Correspondence

Rodobo International, Inc.

380 Chanjiang Road, Nangang District, Harbin, PRC 150001

Tel: +86-0451-82260522

September 18, 2009

Via EDGAR and Fax

Chris White, Branch Chief

Division of Corporation Finance

Securities and Exchange Commission

100 F Street N.E., Stop 3030

Washington, D.C. 20549-3030

| | Re: | Rodobo International, Inc. (the "Company")

Form 10-K for the Fiscal Year Ended September 30, 2008

Filed January 13, 2009

Form 10-K/A for the Fiscal Year Ended September 30, 2008

Filed March 10, 2009

Form 10-Q for the Fiscal Quarter Ended March 31, 2009

Filed May 15, 2009

File No. 000-50340 |

Dear Mr. White:

The purpose of this letter is to respond to your letter of August 24, 2009 with respect to the above-captioned filings. For ease of reference, our responses are keyed to your comments.

| | Form 10-K for the fiscal year ended September 30, 2008

Business History, page 2 |

| | 1. | We note your disclosure that on September 30, 2008, pursuant to the merger agreement, Navstar completed its acquisition of 100% of Harbin Rodobo. We note the same disclosure in the overview to your Management’s Discussion and Analysis on page 20. This disclosure regarding your corporate structure appears inconsistent with the disclosure in Note 1 on page F-7, which states Harbin mega Profit consolidates Harbin Rodobo based on the application of FIN 46(R). Please revise your disclosure to clarify the description of your corporate structure on a consolidated basis and provide consistent disclosure throughout your filing. Please supplement this description with a chart which displays the organizational structure of you and all of your affiliated entities. This chart should identify the percentage of equity ownership that Rodobo International, Inc. has in each of the affiliated entities. |

Mr. Chris White

September 18, 2009

Page 2

Response to Comment No. 1:

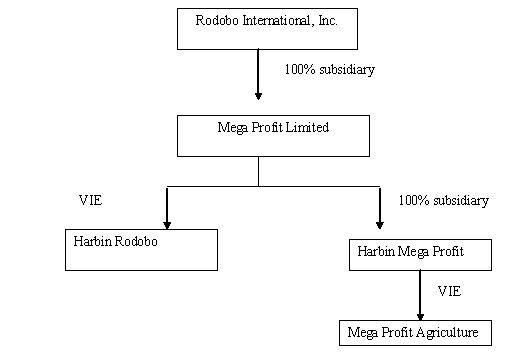

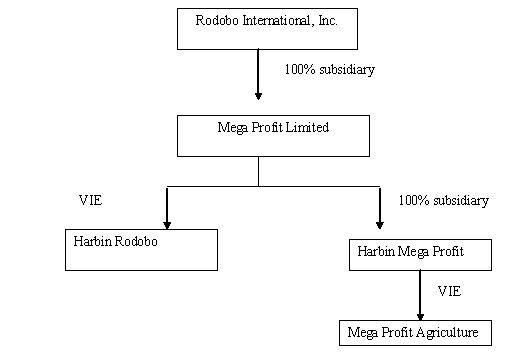

Rodobo International, Inc. (formerly known as Navstar Media Holdings, Inc.) owns 100% of Mega Profit Limited, which owns 100% of Harbin Mega Profit Management Consulting Co., Ltd. (“Harbin Mega Profit”), and has exclusive contractual agreements with Harbin Rodobo Dairy Co., Ltd. (“Harbin Rodobo”) through which Harbin Rodobo has been consolidated as a Variable Interest Entity (“VIE”) until December 31, 2008. Both Harbin Mega Profit and Harbin Rodobo are corporations established under the laws of the People’s Republic of China. Another entity, Qinggang Mega Profit Agriculture Co., Ltd. (“Mega Profit Agriculture”), is owned by major shareholders of the Company and has been consolidated with Harbin Mega Profit as VIE because of its effective control over Mega Profit Agriculture through a series of contractual agreements.

We are supplementing this description with a chart shown below, which displays the organizational structure of the Company and all of its affiliated entities as of September 30, 2008:

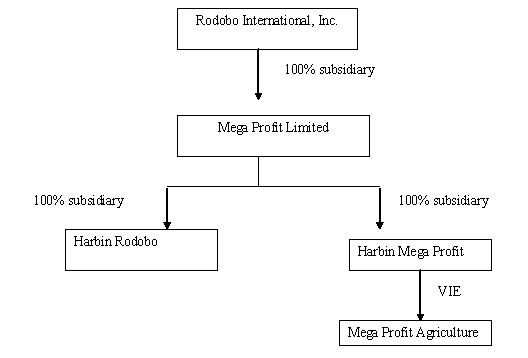

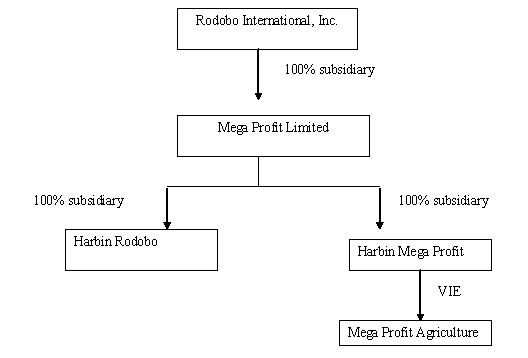

Effective January 1, 2009, the shareholders of Harbin Rodobo transferred their ownership interests to Mega Profit Limited for the benefit of the shareholders of the Company and as a result, Harbin Rodobo is no longer considered a VIE of Mega Profit Limited. Instead it is now a wholly-owned subsidiary of Mega Profit Limited. This ownership transfer was between related parties since the principal shareholders of Harbin Rodobo were also principal shareholders of the Company. Therefore, there was no goodwill recognized in this transaction. The following chart reflects the current organizational structure of the Company and all of its affiliated entities as of the date of this letter:

Mr. Chris White

September 18, 2009

Page 3

Upon review of this Staff’s comment, management has determined that the disclosure in Note 1 of our audited financial statements as of September 30, 2008 in fact correctly reflected the organizational structure of the Company at the time. However, the disclosures in the Note 1 of our unaudited financial statements for the quarters ended March 31, 2009 and June 30, 2009 were insufficient because they did not reflect the correct organizational structure after January 1, 2009. We will revise our disclosures in all future filings to correctly reflect our current organizational structure.

Report of Independent Registered Public. Accounting Firm, Page F-1

| | 2. | We note that your audit report was signed by an audit firm based in New Jersey and your corporate offices are located in China. We also note that you conduct your operations in China, your revenues are generated in China and all of your assets are located in China. Please tell us where the majority of audit work was conducted and how you concluded that it is appropriate to have an audit report issued by an auditor licensed in New Jersey. |

Response to Comment No. 2:

Our independent auditor, Bagell, Josephs, Levine & Company, LLC (“BJL”), is based in Marlton, New Jersey. BJL employs six Chinese-speaking auditors in its office, including one partner, one supervisor and four senior associates. BJL also has an office in Beijing, China where it employs eight other China-based auditors, who have been trained by BJL to be equipped with knowledge of U.S. GAAP and PCAOB Standards. BJL sent its Chinese-speaking partner and supervisor for this audit, both of whom are U.S. licensed Certified Public Accountants. All of the required audit procedures were done on site at our headquarters in Harbin, China. BJL did not use any other auditors in performing the audit of our financial statements. Management believes that it is appropriate to have our audit report issued by BJL, who has sufficient resources both in China and U.S. to conduct the audit. We also learned that BJL has just been inspected by the PCAOB and received a clean report on all their audits conducted for China-based companies.

Mr. Chris White

September 18, 2009

Page 4

Consolidated Statement of Income and Comprehensive Income, page F-3

| | 3. | It appears that you have reported all depreciation and amortization expense as an operating expense and hence, excluded depreciation and amortization expense from gross profit. To avoid placing undue emphasis on “cash flow,” depreciation and amortization should not be positioned in the income statement in a manner which results in reporting a figure for income before depreciation; we refer you to SAB Topic 11:B. Therefore, please revise your presentation to comply with this guidance. |

Response to Comment No. 3:

Per the Staff’s comment, we will revise our presentation in all future filings to reclassify a portion of depreciation and amortization expense as cost of goods sold in compliance with SAB Topic 11:B. This error was $61,732 for the fiscal year ended September 30, 2008. Therefore, it does not have a material effect on our financial statements.

Note 1. Organization and Basis of Presentation, page F-6

| | 4. | Please provide your complete analysis in accordance with paragraph 5 of FIN 46(R) supporting your conclusion that Harbin Rodobo Dairy Co., Ltd. (“Harbin Rodobo”) is a variable interest entity. |

Response to Comment No. 4:

On October 27, 2007, Harbin Mega Profit entered into certain exclusive agreements with Harbin Rodobo and its stockholders. Pursuant to these agreements, Harbin Mega Profit provided exclusive consulting and other general business operation services to Harbin Rodobo, in return for a consulting services fee which was equal to Harbin Rodobo’s net income. In addition, Harbin Rodobo’s shareholders have pledged their equity interest in Harbin Rodobo to Harbin Mega Profit, irrevocably granted Harbin Mega Profit all or part of the equity interests in Harbin Rodobo and all the rights to exercise the voting power to the person(s) appointed by Harbin Mega Profit. Through these contractual arrangements, Harbin Mega Profit had the ability to substantially influence Harbin Rodobo’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring stockholders’ approval. As a result of these contractual arrangements, which obligates Harbin Mega Profit to absorb a majority of the risk of loss from Harbin Rodobo’s activities, Harbin Mega Profit was able to receive a majority of its expected residual returns. Therefore, Harbin Mega Profit accounted for Harbin Rodobo as a VIE under FIN 46(R). As noted in our response to comment No. 1 above, the 100% ownership of Harbin Rodobo was subsequently transferred to Mega Profit Limited. Thus, this VIE application is no longer existing.

Mr. Chris White

September 18, 2009

Page 5

| | 5. | We note Harbin Mega Profit Management Consulting Co., Ltd. (“Harbin Mega Profit”) provides exclusive consulting and other general business operation services to Harbin Rodobo in return for a consulting services fee which is equal to Harbin Rodobo’s revenue. Please provide more specific information regarding the terms of this agreement and tell us in detail how each entity accounts for this arrangement. Explain how you determined that this contractual arrangement causes you to absorb a majority of the expected losses and receive a majority of the expected returns of Harbin Rodobo. Please provide the calculations which support your conclusion. |

Response to Comment No. 5:

According to the agreements between Harbin Mega Profit and Harbin Rodobo, Harbin Mega Profit provided exclusive consulting and other general business operation services to Harbin Rodobo in return for a consulting services fee which is equal to all of Harbin Rodobo’s net income, not revenue. The use of “revenue” in this case was erroneous. The Company will revise the wording in future filings to reflect the correct interpretation.

In detail, Harbin Mega Profit accounts for this contractual arrangement as follows:

| | Dr. Inter-company receivable

Cr. Consulting revenue |

While Harbin Rodobo makes the following entries:

| | Dr. Consulting expense

Cr. Inter-company payable |

As you can see, both entries are offset upon consolidation and there is no real impact on the Company’s consolidated financial statements. However, for Harbin Mega Profit, there will be real impact on its books because if Harbin Rodobo generates profits, it should record on its books the expected revenue but if Harbin Rodobo’s operations result in loss, it will have to absorb the losses. Therefore, Harbin Mega Profit absorbs a majority of the expected losses and received a majority of the expected returns of Harbin Rodobo.

| | 6. | Explain how you determined that the contractual arrangements entitle you to 100% of the equity interest in Harbin Mega Profit. In this regard, explain how you applied paragraphs 118 and 19 of FIN 46(R), when determining that there is not a non-controlling interest that you are required to record based on the initial measurement of Harbin Mega Profit. |

Mr. Chris White

September 18, 2009

Page 6

Response to Comment No. 6:

Upon our review of this comment, we are unclear why you mentioned “100% of the equity interest in Harbin Mega Profit” rather than “Harbin Rodobo”. We believe you actually meant for “Harbin Rodobo” in this context. If our understanding is correct, we refer you to our response to comment No. 5 above. Please also note that Harbin Mega Profit is a 100% owned subsidiary of Mega Profit Limited and not a VIE.

| | 7. | Please demonstrate how you have determined that Harbin Mega Profit and Harbin Rodobo are entities under common control. Clarify how your conclusion is consistent with the guidance in paragraph 3 of EITF 02-5. |

Response to Comment No. 7:

Both Harbin Mega Profit and Harbin Rodobo are owned by Mega Profit Limited as illustrated in our response to comment No. 1. Therefore, they are considered under common control. Prior to the transfer of the ownership of Harbin Rodobo to Mega Profit Limited, Harbin Mega Profit was owned indirectly by the Company through Mega Profit Limited, while Harbin Rodobo was owned by the major shareholders as of the Company and consolidated into the Company as VIE. Therefore, they were also considered under common control.

Note 2. Summary of Significant Accounting Policies

Revenue Recognition page F-9

| | 8. | We note your disclosure under “Product Distribution” on page 4 which discloses your products are sold primarily through distributors, and your products are generally delivered only after receipt of payment from the, distributors. Please revise your disclosure in the footnotes to your financial statements to more specifically describe your revenue recognition policies with your distributors. Tell us and disclose your revenue recognition policy for direct sales to end users, if any. |

| | If you recognize revenue upon delivery to resellers, please clarify how you have determined the fee for products is fixed and determinable pursuant to the guidance in SAB Topic 13. Please clarify the following specific comments as part of your response: |

| • | Please clarify how you have evaluated your distributors’ business practices, such as their operating history, competitive pressures. Tell us the names of your primary distributors. |

| • | Explain whether the terms of the agreement require the distributor to pay you after you deliver the product to them or whether the distributor is obligated to pay as and if the sales are made to end customers. If the terms require the distributor to pay after you deliver the product to them, and are not contingent on resale to the end customer, explain how your collection history supports the terms of the agreement. In this respect, explain whether you generally receive payment before or after the distributor sells the product to the end customer. |

Mr. Chris White

September 18, 2009

Page 7

| • | Explain how you have evaluated your distributors are financially secure, noting such factors as whether they are established in the market or new distributors and are properly capitalized, when determining that they have the ability to honor a commitment to make fixed and determinable payments prior to collecting cash from their customers. |

| • | Please clarify if you are required to rebate or credit a portion of the original fee if you subsequently reduce the price of your product and the distributor still has rights with respect to that product; that is whether you offer price protection. |

Response to Comment No. 8:

Our products are sold primarily through two sources: our formulated powdered-milk products are sold through our distributors throughout China, and our bulk powdered milk products are sold directly to other packaging plants. The majority of our revenues is derived from our formulated powdered-milk products.

Generally, our formulated products are delivered upon receipt of payments from our distributors and revenue is recognized upon delivery of products. For some distributors with a good credit history, we also provide credit sales with a 90-day term.

For our bulk powered-milk products, all deliveries are made upon receipt of payments from our end users and revenue is recognized upon delivery of products.

| • | Our major distributors are Chengdu Luoling and Harbin Huijiabei, to whom we offer credit sales. Prior to offering of credits, it is our mandatory practice to check these distributors’ operating history, credit history and competitive pressures. |

| • | We generally sign annual purchase agreements with distributors with a fixed pricing memo attached. The terms of the agreement generally require the distributor to pay us before we deliver the products. For long-term distributors with good credit history, we offer credit sales with 90 day terms. Regardless of whether they sell our products to end customers, they have to pay us within 90 days. We do not offer any consignment sales to our distributors. More than 88% of our accounts receivable as of September 30, 2008 were aged within 90 days. As of today, we have not experienced any significant default by our customers. |

| • | We perform credit checks on our distributors’ operating history and credit history before we offer any credit sales to them. We evaluate the collectability of accounts receivable by performing an aging of accounts receivable by customers on a monthly basis. Based on our evaluations of our distributors, the Company’s management determines whether our distributors have the ability to make payments to us within the credit terms. |

| • | Per sales agreements we have with distributors, we are not required to rebate or credit a portion of the original fee after delivery of products, even if subsequently the market price changes. This is because our sales agreements are signed annually but the prices listed in the contract memo are usually subject to final purchase orders with fixed prices. Once shipments are made, no price change or reduction is allowed. |

Mr. Chris White

September 18, 2009

Page 8

| | 9. | We also note you do not provide rights to return merchandise, except in some special cases. Beyond the one example cited on page 4, please tell us and disclose specifically when your customers have a right to return merchandise. In addition, tell us the amount of returns you have received in each period reported in your filing. Clarify how your accounting complies with paragraph 6 of SFAS 48. |

Response to Comment No.9:

Except for the one example cited on page 4, we do not provide our customers with rights to return merchandise.

| | 10. | We note your disclosure of the recent nation-wide melamine contamination that occurred in the Republic of China. Please explain whether your milk formula products that were sold or held in inventory were affected by this contamination, If so, explain how your accounting complied with SFAS 48, SFAS 5 and/or Chapter 4 of ARB 43. |

Response to Comment No.10:

None of our powdered-milk products that were sold or held in inventory were affected by melamine contamination as a result of our strict quality control over sources of milk we use. The contaminated milk sources were primarily from certain regions in Hebei and Inner Mongolia provinces. All milk we buy from dairy farmers is from certain regions in the Heilongjiang province, which has not been affected by melamine contamination at all.

| | 11. | We note your disclosure on page 21 which states distributor rebates increased by approximately $1.0 million in fiscal year 2008. Please explain how you evaluated Issue 1 of EITF 01-9 when determining that these rebates should be characterized as an operating expense as opposed to a reduction in revenue. Please describe the exact nature of the rebates that you offer to your customers. In addition, please clarify whether all of the expenses classified as distributor expenses in your statements of income in fiscal years 2008 and 2007 are distributor rebates. Please explain the nature of any other types of expenses that are classified as distributor expenses in your statements of income. |

Response to Comment No.11:

Upon review of the Staff’s comment, we have determined that the use of the wording “distributor rebate” in our disclosures was inappropriate. It should be rephrased as “distributor reimbursement”. Distributor reimbursement represents marketing and selling expenses incurred by our distributors on behalf of the Company, in efforts to promote our brand awareness. We reimburse our distributors upon presentation of proper receipts for those marketing efforts. In accordance with EITF 01-9, these distributor reimbursements should be characterized as an operating expense as opposed to a reduction in revenue.

Mr. Chris White

September 18, 2009

Page 9

A majority of the expenses classified as distributor expenses in our statements of income in fiscal years 2008 and 2007 are distributor reimbursement. Distributor expenses also include salaries for the Company’s internal sales force and other direct marketing expenses.

| | 12. | Explain how your recognition and measurement of the rebates complies with Issues 3 through 6 of EITF 01-9. |

Response to Comment No.12:

Please refer to our response to comment No. 11 above.

Note 7, Deposits on Land and Equipment, page F-14

| | 13. | We note your disclosure here and on page F-6 which states that you have entered into an “investment agreement” with Harbin Mega Profit to incorporate a subsidiary company, Mega Profit Agriculture. Please clarify the following with respect to your accounting for this investment agreement: |

| | • | Explain the material terms of this investment agreement, including whether you were purchasing assets of Qinggang Mega Profit Agriculture Co., Ltd. ("Mega Profit Agriculture") or an equity interest in Mega Profit Agriculture. |

| | • | Explain your relationship with Mega Profit Agriculture prior to entering into the investment agreement. In addition, explain Harbin Mega Profits relationship with Mega Profit Agriculture prior to entering into the investment agreement. Identify all other parties that involved with this agreement. |

| | • | Explain how you determined that the $10.9 million paid as of September 30, 2008 to acquire land, buildings and equipment should be recorded as a deposit. |

Response to Comment No.13:

With respect to the investment agreement between Harbin Mega Profit and Mega Profit Agriculture, we answer the Staff’s comments as follows:

Under the investment agreement, Harbin Mega Profit initially incorporated a brand new company, Mega Profit Agriculture, aiming to establish our own dairy farm to raise cattle for milking purpose in an effort to control and ensure our raw milk sources. Mega Profit Agriculture is a new start-up company. There were no assets in Mega Profit Agriculture at the time of inception.

Mr. Chris White

September 18, 2009

Page 10

| • | Mega Profit Agriculture did not exist prior to entering into the “Investment Agreement” with Harbin Mega Profit. There was no other party involved with this agreement. |

| | Although the Company has made the payment of $10.9 million associated with the purchase of the land, buildings and equipments in accordance with the Investment Agreement, the Company will not receive the ownership titles of those assets until the completion of the site stipulated by the local authority. Therefore, the payment was recorded as a long-term advance (Deposit). The Company will reclassify the amount to the appropriate accounts upon receipt of government certification. |

Note 10. Shareholder’s Equity, page F-15

| | 14. | We note your disclosure which states that no convertible preferred shares may be converted to common stock until the authorized common stock is increased to allow for such conversions. Please clarify how you have considered the fact that you do not have sufficient authorized and unissued shares available to settle the convertible preferred stock instrument when determining that equity classification is appropriate for the convertible preferred stock instrument; we refer you to paragraph 19 of EITF 00-19. In addition, clarify how this affects the classification of other instruments that could require share settlement that are outstanding, such as the warrants issued in connection with the convertible preferred stock. |

Response to Comment No.14:

Our preferred stock holders had agreed not to convert their convertible preferred stock and warrants until after the increase of the authorized shares of common stock. Accordingly, no preferred shares or warrants could have been converted until the increase in the authorized number of shares of common stock has been effected. Since the settlement of conversion of the preferred stock and warrants is within the control of the Company, we believe our equity classification of these preferred shares is appropriate.

Note 11. Earnings per Share, page F-16

| | 15. | We note you have not included 12,976,316 shares of convertible preferred stock in your earnings per share calculation due to the authorized number of shares not being increased to allow for conversion at September 30, 2008. Please cite the accounting guidance used to conclude these shares should not be included as part of your diluted earnings per share calculation. |

Response to Comment No.15:

Because of the restriction on the conversion of these preferred shares to common stock until the effectiveness of our increase of the number of authorized common stock, these preferred shares can not be assumed for conversion under this circumstance. Therefore, we believe that it is appropriate not to include them as part of our diluted earnings per share calculation.

Mr. Chris White

September 18, 2009

Page 11

Form 10-Q for the quarterly period ended March 31, 2099

Note 1. Organization and Basis of Presentation, page 4

| | 16. | We note the ownership of Qinggang Mega Profit Agriculture Co., Ltd. (“Mega Profit Agriculture”) has been transferred to individual shareholders and is no longer a subsidiary of Harbin Mega Profit. Further, we note as of January 1, 2009, Harbin Mega Profit has entered into certain exclusive agreements with Mega Profit Agriculture, and now consolidates their financial statements as a variable interest entity under FIN 46(R). Please tell us: |

| | • | At what specific date ownership of Mega Profit Agriculture was transferred to individual shareholders and how you accounted for this transaction; |

| | • | How this transaction facilitated obtaining government tax incentives after the powdered milk contamination scandal in China; |

| | • | Provide your complete analysis in accordance with paragraph 5 of FIN 46(R) supporting your conclusion that Mega Profit Agriculture is a variable interest entity. Tell us how you determined that you are the primary beneficiary of Mega Profit Agriculture; |

| | • | In addition, we note Harbin Mega Profit provides exclusive consulting and other general business operation services to Mega Profit Agriculture in return for a consulting services fee which is equal to Mega Profit Agriculture revenue. Please provide more specific information regarding the terms of this agreement and tell us in detail how each entity accounts for this arrangement. |

| | • | It appears that you are still recording the amounts paid for certain assets. of Mega Profit Agriculture as a deposit as of March 31, 2009. Explain how you determined that this accounting is still appropriate. If you have determined that Harbin Mega Profit should consolidate Mega Profit Agriculture based on the application of FIN 46(R), please explain why you have not reflected the consolidated results of Mega Profit Agriculture in your financial statements as of March 31, 2009. |

| | • | Further explain why you loaned $1.2 million to your principal shareholders in connection with this agreement. |

Response to Comment No.16:

With regard to the transfer of the ownership of Mega Profit Agriculture, we hereby answer the Staff’s comments as follows:

Mr. Chris White

September 18, 2009

Page 12

| | • | On January 1, 2009, the ownership of Mega Profit Agriculture was transferred to two principal shareholders of the Company, in an effort to qualify for a government grant and tax incentives. Since this transfer was between related parties and there were no other assets or liabilities other than the cash investment of $1.2 million, we determined that there was no goodwill involved. On Harbin Mega Profit’s books, we accounted for this transaction as follows: |

| | |

|---|

| DR. Loan to Shareholders | $1.2 million |

| CR. Investment in Subsidiary | $1.2 million |

| | • | As a result of this transfer, Mega Profit Agriculture, now as a domestic registered company owned by Chinese nationals, is eligible to obtain government tax incentives and grants, which are only available to Chinese domestic dairy companies. |

| | • | Mega Profit Agriculture is currently owned by two of the principal shareholders of the Company but has been arranged to be controlled by Harbin Mega Profit through a series of contractual arrangements. This arrangement is made solely for the purpose of ensuring that the Company is the primary beneficiary of Mega Profit Agriculture business operations. According to the contractual agreements, Harbin Mega Profit will provide exclusive consulting and other general business operation services to Mega Profit Agriculture, in return for a consulting services fee which is equal to all of Mega Profit Agriculture’s net income. In addition, Mega Profit Agriculture’s shareholders have pledged their equity interests in Mega Profit Agriculture to Harbin Mega Profit, irrevocably granted Harbin Mega Profit an exclusive option to purchase in the future, to the extent permitted under PRC law, all or part of the equity interests in Mega Profit Agriculture and the ability to entrust all the rights to exercise their voting power to the person(s) appointed by Harbin Mega Profit. Through these contractual arrangements, Harbin Mega Profit has the ability to substantially influence Mega Profit Agriculture’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring stockholders’ approval. As a result of these contractual arrangements, which obligate Harbin Mega Profit to absorb a majority of the risk of loss from Mega Profit Agriculture’s activities and enable Harbin Mega Profit to receive a majority of its expected residual returns, we believe that it is appropriate for Harbin Mega Profit to account for Mega Profit Agriculture as a Variable Interest Entity under FIN 46(R). Accordingly, Harbin Mega Profit consolidates Mega Profit Agriculture’s results, assets and liabilities. |

| | • | As illustrated earlier, the Company will not be able to receive ownership titles of these assets until completion of the construction under the local governance. As of March 31, 2009, the construction of the dairy farm site was still in process. Therefore, we believe it was appropriate to keep the amounts paid as long-term advance (Deposits) until we receive the ownership certification. Moreover, Mega Profit Agriculture has not had any operations as of March 31, 2009, except for the construction of the dairy farm site. Thus, we have not reflected any results of operations of Mega Profit Agriculture in our consolidated financial statements. |

Mr. Chris White

September 18, 2009

Page 13

| | • | The $1.2 million loan to our principal shareholders was recorded as a result of the change of ownership from Harbin Mega Profit to our principal shareholders. The funds were already paid out to Mega Profit Agriculture at the time of the ownership transfer. This loan was never intended for any personal use, rather it was extended solely for the purpose of switching Mega Profit Agriculture to a Chinese domestic Company in order to receive government grant and tax incentive, as opposed to be considered as a foreign-owned entity if under Harbin Mega Profit (Harbin Mega Profit is 100% owned by Mega Profit Limited, a Cayman Islands corporation). |

| | 17. | Please clarify whether the principal shareholder to whom you loaned $1.2 million is also an officer or director of the Company, If so we refer you to Section 402 of the Sarbanes-Oxley Act of 2002 which states that “it shall be unlawful for any issuer (as defined in section 2 of the Sarbanes-Oxley Act of 2002), directly of indirectly, including through any subsidiary, to extend or maintain credit, to arrange for the extension of credit, or to renew an extension of credit, in the for of a personal loan to or for any director or executive officer (or equivalent thereof) of that issuer.” Please advise. |

Response to Comment No.17:

Mr. Yanbin Wang, the principal shareholder of the Company, is also the Chief Executive Officer of the Company. However, the loan is not considered a personal loan to Mr. Wang because the funds were used to invest in Mega Profit Agriculture. Further, the funds were used for the sole benefit of the Company, not the individual shareholder because the two principal shareholders of Mega Profit Agriculture pledged to the Company their interests in Mega Profit Agriculture, which essentially entrusts all the assets to the Company. This transaction, hence offering of the loan, was made solely for the purpose of ensuring Mega Profit Agriculture would be able to qualify for government tax incentives in the wake of the powdered-milk contamination scandal in China. Considering the nature and purpose of this loan, we do not believe offering of this loan is in violation of the Sarbanes-Oxley Act of 2002. We also point to our disclosure in Item 2 of our Quarterly Report on Form 10-Q filed on August 13, 2009, under the caption “Loans to Related Parties” where we stated that “The transaction, including the loan, was made solely in order for the Company to obtain government tax incentives in the wake of the powdered-milk contamination scandal in China, and not for any personal interest of the shareholders.”

Mr. Chris White

September 18, 2009

Page 14

Note 10. Earnings per Share, page 12

| | 18. | We note you have not included 12,976,316 shares of convertible preferred stock or outstanding warrants to acquire 1,363,637 shares of common stock in your calculation of diluted weighted average shares due to the limitation on authorized shares as of March 31, 2009. We further note your disclosure in Note 13 of this Form 10-Q that you increased your authorized common stock on April 2, 2009. Please clarify how this date of April 2, 2009 reconciles with the disclosure in your Form 10-K that states the increase in authorized shares was approved by written consent in lieu of a meeting of stockholders as of December 12, 2008. Please revise your earnings per share calculation for all affected periods or tell us in detail why you believe your financial statements should not be amended. |

Response to Comment No.18:

The resolution to increase the Company’s authorized shares was approved by written consent in lieu of a meeting of stockholders on December 12, 2008. In this regard a preliminary information statement on Schedule 14-C was filed on December 12, 2009. After clearing the Commission’s comments, a definitive information statement on Schedule 14-C was filed on March 4, 2009. The filing of the amended articles with the Secretary of State of the State of Nevada was done 20 days from the completion of the mailing of the information statement to the Company’s shareholders and therefore did not take place until April 2, 2009. Thus, the Company’s earnings per share calculation for prior periods ended March 31, 2009 are not affected because the increase of authorized common stock was not effective until April 2, 2009.

We acknowledge and understand the following:

| | • | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please call Oded Har-Even, Esq. at (212) 660-5002, or Howard E. Berkenblit, Esq. at (617) 338-2979, both attorneys at Sullivan & Worcester LLP, if you have any questions or require additional information.

| | /s/ Yanbin Wang

Yanbin Wang, Chief Executive Officer |