Exhibit 1

| 151 Bloor St West Suite 703 Toronto, Ontario Canada M5S 1S4 Tel : 416.927.7000 Fax : 416.927.1222 www.lingomedia.com |

Lingo Media Corporation

Form 51 – 102 F1

Management Discussion & Analysis

Second Quarter Ended June 30, 2019

August 29, 2019

MANAGEMENT DISCUSSION & ANALYSIS

FOR THE PERIOD ENDED JUNE 30, 2019

Notice to Reader The following Management Discussion & Analysis ("MD&A") of Lingo Media Corporation’s (the "Company" or "Lingo Media") financial condition and results of operations, prepared as of August 29, 2019, should be read in conjunction with the Company's Condensed Consolidated Interim Financial Statements and accompanying Notes for the period ended June 30, 2019 and 2018, which have been prepared in accordance with International Financial Reporting Standards are incorporated by reference herein and form an integral part of this MD&A. All dollar amounts are in Canadian Dollars unless stated otherwise. These documents can be found on the SEDAR website www.sedar.com. Our MD&A is intended to enable readers to gain an understanding of Lingo Media’s current results and financial position. To do so, we provide information and analysis comparing the results of operations and financial position for the current period to those of the preceding comparable three-month period. We also provide analysis and commentary that we believe is required to assess the Company's future prospects. Accordingly, certain sections of this report contain forward-looking statements that are based on current plans and expectations. These forward-looking statements are affected by risks and uncertainties that are discussed in this document and that could have a material impact on future prospects. Readers are cautioned that actual results could vary. |

| |

Cautions Regarding Forward-Looking Statements This MD&A contains certain forward-looking statements, which reflect management’s expectations regarding the Company’s results of operations, performance, growth, and business prospects and opportunities. Statements about the Company’s future plans and intentions, results, levels of activity, performance, goals or achievements or other future events constitute forward-looking statements. Wherever possible, words such as "may," "will," "should," "could," "expect," "plan," "intend," "anticipate," "believe," "estimate," "predict," or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this MD&A are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this MD&A, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Many factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including: general economic and market segment conditions, competitor activity, product capability and acceptance, international risk and currency exchange rates and technology changes. More detailed assessment of the risks that could cause actual results to materially differ than current expectations is contained in the "Quantitative and Qualitative Disclosures of Market Risk" section of this MD&A. |

| | Lingo Media Corporation Management Discussion & Analysis | 2 |

Summary Description of Lingo Media

Lingo Media (“Lingo Media,” the “Company,” “we” or” us”) is an EdTech company that is ‘Changing the way the world learns Languages’ through the combination of education with technology. The Company is focused on online and print-based technologies and solutions through its two subsidiaries: Lingo Learning Inc. (Lingo Learning”) and ELL Technologies Ltd. (“ELL Technologies”). Through its two distinct business units, Lingo Media develops, markets and supports a suite of English language learning solutions consisting of web-based software licensing subscriptions, online and professional services, audio practice tools and multi-platform applications. The Company continues to operate its legacy textbook publishing business from which it collects recurring royalty revenues.

Lingo Media’s two distinct business units include ELL Technologies and Lingo Learning. ELL Technologies is a web-based educational technology (“EdTech”) English language learning training and assessment company that creates innovative software-as-a-service e-learning solutions. Lingo Learning is a print-based publisher of English language learning textbook programs in China. The Company has formed successful relationships with key government and industry organizations, establishing a strong presence in China’s education market. Lingo Media is extending its global reach, beyond its initial market expansion into Latin America and continues to expand its product offerings and technology applications.

The Company continues to invest in language learning and leverage its industry expertise to expand into more scalable education-technology. Recent product initiatives have allowed us to expand the breadth of our language learning product offerings and reinforced the belief that the web-based EdTech learning segment continues to present a significant opportunity for long-term value creation.

Lingo Media continues to focus on software and content development to address market needs within the government and academic training sectors.

Q2 2019 Operational Highlights

● | Online English Language Learning: |

| | ✓ | advanced development of the teacher methodology course |

| | ✓ | completed development of lesson assignment functionality in the new Learning Management System (LMS) |

| | ✓ | Enabled recordings of speech exercises for teachers to review |

| | ✓ | Renewed Agreement with FloridaBlanca, Colombia for an additional year |

| | ✓ | Renewed Agreement with Innovalingua de Mexico SAS de CV in Mexico |

● | Print-Based English Language Learning: |

| | ✓ | expanded existing market for PEP Primary English program into one additional province in China |

Our strategy continues to transition more and more of our business to online subscriptions and digital downloads that enable learners to bring your own device (“BYOD”) and beyond paper-based textbook publishing. We have implemented functionality that allows for “Personalization” of learning by allowing teachers to upload material into our system and assign it to individual/group of students, as well as, assign individual lessons based on level, skill, and subject. We recognize that students learn at their own pace and haVE to complete certain components of the course, both the students who are struggling or the advanced ones are left behind. This new functionality gives teachers very powerful tools to help such students with additional material, thus personalizing the learning. We are continuously pursuing business relationships in various markets, as well as, working closely with our existing channel partners in building the business.

| | Lingo Media Corporation Management Discussion & Analysis | 3 |

Online English Language Learning

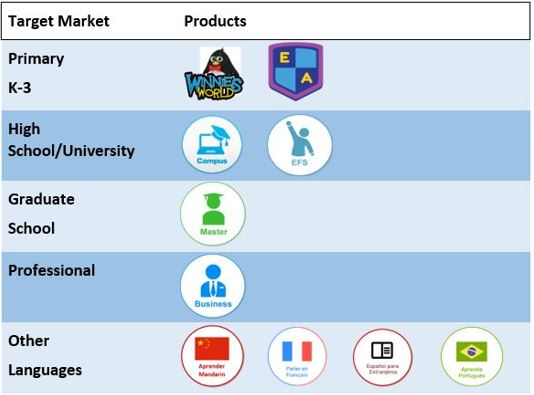

ELL Technologies offers more than 3,000 hours of interactive learning through a number of product offerings that include Winnie’s World, English Academy, Campus, English for Success, Master and Business in addition to offering custom solutions. ELL Technologies is primarily marketed in Latin America through a network of distributors and earns its revenues from online and offline licensing fees from its suite of web-based language learning products and applications.

ELL Technologies had an extensive existing product line which required substantial revisions in the technology platform and user interface. Over the past three years, our development team has engineered an eLearning platform and has been introducing new products to the market since the beginning of 2015, integrating cutting-edge technologies, solutions, content and pedagogy.

ELL Technologies’ high-tech, easy to implement eLearning Software-as-a-Service have positioned the Company to develop courses and content that delivers a solution to learners of different age groups (i.e. university, professionals etc.). The table below provides our portfolio of products and their associated target/market segment:

All products have been designed for our proprietary learning management system enabling ELL Technologies to market and sell to academic institutions and governments. Educators who license the platform are able to easily create, convert, edit, and arrange lessons and courses as they see fit.

Formative assessments and data gathering functionality allows us to adapt and improve content. Based on that data, we are able to program iterations to address specific problem areas and to make learning more accessible, efficient and measurable. Built for learners, by learners, we empower educators and allow them to easily transition from pure classroom paper-based teaching to the online world.

| | Lingo Media Corporation Management Discussion & Analysis | 4 |

Summary of Q3 2019 product development achievements:

| | ● | advanced development of the teacher methodology course |

| | ● | completed development of lesson assignment functionality in the new Learning Management System (LMS) |

| | ● | Enabled recordings of speech exercises for teachers to review |

| | ● | Enhanced reporting functionality for large institutions |

| | ● | Developed functionality for mass uploading of licenses for large institutions. |

Print-Based English Language Learning

The Company continues to maintain its legacy textbook publishing business through Lingo Learning, a print-based publisher of English language learning programs in China since 2001. Lingo Learning has an established presence in China’s education market of over 300 million students. To date, it has co-published more than 600 million units from its library of program titles.

Overall Performance

During the three-month period ended June 30, 2019, Lingo Media recorded revenues of $895,205 as compared to $960,159 in 2018. Net profit was $430,651 as compared to a net profit of $477,208 in 2018. Total comprehensive income was $418,142 as compared to a comprehensive income of $478,062 in 2018. At the same time, the Company’s selling general and administrative costs was $153,914 compared to $313,659 in 2018. Lingo Media recorded share-based payments of $29,001 as compared to $49,663 in 2018.

In addition, cash generated in operations during the period was $390,970 as compared to $515,666 in 2018. The decrease in cash generated from the operation is primary due to a bad debt recovery of $143,039 recorded during Q2 2018.

Online English Language Learning

ELL Technologies earned revenue from its portfolio of products of $68,679 for the three months period, compared to $126,764 in 2018. The decrease in revenue is a result of extended sales cycles in securing contracts.

Print-Based English Language Learning

Lingo Media earned royalty revenue of $826,526 in 2019 compared to $878,138 in 2018 from People’s Education Press and People’s Education & Audio Visual Press (“PEP AV”). This revenue consists of royalties generated through licensing sales from provincial distributors as a result of Lingo Media and PEP AV’s local marketing and training initiatives. Although royalty revenue in the second quarter of 2019 is consistent with that of prior year in RMB, the decrease is due to fluctuation in foreign exchange rates.

Market Trends

Lingo Media believes that the global market trends in English language learning are strong and will continue to grow. Developing countries around the world, specifically in Latin America and Asia are expanding their mandates for the teaching of English amongst students, young professionals and adults.

The British Council suggests that there are 1.6 Billion people learning English globally. English language learning products and services are currently a US$8.9 Billion global market notes Orbit Research.

| | Lingo Media Corporation Management Discussion & Analysis | 5 |

GlobalEnglish forecasts the global eLearning market to grow to 17% year over year.

Markets and Markets forecasts the global EdTech market to grow from US$43.27 Billion in 2015 to US$93.76 Billion to 2020, or at a CAGR or 16.72%.

Latin American Region

The Inter-American Dialogue recently noted that while English language training programs exist in various forms throughout Latin American region, there are three key factors that these programs must address to be successful: ensuring continuity, developing a strong monitoring and evaluation framework that informs adaptation, and addressing the lack of sufficient quality teachers. Students attending English language training (“ELT”) classes in Latin America accounted for approximately 14 per cent of worldwide revenues, or US$321 million in 2018. Growth has been very rapid in the Latin American region and represents a particularly strong opportunity moving forward relative to other geographic regions.

Asia-Pacific Region

Technavio forecasts the English language training (ELT) market in China to be worth $75 Billion by 2022, growing at a CAGR of 22%. The growth of the ELT market in China is driven by more people desiring to learn English, the adaptation of smartphones, increasing levels of disposable income, and the inherent advantages of online education. Technavio also notes that 49% of the growth in the global digital English language learning market will come from the Asia-Pacific region.

Lingo Media is positioned to take advantage of the market opportunity for English language training in Latin America and Asia, with its scalable digital language learning technology and solutions. Although the market outlook remains positive, there can be no assurance that this trend will continue or that the Company will benefit from this trend.

General Financial Condition

As at June 30, 2019 Lingo Media had working capital of $648,345 compared to $533,060 as at June 30, 2018. Total comprehensive income for the three-month period ended June 30, 2019 was $418,142 compared to comprehensive income of $478,062 for the period ended June 30, 2018.

Financial Highlights – for the Second Quarter Ended June 30, 2019

| | | 2019 | | | 2018 | | | 2017 | |

| Revenue | | | | | | | | | | | | |

Print-Based English Language Learning | | $ | 826,526 | | | $ | 833,395 | | | $ | 864,344 | |

| Online English Language Learning | | | 68,679 | | | | 126,764 | | | | 204,571 | |

| | | | 895,205 | | | | 960,159 | | | | 1,068,915 | |

Net Profit for the Period | | | 430,651 | | | | 477,208 | | | | 43,122 | |

Total Comprehensive Income | | | 418,142 | | | | 478,062 | | | | 42,392 | |

Earnings per Share | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.00 | |

Total Assets | | | 1,736,278 | | | | 1,425,690 | | | | 6,981,686 | |

Working Capital | | | 648,345 | | | | 533,060 | | | | 2,068,187 | |

Cash Provided – Operations | | | 390,970 | | | | 515,666 | | | | 886,651 | |

The Company had cash on hand as at June 30, 2019 of $191,290 (2018 - $239,763) and continues to rely on its revenues from its recurring royalty stream, its online English language learning services, and future debt and/or equity financings to fund its operations.

| | Lingo Media Corporation Management Discussion & Analysis | 6 |

Results of Operations

During the quarter, Lingo Media earned $68,679 in online licensing sales revenue as compared to $126,764 in 2018. The decrease in revenue is a result of extended sales cycles in securing contracts and time shifting of the sales pipeline.

Revenues from Print-Based English language learning for the quarter were $826,526 compared to $833,395 in 2018. Direct costs associated with publishing revenue are relatively modest and have been consistent throughout the years. The Company continues to maintain its relationship with PEP and is investing in the development of its existing and new programs and marketing activities to maintain and increase its royalty revenues.

During the period, Lingo Media recorded revenues of $895,205 as compared to $960,159 in 2018. Net profit was $430,651 as compared to $477,208 in 2018 resulting in a $0.01 earning per share as same as in 2018.

Selling, General and Administrative

Selling, general and administrative expenses for 3-month period ended June 30, 2019 were $153,914 compared to $313,659 in 2018. Selling, general and administrative expenses for the three segments are segregated below.

(i) | Print-Based English Language Learning |

Selling, general and administrative cost for print-based publishing decreased from $22,387 in 2018 to $(9,184) in 2019 primarily due to the decrease in sales, marking & administration, travel and reversal of office rent recorded in the first quarter upon applying new accounting policy. The following is a breakdown of selling, general and administrative costs directly related to print-based English language learning:

For the Quarter Ended June 30th | | 2019 | | | 2018 | |

Sales, marketing & administration | | $ | 15,441 | | | $ | 24,557 | |

Consulting fees and salaries | | | 97,714 | | | | 55,951 | |

General & admin expense recovery | | | (36,923 | ) | | | (30,205 | ) |

Travel | | | 9,488 | | | | 18,942 | |

Premises (a) | | | (33,891 | ) | | | 9,181 | |

Professional fees | | | 2,294 | | | | 2,182 | |

Less: Grants | | | (63,307 | ) | | | (58,229 | ) |

| | | $ | (9,184 | ) | | $ | 22,387 | |

| | (a) | The recovery of premises represents the reallocation of rent expense which is now being recorded as depreciation expense of the right-of-use assets. |

(ii) | Online English Language Learning |

Selling, general and administrative costs related to online English language learning was $20,238 for the period compared to $66,296 in 2018. Selling, general and administrative costs for this reporting unit decreased in 2019 as compared to 2018, which is the result of decrease on expenditures related to consulting fees and rent.

For the Quarter Ended June 30th | | 2019 | | | 2018 | |

Sales, marketing & administration | | $ | 27,687 | | | $ | 20,009 | |

Consulting fees and salaries | | | - | | | | 37,472 | |

Travel | | | 4,551 | | | | (3,185 | ) |

Premises (a) | | | (12,000 | ) | | | 12,000 | |

| | | $ | 20,238 | | | $ | 66,296 | |

| | Lingo Media Corporation Management Discussion & Analysis | 7 |

| | (a) | The recovery of premises represents the reallocation of rent expense which is now being recorded as depreciation expense of the right-of-use assets. |

Selling, general and administrative costs related to head office was $142,860 for the period compared to $224,976 in 2018. Selling, general and administrative costs for this reporting unit decreased in 2019 as compared to 2018, which is the result of decrease on expenditures related to sales, marking and administration expenses, consulting fees, travel and professional fees.

For the Period Ended June 30th | | 2019 | | | 2018 | |

Sales, marketing & administration | | $ | 22,582 | | | $ | 29,067 | |

Consulting fees & salaries | | | 74,310 | | | | 132,911 | |

Travel | | | 798 | | | | 6,137 | |

Shareholder services | | | 19,140 | | | | 17,622 | |

Professional fees | | | 26,030 | | | | 39,239 | |

| | | $ | 142,860 | | | $ | 224,976 | |

| | | | | | | | | |

| Total Selling and Administrative Expenses | | $ | 153,914 | | | $ | 313,659 | |

Net Income

Total comprehensive income for the Company was $418,142 for the 3-month period ended June 30, 2019 as compared to a comprehensive income of $478,062 in 2018. These incomes can be attributed to the two operating segments and head office as a reporting segment as shown below:

| | | Quarter Ended June 30 | |

Online ELL | | 2019 | | | 2018 | |

Revenue | | $ | 68,679 | | | $ | 126,764 | |

Expenses: | | | | | | | | |

Direct costs | | | 7,210 | | | | 33,782 | |

General & administrative | | | 20,238 | | | | 22,387 | |

Bad debt (recovery) | | | - | | | | (143,039 | ) |

Amortization | | | 12,320 | | | | 400 | |

Development cost | | | 46,972 | | | | 80,002 | |

Income taxes and other taxes | | | 1,279 | | | | 4,709 | |

| | | | 88,019 | | | | (1,759 | ) |

Segmented Profit / (Loss) - Online ELL | | $ | (19,340 | ) | | $ | 128,521 | |

Print-Based ELL | | | | | | | | |

Revenue | | $ | 826,526 | | | $ | 833,395 | |

Expenses: | | | | | | | | |

Direct costs | | | 22,276 | | | | 21,034 | |

General & administrative | | | (9,184 | ) | | | 66,296 | |

Amortization | | | 78,028 | | | | 941 | |

Income taxes and other taxes | | | 88,603 | | | | 131,950 | |

| | | | 179,723 | | | | 220,491 | |

Segmented Profit / (Loss) – Print-Based ELL | | $ | 646,803 | | | $ | 612,904 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Head Office | | | | | | | | |

Expenses: | | | | | | | | |

General & administrative | | $ | 142,860 | | | $ | 184,079 | |

Amortization of property & equipment | | | 178 | | | | 223 | |

| | | $ | 143,038 | | | $ | 184,302 | |

| | | | | | | | | |

Total Segmented Loss | | $ | 484,425 | | | $ | 516,231 | |

| | | | | | | | | |

Other | | | | | | | | |

Foreign exchange | | $ | (4,457 | ) | | $ | 34,615 | |

Interest and other financial expenses | | | (20,316 | ) | | | (23,972 | ) |

Share based payment | | | (29,001 | ) | | | (49,663 | ) |

Other comprehensive income | | | (12,509 | ) | | | 854 | |

| | | | (66,283 | ) | | | (38,166 | ) |

Total Comprehensive Income | | $ | 418,142 | | | $ | 478,060 | |

| | Lingo Media Corporation Management Discussion & Analysis | 8 |

Foreign Exchange

The Company recorded foreign exchange loss of $4,457 as compared to a foreign exchange gain of $34,615 in 2018, relating to the Company's currency risk through its activities denominated in foreign currencies as the Company is exposed to foreign exchange risk as a significant portion of its revenue and expenses are denominated in Chinese Renminbi and US Dollars.

Share-Based Payments

The Company amortizes share-based payments with a corresponding increase to the contributed surplus account. During the period, the Company recorded an expense of $29,001 compared to $49,663 during 2018.

Depreciation Expense

The company recorded depreciation expense of $90,526 compared to $1,564 in 2018. The increase is due to the application of IFRS 16. Accordingly, the lease of its premises has been capitalized as right-of-use assets that is now being depreciated over the term of the lease.

Net Profit for the Period

The Company reported a net profit of $430,651 for the period as compared to $477,208 in 2018.

Total Comprehensive Income

The total comprehensive income is calculated after the application of exchange differences on translating foreign operations gain/(loss). The Company reported a total comprehensive income of $418,142 for the period ended June 30, 2019, as compared to $478,062 in 2018.

Summary of Quarterly Results

| | | Q3 – 18 | | | Q4 – 18 | | | Q1 – 19 | | | Q2 - 19 | |

Revenue | | $ | 186,518 | | | $ | 713,170 | | | | 111,964 | | | | 895,205 | |

Income / (Loss) Before Taxes and Other Comprehensive Income | | | (145,813 | ) | | | 167,707 | | | | (306,962 | ) | | | 520,553 | |

Total Comprehensive Income / (Loss) | | | (160,765 | ) | | | 155,060 | | | | (328,899 | ) | | | 418,142 | |

Income / (Loss) per Basic and Diluted Share | | $ | (0.00 | ) | | $ | 0.00 | | | $ | (0.00 | ) | | $ | 0.01 | |

| | Lingo Media Corporation Management Discussion & Analysis | 9 |

| | | Q3 – 17 | | | Q4 – 17 | | | Q1 – 18 | | | Q2 – 18 | |

Revenue | | $ | 354,914 | | | $ | 754,962 | | | $ | 80,335 | | | $ | 960,159 | |

Income / (Loss) Before Taxes and Other Comprehensive Income | | | (473,026 | ) | | | (5,663,320 | ) | | | (536,836 | ) | | | 613,867 | |

Total Comprehensive Income (Loss) | | | (475,632 | ) | | | (5,833,279 | ) | | | (544,311 | ) | | | 478,062 | |

Income / (Loss) per Basic and Diluted Share | | $ | (0.013 | ) | | $ | (0.18 | ) | | $ | (0.02 | ) | | $ | 0.00 | |

Liquidity and Capital Resources

As at June 30, 2019, the Company had cash of $191,290 compared to $239,763 in 2018. Accounts and grants receivable of $1,049,433 were outstanding at the end of the period compared to $1,073,843 in 2018. With 89% of the receivables from PEP and the balance due from ELL customers with a 90 - 180 day collection cycle, the Company does not anticipate an effect on its liquidity. Total current assets amounted to $1,341,173 (2018 - $1,398,174) with current liabilities of $692,828 (2018 - $865,114) resulting in working capital of $648,345 (2018 - $533,060).

Lingo Learning receives government grants based on certain eligibility criteria for publishing industry development in Canada and for international marketing support. These government grants are recorded as a reduction of general and administrative expenses to offset direct expenditure funded by the grant. The Company receives these grants throughout the year. The grant is applied based on Lingo Learning meeting certain eligibility requirements. The Company has relied on obtaining these grants for its operations and has been successful at securing them in the past, but it cannot be assured of obtaining these grants in the future.

Lingo Media has access to working capital through equity financings or debt financings, if required to finance its growth plans and expansion into new international markets. The Company has been successful in raising sufficient working capital in the past.

Off-Balance Sheet Arrangements

The Company has not entered into any off-balance sheet finance arrangements.

Contractual Obligations

Future minimum lease payments under operating leases for premises and equipment are as follows:

2019 | | | 128,393 | |

2020 | | | 222,541 | |

2021 | | | 49,280 | |

Transactions with Related Parties

The Company’s key management includes Michael Kraft, Chairman, Gali Bar-Ziv, President & CEO, Khurram Qureshi, CFO in addition to Board Directors and the Secretary of the Board.

The Company had the following transactions with related parties, made in the normal course of operations, and accounted for at an amount of consideration established and agreed to by the Company and related parties.

The Company charged $22,168 (2018 - $45,891) to the corporations with director or officer in common for rent, administration, office charges and telecommunications.

Key management compensation for the quarter was $ 79,500 (2018 – $82,500) and is reflected as consulting fees paid to corporations owned by a director and officers of the Company and is deferred and included in accrued liabilities.

| | Lingo Media Corporation Management Discussion & Analysis | 10 |

As of June 30, 2019, the Company had repaid all loans payable. Interest expense related to these loans is $5,703 (2018 - $19,246).

Additional Disclosure

Right-of-use Asset

| | | Office Lease | | | Leasehold Improvements | | | Total | |

| | | | | | | | | | |

Cost, January 1, 2018 | | $ | - | | | $ | - | | | $ | - | |

Additions | | | - | | | | - | | | | - | |

Cost, June 30, 2018 | | $ | - | | | $ | - | | | $ | - | |

Additions | | | - | | | | 33,180 | | | | 33,180 | |

Cost, December 31, 2018 | | $ | - | | | $ | 33,180 | | | $ | 33,180 | |

Additions | | | 436,455 | | | | - | | | | 436,455 | |

Cost, June 30, 2019 | | $ | 436,455 | | | $ | 33,180 | | | $ | 469,635 | |

Accumulated depreciation, January 1, 2018 | | $ | - | | | $ | - | | | $ | - | |

Charge for the period | | | - | | | | - | | | | - | |

Accumulated depreciation, June 30, 2018 | | $ | - | | | $ | - | | | $ | - | |

Charge for the period | | | - | | | | 11,613 | | | | 11,613 | |

Accumulated depreciation, December 31, 2018 | | $ | - | | | $ | 11,613 | | | $ | 11,613 | |

Charge for the period | | | 85,905 | | | | 5,807 | | | | 91,712 | |

Accumulated depreciation, June 30, 2019 | | $ | 85,905 | | | $ | 17,420 | | | $ | 103,325 | |

Net book value, December 31, 2018 | | $ | - | | | $ | 21,567 | | | $ | 21,567 | |

Net book value, June 30, 2019 | | $ | 350,550 | | | $ | 15,761 | | | $ | 366,310 | |

Property and Equipment

Cost, January 1, 2018 | | $ | 89,787 | |

Effect of foreign exchange | | | 566 | |

Cost, June 30, 2018 | | $ | 90,353 | |

Additions | | | 7,839 | |

Effect of foreign exchange | | | (317 | ) |

Cost, December 31, 2018 | | $ | 97,875 | |

Additions | | | 450 | |

Write off | | | (12,126 | ) |

Effect of foreign exchange | | | (517 | ) |

Cost, June 30, 2019 | | $ | 85,682 | |

| | | | | |

Accumulated depreciation, January 1, 2018 | | $ | 59,098 | |

Charge for the period | | | 3,217 | |

Effect of foreign exchange | | | 522 | |

Accumulated depreciation, June 30, 2018 | | $ | 62,837 | |

Charge for the period | | | 3,539 | |

Effect of foreign exchange | | | (98 | ) |

Accumulated depreciation, December 31, 2018 | | $ | 66,278 | |

| | | | | |

Charge for the period | | $ | 3,224 | |

Write off | | | (12,126 | ) |

Effect of foreign exchange | | | (489 | ) |

Accumulated depreciation, June 30, 2019 | | | 56,887 | |

Net book value, January 1, 2018 | | $ | 30,689 | |

Net book value, June 30, 2018 | | $ | 27,516 | |

Net book value, December 31, 2018 | | $ | 31,597 | |

Net book value, June 30, 2019 | | $ | 28,795 | |

| | Lingo Media Corporation Management Discussion & Analysis | 11 |

Risk Factors

Business Risk and Uncertainties

We are subject to a number of risks and uncertainties that can significantly affect our business, financial condition and future financial performance, as described below. In particular, there remain significant uncertainties in capital markets impacting the availability of equity financing. While these uncertainties in capital markets do not have a direct impact on our ability to carry out our business, the Company may be impacted should it become more difficult to gain access to capital when and if needed. These risks and uncertainties are not necessarily the only risks the Company faces. Additional risks and uncertainties that are presently unknown to the Company may adversely affect our business.

Foreign Currency Risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Company’s exposure to the risk of changes in foreign exchange rates relates primarily to the Company’s monetary assets and liabilities denominated in currencies other than the Canadian Dollar and the Company’s net investments in foreign subsidiaries.

The Company operates internationally and is exposed to foreign exchange risk as certain expenditures are denominated in non-Canadian Dollar currencies.

The Company has been exposed to this fluctuation and has not implemented a program against these foreign exchange fluctuations.

The Company operates internationally and is exposed to foreign exchange risk as certain expenditures are denominated in non-Canadian Dollar currencies.

The Company has been exposed to this fluctuation and has not implemented a program against these foreign exchange fluctuations.

A 10% strengthening of the US Dollar against the Canadian Dollar would have increased the net equity approximately by $59,513 (2017 - $51,037) due to reduction in the value of net liability balance. A 10% of weakening of the US Dollar against the Canadian Dollar at June 30, 2018 would have had the equal but opposite effect. The significant financial instruments of the Company, their carrying values and the exposure to other denominated monetary assets and liabilities, as of June 30, 2018 are as follows:

| | | US Denominated | |

| | | USD | |

Cash | | | 75,041 | |

Accounts receivable | | | 713,246 | |

Accounts payable | | | 34,442 | |

| | Lingo Media Corporation Management Discussion & Analysis | 12 |

Liquidity Risk

The Company manages its liquidity risk by preparing and monitoring forecasts of cash expenditures to ensure that it will have sufficient liquidity to meet liabilities when due. The Company’s accounts payable and accrued liabilities generally have maturities of less than 90 days. At June 30, 2019, the Company had cash of $191,290, accounts and grants receivable of $1,049,433 and prepaid and other receivables of $100,450 to settle current liabilities of $692,828.

Credit Risk

Credit risk refers to the risk that one party to a financial instrument will cause a financial loss for the counterparty by failing to discharge an obligation. The Company is primarily exposed to credit risk through accounts receivable. The maximum credit risk exposure is limited to the reported amounts of these financial assets. Credit risk is managed by ongoing review of the amount and aging of accounts receivable balances. As at June 30, 2019, the Company has outstanding receivables of $939,433 (2018 - $941,287). New impairment requirements use an 'expected credit loss' ('ECL') model to recognize an allowance. Impairment is measured using a 12-month ECL method unless the credit risk on a financial instrument has increased significantly since initial recognition in which case the lifetime ECL method is adopted. For receivables, a simplified approach to measuring expected credit losses using a lifetime expected loss allowance is available. The Company deposits its cash with high credit quality financial institutions, with the majority deposited within Canadian Tier 1 Banks.

Retention or Maintenance of Key Personnel

Although Lingo Media’s management has made efforts to align the interests of key employees with the Company by, among other things, granting equity interests to its operations personnel with vesting schedules tied to continued employment, there is no assurance that Lingo Media can attract or retain key personnel in a timely manner as the need arises. Failure to have adequate personnel may materially compromise the ability of the Company to operate its business.

Disclosure of Outstanding Share Data

As of August 29, 2019, the followings are outstanding:

Common Shares – 35,529,192

Warrants – Nil

Stock Options – 6,762,000

Approval

The Directors of Lingo Media have approved the disclosure contained in this MD&A.

Additional Information

Additional information relating to the Company can be found on SEDAR at www.sedar.com.

| | Lingo Media Corporation Management Discussion & Analysis | 13 |