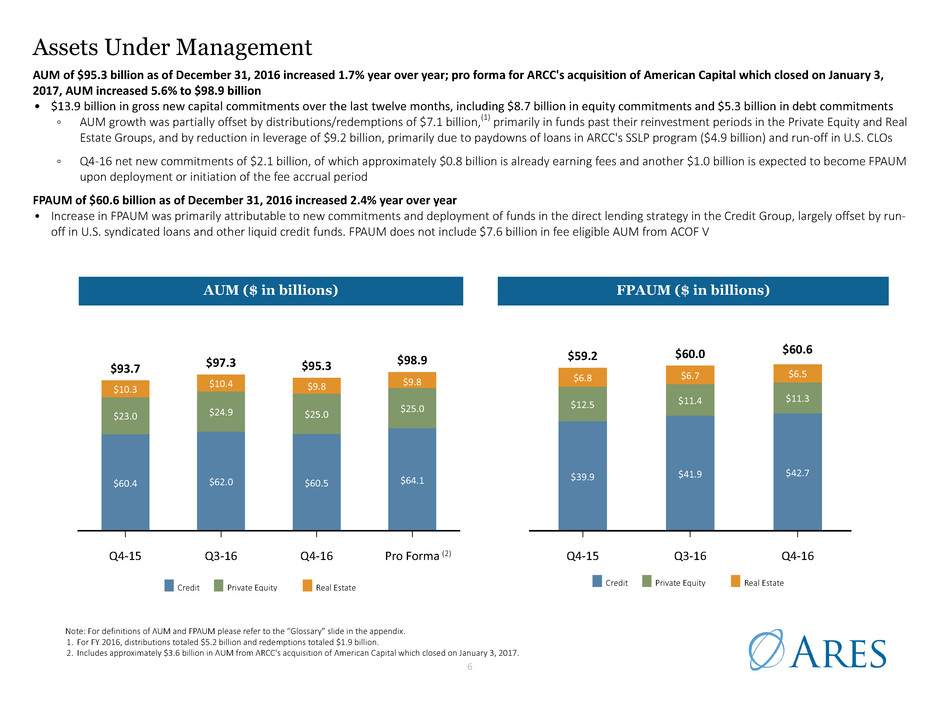

6 Assets Under Management Note: For definitions of AUM and FPAUM please refer to the “Glossary” slide in the appendix. 1. For FY 2016, distributions totaled $5.2 billion and redemptions totaled $1.9 billion. 2. Includes approximately $3.6 billion in AUM from ARCC's acquisition of American Capital which closed on January 3, 2017. AUM of $95.3 billion as of December 31, 2016 increased 1.7% year over year; pro forma for ARCC's acquisition of American Capital which closed on January 3, 2017, AUM increased 5.6% to $98.9 billion • $13.9 billion in gross new capital commitments over the last twelve months, including $8.7 billion in equity commitments and $5.3 billion in debt commitments ◦ AUM growth was partially offset by distributions/redemptions of $7.1 billion,(1) primarily in funds past their reinvestment periods in the Private Equity and Real Estate Groups, and by reduction in leverage of $9.2 billion, primarily due to paydowns of loans in ARCC's SSLP program ($4.9 billion) and run-off in U.S. CLOs ◦ Q4-16 net new commitments of $2.1 billion, of which approximately $0.8 billion is already earning fees and another $1.0 billion is expected to become FPAUM upon deployment or initiation of the fee accrual period FPAUM of $60.6 billion as of December 31, 2016 increased 2.4% year over year • Increase in FPAUM was primarily attributable to new commitments and deployment of funds in the direct lending strategy in the Credit Group, largely offset by run- off in U.S. syndicated loans and other liquid credit funds. FPAUM does not include $7.6 billion in fee eligible AUM from ACOF V AUM ($ in billions) FPAUM ($ in billions) Q4-15 Q3-16 Q4-16 Pro Forma $60.4 $62.0 $60.5 $64.1 $23.0 $24.9 $25.0 $25.0 $10.3 $93.7 $10.4 $97.3 $9.8 $95.3 $9.8 $98.9 Q4-15 Q3-16 Q4-16 $39.9 $41.9 $42.7 $12.5 $11.4 $11.3 $6.8 $59.2 $6.7 $60.0 $6.5 Credit Private Equity Real Estate Credit Private Equity Real Estate (2) $60.6

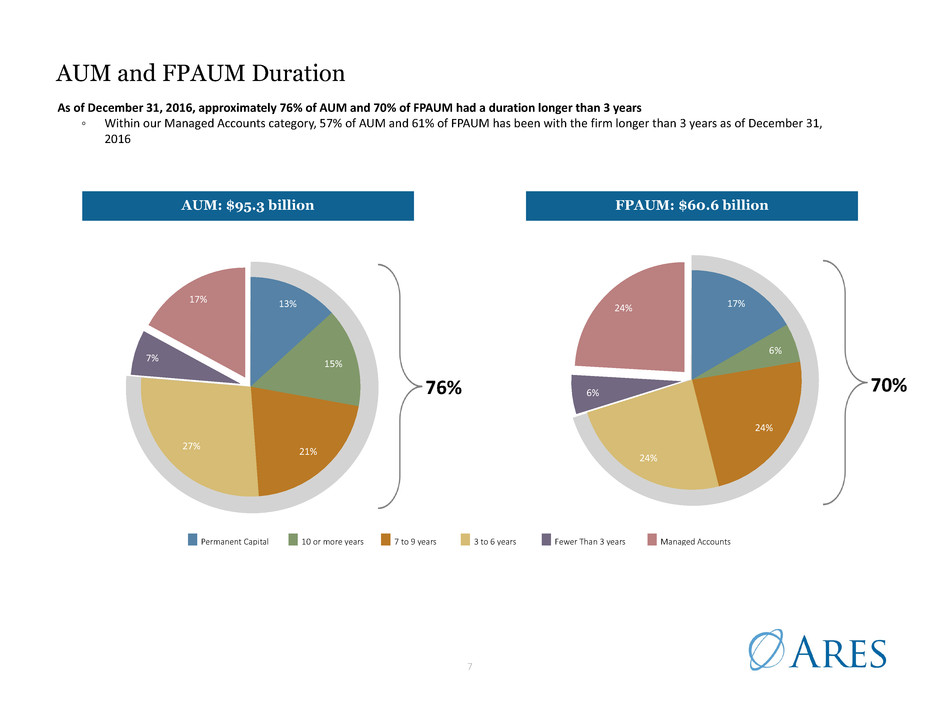

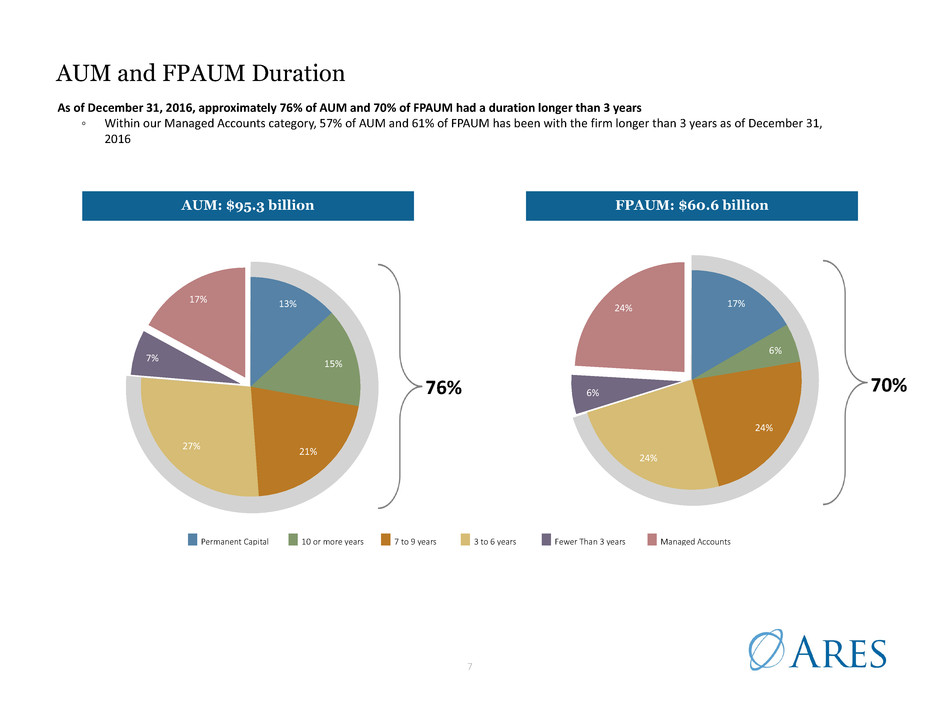

7 AUM and FPAUM Duration As of December 31, 2016, approximately 76% of AUM and 70% of FPAUM had a duration longer than 3 years ◦ Within our Managed Accounts category, 57% of AUM and 61% of FPAUM has been with the firm longer than 3 years as of December 31, 2016 14% 24% 7% 17% 7 % 30% 6% 22% 6% 20% Permanent Capital 10 or more years 7 to 9 years 3 to 6 years Fewer Than 3 years Managed Accounts 76% 15% 70% 13% 15% 21%27% 7% 17% 17% 6% 24% 24% 6% 24% AUM: $95.3 billion FPAUM: $60.6 billion

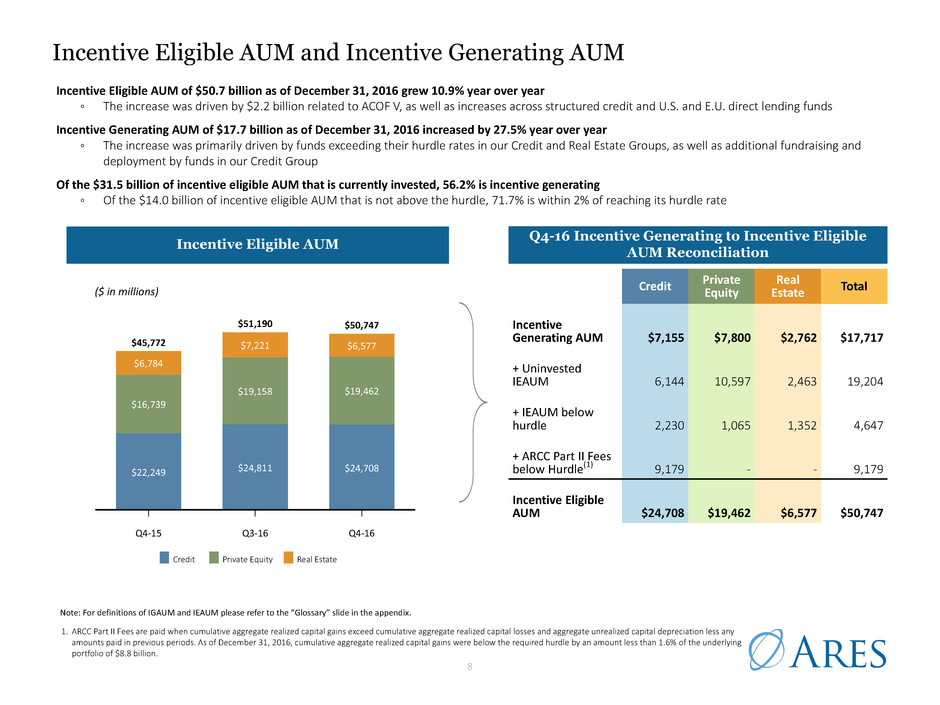

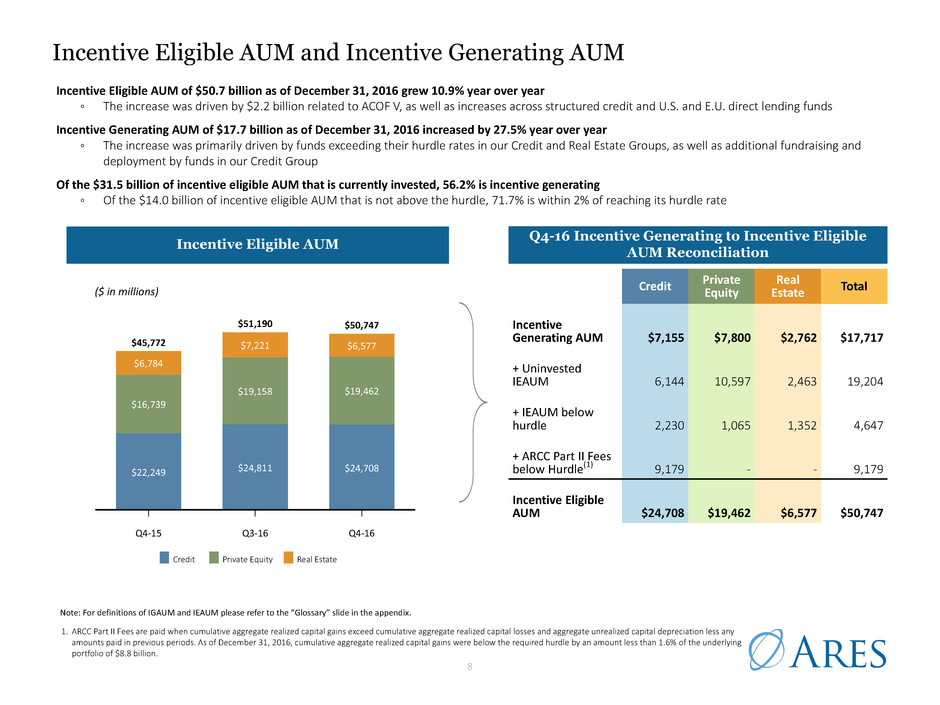

8 Q4-15 Q3-16 Q4-16 $22,249 $24,811 $24,708 $16,739 $19,158 $19,462 $6,784 $45,772 $7,221 $51,190 $6,577 $50,747 Incentive Eligible AUM and Incentive Generating AUM Note: For definitions of IGAUM and IEAUM please refer to the “Glossary” slide in the appendix. 1. ARCC Part II Fees are paid when cumulative aggregate realized capital gains exceed cumulative aggregate realized capital losses and aggregate unrealized capital depreciation less any amounts paid in previous periods. As of December 31, 2016, cumulative aggregate realized capital gains were below the required hurdle by an amount less than 1.6% of the underlying portfolio of $8.8 billion. Incentive Eligible AUM Incentive Eligible AUM of $50.7 billion as of December 31, 2016 grew 10.9% year over year ◦ The increase was driven by $2.2 billion related to ACOF V, as well as increases across structured credit and U.S. and E.U. direct lending funds Incentive Generating AUM of $17.7 billion as of December 31, 2016 increased by 27.5% year over year ◦ The increase was primarily driven by funds exceeding their hurdle rates in our Credit and Real Estate Groups, as well as additional fundraising and deployment by funds in our Credit Group Of the $31.5 billion of incentive eligible AUM that is currently invested, 56.2% is incentive generating ◦ Of the $14.0 billion of incentive eligible AUM that is not above the hurdle, 71.7% is within 2% of reaching its hurdle rate ($ in millions) Credit Private Equity Real Estate Credit PrivateEquity Real Estate Total Incentive Generating AUM $7,155 $7,800 $2,762 $17,717 + Uninvested IEAUM 6,144 10,597 2,463 19,204 + IEAUM below hurdle 2,230 1,065 1,352 4,647 + ARCC Part II Fees below Hurdle(1) 9,179 - - 9,179 Incentive Eligible AUM $24,708 $19,462 $6,577 $50,747 Q4-16 Incentive Generating to Incentive Eligible AUM Reconciliation

9 Available Capital and AUM Not Yet Earning Fees Available Capital as of December 31, 2016 increased 3.6% year over year ◦ The increase was primarily driven by $2.2 billion of additional commitments to ACOF V, which were largely offset by capital deployment, primarily in the Credit Group AUM Not Yet Earning Fees* as of December 31, 2016 increased 16.3% year over year ◦ AUM Not Yet Earning Fees increased from $15.5 billion as of year end 2015 to $18.0 billion as of year end 2016, driven by an additional $2.2 billion of limited partner commitments to ACOF V, which were partially offset by deployment, primarily in funds within the Credit Group Available Capital ($ in millions) AUM Not Yet Earning Fees ($ in millions) *AUM Not Yet Earning Fees, also referred to as Shadow AUM, is our AUM that is not currently generating fees and is eligible to earn management fees upon deployment. Q4-15 Q3-16 Q4-16 $9,192 $9,158 $8,330 $9,621 $11,776 $11,876 $3,606 $22,419 $3,582 $24,516 $3,029 $23,235 Credit Private Equity Real EstateCredit Private Equity Real Estate Q4-15 Q3-16 Q4-16 $7,318 $8,121 $7,744 $7,205 $9,272 $9,313 $934 $15,457 $981 $18,374 $917 $17,974

10 $5,937 $8,927 $693 AUM Not Yet Earning Fees Available for Future Deployment: $15.6 billion AUM Not Yet Earning Fees As of December 31, 2016, AUM Not Yet Earning Fees of $18.0 billion could generate approximately $215.6 million in potential incremental annual management fees, of which $188.2 million relates to the $15.6 billion of AUM Available for Future Deployment* $15.6 billion of AUM Not Yet Earning Fees was available for future deployment as of December 31, 2016 ◦ The $15.6 billion includes $7.6 billion in ACOF V, $1.9 billion in ACE III, $1.4 billion in U.S. direct lending funds and $1.0 billion in structured credit funds, among other funds *No assurance can be made that such results will be achieved. Assumes the AUM not yet paying fees as of December 31, 2016 is invested and such fees are paid on an annual basis. Does not reflect any associated reductions in management fees from certain funds, some of which may be material. For example, upon deployment of ACOF V, ACOF IV is expected to have a reduction in management fees of up to $45.2 million based on invested capital at December 31, 2016. The reduction will likely decrease as ACOF IV invests additional capital. Reference to $215.6 million includes approximately $21.4 million in potential incremental management fees from deploying undrawn/ available credit facilities at ARCC, which may not be drawn due to leverage target limitations and restrictions. Excludes any potential ARCC Part I Fees. 1. Capital available for deployment for follow-on investments represents capital committed to funds that are past their investment periods but for which capital is available to be called for follow-on investments in existing portfolio companies. There is no assurance such capital will be invested. $15.6 billion of AUM Not Yet Earning Fees was available for future deployment as of December 31, 2016 ($ in millions)($ in millions) Capital Available for Future Deployment Capital Available for Deployment for Follow-on Investments (1) Available Capital Currently in Funds Unlikely to Be Drawn Due to Leverage Targets and Restrictions Funds in or Expected to Be in Wind-down Credit Private Equity Real Estate AUM Not Yet Earning Fees: $18.0 billion $15,558 $653 $1,424 $338

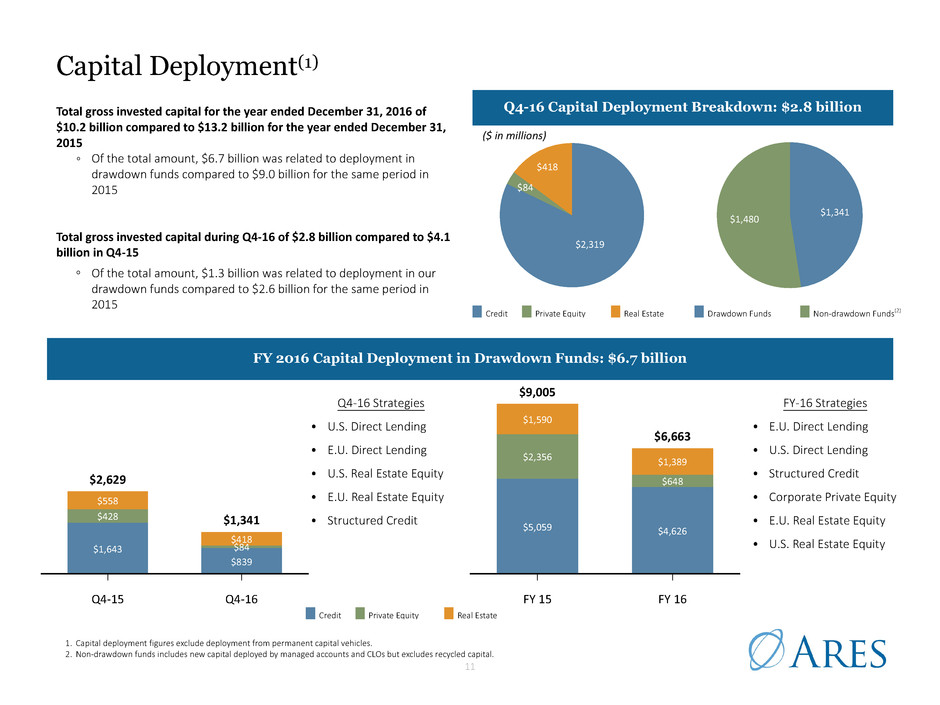

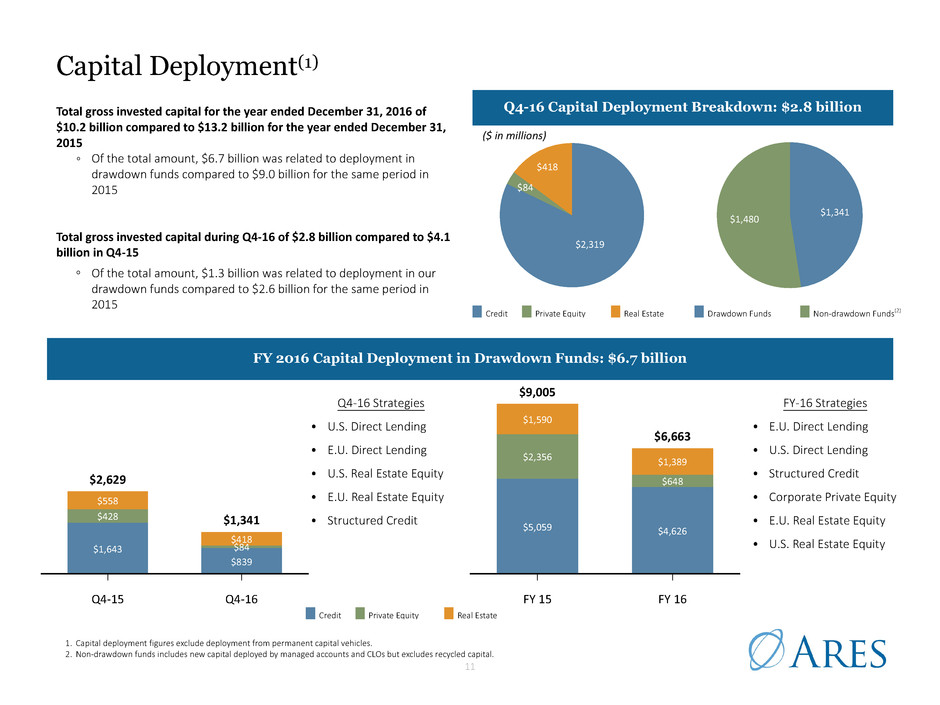

11 $2,319 $84 $418 Q4-16 Capital Deployment Breakdown: $2.8 billion Capital Deployment(1) Total gross invested capital for the year ended December 31, 2016 of $10.2 billion compared to $13.2 billion for the year ended December 31, 2015 ◦ Of the total amount, $6.7 billion was related to deployment in drawdown funds compared to $9.0 billion for the same period in 2015 Total gross invested capital during Q4-16 of $2.8 billion compared to $4.1 billion in Q4-15 ◦ Of the total amount, $1.3 billion was related to deployment in our drawdown funds compared to $2.6 billion for the same period in 2015 ($ in millions) (2) 1. Capital deployment figures exclude deployment from permanent capital vehicles. 2. Non-drawdown funds includes new capital deployed by managed accounts and CLOs but excludes recycled capital. $1,341 $1,480 Drawdown Funds Non-drawdown Funds(2) Credit Private Equity Real Estate Credit Private Equity Real Estate FY-16 Strategies • E.U. Direct Lending • U.S. Direct Lending • Structured Credit • Corporate Private Equity • E.U. Real Estate Equity • U.S. Real Estate Equity FY 2016 Capital Deployment in Drawdown Funds: $6.7 billion FY 15 FY 16 $5,059 $4,626 $2,356 $648 $1,590 $9,005 $1,389 $6,663 Q4-16 Strategies • U.S. Direct Lending • E.U. Direct Lending • U.S. Real Estate Equity • E.U. Real Estate Equity • Structured Credit Q4-15 Q4-16 $1,643 $839 $428 $84 $558 $2,629 $418 $1,341

12 $ in thousands, except share data Three Months Ended December 31, Year Ended December 31, 2016 2015 2016 2015 Revenues Management fees (includes ARCC Part I Fees of $30,297, $121,181 and $31,520, $121,491 for the three and twelve months ended December 31, 2016 and 2015, respectively) $161,505 $161,058 $642,068 $634,399 Performance fees 180,166 (9,736) 517,852 150,615 Administrative and other fees 16,524 8,197 39,285 29,428 Total revenues 358,195 159,519 1,199,205 814,442 Expenses Compensation and benefits $112,476 $108,646 $447,725 $414,454 Performance fee compensation 134,107 (960) 387,846 111,683 General, administrative and other expenses 42,931 75,058 159,776 224,798 Consolidated Funds' expenses 10,059 2,878 21,073 18,105 Total expenses 299,573 185,622 1,016,420 769,040 Other income (expense) Net interest and investment income (expense) (includes interest expense of $4,162, $17,981 and $5,698, $18,949 for the three and twelve months ended December 31, 2016 and 2015, respectively) 5,847 (4,099) 5,800 (4,904) Debt extinguishment expense — (11,641) — (11,641) Other income, net 1,694 22,479 35,650 21,680 Net realized and unrealized gain on investments 6,902 4,974 28,251 17,009 Net interest and investment income of the Consolidated Funds (includes interest expense of $23,983, $91,452 and $18,827, $78,819 for the three and twelve months ended December 31, 2016 and 2015, respectively) 21,732 8,554 47,491 38,554 Net realized and unrealized gain (loss) on investments of Consolidated Funds 3,666 15,406 (2,057) (24,616) Total other income (expense) 39,841 35,673 115,135 36,082 Income before taxes 98,463 9,570 297,920 81,484 Income tax expense 3,147 3,323 11,019 19,064 Net income 95,316 6,247 286,901 62,420 Less: Net income (loss) attributable to non-controlling interests in Consolidated Funds 6,450 2,020 3,386 (5,686) Less: Net income attributable to redeemable interests in Ares Operating Group entities — 28 456 338 Less: Net income attributable to non-controlling interests in Ares Operating Group entities 54,847 4,014 171,251 48,390 Net income attributable to Ares Management, L.P. 34,019 185 111,808 19,378 Preferred equity distributions paid 5,425 — 12,176 — Net income attributable to Ares Management, L.P. common unitholders $28,594 $185 $99,632 $19,378 Net income (loss) attributable to Ares Management, L.P. per common unit Basic $0.35 $0.00 $1.22 $0.23 Diluted $0.34 $0.00 $1.20 $0.23 Weighted-average common units Basic 80,804,833 80,678,042 80,749,671 80,673,360 Diluted 83,777,502 80,678,042 82,937,030 80,673,360 Distribution declared and paid per common unit $0.20 $0.13 $0.83 $0.88 GAAP Statements of Operations

13 Stand Alone Financial Summary 1.Includes ARCC Part I Fees of $30.3 million and $31.5 million for Q4-16 and Q4-15, respectively, and $121.2 million and $121.5 million for FY-16 and FY-15, respectively. 2.Includes compensation and benefits expenses attributable to OMG of $25.1 million and $26.4 million for the three months ended December 31, 2016 and 2015, respectively, and $111.6 million and $98.1 million for the years ended December 31, 2016 and 2015, respectively, which are not allocated to an operating segment. 3.Includes G&A expenses attributable to OMG of $17.0 million and $16.4 million for the three months ended December 31, 2016 and 2015, respectively, and $63.5 million and $59.8 million for the years ended December 31, 2016 and 2015, respectively, which are not allocated to an operating segment. 4.Non-Core/Non-Recurring Other Cash Uses includes one-time acquisition costs, non-cash depreciation and amortization and placement fees and underwriting costs associated with selected strategies. See slide 14 in this presentation for additional details. 5.After income tax. Distributable Earnings attributable to common unitholders per unit calculation uses total common units outstanding, assuming no exchange of Ares Operating Group Units. 6.Units of 214,208,695 includes the sum of common units, Ares Operating Group Units that are exchangeable for common units on a one-for-one basis and the dilutive effects of the Company’s equity-based awards. 7.Total fee revenue is calculated as management fees plus net performance fees. 8.All periods shown are annualized. $ in thousands, except share data (unless otherwise noted) Three Months Ended December 31, Year Ended December 31, 2016 2015 % Change 2016 2015 % Change Management fees(1) $165,375 $165,905 0% $659,451 $650,918 1% Other fees 9,574 1,435 NM 12,351 4,599 169% Compensation and benefits expenses(2) (94,539) (95,089) (1)% (384,715) (360,622) 7% General, administrative and other expenses(3) (32,008) (32,448) (1)% (114,737) (117,903) (3)% Fee Related Earnings $48,402 $39,803 22% $172,350 $176,992 (3)% Net performance fees $48,239 $(1,960) NM $133,624 $41,912 219% Net investment income 17,111 13,597 26% 51,009 (2,526) NM Performance Related Earnings $65,350 $11,637 NM $184,633 $39,386 NM Economic Net Income $113,752 $51,440 121% $356,983 $216,378 65% (-) Unrealized net performance fees $27,503 $(17,550) NM $38,890 $(14,845) NM (-) Unrealized net investment income (loss) (4,752) 10,036 NM 17,765 (27,362) NM (-) Non-core/non-recurring other cash uses(4) 11,531 8,200 41% 36,022 27,996 29% Distributable Earnings $79,470 $50,754 57% $264,306 $230,589 15% (-) Preferred unit distribution $(5,425) $0 NM $(12,176) $0 NM Distributable Earnings, net of preferred unit distribution $74,045 $50,754 46% $252,130 $230,589 9% After-tax Distributable Earnings per common unit, net of preferred unit distribution(5) $0.31 $0.23 35% $1.00 $0.91 10% After-tax Economic Net Income, net of preferred unit distribution $95,081 $42,615 123% $303,560 $185,235 64% After-tax Economic Net Income per unit, net of preferred unit distribution(6) $0.44 $0.20 120% $1.42 $0.87 63% Other Data Total fee revenue(7) $213,614 $163,945 30% $793,075 $692,830 14% Management fee as a percentage of average FPAUM(8) 1.11% 1.18% (6)% 1.11% 1.20% (8)%

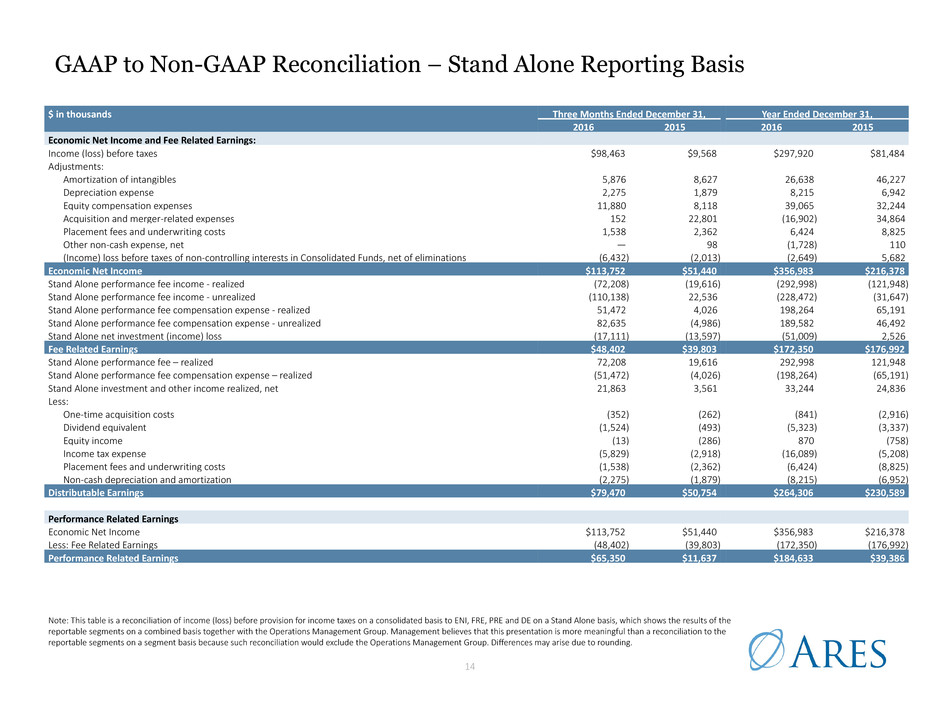

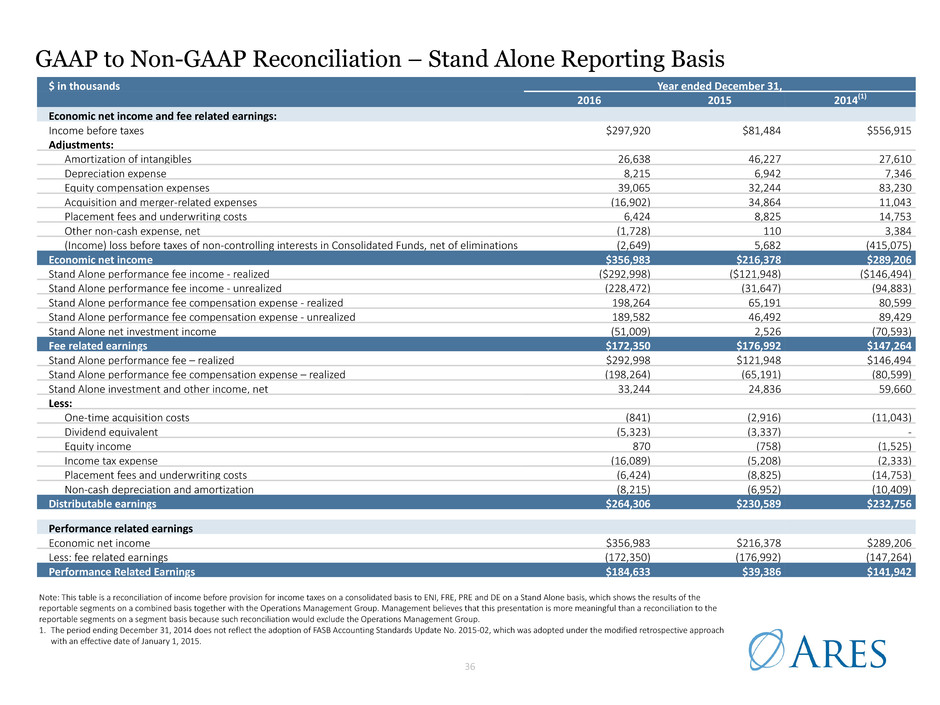

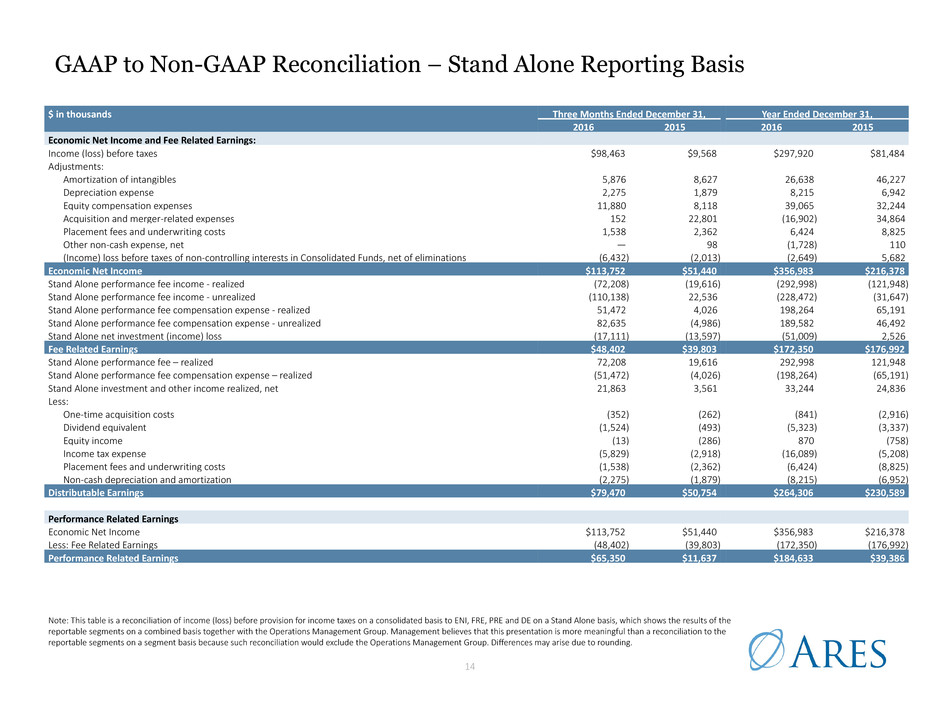

14 GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis Note: This table is a reconciliation of income (loss) before provision for income taxes on a consolidated basis to ENI, FRE, PRE and DE on a Stand Alone basis, which shows the results of the reportable segments on a combined basis together with the Operations Management Group. Management believes that this presentation is more meaningful than a reconciliation to the reportable segments on a segment basis because such reconciliation would exclude the Operations Management Group. Differences may arise due to rounding. $ in thousands Three Months Ended December 31, Year Ended December 31, 2016 2015 2016 2015 Economic Net Income and Fee Related Earnings: Income (loss) before taxes $98,463 $9,568 $297,920 $81,484 Adjustments: Amortization of intangibles 5,876 8,627 26,638 46,227 Depreciation expense 2,275 1,879 8,215 6,942 Equity compensation expenses 11,880 8,118 39,065 32,244 Acquisition and merger-related expenses 152 22,801 (16,902) 34,864 Placement fees and underwriting costs 1,538 2,362 6,424 8,825 Other non-cash expense, net — 98 (1,728) 110 (Income) loss before taxes of non-controlling interests in Consolidated Funds, net of eliminations (6,432) (2,013) (2,649) 5,682 Economic Net Income $113,752 $51,440 $356,983 $216,378 Stand Alone performance fee income - realized (72,208) (19,616) (292,998) (121,948) Stand Alone performance fee income - unrealized (110,138) 22,536 (228,472) (31,647) Stand Alone performance fee compensation expense - realized 51,472 4,026 198,264 65,191 Stand Alone performance fee compensation expense - unrealized 82,635 (4,986) 189,582 46,492 Stand Alone net investment (income) loss (17,111) (13,597) (51,009) 2,526 Fee Related Earnings $48,402 $39,803 $172,350 $176,992 Stand Alone performance fee – realized 72,208 19,616 292,998 121,948 Stand Alone performance fee compensation expense – realized (51,472) (4,026) (198,264) (65,191) Stand Alone investment and other income realized, net 21,863 3,561 33,244 24,836 Less: One-time acquisition costs (352) (262) (841) (2,916) Dividend equivalent (1,524) (493) (5,323) (3,337) Equity income (13) (286) 870 (758) Income tax expense (5,829) (2,918) (16,089) (5,208) Placement fees and underwriting costs (1,538) (2,362) (6,424) (8,825) Non-cash depreciation and amortization (2,275) (1,879) (8,215) (6,952) Distributable Earnings $79,470 $50,754 $264,306 $230,589 Performance Related Earnings Economic Net Income $113,752 $51,440 $356,983 $216,378 Less: Fee Related Earnings (48,402) (39,803) (172,350) (176,992) Performance Related Earnings $65,350 $11,637 $184,633 $39,386

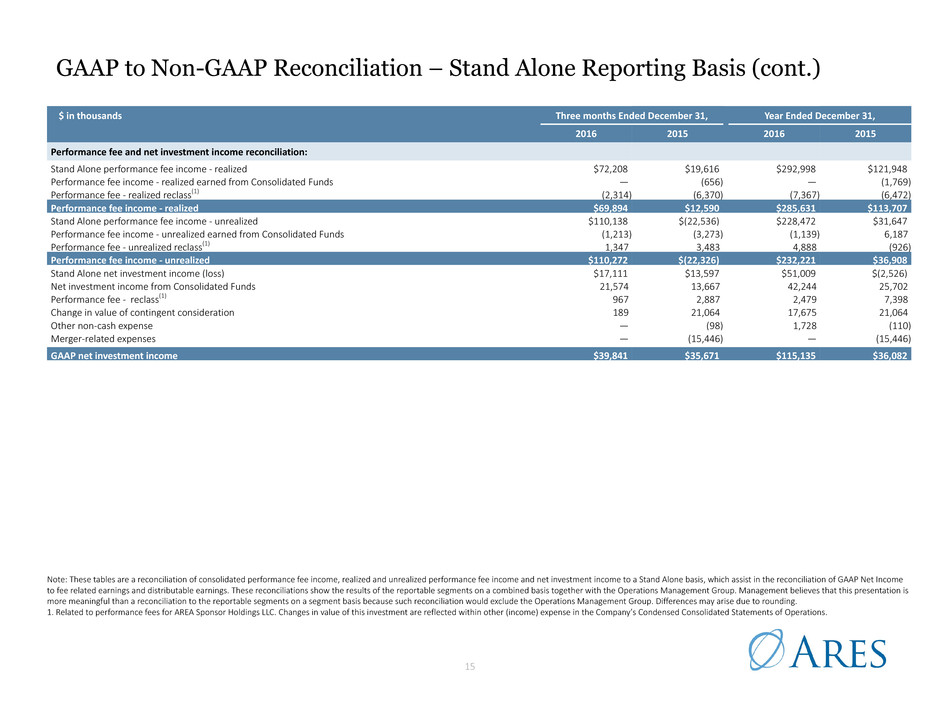

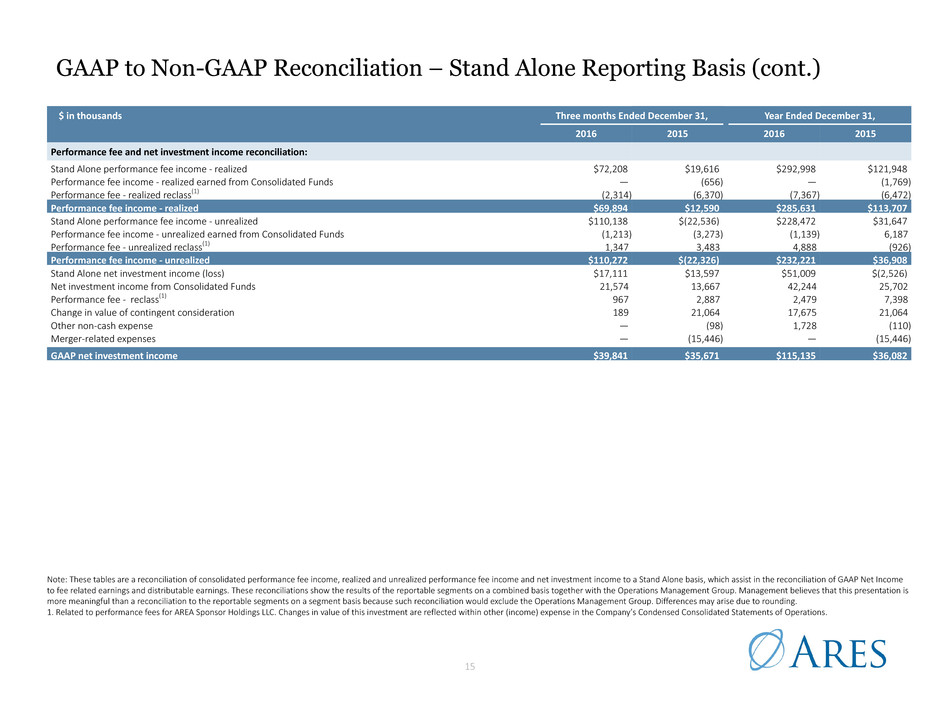

15 GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis (cont.) Note: These tables are a reconciliation of consolidated performance fee income, realized and unrealized performance fee income and net investment income to a Stand Alone basis, which assist in the reconciliation of GAAP Net Income to fee related earnings and distributable earnings. These reconciliations show the results of the reportable segments on a combined basis together with the Operations Management Group. Management believes that this presentation is more meaningful than a reconciliation to the reportable segments on a segment basis because such reconciliation would exclude the Operations Management Group. Differences may arise due to rounding. 1. Related to performance fees for AREA Sponsor Holdings LLC. Changes in value of this investment are reflected within other (income) expense in the Company’s Condensed Consolidated Statements of Operations. $ in thousands Three months Ended December 31, Year Ended December 31, 2016 2015 2016 2015 Performance fee and net investment income reconciliation: Stand Alone performance fee income - realized $72,208 $19,616 $292,998 $121,948 Performance fee income - realized earned from Consolidated Funds — (656) — (1,769) Performance fee - realized reclass(1) (2,314) (6,370) (7,367) (6,472) Performance fee income - realized $69,894 $12,590 $285,631 $113,707 Stand Alone performance fee income - unrealized $110,138 $(22,536) $228,472 $31,647 Performance fee income - unrealized earned from Consolidated Funds (1,213) (3,273) (1,139) 6,187 Performance fee - unrealized reclass(1) 1,347 3,483 4,888 (926) Performance fee income - unrealized $110,272 $(22,326) $232,221 $36,908 Stand Alone net investment income (loss) $17,111 $13,597 $51,009 $(2,526) Net investment income from Consolidated Funds 21,574 13,667 42,244 25,702 Performance fee - reclass(1) 967 2,887 2,479 7,398 Change in value of contingent consideration 189 21,064 17,675 21,064 Other non-cash expense — (98) 1,728 (110) Merger-related expenses — (15,446) — (15,446) GAAP net investment income $39,841 $35,671 $115,135 $36,082

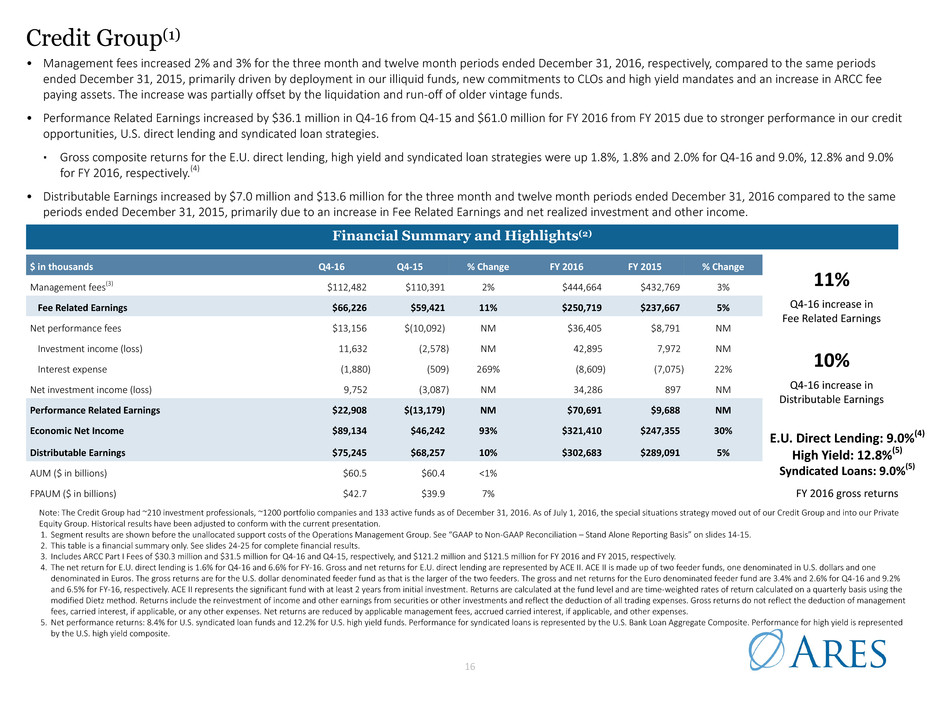

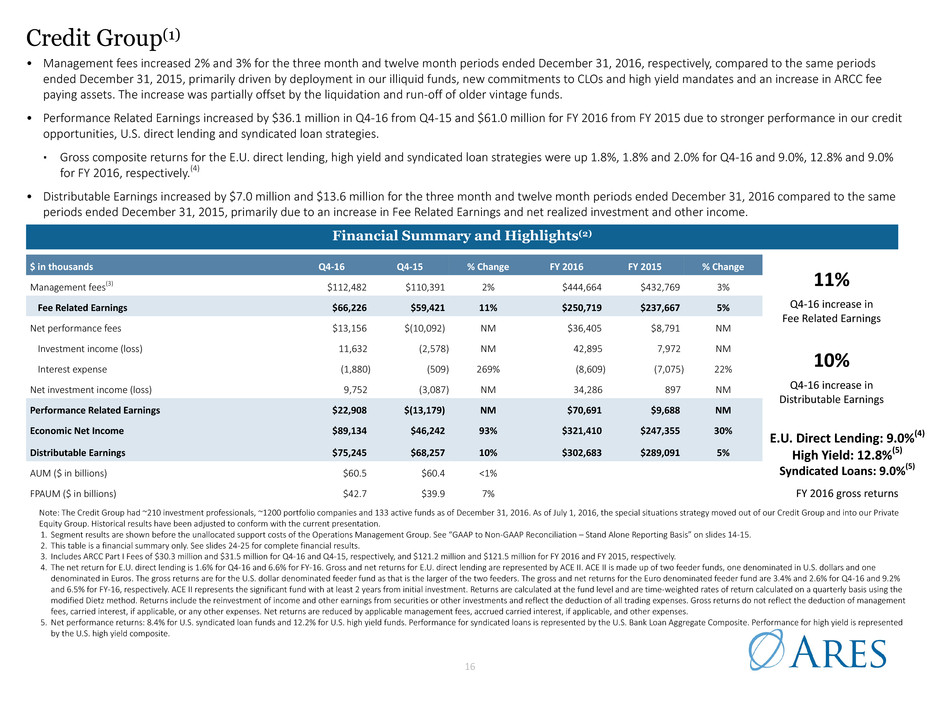

16 Credit Group(1) Note: The Credit Group had ~210 investment professionals, ~1200 portfolio companies and 133 active funds as of December 31, 2016. As of July 1, 2016, the special situations strategy moved out of our Credit Group and into our Private Equity Group. Historical results have been adjusted to conform with the current presentation. 1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis” on slides 14-15. 2. This table is a financial summary only. See slides 24-25 for complete financial results. 3. Includes ARCC Part I Fees of $30.3 million and $31.5 million for Q4-16 and Q4-15, respectively, and $121.2 million and $121.5 million for FY 2016 and FY 2015, respectively. 4. The net return for E.U. direct lending is 1.6% for Q4-16 and 6.6% for FY-16. Gross and net returns for E.U. direct lending are represented by ACE II. ACE II is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross returns are for the U.S. dollar denominated feeder fund as that is the larger of the two feeders. The gross and net returns for the Euro denominated feeder fund are 3.4% and 2.6% for Q4-16 and 9.2% and 6.5% for FY-16, respectively. ACE II represents the significant fund with at least 2 years from initial investment. Returns are calculated at the fund level and are time-weighted rates of return calculated on a quarterly basis using the modified Dietz method. Returns include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses. Net returns are reduced by applicable management fees, accrued carried interest, if applicable, and other expenses. 5. Net performance returns: 8.4% for U.S. syndicated loan funds and 12.2% for U.S. high yield funds. Performance for syndicated loans is represented by the U.S. Bank Loan Aggregate Composite. Performance for high yield is represented by the U.S. high yield composite. • Management fees increased 2% and 3% for the three month and twelve month periods ended December 31, 2016, respectively, compared to the same periods ended December 31, 2015, primarily driven by deployment in our illiquid funds, new commitments to CLOs and high yield mandates and an increase in ARCC fee paying assets. The increase was partially offset by the liquidation and run-off of older vintage funds. • Performance Related Earnings increased by $36.1 million in Q4-16 from Q4-15 and $61.0 million for FY 2016 from FY 2015 due to stronger performance in our credit opportunities, U.S. direct lending and syndicated loan strategies. ▪ Gross composite returns for the E.U. direct lending, high yield and syndicated loan strategies were up 1.8%, 1.8% and 2.0% for Q4-16 and 9.0%, 12.8% and 9.0% for FY 2016, respectively.(4) • Distributable Earnings increased by $7.0 million and $13.6 million for the three month and twelve month periods ended December 31, 2016 compared to the same periods ended December 31, 2015, primarily due to an increase in Fee Related Earnings and net realized investment and other income. Financial Summary and Highlights(2) 10% Q4-16 increase in Distributable Earnings 11% Q4-16 increase in Fee Related Earnings E.U. Direct Lending: 9.0%(4) High Yield: 12.8%(5) Syndicated Loans: 9.0%(5) FY 2016 gross returns $ in thousands Q4-16 Q4-15 % Change FY 2016 FY 2015 % Change Management fees(3) $112,482 $110,391 2% $444,664 $432,769 3% Fee Related Earnings $66,226 $59,421 11% $250,719 $237,667 5% Net performance fees $13,156 $(10,092) NM $36,405 $8,791 NM Investment income (loss) 11,632 (2,578) NM 42,895 7,972 NM Interest expense (1,880) (509) 269% (8,609) (7,075) 22% Net investment income (loss) 9,752 (3,087) NM 34,286 897 NM Performance Related Earnings $22,908 $(13,179) NM $70,691 $9,688 NM Economic Net Income $89,134 $46,242 93% $321,410 $247,355 30% Distributable Earnings $75,245 $68,257 10% $302,683 $289,091 5% AUM ($ in billions) $60.5 $60.4 <1% FPAUM ($ in billions) $42.7 $39.9 7%

17 Private Equity Group(1) Note: The Private Equity Group had ~85 investment professionals, 28 portfolio companies, 75 U.S. Power and Energy Assets and 23 active funds as of December 31, 2016. As of July 1, 2016, the special situations strategy moved out of our Credit Group and into our Private Equity Group. Historical results have been adjusted to conform with the current presentation. 1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis” on slides 14-15. 2. This table is a financial summary only. See slides 24-25 for complete financial results. 3. Performance for corporate private equity portfolio is represented by the ACOF I-IV Aggregate, which is comprised of investments held by ACOF I, ACOF II, ACOF III and ACOF IV. Performance returns are gross time-weighted rates of return calculated on a quarterly basis. Returns include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses. We believe aggregated performance returns reflect overall quarterly performance returns in a strategy, but are not necessarily investable funds or products themselves. • Management fees declined 5% and 3% for the three month and twelve month periods ended December 31, 2016, respectively, compared to the same periods ended December 31, 2015, primarily attributable to the absence of management fees from ACOF II in the current year. As of December 31, 2016, ACOF V management fees had not yet been activated. • Performance Related Earnings for the three months ended December 31, 2016 increased by $23.1 million from the same period ended December 31, 2015 due to a $27.6 million increase in net performance fees, primarily driven by an 8.8% gross return in the corporate private equity portfolio.(3) For the twelve months ended December 31, 2016, Performance Related Earnings increased by $100.9 million, primarily driven by a 31.4% gross return in the corporate private equity portfolio(3) due to aggregate market appreciation across the portfolio. • Distributable Earnings increased by $20.4 million and $57.2 million for the three month and twelve month periods ended December 31, 2016, respectively, compared to the same periods ended December 31, 2015. The increase in Distributable Earnings was primarily driven by realizations in our corporate private equity portfolio. Financial Summary and Highlights(2) $8.9 billion AUM Not Yet Earning Fees available for future deployment 62% FY 2016 growth in Distributable Earnings 31.4% FY 16 gross return in Corporate Private Equity portfolio(3) $ in thousands Q4-16 Q4-15 % Change FY 2016 FY 2015 % Change Management fees $36,690 $38,472 (5)% $147,790 $152,104 (3)% Fee Related Earnings $19,523 $19,575 <(1)% $78,066 $83,984 (7)% Net performance fees $29,076 $1,518 NM $84,421 $18,805 NM Investment income (loss) 12,596 15,840 (20)% 34,739 (199) NM Interest expense (1,388) (193) NM (5,589) (5,936) (6)% Net investment income 11,208 15,647 (28)% 29,150 (6,135) NM Performance Related Earnings $40,284 $17,165 135% $113,571 $12,670 NM Economic Net Income $59,807 $36,740 63% $191,637 $96,654 98% Distributable Earnings $41,173 $20,786 98% $148,996 $91,800 62% AUM ($ in billions) $25.0 $23.0 9% FPAUM ($ in billions) $11.3 $12.5 (8)%

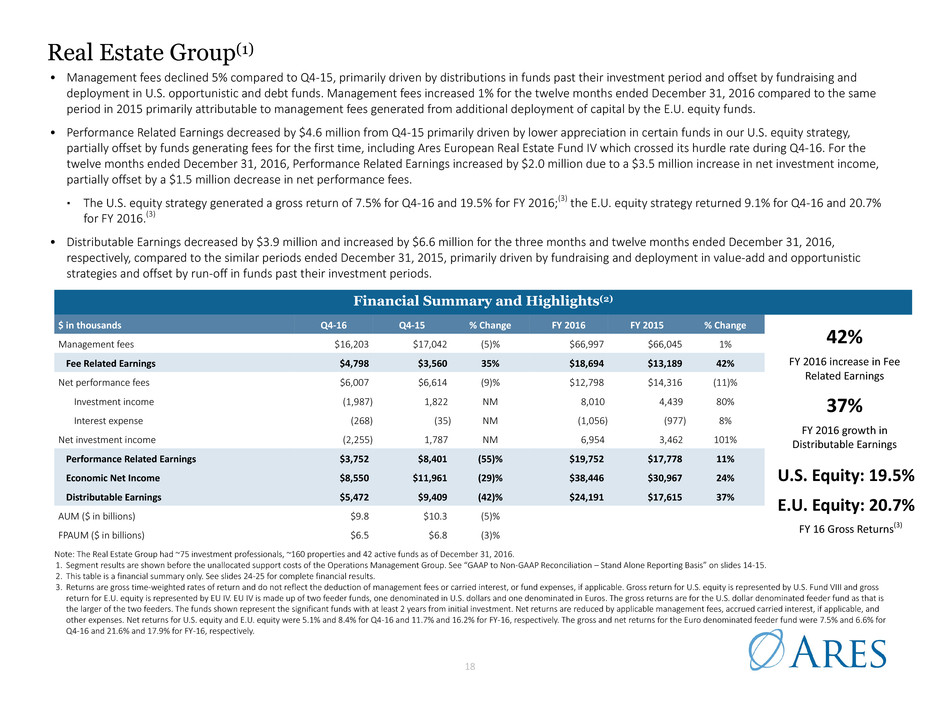

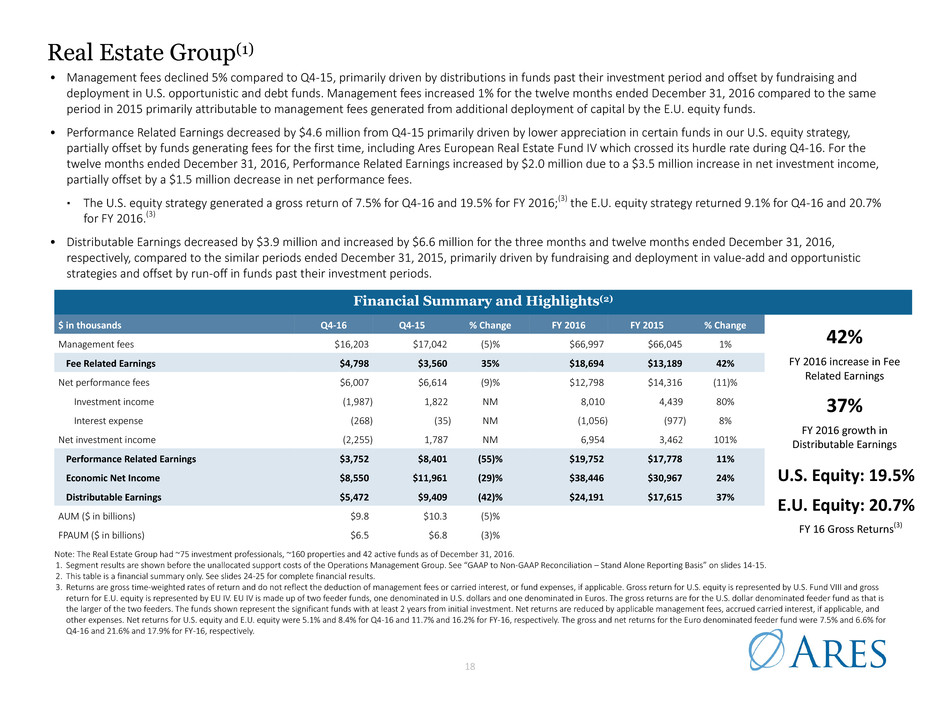

18 Real Estate Group(1) Note: The Real Estate Group had ~75 investment professionals, ~160 properties and 42 active funds as of December 31, 2016. 1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis” on slides 14-15. 2. This table is a financial summary only. See slides 24-25 for complete financial results. 3. Returns are gross time-weighted rates of return and do not reflect the deduction of management fees or carried interest, or fund expenses, if applicable. Gross return for U.S. equity is represented by U.S. Fund VIII and gross return for E.U. equity is represented by EU IV. EU IV is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross returns are for the U.S. dollar denominated feeder fund as that is the larger of the two feeders. The funds shown represent the significant funds with at least 2 years from initial investment. Net returns are reduced by applicable management fees, accrued carried interest, if applicable, and other expenses. Net returns for U.S. equity and E.U. equity were 5.1% and 8.4% for Q4-16 and 11.7% and 16.2% for FY-16, respectively. The gross and net returns for the Euro denominated feeder fund were 7.5% and 6.6% for Q4-16 and 21.6% and 17.9% for FY-16, respectively. • Management fees declined 5% compared to Q4-15, primarily driven by distributions in funds past their investment period and offset by fundraising and deployment in U.S. opportunistic and debt funds. Management fees increased 1% for the twelve months ended December 31, 2016 compared to the same period in 2015 primarily attributable to management fees generated from additional deployment of capital by the E.U. equity funds. • Performance Related Earnings decreased by $4.6 million from Q4-15 primarily driven by lower appreciation in certain funds in our U.S. equity strategy, partially offset by funds generating fees for the first time, including Ares European Real Estate Fund IV which crossed its hurdle rate during Q4-16. For the twelve months ended December 31, 2016, Performance Related Earnings increased by $2.0 million due to a $3.5 million increase in net investment income, partially offset by a $1.5 million decrease in net performance fees. ▪ The U.S. equity strategy generated a gross return of 7.5% for Q4-16 and 19.5% for FY 2016;(3) the E.U. equity strategy returned 9.1% for Q4-16 and 20.7% for FY 2016.(3) • Distributable Earnings decreased by $3.9 million and increased by $6.6 million for the three months and twelve months ended December 31, 2016, respectively, compared to the similar periods ended December 31, 2015, primarily driven by fundraising and deployment in value-add and opportunistic strategies and offset by run-off in funds past their investment periods. Financial Summary and Highlights(2) 37% FY 2016 growth in Distributable Earnings 42% FY 2016 increase in Fee Related Earnings U.S. Equity: 19.5% E.U. Equity: 20.7% FY 16 Gross Returns(3) $ in thousands Q4-16 Q4-15 % Change FY 2016 FY 2015 % Change Management fees $16,203 $17,042 (5)% $66,997 $66,045 1% Fee Related Earnings $4,798 $3,560 35% $18,694 $13,189 42% Net performance fees $6,007 $6,614 (9)% $12,798 $14,316 (11)% Investment income (1,987) 1,822 NM 8,010 4,439 80% Interest expense (268) (35) NM (1,056) (977) 8% Net investment income (2,255) 1,787 NM 6,954 3,462 101% Performance Related Earnings $3,752 $8,401 (55)% $19,752 $17,778 11% Economic Net Income $8,550 $11,961 (29)% $38,446 $30,967 24% Distributable Earnings $5,472 $9,409 (42)% $24,191 $17,615 37% AUM ($ in billions) $9.8 $10.3 (5)% FPAUM ($ in billions) $6.5 $6.8 (3)%

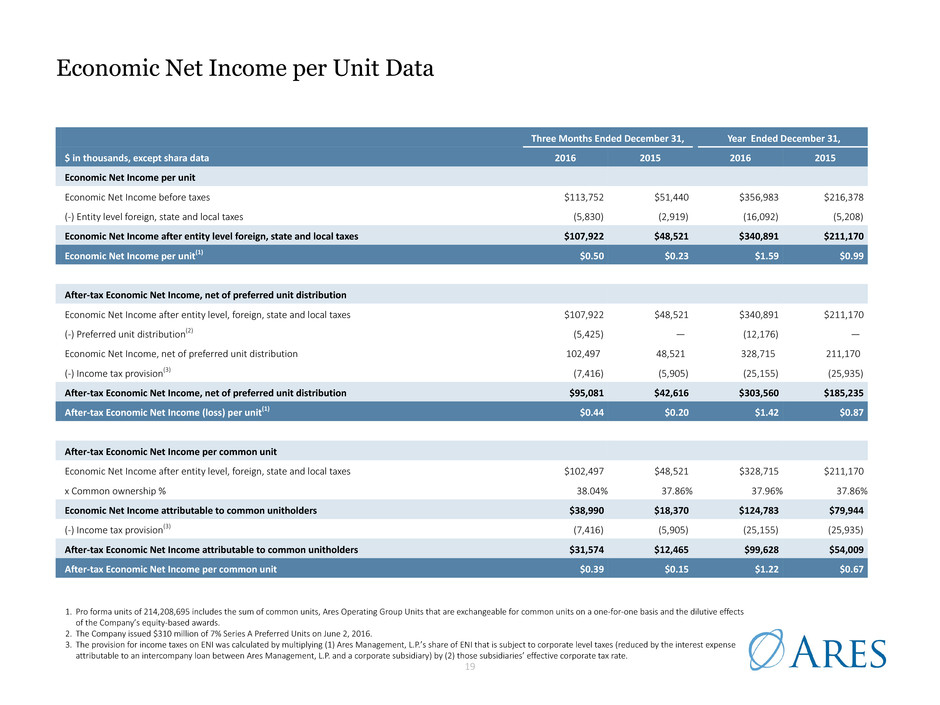

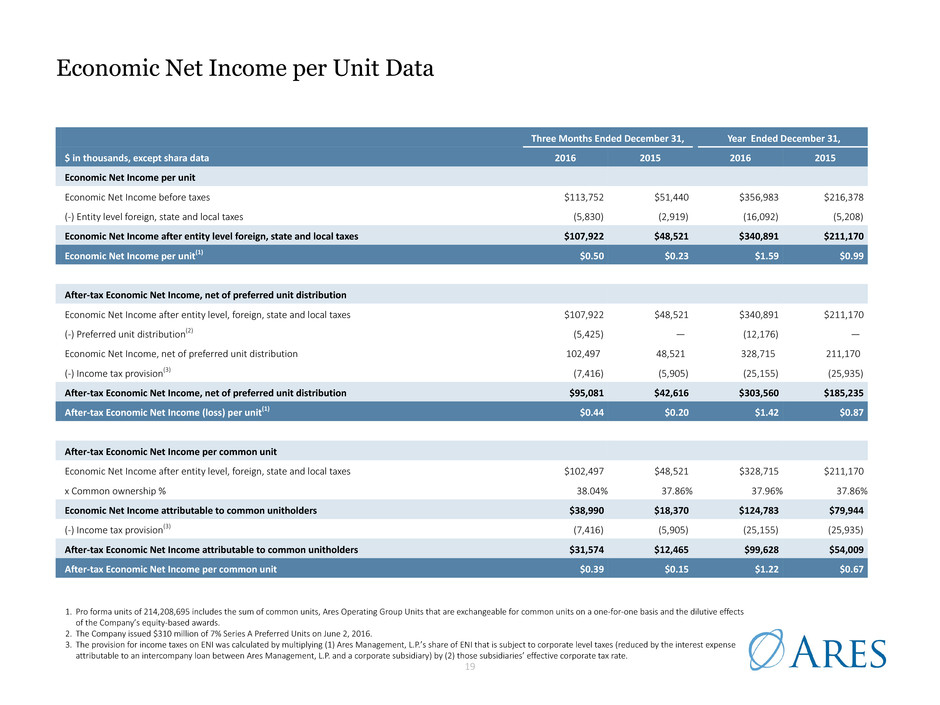

19 Economic Net Income per Unit Data 1. Pro forma units of 214,208,695 includes the sum of common units, Ares Operating Group Units that are exchangeable for common units on a one-for-one basis and the dilutive effects of the Company’s equity-based awards. 2. The Company issued $310 million of 7% Series A Preferred Units on June 2, 2016. 3. The provision for income taxes on ENI was calculated by multiplying (1) Ares Management, L.P.’s share of ENI that is subject to corporate level taxes (reduced by the interest expense attributable to an intercompany loan between Ares Management, L.P. and a corporate subsidiary) by (2) those subsidiaries’ effective corporate tax rate. Three Months Ended December 31, Year Ended December 31, $ in thousands, except shara data 2016 2015 2016 2015 Economic Net Income per unit Economic Net Income before taxes $113,752 $51,440 $356,983 $216,378 (-) Entity level foreign, state and local taxes (5,830) (2,919) (16,092) (5,208) Economic Net Income after entity level foreign, state and local taxes $107,922 $48,521 $340,891 $211,170 Economic Net Income per unit(1) $0.50 $0.23 $1.59 $0.99 After-tax Economic Net Income, net of preferred unit distribution Economic Net Income after entity level, foreign, state and local taxes $107,922 $48,521 $340,891 $211,170 (-) Preferred unit distribution(2) (5,425) — (12,176) — Economic Net Income, net of preferred unit distribution 102,497 48,521 328,715 211,170 (-) Income tax provision(3) (7,416) (5,905) (25,155) (25,935) After-tax Economic Net Income, net of preferred unit distribution $95,081 $42,616 $303,560 $185,235 After-tax Economic Net Income (loss) per unit(1) $0.44 $0.20 $1.42 $0.87 After-tax Economic Net Income per common unit Economic Net Income after entity level, foreign, state and local taxes $102,497 $48,521 $328,715 $211,170 x Common ownership % 38.04% 37.86% 37.96% 37.86% Economic Net Income attributable to common unitholders $38,990 $18,370 $124,783 $79,944 (-) Income tax provision(3) (7,416) (5,905) (25,155) (25,935) After-tax Economic Net Income attributable to common unitholders $31,574 $12,465 $99,628 $54,009 After-tax Economic Net Income per common unit $0.39 $0.15 $1.22 $0.67

20 $ in thousands, except share data Three Months Ended December 31, Year Ended December 31, 2016 2015 2016 2015 Distributable Earnings per Ares Operating Group Unit(1) outstanding Distributable Earnings $79,470 $50,754 $264,306 $230,589 (-) Preferred unit distribution(2) (5,425) - (12,176) - Distributable Earnings, net of preferred unit distribution $74,045 $50,754 $252,130 $230,589 x Ares Operating Group Units(1) ownership % 61.74% 62.14% 61.91% 62.14% Distributable Earnings attributable to Ares Operating Group Units(1) $45,718 $31,538 $156,098 $143,292 Distributable Earnings per Ares Operating Group Unit outstanding(1) $0.35 $0.24 $1.18 $1.08 Distributable Earnings per common unit outstanding Distributable Earnings, net of preferred unit distribution $74,045 $50,754 $252,130 $230,589 x Common unitholder ownership % 38.26% 37.86% 38.09% 37.86% Distributable Earnings attributable to common unitholders $28,330 $19,215 $96,035 $87,296 (-) Current provision for income taxes(3) (3,664) (298) (14,934) (13,248) After-tax Distributable Earnings attributable to common unitholders $24,666 $18,917 $81,101 $74,048 Distributable Earnings per common unit, net of preferred unit distribution $0.31 $0.23 $1.00 $0.91 Actual Distribution per common unit $0.28 $0.20 $0.91 $0.84 Distributable Earnings per Unit Data 1. Exchangeable into common units. 2. The Company issued $310 million of 7% Series A Preferred Units on June 2, 2016. 3. The current provision for income taxes of Ares Management, L.P. on Distributable Earnings (DE) represents the current provision for income taxes on pre-tax net income or loss (reduced by the pro forma interest expense attributable to an intercompany loan between Ares Management, L.P. and a corporate subsidiary).

21 • $342.9 million in cash and cash equivalents, $305.8 million in debt obligations with no amounts drawn against the $1.03 billion revolving credit facility as of December 31, 2016 • Substantial balance sheet value related to investments in Ares managed vehicles and net performance fees receivable ◦ As of December 31, 2016, investments reported on a GAAP basis were $468.5 million. On a Stand Alone basis, investments were $622.2 million(1) ◦ As of December 31, 2016, gross performance fees receivable reported on a GAAP basis were $759.1 million. On a Stand Alone basis, performance fees receivable were $767.4 million(2) ◦ As of December 31, 2016, net performance fees receivable reported on a GAAP basis were $161.0 million. On a Stand Alone basis, performance fees receivable were $169.4 million(2) ◦ As of December 31, 2016, net performance fees receivable reported on a GAAP basis increased 21.1% compared to the fourth quarter of 2015 26% 65% 9% 22% 69% 9% Balance Sheet 1. As of December 31, 2016, $53.2 million was invested in non-Ares managed vehicles. Difference between GAAP and Stand Alone investments represents investments of $153.7 million in Consolidated Funds that are eliminated upon consolidation. 2. Difference between GAAP and Stand Alone gross and net performance fees receivable of $8.3 million represents fees earned from Consolidated Funds that are eliminated upon consolidation. FY 2016: $169,379 $ in thousands Net Performance Fees Receivable by Group – Stand Alone Net Performance Fees Receivable by Group – GAAP $ in thousands FY 2016: $161,049 Credit Private Equity Real Estate Credit Private Equity Real Estate

22 Corporate Data Board of Directors Michael Arougheti Co-Founder and President of Ares Paul G. Joubert Founding Partner of EdgeAdvisors and Investing Partner in Common Angels Ventures David Kaplan Co-Founder and Partner of Ares, Co- Head of Private Equity Group John Kissick Co-Founder and Former Partner of Ares Michael Lynton Former Chief Executive Officer of Sony Entertainment Dr. Judy D. Olian Dean of UCLA Anderson School of Management and the John E. Anderson Chair in Management Antony P. Ressler Co-Founder, Chairman and Chief Executive Officer of Ares Bennett Rosenthal Co-Founder and Partner of Ares, Co- Head of Private Equity Group Management Committee Michael Arougheti Co-Founder and President of Ares William Benjamin Partner, Head of Real Estate Group Seth Brufsky Partner, Credit Group Janine Cristiano Partner, Global Head of Human Resources and Corporate Services Michael Dennis Partner, Credit Group Kipp deVeer Partner, Head of Credit Group Mitch Goldstein Partner, Co-Head of Credit Group Blair Jacobson Partner, Credit Group John Jardine Partner, Real Estate Group David Kaplan Co-Founder and Partner of Ares, Co- Head of Private Equity Group Ann Kono Partner, Chief Information and Risk Officer Herb Magid Partner, Co-Head of Ares EIF Greg Margolies Partner, Head of Markets Michael McFerran Partner and Chief Financial Officer Antony P. Ressler Chairman, Co-Founder and Chief Executive Officer of Ares Bennett Rosenthal Co-Founder and Partner of Ares, Co- Head of Private Equity Group Michael Smith Partner, Co-Head of Credit Group Michael Weiner Chief Legal Officer of Ares, Partner and General Counsel, Legal Group Steven Wolf Partner, Real Estate Group Corporate Officers Michael Arougheti Co-Founder and President Kipp deVeer Partner David Kaplan Co-Founder and Partner Michael McFerran Chief Financial Officer Antony P. Ressler Co-Founder and Chief Executive Officer Bennett Rosenthal Co-Founder and Partner Michael Weiner Executive Vice President, Chief Legal Officer of Ares Research Coverage Autonomous Patrick Davitt (646) 561-6254 Bank of America Merrill Lynch Michael Carrier (646) 855-5004 Credit Suisse Craig Sigenthaler (212) 325-3104 Goldman Sachs Alexander Blostein (212) 357-9976 JP Morgan Kenneth Worthington (212) 622-6613 Keefe, Bruyette & Woods Robert Lee (212) 887-7732 Morgan Stanley Michael Cyprys (212) 761-7619 SunTrust Robinson Humphrey Douglas Mewhirter (404) 926-5745 Wells Fargo Securities Christopher Harris (443) 263-6513 Corporate Counsel Proskauer Rose LLP Los Angeles, CA Corporate Headquarters 2000 Avenue of the Stars 12th Floor Los Angeles, CA 90067 Tel: (310) 201-4100 Fax: (310) 201-4170 Independent Registered Public Accounting Firm Ernst & Young LLP Los Angeles, CA Securities Listing NYSE: ARES NYSE: ARES PR A Transfer Agent American Stock Transfer & Trust Company, LLC 6201 15th Avenue Brooklyn, NY 11210 Tel: (877) 681-8121 Fax: (718) 236-2641 info@amstock.com www.amstock.com Investor Relations Contacts Carl Drake Partner/Head of Ares Management, LLC Public Investor Relations and Communications Tel: (678) 538-1981 cdrake@aresmgmt.com Veronica Mendiola Vice President Tel: (212) 808-1150 General IR Contact Tel (U.S.): (800) 340-6597 Tel (International): (212) 808-1101 IRARES@aresmgmt.com Please visit our website at: www.aresmgmt.com

Appendix

24 Financial Details – Segments 1. Includes results of the reportable segments on a combined basis together with the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis” on slides 14-15. Three Months Ended December 31, 2016 $ in thousands Credit Group Private Equity Group Real Estate Group Total Segments Operations Management Group Total Stand Alone(1) Management fees (Credit Group includes ARCC Part I Fees of $30,297) $112,482 $36,690 $16,203 $165,375 $— $165,375 Other fees 9,014 561 (1) 9,574 — 9,574 Compensation and benefits (46,575) (13,653) (9,162) (69,390) (25,149) (94,539) General, administrative and other expenses (8,695) (4,075) (2,242) (15,012) (16,996) (32,008) Fee Related Earnings $66,226 $19,523 $4,798 $90,547 ($42,145) $48,402 Performance fees - realized $6,811 $59,138 $6,259 $72,208 $— $72,208 Performance fees - unrealized 24,395 78,439 7,304 110,138 — 110,138 Performance fee compensation - realized (1,794) (47,311) (2,367) (51,472) — (51,472) Performance fee compensation - unrealized (16,256) (61,190) (5,189) (82,635) — (82,635) Net performance fees $13,156 $29,076 $6,007 $48,239 $— $48,239 Investment income - realized $4,538 $4,132 $519 $9,189 $5,487 $14,676 Investment income (loss) - unrealized 2,592 417 (2,525) 484 (6,657) (6,173) Interest and other investment income 4,502 8,047 19 12,568 202 12,770 Interest expense (1,880) (1,388) (268) (3,536) (626) (4,162) Net investment income (loss) $9,752 $11,208 ($2,255) $18,705 ($1,594) $17,111 Performance Related Earnings $22,908 $40,284 $3,752 $66,944 ($1,594) $65,350 Economic Net Income $89,134 $59,807 $8,550 $157,491 ($43,739) $113,752 Distributable Earnings $75,245 $41,173 $5,472 $121,890 ($42,420) $79,470 Three Months Ended December 31, 2015 $ in thousands Credit Group Private Equity Group Real Estate Group Total Segments Operations Management Group Total Stand Alone(1) Management fees (Credit Group includes ARCC Part I Fees of $31,520) $110,391 $38,472 $17,042 $165,905 $— $165,905 Other fees 114 678 643 1,435 — 1,435 Compensation and benefits (44,301) (14,226) (10,206) (68,733) (26,356) (95,089) General, administrative and other expenses (6,783) (5,349) (3,919) (16,051) (16,397) (32,448) Fee Related Earnings $59,421 $19,575 $3,560 $82,556 ($42,753) $39,803 Performance fees - realized $9,893 $3,353 $6,370 $19,616 $— $19,616 Performance fees - unrealized (30,189) 1,817 5,836 (22,536) — (22,536) Performance fee compensation - realized (1,471) (2,555) — (4,026) — (4,026) Performance fee compensation - unrealized 11,675 (1,097) (5,592) 4,986 — 4,986 Net performance fees ($10,092) $1,518 $6,614 ($1,960) $— ($1,960) Investment income (loss) - realized ($916) $1,258 $1,208 $1,550 ($23) $1,527 Investment income (loss) - unrealized (5,006) 14,430 560 9,984 52 10,036 Interest and other investment income 3,344 152 54 3,550 379 3,929 Interest expense (509) (193) (35) (737) (1,158) (1,895) Net investment income (loss) ($3,087) $15,647 $1,787 $14,347 ($750) $13,597 Performance Related Earnings ($13,179) $17,165 $8,401 $12,387 ($750) $11,637 Economic Net Income $46,242 $36,740 $11,961 $94,943 ($43,503) $51,440 Distributable Earnings $68,257 $20,786 $9,409 $98,452 ($47,698) $50,754

25 1. Includes results of the reportable segments on a combined basis together with the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Stand Alone Reporting Basis” on slides 14-15. Year Ended December 31, 2016 $ in thousands Credit Group Private Equity Group Real Estate Group Total Segments Operations Management Group Total Stand Alone(1) Management fees (Credit Group includes ARCC Part I Fees of $121,181) $444,664 $147,790 $66,997 $659,451 $— $659,451 Other fees 9,953 1,544 854 12,351 — 12,351 Compensation and benefits (177,071) (57,012) (39,033) (273,116) (111,599) (384,715) General, administrative and other expenses (26,827) (14,256) (10,124) (51,207) (63,530) (114,737) Fee Related Earnings $250,719 $78,066 $18,694 $347,479 ($175,129) $172,350 Performance fees - realized $51,435 $230,162 $11,401 $292,998 $— $292,998 Performance fees - unrealized 22,851 188,287 17,334 228,472 — 228,472 Performance fee compensation - realized (11,772) (184,072) (2,420) (198,264) — (198,264) Performance fee compensation - unrealized (26,109) (149,956) (13,517) (189,582) — (189,582) Net performance fees $36,405 $84,421 $12,798 $133,624 — $133,624 Investment income (loss) - realized $4,928 $18,773 $931 $24,632 ($14,606) $10,026 Investment income (loss) - unrealized 11,848 (613) 5,418 16,653 (2,197) 14,456 Interest and other investment income 26,119 16,579 1,661 44,359 149 44,508 Interest expense (8,609) (5,589) (1,056) (15,254) (2,727) (17,981) Net investment income (loss) $34,286 $29,150 $6,954 $70,390 ($19,381) $51,009 Performance Related Earnings $70,691 $113,571 $19,752 $204,014 ($19,381) $184,633 Economic Net Income $321,410 $191,637 $38,446 $551,493 ($194,510) $356,983 Distributable Earnings $302,683 $148,996 $24,191 $475,870 ($211,564) $264,306 Year Ended December 31, 2015 $ in thousands Credit Group Private Equity Group Real Estate Group Total Segments Operations Management Group Total Stand Alone(1) Management fees (Credit Group includes ARCC Part I Fees of $121,491) $432,769 $152,104 $66,045 $650,918 $— $650,918 Other fees 414 1,406 2,779 4,599 — 4,599 Compensation and benefits (167,735) (54,231) (40,591) (262,557) (98,065) (360,622) General, administrative and other expenses (27,781) (15,295) (15,044) (58,120) (59,783) (117,903) Fee Related Earnings $237,667 $83,984 $13,189 $334,840 ($157,848) $176,992 Performance fees - realized $87,583 $24,849 $9,516 $121,948 $— $121,948 Performance fees - unrealized (71,341) 87,809 15,179 31,647 — 31,647 Performance fee compensation - realized (44,110) (19,255) (1,826) (65,191) — (65,191) Performance fee compensation - unrealized 36,659 (74,598) (8,553) (46,492) — (46,492) Net performance fees $8,791 $18,805 $14,316 $41,912 $— $41,912 Investment income (loss) - realized $13,274 $6,840 $2,658 $22,772 ($23) $22,749 Investment income (loss) - unrealized (15,731) (13,205) 1,522 (27,414) 52 (27,362) Interest and other investment income 10,429 6,166 259 16,854 379 17,233 Interest expense (7,075) (5,936) (977) (13,988) (1,158) (15,146) Net investment income (loss) $897 ($6,135) $3,462 ($1,776) ($750) ($2,526) Performance Related Earnings $9,688 $12,670 $17,778 $40,136 ($750) $39,386 Economic Net Income $247,355 $96,654 $30,967 $374,976 ($158,598) $216,378 Distributable Earnings $289,091 $91,800 $17,615 $398,506 ($167,917) $230,589 Financial Details – Segments

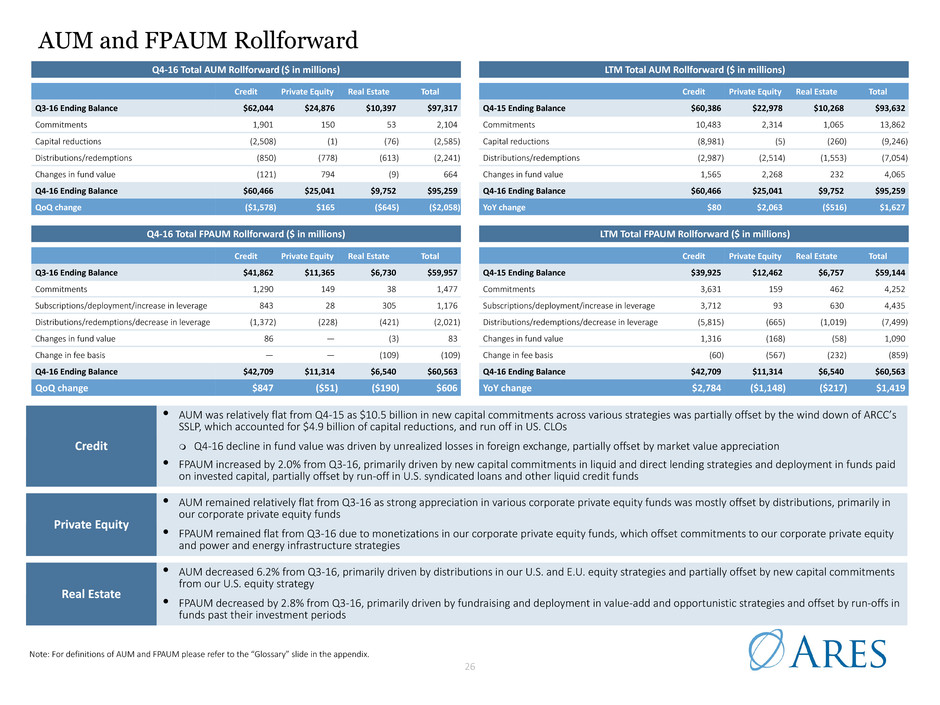

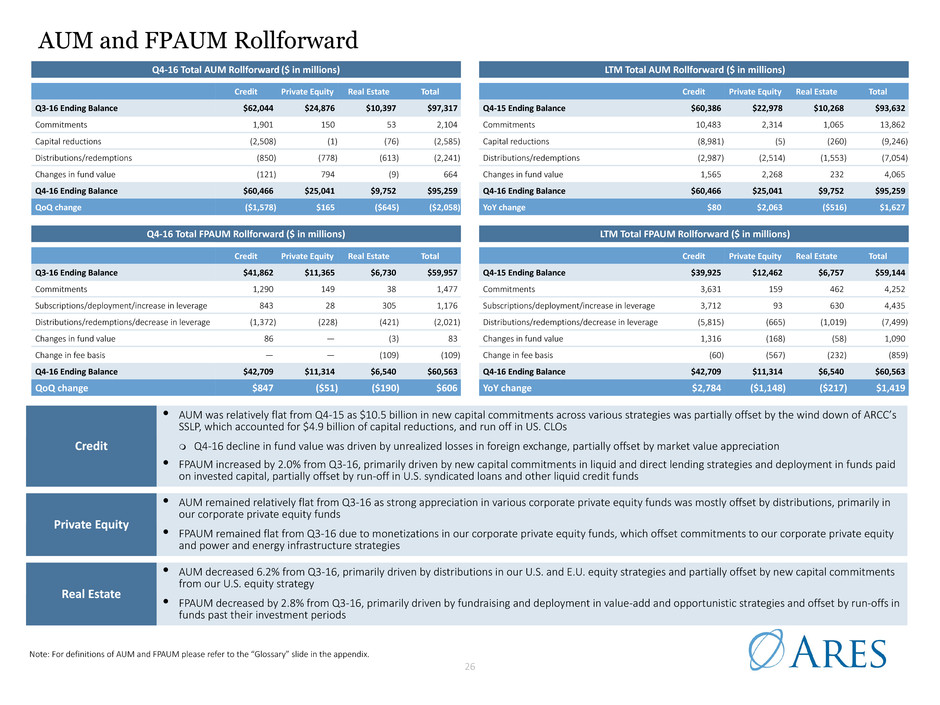

26 AUM and FPAUM Rollforward Note: For definitions of AUM and FPAUM please refer to the “Glossary” slide in the appendix. Credit l AUM was relatively flat from Q4-15 as $10.5 billion in new capital commitments across various strategies was partially offset by the wind down of ARCC’s SSLP, which accounted for $4.9 billion of capital reductions, and run off in US. CLOs m Q4-16 decline in fund value was driven by unrealized losses in foreign exchange, partially offset by market value appreciation l FPAUM increased by 2.0% from Q3-16, primarily driven by new capital commitments in liquid and direct lending strategies and deployment in funds paid on invested capital, partially offset by run-off in U.S. syndicated loans and other liquid credit funds Private Equity l AUM remained relatively flat from Q3-16 as strong appreciation in various corporate private equity funds was mostly offset by distributions, primarily in our corporate private equity funds l FPAUM remained flat from Q3-16 due to monetizations in our corporate private equity funds, which offset commitments to our corporate private equity and power and energy infrastructure strategies Real Estate l AUM decreased 6.2% from Q3-16, primarily driven by distributions in our U.S. and E.U. equity strategies and partially offset by new capital commitments from our U.S. equity strategy l FPAUM decreased by 2.8% from Q3-16, primarily driven by fundraising and deployment in value-add and opportunistic strategies and offset by run-offs in funds past their investment periods Q4-16 Total AUM Rollforward ($ in millions) LTM Total AUM Rollforward ($ in millions) Credit Private Equity Real Estate Total Credit Private Equity Real Estate Total Q3-16 Ending Balance $62,044 $24,876 $10,397 $97,317 Q4-15 Ending Balance $60,386 $22,978 $10,268 $93,632 Commitments 1,901 150 53 2,104 Commitments 10,483 2,314 1,065 13,862 Capital reductions (2,508) (1) (76) (2,585) Capital reductions (8,981) (5) (260) (9,246) Distributions/redemptions (850) (778) (613) (2,241) Distributions/redemptions (2,987) (2,514) (1,553) (7,054) Changes in fund value (121) 794 (9) 664 Changes in fund value 1,565 2,268 232 4,065 Q4-16 Ending Balance $60,466 $25,041 $9,752 $95,259 Q4-16 Ending Balance $60,466 $25,041 $9,752 $95,259 QoQ change ($1,578) $165 ($645) ($2,058) YoY change $80 $2,063 ($516) $1,627 Q4-16 Total FPAUM Rollforward ($ in millions) LTM Total FPAUM Rollforward ($ in millions) Credit Private Equity Real Estate Total Credit Private Equity Real Estate Total Q3-16 Ending Balance $41,862 $11,365 $6,730 $59,957 Q4-15 Ending Balance $39,925 $12,462 $6,757 $59,144 Commitments 1,290 149 38 1,477 Commitments 3,631 159 462 4,252 Subscriptions/deployment/increase in leverage 843 28 305 1,176 Subscriptions/deployment/increase in leverage 3,712 93 630 4,435 Distributions/redemptions/decrease in leverage (1,372) (228) (421) (2,021) Distributions/redemptions/decrease in leverage (5,815) (665) (1,019) (7,499) Changes in fund value 86 — (3) 83 Changes in fund value 1,316 (168) (58) 1,090 Change in fee basis — — (109) (109) Change in fee basis (60) (567) (232) (859) Q4-16 Ending Balance $42,709 $11,314 $6,540 $60,563 Q4-16 Ending Balance $42,709 $11,314 $6,540 $60,563 QoQ change $847 ($51) ($190) $606 YoY change $2,784 ($1,148) ($217) $1,419

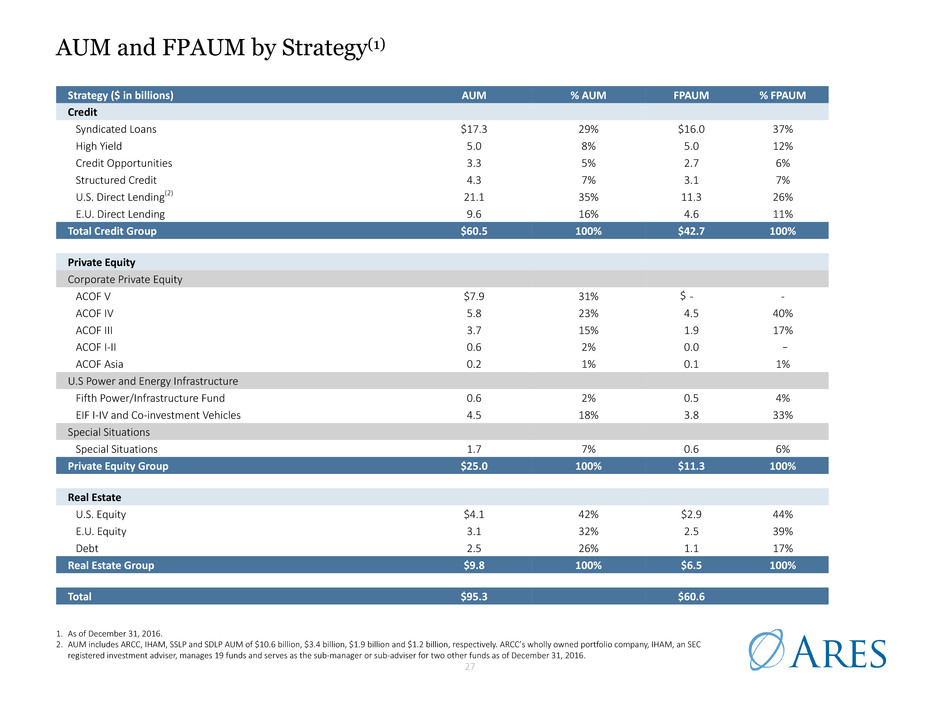

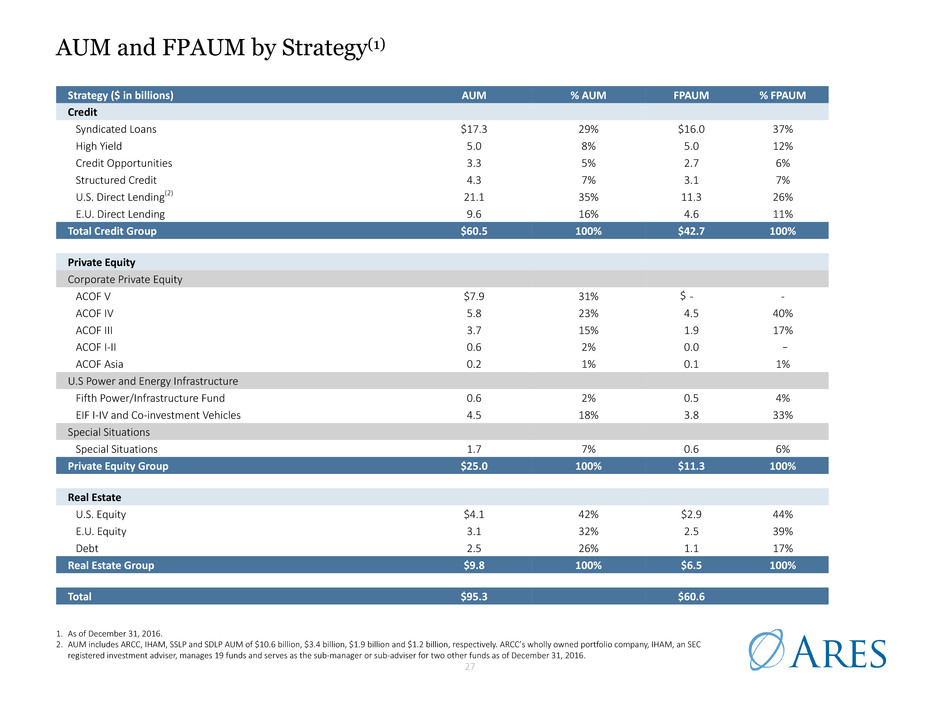

27 AUM and FPAUM by Strategy(1) 1. As of December 31, 2016. 2. AUM includes ARCC, IHAM, SSLP and SDLP AUM of $10.6 billion, $3.4 billion, $1.9 billion and $1.2 billion, respectively. ARCC’s wholly owned portfolio company, IHAM, an SEC registered investment adviser, manages 19 funds and serves as the sub-manager or sub-adviser for two other funds as of December 31, 2016. Strategy ($ in billions) AUM % AUM FPAUM % FPAUM Credit Syndicated Loans $17.3 29% $16.0 37% High Yield 5.0 8% 5.0 12% Credit Opportunities 3.3 5% 2.7 6% Structured Credit 4.3 7% 3.1 7% U.S. Direct Lending(2) 21.1 35% 11.3 26% E.U. Direct Lending 9.6 16% 4.6 11% Total Credit Group $60.5 100% $42.7 100% Private Equity Corporate Private Equity ACOF V $7.9 31% - - ACOF IV 5.8 23% 4.5 40% ACOF III 3.7 15% 1.9 17% ACOF I-II 0.6 2% 0.0 — ACOF Asia 0.2 1% 0.1 1% U.S Power and Energy Infrastructure Fifth Power/Infrastructure Fund 0.6 2% 0.5 4% EIF I-IV and Co-investment Vehicles 4.5 18% 3.8 33% Special Situations Special Situations 1.7 7% 0.6 6% Private Equity Group $25.0 100% $11.3 100% Real Estate U.S. Equity $4.1 42% $2.9 44% E.U. Equity 3.1 32% 2.5 39% Debt 2.5 26% 1.1 17% Real Estate Group $9.8 100% $6.5 100% Total $95.3 $60.6 $

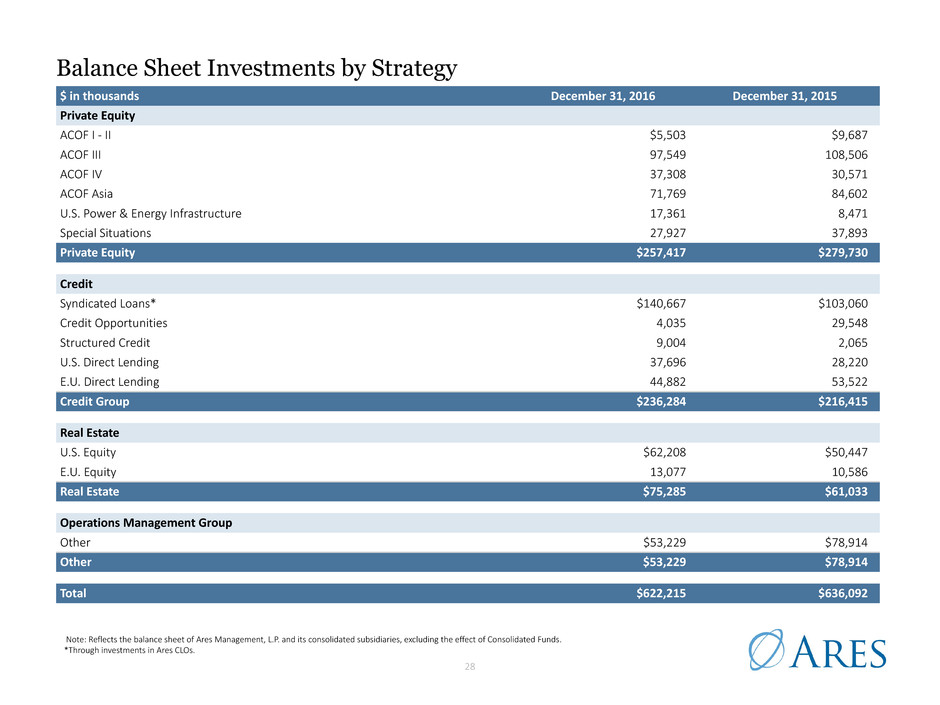

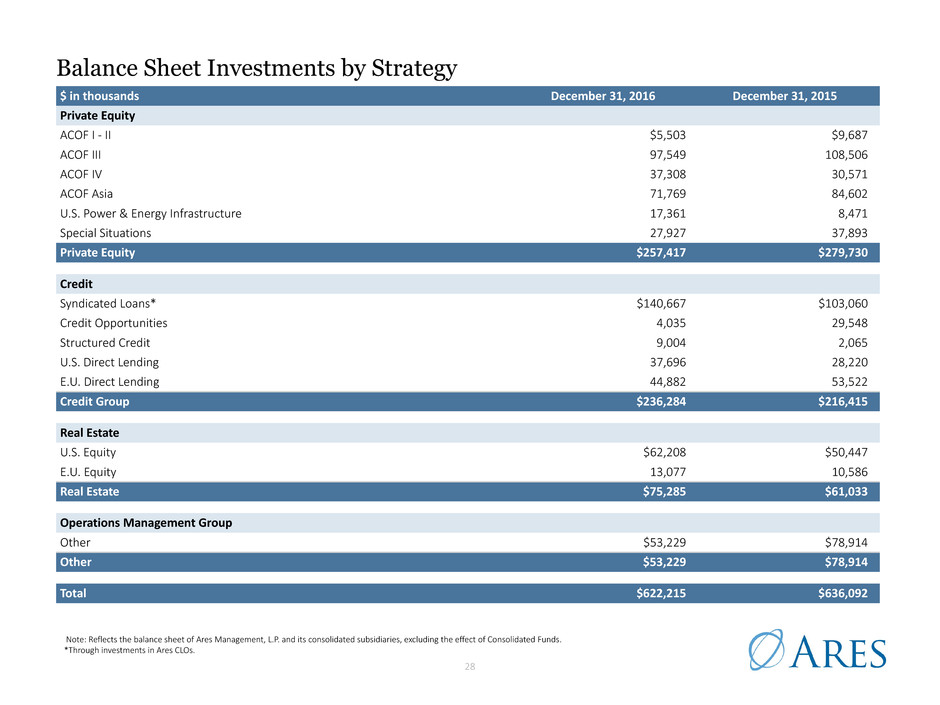

28 Balance Sheet Investments by Strategy Note: Reflects the balance sheet of Ares Management, L.P. and its consolidated subsidiaries, excluding the effect of Consolidated Funds. *Through investments in Ares CLOs. $ in thousands December 31, 2016 December 31, 2015 Private Equity ACOF I - II $5,503 $9,687 ACOF III 97,549 108,506 ACOF IV 37,308 30,571 ACOF Asia 71,769 84,602 U.S. Power & Energy Infrastructure 17,361 8,471 Special Situations 27,927 37,893 Private Equity $257,417 $279,730 Credit Syndicated Loans* $140,667 $103,060 Credit Opportunities 4,035 29,548 Structured Credit 9,004 2,065 U.S. Direct Lending 37,696 28,220 E.U. Direct Lending 44,882 53,522 Credit Group $236,284 $216,415 Real Estate U.S. Equity $62,208 $50,447 E.U. Equity 13,077 10,586 Real Estate $75,285 $61,033 Operations Management Group Other $53,229 $78,914 Other $53,229 $78,914 Total $622,215 $636,092

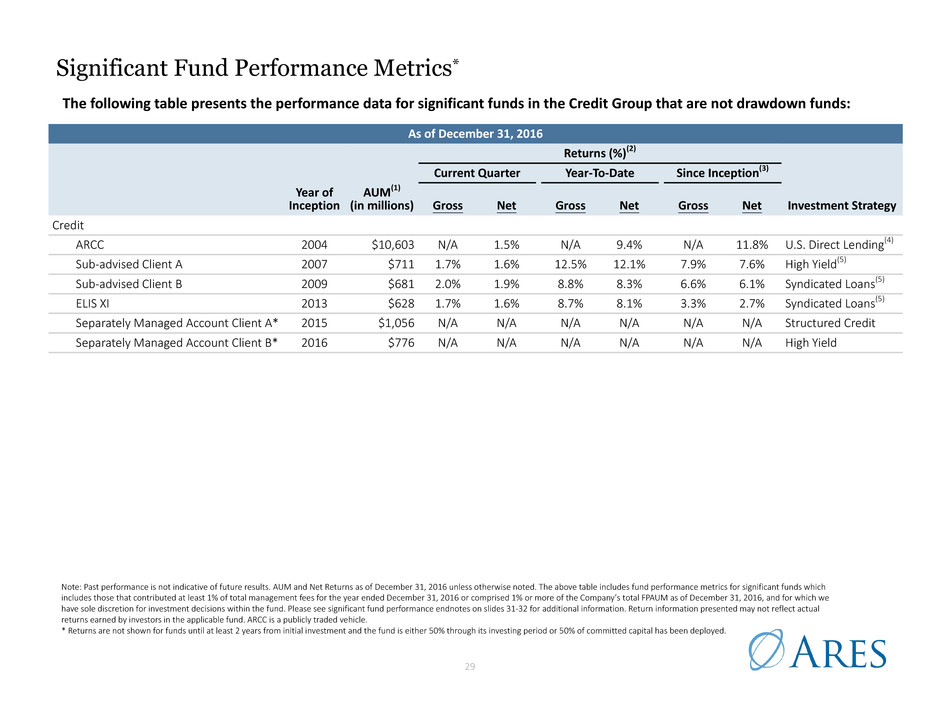

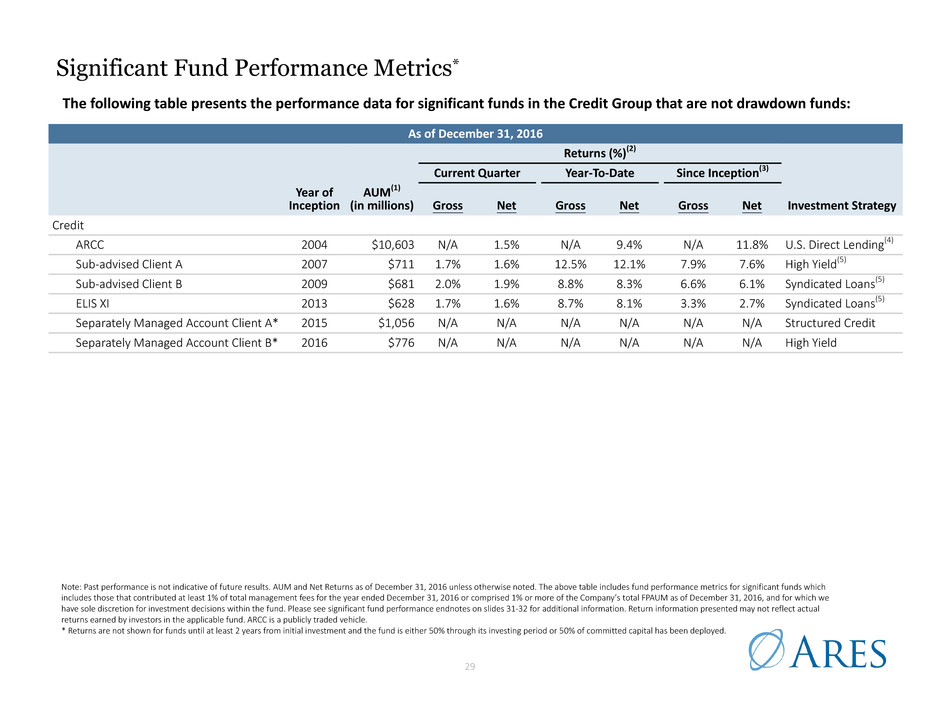

29 Significant Fund Performance Metrics* The following table presents the performance data for significant funds in the Credit Group that are not drawdown funds: Note: Past performance is not indicative of future results. AUM and Net Returns as of December 31, 2016 unless otherwise noted. The above table includes fund performance metrics for significant funds which includes those that contributed at least 1% of total management fees for the year ended December 31, 2016 or comprised 1% or more of the Company’s total FPAUM as of December 31, 2016, and for which we have sole discretion for investment decisions within the fund. Please see significant fund performance endnotes on slides 31-32 for additional information. Return information presented may not reflect actual returns earned by investors in the applicable fund. ARCC is a publicly traded vehicle. * Returns are not shown for funds until at least 2 years from initial investment and the fund is either 50% through its investing period or 50% of committed capital has been deployed. As of December 31, 2016 Returns (%)(2) Current Quarter Year-To-Date Since Inception(3) Year of Inception AUM(1) (in millions) Gross Net Gross Net Gross Net Investment Strategy Credit ARCC 2004 $10,603 N/A 1.5% N/A 9.4% N/A 11.8% U.S. Direct Lending(4) Sub-advised Client A 2007 $711 1.7% 1.6% 12.5% 12.1% 7.9% 7.6% High Yield(5) Sub-advised Client B 2009 $681 2.0% 1.9% 8.8% 8.3% 6.6% 6.1% Syndicated Loans(5) ELIS XI 2013 $628 1.7% 1.6% 8.7% 8.1% 3.3% 2.7% Syndicated Loans(5) Separately Managed Account Client A* 2015 $1,056 N/A N/A N/A N/A N/A N/A Structured Credit Separately Managed Account Client B* 2016 $776 N/A N/A N/A N/A N/A N/A High Yield

30 Significant Fund Performance Metrics* Note: Past performance is not indicative of future results. AUM and Net Returns as of December 31, 2016 unless otherwise noted. The above table includes fund performance metrics for significant funds which includes those that contributed at least 1% of total management fees for the year ended December 31, 2016 or comprised 1% or more of the Company’s total FPAUM as of December 31, 2016, and for which we have sole discretion for investment decisions within the fund. Please see significant fund performance endnotes on slides 31-32 for additional information. Return information presented may not reflect actual returns earned by investors in the applicable fund. * IRRs are not shown for funds until at least 2 years from initial investment and the fund is either 50% through its investing period or 50% of committed capital has been deployed. The following table presents the performance data for our significant funds, all of which are drawdown funds: As of December 31, 2016 Year of Inception AUM(1) (in millions) Original Capital Commitments Cumulative Invested Capital Realized Proceeds Unrealized Value Total Value MOIC IRR Investment StrategyGross Net Gross Net Credit CSF 2008 $388 $1,500 $1,500 $2,138 $362 $2,500 1.9x 1.7x 12.9% 10.0% Credit Opportunities(6)(7)(8)(9)(10)(11)(12) ACE II 2013 $1,529 $1,216 $938 $163 $972 $1,135 1.3x 1.2x 10.1% 7.2% E.U. Direct Lending(7)(8)(9)(10)(11)(12)(13) ACE III* 2015 $3,906 $2,822 $753 $18 $801 $819 1.1x 1.1x N/A N/A E.U. Direct Lending(7)(8)(9)(10)(14) Private Equity USPF III 2007 $1,406 $1,350 $1,808 $1,280 $1,397 $2,678 1.5x 1.5x 9.1% 6.5% U.S. Power and Energy Infrastructure(15)(16)(17)(18)(19)(20) ACOF III 2008 $3,738 $3,510 $3,867 $5,517 $3,336 $8,853 2.3x 2.0x 30.3% 22.0% Corporate Private Equity(15)(16)(17)(18)(19)(20) USPF IV 2010 $1,951 $1,688 $1,623 $649 $1,673 $2,322 1.4x 1.4x 14.4% 11.5% U.S. Power and Energy Infrastructure(15)(16)(17)(18)(19)(20) ACOF IV 2012 $5,838 $4,700 $3,306 $786 $4,391 $5,178 1.6x 1.4x 22.4% 14.2% Corporate Private Equity(15)(16)(17)(18)(19)(20) Real Estate EU IV 2014 $1,242 $1,302 $795 $45 $943 $988 1.3x 1.1x 19.1% 10.0% E.U. Real Estate Equity(12)(16)(21)(22)(23)(24)(25) US VIII 2010 $839 $823 $502 $56 $592 $647 1.2x 1.1x 19.6% 12.8% U.S. Real Estate Equity(12)(16)(21)(22)(23)(24) EPEP II* 2015 $697 $747 $175 $8 $185 $193 1.1x 1.0x N/A N/A E.U. Real Estate Equity(16)(22)(23)(24)

31 Significant Fund Performance Metrics Endnotes 1. AUM equals the sum of the NAV for such fund, the drawn and undrawn debt (at the fund-level including amounts subject to restrictions) and uncalled committed capital. 2. Returns are time-weighted rates of return and include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. 3. Since inception returns are annualized. 4. Net returns are calculated using the fund's NAV and assume dividends are reinvested at the closest quarter-end NAV to the relevant quarterly ex-dividend dates. Additional information related to ARCC can be found in its financial statements filed with the SEC, which are not part of this presentation. 5. Gross returns do not reflect the deduction of management fees or any other expenses. Net returns are calculated by subtracting the applicable management fee from the gross returns on a monthly basis. 6. The AUM for CSF, a fund of funds, includes AUM that has been committed to other Ares funds. 7. Realized proceeds represent the sum of all cash distributions to all partners and if applicable, exclude tax and incentive distributions made to the general partner. 8. Unrealized value represents the fund's net asset value reduced by the accrued incentive allocation, if applicable. There can be no assurance that unrealized values will be realized at the valuations indicated. 9. The gross multiple of invested capital (“MoIC”) is calculated at the fund-level and is based on the interests of the fee-paying limited partners and if applicable, excludes interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or performance fees. The gross MoIC is before giving effect to management fees, performance fees as applicable and other expenses. 10. The net MoIC is calculated at the fund-level and is based on the interests of the fee-paying limited partners and if applicable, excludes those interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or performance fees. The net MoIC is after giving effect to management fees, performance fees as applicable and other expenses. 11. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Gross IRR reflects returns to the fee-paying limited partners and if applicable, excludes interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or performance fees. The cash flow dates used in the gross IRR calculation are based on the actual dates of the cash flows. Gross IRRs are calculated before giving effect to management fees, performance fees as applicable, and other expenses. 12. The net IRR is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Net IRRs reflect returns to the fee-paying limited partners and if applicable, exclude interests attributable to the non-fee paying limited partners and /or the general partner who does not pay management fees or performance fees. The cash flow dates used in the net IRR calculations are based on the actual dates of the cash flows. The net IRRs are calculated after giving effect to management fees, performance fees as applicable, and other expenses. 13. ACE II is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net IRR and gross and net MoIC presented in the chart are for the U.S. dollar denominated feeder fund as that is the larger of the two feeders. The gross and net IRR for the Euro denominated feeder fund are 13.4% and 10.0%, respectively. The gross and net MoIC for the Euro denominated feeder fund are 1.4x and 1.3x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of the fund's closing. All other values for ACE II are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. The variance between the gross and net MoICs and the net IRRs for the U.S. dollar denominated and Euro denominated feeder funds is driven by the U.S. GAAP mark-to-market reporting of the foreign currency hedging program in the U.S. dollar denominated feeder fund. The feeder fund will be holding the foreign currency hedges until maturity, and therefore is expected to ultimately recognize a gain while mitigating the currency risk associated with the initial principal investments. 14. ACE III is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net MoIC presented in the chart are for the Euro denominated feeder fund as that is the larger of the two feeders. The gross and net MoIC for the U.S. dollar denominated feeder fund are 1.1x and 1.1x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of the fund's closing. All other values for ACE III are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. 15. Realized proceeds represents the sum of all cash dividends, interest income, other fees and cash proceeds from realizations of interests in portfolio investments. 16. Unrealized value represents the fair market value of remaining investments. There can be no assurance that unrealized investments will be realized at the valuations indicated. 17. The gross MoIC is calculated at the investment-level and is based on the interests of all partners. The gross MoIC is before giving effect to management fees, performance fees as applicable and other expenses. 18. The net MoIC for the U.S. power and energy infrastructure funds is calculated at the fund-level. The net MoIC for the corporate private equity funds is calculated at the investment-level. For all funds, the net MoIC is based on the interests of the fee-paying limited partners, and, if applicable, excludes those interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or performance fees. The net MoIC is after giving effect to management fees, performance fees as applicable and other expenses. 19. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Gross IRRs reflect returns to all partners. Cash flows used in the gross IRR calculation are assumed to occur at month end. The gross IRRs are calculated before giving effect to management fees, performance fees as applicable, and other expenses.

32 Significant Fund Performance Metrics Endnotes (cont’d) 20. The net IRR for the U.S. power and infrastructure funds is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. The cash flow dates used in the net IRR calculations are based on the actual dates of the cash flows. The net IRR for the corporate private equity funds is an annualized since inception net internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Cash flows used in the net IRR calculations are assumed to occur at month end. For all funds, the net IRRs reflect returns to the fee-paying limited partners and if applicable, exclude interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or performance fees. The net IRRs are calculated after giving effect to management fees, performance fees as applicable, and other expenses. 21. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Gross IRRs reflect returns to all partners. Cash flows used in the gross IRR calculation are assumed to occur at quarter-end. The gross IRRs are calculated before giving effect to management fees, performance fees as applicable, and other expenses. 22. Realized proceeds include distributions of operating income, sales and financing proceeds received. 23. The gross MoIC is calculated at the investment level. For EU IV, the gross MoIC is based on the interests of the fee-paying partners and, if applicable, excludes interests attributable to the non fee-paying partners and/or the general partner who does not pay management fees or performance fees. For US VIII and EPEP II, the gross MoIC is based on the interests of all partners. The gross MoIC for all funds is before giving effect to management fees, performance fees as applicable and other expenses. 24. The net MoIC is calculated at the fund-level and is based on the interests of the fee-paying partners and, if applicable, excludes interests attributable to the non fee-paying partners and/or the general partner who does not pay management fees or performance fees. The net MoIC is after giving effect to management fees, performance fees as applicable and other expenses. 25. EU IV is made up of two parallel funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net MoIC and gross and net IRR presented in the chart are for the U.S. dollar denominated parallel fund as that is the larger of the two funds. The gross and net IRRs for the Euro denominated parallel fund are 19.5% and 10.7%, respectively. The gross and net MoIC for the Euro denominated parallel fund are 1.2x and 1.1x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of fund's closing. All other values for EU IV are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate.

33 Weighted Average Unit Information 1. Represents units exchangeable for Ares Management, L.P. common units on a one-for-one basis. 2. We apply the treasury stock method to determine the dilutive weighted-average common units represented by our restricted stock to be settled in common units and options to acquire common units. Under the treasury stock method, compensation expense attributed to future services and not yet recognized is presumed to be used to acquire outstanding common units, thus reducing the weighted-average number of units and the dilutive effect of these awards. 3. Represents proportional dilutive impact based upon the percentage of Ares Operating Group owned by Ares Management, L.P. (38.04% and 37.86% as of December 31, 2016 and 2015, respectively). Q4-16 Q4-15 GAAP Units Adjusted Common Units GAAP Units Adjusted Common Units Ares Management, L.P. weighted average common units 80,804,833 80,804,833 80,678,042 80,678,042 Ares Operating Group Units exchangeable into common units(1) 130,431,193 — 132,405,131 — Dilutive effect of unvested restricted common units(2)(3) 2,972,669 1,130,803 685,353 259,475 Total Pro Forma Units 214,208,695 81,935,636 213,768,526 80,937,517