UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21149

T. Rowe Price Retirement Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

Retirement Income 2025 Fund

This annual shareholder report contains important information about Retirement Income 2025 Fund (the "fund") for the period of January 17, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retirement Income 2025 Fund - Investor Class | $57 | 0.54% |

|---|

What drove fund performance during the past 12 months?

Global stock indexes and global fixed income markets were mostly positive in 2024. Shares were supported by generally favorable corporate earnings, a resilient labor market, easing inflation pressures, and the beginning of interest rate-cutting cycles by several major central banks later in the period. Cutting cycles boosted sentiment, as did optimism surrounding artificial intelligence.

Compared with the S&P Target Date 2025 Index, the fund’s higher total equity exposure in its glide path contributed to results for the period. As some U.S. equity indexes reached all-time highs, the fund’s greater allocation to U.S. equity versus the benchmark added value, as domestic stocks outperformed international equities.

On the negative side, security selection very slightly detracted from performance overall, led by unfavorable selection among U.S. mid-cap growth and U.S. large-cap growth equities. Tactical allocation also modestly detracted overall, with an overweight to real assets equities weighing, as real assets equities underperformed global equities.

The fund seeks to provide monthly income. The fund pursues its objectives by investing in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. The fund’s allocation among T. Rowe Price mutual funds will change over time in relation to its target retirement date.

How has the fund performed?

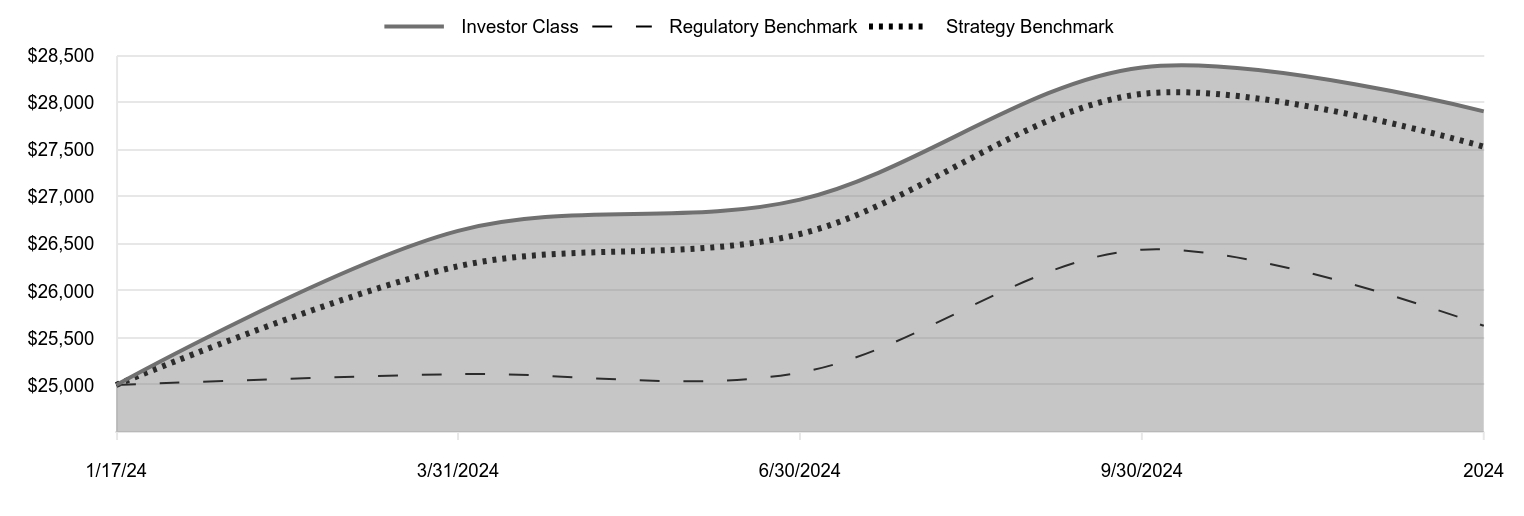

Cumulative Returns of a Hypothetical $25,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 1/17/24 | 25,000 | 25,000 | 25,000 |

|---|

| 3/31/2024 | 26,638 | 25,116 | 26,262 |

|---|

| 6/30/2024 | 26,970 | 25,132 | 26,605 |

|---|

| 9/30/2024 | 28,375 | 26,438 | 28,094 |

|---|

| 2024 | 27,908 | 25,629 | 27,533 |

|---|

202501-4140694, 202502-4108784

Average Annual Total Returns

| | Since Inception 1/17/24 |

|---|

| Retirement Income 2025 Fund (Investor Class) | 11.63% |

|---|

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 2.51 |

|---|

| S&P Target Date 2025 Index (Strategy Benchmark) | 10.13 |

|---|

The preceding line graph shows the value of a hypothetical $25,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$5,766

- Number of Portfolio Holdings27

- Investment Advisory Fees Paid (000s)$17

- Portfolio Turnover Rate39.6%

What did the fund invest in?

Asset Allocation (as a % of Net Assets)

| Domestic Equity Funds | 42.7% |

| Domestic Bond Funds | 29.2 |

| International Equity Funds | 13.8 |

| International Bond Funds | 11.8 |

| Short-Term and Other | 2.5 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price New Income Fund | 13.3% |

| T. Rowe Price Limited Duration Inflation Focused Bond Fund | 9.2 |

| T. Rowe Price Value Fund | 8.0 |

| T. Rowe Price Growth Stock Fund | 7.9 |

| T. Rowe Price U.S. Large-Cap Core Fund | 5.6 |

| T. Rowe Price Equity Index 500 Fund | 5.4 |

| T. Rowe Price Hedged Equity Fund | 5.4 |

| T. Rowe Price International Bond Fund (USD Hedged) | 4.8 |

| T. Rowe Price Overseas Stock Fund | 4.0 |

| T. Rowe Price International Value Equity Fund | 3.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Retirement Income 2025 Fund

Investor Class (TRAVX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Retirement Income 2025 Fund

This annual shareholder report contains important information about Retirement Income 2025 Fund (the "fund") for the period of January 17, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retirement Income 2025 Fund - I Class | $40 | 0.38% |

|---|

What drove fund performance during the past 12 months?

Global stock indexes and global fixed income markets were mostly positive in 2024. Shares were supported by generally favorable corporate earnings, a resilient labor market, easing inflation pressures, and the beginning of interest rate-cutting cycles by several major central banks later in the period. Cutting cycles boosted sentiment, as did optimism surrounding artificial intelligence.

Compared with the S&P Target Date 2025 Index, the fund’s higher total equity exposure in its glide path contributed to results for the period. As some U.S. equity indexes reached all-time highs, the fund’s greater allocation to U.S. equity versus the benchmark added value, as domestic stocks outperformed international equities.

On the negative side, security selection very slightly detracted from performance overall, led by unfavorable selection among U.S. mid-cap growth and U.S. large-cap growth equities. Tactical allocation also modestly detracted overall, with an overweight to real assets equities weighing, as real assets equities underperformed global equities.

The fund seeks to provide monthly income. The fund pursues its objectives by investing in a diversified portfolio of other T. Rowe Price stock and bond mutual funds that represent various asset classes and sectors. The fund’s allocation among T. Rowe Price mutual funds will change over time in relation to its target retirement date.

How has the fund performed?

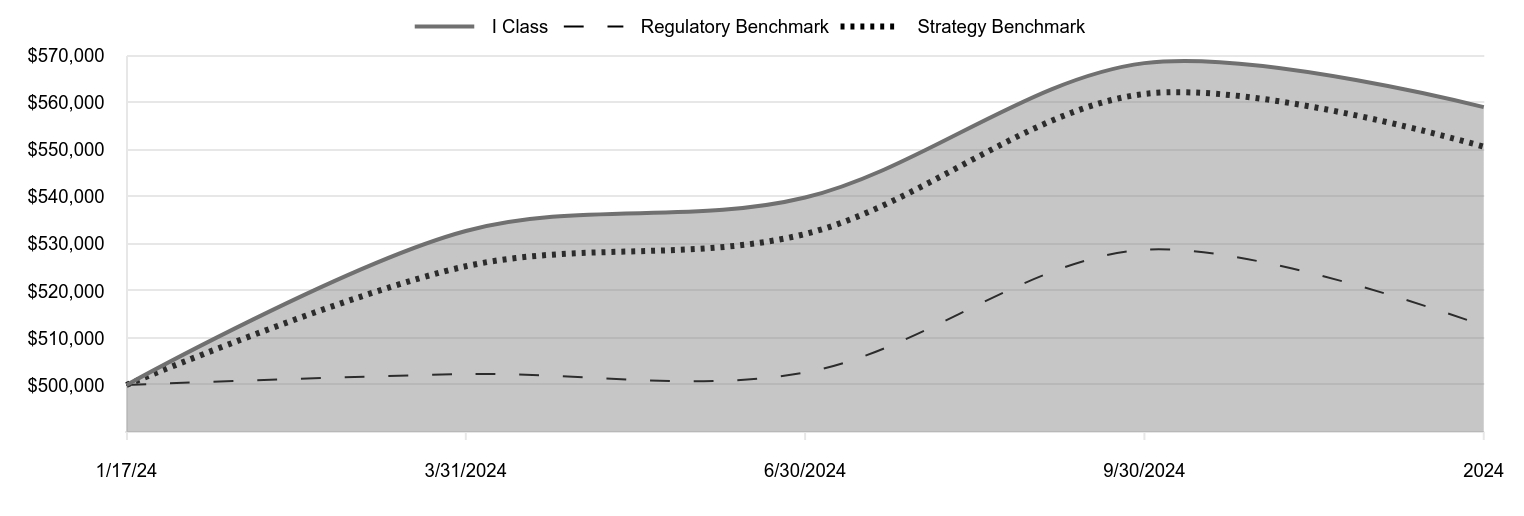

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 1/17/24 | 500,000 | 500,000 | 500,000 |

|---|

| 3/31/2024 | 532,742 | 502,314 | 525,236 |

|---|

| 6/30/2024 | 539,846 | 502,641 | 532,105 |

|---|

| 9/30/2024 | 568,431 | 528,759 | 561,876 |

|---|

| 2024 | 559,063 | 512,570 | 550,662 |

|---|

202501-4140694, 202502-4108784

Average Annual Total Returns

| | Since Inception 1/17/24 |

|---|

| Retirement Income 2025 Fund (I Class) | 11.81% |

|---|

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 2.51 |

|---|

| S&P Target Date 2025 Index (Strategy Benchmark) | 10.13 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$5,766

- Number of Portfolio Holdings27

- Investment Advisory Fees Paid (000s)$17

- Portfolio Turnover Rate39.6%

What did the fund invest in?

Asset Allocation (as a % of Net Assets)

| Domestic Equity Funds | 42.7% |

| Domestic Bond Funds | 29.2 |

| International Equity Funds | 13.8 |

| International Bond Funds | 11.8 |

| Short-Term and Other | 2.5 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price New Income Fund | 13.3% |

| T. Rowe Price Limited Duration Inflation Focused Bond Fund | 9.2 |

| T. Rowe Price Value Fund | 8.0 |

| T. Rowe Price Growth Stock Fund | 7.9 |

| T. Rowe Price U.S. Large-Cap Core Fund | 5.6 |

| T. Rowe Price Equity Index 500 Fund | 5.4 |

| T. Rowe Price Hedged Equity Fund | 5.4 |

| T. Rowe Price International Bond Fund (USD Hedged) | 4.8 |

| T. Rowe Price Overseas Stock Fund | 4.0 |

| T. Rowe Price International Value Equity Fund | 3.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Retirement Income 2025 Fund

I Class (TRATX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | | 2024 | | | | | | 2023 | |

| | Audit Fees | | $ | 16,811 | | | | | | | | $- | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | - | | | | | | | | - | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TRAVX

Retirement

Income

2025

Fund

TRATX

Retirement

Income

2025

Fund–

.

I Class

T.

ROWE

PRICE

Retirement

Income

2025

Fund

For

a

share

outstanding

throughout

the

period

Investor

Class

(1)

1/17/24

(1)

Through

12/31/24

NET

ASSET

VALUE

Beginning

of

period

$

10.00

Investment

activities

Net

investment

income

(2)(3)

0.29

Net

realized

and

unrealized

gain/loss

0.86

Total

from

investment

activities

1.15

Distributions

Net

investment

income

(0.40)

Net

realized

gain

(0.20)

Tax

return

of

capital

(0.01)

Total

distributions

(0.61)

NET

ASSET

VALUE

End

of

period

$

10.54

T.

ROWE

PRICE

Retirement

Income

2025

Fund

For

a

share

outstanding

throughout

the

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

(1)

1/17/24

(1)

Through

12/31/24

Ratios/Supplemental

Data

Total

return

(3)(4)(5)

11.63%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

payments

by

Price

Associates

(5)

0.54%

(6)

Net

expenses

after

payments

by

Price

Associates

(5)

0.54%

(6)

Net

investment

income

(5)

2.86%

(6)

Portfolio

turnover

rate

(5)

39.6%

Net

assets,

end

of

period

(in

thousands)

$2,470

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

the

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

The

fund's

total

return

may

be

higher

or

lower

than

the

investment

results

of

the

individual

underlying

Price

Funds.

(5)

Reflects

the

activity

of

the

fund,

and

does

not

include

the

activity

of

the

underlying

Price

Funds.

However,

investment

performance

of

the

fund

is

directly

related

to

the

investment

performance

of

the

underlying

Price

Funds

in

which

it

invests.

(6)

Annualized

T.

ROWE

PRICE

Retirement

Income

2025

Fund

For

a

share

outstanding

throughout

the

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

(1)

1/17/24

(1)

Through

12/31/24

NET

ASSET

VALUE

Beginning

of

period

$

10.00

Investment

activities

Net

investment

income

(2)(3)

0.38

Net

realized

and

unrealized

gain/loss

0.79

Total

from

investment

activities

1.17

Distributions

Net

investment

income

(0.40)

Net

realized

gain

(0.20)

Tax

return

of

capital

(0.01)

Total

distributions

(0.61)

NET

ASSET

VALUE

End

of

period

$

10.56

Ratios/Supplemental

Data

Total

return

(3)(4)(5)

11.81%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

payments

by

Price

Associates

(5)

0.38%

(6)

Net

expenses

after

payments

by

Price

Associates

(5)

0.38%

(6)

Net

investment

income

(5)

3.67%

(6)

Portfolio

turnover

rate

(5)

39.6%

Net

assets,

end

of

period

(in

thousands)

$3,296

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

the

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

The

fund's

total

return

may

be

higher

or

lower

than

the

investment

results

of

the

individual

underlying

Price

Funds.

(5)

Reflects

the

activity

of

the

fund,

and

does

not

include

the

activity

of

the

underlying

Price

Funds.

However,

investment

performance

of

the

fund

is

directly

related

to

the

investment

performance

of

the

underlying

Price

Funds

in

which

it

invests.

(6)

Annualized

T.

ROWE

PRICE

Retirement

Income

2025

Fund

December

31,

2024

Portfolio

of

Investments

(1)

(1)

$

Value

1/17/24

$

Purchase

Cost

(2)

$

Sales

Cost

(2)

Shares

$

Value

12/31/24

(Cost

and

value

in

$000s)

BOND

MUTUAL

FUNDS

41.0%

T.

Rowe

Price

Funds:

New

Income

Fund

–

946

175

97,698

768

Limited

Duration

Inflation

Focused

Bond

Fund

–

657

120

115,565

532

International

Bond

Fund

(USD

Hedged)

–

336

62

32,536

278

Dynamic

Global

Bond

Fund

–

227

43

23,852

186

U.S.

Treasury

Long-Term

Index

Fund

–

233

45

25,695

182

Emerging

Markets

Bond

Fund

–

189

35

16,998

155

High

Yield

Fund

–

180

34

25,130

148

Dynamic

Credit

Fund

–

79

15

7,236

64

Floating

Rate

Fund

–

64

13

5,456

51

Total

Bond

Mutual

Funds

(Cost

$2,368)

2,364

EQUITY

MUTUAL

FUNDS

56.5%

T.

Rowe

Price

Funds:

Value

Fund

–

599

132

10,311

459

Growth

Stock

Fund

–

551

134

4,271

458

U.S.

Large-Cap

Core

Fund

–

392

77

7,862

325

Equity

Index

500

Fund

–

393

118

2,013

311

Hedged

Equity

Fund

–

355

68

24,741

308

Overseas

Stock

Fund

–

293

58

18,440

232

International

Value

Equity

Fund

–

275

59

12,862

217

Real

Assets

Fund

–

265

53

14,839

207

International

Stock

Fund

–

254

56

10,178

197

Mid-Cap

Growth

Fund

–

146

29

1,130

114

Mid-Cap

Value

Fund

–

135

28

3,252

104

Emerging

Markets

Discovery

Stock

Fund

–

101

20

5,973

81

Emerging

Markets

Stock

Fund

–

89

17

2,115

71

Small-Cap

Value

Fund

–

80

17

1,219

65

Small-Cap

Stock

Fund

–

79

20

1,027

58

New

Horizons

Fund (3)

–

63

11

910

52

Total

Equity

Mutual

Funds

(Cost

$3,174)

3,259

OTHER

MUTUAL

FUNDS

0.0%

T.

Rowe

Price

Funds:

Transition

Fund

–

32

32

3

1

Total

Other

Mutual

Funds

(Cost

$–)

1

T.

ROWE

PRICE

Retirement

Income

2025

Fund

$

Value

1/17/24

$

Purchase

Cost

(2)

$

Sales

Cost

(2)

Shares

$

Value

12/31/24

(Cost

and

value

in

$000s)

SHORT-TERM

INVESTMENTS

2.2%

Money

Market

Funds

2.2%

T.

Rowe

Price

U.S.

Treasury

Money

Fund,

4.52% (4)

–

225

100

125,390

125

Total

Short-Term

Investments

(Cost

$125)

125

Total

Investments

in

Securities

99.7%

of

Net

Assets

(Cost

$5,667)

$

5,749

(1)

Each

underlying

Price

Fund

is

an

affiliated

company;

the

fund

is

invested

in

the Z

Class

of

each

underlying

Price

Fund,

except

for

the

Transition

Fund,

if

held,

which

is

a

single

class

fund.

Additional

information

about

each underlying

Price

Fund

is

available

by

calling

1-877-495-1138

and

at www.troweprice.com.

(2)

Purchase

cost

and

Sales

cost

for

affiliates

not

held

at

period

end

totaled

$4

and

$4,

respectively.

(3)

Non-income

producing

(4)

Seven-day

yield

T.

ROWE

PRICE

Retirement

Income

2025

Fund

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

period

ended

December

31,

2024.

Net

realized

gain

(loss),

investment

income,

and

change

in

net

unrealized

gain/loss

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Funds:

Dynamic

Credit

Fund

$

—

$

—

$

3

Dynamic

Global

Bond

Fund

—

2

5

Emerging

Markets

Bond

Fund

—

1

6

Emerging

Markets

Discovery

Stock

Fund

—

—

3

Emerging

Markets

Stock

Fund

—

(1)

1

Equity

Index

500

Fund

2

36

3

Floating

Rate

Fund

—

—

3

Growth

Stock

Fund

31

41

1

Hedged

Equity

Fund

5

21

5

High

Yield

Fund

—

2

7

International

Bond

Fund

(USD

Hedged)

—

4

6

International

Stock

Fund

—

(1)

4

International

Value

Equity

Fund

(1)

1

8

Limited

Duration

Inflation

Focused

Bond

Fund

—

(5)

20

Mid-Cap

Growth

Fund

10

(3)

1

Mid-Cap

Value

Fund

10

(3)

2

New

Horizons

Fund

2

—

—

New

Income

Fund

(2)

(3)

23

Overseas

Stock

Fund

(1)

(3)

7

Real

Assets

Fund

(1)

(5)

5

Small-Cap

Stock

Fund

8

(1)

1

Small-Cap

Value

Fund

5

2

1

Transition

Fund

—

1

—

U.S.

Large-Cap

Core

Fund

18

10

4

U.S.

Treasury

Long-Term

Index

Fund

(1)

(6)

5

Value

Fund

30

(8)

8

U.S.

Treasury

Money

Fund,

4.52%

—

—

4

Affiliates

not

held

at

period

end

—

—

—

Totals

$

115#

$

82

$

136+

T.

ROWE

PRICE

Retirement

Income

2025

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$120

of

the

net

realized

gain

(loss).

+

Investment

income

comprised

$136

of

income

distributions

from

underlying

Price

Funds.

T.

ROWE

PRICE

Retirement

Income

2025

Fund

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Assets

Investments

in

securities,

at

value

(cost

$5,667)

$

5,749

Due

from

affiliates

20

Total

assets

5,769

Liabilities

Investment

management

and

administrative

fees

payable

2

Payable

for

investment

securities

purchased

1

Total

liabilities

3

NET

ASSETS

$

5,766

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

65

Paid-in

capital

applicable

to

546,416

shares

of

$0.0001

par

value

capital

stock

outstanding;

30,000,000,000

shares

of

the

Corporation

authorized

5,701

NET

ASSETS

$

5,766

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$2,470;

Shares

outstanding:

234,367)

$

10.54

I

Class

(Net

assets:

$3,296;

Shares

outstanding:

312,049)

$

10.56

T.

ROWE

PRICE

Retirement

Income

2025

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

1/17/24

Through

12/31/24

Investment

Income

(Loss)

Income

distributions

from

underlying

Price

Funds

$

136

Investment

management

and

administrative

expense

17

Net

investment

income

119

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

(loss)

Sales

of

underlying

Price

Funds

(5)

Capital

gain

distributions

from

underlying

Price

Funds

120

Net

realized

gain

115

Change

in

net

unrealized

gain

/

loss

on

underlying

Price

Funds

82

Net

realized

and

unrealized

gain

/

loss

197

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

316

T.

ROWE

PRICE

Retirement

Income

2025

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

1/17/24

Through

12/31/24

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

119

Net

realized

gain

115

Change

in

net

unrealized

gain

/

loss

82

Increase

in

net

assets

from

operations

316

Distributions

to

shareholders

Net

earnings

Investor

Class

(116)

I

Class

(135)

Tax

return

of

capital

–

Investor

Class

(2)

I

Class

(3)

Decrease

in

net

assets

from

distributions

(256)

Capital

share

transactions

*

Shares

sold

Investor

Class

3,067

I

Class

4,618

Distributions

reinvested

Investor

Class

38

I

Class

59

Shares

redeemed

Investor

Class

(673)

I

Class

(1,403)

Increase

in

net

assets

from

capital

share

transactions

5,706

T.

ROWE

PRICE

Retirement

Income

2025

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

1/17/24

Through

12/31/24

Net

Assets

Increase

during

period

5,766

Beginning

of

period

–

End

of

period

$

5,766

*Share

information

(000s)

Shares

sold

Investor

Class

293

I

Class

437

Distributions

reinvested

Investor

Class

4

I

Class

6

Shares

redeemed

Investor

Class

(63)

I

Class

(131)

Increase

in

shares

outstanding

546

T.

ROWE

PRICE

Retirement

Income

2025

Fund

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

Retirement

Funds,

Inc.

(the

corporation)

is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

T.

Rowe

Price

Retirement

Income

2025

Fund

(the

fund)

is

a

diversified,

open-end

management

investment

company

and

is

one

of

the

portfolios

established

by

the

corporation.

The

fund

incepted

on

January

17,

2024.

The

fund

invests

in

a

portfolio

of

other

T.

Rowe

Price

stock

and

bond

funds

(underlying

Price

Funds)

that

represent

various

asset

classes

and

sectors.

The

fund’s

allocation

among

underlying

Price

Funds

will

change,

and

its

asset

mix

will

become

more

conservative

over

time.

The

fund

seeks

to

provide

monthly

income.

The

fund

has

two classes

of

shares:

the Retirement

Income

2025

Fund

(Investor

Class)

and

Retirement

Income

2025

Fund–I

Class

(I

Class).

I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans,

and

certain

other

accounts. Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to all

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

class.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

of

the

underlying

Price

Funds

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

of

the

underlying

Price

Funds.

Investment

Transactions

and Investment

Income

Investment

transactions are

accounted

for

on

the

trade

date.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses are

reported

on

the

identified

cost

basis.

Income

tax-related

interest

and

penalties,

if

incurred,

would

be

recorded

as

income

tax

expense.

Dividends

received

from

underlying

T.

ROWE

PRICE

Retirement

Income

2025

Fund

Price

Fund

investments

are

reflected

as income;

capital

gain

distributions

are

reflected

as

realized

gain/loss.

Income

and

capital

gain

distributions

from

the

underlying

Price

Funds

are

recorded

on

the

ex-dividend

date.

Distributions

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

The

fund

declares

and

pays

twelve

equal

monthly

distributions

based

on

a

specified

annual

payout

rate

of

approximately

5%

of

the

fund’s

average

net

asset

value

over

the

prior

five

years.

The

monthly

distribution

rate

per

share

is

expected

to

remain

constant

from

month

to

month

for

a

particular

calendar

year

and

is

reset

annually

each

January

based

on

the

fund’s

historical

average

net

asset

value

over

the

previous

five

years

(or,

until

the

fund

has

five

years

of

operating

history,

the

average

net

asset

value

of

a

similarly

managed

fund). The

estimated

sources

of

each

distribution

are

communicated

to

shareholders

monthly;

at

fiscal

year-end,

distributions

are

re-characterized

to

ordinary

income,

capital

gain,

and

return

of

capital

(if

any)

to

reflect

their

tax

character

and

shareholders

are

notified

of

the

final

sources

of

the

per

share

distributions.

For

the

period

ended

December

31,

2024,

the

fund

made

monthly

distributions

of

$0.0367

per

share

to

the

Investor

Class

and

$0.0365

per

share

to

the

I

Class,

and

also

distributed

$0.2099

per

share

to

Investor

Class

and

$0.2099

per

share

to

I

Class

shareholders

of

record

on

December

27,

2024.

For

the

year

ended

December

31,

2025,

the

fund

intends

to

make

monthly

distributions

of

$0.0391

per

share

to

Investor

Class

shareholders

and

$0.0390

per

share

to

I

class

shareholders.

Class

Accounting

Investment

management

and

administrative

expenses

incurred

by

each

class

are

charged

directly

to

the

class

to

which

they

relate.

Expenses

common

to

all

classes,

investment

income,

and

realized

and

unrealized

gains

and

losses

are

allocated

to

the

classes

based

upon

the

relative

daily

net

assets

of

each

class.

Capital

Transactions

Each

investor’s

interest

in

the

net

assets

of the

fund

is

represented

by

fund

shares. The

fund’s

net

asset

value

(NAV)

per

share

is

computed

at

the

close

of

the

New

York

Stock

Exchange

(NYSE),

normally

4

p.m.

Eastern

time,

each

day

the

NYSE

is

open

for

business.

However,

the

NAV

per

share

may

be

calculated

at

a

time

other

than

the

normal

close

of

the

NYSE

if

trading

on

the

NYSE

is

restricted,

if

the

NYSE

closes

earlier,

or

as

may

be

permitted

by

the

SEC.

Purchases

and

redemptions

of

fund

shares

are

transacted

at

the

next-computed

NAV

per

share,

after

receipt

of

the

transaction

order

by

T.

Rowe

Price

Associates,

Inc.,

or

its

agents.

T.

ROWE

PRICE

Retirement

Income

2025

Fund

Indemnification

In

the

normal

course

of

business,

the fund

may

provide

indemnification

in

connection

with

its

officers

and

directors,

service

providers

and/or

private

company

investments. The

fund’s

maximum

exposure

under

these

arrangements

is

unknown;

however,

the

risk

of

material

loss

is

currently

considered

to

be

remote.

NOTE

2

-

VALUATION

The fund’s

financial

instruments

are

valued

at

the

close

of

the

NYSE

and

are

reported

at

fair

value,

which

GAAP

defines

as

the

price

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

at

the

measurement

date.

Investments

in

the

underlying

Price

Funds

are

valued

at

their

closing

NAV

per

share

on

the

day

of

valuation. Assets

and

liabilities

other

than

financial

instruments,

including

short-term

receivables

and

payables,

are

carried

at

cost,

or

estimated

realizable

value,

if

less,

which

approximates

fair

value.

The

fund’s

Board

of

Directors

(the

Board) has

designated

T.

Rowe

Price

Associates,

Inc.

as

the fund’s

valuation

designee

(Valuation

Designee).

Subject

to

oversight

by

the

Board,

the

Valuation

Designee

performs

the

following

functions

in

performing

fair

value

determinations:

assesses

and

manages

valuation

risks;

establishes

and

applies

fair

value

methodologies;

tests

methodologies;

and

evaluates

pricing

vendors

and

pricing

agents.

The

duties

and

responsibilities

of

the

Valuation

Designee

are

performed

by

its

Valuation

Committee.

The

Valuation Designee

provides

periodic

reporting

to

the

Board

on

valuation

matters.

Various

valuation

techniques

and

inputs

are

used

to

determine

the

fair

value

of

financial

instruments.

GAAP

establishes

the

following

fair

value

hierarchy

that

categorizes

the

inputs

used

to

measure

fair

value:

Level

1 – quoted

prices

(unadjusted)

in

active

markets

for

identical

financial

instruments

that

the

fund

can

access

at

the

reporting

date

Level

2 – inputs

other

than

Level

1

quoted

prices

that

are

observable,

either

directly

or

indirectly

(including,

but

not

limited

to,

quoted

prices

for

similar

financial

instruments

in

active

markets,

quoted

prices

for

identical

or

similar

financial

instruments

in

inactive

markets,

interest

rates

and

yield

curves,

implied

volatilities,

and

credit

spreads)

Level

3 – unobservable

inputs

(including

the

Valuation Designee’s

assumptions

in

determining

fair

value)

T.

ROWE

PRICE

Retirement

Income

2025

Fund

Observable

inputs

are

developed

using

market

data,

such

as

publicly

available

information

about

actual

events

or

transactions,

and

reflect

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

Unobservable

inputs

are

those

for

which

market

data

are

not

available

and

are

developed

using

the

best

information

available

about

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

GAAP

requires

valuation

techniques

to

maximize

the

use

of

relevant

observable

inputs

and

minimize

the

use

of

unobservable

inputs.

When

multiple

inputs

are

used

to

derive

fair

value,

the

financial

instrument

is

assigned

to

the

level

within

the

fair

value

hierarchy

based

on

the

lowest-level

input

that

is

significant

to

the

fair

value

of

the

financial

instrument.

Input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

financial

instruments

at

that

level

but

rather

the

degree

of

judgment

used

in

determining

those

values.

On

December

31,

2024,

all

of

the

fund’s

financial

instruments

were

classified

as

Level

1,

based

on

the

inputs

used

to

determine

their

fair

values.

NOTE

3

-

INVESTMENTS

IN

UNDERLYING

PRICE

FUNDS

Purchases

and

sales

of

the

underlying

Price

Funds

other

than

in-kind

transactions,

if

any,

during

the

period

ended

December

31,

2024,

aggregated

$7,242,000

and

$1,570,000,

respectively.

NOTE

4

-

FEDERAL

INCOME

TAXES

Generally,

no

provision

for

federal

income

taxes

is

required

since

the

fund

intends

to qualify

as

a

regulated

investment

company

under

Subchapter

M

of

the

Internal

Revenue

Code

and

distribute

to

shareholders

all

of

its taxable

income

and

gains.

Distributions

determined

in

accordance

with

federal

income

tax

regulations

may

differ

in

amount

or

character

from

net

investment

income

and

realized

gains

for

financial

reporting

purposes.

The

fund

files

U.S.

federal,

state,

and

local

tax

returns

as

required.

The

fund’s

tax

returns

are

subject

to

examination

by

the

relevant

tax

authorities

until

expiration

of

the

applicable

statute

of

limitations,

which

is

generally

three

years

after

the

filing

of

the

tax

return

but

which

can

be

extended

to

six

years

in

certain

circumstances.

Capital

accounts

within

the

financial

reporting

records

are

adjusted

for

permanent

book/tax

differences

to

reflect

tax

character

but

are

not

adjusted

for

temporary

differences.

The

permanent

book/tax

adjustments,

if

any,

have

T.

ROWE

PRICE

Retirement

Income

2025

Fund

no

impact

on

results

of

operations

or

net

assets.

The

permanent

book/tax

adjustments

relate

primarily

to

the

character

of

distributions

from

the

underlying

funds

and

the

recharacterization

of

distributions.

The

tax

character

of

distributions

paid

for

the

periods

presented

was

as

follows:

At

December

31,

2024,

the

tax-basis

cost

of

investments

(including

derivatives,

if

any)

and

gross

unrealized

appreciation

and

depreciation

were as

follows:

At

December

31,

2024,

the

tax-basis

components

of

accumulated

net

earnings

(loss)

were

as

follows:

Temporary

differences

between

book-basis

and

tax-basis

components

of

total

distributable

earnings

(loss)

arise

when

certain

items

of

income,

gain,

or

loss

are

recognized

in

different

periods

for

financial

statement

purposes

versus

for

tax

purposes;

these

differences

will

reverse

in

a

subsequent

reporting

period. The

temporary

differences

relate

primarily

to

the

deferral

of

losses

from

wash

sales.

($000s)

December

31,

2024

Ordinary

income

(including

short-term

capital

gains,

if

any)

$

144

Long-term

capital

gain

107

Return

of

capital

5

Total

distributions

$

256

($000s)

Cost

of

investments

$

5,684

Unrealized

appreciation

$

121

Unrealized

depreciation

(56

)

Net

unrealized

appreciation

(depreciation)

$

65

($000s)

Net

unrealized

appreciation

(depreciation)

$

65

Total

distributable

earnings

(loss)

$

65

T.

ROWE

PRICE

Retirement

Income

2025

Fund

NOTE

5

-

RELATED

PARTY

TRANSACTIONS

The

fund

is

managed

by

T.

Rowe

Price

Associates,

Inc.

(Price

Associates),

a

wholly

owned

subsidiary

of

T.

Rowe

Price

Group,

Inc.

Price

Associates,

directly

or

through

sub-advisory

agreements

with

its

wholly

owned

subsidiaries,

also

provides

investment

management

services

to

all

the

underlying

Price

Funds.

Certain

officers

and

directors

of

the

fund

are

also

officers

and

directors

of

Price

Associates

and

its

subsidiaries

and

the

underlying

Price

Funds.

The

fund

operates

in

accordance

with

an

amended

investment

management

agreement

(amended

management

agreement),

between

the

corporation,

on

behalf

of

the

fund,

and

Price

Associates.

Under

the

amended

management

agreement,

the

fund

pays

an

annual

all-inclusive fee

that

is

based

on

a

predetermined

fee

schedule

that ranges

from

0.64%

to

0.49%

for

the

Investor

Class

and

0.46%

to

0.34%

for

the

I

Class,

generally

declining

as

the

fund

reduces

its

overall

stock

exposure

along

its

investment

glide

path.

The

annual

all-inclusive fee

covers

investment

management

services

and

all

of

the

fund’s

operating

expenses

except

for

interest

expense;

expenses

related

to

borrowings,

taxes,

and

brokerage; nonrecurring,

extraordinary

expenses;

and

acquired

fund

fees

and

expenses.

Differences

in

the

annual

all-inclusive

fees

between

certain

classes

relate

to

differences

in

expected

shareholder

servicing

expenses. At

December

31,

2024,

the

effective

annual

all-inclusive fee

rate

was

0.54%

for

the

Investor

Class

and 0.38%

for

the

I

Class.

In

addition,

the fund

has entered

into

service

agreements

with

Price

Associates

and

two

wholly

owned

subsidiaries

of

Price

Associates,

each

an

affiliate

of

the

fund

(collectively,

Price).

Price

Associates

provides

certain

accounting

and

administrative

services

to

the

fund.

T.

Rowe

Price

Services,

Inc.

provides

shareholder

and

administrative

services

in

its

capacity

as

the

fund’s

transfer

and

dividend-disbursing

agent.

T.

Rowe

Price

Retirement

Plan

Services,

Inc.

provides

subaccounting

and

recordkeeping

services

for

certain

retirement

accounts

invested

in

the

fund.

Pursuant

to

the

annual

all-inclusive

fee

arrangement

under

the

investment

management

and

administrative

agreement,

expenses

incurred

by

the

fund

pursuant

to

these

service

agreements

are

paid

by

Price

Associates.

T.

Rowe

Price

Investment

Services,

Inc.

(Investment

Services)

serves

as

distributor

to

the

fund.

Pursuant

to

an

underwriting

agreement,

no

compensation

for

any

distribution

services

provided

is

paid

to

Investment

Services

by

the

fund

(except

for

12b-1

fees

under

a

Board-approved

Rule

12b-1

plan).

T.

ROWE

PRICE

Retirement

Income

2025

Fund

The

fund

may

invest

in

the

T.

Rowe

Price

Transition

Fund

(Transition

Fund)

to

facilitate

the fund’s

transition

between

the

various

underlying

Price

Funds

as

the

fund

rebalances

its

allocation

to

the

underlying

Price

Funds.

There

is

no

specific

neutral

allocation

to

the

Transition

Fund.

In

addition,

the

fund

may

also

maintain

a

small

position

in

the

Transition

Fund

when

it

is

not

actively

involved

in

a

transition.

The

fund

does

not

invest

in

the

underlying

Price

Funds

for

the

purpose

of

exercising

management

or

control;

however,

investments

by

the

fund

may

represent

a

significant

portion

of

an

underlying

Price

Fund’s

net

assets.

At

December

31,

2024,

the

fund

held

less

than

25%

of

the

outstanding

shares

of

any

underlying

Price

Fund.

As

of

December

31,

2024,

T.

Rowe

Price

Group,

Inc.,

or

its

wholly

owned

subsidiaries,

owned

75,000

shares

of

the

Investor

Class,

representing

32%

of

the

Investor

Class's

net

assets,

and

25,000

shares

of

the

I

Class,

representing

8%

of

the

I

Class's

net

assets.

NOTE

6

-

SEGMENT

REPORTING

Operating

segments

are

defined

as

components

of

a

company

that

engage

in

business

activities

and

for

which

discrete

financial

information

is

available

and

regularly

reviewed

by

the

chief

operating

decision

maker

(CODM)

in

deciding

how

to

allocate

resources

and

assess

performance.

The

Management

Committee

of

Price

Associates

acts

as

the

fund’s

CODM.

The

fund

makes

investments

in

accordance

with

its

investment

objective

as

outlined

in

the

Prospectus

and

is

considered

one

reportable

segment

because

the

CODM

allocates

resources

and

assesses

the

operating

results

of

the

fund

on

the

whole.

The

fund’s

revenue

is

derived

from

investments

in

portfolio

of

securities.

The

CODM

allocates

resources

and

assesses

performance

based

on

the

operating

results

of

the

fund,

which

is

consistent

with

the

results

presented

in

the

statement

of

operations,

statement

of

changes

in

net

assets

and

financial

highlights.

The

CODM

compares

the

fund’s

performance

to

its

benchmark

index

and

evaluates

the

positioning

of

the

fund

in

relation

to

its

investment

objective.

The

measure

of

segment

assets

is

net

assets

of

the

fund

which

is

disclosed

in

the

statement

of

assets

and

liabilities.

T.

ROWE

PRICE

Retirement

Income

2025

Fund

The

accounting

policies

of

the

segment

are

the

same

as

those

described

in

the

summary

of

significant

accounting

policies.

The

financial

statements

include

all

details

of

the

segment

assets,

segment

revenue

and

expenses;

and

reflect

the

financial

results

of

the

segment.

NOTE

7

-

OTHER

MATTERS

Unpredictable

environmental,

political,

social

and

economic

events,

including

but

not

limited

to,

environmental

or

natural

disasters,

war

and

conflict

(including

Russia’s

military

invasion

of

Ukraine

and

the

conflict

in

Israel,

Gaza

and

surrounding

areas),

terrorism,

geopolitical

developments

(including

trading

and

tariff

arrangements,

sanctions

and

cybersecurity

attacks),

and

public

health

epidemics

(including

the

global

outbreak

of

COVID-19)

and

similar

public

health

threats,

may

significantly

affect

the

economy

and

the

markets

and

issuers

in

which

a

fund

invests.

The

extent

and

duration

of

such

events

and

resulting

market

disruptions

cannot

be

predicted.

These

and

other

similar

events

may

cause

instability

across

global

markets,

including

reduced

liquidity

and

disruptions

in

trading

markets,

while

some

events

may

affect

certain

geographic

regions,

countries,

sectors,

and

industries

more

significantly

than

others,

and

exacerbate

other

pre-existing

political,

social,

and

economic

risks.

The

fund’s

performance

could

be

negatively

impacted

if

the

value

of

a

portfolio

holding

were

harmed

by

these

or

such

events.

Management

actively

monitors

the

risks

and

financial

impacts

arising

from

such

events.

T.

ROWE

PRICE

Retirement

Income

2025

Fund

REPORT

OF

INDEPENDENT

REGISTERED

PUBLIC

ACCOUNTING

FIRM

To

the

Board

of

Directors

of

T.

Rowe

Price

Retirement

Funds,

Inc.

and

Shareholders

of

T.

Rowe

Price

Retirement

Income

2025

Fund

Opinion

on

the

Financial

Statements

We

have

audited

the

accompanying

statement

of

assets

and

liabilities,

including

the

portfolio

of

investments,

of

T.

Rowe

Price

Retirement

Income

2025

Fund

(one

of

the

funds

constituting

T.

Rowe

Price

Retirement

Funds,

Inc.,

referred

to

hereafter

as

the

"Fund")

as

of

December

31,

2024,

and

the

related

statements

of

operations

and

changes

in

net

assets,

including

the

related

notes,

and

the

financial

highlights

for

the

period

January

17,

2024

(inception)

through

December

31,

2024

(collectively

referred

to

as

the

“financial

statements”).

In

our

opinion,

the

financial

statements

present

fairly,

in

all

material

respects,

the

financial

position

of

the

Fund

as

of

December

31,

2024,

and

the

results

of

its

operations,

changes

in

its

net

assets,

and

the

financial

highlights

for

the

period

January

17,

2024

(inception)

through

December

31,

2024

in

conformity

with

accounting

principles

generally

accepted

in

the

United

States