Notice of 2011 Annual Shareholder Meeting

and

Management Proxy Circular

Suite 1600

555 - 4th Avenue S.W.

Calgary, Alberta T2P 3E7

Telephone: (403) 249-9425

Notice of Annual Meeting of Shareholders

The annual meeting of the shareholders of OPTI Canada Inc. (the “Corporation”) will be held at The Metropolitan Centre, 333 Fourth Avenue S.W., Calgary, Alberta at 9:00 a.m. (Calgary time) on Wednesday, April 27, 2011.

The meeting will have the following purposes:

| · | to receive the financial statements of the Corporation for the financial year ended December 31, 2010, together with the report of the auditors; |

| · | to elect directors of the Corporation; |

| · | to appoint the auditors of the Corporation; and |

| · | to transact such other business as may properly come before the meeting or any continuation of the meeting after an adjournment. |

Shareholders who are unable to attend the meeting in person and who wish to ensure that their shares will be voted are requested to submit a proxy in accordance with the instructions set out in the form of proxy and in the Proxy Circular accompanying this notice. Also, the Proxy Circular contains detailed information relating to the matters to be addressed at the meeting.

DATED at Calgary, Alberta, this 15th day of March, 2011.

By Order of the Board of Directors

(signed) “Christopher P. Slubicki”

Christopher P. Slubicki

President and Chief Executive Officer

Management Proxy Circular

This Proxy Circular dated March 15, 2011, is furnished in connection with the solicitation on behalf of management of OPTI Canada Inc. (the "Corporation" or "OPTI") of proxies to be used at the Annual Meeting of holders of common shares of the Corporation on April 27, 2011 at 9:00 a.m. (Calgary time) at the place and for the purposes set out in the Notice of meeting accompanying this Proxy Circular. Information contained in this Circular is given as of March 1, 2011, unless otherwise noted.

Your vote is important to us. If you are a registered shareholder and unable to attend in person, you are requested to date, complete and sign the accompanying instrument of proxy and return it to Valiant Trust Company, 600 – 750 Cambie Street, Vancouver, British Columbia V6B 0A2. If you are an unregistered shareholder and receive these materials through your broker or other nominee (usually a bank, trust company or other financial institution), please complete and return the voting instruction in accordance with the instructions from your nominee.

Anyone who intends to exercise their voting rights at the meeting either in person or indirectly by way of proxy is encouraged to read the following for answers to commonly asked questions regarding voting and proxies.

1. Am I entitled to vote?

A. You are entitled to vote if you were a holder of common shares of OPTI as of the close of business on March 9, 2011, the record date for the meeting. Each common share entitles the holder thereof to one vote at the meeting.

The list of registered shareholders maintained by the Corporation will be available for inspection by registered shareholders after March 9, 2011, during usual business hours at the offices of Valiant Trust Company, 310, 606 - 4th Street S.W., Calgary, Alberta, T2P 1T1, and will be available at the meeting.

2. How can a registered shareholder vote?

If you are entitled to vote and your shares are registered in your name, you can vote your shares in person at the meeting, or by signing and returning your form of proxy in the envelope provided, or by faxing your completed proxy to Valiant Trust Company at (604) 681-3067 or by voting using the Internet voting link at www.valianttrust.com. In order to vote on the internet you will need your Control Number (you will find it on the form of proxy provided in your Proxy Circular package).

If your shares are not registered in your name but are held by a nominee, please see Questions 3 and 4 for voting instructions.

3. How can a non-registered shareholder vote by proxy?

A. If your shares are not registered in your name, but are held in the name of a nominee (usually a bank, trust company, securities broker or other financial institution), your nominee is required to seek your instructions as to how to vote your shares. Your nominee will have provided you with a package of information, including these meeting materials and either a proxy or a voting form. Carefully follow the instructions accompanying the proxy or voting form.

4. How can a non-registered shareholder vote in person?

A. OPTI has access to names of its registered shareholders only. If you are not a registered shareholder and attend the meeting, we will have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as a proxy holder. If you wish to vote in person at the meeting, insert your name in the space provided on the proxy or voting form sent to you by your nominee. By doing so you are instructing your nominee to appoint you as a proxy holder. Complete the form by following the return instructions provided by your nominee. Please report to a representative of Valiant Trust Company upon your arrival at the meeting.

5. What am I voting on?

A. You will be voting on:

| · | the election of directors to the board of directors of the Corporation until the close of the next annual meeting; and |

| · | the appointment of PricewaterhouseCoopers llp as auditors of the Corporation until the close of the next annual meeting. |

6. What if amendments are made to these matters or if other matters are brought before the meeting?

A. If you attend the meeting in person and are eligible to vote, you may vote on such matters as you choose. If you have completed and returned a proxy, the person named in the proxy form will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Annual Meetings of Shareholders and to other matters that may properly come before the meeting. As of the date of this Proxy Circular, our management knows of no such amendment, variation or other matter expected to come before the meeting. If any other matters properly come before the meeting, the persons named in the proxy form will vote on them in accordance with their best judgment.

7. Who is soliciting my proxy?

A. The management of OPTI is soliciting your proxy and is providing this Proxy Circular in connection with that solicitation. Solicitation of proxies is done primarily by mail, and may be supplemented by telephone or other contact, by our employees or agents at a nominal cost, and all of these costs are paid by the Corporation.

8. What if I sign the proxy form enclosed with this Proxy Circular?

A. Signing the enclosed proxy form gives authority to representatives of management of OPTI to vote your shares at the meeting.

9. Can I appoint someone other than management representatives to vote my shares?

A. Yes, you can appoint someone other than management representatives to vote your shares. Write the name of the person you wish to appoint, who need not be a shareholder, in the blank space provided in the proxy form or voting direction, as the case may be.

Please note that it is important to ensure that any other person you appoint is attending the meeting and is aware that his or her appointment has been made to vote your shares. Persons who are appointed as proxy holders should, upon arrival at the meeting, present themselves to a representative of Valiant Trust Company.

10. What do I do with my completed proxy form?

A. Return it to Valiant Trust Company, in the envelope provided, so that it arrives no later than 8:30 a.m. (Calgary time) on April 25, 2011, or at least 48 hours prior to any adjournment of the Meeting. All Common Shares represented by properly executed proxy forms received by Valiant Trust Company prior to such time will be voted for or against or withheld from voting, in accordance with your instructions as specified in the proxy form or voting direction, as the case may be, on any matter dealt with at the meeting.

11. How will my shares be voted if I give my proxy?

A. The persons named in the proxy form or voting direction, must vote or withhold from voting your Common Shares in accordance with your directions on any ballot that may be called for and that, if you specify a choice with respect to any matter to be acted upon, your common shares will be voted accordingly. In the absence of such directions, shares represented by proxies received by management will be voted FOR the matters specified in the proxy.

12. If I change my mind, can I take back my proxy once I have given it?

A. If you are a registered shareholder and have returned a proxy, you may revoke it by:

| (a) | completing and signing a proxy bearing a later date, and delivering it to Valiant Trust Company prior to the deadline for submitting proxies for the meeting; or |

| (b) | delivering a written statement, signed by you or your authorized attorney to: |

| (i) | the Corporate Secretary of OPTI at Suite 1600, 555 - 4th Avenue S.W., Calgary, Alberta T2P 3E7 at any time up to and including the last business day prior to the meeting, or the business day preceding the day to which the meeting is adjourned; or |

| (ii) | the Chairman of the meeting prior to the commencement of the meeting on any day of the meeting or the day to which the meeting is adjourned. |

If you are a non-registered shareholder, please contact your nominee for instructions on revoking a proxy or voting direction. A shareholder may also revoke a proxy in any other manner permitted by law.

13. Who counts the votes?

A. The Corporation's registrar and transfer agent, Valiant Trust Company, counts and tabulates the votes. This is done independently of OPTI to preserve the confidentiality of individual votes. Proxies are referred to OPTI only in cases where a shareholder clearly intends to communicate with management (by making a written statement on the proxy form), in the event of a proxy contest or when it is necessary to do so to meet the requirements of applicable law.

14. What if I have other questions?

A. If you have a question regarding the meeting, please make inquiries through:

North America: Valiant at 1-866-313-1872, inquiries@valianttrust.com

or Krista Ostapovich, Head of Investor Relations, at (403) 218-4705 or kostapovich@opticanada.com.

Voting Shares and Principal Holders

OPTI's issued and outstanding voting securities as at March 1, 2011, consist of 281,749,526 common shares (“Common Shares”).

As of March 1, 2011, there is no person who, to the knowledge of our directors and officers, beneficially owns, or controls or directs, directly or indirectly, more than 10 percent of the issued and outstanding Common Shares.

BUSINESS OF THE ANNUAL SHAREHOLDER MEETING

Receipt of the Financial Statements and Auditor's Report

The financial statements of the Corporation for the year ended December 31, 2010 and the auditors report thereon will be placed before the shareholders at the meeting.

Under National Instrument 51-102 – Continuous Disclosure Obligations, a person or corporation who in the future wishes to receive interim financial statements from the Corporation must deliver a written request for such material to the Corporation, together with a signed statement that the person or corporation is the owner of securities (other than debt instruments) of the Corporation. If you wish to receive interim financial statements you are encouraged to send the enclosed return card, together with the completed form of proxy to Valiant Trust Company, 600 – 750 Cambie Street, Vancouver, British Columbia V6B 0A2.

Election of Directors

OPTI's board of directors currently consists of six members. It is proposed that six directors be elected at the meeting. All directors elected at the meeting will hold office until the close of the next annual meeting of shareholders following their election, until a successor is elected or appointed, or until the director vacates the office of director. The board of directors may appoint additional directors subsequent to the meeting. Any such additional appointments would be made in accordance with applicable corporate law and the Corporation's articles.

The persons named in the accompanying form of proxy intend to vote for the election of the nominees listed below unless the shareholder has specified in the proxy that the shares represented thereby be withheld from voting on the election of any or all nominees. These are ordinary resolutions and as such a simple majority of the Common Shares represented at the meeting must be voted in favour of the resolution in order for the resolutions to be effective.

To management’s knowledge, the following table lists the name of each person proposed by management to be elected as a director, all other positions and offices with the Corporation he or she now holds, his or her principal occupation or employment, the period during which he or she served as a director of the Corporation and the number of shares of the Corporation he or she beneficially owned, directly or indirectly, or over which he or she exercised direction or control, as at March 1, 2011. Following the table are detailed biographies of each nominee.

All nominees have consented to be named in this Proxy Circular and to serve as directors if elected. Management has no reason to believe that any of the nominees will be unable to serve as directors but, should any nominee become unable to do so for any reason prior to the meeting, the persons named in the enclosed form of proxy or voting instruction form, unless directed to withhold from voting,

reserve the right to vote for other nominees at their discretion. Shareholders should note that the form of proxy or voting instruction form provides for voting for individual directors.

In March 2009, the board of directors adopted a new policy which requires that any nominee for director who on a ballot taken on the election of directors receives a greater number of votes withheld than for his or her election shall tender his or her resignation to the Chairman of the board of directors, subject to acceptance by the board. This policy only applies to uncontested elections, meaning elections where the number of nominees for election is equal to the number of directors to be elected as set out in the management proxy circular. The Governance and Compensation Committee is required to consider the resignation having regard to the best interests of the Corporation and all factors considered relevant and to make a recommendation to the Board with respect to the action to be taken with respect to the resignation. The Board is required to make its decision and announce it in a press release within 90 days of the annual meeting including, if applicable, the reasons for it rejecting a resignation offer. A director who is required to tender a resignation under the policy will not participate in the deliberations of the Governance and Compensation Committee or the Board on any resignation offers from the same meeting unless there are less than three directors who are not required to tender a resignation, in which event the whole Board is to make the determination. If a resignation is accepted, the Board may fill the vacancy created by the resignation.

Name and Municipality of Residence | Present Position and Office | Director since | Number of Common Shares Held Directly or Indirectly | Principal Occupation |

| Directors | | | | |

Ian W. Delaney(1)(2)(3) Toronto, Ontario, Canada | Director | November 16, 2005 | 92,000 | Chairman and Chief Executive Officer of Sherritt International Corporation, a diversified resource company |

Charles L. Dunlap(2) Houston, Texas, USA | Director | June 29, 2006 | 11,200 | President and Chief Executive Officer of TransMontaigne, a terminaling and transportation company; formerly Chief Executive Officer, President and Director of Pasadena Refining System Inc., a refining company |

David Halford(1) Calgary, Alberta, Canada | Director | July 1, 2010 | 2,000 | Executive Vice President, Finance and Chief Financial Officer of ENMAX Corporation, an electricity generation and distribution company; formerly Chief Financial Officer of OPTI; and previously Chief Financial Officer of BA Energy, an oil sands company |

Edythe (Dee) A. Marcoux(1)(3) Gibsons, BC, Canada | Director | July 16, 2008 | 8,000 | Retired oil executive; formerly a consultant to Ensyn Group Inc., a heavy oil upgrading technology company |

Christopher P. Slubicki Calgary, Alberta, Canada | President, Chief Executive Officer and Director | February 1, 2007 | 206,485 | President and Chief Executive Officer of OPTI Canada Inc. |

James M. Stanford(2) Calgary, Alberta, Canada | Director and Chairman of the Board | May 30, 2002 | 127,600 | President of Stanford Resource Management Inc.; formerly President, Chief Executive Officer and Director of Petro-Canada, an integrated oil and gas company |

Notes:

(1) Member of the Audit Committee.

(2) Member of the Governance and Compensation Committee.

| (3) | Mr. Delaney and Ms. Marcoux both also serve on the board of directors of Sherritt International Corporation. For other details of board memberships of the director nominees, see the biographies below. |

A detailed biography for each nominee for the board of directors is set forth below:

Ian W. Delaney

Mr. Delaney is the Chairman and Chief Executive Officer of Sherritt International Corporation (“Sherritt”) of Toronto, Ontario, a diversified natural resource company that produces nickel, cobalt, thermal coal, oil and gas and electricity. Since 1995, and prior to his appointment as Chief Executive Officer, Mr. Delaney was the Executive Chairman of Sherritt. From 1990 to 1995, Mr. Delaney was the Chairman and Chief Executive Officer of Viridian Inc., a fertilizer company (formerly Sherritt Inc.) acquired by Agrium Inc. in 1996. He was President and Chief Executive Officer of The Horsham Corporation, a holding company, from 1987 to 1990; and President and Chief Operating Officer of Merrill Lynch Canada, a financial management and advisory company, from 1984 to 1987.

Mr. Delaney is a director of Cenovus Energy and Chairman of The Westaim Corporation, a technology investment company. He has previously served on a number of boards, including Co-Steel Inc., EnCana Corporation, MacMillan Bloedel Ltd., and GoldCorp Inc. Mr. Delaney is 67 years old.

Charles L. Dunlap

Mr. Dunlap is Chief Executive Officer and President of TransMontaigne, a terminaling and transportation company, and Chief Executive Officer of TransMontaigne Partners L.P., a master limited partnership, both based in Denver, Colorado. Mr. Dunlap served as Chief Executive Officer and President of Pasadena Refining System, Inc., based in Houston, Texas from January 2005 to December 2008. From 2000 to 2004, Mr. Dunlap served as one of the founding partners of Strategic Advisors, L.L.C., a management consulting firm based in Baltimore, Maryland. Prior to that time, Mr. Dunlap served in various senior management and executive positions at various oil and gas companies including Crown Central Petroleum Corporation, Pacific Resources Inc., ARCO Petroleum Products Company and Clark Oil & Refining Corporation.

Mr. Dunlap is a graduate of Rockhurst University, holds a Juris Doctor degree from Saint Louis University Law School and is a graduate of the Harvard Business School Advanced Management Program. Mr. Dunlap is 67 years old.

David Halford

Mr. Halford is the Executive Vice President, Finance and Chief Financial Officer of ENMAX Corporation (“ENMAX”). He is responsible for all financial policy, planning and reporting, risk management, corporate finance, tax and treasury functions of ENMAX and its subsidiaries.

Prior to joining ENMAX, Mr. Halford held Chief Financial Officer roles at OPTI, BA Energy and Irving Oil. He also held a variety of senior-level corporate finance and accounting roles, including partner in the corporate finance group of Deloitte and Touche, LLP.

Mr. Halford is a Chartered Accountant and holds a Bachelor of Arts degree from the University of Western Ontario. Mr. Halford is 49 years old.

Edythe (Dee) A. Marcoux

Ms. Marcoux is a retired executive from the oil industry with extensive experience with several major oil and gas companies including Suncor Inc. She was a consultant to Ensyn Group Inc. a heavy oil upgrading technology company from 2002 to mid-2005 and was previously, from 2001 to 2002, Chairman and Chief Executive Officer of Ensyn Energy, a subsidiary of Ensyn Group Inc. As well, Ms.

Marcoux worked as a consultant and served as a director of Southern Pacific Petroleum NL (“SPP”), a company developing shale oil reserves in Australia from 1998 to 2003. During this time, SPP’s securities were suspended from quotation on the Australian Stock Exchange prior to the commencement of trading on November 23, 2003 for a period of more than 30 consecutive days, and in respect of which receivers were appointed on December 2, 2003. SPP’s securities are not currently traded. Ms. Marcoux resigned as a director of SPP effective 12:00 noon on December 5, 2003.

Ms. Marcoux is currently a director of Sherritt and SNC-Lavalin. Ms. Marcoux holds an engineering degree, a Masters of Business Administration and an honorary Ph.D., all from Queen’s University. Ms. Marcoux is 62 years old.

Christopher P. Slubicki

Mr. Slubicki was appointed the President and Chief Executive Officer of OPTI in April 2009. Previously, he was the Vice Chairman of Scotia Waterous. Mr. Slubicki was one of the founders of Waterous & Co., a private global oil and gas investment banking firm, where he was involved in all aspects of the firm's strategic development as Senior Managing Director and Principal. Waterous & Co. was sold to The Bank of Nova Scotia in 2005. Prior to the founding of Waterous, Mr. Slubicki held operations management and engineering positions within the oil and gas industry, including Placer CEGO Petroleum Ltd. and Chevron Canada Resources Limited. Mr. Slubicki is a director of OptiSolar, Inc., Bonavista Energy Corporation and Insignia Energy Ltd.

Mr. Slubicki holds a Masters of Business Administration from the University of Calgary, a B.Sc. in Mechanical Engineering from Queen's University, and is a professional engineer in Alberta. Mr. Slubicki is 52 years old.

James M. Stanford

Mr. Stanford is the Chairman of OPTI's board of directors. He is the President of Stanford Resource Management Inc., and retired President, Chief Executive Officer and a director of Petro-Canada, having held those positions from 1993 to 2000. Mr. Stanford served as the President, Chief Operating Officer and a director of Petro-Canada from 1990 to 1993. Prior to joining Petro-Canada in 1978, Mr. Stanford worked with Mobil Oil Canada Ltd. for 19 years in numerous engineering and managerial positions.

Mr. Stanford has served on a variety of industry and community organizations.

Mr. Stanford holds an LL.D. (Hon.) and a B.Sc. in petroleum engineering from the University of Alberta and an LL.D. (Hon.) and a B.Sc. in mining from Concordia University. In 2004, he was appointed an Officer of the Order of Canada. Mr. Stanford is 73 years old.

Areas of Expertise

The following are five key areas of board member expertise considered when identifying candidates for OPTI’s board of directors. OPTI seeks to have a balance of expertise to ensure it continues to have a high quality board.

In addition to the biographies, the following summarizes the board nominees' areas of expertise:

| | Energy Industry(1) | Operating Experience(2) | Financial Acumen(3) | Governance/Board(4) | Senior Officer(5) |

| Ian W. Delaney | Yes | Yes | Yes | Yes | Yes |

| Charles Dunlap | Yes | Yes | Yes | Yes | Yes |

| David Halford | Yes | Yes | Yes | Yes | Yes |

| Dee Marcoux | Yes | Yes | Yes | Yes | Yes |

| Christopher Slubicki | Yes | Yes | Yes | Yes | Yes |

| James M. Stanford | Yes | Yes | Yes | Yes | Yes |

| Total | 6 | 6 | 6 | 6 | 6 |

Notes:

(1) Includes experience in the oil & gas, coal and power industries.

(2) Includes construction or operations experience in the oil & gas, coal, and power industries.

(3) Includes financial accounting, corporate finance and reporting experience.

(4) Includes experience as a board member for a public and/or private company.

(5) Includes experience as an executive officer or Chief Executive Officer.

Appointment of Auditors

The shareholders will be asked to vote for the appointment of PricewaterhouseCoopers llp, Chartered Accountants, of Calgary, Alberta, as auditors of the Corporation until the close of the next annual meeting, at such remuneration as may be approved by the board of directors of the Corporation.

This is an ordinary resolution and, as such, a simple majority (50 percent plus one) of the Common Shares represented at the meeting must be voted in favour of the resolution in order for the resolution to be effective.

Auditor Service Fees

PricewaterhouseCoopers LLP has served as the auditors of OPTI since its incorporation. The following table summarizes the total fees paid to PricewaterhouseCoopers LLP for the years ended 2010 and 2009 in thousands of dollars:

| | | 2010 | | | 2009 | |

| Audit fees | | $ | 382 | | | $ | 344 | |

| Audit related fees | | | 68 | | | | 266 | |

| Tax fees | | | 31 | | | | 50 | |

| TOTAL | | $ | 481 | | | $ | 660 | |

Audit fees were paid for professional services rendered by the auditors for the audit of our annual financial statements, review of interim quarterly financial statements and services provided for statutory and regulatory filings. The increase in Audit fees in 2010 is primarily attributed to preparation for the conversion to International Financial Reporting Standards (“IFRS”). This was offset by a decrease due to the Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law on July 21, 2010, exempting non-accelerated filers from internal control audit requirements for fiscal years ended on or after June 15, 2010. Audit-related fees are exclusively related to compulsory services required to support financing activities, as well as translation of public documents. Tax fees were primarily related to the completion of our corporate tax returns.

As per the Audit Committee charter, all permissible categories of non-audit services require pre-approval from the Audit Committee.

Further information with respect to the Audit Committee is available in the Corporation’s annual information form for the year ended December 31, 2010 (“AIF”) under the heading “Directors and

Officers – Audit Committee.” A copy of the AIF is available under OPTI’s issuer’s profile on SEDAR at www.sedar.com, on EDGAR at www.sec.gov/edgar.shtml and, upon request, a copy thereof will be provided free of charge.

Other Business

Management is not aware of any matter to come before the meeting other than the matters referred to in the Notice of the meeting. However, if any other matter properly comes before the meeting, the accompanying proxy confers discretionary authority to vote with respect to amendments or variations to matters identified in the Notice of the meeting and with respect to other matters that properly may come before the meeting.

EXECUTIVE COMPENSATION AND REMUNERATION OF DIRECTORS

Compensation Discussion and Analysis

OPTI offers market-based pay for performance to ensure that the Corporation has the ability to retain high quality employees. To determine executive compensation awards, performance is evaluated and decisions are based on Governance and Compensation Committee discussion. Effort is made to ensure that compensation is sufficient to retain executives in consideration of OPTI’s present circumstances. Performance for the executive group is evaluated by the Governance and Compensation Committee. Compensation of all executive officers, including the President and Chief Executive Officer of the Corporation, is compared against compensation paid to similarly sized oil and gas companies in circumstances similar to OPTI. Compensation levels are determined based on level or seniority, experience and expertise, and individual performance and corporate performance. Overall compensation is reviewed annually by the Governance and Compensation Committee. Compensation recommendations of the Governance and Compensation Committee for the Chief Executive Officer and the other executive officers are approved annually by the board of directors. During 2010, OPTI retained the service of Pekarsky Stein to assist in the development of incentive programs for OPTI employees and executive officers, as well as Hugessen Consulting for executive and director compensation. Total fees paid to outside consultants for compensation work in 2010, including applicable retainers, was $90,137. The Governance and Compensation Committee approves compensation for employees on a pool basis, with individual allocations made by senior management.

Base salaries

Base salary is the most stable component of compensation and must be sufficient to retain the executive in OPTI’s present circumstances. Level of salary compensation recognizes general competence, effort, and achieving results in a manner consistent with corporate values. OPTI in aggregate offers average base salaries. Individual salaries can be above or below average. Base salary for each executive varies based on individual experience, level of demonstrated competence and the importance of retaining each individual executive.

Bonuses

Cash bonuses may be paid annually, but are not guaranteed. Bonuses for certain officers and employees may be in the form of stock options.

The Corporation adopted a strategic alternatives incentive program (the “SAI Program”) for Named Executive Officers (the “NEOs”) in 2010. The purpose of the SAI Program is to align the NEO’s interest with those of the stakeholders. In certain circumstances, under the SAI Program, the Chief Executive Officer could earn a bonus of between $1,000,000 and $3,250,000, the Chief Financial Officer

could earn a bonus of between $400,000 and $500,000, and the other NEOs could individually earn a bonus of between $200,000 and $250,000. SAI bonuses will only be paid upon the completion of a transaction.

The Corporation implemented a retention program for its executive officers in 2010, which provided the Chief Executive Officer and Chief Financial Officer with a retention bonus equal to 14 months’ salary over the course of 2010, and the other NEOs with a retention bonus equal to 12 months’ salary. The retention program in 2011 provides the Chief Executive Officer with a retention payment of $855,000, and the other NEOs with retention payments equal to 14 months’ salary respectively. NEOs must be employed at OPTI at the required dates, in order to receive a retention bonus.

Long Term Incentive Plan (LTIP)

The Corporation currently does not have any long-term incentive plan available to directors or executive officers, other than the stock option plan of OPTI (“Stock Option Plan”) (described in detail below). The principal purposes of the Stock Option Plan are to retain and attract qualified directors, officers, employees and service providers, to promote a proprietary interest in OPTI, to provide an incentive element in compensation, and to promote the profitability of OPTI. At year end, the Governance and Compensation Committee evaluates corporate performance and utilizes this information to determine a total compensation target for executive compensation. The target can range from below to above average market total compensation. Individual awards are based on the number of options required to meet the total compensation target for each executive, given the base salary and bonus awards. Previous option awards are not taken into account when considering new grants.

Savings Plan and Perquisites

Employees of OPTI, including executive officers, can contribute up to 8 percent of base salary to receive a contribution from the Corporation of up to 12 percent of base salary in the first four years of employment and increasing to 16 percent thereafter under the Corporation’s savings plan. The employer portion of the contributions to the savings plan is subject to certain vesting restrictions.

The Corporation does not have a pension plan.

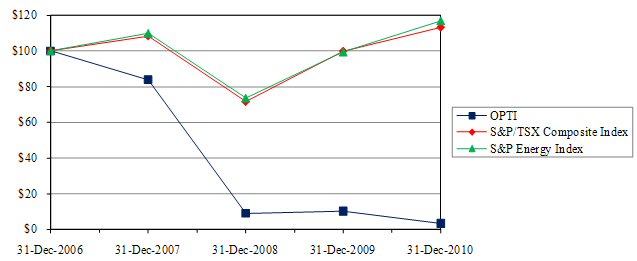

Performance Graph

The following graph compares the yearly change in the cumulative total shareholder return of a $100 investment made on December 31, 2006 in the Corporation's Common Shares with the cumulative total return of the S&P/TSX Composite Total Return Index and the S&P Energy Total Return Index assuming the reinvestment of dividends, where applicable, for the comparable period.

| | | OPTI | | | S&P/TSX Composite Index(1) | | | S&P Energy Index(2) | |

| December 31, 2006 | | $ | 100 | | | $ | 100 | | | $ | 100 | |

| December 31, 2007 | | $ | 83.92 | | | $ | 108.23 | | | $ | 109.83 | |

| December 31, 2008 | | $ | 9.10 | | | $ | 71.57 | | | $ | 73.58 | |

| December 31, 2009 | | $ | 10.26 | | | $ | 99.81 | | | $ | 99.38 | |

| December 31, 2010 | | $ | 3.39 | | | $ | 113.12 | | | $ | 116.87 | |

Notes:

(1) Formerly the TSE 300 Composite Total Return Index

(2) Formerly the TSE Oil and Gas Producers Total Return Index

Salaries are not necessarily tied to share performance.

Option –Based Awards - Long Term Incentive Plans

Stock Option Plan

The Stock Option Plan was established in 2002, and subsequently amended in 2004 in connection with the initial public offering of the Common Shares ("IPO") and, most recently, in 2007. The Stock Option Plan governs the issuance of stock options to directors, officers, employees and persons who have provided services or who are expected to provide services to OPTI. The Stock Option Plan is the only equity compensation plan currently in place.

The maximum number of Common Shares reserved for issuance under the Stock Option Plan may not exceed 15,103,506 Common Shares. Under the Stock Option Plan, the Board determines the number of stock options to be issued, the date on which the stock option is to become effective and all other terms and conditions of the stock options. No options are exercisable less than 12 months after the grant date. No grantee under the Stock Option Plan may receive stock options entitling the grantee to purchase more than 5 percent of the aggregate outstanding voting shares of OPTI. The Stock Option Plan

also provides that: (a) the number of voting securities issuable to insiders, at any time, under all security-based compensation arrangements, cannot exceed 10 percent of the issued and outstanding voting securities of OPTI; and (b) the number of voting securities issued to insiders, within any one year period, under all security-based arrangements, cannot exceed 10 percent of the issued and outstanding voting securities of OPTI. The exercise price of each stock option granted may not be lower than the closing price of the Common Shares on the TSX on the trading day prior to the date of grant. The term and exercise period of the stock options are determined by the Board for each grant, provided that no stock option shall have a term exceeding 10 years, subject to a black-out expiration provision extending the expiration period in circumstances where it would expire during a company-imposed trading black-out. The stock options are not assignable. The Corporation does not provide any financial assistance to facilitate purchase of Common Shares under the Stock Option Plan.

If any options issued under the Stock Option Plan are not exercised within their term, the Common Shares reserved and authorized for issuance pursuant to such stock options will be available for issuance under the Stock Option Plan.

The Board has the right to amend from time to time or to terminate the terms and conditions of the Stock Option Plan and options granted thereunder. Except for the limited circumstances described below, any such amendments are subject to approval of the shareholders and to the prior consent of any applicable regulatory bodies, including any stock exchange on which the Common Shares are listed. Amendments and termination shall take effect only with respect to stock options issued thereafter, provided that they may apply to any stock options previously issued with the mutual consent of the Corporation and the persons holding such stock options. Subject to the foregoing, the Board has the power and authority to approve amendments relating to the Stock Option Plan or to any previously granted stock options, without further approval of the shareholders, to the extent that such amendments relate to:

| (a) | altering, extending or accelerating the terms and conditions of vesting applicable to any stock options; |

| (b) | altering the termination provisions of an option or of the Stock Option Plan, that does not entail an extension beyond the original expiry date; |

| (c) | the addition of a cashless exercise feature to outstanding options, payable in cash or securities, which provides for a full deduction of the number of underlying securities from the plan reserve; |

| (d) | determining the adjustment provisions pursuant to Section 10 of the Stock Option Plan (i.e. relating to typical adjustments considered appropriate to prevent dilution or enlargement of the rights granted in connection with the Stock Option Plan in the event of certain corporate transactions such as stock splits, etc.); |

| (e) | amendments necessary to comply with applicable law or the requirements of any stock exchange on which the Corporation's shares are listed; or |

| (f) | amendments for the purpose of curing any ambiguity, error or omission in the Stock Option Plan or a stock option or to correct or supplement any provision of the Stock Option Plan that is inconsistent with any other provision of the Stock Option Plan and other amendments of a "housekeeping" nature. |

Employment Contracts

Each NEO has a management employment agreement with the Corporation. Each agreement contains provisions relating to annual salary, bonuses and vacation entitlements as well as provisions dealing with the effect of a change of control of the Corporation. The details of the key terms and conditions of these agreements are set forth below. Details of compensation paid to the NEOs pursuant to these agreements are set forth in this Proxy Circular in the tables set out under "Executive Compensation and Remuneration of Directors - Executive Compensation" and "Incentive Plan Awards."

Each of the management employment agreements provides for an initial grant of stock options and contains provisions providing for non-competition and non-solicitation. The management employment agreements can be terminated by the Corporation without cause, upon written notice and payment, which is to be provided within 15 days of the notice. For all NEOs, this payment represents base salary plus an amount equal to the average annual bonus and benefits pro rated over a "severance period," which is 18 months, plus one additional month for each year of service, to a maximum aggregate of 24 months. Within 30 days following the occurrence of a Terminating Event (as defined in such agreements, such definition including a Major Change of Control) the NEO can elect to terminate his or her employment with the Corporation in which case the NEO would receive severance as outlined above. A Major Change of Control is defined as the acquisition of more than 50 percent of the issued and outstanding voting shares of the Employer at the time of such acquisition. Major Change of Control also means the sale, lease or transfer by the Employer of all or substantially all of the assets of the Employer to any Person or group. In order for the executive officer to be entitled to severance upon a Major Change of Control, there must, following such change of control, occur an additional event which constitutes a material alteration in the executive officer's role and relationship with the Corporation. However, within 30 days following the first anniversary of a Major Change of Control, with no additional event, the NEO may provide 30 days’ notice of termination of employment, in which case the NEO shall receive severance as outlined above. The management employment agreements provide that the agreements can be terminated by the Corporation with cause, upon the payment of a pro rata amount of any salary, bonus and vacation, earned but not paid, to the date of termination. Under these circumstances, the NEO is entitled to payment of a pro rata amount of any salary, bonus and vacation, earned but not paid, to the date of termination.

Executive Compensation

The following table discloses, for the periods indicated, total compensation received by the following executive officers: (i) OPTI's Chief Executive Officer; (ii) OPTI's Chief Financial Officer; and (iii) the two most highly compensated executive officers (other than the Chief Executive Officer and Chief Financial Officer) whose total salary and bonus exceeded $150,000 in respect of fiscal 2010 (collectively the "NEOs").

OPTI's current NEOs consist of: Christopher Slubicki, President and Chief Executive Officer; Travis Beatty, VP, Finance and Chief Financial Officer; Joseph Bradford, VP, Legal and Administration and Corporate Secretary; and Alan Smith, VP, Marketing.

Summary Compensation Table

| Name and principal position | Year | Salary ($) | Option-based awards(1) ($) | Non-equity incentive plan compensation ($) | All Other compensation(2) ($) | Total compensation ($) |

| Annual incentive plans ($) |

Chris P. Slubicki(3) CEO | 2010 2009 | 350,000 271,923 | 154,400 3,001,156 | 0 200,000 | 499,333 32,631 | 1,003,733 3,505,710 |

Travis Beatty(4) CFO | 2010 2009 | 250,000 236,041 | 28,950 194,980 | 130,000 220,525 | 378,333 37,233 | 787,283 688,779 |

Joe Bradford(5) VP, Legal & Admin | 2010 2009 2008 | 250,000 250,000 54,006 | 28,950 194,980 204,347 | 100,000 166,250 0 | 310,000 30,000 6,481 | 688,950 641,230 264,834 |

Alan Smith(6) VP, Marketing | 2010 2009 | 250,000 245,958 | 28,950 194,980 | 100,000 162,249 | 314,167 29,515 | 693,117 632,702 |

| Former NEOs | | | | | | |

Kiren Singh(7) VP and Treasurer | 2010 2009 | 188,461 239,792 | 0 194,980 | 0 200,475 | 903,775 28,775 | 1,092,236 664,022 |

Notes:

| (1) | This value does not represent the current benefit to the option holders (see “Outstanding Option-Based Awards” table for current benefit.) The value of share based awards above is the accounting value based on the Black-Scholes method in accordance with CICA guidelines for Canadian GAAP. As a result of significant share price volatility, this option valuation included a volatility of 74% in 2010 (2009 – 75%). |

| (2) | Relates to an annual employee savings plan which allows each employee to contribute up to 8 percent of base salary to receive a contribution by OPTI of up to 12 percent in the first four years and increasing to 16 percent thereafter. Also includes retention payments paid in accordance with the Company’s Retention Program. For former NEOs, it also includes termination payments. |

| (3) | Mr. Slubicki was appointed President and Chief Executive Officer on April 27, 2009. |

| (4) | Mr. Beatty was appointed Vice President, Finance and Chief Financial Officer on March 1, 2009. |

| (5) | Mr. Bradford was appointed October 15, 2008. |

| (6) | Mr. Smith was appointed Vice President, Marketing on March 1, 2009. |

| (7) | Ms. Singh was appointed Vice President on April 27, 2009 and left OPTI on October 2, 2010. |

Incentive Plan Awards

| | Outstanding Option-Based Awards |

The following table outlines all outstanding stock options awarded under the Stock Option Plan to the current NEOs as at December 31, 2010.

| | | | Option Based Awards | |

| Name | Grant Date | | Number of securities underlying unexercised options (#) | | | Option exercise price ($) | | Option expiration date(1) | | Value of unexercised in-the-money options ($)(2) | |

| Chris P. Slubicki | December 17, 2010 | | | 400,000 | | | | 0.55 | | December 17, 2017 | | | 48,000.00 | |

| | December 30, 2009 | | | 400,000 | | | | 2.04 | | December 30, 2016 | | | 0.00 | |

| | May 27, 2009 | | | 1,000,000 | | | | 3.36 | | May 27, 2016 | | | 0.00 | |

| | April 30, 2008 | | | 7,000 | (3) | | | 20.61 | | April 30, 2018 | | | 0.00 | |

| | April 30, 2007 | | | 7,000 | (3) | | | 22.56 | | April 30, 2017 | | | 0.00 | |

| Travis Beatty | December 17, 2010 | | | 75,000 | | | | 0.55 | | December 17, 2017 | | | 9,000.00 | |

| | December 30, 2009 | | | 75,000 | | | | 2.04 | | December 30, 2016 | | | 0.00 | |

| | April 8, 2009 | | | 75,000 | | | | 1.59 | | April 8, 2016 | | | 0.00 | |

| | January 24, 2008 | | | 5,000 | | | | 16.42 | | January 24, 2018 | | | 0.00 | |

| | November 27, 2007 | | | 11,000 | | | | 19.15 | | November 27, 2017 | | | 0.00 | |

| | November 13, 2006 | | | 20,000 | | | | 18.30 | | November 13, 2016 | | | 0.00 | |

| | February 20, 2006 | | | 9,000 | | | | 21.03 | | February 20, 2016 | | | 0.00 | |

| | February 10, 2005 | | | 15,000 | | | | 10.75 | | February 10, 2015 | | | 0.00 | |

| | April 15, 2004 | | | 30,000 | | | | 11.00 | | April 15, 2014 | | | 0.00 | |

| | August 1, 2003 | | | 20,000 | | | | 7.63 | | August 1, 2013 | | | 0.00 | |

| | October 21, 2002 | | | 10,000 | | | | 7.25 | | October 21, 2012 | | | 0.00 | |

| Joe Bradford | December 17, 2010 | | | 75,000 | | | | 0.55 | | December 17, 2017 | | | 9,000.00 | |

| | December 30, 2009 | | | 75,000 | | | | 2.04 | | December 30, 2016 | | | 0.00 | |

| | April 8, 2009 | | | 75,000 | | | | 1.59 | | April 8, 2016 | | | 0.00 | |

| | October 14, 2008 | | | 50,000 | | | | 5.60 | | October 14, 2018 | | | 0.00 | |

| Alan Smith | December 17, 2010 | | | 75,000 | | | | 0.55 | | December 17, 2017 | | | 9,000.00 | |

| | December 30, 2009 | | | 75,000 | | | | 2.04 | | December 30, 2016 | | | 0.00 | |

| | April 8, 2009 | | | 75,000 | | | | 1.59 | | April 8, 2016 | | | 0.00 | |

| | November 27, 2007 | | | 17,000 | | | | 19.15 | | November 27, 2017 | | | 0.00 | |

| | October 6, 2006 | | | 25,000 | | | | 17.28 | | October 2, 2016 | | | 0.00 | |

Note:

(1) Pursuant to the terms of the Stock Option Plan, all options for each NEO expire 90 days after he or she leaves OPTI. Options granted in 2009 or after have a seven year term. Options granted prior to 2009 have a ten year term.

(2) Calculated based on the difference between the closing price of Common Shares as at December 31, 2010, being $0.67, and the exercise price of the option.

(3) Mr. Slubicki was awarded these options in his previous role as a director of OPTI.

Incentive Plan Awards – value vested or earned during the year

The following table sets out the value of incentive plan awards vested or earned during 2010. All stock options granted to the former NEO expired prior to December 31, 2010.

| Name | | Option-based awards – Value vested during the year ($)(1) | | | Non-equity incentive plan compensation – Value earned during the year ($) | | | Retention(2) ($) | |

| Chris P. Slubicki | | | 0.00 | | | | 0 | | | | 408,333 | |

| Travis Beatty | | | 0.00 | | | | 130,000 | | | | 291,667 | |

| Joe Bradford | | | 0.00 | | | | 100,000 | | | | 250,000 | |

| Alan Smith | | | 0.00 | | | | 100,000 | | | | 250,000 | |

(1) Value that would have been realized if the stock options were exercised on the vesting date.

(2) Value of payments earned in 2010 through the Retention Program.

Termination and Change of Control Benefits (1)

Name | Triggering Event(2) | | Cash Portion ($) | | | Value of Equity and Share Based Awards and Other Benefits(3) ($) | | | Total ($) | |

| Chris Slubicki | Change in Control or Terminating Event Resignation | | | 756,614 0 | | | | 66,500 0 | | | | 823,114 0 | |

| Travis Beatty | Change in Control or Terminating Event Resignation | | | 763,943 0 | | | | 80,000 0 | | | | 843,943 0 | |

| Joe Bradford | Change in Control or Terminating Event Resignation | | | 642,477 0 | | | | 50,000 0 | | | | 692,477 0 | |

| Alan Smith | Change in Control or Terminating Event Resignation | | | 785,092 0 | | | | 80,000 0 | | | | 785,092 0 | |

Notes:

(1) For current NEOs, all calculations are as at December 31, 2010, excluding any amounts from the SAI Program.

(2) NEOs can only receive either a Change of Control or a Termination Event payment, not both. No compensation is paid upon a NEOs resignation.

(3) Includes savings plan benefits; however, excludes group health and dental coverage, which continues for the duration of the NEO’s severance period.

Securities Authorized for Issuance Under Equity Compensation Plans

As of December 31, 2010, the Corporation's Stock Option Plan was the only active compensation plan under which equity securities of OPTI were authorized for issuance. The Stock Option Plan governs future stock option grants to directors, officers, employees and service providers of the Corporation.

The following table sets forth details as of December 31, 2010 concerning Common Shares issuable in connection with the Stock Option Plan and the anti-dilutive stock option agreements.

Equity Compensation Plan Information as of December 31, 2010

| Plan Category | | Number of Common Shares to be issued upon exercise of outstanding options | | | Weighted-average exercise price of outstanding options ($) | | | Number of Common Shares remaining available for future issuance under equity compensation plans (excluding Common Shares reflected in column (a)) | |

| | | (a) | | | (b) | | | (c) | |

Equity compensation plans approved by securityholders(1) | | | 3,471,500 | | | | 3.63 | | | | 10,261,106 | |

Notes:

(1) For material features of the Stock Option Plan see “Option –Based Awards - Long Term Incentive Plans - Stock Option Plan.

Compensation of Directors

Effective April 29, 2010, the Board approved an increase in director compensation rates.

All directors, excluding the President and Chief Executive Officer, now receive an annual retainer of $40,000 (from $25,000), and a meeting fee of $1,750 (from $1,500) for each board meeting attended in person, or $1,000 (from $750) per meeting via teleconference. A fee of $1,250 (from $1,000) is paid to any director who travels from the United States to attend a board meeting in person, or who spends more than three hours travelling from another Canadian location.

All committee members receive an additional fee of $1,250 (from $1,000) for each in-person meeting, or $750 (from $500) for each conference call. If an ad hoc committee is established on a temporary basis for a limited purpose, similar meeting fees are paid.

There were no changes to the retainers earned by the Chairman of the Board and the Chairman of the Audit Committee, who earn an additional annual retainer of $35,000 and $15,000, respectively. The Chairman of the Board is entitled to receive an office and administrative support allowance of $2,300 per month to offset disbursements associated with his or her position. For 2010, the allowance for the Chairman of the Board averaged $1,410 per month.

OPTI has a policy providing for an annual stock option grant to each director (other than the Chief Executive Officer) of 7,000 options to acquire Common Shares under the Stock Option Plan. The first annual grant of options under this policy was made in April 2006 to each director elected at the annual and special meeting of shareholders held on April 27, 2006. Additional annual grants of 7,000 options were made to all directors elected at the annual meetings of shareholders each year thereafter. Due to the fluctuation in stock price, the grants to the directors in 2010 were based on the accounting value of the options. As a result, each of the directors was granted 29,000 options.

The Corporation does not have a retirement policy for directors.

The following table sets out, for the most recently-completed financial year, the value of the total compensation paid to each current director (including the cash value of meeting fees paid, plus the value of stock option grants).

| Name of Director | | Annual Retainer(1) ($) | | | Meeting Attendance Fees ($) | | | Option-Based Awards(2) ($) | | | All Other Compensation(3) ($) | | | Total ($) | |

| Ian W. Delaney | | | 42,500 | | | | 23,250 | | | | 40,281 | | | | 0 | | | | 106,031 | |

| Charles L. Dunlap | | | 35,000 | | | | 24,000 | | | | 40,281 | | | | 0 | | | | 99,281 | |

David Halford(4) | | | 20,000 | | | | 15,750 | | | | 36,801 | | | | 0 | | | | 72,551 | |

| Edythe (Dee) Marcoux | | | 35,000 | | | | 27,000 | | | | 40,281 | | | | 0 | | | | 102,281 | |

| Christopher P. Slubicki | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| James M. Stanford | | | 70,000 | | | | 16,250 | | | | 40,281 | | | | 5,100 | | | | 131,631 | |

Bruce Waterman(4) | | | 22,500 | | | | 11,500 | | | | 40,281 | | | | 0 | | | | 74,281 | |

Notes:

(1) Includes retainers for Board membership and, where applicable, committee chairmanships.

(2) Estimated dollar value of stock options granted, using a Black-Scholes option pricing model which assigns an accounting value to an individual option.

(3) Includes the benefit received for a parking stall.

(4) David Halford was appointed to the Board on July 1, 2010, following Bruce Waterman’s resignation on June 30, 2010

Outstanding Option-based Awards

The following table outlines all outstanding stock options, as at December 31, 2010, granted to the current directors of OPTI under the Stock Option Plan.

| | Option Based Awards | |

| Name | Grant Date | | Number of securities underlying unexercised options (#) | | | Option exercise price ($) | | Option expiration date(1) | | Value of unexercised in-the-money options ($)(2) | |

| Ian Delaney | May 31, 2010 | | | 29,000 | | | | 1.96 | | May 31, 2017 | | | 0.00 | |

| | April 28, 2009 | | | 7,000 | | | | 1.96 | | April 28, 2016 | | | 0.00 | |

| | April 30, 2008 | | | 7,000 | | | | 20.61 | | April 30, 2018 | | | 0.00 | |

| | April 30, 2007 | | | 7,000 | | | | 22.56 | | April 30, 2017 | | | 0.00 | |

| | April 27, 2006 | | | 7,000 | | | | 21.35 | | April 27, 2016 | | | 0.00 | |

| Charles Dunlap | May 31, 2010 | | | 29,000 | | | | 1.96 | | May 31, 2017 | | | 0.00 | |

| | April 28, 2009 | | | 7,000 | | | | 1.96 | | April 28, 2016 | | | 0.00 | |

| | April 30, 2008 | | | 7,000 | | | | 20.61 | | April 30, 2018 | | | 0.00 | |

| | April 30, 2007 | | | 7,000 | | | | 22.56 | | April 30, 2017 | | | 0.00 | |

| David Halford | July 1, 2010 | | | 29,000 | | | | 1.79 | | July 1, 2017 | | | 0.00 | |

| Edythe Marcoux | May 31, 2010 | | | 29,000 | | | | 1.96 | | May 31, 2017 | | | 0.00 | |

| | April 28, 2009 | | | 7,000 | | | | 1.96 | | April 28, 2016 | | | 0.00 | |

| | July 18, 2002 | | | 7,000 | | | | 20.89 | | July 18, 2018 | | | 0.00 | |

| James Stanford | May 31, 2010 | | | 29,000 | | | | 1.96 | | May 31, 2017 | | | 0.00 | |

| | April 28, 2009 | | | 7,000 | | | | 1.96 | | April 28, 2016 | | | 0.00 | |

| | April 30, 2008 | | | 7,000 | | | | 20.61 | | April 30, 2018 | | | 0.00 | |

| | April 30, 2007 | | | 7,000 | | | | 22.56 | | April 30, 2017 | | | 0.00 | |

| | April 27, 2006 | | | 7,000 | | | | 21.35 | | April 27, 2016 | | | 0.00 | |

| | April 15, 2004 | | | 20,000 | | | | 11.00 | | April 15, 2014 | | | 0.00 | |

| | July 18, 2002 | | | 10,000 | | | | 7.25 | | July 18, 2012 | | | 0.00 | |

Note:

(1) Pursuant to the terms of the Stock Option Plan, all options for each director expire 90 days after he or she leaves OPTI. Options granted in 2009 and after have a seven year term. Options granted prior to 2009 have a ten year term.

(2) Calculated based on the difference between the closing price of Common Shares as at December 31, 2010, being $0.67, and the exercise price of the option.

Incentive plan awards – value vested or earned during the year

Value of stock options granted to the directors of OPTI that vested in 2010 was nil. Directors of OPTI are not eligible to receive annual bonuses.

Submitted by the Governance and Compensation Committee:

James Stanford,

Ian Delaney, and

Charles Dunlap

INDEBTEDNESS

No director, proposed director, executive officer, nor any of their respective associates or affiliates, is or has been at any time since the date of incorporation indebted to the Corporation.

MANAGEMENT CONTRACTS

During the financial year ended December 31, 2010, no management functions of the Corporation were to any substantial degree performed by a person or company other than the directors or executive officers of the Corporation.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Management of the Corporation is not aware of any material interest, direct or indirect, of any director or executive officer of the Corporation, any person beneficially owning, directly or indirectly, more than 10 percent of the Corporation's voting securities, or any associate or affiliate of such person in any transaction within the last fiscal year or in any proposed transaction which in either case has materially affected or will materially affect the Corporation or its subsidiaries.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

OPTI's Statement of Corporate Governance Practices is set out in Schedule A to this Proxy Circular.

ADDITIONAL INFORMATION

Additional information relating to the Corporation is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.shtml. Financial information relating to the Corporation is contained in OPTI's financial statements and management's discussion and analysis (“MD&A) for the year ended December 31, 2010. If you wish to request copies of the Corporation's financial statements and MD&A, please contact Investor Relations at OPTI Canada Inc., Suite 1600, 555 - 4th Avenue S.W., Calgary, Alberta, T2P 3E7, Tel: (403) 249-9425, or OPTI's transfer agent at Valiant Trust Company, 310, 606 – 4th Street S.W., Calgary, Alberta, T2P 1T1.

SHAREHOLDER PROPOSALS

Shareholders who comply with the applicable provisions of the Canada Business Corporations Act (the “CBCA”) are, subject to certain conditions in the CBCA, entitled to have OPTI include in its management proxy circular any matter that the person proposes to raise at an annual meeting. Any shareholder who intends to make such a proposal to be considered by OPTI for the 2012 annual meeting must arrange for OPTI to receive the proposal at is principal executive office no later than December 15, 2011. Shareholders should consult their legal advisors for more information.

DIRECTORS’ APPROVAL

The board of directors of OPTI has approved the contents and the sending of this Proxy Circular.

(signed) “Christopher P. Slubicki”

Christopher P. Slubicki

President and Chief Executive Officer

March 15, 2011

SCHEDULE A

OPTI CANADA INC.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

OPTI's board of directors is committed to a high standard of corporate governance practices. The board believes that this commitment is not only in the best interest of its shareholders, but that it also promotes effective decision making at the board level. The board is of the view that its approach to corporate governance is appropriate and continues to work to align with the recommendations currently in effect and contained in National Policy 58-201 - Corporate Governance Guidelines ("NP 58-201"), which are addressed below. In addition, the board monitors and considers for implementation the corporate governance standards which are proposed by various Canadian regulatory authorities or which are published by various non-regulatory organizations in Canada.

Share Ownership Policy

In February 2007, the board adopted a policy providing that each director of the board is required to hold 8,000 common shares of the Corporation and each director has two years from appointment or election date to meet the requirement. The Chief Executive Officer is to own Common Shares equal in value to four times his or her annual salary and other executive officers of the Corporation should hold Common Shares having a value equal to one times their annual base salary for the preceding financial year. Going forward, this value will be calculated on a cost basis, that being share purchase price value. Executive officers have a period of three years from February 2007, or three years from appointment if subsequent to this time, to meet the requirement. The board has suspended the share ownership policy for Executives during the strategic alternatives process.

Mandate of the Board

The board has responsibility for the stewardship of the Corporation. In early 2005, the board adopted Terms of Reference that were designed to assist the board and management in clarifying their respective responsibilities and ensuring effective communication between them. Included in the Terms of Reference is a written Board Mandate, a copy of which is attached as Schedule B to this Proxy Circular.

In carrying out its mandate, the board meets regularly and a broad range of matters are discussed and reviewed for approval. These matters include overall corporate plans and strategies, budgets, internal controls and management information systems, risk management as well as annual financial and operating results. The board is also responsible for the approval of all major transactions, including equity issuances and the Corporation's debt and borrowing policies. The board strives to ensure that actions taken by the Corporation correspond closely with the objectives of its shareholders. The board meets at least once annually to review in depth the Corporation's strategic plan and the Corporation's resources which are required to carry out the Corporation's growth strategy and to achieve its objectives. The following table discloses the attendance record for each director for all board meetings and committee meetings held during 2010.

| Board Member | | Board Meetings(1) | | | Audit Committee Meetings | | | Governance and Compensation Committee Meetings | |

Ian W. Delaney(2) | | | 10/13 | | | | 2/2 | | | | 4/5 | |

| Charles Dunlap | | | 13/13 | | | | 4/4 | | | | 3/3 | |

David Halford(3) | | | 6/6 | | | | 2/2 | | | | - | |

| Edythe (Dee) Marcoux | | | 13/13 | | | | 5/5 | | | | - | |

| Christopher Slubicki | | | 13/13 | | | | - | | | | - | |

James M. Stanford(4) | | | 13/13 | | | | 5/5 | | | | 5/5 | |

Bruce Waterman(3) | | | 7/7 | | | | 3/3 | | | | 1/2 | |

Notes:

| (1) | In respect of each director, the number of board and committee meetings attended is shown relative to the maximum number of board and committee meetings that such director was eligible to attend, based on such director’s committee membership and tenure as a director of the Corporation. |

| (2) | Mr. Delaney became Chair of the Audit Committee in July 2010. |

| (3) | Mr. Halford joined the board on July 1, 2010, following Mr. Waterman’s resignation on June 30, 2010. |

| (4) | As Chairman of the Board, Mr. Stanford attended all committee meetings that were held in 2010. |

The Chairman of the Board is charged with ensuring that the board carries out its responsibilities and that these responsibilities are clearly understood by all of its members. The Chairman also ensures that the board can function independently of management, the necessary resources and procedures are available or in place to support its responsibilities and the appropriate functions are delegated to the relevant committees. The Chairman is responsible for overseeing and setting the board agendas, for the quality of information sent to directors and for the in camera sessions held without management. The Chairman is also responsible for assuring a process is in place for the Chief Executive Officer’s annual performance review, which is conducted by the board, and senior management succession planning matters.

Composition of the Board

Management is proposing the election at the annual meeting of shareholders of six directors, of whom a majority of four are independent. The board of directors may appoint additional directors subsequent to the meeting.

OPTI uses the standard established under NP 58-201, which provides that a director is independent if he or she has no direct or indirect material relationship with the Corporation. A "material relationship" is a relationship which could, in the view of the board, reasonably interfere with the exercise of a director's independent judgment. In addition, certain individuals are deemed, for the purposes of NP 58-201, to have material relationships with the Corporation, including any individual who is, or has been, within the last three years, an employee or an executive officer of the Corporation. Under this definition, the board had four independent directors for the majority of 2010: Ian W. Delaney, Charles Dunlap, Edythe (Dee) Marcoux and James M. Stanford.

The directors in 2010 that were not independent were Christopher Slubicki, OPTI’s President and Chief Executive Officer and David Halford, who was OPTI’s Chief Financial Officer within the last three years.

The non-management directors hold regularly scheduled meetings at which the Chief Executive Officer and other members of management are not in attendance. Such meetings occur in conjunction with each regularly scheduled full board meeting. In 2010, the non-management directors held nine in camera sessions.

Position Descriptions

Mr. James M. Stanford is the Chairman of the Board and is considered to be independent under NP 58-201. The Chairman of the Board is responsible for such things as: the efficient organization and operation of the board and its committees in order to facilitate the operations and deliberations of the board and the satisfaction of the board’s responsibilities under its Mandate; ensuring the effective communication between the board and management and that the board effectively carries out its mandate; in consultation with management and committees, setting agendas for board meetings and coordinating with management to ensure preparation documents are sent to directors with sufficient time for study prior to the meetings; reviewing director conflict of interest issues as they arise; ensuring the board has a process for assessing the performance of the Chief Executive Officer and ensuring that appropriate succession, development and compensation plans are in place for senior management; and chairing regular board meetings and the annual shareholders meeting. The board has developed written position descriptions for the Chairman and for the chair of each board committee.

The responsibilities of the Chief Executive Officer include the general mandate to manage the Corporation and its businesses and to maximize shareholder value. In addition, the responsibilities of the office include, but are not limited to: in consultation with the board, annually determine the strategic direction of the Corporation and to determine with the board the near-term objectives toward achieving those strategies and the related annual plans and budgets; to undertake the day-to-day management and operation of the Corporation and provide leadership to review the annual plans and budgets; to consider the balance among the interests of shareholders, regulatory agencies, employees and the community at large; and to undertake an appropriate communication with shareholders regarding the Corporation's activities and objectives. The board and the Chief Executive Officer have developed a written position description for the Chief Executive Officer.

Orientation and Continuing Education

The Corporation conducts an informal orientation involving meetings with senior management on key business, financial and operational issues and provides each director with a comprehensive board information binder which describes, among other things, the role of the board, its committees and its directors.

In addition, the Corporation provides all directors with access to the President and Chief Executive Officer and all other senior management to provide each director with an understanding of the Corporation and its business. Updates on the Corporation’s business and activities are provided to directors on a regular basis to ensure that directors have the necessary knowledge concerning the Corporation’s business to meet their obligations as directors. All directors are also encouraged to visit the Corporation’s facilities with a view to enabling them to better understand the Corporation’s business.

Ethical Business Conduct

OPTI has adopted a written code of conduct for its directors, officers and employees. OPTI will arrange for a copy of the code of conduct to be mailed to an interested party, upon request to Investor Relations at OPTI Canada Inc., Suite 1600, 555 - 4th Avenue S.W., Calgary, Alberta, T2P 3E7, Tel: (403) 249-9425. The code of conduct is also available on SEDAR at www.sedar.com.

The code has been adopted by the board of directors and senior management, and requires every officer, director and employee to observe high standards of business and personal ethics as they carry out their duties and responsibilities. The code sets forth guidelines, policies and procedures which comprise the core principles applicable to all, and address ethical conduct, conflicts of interest and compliance with

the law. The code is administered by the Governance and Compensation Committee which oversees and monitors the code and reports to the board on the implementation and monitoring of the code and all matters that arise related to its provisions. Each employee of OPTI is required to sign an acknowledgement of the code upon commencement of employment, and annually thereafter.

OPTI has established an independently-operated "whistle-blower" hotline service which enables interested persons to identify potential breaches of ethical issues and other sensitive matters to the board on an anonymous basis. The whistle-blower system is overseen by the Audit Committee.

The board also ensures that directors exercise independent judgment in considering transactions in respect of which a director or executive officer has a material interest by requiring all directors to adhere to the declaration of conflict of interest requirements mandated by the Canada Business Corporations Act.

The Canada Business Corporations Act provides that a director or officer shall disclose the nature and extent of any interest that he or she has in a material contract or material transaction, whether made or proposed, if the director or officer:

| | · | is a party to the contract or transaction, |

| | · | is a director or an officer, or an individual acting in a similar capacity, of a party to the contract or transaction, or |

| | · | has a material interest in a party to the contract or transaction, |

and shall refrain from voting on any matter in respect of such contract or transaction unless otherwise provided under the Canada Business Corporations Act.

Board Committees and their Mandates

The board of directors of OPTI has an Audit Committee and a Governance and Compensation Committee. Each committee has an independent director as chairman.

The Audit Committee is comprised of three directors. The purpose of the Audit Committee is to assist the board of directors in fulfilling its responsibility of oversight and supervision of, among other things:

| | · | the audit of the financial statements of OPTI, managing the relationship with the external auditor and meeting with the external auditor as required in connection with the audit services provided by the external auditor; |

| | · | the preparation and reporting of OPTI’s annual and quarterly financial statements and management’s discussion and analysis; |

| | · | the accounting and financial reporting practices and procedures of OPTI; |

| | · | the adequacy of internal controls and accounting procedures of OPTI; and |

| | · | financial risk management. |

The majority of the Audit Committee members are independent, as is the Chair of the Audit Committee. Due to Mr. Halford’s extensive financial expertise, the Board determined that it was in the Corporation’s best interest to appoint for Mr. Halford to the Audit Committee.

The Audit Committee's mandate is included as a schedule to the Corporation's current AIF, a copy of which is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.shtml.

| CURRENT MEMBERSHIP: | Ian Delaney (Chair), David Halford, Edythe (Dee) Marcoux. |

Governance and Compensation Committee

All of the members of the Governance and Compensation Committee are independent directors. The purpose of the Governance and Compensation Committee is to assist the board of directors in:

| · | fulfilling its responsibilities in relation to the monitoring and oversight of the quality and effectiveness of OPTI's corporate governance practices and policies; |

| · | fulfilling its stewardship in relation to, compensation practices and practices of officers and employees of OPTI, as well as the board of directors, and administering and making recommendations regarding the operation of OPTI’s Stock Option Plan and any other long term incentive programs of OPTI; and |

| · | identifying new nominees to the board. |

In order to identify and propose nominees for election to the board, the committee looks for new nominees who have expertise in an area of strategic interest to the Corporation, the ability to devote the time required for board service and a willingness to serve on the board and any of its committees. In order to encourage an objective nomination process, the lead interviewer of prospective candidates is an independent member of the committee and the committee regularly reports to or consults with the board as a whole.

| CURRENT MEMBERSHIP: | James Stanford (Chair), Ian Delaney, Charles Dunlap. |

Please refer to the Report of the Governance and Compensation Committee under the Heading "Executive Compensation and Remuneration of the Directors" for details on the process by which the committee determines the compensation for the directors and officers of the Corporation.

Board and Committee Assessments

The Chairman of the board is responsible for the effective operation of the board and its committees. Issues regarding quality of information and board performance have been reviewed at board meetings. In addition, the Chairman has made himself available for discussions with individual board members regarding board performance. In carrying out his responsibilities, the Chairman also reviews the contributions of its individual directors and considers whether the current composition of the board promotes effectiveness and efficiency in its decision-making. On an annual basis, the Governance and Compensation Committee informally assesses the effectiveness of each member of the board, its committees and each individual director relative to (i) in the case of the board and each committee of the board, their roles and responsibilities and the board or committee’s mandate, as applicable, and (ii) in the case of individual directors, the competencies and skills that each individual director is expected to bring to the board. The chair of the Governance and Compensation Committee periodically reports to the board on the evaluation of the performance of the board and each committee.

In 2008, the board implemented a new annual self-assessment process. Each director completes a detailed questionnaire, and forwards it to the Corporate Secretary. The chair has the results compiled and presents the consolidated results to the Governance and Compensation Committee and then to the full board.

SCHEDULE B

BOARD OF DIRECTORS MANDATE

The mandate of the board is to undertake stewardship of the Corporation pursuant to applicable statutes and regulations. It undertakes the stewardship principally through: (i) review and decisions in respect to management's plans, recommendations and actions; (2) recommendations from its committees; and (3) initiatives of the board. In discharging its duties and responsibilities, the board shall act in accordance with applicable laws and regulations, including but not limited to the provisions of the Canada Business Corporations Act ("Act") and shall act with a view to the best interests of the Corporation and with an aim of maximizing shareholder value through balancing opportunities and risks.

Pursuant to the articles, by-laws and the Act, the board shall have a minimum of three and a maximum of fifteen directors, with the number of directors approved by the shareholders at an annual meeting. At least one-quarter of the directors must be resident Canadians (as defined in the Act) and at least a majority must satisfy the independence requirements of applicable securities laws.

The directors, other than interim appointments, are elected by the shareholders and each serves until succeeded or resigns.

The board chair is appointed by the board to serve at the pleasure of the board until succeeded or resigns.

The board shall appoint a corporate secretary who shall be recording assistant to the board.

MEETINGS, MINUTES AND REPORTING

The board shall determine the number of, dates and times, place and the procedures for meetings provided that:

| | · | proper notice of meetings is given; |

| | · | the board meets at least quarterly; |

| | · | agendas and preparation documents are sent to directors with sufficient time for study prior to the meetings; |

| | · | a quorum of a majority of the members are present in person or via phone and, subject to certain exceptions in the by-laws, at least 25% of the members present must be resident Canadians for the purposes of the Act; |