YM BIOSCIENCES INC.

AMENDED ANNUAL INFORMATION FORM

YEAR ENDED JUNE 30, 2005

September 8, 2005

EXPLANATORY NOTE: This Annual Information Form has been amended to incorporate by reference the previously filed business acquisition report dated June 28, 2005 in respect of the acquisition of DELEX Therapeutics Inc. on May 2, 2005.

YM BIOSCIENCES INC.

ANNUAL INFORMATION FORM

TABLE OF CONTENTS

| DOCUMENTS INCORPORATED BY REFERENCE | 2 | |||

| GLOSSARY OF TERMS AND PROPER NAMES | 3 | |||

| FORWARD LOOKING STATEMENTS | 7 | |||

| CORPORATE STRUCTURE | 7 | |||

| GENERAL DEVELOPMENT OF THE BUSINESS | 8 | |||

| NARRATIVE DESCRIPTION OF THE BUSINESS (the “Business”) | 10 | |||

| DIVIDENDS | 47 | |||

| CAPITAL STRUCTURE | 47 | |||

| COMMON SHARES | 47 | |||

| MARKET FOR SECURITIES | 48 | |||

| DIRECTORS AND OFFICERS | 48 | |||

| AUDIT FEES | 54 | |||

| LEGAL PROCEEDINGS | 54 | |||

| TRANSFER AGENT AND REGISTRAR | 54 | |||

| MATERIAL CONTRACTS | 54 | |||

| ADDITIONAL INFORMATION | 55 |

DOCUMENTS INCORPORATED BY REFERENCE

YM BioSciences’ “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (the “MD&A”) and the audited consolidated balance sheets as at June 30, 2005 and June 30, 2004, and the audited consolidated statements of earnings and retained earnings and changes in financial position for each of the years in the three year period ended June 30, 2005 (the “Financial Statements”) previously filed.

The MD&A and the Financial Statements, in their entirety, are incorporated by reference in, and form part of, this Annual Information Form. The previously filed business acquisition report dated June 28, 2005 in respect of the acquisition of Delex Therapeutics Inc. on May 2, 2005 is also incorporated by reference in, and forms part of, this Annual Information Form.

All of the documents referred to above have been filed via SEDAR (System for Electronic Document Analysis and Retrieval) and are available to the public at SEDAR’s website, www.sedar.com. Further information may also be found on the Corporation’s website www.ymbiosciences.com.

-2-

GLOSSARY OF TERMS AND PROPER NAMES

This glossary contains general terms used in the discussion of the biopharmaceutical industry, as well as specific technical terms used in the descriptions of our technology and business.

Abgenix - Abegnix Incorporated

Active Immunotherapy - Deliberate stimulation of the patient's own immune response through administration of antigens with or without immunological adjuvants. Therapeutic cancer vaccines are considered Active Specific Immunotherapy agents because the body is stimulated to make its own antibodies specific for the tumor cells

Adjuvant - Substance added to a vaccine to enhance its immunogenicity (i.e. its ability to stimulate an immune response)

Affinity - Binding strength of an antibody to a target

Amgen - Amgen Incorporated

Antisense Drug - Short spans of nucleic acid (DNA or RNA) used to disrupt the expression of disease related genetic code

Aphton - Aphton Corporation

ASCO - The American Society of Clinical Oncology

AZ/AstraZeneca - AstraZeneca PLC

Autocrine - Used herein to describe a hormonal pathway characterized by the production of a biologically active substance by a cell; the substance then binds to receptors on that same cell to initiate a cellular response

Autocrine loop - A self-sustaining process built on a self-feeding positive feedback cycle. Refers to the ability of a substance to act on the same cell that produced it

BMS - Bristol Myers Squibb Company

Cancer Vaccine - Vaccines or candidate vaccines designed to treat cancer, using pure or extracted tumor-specific antigens or using the patient's own whole tumor cells as the source of antigens - see “Active Immunotherapy”

CBQ - Centro de Bioactivos Quimicos (Center for Bioactive Chemicals), Santa Clara, Cuba

cDNA - Cloned copies of mRNA - the essential messenger element of the genes in the DNA that help in the coding of proteins

cGMP - current good manufacturing practices, as mandated from time to time by Health Canada and the FDA

CTA - Clinical Trial Application - an application made for Health Canada, the Canadian health regulatory authority for clinical trial

Chemopotentiator - A substance that enhances the activity of a chemotherapy agent

Chimeric - A chimeric antibody consists mainly of human protein, but the portion of the antibody that binds to the target is still mouse protein

CIM - Centro de Inmunologia Molecular (Center for Molecular Immunology), Havana, Cuba

-3-

CIMAB - a Cuban company responsible for commercializing products developed at CIM

Cisplatin - Approved chemotherapeutic agent

c-myc - Cellular gene involved in proliferation, commonly deregulated in cancer

CTA - Clinical Trial Application - previously known as an Investigational New Drug application which must be filed and accepted by the regulatory agency of Health Canada before each phase of human clinical trials may begin

Cyclophosphamide - Approved chemotherapeutic agent

Cytoprotective - Having the capacity to protect cells

Cytostatic - Having capacity to arrest the growth of cells

Cytotoxic - Having capacity to kill cells

Cytotoxic T cell response - Killing the tumor cell by activated tumor-specific T cells

DELEX - DELEX Therapeutics Inc.

Doxorubicin - Approved chemotherapeutic agent

E. coli - A common bacterial strain often used as a host for recombinant protein production

Eli Lilly - Eli Lilly and Company

EMEA - The Europe Agency for the Evaluation of Medicinal Products - the European health regulatory authority

Epidermal Growth Factor - A growth factor known to be involved in regulation of epithelial cell growth

Epithelial - Derived from epithelium which is the layer of cells forming the epidermis of the skin and the surface layer of the serous and mucous membranes

Estramustine - An approved chemotherapeutic agent

Extracellular domain (ECD) - The portion of a cell surface protein located outside the cell

5-FU - See Fluorouracil

Fluorouracil (5-Fluorouracil, 5-FU) - Approved chemotherapeutic agent

Fusion protein - Two or more proteins genetically engineered to be produced as a single protein

Genentech - Genentech Incorporated

Genmab - Genmab A/S

Genta - Genta Incorporated

Glioma - A form of brain cancer involving the malignant transformation of a glial cell

GMP - good manufacturing practices, i.e. guidelines established by the governments of various countries, including Canada and the United States, to be used as a standard in accordance with the World Health Organization's Certification Scheme on the quality of pharmaceutical products

-4-

GnRH - Gonadotrophin Releasing Hormone; controlling the circulating levels of the sex hormones

HER-1 positive tumors - Tumors expressing/producing the EGF receptor

Hormone-refractory - Term used to indicate that a tumor is no longer responsive to hormone therapy

Humanized - The process whereby an antibody derived from murine cells is altered to resemble a human antibody. Humanized antibodies are less likely to cause allergic reactions when given to humans but retain the biological activity of the original murine form

ImClone - ImClone Systems Incorporated

IND - Investigational New Drug application which must be filed and accepted by the FDA before each phase of human clinical trials may begin

Irinotecan - An approved chemotherapeutic agent

In vivo - In the living body or organism. A test performed on a living organism

ISIS - ISIS Pharmaceuticals

KFDA - Korea Food and Drug Administration - the Korean health regulatory authority

Ligand - Used herein to describe a protein or peptide that binds to a particular receptor

Lorus - Lorus Therapeutics Inc.

Merck - Merck KGaA

Metastatic - A term used to describe a cancer where tumor cells have migrated from the primary tumor to a secondary site (e.g. from prostate to bone)

Mitoxantrone - An approved chemotherapy agent

Monoclonal antibody (“MAb”) - Antibodies of exceptional purity and specificity derived from hybridoma cells (cells which are fused cells, generally MAb produced in mice, that secrete MAbs)

Murine - Derived from mouse cells

NCE - A new chemical entity

NCIC - The National Cancer Institute of Canada

Neoplastic - New and abnormal growth of tissue (neoplasm), which may be benign or cancerous

NSCLC - Non Small Cell Lung Cancer

OFAC - US Department of the Treasury Office of Foreign Asset & Control

Oncogene - A gene that induces or promotes uncontrolled cell growth

Oncoscience - Oncoscience AG

Orange Book - A reference to the Hatch/Waxman Act

-5-

Orphan Drug - A drug aimed at treating a condition with an incidence of less than 200,000 per year in the United States (often given a seven year market exclusivity by the FDA

OSI - OSI Pharmaceuticals, Inc.

Overall Survival - For patients who have died, overall survival was calculated in months from the day of randomization to date of death. Otherwise, survival was censored at the last day the patient is known alive

P64k - Outer membrane protein of N. meningitides

Passive Immunotherapy - Immunologically active material transferred into the patient as a passive recipient. Monoclonal antibodies are considered Passive Immunotherapy since antibodies are generated outside the body and given to the patient

pGp - P-Glycoprotein. A pumping mechanism that removes noxious substances from the cell

pGp inhibitor - Inhibitor of the activity of P-Glycoprotein

P. haemolytica - A bacterium causing respiratory disease in cattle and sheep

Phosphorylation - Addition/donation of a phosphate group to a particular amino acid which can lead to tumor growth

Prednisone - An approved standard anti-inflammatory

Resection - The process of tumor removal

Roche - F.Hoffmann-LaRoche Ltd.

TAP - TAP Pharmaceuticals

Taxol - An approved chemotherapeutic agent

Taxotere - An approved chemotherapeutic agent

TGFα - Transforming growth factor alpha

Th 1 - T helper cell type 1 (generally involved in stimulating a cell-mediated immune response)

Therapeutic vaccine - An approach to the treatment of cancer utilizing “active immunotherapy”

Titers - Term used to express levels of circulating antibodies

Tyrosine kinase - An enzyme that catalyzes the phosphorylation of tyrosine residues in proteins with nucleotides as phosphate donors

Upregulation - Increased production of an RNA transcript or a protein by a cell

Vinyl furan - A chemical polymer

Yttrium 90 - A radioisotope used in the treatment of disease

-6-

FORWARD LOOKING STATEMENTS

Statements contained herein that are not based on historical fact, including without limitation statements containing the words "believes," "may," “likely,” "plans," "will," "estimate," "continue," "anticipates," "intends," "expects" and similar expressions, constitute "forward-looking statements" within the meaning of the US Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward-looking statements. Such factors include, without limitation, changing market conditions, our ability to obtain patent protection and protect our intellectual property rights, commercialization limitations imposed by intellectual property rights owned or controlled by third parties, intellectual property liability rights and liability claims asserted against us, the successful and timely completion of clinical studies, the impact of competitive products and pricing, new product development, uncertainties related to the regulatory approval process, product development delays, our ability to attract and retain business partners and key personnel, future levels of government funding, our ability to obtain the capital required for research, operations and marketing and other risks detailed from time-to-time in the Corporation’s ongoing quarterly filings, annual information forms and annual reports. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this annual information form might not occur.

Unless otherwise indicated, or the context requires otherwise, the information appearing in this annual information form is stated as at June 30, 2005 and references in this annual information form to “$” or “dollars” are to Canadian dollars. Information contained on our website is not part of this annual information form.

CORPORATE STRUCTURE

YM BioSciences Inc. (“YM BioSciences” or “YM” or the “Corporation”) was incorporated under the laws of the Province of Ontario on August 17, 1994. On February 7, 2001 the Corporation changed its name to YM BioSciences Inc. and on December 11, 2001 was continued into the Province of Nova Scotia under the Nova Scotia Companies Act.

The head office and principal place of business of the Corporation is 5045 Orbitor Drive, Building 11, Suite 400, Mississauga, Ontario, L4W 4Y4. The registered head office of YM BioSciences is 1959 Upper Water Street, Suite 800, Halifax, Nova Scotia, B3J 2X2

ORGANIZATIONAL STRUCTURE

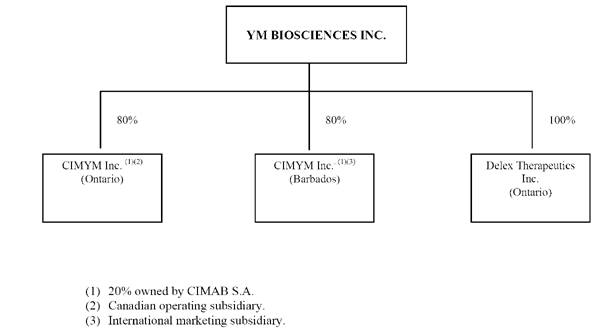

The Corporation currently has three material subsidiaries, shown in the following diagram:

-7-

CIMYM is 80% owned by the Corporation and 20% owned by CIMAB. It is a Canadian operating subsidiary incorporated under the laws of Ontario.

CIMYM (Barbados) 80% owned by the Corporation and 20% owned by CIMAB. It is an international marketing subsidiary incorporated under the laws of Barbados.

DELEX is 100% owned by the Corporation. On May 2, 2005, the Corporation acquired all of the issued and outstanding shares of capital stock of DELEX. YM issued to the DELEX shareholders common shares of YM in consideration for their DELEX shares and additional shares of YM in consideration for working capital in DELEX. See “General Development of the Business” for more details regarding the acquisition. DELEX is now a Canadian operating subsidiary of YM incorporated under the laws of Ontario.

Unless otherwise noted, “YM BioSciences”, “YM”, and the “Corporation” includes YM BioSciences Inc. and its subsidiaries.

GENERAL DEVELOPMENT OF THE BUSINESS

The Corporation was founded in 1994 to acquire rights to develop drug products. The Corporation is principally focused on products for the treatment of patients with cancer.

In 1995, the Corporation secured our first drug licenses and our initial financing. The Corporation initially licensed a range of drug products at various stages of assessment and development, including certain of the Corporation's current anti-cancer products. In 1998, the Corporation decided to concentrate on anti-cancer products. The Corporation has used funds raised in our initial financing and subsequent financings in 1997, 1999, 2000, 2002, 2003 and 2004 to advance certain of our licensed drug products through clinical trials in Canada, the United States and Europe, and to expand our portfolio initially of anti-cancer products by licensing additional drug and cancer-related products in later stages of development. In addition, the Corporation has licensed certain drug products that were in pre-clinical. See “Narrative Description of the Business - Products in Clinical Development” and “- Products in Pre-Clinical Development”.

The Corporation has four product candidates currently in the clinical stage of development:

o TESMILIFENE is a small molecule chemopotentiator that has been clinically demonstrated to augment the anti-tumor activity of the cytotoxic drug families of anthracyclines and taxanes and preclinically of other families of chemotherapy. In a Phase III trial the drug was used in combination with doxorubicin and demonstrated a greater than 50% increase in survival in women with metastatic and recurrent breast cancer compared with the patients treated with doxorubicin alone.

o NIMOTUZUMAB (previously known as TheraCIM hR3), a humanized monoclonal antibody, targeting the protein known as Epidermal Growth Factor Receptor ("EGFr"), is designed to treat epithelial cancers and to be administered prior to, simultaneously with, or subsequent to, chemotherapy and radiotherapy. In various Phase II trials, the drug has doubled the reported complete response rate to radiation in head-and-neck tumors and demonstrated clinical benefit in adult and pediatric glioma. The drug has been approved for sale in the People’s Republic of China, Argentina and Columbia for nasopharangeal cancer in the first case and for head and neck cancer in the latter two.

-8-

o AeroLEF™, a proprietary formulation of both free and liposome-encapsulated fentanyl administered by pulmonary inhalation, is being developed for the treatment of severe and moderate acute pain and cancer pain. AeroLEF™ has been developed to provide both rapid onset and extended relief while recognizing the need for interpersonal variability as well as inter-episode variability in the amount of drug needed. The drug has completed a Phase IIa trial and cleared for initiatiation of a randomized Phase IIb trial.

o NORELINTM is a therapeutic vaccine designed to stimulate the production of antibodies against GnRH in patients, resulting in reduced production of hormones that may cause or contribute to the growth of certain sex-hormone dependent cancers. It has completed a Phase I/II safety and immunogenicity trial in hormone-sensitive prostate cancer suggesting that the approach may be better tolerated than currently available therapies.

o RADIOTHERACIM is a radiolabelled humanized MAb, targeting the EGFr, that completed a pilot trial for the treatment of brain cancers. In published results from that clinical study in patients with glioma the product appeared to increase survival compared with historical results with standard radiation therapy. No additional clinical trials are planned at this time.

The Corporation also has interests in therapeutic cancer vaccines in the pre-clinical stage of development, namely TGFα Cancer Vaccine and HER-1 Cancer Vaccine. The Corporation's license for the TGFα Vaccine and the HER-1 Vaccine is suspended under the terms of the out-licensing agreement in July 2004 between the Corporation, our subsidiary CIMYM, Inc., a Barbados corporation ("CIMYM (Barbados)"), CIMAB and Tarcanta Inc. and Tarcanta, Ltd. (collectively, "Tarcanta"), two wholly-owned subsidiaries of California-based CancerVax Corporation ("CancerVax") relating to Tarcanta licensing TGFα and HER-1 from CIMAB. In connection with the out-licensing agreement, CancerVax has announced that it has received a license from the Office of Foreign Asset Control of the United States Department of Treasury ("OFAC" or "Treasury") authorizing Tarcanta to enter into the transactions with CIMAB and the Corporation. See "Business - Licensing Arrangements - Out-Licensing".

On May 2, 2005, the Corporation acquired DELEX Therapeutics Inc. (“DELEX”), a private clinical stage company developing inhalation-delivered products to treat severe or moderate pain including cancer pain. DELEX’s lead product is AeroLEFTM, a proprietary formulation of opioids for the treatment of acute and breakthrough pain that has completed preliminary efficacy trials and is positioned to undergo further Phase II efficacy trials in 2005.

Through this acquisition, DELEX became a wholly-owned subsidiary of the Corporation. Prior to the acquisition, DELEX’s principal shareholders, in addition to its founders and management, were New Generation Biotech (Equity) Fund, a fund managed by Genesys Capital Partners, BDC Venture Capital, a corporation owned by the Business Development Bank of Canada, and the Eastern Technology Seed Investment Fund Limited Partnership. In consideration for their shares and the accompanying working capital in DELEX, YM BioSciences issued to the DELEX shareholders 1,587,302 common shares upon closing of the transaction. In addition, the Corporation issued 4,603,174 to be held in escrow for the benefit of DELEX shareholders. Of the escrowed common shares an aggregate of 1,825,396 will be released in four tranches of approximately 456,349 common shares each of two in November 2005, May 2006, and November 2006, and May 2007 following closing and up to 2,777,779 common shares in escrow will be released only if specific milestones are achieved, including the receipt of an IND for the planned Phase IIb trial, the conclusion of a strategic partnership for further development and commercialization of the product, and upon the initiation of Phase III trials. On receipt of US regulatory approval, if any, for AeroLEFTM or any product using DELEX’s technology, the Corporation will make an additional payment to the DELEX shareholders of $4.75 million in cash and/or common shares at the Corporation’s option.

In addition to the above consideration, DELEX employees were granted an aggregate of 437,000 stock options under the Corporation’s stock option plan.

There is no indication of any public takeover offers by third parties in respect of the YM's shares or by YM in respect of other companies' shares which have occurred during the last and current financial year.

-9-

NARRATIVE DESCRIPTION OF THE BUSINESS (the “Business”)

The Corporation is a biopharmaceutical company engaged in the development of products primarily for the treatment of patients with cancer. YM generally in-licenses substances designed for anti-cancer use in order to advance them along the regulatory and clinical pathways toward commercial approval. The Corporation's licenses generally cover the major market countries of the developed world (including Canada, the United States, Japan and Europe) or are world-wide. The Corporation uses our expertise to manage and perform what we believe are the most critical aspects of the drug development process which include the design and conduct of clinical trials, the development and execution of strategies for the protection and maintenance of intellectual property rights and the interaction with drug regulatory authorities internationally. YM concentrates on drug development and does not engage in drug discovery, avoiding the significant investment of time and capital that is generally required before a compound is identified as appropriate forclinical trials. YM has in-licensed certain preclinical products which have been related to its clinical programs. YM both conducts and out-sources clinical trials and out-sources the manufacture of clinical materials to third parties.

The Corporation's current portfolio of products in clinical development includes three anti-cancer agents (a small molecule, a vaccine and a monoclonal antibody) in a number of formulations currently targeting nine different tumors and/or stages of cancer as well as a proprietary inhalation delivery system for fentanyl to treat acute pain including cancer pain. The Corporation also has a financial interest in two additional anti-cancer immunotherapies in pre-clinical development. The Corporation intends to license the rights to manufacture and market our drug products to other pharmaceutical companies in exchange for license fees and royalty payments and to continue to seek other in-licensing opportunities in pursuing our business strategy. The Corporation does not currently intend to manufacture or market products although we may, if the opportunity is available on terms that are considered attractive, participate in ownership of manufacturing facilities or retain marketing or co-development rights to specific products.

RISK FACTORS

Risks Related To Our Business

WE ARE IN THE EARLY STAGES OF DEVELOPMENT AND, AS A RESULT, ARE UNABLE TO PREDICT WHETHER WE WILL BE ABLE TO PROFITABLY COMMERCIALIZE OUR PRODUCTS.

The Corporation was founded in 1994 and none of the products, licensed or owned, have received regulatory approval for sale in any of the Corporation’s licensed territories. Accordingly, the Corporation has not generated any revenues from the commercialization of our products. A significant commitment of resources to conduct clinical trials and additional development will be required to commercialize most of the products. There can be no assurance that the products will meet applicable regulatory standards, be capable of being produced in commercial quantities at reasonable cost or be successfully marketed, or that the investment made by the Corporation in the commercialization of the products will be recovered through sales, license fees or related royalties.

WE HAVE A LACK OF REVENUES AND A HISTORY OF LOSSES AND, THEREFORE, ARE UNABLE TO PREDICT THE EXTENT OF ANY FUTURE LOSSES OR WHEN WE WILL BECOME PROFITABLE.

Up to June 30, 2005, the Corporation recognized approximately $748,000 from the out-licensing of our licensed products TGFα and HER-1 from Tarcanta and tesmilifene from Shin Poong. Since incorporation and up to June 30, 2005, YM has an accumulated deficit of $60.8 million. The Corporation expects expenditures and the accumulated deficit to increase as we proceed with our commercialization programs until such time as any sales, license fees and royalty payments generate sufficient revenues to fund our continuing operations.

WE ARE DEPENDENT ON OTHERS FOR THE MANUFACTURE, DEVELOPMENT AND SALE OF OUR PRODUCTS. IF WE ARE UNABLE TO ESTABLISH OR MANAGE COLLABORATIONS IN THE FUTURE, THERE COULD BE A DELAY IN THE MANUFACTURE, DEVELOPMENT AND SALE OF OUR PRODUCTS.

-10-

We do not conduct any of our own basic research. Basic research on a particular product licensed to us or acquired by us is conducted by other biopharmaceutical companies, scientific and academic institutions and hospitals, or scientists affiliated with those institutions. Once the basic research is complete, the Corporation generally enters into license agreements to in-license the right to develop and market the products. The Corporation has negotiated certain in-licensing agreements with: the University of Manitoba, CancerCare Manitoba, Vincent Research and Consulting, CIMAB, Biostar Inc., the Veterinary Infectious Disease Organization ("VIDO") (a division of the University of Saskatchewan), the University of Saskatchewan, and DELEX technology was developed at Dalhousie University. See "Business - Licensing Arrangements - In-Licensing".

The Corporation enters into arrangements with, and is dependent on others with, respect to the manufacture, development and sale of our in-licensed products. Product development includes, but is not limited to, pre-clinical testing, clinical testing, regulatory approvals and the development of additional regulatory and marketing information. The Corporation's ability to successfully develop and commercialize our in-licensed or acquired products is dependent on our ability to make arrangements with others on commercially acceptable terms. The product development process may be delayed or terminated if the Corporation cannot secure or maintain such arrangements. The Corporation does not have long-term, material, third-party manufacture, formulation or supply agreements, except with respect to two of the Corporation's licensed products (TheraCIM and RadioTheraCIM) which are expected to be manufactured by CIMAB or a related party, subject to certain terms and conditions of the licensing agreements between the Corporation and CIMAB. The Corporation has entered into an agreement with Pharm-Olam International, Ltd. ("POI") in connection with clinical testing of tesmilifene.

The Corporation expects to enter into out-licensing agreements with others with respect to manufacturing and marketing our products. The Corporation may retain co-development and marketing rights if management deems it appropriate to do so. At this time, the Corporation has entered into four out-licensing agreements.

The Corporation entered into the first out-licensing agreement through our subsidiary, CIMYM Inc., an Ontario corporation ("CIMYM"). On November 12, 2003, CIMYM out-licensed the rights for TheraCIM in most of Europe to Oncoscience AG (“Oncoscience”) of Germany. Under the terms of the agreement, CIMYM is entitled to receive up to US$30 million as a share of any amounts received by Oncoscience in relation to the development or sublicensing of the product and as a royalty on initial net sales. After CIMYM has received US$30 million, CIMYM continues to receive royalties on net sales but at a lesser percentage.

The Corporation and CIMYM (Barbados) entered into the second out-licensing agreement with Tarcanta and CIMAB relating to Tarcanta licensing TGFα and HER-1 from CIMAB. CancerVax has announced that it has received a license from Treasury authorizing Tarcanta to enter into the transactions with CIMAB and the Corporation. On July 13, 2004, the Corporation, CIMYM (Barbados), CIMAB and Tarcanta entered into a License, Development, Manufacturing and Supply Agreement. By the terms of this agreement with Tarcanta, the 2001 CIMYM License has been suspended until such time, if at all, there is a default under the agreement with Tarcanta. Under the terms of the new agreement and in consideration for the suspension of the 2001 CIMYM License, the Corporation is entitled to receive an aggregate payment of $1,000,000 which is payable in four equal installments, the final payment due December 31, 2005. In addition, under the new agreement the Corporation may receive 35% of an aggregate of $16,350,000 in milestone payments to be paid by Tarcanta upon the successful completion of certain research and development activities. The Corporation has no continuing involvement in these research and development activities and has no future obligations under the development plan established by the out-licensing arrangement between CIMAB and Tarcanta. Finally, the Corporation retains an interest in the revenues from the manufacture and marketing of the drugs or from their sub-licensing. See "Business - Licensing Arrangements - Out-Licensing" and see "Business - Licensing Arrangements - In-Licensing - Licenses for TheraCIM, RadioTheraCIM, TGFα and HER-1".

The Corporation entered into an out-licensing agreement with Kuhnil Pharmaceutical Company (“Kuhnil”) of Seoul, Korea to expand the development program for nimotuzumab (TheraCIM-hR3), its monoclonal antibody against the EGF receptor, for specific population of patients with non-small cell lung cancer (NSCLC). Kuhnil will join the Joint Development Team, already comprised of YM, Oncoscience and CIMAB management, to oversee the development of nimotuzumab. Kuhnil will fund Korean development costs and provide an undisclosed amount of up-front, milestone and royalty payments. In addition, Kuhnil will launch bridging studies in the local population as required by the Korean health regulatory authority, KFDA, in order to support all indications currently under study by CIMYM and Oncoscience to permit them to be launched in Korea and other Asian countries. In Europe, Oncoscience is currently awaiting advice from EMEA for two pivotal trials with nimotuzumab in glioma where the drug is currently undergoing a phase II monotherapy trial in pancreatic cancer.

-11-

The Corporation entered into an agreement with Shin Poong Pharmaceutical Company (“Shin Poong”) of Seoul, Korea to expand the development program for its lead drug, tesmilifene, into gastric cancer. The two companies will form a Joint Development Team to oversee the development of tesmilifene in gastric cancer. Shin Poong will fully fund development costs and provide an undisclosed amount of up-front, milestone and royalty payments. In addition, Shin Poong will launch a bridging study in the local population in calendar 2005 in order to allow the breast cancer indication currently under study by YM to be launched in Korea and other Asian countries. Shin Poong recently completed recruitment for a gastric cancer study with its proprietary taxane drug, Padexol®.

There can be no assurance that the Corporation will be successful in maintaining our relationships with research institutions or others or in negotiating additional in-licensing or out-licensing agreements on terms acceptable to the Corporation or that any such arrangements will be successful. In addition, there can be no assurance that the arrangements between the Corporation and others will prevent other parties from entering into arrangements with such entities for the development or commercialization of similar products or that the parties with whom the Corporation has such arrangements will not be pursuing alternative technologies or developing products either on their own or in collaboration with others, including the Corporation's competitors. If the Corporation does not establish sufficient in-licensing and out-licensing arrangements, we could encounter delays in product introductions or could find that the development, manufacture or sale of our licensed products could be materially adversely affected.

WE HAVE NO EXPERIENCE IN COMMERCIAL MANUFACTURING OF OUR PRODUCTS AND MAY ENCOUNTER PROBLEMS OR DELAYS IN MAKING ARRANGEMENTS FOR PRODUCTS TO BE COMMERCIALLY MANUFACTURED, WHICH COULD RESULT IN DELAYED DEVELOPMENT, REGULATORY APPROVAL AND MARKETING.

The Corporation has not commercially launched any of its licensed or owned products and has no commercial manufacturing experience. To be successful, the products must be manufactured in commercial quantities in compliance with regulatory requirements and at acceptable costs. The Corporation does not have and does not intend to acquire facilities for the production of the products although we may invest in the ownership of production facilities if appropriate opportunities are available.

Two of the Corporation's licensed products (namely, TheraCIM and RadioTheraCIM) are currently manufactured at commercial scale, but in small quantities for testing, by the relevant licensor (namely, CIMAB) or a related party, subject to certain terms and conditions of the licensing agreements between the Corporation and CIMAB. Currently these expectations are being met. There can be no assurance, however, that such entities will be able to develop adequate manufacturing capabilities for additional commercial scale quantities in a commercially reasonable manner.

Three other products of the Corporation which are currently manufactured, and finished and filled, in small quantities for testing, by third parties are tesmilifene and NorelinTM which are licensed and AeroLEFTM which is owned by the Corporation. The manufacturing process for these products is such that the Corporation expects that commercial quantities can be manufactured. If current suppliers cannot manufacture commercial quantities or the Corporation otherwise experiences a problem with current suppliers, it will be necessary for the Corporation to obtain these products from new suppliers. The Corporation does not have supply agreements with the third party suppliers of tesmilifene, NorelinTM or AeroLEFTM, but such suppliers have produced quantities for the Corporation, or in the case of AeroLEFTM for DELEX, to specification on purchase order. The Corporation expects that we could find new suppliers, if necessary. There can be no assurance, however, that the Corporation or our licensors will be able to reach satisfactory arrangements with our current suppliers or, if necessary, new suppliers or that such arrangements will be successful.

All manufacturing facilities must comply with applicable regulations in their jurisdiction or where products are to be sold. In addition, production of the licensed and owned products may require raw materials for which the sources and amount of supply are limited. An inability to obtain adequate supplies of such raw materials could significantly delay the development, regulatory approval and marketing of the Corporation's licensed and owned products.

-12-

WE ARE DEPENDENT ON DEVICES FROM THIRD PARTIES IN ORDER TO SUCCESSFULLY COMMERCIALIZE AEROLEFTM

Device use will be an important element for successful commercialization of AeroLEFTM in both the inpatient and outpatient settings.

We have selected the AeroEclipse(R) inhalation device for our Phase II clinical studies for the inpatient indications for AeroLEFTM and anticipate using the AeroEclipse(R) for our planned Phase III clinical studies for the inpatient market opportunity. Material changes to the AeroEclipse(R) device by the manufacturer, Trudell Medical, or a decision to change to an alternative inhalation device would likely delay the initiation of Phase III clinical trials. A change of devices after the initiation of Phase III studies, however, would require additional clinical trials bridging studies and could significantly delay the commercialization of AeroLEFTM. Currently DELEX purchases the AeroEclipse(R) and it does not have a defined supply agreement.

While inpatient use of AeroLEFTM, in the hospital or hospice setting, may be achieved with existing equipment such as the AeroEclipse(R), outpatient use will require a portable nebulization device. Several devices currently exist and are available for use with approved respiratory agents (bronchodilators, antibiotics, steroids). The Company has an active development program to evaluate and identify the best devices for use with AeroLEFTM and other pipeline products. Although the Company would prefer to access these devices on an arms-length basis from the manufacturer, it will explore the benefits of a strategic partnership that could provide for custom adaptations to optimize product delivery, lower prices or other benefits.

THE DRUG ENFORCEMENT ADMINISTRATION (“DEA”) LIMITS THE AVAILABILITY OF THE ACTIVE INGREDIENTS IN CERTAIN OF OUR CURRENT DRUG CANDIDATES AND, AS A RESULT, OUR QUOTA MAY NOT BE SUFFICIENT TO COMPLETE CLINICAL TRIALS, OR TO MEET COMMERCIAL DEMAND OR MAY RESULT IN CLINICAL DELAYS.

The DEA regulates chemical compounds as Schedule I, II, III, IV and V substances, with Schedule I substances considered to present the highest risk of substance abuse and Schedule V substances the lowest risk. Certain active ingredients in AeroLEFTM, such as fentanyl, are listed by the DEA as Schedule II under the Controlled Substances Act of 1970. Consequently, their manufacture, research, shipment, storage, sale and use are subject to a high degree of oversight and regulation. For example, all Schedule II drug prescriptions must be signed by a physician, physically presented to a pharmacist and may not be refilled without a new prescription. Further, the amount of Schedule II substances we can obtain for clinical trials and commercial distribution is limited by the DEA and our quota may not be sufficient to complete clinical trials or meet commercial demand. There is a risk that DEA regulations may interfere with the supply of the drugs used in our clinical trials, and, in the future, our ability to produce and distribute our products in the volume needed to meet commercial demand.

WE ARE DEPENDENT ON LICENSES FROM THIRD PARTIES AND THE MAINTENANCE OF LICENSES IS NECESSARY FOR OUR SUCCESS.

We have obtained our rights to the licensed products under license agreements from various third party licensors as follows:

| (a) | License Agreement between CIMYM Inc. and CIMAB SA, January 24, 2001 with respect to TGFα and HER-1, which agreement has been suspended in accordance with the terms of the Tarcanta out-licensing agreement (See "Business - Licensing Agreements - Out-Licensing"); |

| (b) | License Agreement between YM BioSciences Inc. (formerly known as York Medical Inc.), University of Manitoba and The Manitoba Cancer Treatment and Research Foundation, carrying on its undertaking as Cancercare Manitoba, dated November 2, 2000 with respect to tesmilifene; |

| (c) | License Agreement between YM BioSciences Inc. (formerly known as York Medical Inc.) and Biostar Inc. dated October 11, 2000 with respect to NorelinTM; and |

| (d) | License Agreement, as amended between YM BioSciences Inc. (formerly known as Yorkton Medical Inc.) and CIMAB SA, dated May 3, 1995 with respect to TheraCIM and RadioTheraCIM. |

-13-

The above listed license agreements are more fully described under the heading "Business Overview - Licensing Arrangements - In-Licensing". The Corporation owns AeroLEFTM and therefore is not subject to a license in respect of it.

The Corporation is dependent upon the licenses for our rights to the licensed products and commercialization of the licensed products. While the Corporation believes we are in compliance with our obligations under the licenses, certain licenses may be terminated or converted to non-exclusive licenses by the licensors if there is a breach of the terms of the licenses. There can be no assurance that the licenses are enforceable or will not be terminated or converted. The termination or conversion of the licenses or the inability of the Corporation to enforce our rights under the licenses would have a material adverse effect on the Corporation as the Corporation would not have products to develop. To the extent that management considers a particular license to be material to the undertaking of the Corporation, the Corporation has entered into a signed license agreement for that license. Terms of certain remaining licenses are to be determined at a later date. The in-license agreements to which the Corporation is currently a party require the Corporation to maintain and defend the patent rights that we in-license against third parties.

Although the Corporation's current in-licenses are governed by the laws of Saskatchewan, Manitoba, Ontario and Canada, and Barbados, the enforcement of certain of them may necessitate pursuing legal proceedings and obtaining orders in other jurisdictions, including the United States and the Republic of Cuba. There can be no assurance that a court judgment or order obtained in one jurisdiction will be enforceable in another. In international venture undertakings it is standard practice to attorn to a neutral jurisdiction to seek remedy for unresolved commercial disputes. These arrangements are usually negotiated as part of the original business agreement. In the case of the out-license agreements by the Corporation, the parties have agreed that the proper laws of the contracts are variously, Ontario or Canada and England.

One of our products is licensed from a developing state. As is the case in many developing states, the commercial legal environment in Cuba is in a formative stage and may be subject to greater political risk. It is possible that the Corporation may not be able to enforce our legal rights in Cuba or against Cuban entities to the same extent as it would in a country with a more developed commercial and legal system. Termination of the Corporation's license arrangements or difficulties in enforcement of such arrangements could have a material adverse effect on the Corporation's ability to continue development of our licensed products.

As described under "Business of the Corporation - Licensing Arrangements", the Corporation has a number of license agreements with CIMAB. CIMAB is an institution of the Government of Cuba that purportedly operates at arms-length from the state bureaucracy with regard to its business, scientific and administrative decision-making. It is akin to a "crown corporation" in Canada. CIMAB's management is purportedly both autonomous and responsible for the success of their business decisions. Despite the fact that CIMAB's management is purportedly both autonomous and responsible for business decisions and that the license agreements with the Corporation declare Ontario as proper law, because of the fact that CIMAB is a state-owned entity, the Corporation will not be able to force CIMAB to comply with any judgment if CIMAB or the Government of Cuba refuses to comply.

WE HAVE ADVANCED FUNDS TO OUR JOINT VENTURE SUBSIDIARIES WHICH WE ARE ONLY ENTITLED TO RECOVER WHEN THE JOINT VENTURE'S NET INCOME EXCEEDS THE AMOUNT OF CUMULATIVE ADVANCES.

YM and CIMAB entered into a funding agreement with CIMYM in November 1995 (the "Funding Agreement") in connection with the 1995 CIMYM License. The Funding Agreement provides that YM will arrange for the appropriate studies and clinical trials for the licensed products held by CIMYM and will fund the cost of such studies and trials provided that doing so would not be commercially or scientifically unreasonable. Accordingly, YM makes the final determination as to whether or not a clinical trial expense is justified with respect to any given product.

-14-

CIMYM (Barbados) was incorporated in Barbados in May 1996 to market the licensed products under the 1995 CIMYM License outside of Canada. YM provides funding to CIMYM (Barbados) under similar terms and conditions as funding to CIMYM, except that while CIMYM has a payable outstanding for the amounts advanced by YM to CIMYM, CIMYM (Barbados) has issued redeemable preferred shares to YM for the amounts advanced to CIMYM (Barbados).

YM is entitled to be reimbursed for all funds we provide pursuant to the Funding Agreement out of revenue generated from the exploitation of the CIMYM License, subject to the successful development of the licensed products and adequate generation of revenue. There can be no assurance, however, that the Corporation will be able to recover the advances, as the Corporation is not entitled to recover such advances unless and until the joint venture's net income exceeds the amount of the cumulative advances.

As at June 30, 2005, YM has advanced $26.7 million to CIMYM and CIMYM (Barbados), collectively. Accordingly, the Corporation has set up a reserve in full against the other joint venture partners share of the advances. All advances have been expensed and, therefore, any reimbursement of such advances would be considered to be income by the Corporation.

WE ARE RELIANT ON LICENSORS FOR RESEARCH ON NEW PRODUCTS.

The Corporation does not conduct our own basic research with respect to the identification of new products. Instead, the Corporation relies upon research and development work conducted by others as a primary source for new products. While the Corporation expects that we will be able to continue to identify licensable products or research suitable for licensing and commercialization by the Corporation, there can be no assurance that this will occur.

WE CONDUCT OUR BUSINESS INTERNATIONALLY AND ARE SUBJECT TO LAWS AND REGULATIONS OF SEVERAL COUNTRIES WHICH MAY AFFECT OUR ABILITY TO ACCESS REGULATORY AGENCIES AND MAY AFFECT THE ENFORCEABILITY AND VALUE OF OUR LICENSES.

The Corporation has conducted clinical trials in more than 20 countries including Canada, the United Kingdom, India, Russia and the United States and intends to, and may, conduct future clinical trials in these and other jurisdictions. There can be no assurance that any sovereign government, including Canada's, will not establish laws or regulations that will be deleterious to the interests of the Corporation. There is no assurance that the Corporation, as a foreign corporation, will continue to have access to the regulatory agencies in any jurisdiction where we might want to conduct clinical trials or obtain final regulatory approval, and there can be no assurance that the Corporation will be able to enforce our licenses in foreign jurisdictions. Governments have, from time to time, established foreign exchange controls which could have a material adverse effect on the Corporation and our financial condition, since such controls may limit the Corporation's ability to flow funds into a country to meet our obligations under in-licensing agreements and to flow funds out of a country which the Corporation may be entitled to, in the form of royalty and milestone payments, under out-licensing agreements. In addition, the value of the Corporation's licenses will depend upon no punitive or prohibitive legislation in respect of biological materials.

WE ALSO CONDUCT OUR BUSINESS INTERNATIONALLY IN THAT WE CURRENTLY LICENSE PRODUCTS AND TECHNOLOGIES FROM SOURCES IN CANADA AND CUBA. WE HAVE PREVIOUSLY, AND INTEND TO, AND MAY, LICENSE PRODUCTS FROM SOURCES IN OTHER JURISDICTIONS.

The Corporation has licensed products, namely TheraCIM and RadioTheraCIM, from an academic institute in Cuba, namely CIM. The United States has maintained an embargo against Cuba, administered by Treasury. The laws and regulations establishing the embargo have been amended from time to time, most recently by the passage of the Cuban Liberty and Democratic Solidarity Act (the "Helms-Burton Bill"). The embargo applies to almost all transactions involving Cuba or Cuban enterprises, and it bars from such transactions any US persons unless such persons obtain specific licenses from Treasury authorizing their participation in the transactions. There is Canadian legislation (the Foreign Extraterritorial Measures Act) which provides generally that judgments against Canadian companies under the Helms-Burton Bill will not be enforced in Canada. The US embargo could have the effect of limiting the Corporation's access to US capital, US finance, US customers and US suppliers. In particular, the Corporation's products licensed from Cuban sources, noted above, are likely to be prohibited from sale in the United States unless Treasury issues a license or the embargo is lifted.

-15-

The Corporation's licensed rights to the TGFα Vaccine and the HER-1 Vaccine are suspended under the terms of the out-licensing agreement between the Corporation, CIMYM (Barbados), CIMAB and Tarcanta relating to Tarcanta licensing TGFα and HER-1 from CIMAB. In connection with the out-licensing agreement, CancerVax has announced that it has received a license from Treasury authorizing Tarcanta to enter into the transactions with CIMAB and the Corporation. See "Business - Licensing Arrangements - Out-Licensing" and see "Business - Licensing Arrangements - In-Licensing - Licenses for TheraCIM, RadioTheraCIM, TGFα and HER-1".

The Helms-Burton Bill authorizes private lawsuits for damages against anyone who "traffics" in property confiscated, without compensation, by the Government of Cuba from persons who at the time were, or have since become, nationals of the United States. The Corporation does not own any real property in Cuba and, to the best of the Corporation's knowledge, and based upon the advice of the Cuban government, none of the properties of the scientific centers of the licensors from where the licensed products were developed and are or may be manufactured was confiscated by the Government of Cuba from persons who at the time were, or have since become, nationals of the United States. However, there can be no assurance that the Corporation's understanding in this regard is correct. The Corporation does not intend to traffic in confiscated property.

Risks Related To Our Financial Results And Need For Financing

WE MAY BE A "PASSIVE FOREIGN INVESTMENT COMPANY" WHICH COULD RESULT IN ADVERSE US TAX CONSEQUENCES FOR US INVESTORS.

The Corporation may be deemed to be a "Passive Foreign Investment Company" ("PFIC"). A PFIC is a non-US corporation that meets an income test and/or an asset test. The income test is met if 75% or more of a corporation's gross income is "passive income" (generally, dividends, interest, rents, royalties, and gains from the disposition of assets producing passive income) in any taxable year. The asset test is met if at least 50% of the average value of a corporation's assets produce, or are held for the production of, passive income. Based on our current income, assets and activities, the Corporation may be a PFIC. See "United States Federal Income Tax Considerations - US Holders". As a result, a US Holder of the Corporation's common shares could be subject to increased tax liability, possibly including an interest charge, upon the sale or other disposition of the US Holder's common shares or upon the receipt of "excess distributions".

WE MAY NOT BE ABLE TO OBTAIN NECESSARY FUNDING FROM SALES OR LICENSE FEES OR ROYALTIES AND, AS A RESULT, MAY NEED TO TRY TO OBTAIN FUTURE CAPITAL THROUGH THE PUBLIC MARKET OR PRIVATE FINANCING WHICH MAY NOT BE AVAILABLE ON ACCEPTABLE TERMS.

The Corporation may require additional funding for the commercialization of our products, licensed and owned, and we will require additional funds if new products are licensed or acquired and put into development. The amount of additional funding required depends on the status of each project or new opportunity at any given time. The Corporation's business strategy is to in-license rights to promising drug products, further develop those products by progressing the products toward regulatory approval by conducting and managing clinical trials, and finally to out-license rights to manufacture and/or market resulting drug products to other pharmaceutical firms in exchange for royalties and license fees. Due to the in- and out-licensing arrangements and the Corporation's dependence on others for the manufacture, development and sale of our in-licensed products, the Corporation does not have consistent monthly or quarterly expenditures and cannot determine the amount and timing of required additional funding with any certainty. As at June 30, 2005 the Corporation had cash and short-term deposits totaling $30,568,845 and payables of $3,825,615. Management expects that the current cash reserves will be sufficient to fund the Corporation's development program beyond the fiscal year ending June 30, 2006.

-16-

The Corporation assesses our additional funding needs on a project-by-project basis from time-to-time. To the extent that the Corporation is unable to fund our expenditures from sales, license fees and royalties, it may be necessary to reconsider the continuation of existing projects or entering into new projects, or require the Corporation to access either the public markets or private financings whenever conditions permit. In addition, the Corporation has no established bank financing arrangements and there can be no assurance that the Corporation will be able to establish such arrangements on satisfactory terms. Such financing, if required and completed, may have a dilutive effect on the holders of our common shares. There is no assurance that such financing will be available if required, or that it will be available on favorable terms.

OUR OPERATING RESULTS AND STOCK PRICE MAY FLUCTUATE SIGNIFICANTLY.

The trading price of the Corporation's common shares, as with many emerging biopharmaceutical companies, is likely to be highly volatile. Factors such as the efficacy of the Corporation's products or the products of the Corporation's competitors, announcements of technological innovations by the Corporation or our competitors, governmental regulations, developments in patents or other proprietary rights of the Corporation, our licensors or our competitors, litigation, fluctuations in the Corporation's operating results, the Corporation being thinly capitalized, market conditions for biopharmaceutical stocks and general market and economic conditions could have a significant impact on the future trading price of the common shares. In addition, the Corporation's common shares are highly volatile since it may take years before any of our licensed products will receive final regulatory approval to be marketed in Canada, the United States or other territories.

Since September 30, 2004, our common shares have been listed for trading on the American Stock Exchange. However, there can be no assurance that an active trading market in our shares in the US will be sustained. Similarly, there can be no assurance that an active trading market in our shares on the TSX or AIM will be sustained.

Risks Related To Our Industry

IF OUR PRE-CLINICAL AND CLINICAL TESTING OF DRUG PRODUCTS DO NOT PRODUCE SUCCESSFUL RESULTS, WE WILL NOT BE ABLE TO COMMERCIALIZE OUR PRODUCTS.

Each of the Corporation's products, licensed or owned, must be subjected to additional pre-clinical and/or clinical testing in order to demonstrate the safety and efficacy of the Corporation's products in humans. The Corporation's ability to commercialize our products will depend on the success of currently ongoing pre-clinical and clinical trials and subsequent pre-clinical and clinical trials that have not yet begun.

The Corporation is not able to predict the results of pre-clinical and clinical testing of drug products, including the Corporation's products. It is not possible to predict, based on studies or testing in laboratory conditions or in animals, whether a drug product will prove to be safe or effective in humans.

In addition, success in one stage of testing is not necessarily an indication that the particular drug product will succeed in later stages of testing and development. There can be no assurance that the pre-clinical or clinical testing of the Corporation's products will yield satisfactory results that will enable the Corporation to progress toward commercialization of such products. Unsatisfactory results may cause material adverse affects on the Corporation's business, financial condition or results of operations as it could result in the Corporation having to reduce or abandon future testing or commercialization of particular drug products.

-17-

IF OUR COMPETITORS DEVELOP AND MAINTAIN THEIR TECHNOLOGICAL CAPABILITIES BETTER THAN THE CORPORATION, WE MAY NOT BE ABLE TO REMAIN COMPETITIVE IF DEFICIENCIES IN OUR TECHNOLOGICAL CAPABILITIES DELAY PRE-CLINICAL AND CLINICAL TRIALS OF OUR PRODUCTS.

The Corporation's success depends in part on developing and maintaining a competitive position in the development and commercialization of our products, licensed or owned, and technological capabilities in our areas of expertise. The biotechnology and pharmaceutical industries are subject to rapid and substantial technological change. While the Corporation will seek to expand our technological capabilities in order to remain competitive, there can be no assurance that developments by others will not render the Corporation's products non-competitive or that the Corporation or our licensors will be able to keep pace with technological developments. Competitors have developed technologies that could be the basis for competitive products. Some of those products may have an entirely different approach or means of accomplishing the desired therapeutic effect than the Corporation's products and may be more effective or less costly than the Corporation's products. In addition, other forms of medical treatment may offer competition to the products. The Corporation's technological capabilities and competitiveness and the success of the Corporation's competitors and their products and technologies, could have a material adverse impact on the future pre-clinical and clinical trials of the Corporation's products, including the Corporation's ability to obtain the necessary regulatory approvals for the conduct of such clinical trials.

IF OUR COMPETITORS DEVELOP AND MARKET PRODUCTS THAT ARE MORE EFFECTIVE THAN OUR EXISTING PRODUCT CANDIDATES OR ANY PRODUCTS THAT WE MAY DEVELOP, OR OBTAIN MARKETING APPROVAL BEFORE WE DO, OUR PRODUCTS MAY BE RENDERED OBSOLETE OR UNCOMPETITIVE.

Technological competition from pharmaceutical companies, biotechnology companies and universities is intense and is expected to increase. Many competitors and potential competitors of the Corporation have substantially greater product development capabilities and financial, scientific, marketing and human resources than the Corporation. The Corporation's future success depends in part on our ability to maintain a competitive position, including our ability to further progress our products, licensed or owned, through the necessary pre-clinical and clinical trials towards regulatory approval for sale and commercialization. Other companies may succeed in commercializing products earlier than the Corporation is able to commercialize our products or in developing products that are more effective than our products. The Corporation considers its main competitors to be: Genentech, Inc. ("Genentech"), Lorus Therapeutics Inc., ISIS Pharmaceuticals and Eli Lilly and Company with respect to tesmilifene; Aphton Corporation ("Aphton"), TAP Pharmaceuticals and AstraZeneca PLC ("AstraZeneca") with respect to NorelinTM; and Abgenix Inc. ("Abgenix"), Amgen Inc. ("Amgen"), Genmab A/S ("Genmab"), ImClone Systems Inc. ("ImClone"), Bristol-Myers Squibb Company ("BMS"), Merck KGaA ("Merck"), OSI Pharmaceuticals, Inc. ("OSI"), F.Hoffmann-LaRoche Ltd. ("Roche"), Genentech and AstraZeneca with respect to TheraCIM and RadioTheraCIM. The main competitors for the AeroLEFTM product are Cephalon, Inc. (“Cephalon”), Endo Pharmaceuticals Holdings Inc. (“Endo”), LAB International Inc. (“LAB”), Alexza Molecular Delivery Corporation (“Alexza”), Aradigm Corporation (“Aradigm”), Barr Pharmaceuticals, Inc. (“Barr”), CeNeS Pharmaceuticals plc (“CeNeS”) and Alza Corporation (“Alza”).

While the Corporation will seek to expand our technological capabilities in order to remain competitive, there can be no assurance that research and development by others will not render our products obsolete or uncompetitive or result in treatments or cures superior to our products, or that our products will be preferred to any existing or newly developed technologies.

WE ARE SUBJECT TO EXTENSIVE GOVERNMENT REGULATION THAT INCREASES THE COST AND UNCERTAINTY ASSOCIATED WITH GAINING FINAL REGULATORY APPROVAL OF OUR PRODUCT CANDIDATES.

Securing final regulatory approval for the manufacture and sale of human therapeutic products in Canada and the Corporation's other territories, including the United States, is a long and costly process that is controlled by that particular territory's national regulatory agency. The national regulatory agency in Canada is Health Canada ("Health Canada"), and in the United States it is the United States Health and Human Services Food and Drug Administration ("FDA"). See "Regulatory Approvals" for a description of approval processes in Canada and the United Sates. Other national regulatory agencies have similar regulatory approval processes, but each national regulatory agency has its own approval processes. Approval in either Canada or the United States does not assure approval by other national regulatory agencies, although often test results from one country may be used in applications for regulatory approval in another country.

-18-

Prior to obtaining final regulatory approval to market a drug product, every national regulatory agency has a variety of statutes and regulations which govern the principal development activities. These laws require controlled research and testing of products, government review and approval of a submission containing pre-clinical and clinical data establishing the safety and efficacy of the product for each use sought, approval of manufacturing facilities including adherence to GMP during production and storage, and control of marketing activities, including advertising and labeling.

None of the Corporation's products have been completely developed or tested and, therefore, we are not yet in a position to seek final regulatory approval to market any of our products, licensed or owned. To date we have obtained various regulatory approvals to develop and test our products. Currently the Corporation is conducting an international Phase III trial of tesmilifene in metastatic and recurrent breast cancer in 700 patients. The Corporation has received regulatory approvals for the tesmilifene study in several countries, including Canada and the United States, and approval is pending in a few other countries. In addition, TheraCIM has been approved for testing in Canada and Europe and has been designated an orphan drug in Europe and by the FDA in the United States. Finally, DELEX has conducted Phase I and II trials in Canada of AeroLEFTM. See "Products in Clinical Development".

Two of the Corporation's products, namely TheraCIM and RadioTheraCIM which are being developed in Canada and Europe are also being separately developed or tested in Cuba. Cuba is among several nations which have been identified by the US Department of State as being a state sponsoring terrorism and as such the US Government has put in place certain anti-terrorism controls against Cuba. Although as of the date of this filing such anti-terrorism controls have not had any adverse affect on the operations of the Corporation, because of the anti-terrorism controls and the Helms-Burton Bill there is no assurance that the Corporation will be able to successfully complete clinical testing in the United States and obtain final regulatory approval or a license from OFAC in order to successfully commercialize our Cuban sourced products in that jurisdiction. There can be no assurance that the licensed products will be successfully commercialized. The process of completing clinical testing and obtaining final regulatory and other US government approvals to market the licensed products is likely to take a number of years for most of the licensed products and require the expenditure of substantial resources. Any failure to obtain, or a delay in obtaining, such approvals could adversely affect the Corporation's ability to develop the product and delay commercialization of the product. Further, there can be no assurance that the Corporation's licensed products will prove to be safe and effective in clinical trials under the standards of the regulations in the Corporation's territories or receive applicable regulatory approvals from applicable regulatory bodies.

CHANGES IN GOVERNMENT REGULATIONS ALTHOUGH BEYOND OUR CONTROL COULD HAVE AN ADVERSE EFFECT ON OUR BUSINESS.

The Corporation has, or has had, licenses with, or clinical trials at, various academic organizations, hospitals and companies in Canada, Cuba, Italy, the United States and the United Kingdom and numerous other countries and depends upon the validity of our licenses and access to the data for the timely completion of clinical research in those jurisdictions. Any changes in the drug development regulatory environment or shifts in political attitudes of a government are beyond the control of the Corporation and may adversely affect our business.

Two of the Corporation's products, namely TheraCIM and RadioTheraCIM which are being developed in Canada and Europe are also being separately developed or tested in Cuba. Cuba is among several nations which have been identified by the US Department of State as being a state sponsoring terrorism and as such the US Government has put in place certain anti-terrorism controls against Cuba. Although as of the date of this filing such anti-terrorism controls have not had any adverse affect on the operations of the Corporation, because of the anti-terrorism controls and the Helms-Burton Bill there is no assurance that the Corporation will be able to successfully complete our clinical testing and obtain final regulatory approval in order to successfully commercialize our Cuban sourced products.

The business of the Corporation may also be affected in varying degrees by such factors as government regulations with respect to intellectual property, regulation or export controls. Such changes remain beyond the control of the Corporation and the effect of any such changes cannot be predicted.

These factors could have a material adverse effect on the Corporation's ability to further develop our licensed products.

-19-

Risks Related To Intellectual Property And Litigation

OUR SUCCESS DEPENDS UPON OUR ABILITY TO PROTECT OUR INTELLECTUAL PROPERTY AND OUR PROPRIETARY TECHNOLOGY.

The Corporation's success will depend, in part, on the ability of the Corporation and our licensors to obtain patents, maintain trade secrets protection, and operate without infringing on the proprietary rights of third parties or having third parties circumvent the Corporation's rights. Certain licensors and the institutions that they represent, and in certain cases, the Corporation on behalf of the licensors and the institutions that they represent, have filed and are actively pursuing certain applications for Canadian and foreign patents. The patent position of pharmaceutical and biotechnology firms is uncertain and involves complex legal and financial questions for which, in some cases, important legal principles are largely unresolved. There can be no assurance that the patent applications made in respect of the licensed products will result in the issuance of patents, that the term of a patent will be extendable after it expires in due course, that the licensors or the institutions that they represent will develop additional proprietary products that are patentable, that any patent issued to the licensors or the Corporation will provide the Corporation with any competitive advantages, that the patents of others will not impede the ability of the Corporation to do business or that third parties will not be able to circumvent the patents obtained in respect of the licensed products. The cost to the Corporation of obtaining and maintaining patents is high. Furthermore, there can be no assurance that others will not independently develop similar products which duplicate any of the licensed products, or, if patents are issued, design around the patent for the product. There can be no assurance that processes or products of the Corporation's licensors or the Corporation do not or will not infringe upon the patents of third parties, or that the scope of patents issued to the Corporation's licensors or the Corporation will successfully prevent third parties from developing similar and competitive products.

Much of the Corporation's know-how and technology may not be patentable, though they may constitute trade secrets. There can be no assurance, however, that the Corporation will be able to meaningfully protect our trade secrets. To help protect our rights, the Corporation requires employees, consultants, advisors and collaborators to enter into confidentiality agreements. There can be no assurance that these agreements will provide meaningful protection for the Corporation's trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure.

Further, the Corporation's business may be materially adversely affected by competitors who independently develop competing technologies, especially if no patents or only narrow patents are obtained by the Corporation in respect of our licensed products.

The Corporation maintains patents in connection with tesmilifene, NorelinTM, TheraCIM and AeroLEFTM. The following is a description of the Corporation's key current and pending patents in connection with these drug products.

TESMILIFENE

YM is the exclusive licensee to patents and patent applications from the University of Manitoba for tesmilifene. Patents that claim the use of tesmilifene in combination with chemotherapeutic agents have issued in the United States, Europe, Japan, Canada and Australia. US patent 5,859,065 broadly claims the use of tesmilifene and structurally related analogs in combination with any chemotherapeutic for the treatment of any cancer. Although the twenty-year term of this patent expires in December 2010, YM plans to take full advantage of patent terms extensions of up to five additional years granted under the Patent Term Restoration Act in the United States. Other issued patents US 6,284,799 and US 5,747,543 expire in 2014 and 2015 respectively.

In addition to these granted patents, YM is also exclusively licensed to patent applications relevant to the current clinical development program. Patent applications, based upon WO 03/039526 and WO 03/037318, have been nationalized not only in the United States, Western Europe, and Japan but also in emerging markets, including China, India, Asia, and Eastern Europe. These international patent applications claim the use of tesmilifene in patient subpopulations that benefit from the chemopotentiating and cytoprotective properties of the drug. Patents resulting from these patent filings will expire in November 2022.

-20-

In addition to patent protection, YM intends to rely upon the available term of data exclusivity in the US and other countries for an NCE. Furthermore, full advantage will be taken of the Orange Book provisions in the United States and equivalent provision in Canada and other countries, as a means for delaying generic competition.

NORELINTM

YM has a license to human therapeutic applications of this GnRH vaccine based on a leukotoxin-derived but non-leukotoxic carrier protein, to which multimeric units of GnRH are coupled at each flank. By eliciting an antibody response to GnRH, NorelinTM is designed to block GnRH from reaching its receptors in the pituitary gland.

The NorelinTM patent estate is extensive, and includes four key US patents covering various aspects of NorelinTM as a composition of matter, the carrier component of the NorelinTM vaccine, as well as production of NorelinTM as a recombinant product. A key US patent is US 5,837,268, which covers the particular NorelinTM sequence, its formulation as a vaccine, and its end-use, and subject to any term restoration, will expire in 2012. Other key US patents are US 5,422,110; US 5,708,155; and US 5,837,268. All of the key patents are owned by the University of Saskatchewan and licensed to YM, through Biostar (See "Licensing Arrangements").

In addition, YM has more recently applied for our own patents covering the NorelinTM formulation and dosing regimen that was the subject of our clinical trials. Patents resulting from these applications will not expire until 2024.

The Corporation is aware of US patent #6,303,123 owned by Aphton relating to the use of GnRH immunogenic conjugates to treat GnRH-dependent diseases, including prostatic hypertrophy, and is developing a strategy for addressing this patent should it prove relevant to the Corporation's commercial activities with NorelinTM.

There can be no assurance that litigation or other proceedings will not be commenced seeking to challenge patent protection or patent applications of the Corporation's licensors, or that any such challenges will not be successful. The cost of litigation to uphold the validity and prevent infringement of patents related to the Corporation's licensed drug products may be significant. In addition, it is possible that others may claim rights in YM's licensed drug products, patents or patent applications. These other persons could bring legal actions against the Corporation, our licensors or our customers or licensees claiming damages and seeking to enjoin them from using, manufacturing and marketing the affected products or processes. If any such action were successful, in addition to any potential liability for damages, the Corporation could be required to obtain a license in order to continue to develop, use, license or market the affected product or process. There can be no assurance that the Corporation would prevail in any such action or that any required license would be made available or, if available, would be available on acceptable terms.

THERACIM

CIMYM is the exclusive licensee for particular territories including the United States under a patent estate that includes composition of matter coverage for Nimotuzumab, and further includes coverage for TheraCIM-based formulations and end-uses in the treatment of EGFR-dependent cancers. The composition of matter patents are granted in the United States, in Europe, are allowable in Japan, and are pending in Canada.

CIMYM's key US patent, US 5,891,996 expires in November 2015, and term extensions of up to five years may be available under the Patent Term Restoration Act. The same term and extension apply also to the key European patent, EP 712863.

The Corporation is aware of US patent #5,770,195 granted to Genentech, Inc. ("Genentech"), for the anti-cancer use of EGFr MAbs in combination with a cytotoxic agent. The Corporation is also aware of US patents granted to others in this field. In April 2001 Rorer International (Overseas) ("Rorer") was issued the US patent #6,217,866 which includes claims to any antibody targeting the EGFr administered with any anti-neoplastic agent. A counterpart patent has been granted in Europe. The Corporation has filed an opposition to the grant of the European patent. The Corporation believes that the Rorer patents are licensed to ImClone. Management is aware that inventorship of the Rorer patent is currently being challenged. In the event that the challenge is successful , management believes we will be able to obtain licenses under such patents on commercially reasonable terms, though there can be no assurance thereof. In addition, the Corporation is aware of a separate series of national patent applications filed by ImClone, and represented by EP1080113, claiming the anti-cancer use of radiation in combination with any inhibitor of any receptor tyrosine kinase that is involved in the genesis of tumors. ImClone is also reported to have filed a PCT application covering the use of EGFr MAbs to treat patients having tumors that do not respond to treatment with conventional therapies. The Corporation is also challenging ImClone's claims in respect of the radiation-related patent applications by having filed additional prior art at the relevant national patent offices. The outcome of these challenges cannot be predicted, and there can be no assurance that the Corporation will succeed in challenging the validity or scope of patent claims by ImClone or any other patent applicant.

-21-

The manufacturing of TheraCIM may fall within the scope of process patents owned by Protein Design Labs Inc., Genentech, and the Medical Research Council of the United Kingdom. Management is aware that some of these process patents are currently being challenged by companies other than YM. In the event any of the applicable process patents are upheld, management believes we will be able to obtain licenses under such patents on commercially reasonable terms, though there can be no assurance thereof.