Exhibit 1

| | Trading Symbols (TSX-V: LM; OTCQB: LMDCF) |

| | |

| 151 Bloor St West Suite 703 Toronto, Ontario Canada M5S 1S4 Tel : 416.927.7000 Fax : 416.927.1222 www.lingomedia.com |

Lingo Media Corporation

Form 51 – 102 F1

Management Discussion & Analysis

Second Quarter Ended June 30, 2015

August26, 2015

MANAGEMENT DISCUSSION & ANALYSIS

FOR THESECOND QUARTER ENDEDJUNE 30, 2015

Notice to Reader The following Management Discussion & Analysis ("MD&A") of Lingo Media Corporation’s (the "Company" or "Lingo Media") financial condition and results of operations, prepared as of August 26, 2015, should be read in conjunction with the Company's Condensed Consolidated Interim Financial Statements and accompanying Notes for the three months ended June 30, 2015, which have been prepared in accordance with International Financial Reporting Standards are incorporated by reference herein and form an integral part of this MD&A. All dollar amounts are in Canadian Dollars unless stated otherwise. These documents can be found on the SEDAR websitewww.sedar.com. Our MD&A is intended to enable readers to gain an understanding of Lingo Media’s current results and financial position. To do so, we provide information and analysis comparing the results of operations and financial position for the current period to those of the preceding comparable three month period. We also provide analysis and commentary that we believe is required to assess the Company's future prospects. Accordingly, certain sections of this report contain forward-looking statements that are based on current plans and expectations. These forward-looking statements are affected by risks and uncertainties that are discussed in this document and that could have a material impact on future prospects. Readers are cautioned that actual results could vary. |

Cautions Regarding Forward-Looking Statements This MD&A contains certain forward-looking statements, which reflect management’s expectations regarding the Company’s results of operations, performance, growth, and business prospects and opportunities. Statements about the Company’s future plans and intentions, results, levels of activity, performance, goals or achievements or other future events constitute forward-looking statements. Wherever possible, words such as "may," "will," "should," "could," "expect," "plan," "intend," "anticipate," "believe," "estimate," "predict," or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this MD&A are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this MD&A, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Many factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including: general economic and market segment conditions, competitor activity, product capability and acceptance, international risk and currency exchange rates and technology changes. More detailed assessment of the risks that could cause actual results to materially differ than current expectations is contained in the "Quantitative and Qualitative Disclosures of Market Risk" section of this MD&A. |

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 2 |

Summary Description of Lingo Media

Lingo Media (“Lingo Media,” the “Company,” “we” or ”us”) is an EdTech company that is ‘Changing the way the world learns English’ through the combination of education with technology. Through its two distinct business units, Lingo Media develops, markets and supports a suite of English language learning solutions consisting of web-based software licensing subscriptions, online and professional services, audio practice tools and multi-platform applications. The Company continues to operate its legacy textbook publishing business from which it collects recurring royalty revenues.

Lingo Media’s two distinct business units include ELL Technologies and Lingo Learning. ELL Technologies is a global web-based educational technology (“EdTech”) English language learning training and assessment company that creates innovative Software-as-a-Service eLearning solutions Lingo Learning is a print-based publisher of English language learning textbook programs in China. Lingo Media has formed successful relationships with key government and industry organizations, establishing a strong presence in China’s education market of more than 300 million students. The Company is extending its global reach, with an initial market expansion into Latin America and continues to expand its product offerings and technology applications.

Lingo Media has undertaken a business transition which began to gather momentum during the second quarter of 2015. Lingo Media has continued to invest in language learning and leverage its industry expertise to expand into more scalable education-technology. Recent product initiatives have allowed us to expand the breadth of our language learning product offerings, and reinforced the belief that the web-based EdTech learning segment continues to present a significant opportunity for long-term value creation. Customers in this market have demands that recur each year, creating a higher likelihood of return business and predictable revenue opportunity. This demand profile also fits well with our suite of products and increasingly recognizable ELL Technologies brand.

Lingo Media continues to focus on software and content development to address market needs within the government, academic and corporate sectors.

Operational Highlights

● | Print-Based English Language Learning: |

| | ☑ | launched primary-level,PEP Primary English program into additional provinces in China |

● | Online English Language Learning: |

| | ☑ | completed the development of two leading-edge technology tools,Lesson Builder andCourse Builder enabling educators to easily create, convert, edit, and arrange online lessons and courses |

| | ☑ | significantly expanded our digital English language learning library by entering a licensing agreement with Editions Grand Duc to digitize and globally distribute the best-selling general English program in Canada,Connecting Doors |

| | ☑ | completed digitization ofConnecting Doors content, released as a Software-as-a-Service platform where it will generate licensing and maintenance fees under the brandCampus for young adults from junior middle school through to undergraduates (ages 13 and up) and can extend to adult learners |

| | ☑ | advanced the development ofEnglish Academy, a new ELL Technologies’ program for the primary school market for 8 – 12 years old, which will complete our suite of products for K-12. |

| | ☑ | continued the development of ELL Technologies’Freddy’s World, for the early childhood education market andWinnie’s World, for the pre-kindergarten and kindergarten market |

| | ☑ | supported existing software sales contracts in China and Europe |

| | ☑ | secured new software licensing contracts for ELL Technologies’ programs in Colombia, Mexico and Peru |

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 3 |

Over the last two quarters, our strategy has been to transition more and more of our business to online subscriptions and digital downloads that enable learners to bring your own device (“BYOD”) and beyond paper-based textbook publishing. We believe that these online subscription formats provide customers with an overall better learning experience, the flexibility to use our products on multiple platforms (i.e., beyond desktops to tablets and mobile extensions), and is a more economical and relevant way for us to deliver our products to customers.

As a result of strategic reorganization and realignment of the business, as of June 30, 2015, we integrated Speak2Me Inc., Parlo Corp. and ELL Technologies Ltd. into one segment, ELL Technologies Ltd., and now operate only two segments. Our web-based online English language learning division is ELL Technologies Ltd. (“ELL Technologies”) and our print-based English language learning textbook publishing division is Lingo Learning Inc. (“Lingo Learning”).

Online English Language Learning

ELL Technologies, acquired in 2010, now offers over 2,000 hours of interactive learning through a number of product offerings that includeWinnie’s World, English Academy, Scholar,Campus,Master andBusiness, in addition to custom solutions. ELL Technologies is marketed in 14 countries through a network of distributors and earns its revenues from licensing and subscription fees from its suite of web-based EdTech language learning products and applications.

At the time of the acquisition, ELL Technologies had an extensive existing product line which required substantial revisions in the technology platform and user interface. Over the past few years, our development team has engineered an eLearning platform and has been introducing new products to the market since the beginning of 2015, integrating cutting-edge technologies, solutions, content and pedagogy.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 4 |

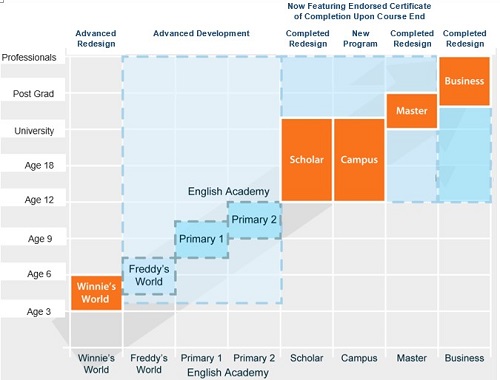

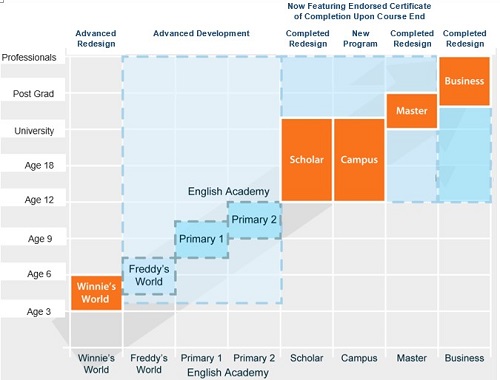

ELL Technologies’ high-tech, easy to implement eLearning Software-as-a-Service solutions have positioned the Company to teach the world English. As a result of ongoing investment into product development, we are able to provide learners of all ages and levels of English proficiency with a platform to further their language learning development. See our “Correlation Table” below:

The horizontal axis contains our product line and correlates to the vertical axis which contains the ages and levels of proficiency that the product has been designed for. To summarize our 2015 product development achievements to date, we have:

| | ● | Completed the redesign ofScholar, Master and Business |

| | ● | Released a new product,Campus |

| | ● | Advanced development ofEnglish Academy |

| | ● | Advanced redesign ofWinnie’s World |

All of our products have been designed for our proprietary learning management system which completes the suite of products and allows ELL Technologies to market and sell to academic institutions, governments and corporations. Educators who license the platform will be able to easily create, convert, edit, and arrange lessons and courses as they see fit. ELL Technologies retains all rights to user generated content to continuously expand its digital library.

Formative assessments and data gathering functionality allows us to adapt and improve content. Based on that data, we are able to program iterations to address specific problem areas and to make learning more accessible, efficient and measurable. Built for learners, by learners, we empower educators and allow them to easily transition from pure classroom paper-based teaching to the online world.

Print-Based English Language Learning

The Company continues to maintain its legacy textbook publishing business through Lingo Learning, a print-based publisher of English language learning programs in China since 2001. Lingo Learning has an established presence in China’s education market of over 300 million students. To date, it has co-published more than 510 million units from its library of program titles.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 5 |

Revenue Recognition Policy

Lingo Learning earns royalty revenues from its key customer, People’s Education Press and People’s Education & Audio Visual Press (collectively “PEP”), who are China’s State Ministry of Education’s publishing arm, on the following basis:

● | Finished Product Sales – PEP prints and sells Lingo Learning’s English language training programs to provincial distributors in China; and |

● | Licensing Sales – PEP licenses Lingo Learning’s English language training programs to provincial publishers who then print and sell the programs to provincial distributors in China. |

Lingo Learning earns significantly higher royalties from Licensing Sales compared to Finished Product Sales.

In accordance with the co-publishing agreements between PEP and Lingo Learning, PEP pays to Lingo Learning a royalty on sales of textbooks and supplemental products called Finished Product Sales. In addition, PEP pays to Lingo Learning a percentage of their royalties earned on actual revenues called Licensing Sales. PEP provides Lingo Learning with sales reconciliations on a semi-annual basis, as their reporting systems are not able to provide quarterly sales information. Revenue is recognized upon the confirmation of such sales and when collectability is reasonably assured.

Royalty revenues from PEP’s audiovisual-based products are recognized quarterly upon the confirmation of sales, and when collectability is reasonably assured. Royalty revenues are not subject to right of return or product warranties. Revenue from the sale of published and supplemental products is recognized upon delivery and when the risk of ownership is transferred and collectability is reasonably assured.

ELL Technologies has now fully-integrated Parlo and Speak2Me into its offerings, and it earns training revenue by developing and hosting online English language learning solutions for its customers, both off the shelf and customized solutions. Revenue is recognized upon delivery of the online courses to the end client through its distributor and when collectability is reasonably assured.

When the outcome of a contract cannot be reliably estimated, all contract related costs are expensed and revenues are recognized only to the extent that those costs are recoverable. When the uncertainties that prevented reliable estimation of the outcome of a contract no longer exist, contract revenue and expenses are recognized using the percentage of completion method. During the second quarter of 2015, the Company recognized revenue of $741,540 based on the percentage completion method as and when the collectability was assured.

Overall Performance

For the second quarter ended June 30, 2015, Lingo Media earned revenue of $1,794,659 as compared to $877,879, recording a 104% increase. As a result of the increased revenue, the Company recorded a net profit for the period of $979,103 as compared to $217,633, an increase of 350%. The increase in revenue and net profit are primarily attributed to company’s sales and marketing efforts in Online English Language Learning segment of its business.

Online English Language Learning

ELL Technologies earned revenue from its portfolio of products of $919,410 for the quarter ended June 30, 2015, compared to $104,904 for the same period in 2014, an increase of 776%. This increase in sales is due to the Company maximizing its sales efforts related to its ELL Technologies’ redesigned suite of products. Since 2012, the Company has completely redesigned the user interface, learning management system and the multi-browser delivery system for desktops and tablets for its ELL Technologies suite of products includingWinnie’s World, English Academy, Scholar,Campus Master andBusiness. The redesign has now been completed and full sales efforts have resumed and recorded a 776% increase in revenue in the 2015 second quarter as compared to the same period in 2014.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 6 |

Print-Based English Language Learning

Lingo Media earned royalty revenue of $875,249 for the three months period ended June 30, 2015 compared to $772,975 for 2014 from People’s Education & Audio Visual Press.

According to the Company’s current practice of recording revenues from PEP, Lingo Media recognizes no revenues from its print-based English language learning business in the first and third quarters as the sales from print-based products in China are reported semi-annually in the second and fourth quarters.

Market Trends and Business Uncertainties

Lingo Media believes that the global market trends in English language learning are strong and will continue to grow at a rapid pace. Developing countries around the world, specifically in Asia and Latin America are expanding their mandates for the teaching of English amongst students, young professionals and adults.

The British Council suggests that there are 1.6 Billion people learning English globally. English language learning products and services are a US$56.3 Billion global market notes Ambient Insight, who also forecasts digital English learning expenditures to account for US$3.1 Billion by 2018.

GSV Advisors forecasts digital English learning product expenditures to be US$2.5 Billion (or 7.3%) of the global market by 2016, with Latin America representing approximately US$260.9 Million of that figure. Students attending English language training (“ELT”) classes in Latin America accounted for approximately 14 per cent of worldwide revenues, or US$321-million in 2013. Growth has been very rapid in the region, and represents a particularly strong opportunity moving forward relative to other geographic regions. The remaining market for ELT is largely concentrated in Europe, the Middle East and Africa (45 per cent of revenues or US$1.04-billion) and the Asia Pacific region (35 per cent of revenues or US$825-million).

Lingo Media is uniquely positioned to take advantage of the market opportunity for teaching English in Latin America, China and other countries in Asia, with its scalable web-based learning technology and solutions. Although the market outlook remains positive, there can be no assurance that this trend will continue or that the Company will benefit from this trend.

General Financial Condition

As at June 30, 2015 Lingo Media had working capital of $887,826 compared to a working capital deficiency of $(475,856) as at June 30, 2014. Total comprehensive income for the period ended June 30, 2015 was $993,552 compared to total comprehensive income of $200,534 for the period ended June 30, 2014.

Financial Highlights

| | | 2015 | | | 2014 | |

Revenue | | | | | | | | |

| Print-Based English Language Learning | | $ | 875,249 | | | $ | 772,975 | |

| Online English Language Learning | | | 919,410 | | | | 104,904 | |

| | | | 1,794,659 | | | | 877,879 | |

Net Profit for the Period | | | 979,103 | | | | 217,633 | |

Total Comprehensive Income | | | 993,552 | | | | 200,534 | |

Profit per Share, Basic and Diluted: | | $ | 0.04 | | | $ | 0.01 | |

Total Assets | | | 3,867,996 | | | | 2,130,756 | |

Working Capital / (Deficit) | | | 887,826 | | | | (475,856 | ) |

Cash Provided – Operations | | $ | 138,764 | | | $ | 208,702 | |

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 7 |

The Company had cash on hand as at June 30, 2015 of $142,328 (2014 - $144,537) and continues to rely on its revenues from its recurring textbook royalties, its online licensing sales, and future equity and/or debt financings to fund its operations.

Results of Operations

During the period, Lingo Media earned $919,410 in online licensing sales revenue as compared to $104,904 in 2014. This revenue increase from online English Language Learning is due to the fact that the Company has resumed its sales efforts related to its ELL Technologies redesigned suite of products. The Company has completely redesigned the user interface, learning management system and the multi-browser delivery system for desktops and tablets for its ELL Technologies suite of products includingWinnie’s World, English Academy, Scholar,Campus Master andBusiness.The product overhaul has been completed and full sales efforts have resumed in 2015 and recorded a 776% increase in online English language learning revenue in the second quarter of 2015 as compared to the same period in 2014.

Revenues from Print-Based English language learning for the period were $875,249 compared to $772,975 for the same period in 2014. Direct costs associated with publishing revenue are kept to a minimum and has been consistent throughout the years. The Company continues to maintain its relationship with PEP and is investing in the development of its existing and new programs and marketing activities to maintain and increase its royalty revenues.

Selling, General and Administrative

Selling, general and administrative expenses were $321,442 compared to $103,362 in 2014. This increase was due to the increase of consulting fees & salaries in 2015. Selling, general and administrative expenses for the two segments are segregated below.

(i) | Print-Based English Language Learning |

Selling, general and administrative cost for print-based publishing decreased from $165,666 in the second quarter of 2014 to $154,161 in the second quarter of 2015 due to a small reduction in sales, marketing & administration expenses and increased government grants. The following is a breakdown of selling, general and administrative costs directly related to print-based English language learning:

| | | 2015 | | | 2014 | |

Sales, marketing & administration | | $ | 18,521 | | | $ | 42,119 | |

Consulting fees & salaries | | | 144,247 | | | | 77,652 | |

Travel | | | 28,793 | | | | 22,226 | |

Premises | | | 18,703 | | | | 25,793 | |

Shareholder service | | | 10,070 | | | | 7,601 | |

Professional fees | | | 7,073 | | | | 22,775 | |

Less: Grants | | | (73,246 | ) | | | (32,500 | ) |

| | | $ | 154,161 | | | $ | 165,666 | |

(ii) | Online English Language Learning |

Selling, general and administrative costs related to online English language learning was $167,281 for the period compared to $103,362 for the same period in 2014. Selling, general and administrative costs for this business unit increased in 2015 as compared to 2014, which included an increase of sales, marketing and administration expenditures and shareholder services.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 8 |

| | | 2015 | | | 2014 | |

Sales, marketing & administration | | $ | 65,996 | | | $ | 25,061 | |

Consulting fees and salaries | | | 12,152 | | | | 44,182 | |

Travel | | | 633 | | | | 1,690 | |

Premises | | | 12,000 | | | | 9,805 | |

Shareholder services | | | 54,046 | | | | - | |

Professional fees | | | 22,454 | | | | 22,624 | |

Less: Grants | | | - | | | | - | |

| | | $ | 167,281 | | | $ | 103,362 | |

| Total Selling and Administrative Expenses | | $ | 321,442 | | | $ | 269,028 | |

NetIncome

Total comprehensive income for the Company was $993,552 for the quarter ended June 30, 2015 as compared to total comprehensive income of $200,534 in 2014. Total comprehensive income can be attributed to the two operating segments as shown below:

| | | 2015 | | | 2014 | |

| Online ELL | | | | | | |

Revenue | | $ | 919,410 | | | $ | 104,904 | |

Expenses: | | | | | | | | |

Direct costs | | | 80,835 | | | | 31,808 | |

General & administrative | | | 167,281 | | | | 103,362 | |

Amortization of property & equipment | | | 1,672 | | | | 1,125 | |

Amortization of development costs | | | 174,389 | | | | 146,319 | |

Income taxes and other taxes | | | 33 | | | | - | |

| | | | 424,210 | | | | 282,614 | |

SegmentedProfit /(Loss) - Online ELL | | | 495,200 | | | | (177,710 | ) |

Print-Based ELL | | | | | | | | |

Revenue | | | 875,249 | | | | 772,975 | |

Expenses: | | | | | | | | |

Direct costs | | | 20,292 | | | | 18,594 | |

General & administrative | | | 154,161 | | | | 165,666 | |

Amortization of property & equipment | | | 506 | | | | 1,091 | |

Income taxes and other taxes | | | 136,539 | | | | 122,136 | |

| | | | 311,498 | | | | 307,487 | |

SegmentedProfit – Print-Based ELL | | | 563,751 | | | | 465,488 | |

| | | | | | | | | |

Other | | | | | | | | |

Foreign exchange | | | (27,110 | ) | | | (23,163 | ) |

Interest and other financial expenses | | | (46,160 | ) | | | (46,982 | ) |

Share-based payment | | | (6,578 | ) | | | - | |

Other comprehensive income | | | 14,449 | | | | (17,099 | ) |

| | | | (65,399 | ) | | | (87,244 | ) |

Total Comprehensive Income | | $ | 993,552 | | | $ | 200,534 | |

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 9 |

Foreign Exchange

The Company recorded foreign exchange loss of $27,110 as compared to a loss of $23,163 in 2014, relating to the Company's currency risk through its activities denominated in foreign currencies as the Company is exposed to foreign exchange risk as a significant portion of its revenue and expenses are denominated in US Dollars, European Euros, and Chinese Renminbi.

Share-basedPayments

The Company amortizes share-based payments with a corresponding increase to the contributed surplus account. During the period, the Company recorded an expense of $6,578 compared to $Nil during 2014.

NetProfit for the Period

The Company reported a net profit of $979,103 for the period as compared to a net profit of $217,633 in 2014, an operational improvement of $761,470. This improvement is primarily attributed to increase in revenue of $916,780.

Total ComprehensiveIncome

The total comprehensive income is calculated after the application of exchange differences on translating foreign operations gain/ (loss). The Company reported a total comprehensive income of $993,552 for the quarter ended June 30, 2015, as compared to a total comprehensive income of $200,534 for same quarter in 2014. The earning per share for the quarter is $0.04 as compared to income per share of $0.01 in 2014.

Summary of Quarterly Results

| | | Q3-14 | | | Q4-14 | | | Q1-15 | | | Q2-15 | |

Revenue | | $ | 222,468 | | | $ | 1,176,066 | | | $ | 651,627 | | | $ | 1,794,659 | |

Income / (Loss) Before Taxes and Other Comp Income | | | (169,200 | ) | | | 286,673 | | | | 232,580 | | | | 1,115,675 | |

Total Comprehensive Income / (Loss) | | | (255,659 | ) | | | 344,096 | | | | 146,598 | | | | 993,552 | |

Income / (Loss) per Basic and Diluted Share | | | (0.01 | ) | | | 0.01 | | | $ | 0.01 | | | $ | 0.04 | |

| | | Q3-13 | | | Q4-13 | | | Q1-14 | | | Q2-14 | |

Revenue | | $ | 130,139 | | | $ | 1,024,555 | | | $ | 236,051 | | | $ | 877,879 | |

Income / (Loss) Before Taxes and Other Comp Income | | | (338,785 | ) | | | 635,183 | | | | (44,110 | ) | | | 339,769 | |

Total Comprehensive Income / (Loss) | | | (323,227 | ) | | | 446,766 | | | | (181,565 | ) | | | 200,534 | |

Income / (Loss) per Basic and Diluted Share | | $ | (0.015 | ) | | $ | 0.02 | | | $ | (0.00 | ) | | | 0.01 | |

Liquidity and Capital Resources

As at June 30, 2015, the Company had cash of $142,328 compared to $144,537 for the same period in 2014. Accounts and grants receivable of $1,790,758 were outstanding at the end of the period compared to $895,334 in the second quarter of 2014. With 47% of the receivables from PEP and a 90 day collection cycle, the Company does not anticipate an effect on its liquidity. Total current assets amounted to $2,335,899 (2014 - $1,122,136) with current liabilities of $1,448,073 (2014 - $1,597,992) resulting in working capital of $887,826 (2014 - working capital deficit of $475,856).

The Company receives government grants based on certain eligibility criteria for publishing industry development in Canada and for international marketing support. These government grants are recorded as a reduction of general and administrative expenses to offset direct expenditure funded by the grant. The Company receives these grants throughout the year. The grant is applied based on the Company meeting certain eligibility requirements. The Company has relied on obtaining these grants for its operations and has been successful at securing them in the past, but it cannot be assured of obtaining these grants in the future.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 10 |

The Company plans on raising additional working capital through an equity private placement financing or a debt financing, as the capital markets permit, in an effort to finance its growth plans and expansion into new international markets. The Company has been successful in raising sufficient working capital in the past.

The Company has incurred significant losses over the years. The Company’s success depends on the continued profitable commercialization of its online English language learning technology. Given the fact that the Company has had an increase in revenue of $916,780, increase in net profit of $761,470, and the Company’s current operating and financial plans, management of the Company believes that it will have sufficient access to financial resources to fund the Company’s planned operations through fiscal 2015.

On April 17, 2015, the Company closed a non-brokered private placement financing of 5,000,000 units at $0.10 per unit for gross proceeds of $500,000. Each Unit is comprised of one common share in the capital of the Company and one common share purchase warrant. Each Warrant entitles the holder to purchase one Common Share at an exercise price of $0.125 per share until April 17, 2016. No finders’ fee was paid. One director participated private placement financing. One director of the Company participated in the private placement and subscribed to 400,000 Units for a total price of $40,000

Off-Balance Sheet Arrangements

The Company has not entered into any off-balance sheet finance arrangements.

Contractual Obligations

Future minimum lease payments under operating leases for premises and equipment are as follows:

2015 | | $ | 98,853 | |

| 2016 | | | 39,251 | |

| 2017 | | | - | |

Transactions with Related Parties

During the quarter, the Company had the following transactions with related parties, made in the normal course of operations, and accounted for at an amount of consideration established and agreed to by the Company and related parties.

Key management compensation was $235,191 (2014 – $180,419) and is reflected as consulting fees paid to corporations owned by a director and officers of the Company, $60,833 is deferred and included in accounts payable.

At June 30, 2015, the Company had loans payable due to corporations controlled by directors and officers of the Company in the amount of $480,000 (2014 - $480,000) bearing interest at 9% per annum. Interest expense related to these loans is $22,415 (2014 - $21,422.46).

On April 17, 2015, Lingo Media closed a non-brokered private placement financing of 5,000,000 units at $0.10 per Unit for gross proceeds of $500,000. One director of the Company participated in the private placement and subscribed to 400,000 Units for a total price of $40,000.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 11 |

Additional Disclosure

Intangibles

| | | Software& WebDevelopment | | | Content Platform | | | Content Development | | | Total | |

| | | | | | | | | | | | | |

Cost, January 1, 2014 | | $ | 7,225,065 | | | $ | 1,477,112 | | | $ | - | | | $ | 8,702,177 | |

Additions | | | 244,161 | | | | - | | | | - | | | | 244,161 | |

Effect of foreign exchange | | | 514 | | | | - | | | | - | | | | 514 | |

Cost, June 30, 2014 | | | 7,469,740 | | | | 1,477,112 | | | | - | | | | 8,946,852 | |

Additions | | | 300,474 | | | | - | | | | - | | | | 300,474 | |

Effect of foreign exchange | | | 11,397 | | | | - | | | | - | | | | 11,397 | |

Cost, December 31, 2014 | | | 7,781,611 | | | | 1,477,112 | | | | - | | | | 9,258,723 | |

Additions | | | 406,055 | | | | - | | | | 455,407 | | | | 861,462 | |

Effect of foreign exchange | | | 13,355 | | | | - | | | | - | | | | 13,355 | |

Cost, June 30, 2015 | | $ | 8,201,021 | | | $ | 1,477,112 | | | $ | 455,407 | | | $ | 10,133,540 | |

| | | Software& WebDevelopment | | | Content Platform | | | Content D evelopment | | | Total | |

| | | | | | | | | | | | | |

Accumulated depreciation,January 1, 2014 | | $ | 6,763,414 | | | $ | 1,061,868 | | | $ | - | | | $ | 7,825,282 | |

Charge for the period | | | 128,665 | | | | 146,498 | | | | - | | | | 275,163 | |

Effect of foreign exchange | | | (468 | ) | | | - | | | | - | | | | (468 | ) |

Accumulated depreciation,June 30, 2014 | | | 6,891,611 | | | | 1,208,366 | | | | - | | | | 8,099,977 | |

Charge for the period | | | 158,770 | | | | 148,924 | | | | - | | | | 307,694 | |

Effect of foreign exchange | | | 3,454 | | | | - | | | | - | | | | 3,454 | |

Accumulated depreciation,December 31, 2014 | | | 7,053,835 | | | | 1,357,290 | | | | - | | | | 8,411,125 | |

Charge for the period | | | 221,071 | | | | 119,822 | | | | 13,537 | | | | 354,430 | |

Effect of foreign exchange | | | 8,884 | | | | - | | | | - | | | | 8,884 | |

Accumulated depreciation,June 30, 2015 | | $ | 7,283,790 | | | $ | 1,477,112 | | | $ | 13,537 | | | | 8,774,438 | |

Net book value, December 31, 2014 | | $ | 727,776 | | | $ | 119,822 | | | | - | | | $ | 847,598 | |

Net book value, June 30, 2015 | | $ | 917,231 | | | $ | - | | | $ | 441,870 | | | $ | 1,359,101 | |

The Company began commercial production and sale of its services and products during 2009 and started amortizing the cost of software and web development costs on a straight-line basis over the useful life of the assets which is estimated to be 3 years.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 12 |

Property and Equipment

Cost, January 1, 2014 | | $ | 215,599 | |

Additions | | | 3,277 | |

Disposal | | | (53,494 | ) |

Effect of foreign exchange | | | (368 | ) |

Cost, June 30, 2014 | | | 165,014 | |

Additions | | | 6,259 | |

Effect of foreign exchange | | | 2,406 | |

Cost, December 31, 2014 | | | 173,679 | |

Additions | | | 13,281 | |

Disposal | | | (5,000 | ) |

Effect of foreign exchange | | | 2,272 | |

Cost, June 30, 2015 | | $ | 184,232 | |

| | | | | |

Accumulated depreciation, January 1, 2014 | | $ | 183,673 | |

Charge for the period | | | 3,614 | |

Disposal | | | (44,276 | ) |

Effect of foreign exchange | | | (123 | ) |

Accumulated depreciation, June 30, 2014 | | | 142,888 | |

Charge for the period | | | 3,772 | |

Effect of foreign exchange | | | (2,213 | ) |

Accumulated depreciation, December 31, 2014 | | | 148,873 | |

Charge for the period | | | 3,896 | |

Effect of foreign exchange | | | (1,915 | ) |

Accumulated depreciation,June 30, 2015 | | $ | 150,854 | |

| | | | | |

| | | | | |

Net book value, January 1, 2014 | | $ | 31,926 | |

Net book value, December 31, 2014 | | $ | 24,806 | |

Net book value,June 30, 2015 | | $ | 33,378 | |

Disclosure of Outstanding Share Data

As of August 26, 2015, the followings are outstanding:

| Common Shares | – | 27,379,177 | |

| Warrants | – | 10,533,668 | |

| Stock Options | – | 3,742,500 | |

Approval

The Directors of Lingo Media have approved the disclosure contained in this MD&A.

Additional Information

Additional information relating to the Company can be found on SEDAR at www.sedar.com.

Lingo Media Corporation (TSX-V: LM; OTCQB: LMDCF) Management Discussion & Analysis | 13 |