UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21148

Eaton Vance New York Municipal Bond Fund

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

March 31, 2013

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Municipal Bond Funds

Semiannual Report

March 31, 2013

Municipal (EIM) • California (EVM) • New York (ENX)

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. Each Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act and is not subject to the CFTC regulation. Because of its management of other strategies, each Fund’s adviser is registered with the CFTC as a commodity pool operator.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Semiannual Report March 31, 2013

Eaton Vance

Municipal Bond Funds

Table of Contents

| | | | |

| |

Performance and Fund Profile | | | | |

| |

| | | | |

Municipal Bond Fund | | | 2 | |

California Municipal Bond Fund | | | 3 | |

New York Municipal Bond Fund | | | 4 | |

| |

| | | | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Financial Statements | | | 6 | |

| |

Officers and Trustees | | | 34 | |

| |

Important Notices | | | 35 | |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Performance1,2

Portfolio Manager William H. Ahern, Jr., CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Fund at NAV | | | 08/30/2002 | | | | 1.29 | % | | | 10.97 | % | | | 8.64 | % | | | 6.60 | % |

Fund at Market Price | | | — | | | | –2.30 | | | | 11.80 | | | | 8.12 | | | | 6.96 | |

Barclays Capital Long (22+) Municipal Bond Index | | | — | | | | 1.44 | % | | | 7.50 | % | | | 7.32 | % | | | 5.76 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Premium/Discount to NAV | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | –1.08 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Distributions3 | | | | | | | | | | | | | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | | | | | | $0.383 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 5.51 | % |

Taxable-Equivalent Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 9.73 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 5.57 | % |

Taxable-Equivalent Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 9.84 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Leverage4 | | | | | | | | | | | | | | | |

Residual Interest Bond (RIB) | | | | | | | | | | | | | | | | | | | 39.41 | % |

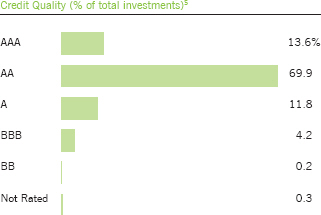

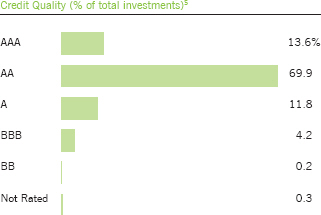

Fund Profile

The above chart includes the ratings of securities held by special purpose vehicles established in connection with the RIB financing.4 Absent such securities, credit quality (% of total investments) is as follows:5

| | | | | | | | | | |

AAA | | | 13.3 | % | | BBB | | | 6.9 | % |

AA | | | 59.5 | | | BB | | | 0.2 | |

A | | | 19.6 | | | Not Rated | | | 0.5 | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Eaton Vance

California Municipal Bond Fund

March 31, 2013

Performance1,2

Portfolio Manager Cynthia J. Clemson

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Fund at NAV | | | 08/30/2002 | | | | 2.16 | % | | | 9.92 | % | | | 6.75 | % | | | 5.55 | % |

Fund at Market Price | | | — | | | | –0.77 | | | | 7.79 | | | | 4.69 | | | | 5.57 | |

Barclays Capital Long (22+) Municipal Bond Index | | | — | | | | 1.44 | % | | | 7.50 | % | | | 7.32 | % | | | 5.76 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Premium/Discount to NAV | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | –5.34 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Distributions3 | | | | | | | | | | | | | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | | | | | | $0.327 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 5.06 | % |

Taxable-Equivalent Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 10.31 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 5.35 | % |

Taxable-Equivalent Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 10.90 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Leverage4 | | | | | | | | | | | | | | | |

RIB | | | | | | | | | | | | | | | | | | | 41.80 | % |

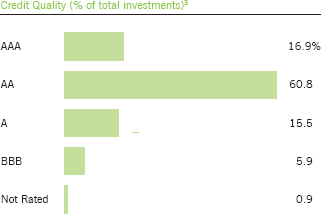

Fund Profile

The above chart includes the ratings of securities held by special purpose vehicles established in connection with the RIB financing.4 Absent such securities, credit quality (%of total investments) is as follows:5

| | | | | | | | | | |

AAA | | | 14.0 | % | | BBB | | | 7.6 | % |

AA | | | 54.9 | | | BB | | | 2.7 | |

A | | | 20.8 | | | | | | | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Eaton Vance

New York Municipal Bond Fund

March 31, 2013

Performance1,2

Portfolio Manager Craig R. Brandon, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Fund at NAV | | | 08/30/2002 | | | | 0.36 | % | | | 8.78 | % | | | 7.48 | % | | | 5.79 | % |

Fund at Market Price | | | — | | | | –2.13 | | | | 9.23 | | | | 7.01 | | | | 6.26 | |

Barclays Capital Long (22+) Municipal Bond Index | | | — | | | | 1.44 | % | | | 7.50 | % | | | 7.32 | % | | | 5.76 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Premium/Discount to NAV | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | –1.13 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Distributions3 | | | | | | | | | | | | | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | | | | | | $0.344 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 4.86 | % |

Taxable-Equivalent Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 9.42 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 4.91 | % |

Taxable-Equivalent Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 9.51 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Leverage4 | | | | | | | | | | | | | | | |

RIB | | | | | | | | | | | | | | | | | | | 38.62 | % |

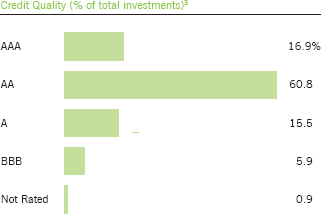

Fund Profile

The above chart includes the ratings of securities held by special purpose vehicles established in connection with the RIB financing.4 Absent such securities, credit quality (% of total investments) is as follows:5

| | | | | | | | | | |

AAA | | | 14.2 | % | | BBB | | | 9.7 | % |

AA | | | 49.3 | | | Not Rated | | | 1.5 | |

A | | | 25.3 | | | | | | | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Eaton Vance

Municipal Bond Funds

March 31, 2013

Endnotes and Additional Disclosures

| 1 | Barclays Capital Long (22+) Municipal Bond Index is an unmanaged index of municipal bonds traded in the U.S. with maturities of 22 years or more. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Performance results reflect the effects of leverage. |

| 3 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be composed of ordinary income, tax-exempt income, net realized capital gains and return of capital. Taxable-equivalent performance is based on the highest combined federal and state income tax rates, where applicable. Lower tax rates would result in lower tax-equivalent performance. Actual tax rates will vary depending on your income, exemptions and deductions. Rates do not include local taxes. |

| 4 | Fund employs RIB financing. The leverage created by RIB investments provides an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater price volatility). The cost of leverage rises and falls with changes in short-term interest rates. See “Floating Rate Notes Issued in Conjunction with Securities Held” in the notes to the financial statements for more information about RIB financing. RIB leverage represents the amount of Floating Rate Notes outstanding at period end as a percentage of Fund net assets plus Floating Rate Notes. Floating Rate Notes reflect adjustments for executed but unsettled RIB transactions, if applicable. |

| 5 | Ratings are based on Moody’s, S&P or Fitch, as applicable. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by Standard and Poor’s or Fitch (Baa or higher by Moody’s) are considered to be investment grade quality. Credit ratings are based largely on the rating agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. If securities are rated differently by the rating agencies, the higher rating is applied. Holdings designated as “Not Rated” are not rated by the national rating agencies stated above. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited)

| | | | | | | | |

| Tax-Exempt Municipal Securities — 163.5% | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Education — 15.0% | |

California Educational Facilities Authority, (University of Southern California), 5.25%, 10/1/38(1) | | $ | 9,750 | | | $ | 11,378,348 | |

Connecticut Health and Educational Facilities Authority, (Wesleyan University), 5.00%, 7/1/39(1) | | | 14,700 | | | | 16,275,546 | |

Houston, TX, Higher Education Finance Corp., (William Marsh Rice University), 5.00%, 5/15/35(1) | | | 15,000 | | | | 17,176,500 | |

Massachusetts Health and Educational Facilities Authority, (Boston College), 5.50%, 6/1/27 | | | 5,810 | | | | 7,405,600 | |

Massachusetts Health and Educational Facilities Authority, (Boston College), 5.50%, 6/1/30 | | | 8,325 | | | | 10,730,259 | |

Massachusetts Health and Educational Facilities Authority, (Harvard University), 5.00%, 10/1/38(1) | | | 2,000 | | | | 2,279,660 | |

Massachusetts Health and Educational Facilities Authority, (Harvard University), 5.50%, 11/15/36 | | | 8,790 | | | | 10,502,028 | |

New York Dormitory Authority, (Rockefeller University), 5.00%, 7/1/40(1) | | | 15,300 | | | | 17,047,413 | |

New York Dormitory Authority, (State University Educational Facilities), 4.00%, 5/15/28 | | | 8,025 | | | | 8,678,235 | |

North Carolina Capital Facilities Finance Agency, (Duke University), 5.00%, 10/1/38(1) | | | 13,500 | | | | 15,678,360 | |

Tennessee School Bond Authority, 5.50%, 5/1/38 | | | 5,000 | | | | 5,793,700 | |

University of California, 5.25%, 5/15/39 | | | 4,450 | | | | 5,181,313 | |

University of Colorado, (University Enterprise Revenue),

5.25%, 6/1/36(1) | | | 10,000 | | | | 11,624,000 | |

University of North Carolina at Charlotte, 5.00%, 4/1/32 | | | 2,090 | | | | 2,425,863 | |

| | |

| | | | | | $ | 142,176,825 | |

| | |

|

Electric Utilities — 2.6% | |

JEA St. Johns River Power Park System Revenue, FL, 4.00%, 10/1/32(1) | | $ | 10,000 | | | $ | 10,305,800 | |

Pima County, AZ, Industrial Development Authority, (Tucson Electric Power Co.), 4.00%, 9/1/29 | | | 2,055 | | | | 2,061,638 | |

South Carolina Public Service Authority, (Santee Cooper), 5.50%, 1/1/38 | | | 7,110 | | | | 8,191,431 | |

Wyandotte County/Kansas City, KS, Unified Government Board of Public Utilities, 5.00%, 9/1/36 | | | 3,425 | | | | 3,832,746 | |

| | |

| | | | | | $ | 24,391,615 | |

| | |

|

Escrowed / Prerefunded — 0.9% | |

Lehigh County, PA, General Purpose Authority, (Lehigh Valley Health Network), Prerefunded to 7/1/13, 5.25%, 7/1/32 | | $ | 8,165 | | | $ | 8,352,060 | |

| | |

| | | | | | $ | 8,352,060 | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

General Obligations — 17.2% | |

Chicago Park District, IL, (Harbor Facilities), 5.25%, 1/1/37(1) | | $ | 8,320 | | | $ | 9,406,925 | |

City & County of San Francisco, CA, (Earthquake Safety & Emergency Response), 4.00%, 6/15/27 | | | 9,080 | | | | 9,793,143 | |

Delaware Valley, PA, Regional Finance Authority, 5.75%, 7/1/32 | | | 3,000 | | | | 3,576,510 | |

Florida Board of Education, 5.00%, 6/1/31 | | | 10,000 | | | | 11,752,900 | |

Frisco, TX, Independent School District, (PSF Guaranteed), 5.00%, 8/15/37 | | | 6,465 | | | | 7,393,439 | |

Georgia, 5.00%, 7/1/29 | | | 10,000 | | | | 11,941,000 | |

Hawaii, 5.00%, 12/1/29 | | | 7,620 | | | | 8,996,172 | |

Hawaii, 5.00%, 12/1/30 | | | 6,500 | | | | 7,646,340 | |

Klein, TX, Independent School District, (PSF Guaranteed), 5.00%, 2/1/36(1) | | | 2,000 | | | | 2,308,540 | |

Mississippi, (Capital Improvements Projects), 5.00%, 10/1/30(1) | | | 10,000 | | | | 11,684,200 | |

Mississippi, (Capital Improvements Projects), 5.00%, 10/1/36 | | | 15 | | | | 17,135 | |

Mississippi, 5.00%, 10/1/36(1) | | | 12,075 | | | | 13,793,755 | |

New York, 5.00%, 12/15/30 | | | 7,660 | | | | 9,016,280 | |

New York, 5.00%, 2/15/36 | | | 5,000 | | | | 5,657,700 | |

North East Independent School District, TX, (PSF Guaranteed), 5.25%, 2/1/28 | | | 2,000 | | | | 2,584,580 | |

Northside Independent School District, TX, (PSF Guaranteed), 5.00%, 6/15/35 | | | 180 | | | | 199,283 | |

Northside Independent School District, TX, (PSF Guaranteed), 5.00%, 6/15/35(1) | | | 12,250 | | | | 13,562,342 | |

Oregon, 5.00%, 8/1/35(1) | | | 6,750 | | | | 7,899,660 | |

Oregon, 5.00%, 8/1/36 | | | 2,000 | | | | 2,332,520 | |

Port of Houston Authority of Harris County, TX, 5.00%, 10/1/35 | | | 7,500 | | | | 8,956,425 | |

Virginia Beach, VA, 4.00%, 4/1/27 | | | 690 | | | | 765,555 | |

Virginia Beach, VA, 4.00%, 4/1/28 | | | 2,820 | | | | 3,105,497 | |

Washington, 4.00%, 7/1/27(1) | | | 10,000 | | | | 10,960,400 | |

| | |

| | | | | | $ | 163,350,301 | |

| | |

|

Hospital — 6.5% | |

California Health Facilities Financing Authority, (Catholic Healthcare West), 5.25%, 3/1/27 | | $ | 1,000 | | | $ | 1,146,390 | |

California Health Facilities Financing Authority, (Catholic Healthcare West), 5.25%, 3/1/28 | | | 1,770 | | | | 2,013,552 | |

California Health Facilities Financing Authority, (Cedars-Sinai Medical Center), 5.00%, 8/15/39 | | | 11,760 | | | | 12,954,698 | |

California Statewide Communities Development Authority, (John Muir Health), 5.00%, 8/15/36 | | | 4,215 | | | | 4,502,168 | |

Camden County, NJ, Improvement Authority, (Cooper Health System), 5.00%, 2/15/35 | | | 2,520 | | | | 2,604,622 | |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Hospital (continued) | |

Camden County, NJ, Improvement Authority, (Cooper Health System), 5.25%, 2/15/27 | | $ | 860 | | | $ | 895,948 | |

Camden County, NJ, Improvement Authority, (Cooper Health System), 5.75%, 2/15/34 | | | 4,535 | | | | 4,763,428 | |

Hawaii Department of Budget and Finance, (Hawaii Pacific Health), 5.60%, 7/1/33 | | | 3,900 | | | | 3,916,224 | |

Highlands County, FL, Health Facilities Authority, (Adventist Health System), 5.25%, 11/15/36 | | | 7,190 | | | | 7,964,507 | |

Knox County, TN, Health, Educational and Housing Facilities Board, (Covenant Health), 0.00%, 1/1/38 | | | 8,310 | | | | 2,449,622 | |

Knox County, TN, Health, Educational and Housing Facilities Board, (Covenant Health), 0.00%, 1/1/41 | | | 10,000 | | | | 2,512,900 | |

Michigan Hospital Finance Authority, (Henry Ford Health System), 5.25%, 11/15/46 | | | 5,355 | | | | 5,649,418 | |

Orange County, FL, Health Facilities Authority, (Orlando Health, Inc.), 5.00%, 10/1/42 | | | 2,000 | | | | 2,180,840 | |

South Miami, FL, Health Facilities Authority, (Baptist Health South Florida Obligated Group), 5.00%, 8/15/42 | | | 100 | | | | 107,354 | |

South Miami, FL, Health Facilities Authority, (Baptist Health South Florida Obligated Group), 5.00%, 8/15/42(1) | | | 900 | | | | 966,186 | |

Tarrant County, TX, Cultural Education Facilities Finance Corp., (Scott & White Healthcare), 5.25%, 8/15/40 | | | 6,105 | | | | 6,775,512 | |

| | |

| | | | | | $ | 61,403,369 | |

| | |

|

Industrial Development Revenue — 1.7% | |

New York Liberty Development Corp., (Goldman Sachs Group, Inc.), 5.25%, 10/1/35 | | $ | 9,160 | | | $ | 10,735,886 | |

St. Charles Parish, LA, (Valero Energy Corp.), 4.00% to 6/1/22 (Put Date), 12/1/40 | | | 1,000 | | | | 1,098,170 | |

St. John Baptist Parish, LA, (Marathon Oil Corp.), 5.125%, 6/1/37 | | | 4,370 | | | | 4,632,943 | |

| | |

| | | | | | $ | 16,466,999 | |

| | |

|

Insured – Education — 2.9% | |

Massachusetts Development Finance Agency, (College of the Holy Cross), (AMBAC), 5.25%, 9/1/32 | | $ | 14,400 | | | $ | 18,560,160 | |

Miami-Dade County, FL, Educational Facilities Authority, (University of Miami), (AMBAC), (BHAC), 5.00%, 4/1/31 | | | 7,865 | | | | 8,708,679 | |

| | |

| | | | | | $ | 27,268,839 | |

| | |

|

Insured – Electric Utilities — 3.6% | |

American Municipal Power-Ohio, Inc., OH, (Prairie State Energy Campus), (AGC), 5.75%, 2/15/39 | | $ | 5,000 | | | $ | 5,662,550 | |

Long Island Power Authority, NY, Electric System Revenue, (BHAC), 5.50%, 5/1/33 | | | 1,350 | | | | 1,589,018 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Electric Utilities (continued) | |

Mississippi Development Bank, (Municipal Energy), (XLCA), 5.00%, 3/1/41 | | $ | 13,895 | | | $ | 14,185,961 | |

Paducah, KY, Electric Plant Board, (AGC), 5.25%, 10/1/35 | | | 2,735 | | | | 3,011,782 | |

South Carolina Public Service Authority, (Santee Cooper), (BHAC), 5.50%, 1/1/38 | | | 7,840 | | | | 9,229,483 | |

| | |

| | | | | | $ | 33,678,794 | |

| | |

|

Insured – Escrowed / Prerefunded — 0.6% | |

Centre County, PA, Hospital Authority, (Mount Nittany Medical Center), (AGC), Prerefunded to 11/15/14, 6.125%, 11/15/39 | | $ | 3,950 | | | $ | 4,321,576 | |

Centre County, PA, Hospital Authority, (Mount Nittany Medical Center), (AGC), Prerefunded to 11/15/14, 6.25%, 11/15/44 | | | 1,050 | | | | 1,150,905 | |

| | |

| | | | | | $ | 5,472,481 | |

| | |

|

Insured – General Obligations — 10.7% | |

Cincinnati, OH, City School District, (AGM), (FGIC), 5.25%, 12/1/30 | | $ | 3,750 | | | $ | 4,928,138 | |

Clark County, NV, (AMBAC), 2.50%, 11/1/36 | | | 11,845 | | | | 9,483,818 | |

Frisco, TX, Independent School District, (AGM), (PSF Guaranteed), 2.75%, 8/15/39 | | | 9,530 | | | | 8,842,125 | |

Kane, Cook and DuPage Counties, IL, School District No. 46, (AMBAC), 0.00%, 1/1/22 | | | 39,750 | | | | 30,427,432 | |

King County, WA, Public Hospital District No. 1, (AGC), 5.00%, 12/1/37(1) | | | 7,000 | | | | 7,670,390 | |

Palm Springs, CA, Unified School District, (AGC), 5.00%, 8/1/32 | | | 8,955 | | | | 10,034,078 | |

Port Arthur, TX, Independent School District, (AGC), 4.75%, 2/15/38 | | | 95 | | | | 104,372 | |

Port Arthur, TX, Independent School District, (AGC), 4.75%, 2/15/38(1) | | | 10,950 | | | | 12,030,217 | |

Schaumburg, IL, (BHAC), (FGIC), 5.00%, 12/1/38(1) | | | 12,750 | | | | 13,484,012 | |

Yuma and La Paz Counties, AZ, Community College District, (Arizona Western College), (NPFG), 3.75%, 7/1/31 | | | 4,275 | | | | 4,362,338 | |

| | |

| | | | | | $ | 101,366,920 | |

| | |

|

Insured – Hospital — 16.1% | |

Arizona Health Facilities Authority, (Banner Health), (BHAC), 5.375%, 1/1/32 | | $ | 8,250 | | | $ | 9,149,085 | |

California Statewide Communities Development Authority, (Sutter Health), (AGM), 5.05%, 8/15/38(1) | | | 11,000 | | | | 12,226,170 | |

Colorado Health Facilities Authority, (Catholic Health), (AGM), 5.10%, 10/1/41(1) | | | 11,500 | | | | 12,418,045 | |

Highlands County, FL, Health Facilities Authority, (Adventist Health System), (BHAC), 5.25%, 11/15/36(1) | | | 15,500 | | | | 17,204,070 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Hospital (continued) | |

Highlands County, FL, Health Facilities Authority, (Adventist Health System), (NPFG), 5.00%, 11/15/35 | | $ | 3,795 | | | $ | 4,070,593 | |

Illinois Finance Authority, (Children’s Memorial Hospital), (AGC), 5.25%, 8/15/47(1) | | | 15,000 | | | | 15,956,400 | |

Indiana Health and Educational Facility Finance Authority, (Sisters of St. Francis Health Services), (AGM), 5.25%, 5/15/41(1) | | | 2,500 | | | | 2,671,675 | |

Iowa Finance Authority, Health Facilities, (Iowa Health System), (AGC), 5.625%, 8/15/37 | | | 2,625 | | | | 2,954,962 | |

Maricopa County, AZ, Industrial Development Authority, (Catholic Healthcare West), (BHAC), 5.25%, 7/1/32 | | | 1,675 | | | | 1,879,719 | |

Maryland Health and Higher Educational Facilities Authority, (LifeBridge Health), (AGC), 4.75%, 7/1/47(1) | | | 19,150 | | | | 19,734,841 | |

New Jersey Health Care Facilities Financing Authority, (Hackensack University Medical Center), (AGC), 5.25%, 1/1/36 | | | 5,250 | | | | 5,626,582 | |

New Jersey Health Care Facilities Financing Authority, (Meridian Health System), Series II, (AGC), 5.00%, 7/1/38 | | | 545 | | | | 578,943 | |

New Jersey Health Care Facilities Financing Authority, (Meridian Health System), Series V, (AGC), 5.00%, 7/1/38 | | | 410 | | | | 435,535 | |

New Jersey Health Care Facilities Financing Authority, (Meridian Health System), Series V, (AGC), 5.00%, 7/1/38(1) | | | 3,250 | | | | 3,452,410 | |

New Jersey Health Care Facilities Financing Authority, (Virtua Health), (AGC), 5.50%, 7/1/38 | | | 13,115 | | | | 14,449,189 | |

Washington Health Care Facilities Authority, (MultiCare Health System), (AGC), 6.00%, 8/15/39 | | | 5,795 | | | | 6,688,009 | |

Washington Health Care Facilities Authority, (Providence Health Care), Series C, (AGM), 5.25%, 10/1/33(1) | | | 8,700 | | | | 9,517,101 | |

Washington Health Care Facilities Authority, (Providence Health Care), Series D, (AGM), 5.25%, 10/1/33(1) | | | 12,605 | | | | 13,795,163 | |

| | |

| | | | | | $ | 152,808,492 | |

| | |

|

Insured – Industrial Development Revenue — 1.1% | |

Pennsylvania Economic Development Financing Authority, (Aqua Pennsylvania, Inc. Project), (BHAC), 5.00%, 10/1/39(1) | | $ | 9,000 | | | $ | 9,964,530 | |

| | |

| | | | | | $ | 9,964,530 | |

| | |

|

Insured – Lease Revenue / Certificates of Participation — 9.2% | |

New Jersey Economic Development Authority, (School Facilities Construction), (AGC), 5.50%, 12/15/34 | | $ | 2,910 | | | $ | 3,375,222 | |

San Diego County, CA, Water Authority, Certificates of Participation, (AGM), 5.00%, 5/1/38(1) | | | 24,000 | | | | 26,671,680 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Lease Revenue / Certificates of Participation (continued) | |

San Jose, CA, Financing Authority, (Civic Center), (AMBAC), (BHAC), 5.00%, 6/1/37(1) | | $ | 42,750 | | | $ | 42,888,937 | |

Tri-Creek Middle School Building Corp., IN, (AGM), 5.25%, 1/15/34(1) | | | 13,000 | | | | 14,152,970 | |

| | |

| | | | | | $ | 87,088,809 | |

| | |

|

Insured – Other Revenue — 4.3% | |

Golden State Tobacco Securitization Corp., CA, (AGC), 5.00%, 6/1/45(1) | | $ | 25,875 | | | $ | 27,097,853 | |

Harris County-Houston, TX, Sports Authority, (NPFG), 0.00%, 11/15/34 | | | 16,795 | | | | 5,608,522 | |

New York, NY, Industrial Development Agency, (Yankee Stadium), (AGC), 7.00%, 3/1/49 | | | 6,750 | | | | 8,318,835 | |

| | |

| | | | | | $ | 41,025,210 | |

| | |

|

Insured – Solid Waste — 0.5% | |

Palm Beach County, FL, Solid Waste Authority, (BHAC), 5.00%, 10/1/24 | | $ | 2,760 | | | $ | 3,299,580 | |

Palm Beach County, FL, Solid Waste Authority, (BHAC), 5.00%, 10/1/26 | | | 1,575 | | | | 1,873,321 | |

| | |

| | | | | | $ | 5,172,901 | |

| | |

|

Insured – Special Tax Revenue — 6.1% | |

Alabama Public School and College Authority, (AGM), 2.50%, 12/1/27 | | $ | 17,940 | | | $ | 17,016,628 | |

Houston, TX, Hotel Occupancy Tax, (AMBAC), 0.00%, 9/1/24 | | | 18,035 | | | | 11,273,679 | |

Miami-Dade County, FL, Professional Sports Franchise Facilities, (AGC), 7.00%, (0.00% until 10/1/19), 10/1/39 | | | 15,000 | | | | 12,960,450 | |

Puerto Rico Sales Tax Financing Corp., (NPFG), 0.00%, 8/1/45 | | | 28,945 | | | | 4,388,062 | |

Utah Transportation Authority, Sales Tax Revenue, (AGM), 4.75%, 6/15/32(1) | | | 10,800 | | | | 12,206,152 | |

| | |

| | | | | | $ | 57,844,971 | |

| | |

|

Insured – Student Loan — 0.9% | |

Maine Educational Loan Authority, (AGC), 5.625%, 12/1/27 | | $ | 7,435 | | | $ | 8,343,334 | |

| | |

| | | | | | $ | 8,343,334 | |

| | |

|

Insured – Transportation — 20.6% | |

Chicago, IL, (O’Hare International Airport), (AGM), 4.75%, 1/1/34(1) | | $ | 21,640 | | | $ | 22,991,632 | |

Clark County, NV, (Las Vegas-McCarran International Airport), (AGM), 5.25%, 7/1/39 | | | 8,080 | | | | 9,019,300 | |

Director of the State of Nevada Department of Business and Industry, (Las Vegas Monorail), (AMBAC), 0.00%, 1/1/23(2) | | | 10,070 | | | | 874,982 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Transportation (continued) | |

Director of the State of Nevada Department of Business and Industry, (Las Vegas Monorail), (AMBAC), 0.00%, 1/1/28(2) | | $ | 3,100 | | | $ | 182,559 | |

Director of the State of Nevada Department of Business and Industry, (Las Vegas Monorail), (AMBAC), 5.375%, 1/1/40(6) | | | 15,000 | | | | 3,622,200 | |

E-470 Public Highway Authority, CO, (NPFG), 0.00%, 9/1/21 | | | 10,200 | | | | 7,617,768 | |

E-470 Public Highway Authority, CO, (NPFG), 0.00%, 9/1/39 | | | 25,000 | | | | 6,228,500 | |

Harris County, TX, Toll Road, Senior Lien, (BHAC), (NPFG), 5.00%, 8/15/33(1) | | | 7,800 | | | | 8,784,594 | |

Manchester, NH, (Manchester-Boston Regional Airport), (AGM), 5.125%, 1/1/30 | | | 6,710 | | | | 7,337,855 | |

Maryland Transportation Authority, (AGM), 5.00%, 7/1/35(1) | | | 20,995 | | | | 23,762,338 | |

Maryland Transportation Authority, (AGM), 5.00%, 7/1/36(1) | | | 14,000 | | | | 15,736,840 | |

Metropolitan Washington, D.C., Airports Authority, (BHAC), 5.00%, 10/1/29 | | | 1,785 | | | | 2,034,596 | |

New Jersey Transportation Trust Fund Authority, (AGC), 5.50%, 12/15/38 | | | 11,700 | | | | 13,507,767 | |

North Carolina Turnpike Authority, (Triangle Expressway System), (AGC), 5.50%, 1/1/29 | | | 1,015 | | | | 1,158,897 | |

North Carolina Turnpike Authority, (Triangle Expressway System), (AGC), 5.75%, 1/1/39 | | | 1,160 | | | | 1,329,801 | |

North Texas Tollway Authority, (BHAC), 5.75%, 1/1/48(1) | | | 20,000 | | | | 23,234,400 | |

Port Authority of New York and New Jersey, (AGM), 5.00%, 8/15/26(1) | | | 10,000 | | | | 11,414,900 | |

Port Palm Beach District, FL, (XLCA), 0.00%, 9/1/24 | | | 1,605 | | | | 847,328 | |

Port Palm Beach District, FL, (XLCA), 0.00%, 9/1/25 | | | 1,950 | | | | 967,629 | |

Port Palm Beach District, FL, (XLCA), 0.00%, 9/1/26 | | | 1,000 | | | | 466,630 | |

San Joaquin Hills Transportation Corridor Agency, CA, (Toll Road Bonds), (NPFG), 0.00%, 1/15/25 | | | 26,215 | | | | 14,740,957 | |

Texas Turnpike Authority, (AMBAC), 0.00%, 8/15/20 | | | 23,845 | | | | 19,412,453 | |

| | |

| | | | | | $ | 195,273,926 | |

| | |

|

Insured – Water and Sewer — 15.0% | |

Austin, TX, Water and Wastewater, (AGM), (BHAC), 5.00%, 11/15/33(1) | | $ | 2,000 | | | $ | 2,232,200 | |

Bossier City, LA, Utilities Revenue, (BHAC), 5.25%, 10/1/26 | | | 3,185 | | | | 3,662,973 | |

Bossier City, LA, Utilities Revenue, (BHAC), 5.25%, 10/1/27 | | | 1,985 | | | | 2,287,335 | |

Bossier City, LA, Utilities Revenue, (BHAC), 5.50%, 10/1/38 | | | 3,170 | | | | 3,660,050 | |

Chicago, IL, Wastewater Transmission Revenue, (BHAC), 5.50%, 1/1/38 | | | 3,060 | | | | 3,486,258 | |

Chicago, IL, Wastewater Transmission Revenue, (NPFG), 0.00%, 1/1/23 | | | 13,670 | | | | 9,832,831 | |

DeKalb County, GA, Water and Sewer, (AGM), 5.25%, 10/1/32(1) | | | 10,000 | | | | 12,351,900 | |

District of Columbia Water and Sewer Authority, (AGC), 5.00%, 10/1/34(1) | | | 8,500 | | | | 9,766,330 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Water and Sewer (continued) | |

Houston, TX, Utility System, (AGM), (BHAC), 5.00%, 11/15/33(1) | | $ | 27,570 | | | $ | 31,194,348 | |

Massachusetts Water Resources Authority, (AGM), 5.25%, 8/1/32 | | | 5,540 | | | | 7,154,134 | |

Massachusetts Water Resources Authority, (AGM), 5.25%, 8/1/38 | | | 1,070 | | | | 1,403,316 | |

Massachusetts Water Resources Authority, (AMBAC), (BHAC), 4.00%, 8/1/40 | | | 9,095 | | | | 9,269,988 | |

New York, NY, Municipal Water Finance Authority, (BHAC), 5.75%, 6/15/40(1) | | | 9,500 | | | | 11,281,155 | |

San Luis Obispo County, CA, (Nacimiento Water Project), (NPFG), 4.50%, 9/1/40 | | | 3,535 | | | | 3,612,417 | |

Seattle, WA, Drain and Wastewater Revenue, (AGM), 5.00%, 6/1/38(1) | | | 27,670 | | | | 31,031,624 | |

| | |

| | | | | | $ | 142,226,859 | |

| | |

|

Lease Revenue / Certificates of Participation — 1.6% | |

Hudson Yards Infrastructure Corp., NY, 5.75%, 2/15/47 | | $ | 2,565 | | | $ | 3,007,950 | |

North Carolina, Capital Improvement Limited Obligation Bonds, 5.00%, 5/1/30 | | | 335 | | | | 387,628 | |

North Carolina, Capital Improvement Limited Obligation Bonds, 5.00%, 5/1/30(1) | | | 10,000 | | | | 11,571,000 | |

| | |

| | | | | | $ | 14,966,578 | |

| | |

|

Other Revenue — 3.0% | |

New York, NY, Transitional Finance Authority, Building Aid Revenue, 5.00%, 7/15/36(1) | | $ | 10,750 | | | $ | 12,128,903 | |

Oregon Department of Administrative Services, Lottery Revenue, 5.25%, 4/1/30 | | | 9,200 | | | | 11,096,304 | |

Texas Municipal Gas Acquisition and Supply Corp. III, Gas Supply Revenue, 5.00%, 12/15/31 | | | 1,440 | | | | 1,528,128 | |

Texas Municipal Gas Acquisition and Supply Corp. III, Gas Supply Revenue, 5.00%, 12/15/32 | | | 3,395 | | | | 3,588,922 | |

| | | | | | | | | |

| | | | | | $ | 28,342,257 | |

| | | | | | | | | |

|

Senior Living / Life Care — 0.1% | |

Maryland Health and Higher Educational Facilities Authority, (Charlestown Community, Inc.), 6.125%, 1/1/30 | | $ | 1,175 | | | $ | 1,354,011 | |

| | |

| | | | | | $ | 1,354,011 | |

| | |

|

Special Tax Revenue — 5.1% | |

Michigan Trunk Line Fund, 5.00%, 11/15/30 | | $ | 1,390 | | | $ | 1,618,919 | |

Michigan Trunk Line Fund, 5.00%, 11/15/31 | | | 1,500 | | | | 1,743,285 | |

Michigan Trunk Line Fund, 5.00%, 11/15/33 | | | 1,285 | | | | 1,480,680 | |

Michigan Trunk Line Fund, 5.00%, 11/15/36 | | | 1,020 | | | | 1,167,808 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Special Tax Revenue (continued) | |

New York City Transitional Finance Authority, Future Tax Revenue, 5.00%, 2/1/37(1) | | $ | 20,000 | | | $ | 22,744,200 | |

New York Dormitory Authority, Personal Income Tax Revenue, 5.00%, 12/15/32 | | | 7,180 | | | | 8,332,749 | |

New York Urban Development Corp., Personal Income Tax Revenue, 5.00%, 3/15/31 | | | 10,000 | | | | 11,396,000 | |

| | |

| | | | | | $ | 48,483,641 | |

| | |

|

Transportation — 10.5% | |

Delaware River Port Authority of Pennsylvania and New Jersey, 5.00%, 1/1/35 | | $ | 8,275 | | | $ | 9,223,977 | |

Los Angeles, CA, Department of Airports, (Los Angeles International Airport), 5.25%, 5/15/28 | | | 3,285 | | | | 3,856,327 | |

Metropolitan Transportation Authority, NY, 5.25%, 11/15/38 | | | 4,640 | | | | 5,212,576 | |

Metropolitan Transportation Authority, NY, 5.25%, 11/15/40 | | | 6,735 | | | | 7,520,436 | |

Miami-Dade County, FL, (Miami International Airport), 5.00%, 10/1/41 | | | 10,940 | | | | 12,079,839 | |

New Jersey Transportation Trust Fund Authority, (Transportation System), 5.00%, 12/15/24 | | | 10,000 | | | | 12,169,300 | |

New York Thruway Authority, 5.00%, 1/1/37 | | | 780 | | | | 866,627 | |

New York Thruway Authority, 5.00%, 1/1/42 | | | 4,695 | | | | 5,160,697 | |

Orlando-Orange County, FL, Expressway Authority, Series A, 5.00%, 7/1/35 | | | 2,915 | | | | 3,205,713 | |

Orlando-Orange County, FL, Expressway Authority, Series A, 5.00%, 7/1/40 | | | 2,590 | | | | 2,827,451 | |

Pennsylvania Turnpike Commission, 6.00%, (0.00% until 12/1/15), 12/1/34 | | | 5,000 | | | | 4,906,350 | |

Port Authority of New York and New Jersey, 4.00%, 7/15/32(1) | | | 9,650 | | | | 10,410,323 | |

Port Authority of New York and New Jersey, 4.75%, 7/15/31 | | | 4,300 | | | | 4,750,554 | |

Port Authority of New York and New Jersey, 5.00%, 7/15/39 | | | 5,000 | | | | 5,586,500 | |

Texas Transportation Commission, (Central Texas Turnpike System), 5.00%, 8/15/41 | | | 5,320 | | | | 5,734,641 | |

Triborough Bridge and Tunnel Authority, NY, 5.00%, 11/15/33 | | | 5,000 | | | | 5,651,200 | |

| | |

| | | | | | $ | 99,162,511 | |

| | |

|

Water and Sewer — 7.7% | |

California Department of Water Resources, (Central Valley Project), 5.25%, 12/1/35(1) | | $ | 10,000 | | | $ | 12,021,500 | |

Charleston, SC, Waterworks and Sewer Revenue, 5.00%, 1/1/35 | | | 2,735 | | | | 3,142,625 | |

Chicago, IL, Water Revenue, 5.00%, 11/1/42 | | | 5,000 | | | | 5,565,500 | |

Detroit, MI, Sewage Disposal System, 5.00%, 7/1/32 | | | 1,070 | | | | 1,154,198 | |

Detroit, MI, Sewage Disposal System, 5.25%, 7/1/39 | | | 1,785 | | | | 1,930,977 | |

Honolulu, HI, City and County Wastewater System, 5.25%, 7/1/36(1) | | | 9,750 | | | | 11,347,538 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Water and Sewer (continued) | |

King County, WA, Sewer Revenue, 5.00%, 1/1/34(1) | | $ | 10,000 | | | $ | 11,334,000 | |

Marco Island, FL, Utility System, 5.00%, 10/1/34 | | | 1,445 | | | | 1,598,589 | |

Marco Island, FL, Utility System, 5.00%, 10/1/40 | | | 6,325 | | | | 6,940,106 | |

New York Municipal Water Finance Authority, 5.00%, 6/15/34 | | | 10,000 | | | | 11,387,500 | |

Portland, OR, Water System, 5.00%, 5/1/36 | | | 5,385 | | | | 6,163,941 | |

| | |

| | | | | | $ | 72,586,474 | |

| | |

| |

Total Tax-Exempt Municipal Securities — 163.5%

(identified cost $1,426,171,525) | | | $ | 1,548,572,707 | |

| | | | | | | | | |

|

| Corporate Bonds & Notes — 0.0%(3) | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

Municipal — 0.0%(3) | |

Las Vegas Monorail Co., Jr. Subordinated Notes, 3.00% to 12/31/15,

5.50%, 7/15/55(4)(5) | | $ | 125 | | | $ | 0 | |

Las Vegas Monorail Co., Sr. Secured Notes, 5.50%, 7/15/19(4)(5) | | | 416 | | | | 208,140 | |

| | | | | | | | | |

| |

Total Corporate Bonds & Notes — 0.0%(3)

(identified cost $0) | | | $ | 208,140 | |

| | |

| |

Total Investments — 163.5%

(identified cost $1,426,171,525) | | | $ | 1,548,780,847 | |

| | |

| |

Other Assets, Less Liabilities — (63.5)% | | | $ | (601,395,341 | ) |

| | |

| |

Net Assets — 100.0% | | | $ | 947,385,506 | |

| | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| | | | |

| AGC | | – | | Assured Guaranty Corp. |

| AGM | | – | | Assured Guaranty Municipal Corp. |

| AMBAC | | – | | AMBAC Financial Group, Inc. |

| BHAC | | – | | Berkshire Hathaway Assurance Corp. |

| FGIC | | – | | Financial Guaranty Insurance Company |

| NPFG | | – | | National Public Finance Guaranty Corp. |

| PSF | | – | | Permanent School Fund |

| XLCA | | – | | XL Capital Assurance, Inc. |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

At March 31, 2013, the concentration of the Fund’s investments in the various states, determined as a percentage of total investments, is as follows:

| | | | |

| California | | | 12.9% | |

| New York | | | 12.8% | |

| Texas | | | 12.4% | |

| Others, representing less than 10% individually | | | 61.9% | |

The Fund invests primarily in debt securities issued by municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. In order to reduce the risk associated with such economic developments, at March 31, 2013, 56.0% of total investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution ranged from 1.1% to 20.0% of total investments.

| (1) | Security represents the municipal bond held by a trust that issues residual interest bonds (see Note 1H). |

| (2) | Defaulted security. Issuer has defaulted on the payment of interest or has filed for bankruptcy. |

| (3) | Amount is less than 0.05%. |

| (4) | Represents a payment-in-kind security which may pay all or a portion of interest in additional par. |

| (5) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 9). |

| (6) | Security is in default and making only partial interest payments. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

California Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited)

| | | | | | | | |

| Tax-Exempt Investments — 170.2% | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Education — 15.1% | |

California Educational Facilities Authority, (California Institute of Technology), 5.00%, 11/1/39(1) | | $ | 10,000 | | | $ | 11,172,000 | |

California Educational Facilities Authority, (Claremont McKenna College), 5.00%, 1/1/27 | | | 2,680 | | | | 3,079,240 | |

California Educational Facilities Authority, (Harvey Mudd College), 5.25%, 12/1/31 | | | 550 | | | | 632,769 | |

California Educational Facilities Authority, (Harvey Mudd College), 5.25%, 12/1/36 | | | 940 | | | | 1,066,251 | |

California Educational Facilities Authority, (Loyola Marymount University), 5.00%, 10/1/23 | | | 365 | | | | 430,412 | |

California Educational Facilities Authority, (Loyola Marymount University), 5.00%, 10/1/30 | | | 1,375 | | | | 1,513,009 | |

California Educational Facilities Authority, (Santa Clara University), 5.00%, 2/1/29 | | | 3,630 | | | | 4,132,428 | |

California Educational Facilities Authority, (University of San Francisco), 6.125%, 10/1/36 | | | 650 | | | | 795,899 | |

California Educational Facilities Authority, (University of Southern California), 5.25%, 10/1/39 | | | 6,200 | | | | 7,186,420 | |

California Educational Facilities Authority, (University of the Pacific), 5.00%, 11/1/30 | | | 1,790 | | | | 2,019,550 | |

California Municipal Finance Authority, (University of San Diego), 5.00%, 10/1/31 | | | 1,175 | | | | 1,311,511 | |

California Municipal Finance Authority, (University of San Diego), 5.00%, 10/1/35 | | | 800 | | | | 875,016 | |

California Municipal Finance Authority, (University of San Diego), 5.25%, 10/1/26 | | | 2,270 | | | | 2,643,233 | |

California Municipal Finance Authority, (University of San Diego), 5.25%, 10/1/27 | | | 2,395 | | | | 2,771,686 | |

California Municipal Finance Authority, (University of San Diego), 5.25%, 10/1/28 | | | 2,520 | | | | 2,899,084 | |

| | |

| | | | | | $ | 42,528,508 | |

| | |

|

Electric Utilities — 3.1% | |

Puerto Rico Electric Power Authority, 5.25%, 7/1/29 | | $ | 3,905 | | | $ | 3,868,879 | |

Southern California Public Power Authority, (Tieton Hydropower), 5.00%, 7/1/35 | | | 1,890 | | | | 2,157,983 | |

Vernon, Electric System Revenue, 5.125%, 8/1/21 | | | 2,375 | | | | 2,687,835 | |

| | |

| | | | | | $ | 8,714,697 | |

| | |

|

General Obligations — 23.7% | |

California, 5.50%, 11/1/35 | | $ | 4,600 | | | $ | 5,550,498 | |

Foothill-De Anza Community College District, 5.00%, 8/1/40(1) | | | 10,000 | | | | 11,320,000 | |

Larkspur-Corte Madera School District, (Election of 2011), 4.00%, 8/1/32 | | | 545 | | | | 591,014 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

General Obligations (continued) | |

Larkspur-Corte Madera School District, (Election of 2011), 4.00%, 8/1/33 | | $ | 600 | | | $ | 648,342 | |

Larkspur-Corte Madera School District, (Election of 2011), 4.00%, 8/1/34 | | | 655 | | | | 704,250 | |

Larkspur-Corte Madera School District, (Election of 2011), 4.25%, 8/1/35 | | | 645 | | | | 705,333 | |

Larkspur-Corte Madera School District, (Election of 2011), 4.25%, 8/1/36 | | | 785 | | | | 855,399 | |

Larkspur-Corte Madera School District, (Election of 2011), 4.50%, 8/1/39 | | | 2,815 | | | | 3,125,579 | |

Palo Alto, (Election of 2008), 5.00%, 8/1/40(1) | | | 7,020 | | | | 7,926,352 | |

San Diego Community College District, (Election of 2002), 5.00%, 8/1/32 | | | 1,375 | | | | 1,584,784 | |

San Diego Community College District, (Election of 2006), 5.00%, 8/1/31 | | | 2,545 | | | | 2,945,532 | |

San Francisco Bay Area Rapid Transit District, (Election of 2004), 5.00%, 8/1/35 | | | 5,000 | | | | 5,671,250 | |

San Jose-Evergreen Community College District, (Election of 2010), 5.00%, 8/1/33 | | | 1,910 | | | | 2,225,055 | |

San Jose-Evergreen Community College District, (Election of 2010), 5.00%, 8/1/35 | | | 2,230 | | | | 2,589,922 | |

San Jose-Evergreen Community College District, (Election of 2010), 5.00%, 8/1/37 | | | 15 | | | | 17,158 | |

San Jose-Evergreen Community College District, (Election of 2010), 5.00%, 8/1/37(1) | | | 4,975 | | | | 5,690,803 | |

Santa Monica-Malibu Unified School District, (Election 2006),

4.50%, 7/1/36(2) | | | 12,000 | | | | 13,282,560 | |

Tamalpais Union High School District, 5.00%, 8/1/26 | | | 1,000 | | | | 1,201,070 | |

| | | | | | | | | |

| | | | | | $ | 66,634,901 | |

| | | | | | | | | |

|

Hospital — 18.4% | |

California Health Facilities Financing Authority, (Catholic Healthcare West), 5.25%, 7/1/23 | | $ | 2,000 | | | $ | 2,104,180 | |

California Health Facilities Financing Authority, (Catholic Healthcare West), 5.25%, 3/1/27 | | | 1,750 | | | | 2,006,183 | |

California Health Facilities Financing Authority, (Catholic Healthcare West), 5.25%, 3/1/28 | | | 550 | | | | 625,680 | |

California Health Facilities Financing Authority, (Cedars-Sinai Medical Center), 5.00%, 8/15/39 | | | 4,580 | | | | 5,045,282 | |

California Health Facilities Financing Authority, (City of Hope), 5.00%, 11/15/35 | | | 2,565 | | | | 2,916,482 | |

California Health Facilities Financing Authority, (City of Hope), 5.00%, 11/15/39 | | | 2,565 | | | | 2,873,800 | |

California Health Facilities Financing Authority, (Lucile Salter Packard Children’s Hospital), 5.00%, 8/15/51(1) | | | 10,000 | | | | 11,084,800 | |

California Health Facilities Financing Authority, (Stanford Hospital and Clinics), 5.00%, 8/15/51 | | | 6,000 | | | | 6,640,800 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

California Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Hospital (continued) | |

California Health Facilities Financing Authority, (Sutter Health), 5.25%, 8/15/31(1) | | $ | 5,000 | | | $ | 5,838,100 | |

California Statewide Communities Development Authority, (John Muir Health), 5.00%, 8/15/34 | | | 2,170 | | | | 2,354,081 | |

Torrance, (Torrance Memorial Medical Center), 5.50%, 6/1/31(3) | | | 3,950 | | | | 3,958,808 | |

Washington Township Health Care District, 5.00%, 7/1/32 | | | 3,165 | | | | 3,297,044 | |

Washington Township Health Care District, 5.25%, 7/1/29 | | | 3,005 | | | | 3,009,538 | |

| | |

| | | | | | $ | 51,754,778 | |

| | |

|

Insured – Education — 11.7% | |

California Educational Facilities Authority, (Pepperdine University), (AMBAC), 5.00%, 12/1/32 | | $ | 2,300 | | | $ | 2,495,776 | |

California State University, (AGM), (BHAC), 5.00%, 11/1/39(1) | | | 8,250 | | | | 9,086,138 | |

University of California, (AGM), 4.50%, 5/15/26(1) | | | 3,095 | | | | 3,328,889 | |

University of California, (AGM), 4.50%, 5/15/28(1) | | | 6,690 | | | | 7,001,419 | |

University of California, (BHAC), (FGIC), 4.75%, 5/15/37(1) | | | 10,750 | | | | 10,920,817 | |

| | |

| | | | | | $ | 32,833,039 | |

| | |

|

Insured – Electric Utilities — 14.2% | |

Anaheim Public Financing Authority, (Electric System District), (BHAC), (NPFG), 4.50%, 10/1/32(1) | | $ | 20,000 | | | $ | 21,214,390 | |

Glendale, Electric System Revenue, (AGC), 5.00%, 2/1/31 | | | 2,240 | | | | 2,460,013 | |

Los Angeles Department of Water and Power, Electric System Revenue, (AMBAC), (BHAC), 5.00%, 7/1/26(1) | | | 6,750 | | | | 7,752,510 | |

Northern California Power Agency, (Hydroelectric), (AGC), 5.00%, 7/1/24 | | | 2,000 | | | | 2,317,160 | |

Sacramento Municipal Utility District, (AGM), 5.00%, 8/15/27 | | | 1,000 | | | | 1,129,780 | |

Sacramento Municipal Utility District, (AMBAC), (BHAC), 5.25%, 7/1/24 | | | 4,000 | | | | 4,926,200 | |

| | |

| | | | | | $ | 39,800,053 | |

| | |

|

Insured – General Obligations — 21.5% | |

Antelope Valley Community College District, (Election of 2004), (NPFG), 5.25%, 8/1/39 | | $ | 4,175 | | | $ | 4,713,617 | |

Burbank Unified School District, (FGIC), (NPFG), 0.00%, 8/1/21 | | | 4,135 | | | | 3,272,274 | |

Coast Community College District, (Election of 2002), (AGM), 0.00%, 8/1/34 | | | 23,150 | | | | 7,555,465 | |

El Camino Hospital District, (NPFG), 4.45%, 8/1/36 | | | 2,385 | | | | 2,458,506 | |

Palm Springs Unified School District, (Election of 2008), (AGC), 5.00%, 8/1/33(3) | | | 4,500 | | | | 5,025,690 | |

Riverside Community College District, (Election of 2004), (AGM), (NPFG), 5.00%, 8/1/32 | | | 5,705 | | | | 6,432,730 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – General Obligations (continued) | |

San Diego Community College District, (Election of 2006), (AGM), 5.00%, 8/1/32 | | $ | 15 | | | $ | 17,169 | |

San Diego Community College District, (Election of 2006), (AGM), 5.00%, 8/1/32(1) | | | 6,100 | | | | 6,982,121 | |

San Diego Unified School District, (FGIC), (NPFG), 0.00%, 7/1/22 | | | 2,300 | | | | 1,708,808 | |

San Diego Unified School District, (FGIC), (NPFG), 0.00%, 7/1/23 | | | 5,000 | | | | 3,488,500 | |

San Juan Unified School District, (AGM), 0.00%, 8/1/21 | | | 5,630 | | | | 4,455,357 | |

San Mateo County, Community College District, (FGIC), (NPFG), 0.00%, 9/1/22 | | | 4,840 | | | | 3,785,267 | |

San Mateo County, Community College District, (FGIC), (NPFG), 0.00%, 9/1/23 | | | 4,365 | | | | 3,261,528 | |

San Mateo County, Community College District, (FGIC), (NPFG), 0.00%, 9/1/25 | | | 3,955 | | | | 2,710,243 | |

San Mateo Union High School District, (FGIC), (NPFG), 0.00%, 9/1/21(3) | | | 5,240 | | | | 4,341,549 | |

Ventura County, Community College District, (NPFG), 5.00%, 8/1/27 | | | 350 | | | | 355,148 | |

| | |

| | | | | | $ | 60,563,972 | |

| | |

|

Insured – Hospital — 7.0% | |

California Health Facilities Financing Authority, (Cedars-Sinai Medical Center), (BHAC), 5.00%, 11/15/34 | | $ | 2,205 | | | $ | 2,400,892 | |

California Statewide Communities Development Authority, (Kaiser Permanente), (BHAC),

5.00%, 4/1/31(1) | | | 10,000 | | | | 11,150,000 | |

California Statewide Communities Development Authority, (Kaiser Permanente), (BHAC),

5.00%, 3/1/41(1) | | | 3,500 | | | | 3,779,090 | |

California Statewide Communities Development Authority, (Sutter Health), (AMBAC), (BHAC), 5.00%, 11/15/38(1) | | | 2,000 | | | | 2,208,240 | |

| | |

| | | | | | $ | 19,538,222 | |

| | |

|

Insured – Lease Revenue / Certificates of Participation — 11.2% | |

Puerto Rico Public Finance Corp., (AMBAC), Escrowed to Maturity, 5.50%, 8/1/27 | | $ | 3,885 | | | $ | 5,259,280 | |

San Diego County Water Authority, Certificates of Participation, (AGM), 5.00%, 5/1/38(1) | | | 10,000 | | | | 11,113,200 | |

San Jose Financing Authority, (Civic Center), (AMBAC), (BHAC), 5.00%, 6/1/37 | | | 1,000 | | | | 1,003,250 | |

San Jose Financing Authority, (Civic Center), (AMBAC), (BHAC), 5.00%, 6/1/37(1) | | | 14,000 | | | | 14,045,500 | |

| | |

| | | | | | $ | 31,421,230 | |

| | |

|

Insured – Special Tax Revenue — 12.7% | |

Ceres, Redevelopment Agency Tax, (AMBAC), 4.00%, 11/1/36 | | $ | 7,765 | | | $ | 6,838,247 | |

Hesperia Public Financing Authority, (Redevelopment and Housing Projects), (XLCA), 5.00%, 9/1/31 | | | 595 | | | | 585,129 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

California Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Special Tax Revenue (continued) | |

Hesperia Public Financing Authority, (Redevelopment and Housing Projects), (XLCA), 5.00%, 9/1/37 | | $ | 7,240 | | | $ | 6,784,097 | |

Pomona, Public Financing Authority, (NPFG), 5.00%, 2/1/33 | | | 5,940 | | | | 5,941,307 | |

Puerto Rico Sales Tax Financing Corp., (NPFG), 0.00%, 8/1/45 | | | 15,020 | | | | 2,277,032 | |

San Francisco Bay Area Rapid Transportation District, Sales Tax Revenue, (AGM), 4.25%, 7/1/36 | | | 1,600 | | | | 1,637,824 | |

San Jose Redevelopment Agency, (Merged Area Redevelopment Project), (XLCA), 4.25%, 8/1/36 | | | 3,680 | | | | 3,316,159 | |

Santa Clara Valley Transportation Authority, Sales Tax Revenue, (AMBAC), 5.00%, 4/1/32(1) | | | 7,500 | | | | 8,436,450 | |

| | |

| | | | | | $ | 35,816,245 | |

| | |

|

Insured – Transportation — 2.0% | |

San Joaquin Hills, Transportation Corridor Agency, (NPFG), 0.00%, 1/15/30 | | $ | 3,445 | | | $ | 1,480,902 | |

San Jose, Airport Revenue, (AMBAC), 5.00%, 3/1/33 | | | 1,885 | | | | 1,983,925 | |

San Jose, Airport Revenue, (AMBAC), 5.00%, 3/1/37 | | | 2,040 | | | | 2,138,654 | |

| | |

| | | | | | $ | 5,603,481 | |

| | |

|

Insured – Water and Sewer — 9.7% | |

Calleguas Las Virgines Public Financing Authority, (Municipal Water District), (BHAC), (FGIC), 4.75%, 7/1/37(1) | | $ | 7,000 | | | $ | 7,411,880 | |

East Bay Municipal Utility District, Water System Revenue, (AGM), (FGIC), 5.00%, 6/1/32 | | | 345 | | | | 389,560 | |

East Bay Municipal Utility District, Water System Revenue, (FGIC), (NPFG), 5.00%, 6/1/32(1) | | | 6,500 | | | | 7,339,540 | |

Riverside, Water System Revenue, (AGM), 5.00%, 10/1/38 | | | 1,595 | | | | 1,741,038 | |

San Luis Obispo County, (Nacimiento Water Project), (BHAC), (NPFG), 5.00%, 9/1/38 | | | 5,000 | | | | 5,393,100 | |

San Luis Obispo County, (Nacimiento Water Project), (NPFG), 4.50%, 9/1/40 | | | 2,750 | | | | 2,810,225 | |

Santa Clara Valley Water District, (AGM), 3.75%, 6/1/28 | | | 2,225 | | | | 2,289,748 | |

| | |

| | | | | | $ | 27,375,091 | |

| | |

|

Special Tax Revenue — 9.4% | |

Contra Costa Community College District, 4.00%, 8/1/30(1) | | $ | 7,500 | | | $ | 7,934,325 | |

San Diego County Regional Transportation Commission, 5.00%, 4/1/42(1) | | | 10,000 | | | | 11,286,300 | |

San Francisco Bay Area Rapid Transportation District, Sales Tax Revenue, 5.00%, 7/1/36(1) | | | 6,250 | | | | 7,207,250 | |

| | |

| | | | | | $ | 26,427,875 | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Transportation — 8.1% | |

Bay Area Toll Authority, Toll Bridge Revenue, (San Francisco Bay Area), 5.25%, 4/1/29(1) | | $ | 6,500 | | | $ | 7,769,580 | |

Long Beach, Harbor Revenue, 5.00%, 5/15/27 | | | 1,960 | | | | 2,261,683 | |

Los Angeles Department of Airports, (Los Angeles International Airport), 5.00%, 5/15/35(1) | | | 7,500 | | | | 8,433,150 | |

San Francisco City and County Airport Commission, (San Francisco International Airport), 5.00%, 5/1/35 | | | 2,190 | | | | 2,417,081 | |

San Jose, Airport Revenue, 5.00%, 3/1/31 | | | 1,750 | | | | 1,919,470 | |

| | |

| | | | | | $ | 22,800,964 | |

| | |

|

Water and Sewer — 2.4% | |

Beverly Hills Public Financing Authority, Water Revenue, 5.00%, 6/1/37 | | $ | 10 | | | $ | 11,676 | |

Beverly Hills Public Financing Authority, Water Revenue, 5.00%, 6/1/37(1) | | | 5,725 | | | | 6,684,682 | |

| | | | | | | | | |

| | | | | | $ | 6,696,358 | |

| | | | | | | | | |

| |

Total Tax-Exempt Investments — 170.2%

(identified cost $444,276,809) | | | $ | 478,509,414 | |

| | |

| |

Other Assets, Less Liabilities — (70.2)% | | | $ | (197,430,768 | ) |

| | |

| |

Net Assets — 100.0% | | | $ | 281,078,646 | |

| | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| | | | |

| AGC | | – | | Assured Guaranty Corp. |

| AGM | | – | | Assured Guaranty Municipal Corp. |

| AMBAC | | – | | AMBAC Financial Group, Inc. |

| BHAC | | – | | Berkshire Hathaway Assurance Corp. |

| FGIC | | – | | Financial Guaranty Insurance Company |

| NPFG | | – | | National Public Finance Guaranty Corp. |

| XLCA | | – | | XL Capital Assurance, Inc. |

The Fund invests primarily in debt securities issued by California municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. In order to reduce the risk associated with such economic developments, at March 31, 2013, 52.9% of total investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution ranged from 2.0% to 21.2% of total investments.

| (1) | Security represents the municipal bond held by a trust that issues residual interest bonds (see Note 1H). |

| (3) | Security (or a portion thereof) has been segregated to cover payable for when-issued securities. |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

New York Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited)

| | | | | | | | |

| Tax-Exempt Investments — 161.3% | |

| | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Bond Bank — 4.7% | |

New York Environmental Facilities Corp., 5.00%, 10/15/39 | | $ | 3,360 | | | $ | 3,789,643 | |

New York Environmental Facilities Corp., Clean Water and Drinking Water, (Municipal Water Finance), 5.00%, 10/15/35 | | | 50 | | | | 55,869 | |

New York Environmental Facilities Corp., Clean Water and Drinking Water, (Municipal Water Finance), 5.00%, 10/15/35(1) | | | 6,100 | | | | 6,815,957 | |

| | |

| | | | | | $ | 10,661,469 | |

| | |

|

Education — 25.7% | |

Hempstead Local Development Corp., (Adelphi University Project), 5.00%, 6/1/20 | | $ | 760 | | | $ | 896,914 | |

Hempstead Local Development Corp., (Adelphi University Project), 5.00%, 6/1/21 | | | 950 | | | | 1,126,975 | |

Hempstead Local Development Corp., (Adelphi University Project), 5.00%, 6/1/31 | | | 800 | | | | 884,936 | |

Hempstead Local Development Corp., (Adelphi University Project), 5.00%, 6/1/32 | | | 300 | | | | 329,835 | |

Monroe County Industrial Development Corp., (St. John Fisher College), 5.00%, 6/1/23 | | | 405 | | | | 466,722 | |

Monroe County Industrial Development Corp., (St. John Fisher College), 5.00%, 6/1/24 | | | 210 | | | | 238,197 | |

Monroe County Industrial Development Corp., (St. John Fisher College), 5.00%, 6/1/25 | | | 135 | | | | 151,196 | |

New York City Cultural Resource Trust, (The Juilliard School), 5.00%, 1/1/39 | | | 240 | | | | 274,085 | |

New York City Cultural Resource Trust, (The Juilliard School), 5.00%, 1/1/39(1) | | | 10,000 | | | | 11,420,200 | |

New York Dormitory Authority, (Columbia University), 5.00%, 10/1/41(1) | | | 10,000 | | | | 11,518,100 | |

New York Dormitory Authority, (Cornell University), 5.00%, 7/1/37(1) | | | 5,700 | | | | 6,508,203 | |

New York Dormitory Authority, (New York University), 5.00%, 7/1/39(1) | | | 10,000 | | | | 11,314,600 | |

New York Dormitory Authority, (Rochester Institute of Technology), 5.00%, 7/1/40 | | | 2,000 | | | | 2,203,520 | |

New York Dormitory Authority, (Rockefeller University),

5.00%, 7/1/40(1) | | | 2,700 | | | | 3,008,367 | |

New York Dormitory Authority, (Skidmore College), 5.00%, 7/1/26 | | | 1,175 | | | | 1,359,675 | |

New York Dormitory Authority, (Skidmore College), 5.25%, 7/1/30 | | | 300 | | | | 344,658 | |

New York Dormitory Authority, (The New School), 5.50%, 7/1/40 | | | 5,250 | | | | 5,926,567 | |

| | | | | | | | | |

| | | | | | $ | 57,972,750 | |

| | | | | | | | | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Electric Utilities — 1.6% | |

Puerto Rico Electric Power Authority, 5.25%, 7/1/30 | | $ | 3,560 | | | $ | 3,513,969 | |

| | | | | | | | | |

| | | | | | $ | 3,513,969 | |

| | | | | | | | | |

|

Escrowed / Prerefunded — 0.7% | |

Madison County Industrial Development Agency, (Colgate University), Prerefunded to 7/1/13, 5.00%, 7/1/33 | | $ | 1,630 | | | $ | 1,650,261 | |

| | | | | | | | | |

| | | | | | $ | 1,650,261 | |

| | | | | | | | | |

|

General Obligations — 11.8% | |

Arlington Central School District, 4.00%, 12/15/29 | | $ | 1,360 | | | $ | 1,481,598 | |

Arlington Central School District, 4.00%, 12/15/30 | | | 2,330 | | | | 2,521,922 | |

Long Beach City School District, 4.50%, 5/1/26 | | | 4,715 | | | | 5,269,625 | |

New York, 5.00%, 2/15/34(1) | | | 7,250 | | | | 8,257,967 | |

New York City, 4.00%, 10/1/30(1) | | | 7,500 | | | | 7,947,450 | |

Peekskill, 5.00%, 6/1/35 | | | 465 | | | | 509,603 | |

Peekskill, 5.00%, 6/1/36 | | | 490 | | | | 535,526 | |

| | | | | | | | | |

| | | | | | $ | 26,523,691 | |

| | | | | | | | | |

|

Hospital — 10.2% | |

New York Dormitory Authority, (Highland Hospital of Rochester), 5.00%, 7/1/26 | | $ | 620 | | | $ | 685,187 | |

New York Dormitory Authority, (Highland Hospital of Rochester), 5.20%, 7/1/32 | | | 820 | | | | 900,737 | |

New York Dormitory Authority, (Memorial Sloan-Kettering Cancer Center), 4.375%, 7/1/34(1) | | | 9,325 | | | | 10,037,523 | |

New York Dormitory Authority, (North Shore-Long Island Jewish Obligated Group), 5.00%, 5/1/20 | | | 1,065 | | | | 1,291,877 | |

New York Dormitory Authority, (North Shore-Long Island Jewish Obligated Group), 5.00%, 5/1/26 | | | 2,055 | | | | 2,206,515 | |

Suffolk County Economic Development Corp., (Catholic Health Services of Long Island Obligated Group), 5.00%, 7/1/28 | | | 6,900 | | | | 7,813,491 | |

| | | | | | | | | |

| | | | | | $ | 22,935,330 | |

| | | | | | | | | |

|

Housing — 1.2% | |

New York Housing Development Corp., 4.95%, 11/1/39 | | $ | 2,500 | | | $ | 2,676,275 | |

| | | | | | | | | |

| | | | | | $ | 2,676,275 | |

| | | | | | | | | |

|

Industrial Development Revenue — 1.0% | |

New York Liberty Development Corp., (Goldman Sachs Group, Inc.), 5.25%, 10/1/35 | | $ | 500 | | | $ | 586,020 | |

New York Liberty Development Corp., (Goldman Sachs Group, Inc.), 5.50%, 10/1/37 | | | 1,440 | | | | 1,746,058 | |

| | | | | | | | | |

| | | | | | $ | 2,332,078 | |

| | | | | | | | | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

New York Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Education — 17.5% | |

New York Dormitory Authority, (City University), (AMBAC), 5.50%, 7/1/35 | | $ | 925 | | | $ | 1,121,211 | |

New York Dormitory Authority, (Educational Housing Services CUNY Student Housing), (AMBAC), 5.25%, 7/1/23 | | | 1,750 | | | | 2,075,833 | |

New York Dormitory Authority, (Fordham University), (AGC), (BHAC), 5.00%, 7/1/38(1) | | | 10,750 | | | | 11,827,795 | |

New York Dormitory Authority, (Pratt Institute), (AGC), 5.00%, 7/1/34 | | | 1,555 | | | | 1,724,168 | |

New York Dormitory Authority, (Pratt Institute), (AGC), 5.125%, 7/1/39 | | | 2,405 | | | | 2,664,860 | |

New York Dormitory Authority, (St. John’s University), (NPFG), 5.25%, 7/1/37 | | | 3,750 | | | | 4,142,738 | |

New York Dormitory Authority, (State University), (BHAC), 5.00%, 7/1/38(1) | | | 8,500 | | | | 9,352,210 | |

Oneida County Industrial Development Agency, (Hamilton College), (NPFG), 0.00%, 7/1/34 | | | 5,555 | | | | 2,165,283 | |

Oneida County Industrial Development Agency, (Hamilton College), (NPFG), 0.00%, 7/1/36 | | | 8,455 | | | | 2,990,449 | |

Oneida County Industrial Development Agency, (Hamilton College), (NPFG), 0.00%, 7/1/37 | | | 4,000 | | | | 1,348,920 | |

| | | | | | | | | |

| | | | | | $ | 39,413,467 | |

| | | | | | | | | |

|

Insured – Electric Utilities — 6.0% | |

Long Island Power Authority, Electric System Revenue, (BHAC), 5.75%, 4/1/33 | | $ | 5,000 | | | $ | 5,964,400 | |

New York Power Authority, (BHAC), (NPFG), 4.50%, 11/15/47(1) | | | 7,210 | | | | 7,588,592 | |

| | | | | | | | | |

| | | | | | $ | 13,552,992 | |

| | | | | | | | | |

|

Insured – Escrowed / Prerefunded — 3.4% | |

Madison County Industrial Development Agency, (Colgate University), (NPFG), Prerefunded to 7/1/14, 5.00%, 7/1/39 | | $ | 4,000 | | | $ | 4,238,800 | |

New York Dormitory Authority, (Brooklyn Law School), (XLCA), Prerefunded to 7/1/13, 5.125%, 7/1/30 | | | 3,280 | | | | 3,321,394 | |

| | | | | | | | | |

| | | | | | $ | 7,560,194 | |

| | | | | | | | | |

|

Insured – General Obligations — 8.7% | |

Brentwood Union Free School District, (AGC), 4.75%, 11/15/23 | | $ | 2,290 | | | $ | 2,678,407 | |

Brentwood Union Free School District, (AGC), 5.00%, 11/15/24 | | | 2,390 | | | | 2,811,022 | |

East Northport Fire District, (AGC), 4.50%, 11/1/20 | | | 200 | | | | 236,956 | |

East Northport Fire District, (AGC), 4.50%, 11/1/21 | | | 200 | | | | 234,890 | |

East Northport Fire District, (AGC), 4.50%, 11/1/22 | | | 200 | | | | 232,800 | |

East Northport Fire District, (AGC), 4.50%, 11/1/23 | | | 200 | | | | 230,648 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – General Obligations (continued) | |

Eastchester Union Free School District, (AGM), 3.75%, 6/15/21 | | $ | 255 | | | $ | 281,658 | |

Eastchester Union Free School District, (AGM), 4.00%, 6/15/23 | | | 175 | | | | 192,052 | |

Freeport, (AGC), 5.00%, 10/15/20 | | | 185 | | | | 221,190 | |

Freeport, (AGC), 5.00%, 10/15/21 | | | 195 | | | | 231,264 | |

Hauppauge Union Free School District, (AGC), 4.00%, 7/15/24 | | | 940 | | | | 1,033,568 | |

Hoosic Valley Central School District, (AGC), 4.00%, 6/15/23 | | | 1,110 | | | | 1,232,844 | |

Longwood Central School District, Suffolk County, (AGC), 4.15%, 6/1/23 | | | 820 | | | | 899,975 | |

Longwood Central School District, Suffolk County, (AGC), 4.25%, 6/1/24 | | | 860 | | | | 942,061 | |

New York City, (AGM), 5.00%, 4/1/22 | | | 2,250 | | | | 2,529,697 | |

Wantagh Union Free School District, (AGC), 4.50%, 11/15/19 | | | 785 | | | | 903,056 | |

Wantagh Union Free School District, (AGC), 4.50%, 11/15/20 | | | 825 | | | | 940,030 | |

Wantagh Union Free School District, (AGC), 4.75%, 11/15/22 | | | 905 | | | | 1,020,940 | |

Wantagh Union Free School District, (AGC), 4.75%, 11/15/23 | | | 950 | | | | 1,064,750 | |

William Floyd Union Free School District, (AGC), 4.00%, 12/15/24 | | | 1,590 | | | | 1,752,577 | |

| | | | | | | | | |

| | | | | | $ | 19,670,385 | |

| | | | | | | | | |

|

Insured – Hospital — 3.3% | |

New York Dormitory Authority, (Hudson Valley Hospital Center), (AGM), (BHAC), 5.00%, 8/15/36 | | $ | 4,355 | | | $ | 4,731,925 | |

New York Dormitory Authority, (Maimonides Medical Center), (NPFG), 5.00%, 8/1/33 | | | 2,525 | | | | 2,681,929 | |

| | | | | | | | | |

| | | | | | $ | 7,413,854 | |

| | | | | | | | | |

|

Insured – Housing — 1.1% | |

New York Housing Development Corp., (FGIC), (NPFG), 5.00%, 7/1/25 | | $ | 2,350 | | | $ | 2,545,309 | |

| | | | | | | | | |

| | | | | | $ | 2,545,309 | |

| | | | | | | | | |

|

Insured – Other Revenue — 6.2% | |

New York City Cultural Resource Trust, (American Museum of Natural History), (NPFG), 5.00%, 7/1/44 | | $ | 2,055 | | | $ | 2,144,680 | |

New York City Industrial Development Agency, (Yankee Stadium), (NPFG), 4.75%, 3/1/46 | | | 6,930 | | | | 7,055,502 | |

New York City Transitional Finance Authority, (BHAC), 5.50%, 7/15/38 | | | 4,050 | | | | 4,688,564 | |

| | | | | | | | | |

| | | | | | $ | 13,888,746 | |

| | | | | | | | | |

| | | | |

| | 16 | | See Notes to Financial Statements. |

Eaton Vance

New York Municipal Bond Fund

March 31, 2013

Portfolio of Investments (Unaudited) — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Insured – Solid Waste — 2.1% | |

Ulster County, Resource Recovery Agency, Solid Waste System, (AMBAC), 0.00%, 3/1/21 | | $ | 1,490 | | | $ | 1,265,233 | |

Ulster County, Resource Recovery Agency, Solid Waste System, (AMBAC), 0.00%, 3/1/23 | | | 1,090 | | | | 848,467 | |

Ulster County, Resource Recovery Agency, Solid Waste System, (AMBAC), 0.00%, 3/1/25 | | | 3,635 | | | | 2,590,810 | |

| | | | | | | | | |

| | | | | | $ | 4,704,510 | |

| | | | | | | | | |

|

Insured – Special Tax Revenue — 6.1% | |

New York State Housing Finance Agency, (AGM), 5.00%, 3/15/37 | | $ | 2,415 | | | $ | 2,653,143 | |

New York Thruway Authority, Miscellaneous Tax Revenue, (AMBAC), 5.50%, 4/1/20 | | | 2,175 | | | | 2,739,847 | |

Puerto Rico Infrastructure Financing Authority, (AMBAC), 0.00%, 7/1/36 | | | 3,000 | | | | 693,570 | |

Puerto Rico Infrastructure Financing Authority, (FGIC), 0.00%, 7/1/32 | | | 4,000 | | | | 1,229,600 | |

Puerto Rico Sales Tax Financing Corp., (NPFG), 0.00%, 8/1/45 | | | 6,705 | | | | 1,016,478 | |

Sales Tax Asset Receivables Corp., (AMBAC), 5.00%, 10/15/29 | | | 850 | | | | 904,783 | |

Sales Tax Asset Receivables Corp., (AMBAC), 5.00%, 10/15/32 | | | 4,185 | | | | 4,446,688 | |

| | | | | | | | | |

| | | | | | $ | 13,684,109 | |

| | | | | | | | | |

|

Insured – Transportation — 8.4% | |

Port Authority of New York and New Jersey, (AGM), 5.00%, 8/15/24(1) | | $ | 5,600 | | | $ | 6,534,356 | |

Port Authority of New York and New Jersey, (AGM), 5.00%, 8/15/33(1) | | | 11,000 | | | | 12,452,770 | |

| | | | | | | | | |

| | | | | | $ | 18,987,126 | |

| | | | | | | | | |

|

Insured – Water and Sewer — 2.9% | |

Nassau County Sewer and Storm Water Finance Authority, (BHAC), 5.125%, 11/1/23 | | $ | 300 | | | $ | 357,813 | |

Nassau County Sewer and Storm Water Finance Authority, (BHAC), 5.375%, 11/1/28 | | | 3,835 | | | | 4,503,785 | |

Suffolk County Water Authority, (NPFG), 4.50%, 6/1/25 | | | 1,475 | | | | 1,536,965 | |

| | | | | | | | | |

| | | | | | $ | 6,398,563 | |

| | | | | | | | | |

|

Other Revenue — 6.5% | |

Battery Park City Authority, 5.00%, 11/1/34 | | $ | 5,225 | | | $ | 6,168,635 | |

Brooklyn Arena Local Development Corp., (Barclays Center), 0.00%, 7/15/31 | | | 4,900 | | | | 2,211,762 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

| | | | | | | | |

|

Other Revenue (continued) | |

New York Liberty Development Corp., (7 World Trade Center), 5.00%, 9/15/40 | | $ | 5,500 | | | $ | 6,195,365 | |

| | | | | | | | | |

| | | | | | $ | 14,575,762 | |

| | | | | | | | | |

|

Special Tax Revenue — 15.3% | |

Metropolitan Transportation Authority Dedicated Tax Fund, 5.00%, 11/15/31(1) | | $ | 10,000 | | | $ | 11,711,900 | |

New York City Transitional Finance Authority, Future Tax Revenue, 5.00%, 2/1/35(1) | | | 10,000 | | | | 11,279,900 | |

New York City Transitional Finance Authority, Future Tax Revenue, 5.50%, 11/1/35(1)(2) | | | 1,000 | | | | 1,183,100 | |

New York Dormitory Authority, Personal Income Tax Revenue, 5.00%, 6/15/31(1) | | | 6,500 | | | | 7,579,195 | |

New York Thruway Authority, Miscellaneous Tax Revenue, 5.00%, 4/1/26 | | | 2,370 | | | | 2,734,411 | |

| | | | | | | | | |

| | | | | | $ | 34,488,506 | |

| | | | | | | | | |

|

Transportation — 11.5% | |

Metropolitan Transportation Authority, 5.25%, 11/15/38 | | $ | 3,430 | | | $ | 3,853,262 | |

Nassau County Bridge Authority, 5.00%, 10/1/35 | | | 1,565 | | | | 1,720,451 | |

Nassau County Bridge Authority, 5.00%, 10/1/40 | | | 300 | | | | 330,216 | |

New York Bridge Authority, 5.00%, 1/1/26 | | | 450 | | | | 539,352 | |

New York Thruway Authority, 5.00%, 1/1/37 | | | 7,380 | | | | 8,199,623 | |

Triborough Bridge and Tunnel Authority, 5.00%, 11/15/38(1) | | | 10,000 | | | | 11,346,800 | |

| | | | | | | | | |

| | | | | | $ | 25,989,704 | |

| | | | | | | | | |

|

Water and Sewer — 5.4% | |