U.S. SECURITIES AND EXCHANGE COMMISSION

Indicate by check mark whether the registrant by filing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934 (the “Exchange Act”). If “Yes” is marked, indicate the file number assigned to the registrant in connection with such rule.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

The following documents have been filed as part of this Annual Report on Form 40-F, beginning on the following page:

Annual Information Form

For the Year Ended

December 31, 2008

March 24, 2009

TABLE OF CONTENTS

| | | PAGEE | |

| INTRODUCTORY INFORMATION | | | 2 | |

| FORWARD LOOKING INFORMATION | | | 2 | |

| CORPORATE STRUCTURE | | | 4 | |

| GENERAL DEVELOPMENT OF THE BUSINESS | | | 5 | |

Competitive Strengths and Operating Strategies | | | 6 | |

Our Industry | | | 9 | |

Our Principal Assets | | | 10 | |

The Long Lake Project and Future Phase Development | | | 10 | |

Marketing | | | 18 | |

Infrastructure | | | 18 | |

Our Lands and Leases | | | 19 | |

Material Agreements Related to the Joint Venture | | | 21 | |

Royalties | | | 27 | |

Regulatory Approvals and Environmental Considerations | | | 28 | |

| Insurance | | | 31 | |

| RESERVES AND RESOURCES SUMMARY | | | 32 | |

| DESCRIPTION OF CAPITAL STRUCTURE | | | 34 | |

| CREDIT RATINGS | | | 38 | |

| MARKET FOR SECURITIES | | | 39 | |

| DIVIDENDS | | | 39 | |

| DIRECTORS AND OFFICERS | | | 39 | |

Board of Directors | | | 41 | |

Officers | | | 45 | |

Audit Committee | | | 47 | |

Auditor Service Fees | | | 48 | |

| CONFLICTS OF INTEREST | | | 48 | |

| RISKS AND UNCERTAINTIES | | | 49 | |

Risks Relating to the Project and to Future Phases of Development | | | 49 | |

Risks Relating to Reserves and Resources | | | 54 | |

Risks Relating to Commodity and Currency Pricing | | | 56 | |

Risks Relating to Technology | | | 57 | |

Risks Relating to Third Parties | | | 58 | |

Risks Relating to Financing and Our Indebtedness | | | 61 | |

| MATERIAL CONTRACTS. | | | 63 | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | | 63 | |

| TRANSFER AGENTS AND REGISTRAR | | | 64 | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | | 63 | |

| INTERESTS OF EXPERTS.. | | | 64 | |

| ADDITIONAL INFORMATION | | | 64 | |

| GLOSSARY | | | 65 | |

| APPENDIX A - | RESERVES DATA AND OTHER OIL AND GAS INFORMATION |

| APPENDIX B - | REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR |

| APPENDIX C - | REPORT OF MANAGEMENT ON RESERVES DATA AND OTHER INFORMATION |

| APPENDIX D - | AUDIT COMMITTEE CHARTER |

INTRODUCTORY INFORMATION

Except as otherwise indicated, or unless the context otherwise requires, the terms "OPTI," "we," "our" and "us," refer to OPTI Canada Inc. capitalized terms used herein and not otherwise defined have the meanings ascribed thereto in the Glossary located on page 66.

Unless otherwise indicated, all financial information included and incorporated by reference in this AIF is determined using Canadian Generally Accepted Accounting Principles ("Canadian GAAP") which differs in some respects from generally accepted accounting principles in the United States.

Unless otherwise specified, all dollar amounts are expressed in Canadian dollars, all references to "dollars'' or "$'' are to Canadian dollars and all references to "US$'' are to United States dollars.

FORWARD LOOKING INFORMATION

This AIF contains forward looking statements and forward looking information within the meaning of the applicable U.S. federal and state securities laws and Canadian securities laws. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward looking statements and forward looking information. The words "believe," "expect," "intend," "estimate," "anticipate," "project," "scheduled" and similar expressions, as well as future or conditional verbs such as "will," "should," "would" and "could" often identify forward looking statements and forward looking information. These statements and information are only predictions. Actual events or results may differ materially. In addition, this AIF may contain forward looking statements and forward looking information attributed to third party industry sources. Undue reliance should not be placed on these forward looking statements and forward looking information, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. By their nature, forward looking statements and forward looking information involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward looking statements and forward looking information will not occur.

Specific forward looking statements and forward looking information contained in this AIF include, among others, statements regarding:

| | • | the level of production expected; |

| | • | the operation of our facilities, including the SOR of the SAGD Operation and the PSC™ yield of the Long Lake Upgrader; |

| | • | our estimated financial performance in future periods; |

| | • | our reserve and resource estimates and our estimates of the present value of our future net cash flow; |

| | • | our expansion plans for our properties and our expected increases in revenues attributable to our expansions; |

| | • | the impact of governmental controls and regulations on our operations; |

| | • | our competitive advantages and ability to compete successfully; and |

| | • | our expectations regarding the development and production potential of our properties. |

With respect to forward looking statements and forward looking information contained in this AIF, we have made assumptions regarding, among other things:

| | • | future natural gas and crude oil prices; |

| | • | the ability for the operator to obtain qualified staff and equipment for the Long Lake Project in a timely and cost-efficient manner to meet our requirements; |

| | • | the regulatory framework representing royalties, taxes and environmental matters in which we conduct our business; |

| | • | the ability to market PSC™ successfully to customers and our ability to achieve product pricing expectations; |

| | • | the impact of changing competition; and |

| | • | our ability to obtain financing on acceptable terms. |

Some of the risks that could affect our future results and could cause results to differ materially from those expressed in our forward looking statements and forward looking information include:

| | • | slower than expected ramp-up of bitumen production; |

| | • | slower than expected ramp-up of the Upgrader; |

| | • | equipment product yields; |

| | • | our ability to source process inputs including water, contract bitumen, and natural gas; |

| | • | costs associated with producing and upgrading bitumen; |

| | • | the impact of competition; |

| | • | the need to obtain required approvals and permits from regulatory authorities; |

| | • | liabilities as a result of accidental damage to the environment; |

| | • | compliance with and liabilities under environmental laws and regulations; |

| | • | the uncertainty of estimates by our independent consultants with respect to our bitumen and synthetic crude oil reserves and resources; |

| | • | the volatility of crude oil and natural gas prices and of the differential between heavy and light crude oil prices; |

| | • | changes in the foreign exchange rate between the Canadian and U.S. dollar; |

| | • | risks that our financial counterparties may not fulfill financial obligations to us; |

| | • | difficulties encountered in delivering PSC™ to commercial markets; |

| | • | difficulties in and/or costs of disposing of process by-products or wastes including liquid sulphur and gasifier ash; |

| | • | we are a non-operator and as such we rely on the operator to generate cash flow from the Project and to provide information on the status and results of operations; |

| | • | we may be unable to sufficiently protect our proprietary technology or may be the subject of technology infringement claims from third parties; |

| | • | general economic conditions in Canada and the United States, |

| | • | failure to obtain industry partner and other third party consents and approvals, when required; |

| | • | royalties payable in respect of our production; |

| | • | the impact of amendments to the Income Tax Act (Canada); |

| | • | changes in or the introduction of new government regulations, in particular related to carbon dioxide ("CO2"), relating to our business; and |

| | • | our ability to attract capital and the cost of that capital. |

The information contained in this AIF, including the information provided under the heading "Risks and Uncertainties", identifies additional factors that could affect our operating results and performance. We urge you to carefully consider those factors and the other information contained in this AIF.

Our forward looking statements and forward looking information are expressly qualified in their entirety by this cautionary statement. Our forward looking statements and forward looking information are only made as of the date of this AIF. We undertake no obligation to update these forward looking statements and forward looking information to reflect new information, subsequent events or otherwise, except as required by law.

CORPORATE STRUCTURE

OPTI Canada Inc. was incorporated under the laws of New Brunswick on January 15, 1999 and was continued under the Canada Business Corporations Act on May 30, 2002. Effective October 1, 2004, we assigned substantially all of our interests in the Project to OPTI Long Lake L.P. ("OPTI LP"), an Alberta limited partnership. The partners of the OPTI LP were OPTI Canada Inc., as limited partner, and OPTI G.P. Inc., a wholly-owned subsidiary of OPTI Canada Inc., as the general partner. Effective January 1, 2008, the limited partnership was dissolved and OPTI Canada Inc. was amalgamated with OPTI G.P. Inc. OPTI has no subsidiaries at December 31, 2008.

Our head office is located at Suite 2100, 555 - 4th Avenue S.W., Calgary, AB, T2P 3E7 and our registered office is located at 3700, 400 - 3rd Avenue S.W., Calgary, Alberta, T2P 4H2

GENERAL DEVELOPMENT OF THE BUSINESS

We are a Calgary, Alberta-based company, established in 1999 to develop major integrated bitumen and heavy oil projects in Canada using our proprietary, next-generation OrCrude™ process. Our first project, the Long Lake Project, includes the Long Lake SAGD Operation and the Long Lake Upgrader, each with expected through-put rates of approximately 72,000 bbl/d of bitumen. We expect that the Project, located near Fort McMurray, AB, will produce 58,500 barrels per day ("bbl/d") of products, primarily 39° API PSC™ with low sulphur content, a highly desirable refinery feedstock. We expect PSC™ to sell at a price similar to West Texas Intermediate ("WTI") crude oil.

The Project is the first to utilize OPTI’s OrCrude™ process, integrated with proven gasification and hydrocracking processes. Through this configuration, we substantially reduce our exposure to and the need to purchase natural gas while producing one of the highest quality synthetic crude oils from the Canadian oil sands.

The SAGD portion of the Project was completed in advance of the Upgrader in order to ramp-up bitumen production prior to Upgrader start-up. We began producing bitumen in 2008 and we announced first production of PSC™ in January 2009. We expect that SAGD volumes will reach full design rates of approximately 72,000 bbl/d of bitumen in 12 to 18 months and that the increasing capacity of the Long Lake Upgrader during ramp-up will enable us to process the forecasted SAGD Operation volumes.

From the commencement of our joint venture with Nexen Inc. (Nexen) in 2001 until December 31, 2008, each company had a 50 percent interest in the Project; OPTI was the operator of the Long Lake Upgrader and Nexen was the operator of the Long Lake SAGD Operation. In December 2008, OPTI announced that it had entered into a definitive agreement to sell a 15 percent working interest in all its joint venture assets to Nexen for $735 million. The deal closed in January 2009. Effective January 1, 2009, OPTI has a 35 percent working interest in all joint venture assets, including the Project, all future phase reserves and resources, and future phases of development. Nexen has a 65 percent working interest in all joint venture assets and is now the operator of both the SAGD operation and the Upgrader for Phase 1 and future phases. For further details on the Nexen Transaction see “The Purchase and Sale Agreement” on page 28.

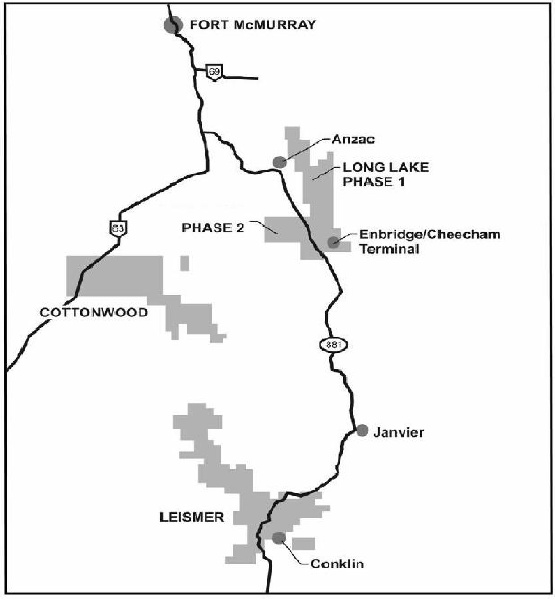

The leases that support our development plans are located in the Athabasca region of north-eastern Alberta. The Project is being developed on a portion of the Long Lake leases that are dedicated to the Project. Additional portions of the Long Lake leases and other leases in areas commonly referred to as Cottonwood and Leismer will be used for possible future expansion phases.

At December 31, 2008, OPTI had approximately 385 employees. Upon Nexen assuming operating responsibility of the Long Lake Upgrader in early 2009, it is anticipated that Nexen will make employment offers to many of OPTI's operating and Project staff. We expect that after this transition OPTI will have approximately 25 employees.

Competitive Strengths and Operating Strategies

Our plan is to optimize the economic recovery of reserves and resources from our lands. We plan to achieve this objective by using a combination of proven operating technologies, employing a multi-staged approach to future expansions when economic conditions permit, and maintaining an integrated approach using SAGD combined with the Integrated OrCrude™ Upgrader.

Our competitive strengths are as:

Operating Project Employing Previously Demonstrated Technologies

The Project began producing bitumen in 2008. We announced first production of PSC™ in January 2009, marking the start-up of only the fourth integrated oil sands project in Canada. We expect SAGD production volumes to ramp-up through 2009 and reach design volumes of 72,000 bbl/d of bitumen in 2010. We anticipate that the increasing capacity of the Upgrader during ramp-up will enable OPTI to process all of the forecasted SAGD volumes. We expect the Upgrader to produce 57,700 bbl/d of PSC™ and 800 bbl/d of butane at full capacity.

Until recently, most oil sands were extracted via mining. However, 80 percent of the Athabasca oil sands are too deep to mine economically. Where bitumen is too deep to mine, SAGD technology, first used in 1978, has become a common recovery method. The majority of existing or planned in-situ oil sands developments use SAGD. The Project includes SAGD in conjunction with on-site bitumen upgrading. The Upgrader utilizes OrCrudeTM technology along with commercially available hydro cracking and gasification technologies that have been used in many applications around the world to process heavy oil into refinery and petrochemical feedstocks.

Both the SAGD and OrCrudeTM technologies have been demonstrated by the JV Participants in the form of the SAGD Pilot and the OrCrudeTM demonstration plant. The SAGD Pilot consisted of three horizontal well pairs and associated facilities. The SAGD Pilot operated from mid 2003 to mid 2006 and provided important design and operating information that has been incorporated into the Project. The OrCrudeTM demonstration plant had a capacity of 500 bbl/d, was in operation from the second quarter of 2001 to the fourth quarter of 2003 and processed over 250,000 bbls of bitumen from various sources, including the SAGD Pilot. The OrCrudeTM demonstration plant provided design and operating parameters that have been incorporated into the Project. OPTI has the exclusive rights to the use of the OrCrude™ process in Canada, including the right to sub-license the technology.

Large, Exploitable Resource Base with Low Geological Risk

Our working interest share of reserves and resources on current leases are estimated to be approximately 2.2 billion barrels of bitumen, comprised of 738 million barrels of proved and possible reserves and 1,424 million barrels of best estimate contingent resources. These reserves and resources are estimated to be sufficient to support production for Long Lake Phase 1, and for up to five additional phases of a similar size as Phase 1, for approximately 40 years. We believe that the approval of future phases by our board of directors, when economic conditions permit, and by regulatory authorities in Alberta will allow us to convert our substantial resource base into additional proved reserves. See "Reserves and Resources Summary."

The timing of future phases is subject to many factors including initial performance of Phase 1, receiving clarity on proposed climate change regulations, developing cost estimates and an improved economic environment. We do not expect to consider sanctioning Phase 2 until mid-2010 at the earliest.

When compared to a conventional exploration and production operation, we believe that an oil sands operation, like our Project, generally has lower geological risk. Unlike conventional oil exploration and production, we expect that the Project will have a constant non-declining rate of production during the life of the Project and therefore would not require ongoing exploration risk to maintain its production rate once operational. To maintain this rate of production, future maintenance and sustaining capital expenditures will be required.

Once the Project is complete, including construction of the steam expansion plant (expected in 2009) and the ash processing unit (expected in 2010), we expect future capital expenditures in connection with the Project will include maintenance and sustaining capital costs, which we define as those capital costs necessary to maintain production at the anticipated level over the anticipated life of the Project. These costs relate to the drilling of new well pairs to sustain production and regular maintenance capital spending on plant and facilities.

Strong Margins

We expect that the sale of PSC™, a high quality sweet synthetic crude, combined with lower operating costs, primarily due to lower natural gas needs, will result in strong margins.

To illustrate these expected margins, we provide a financial outlook of our estimated netback for the Project. Netback costs are updated annually as a result of the JV’s budgeting process. The netback calculation shown below is consistent with this most recent update and includes our estimates of revenue, royalties, operating costs and G&A expenses per barrel of product sold when the Project is at full capacity.

This financial outlook is intended to provide investors with a measure of the ability of our Project to generate cash flow assuming full production capacity. We believe that the ability of the Project to generate cash to fund interest payments and future phases of development is a key advantage of our Project and important to our investors. The netback measure is an appropriate financial gauge to demonstrate this ability as corporate costs, interest, and other non cash items are excluded from the calculation. The financial outlook may not be suitable for other purposes. Netbacks generated by the Project are expected to be lower than shown in this outlook in the years immediately following start-up due to the lower production volumes during ramp-up and an initially higher SOR. The netback calculation as presented is a non-GAAP measure. The closest Canadian GAAP measure to the netback calculation is cash flow from operations. However, cash flow from operations includes many other corporate items that affect cash and are independent of the operations of the Project.

The actual netbacks achieved by the Project could differ materially from these estimates. The material risk factors that OPTI has identified toward achieving these netbacks are as outlined in the Forward Looking Information section of this document. In particular; the SAGD Operation and Upgrader may not operate as planned; the operating costs of the Project may vary considerably during the operating period; our financial results of operations will depend upon the prevailing prices of oil and natural gas in the worldwide market and those prices can fluctuate substantially; we will be subject to foreign currency exchange fluctuation exposure; and our operating cash flows will be directly affected by the applicable royalty regime relating to our business. The key assumptions relating to the netback estimate are set out in the notes beneath the table. Assumptions are considered reasonable by OPTI as at the date of this AIF.

Estimated Future Project Netbacks(1)

| In CDN$/bbl | | Post-payout | | | Pre-payout | |

| | | $/bbl | | | $/bbl | |

Revenue(1,2) | | $ | 86.33 | | | $ | 86.33 | |

Royalties and G&A(3) | | | (8.43 | ) | | | (3.84 | ) |

Operating costs(4) | | | | | | | | |

Natural gas(5) | | | (3.90 | ) | | | (3.90 | ) |

Other variable(6) | | | (2.76 | ) | | | (2.76 | ) |

| Fixed | | | (12.82 | ) | | | (12.82 | ) |

Property taxes and insurance(7) | | | (3.55 | ) | | | (3.55 | ) |

| Netback | | $ | 54.87 | | | $ | 59.46 | |

| (1) | The per barrel amounts are based on the expected yield for the Project of 57,700 bbl/d of PSC™ and 800 bbl/d of butane, and assume that the Upgrader will have an on-stream factor of 96 percent. These numbers are cash costs only and do not reflect non-cash charges. See “Forward Looking Statements.” |

| (2) | For purposes of this projection, OPTI assumes a WTI price of US$75/bbl, foreign exchange rates of CDN$1.00=US$0.85 and an electricity sales price of $106 per megawatt hour. Revenue includes sale of PSCtm, bitumen, butane and electricity. |

| (3) | Royalties are calculated based on a light/heavy differential of 30 percent of WTI. OPTI anticipates payout for royalty purposes to occur in approximately 2022 based on the assumptions noted. |

| (4) | Costs are in 2009 dollars. |

| (5) | Natural gas costs are based on our long term estimate for a SOR of 3.0. |

| (6) | Includes approximately $1.00/bbl for greenhouse gas mitigation costs based on an approximate average 20 percent reduction of CO2 emissions at a cost of $20 per tonne of CO2. |

| (7) | Property taxes are based on expected mill rates for 2009. |

Sustaining capital costs required to maintain production at design rates of capacity are estimated to be approximately $8.00 to $9.00 per barrel of PSC™, assuming full design rate production adjusted for long-term on-stream expectations. The netbacks as shown are prior to abandonment and reclamation costs. We do not include these costs due to the long-term nature of our assets. The estimates do not include any expenditures related to future phases.

Lower Cash Flow Volatility

The majority of in-situ bitumen projects currently being developed in Alberta are intending to use SAGD without on-site upgrading. OPTI believes that the use of the Integrated OrCrude™ Upgrader offers several advantages over these other projects in that we expect the Integrated OrCrude™ Upgrader to provide a solution to the three traditional challenges of stand alone SAGD Operations:

| Challenge | | Integrated OrCrude™ Upgrader Solution |

| Exposure to fluctuating natural gas prices | | Operating costs and the volatility of netbacks are reduced since the Integrated OrCrudeTM Upgrader produces synthesis gas to supply fuel for steam generation and hydrogen for hydrocracking, thereby significantly reducing the need to purchase natural gas |

| Exposure to heavy oil differentials | | The Integrated OrCrude™ Upgrader produces a high quality 39° API synthetic crude oil thereby significantly reducing exposure to heavy oil differentials |

| Exposure to rising diluent prices and potential diluent shortages | | The Integrated OrCrude™ Upgrader produces a synthetic crude oil that does not require diluent to assist in its transportation, thereby limiting the Project’s exposure to diluent pricing and availability |

Strong Joint Venture Sponsorship and Technical Expertise

OPTI benefits from the participation, sponsorship and execution capabilities of Nexen, one of Canada’s largest independent oil and natural gas producers with reported production of over 249,000 boe/d, prior to royalties, in the third quarter of 2008. Nexen has extensive holdings of heavy oil and bitumen resources, including its 7.23 percent interest in the Syncrude Project, and employs a team of geologists, engineers and other technical personnel to support these interests. Nexen Marketing is currently responsible for marketing all of the output from the Project.

Experienced Management Team

The members of our senior management team have substantial industry experience. Technical teams have been established for the construction and operation of the Project comprised of individuals with extensive previous experience in a number of oil sands operations and construction projects. Based on experience in development of the Project, these teams have unique knowledge that will provide important expertise to future phases.

Our Industry

Oil sands operators produce and process bitumen, which is the heavy oil trapped in the sands. According to the EUB, Canada’s oil sands are estimated to hold 175 billion barrels of bitumen at the end of 2007, second only to Saudi Arabia and significantly more than the recoverable reserves in the United States. According to the Canadian Association of Petroleum Producers (CAPP), in 2007 oil sands production reached over 1.1 million bbl/d. CAPP currently estimates that oil sands production will reach 2.4 million bbl/d by 2015.

Of the 315 billion barrels of potentially recoverable bitumen estimated to be contained in Canada’s oil sands only about 20 percent are shallow enough to be mined economically, leaving the remainder of the resource to be recovered using in-situ techniques. The in-situ techniques currently in use employ steam to heat the bitumen, allowing it to flow into a well and be produced. The two most common methods of in-situ production are Cyclic Steam Stimulation ("CSS") and SAGD. The steam used in both processes is normally generated using natural gas, and natural gas is the primary input cost of both methods. SAGD typically has higher recovery rates and is a more energy efficient process than CSS in bitumen deposits such as OPTI’s.

Bitumen is currently sold in two principal forms: either as a bitumen blend, in which the bitumen is mixed with a lighter crude oil (to create synbit) or a very light condensate (to create dilbit) so that it will flow in pipelines; or, after upgrading, as a synthetic crude oil. Bitumen blend has many characteristics similar to, and is generally priced like, conventional heavy oil. Synthetic crude oil, depending on the level of upgrading it has undergone, has many characteristics similar to, and is generally priced like, conventional medium or light oil.

Upgrading is the process that changes bitumen into synthetic crude oil. Bitumen, like crude oil, is a complex mixture of hydrocarbon components with a relatively high content of carbon in relation to hydrogen compared to conventional light crude oil. Some upgrading processes remove carbon, while others add hydrogen or change molecular structures. The main product of upgrading is synthetic crude oil that can be later refined like conventional oil into a range of hydrocarbon products.

Our Principal Assets

Our principal assets include:

| | • | 35 percent interest in an operating project, the Long Lake Project, as of January 1, 2009; |

| | • | $3.2 billion investment to the end of 2008; |

| | • | proved plus probable plus possible bitumen reserves associated with a portion of the Long Lake Leases of 803 million bbls. See “Reserves and Resources Summary”; |

| | • | contingent and prospective bitumen resources of an estimated 1.424 billion bbls contained in the remainder of the Long Lake, Leismer and Cottonwood Leases. See "Reserves and Resources Summary"; and |

| | • | the exclusive right to the use of the OrCrude™ Process technology in Canada. |

The Long Lake Project and Future Phase Development

The Long Lake Project

In 2001, OPTI formed a joint venture with Nexen to develop integrated oil sands projects in Canada. The first such project is Phase 1 of the Project, located on our Long Lake lease 42 km south east of Fort McMurray, Alberta. See: “Our Lands and Leases.”

Effective January 1, 2009, OPTI owns a 35 percent undivided interest in the Project, which, among other assets, includes the SAGD Operation and the Upgrader, each with expected capacities of approximately 72,000 bbl/d of bitumen. The yield from bitumen produced from the SAGD Operation is expected to be 57,700 bbl/d of PSCtm and approximately 800 bbl/d of butane. OPTI expects PSCtm to sell at a price similar to WTI crude oil

The Project is the first commercial application of the Integrated OrCrudetm Process. The Project involves two major components, being the recovery of bitumen and the upgrading of bitumen into PSCtm and other petroleum products. Included in the Project is a cogeneration facility that generates steam for the SAGD wells and electricity for use by the Project or sales to the Alberta interconnected electric system in the event of surplus. The cogeneration facility has a capacity of 170 megawatts.

From commencement of the Project until January 1, 2009, OPTI was the operator of the Upgrader and had primary responsibility for all matters relating to the Upgrader, subject to certain approvals of the management committee of the joint venture. OPTI was responsible for overseeing the construction, commissioning and start-up and operation of the Upgrader. During this period, Nexen was the operator of the SAGD Operation and had primary responsibility for all matters relating to such lands, plants and operations, subject to certain approvals of the management committee of the joint venture. Nexen has been responsible for overseeing the operation of the SAGD Pilot, as well as the construction and operations of the SAGD Operation. Upon closing the Nexen Transaction, Nexen became the operator of both the Upgrader and the SAGD Operation for Phase 1 and future phases.

There are organizations in place for the management of ongoing operations. These organizations include personnel experienced in the operation and maintenance of oil and gas, petrochemical, and other industrial facilities both locally and internationally. Facility operations are managed locally from an on-site operations administration and maintenance complex. An emphasis is placed on having operations personnel live locally in the region and be part of the local communities.

The Project is being governed pursuant to the terms and conditions of the COJO Agreement and the Technology Agreement. These agreements are reviewed in the "Material Agreements Related to the Joint Venture" section of this document.

Project Status

Major on-site construction of the Project began in mid-2005. The SAGD facilities were completed and steam injection commenced in 2007. SAGD production ramped up in 2008 to approximately 20,000 bbl/d in November. However, SAGD ramp-up has been affected by a variety of surface issues that have limited the amount of steam available to inject into the reservoir over the past few months due to power disruptions, extreme cold weather, and water temperature and treating issues. Since steam injection rates directly impact bitumen production rates, and the ability to generate steam is currently limited, bitumen production is lower than we previously expected. Solutions are being implemented to place more heat into the front-end of the water treatment process to supplement the heat returns from the reservoir and improve the water processing ramp-up capability. Given steaming constraints, only 32 of 81 well pairs are presently in production. Bitumen production in January 2009 averaged approximately 13,000 bbl/d (gross). As steam capacity increases the remaining wells will be brought on stream. The reservoir continues to perform as expected given the amount of steam injected.

Construction of the Upgrader, which intentionally lagged SAGD to ensure sufficient bitumen production at start-up, was completed in early 2008. Turnover of the Upgrader from construction to operations, and Upgrader commissioning and start-up activities, were the main focus in 2008. With all main process units operating, first production of PSC™ from the Project was achieved in January 2009. Preparation is underway to transition gasifier feed from vacuum residue to asphaltenes, the final step in Upgrader commissioning. Synthesis gas from the Upgrader is being used in SAGD operations, decreasing operating costs by reducing the requirement for purchased third-party natural gas. During the initial operating period, we expect periods of Upgrader down time but anticipate that the stability of operations will continue to improve. The Upgrader is currently gasifying and producing PSC™.

During the final commissioning phase, prior to the operation of the solvent deasphalting and thermal cracking units, there is a high percentage of diluent that feeds the Upgrader and continues to the hydrocracker, forming part of the PSC™ stream. The Project has produced over 20,000 bbl/d (gross) of on-spec PSC™, with between 10,000 and 12,000 bbl/d (gross) of this representing upgraded bitumen. The remainder represents diluent processed through the Upgrader. The percentage of diluent in the Upgrader feed will decrease as bitumen production increases.

Based on industry experience, we expect the Upgrader to reach full production more quickly than SAGD operations. Therefore, during the SAGD ramp-up period, we expect that up to 10,000 bbl/d of externally sourced bitumen will be imported and processed. We expect the Project to reach full capacity of approximately 72,000 bbl/d of internally produced bitumen, upgraded into 58,500 bbl/d of PSC™ and other products, in 12 to 18 months.

The final cost of the Project is expected to be approximately $6.5 billion of which $3.25 billion will be net to OPTI. As of December 31, 2008, $6.4 billion or $3.2 billion net to OPTI had been incurred on the Project. As the Project is essentially complete as of December 31, 2008, nearly all expenditures were completed when OPTI retained a 50 percent working interest in the Project. The remaining capital costs relate to the completion of the steam expansion project, expected in 2009, and the ash processing unit in the following year. The cost to complete these two projects is estimated at approximately $45 million net to OPTI’s current 35 percent working interest.

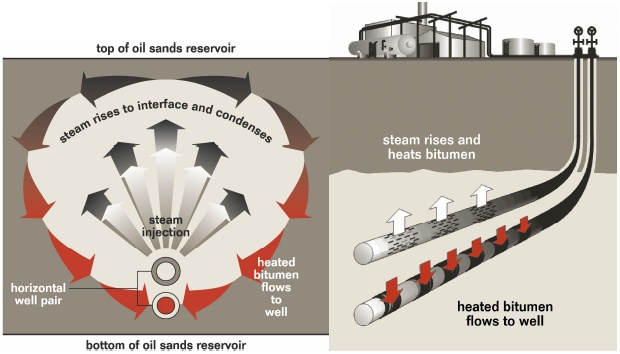

The SAGD Process

SAGD is an in-situ process that removes bitumen from the oil sand reservoir without removing the sand. The bitumen recovery component of the Project will use the SAGD process, as depicted above, which involves drilling multiple pairs of horizontal wells in the oil sands. Steam is injected into the upper well and released in the oil sands reservoir where it heats the bitumen. The heated bitumen becomes mobile and flows with condensed water from the steam to the lower horizontal well and then flows or is pumped to the surface.

The SAGD recovery process used by the Project causes considerably less surface disturbance than mining operations that extracts both the sand and bitumen from the ground, separates the bitumen from the sand and returns the sand to tailings ponds. The SAGD process was first used in 1978 and is being employed as the recovery process in most new or developing in-situ projects.

SAGD Commercial Project

To achieve approximately 72,000 bbl/d of bitumen production, we expect that the Project will require 81 SAGD well pairs. Additional wells will be drilled as required in future years to maintain an annual average production profile of approximately 72,000 bbl/d.

The facilities associated with the SAGD Operation are typical of in-situ projects and consist of bitumen, gas and water processing, steam generation and cogeneration facilities and the infrastructure, such as storage tanks, to support these facilities.

The bitumen is processed to remove water and solids, making it suitable for use in the Upgrader. Until start-up of the Upgrader, the bitumen was blended with diluent and shipped to markets. In the event that the Upgrader is unavailable, the JV Participants will continue to market the bitumen directly. Gas produced with the bitumen is sweetened and used as fuel for the steam generators. Over 90 percent of the water produced with the bitumen will be recycled and converted into steam for injection into SAGD wells. Impurities in the water are removed to allow the water to be used as a feed to the steam generators. The majority of the Project’s initial steam for injection is generated using two cogeneration facilities, each of which consist of a gas turbine and heat recovery steam generator, while the remainder is produced by four once-through boilers. Approximately 170 megawatts of electricity are produced by the combined cogeneration facilities when at full capacity.

The Project was originally designed for steam capacity to support a SOR of approximately 2.4 at a production rate of 72,000 bbl/d of bitumen. If the reservoir performance of the initial well pairs requires operation at a higher SOR, there would not have been adequate steam capacity to allow for the full production rate of 72,000 bbl/d based on the initial design. In order to mitigate this risk, the JV Participants have installed additional water treatment and steam generation facilities to allow for a SOR of up to 3.3, while maintaining the 72,000 bbl/d production rate. The capital cost of these additional facilities is approximately $615 million, or $300 million net to OPTI. The steam generation facilities are mechanically complete and are expected to become operational in the first half of 2009. We expect the long-term average SOR for the Project to be approximately 3.0.

SAGD Pilot Facility

The SAGD Pilot operated from the second quarter of 2003 to the third quarter of 2006. The purpose of the SAGD Pilot was to confirm reservoir performance assumptions and the response of the Long Lake reservoir to the SAGD process as well as to gain site specific operational experience on the drilling, start-up and operation of SAGD well pairs at the Project. The SAGD Pilot consisted primarily of a steam generator and bitumen processing facilities, wellsite facilities and three horizontal well pairs. The initial phase of the SAGD Pilot, consisting of circulating steam into all producer and injector wells, commenced in the second quarter of 2003. In the third quarter of 2003, the wells were switched over to SAGD production mode.

The performance of the three well pairs varied widely, as would be expected in a large scale commercial development. Individual well performance may be influenced by geological factors, including the presence of low bitumen saturation lean zones. Specifically, lean zones were present at the SAGD Pilot and believed to have caused the lower than expected performance of the pilot wells. It is expected that similar lean zones may occur over a portion of the Project area. The SAGD commercial well pairs that have been drilled for the Project are in areas where we expect these zones to occur less frequently than in other areas of the Long Lake leases. In the 156 horizontal commercial wells drilled for the Project, only four wells have encountered lean zones.

The SAGD Pilot operations have provided several important lessons that have been applied to the Project well pairs, including start-up and operating strategies, well bore optimization, stimulation techniques and improvement to reservoir simulation models. Based on the absence of any sand production at the SAGD Pilot, the size of the slotted liners utilized in the Project wells was increased, which is anticipated to allow for enhanced productivity.

During 2006, operation of the SAGD Pilot wells and facility was suspended in order to allow for the tie-in of the wells and portions of the facility to the SAGD Operation. The pilot facility was then tied in with the main SAGD facilities and the SAGD Pilot wells have been re-activated coincident with the SAGD start-up in the spring of 2008.

Long Lake Upgrader

Upgrading of Bitumen

The bitumen recovered by the SAGD Operation is upgraded in the Upgrader. Once the Upgrader ramps up to full production, it will have the capacity to upgrade approximately 72,000 bbl/d of bitumen, yielding approximately 57,700 bbl/d of PSCTM and approximately 800 bbl/d of butane. The JV Participants have sold bitumen blend in the period prior to Upgrader start-up and will continue to do so in periods of Upgrader downtime including periods of major maintenance at the Upgrader. Electricity not consumed by the Project is also sold.

Integrated OrCrudeTM Upgrader

A complete upgrading process has been developed which combines the OrCrudeTM Process with proven hydrocracking and gasification processes to produce PSCTM, a premium sweet crude oil, and syngas, a synthesis fuel gas. The OrCrudeTM Process, when combined with these hydrocracking and gasification processes, is referred to as an "Integrated OrCrudeTM Upgrader." ORMAT Industries Ltd. ("ORMAT") has been granted patents respecting the Integrated OrCrudeTM Upgrader configuration in the United States and Canada. The OPTI License provides OPTI with the exclusive right to the use of and the sub-license of the OrCrudeTM process in Canada.

The syngas produced by an Integrated OrCrudeTM Upgrader is used as clean fuel in the Integrated OrCrudeTM Upgrader, and is also available for other purposes, such as a fuel source for the steam required for in-situ bitumen production (i.e. when the Integrated OrCrudeTM Upgrader is integrated with a SAGD facility) and a fuel source for a cogeneration facility. As a result, the Project will only need to purchase limited amounts of third party natural gas and therefore will have significantly reduced the exposure to fluctuations in natural gas prices. The ultimate exposure to natural gas prices and cost will depend on the SOR achieved. We expect that the integration of the Integrated OrCrudeTM Upgrader and the SAGD facility will create operating cost advantages for the Project over other SAGD projects.

The PSCTM to be produced by the Long Lake Upgrader is expected to have a gravity of approximately 39°API. Therefore, the Project will not be exposed to fluctuating heavy oil differentials during regular operations. The Integrated OrCrudeTM Upgrader produces a light synthetic crude oil which will eliminate the requirement to add diluent to assist in bitumen transportation. There will be no need to purchase diluent for normal operations and no exposure to fluctuations in diluent prices or supply will be present when the Upgrader is fully operational. The Project will only need to purchase diluent for periods when the Upgrader is not operating.

OrCrudeTM Unit

The OrCrudeTM unit receives diluted bitumen from the SAGD Operation, recovers the diluent and recycles it back to the SAGD Operation. It then processes the bitumen and produces the feeds to the gasifiers and the hydrocracker. Because the diluent is generated in the OrCrudeTM unit and recycled back to the SAGD Operation, the Project is not exposed to fluctuations in diluent prices while the Upgrader is operational.

The OrCrudeTM unit first desalts the diluted bitumen in a conventional desalter. The diluted bitumen is then fed to a single train atmospheric distillation column that recovers the diluent stream, an atmospheric gas oil distillate stream, an atmospheric bottoms stream, and some fuel gas. The atmospheric bottoms stream is fed into a vacuum distillation unit where vacuum gas oil distillate is recovered and a vacuum bottoms stream results, which is in turn fed to the solvent deasphalter. There, the vacuum bottoms are deasphalted using a pentane solvent, producing asphaltenes and a deasphalted oil.

The asphaltenes are fed to the gasifier as a liquid stream for the production of syngas. The deasphalted oil is fed to two thermal crackers where it is cracked and recycled back to the distillation section where the converted material is recovered as additional distillate. This cycle continues until 100 percent of the original bitumen is converted to either distillate or asphaltenes. Distillates from both the atmospheric and vacuum units are combined and form the OrCrudeTM Product stream which is fed to the hydrocracker.

ORMAT energy converters will be used to recover thermal energy that would otherwise be wasted in the OrCrudeTM Process. ORMAT energy converters generate power by using the waste heat to vaporize pentane, expanding it across a turbine to generate power and then condensing it with an air cooler.

Gasifier

The gasification technology used in the Integrated OrCrudeTM Upgrader is licensed from Shell Global Solutions International B.V. ("Shell Global Solutions"). There are a number of liquid-feed Shell Global Solutions gasification process trains currently in use around the world today.

The Long Lake asphaltene gasification unit consists of four liquid-feed gasification trains and a common syngas processing train. The gasifier receives the liquid asphaltenes from the OrCrudeTM Process and produces syngas consisting of mostly hydrogen and carbon monoxide.

The oxygen required as part of the gasification process is produced in an air separation unit. This unit consists of large compressors to compress filtered outside air, cool it, and then expand the air to produce a low enough temperature to liquefy the air. The liquid air is then distilled to produce high purity oxygen and nitrogen. The single train air separation unit includes liquid oxygen storage for increased reliability.

The syngas is purified to remove sulphur and other impurities using a SelexolTM solvent stripping process. This is a licensed process from UOP LLC and consists of a single train to contact the lean solvent with the impure gas, allowing impurities to dissolve in the solvent. The impurity-rich solvent is heated and regenerated in a solvent stripper, driving off the impurities into a concentrated gas that is further processed to remove sulphur.

The "clean" syngas is then processed in a pressure swing adsorption unit to recover a portion of the hydrogen from the syngas fuel. The pressure swing adsorption unit produces a high-purity hydrogen and residual syngas fuel. The high-purity hydrogen is used in the hydrocracker. The remaining residual syngas fuel consists of a hydrogen and carbon monoxide mixture that is sent to the Long Lake Upgrader for use as fuel and to the Long Lake SAGD Operation to fuel the steam generators and gas turbine generators.

Soot produced by the gasifier will be separated from the syngas by contacting it with water, producing a soot water slurry. The water is recycled back to the gasification unit.

Initially the soot water slurry is processed to remove a portion of the water which is recycled back to the gasification unit, and the resultant product will be transported by rail or truck for sale to a metal reclaimer or disposed in an approved landfill. However, the JV Participants have developed a method to further process the gasifier soot waste through use of wet oxidation technology. By adding a soot processing facility, the soot solid waste stream is eliminated by further processing the stream into a metals rich product with about 10 percent of the original volume. The resulting product, ash, can be marketed to vanadium processors. This ash processing facility is expected to reduce Project operating costs, provide additional product revenue, and reduce the environmental impact of the plant. Final construction completion of the ash processing unit has been deferred to 2010.

Hydrocracker

The hydrocracker unit contains the facilities to process OrCrudeTM Product into PSCTM. The hydrocracking process is licensed from Chevron Lummus Global LLC ("Chevron Lummus"). There are a number of similar hydrocrackers from Chevron Lummus currently in commercial applications using high pressure hydroprocessing and hydrocracking.

Within the hydrocracker unit, the OrCrudeTM Product is fed to a single hydrotreating reactor, where hydrogen is added over a catalyst to remove sulphur and nitrogen compounds in the OrCrudeTM Product by converting them into gases that are processed in the sulphur treatment facilities. The hydrotreated oil is fed into a hydrocracking reactor where more hydrogen is added in the presence of a catalyst to crack large hydrocarbon molecules into smaller, lighter products.

Products from the hydrocracker are treated in two distillation columns in series to remove gas and butane from the hydrocracked oil. Some butane produced in the units is blended into the PSC product, and the remainder is sold as an end product.

Sulphur Facilities

The sulphur recovery unit treats all of the sour gas and water streams to remove the sulphur as a liquid product for sale. The sulphur recovery unit is licensed by Fluor Intercontinental Inc. and consists of two oxygen enriched sulphur plant trains and a common hydrogenation/amine tail gas treating train to remove virtually all of the total sulphur fed to the Upgrader, including the sulphur from the SAGD wells.

Liquid sulphur is loaded directly onto rail cars for transportation to markets which are primarily in the United States.

The OrCrudeTM Process

Background

The OrCrudeTM Process is a proprietary process owned by ORMAT for upgrading bitumen and heavy oil into OrCrudeTM Product. ORMAT was our principal founding shareholder. ORMAT has received numerous patents respecting the OrCrudeTM Process from the U.S. Patent and Trademark Office and patents from the Canadian Intellectual Property Office, and has additional outstanding patent applications respecting the OrCrudeTM Process in the United States, Canada and other jurisdictions. We have an exclusive license to use the OrCrudeTM Process anywhere in Canada for an unlimited period of time, with the right to sub-license the technology to third parties.

The OrCrudeTM Process consists of three main process units: the distillation unit, the solvent deasphalting unit and the thermal cracking unit. All three processes have been employed in conventional upgraders and refineries around the world for over 70 years. The unique feature of the OrCrudeTM Process is the manner in which the process is integrated to upgrade the deasphalted vacuum residue stream and recycle it to extinction.

The OrCrudeTM Process was successfully used in a 500 bbl/d demonstration plant which was operated from May 2001 to November 2003. The design of the demonstration plant was very similar, with the exception of the capacity, to the OrCrudeTM portion of the Long Lake Upgrader, with nearly the same number of equipment components, process streams and control system elements.

OrCrudeTM Process License

The OrCrudeTM Process is a proprietary process that, when combined with commercially available hydrocracking and gasification technologies, forms a method capable of efficiently upgrading bitumen and heavy oil into PSCTM. On July 30, 1999, ORMAT granted to its subsidiary OPTI Technologies BV ("OPTI BV") an exclusive worldwide license (excluding Israel) to use the OrCrudeTM Process technology for an unlimited period of time, with the right to sub-license the technology to third parties. On that same date, OPTI BV granted us an exclusive license to use the OrCrudeTM Process technology for an unlimited period of time anywhere in Canada, with the right to sub-license the technology to third parties. We refer to this sub-license as the OPTI License.

The key terms of the OPTI License are as follows:

| | • | Improvements made by OPTI BV or ORMAT in the OrCrudeTM Process technology will be deemed to be included in the OPTI License, and OPTI Canada is obligated to license to OPTI BV, at no additional cost, the rights to use and sub-license any improvements made by OPTI Canada to the OrCrudeTM Process technology; |

| | • | OPTI BV is paid a one-time royalty based on the installed cost to the end user of any facility using the OrCrudeTM Process. The estimate of the royalty payable to OPTI BV for the Project is approximately $12 million, of which OPTI’s share is 50 percent as the OrCrude™ unit was completed in 2008 at which time OPTI held a 50 percent interest in the JV; |

| | • | OPTI BV and its affiliates have the right, but not the obligation, to engineer, procure, construct and fabricate the solvent deasphalting units for projects using the OrCrudeTM Process. |

OPTI BV may terminate the OPTI License if OPTI were to be wound-up or become insolvent or materially breach the terms of the OPTI License. Notwithstanding the foregoing, OPTI BV may not terminate the OPTI License in respect of a particular facility if the royalty described above has been paid by OPTI. If OPTI BV’s license from ORMAT is terminated, the OPTI License will convert into a direct license with ORMAT on substantially the same terms and conditions provided for in the OPTI License.

Marketing

We currently use Nexen Marketing to market the products on behalf of the joint venture. These products include Premium Synthetic Heavy ("PSH"), PSCTM, surplus electricity from our Cogeneration Facility and sulphur, and bitumen in the event that the Upgrader is unavailable. OPTI has the right to take such production in kind in certain circumstances. We expect PSC™ to sell at a price similar to West Texas Intermediate (WTI) crude oil. The price OPTI receives is generally the price actually received by Nexen Marketing, subject to certain exceptions. No marketing fees are to be charged by Nexen Marketing. Payment from Nexen Marketing is due within 25 days of the month end following the date of delivery of products to Nexen Marketing.

During SAGD start-up and other periods where the Upgrader is not operational, including during the Upgrader start-up period, diluent is purchased to blend with the bitumen to produce a bitumen blend marketed as PSH. This product is being primarily marketed in the Midwest region of the U.S. to refiners capable of processing heavier crude types. PSH has a gravity of approximately 20° API.

While some PSCTM is expected to be sold in Canada, most volumes are expected to be exported to various refineries in the U.S. Great Lakes and Midwest region with some volumes sold as diluent to other bitumen producers in Canada. PSCTM has a low density (39° API) and low sulphur (<10 parts per million). We believe these characteristics make it attractive to other bitumen producers for use as a diluent which could improve OPTI’s netbacks.

The main crude products, PSH and PSCTM, are transported to market via the Enbridge Athabasca Pipeline.

Infrastructure

The Project is located 42 kilometres southeast of Fort McMurray with connections to existing infrastructure including road access (highways 881 and 63), a natural gas supply pipeline, the electric power transmission grid to allow for both the import and export of electricity and rail. The JV Participants have a long term traffic guarantee agreement with Canadian National Railway Company ("CN") under which traffic is moved to and from the Project site by rail and CN invests in upgrades to the rail line north of Boyle, Alberta. The rail line will move, amongst other commodities, sulphur, catalysts, and construction materials to and from the Project site.

The JV Participants have an agreement with Enbridge to provide lateral facilities and transportation services on the Enbridge Athabasca Pipeline. This pipeline will transport PSH and PSCTM produced by the Project to Hardisty, Alberta. The products are then pipeline transported to markets in Canada and the United States. In addition, the JV Participants also have an agreement with Pembina Oil Sands Pipeline L.P. for the transportation of purchased diluent from the Athabasca Oil Sands Project pipeline system to the Project.

Our Lands and Leases

The following table sets forth our gross and net acreage in respect of the leases comprising our lands as well as the delineation wells the JV Participants have drilled on these lands to December 31, 2008.

| | | Gross Acres | | | Net Acres | | | Delineation Wells | |

| Long Lake | | | 62,720 | | | | 21,952 | | | | 608 | |

| Leismer | | | 93,440 | | | | 32,704 | | | | 160 | |

| Cottonwood | | | 90,240 | | | | 31,584 | | | | 75 | |

| Other | | | 12,800 | | | | 4,480 | | | | - | |

| | | | | | | | | | | | | |

| Total | | | 259,200 | | | | 90,720 | | | | 843 | |

We own a 35 percent interest in the rights to recover bitumen found in the oil sands deposits within the Long Lake, Leismer and Cottonwood leases.

Long Lake Leases

These lands are located in the Athabasca oil sands region of Alberta approximately 40 kilometres south of Fort McMurray. The Long Lake leases cover an area of 98 sections (approximately 62,000 acres) and are estimated by McDaniel to contain approximately 738 million barrels of proved and probable reserves and 254 million barrels of best estimate contingent resources for our 35 percent working interest share. See "Appendix A - Reserves Data and Other Oil and Gas Information."

OPTI’s capital program for 2009 includes funds allocated for additional core hole drilling to further delineate our nearer-term development leases at Long Lake. The 2008/2009 winter program is expected to include the drilling of 21 wells and 47 square kilometres of 3D seismic.

According to the Oil Sands Tenure Regulation (AR 50/2000), the lease on which the Project is located is a deemed primary lease and can be continued beyond its term, whether it is a producing or non-producing lease, if minimum production levels or minimum levels of evaluation, respectively, have been achieved. The JV Participants conducted in excess of the minimum levels of evaluation, and Lease 27 was continued in May 2002 pursuant to section 13 of the Oil Sands Tenure Regulation. The other oil sands leases that govern the Long Lake leases are within their primary terms expiring in 2017 or 2018 unless otherwise continued.

Leismer Leases

The Leismer leases, located approximately 64 kilometres southwest of the Project, are comprised of 146 sections of land and are estimated by McDaniel to contain 668 million barrels of best estimate contingent resources for our 35 percent working interest share. See "Reserves and Resources Summary - Resources Data".

At Leismer, there have been 190 delineation wells drilled by the JV Participants along with 52 square kilometres of 3D seismic gathered. In order to concentrate capital expenditures in 2009 on Phase 1 and nearer-term development projects on the Long Lake lease, no delineation wells or seismic are planned on these leases during the 2008/2009 winter season.

Cottonwood Leases

The Cottonwood Leases, located approximately 32 kilometres southwest of the Project, are comprised of 141 sections of land and are estimated by McDaniel to contain 502 million barrels of best estimate contingent and prospective resources for our 35 percent working interest share. See "Reserves and Resources Summary - Resources Data."

There are over 75 wells drilled on these lands, including 44 drilled by the JV Participants, 25 of which were drilled in 2008. In order to concentrate capital expenditures in 2009 on Phase 1 and nearer-term development projects on the Long Lake lease, no delineation wells or seismic are planned on these leases during the 2008/2009 winter season.

Development of Future Phases

The JV Participants believe that the lands will support approximately 360,000 bbl/d of PSCTM production (126,000 bbl/d net to OPTI) from six phases, including Long Lake Phase 1. Based on reserve and resource estimates, OPTI believes there is potential for three phases at Long Lake. In addition, we believe we have sufficient resources to support two phases at Leismer and one at Cottonwood. From inception, the JV Participants have spent over $800 million on the expansion activities beyond Phase 1 and OPTI expects to continue to invest in engineering and planning for future phases of development.

The sanctioning of Phase 2 will depend on multiple factors including the initial performance of Phase 1, receiving regulatory approval for Phase 2 SAGD operations, receiving clarity on proposed climate change regulations, finalizing cost estimates and an improved economic environment. OPTI therefore does not expect to consider sanctioning of Phase 2 until mid 2010 at the earliest. In addition, the Alberta government announced significant changes to the oil sands royalty regime in late 2007. Increases in royalties will impact the economics of our business and may impact the timing of future investment decisions.

In 2009, the JV partners plan to advance detailed engineering on the SAGD and upgrader facilities for Phase 2 of Long Lake and conduct core hole drilling to further delineate the leases. Regulatory approval has been obtained for the Phase 2 upgrader, which is expected to be constructed adjacent to Phase 1 of the Long Lake Upgrader. The SAGD portion of Phase 2 is planned to be located in the southern portion of the Long Lake lease (Long Lake South). Planning and delineation for the Phase 2 SAGD project is ongoing. In late 2006, a regulatory application for the Long Lake South project was filed, comprising two SAGD phases totalling 140,000 bbl/d of bitumen production in addition to Phase 1. The regulatory approval for this project was obtained in February 2009.

Lease delineation and preliminary environmental evaluations are underway for phases beyond Phase 2. Each future phase is planned to be of a similar size and design to the Project and anticipated to consist of integrated SAGD and OrCrudeTM Upgrader projects. The specific design of these phases will be dependent upon a number of factors including key learnings from Phase 1 and our strategy to address CO2 and other greenhouse gas emissions. Alternatives to facilitate CO2 capture are being evaluated.

Material Agreements Related to the Joint Venture

Background

Prior to March 12, 2004, the Project was being developed by the JV Participants pursuant to the terms and conditions of a MOU dated October 29, 2001. The Project is now governed by the COJO Agreement and, with regard to the associated upgrading technology rights, by a technology agreement between the JV Participants (the "Technology Agreement").

Development of those Long Lake lands not subject to the COJO Agreement and certain other Leismer and Cottonwood area lands is governed by additional construction, ownership and joint operation agreements with Nexen that contain substantially the same terms as the COJO Agreement subject to those material differences as summarized on page 26 and are referred to as the New COJO Agreements. The Technology Agreement will govern these projects as well.

While the MOU was superceded by the COJO Agreement, the New COJO Agreements, and the Technology Agreement with respect to the Project and certain additional lands, the MOU continues to otherwise govern the joint venture relationship between OPTI and Nexen.

The MOU provides for an Area of Mutual Interest respecting Townships 60 to 100 inclusive, and Ranges 1 to 24 inclusive, W4M, excepting certain specific areas. The MOU will govern any new oil sands leases or petroleum and natural gas rights overlying owned oil sands leases jointly acquired by OPTI and Nexen within the Area of Mutual Interest and projects thereon, unless the parties agree otherwise.

COJO Agreement and the Technology Agreement

On March 12, 2004, OPTI and Nexen entered into an interim joint venture agreement whereby it was agreed the COJO Agreement and the Technology Agreement superseded the MOU in respect of the subject matter of those agreements.

The COJO Agreement

General

The COJO Agreement is based on the MOU and relevant provisions of industry standard agreements, and provides for the development, construction, ownership and operation of the Project. The purpose of the COJO Agreement is to document the terms upon which:

| • | the Project will be constructed, owned and operated; |

| • | each JV Participant shall be responsible and pay for its respective share of joint Project costs; and |

| • | the share of the SAGD production volumes, Upgrader products and the surplus Project electricity will be allocated and distributed to each of the JV Participants. |

Subject to available Upgrader capacity, each JV Participant has agreed to process at the Upgrader its entire share of the SAGD production volumes produced from the Project.

Management Committee

The COJO Agreement provides for the establishment of a Management Committee composed of representatives of each JV Participant. The Management Committee exercises supervision and control of each operator and all matters relating to the joint operation of the Project, excluding matters specifically designated to be within the exclusive jurisdiction of an operator, any unresolved audit claims, and the interpretation of the COJO Agreement. Each JV Participant has appointed one representative and one alternate representative to serve on the Management Committee. If there are only two parties to the COJO Agreement, all decisions of the Management Committee are required to be unanimous.

If there are more than two parties, different Management Committee approval thresholds are specified. In such an event, a matter being voted on by the Management Committee will generally be approved only upon the affirmative vote of two or more JV Participants having a combined Project interest of more than 75 percent. However, there are certain exceptions to these voting requirements and, among other things, the COJO Agreement provides that the following matters will be approved by the Management Committee only upon the unanimous approval of all JV Participants with regards to:

| | • | the approval of any design or scope change to a construction plan such that the facility or joint operation in question is or will be substantially different than what was provided for previously; |

| | • | the processing at the Long Lake Upgrader of production from lands other than the Project; |

| | • | any matter which significantly affects the integration of the Long Lake Upgrader and the SAGD Operation; |

| | • | any enlargement work plan and budget, and any amendments thereto; or |

| | • | the termination of the COJO Agreement. |

Operators

Under the original COJO Agreement, OPTI was the operator of the Upgrader and Nexen was the operator of the SAGD facilities. In January 2009, Nexen became the operator of both the SAGD facilities and the Upgrader of Phase 1 and all future phases as per the Nexen Transaction.

An operator may be removed by the vote of two or more JV Participants having a combined Project interest of 55 percent or more under certain conditions.

In addition, after one year from the Upgrader or SAGD operational date, as the case may be, a JV Participant may challenge for operatorship by proposing terms which, if not matched by the existing operator, establish the proposing JV Participant’s operatorship terms.

Operators are required by the COJO Agreement to conduct or cause to be conducted all joint operations for which it is responsible diligently, in a good and workmanlike manner and in accordance with good petroleum industry, construction and environmental practices and principles. Each operator is to conduct or cause to be conducted all joint operations as would a prudent operator under the same or similar circumstances. An operator may sub-contract all or substantially all of its duties and responsibilities to a reliable and competent third party subcontractor or an affiliate of that operator with the approval of and on the terms approved by the Management Committee, provided that such operator retains full control and supervision of such subcontract and that any third party subcontractor is retained on a general arm’s length basis.

Contracts, Agreements and Commitments

A contracting policy and procedure establishes limits on each operator’s authority to enter into agreements on behalf of the JV Participants for Project purposes.

Force Majeure

If prior to an operational date an event or series of events of force majeure suspends a JV Participant’s obligations for longer than one year, any JV Participant is entitled, in certain circumstances, to terminate the COJO Agreement.

Default

Under the terms of the COJO Agreement, each JV Participant has a first priority fixed and specific lien, charge and security interest in and on the right, title, estate and interest of each other JV Participant in the Project (including, without limitation, that JV Participant’s Project interest) to secure payment and performance of each other JV Participant’s Project obligations.

If a JV Participant fails to pay an amount within the time period prescribed in the COJO Agreement or is otherwise in material default under the COJO Agreement, each non-defaulting JV Participant will be entitled to exercise the lien and thereafter enforce the rights and remedies set out in the COJO Agreement that include:

| • | for the period prior to the expenditure by the JV Participants of 80 percent of the aggregate of all costs expended and to be expended in respect of the Project, treat non-payment of amounts as a sale, assignment, transfer and conveyance to the non-defaulting JV Participant of the defaulting JV Participant’s entire Project interest in and to the Project, subject to certain exclusions, provided that such sale, assignment, transfer and conveyance shall not be effective unless and until the non-defaulting JV Participant pays to the defaulting JV Participant as consideration for such sale, assignment, transfer and conveyance 80 percent of the total joint account Project costs paid by the defaulting JV Participant. If this remedy is exercised, the defaulting JV Participant shall have no further obligations thereafter arising in connection with the assigned Project interest; |

| • | for the non-payment of amounts occurring after the expenditure by a JV Participant of 80 percent of such Project costs but before commercial operation of the Project, the JV Participant exercising the lien, upon a default in payment by the other JV Participant, can acquire from the other JV Participant a portion of that JV Participant’s Project interest (subject to certain exclusions) which is determined by multiplying the defaulting JV Participant’s Project interest by the quotient obtained by taking 125 percent of the default amount in question, and dividing that product by the joint account expenditure amount spent in respect of the Project by the defaulting JV Participant as of the default date. If this remedy is exercised, the defaulting JV Participant will have no further obligations thereafter arising in connection with the assigned Project interest; |

| • | withhold from the defaulting JV Participant any further information and privileges with respect to the ongoing operations of the Project, including the right to participate in decisions of the Management Committee, and in such event the non-defaulting JV Participants will be entitled to, subject to certain limitations, vote the defaulting JV Participant’s interest; |

| • | treat the non-payment of an amount as an assignment to the non-defaulting JV Participant of the proceeds of the sale of the defaulting JV Participant’s share of production that has been produced from the Project or has been processed at the Long Lake Upgrader; and |

| • | if the default occurs after commercial production is achieved, the JV Participant exercising the lien may sell the defending JV Participant’s interest in the Project. |

The foregoing and certain other rights can only be exercised after notice from a non-defaulting JV Participant and the expiry of certain cure periods.

Additionally, if material physical damage occurs to Project property prior to the last occurring operational date, each JV Participant shall have the right to nonetheless commence reconstruction efforts. If in certain circumstances reconstruction is not commenced by a JV Participant, we have the right (but not the obligation) to terminate the COJO Agreement and the Technology Agreement.

Technology

Technology developed by the JV Participants in connection with the Project will be jointly owned by the JV Participants, provided that upgrading technology included in the Technology Agreement is expressly not subject to the COJO Agreement but rather is governed by the Technology Agreement.

Marketing

Pursuant to the COJO Agreement all SAGD production volumes, Upgrader products, surplus Project electricity, any sulphur production or any other by-product that is produced from or processed at the SAGD Operation or the Upgrader, as the case may be, shall be marketed by Nexen Marketing on behalf of the JV Participants, subject to each JV Participant’s right to take in kind its share of such committed production in certain circumstances. The price to which each JV Participant shall be entitled for its committed production purchased by Nexen Marketing shall be equivalent to the price actually received by Nexen, subject to certain exceptions. No marketing fees are to be charged by Nexen Marketing.

Right of First Offer

If after the project sanction date a JV Participant wishes to solicit bids or has received an unsolicited bid it is favourably considering in respect of all or any of its interest in the Project, it will by notice (a "ROFO Notice") advise the other JV Participants of its desire to make the disposition. In addition, if a JV Participant executes a binding agreement respecting the sale of all or any of its interests, it will by notice (a "ROFR Notice") advise each other JV Participant, by providing notice of the formal sale agreement. However, a disposing JV Participant is not required to issue a ROFR Notice if that JV Participant had issued a ROFO Notice within the previous 180 days and the consideration set forth in the binding agreement which forms part of the ROFR Notice is at least 95 percent of the consideration set forth in that ROFO Notice.

Nomination Process

The Agreement allows either party to elect to reduce its participation in the project in question. If a party reduces its participation, the other party is obligated to purchase this reduced participation for an amount equal to OPTI’s sunk costs related to the reduced participation. If the other party elects not to purchase the reduced participation, then the project will stop.

The Technology Agreement

The Technology Agreement grants two sets of licensed rights, the AMI License relating to the lands within the Area of Mutual Interest, and the Territory License relating to Canada, excluding the Area of Mutual Interest (the "Territory").

License Rights

Under the AMI License, we have granted to Nexen, for a term commencing on October 31, 2001 and ending October 31, 2026 an exclusive license (with the exception of the license to Suncor) to use the technology to process and upgrade hydrocarbons, including bitumen, oil sands and crude oil (the "Upgrading Technology") associated patents (while they are in force), and information, knowledge and experience of a technical, operating or commercial nature of OPTI, referred to as the Licensor Information, to design, engineer, construct, operate and maintain any facility using the Upgrading Technology, including the right to sub-license the rights to third parties and affiliates.

The Territory License is a perpetual, non-exclusive license, which grants the same rights to Nexen in the Territory as long as that use is for an upgrader used to develop hydrocarbons, including bitumen, oil sands and crude oil in which Nexen has an ownership interest and OPTI has been offered the right to participate. Nexen is able to grant sub-licenses to its affiliates without our permission. For Nexen to grant a sub-license to a non-affiliate for use in an upgrading facility, Nexen must have an interest in the facility, the sub-license must contain terms consistent with the Technology Agreement, including the payment of royalties to us, and we must consent to the issuance of such sub-license.

For the purposes of each of the AMI License and the Territory License, improvements made by us and our affiliates (which includes OPTI BV and ORMAT) are included in the rights licensed to Nexen. In granting the AMI License and Territory License rights, we retain all of its rights and entitlements, including use, associated with the Upgrading Technology. Neither the AMI License rights nor the Territory License rights include the right to design or manufacture any other proprietary products of ORMAT, OPTI BV or ourselves. OPTI and our affiliates’ rights under the Technology Agreement include the right to engineer, procure, construct or fabricate solvent deasphalter units and the right to use the improvements made by Nexen. Our right to use improvements made by Nexen, its affiliates or sub-licensees survives the termination of the Technology Agreement.

Royalty Provisions