QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21241

RMR REAL ESTATE FUND

(Exact name of registrant as specified in charter)

400 CENTRE STREET

NEWTON, MASSACHUSETTS 02458

(Address of principal executive offices)(Zip code)

(Name and Address of Agent

for Service of Process) |

|

Copy to: |

Thomas M. O'Brien, President

RMR Real Estate Fund

400 Centre Street

Newton, Massachusetts 02458 | | Robert N. Hickey, Esq.

Sullivan & Worcester LLP

1666 K Street, NW

Washington, DC 20006 |

|

|

Karen Jacoppo-Wood, Esq.

State Street Bank and Trust Company

One Federal Street, 9th Floor

Boston, Massachusetts 02110 |

Registrant's telephone number, including area code: (617) 332-9530

Date of fiscal year end: December 31

Date of reporting period: December 31, 2003

Item 1. Reports to Shareholders.

RMR Real Estate Fund

December 31, 2003

To Our Shareholders:

Because we completed the initial public offering of RMR Real Estate Fund in late December 2003, the accompanying financial report and related data covers only a brief period.

Since year end 2003, we have continued to make investments and position the portfolio for the long term. We now expect to issue fund preferred shares before the end of the first calendar quarter of 2004.

On February 11, 2004, our board of trustees announced our first three monthly distributions of 10 cents per share each. This distribution rate, annualized, equates to 8% of our initial public offering price of $15 per share.

Our website, www.rmrfund.com, is operational and we expect to make additional information available through our website during the course of the coming year.

Looking forward, we continue to see what we believe are long term positives for the real estate sector including an aging U.S. population with an increased focus on yield oriented investments and a growing acceptance by money managers of REITs as a portion of a diversified investment program.

We believe these factors, combined with a U.S. economy that appears to be rebounding, make now an excellent time to manage our investment portfolio for stable income over the long term.

Thank you for you continued support of the RMR Real Estate Fund.

Sincerely,

Thomas M. O'Brien

President

1

RMR Real Estate Fund

December 31, 2003

Relevant Market Conditions

During the brief period of the Fund's operations in 2003, the market for real estate securities showed strength, and the Morgan Stanley REIT Index, a total return index which includes a market weighted basket of most of the actively traded equity real estate investment trust, or REIT, shares, closed the year at 585.25, near its highest level ever to that point. Since year end 2003, and through February 13, 2004, this index has continued to grow steadily.

The low interest rate environment brought a fair amount of REIT fixed income securities to market at the end of 2003 and the beginning of 2004.

Fund Strategies, Techniques and Performance

RMR Real Estate Fund's primary objective is to earn and pay its shareholders a high level of current income by investing in securities issued by real estate companies. Our secondary objective is capital appreciation.

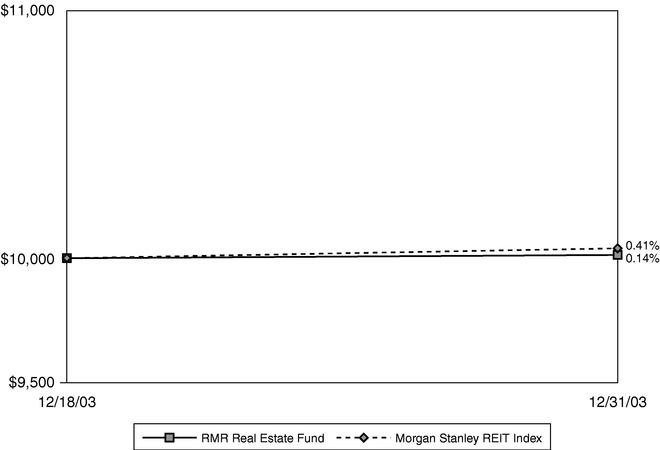

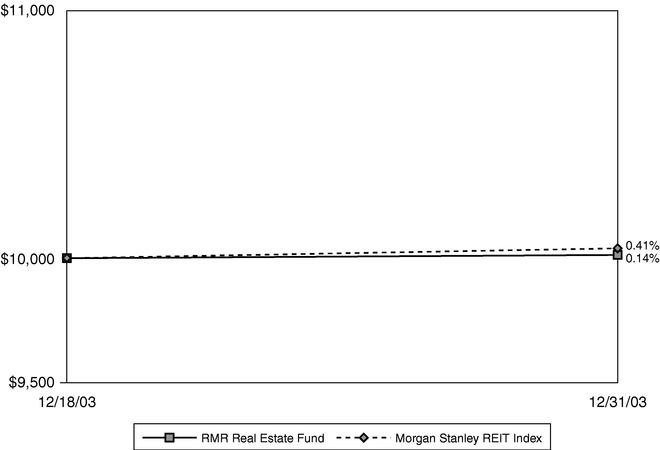

We began investment activities on December 18, 2003, just prior to closing our initial public offering, taking advantage of the three day settlement period common in the market place. During this brief period our total return on the net asset value of our common shares was 0.14%. By comparison the Morgan Stanley REIT Index was 0.41% and the S&P 500 Index (an unmanaged index published as Standard & Poor's Composite Index of 500 Stocks) total return was 1.79% for the same period.

RMR Real Estate Fund

Comparison of a hypothetical $10,000 investment

in the Fund (at NAV) and the Morgan Stanley REIT Index

2

RMR Real Estate Fund

Portfolio of Investments – December 31, 2003

| |

|---|

Company

| | Shares

| | Value

| |

|---|

| |

|---|

Real Estate Investment Trusts – 94.6%

Common Stocks – 85.1% | | | | | | | |

| | Apartments – 29.0% | | | | | | | |

| | | AMLI Residential Properties Trust | | | 106,700 | | $ | 2,859,560 | |

| | | Apartment Investment & Management Co. Class A | | | 135,000 | | | 4,657,500 | |

| | | Avalonbay Communities, Inc. | | | 124,100 | | | 5,931,980 | |

| | | Cornerstone Realty Income Trust, Inc. | | | 75,000 | | | 657,000 | |

| | | Essex Property Trust, Inc. | | | 83,100 | | | 5,336,682 | |

| | | Post Properties, Inc. | | | 150,000 | | | 4,188,000 | |

| | | Summit Properties, Inc. | | | 80,000 | | | 1,921,600 | |

| | | United Dominion Realty Trust, Inc. | | | 115,000 | | | 2,208,000 | |

| | | | | |

| |

| | | | | | | 27,760,322 | |

| | Diversified – 9.5% | | | | | | | |

| | | Bedford Property Investors, Inc. | | | 68,900 | | | 1,972,607 | |

| | | Commercial Net Lease Realty | | | 75,000 | | | 1,335,000 | |

| | | Crescent Real Estate Equities Co. | | | 324,000 | | | 5,550,120 | |

| | | Liberty Property Trust | | | 6,600 | | | 256,740 | |

| | | | | |

| |

| | | | | | | 9,114,467 | |

| | Health Care – 3.5% | | | | | | | |

| | | Health Care REIT, Inc. | | | 12,900 | | | 464,400 | |

| | | Nationwide Health Properties, Inc. | | | 42,000 | | | 821,100 | |

| | | Ventas, Inc. | | | 95,000 | | | 2,090,000 | |

| | | | | |

| |

| | | | | | | 3,375,500 | |

| | Hotels – 1.0% | | | | | | | |

| | | LaSalle Hotel Properties | | | 33,000 | | | 612,150 | |

| | | Winston Hotels, Inc. | | | 28,900 | | | 294,780 | |

| | | | | |

| |

| | | | | | | 906,930 | |

| | Industrial – 4.4% | | | | | | | |

| | | First Industrial Realty Trust, Inc. | | | 125,100 | | | 4,222,125 | |

| | Office Property – 8.8% | | | | | | | |

| | | American Financial Realty Trust | | | 25,000 | | | 426,250 | |

| | | Brandywine Realty Trust | | | 39,300 | | | 1,052,061 | |

| | | Equity Office Properties Trust | | | 20,000 | | | 577,316 | |

| | | Glenborough Realty Trust, Inc. | | | 83,000 | | | 1,655,850 | |

| | | Koger Equity | | | 4,800 | | | 100,464 | |

| | | Mack-Cali Realty Corp. | | | 40,000 | | | 1,668,520 | |

| | | Maguire Properties, Inc. | | | 81,900 | | | 1,990,170 | |

| | | Prentiss Properties Trust | | | 30,000 | | | 981,879 | |

| | | | | |

| |

| | | | | | | 8,452,510 | |

| | Regional Malls – 3.9% | | | | | | | |

| | | CBL & Associates Properties, Inc. | | | 30,000 | | | 1,695,000 | |

| | | Taubman Centers, Inc. | | | 77,100 | | | 1,588,260 | |

| | | The Mills Corp. | | | 10,700 | | | 470,800 | |

| | | | | |

| |

| | | | | | | 3,754,060 | |

| See notes to financial statements and notes to portfolio of investments. | |

3

| | Shopping Centers – 20.3% | | | | | | | |

| | | Federal Realty Investment Trust | | | 107,000 | | $ | 4,107,730 | |

| | | Glimcher Realty Trust | | | 130,000 | | | 2,909,400 | |

| | | Heritage Property Investment Trust | | | 170,000 | | | 4,836,500 | |

| | | Kimco Realty Corp. | | | 86,800 | | | 3,884,300 | |

| | | New Plan Excel Realty Trust | | | 151,100 | | | 3,727,637 | |

| | | | | |

| |

| | | | | | | 19,465,567 | |

| | Specialty – 3.2% | | | | | | | |

| | | Entertainment Properties Trust | | | 14,500 | | | 503,295 | |

| | | Getty Realty Corp. | | | 11,300 | | | 295,495 | |

| | | U.S. Restaurant Properties, Inc. | | | 130,000 | | | 2,215,200 | |

| | | | | |

| |

| | | | | | | 3,013,990 | |

| | Storage – 1.5% | | | | | | | |

| | | Sovran Self Storage, Inc. | | | 39,000 | | | 1,448,850 | |

| Total Common Stocks (Cost $82,183,163) | | | | | | 81,514,321 | |

| Preferred Stocks – 9.2% | | | | | | | |

| | Apartments – 2.2% | | | | | | | |

| | | Apartment Investment & Research Management Co. Series G | | | 20,000 | | | 541,200 | |

| | | Apartment Investment & Research Management Co. Series T | | | 60,000 | | | 1,548,000 | |

| | | | | |

| |

| | | | | | | 2,089,200 | |

| | Diversified – 0.3% | | | | | | | |

| | | First Union Real Estate Equity & Mortgage Investments | | | 5,000 | | | 114,000 | |

| | | Keystone Property Trust Series D | | | 6,500 | | | 176,475 | |

| | | | | |

| |

| | | | | | | 290,475 | |

| | Finance – 0.3% | | | | | | | |

| | | Anthracite Capital, Inc. Series C | | | 10,000 | | | 273,500 | |

| | Health Care – 0.0%* | | | | | | | |

| | | Health Care REIT, Inc. Series D | | | 700 | | | 18,487 | |

| | Hotels – 4.3% | | | | | | | |

| | | FelCor Lodging Trust, Inc. Series A | | | 8,000 | | | 193,440 | |

| | | Equity Inns, Inc. Series B | | | 34,000 | | | 924,460 | |

| | | Innkeepers USA Trust Series C | | | 120,000 | | | 3,000,000 | |

| | | | | |

| |

| | | | | | | 4,117,900 | |

| | Industrial – 0.1% | | | | | | | |

| | | AMB Property Corp. Series L | | | 3,000 | | | 74,250 | |

| See notes to financial statements and notes to portfolio of investments. | |

4

| | Office Property – 0.6% | | | | | | | |

| | | Reckson Associates Realty Corp. | | | 21,800 | | $ | 550,450 | |

| | Regional Malls – 1.4% | | | | | | | |

| | | CBL & Associates Properties, Inc. Series B | | | 20,000 | | | 1,096,000 | |

| | | The Mills Corp. Series B | | | 1,300 | | | 35,802 | |

| | | The Mills Corp. Series E | | | 7,100 | | | 192,410 | |

| | | | | |

| |

| | | | | | | 1,324,212 | |

| | Shopping Centers – 0.0%* | | | | | | | |

| | | Kimco Realty Corp. Series F | | | 700 | | | 18,144 | |

| Total Preferred Stocks (Cost $8,758,377) | | | | | | 8,756,618 | |

| Convertible Preferred Stock – 0.3% | | | | | | | |

| | Health Care – 0.3% | | | | | | | |

| | | LTC Properties, Inc. Series E (Cost $273,476) | | | 8,800 | | | 276,056 | |

| Total Real Estate Investment Trusts (Cost $91,215,016) | | | | | | 90,546,995 | |

| Short-Term Investments – 20.0% | | | | | | | |

| | U.S. Government Agency Security – 16.7% | | | | | | | |

| | | U.S. Treasury Bill 0.65%, 01/02/04 (Cost $15,999,711) | | $ | 16,000,000 | | | 15,999,711 | |

| | Other Investment Companies – 3.3% | | | | | | | |

| | | SSgA Money Market Fund, 0.716%** (Cost $3,170,000) | | | 3,170,000 | | | 3,170,000 | |

| Total Short-Term Investments (Cost $19,169,711) | | | | | | 19,169,711 | |

| Total Investments – 114.6% (Cost $110,384,727) | | | | | | 109,716,706 | |

| Other assets less liabilities including net payable for securities transactions entered but not settled – (14.6%) | | | | | | (13,940,946 | ) |

| Net Assets – 100% | | | | | $ | 95,775,760 | |

Notes to Portfolio of Investments

- *

- Less than 0.05%.

- **

- Rate reflects 7 day yield as of December 31, 2003.

See notes to financial statements and notes to portfolio of investments.

5

RMR Real Estate Fund

Financial Statements

Statement of Assets and Liabilities

| |

|---|

December 31, 2003

| |

| |

|---|

| |

|---|

| Assets | | | | |

| | Investments in securities, at value (cost $110,384,727) | | $ | 109,716,706 | |

| | Cash | | | 8,982 | |

| | Receivable for investment securities sold | | | 10,800,608 | |

| | Dividends and interest receivable | | | 969,822 | |

| | Prepaid expenses | | | 5,000 | |

| | |

| |

| | | Total assets | | | 121,501,118 | |

| | |

| |

| Liabilities | | | | |

| | Payable for investment securities purchased | | | 25,462,469 | |

| | Advisory fee payable | | | 15,781 | |

| | Payable for offering costs | | | 200,010 | |

| | Accrued expenses and other liabilities | | | 47,098 | |

| | |

| |

| | | Total liabilities | | | 25,725,358 | |

| | |

| |

| Net assets | | $ | 95,775,760 | |

| | |

| |

| Composition of net assets | | | | |

| | Common stock, $.001 par value per share; unlimited number of shares authorized,

6,674,000 shares issued and outstanding | | $ | 6,674 | |

| | Additional paid-in capital | | | 95,371,188 | |

| | Undistributed net investment income | | | 822,958 | |

| | Accumulated net realized gain on investment transactions | | | 242,961 | |

| | Net unrealized loss on investments | | | (668,021 | ) |

| | |

| |

| Net assets | | $ | 95,775,760 | |

| | |

| |

| Net asset value per share | | | | |

| | (based on 6,674,000 shares outstanding) | | $ | 14.35 | |

| | |

| |

See notes to financial statements.

6

RMR Real Estate Fund

Financial Statements – continued

Statement of Operations

| |

|---|

For the Period December 18, 2003(a) to December 31, 2003

| |

| |

|---|

| |

|---|

| Investment income | | | | |

| | Dividends | | $ | 966,840 | |

| | Interest | | | 5,626 | |

| | |

| |

| | | Total investment income | | | 972,466 | |

| | |

| |

| Expenses | | | | |

| | Advisory fee | | | 22,357 | |

| | Professional services | | | 7,000 | |

| | Custodian | | | 4,100 | |

| | Printing | | | 3,000 | |

| | Excise tax | | | 31,903 | |

| | Miscellaneous | | | 1,419 | |

| | |

| |

| | | Total expenses | | | 69,779 | |

| | Less: expenses waived by the advisor | | | (6,576 | ) |

| | |

| |

| | | Net expenses | | | 63,203 | |

| | |

| |

| | | | Net investment income | | | 909,263 | |

| | |

| |

| Realized and unrealized gain (loss) on investment transactions | | | | |

| | Net realized gain on investment transactions | | | 124,753 | |

| | Net change in unrealized loss on investments | | | (668,021 | ) |

| | |

| |

| | Net realized and unrealized loss on investment transactions | | | (543,268 | ) |

| | |

| |

| | | Net increase in net assets resulting from operations | | $ | 365,995 | |

| | |

| |

(a) Commencement of operations.

See notes to financial statements.

7

RMR Real Estate Fund

Financial Statements – continued

Statement of Changes in Net Assets

| |

|---|

For the Period December 18, 2003(a) to December 31, 2003

| |

| |

|---|

| |

|---|

| Increase (decrease) in net assets resulting from operations | | | | |

| | Net investment income | | $ | 909,263 | |

| | Net realized gain on investment transactions | | | 124,753 | |

| | Net change in unrealized loss on investments | | | (668,021 | ) |

| | |

| |

| | | Net increase in net assets resulting from operations | | | 365,995 | |

| Capital shares transactions | | | | |

| | Net proceeds from sales of common shares | | | 95,304,765 | |

| | |

| |

| | | Total increase in net assets | | | 95,670,760 | |

| Net assets | | | | |

| | Beginning of period | | | 105,000 | |

| | |

| |

| | End of period (including undistributed net investment income of $822,958) | | $ | 95,775,760 | |

| | |

| |

| Shares issued and repurchased | | | | |

| | Shares outstanding, beginning of period | | | 7,000 | |

| | | Shares sold | | | 6,667,000 | |

| | |

| |

| | Shares outstanding, end of period | | | 6,674,000 | |

| | |

| |

(a) Commencement of operations.

See notes to financial statements.

8

RMR Real Estate Fund

Notes to Financial Statements

December 31, 2003

Note A

(1) Organization

RMR Real Estate Fund (the "Fund") was organized as a Massachusetts business trust on July 2, 2002, and is registered under the Investment Company Act of 1940, as amended, as a non-diversified closed-end management investment company. The Fund had no operations until December 18, 2003, other than matters relating to the Fund's establishment, registration of the Fund's common shares under the Securities Act of 1933, and the sale in 2002 of a total of 7,000 Fund common shares for $105,000 to RMR Advisors, Inc. ("RMR Advisors"). On December 18, 2003, the Fund sold 6,667,000 common shares in an initial public offering. Proceeds to the Fund were $95,304,765 after deducting underwriting commissions and offering expenses of $200,010. On February 4, 2004, the Fund sold an additional 150,000 shares pursuant to an overallotment option. Proceeds to the fund were $2,148,750 after deducting underwriting commissions and offering expenses of $4,500.

(2) Summary of Significant Accounting Policies

Preparation of these financial statements in conformity with accounting principles generally accepted in the United States requires the Fund's management to make estimates and assumptions that may affect the amounts reported in the financial statements and related notes. The actual results could differ from these estimates.

(3) Portfolio Valuation

Investment securities of the Fund are valued at the latest sales price where that price is readily available on that day; securities for which no sales were reported on that day, unless otherwise noted, are valued at the last available bid price on that day. Securities traded primarily on the NASDAQ Stock Market ("NASDAQ") are normally valued by the Fund at the NASDAQ Official Closing Price ("NOCP") provided by NASDAQ each business day. The NOCP is the most recently reported price as of 4:00:06 p.m., Eastern time, unless that price is outside the range of the "inside" bid and asked prices (i.e., the bid and asked prices that dealers quote to each other when trading for their own accounts); in that case, NASDAQ will adjust the price to equal the inside bid or asked price, whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. The Fund values all other securities by a method the Trustees of the Fund believe accurately reflects fair value. Numerous factors may be considered when determining fair value of a security, including available analyst, media or other reports, trading in futures or ADRs and whether the issuer of the security being fair valued has other securities outstanding. Short-term debt securities with less than 60 days until maturity may be valued at cost, which when combined with interest earned, approximates market value.

(4) Securities Transactions and Investment Income

Securities transactions are recorded on a trade date basis. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including accretion of original issue discount, where applicable, and accretion of discount on short-term investments, is recorded on the accrual basis. Realized gains and losses from securities transactions are recorded on the basis of identified cost.

9

(5) Federal Income Taxes

The Fund has qualified and intends to qualify in the future as a "regulated investment company" and to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended, such that it will not be subject to federal income tax.

(6) Distributable Earnings

The Fund earns income, net of expenses, daily on its investments. It is the policy of the Fund to declare and pay dividends from net investment income on a monthly basis. Distributions from net realized capital gains, if any, are normally made in December. Income dividends and capital gain distributions to shareholders are recorded on the ex-dividend date. To the extent the Fund's net realized capital gains, if any, can be offset by capital loss carry-forwards, it is the policy of the Fund not to distribute such gains.

The Fund distinguishes between dividends on a tax basis and a financial reporting basis. Only distributions in excess of accumulated tax basis earnings and profits are reported in the financial statements as a tax return of capital. Differences in the recognition or classification of income between the financial statements and tax earnings and profits which result in temporary over-distributions for financial statement purposes are classified as distributions in excess of net investment income or accumulated net realized gains in the components of net assets on the Statement of Assets and Liabilities.

As of December 31, 2003, the components of distributable earnings (accumulated losses) on a federal income tax basis were as follows:

| Undistributed ordinary income | | $ | 878,539 | |

| Undistributed long-term capital gain | | | 111,155 | |

| Net unrealized appreciation/(depreciation) | | | (591,796 | ) |

Because the Fund made no distributions to shareholders for 2003, it is subject to a Federal excise tax of approximately $31,903 on its undistributed net investment income during the period ended December 31, 2003. The Fund does not expect to incur Federal excise tax in the future.

The cost of investments for federal income tax purposes, gross unrealized appreciation and unrealized depreciation are as follows:

| Cost | | $ | 110,308,502 | |

| | |

| |

| Gross unrealized appreciation | | $ | 288,962 | |

| Gross unrealized depreciation | | | (880,758 | ) |

| | |

| |

| | Net unrealized appreciation/(depreciation) | | $ | (591,796 | ) |

| | |

| |

(7) Organization Expenses and Offering Costs

RMR Advisors has agreed to pay the organizational expenses and offering costs (other than sales load) of the Fund's initial public offering of common shares which exceeded $0.03 per share. The total amount incurred by RMR Advisors is estimated to be $522,000. The Fund incurred offering costs of $200,010. Offering costs incurred by the Fund were charged as a reduction of paid in capital.

10

(8) Concentration of Risk

Under normal market conditions, the Fund's investments will be concentrated in income producing common shares, preferred shares and debt securities, including convertible preferred and debt securities, issued by real estate companies and real estate investment trusts (REITS). The value of Fund shares may fluctuate more than the shares of a fund not concentrated in the real estate industry due to economic, legal, regulatory, technological or other developments affecting the United States real estate industry.

Note B

Advisory and Administration Agreements and Other Transactions with Affiliates

The Fund has an advisory agreement with RMR Advisors to provide the Fund with a continuous investment program, to make day-to-day investment decisions and to generally manage the business affairs of the Fund in accordance with its investment objectives and policies. Pursuant to the agreement, RMR Advisors is compensated at an annual rate of 0.85% of the Fund's average daily managed assets. Managed assets means the total assets of the Fund less liabilities other than the aggregate indebtedness entered into for purposes of leverage. For purposes of calculating managed assets, the liquidation preference of preferred shares or indebtedness outstanding will not be considered a liability.

RMR Advisors has contractually agreed to waive a portion of its annual fee equal to 0.25% of the Fund's average daily managed assets, for the first five years of the Fund's operation after the initial public offering.

RMR Advisors, and not the Fund, has agreed to pay RBC Dain Rauscher Inc., the lead underwriter of the Fund's initial public offering, an annual fee equal to 0.15% of the Fund's managed assets. This fee will be paid quarterly in arrears during the term of RMR Advisors' advisory agreement and is paid by the Advisor, not the Fund. The aggregate fees paid during the term of the contract plus reimbursement of legal expenses of the underwriters will not exceed 4.5% of the total price of the common shares in the initial public offering.

RMR Advisors also performs administrative functions for the Fund pursuant to an administration agreement with the Fund. RMR Advisors has entered into a sub-administration agreement with State Street Bank and Trust Company ("State Street").

No director, officer or employee of the investment advisor, or any affiliate of that entity, receives any compensation from the Fund for serving as an officer or Trustee of the Fund. The Fund pays each Trustee (who is not a director, officer or employee of the investment advisor) (a "Disinterested Trustee") an annual fee of $10,000 plus $1,000 for each Board of Trustees' meeting or committee meeting attended, other than meetings held on days on which there is also a Board of Trustees' meeting or another committee meeting for which they are paid. In addition, the Fund reimburses all Trustees for travel and out-of-pocket expenses incurred in connection with attending Board or committee meetings.

Note C

Securities Transactions

During the period ended December 31, 2003, there were purchases and sales transactions (excluding short-term securities) of $101,890,871 and $10,800,608, respectively. Brokerage commissions on securities transactions amounted to $114,099 during the period ended December 31, 2003.

11

Note D

Capital

At December 31, 2003, the common shares outstanding were 6,674,000, including common shares owned by RMR Advisors purchased at $15 each in connection with the Fund's initial capitalization, and 6,667,000 common shares issued in the Fund's initial public offering of shares at $15 each. On February 4, 2004, the Fund sold an additional 150,000 shares pursuant to an overallotment option.

Note E

Use of Leverage

Subject to market conditions, the Fund intends to offer Preferred Shares representing approximately 331/3% of the Fund's capital after issuance. The Fund may issue Preferred Shares so long as after their issuance the liquidation value of the Preferred Shares, plus the aggregate amount of senior securities representing indebtedness, does not exceed 50% of the Fund's capital.

On February 10, 2004, the Fund entered into a revolving credit agreement with Wachovia Bank, N.A. (Wachovia). This facility matures on August 9, 2004. This facility permits borrowing up to $30,000,000. Funds may be drawn, repaid and redrawn until maturity, and no principal payment is due until maturity. Interest on borrowings under the credit facility are payable at a spread above LIBOR. The Fund intends to repay and cancel the credit agreement upon completion of the Preferred Share offering.

12

Financial Highlights

Selected Data For A Common Share Outstanding Throughout The Period

| |

|---|

| | For the

Period

December 18,

2003(a) to

December 31,

2003

| |

|---|

| |

|---|

| Net asset value, beginning of period | | $ | 14.33 | |

| | |

| |

| Income from Investment Operations | | | | |

| Net investment income(b)(c) | | | .14 | |

| Net realized and unrealized loss on investment transactions | | | (.09 | ) |

| | |

| |

| Net increase in net asset value from operations | | | .05 | |

| Offering costs charged to paid-in capital | | | (.03 | ) |

| | |

| |

| Net asset value, end of period | | $ | 14.35 | |

| | |

| |

| Market price, beginning of period | | $ | 15.00 | |

| | |

| |

| Market price, end of period | | $ | 15.00 | |

| | |

| |

| Total Return(d) | | | | |

| Total investment return based on:(e) | | | | |

| | Market price | | | 0.00 | % |

| | Net asset value | | | 0.14 | % |

| Ratios/Supplemental Data: | | | | |

| Net assets, end of period (000s) | | $ | 95,776 | |

| Ratio to average net assets of: | | | | |

| | Expenses, net of fee waivers(f) | | | 2.40 | % |

| | Expenses, before fee waivers(f) | | | 2.65 | % |

| | Net investment income(c)(f) | | | 34.57 | % |

| Portfolio turnover rate | | | 17.49 | % |

- (a)

- Commencement of operations.

- (b)

- Based on average shares outstanding.

- (c)

- Net of expenses waived by the Advisor.

- (d)

- Not annualized.

- (e)

- Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during the fiscal period. Total return based on per share market price assumes the purchase of common shares at the market price on the first day and sales of common shares at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Results represent past performance and do not guarantee future results. Total return would have been lower if our Advisor had not contractually waived a portion of its investment advisory fee.

- (f)

- Annualized.

13

Report Of Ernst & Young LLP, Independent Auditors

To the Board of Trustees and

Shareholders of RMR Real Estate Fund:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of RMR Real Estate Fund (the "Fund") as of December 31, 2003, and the related statement of operations, the statement of changes in net assets and the financial highlights for the period from December 18, 2003 (commencement of operations) to December 31, 2003. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2003, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of RMR Real Estate Fund at December 31, 2003, the results of its operations, the changes in its net assets and the financial highlights for the period from December 18, 2003 (commencement of operations) to December 31, 2003, in conformity with accounting principles generally accepted in the United States.

Boston, Massachusetts

February 10, 2004

14

RMR Real Estate Fund

December 31, 2003

About information contained in this report:

- •

- Our performance data is historical and reflects historical expenses and historical changes in net asset value. We have been in operation only since December 18, 2003. As a result of this brief history, the financial data herein covers only a brief period of 14 days. Historical results are not indicative of future results.

- •

- If our advisor had not waived fees or paid a portion of our organizational costs, our returns would have been lower.

- •

- An investment in the Fund's shares is subject to material risks, including those summarized below:

No Operating History – The Fund is a newly organized company and has no history of operations prior to December 2003.

Inexperienced Advisor – The Fund's Advisor is an entity recently organized and has no experience managing a registered investment company other than the Fund.

Concentration of Investments – The Fund's investment portfolio is concentrated in the real estate industry. A decline in the market value of real estate generally is likely to cause a decline in the value of the Fund's common shares.

Non-diversification Risk – The Fund's investment portfolio is focused upon securities in one industry. Also, because the Fund is non-diversified under the Investment Company Act of 1940, it can invest a greater percentage of its assets in securities of a single company than can a diversified fund. Accordingly, the market prices of the Fund's common shares may be more volatile than an investment in a diversified fund.

Real Estate Risks – The Fund's investment focus on real estate securities creates risks, including the following:

- •

- Securities of companies that own office or industrial buildings are vulnerable to changes in office or industrial occupancies and rents; securities of companies that own hotels and resorts are highly sensitive to business and leisure travel and general economic conditions; securities of companies that own healthcare facilities, age restricted apartments, congregate care properties, assisted living facilities and nursing homes may be highly dependent upon Medicare and Medicaid payments which are subject to changes in government policies; securities of companies that own retail properties are vulnerable to changes in consumer spending practices and to bankruptcies of large retail firms; securities of companies that own apartment buildings are affected by changes in housing market conditions; and securities of companies that own other types of real estate are subject to risks associated with that type of real estate.

- •

- Many real estate companies in which the Fund invests may be smaller and have more debt than companies traded in the equity markets as a whole. Smaller equity capitalization and more leverage may mean that securities issued by real estate companies may be more volatile than securities issued by larger or less leveraged companies.

- •

- Real estate companies in which the Fund invests are susceptible to other special risks. For example: real estate taxes and property insurance costs have increased materially within the past year; environmental laws have made real estate owners responsible for clean up costs which can be material; and other laws require real estate owners to incur capital expenditures such as laws that require access for disabled persons.

15

Leverage Risks – The Fund intends to use leverage to increase its investments. Holders of the Fund's preferred shares or debt will have priority claims to the Fund's income and assets over an owner of the Fund's common shares. Because the Fund will use leverage, if the value of the Fund's investments declines, the value of the Fund's common shares will decline faster than it would if the Fund had invested without leverage.

Interest Rate Risks – The Fund will be exposed to two principal types of interest rate risks:

- •

- The Fund's cost of leverage will increase as interest rates increase. These increased costs may result in less net income available for distribution to common shareholders.

- •

- When interest rates rise the market values of dividend and interest paying securities usually fall. Because most of the Fund's investments will be in dividend and interest paying securities, and because the Fund expects to make distributions to shareholders, both the Fund's net asset value and the market price of the Fund's common shares are likely to decline when interest rates rise.

The Fund may mitigate, but is unlikely to eliminate, interest rate risks by investing in interest rate hedges. Interest rate risks may be magnified if the Fund hedges interest rates based upon expectations concerning interest rates that prove inaccurate

Market Discount Risk – Shares of closed end investment companies frequently trade at a discount to net asset value.

Redeemable Securities Risks – Most of the preferred securities in which the fund invests provide their issuer a right of redemption at a fixed price. If the issuers exercise their redemption rights, the Fund may not realize the value for any premium the Fund may have paid for these securities.

Low Rated Securities Risks – The Fund may invest up to 25% of its managed assets in ratable securities which are below investment grade. In addition, none of the common equity securities in which the Fund invests are rated. These investments should be considered speculative. Because the Fund invests in speculative securities, an investment in the Fund's common shares involves a greater risk of loss than an investment which is focused only on higher rated securities.

Anti-takeover Provisions – The Fund's declaration of trust and bylaws contain provisions which limit the ability of any person to acquire control of the Fund or to convert the Fund to an open end fund. These provisions may deprive common shareholders of the ability to sell their common shares at a premium to their market value.

Market Disruption Risk – Volatility in securities markets precipitated by terrorist attacks, war or other world events such as those that occurred in 2001, 2002 and 2003 may have long term negative effects on those markets. The value of securities in which the Fund invests and the Fund's common shares may be more volatile or decline in the event of future terrorist activity, war or instability.

An investment in the RMR Real Estate Fund is not a deposit or obligation of, and is not guaranteed or endorsed by, any bank or other depository institution, and is not insured by the Federal Deposit Insurance Corporation or by any other governmental agency.

16

Dividend Reinvestment Plan (unaudited)

We have adopted a dividend reinvestment plan (the "Plan") which is sometimes referred to as an "opt out plan." You will have all of your cash distributions invested in our common shares automatically unless you elect to receive cash. As part of this Plan, you will also have the opportunity to purchase additional common shares by submitting a cash payment for the purchase of such shares (the "Cash Purchase Option"). Your cash payment, if any, for the additional shares may not exceed $10,000 per quarter and must be for a minimum of $100 per quarter. EquiServe Trust Company, N.A. and EquiServe, Inc., an affiliate of EquiServe Trust Company, N.A. and a transfer agent registered with the SEC acting as service agent for EquiServe Trust Company, N.A., as agent for the common shareholders (together, the "Plan Agent"), will receive your distributions and your additional cash payments under the Cash Purchase Option and either purchase our common shares in the open market for your account or directly from us. If you elect not to participate in the Plan, you will receive all cash distributions in cash paid by check mailed to you (or, generally, if your shares are held in street name, to your broker) by EquiServe as our paying agent.

The number of common shares you will receive if you do not opt out will be determined as follows:

(1) If, on the payment date of the distribution, the market price per common share plus estimated per share brokerage commissions applicable to an open market purchase of common shares is below the net asset value per common share on that payment date, the Plan Agent will receive the distribution in cash and, together with your additional cash payments, if any, will purchase common shares in the open market, on the AMEX or elsewhere, for your account prior to the next ex-dividend date. It is possible that the market price for our common shares may increase before the Plan Agent has completed its purchases. Therefore, the average purchase price per share paid by the Plan Agent may exceed the market price at the time of valuation, resulting in the purchase of fewer shares than if the distribution had been paid to you in common shares newly issued by us. In the event it appears that the Plan Agent will not be able to complete the open market purchases prior to the next ex-dividend date, we will determine whether to issue the remaining shares at the greater of (i) net asset value per common share at the time of purchase or (ii) 100% of the per common share market price at the time of purchase. Interest will not be paid on any uninvested amounts.

(2) If, on the payment date of the distribution, the market price per common share plus estimated per share brokerage commissions applicable to an open market purchase of common shares is at or above the net asset value per common share on that payment date, we will issue new shares for your account, at a price equal to the greater of (i) net asset value per common share on that payment date or (ii) 95% of the per common share market price on that payment date.

The Plan Agent* maintains all shareholder accounts in the Plan (including all shares purchased under the Cash Purchase Option) and provides written confirmation of all transactions in the accounts, including information you may need for tax records. Common shares in your account will be held by the Plan Agent* in non-certificated form. Any proxy you receive will include all common shares you have received or purchased under the Plan.

You may withdraw from the Plan at any time by giving written notice to the Plan Agent*. If you withdraw or the Plan is terminated, the Plan Agent* will transfer the shares in your account to you (which may include a cash payment for any fraction of a share in your account). If you wish, the Plan Agent* will sell your shares and send you the proceeds, minus brokerage commissions to be paid by you.

The Plan Agent's administrative fees will be paid by us. There will be no brokerage commission charged with respect to common shares issued directly by us. Each participant will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases of our shares pursuant to the Plan including the Cash Purchase Option. We may amend or terminate the Plan or the Cash Purchase Option

17

if our board of trustees determines the change is warranted. However, no additional charges will be imposed upon participants by amendment to the Plan except after prior notice to Plan participants.

Participation in the Plan will not relieve you of any federal, state or local income tax that may be payable (or required to be withheld) as a result of distributions you receive which are credited to your account under the Plan rather than paid in cash. The automatic reinvestment of distributions in our common shares will not relieve you of tax obligations arising from your receipt of distributions even though you will not receive any cash. All correspondence about the Plan should be directed to EquiServe Trust Company N.A., at P.O. Box 43010, Providence, RI 02940-3010 or by telephone at 1-800-426-5523.

- *

- Shareholders who hold shares of the Fund in "Street Name", that is, through a broker, financial advisor or other intermediary should not contact EquiServe with Plan correspondence, opt-out cash purchase option or other requests. If you own your shares in street name, you must instead contact your broker, financial advisor or intermediary.

18

RMR Real Estate Fund

Trustees and Officers (unaudited)

December 31, 2003

Name, Age and Address

| | Present

Office with

the Fund**

| | Principal Occupation or Employment

During Past Five Years

and Other Directorships

| | Trustee

Since

|

|---|

| Interested Trustees*** | | | | | | |

Barry M. Portnoy

(58) | | Class III Trustee | | Chairman of Reit Management & Research LLC — 1986 to present; Director and Vice President of the Fund's Advisor — July 2002 to present; Managing Director of Five Star Quality Care, Inc. — 2001 to present; Managing Trustee of Senior Housing Properties Trust — 1999 to present; Managing Trustee of Hospitality Properties Trust — 1995 to present; Managing Trustee of HRPT Properties Trust — 1986 to present. | | 2002 |

Gerard M. Martin

(69) | | Class II Trustee | | Director of Reit Management — 1986 to present; Director and Vice President of the Fund's Advisor — July 2002 to present; Managing Director of Five Star Quality Care, Inc. — 2001 to present; Managing Trustee of Senior Housing Properties Trust — 1999 to present; Managing Trustee of Hospitality Properties Trust — 1995 to present; Managing Trustee of HRPT Properties Trust — 1986 to present. | | 2002 |

| Disinterested Trustees | | | | | | |

Frank J. Bailey

(48) | | Class II Trustee | | Partner in the Boston law firm of Sherin and Lodgen LLP; Trustee of Hospitality Properties Trust — 2003 to present; Trustee of Senior Housing Properties Trust — 2002 to present. | | 2003 |

Arthur G. Koumantzelis

(73) | | Class III Trustee | | President and Chief Executive Officer of Gainesborough Investments LLC — June 1998 to present; Trustee of Hospitality Properties Trust — 1995 to present; Director of Five Star Quality Care, Inc. — 2001 to present; Trustee of Senior Housing Properties Trust — 1999 to 2003. | | 2003 |

John L. Harrington

(67) | | Class I Trustee | | Executive Director and Trustee of the Yawkey Foundation (a charitable trust) and a Trustee of the JRY Trust (a charitable trust) — 1982 to present; Chief Executive Officer of the Boston Red Sox Baseball Club — 1982 to 2002; Trustee of Hospitality Properties Trust — 1995 to present; Director of Five Star Quality Care, Inc. — 2001 to January 2004; Trustee of Senior Housing Properties Trust — 1999 to present. | | 2003 |

19

Name, Age and Address

| | Present

Office with

the Fund**

| | Principal Occupation or Employment

During Past Five Years

and Other Directorships

|

|---|

| Executive Officers | | | | |

Thomas M. O'Brien

(37) | | President | | President and Director of the Fund's Advisor — July 2002 to present; Vice President of Reit Management — April 1996 to present; Treasurer and Chief Financial Officer, Hospitality Properties Trust — April 1996 to October 2002; Executive Vice President, Hospitality Properties Trust — October 2002 to December 2003. |

Mark L. Kleifges

(43) | | Treasurer | | Vice President of the Fund's Advisor — December 2003 to present; Vice President of Reit Management — 2002 to present; Treasurer and Chief Financial Officer, Hospitality Properties Trust — 2002 to present; Partner, Arthur Andersen LLP — 1993-2002. |

Adam D. Portnoy

(33) | | Vice President | | Vice President of Reit Management — September 2003 to present; Vice President of the Fund's Advisor — December 2003 to present; Executive Vice President of HRPT Properties Trust — December 2003 to present; Senior Investment Officer, International Finance Corporation — June 2001 to July 2003; Vice President, ABN AMRO Investment Banking — January 2001 to May 2001; President and CEO, Surfree.com, Inc. — June 1997 to June 2000. |

Jennifer B. Clark

(42) | | Secretary | | Vice President of Reit Management — 1999 to present; Clerk of the Fund's Advisor — July 2002 to present; Vice President of HRPT Properties Trust — 1999 to present; Partner, Sullivan & Worcester LLP — 1997 to 1999. |

John C. Popeo

(43) | | Vice President | | Vice President of the Fund's Advisor — July 2002 to present; Treasurer of Reit Management — 1997 to present. Treasurer and Chief Financial Officer of HRPT Properties Trust- 1997 to present; Vice President and Controller of The Beacon Companies — 1996 to 1997. |

- *

- The business address of each listed person is 400 Centre Street, Newton, Massachusetts 02458.

- **

- The Board of Trustees is divided into three classes of Trustees designated as Class I, Class II and Class III. The terms of office of Class I, Class II and Class III Trustees shall expire at the annual meeting of stockholders held in 2005, 2006 and 2007, respectively.

- ***

- Indicates a trustee who is an "interested person" of the Fund within the meaning of the Investment Company Act of 1940, as amended. Mr. Portnoy and Mr. Martin are interested persons of the Fund by virtue of control of the Fund's investment advisor.

20

RMR Real Estate Fund

December 31, 2003

Privacy Policy

The Fund is committed to maintaining shareholder privacy and to safeguard shareholder nonpublic personal information.

The Fund does not receive any nonpublic personal information relating to shareholders who purchase Fund shares through an intermediary that acts as the record owner of the shares. If a shareholder is the record owner of Fund shares, the Fund may receive nonpublic personal information on shareholder account documents or other forms and also have access to specific information regarding shareholder Fund share transactions, either directly or through EquiServe Trust Company, N.A., the Fund's transfer agent.

The Fund does not disclose any nonpublic personal information about shareholders or any former shareholders to anyone, except as permitted by law or as is necessary to service shareholder accounts. The Fund restricts access to nonpublic personal information about shareholders to Fund employees with a legitimate business need for the information.

Proxy Voting Policies and Procedures

A description of the policies and procedures that are used by the Fund's investment advisor to vote proxies relating to the Fund's portfolio securities is available: (1) without charge, upon request, by calling 1-866-790-8165; and (2) as an exhibit to the Fund's annual report on Form N-CSR, which is available on the website of the U.S. Securities and Exchange Commission (the "Commission") at http://www.sec.gov. Information regarding how the investment advisor votes these proxies will become available by calling the same number and on the Commission's website when the Fund files its first report on Form N-PX which is due by August 31, 2004 covering the Fund's proxy voting record for the 12-month period ending June 30, 2004.

Procedures for the Submission of Confidential and Anonymous Concerns or Complaints about Accounting, Internal Accounting Controls or Auditing Matters

The Fund is committed to compliance with all applicable securities laws and regulations, accounting standards, accounting controls and audit practices and has established procedures for handling concerns or complaints about accounting, internal accounting controls or auditing matters. Shareholders may use the Fund's website (http://www.rmrfund.com) to communicate concerns or complaints about accounting, internal accounting controls or auditing matters.

21

Item 2. Code of Ethics.

(a) As of the end of the period, December 31, 2003, the registrant had adopted a code of ethics, as defined in Item 2(b) of Form N-CSR, that applies to the registrant's principal executive officer and principal financial officer.

(c) The registrant has not made any amendment to its code of ethics during the covered period.

(d) The registrant has not granted any waivers from any provisions of the code of ethics during the covered period.

(f) The registrant's code of ethics has been posted on its Internet website at http://www.rmrfund.com.

Item 3. Audit Committee Financial Expert.

(a)(1) The registrant's Board of Trustees (the "Board") has determined that the registrant has at least one member serving on the registrant's Audit Committee that possesses the attributes identified in Item 3 of Form N-CSR to qualify as an "audit committee financial expert."

(a)(2) The name of the audit committee financial expert is Arthur G. Koumantzelis. Mr. Koumantzelis has been deemed to be "independent" as that term is defined in Item 3(a)(2) of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees For the fiscal year ending December 31, 2003, the aggregate audit fees billed were $11,500 for professional services rendered. The nature of the services were: (1) auditing of the statements of assets and liabilities, related statements of operations and changes in net assets, and the financial highlights of the registrant; (2) auditing and reporting on the financial statements that were included in the registrant's registration statement on Form N-2 as filed with the Securities and Exchange Commission; and (3) issuance of a Report on Internal Control for inclusion in the registrant's Form N-SAR.

(b) Audit-Related Fees For the fiscal year ending December 31, 2003, the aggregate audit-related fees billed were $21,000 for the issuance of consents and the preparation and issuance to underwriters of related comfort letters in connection with the registrant's initial public offering of common shares. The registrant's investment advisor has agreed to pay the organizational expenses and offering costs (other than sales load) of the registrant's initial public offering of common shares which exceeded $0.03 per share.

(c) Tax Fees For the fiscal year ending December 31, 2003, the aggregate tax fees billed for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $3,000. Services include the review of the registrant's federal, state and local income, franchise and other tax returns.

(d) All Other Fees There were no other fees billed by the principal accountant for the fiscal year ending December 31, 2003.

(e)(1) Audit Committee Pre-Approval Policies and Procedures Attached to this Form N-CSR as Exhibit 11(c) is a copy of the audit and non-audit services approval policy.

(e)(2) Percentages of Services Not applicable.

(f) Not applicable.

(g) There were no non-audit fees billed by the principal accountant for services rendered to the registrant for the fiscal year ending December 31, 2003. During the same period, the aggregate non-audit fees billed by the principal accountant for services rendered to Reit Management and Research, LLC, the parent company of the registrant's investment advisor, RMR Advisors, Inc., were

$5,000. The non-audit services provided to Reit Management and Research, LLC were comprised of tax services and were not related directly to the operation and financial reporting of the registrant.

(h) The registrant's Audit Committee has determined that the provision of non-audit services by the principal accountant to Reit Management and Research, LLC is compatible with maintaining the principal accountant's independence.

Item 5. Disclosure of Audit Committees for Listed Companies.

(a) The registrant has a separately-designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The members of the registrant's Audit Committee are Frank J. Bailey, John L. Harrington and Arthur G. Koumantzelis.

Item 6. [Reserved by SEC for future use.]

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Attached to this Form N-CSR as Exhibit 11(d) is a copy of the proxy voting policies and procedures for the registrant.

Item 8. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Form N-CSR disclosure requirement not yet effective with respect to the registrant.

Item 9. Submission of Matters to a Vote of Security Holders.

Form N-CSR disclosure requirement not yet effective with respect to the registrant.

Item 10. Controls and Procedures.

(a) The registrant's principal executive officer and principal financial officer have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act")) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934.

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act that occurred during the registrant's second fiscal half-year that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

Item 11. Exhibits.

(a)(2) Certifications of principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the 1940 Act are attached hereto.

(b) Certifications of principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

(c) Audit and non-audit services approval policy of the registrant is attached hereto.

(d) Proxy voting policies and procedures of the registrant are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| RMR REAL ESTATE FUND | | |

By: |

/s/ THOMAS M. O'BRIEN

Thomas M. O'Brien

President |

|

|

Date: |

March 1, 2004

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: |

/s/ THOMAS M. O'BRIEN

Thomas M. O'Brien

President |

|

|

Date: |

March 1, 2004

|

|

|

By: |

/s/ MARK L. KLEIFGES

Mark L. Kleifges

Treasurer |

|

|

Date: |

March 1, 2004

|

|

|

QuickLinks

RMR Real Estate Fund Financial StatementsRMR Real Estate Fund Financial Statements – continuedRMR Real Estate Fund Financial Statements – continuedRMR Real Estate Fund Notes to Financial Statements December 31, 2003RMR Real Estate Fund Trustees and Officers (unaudited) December 31, 2003SIGNATURES