QuickLinks -- Click here to rapidly navigate through this document

OPERATING AGREEMENT

OF

BEAZER CLARKSBURG, LLC

THIS OPERATING AGREEMENT (this "Agreement") is made this 15th day of May, 2001, byBEAZER HOMES CORP, a Tennessee corporation ("Beazer").

Explanatory Statement

A. The Members (as hereinafter defined), desiring to form a Maryland limited liability company under the Maryland Limited Liability Company Act, Title 4A of the Corporations and Associations Article of the Annotated Code of Maryland, as amended from time to time, (the "Act") have entered into this Agreement. The Members have caused the formation of a limited liability company under the name Beazer-Clarksburg, LLC (the "Company") and have caused Articles of Organization in the form attached hereto asExhibit A (the "Articles") to be executed and filed with the Maryland State Department of Assessments and Taxation ("SDAT") on May 10, 2001.

B. This operating agreement is subject to, and governed by, the Act and the Articles. The Members hereby ratify the execution and filing of the Articles and approve the Articles as the Articles of Organization of the Company. In the event of a direct conflict between the provisions of this Agreement and either the mandatory provisions of the Act or the Articles, such provisions of the Act or the Articles, as the case may be, will be controlling.

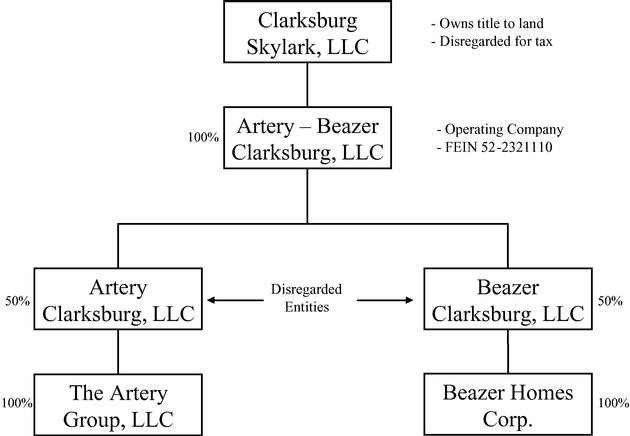

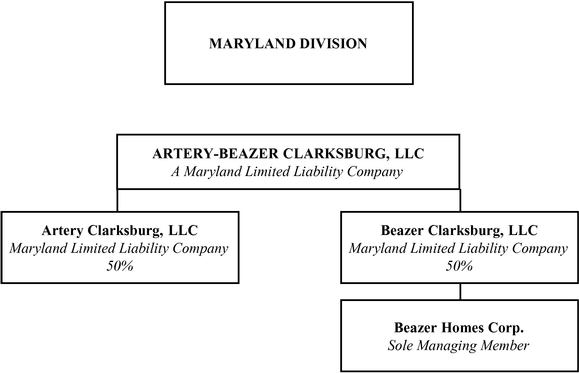

C. The Members of the Beazer Clarksburg, LLC desire to acquire Fifty Percent (50%) of the ownership interests of the newly formed Maryland limited liability company, Artery-Beazer Clarksburg, LLC ("Artery-Beezer"), which in turn shall acquire One Hundred Percent (100%) of the ownership interests of the newly formed Maryland limited liability company, Clarksburg Skylark, LLC, which owns a 374-acre site located in Clarksburg, Maryland (the "Property"), as more particularly described inExhibit B attached hereto, which Property has recently been rezoned PD-4 and which would permit approximately 1,330 residential units and 89,000 square feet of retail use.

NOW, THEREFORE, in consideration of the mutual promises of the Members set forth below, and for other good and valuable consideration, the receipt and sufficiency of which the Members acknowledge, the Members agree as follows:

1. Formation and Name. Beazer ratifies and confirms (a) the formation of the Company as a limited liability company under and pursuant to the provisions of the Act and this Agreement, (b) the name of the Company as "Beazer Clarksburg, LLC."

2. Principal Office and Resident Agent. The principal office of the Company shall be located at c/o Beazer Homes Corp., 8965 Guilford Road, Suite 290, Columbia, Maryland 21046. The name and address of the resident agent for the Company is William M. Shipp, Esquire, 6404 Ivy Lane, Suite 720, Greenbelt, Maryland 20770.

3. Purposes. The purposes for which the Company is formed are as follows: (a) to hold a Membership interest in Artery-Beazer and exercise all power and authority in its capacity as Member thereof (b) to acquire, hold, own, sell, convey, manage, obtain the Approvals for, distribute to the Members, sell portions of the Property to other third party builders and otherwise deal with the Property in accordance with this Agreement; (c) to have and exercise all powers now or hereafter conferred by the laws of the State of Maryland on limited liability companies formed pursuant to the Act; and (d) to do any and all things necessary, convenient or incidental to the achievement of the foregoing.

4. Deleted.

5. Members and Percentage Interest. The names, addresses, and designations of the Members of the Company are as set forth onExhibit "C" attached to and made a part of this Agreement. Each Member shall have a percentage interest ("Interest" or "Percentage of Interest") in the Company as set forth opposite the Member's name onExhibit "C". New members may be admitted to the Company only upon the consent of all the Members and on such terms and conditions as shall be agreed upon by all of the Members and any new Members.

6. Capital and Loans.

6.1 The Members have made initial capital contributions in cash to the Company as set forth onExhibit "C".

6.2 The Members shall make additional capital contributions in cash to the Company as and when needed to pay for the costs, expenses, liabilities, and obligations of the Company relating to the Property, including, without limitation, the costs of acquiring the Property under the Purchase Contract and the costs of obtaining the Approvals. All such capital contributions shall be made equally by the Members.

6.3 The Company shall comply with the terms of the Operating Agreement of Artery-Beazer in connection with the acquisition and development of the Property.

6.4 The Members shall cooperate to arrange for third-party financing for the Company on terms acceptable to the Members.

6.5 If any Member (the "Defaulting Member") fails to make any capital contribution to the Company when required, the other Member (the "Nondefaulting Member") shall have the option, as its sole right and remedy for the default, to loan to the Company, on an unsecured basis, an amount equal to the funds which the Defaulting Member was obligated to contribute to the Company (such loan being referred to as a "Default Loan"). In the event a Default Loan is made, simple interest on the outstanding principal balance of the Default Loan shall accrue at the prime rate of interest then prevailing at large money center banks, as published in the money rates section of the Wall Street Journal, plus five percent (5%). The Default Loan, including all accrued interest, shall be repaid to the Nondefaulting Member no later than the date the Property is distributed to the Members under Section 12 below. Such repayment shall be made by the Defaulting Member supplying sufficient funds to the Company to allow the Company to repay the Default Loan (including all accrued interest) in full. If the Defaulting Member fails to do so by the date of distribution under Section 12, there shall be an adjustment in the Lots to be distributed to the Members under Section 12 so that the Nondefaulting Member receives an additional Lot or Lots having a fair market value as close as possible to (but not less than) the amount of the unpaid principal and accrued interest under the Default Loan. If such value exceeds the amount of the unpaid principal and accrued interest under the Default Loan, then, upon the first sale and conveyance of a distributed Lot to a third party by the Nondefaulting Member, the Nondefaulting Member shall refund to the Defaulting Member the amount of the overage.

6.6 The provisions of this Section 6 are not intended to be for the benefit of any creditor or person (other than a Member in its capacity as Member) to whom any debts, liabilities or obligation are owed by, or who otherwise has a claim against, the Company or any of the Members. No such creditor or other person shall obtain any right or make any claim with respect to any debt, liability or obligation against the Company or any of its Members by virtue of this Section 6.

7. Capital Accounts. A capital account shall be maintained for each Member. The capital account shall reflect all capital contributions actually made by that Member, plus all profit of the Company allocated to that Member and minus the sum of (a) all loss of the Company allocated to that Member, and (b) the amount of cash and the fair market value of any other asset distributed to that

2

Member (net of liabilities assumed or taken subject to by such Member). Each Member's capital account shall be determined and maintained in accordance with the Treasury Regulations adopted under Section 704(b) of the Internal Revenue Code of 1986 as amended, or any corresponding section of any succeeding law. No Member shall be paid interest on any capital contribution, and except as otherwise provided in this Agreement, no Member shall have the right to withdraw or receive any return of the Member's capital contribution. Increases or decreases to a Member's capital account shall not affect a Member's Percentage of Interest.

8. Profits, Losses and Distributions. Profits and losses of the Company and distributions of cash by the Company, if any, shall be allocated between the Members in accordance with the Act.

9. Management.

9.1 The Company shall be managed by David L. Carney (the "Manager"). Without limiting the generality of the preceding sentence, the joint action or joint written approval of the Members shall be required for the following (provided that so long as Beazer Homes Corp. is the sole Member, the signature and consent of David L. Carney without further authorization by the Company shall be sufficient to bind the Company for any act or consent):

A. Execution on behalf of the Company of all documents and instruments which may be necessary or desirable to carry on the business of the Company, including, without limitation, any and all easements, plats, declarations of covenants, deeds, contracts, agreements, leases, mortgages, deeds of trust, promissory notes, security agreements, and financing statements pertaining to the Property.

B. Borrowing of money for and on behalf of the Company.

C. Making of any expenditure on behalf of the Company (i) for any item of cost other than the line items set forth in the budget attached to and made a part of this Agreement asExhibit "D" (the "Budget") or (ii) which would result in a cost overrun in the Budget of Ten Thousand Dollars ($10,000) or more for any line item or Fifty Thousand Dollars ($50,000) or more in the total project costs.

9.2 the Manager shall be responsible for pursuing the Approvals through Artery-Beazer.

9.3 The Manager shall represent the Company in all actions and discussions of Artety-Beazer in connection with the preparation of all plans, approvals, Budgets, etc., concerning the Property.

10. Restrictions on Transfer of Interests. No Member shall sell, exchange, transfer, pledge, mortgage, hypothecate, encumber, or otherwise dispose of all or any part of its respective Interest, nor shall any such Interest be transferable, nor shall any legal or equitable interest in such Interest be sold assigned, transferred, exchanged or otherwise disposed of, without the prior written consent of the other Member.

11. Dissolution. The Company shall be dissolved upon the first to occur of any of the following events: (a) the sale and/or conveyance of all lots and parcels within the Property and the release of all bonds and security related thereto; (b) the unanimous written agreement of all Members; (c) the withdrawal, bankruptcy or dissolution of a Member, or the occurrence of any other event which terminates the continued membership of a Member in the Company; or (d) the recordation of the Subdivision Plats. The events described in (a), (c) and (d), however, shall not result in a dissolution of the Company if all of the Members or remaining Members, as the case may be, unanimously elect, within thirty (30) days after such event, to continue the business of the Company.

12. Liquidation and Termination.

12.1 Subject to any restrictions in agreements to which the Company is a party, the Company shall be terminated after dissolution unless the Members or remaining Members' as the case

3

maybe, elect to continue the Company, in business as provided above in Section 11. In the event of termination, the Members shall promptly liquidate the Company and cease its affairs by discharging all debts and liabilities of the Company and by distributing all assets of the Company as provided below.

12.2 Events of Dissolution. The Company shall be dissolved upon the happening of any of the following events:

12.2.1 Deleted;

12.2.2 upon the unanimous written agreement of all of the Members; or

12.2.3 upon the occurrence of an Involuntary Withdrawal of a Member, unless the remaining Members, within ninety (90) days after the occurrence of the Involuntary Withdrawal, unanimously elect to continue the business of the company pursuant to the terms of this Agreement

12.3 Procedure for Winding Up and Dissolution. In the Company is dissolved, the Manager shall wind up its affairs. On winding up of the Company, the assets of the Company shall be distributed, first, to creditors of the Company, including Interest Holders who are creditors, in satisfaction of the liabilities of the Company, and then to the Interest Holders in accordance with Section 8.

12.4 Filing of Articles of Cancellation. If the Company is dissolved, the Manager shall promptly file Articles of Cancellation with SDAT. If there is no Manager, then the Articles of Cancellation shall be filed by the remaining Members; if there are no remaining members, the Articles shall be filed by the last Person to be a Member, if there is neither a Manager, remaining Members, or a Person who last was a Member, the Articles shall be filed by the legal or personal representatives of the Person who last was a Member.

13. Books and Records. Adequate accounting records of all Company business shall be kept by the Manager and these shall be open to inspection by any of the Members at all reasonable times. Within seventy-five (75) days after the end of each taxable year and at the expense of the Company, the Members shall cause to be prepared a complete accounting of the affairs of the Company, together with whatever appropriate information is required by each Member for the purpose of preparing such Member's income tax return for that year. The accounting and information shall be furnished to each Member.

14. Bank Accounts. If the Members so agree, funds of the Company shall be deposited in Company checking or other bank accounts, subject to such authorized signatures as the Members may determine.

15. Miscellaneous.

15.1 Other Businesses of Members. The Company is one of several businesses in which the Members are active. It is not intended, therefore, that any of the Members will devote full-time effort to the Company, but it is understood that each of the Members shall use its commercially reasonable efforts to further the interests of the Company. However, nothing contained in this Agreement shall be construed as preventing a Member from engaging in any other business activity, including an activity that would compete with this Company's business.

15.2 Liability of the Members. No Member or Manager shall be liable, responsible or accountable in damages or otherwise to any other Member or to the Company for any act or omission performed or omitted by the Member except for acts of gross negligence or intentional wrongdoing.

15.3 Insurance. The Company shall endeavor to obtain liability or other insurance payable to the Company (or as otherwise agreed by the Members) to protect the Company and the Members

4

from the acts or omissions of each of the Members. Such insurance shall be an expense of the Company.

15.4 Binding Provisions. The covenants and agreements contained in this Agreement shall be binding upon the successors and assigns of the respective parties to this Agreement.

15.5 Separability of Provisions. Each provision of this Agreement shall be considered separable and if for any reason any provision or provisions are determined to be invalid under any law, such invalidity shall not impair the operation of or affect those portions of this Agreement that are valid.

15.6 Entire Agreement Amendment. Except for the Development Agreement, this Agreement constitutes the entire understanding and agreement between the parties with respect to the subject matter of this Agreement and supersedes all prior and contemporaneous agreements and understandings, inducements, or conditions, express or implied, oral or written, not contained in this Agreement.

15.7 Waiver of Valuation and Accounting. All Members, for themselves and for their successors and assigns, waive, release, discharge, and dispense with the right to valuation and payment of the Interest of any Member and the right to an accounting of the Interest of any Member.

15.8 Applicable Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, excluding choice of law principles.

15.9 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed to be an original and all of which, taken together, shall constitute one and the same instrument, binding on the Members. The signature of any party to any counterpart shall be deemed a signature to, and may be appended to, any other counterpart.

IN WITNESS WHEREOF, the Members have executed this Agreement under seal the day and year first written above.

| WITNESS: | BEAZER HOMES CORP., a Tennessee corporation | |||

/s/ | By: | /s/ | (SEAL) | |

5

EXHIBIT "C"

OPERATING AGREEMENT

OF

CASEY PROPERTY, LLC

| MEMBER NAME AND ADDRESS | CAPITAL CONTRIBUTION | PERCENTAGE OF INTEREST | |||

|---|---|---|---|---|---|

| Beazer Homes Corp. 8965 Guilford Road, Suite 290 Columbia, MD 21046 Attention: David Carney | $100.00 | 100% | |||

TOTAL | $100.00 | 100.00% | |||

PARTNERSHIPS AND OTHER ENTITIES

As of December 14, 2001

OPERATING AGREEMENT OF BEAZER CLARKSBURG, LLC