A CUSTOMER EXPERIENCE (CX) SOLUTIONS COMPANY Analyst Meeting November 2020 Exhibit 99.1

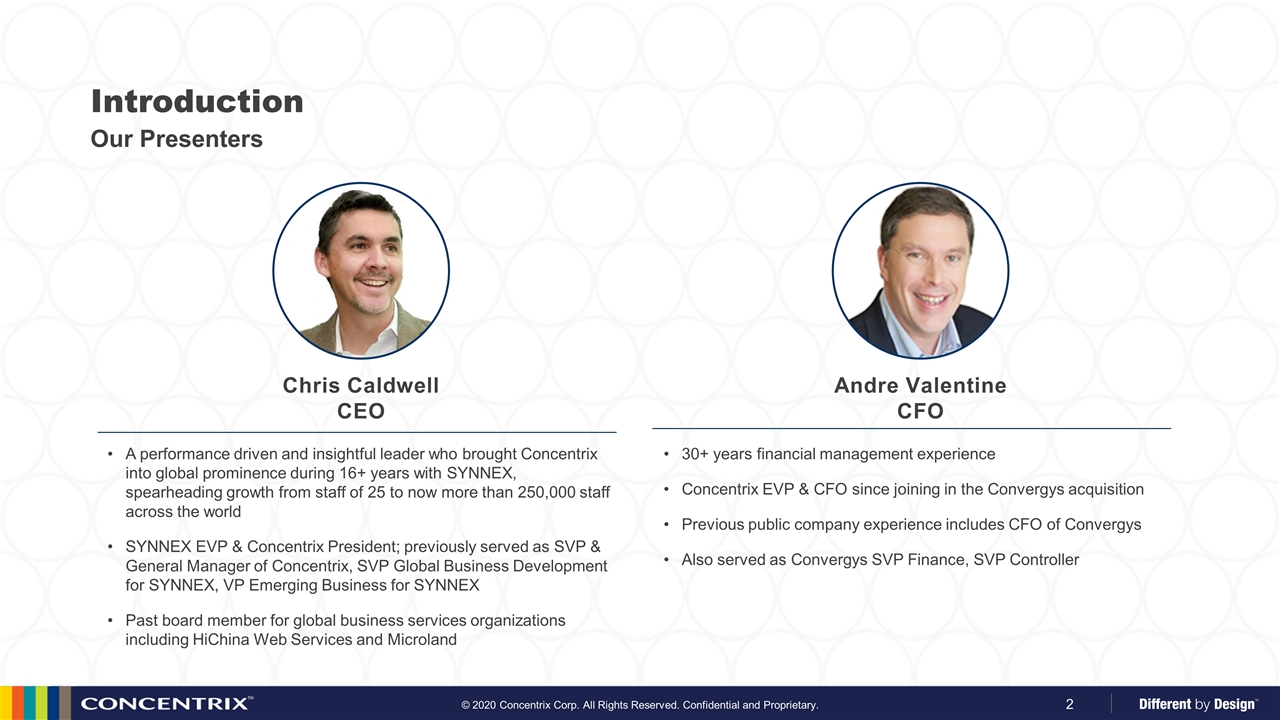

Our Presenters Introduction Chris Caldwell CEO A performance driven and insightful leader who brought Concentrix into global prominence during 16+ years with SYNNEX, spearheading growth from staff of 25 to now more than 250,000 staff across the world SYNNEX EVP & Concentrix President; previously served as SVP & General Manager of Concentrix, SVP Global Business Development for SYNNEX, VP Emerging Business for SYNNEX Past board member for global business services organizations including HiChina Web Services and Microland Andre Valentine CFO 30+ years financial management experience Concentrix EVP & CFO since joining in the Convergys acquisition Previous public company experience includes CFO of Convergys Also served as Convergys SVP Finance, SVP Controller

Safe Harbor Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include, but are not limited to, statements regarding the Company’s expected future financial condition, results of operations, cash flows, leverage, liquidity, business strategy, competitive position, acquisition opportunities, capital allocation and dividend plans, growth opportunities, market forecasts, the timing of the spin-off, and statements that include words such as believe, expect, may, will, provide, could and should and other similar expressions. These forward-looking statements are inherently uncertain, and actual results may differ from the Company’s expectations. The Company does not undertake a duty to update these forward-looking statements, which speak only as of the date on which they are made. Forward-looking statements involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Risks and uncertainties include, among other things: risks related to general economic conditions, including uncertainty related to the COVID-19 pandemic and its impact on the global economy; the level of outsourced business services; the level of business activity of the Company’s clients and the market acceptance and performance of their products and services; consolidation of the Company’s competitors; competitive conditions in the Company’s industry; currency exchange rate fluctuations; variability in demand by the Company’s clients or the early termination of the Company’s client contracts; competition in the customer experience solutions industry; political and economic stability in the countries in which the Company operates; the outbreak of communicable disease or other public health crises; cyberattacks on the Company’s networks and information technology systems; the inability to protect personal and proprietary information; increases in the cost of labor; the operability of the Company’s communication services and information technology systems and networks; changes in law, regulations or regulatory guidance; investigative or legal actions; the loss of key personnel; natural disasters, adverse weather conditions, terrorist attacks, work stoppages or other business disruptions; and the other factors contained in the Company’s Registration Statement on Form 10 filed with the Securities and Exchange Commission.

Concentrix Overview & Strategy Chris Caldwell

Relationships Customers Clients

What we believe… Clients want fewer but deeper relationships with partners The line has blurred across distinct capabilities to “solutions” Barriers to entry and opportunities for growth continue to increase, favoring scale players Brands must distinguish themselves in the market with unique CX delivery The experience is everything

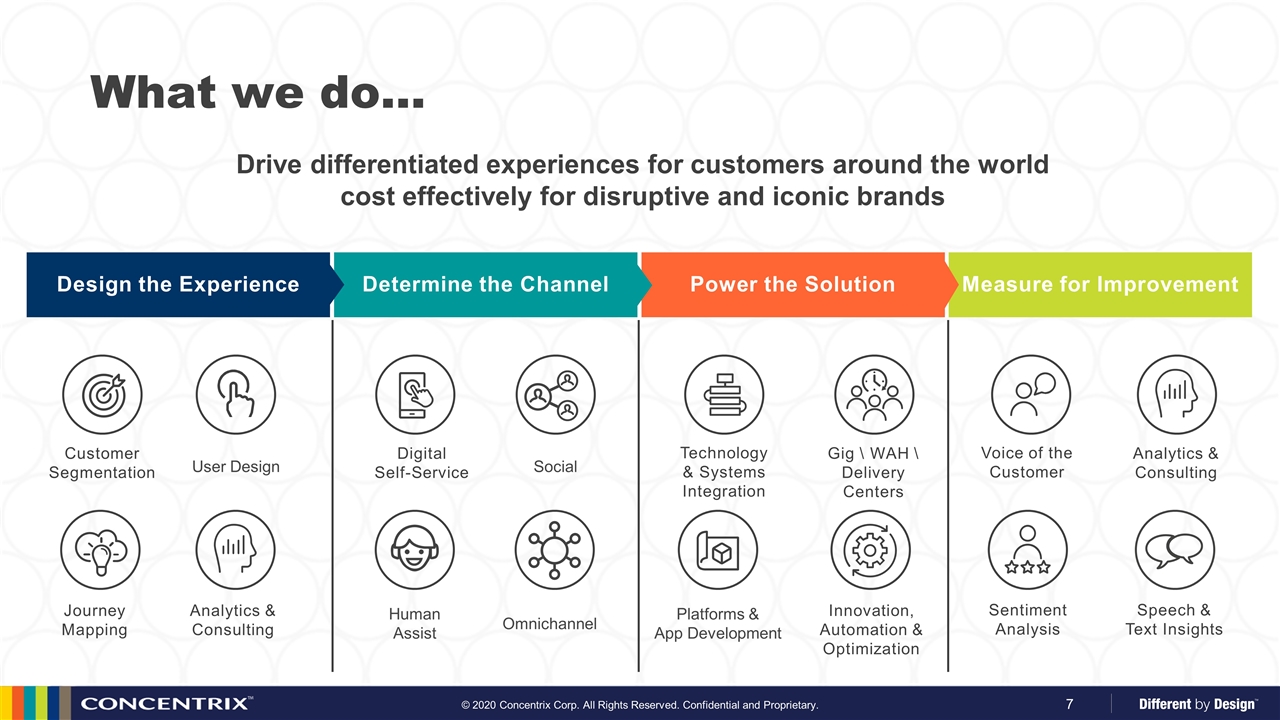

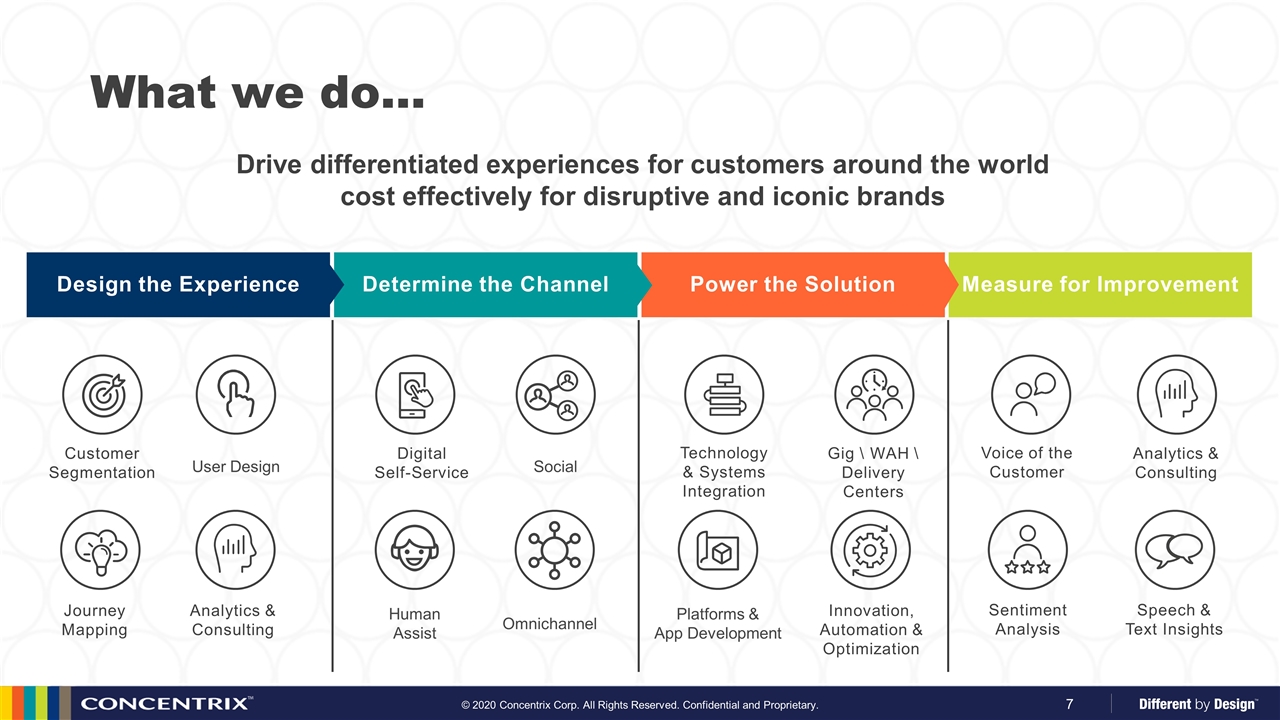

Drive differentiated experiences for customers around the world cost effectively for disruptive and iconic brands Determine the Channel Design the Experience Power the Solution Measure for Improvement What we do… Innovation, Automation & Optimization Digital Self-Service Gig \ WAH \ Delivery Centers Customer Segmentation Journey Mapping Analytics & Consulting Analytics & Consulting Social User Design Human Assist Technology & Systems Integration Omnichannel Platforms & App Development Voice of the Customer Sentiment Analysis Speech & Text Insights

Revenue $4.7B Non-GAAP Op Margin 11.5% 96% client renewal rate 15 years average client tenure exceptional technology, digital, analytics, global delivery Top 2 global CX solutions provider 360o customer full lifecycle services (2) (1) Free Cash Flow $339M (2) (1) 2019 revenue; (2) 2019 non-GAAP Measure. See Appendix for definitions of Non-GAAP measures and a reconciliation of such measures to GAAP. 650+ clients 250k+ team members 90+ global disruptors 6.5k+ credentialed professionals 95+ fortune global 500 clients 40+ countries 6 continents 84 industry awards FY 2019 70+ languages Who we are…

Strong Execution Market Leader Future Growth Only company in our industry to achieve our scale in 16 years Proven ability to drive strong financial returns Rebalancing portfolio toward strategic verticals, geographies Top 2 industry leader, tech-infused solutions, global scale advantage $85B+ core market servicing iconic brands, global disruptors Proven consolidator in fragmented industry Executing plan for above market growth, enhanced value creation Continue to invest in digital innovation and bold M&A Leverage strong balance sheet, disciplined capital deployment Concentrix is a Global CX Solutions Leader, Ideally Positioned for Growth Why invest…

Platform for performance Growth strategy Agenda Historical results Path to above market growth Allocation of capital Concentrix Overview & Strategy Financial Highlights

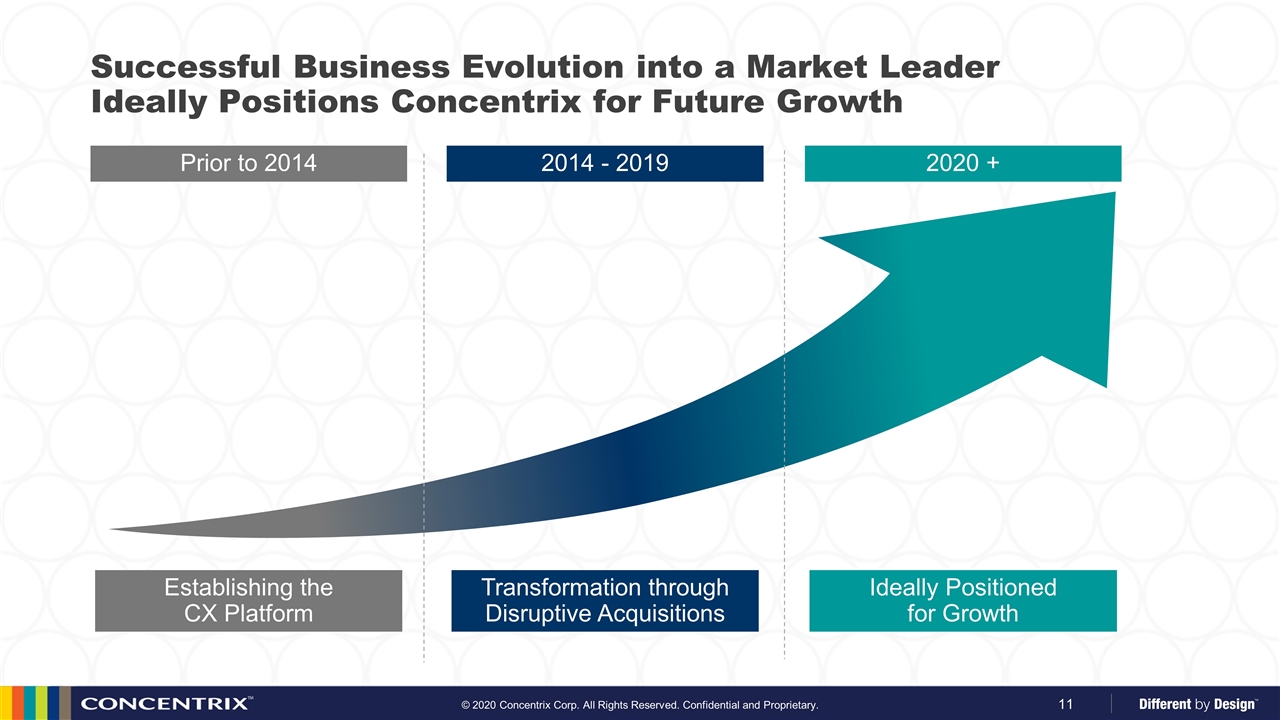

Successful Business Evolution into a Market Leader Ideally Positions Concentrix for Future Growth 2020 + Establishing the CX Platform Transformation through Disruptive Acquisitions Ideally Positioned for Growth 2014 - 2019 Prior to 2014

Delivering Strong Revenue Growth and Margin Expansion… 6.9% 11.5% Adj. Operating Income % +460 bps Strong Revenue Growth ($M) Margin Expansion Note: See Appendix for definitions of Non-GAAP measures and a reconciliation of such measures to GAAP. 62% CAGR ’12-’19

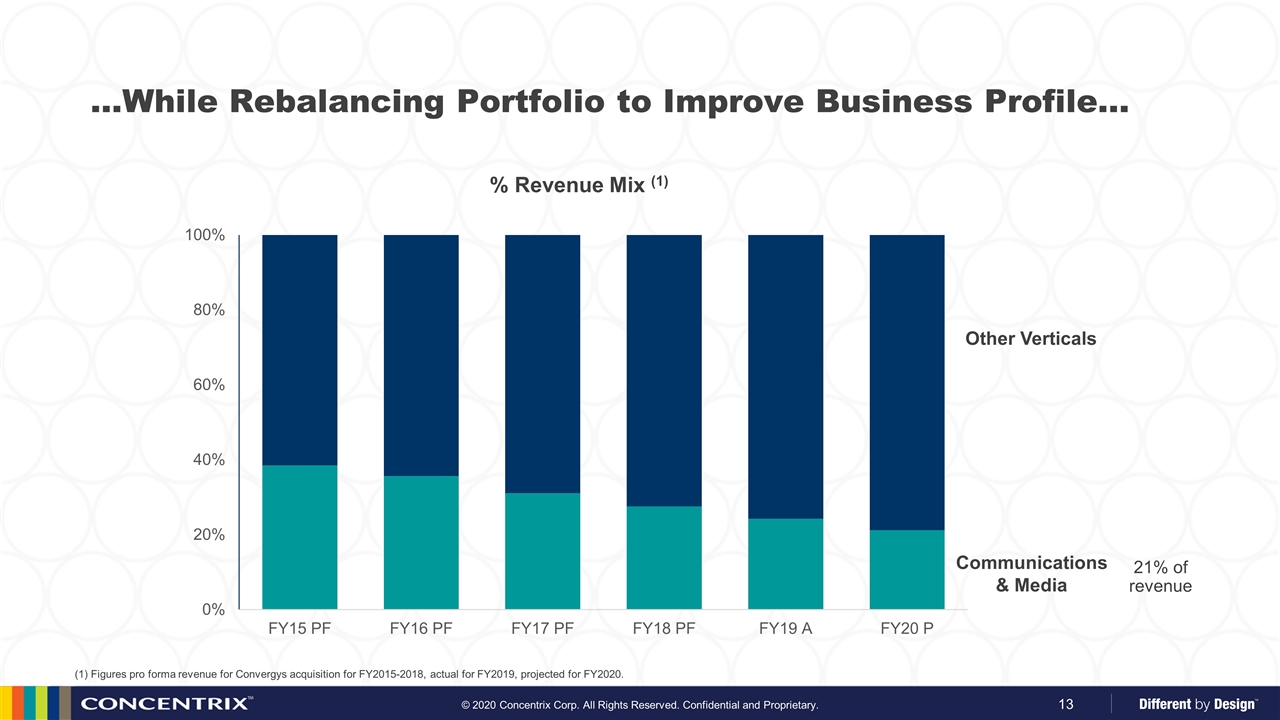

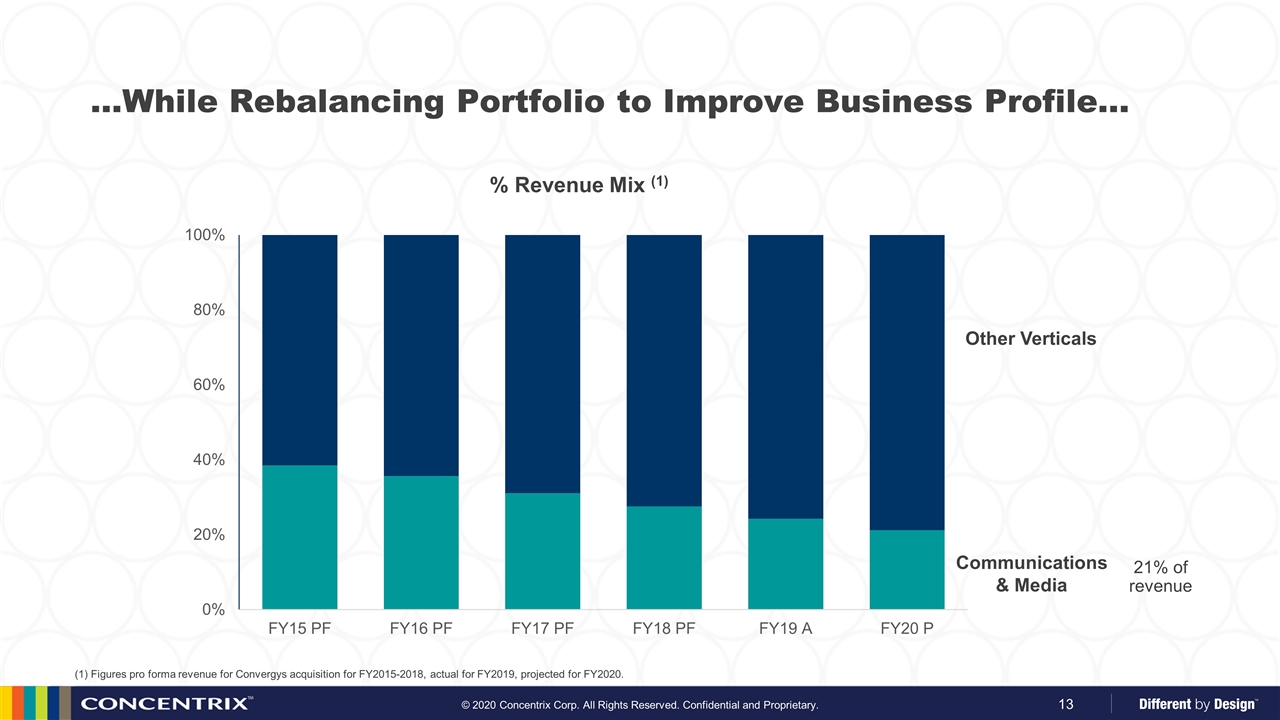

…While Rebalancing Portfolio to Improve Business Profile… % Revenue Mix (1) 21% of revenue Communications & Media (1) Figures pro forma revenue for Convergys acquisition for FY2015-2018, actual for FY2019, projected for FY2020. Other Verticals

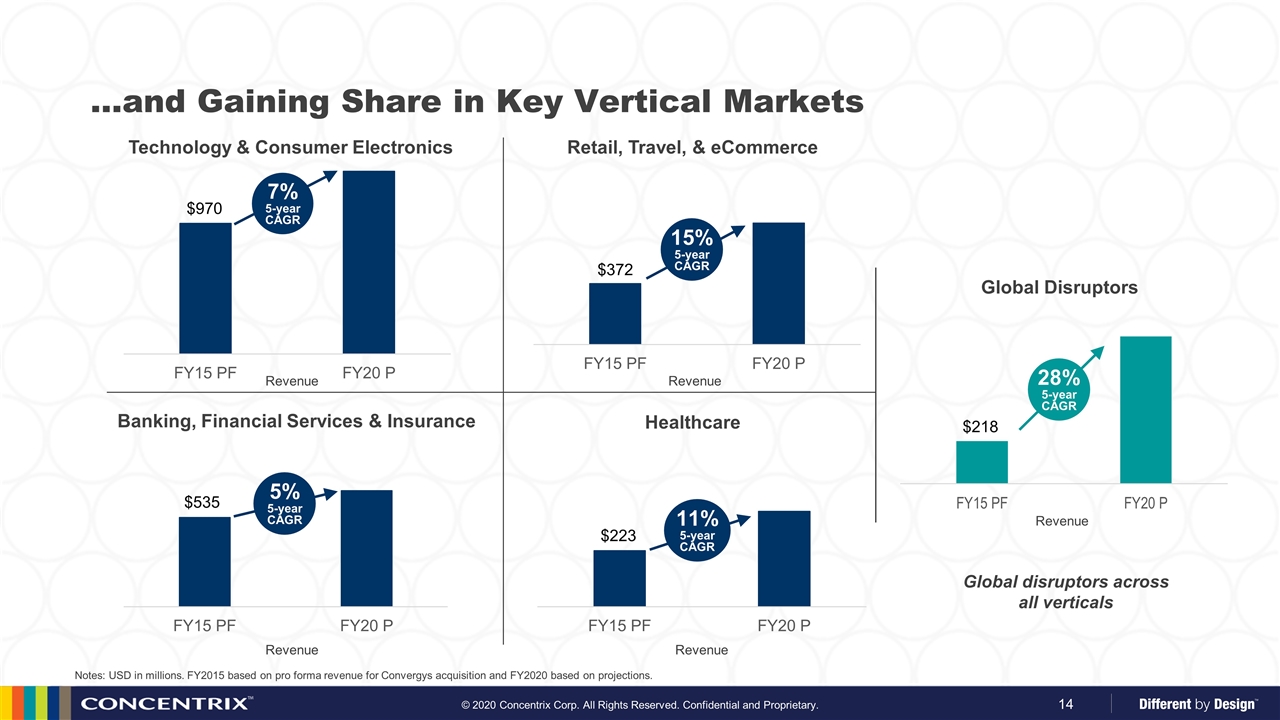

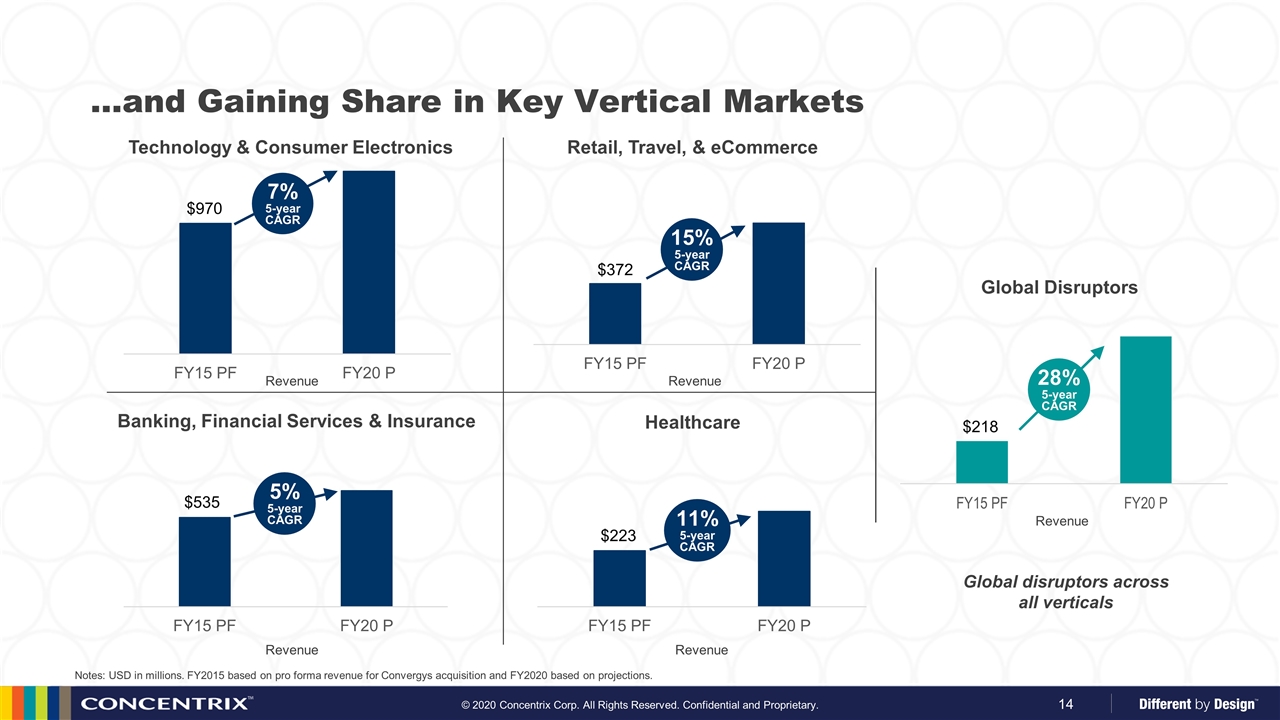

…and Gaining Share in Key Vertical Markets Healthcare Banking, Financial Services & Insurance Retail, Travel, & eCommerce Technology & Consumer Electronics 7% 5-year CAGR 15% 5-year CAGR 5% 5-year CAGR 11% 5-year CAGR $372 $970 Notes: USD in millions. FY2015 based on pro forma revenue for Convergys acquisition and FY2020 based on projections. $223 $535 (3) Revenue Revenue Revenue Revenue Global Disruptors 28% 5-year CAGR $218 Revenue Global disruptors across all verticals

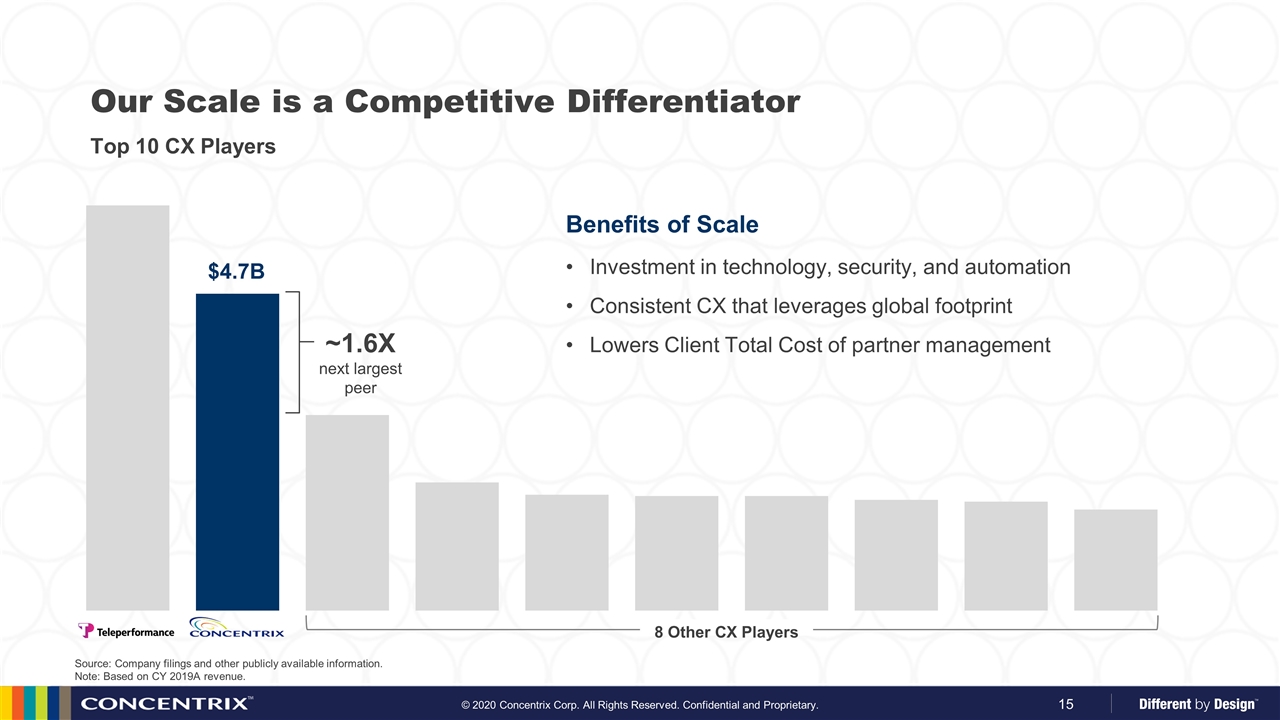

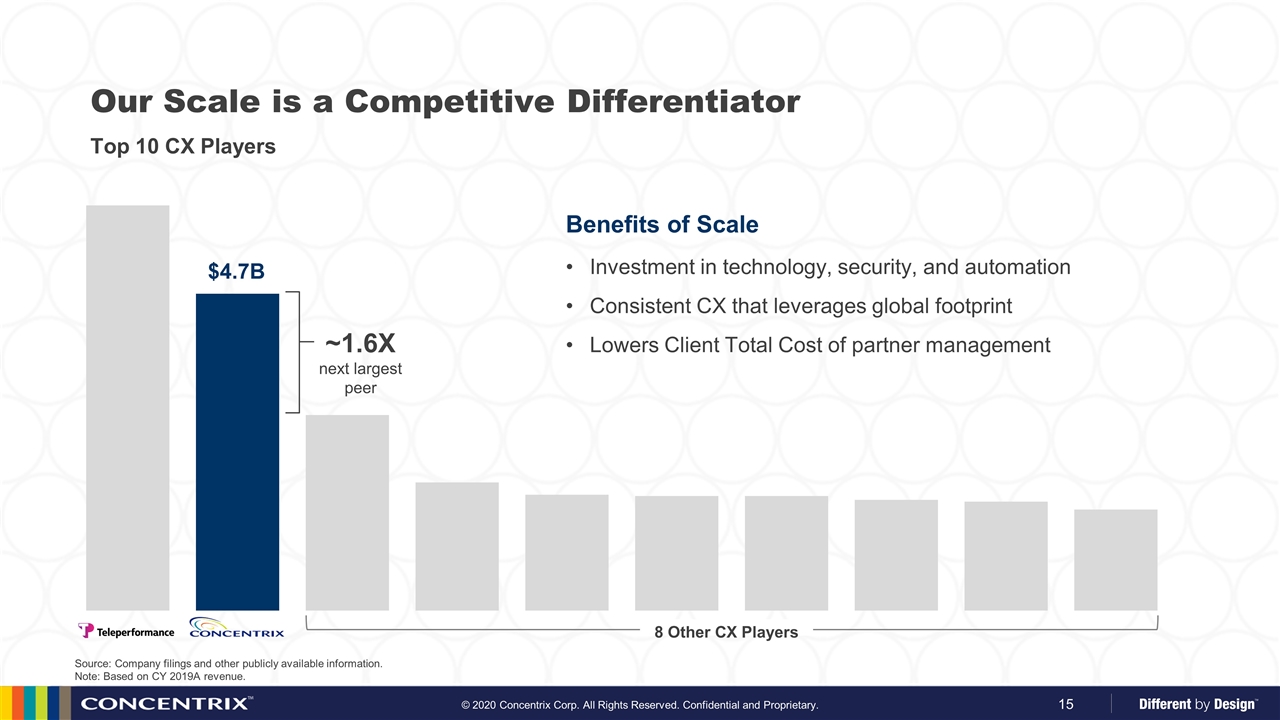

Top 10 CX Players Our Scale is a Competitive Differentiator $4.7B ~1.6X next largest peer Benefits of Scale Investment in technology, security, and automation Consistent CX that leverages global footprint Lowers Client Total Cost of partner management Source: Company filings and other publicly available information. Note: Based on CY 2019A revenue. 8 Other CX Players

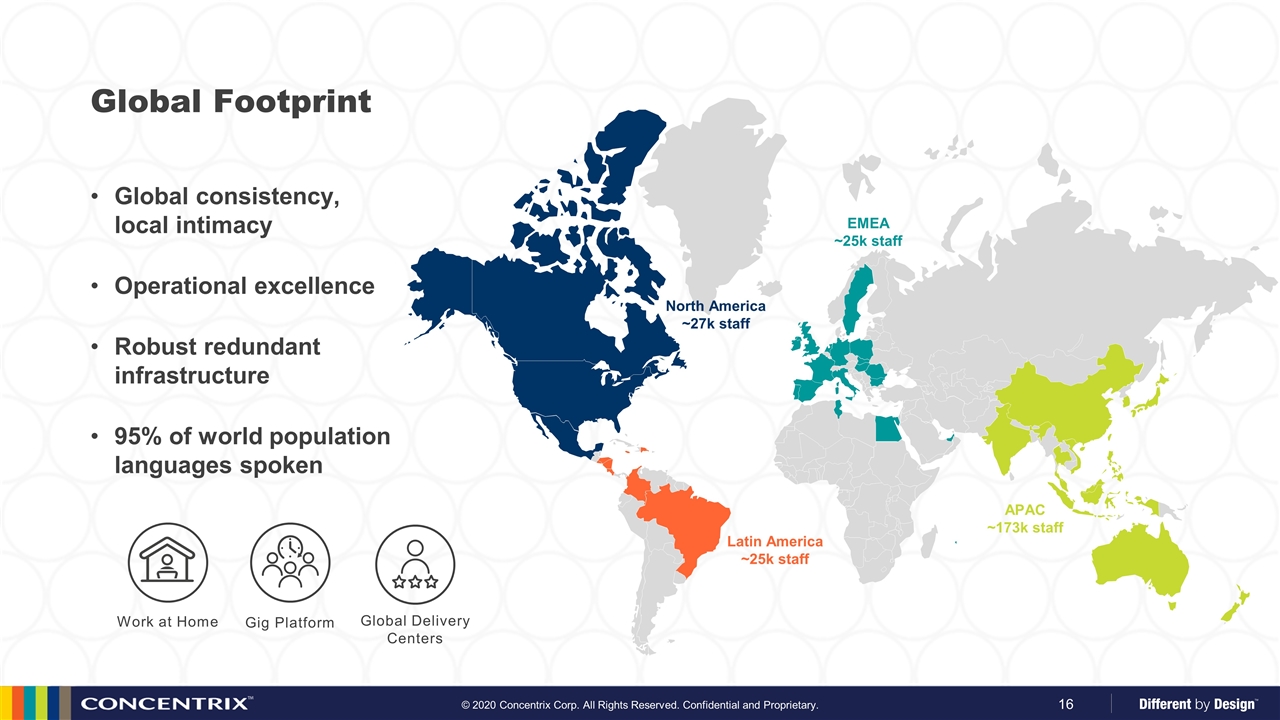

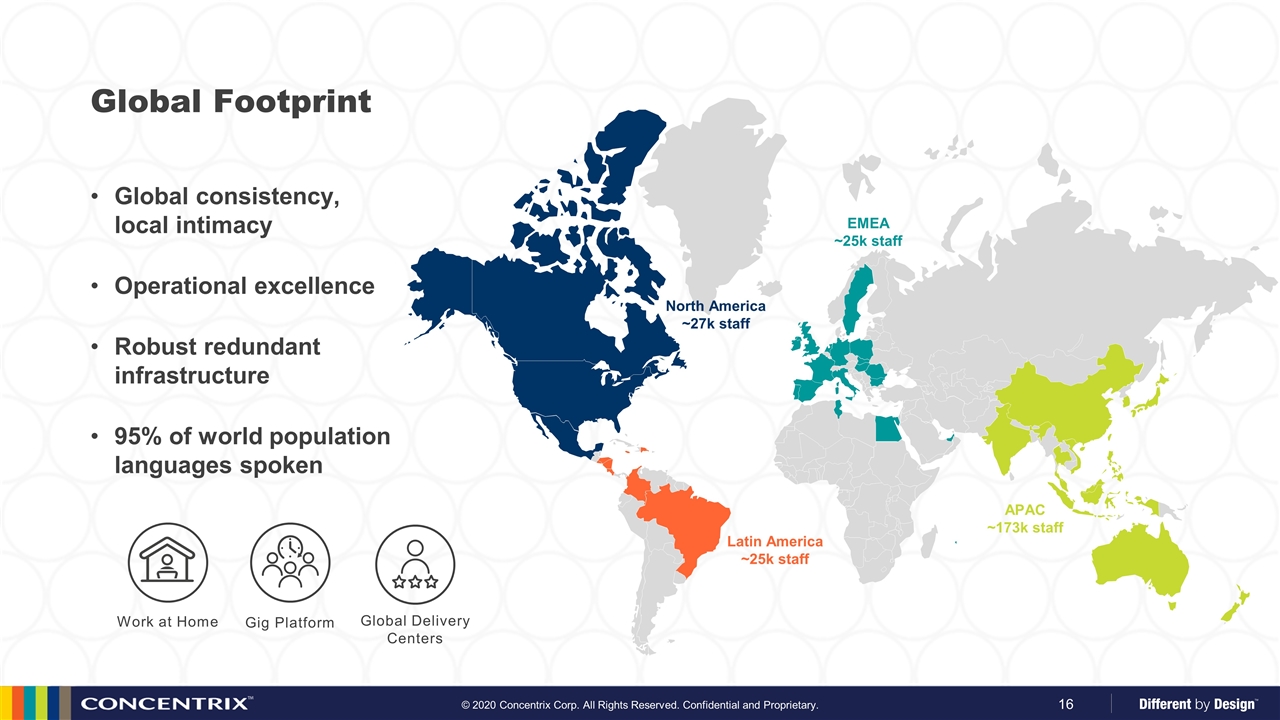

Global consistency, local intimacy Operational excellence Robust redundant infrastructure 95% of world population languages spoken APAC ~173k staff North America ~27k staff EMEA ~25k staff Latin America ~25k staff Global Footprint Gig Platform Work at Home Global Delivery Centers

2018 2014 2016 2013 2015 2017 2020 2005 2006 2008 2010 2007 2009 2011 2012 2019 Banking workflow automation & back office platform Social media care & forum moderation Security automation, fraud prevention UX, real-time intelligence, self-serve automation Process optimization, workflow automation K-base automation, web-based coaching User design, CX journey analytics & consulting Omnichannel, fraud automation, cognitive learning & AI AI- enabled gamification Speech & text analytics Sentiment analysis, digital VOC platform Facial recognition biometrics for WAH Solv™ gig platform, conversational virtual assistants SecureCX™ work at home security Enabling Leading Technology-Infused Solutions for over a Decade Examples of our investments in technology that differentiate us IoT, Connected Car, machine learning, voice biometrics Social media care, next best action Voice of the Customer (VOC) Platform Advanced customer experience feedback platform combined with tailored experience management services Solv™ gig Platform Provides clients access to knowledge-rich, on-demand talent from around the world and the ability to scale more quickly SecureCX™ Platform Proprietary technology platform to maintain security and operational integrity in our WAH environment Pulse CX Management Platform Enterprise intelligent all-in-one CX workforce management platform used by our operations globally

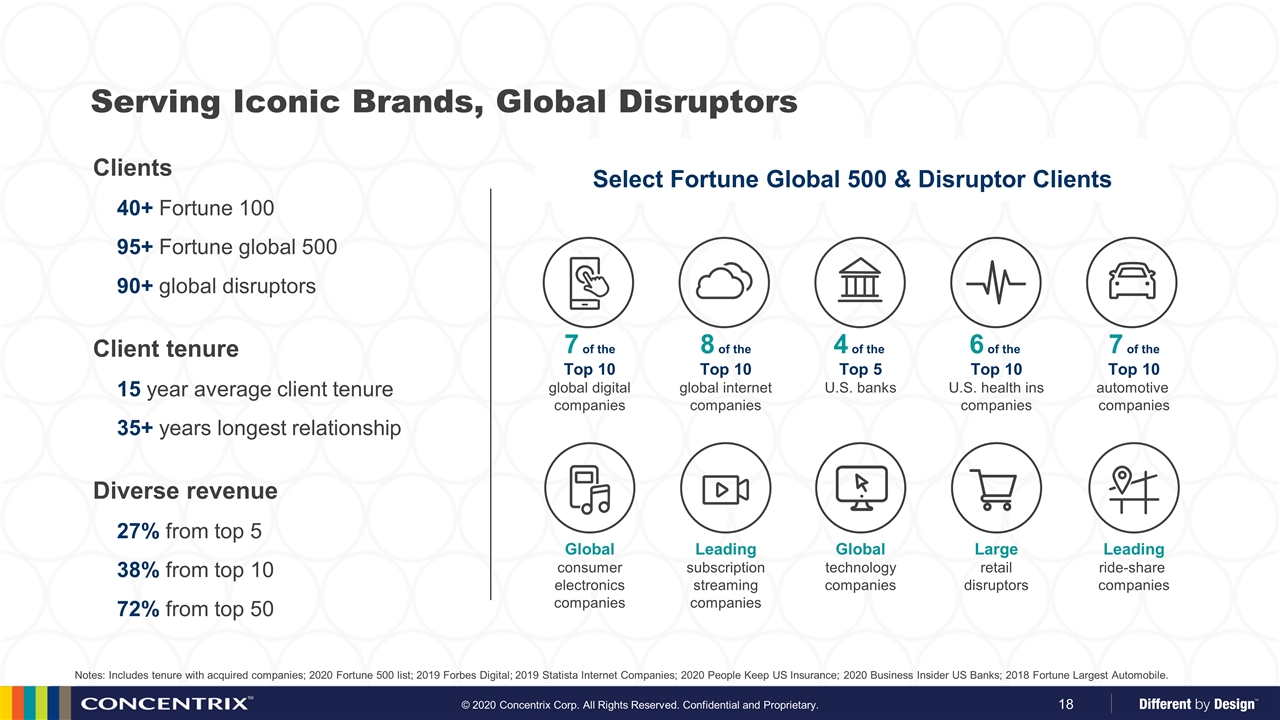

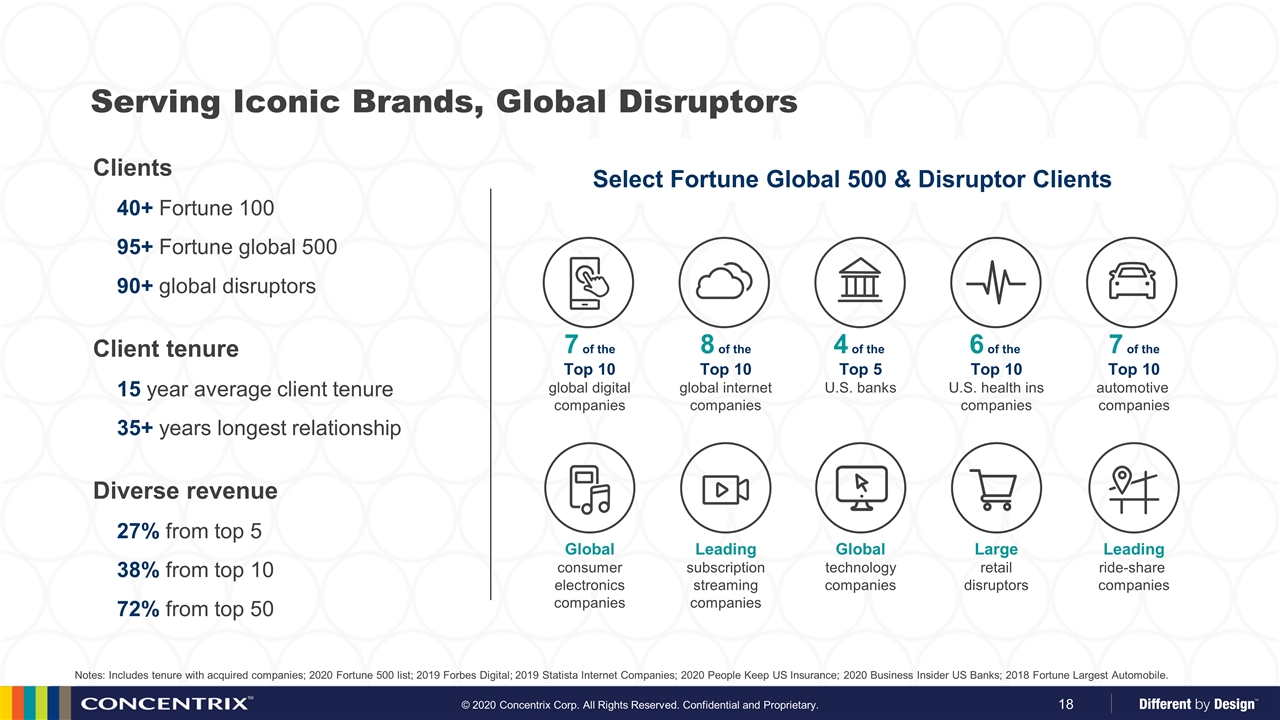

Serving Iconic Brands, Global Disruptors Notes: Includes tenure with acquired companies; 2020 Fortune 500 list; 2019 Forbes Digital; 2019 Statista Internet Companies; 2020 People Keep US Insurance; 2020 Business Insider US Banks; 2018 Fortune Largest Automobile. Clients 40+ Fortune 100 95+ Fortune global 500 90+ global disruptors Client tenure 15 year average client tenure 35+ years longest relationship Diverse revenue 27% from top 5 38% from top 10 72% from top 50 Select Fortune Global 500 & Disruptor Clients 7 of the Top 10 global digital companies Global consumer electronics companies 7 of the Top 10 automotive companies Leading ride-share companies 8 of the Top 10 global internet companies Leading subscription streaming companies 4 of the Top 5 U.S. banks Global technology companies 6 of the Top 10 U.S. health ins companies Large retail disruptors

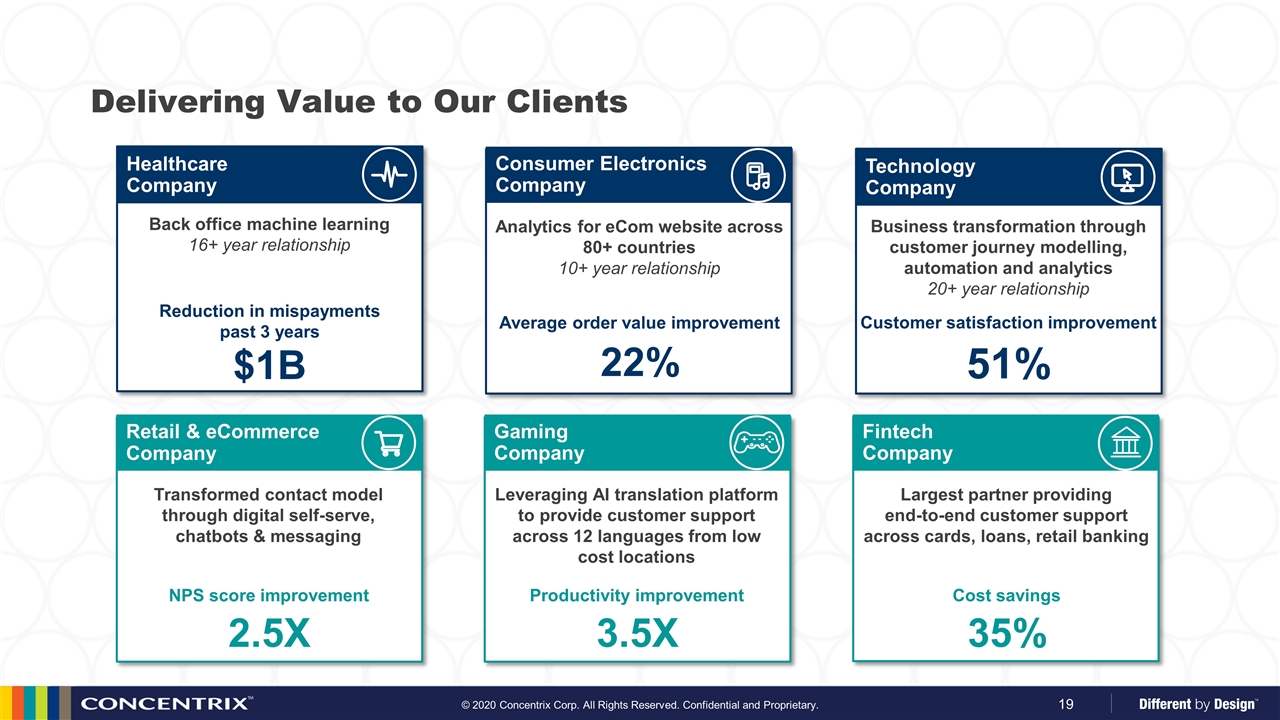

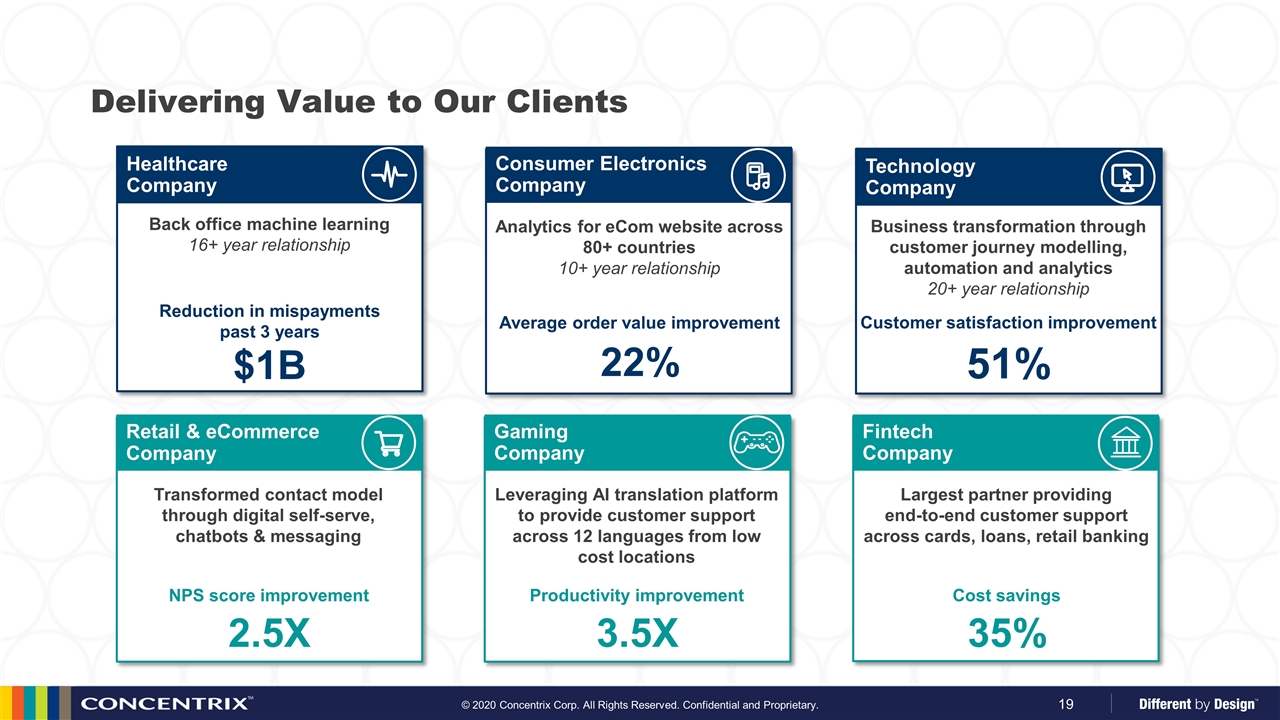

Delivering Value to Our Clients Healthcare Company $1B Back office machine learning 16+ year relationship Reduction in mispayments past 3 years Retail & eCommerce Company 2.5X Transformed contact model through digital self-serve, chatbots & messaging NPS score improvement Fintech Company 35% Largest partner providing end-to-end customer support across cards, loans, retail banking Cost savings Technology Company 51% Business transformation through customer journey modelling, automation and analytics 20+ year relationship Customer satisfaction improvement Gaming Company 3.5X Leveraging AI translation platform to provide customer support across 12 languages from low cost locations Productivity improvement Consumer Electronics Company 22% Analytics for eCom website across 80+ countries 10+ year relationship Average order value improvement

Additional analyst rankings Leader in Forrester Omnichannel ranking #2 in HFS Top 10 Customer Engagement Operations Services ranking Leader in NelsonHall Digital Experience Consulting ranking Leader in Everest CX Analytics ranking Leader in NelsonHall Cognitive CX Services ranking Recognized as a Global Leader

Recognized as a Leading Employer Our commitment to staff, diversity, culture and thought leadership makes us one of the most awarded and globally recognized companies in the industry People, Culture & Diversity Notes: Includes tenure with acquired companies; 2020 Fortune 500 list; 2019 Forbes Digital; 2019 Statista Internet Companies; 2020 People Keep US Insurance; 2020 Business Insider US Banks; 2018 Fortune Largest Automobile.

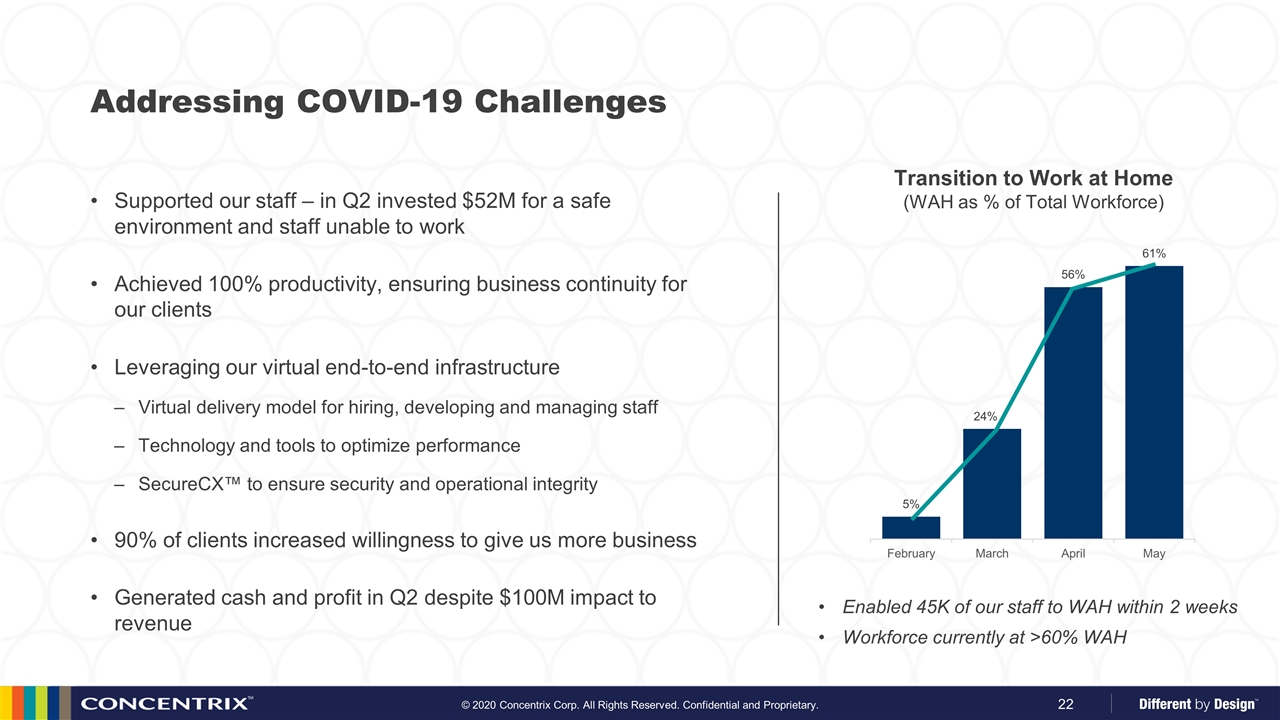

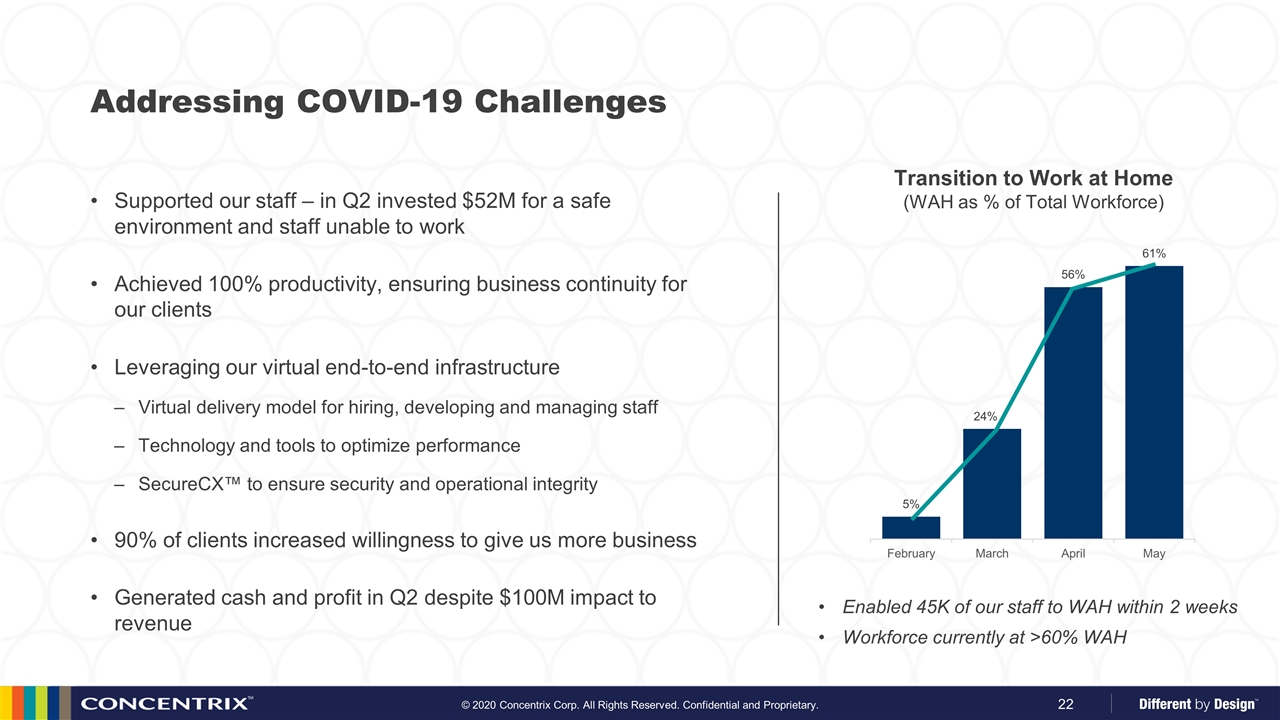

Supported our staff – in Q2 invested $52M for a safe environment and staff unable to work Achieved 100% productivity, ensuring business continuity for our clients Leveraging our virtual end-to-end infrastructure Virtual delivery model for hiring, developing and managing staff Technology and tools to optimize performance SecureCX™ to ensure security and operational integrity 90% of clients increased willingness to give us more business Generated cash and profit in Q2 despite $100M impact to revenue Addressing COVID-19 Challenges Transition to Work at Home (WAH as % of Total Workforce) Enabled 45K of our staff to WAH within 2 weeks Workforce currently at >60% WAH

Strong Leadership Team with 380+ Years of Experience ANDRE VALENTINE Chief Financial Officer 36 years 8 CORMAC TWOMEY EVP – Global Operations & Delivery 28 years 8 GUY BROSSEAU EVP – Information Systems & Security 36 years 8 8 PHILIP CASSIDY EVP – Strategic Projects & Corporate Strategy 30 years CHRIS CALDWELL Chief Executive Officer 32 years 8 MONICA EGGER SVP – Financial Planning & Analysis 27 years 8 8 KATHY JUVE EVP – Customer Experience, Technology & Insights 25 years JASON MARASIGAN Corporate VP – Corporate Development 18 years 8 8 JYLLENE MILLER EVP – Marketing & Emerging Business 33 years RICK ROSSO EVP – Global Sales & Account Management 36 years 8 8 STEVE RICHIE EVP – Legal 27 years 8 KIM SULLIVAN SVP – People Solutions 24 years DEBBIE GONZALEZ SVP – Global Marketing & Communications 28 years 8

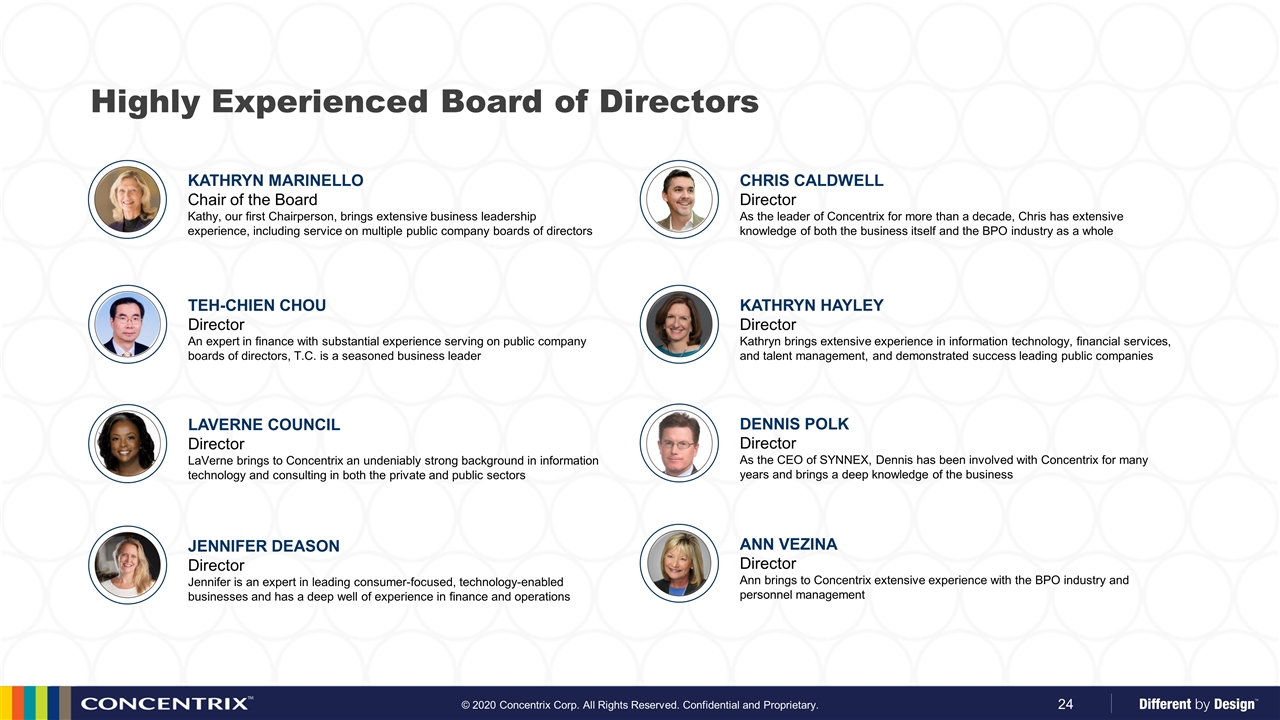

Highly Experienced Board of Directors 8 JENNIFER DEASON Director Jennifer is an expert in leading consumer-focused, technology-enabled businesses and has a deep well of experience in finance and operations TEH-CHIEN CHOU Director An expert in finance with substantial experience serving on public company boards of directors, T.C. is a seasoned business leader 8 DENNIS POLK Director As the CEO of SYNNEX, Dennis has been involved with Concentrix for many years and brings a deep knowledge of the business 8 LAVERNE COUNCIL Director LaVerne brings to Concentrix an undeniably strong background in information technology and consulting in both the private and public sectors 8 8 ANN VEZINA Director Ann brings to Concentrix extensive experience with the BPO industry and personnel management CHRIS CALDWELL Director As the leader of Concentrix for more than a decade, Chris has extensive knowledge of both the business itself and the BPO industry as a whole 8 8 KATHRYN HAYLEY Director Kathryn brings extensive experience in information technology, financial services, and talent management, and demonstrated success leading public companies KATHRYN MARINELLO Chair of the Board Kathy, our first Chairperson, brings extensive business leadership experience, including service on multiple public company boards of directors 8

Agenda Platform for performance Growth strategy Historical results Path to above market growth Allocation of capital Concentrix Overview & Strategy Financial Highlights

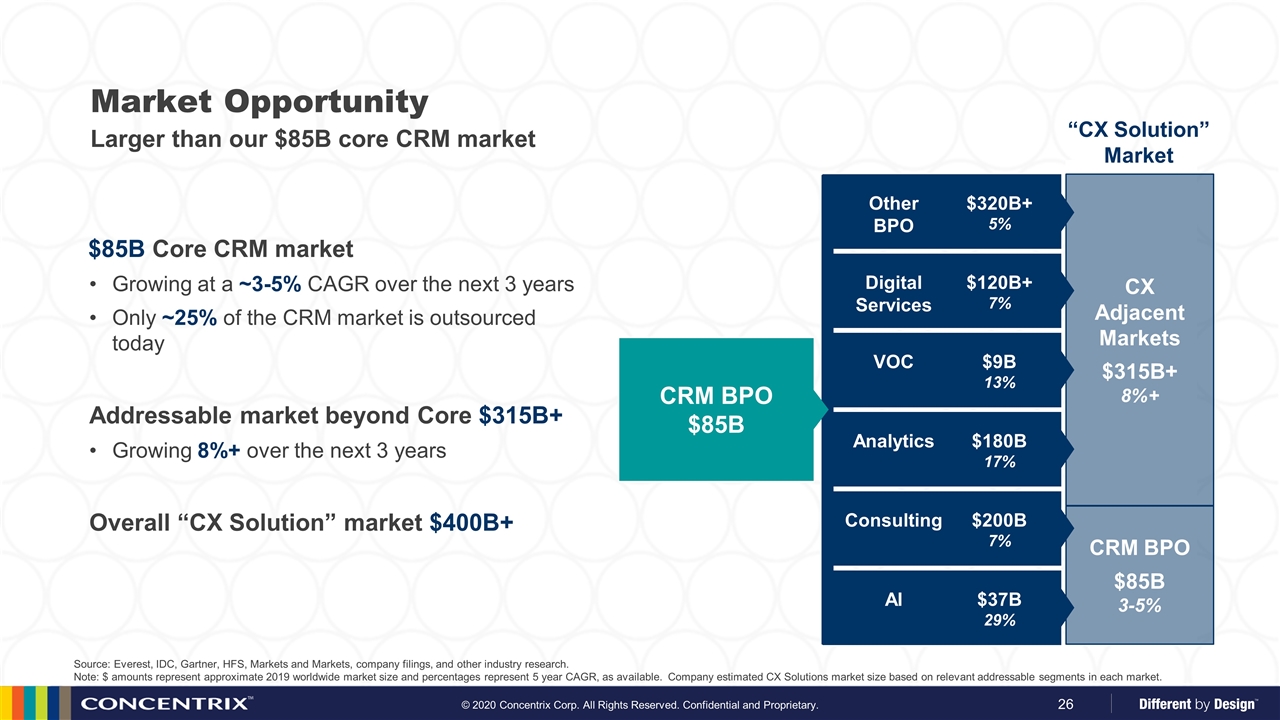

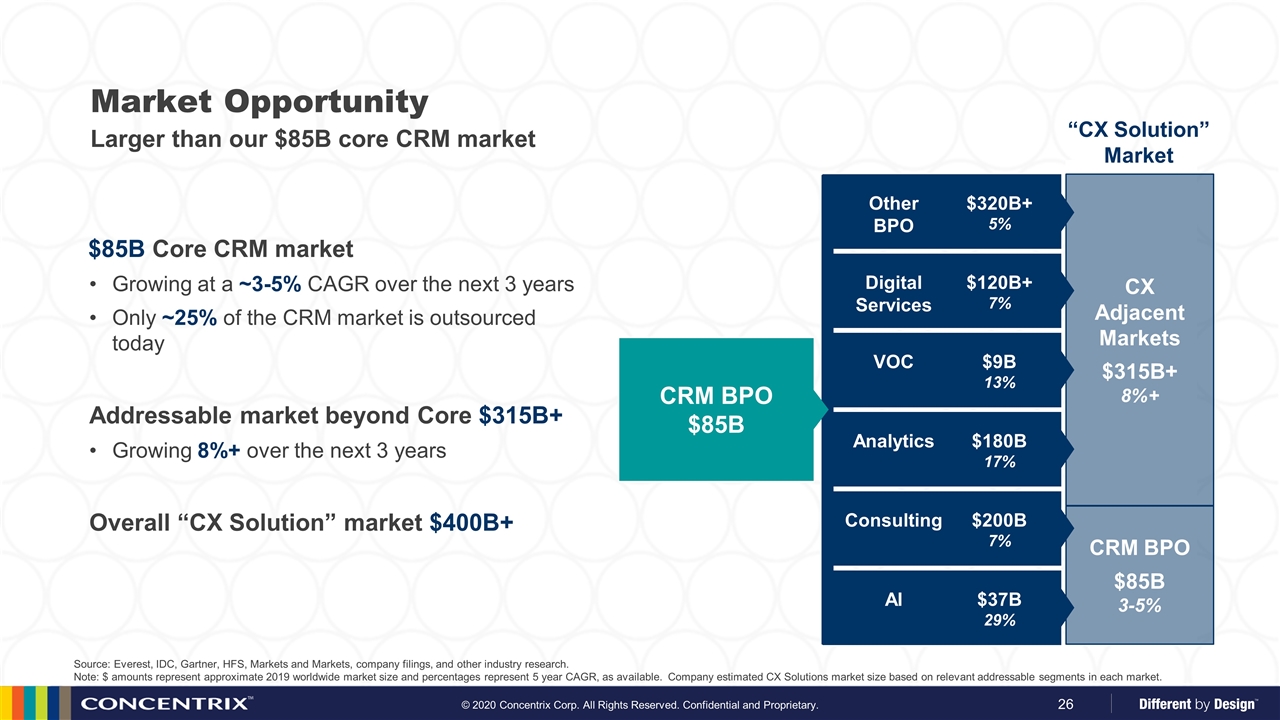

Market Opportunity $85B Core CRM market Growing at a ~3-5% CAGR over the next 3 years Only ~25% of the CRM market is outsourced today Addressable market beyond Core $315B+ Growing 8%+ over the next 3 years Overall “CX Solution” market $400B+ “CX Solution” Market Source: Everest, IDC, Gartner, HFS, Markets and Markets, company filings, and other industry research. Note: $ amounts represent approximate 2019 worldwide market size and percentages represent 5 year CAGR, as available. Company estimated CX Solutions market size based on relevant addressable segments in each market. CX Adjacent Markets $315B+ 8%+ Other BPO $320B+ 5% Digital Services $120B+ 7% VOC $9B 13% Analytics $180B 17% CRM BPO $85B 3-5% AI $37B 29% Consulting $200B 7% CRM BPO $85B Larger than our $85B core CRM market

Growing Importance of the Customer Experience CX companies are becoming more critical in the ecosystem Customer Experience seen by CEOs as most effective method for creating competitive advantage (1) 84% of customers feel that experiences are as important as the actual products and services (2) 73% of customers say that one extraordinary experience raises the expectations they have for other companies (2) 63% say the best brands exceed expectations across the customer journey (3) 57% of customers stopped buying from a company because one of their competitors provided a better service experience (2) Source: Salesforce, Wunderman, and Walker research reports. Walker – The Customer-Focused CEO report; (2) Salesforce – State of the Connected Consumer; (3) Wunderman – Wantedness.

Further invest in emerging markets Selectively pursue strategic acquisitions Relentlessly innovate, develop new digital solutions Expand wallet share through deeper client relationships Driving sustainable profitable growth Growth Strategy Organic Inorganic 1 2 3 4

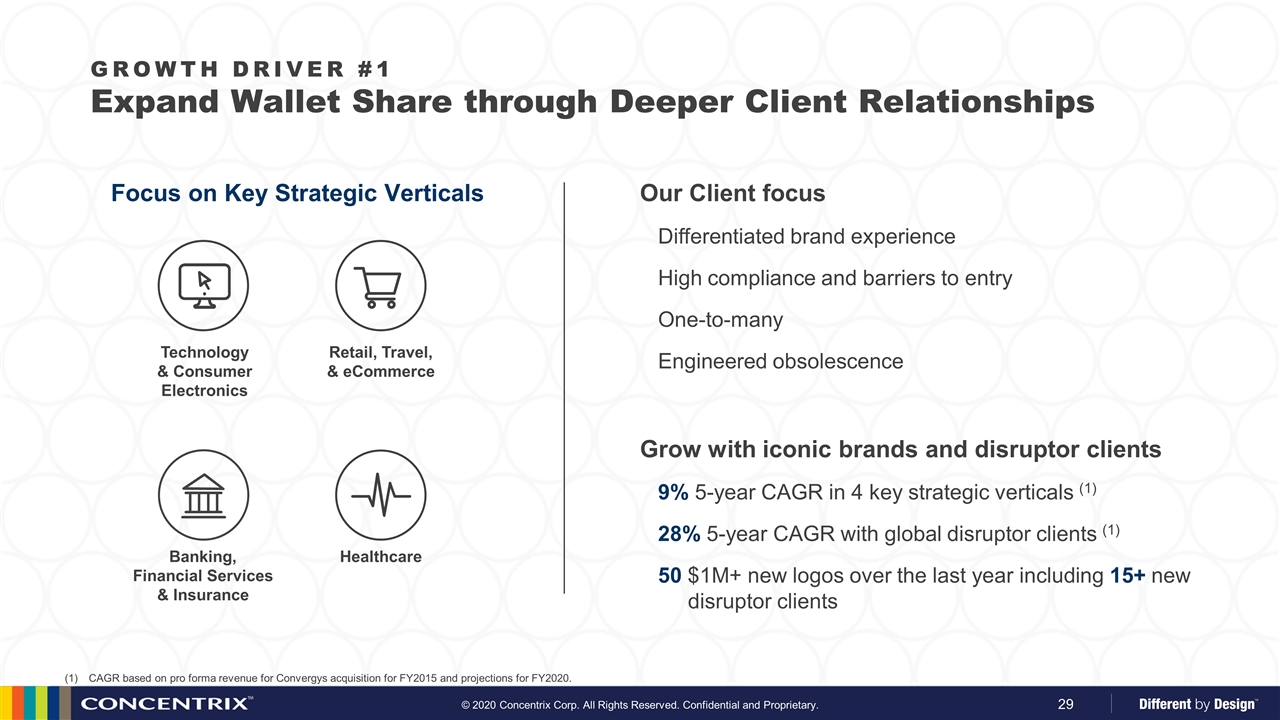

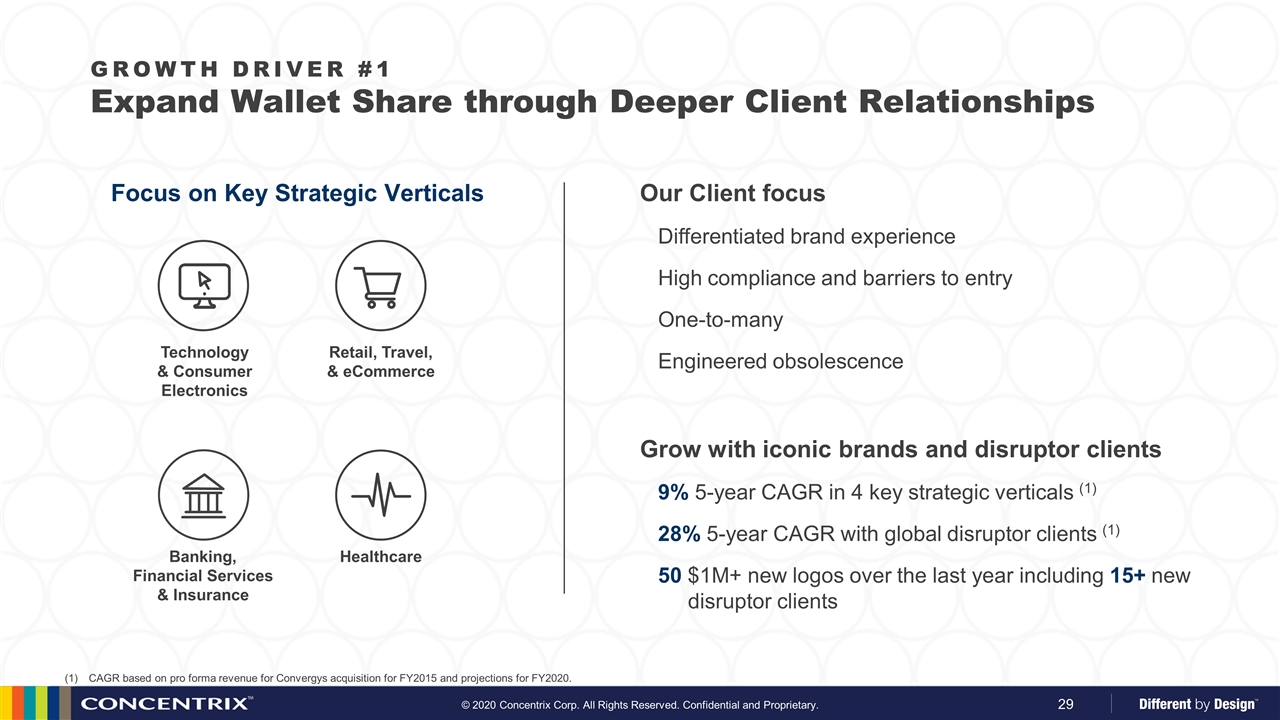

Our Client focus Differentiated brand experience High compliance and barriers to entry One-to-many Engineered obsolescence Grow with iconic brands and disruptor clients 9% 5-year CAGR in 4 key strategic verticals (1) 28% 5-year CAGR with global disruptor clients (1) 50 $1M+ new logos over the last year including 15+ new disruptor clients GROWTH DRIVER #1 Expand Wallet Share through Deeper Client Relationships Focus on Key Strategic Verticals Healthcare Banking, Financial Services & Insurance Retail, Travel, & eCommerce Technology & Consumer Electronics CAGR based on pro forma revenue for Convergys acquisition for FY2015 and projections for FY2020.

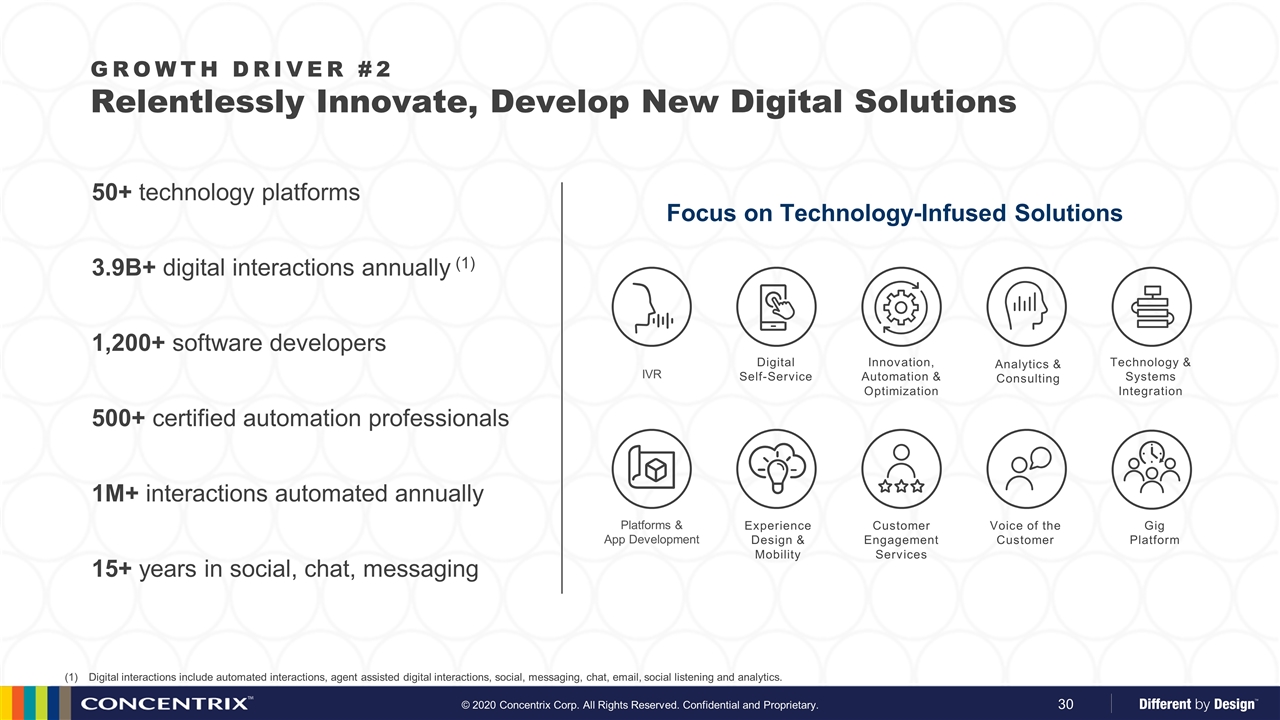

Focus on Technology-Infused Solutions 1M+ interactions automated annually 1,200+ software developers 500+ certified automation professionals 3.9B+ digital interactions annually (1) Digital interactions include automated interactions, agent assisted digital interactions, social, messaging, chat, email, social listening and analytics. 15+ years in social, chat, messaging 50+ technology platforms IVR Platforms & App Development Technology & Systems Integration Gig Platform Voice of the Customer Analytics & Consulting Innovation, Automation & Optimization Customer Engagement Services Digital Self-Service Experience Design & Mobility GROWTH DRIVER #2 Relentlessly Innovate, Develop New Digital Solutions

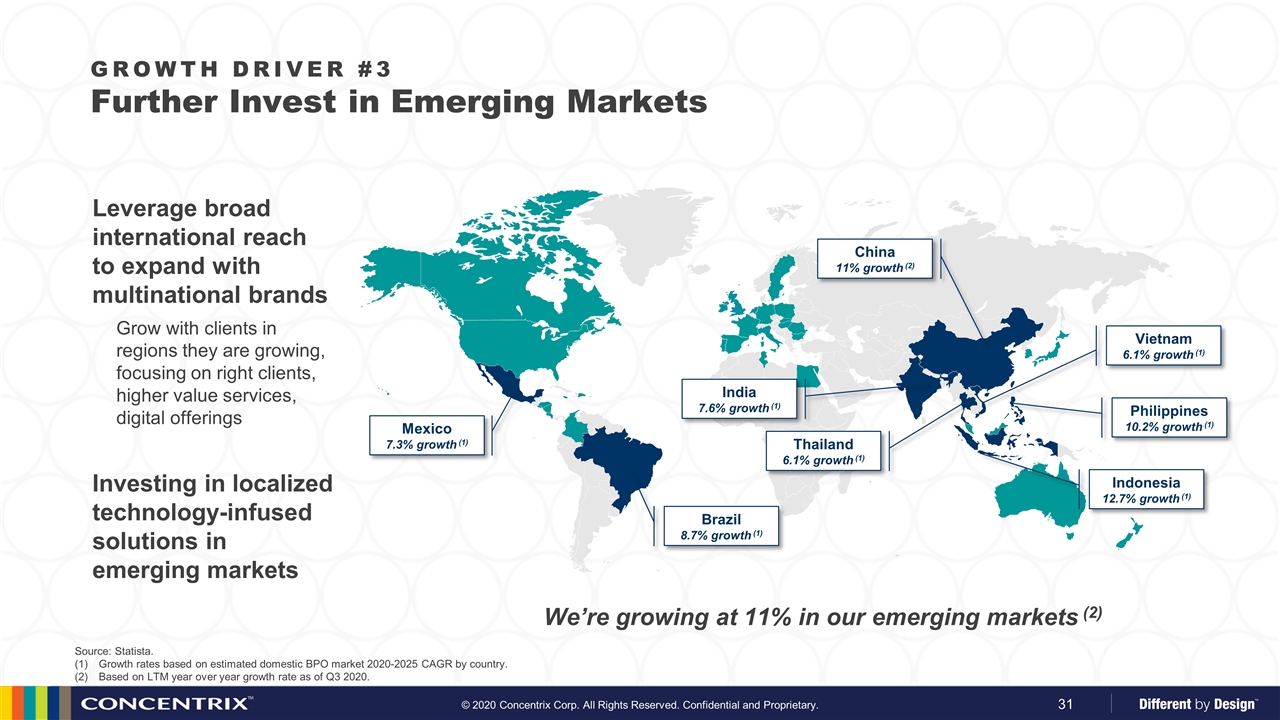

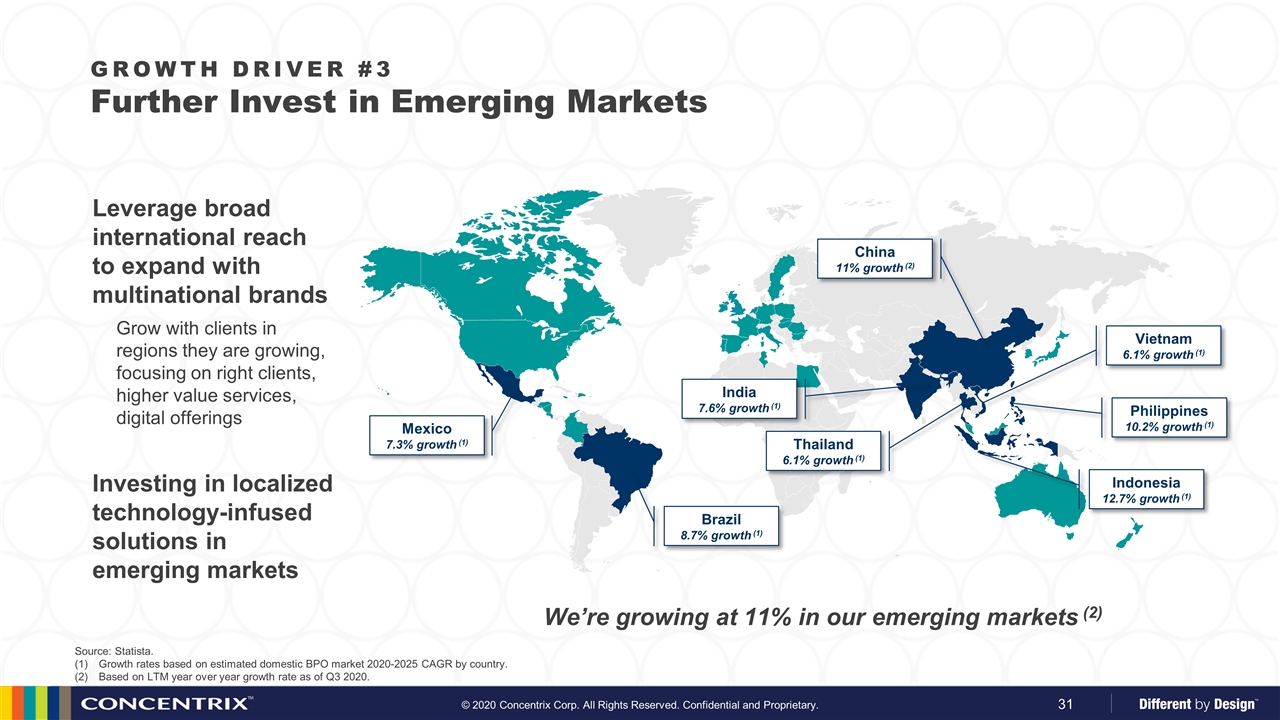

Leverage broad international reach to expand with multinational brands Grow with clients in regions they are growing, focusing on right clients, higher value services, digital offerings Investing in localized technology-infused solutions in emerging markets GROWTH DRIVER #3 Further Invest in Emerging Markets Brazil 8.7% growth (1) India 7.6% growth (1) Thailand 6.1% growth (1) Indonesia 12.7% growth (1) Philippines 10.2% growth (1) Vietnam 6.1% growth (1) China 11% growth (2) Mexico 7.3% growth (1) We’re growing at 11% in our emerging markets (2) Source: Statista. Growth rates based on estimated domestic BPO market 2020-2025 CAGR by country. Based on LTM year over year growth rate as of Q3 2020.

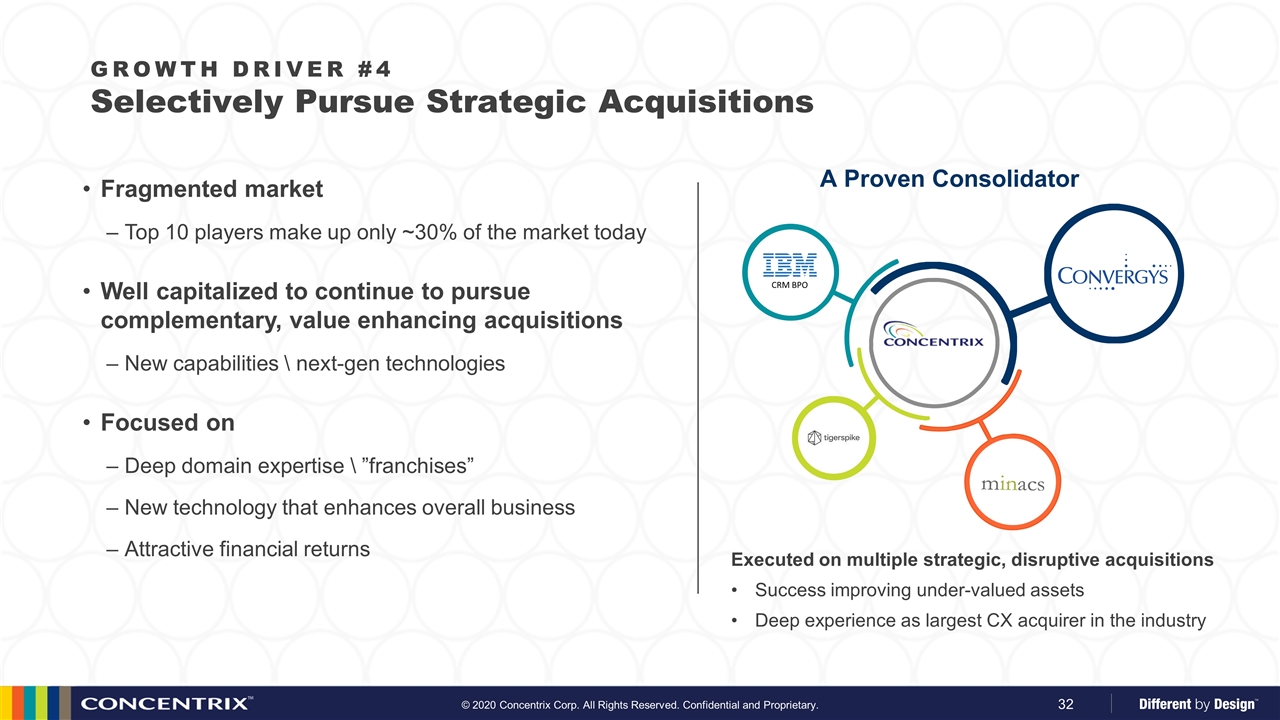

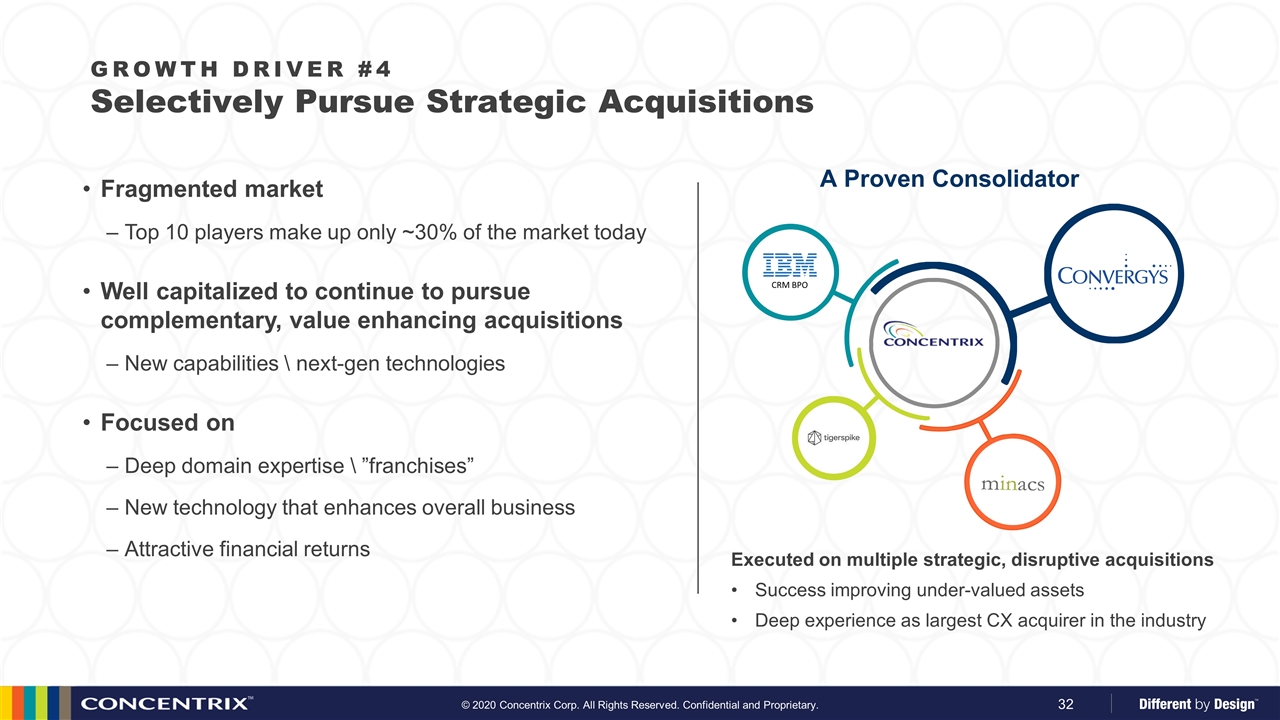

Fragmented market Top 10 players make up only ~30% of the market today Well capitalized to continue to pursue complementary, value enhancing acquisitions New capabilities \ next-gen technologies Focused on Deep domain expertise \ ”franchises” New technology that enhances overall business Attractive financial returns GROWTH DRIVER #4 Selectively Pursue Strategic Acquisitions A Proven Consolidator Executed on multiple strategic, disruptive acquisitions Success improving under-valued assets Deep experience as largest CX acquirer in the industry CRM BPO

Executing a plan for above market growth Successful CX industry consolidator investing for innovation, expansion Well positioned for long term value creation Differentiating the customer experience Clients want fewer, deeper relationships with partners Concentrix able to capitalize on evolving market trends Leading with a proven platform Gaining share in high growth segments Global scale, deep client relationships, technology-infused solutions IN SUMMARY Global CX Solutions Leader. Ideally Positioned for Growth

Financial Highlights Andre Valentine

Agenda Platform for performance Growth strategy Historical results Path to above market growth Allocation of capital Concentrix Overview & Strategy Financial Highlights

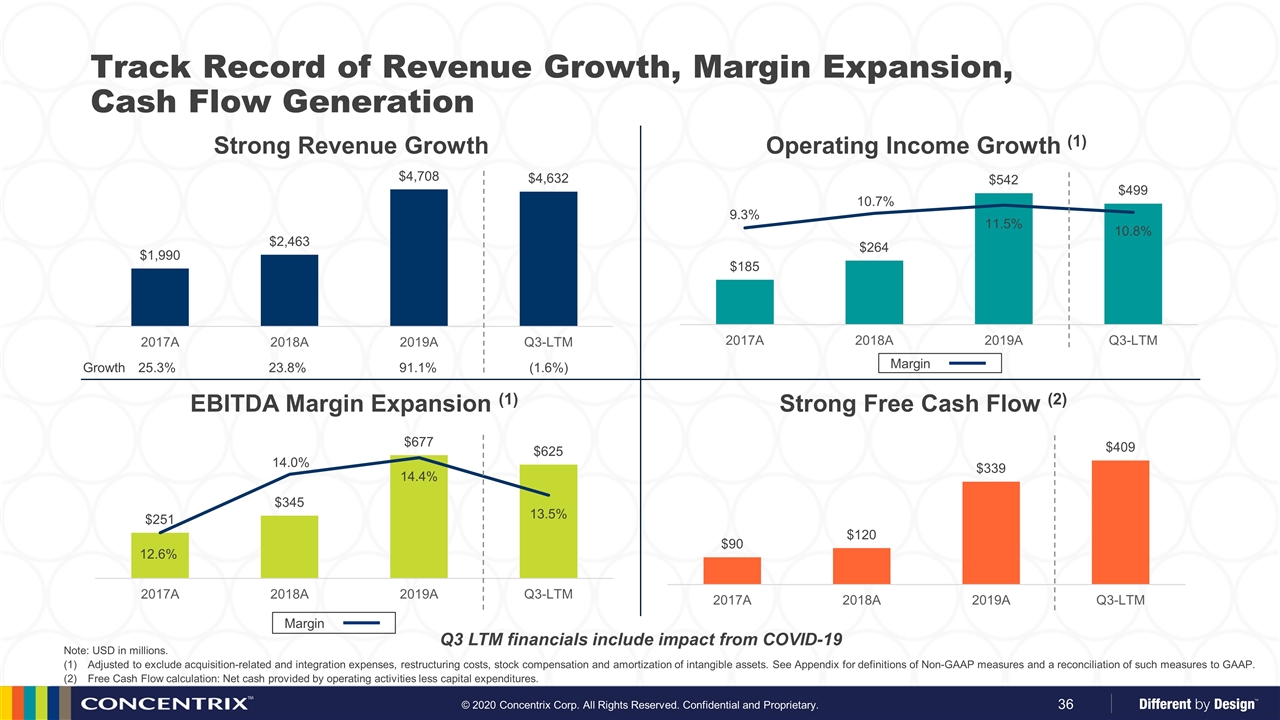

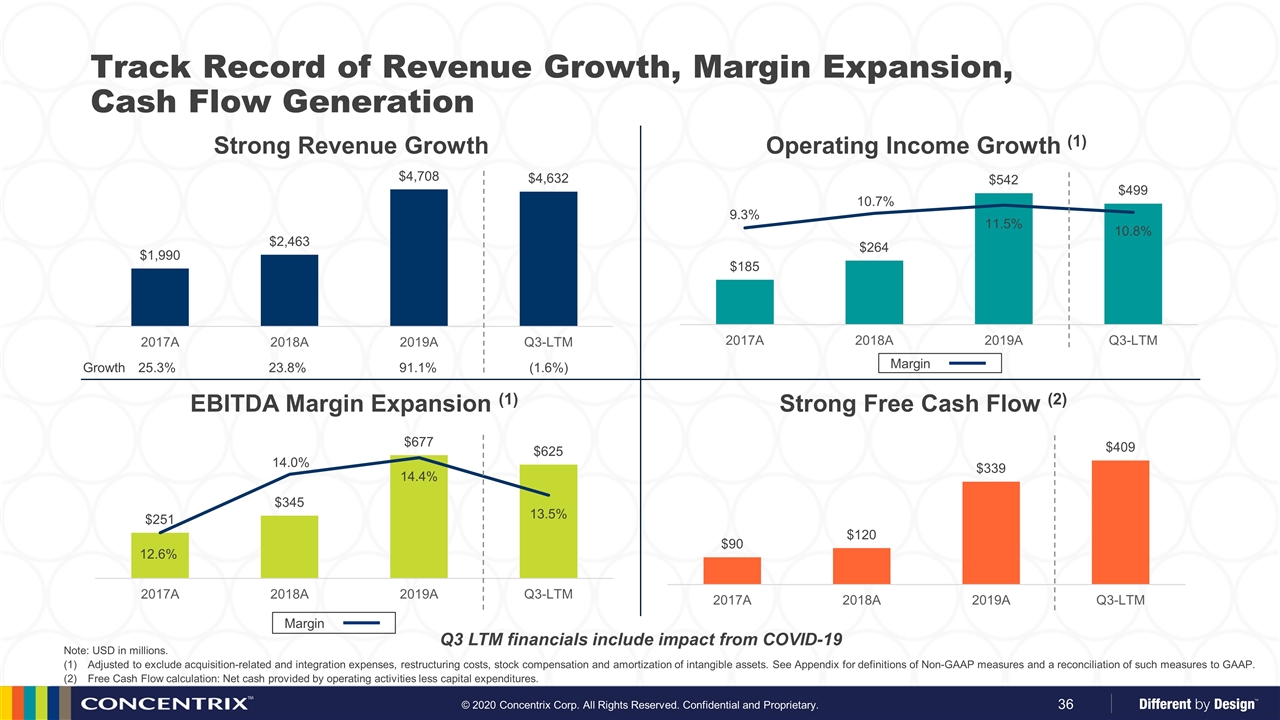

Track Record of Revenue Growth, Margin Expansion, Cash Flow Generation Strong Free Cash Flow (2) Strong Revenue Growth Operating Income Growth (1) EBITDA Margin Expansion (1) Growth 25.3% 23.8% 91.1% (1.6%) Margin Margin Note: USD in millions. Adjusted to exclude acquisition-related and integration expenses, restructuring costs, stock compensation and amortization of intangible assets. See Appendix for definitions of Non-GAAP measures and a reconciliation of such measures to GAAP. Free Cash Flow calculation: Net cash provided by operating activities less capital expenditures. Q3 LTM financials include impact from COVID-19

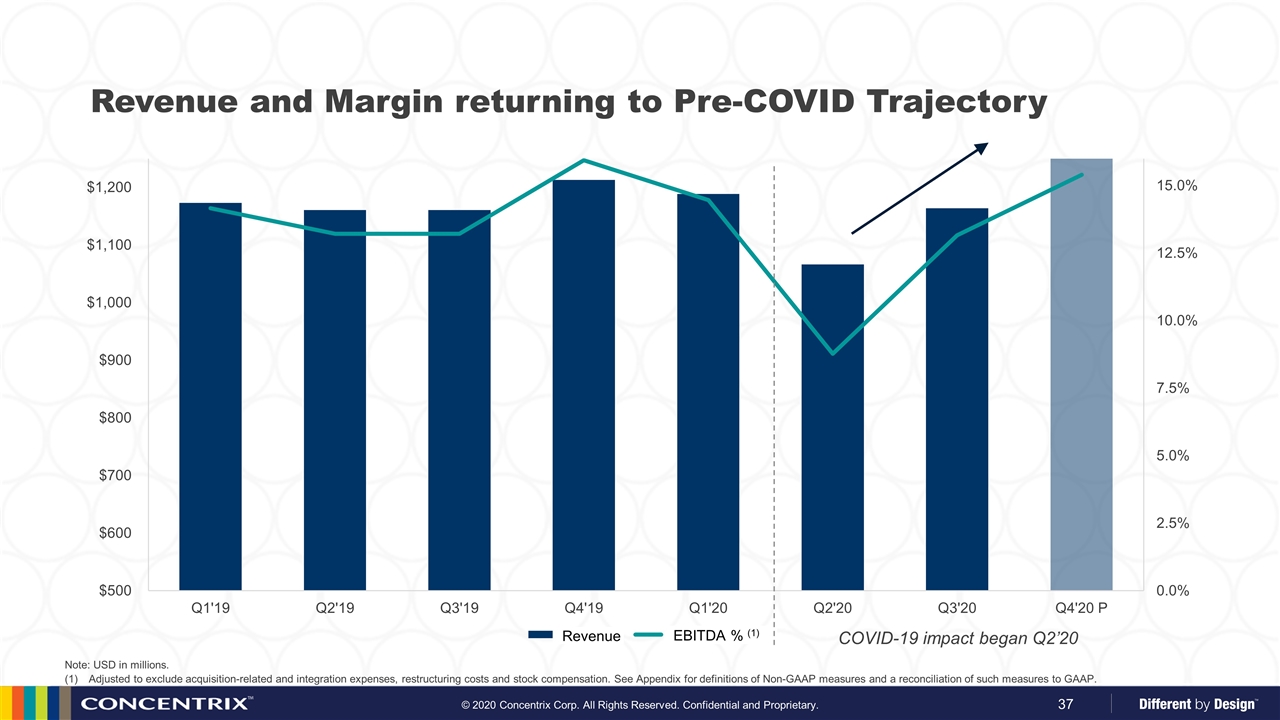

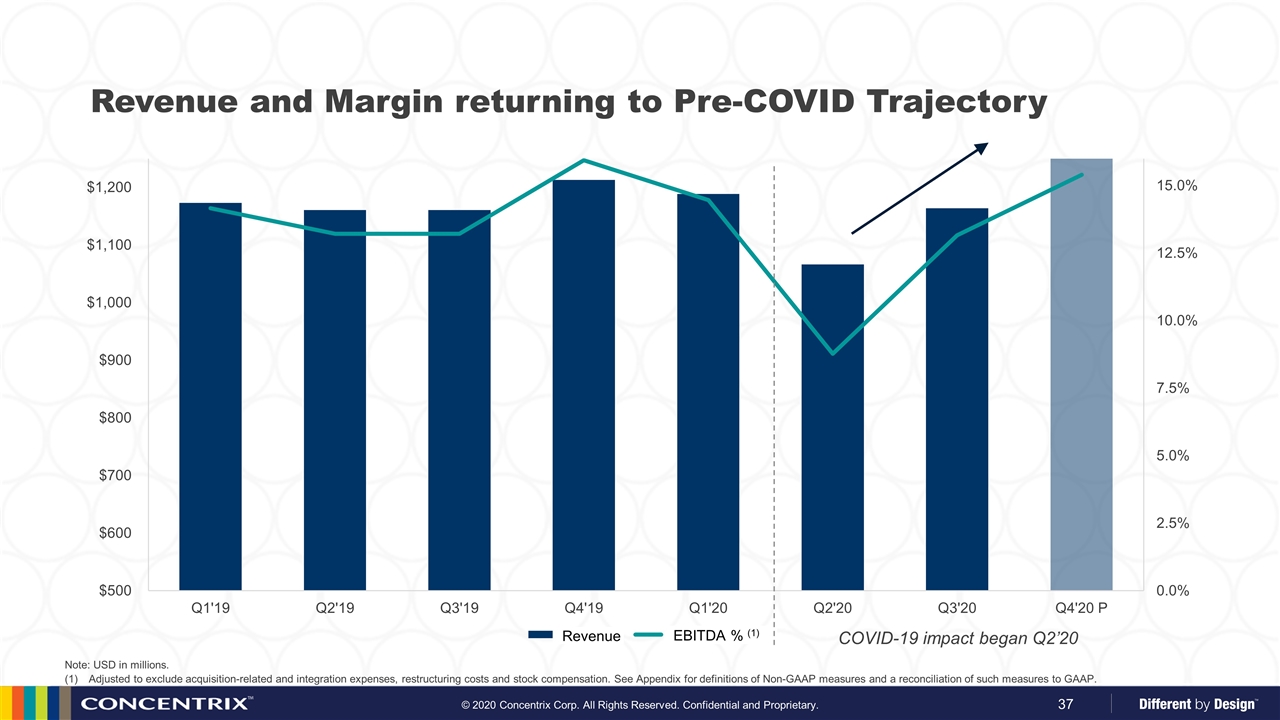

Revenue and Margin returning to Pre-COVID Trajectory Note: USD in millions. Adjusted to exclude acquisition-related and integration expenses, restructuring costs and stock compensation. See Appendix for definitions of Non-GAAP measures and a reconciliation of such measures to GAAP. COVID-19 impact began Q2’20

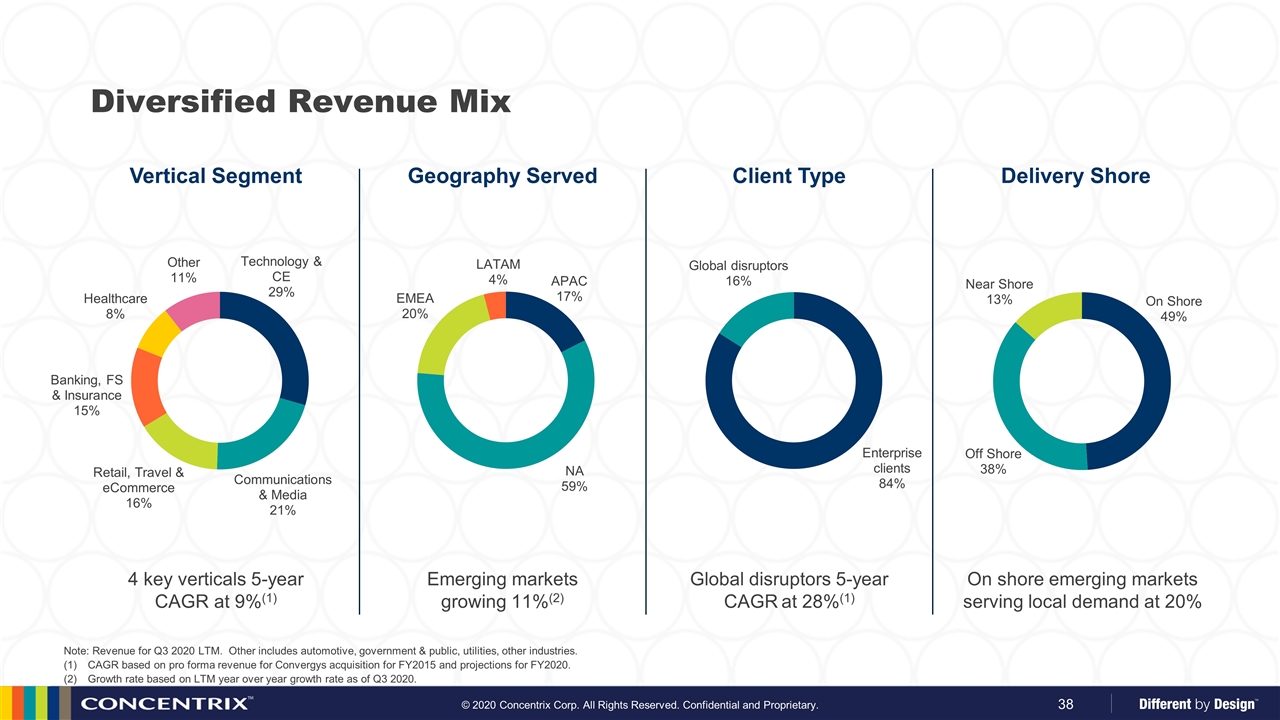

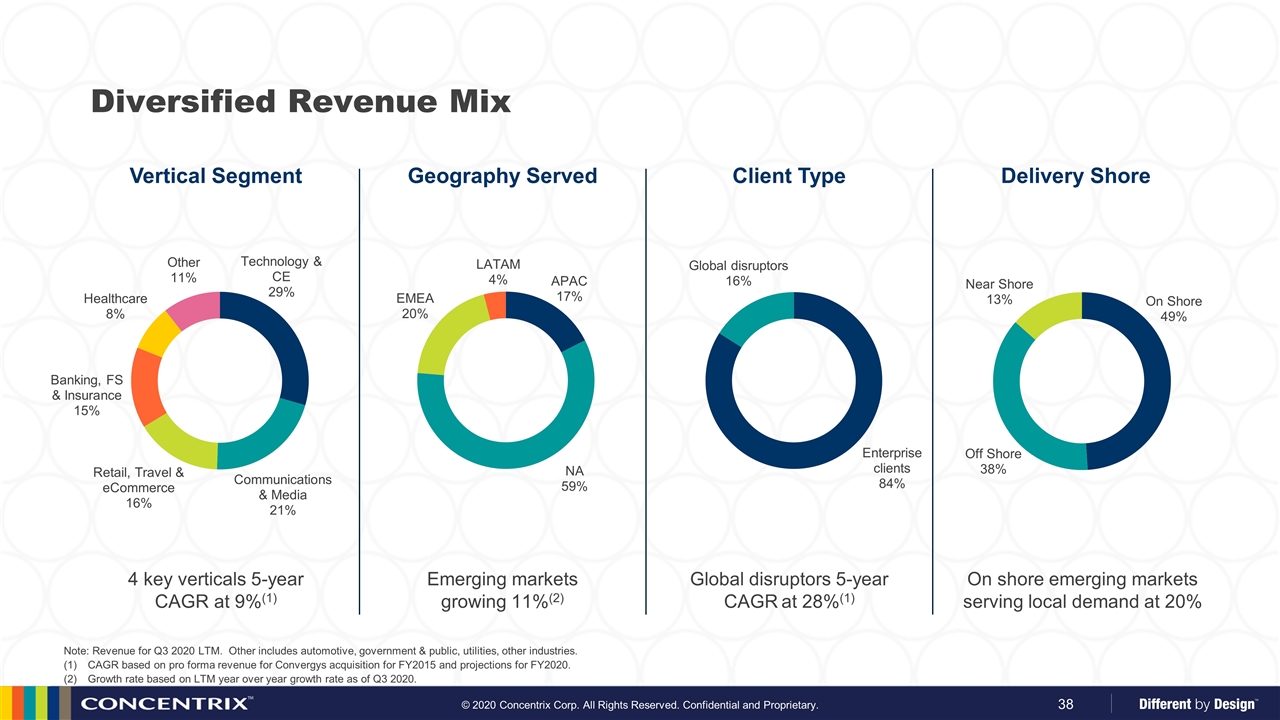

Diversified Revenue Mix Geography Served Global disruptors 5-year CAGR at 28%(1) Client Type Delivery Shore Vertical Segment 4 key verticals 5-year CAGR at 9%(1) Note: Revenue for Q3 2020 LTM. Other includes automotive, government & public, utilities, other industries. CAGR based on pro forma revenue for Convergys acquisition for FY2015 and projections for FY2020. Growth rate based on LTM year over year growth rate as of Q3 2020. Emerging markets growing 11%(2) On shore emerging markets serving local demand at 20%

Successful Strategic Acquisitions Power of combined client sets diversified revenue stream Turned around revenue decline Successful integration in less than 12 months Overachieved cost synergies by >30% Generated $650M+ free cash flow over 24 months Transformational acquisition Established Concentrix as top 10 player Increased size of Concentrix by 6x Significantly enhanced global footprint Added strong client base, vertical expertise Carveout transaction successfully completed in 12 months Acquisition Scorecard Acquisition Scorecard CRM BPO

Agenda Platform for performance Growth strategy Historical results Path to above market growth Allocation of capital Concentrix Overview & Strategy Financial Highlights

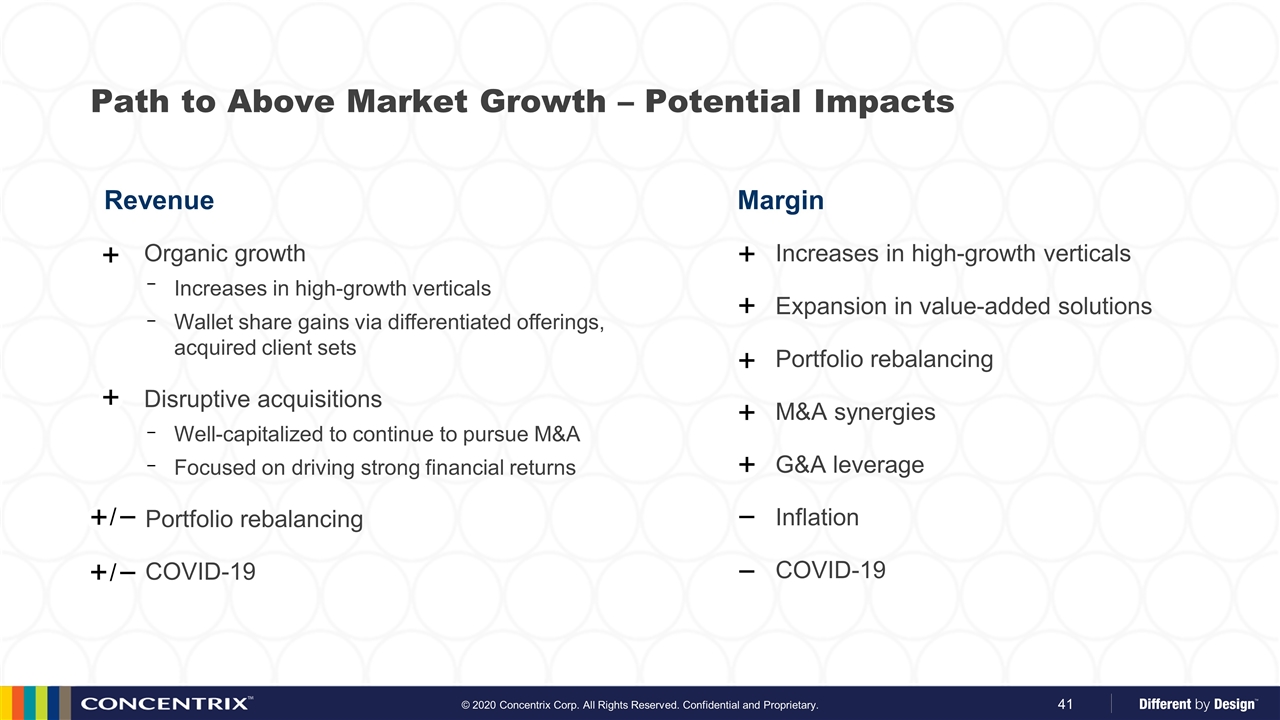

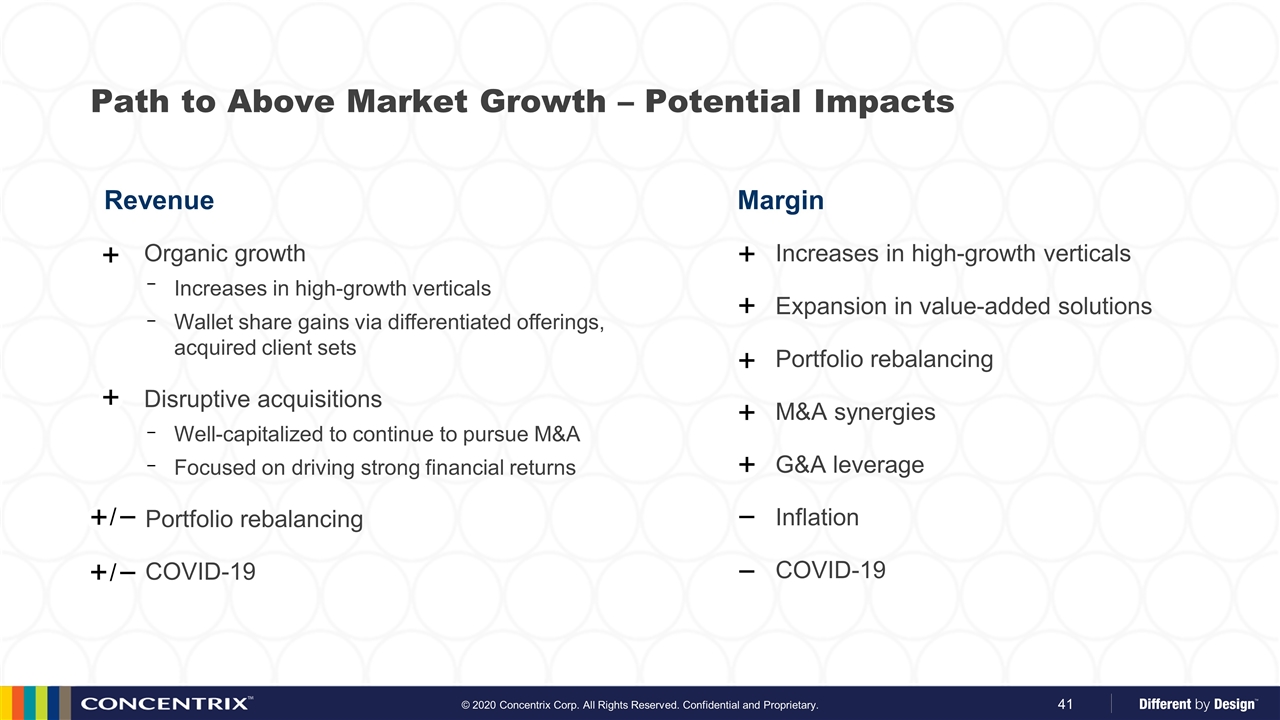

Path to Above Market Growth – Potential Impacts Revenue Margin Organic growth Increases in high-growth verticals Wallet share gains via differentiated offerings, acquired client sets Disruptive acquisitions Well-capitalized to continue to pursue M&A Focused on driving strong financial returns Portfolio rebalancing COVID-19 Increases in high-growth verticals Expansion in value-added solutions Portfolio rebalancing M&A synergies G&A leverage Inflation COVID-19 + ̶ ̶ + + + + + + + ̶ / + ̶ /

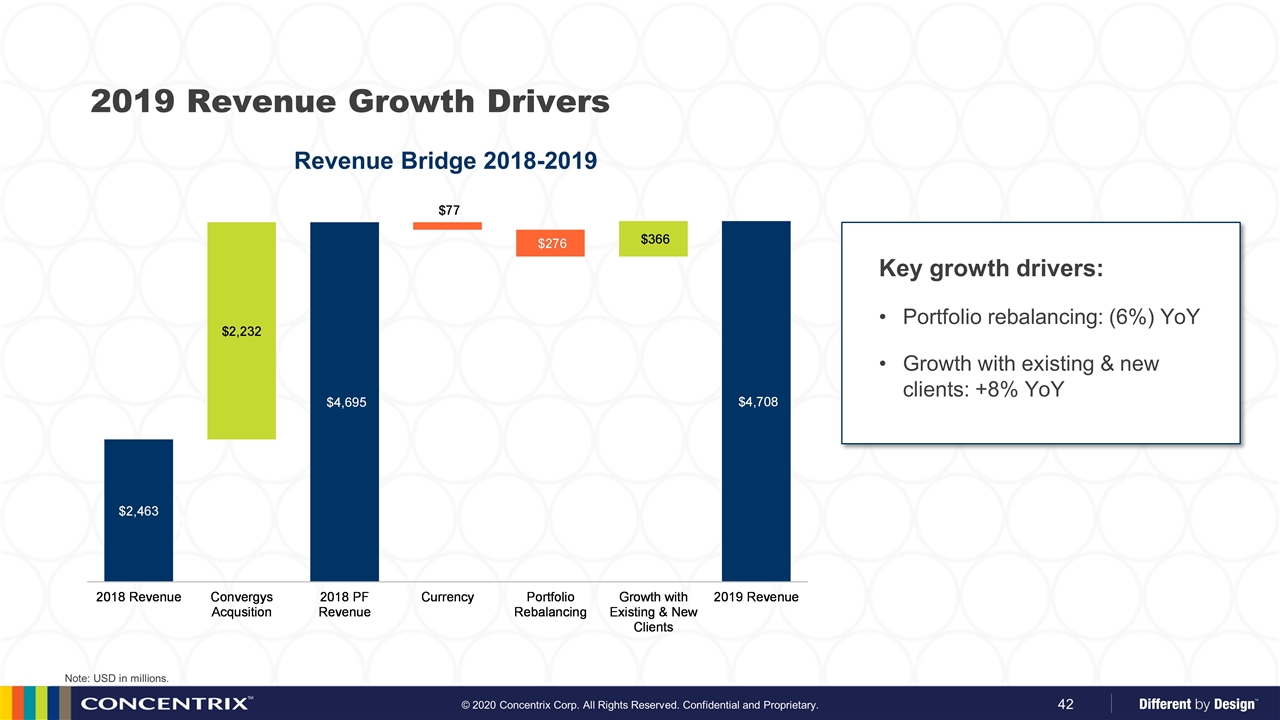

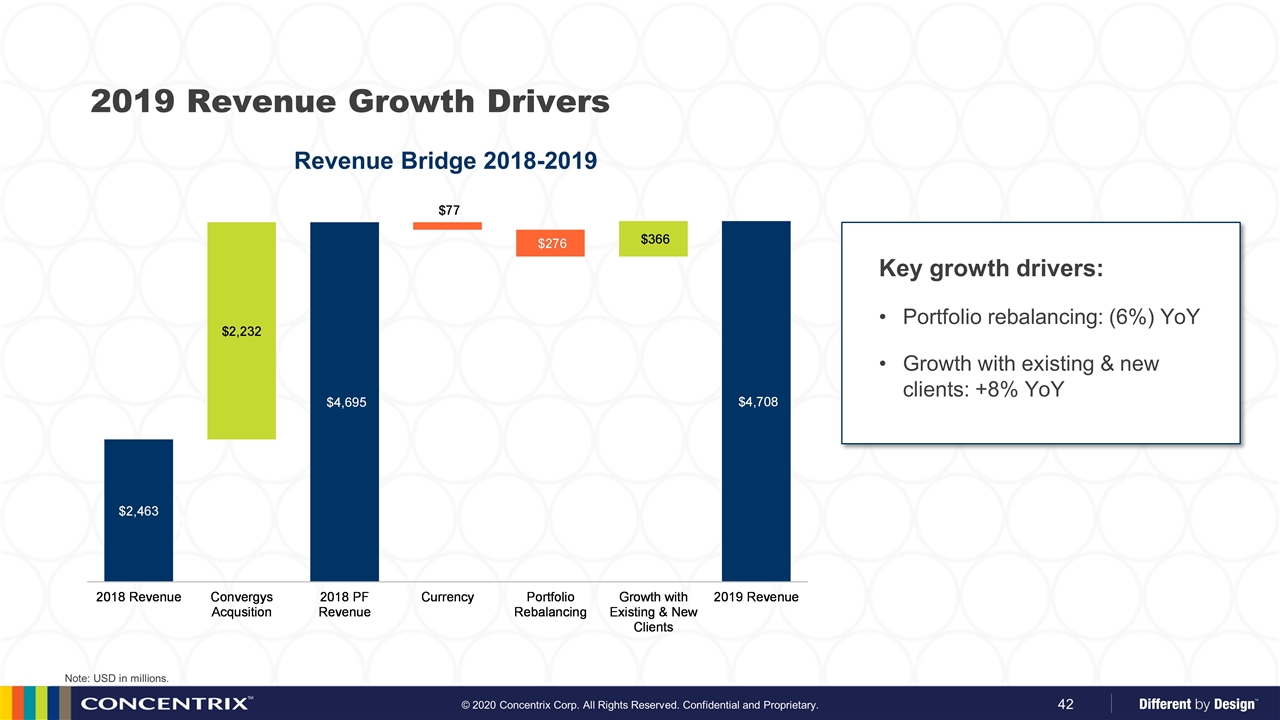

2019 Revenue Growth Drivers Key growth drivers: Portfolio rebalancing: (6%) YoY Growth with existing & new clients: +8% YoY Revenue Bridge 2018-2019 Note: USD in millions.

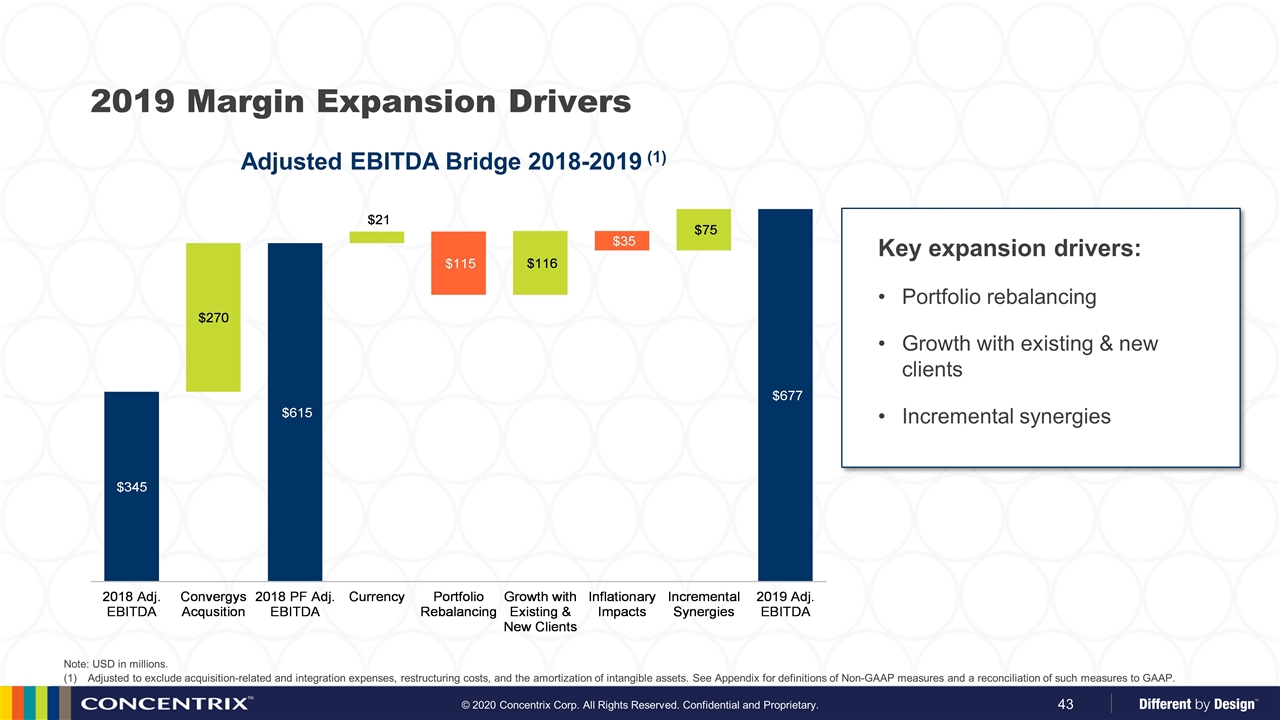

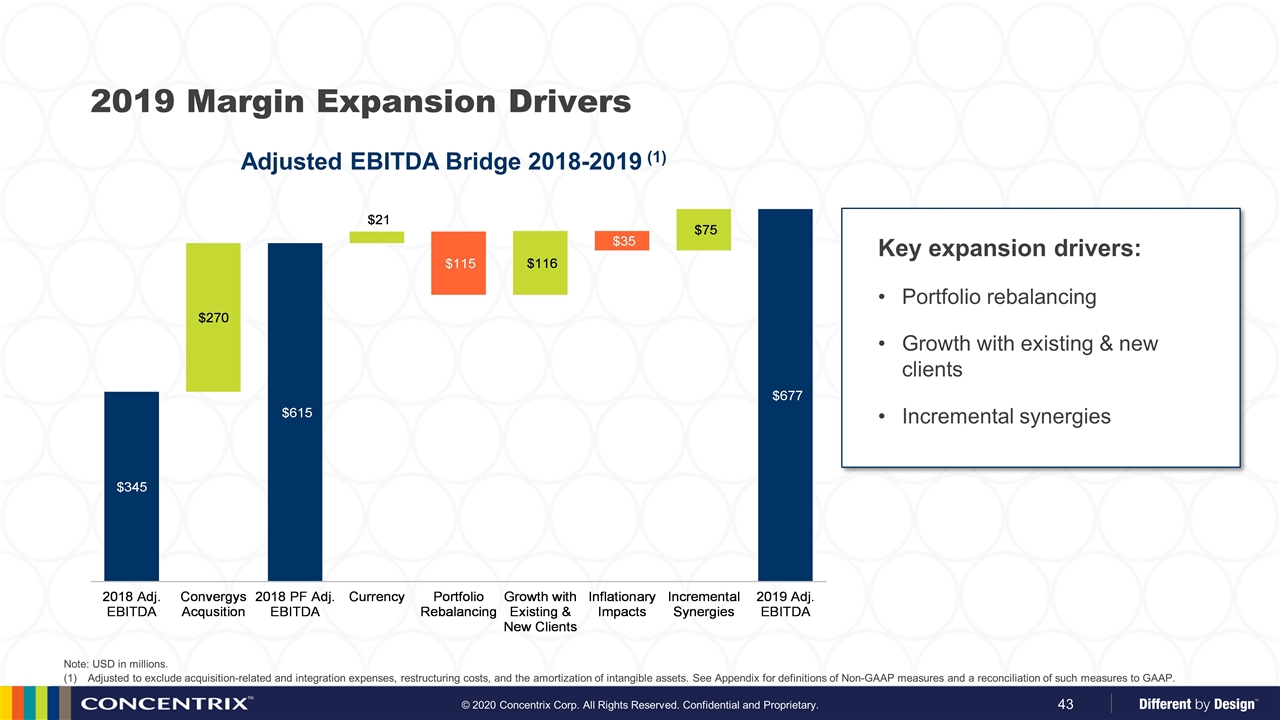

2019 Margin Expansion Drivers Key expansion drivers: Portfolio rebalancing Growth with existing & new clients Incremental synergies Adjusted EBITDA Bridge 2018-2019 (1) Note: USD in millions. Adjusted to exclude acquisition-related and integration expenses, restructuring costs, and the amortization of intangible assets. See Appendix for definitions of Non-GAAP measures and a reconciliation of such measures to GAAP.

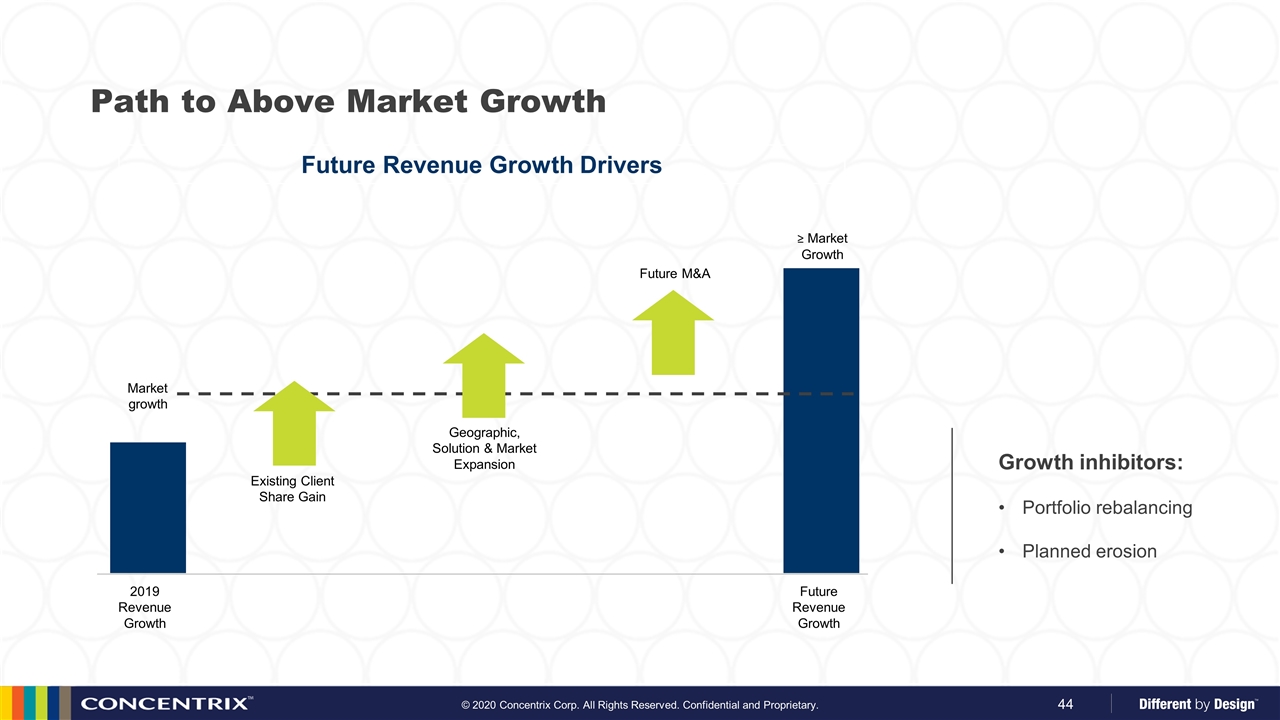

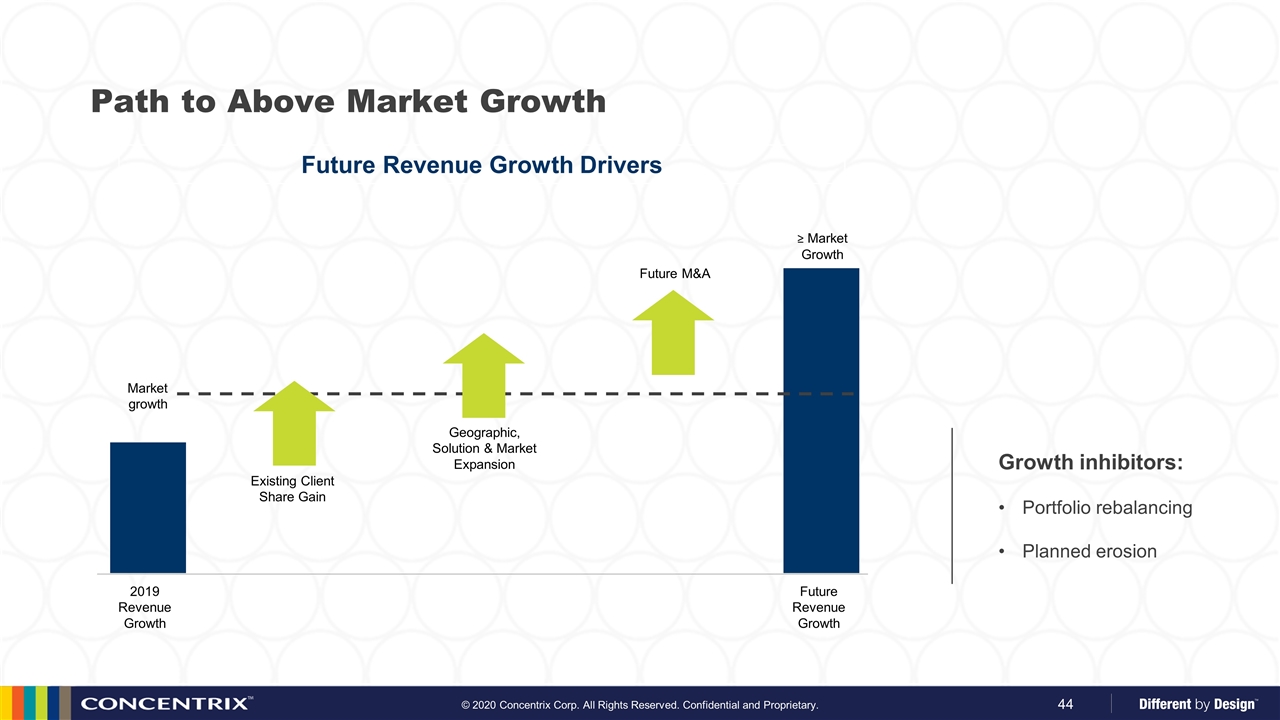

Path to Above Market Growth Growth inhibitors: Portfolio rebalancing Planned erosion Future Revenue Growth Drivers Market growth Future Revenue Growth Existing Client Share Gain Geographic, Solution & Market Expansion Future M&A 2019 Revenue Growth ≥ Market Growth

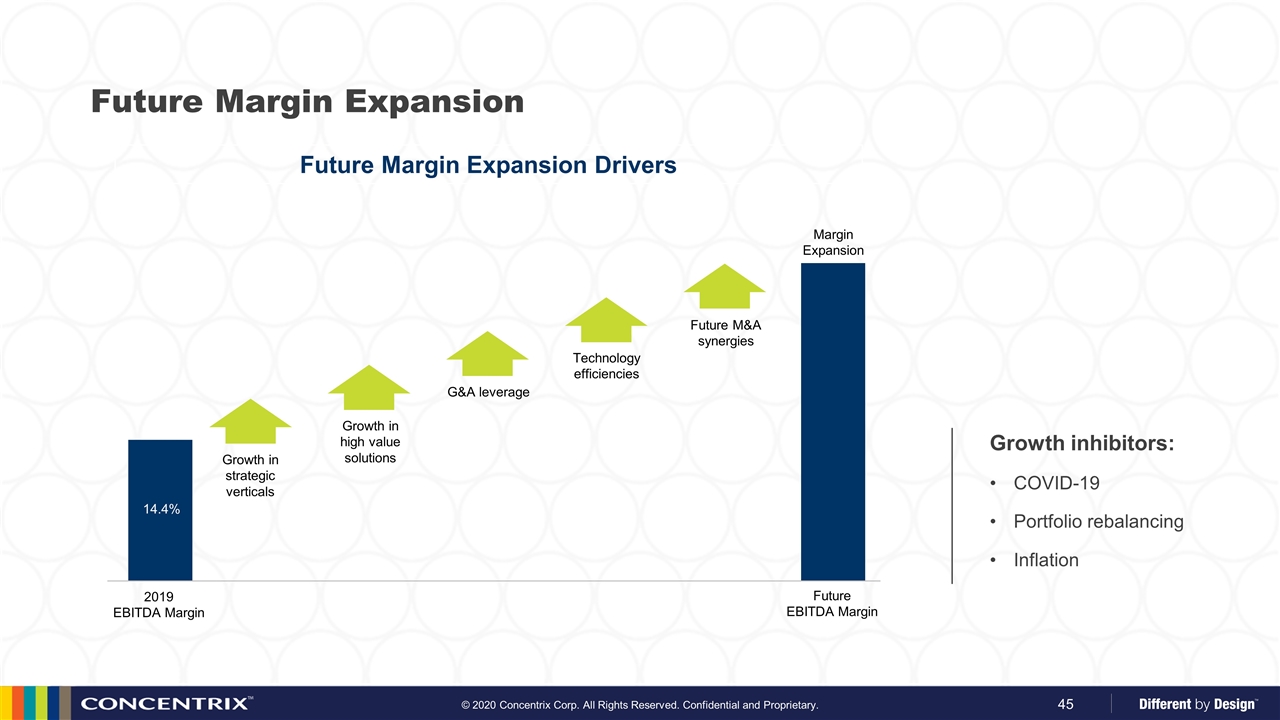

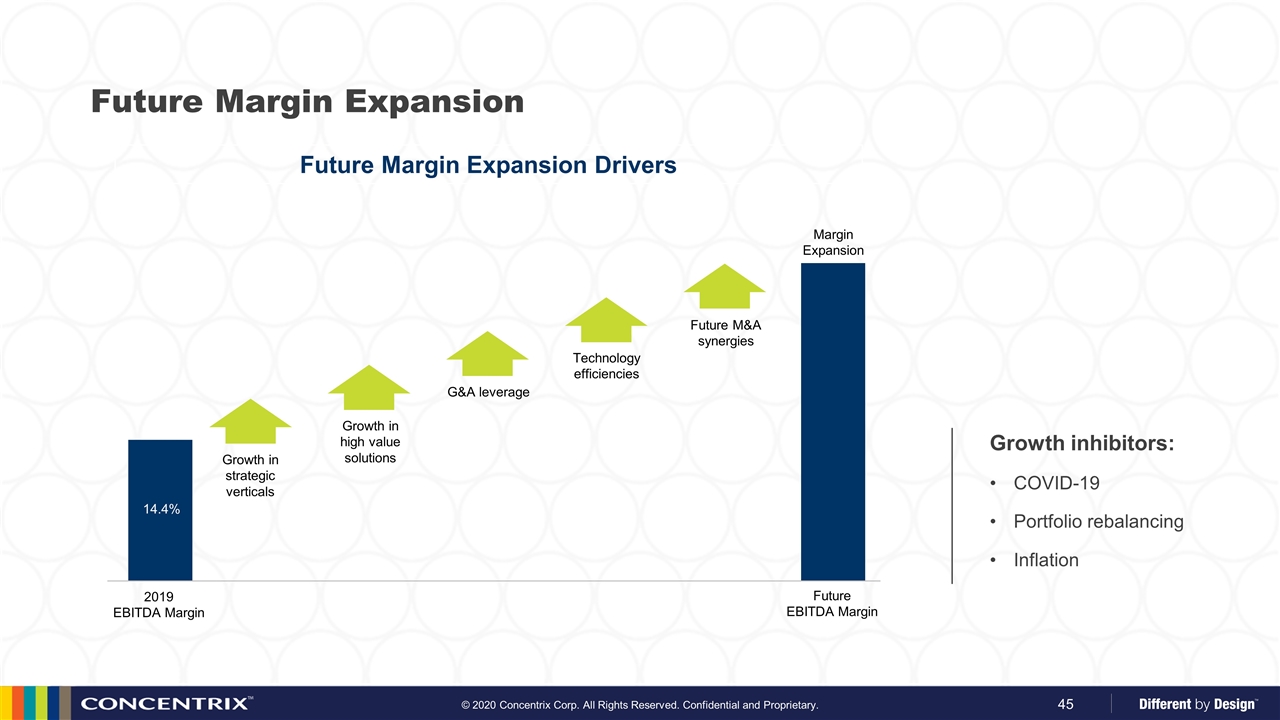

Future Margin Expansion Growth inhibitors: COVID-19 Portfolio rebalancing Inflation Future Margin Expansion Drivers Growth in strategic verticals Growth in high value solutions G&A leverage Technology efficiencies Future M&A synergies Margin Expansion 14.4% Future EBITDA Margin 2019 EBITDA Margin

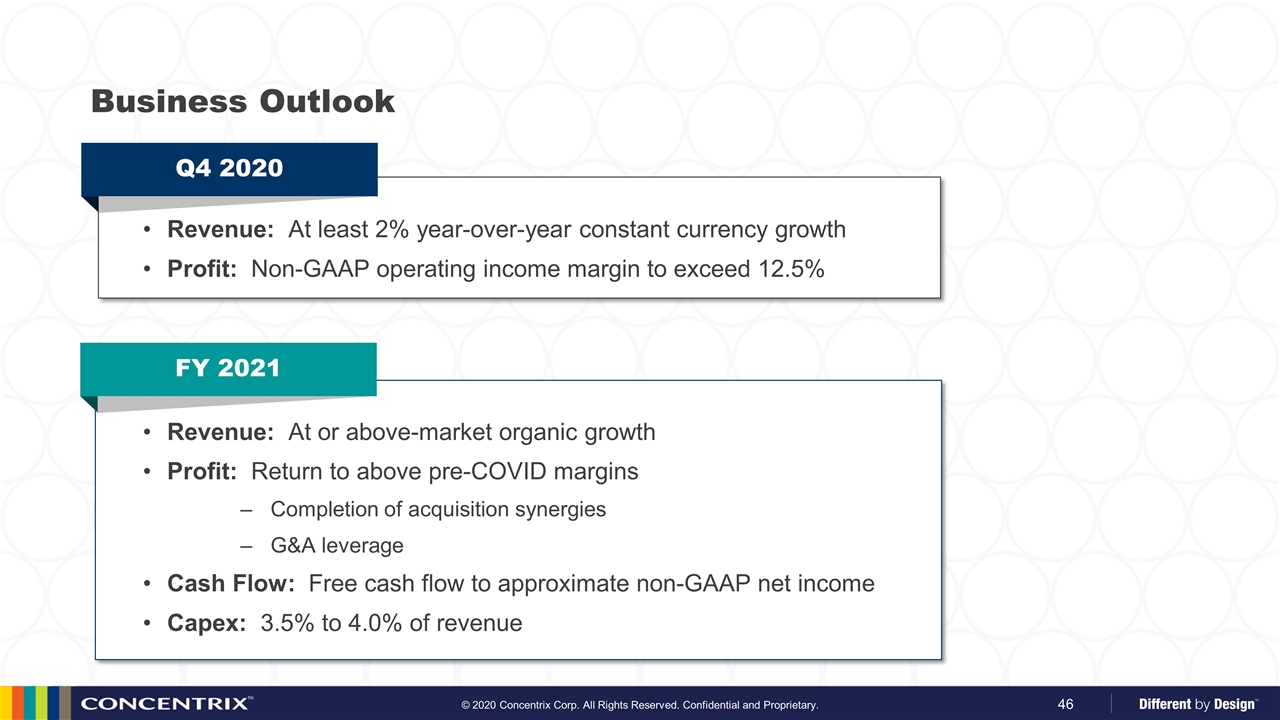

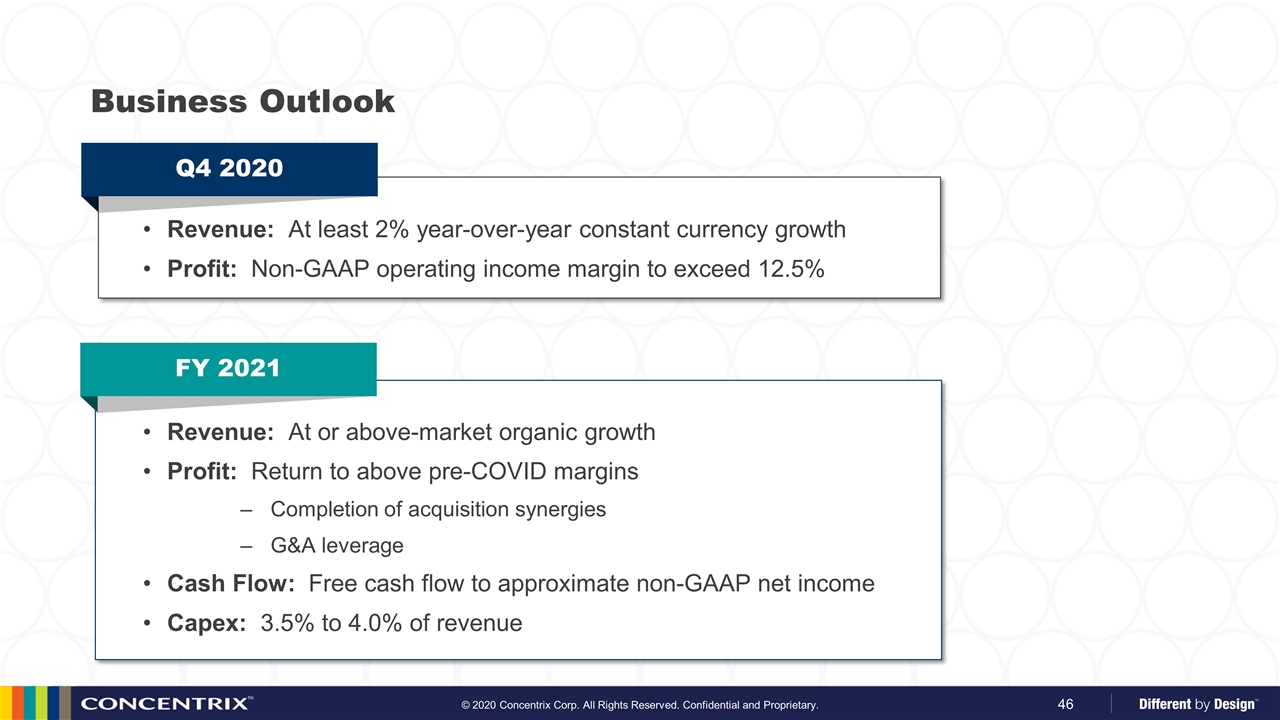

Business Outlook Revenue: At least 2% year-over-year constant currency growth Profit: Non-GAAP operating income margin to exceed 12.5% Revenue: At or above-market organic growth Profit: Return to above pre-COVID margins Completion of acquisition synergies G&A leverage Cash Flow: Free cash flow to approximate non-GAAP net income Capex: 3.5% to 4.0% of revenue FY 2021 Q4 2020

Agenda Platform for performance Growth strategy Historical results Path to above market growth Allocation of capital Concentrix Overview & Strategy Financial Highlights

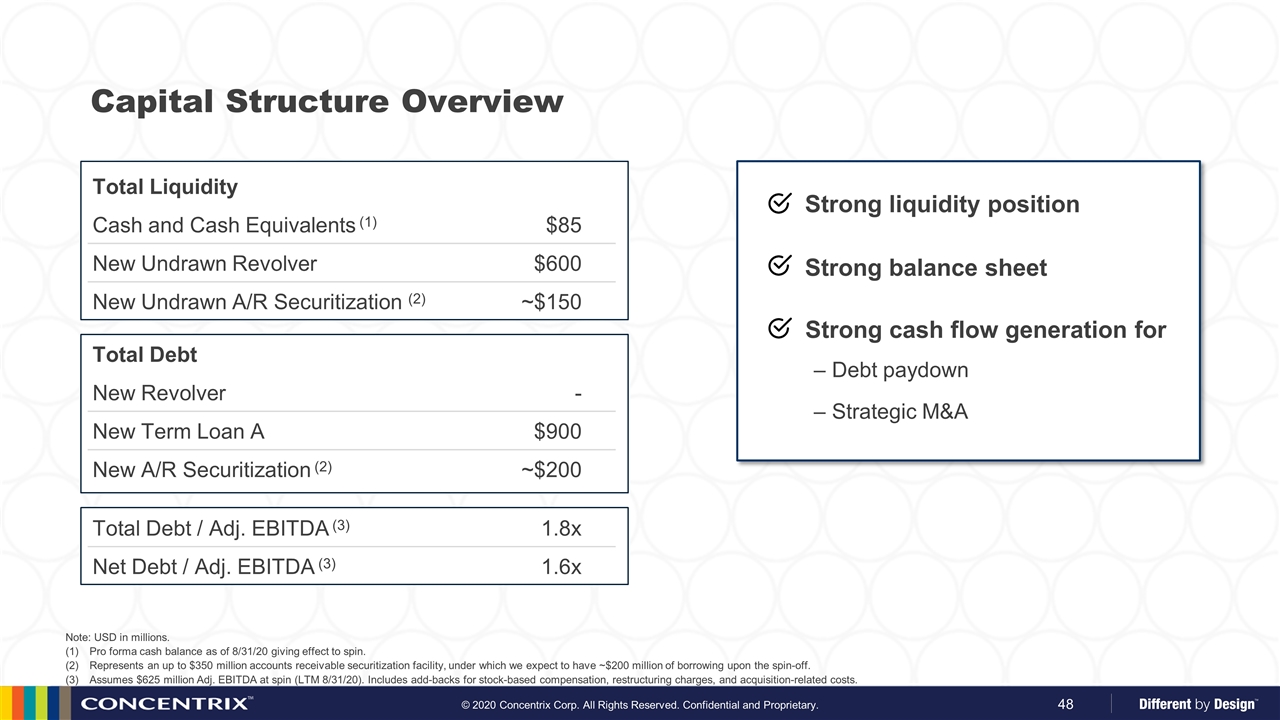

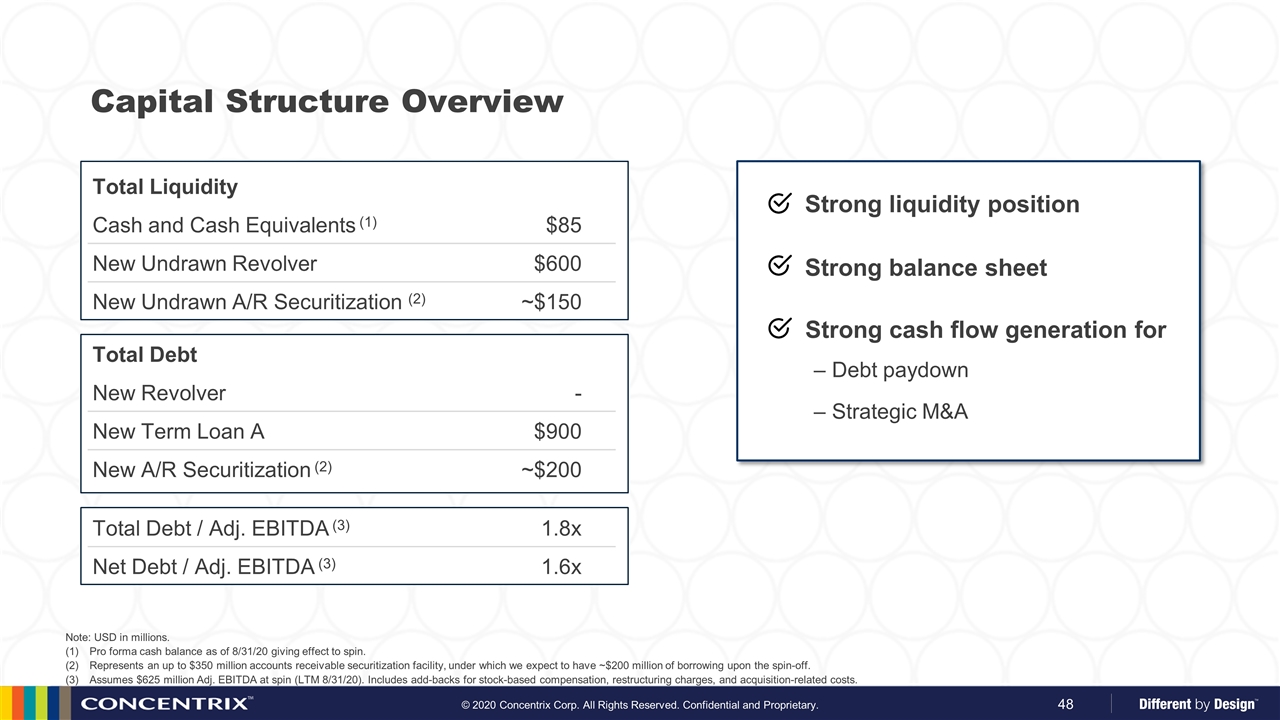

Total Liquidity Cash and Cash Equivalents (1) $85 New Undrawn Revolver $600 New Undrawn A/R Securitization (2) ~$150 Total Debt New Revolver - New Term Loan A $900 New A/R Securitization (2) ~$200 Total Debt / Adj. EBITDA (3) 1.8x Net Debt / Adj. EBITDA (3) 1.6x Capital Structure Overview Strong liquidity position Strong balance sheet Strong cash flow generation for Note: USD in millions. Pro forma cash balance as of 8/31/20 giving effect to spin. Represents an up to $350 million accounts receivable securitization facility, under which we expect to have ~$200 million of borrowing upon the spin-off. Assumes $625 million Adj. EBITDA at spin (LTM 8/31/20). Includes add-backs for stock-based compensation, restructuring charges, and acquisition-related costs. Debt paydown Strategic M&A

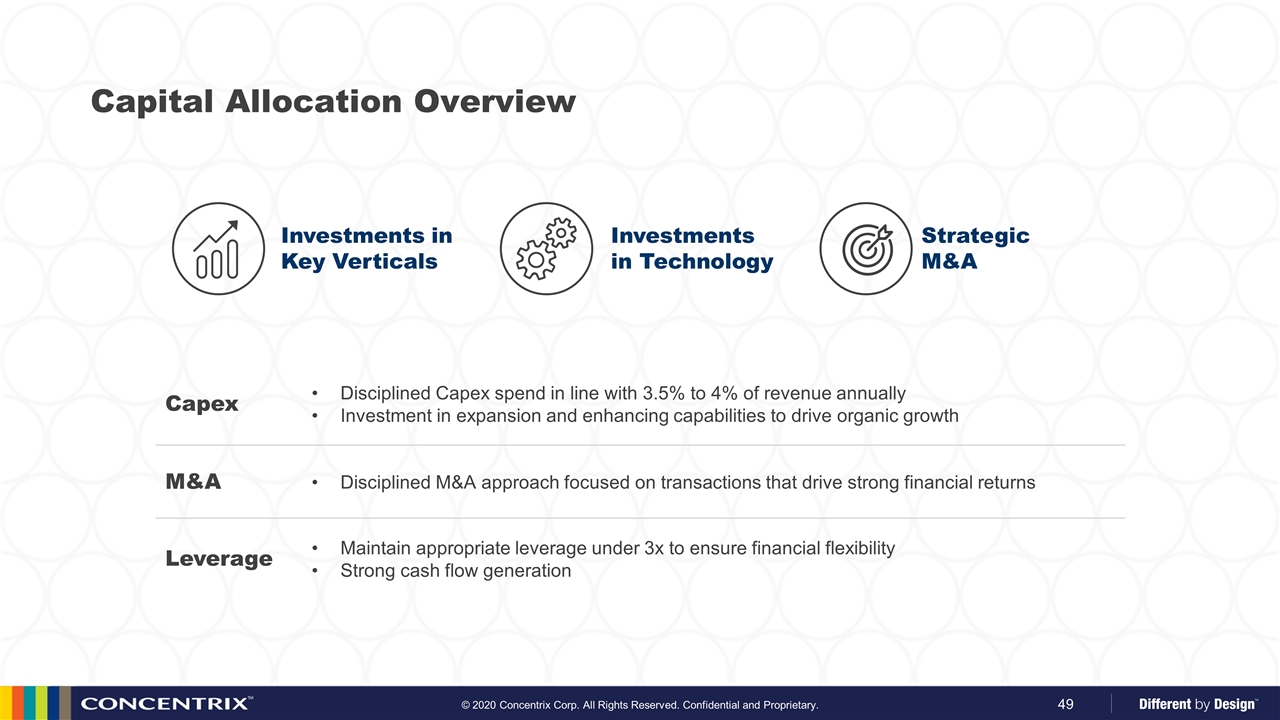

Capital Allocation Overview Investments in Technology Investments in Key Verticals Strategic M&A Capex Disciplined Capex spend in line with 3.5% to 4% of revenue annually Investment in expansion and enhancing capabilities to drive organic growth M&A Disciplined M&A approach focused on transactions that drive strong financial returns Leverage Maintain appropriate leverage under 3x to ensure financial flexibility Strong cash flow generation

Well positioned global leader in large, growing market Disciplined investments, superior execution driving share gains Generating strong free cash flow Substantial financial flexibility for organic, inorganic growth Poised for multiple expansion, enhanced shareholder returns IN SUMMARY Attractive Financial Profile

Why Invest in Concentrix Concentrix is a Global CX Solutions Leader, Ideally Positioned for Growth Strong Execution Market Leader Future Growth Only company in our industry to achieve our scale in 16 years Proven ability to drive strong financial returns Rebalancing portfolio toward strategic verticals, geographies Top 2 industry leader, tech-infused solutions, global scale advantage $85B+ core market servicing iconic brands, global disruptors Proven consolidator in fragmented industry Executing plan for above market growth, enhanced value creation Continue to invest in digital innovation and bold M&A Leverage strong balance sheet, disciplined capital deployment

Appendix

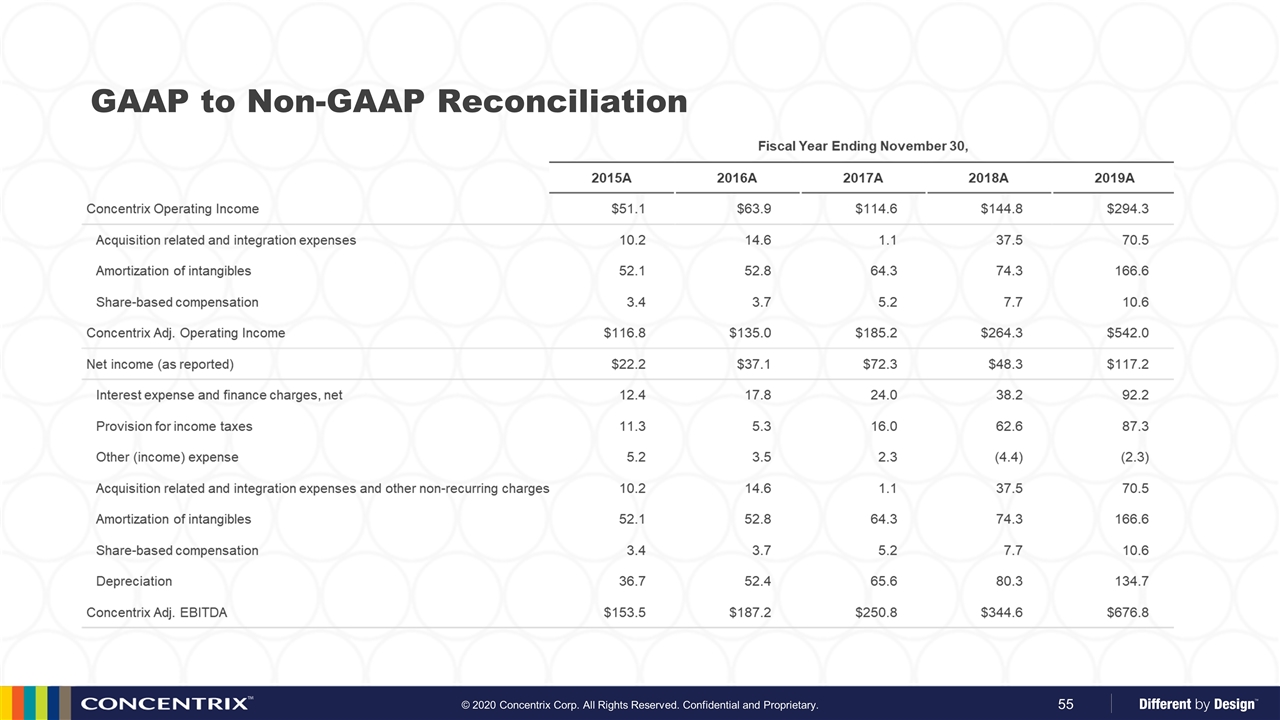

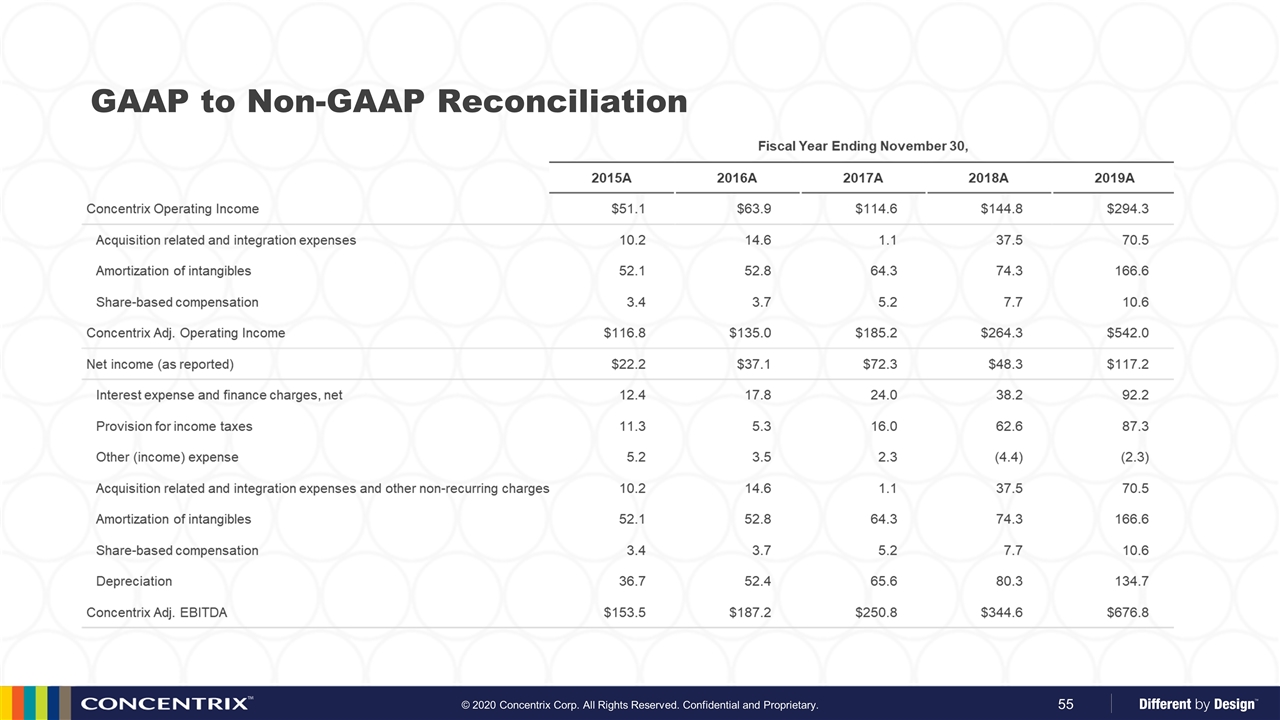

Non-GAAP Financial Measures In addition to disclosing financial results that are determined in accordance with GAAP, we also disclose certain non-GAAP financial information, including: Non-GAAP operating income, which is operating income, adjusted to exclude acquisition-related and integration expenses, including related restructuring costs, amortization of intangible assets and share-based compensation. Non-GAAP operating margin, which is non-GAAP operating income, as defined above, divided by revenue. Adjusted earnings before interest, taxes, depreciation, and amortization, or adjusted EBITDA, which is non-GAAP operating income, as defined above, plus depreciation. Adjusted EBITDA margin, which is adjusted EBITDA, as defined above, divided by revenue. Free cash flow, which is cash flows from operating activities less capital expenditures. We believe that free cash flow is a meaningful measure of cash flows since capital expenditures are a necessary component of ongoing operations. However, free cash flow has limitations because it does not represent the residual cash flow available for discretionary expenditures. For example, free cash flow does not incorporate payments for business acquisitions. We believe that providing this additional information is useful to the reader to better assess and understand our base operating performance, especially when comparing results with previous periods and for planning and forecasting in future periods, primarily because management typically monitors the business adjusted for these items in addition to GAAP results. Management also uses these non-GAAP measures to establish operational goals and, in some cases, for measuring performance for compensation purposes. These non-GAAP financial measures exclude amortization of intangible assets. Although intangible assets contribute to our revenue generation, the amortization of intangible assets does not directly relate to the services performed for our clients. Additionally, intangible asset amortization expense typically fluctuates based on the size and timing of our acquisition activity. Accordingly, we believe excluding the amortization of intangible assets, along with the other non-GAAP adjustments which neither relate to the ordinary course of our business nor reflect our underlying business performance, enhances our and our investors’ ability to compare our past financial performance with its current performance and to analyze underlying business performance and trends. These non-GAAP financial measure also exclude share-based compensation expense. Given the subjective assumptions and the variety of award types that companies can use when calculating share-based compensation expense, management believes this additional information allows investors to make additional comparisons between our operating results and those of our peers. As these non-GAAP financial measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures employed by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures and should be used as a complement to, and in conjunction with, data presented in accordance with GAAP.

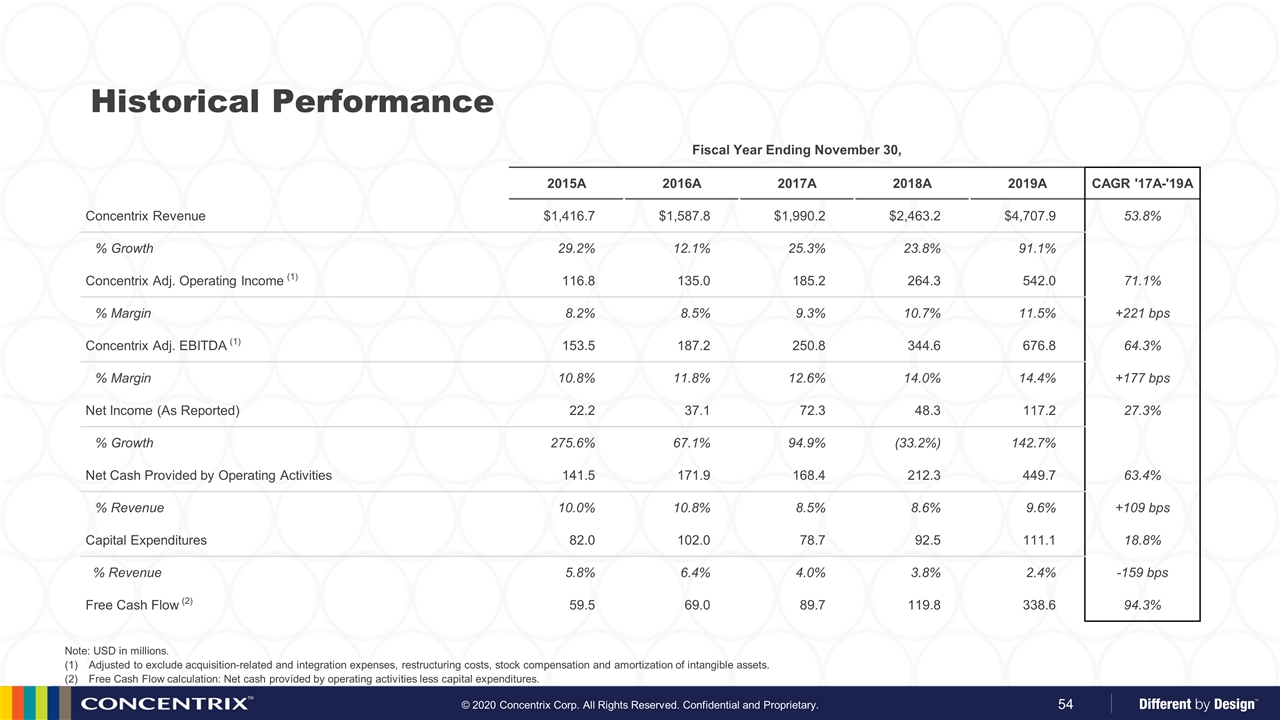

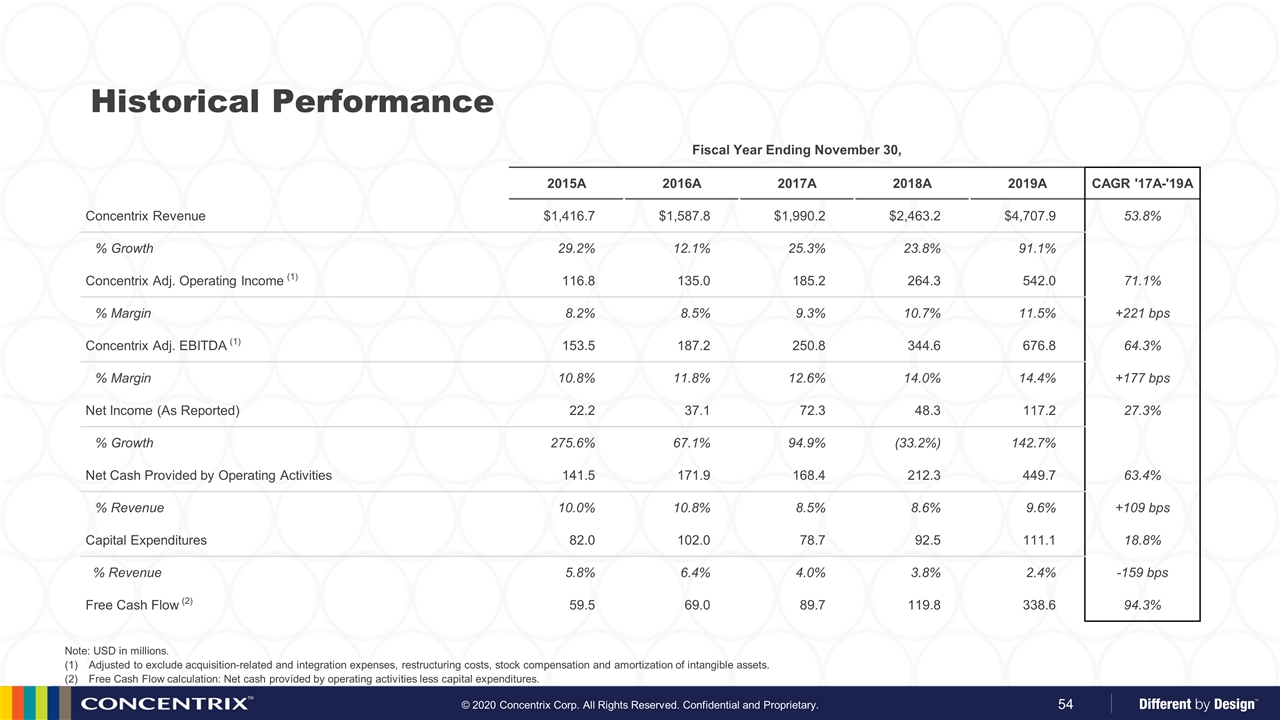

Historical Performance Note: USD in millions. Adjusted to exclude acquisition-related and integration expenses, restructuring costs, stock compensation and amortization of intangible assets. Free Cash Flow calculation: Net cash provided by operating activities less capital expenditures. Fiscal Year Ending November 30, 2015A 2016A 2017A 2018A 2019A CAGR '17A-'19A Concentrix Revenue $1,416.7 $1,587.8 $1,990.2 $2,463.2 $4,707.9 53.8% % Growth 29.2% 12.1% 25.3% 23.8% 91.1% Concentrix Adj. Operating Income (1) 116.8 135.0 185.2 264.3 542.0 71.1% % Margin 8.2% 8.5% 9.3% 10.7% 11.5% +221 bps Concentrix Adj. EBITDA (1) 153.5 187.2 250.8 344.6 676.8 64.3% % Margin 10.8% 11.8% 12.6% 14.0% 14.4% +177 bps Net Income (As Reported) 22.2 37.1 72.3 48.3 117.2 27.3% % Growth 275.6% 67.1% 94.9% (33.2%) 142.7% Net Cash Provided by Operating Activities 141.5 171.9 168.4 212.3 449.7 63.4% % Revenue 10.0% 10.8% 8.5% 8.6% 9.6% +109 bps Capital Expenditures 82.0 102.0 78.7 92.5 111.1 18.8% % Revenue 5.8% 6.4% 4.0% 3.8% 2.4% -159 bps Free Cash Flow (2) 59.5 69.0 89.7 119.8 338.6 94.3%

GAAP to Non-GAAP Reconciliation