Exhibit 99.2 Fourth Quarter and Full Year 2018 Earnings Presentation

Important Notice This presentation contains “forward looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the control of Ares Management Corporation (“Ares”), including those listed in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”). Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and Ares assumes no obligation to update or revise any such forward-looking statements. Certain information discussed in this presentation was derived from third party sources and has not been independently verified and, accordingly, Ares makes no representation or warranty in respect of this information. The following slides contain summaries of certain financial and statistical information about Ares. The information contained in this presentation is summary information that is intended to be considered in the context of Ares’ SEC filings and other public announcements that Ares may make, by press release or otherwise, from time to time. Ares undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this presentation. In addition, this presentation contains information about Ares, its affiliated funds and certain of their respective personnel and affiliates, and their respective historical performance. You should not view information related to the past performance of Ares and its affiliated funds as indicative of future results. Certain information set forth herein includes estimates and targets and involves significant elements of subjective judgment and analysis. Further, such information, unless otherwise stated, is before giving effect to management and incentive fees and deductions for taxes. No representations are made as to the accuracy of such estimates or targets or that all assumptions relating to such estimates or targets have been considered or stated or that such estimates or targets will be realized. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of Ares. Management uses certain non-GAAP financial measures, including assets under management, fee paying assets under management, fee related earnings and realized income, to evaluate Ares’ performance and that of its business segments. Management believes that these measures provide investors with a greater understanding of Ares’ business and that investors should review the same supplemental non-GAAP financial measures that management uses to analyze Ares’ performance. The measures described herein represent those non-GAAP measures used by management, in each case, before giving effect to the consolidation of certain funds that the company consolidates with its results in accordance with GAAP. These measures should be considered in addition to, and not in lieu of, Ares’ financial statements prepared in accordance with GAAP. The definitions and reconciliations of these measures to the most directly comparable GAAP measures, as well as an explanation of why we use these measures, are included in the Appendix. Amounts and percentages may reflect rounding adjustments and consequently totals may not appear to sum. For the definitions of certain terms used in this presentation, please refer to the "Glossary" slide in the appendix. 2

Fourth Quarter and Year Ended 2018 Highlights • Total Assets Under Management ("AUM") of $130.7 billion • Total Fee Paying AUM ("FPAUM") of $81.9 billion • Available Capital of $38.1 billion Assets Under • AUM Not Yet Earning Fees available for future deployment of $24.8 billion Management • Raised $10.4 billion and $36.1 billion in gross new capital with net inflows of $9.2 billion and $33.4 billion(1) for the quarter and year ended December 31, 2018, respectively • Capital deployment of $5.4 billion and $22.4 billion for the quarter and year ended December 31, 2018, respectively, of which $4.6 billion and $17.2 billion was related to our drawdown funds for these periods • Q4-18 and FY 2018 GAAP net income attributable to Ares Management Corporation of $11.9 million and $57.0 million, respectively • Q4-18 and FY 2018 GAAP basic and diluted earnings per share of Class A common stock of $0.05 and $0.30, respectively • Q4-18 and FY 2018 GAAP management fees of $214.4 million and $802.5 million, respectively(2) (2) Financial Results • Q4-18 and FY 2018 unconsolidated management and other fees of $231.1 million and $861.0 million, respectively • Q4-18 and FY 2018 Fee Related Earnings of $68.4 million and $255.3 million, respectively • Q4-18 and FY 2018 Realized Income of $123.9 million and $395.4 million, respectively • Q4-18 and FY 2018 after-tax Realized Income of $0.41 per share of Class A common stock and $1.42 per share of Class A common stock, respectively(3) • Declared a quarterly dividend of $0.32 per share of Class A common stock(4) • Declared a quarterly dividend of $0.4375 per share of Series A preferred stock(5) Corporate Actions • In February 2019, the Board of Directors authorized the repurchase of up to $150 million shares of Class A common stock. Under this stock repurchase program, shares may be repurchased from time to time in open market purchases, privately negotiated transactions or otherwise, including in reliance on Rule 10b5-1 of the Securities Act. The program is scheduled to expire in February 2020. Repurchases under the program, if any, will depend on the prevailing market conditions and other factors. There is no assurance that any shares will be repurchased under the program. 1. Net inflows represents gross commitments less redemptions. 2. Includes ARCC Part I Fees of $37.1 million and $128.8 million for the three months and year ended December 31, 2018, respectively. Difference between GAAP and unconsolidated management fees represents $9.5 million and $34.2 million from Consolidated Funds that are eliminated upon consolidation for Q4-18 and FY 2018, respectively. Q4-18 and FY 2018 other fees of $7.1 million and $24.3 million, respectively, represents primarily transaction-based fees earned from Credit Group funds. 3. After-tax Realized Income per share of Class A common stock is net of the preferred share dividend. 4. Payable on March 29, 2019 to Class A common stockholders of record as of March 15, 2019. 5. Payable on March 31, 2019 to Series A preferred stockholders of record as of March 15, 2019. 3

#ACACAC #1E3154 Gross New Capital Commitments – Fourth Quarter and Full Year 2018(1) #225070 #828282 $ in millions Q4 2018 FY 2018 Full Year Commentary Credit Group Ares Capital Europe IV ("ACE IV") $1,446 $9,039 New equity commitments of $7.7 billion and new debt commitments of $1.4 billion #D2D2D2 #49749B U.S. Senior Direct Lending Commingled Fund 1,846 3,466 New equity commitments of $3.0 billion and new debt commitments of $0.5 billion ARCC and affiliates 177 2,875 New and additional debt and equity commitments to ARCC, IHAM and SDLP Other U.S. Direct Lending 213 5,559 New and additional equity and debt commitments to various funds #679FD1 Other E.U. Direct Lending 2,095 4,236 New and additional equity and debt commitments to various funds CLOs 511 3,287 Closed four new U.S. CLOs and two new E.U. CLOs Alternative Credit 1,368 2,568 New and additional equity commitments to various funds Other Credit Funds 192 575 New and additional equity and debt commitments to various funds #75B8F4 Total Credit Group $7,848 $31,605 Private Equity Group Energy Opportunities $756 $756 New equity commitments #A7D1EA Infrastructure and Power 4 354 New equity co-investment commitments Other Private Equity Funds 375 488 New and additional equity and debt commitments to various funds #DBE6EF Total Private Equity Group $1,135 $1,598 Real Estate Group E.U. Real Estate Equity $177 $1,457 New equity commitments U.S. Real Estate Equity 614 813 New and additional equity commitments to various funds and co-investments U.S. Debt 598 653 New and additional equity and debt commitments to various funds Total Real Estate Group $1,389 $2,923 Total $10,372 $36,126 1. Represents gross new commitments during Q4-18 and full year 2018, including equity and debt commitments and gross inflows into our open-ended managed accounts and sub-advised accounts. 4

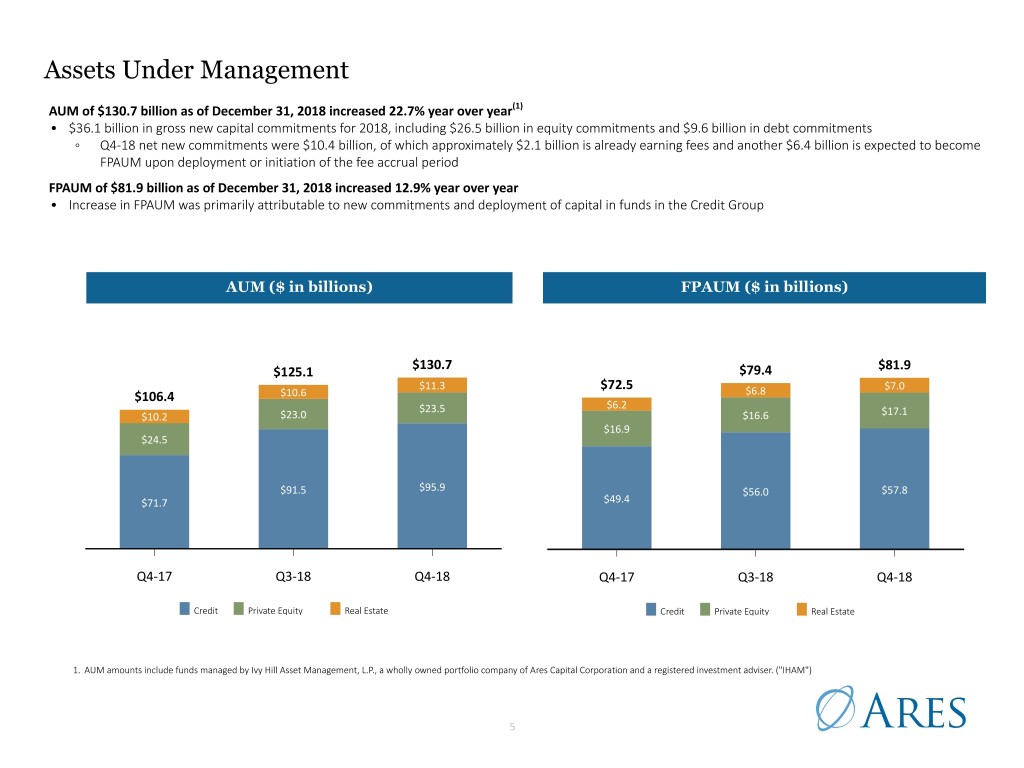

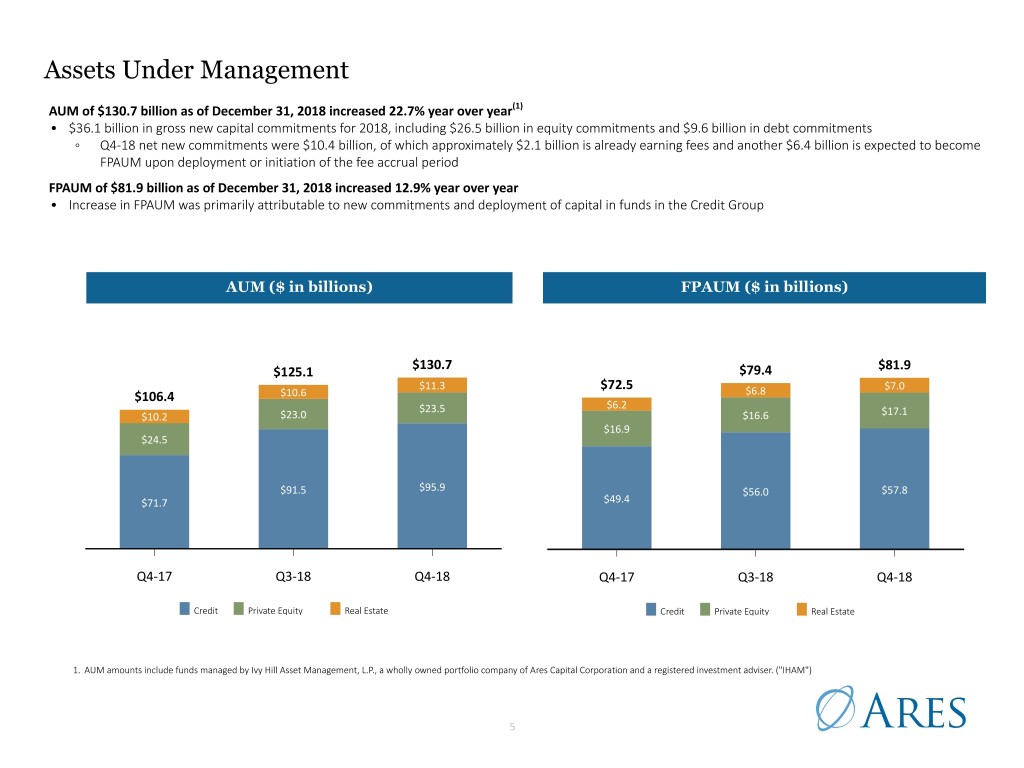

Assets Under Management AUM of $130.7 billion as of December 31, 2018 increased 22.7% year over year(1) • $36.1 billion in gross new capital commitments for 2018, including $26.5 billion in equity commitments and $9.6 billion in debt commitments ◦ Q4-18 net new commitments were $10.4 billion, of which approximately $2.1 billion is already earning fees and another $6.4 billion is expected to become FPAUM upon deployment or initiation of the fee accrual period FPAUM of $81.9 billion as of December 31, 2018 increased 12.9% year over year • Increase in FPAUM was primarily attributable to new commitments and deployment of capital in funds in the Credit Group AUM ($ in billions) FPAUM ($ in billions) $130.7 $125.1 $79.4 $81.9 $11.3 $72.5 $7.0 $106.4 $10.6 $6.8 $23.5 $6.2 $10.2 $23.0 $16.6 $17.1 $16.9 $24.5 $91.5 $95.9 $56.0 $57.8 $71.7 $49.4 Q4-17 Q3-18 Q4-18 Q4-17 Q3-18 Q4-18 Credit Private Equity Real Estate Credit Private Equity Real Estate 1. AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and a registered investment adviser. ("IHAM") 5

AUM and FPAUM by Duration As of December 31, 2018, approximately 72% of AUM and 73% of FPAUM had a duration longer than 3 years ◦ At time of fund closing, the initial duration was greater than 7 years for approximately 80% of AUM AUM: $130.7 billion FPAUM: $81.9 billion 14% 17% 3% 3% 22% 7% 13% 17% 7 18% 17% % 6% 10% 72% 6% 11% 8% 73% 12% 19% 26% 37% 24% 30% Permanent Capital 10 or more years 7 to 9 years 3 to 6 years Fewer Than 3 years Differentiated Managed Managed Accounts Accounts(1) 1. Differentiated managed accounts have been managed by the firm for longer than three years, are investing in illiquid strategies or are co-investments structured to pay management fees. 6

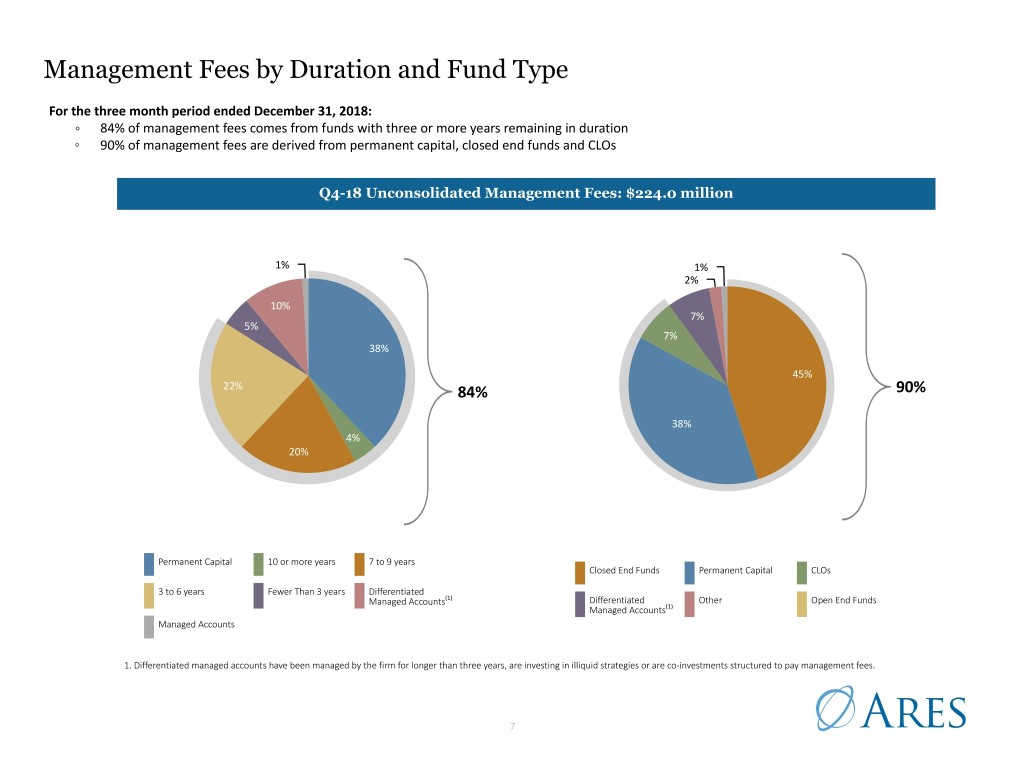

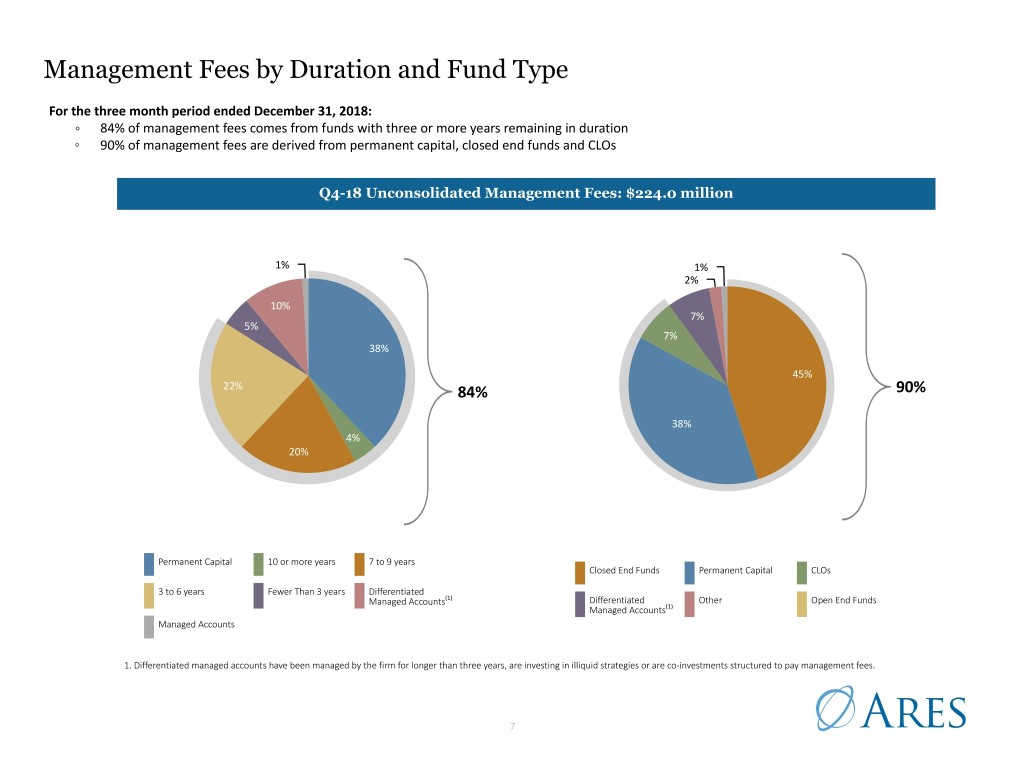

Management Fees by Duration and Fund Type For the three month period ended December 31, 2018: ◦ 84% of management fees comes from funds with three or more years remaining in duration ◦ 90% of management fees are derived from permanent capital, closed end funds and CLOs Q4-18 Unconsolidated Management Fees: $224.0 million 1% 1% 2% 10% 6% 7% 5% 7% 38% 45% 22% 84% 90% 20% 38% 4% 20% Permanent Capital 10 or more years 7 to 9 years Closed End Funds Permanent Capital CLOs 3 to 6 years Fewer Than 3 years Differentiated Managed Accounts(1) Differentiated Other Open End Funds Managed Accounts(1) Managed Accounts 1. Differentiated managed accounts have been managed by the firm for longer than three years, are investing in illiquid strategies or are co-investments structured to pay management fees. 7

Available Capital and AUM Not Yet Earning Fees Available Capital of $38.1 billion as of December 31, 2018 increased 51.5% year over year ◦ During 2018, $29.1 billion in available capital came from new commitments, including $24.2 billion in net equity commitments and $4.9 billion in debt commitments primarily in U.S. and E.U. direct lending funds ◦ Available capital growth was partially offset by capital deployment of $13.0 billion and redemptions and change in leverage of $3.4 billion AUM Not Yet Earning Fees of $28.2 billion as of December 31, 2018 increased 94.1% year over year ◦ AUM Not Yet Earning Fees increased from $14.5 billion as of Q4-17 to $28.2 billion as of Q4-18, primarily driven by new and additional commitments to U.S. and E.U. direct lending funds and partially offset by capital deployment within funds in our Credit and Private Equity groups Available Capital ($ in millions) AUM Not Yet Earning Fees ($ in millions) $38,075 $28,180 $34,419 $4,466 $25,834 $1,681 $990 $1,691 $3,565 $1,308 $6,747 $25,132 $6,549 $2,770 $14,517 $863 $9,366 $2,214 $23,536 $24,808 $26,862 $24,305 $11,440 $12,996 Q4-17 Q3-18 Q4-18 Q4-17 Q3-18 Q4-18 Credit Private Equity Real Estate Credit Private Equity Real Estate 8

AUM Not Yet Earning Fees As of December 31, 2018, AUM Not Yet Earning Fees of $28.2 billion could generate approximately $281.3 million in potential incremental annual base management fees, of which $245.5 million relates to the $24.8 billion of AUM Available for Future Deployment(1) ◦ The $24.8 billion of AUM not yet earning fees available for future deployment includes approximately $20.4 billion relating to U.S. and E.U. direct lending funds, $2.1 billion in alternative credit funds and $1.5 billion in Real Estate funds AUM Not Yet Earning Fees Available for Future AUM Not Yet Earning Fees: $28.2 billion Deployment: $24.8 billion $438 $1,529 $1,455 $1,410 $668 $24,803 $22,680 $24.8 billion of AUM Not Yet Earning Fees was available for future deployment as of December 31, 2018 ($ in millions) ($ in millions) Capital Available for Future Deployment Capital Available for Deployment for Follow-on Investments (2) Available Capital Currently in Funds Unlikely to Be Drawn Due to Leverage Targets and Restrictions Credit Private Equity Real Estate Funds in or Expected to Be in Wind-down 1. No assurance can be made that such results will be achieved. Assumes the AUM Not Yet Earning Fees as of December 31, 2018 is invested and such fees are paid on an annual basis. Does not reflect any associated reductions in management fees from certain existing funds, some of which may be material. Reference to $281.3 million includes approximately $22.9 million in potential incremental management fees from deploying undrawn/available credit facilities at ARCC (in excess of 0.75X leverage), which may not be drawn due to leverage target limitations and restrictions until June 21, 2019. Note that ARCC has announced its intention to increase its target leverage (over a one to three year period) to a range of 0.9X to 1.25X debt-to-equity beginning on June 21, 2019, as provided for in the 2018 Small Business Credit Availability Act. Such additional management fees from deploying undrawn/available credit in excess of 1X leverage are not reflected above. Note that no potential ARCC Part I fees are reflected in any of the amounts above. 2. Capital available for deployment for follow-on investments represents capital committed to funds that are past their investment periods but for which capital is available to be called for follow-on investments in existing portfolio companies. As of December 31, 2018, capital available for deployment for follow-on investments could generate approximately $12.9 million in potential management fees. There is no assurance such capital will be invested. 9

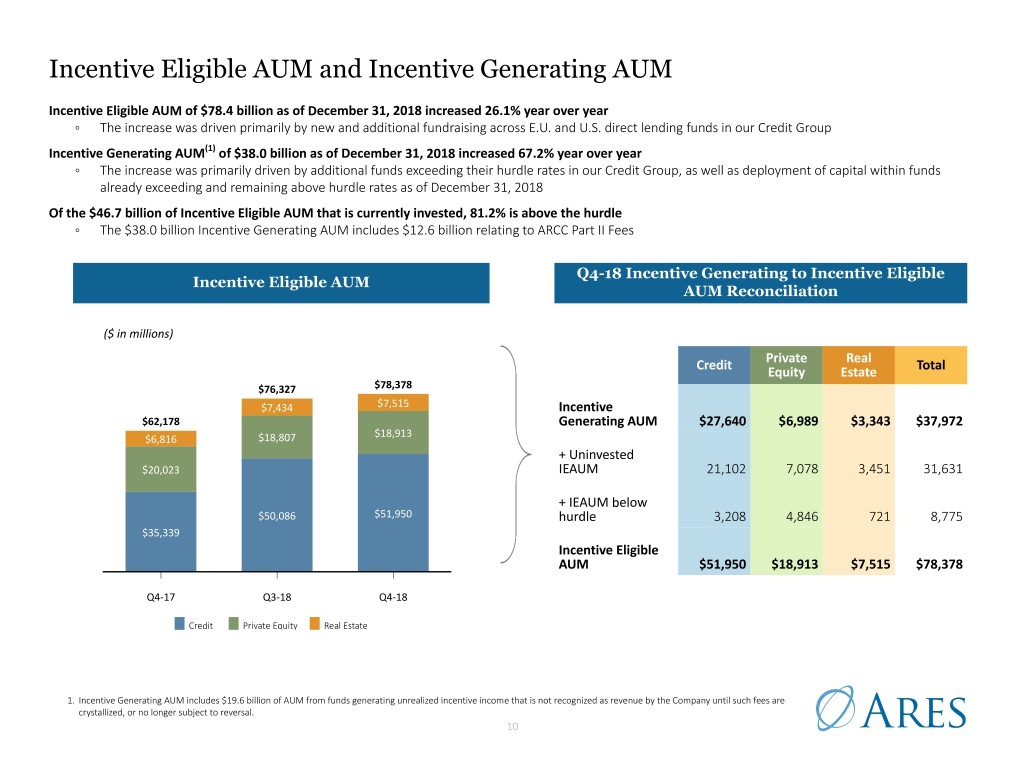

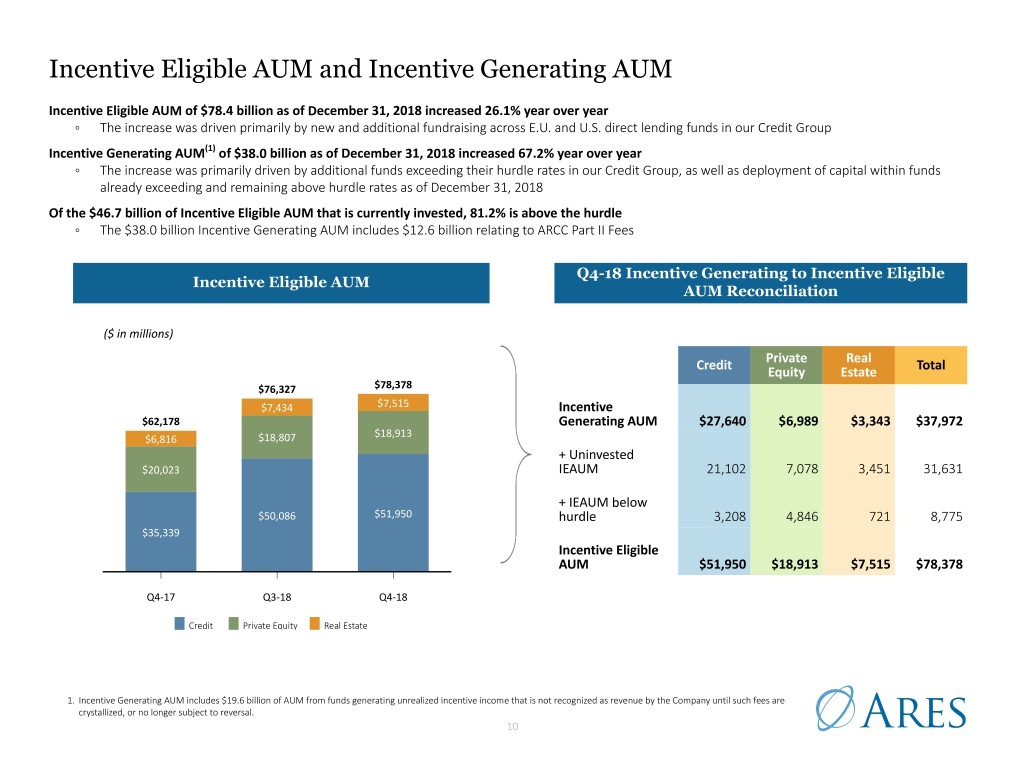

Incentive Eligible AUM and Incentive Generating AUM Incentive Eligible AUM of $78.4 billion as of December 31, 2018 increased 26.1% year over year ◦ The increase was driven primarily by new and additional fundraising across E.U. and U.S. direct lending funds in our Credit Group Incentive Generating AUM(1) of $38.0 billion as of December 31, 2018 increased 67.2% year over year ◦ The increase was primarily driven by additional funds exceeding their hurdle rates in our Credit Group, as well as deployment of capital within funds already exceeding and remaining above hurdle rates as of December 31, 2018 Of the $46.7 billion of Incentive Eligible AUM that is currently invested, 81.2% is above the hurdle ◦ The $38.0 billion Incentive Generating AUM includes $12.6 billion relating to ARCC Part II Fees Q4-18 Incentive Generating to Incentive Eligible Incentive Eligible AUM AUM Reconciliation ($ in millions) Private Real Credit Equity Estate Total $76,327 $78,378 $7,434 $7,515 Incentive $62,178 Generating AUM $27,640 $6,989 $3,343 $37,972 $18,913 $6,816 $18,807 + Uninvested $20,023 IEAUM 21,102 7,078 3,451 31,631 + IEAUM below $50,086 $51,950 hurdle 3,208 4,846 721 8,775 $35,339 Incentive Eligible AUM $51,950 $18,913 $7,515 $78,378 Q4-17 Q3-18 Q4-18 Credit Private Equity Real Estate 1. Incentive Generating AUM includes $19.6 billion of AUM from funds generating unrealized incentive income that is not recognized as revenue by the Company until such fees are crystallized, or no longer subject to reversal. 10

Capital Deployment(1) Total gross invested capital for the year ended December 31, 2018 was Q4-18 Capital Deployment Breakdown: $5.4 billion $22.4 billion compared to $16.4 billion for the year ended December 31, 2017 ($ in millions) ◦ Of the total amount, $17.2 billion was related to deployment in drawdown funds compared to $12.6 billion for the same period in $535 2017 $1,237 Total gross invested capital during Q4-18 of $5.4 billion compared to $4.0 $3,584 billion in Q4-17 ◦ Of the total amount, $4.6 billion was related to deployment in our drawdown funds compared to $2.9 billion for the same period in 2017 Credit Private Equity Real Estate FY 2018 Capital Deployment in Drawdown Funds: Q4-18 Capital Deployment by Type: $5.4 billion $17.2 billion ($ in millions) ($ in millions) $17,156 $1,299 FY-18 Strategies $12,639 $4,438 $772 (2) $908 • E.U. Direct Lending $3,415 • U.S. Direct Lending • Corporate Private Equity • Special Opportunities $11,419 $4,584 $8,316 • Alternative Credit • U.S. Real Estate Equity Private Equity Real Estate Drawdown Funds Non-drawdown Funds(2) FY 17 FY 18 Credit Private Equity Real Estate 1. Capital deployment figures exclude deployment from permanent capital vehicles. 2. Non-drawdown funds includes new capital deployed by managed accounts and CLOs but excludes recycled capital. 11

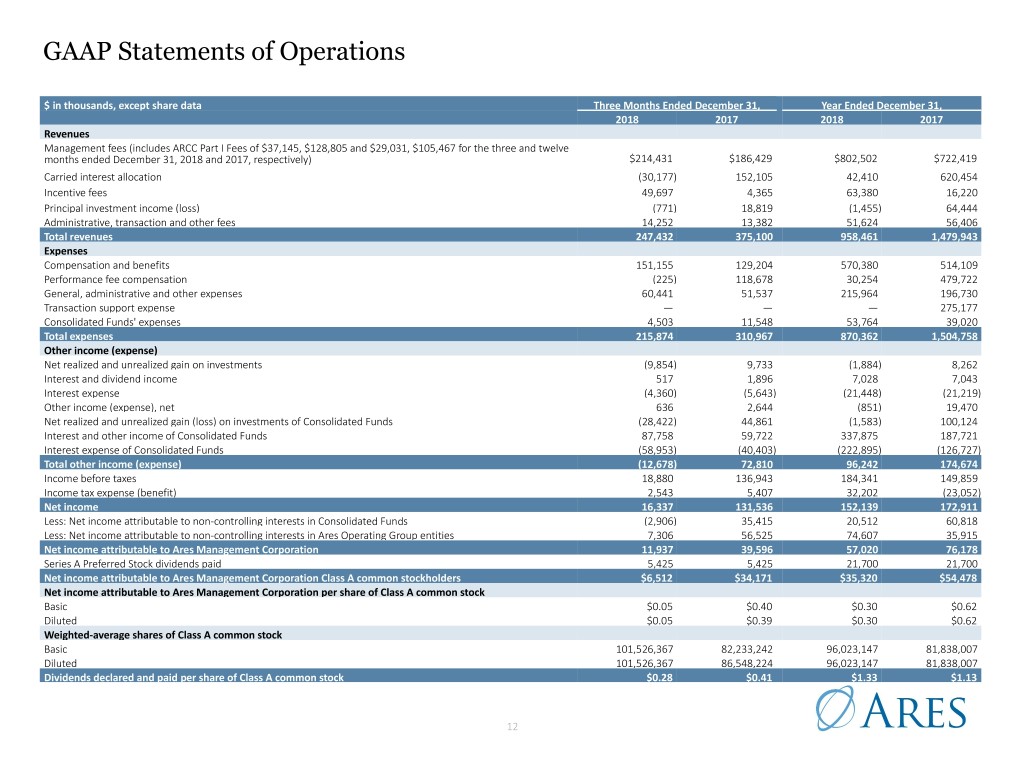

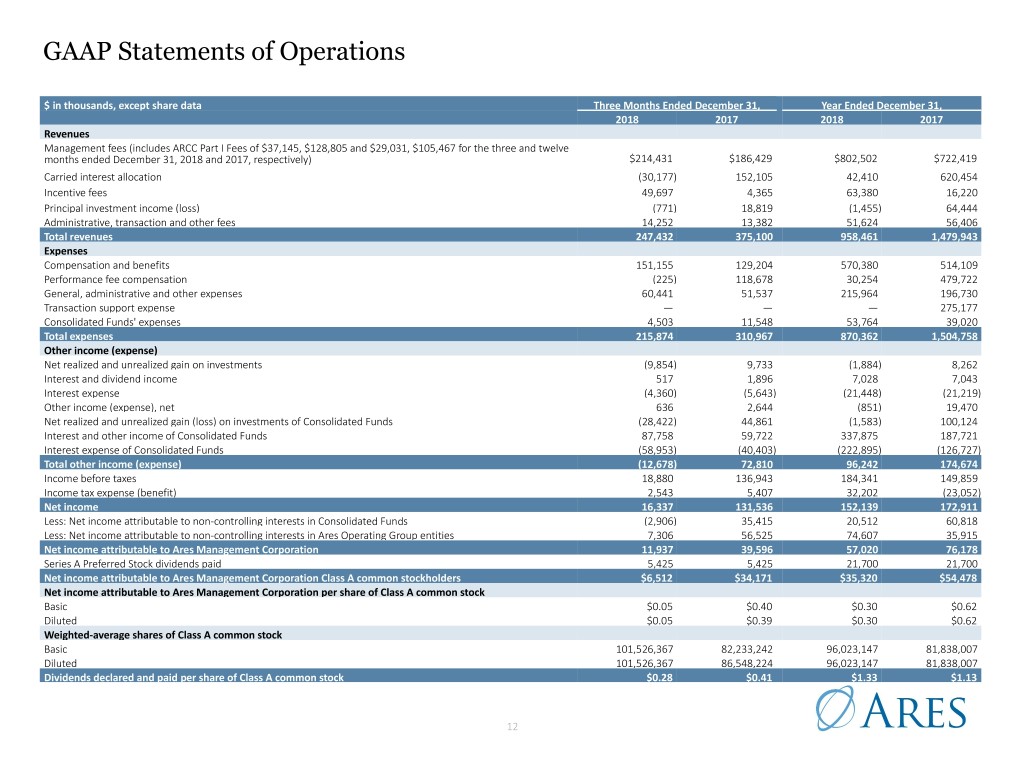

GAAP Statements of Operations $ in thousands, except share data Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Revenues Management fees (includes ARCC Part I Fees of $37,145, $128,805 and $29,031, $105,467 for the three and twelve months ended December 31, 2018 and 2017, respectively) $214,431 $186,429 $802,502 $722,419 Carried interest allocation (30,177) 152,105 42,410 620,454 Incentive fees 49,697 4,365 63,380 16,220 Principal investment income (loss) (771) 18,819 (1,455) 64,444 Administrative, transaction and other fees 14,252 13,382 51,624 56,406 Total revenues 247,432 375,100 958,461 1,479,943 Expenses Compensation and benefits 151,155 129,204 570,380 514,109 Performance fee compensation (225) 118,678 30,254 479,722 General, administrative and other expenses 60,441 51,537 215,964 196,730 Transaction support expense — — — 275,177 Consolidated Funds' expenses 4,503 11,548 53,764 39,020 Total expenses 215,874 310,967 870,362 1,504,758 Other income (expense) Net realized and unrealized gain on investments (9,854) 9,733 (1,884) 8,262 Interest and dividend income 517 1,896 7,028 7,043 Interest expense (4,360) (5,643) (21,448) (21,219) Other income (expense), net 636 2,644 (851) 19,470 Net realized and unrealized gain (loss) on investments of Consolidated Funds (28,422) 44,861 (1,583) 100,124 Interest and other income of Consolidated Funds 87,758 59,722 337,875 187,721 Interest expense of Consolidated Funds (58,953) (40,403) (222,895) (126,727) Total other income (expense) (12,678) 72,810 96,242 174,674 Income before taxes 18,880 136,943 184,341 149,859 Income tax expense (benefit) 2,543 5,407 32,202 (23,052) Net income 16,337 131,536 152,139 172,911 Less: Net income attributable to non-controlling interests in Consolidated Funds (2,906) 35,415 20,512 60,818 Less: Net income attributable to non-controlling interests in Ares Operating Group entities 7,306 56,525 74,607 35,915 Net income attributable to Ares Management Corporation 11,937 39,596 57,020 76,178 Series A Preferred Stock dividends paid 5,425 5,425 21,700 21,700 Net income attributable to Ares Management Corporation Class A common stockholders $6,512 $34,171 $35,320 $54,478 Net income attributable to Ares Management Corporation per share of Class A common stock Basic $0.05 $0.40 $0.30 $0.62 Diluted $0.05 $0.39 $0.30 $0.62 Weighted-average shares of Class A common stock Basic 101,526,367 82,233,242 96,023,147 81,838,007 Diluted 101,526,367 86,548,224 96,023,147 81,838,007 Dividends declared and paid per share of Class A common stock $0.28 $0.41 $1.33 $1.13 12

RI and Other Measures Financial Summary $ in thousands, except share data (unless otherwise noted) Three Months Ended December 31, Year Ended December 31, 2018 2017 % Change 2018 2017 % Change Management fees(1) $223,952 $193,856 16% $836,744 $744,825 12% Other fees 7,122 5,433 31% 24,288 22,431 8% Compensation and benefits expenses(2) (122,768) (104,497) 17% (456,255) (413,735) 10% General, administrative and other expenses(3) (39,906) (35,891) 11% (149,465) (136,531) 9% Fee Related Earnings $68,400 $58,901 16% $255,312 $216,990 18% Realized net performance income 51,100 12,786 300% 105,610 75,457 40% Realized net investment income 4,351 3,068 42% 34,474 32,993 4% Realized Income $123,851 $74,755 66% $395,396 $325,440 21% After-tax Realized Income, net of Series A Preferred Stock dividends(4) $106,342 $60,358 76% $345,926 $273,624 26% After-tax Realized Income per share of Class A common stock, net of Series A Preferred Stock dividends(5) $0.41 $0.23 78% $1.42 $1.08 31% Other Data Total fee revenue(6) $275,052 $206,642 33% $942,354 $820,282 15% Effective management fee rate(7) 1.08% 1.05% 3% 1.07% 1.06% 1% 1. Includes ARCC Part I Fees of $37.1 million and $29.0 million for the three months ended December 31, 2018 and 2017, respectively, and $128.8 million and $105.5 million for the year ended December 31, 2018 and 2017, respectively. 2. Includes compensation and benefits expenses attributable to the Operation Management Group of $32.3 million and $28.4 million for the three months ended December 31, 2018 and 2017, respectively, and $126.1 million and $112.2 million for FY-18 and FY-17, respectively, which are not allocated to an operating segment. 3. Includes G&A expenses attributable to the Operation Management Group of $19.5 million and $18.3 million for the three months ended December 31, 2018 and 2017, respectively, and $75.9 million and $74.8 million for the year ended December 31, 2018 and 2017, respectively, which are not allocated to an operating segment. 4. Q4-18 after-tax Realized Income includes $5.9 million of current income tax related to realized performance income and $6.1 million of current income tax related to FRE, of which $0.8 million is entity level taxes and $5.3 million is corporate level taxes. 5. Calculation of after-tax Realized Income per share of Class A common stock uses total average shares of Class A common stock outstanding and proportional dilutive effects of the Company’s equity-based awards. See slide 32 for additional details. 6. Total fee revenue is calculated as management fees plus realized net performance income. 7. Effective management fee rate represents the quotient of management fees and the aggregate fee bases for the quarters presented. The effective rate shown excludes the effect of one-time catch-up fees. 13

GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis $ in thousands Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Realized Income and Fee Related Earnings: Income before taxes $18,880 136,943 $184,341 149,859 Adjustments: Amortization of intangibles 1,215 3,650 9,032 17,850 Depreciation expense 3,638 3,173 16,055 12,631 Equity compensation expenses(1) 22,190 17,614 89,724 69,711 Acquisition and merger-related expenses 2,955 1,177 2,936 259,899 Placement fees and underwriting costs 10,633 5,448 20,343 19,765 Offering costs — — 3 688 Other income (expense), net(2) (75) (1,730) 13,486 (1,730) Expense of non-controlling interests in consolidated subsidiaries 1,165 1,332 3,343 1,739 Income before taxes of non-controlling interests in Consolidated Funds, net of eliminations 2,857 (35,240) (20,643) (62,705) Unconsolidated performance income - unrealized 119,988 (102,448) 247,212 (325,915) Unconsolidated performance realted compensation expense - unrealized (89,049) 75,601 (221,343) 237,392 Unconsolidated net investment income - unrealized 29,454 (30,765) 50,907 (53,744) Realized Income $123,851 $74,755 $395,396 $325,440 Unconsolidated performance income - realized (139,924) (55,863) (357,207) (317,787) Unconsolidated performance related compensation expense - realized 88,824 43,077 251,597 242,330 Unconsolidated net investment income - realized (4,351) (3,068) (34,474) (32,993) Fee Related Earnings $68,400 $58,901 $255,312 $216,990 Note: This table is a reconciliation of income (loss) before provision for income taxes on a GAAP basis to RI and FRE on an unconsolidated basis, which shows the results of the reportable segments on a combined basis together with the Operations Management Group. Management believes that this presentation is more meaningful than a reconciliation to the reportable segments on a segment basis because such reconciliation would exclude the Operations Management Group. Differences may arise due to rounding. 1. Equity compensation expense includes $4.4 million, $19.0 million and $2.8 million, $12.5 million, related to annual bonus program for the three and twelve months ended December 31, 2018 and 2017, respectively, and $14.3 million, $55.5 million and $11.2 million, $41.6 million, related to IPO and retention grants of restricted units for the three and twelve months ended December 31, 2018 and 2017, respectively. Also includes $0.9 million and $1.5 million of restricted stock awards based on a market condition for the three and twelve months ended December 31, 2018. 2. Twelve months ended December 31, 2018 includes an $11.8 million payment made to ARCC during the second quarter of 2018 for certain rent and utilities expenses for the years ended 2017, 2016, 2015 and 2014, and for the first quarter of 2018. The payment included $0.6 million related to the first quarter of 2018 and $0.7 million and $2.5 million related to the three and twelve months ended December 31, 2017, respectively. Beginning April 1, 2018, the Company paid these expenses and recorded them as a direct operating expense within G&A. 14

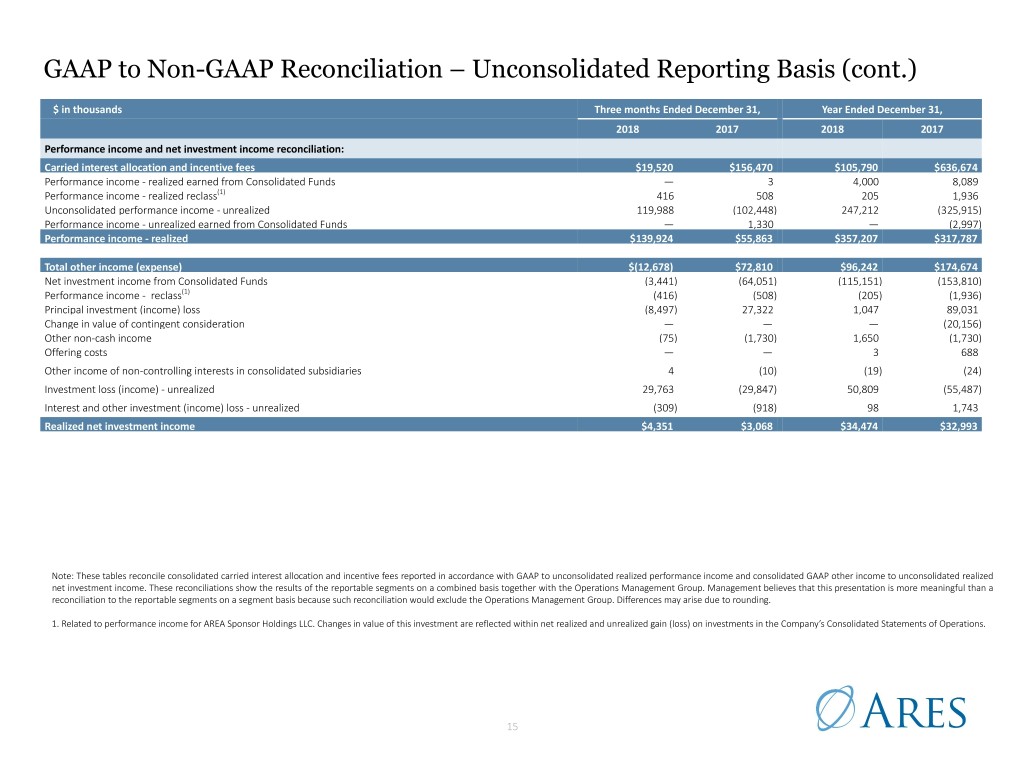

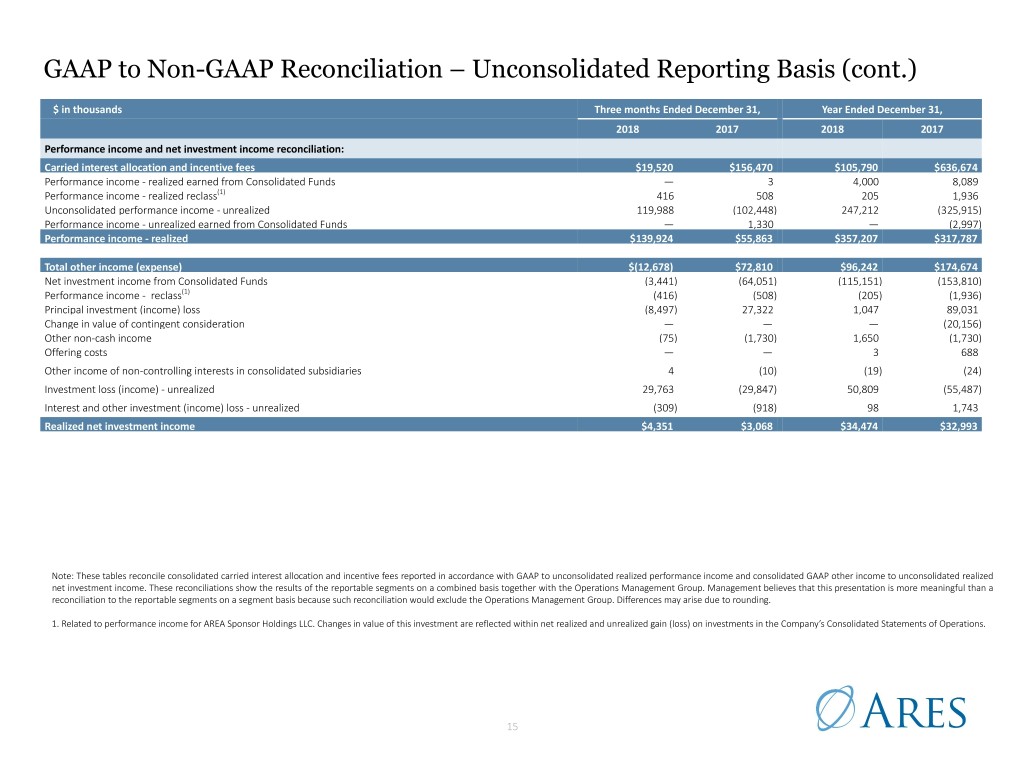

GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis (cont.) $ in thousands Three months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Performance income and net investment income reconciliation: Carried interest allocation and incentive fees $19,520 $156,470 $105,790 $636,674 Performance income - realized earned from Consolidated Funds — 3 4,000 8,089 Performance income - realized reclass(1) 416 508 205 1,936 Unconsolidated performance income - unrealized 119,988 (102,448) 247,212 (325,915) Performance income - unrealized earned from Consolidated Funds — 1,330 — (2,997) Performance income - realized $139,924 $55,863 $357,207 $317,787 Total other income (expense) $(12,678) $72,810 $96,242 $174,674 Net investment income from Consolidated Funds (3,441) (64,051) (115,151) (153,810) Performance income - reclass(1) (416) (508) (205) (1,936) Principal investment (income) loss (8,497) 27,322 1,047 89,031 Change in value of contingent consideration — — — (20,156) Other non-cash income (75) (1,730) 1,650 (1,730) Offering costs — — 3 688 Other income of non-controlling interests in consolidated subsidiaries 4 (10) (19) (24) Investment loss (income) - unrealized 29,763 (29,847) 50,809 (55,487) Interest and other investment (income) loss - unrealized (309) (918) 98 1,743 Realized net investment income $4,351 $3,068 $34,474 $32,993 Note: These tables reconcile consolidated carried interest allocation and incentive fees reported in accordance with GAAP to unconsolidated realized performance income and consolidated GAAP other income to unconsolidated realized net investment income. These reconciliations show the results of the reportable segments on a combined basis together with the Operations Management Group. Management believes that this presentation is more meaningful than a reconciliation to the reportable segments on a segment basis because such reconciliation would exclude the Operations Management Group. Differences may arise due to rounding. 1. Related to performance income for AREA Sponsor Holdings LLC. Changes in value of this investment are reflected within net realized and unrealized gain (loss) on investments in the Company’s Consolidated Statements of Operations. 15

Credit Group(1) • Management and other fees increased 20% and 17% for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by deployment in U.S. and E.U. direct lending strategies and an increase in ARCC Part I Fees • Fee related earnings increased by 20% and 19% for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by higher management fees • Realized Income increased by 62% and 28% for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by increases in fee related earnings and higher net realized performance income attributable to ARCC Part II fees Financial Summary and Highlights(2) $ in thousands Q4-18 Q4-17 % Change FY 2018 FY 2017 % Change 28% (3) Management and other fees $158,855 $132,283 20% $588,146 $502,296 17% FY 2018 increase in Fee Related Earnings $86,645 $72,009 20% $327,369 $275,323 19% Realized Income Realized net performance income $25,035 $561 NM $45,729 $11,869 285% Realized net investment income 995 (2,908) NM 1,456 4,889 (70)% 17% Realized Income $112,675 $69,662 62% $374,554 $292,081 28% FY 2018 increase in AUM ($ in billions) $95.9 $71.7 34% FPAUM FPAUM ($ in billions) $57.8 $49.4 17% E.U. Direct Lending: 16.2%(4) High Yield: (2.4%)(5) Syndicated Loans: 0.1%(5) Note: Past performance is not indicative of future results. The Credit Group had ~245 investment professionals, over 1,652 portfolio companies and 156 active funds as of December 31, 2018. FY 2018 gross returns 1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis” on slides 14-15. 2. This table is a financial summary only. See slides 23-24 for complete financial results. 3. Includes ARCC Part I Fees of $37.1 million and $29.0 million for Q4-18 and Q4-17, respectively, and $128.8 million and $105.5 million for FY 2018 and FY 2017, respectively. The 2018 amounts are net of the $10 million quarterly ARCC– ACAS transaction fee waiver. 4. The net return for E.U. direct lending is 3.4% for Q4-18 and 12.2% for FY-18. Gross and net returns for E.U. direct lending are represented by a composite made up of the ACE II and ACE III Euro-denominated feeder funds. The gross and net returns for the composite made up of the ACE II and ACE III U.S. dollar denominated feeder funds are 4.9% and 3.8% for Q4-18 and 14.9% and 10.9% for FY-18, respectively. Returns in the chart are shown for the Euro- denominated composite as it is the larger of the two composites. Composite returns are calculated by asset-weighting the underlying fund-level returns. Returns include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses. Net returns are reduced by applicable management fees, carried interest, if applicable, and other expenses. We believe aggregated performance returns reflect overall quarterly performance returns in a strategy, but are not necessarily investable funds or products themselves. 5. Net performance returns: (0.4%) for U.S. syndicated loan funds and (2.9%) for U.S. high yield funds. Performance for syndicated loans is represented by the U.S. Bank Loan Aggregate Composite which includes all actual, fully discretionary, fee-paying, funds that are benchmarked to the Credit Suisse Leveraged Loan Index and primarily invested in USD denominated banks loans. Such funds may have limited allocations to high yield and structured securities. Performance for high yield is represented by the U.S. High Yield Composite which includes all actual, fully discretionary, fee-paying, separately managed funds that primarily invest in U.S. high yield fixed income securities and are benchmarked to the BofA Merrill Lynch US High Yield Master II Constrained Index, or a similar index. 16

Private Equity Group(1) • Management and other fees were flat for the three month and twelve month periods ended December 31, 2018, compared to the same periods ended December 31, 2017, driven mostly by distributions from private equity funds that are past their investment periods offset by fees earned on new commitments from our special opportunities and energy opportunities strategies • Fee related earnings decreased by 7% for the three month and twelve month periods ended December 31, 2018, compared to the same periods ended December 31, 2017, primarily driven by higher compensation and benefits expense • Realized Income decreased by 40% and 22% for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by reduced monetization activity Financial Summary and Highlights(2) $ in thousands Q4-18 Q4-17 % Change FY 2018 FY 2017 % Change 1% Management and other fees $50,815 $51,307 (1)% $199,190 $199,993 —% FY 2018 growth in Fee Related Earnings $27,057 $29,237 (7)% $106,036 $113,863 (7)% FPAUM Realized net performance income $430 $9,805 (96)% $28,056 $58,318 (52)% Realized net investment income (1,117) 4,659 NM 16,440 20,633 (20)% (5.6%) Q4-18 Realized Income $26,370 $43,701 (40)% $150,532 $192,814 (22)% ((7.5%) FY 2018 AUM ($ in billions) $23.5 $24.5 (4)% FPAUM ($ in billions) $17.1 $16.9 1% 16.2% 3-yr Avg Annual Gross returns in Corporate Private Equity portfolio(3) Note: Past performance is not indicative of future results. The Private Equity Group had ~95 investment professionals, 43 portfolio companies, 56 infrastructure and power assets and 22 active funds as of December 31, 2018. 1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis” on slides 14-15. 2. This table is a financial summary only. See slides 23-24 for complete financial results. 3. Performance for the corporate private equity portfolio is represented by the ACOF I-V Aggregate, which is comprised of investments held by ACOF I, ACOF II, ACOF III, ACOF IV and ACOF V. Performance returns are gross time-weighted rates of return calculated on a quarterly basis. Returns include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses. Net returns are reduced by applicable management fees, carried interest, if applicable, and other expenses. Net returns for the corporate private equity portfolio was (5.3%) for Q4-18, (7.6%) for FY 2018 and 11.1% for the three year average annualized. We believe aggregated performance returns reflect overall quarterly performance returns in a strategy, but are not necessarily investable funds or products themselves. 17

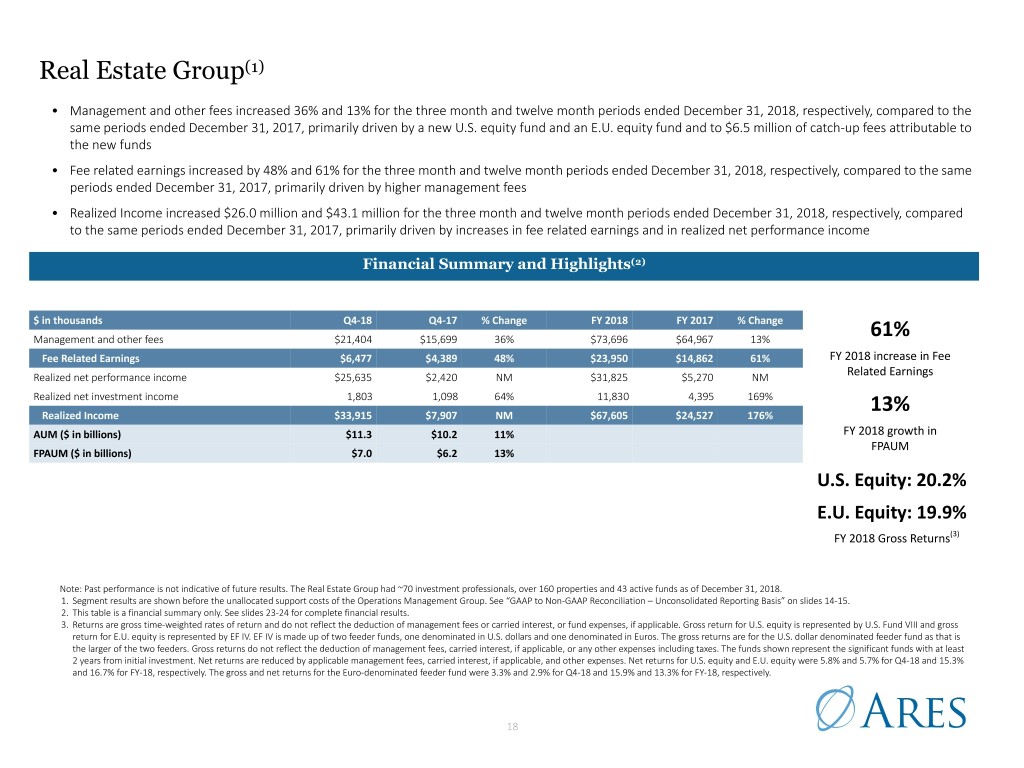

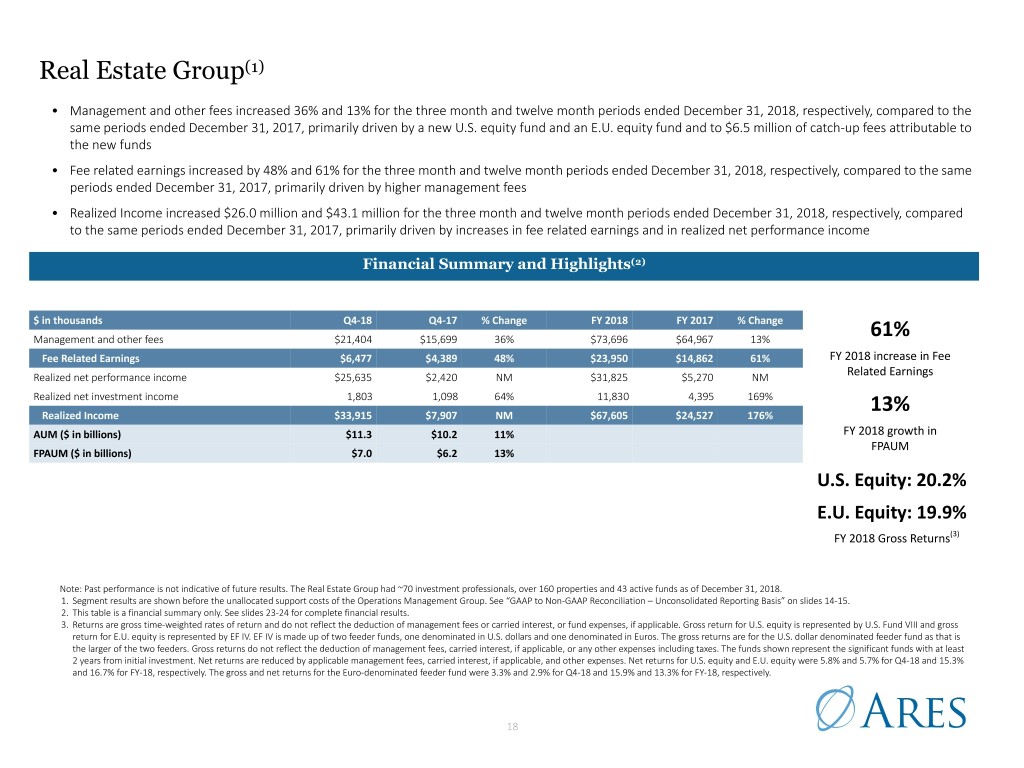

Real Estate Group(1) • Management and other fees increased 36% and 13% for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by a new U.S. equity fund and an E.U. equity fund and to $6.5 million of catch-up fees attributable to the new funds • Fee related earnings increased by 48% and 61% for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by higher management fees • Realized Income increased $26.0 million and $43.1 million for the three month and twelve month periods ended December 31, 2018, respectively, compared to the same periods ended December 31, 2017, primarily driven by increases in fee related earnings and in realized net performance income Financial Summary and Highlights(2) $ in thousands Q4-18 Q4-17 % Change FY 2018 FY 2017 % Change Management and other fees $21,404 $15,699 36% $73,696 $64,967 13% 61% Fee Related Earnings $6,477 $4,389 48% $23,950 $14,862 61% FY 2018 increase in Fee Realized net performance income $25,635 $2,420 NM $31,825 $5,270 NM Related Earnings Realized net investment income 1,803 1,098 64% 11,830 4,395 169% Realized Income $33,915 $7,907 NM $67,605 $24,527 176% 13% AUM ($ in billions) $11.3 $10.2 11% FY 2018 growth in FPAUM FPAUM ($ in billions) $7.0 $6.2 13% U.S. Equity: 20.2% E.U. Equity: 19.9% FY 2018 Gross Returns(3) Note: Past performance is not indicative of future results. The Real Estate Group had ~70 investment professionals, over 160 properties and 43 active funds as of December 31, 2018. 1. Segment results are shown before the unallocated support costs of the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – Unconsolidated Reporting Basis” on slides 14-15. 2. This table is a financial summary only. See slides 23-24 for complete financial results. 3. Returns are gross time-weighted rates of return and do not reflect the deduction of management fees or carried interest, or fund expenses, if applicable. Gross return for U.S. equity is represented by U.S. Fund VIII and gross return for E.U. equity is represented by EF IV. EF IV is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross returns are for the U.S. dollar denominated feeder fund as that is the larger of the two feeders. Gross returns do not reflect the deduction of management fees, carried interest, if applicable, or any other expenses including taxes. The funds shown represent the significant funds with at least 2 years from initial investment. Net returns are reduced by applicable management fees, carried interest, if applicable, and other expenses. Net returns for U.S. equity and E.U. equity were 5.8% and 5.7% for Q4-18 and 15.3% and 16.7% for FY-18, respectively. The gross and net returns for the Euro-denominated feeder fund were 3.3% and 2.9% for Q4-18 and 15.9% and 13.3% for FY-18, respectively. 18

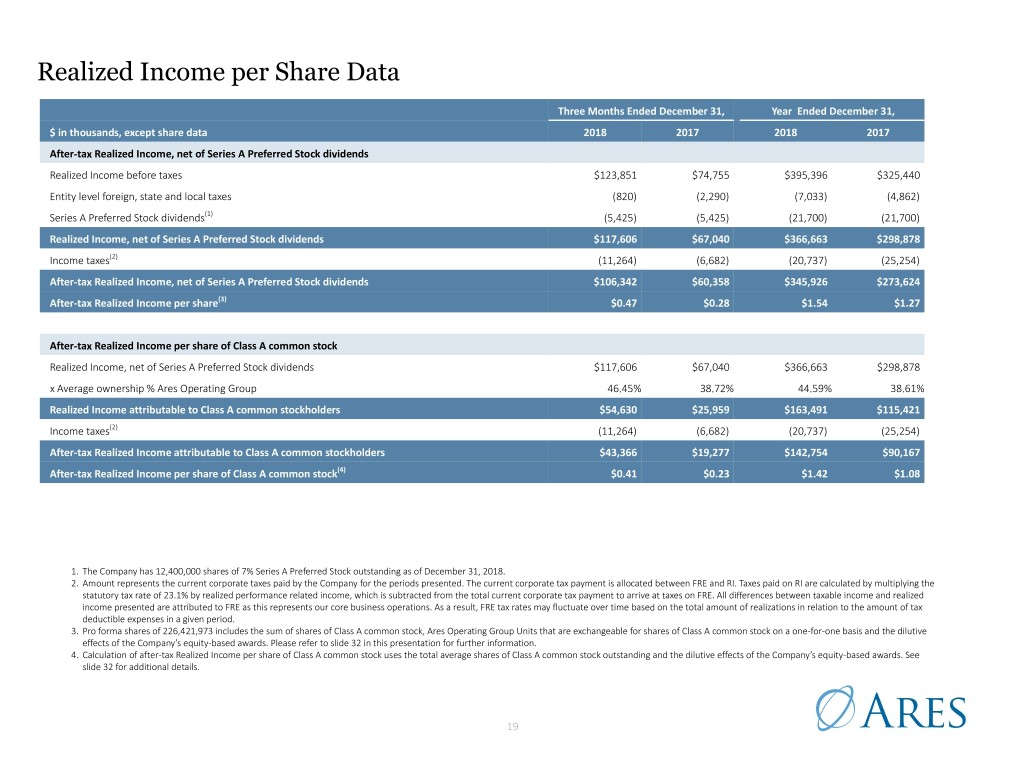

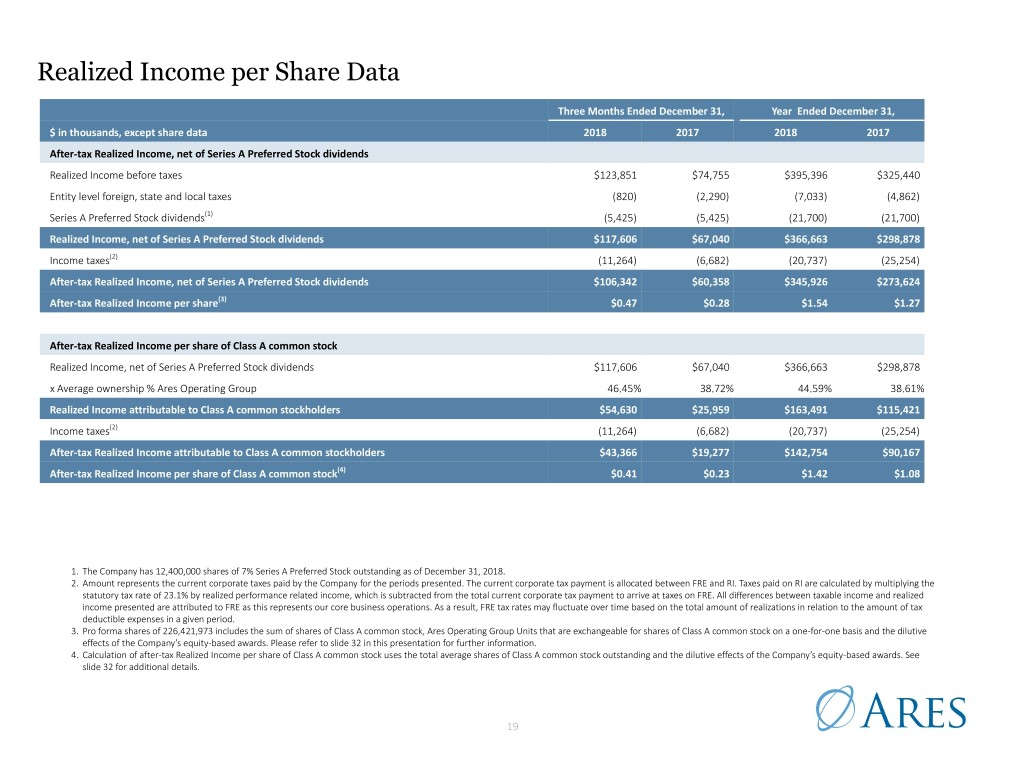

Realized Income per Share Data Three Months Ended December 31, Year Ended December 31, $ in thousands, except share data 2018 2017 2018 2017 After-tax Realized Income, net of Series A Preferred Stock dividends Realized Income before taxes $123,851 $74,755 $395,396 $325,440 Entity level foreign, state and local taxes (820) (2,290) (7,033) (4,862) Series A Preferred Stock dividends(1) (5,425) (5,425) (21,700) (21,700) Realized Income, net of Series A Preferred Stock dividends $117,606 $67,040 $366,663 $298,878 Income taxes(2) (11,264) (6,682) (20,737) (25,254) After-tax Realized Income, net of Series A Preferred Stock dividends $106,342 $60,358 $345,926 $273,624 After-tax Realized Income per share(3) $0.47 $0.28 $1.54 $1.27 After-tax Realized Income per share of Class A common stock Realized Income, net of Series A Preferred Stock dividends $117,606 $67,040 $366,663 $298,878 x Average ownership % Ares Operating Group 46.45% 38.72% 44.59% 38.61% Realized Income attributable to Class A common stockholders $54,630 $25,959 $163,491 $115,421 Income taxes(2) (11,264) (6,682) (20,737) (25,254) After-tax Realized Income attributable to Class A common stockholders $43,366 $19,277 $142,754 $90,167 After-tax Realized Income per share of Class A common stock(4) $0.41 $0.23 $1.42 $1.08 1. The Company has 12,400,000 shares of 7% Series A Preferred Stock outstanding as of December 31, 2018. 2. Amount represents the current corporate taxes paid by the Company for the periods presented. The current corporate tax payment is allocated between FRE and RI. Taxes paid on RI are calculated by multiplying the statutory tax rate of 23.1% by realized performance related income, which is subtracted from the total current corporate tax payment to arrive at taxes on FRE. All differences between taxable income and realized income presented are attributed to FRE as this represents our core business operations. As a result, FRE tax rates may fluctuate over time based on the total amount of realizations in relation to the amount of tax deductible expenses in a given period. 3. Pro forma shares of 226,421,973 includes the sum of shares of Class A common stock, Ares Operating Group Units that are exchangeable for shares of Class A common stock on a one-for-one basis and the dilutive effects of the Company’s equity-based awards. Please refer to slide 32 in this presentation for further information. 4. Calculation of after-tax Realized Income per share of Class A common stock uses the total average shares of Class A common stock outstanding and the dilutive effects of the Company’s equity-based awards. See slide 32 for additional details. 19

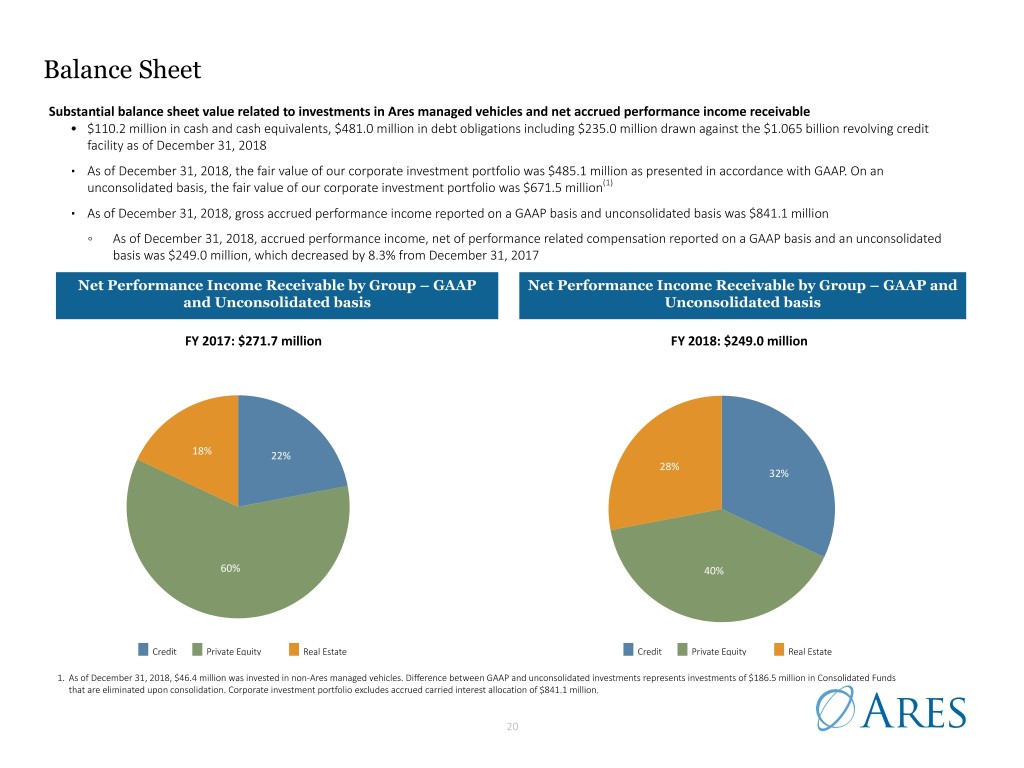

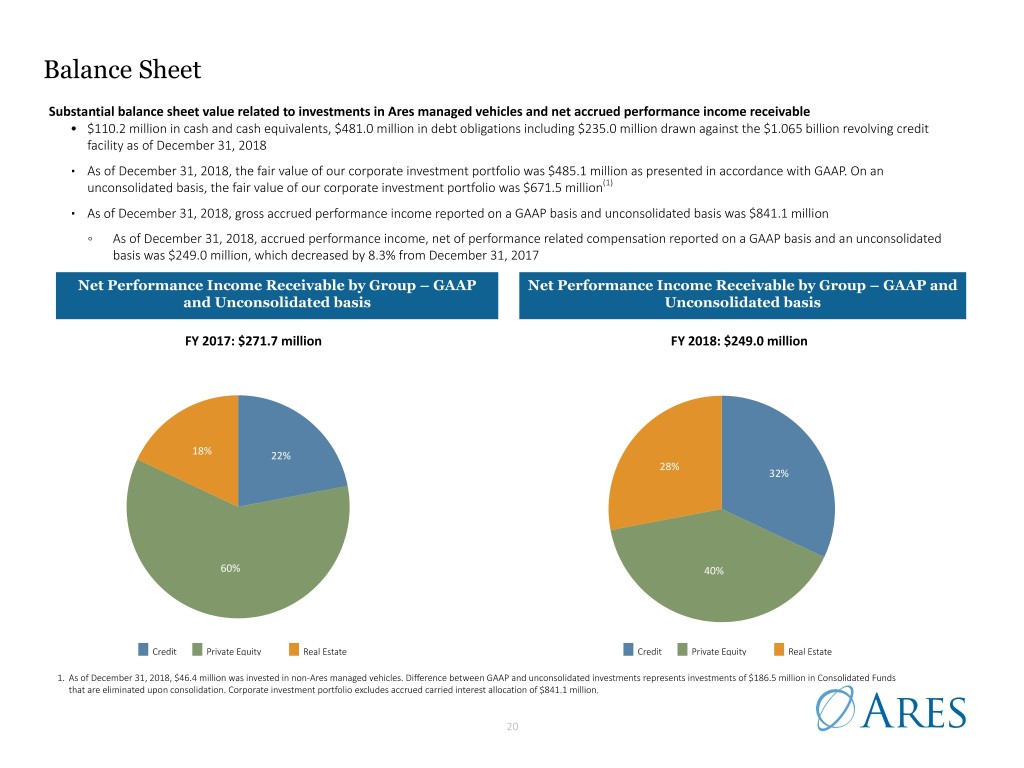

Balance Sheet Substantial balance sheet value related to investments in Ares managed vehicles and net accrued performance income receivable • $110.2 million in cash and cash equivalents, $481.0 million in debt obligations including $235.0 million drawn against the $1.065 billion revolving credit facility as of December 31, 2018 ▪ As of December 31, 2018, the fair value of our corporate investment portfolio was $485.1 million as presented in accordance with GAAP. On an unconsolidated basis, the fair value of our corporate investment portfolio was $671.5 million(1) ▪ As of December 31, 2018, gross accrued performance income reported on a GAAP basis and unconsolidated basis was $841.1 million ◦ As of December 31, 2018, accrued performance income, net of performance related compensation reported on a GAAP basis and an unconsolidated basis was $249.0 million, which decreased by 8.3% from December 31, 2017 Net Performance Income Receivable by Group – GAAP Net Performance Income Receivable by Group – GAAP and and Unconsolidated basis Unconsolidated basis FY 2017: $271.7 million FY 2018: $249.0 million 18% 22% 28% 32% 60% 40% Credit Private Equity Real Estate Credit Private Equity Real Estate 1. As of December 31, 2018, $46.4 million was invested in non-Ares managed vehicles. Difference between GAAP and unconsolidated investments represents investments of $186.5 million in Consolidated Funds that are eliminated upon consolidation. Corporate investment portfolio excludes accrued carried interest allocation of $841.1 million. 20

Corporate Data Board of Directors Executive Officers Research Coverage Investor Relations Contacts Michael Arougheti Michael Arougheti Bank of America Merrill Lynch Carl Drake Co-Founder, Chief Executive Officer and Co-Founder, Chief Executive Officer and Michael Carrier Partner/Head of Ares Management, LLC President of Ares President (646) 855-5004 Public Investor Relations and Communications Antoinette Bush Ryan Berry Credit Suisse Tel: (678) 538-1981 Executive Vice President and Global Head Chief Marketing Officer and Strategy Officer Craig Siegenthaler cdrake@aresmgmt.com of Government Affairs of News Corp (212) 325-3104 Kipp deVeer Cameron Rudd Paul G. Joubert Partner Goldman Sachs Senior Associate Founding Partner of EdgeAdvisors and Alexander Blostein Tel: (678) 538-1986 Investing Partner in Converge Venture David Kaplan (212) 357-9976 crudd@aresmgmt.com Partners Co-Founder and Partner Jefferies General IR Contact David Kaplan Michael McFerran Gerald O'Hara Tel (U.S.): Co-Founder and Partner of Ares, Co-Head Executive Vice President, Chief Financial (415) 229-1510 (800) 340-6597 of Private Equity Group Officer and Chief Operating Officer Tel (International): JP Morgan (212) 808-1101 John Kissick Antony P. Ressler Kenneth Worthington IRARES@aresmgmt.com Co-Founder and Former Partner of Ares Co-Founder and Executive Chairman (212) 622-6613 Please visit our website at: Michael Lynton Bennett Rosenthal Keefe, Bruyette & Woods www.aresmgmt.com Chairman of Snap Inc. Co-Founder and Partner Robert Lee (212) 887-7732 Dr. Judy D. Olian Michael Weiner President of Quinnipiac University Executive Vice President, Chief Legal Officer Morgan Stanley and Secretary Michael Cyprys Antony P. Ressler (212) 761-7619 Transfer Agent Co-Founder and Executive Chairman Oppenheimer & Co American Stock Transfer & Trust Company, Bennett Rosenthal Allison Rudary LLC Co-Founder and Partner of Ares, Co-Head (212) 667-5366 6201 15th Avenue of Private Equity Group Corporate Headquarters Brooklyn, NY 11210 RBC Capital Markets Tel: (877) 681-8121 Kenneth Lee Fax: (718) 236-2641 2000 Avenue of the Stars (212) 905-5995 12th Floor info@amstock.com www.amstock.com Los Angeles, CA 90067 UBS Investment Bank Tel: (310) 201-4100 Brent Dilts Fax: (310) 201-4170 (212) 713-1841 Wells Fargo Securities Corporate Counsel Christopher Harris Securities Listing (443) 263-6513 Proskauer Rose LLP NYSE: ARES Los Angeles, CA NYSE: ARES PRA Independent Registered Public Accounting Firm Ernst & Young LLP Los Angeles, CA 21

Appendix

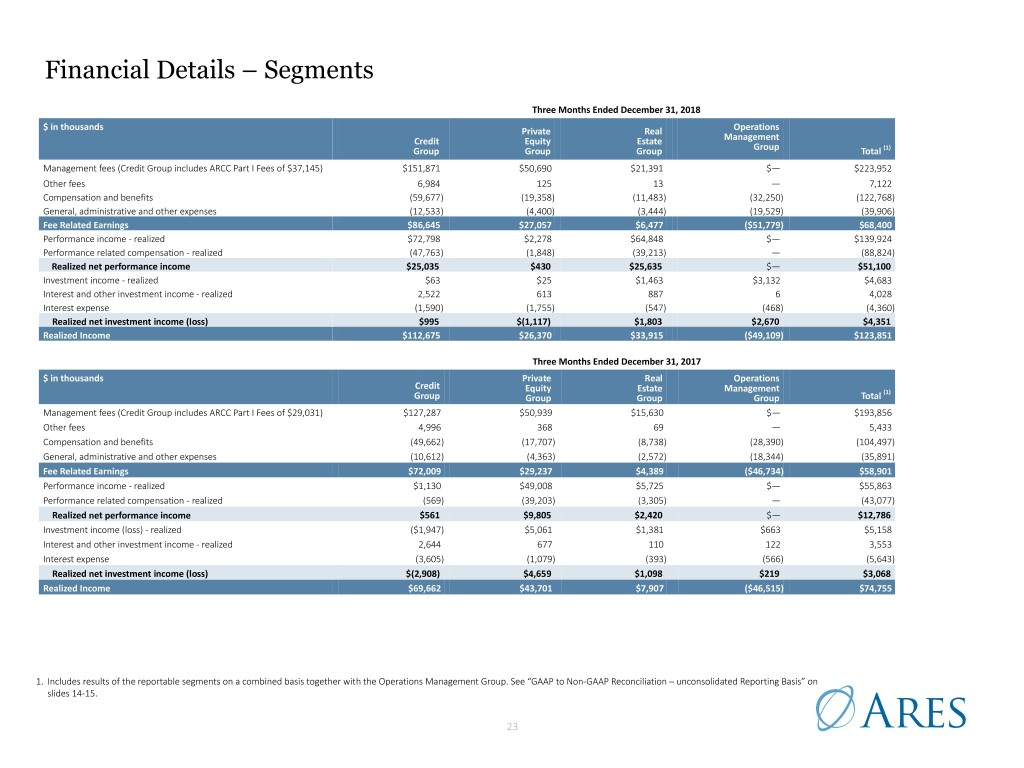

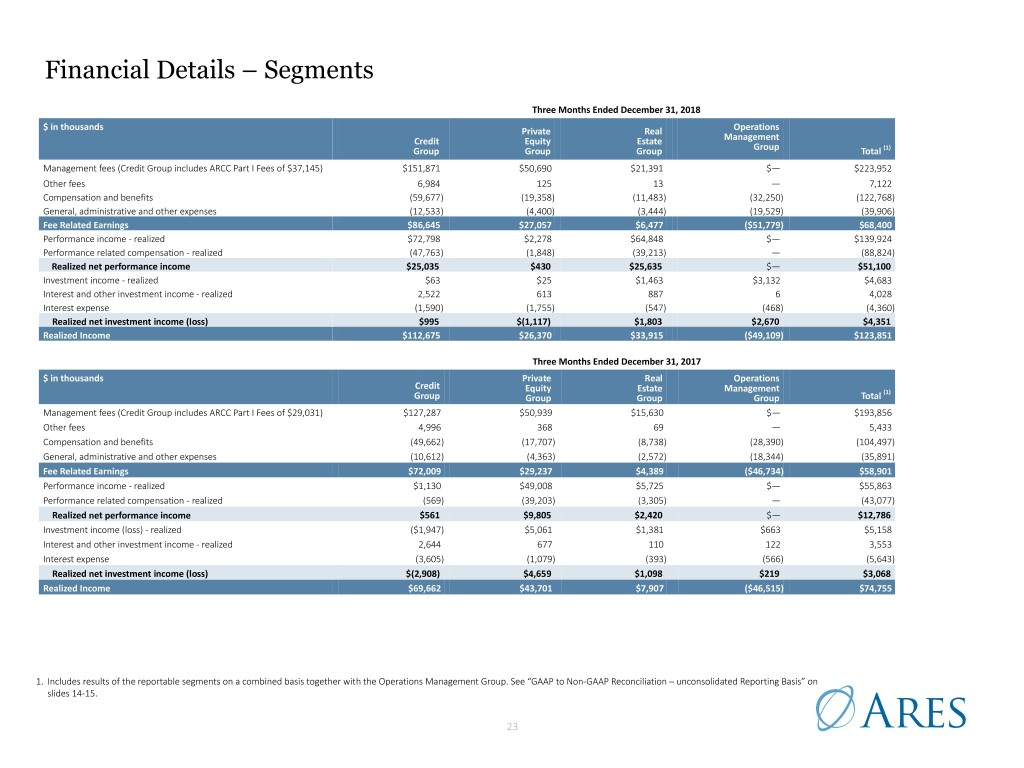

Financial Details – Segments Three Months Ended December 31, 2018 $ in thousands Private Real Operations Credit Equity Estate Management Group Group Group Group Total (1) Management fees (Credit Group includes ARCC Part I Fees of $37,145) $151,871 $50,690 $21,391 $— $223,952 Other fees 6,984 125 13 — 7,122 Compensation and benefits (59,677) (19,358) (11,483) (32,250) (122,768) General, administrative and other expenses (12,533) (4,400) (3,444) (19,529) (39,906) Fee Related Earnings $86,645 $27,057 $6,477 ($51,779) $68,400 Performance income - realized $72,798 $2,278 $64,848 $— $139,924 Performance related compensation - realized (47,763) (1,848) (39,213) — (88,824) Realized net performance income $25,035 $430 $25,635 $— $51,100 Investment income - realized $63 $25 $1,463 $3,132 $4,683 Interest and other investment income - realized 2,522 613 887 6 4,028 Interest expense (1,590) (1,755) (547) (468) (4,360) Realized net investment income (loss) $995 $(1,117) $1,803 $2,670 $4,351 Realized Income $112,675 $26,370 $33,915 ($49,109) $123,851 Three Months Ended December 31, 2017 $ in thousands Private Real Operations Credit Equity Estate Management (1) Group Group Group Group Total Management fees (Credit Group includes ARCC Part I Fees of $29,031) $127,287 $50,939 $15,630 $— $193,856 Other fees 4,996 368 69 — 5,433 Compensation and benefits (49,662) (17,707) (8,738) (28,390) (104,497) General, administrative and other expenses (10,612) (4,363) (2,572) (18,344) (35,891) Fee Related Earnings $72,009 $29,237 $4,389 ($46,734) $58,901 Performance income - realized $1,130 $49,008 $5,725 $— $55,863 Performance related compensation - realized (569) (39,203) (3,305) — (43,077) Realized net performance income $561 $9,805 $2,420 $— $12,786 Investment income (loss) - realized ($1,947) $5,061 $1,381 $663 $5,158 Interest and other investment income - realized 2,644 677 110 122 3,553 Interest expense (3,605) (1,079) (393) (566) (5,643) Realized net investment income (loss) $(2,908) $4,659 $1,098 $219 $3,068 Realized Income $69,662 $43,701 $7,907 ($46,515) $74,755 1. Includes results of the reportable segments on a combined basis together with the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – unconsolidated Reporting Basis” on slides 14-15. 23

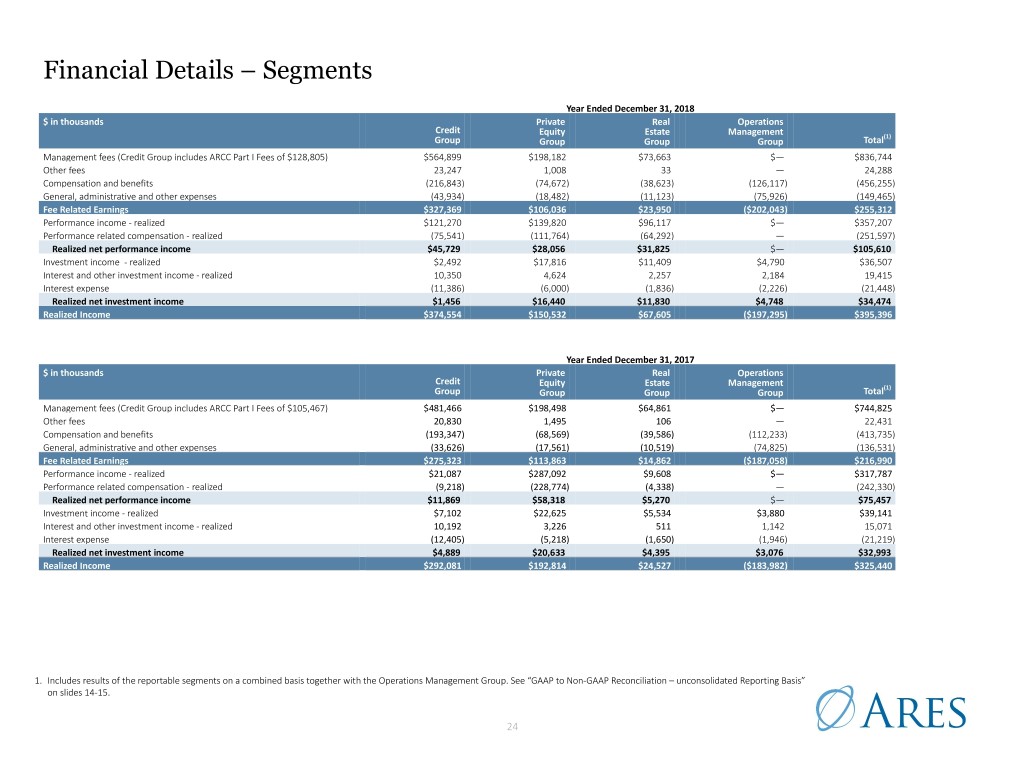

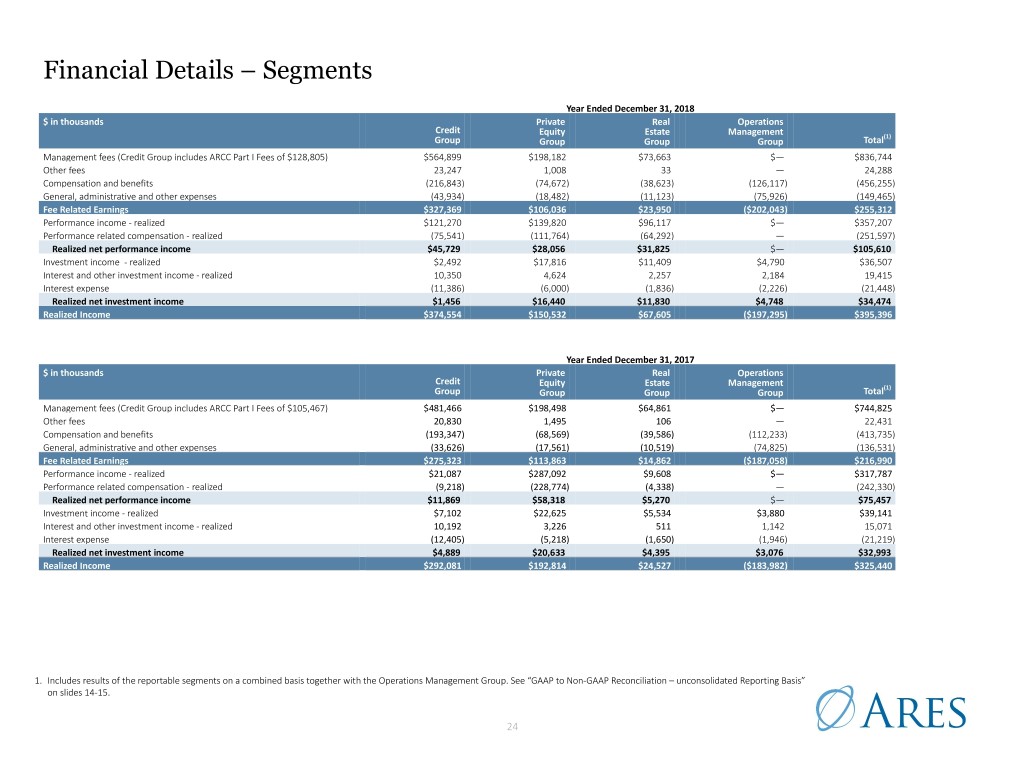

Financial Details – Segments Year Ended December 31, 2018 $ in thousands Private Real Operations Credit Equity Estate Management (1) Group Group Group Group Total Management fees (Credit Group includes ARCC Part I Fees of $128,805) $564,899 $198,182 $73,663 $— $836,744 Other fees 23,247 1,008 33 — 24,288 Compensation and benefits (216,843) (74,672) (38,623) (126,117) (456,255) General, administrative and other expenses (43,934) (18,482) (11,123) (75,926) (149,465) Fee Related Earnings $327,369 $106,036 $23,950 ($202,043) $255,312 Performance income - realized $121,270 $139,820 $96,117 $— $357,207 Performance related compensation - realized (75,541) (111,764) (64,292) — (251,597) Realized net performance income $45,729 $28,056 $31,825 $— $105,610 Investment income - realized $2,492 $17,816 $11,409 $4,790 $36,507 Interest and other investment income - realized 10,350 4,624 2,257 2,184 19,415 Interest expense (11,386) (6,000) (1,836) (2,226) (21,448) Realized net investment income $1,456 $16,440 $11,830 $4,748 $34,474 Realized Income $374,554 $150,532 $67,605 ($197,295) $395,396 Year Ended December 31, 2017 $ in thousands Private Real Operations Credit Equity Estate Management (1) Group Group Group Group Total Management fees (Credit Group includes ARCC Part I Fees of $105,467) $481,466 $198,498 $64,861 $— $744,825 Other fees 20,830 1,495 106 — 22,431 Compensation and benefits (193,347) (68,569) (39,586) (112,233) (413,735) General, administrative and other expenses (33,626) (17,561) (10,519) (74,825) (136,531) Fee Related Earnings $275,323 $113,863 $14,862 ($187,058) $216,990 Performance income - realized $21,087 $287,092 $9,608 $— $317,787 Performance related compensation - realized (9,218) (228,774) (4,338) — (242,330) Realized net performance income $11,869 $58,318 $5,270 $— $75,457 Investment income - realized $7,102 $22,625 $5,534 $3,880 $39,141 Interest and other investment income - realized 10,192 3,226 511 1,142 15,071 Interest expense (12,405) (5,218) (1,650) (1,946) (21,219) Realized net investment income $4,889 $20,633 $4,395 $3,076 $32,993 Realized Income $292,081 $192,814 $24,527 ($183,982) $325,440 1. Includes results of the reportable segments on a combined basis together with the Operations Management Group. See “GAAP to Non-GAAP Reconciliation – unconsolidated Reporting Basis” on slides 14-15. 24

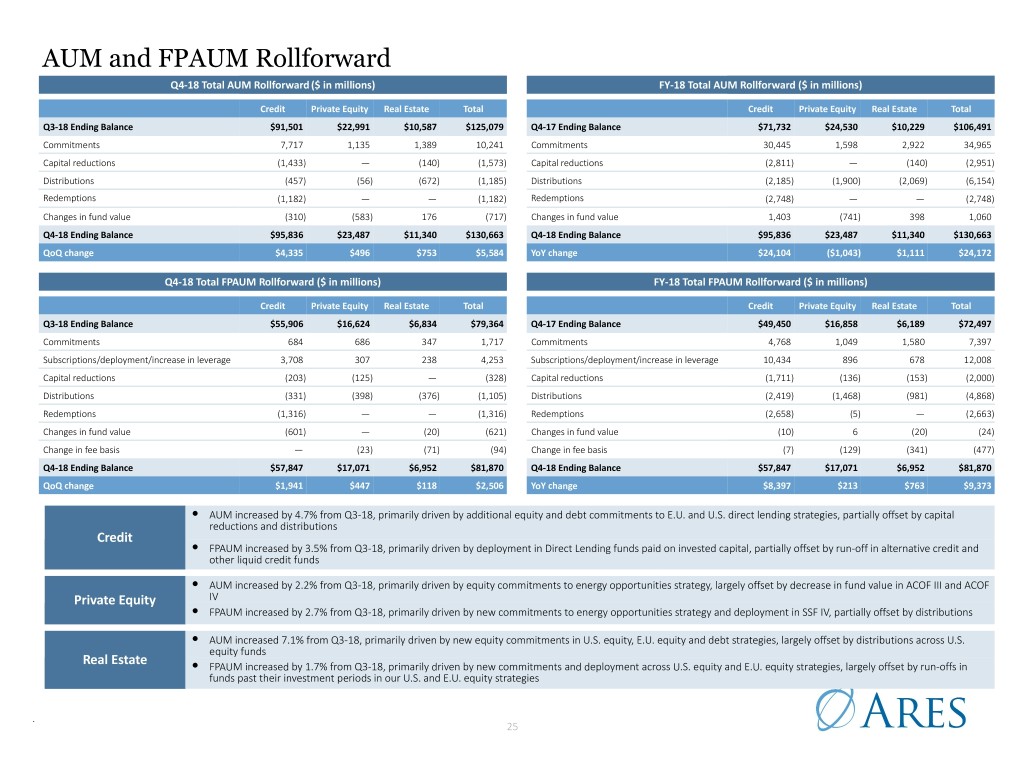

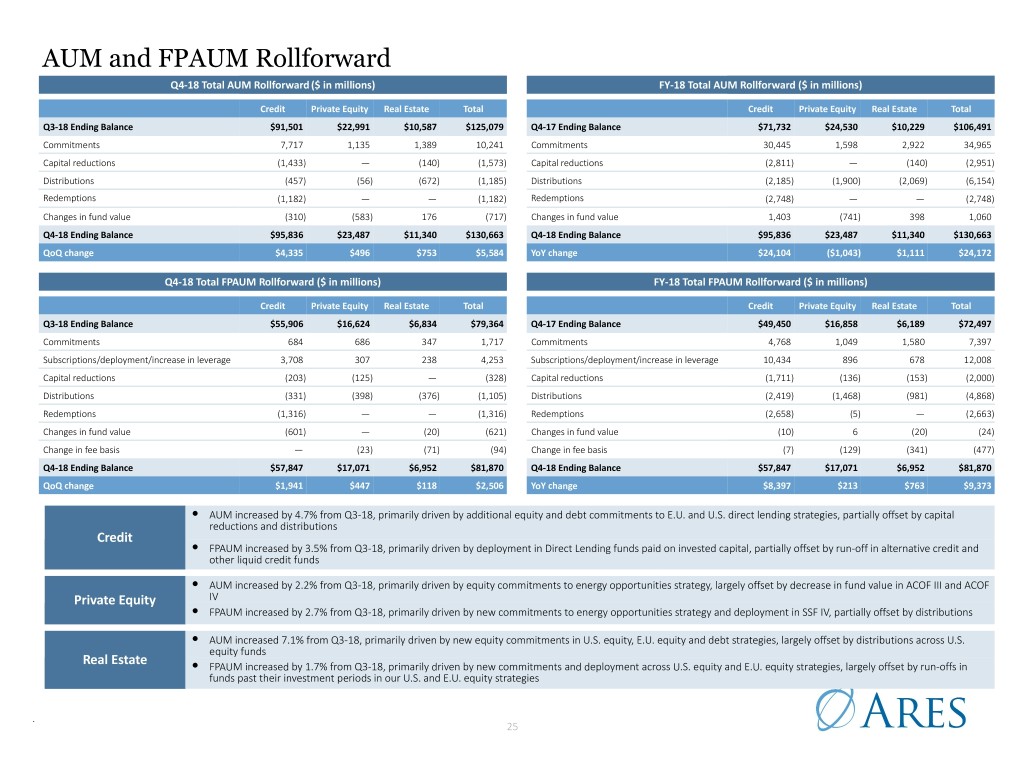

AUM and FPAUM Rollforward Q4-18 Total AUM Rollforward ($ in millions) FY-18 Total AUM Rollforward ($ in millions) Credit Private Equity Real Estate Total Credit Private Equity Real Estate Total Q3-18 Ending Balance $91,501 $22,991 $10,587 $125,079 Q4-17 Ending Balance $71,732 $24,530 $10,229 $106,491 Commitments 7,717 1,135 1,389 10,241 Commitments 30,445 1,598 2,922 34,965 Capital reductions (1,433) — (140) (1,573) Capital reductions (2,811) — (140) (2,951) Distributions (457) (56) (672) (1,185) Distributions (2,185) (1,900) (2,069) (6,154) Redemptions (1,182) — — (1,182) Redemptions (2,748) — — (2,748) Changes in fund value (310) (583) 176 (717) Changes in fund value 1,403 (741) 398 1,060 Q4-18 Ending Balance $95,836 $23,487 $11,340 $130,663 Q4-18 Ending Balance $95,836 $23,487 $11,340 $130,663 QoQ change $4,335 $496 $753 $5,584 YoY change $24,104 ($1,043) $1,111 $24,172 Q4-18 Total FPAUM Rollforward ($ in millions) FY-18 Total FPAUM Rollforward ($ in millions) Credit Private Equity Real Estate Total Credit Private Equity Real Estate Total Q3-18 Ending Balance $55,906 $16,624 $6,834 $79,364 Q4-17 Ending Balance $49,450 $16,858 $6,189 $72,497 Commitments 684 686 347 1,717 Commitments 4,768 1,049 1,580 7,397 Subscriptions/deployment/increase in leverage 3,708 307 238 4,253 Subscriptions/deployment/increase in leverage 10,434 896 678 12,008 Capital reductions (203) (125) — (328) Capital reductions (1,711) (136) (153) (2,000) Distributions (331) (398) (376) (1,105) Distributions (2,419) (1,468) (981) (4,868) Redemptions (1,316) — — (1,316) Redemptions (2,658) (5) — (2,663) Changes in fund value (601) — (20) (621) Changes in fund value (10) 6 (20) (24) Change in fee basis — (23) (71) (94) Change in fee basis (7) (129) (341) (477) Q4-18 Ending Balance $57,847 $17,071 $6,952 $81,870 Q4-18 Ending Balance $57,847 $17,071 $6,952 $81,870 QoQ change $1,941 $447 $118 $2,506 YoY change $8,397 $213 $763 $9,373 l AUM increased by 4.7% from Q3-18, primarily driven by additional equity and debt commitments to E.U. and U.S. direct lending strategies, partially offset by capital reductions and distributions Credit l FPAUM increased by 3.5% from Q3-18, primarily driven by deployment in Direct Lending funds paid on invested capital, partially offset by run-off in alternative credit and other liquid credit funds l AUM increased by 2.2% from Q3-18, primarily driven by equity commitments to energy opportunities strategy, largely offset by decrease in fund value in ACOF III and ACOF Private Equity IV l FPAUM increased by 2.7% from Q3-18, primarily driven by new commitments to energy opportunities strategy and deployment in SSF IV, partially offset by distributions l AUM increased 7.1% from Q3-18, primarily driven by new equity commitments in U.S. equity, E.U. equity and debt strategies, largely offset by distributions across U.S. equity funds Real Estate l FPAUM increased by 1.7% from Q3-18, primarily driven by new commitments and deployment across U.S. equity and E.U. equity strategies, largely offset by run-offs in funds past their investment periods in our U.S. and E.U. equity strategies . 25

AUM and FPAUM by Strategy(1) Strategy ($ in billions) AUM % AUM FPAUM % FPAUM Credit Syndicated Loans $18.9 20% $ 18.3 32% High Yield 4.0 4% 4.0 7% Credit Opportunities 2.8 3% 2.2 4% Alternative Credit 5.4 6% 2.8 5% U.S. Direct Lending(2) 40.7 42% 21.7 37% E.U. Direct Lending 24.1 25% 8.8 15% Total Credit Group $95.9 100% $ 57.8 100% Private Equity Corporate Private Equity ACOF V $7.8 33% $ 7.6 44% ACOF IV 5.3 23% 2.6 15% ACOF III 3.2 14% 1.4 8% Energy Opportunities 0.8 4% 0.7 4% ACOF I-II 0.5 2% — — ACOF Asia 0.3 1% 0.1 1% Infrastructure and Power EIF I-IV and Co-investment Vehicles 3.1 13% 2.7 16% EIF V 0.8 3% 0.8 5% Special Opportunities Special Opportunities 1.7 7% 1.2 7% Private Equity Group $23.5 100% $ 17.1 100% Real Estate U.S. Equity $4.2 37% $ 2.7 39% E.U. Equity 3.7 33% 3.3 47% Debt 3.4 30% 1.0 14% Real Estate Group $11.3 100% $ 7.0 100% Total $130.7 $ 81.9 1. As of December 31, 2018. 2. AUM includes ARCC, IHAM and SDLP AUM of $14.3 billion, $4.1 billion and $2.6 billion, respectively. ARCC’s wholly owned portfolio company, IHAM, an SEC registered investment adviser, manages 21 funds and serves as the sub-manager or sub-adviser for 2 other funds as of December 31, 2018. 26

Balance Sheet Investments by Strategy $ in thousands December 31, 2018 December 31, 2017 Credit Syndicated Loans(1) $75,029 $246,460 Credit Opportunities 3,420 4,464 Alternative Credit 19,518 14,067 U.S. Direct Lending 58,970 61,411 E.U. Direct Lending 47,854 48,672 Credit Group $204,791 $375,074 Private Equity ACOF I - II $3,417 $4,047 ACOF III 81,658 120,598 ACOF IV 37,207 35,984 ACOF Asia 83,492 80,738 Energy Opportunities 1,741 — Infrastructure and Power 30,487 9,353 Special Opportunities 37,817 25,863 Private Equity $275,819 $276,583 Real Estate U.S. Equity $109,893 $74,617 E.U. Equity 16,453 15,914 Real Estate Debt 18,108 — Real Estate $144,454 $90,531 Operations Management Group Other $46,449 $80,767 Other $46,449 $80,767 Total $671,513 $822,955 Note: Reflects the balance sheet of Ares Management Corporation and its consolidated subsidiaries, excluding the effect of Consolidated Funds. (1) Through investments in Ares CLOs. Represents the Company's maximum exposure of loss from its investments in CLOs as of December 31, 2018. 27

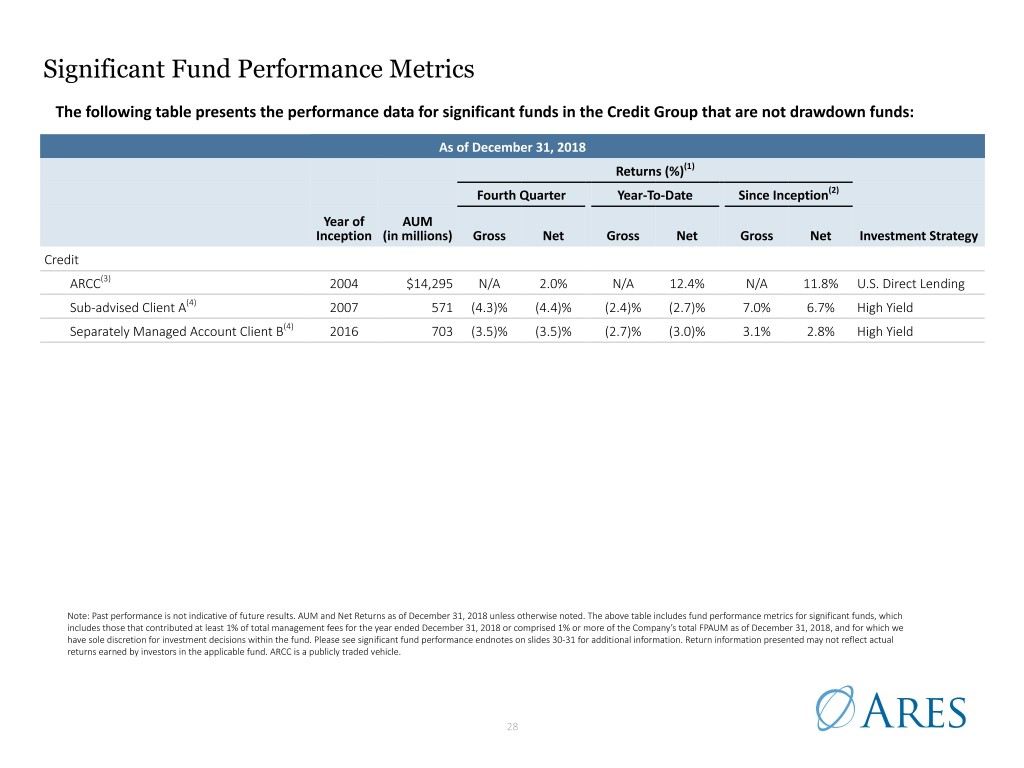

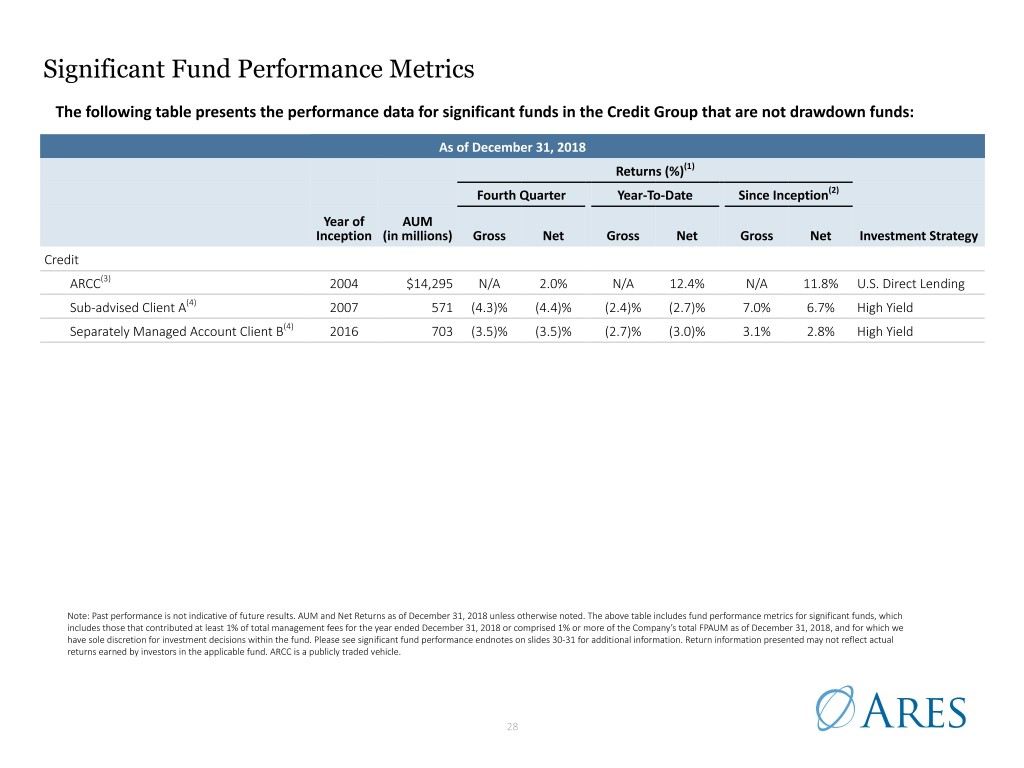

Significant Fund Performance Metrics The following table presents the performance data for significant funds in the Credit Group that are not drawdown funds: As of December 31, 2018 Returns (%)(1) Fourth Quarter Year-To-Date Since Inception(2) Year of AUM Inception (in millions) Gross Net Gross Net Gross Net Investment Strategy Credit ARCC(3) 2004 $14,295 N/A 2.0% N/A 12.4% N/A 11.8% U.S. Direct Lending Sub-advised Client A(4) 2007 571 (4.3)% (4.4)% (2.4)% (2.7)% 7.0% 6.7% High Yield Separately Managed Account Client B(4) 2016 703 (3.5)% (3.5)% (2.7)% (3.0)% 3.1% 2.8% High Yield Note: Past performance is not indicative of future results. AUM and Net Returns as of December 31, 2018 unless otherwise noted. The above table includes fund performance metrics for significant funds, which includes those that contributed at least 1% of total management fees for the year ended December 31, 2018 or comprised 1% or more of the Company’s total FPAUM as of December 31, 2018, and for which we have sole discretion for investment decisions within the fund. Please see significant fund performance endnotes on slides 30-31 for additional information. Return information presented may not reflect actual returns earned by investors in the applicable fund. ARCC is a publicly traded vehicle. 28

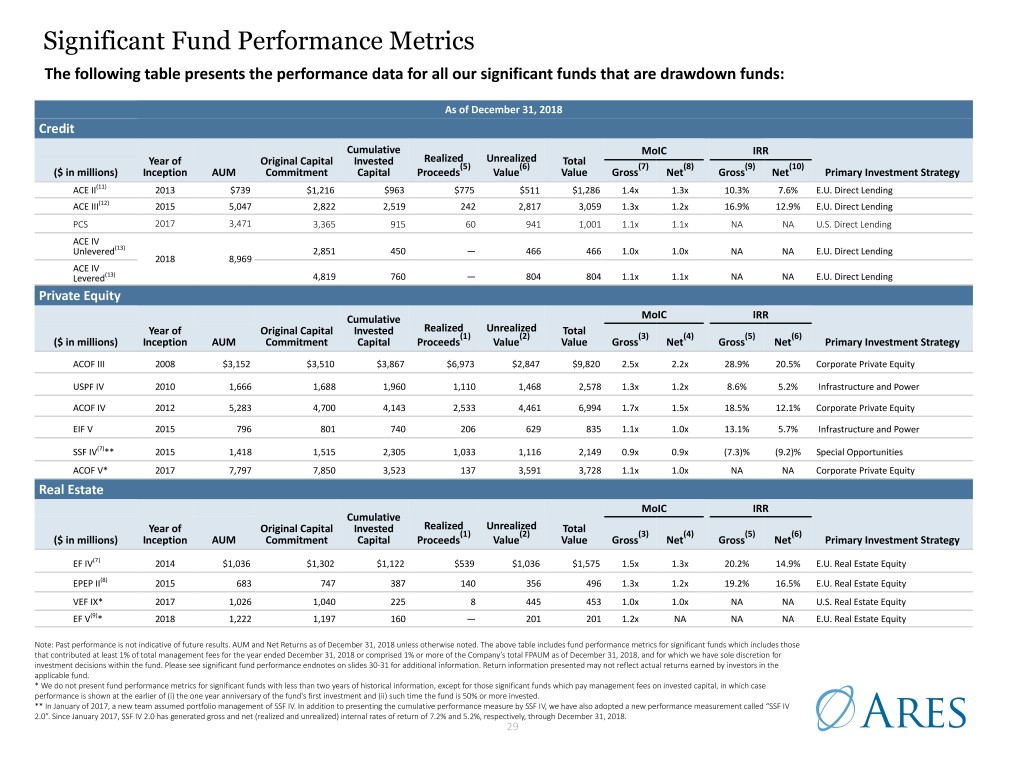

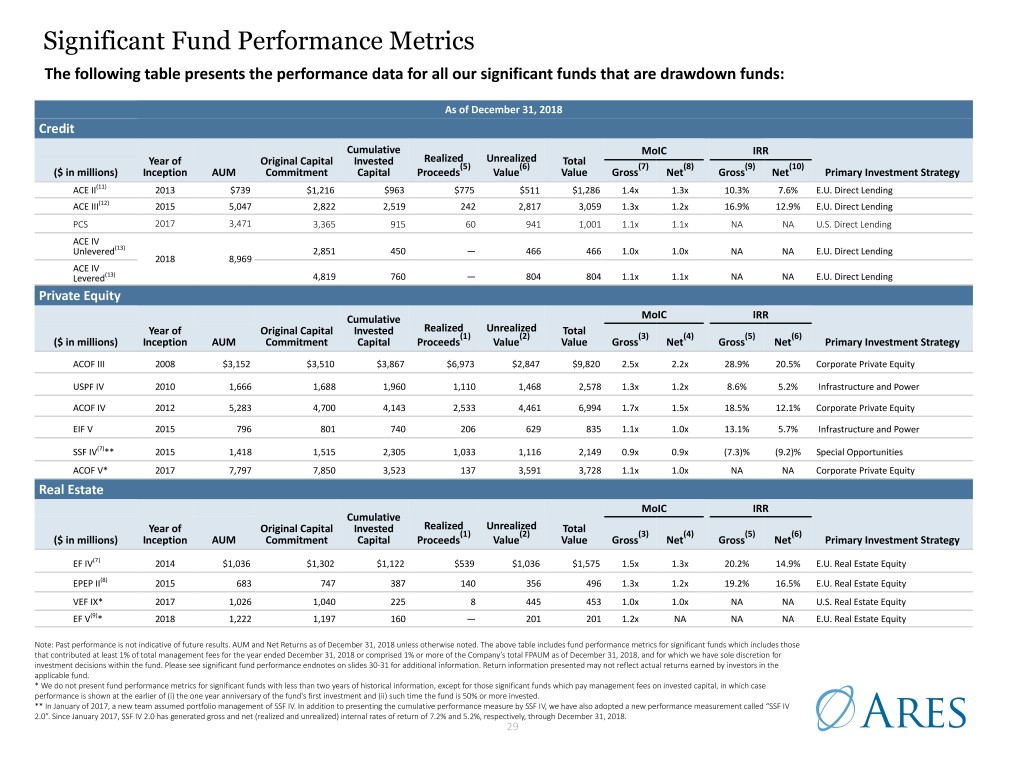

Significant Fund Performance Metrics The following table presents the performance data for all our significant funds that are drawdown funds: As of December 31, 2018 Credit Cumulative MoIC IRR Realized Unrealized Year of Original Capital Invested (5) (6) Total (7) (8) (9) (10) ($ in millions) Inception AUM Commitment Capital Proceeds Value Value Gross Net Gross Net Primary Investment Strategy ACE II(11) 2013 $739 $1,216 $963 $775 $511 $1,286 1.4x 1.3x 10.3% 7.6% E.U. Direct Lending ACE III(12) 2015 5,047 2,822 2,519 242 2,817 3,059 1.3x 1.2x 16.9% 12.9% E.U. Direct Lending PCS 2017 3,471 3,365 915 60 941 1,001 1.1x 1.1x NA NA U.S. Direct Lending ACE IV Unlevered(13) 2,851 450 — 466 466 1.0x 1.0x NA NA E.U. Direct Lending 2018 8,969 ACE IV Levered(13) 4,819 760 — 804 804 1.1x 1.1x NA NA E.U. Direct Lending Private Equity Cumulative MoIC IRR Realized Unrealized Year of Original Capital Invested (1) (2) Total (3) (4) (5) (6) ($ in millions) Inception AUM Commitment Capital Proceeds Value Value Gross Net Gross Net Primary Investment Strategy ACOF III 2008 $3,152 $3,510 $3,867 $6,973 $2,847 $9,820 2.5x 2.2x 28.9% 20.5% Corporate Private Equity USPF IV 2010 1,666 1,688 1,960 1,110 1,468 2,578 1.3x 1.2x 8.6% 5.2% Infrastructure and Power ACOF IV 2012 5,283 4,700 4,143 2,533 4,461 6,994 1.7x 1.5x 18.5% 12.1% Corporate Private Equity EIF V 2015 796 801 740 206 629 835 1.1x 1.0x 13.1% 5.7% Infrastructure and Power SSF IV(7)** 2015 1,418 1,515 2,305 1,033 1,116 2,149 0.9x 0.9x (7.3)% (9.2)% Special Opportunities ACOF V* 2017 7,797 7,850 3,523 137 3,591 3,728 1.1x 1.0x NA NA Corporate Private Equity Real Estate MoIC IRR Cumulative Realized Unrealized Year of Original Capital Invested (1) (2) Total (3) (4) (5) (6) ($ in millions) Inception AUM Commitment Capital Proceeds Value Value Gross Net Gross Net Primary Investment Strategy EF IV(7) 2014 $1,036 $1,302 $1,122 $539 $1,036 $1,575 1.5x 1.3x 20.2% 14.9% E.U. Real Estate Equity EPEP II(8) 2015 683 747 387 140 356 496 1.3x 1.2x 19.2% 16.5% E.U. Real Estate Equity VEF IX* 2017 1,026 1,040 225 8 445 453 1.0x 1.0x NA NA U.S. Real Estate Equity EF V(9)* 2018 1,222 1,197 160 — 201 201 1.2x NA NA NA E.U. Real Estate Equity Note: Past performance is not indicative of future results. AUM and Net Returns as of December 31, 2018 unless otherwise noted. The above table includes fund performance metrics for significant funds which includes those that contributed at least 1% of total management fees for the year ended December 31, 2018 or comprised 1% or more of the Company’s total FPAUM as of December 31, 2018, and for which we have sole discretion for investment decisions within the fund. Please see significant fund performance endnotes on slides 30-31 for additional information. Return information presented may not reflect actual returns earned by investors in the applicable fund. * We do not present fund performance metrics for significant funds with less than two years of historical information, except for those significant funds which pay management fees on invested capital, in which case performance is shown at the earlier of (i) the one year anniversary of the fund's first investment and (ii) such time the fund is 50% or more invested. ** In January of 2017, a new team assumed portfolio management of SSF IV. In addition to presenting the cumulative performance measure by SSF IV, we have also adopted a new performance measurement called “SSF IV 2.0”. Since January 2017, SSF IV 2.0 has generated gross and net (realized and unrealized) internal rates of return of 7.2% and 5.2%, respectively, through December 31, 2018. 29

Significant Fund Performance Metrics Endnotes Credit 1. Returns are time-weighted rates of return and include the reinvestment of income and other earnings from securities or other investments and reflect the deduction of all trading expenses. 2. Since inception returns are annualized. 3. Net returns are calculated using the fund's NAV and assume dividends are reinvested at the closest quarter-end NAV to the relevant quarterly ex-dividend dates. Additional information related to ARCC can be found in its financial statements filed with the SEC, which are not part of this presentation. 4. Gross returns do not reflect the deduction of management fees or any other expenses. Net returns are calculated by subtracting the applicable management fee from the gross returns on a monthly basis. 5. Realized proceeds represent the sum of all cash distributions to all partners and if applicable, exclude tax and incentive distributions made to the general partner. 6. Unrealized value represents the fund's NAV reduced by the accrued incentive allocation, if applicable. There can be no assurance that unrealized values will be realized at the valuations indicated. 7. The gross multiple of invested capital (“MoIC”) is calculated at the fund-level and is based on the interests of the fee-paying limited partners and if applicable, excludes interests attributable to the non-fee paying limited partners and/or the general partner which does not pay management fees or carried interest. The gross MoIC is before giving effect to management fees, carried interest as applicable and other expenses. 8. The net MoIC is calculated at the fund-level and is based on the interests of the fee-paying limited partners and if applicable, excludes those interests attributable to the non-fee paying limited partners and/or the general partner which does not pay management fees or carried interest. The net MoIC is after giving effect to management fees, carried interest as applicable and other expenses. The funds may utilize a credit facility during the investment period and for general cash management purposes. 9. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Gross IRR reflects returns to the fee-paying limited partners and if applicable, excludes interests attributable to the non-fee paying limited partners and/or the general partner which does not pay management fees or carried interest. The cash flow dates used in the gross IRR calculation are based on the actual dates of the cash flows. Gross IRRs are calculated before giving effect to management fees, carried interest as applicable, and other expenses. 10. The net IRR is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Net IRRs reflect returns to the fee- paying limited partners and if applicable, exclude interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or carried interest. The cash flow dates used in the net IRR calculations are based on the actual dates of the cash flows. The net IRRs are calculated after giving effect to management fees, carried interest as applicable, and other expenses. The funds may utilize a credit facility during the investment period and for general cash management purposes. Net fund-level IRRs would likely have been lower had such fund called capital from its limited partners instead of utilizing the credit facility. 11. ACE II is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net IRR and gross and net MoIC presented in the chart are for the U.S. dollar denominated feeder fund as that is the larger of the two feeders. The gross and net IRR for the Euro denominated feeder fund are 11.9% and 9.0%, respectively. The gross and net MoIC for the Euro denominated feeder fund are 1.5x and 1.4x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of the fund's closing. All other values for ACE II are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. The variance between the gross and net MoICs and the net IRRs for the U.S. dollar denominated and Euro denominated feeder funds is driven by the U.S. GAAP mark-to-market reporting of the foreign currency hedging program in the U.S. dollar denominated feeder fund. The feeder fund will be holding the foreign currency hedges until maturity, and therefore is expected to ultimately recognize a gain while mitigating the currency risk associated with the initial principal investments. 12. ACE III is made up of two feeder funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net MoIC presented in the chart are for the Euro denominated feeder fund as that is the larger of the two feeders. The gross and net IRR for the U.S. dollar denominated feeder fund are 16.6% and 12.6%, respectively. The gross and net MoIC for the U.S. dollar denominated feeder fund are 1.3x and 1.2x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of the fund's closing. All other values for ACE III are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. 13. ACE IV is made up of four parallel funds: ACE IV (E) Unlevered, ACE IV (G) Unlevered, ACE IV (E) Levered, and ACE IV (G) Levered. The gross and net MoIC presented in the chart are for ACE IV (E) Unlevered and ACE IV (E) Levered as those are the largest of the levered and unlevered parallel funds. Metrics for ACE IV (E) Levered are inclusive of a U.S. Dollar denominated feeder fund, which has not been presented separately. The gross and net MoIC for ACE IV (G) Unlevered are 1.0x and 1.0x, respectively. The gross and net MoIC for ACE IV (G) Levered are 1.1x and 1.0x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of the fund's closing. AUM is presented as the aggregate ACE IV amount. All other values for ACE IV Unlevered and ACE IV Levered are for the combined levered and unlevered parallel funds and are converted to U.S. dollars at the prevailing quarter-end exchange rate. Private Equity 1. Realized proceeds represent the sum of all cash dividends, interest income, other fees and cash proceeds from realizations of interests in portfolio investments. 2. Unrealized value represents the fair market value of remaining investments. There can be no assurance that unrealized investments will be realized at the valuations indicated. 3. The gross MoIC is calculated at the investment-level and is based on the interests of all partners. The gross MoIC is before giving effect to management fees, carried interest, as applicable, and other expenses. 4. The net MoIC for the infrastructure and power and special opportunities funds is calculated at the fund-level. The net MoIC for the corporate private equity funds is calculated at the investment level. For all funds, the net MoIC is based on the interests of the fee-paying limited partners and, if applicable, excludes interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or carried interest. The net MoIC is after giving effect to management fees, carried interest, as applicable, and other expenses. The funds may utilize a credit facility during the investment period and for general cash management purposes. 30

Significant Fund Performance Metrics Endnotes (cont’d) Private Equity - Cont. 5. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Gross IRRs reflect returns to all partners. For SSF IV, cash flows used in the gross IRR calculation are based on the actual dates of the cash flows. For all other funds, cash flows are assumed to occur at month-end. The gross IRRs are calculated before giving effect to management fees, carried interest, as applicable, and other expenses. 6. The net IRR is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Net IRRs reflect returns to the fee-paying limited partners and, if applicable, exclude interests attributable to the non-fee paying limited partners and/or the general partner who does not pay management fees or carried interest. The cash flow dates used in the net IRR calculation are based on the actual dates of the cash flows. The net IRRs are calculated after giving effect to management fees, carried interest, as applicable, and other expenses and exclude commitments by the general partner and Schedule I investors who do not pay either management fees or carried interest. The funds may utilize a credit facility during the investment period and for general cash management purposes. Net fund-level IRRs would have generally been lower had such fund called capital from its limited partners instead of utilizing the credit facility. 7. SSF IV 2.0 is a subset of SSF IV positions and is intended to provide insight into the new team’s cumulative investment performance. SSF IV 2.0 investments represent (i) existing and re-underwritten positions by the new team on January 1, 2017 and (ii) all new investments made by the new team since January 1, 2017. As part of the re-underwriting process, each liquid investment in the SSF IV portfolio was evaluated and a determination was made whether to continue to hold such investment in the SSF IV portfolio or dispose of such investment. At the same time, legacy illiquid investments have been excluded from the SSF IV 2.0 track record as it was not possible to dispose of such investments in the near-term due to their private, illiquid nature. Real Estate 1. Realized proceeds include distributions of operating income, sales and financing proceeds received. 2. Unrealized value represents the fair market value of remaining investments. There can be no assurance that unrealized investments will be realized at the valuations indicated. 3. The gross MoIC is calculated at the investment level and is based on the interests of all partners. The gross MoIC for all funds is before giving effect to management fees, carried interest, as applicable, and other expenses. 4. The net MoIC is calculated at the fund-level and is based on the interests of the fee-paying partners and, if applicable, excludes interests attributable to the non fee-paying partners and/or the general partner who does not pay management fees or carried interest or has such fees rebated outside of the fund. The net MoIC is after giving effect to management fees, carried interest, as applicable, and other expenses. 5. The gross IRR is an annualized since inception gross internal rate of return of cash flows to and from investments and the residual value of the investments at the end of the measurement period. Gross IRRs reflect returns to all partners. Cash flows used in the gross IRR calculation are assumed to occur at quarter-end. The gross IRRs are calculated before giving effect to management fees, carried interest as applicable, and other expenses. 6. The net IRR is an annualized since inception net internal rate of return of cash flows to and from the fund and the fund’s residual value at the end of the measurement period. Net IRRs reflect returns to the fee-paying partners and, if applicable, excludes interests attributable to the non fee-paying partners and/or the general partner who does not pay management fees or carried interest or has such fees rebated outside of the fund. The cash flow dates used in the net IRR calculation are based on the actual dates of the cash flows. The net IRRs are calculated after giving effect to management fees, carried interest, as applicable, and other expenses. The funds may utilize a credit facility during the investment period and for general cash management purposes. Net fund-level IRRs would generally likely have been lower had such fund called capital from its limited partners instead of utilizing the credit facility. 7. EF IV is made up of two parallel funds, one denominated in U.S. dollars and one denominated in Euros. The gross and net MoIC and gross and net IRRs presented in the chart are for the U.S. dollar denominated parallel fund as that is the larger of the two funds. The gross and net IRRs for the Euro denominated parallel fund are 20.6% and 14.6%, respectively. The gross and net MoIC for the Euro denominated parallel fund are 1.5x and 1.3x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of fund's closing. All other values for EF IV are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. 8. EPEP II is made up of dual currency investors and Euro currency investors. The gross and net MoIC presented in the chart are for dual currency investors as dual currency investors represent the largest group of investors in the fund. Multiples exclude foreign currency gains and losses since dual currency investors fund capital contributions and receive distributions in local deal currency (GBP or EUR) and therefore, do not realize foreign currency gains or losses. The gross and net IRRs for the euro currency investors, which include foreign currency gains and losses, are 18.6% and 15.4%, respectively. The gross and net MoIC for the Euro currency investors, which include foreign currency gains and losses, are 1.3x and 1.2x, respectively. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of fund's closing. All other values for EPEP II are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. 9. EF V is made up of two parallel funds, one denominated in U.S. dollars and one denominated in Euros. The gross MoIC presented in the chart is for the Euro denominated parallel fund as that is the larger of the two funds. The gross MoIC for the U.S. dollar denominated parallel fund is 1.2x. The net MoIC cannot be calculated for either of the EF V parallel funds since capital has not yet been called from investors. Original capital commitments are converted to U.S. dollars at the prevailing exchange rate at the time of fund's closing. All other values for EF V are for the combined fund and are converted to U.S. dollars at the prevailing quarter-end exchange rate. 31

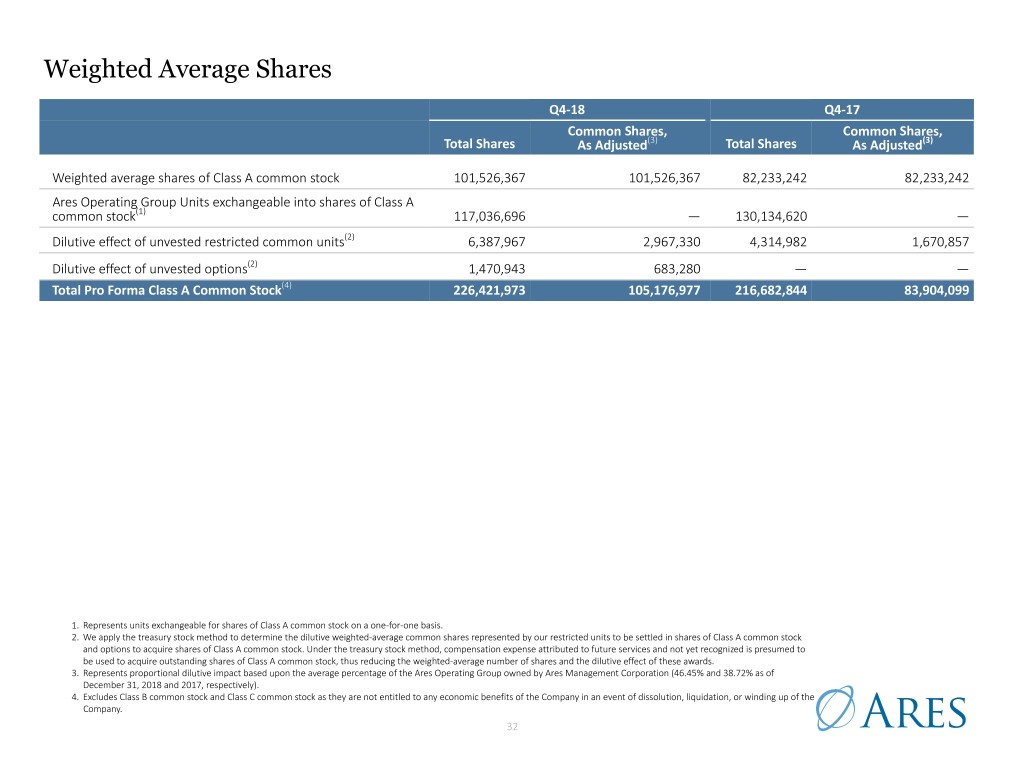

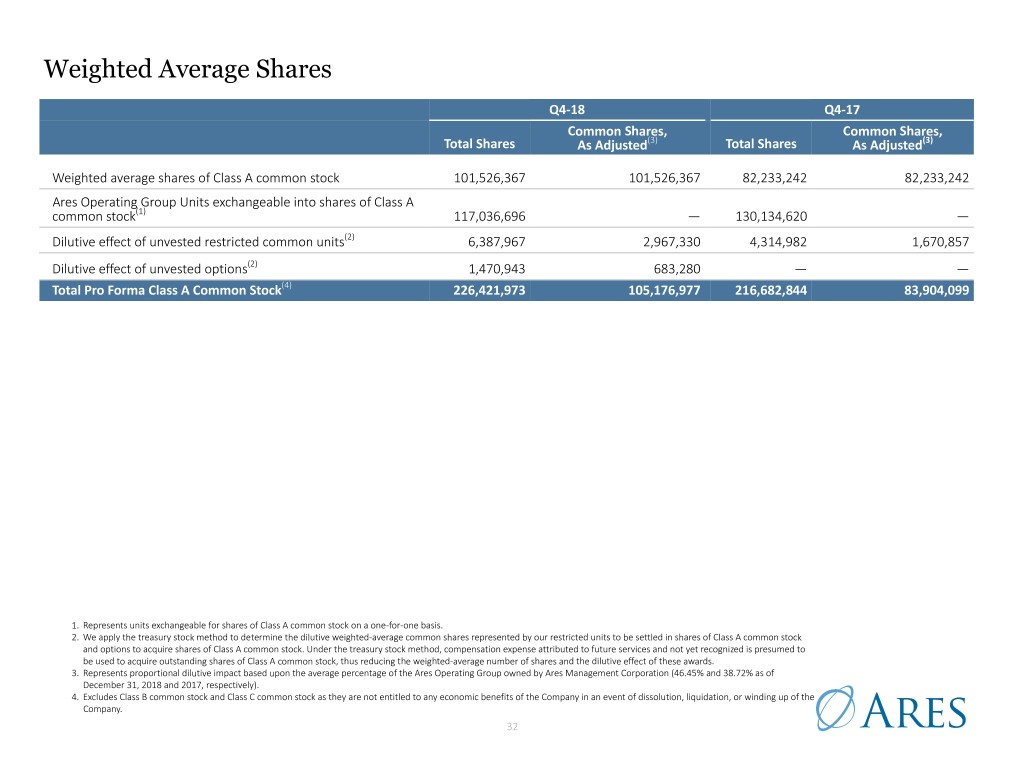

Weighted Average Shares Q4-18 Q4-17 Common Shares, Common Shares, Total Shares As Adjusted(3) Total Shares As Adjusted(3) Weighted average shares of Class A common stock 101,526,367 101,526,367 82,233,242 82,233,242 Ares Operating Group Units exchangeable into shares of Class A common stock(1) 117,036,696 — 130,134,620 — Dilutive effect of unvested restricted common units(2) 6,387,967 2,967,330 4,314,982 1,670,857 Dilutive effect of unvested options(2) 1,470,943 683,280 — — Total Pro Forma Class A Common Stock(4) 226,421,973 105,176,977 216,682,844 83,904,099 1. Represents units exchangeable for shares of Class A common stock on a one-for-one basis. 2. We apply the treasury stock method to determine the dilutive weighted-average common shares represented by our restricted units to be settled in shares of Class A common stock and options to acquire shares of Class A common stock. Under the treasury stock method, compensation expense attributed to future services and not yet recognized is presumed to be used to acquire outstanding shares of Class A common stock, thus reducing the weighted-average number of shares and the dilutive effect of these awards. 3. Represents proportional dilutive impact based upon the average percentage of the Ares Operating Group owned by Ares Management Corporation (46.45% and 38.72% as of December 31, 2018 and 2017, respectively). 4. Excludes Class B common stock and Class C common stock as they are not entitled to any economic benefits of the Company in an event of dissolution, liquidation, or winding up of the Company. 32