Exhibit 1

| Trading Symbols (TSX-V: LM; OTC: LMDCF; FSE: LIMA) 151 Bloor St West Suite 703 Toronto, Ontario Canada M5S 1S4 Tel : 416.927.7000 Fax : 416.927.1222 www.lingomedia.com |

Lingo Media Corporation

Form 51 – 102 F1

Management Discussion & Analysis

Second Quarter Ended June 30, 2018

August 27, 2018

MANAGEMENT DISCUSSION & ANALYSIS

FOR THE PERIOD ENDED JUNE 30, 2018

Notice to Reader The following Management Discussion & Analysis ("MD&A") of Lingo Media Corporation’s (the "Company" or "Lingo Media") financial condition and results of operations, prepared as of August 27, 2018, should be read in conjunction with the Company's Condensed Consolidated Interim Financial Statements and accompanying Notes for the period ended June 30, 2018 and 2017, which have been prepared in accordance with International Financial Reporting Standards are incorporated by reference herein and form an integral part of this MD&A. All dollar amounts are in Canadian Dollars unless stated otherwise. These documents can be found on the SEDAR website www.sedar.com. Our MD&A is intended to enable readers to gain an understanding of Lingo Media’s current results and financial position. To do so, we provide information and analysis comparing the results of operations and financial position for the current period to those of the preceding comparable three-month period. We also provide analysis and commentary that we believe is required to assess the Company's future prospects. Accordingly, certain sections of this report contain forward-looking statements that are based on current plans and expectations. These forward-looking statements are affected by risks and uncertainties that are discussed in this document and that could have a material impact on future prospects. Readers are cautioned that actual results could vary. |

Cautions Regarding Forward-Looking Statements This MD&A contains certain forward-looking statements, which reflect management’s expectations regarding the Company’s results of operations, performance, growth, and business prospects and opportunities. Statements about the Company’s future plans and intentions, results, levels of activity, performance, goals or achievements or other future events constitute forward-looking statements. Wherever possible, words such as "may," "will," "should," "could," "expect," "plan," "intend," "anticipate," "believe," "estimate," "predict," or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this MD&A are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this MD&A, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Many factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including: general economic and market segment conditions, competitor activity, product capability and acceptance, international risk and currency exchange rates and technology changes. More detailed assessment of the risks that could cause actual results to materially differ than current expectations is contained in the "Quantitative and Qualitative Disclosures of Market Risk" section of this MD&A. |

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 2 |

Summary Description of Lingo Media

Lingo Media (“Lingo Media,” the “Company,” “we” or ”us”) is an EdTech company that is ‘Changing the way the world learns Languages’ through the combination of education with technology. The Company is focused on online and print-based technologies and solutions through its two subsidiaries: Lingo Learning Inc. (Lingo Learning”) and ELL Technologies Ltd. (“ELL Technologies”). Through its two distinct business units, Lingo Media develops, markets and supports a suite of English language learning solutions consisting of web-based software licensing subscriptions, online and professional services, audio practice tools and multi-platform applications. The Company continues to operate its legacy textbook publishing business from which it collects recurring royalty revenues.

Lingo Media’s two distinct business units include ELL Technologies and Lingo Learning. ELL Technologies is a web-based educational technology (“EdTech”) English language learning training and assessment company that creates innovative Software-as-a-Service eLearning solutions. Lingo Learning is a print-based publisher of English language learning textbook programs in China. The Company has formed successful relationships with key government and industry organizations, establishing a strong presence in China’s education market of more than 500 million students. Lingo Media is extending its global reach, with an initial market expansion into Latin America and continues to expand its product offerings and technology applications.

Lingo Media has undertaken a business transition which began to gather momentum in 2015. The Company has continued to invest in language learning and leverage its industry expertise to expand into more scalable education-technology. Recent product initiatives have allowed us to expand the breadth of our language learning product offerings and reinforced the belief that the web-based EdTech learning segment continues to present a significant opportunity for long-term value creation.

Lingo Media continues to focus on software and content development to address market needs within the international government, academic and corporate training sectors.

Q2 2018 Operational Highlights

● | Online English Language Learning: |

| | ✓ | entered into a commercial alliance agreement with iTEP International LLC, the developer of the International Test of English Proficiency, to provide bundled product and online English language learning testing solutions |

| | ✓ | completed the first installation of the ELL LAP under the strategic alliance with HP Inc. at the Universidad Autonoma de Chiapas in Mexico |

| | ✓ | closed initial sales contracts with Gale, a part of Cengage Learning, with universities in Thailand & Japan, expanding our reach further into Asia |

| | ✓ | closed sales contract with municipality of Floridablanca and with Unidades Technologicas de Santander, both in Colombia and secured through distribution partner, e-Training SAS |

| | ✓ | further advanced the development of ELL Technologies’ online Spanish course |

Our strategy continues to transition more and more of our business to online subscriptions and digital downloads that enable learners to bring your own device (“BYOD”) and beyond paper-based textbook publishing. Our signing of the commercial agreement with iTEP International LLC is a testament to our commitment to this approach, as well as further validation of the ability of our program suite and course offerings to efficiently and effectively improve learning outcomes. We believe that these online subscription formats provide customers with an overall greater learning experience, the flexibility to use our products on multiple platforms (i.e. beyond desktops to tablets and mobile extensions) and is a more economical and relevant way for us to deliver our products to customers. Furthermore, our ability to configure our extensive library of lessons enables us to offer a more customizable solution to our clients without incurring the costs associated with a customized solution.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 3 |

Online English Language Learning

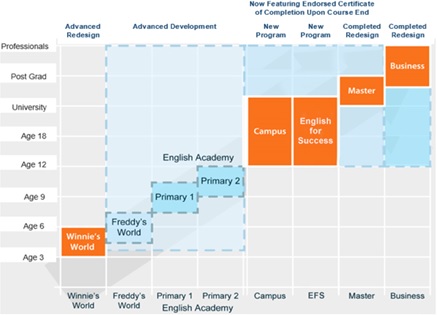

ELL Technologies, acquired in 2010, now offers over 2,000 hours of interactive learning through a number of product offerings that include Winnie’s World, English Academy, Scholar, Campus, English for Success, Master and Business in addition to offering custom solutions. ELL Technologies is primarily marketed in Latin America through a network of distributors and earns its revenues from licensing and subscription fees from its suite of web-based EdTech language learning products and applications.

ELL Technologies had an extensive existing product line which required substantial revisions in the technology platform and user interface. Over the past three years, our development team has engineered an eLearning platform and has been introducing new products to the market since the beginning of 2015, integrating cutting-edge technologies, solutions, content and pedagogy.

ELL Technologies’ high-tech, easy to implement eLearning software-as-a-Service solutions have positioned the Company to teach the world English. As a result of ongoing investment into product development, we are able to provide learners of all ages and levels of English proficiency with a platform to further their language learning development. See our “Correlation Table” below:

The horizontal axis contains our product line and correlates to the vertical axis which contains the ages and levels of proficiency that the product has been designed for.

All of our products have been designed for our proprietary learning management system which completes the suite of products and allows ELL Technologies to market and sell to academic institutions, governments and corporations. Educators who license the platform will be able to easily create, convert, edit, and arrange lessons and courses as they see fit.

Formative assessments and data gathering functionality allows us to adapt and improve content. Based on that data, we are able to program iterations to address specific problem areas and to make learning more accessible, efficient and measurable. Built for learners, by learners, we empower educators and allow them to easily transition from pure classroom paper-based teaching to the online world.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 4 |

Print-Based English Language Learning

The Company continues to maintain its legacy textbook publishing business through Lingo Learning, a print-based publisher of English language learning programs in China since 2001. Lingo Learning has an established presence in China’s education market of over 300 million students. To date, it has co-published more than 600 million units from its library of program titles.

Revenue Recognition Policy

Lingo Learning earns royalty revenues from its key customer, People’s Education Press and People’s Education & Audio Visual Press (collectively “PEP”), who are China’s State Ministry of Education’s publishing arm, on the following basis:

● | Finished Product Sales – PEP prints and sells Lingo Learning’s English language training programs to provincial distributors in China; and |

● | Licensing Sales – PEP licenses Lingo Learning’s English language training programs to provincial publishers who then print and sell the programs to provincial distributors in China. |

Lingo Learning earns significantly higher royalties from Licensing Sales compared to Finished Product Sales.

In accordance with the co-publishing agreements between PEP and Lingo Learning, PEP pays to Lingo Learning a royalty on sales of textbooks and supplemental products called Finished Product Sales. In addition, PEP pays to Lingo Learning a percentage of their royalties earned on actual revenues called Licensing Sales. PEP provides Lingo Learning with sales reconciliations on a semi-annual basis, as their reporting systems are not able to provide quarterly sales information. Revenue is recognized upon the confirmation of such sales and when collectability is reasonably assured.

Royalty revenues from PEP’s audiovisual-based products are recognized quarterly upon the confirmation of sales, and when collectability is reasonably assured. Royalty revenues are not subject to right of return or product warranties. Revenue from the sale of published and supplemental products is recognized upon delivery and when the risk of ownership is transferred and collectability is reasonably assured.

ELL Technologies has now fully-integrated Parlo and Speak2Me into its offerings, and it earns training revenue by developing and hosting online English language learning solutions for its customers, both off the shelf and customized solutions. Revenue is recognized upon delivery of the online courses to the end client through its distributor and when collectability is reasonably assured.

When the outcome of a contract cannot be reliably estimated, all contract related costs are expensed and revenues are recognized only to the extent that those costs are recoverable. When the uncertainties that prevented reliable estimation of the outcome of a contract no longer exist, contract revenue and expenses are recognized using the percentage of completion method.

On January 1, 2018, the Company adopted on a fully retrospective basis the new rules under IFRS 15 which specifies how and when an entity should recognize revenue as well as requiring such entities to provide users of financial statements with more informative disclosures. The retroactive adoption of IFRS 15 will have no material impact to the consolidated financial statements.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 5 |

Overall Performance

During the three-month period ended June 30, 2018, Lingo Media recorded revenues of $960,159 as compared to $1,068,915 in 2017. Net profit was $477,208 as compared to a net profit of $43,122 in 2017. Total comprehensive income was $478,062 as compared to a comprehensive income of $42,392 in 2017. At the same time, the Company’s selling general and administrative costs was $313,659 compared to $358,369 in 2017. Lingo Media recorded share-based payments of $49,663 as compared to $30,721 in 2017.

The Company previously capitalized all development costs related to its software web development, content platform, and content development through to December 31, 2016. During the year ended December 31, 2017, there was uncertainty with respect to feasibility and profitability of the projects due to sales not achieving forecast levels and a resulting decline in expected future cash flows from their intended use. Consequently, the benefit of these development costs may not be realized as soon as previously expected and, as such, the costs incurred during the quarter ended June 30, 2018 were expensed rather than capitalized as they did not meet the criteria for capitalization.

In addition, cash generated in operations during the period was $515,666 as compared to $886,651 in 2017.

Online English Language Learning

ELL Technologies earned revenue from its portfolio of products of $126,764 for the three months period, compared to $204,571 in 2017. The decrease in revenue is a result of extended sales cycles in securing contracts and time shifting of the sales pipeline.

Print-Based English Language Learning

Lingo Media earned royalty revenue of $878,138 in 2018 compared to $864,344 in 2017 from People’s Education Press and People’s Education & Audio Visual Press (“PEP AV”). This revenue consists of royalties generated through licensing sales from provincial distributors as a result of Lingo Media and PEP AV’s local marketing and training initiatives.

Market Trends and Business Uncertainties

Lingo Media believes that the global market trends in English language learning are strong and will continue to grow at a rapid pace. Developing countries around the world, specifically in Latin America and Asia are expanding their mandates for the teaching of English amongst students, young professionals and adults.

The British Council suggests that there are 1.6 Billion people learning English globally. English language learning products and services are a US$56.3 Billion global market notes Ambient Insight, who also forecasts digital English learning expenditures to account for US$3.1 Billion by 2018.

Markets and Markets forecasts the global EdTech market to grow from US$43.27 Billion in 2015 to US$93.76 Billion to 2019, or at a CAGR or 16.72%.

GSV Advisors forecasts digital English learning product expenditures to be US$2.5 Billion (or 7.3%) of the global market by 2018, with Latin America representing approximately US$260.9 Million of that figure. Students attending English language training (“ELT”) classes in Latin America accounted for approximately 14 per cent of worldwide revenues, or US$321-million in 2017. Growth has been very rapid in the region, and represents a particularly strong opportunity moving forward relative to other geographic regions. The remaining market for ELT is largely concentrated in Europe, the Middle East and Africa (45 per cent of revenues or US$1.04-billion) and the Asia Pacific region (35 per cent of revenues or US$825-million).

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 6 |

Lingo Media is positioned to take advantage of the market opportunity for teaching English in Latin America and Asia, with its scalable web-based learning technology and solutions. Although the market outlook remains positive, there can be no assurance that this trend will continue or that the Company will benefit from this trend.

General Financial Condition

As at June 30, 2018 Lingo Media had working capital of $533,060 compared to $2,068,187 as at June 30, 2017. Total comprehensive income for the three month period ended June 30, 2018 was $478,062 compared to comprehensive income of $42,392 for the period ended June 30, 2017.

Financial Highlights – for the Second Quarter Ended June 30, 2018

| | | 2018 | | | 2017 | | | 2016 | |

| Revenue | | | | | | | | | | | | |

Print-Based English Language Learning | | $ | 833,395 | | | $ | 864,344 | | | $ | 906,855 | |

| Online English Language Learning | | | 126,764 | | | | 204,571 | | | | 642,542 | |

| | | | 960,159 | | | | 1,068,915 | | | | 1,549,397 | |

Net Profit for the Period | | | 477,208 | | | | 43,122 | | | | 631,183 | |

Total Comprehensive Income | | | 478,062 | | | | 42,392 | | | | 624,319 | |

Earnings per Share | | $ | 0.01 | | | $ | 0.00 | | | $ | 0.02 | |

Total Assets | | | 1,425,690 | | | | 6,981,686 | | | | 7,663,731 | |

Working Capital | | | 533,060 | | | | 2,068,187 | | | | 4,050,276 | |

Cash Provided - Operations | | | 515,666 | | | | 886,651 | | | | 737,448 | |

The Company had cash on hand as at June 30, 2018 of $239,763 (2017 - $75,415) and continues to rely on its revenues from its recurring royalty stream, its online English language learning services, and future debt and/or equity financings to fund its operations.

Results of Operations

During the quarter, Lingo Media earned $126,764 in online licensing sales revenue as compared to $204,571 in 2017. The decrease in revenue is a result of extended sales cycles in securing contracts and time shifting of the sales pipeline.

Revenues from Print-Based English language learning for the quarter were $833,395 compared to $864,344 in 2017. Direct costs associated with publishing revenue are relatively modest and has been consistent throughout the years. The Company continues to maintain its relationship with PEP and is investing in the development of its existing and new programs and marketing activities to maintain and increase its royalty revenues.

Selling, General and Administrative

Selling, general and administrative expenses were $313,659 compared to $358,369 in 2017. Selling, general and administrative expenses for the two segments are segregated below.

(i) | Print-Based English Language Learning |

Selling, general and administrative cost for print-based publishing decreased from $194,882 in 2017 to $106,440 in 2018 primarily due to the decrease in sales, marking & administration, consulting fees and salaries and premises expense. The following is a breakdown of selling, general and administrative costs directly related to print-based English language learning:

For the Quarter Ended June 30th | | 2018 | | | 2017 | |

Sales, marketing & administration | | $ | 13,741 | | | $ | 51,538 | |

Consulting fees and salaries | | | 91,201 | | | | 130,092 | |

Travel | | | 25,118 | | | | 8,676 | |

Premises | | | 9,181 | | | | 32,522 | |

Shareholder services | | | 3,618 | | | | 12,633 | |

Professional fees | | | 21,802 | | | | 17,650 | |

Less: Grants | | | (58,221 | ) | | | (58,229 | ) |

| | | $ | 106,440 | | | $ | 194,882 | |

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 7 |

(ii) | Online English Language Learning |

Selling, general and administrative costs related to online English language learning was $207,219 for the period compared to $163,487 in 2017. Selling, general and administrative costs, consulting fees and salaries for this business unit increased in 2018 as compared to 2017.

For the Quarter Ended June 30th | | 2018 | | | 2017 | |

Sales, marketing & administration | | $ | 30,767 | | | $ | 56,556 | |

Consulting fees and salaries | | | 135,137 | | | | 51,703 | |

Travel | | | 4,905 | | | | 20,343 | |

Premises | | | 12,000 | | | | 12,000 | |

Shareholder services | | | 14,003 | | | | 9,983 | |

Professional Fees | | | 10,407 | | | | 12,902 | |

| | | $ | 207,219 | | | $ | 163,487 | |

| Total Selling, General and Administrative Expenses | | $ | 313,659 | | | $ | 358,369 | |

Development Costs

The Company began commercial production and sale of its services and products during 2009. In 2018, the Company continued to focus on the maintenance of its ELL Technologies’ suite of products and invested $80,002 (2017 - $715,602) during three month period ended June 30, 2018. The ELL Technologies’ suite of products includes five different products, each designed to suit the needs of different demographic groups. Although the full suite of product is not yet complete, the Company has started the commercial production and sale of three of these products.

The Company previously capitalized all development costs related to its software web development, content platform, and content development through to December 31, 2016. During the year ended December 31, 2017, there was uncertainty with respect to feasibility and profitability of the projects due to sales not achieving forecast levels and a resulting decline in expected future cash flows from their intended use. Consequently, the benefit of these development costs may not be realized as soon as previously expected and, as such, the costs incurred during the quarter ended June 30, 2018 were expensed rather than capitalized as they did not meet the criteria for capitalization.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 8 |

Net Income

Total comprehensive income for the Company was $478,062 for the period ended June 30, 2018 as compared to a comprehensive income of $42,392 in 2017. These incomes can be attributed to the two operating segments and other financial expenses as shown below:

Online ELL | | 2018 | | | 2017 | |

Revenue | | $ | 126,764 | | | $ | 204,571 | |

Expenses: | | | | | | | | |

Direct costs | | | 33,782 | | | | 49,754 | |

General & administrative | | | 207,219 | | | | 163,487 | |

Bad debt (recovery) | | | (143,039 | ) | | | - | |

Amortization of property & equipment | | | 610 | | | | 117 | |

Amortization of development costs | | | - | | | | 307,402 | |

Development cost | | | 80,002 | | | | - | |

Income taxes and other taxes | | | 4,708 | | | | - | |

| | | | 183,282 | | | | 520,760 | |

Segmented Profit / (Loss) - Online ELL | | $ | (56,518 | ) | | $ | (316,189 | ) |

Print-Based ELL | | | | | | | | |

Revenue | | $ | 833,395 | | | $ | 864,344 | |

Expenses: | | | | | | | | |

Direct costs | | | 21,304 | | | | 24,033 | |

General & administrative | | | 106,440 | | | | 194,882 | |

Amortization of property & equipment | | | 954 | | | | 1,303 | |

Income taxes and other taxes | | | 131,951 | | | | 136,937 | |

| | | | 260,649 | | | | 357,155 | |

Segmented Profit / (Loss) – Print-Based ELL | | $ | 572,746 | | | $ | 507,189 | |

| | | | | | | | | |

Other | | | | | | | | |

Foreign exchange | | $ | 34,615 | | | $ | (104,702 | ) |

Interest and other financial expenses | | | (23,972 | ) | | | (12,455 | ) |

Share based payment | | | (49,663 | ) | | | (30,721 | ) |

Other comprehensive income | | | 854 | | | | (730 | ) |

| | | | (38,166 | ) | | | (148,608 | ) |

Total Comprehensive Income | | $ | 478,062 | | | $ | 42,392 | |

Foreign Exchange

The Company recorded foreign exchange gain of $34,615 as compared to a foreign exchange loss of $104,702 in 2017, relating to the Company's currency risk through its activities denominated in foreign currencies as the Company is exposed to foreign exchange risk as a significant portion of its revenue and expenses are denominated in Chinese Renminbi and US Dollars.

Share-Based Payments

The Company amortizes share-based payments with a corresponding increase to the contributed surplus account. During the period, the Company recorded an expense of $49,663 compared to $30,721 during 2017.

Net Profit for the Period

The Company reported a net profit of $477,208 for the period as compared to $43,122 in 2017.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 9 |

Total Comprehensive Income

The total comprehensive income is calculated after the application of exchange differences on translating foreign operations gain/(loss). The Company reported a total comprehensive income of $478,062 for the period ended June 30, 2018, as compared to $42,392 in 2017.

Summary of Quarterly Results

| | | | | | | | | | | | | |

| | | Q3-17 | | | Q4-17 | | | Q1-18 | | | Q2-18 | |

Revenue | | $ | 354,914 | | | $ | 754,962 | | | $ | 80,335 | | | | 960,159 | |

Income / (Loss) Before Taxes and Other Comprehensive Income | | | (473,026 | ) | | | (5,663,320 | ) | | | (536,836 | ) | | | 613,867 | |

Total Comprehensive Income / (Loss) | | | (475,632 | ) | | | (5,833,279 | ) | | | (544,311 | ) | | | 478,062 | |

Income / (Loss) per Basic and Diluted Share | | $ | (0.013 | ) | | $ | (0.18 | ) | | $ | (0.02 | ) | | $ | 0.00 | |

| | | | | | | | | | | | | |

| | | Q3-16 | | | Q4-16 | | | Q1-17 | | | Q2-17 | |

Revenue | | $ | 152,657 | | | $ | 736,309 | | | $ | 597,977 | | | $ | 1,068,915 | |

Income / (Loss) Before Taxes and Other Comprehensive Income | | | (581,710 | ) | | | 2,353 | | | | 9,864 | | | | 43,122 | |

Total Comprehensive Income (Loss) | | | (563,241 | ) | | | (48,446 | ) | | | 3,727 | | | | 42,392 | |

Income / (Loss) per Basic and Diluted Share | | $ | (0.016 | ) | | $ | (0.00 | ) | | $ | 0.00 | | | $ | 0.00 | |

Liquidity and Capital Resources

As at June 30, 2018, the Company had cash of $239,763 compared to $75,415 in 2017. Accounts and grants receivable of $1,073,843 were outstanding at the end of the period compared to $2,303,826 in 2017. With 83% of the receivables from PEP and the balance due from ELL customers with a 90 - 180 day collection cycle, the Company does not anticipate an effect on its liquidity. Total current assets amounted to $1,398,174 (2017 - $2,528,000) with current liabilities of $865,114 (2017 - $459,813) resulting in working capital of $533,060 (2017 - $2,068,187).

Lingo Learning receives government grants based on certain eligibility criteria for publishing industry development in Canada and for international marketing support. These government grants are recorded as a reduction of general and administrative expenses to offset direct expenditure funded by the grant. The Company receives these grants throughout the year. The grant is applied based on Lingo Learning meeting certain eligibility requirements. The Company has relied on obtaining these grants for its operations and has been successful at securing them in the past, but it cannot be assured of obtaining these grants in the future.

Lingo Media has access to working capital through equity financings or debt financings, if required to finance its growth plans and expansion into new international markets. The Company has been successful in raising sufficient working capital in the past.

Off-Balance Sheet Arrangements

The Company has not entered into any off-balance sheet finance arrangements.

Contractual Obligations

Future minimum lease payments under operating leases for premises and equipment are as follows:

2018 | | $ | 114,752 | |

2019 | | | 226,913 | |

2020 | | | 202,705 | |

2021 | | | 41,525 | |

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 10 |

Transactions with Related Parties

The Company’s key management includes Michael Kraft, President & CEO, Gali Bar-Ziv, COO, Khurram Qureshi, CFO in addition to Board Directors and the Secretary of the Board.

The Company had the following transactions with related parties, made in the normal course of operations, and accounted for at an amount of consideration established and agreed to by the Company and related parties.

The Company charged $45,891 (2017 - $13,763, 2016 - $2,891) to the corporations with director or officer in common for rent, administration, office charges and telecommunications.

Key management compensation for the quarter was $82,500 (2017 – $82,500, 2016 – $82,500) and is reflected as consulting fees paid to corporations owned by a director and officers of the Company. $82,500 is deferred and included in accounts payable.

At June 30, 2018, the Company had loans payable due to corporations controlled by directors and officers of the Company in the amount of $90,000 (2017 - $Nil) bearing interest at 12% per annum. Interest expense related to these loans is $8,338 (2017 - $nil).

Additional Disclosure

Intangibles

| | | Software and Web Development | | | Content Platform | | | Content Development | | | Total | |

Cost, January 1, 2017 | | $ | 9,239,088 | | | $ | 1,477,112 | | | $ | 2,474,020 | | | $ | 13,190,220 | |

Additions | | | 482,706 | | | | - | | | | 1,107,713 | | | | 1,590,419 | |

Cost, June 30, 2017 | | $ | 9,721,794 | | | $ | 1,477,122 | | | $ | 3,581,733 | �� | | $ | 14,780,639 | |

Impairment | | | (482,707 | ) | | | - | | | | (1,107,713 | ) | | | (1,590,420 | ) |

Cost, December 31, 2017 | | | 9,239,087 | | | | 1,477,112 | | | | 2,474,020 | | | | 13,190,219 | |

Cost, June 30, 2018 | | $ | 9,239,088 | | | $ | 1,477,112 | | | $ | 2,474,020 | | | $ | 13,190,219 | |

| | | | | | | | | | | | | | | | | |

Accumulated depreciation, January 1, 2017 | | $ | 8,229,946 | | | $ | 1,477,112 | | | $ | 483,152 | | | $ | 10,190,210 | |

Charge for the period | | | 335,498 | | | | - | | | | 266,176 | | | | 601,674 | |

Accumulated depreciation, June 30, 2017 | | $ | 8,565,444 | | | $ | 1,477,112 | | | $ | 749,328 | | | $ | 10,791,884 | |

Charge for the period | | | 221,626 | | | | - | | | | 228,628 | | | | 450,254 | |

Impairment | | | 452,018 | | | | - | | | | 1,496,063 | | | | 1,948,081 | |

Accumulated depreciation, December 31, 2017 | | | 9,239,088 | | | | 1,477,112 | | | | 2,474,019 | | | | 13,190,219 | |

Accumulated depreciation, June 30, 2018 | | $ | 9,239,088 | | | $ | 1,477,112 | | | $ | 2,474,019 | | | $ | 13,190,219 | |

| | | | | | | | | | | | | | | | | |

Net book value, December 31, 2017 | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Net book value, June 30, 2018 | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 11 |

The Company previously capitalized all development costs related to its software web development, content platform, and content development through to December 31, 2016. During the year ended December 31, 2017, there was uncertainty with respect to feasibility and profitability of the projects due to sales not achieving forecasted levels and a resulting decline in expected future cash flows from their intended use. Consequently, the benefit of these development costs may not be realized as soon as previously expected and, as such, the costs incurred during the year ended June 30, 2018 were expensed rather than capitalized as they did not meet the criteria for capitalization.

Property and Equipment

Cost, January 1, 2017 | | $ | 80,713 | |

Additions | | | 676 | |

Effect of foreign exchange | | | (441 | ) |

Cost, June 30, 2017 | | $ | 80,948 | |

Additions | | | 9,247 | |

Effect of foreign exchange | | | (408 | ) |

Cost, December 31, 2017 | | $ | 89,787 | |

Effect of foreign exchange | | | 566 | |

Cost, June 30, 2018 | | $ | 90,353 | |

| | | | | |

Accumulated depreciation, January 1, 2017 | | $ | 53,225 | |

Charge for the period | | | 2,809 | |

Effect of foreign exchange | | | (399 | ) |

Accumulated depreciation, June 30, 2017 | | $ | 55,635 | |

Charge for the period | | | 3,835 | |

Effect of foreign exchange | | | (372 | ) |

Accumulated depreciation, December 31, 2017 | | $ | 59,098 | |

Charge for the period | | | 3,217 | |

Effect of foreign exchange | | | 522 | |

Accumulated depreciation, June 30, 2018 | | | 62,837 | |

Net book value, January 1, 2017 | | $ | 27,488 | |

Net book value, June 30, 2017 | | $ | 25,313 | |

Net book value, December 31, 2017 | | $ | 30,689 | |

Net book value, June 30, 2018 | | $ | 27,516 | |

Risk Factors

Business Risk and Uncertainties

We are subject to a number of risks and uncertainties that can significantly affect our business, financial condition and future financial performance, as described below. In particular, there remain significant uncertainties in capital markets impacting the availability of equity financing. While these uncertainties in capital markets do not have a direct impact on our ability to carry out our business, the Company may be impacted should it become more difficult to gain access to capital when and if needed. These risks and uncertainties are not necessarily the only risks the Company faces. Additional risks and uncertainties that are presently unknown to the Company may adversely affect our business.

Foreign Currency Risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Company’s exposure to the risk of changes in foreign exchange rates relates primarily to the Company’s monetary assets and liabilities denominated in currencies other than Canadian and the Company’s net investments in foreign subsidiaries.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 12 |

The Company operates internationally and is exposed to foreign exchange risk as certain expenditures are denominated in non-Canadian Dollar currencies.

The company has been exposed to this fluctuation and has not implemented a program against these foreign exchange fluctuations.

A 10% strengthening of the US Dollar against the Canadian Dollar would have increased the net equity approximately by $51,037 (2017 - $124,090) due to reduction in the value of net liability balance. A 10% of weakening of the US Dollar against the Canadian Dollar at June 30, 2018 would have had the equal but opposite effect. The significant financial instruments of the Company, their carrying values and the exposure to other denominated monetary assets and liabilities, as of June 30, 2018 are as follows:

| | | US Denominated | |

| | | USD | |

Cash | | | 35,362 | |

Accounts receivable | | | 714,934 | |

Accounts payable | | | 79,616 | |

Liquidity Risk

The Company manages its liquidity risk by preparing and monitoring forecasts of cash expenditures to ensure that it will have sufficient liquidity to meet liabilities when due. The Company’s accounts payable and accrued liabilities generally have maturities of less than 90 days. At June 30, 2018, the Company had cash of $239,763, accounts and grants receivable of $1,073,843 and prepaid and other receivables of $84,568 to settle current liabilities of $865,114.

Credit Risk

Credit risk refers to the risk that one party to a financial instrument will cause a financial loss for the

counterparty by failing to discharge an obligation. The Company is primarily exposed to credit risk through accounts receivable. The maximum credit risk exposure is limited to the reported amounts of these financial assets. Credit risk is managed by ongoing review of the amount and aging of accounts receivable balances. As at June 30, 2018, the Company has outstanding receivables of $941,287. An allowance for doubtful accounts is taken on accounts receivable if the account has not been collected after a predetermined period of time as determined by the contract and collectability is offset to other operating expenses. The Company deposits its cash with high credit quality financial institutions, with the majority deposited within Canadian Tier 1 Banks.

Retention or Maintenance of Key Personnel

Although Lingo Media’s management has made efforts to align the interests of key employees with the Company by, among other things, granting equity interests to its operations personnel with vesting schedules tied to continued employment, there is no assurance that Lingo Media can attract or retain key personnel in a timely manner as the need arises. Failure to have adequate personnel may materially compromise the ability of the Company to operate its business.

Disclosure of Outstanding Share Data

As of August 27, 2018, the followings are outstanding:

Common Shares – 35,529,192

Warrants – Nil

Stock Options – 3,981,000

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 13 |

Approval

The Directors of Lingo Media have approved the disclosure contained in this MD&A.

Additional Information

Additional information relating to the Company can be found on SEDAR at www.sedar.com.

| Lingo Media Corporation (TSX-V: LM; OTC: LMDCF; FSE: LIMA) Management Discussion & Analysis | 14 |