Exhibit 99.1

YM BIOSCIENCES INC.

NOTICE OF 2010

ANNUAL AND SPECIAL MEETING

OF SHAREHOLDERS

AND

MANAGEMENT

PROXY CIRCULAR

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT the annual and special meeting (the “Meeting”) of shareholders of YM BioSciences Inc. (the “Corporation”) will be held at the offices of Ogilvy Renault LLP, located at Royal Bank Plaza, South Tower, 200 Bay Street, Suite 3800, Toronto, Ontario, Canada M5J 2Z4, on Thursday November 18, 2010 at 4:00 PM (Toronto time) for the following purposes:

| | 1. | to receive the 2010 Annual Report of the Corporation, containing the audited consolidated financial statements of the Corporation for the fiscal year ended June 30, 2010, and the auditor’s report thereon; |

| | 2. | to pass a special resolution fixing the number of directors of the Corporation at nine; |

| | 3. | to elect the directors of the Corporation; |

| | 4. | to reappoint the auditors and authorize the directors to fix their remuneration; |

| | 5. | to pass a resolution reconfirming the Corporation’s shareholder rights plan; and |

| | 6. | to transact such further and other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

The specific details of the matters proposed to be put before the Meeting are set forth in the Management Proxy Circular that accompanies and forms part of this Notice.

Dated at Toronto, Ontario, October 8, 2010.

BY ORDER OF THE BOARD OF DIRECTORS

David G.P. Allan (signed)

Chairman and Chief Executive Officer

___________________________________________________________________

Notes:

| 1. | A Management Proxy Circular, Proxy and the 2010 Annual Report accompany this Notice of Meeting. Registered shareholders who are unable to be present at the Meeting are kindly requested to specify on the accompanying form of proxy the manner in which the shares represented thereby are to be voted, and to sign, date and return same in accordance with the instructions set out in the Proxy and Proxy Circular. |

| 2. | The directors have fixed a record date of October 8, 2010. Accordingly, shareholders registered on the books of the Corporation at the close of business on October 8, 2010, are entitled to notice of the Meeting. |

| 3. | Persons who are registered as shareholders on the books of the Corporation at the close of business on October 8, 2010 are entitled to vote at the Meeting. |

| 4. | If you are a beneficial shareholder and receive these materials through your broker or another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or intermediary. |

MANAGEMENT PROXY CIRCULAR

Table of Contents

| SOLICITATION OF PROXIES | | | - 1 - | |

| | | | | | | |

| MANNER IN WHICH PROXIES WILL BE VOTED | | | - 1 - | |

| | | | | | | |

| VOTING BY BENEFICIAL SHAREHOLDERS | | | - 2 - | |

| | | | | | | |

| AUTHORIZED CAPITAL | | | - 3 - | |

| | | | | | | |

| PRINCIPAL HOLDERS OF VOTING SECURITIES | | | - 3 - | |

| | | | | | | |

| PARTICULARS OF MATTERS TO BE ACTED ON | | | - 3 - | |

| | | | | | | |

| | 1. | | Fixing the Number of Directors | | | - 3 - | |

| | | | | | | | |

| | 2. | | Election of Directors | | | - 3 - | |

| | | | | | | | |

| | 3. | | Appointment and Remuneration of Auditors | | | - 7 - | |

| | | | | | | | |

| | 4. | | Reconfirmation of Shareholders Rights Plan | | | - 7 - | |

| | | | | | | | |

| STATEMENT OF EXECUTIVE COMPENSATION | | | - 10 - | |

| | | | | | | | |

| | 1. | | Compensation Discussion and Analysis | | | - 10 - | |

| | | | | | | | |

| | 2. | | Summary Compensation Table | | | - 12 - | |

| | | | | | | | |

| | 3. | | Incentive Plan Awards | | | - 13 - | |

| | | | | | | | |

| | 4. | | Termination and Change of Control Benefits | | | - 16 - | |

| | | | | | | | |

| | 5. | | Director Compensation | | | - 16 - | |

| | | | | | | | |

| CORPORATE GOVERNANCE DISCLOSURE STATEMENT | | | - 18 - | |

| | | | | | | | |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | | | - 18 - | |

| | | | | | | | |

| CERTIFICATE | | | - 18 - | |

YM BIOSCIENCES INC.

MANAGEMENT PROXY CIRCULAR

SOLICITATION OF PROXIES

This Management Proxy Circular (the “Circular”) is furnished in connection with the solicitation of proxies by the Management of YM BioSciences Inc. (“YM BioSciences” or the “Corporation”) for use at the annual meeting of shareholders of the Corporation (the “Meeting”) to be held at the offices of Ogilvy Renault LLP, located at Royal Bank Plaza, South Tower, 200 Bay Street, Suite 3800, Toronto, Ontario, Canada M5J 2Z4, on Thursday November 18, 2010 at 4:00 PM (Toronto time) and at any adjournment or adjournments thereof, for the purposes set out in the foregoing Notice of Meeting (the “Notice”). It is expected that the solicitation of proxies will be primarily by mail. Proxies may a lso be solicited personally or by the Corporation’s investor relations groups by telephone and by officers and directors of the Corporation (but not for additional compensation). The costs of solicitation will be borne by the Corporation. Except as otherwise stated, the information contained herein is given as of the date hereof.

Holders of common shares (the “Common Shares”) may vote on all matters to come before the Meeting. The form of proxy forwarded to holders of Common Shares affords the shareholder the opportunity to specify the manner in which the proxy nominees are to vote with respect to any specific item by checking the appropriate space in order to indicate whether the Common Shares registered in the shareholder’s name shall be: (i) voted for or against the resolution fixing the number of directors of the Corporation; (ii) voted for or withheld from voting for each of the directors to be named in this Circular; and (iii) voted for or withheld from voting for the appointment of auditors and authorizing the directors to fix their remuneration.

The proxy must be signed by the holders of Common Shares or the shareholder’s attorney duly authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized. Persons signing as executors, administrators, trustees or in any other representative capacity should so indicate and give their full title as such. A partnership should sign in the partnership’s name and by an authorized person(s).

The persons named in the enclosed form of proxy are officers of the Corporation and represent Management. Each shareholder has the right to appoint a person other than the persons named in the accompanying form of proxy, who need not be a shareholder, to attend and act for him and on his behalf at the Meeting. A shareholder wishing to appoint some other person as a representative at the Meeting may do so either by inserting such person’s name in the blank space provided in the form of proxy or by completing another proper form of proxy and, in either case, delivering the completed form of proxy to the Corporation’s Registrar and Transfer Agent CIBC Mellon Trust Company, Attention: Proxy Department, P.O. Box 721, Agincourt, ON M1S 0A1 or faxed to (416) 368-2502 a t least 24 hours before the Meeting time or to the Secretary of the Corporation in time for use at the Meeting.

A proxy given by a shareholder for use at the Meeting may be revoked at any time prior to its use. In addition to revocation in any other manner permitted by law, a proxy may be revoked by an instrument in writing executed by the shareholder or by the shareholder's attorney authorized in writing or, if the shareholder is a corporation, by an officer or attorney thereof duly authorized in writing, and deposited either at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the chairman of the Meeting on the day of the Meeting, or any adjournment thereof. The head office of the Corporation is located at 5045 Orbitor Drive, Building 11, Suite 400, Mississauga, Ontario, L4W 4Y4.

MANNER IN WHICH PROXIES WILL BE VOTED

The management representatives designated in the enclosed forms of proxy will vote or withhold from voting the shares in respect of which they are appointed by proxy on any ballot that may be called for in accordance with the instructions of the shareholder as indicated on the proxy and, if the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly.

In the absence of such direction, such shares will be voted by the management representatives in favour of the passing of the matters set out in the Notice. The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice, and with respect to other matters which may properly come before the Meeting or any adjournment thereof. At the date hereof, management of the Corporation knows of no such amendments, variations or other matters. However, if any other matters should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the proxy nominee.

VOTING BY BENEFICIAL SHAREHOLDERS

The information in this section is of significant importance to shareholders who do not hold their shares in their own name. Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of the Corporation are “non-registered” shareholders because the voting shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the voting shares.

More particularly, a person is not a registered shareholder in respect of Common Shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSP’s, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)) of which the Interm ediary is a participant. In accordance with the requirements of National Instrument 54-101, the Corporation has distributed copies of the Notice, this Management Proxy Circular and the Proxy (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| | (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deliver it to CIBC Mellon Trust Company, Attention: Proxy Department, P.O. Box 721, Agincourt, ON M1S 0A1; or |

| | (b) | more typically, be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy authorization form”) which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre-printed form. Sometimes, instead of the one page pre-printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions which contains a removable label containing a bar-code and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Holder must rem ove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the Common Shares which they beneficially own. Should a Non-Registered Holder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Holder should strike out the names of the Management Proxyholders and insert the Non-Registered Holder's name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered.

AUTHORIZED CAPITAL

The authorized share capital of the Corporation consists of 500,000,000 Common Shares without nominal or par value, 500,000,000 Class A non-voting common shares without nominal or par value, 500,000,000 Class A preferred shares without nominal or par value and 500,000,000 Class B preferred shares, issuable in series, without nominal or par value. As at the close of business on October 8, 2010 (the “Record Date”) 80,446,857 Common Shares were issued and outstanding.

Each Common Share carries one vote in respect of each matter to be voted upon at the Meeting. Only holders of Common Shares of record at the close of business on the Record Date are entitled to vote at the Meeting, except to the extent that a person has transferred any of his or her Common Shares after that date and the transferee establishes proper ownership and requests, not later than ten (10) days before the Meeting, that his or her name be included in the list of shareholders for the Meeting, in which case the transferee is entitled to vote his or her shares at the Meeting.

PRINCIPAL HOLDERS OF VOTING SECURITIES

As at the date hereof, to the knowledge of the directors and officers of the Corporation, there are no persons or corporations who beneficially own, directly or indirectly, or exercise control or direction over, shares of the Corporation carrying more than 10% of the voting rights attached to any class of outstanding shares of the Corporation entitled to vote in connection with any matters being proposed for consideration at the Meeting.

PARTICULARS OF MATTERS TO BE ACTED ON

| 1. | Fixing the Number of Directors |

The Articles of Association of the Corporation provide that unless otherwise determined by special resolution, the number of directors shall not be less than one or more than ten. The Corporation’s By-Laws provide that the number of directors to be elected at any meeting shall be the number determined from time to time by special resolution. At the 2009 annual general meeting, eight individuals were elected as directors of the Corporation. Robert Watson was appointed a director of the Corporation in January 2010 following the acquisition by the Corporation of Cytopia Limited (now YM BioSciences Australia Pty Ltd.). The Board of Directors of the Corporation (the “Board of Directors” or the “Board ”) has determined that the size of the Board should be fixed at nine. At the Meeting, the shareholders will be asked to consider a special resolution fixing the number of directors to be elected at nine. In order for the special resolution to be approved, it must receive a majority of not less than three fourths of the votes cast by shareholders at the meeting. In the absence of a contrary specification made in the form of proxy, the persons named in the enclosed form of proxy intend to vote for the special resolution fixing the number of directors at nine.

Pursuant to the preceding matter, the shareholders of the Corporation will have fixed the number of directors at nine. Each of the Corporation’s current directors, other than Robert Watson, intends to stand for election to the Board. In addition, the Board of Directors has recommended that Nick Glover be considered for nomination as a director. The Corporate Governance and Nominating Committee has put forward the names of such nominees as outlined below. The term of each of the Corporation’s present directors expires at the conclusion of the Corporation’s next annual general meeting of shareholders or until his or her successor is duly elected or appointed, unless he or she resigns, is removed or becomes disqualified in accordance with the Corporation’s bylaws or governing legislatio n.

The persons named in the enclosed form of proxy intend to vote for the re-election of each of the below-named nominees unless otherwise instructed on a properly executed and validly deposited proxy. Management does not contemplate that any nominees named below will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another nominee in their discretion.

The following table sets out the name of each person proposed to be nominated by management for election as a director at the Meeting, all offices of the Corporation now held by such person, their principal occupation, the period of time for which they have been a director of the Corporation, and the number of Common Shares of the Corporation beneficially owned by them, directly or indirectly, or over which they exercise control or direction, as at the date hereof. The information as to Common Shares owned or controlled has been provided by the person named. Biographical information for each director is also provided below.

Name, Age and Municipality of Residence | Present Principal Occupation and positions with the Corporation | Director Since | Common Shares beneficially owned, directly or indirectly, or controlled or directed |

David G.P. Allan, 68 Toronto, Ontario | Chairman and Chief Executive Officer, YM BioSciences Inc. | August 23, 1994 | 1,135,492 |

Thomas I.A. Allen, Q.C., 70 (1)(2)(3)Toronto, Ontario | Counsel, Ogilvy Renault LLP, Toronto | December 13, 1996 | Nil |

Mark Entwistle, M.A., 54 (3)Ottawa, Ontario | President, Chibas Consulting Inc. | October 9, 1997 | Nil |

Henry Friesen, C.C., M.D., 76 (1) Winnipeg, Manitoba | Distinguished University Professor Emeritus, University of Manitoba | September 10, 2001 | Nil |

Philip Frost, M.D., Ph.D., 69 (2) Morristownship, New Jersey | President, Calesca Pharmaceuticals, New Jersey Chief Scientific Officer, Primrose Therapeutics Inc. | November 28, 2007 | 1,000 |

Nick Glover, Ph.D, 41 Erin, Ontario | President and Chief Operating Officer, YM BioSciences Inc. | - | Nil |

François Thomas, M.D., 51 (3) Brussels, Belgium | Managing Director, Bioserve Ltd., London | November 28, 2007 | Nil |

Gilbert Wenzel, PhD, 54 (1)Zurich, Switzerland | Chairman and CEO, Wenzel Healthcare Services AG | March 19, 2001 | Nil |

Tryon M. Williams, BSc, 69 (1)(2) The Valley, Anguilla | Chairman, CellStop Systems, Inc. Chairman and CEO, Bingo.com Ltd. | November 6, 1995 | 20,100 |

(1) Member of Audit Committee.

(2) Member of Corporate Governance and Nominating Committee.

(3) Member of Compensation Committee.

For the past five years, each of the foregoing directors and officers of the Corporation has been engaged in his current occupation or in other capacities with the same or a related entity, except as follows: Mr. Allen was most recently a partner at Ogilvy Renault LLP from 1996 until January 2008; Dr. Friesen was previously Founding Chair, Genome Canada from 2000 until July 2005; Dr. Frost was previously interim CEO and Chief Scientific Officer of Imclone Systems and Executive Vice-President and Chief Scientific Officer from 2005 to 2007. Prior to 2005, he was Vice-President for Oncology and Co-Director of the Oncology Therapeutic Area Leadership Team at Wyeth; Dr. Thomas was previously Senior Advisor at Bryan Garnier, a Paris-based investment bank from 2006 to 2007, responsible for corporate finance activities for ph armaceutical and biotechnology companies. Prior to 2005, he was Venture Partner at Atlas Venture (London, UK); Dr. Wenzel was most recently Chairman of QUISISANA AG from 2003 until March 2009; Dr. Glover was most recently an independent life sciences consultant, and prior to that was President and Chief Executive Officer of Viventia Biotech Inc. from 2004 to 2008.

Biographical Information

David G.P. Allan - Chairman, Chief Executive Officer and Director

Mr. Allan has been Chief Executive Officer of the Company since April 1998 and Chairman of the board of directors of the Company since 1994. In addition, Mr. Allan is a Director of Synthemed Inc. (medical devices), USA and DiaMedica Inc. (diabetes therapeutics), Canada. Mr. Allan was formerly a governor of The Toronto Stock Exchange, a member, and working group Chair, of the Ontario Biotechnology Advisory Board, a member of the Awards Selection Committee for the Networks of Centres of Excellence in Canada and a member of the Board of Trustees for the Ontario College of Art and Design. Mr. Allan is currently a member of BIOTECanada’s Emerging Companies Advisory Board.

Thomas I.A. Allen, Q.C., F.C.I.Arb - Director

Mr. Allen is counsel to Ogilvy Renault LLP, a Canadian law firm. Mr. Allen was the initial Chairman of the Accounting Standards Oversight Council of Canada and was a member of the Advisory Board of the Office of the Superintendent of Financial Institutions of Canada. He is currently a director of a number of public companies including Mundoro Capital Inc., Middlefield Bancorp Limited and Forsys Metals Corp. Mr. Allen recently acted as Chairman of the Task Force to Modernize Securities Legislation in Canada. Mr Allen has been a director of the Company since 1996.

Mark Entwistle, M.A. - Director

Prior to founding his own consulting practice in 1997 in international trade, political business intelligence and strategic communications, Mr. Entwistle was Ambassador for Canada to Cuba from 1993 to 1997. Mr. Entwistle was previously a career diplomat with the Canadian Department of Foreign Affairs and International Trade in a variety of embassy positions from 1982 to 1997, and served as Press Secretary and Director of Communications to the Prime Minister of Canada from 1991-1993. He is a Fellow of the Canadian Defence and Foreign Affairs Institute. Mr. Entwistle has been a director of the Company since October 1997.

Henry Friesen, C.C., M.D., F.R.S.C. - Director

Dr. Friesen served from 2002-2009 as Chair of the Gardiner Foundation whose international awards are Canada’s most prestigious prizes in the biomedical sciences. He was Founding Chair, Genome Canada, 2000-2005, a $600 million budget non-profit organization that supports genomics/proteomics programs to position Canada as a world leader in selected areas in this important sector. From 1991 to 2000 Dr. Friesen was President of the Medical Research Council of Canada and was instrumental in transforming it into the Canadian Institutes of Health Research, an organization with an annual budget in 2008 of over $900 million dedicated to supporting Canadian researchers as well as industry participants. Dr. Friesen is noted for his discoveries of the human hormone prolactin. For 19 years he was Head of the Department of Physiology at the University of Manitoba and now is Distinguished University Professor Emeritus. Dr. Friesen is a Fellow of the Royal Society of Canada, a Companion of the Order of Canada, recipient of 8 honorary degrees and also sits on the board of directors of Sanofi Pasteur Canada .Dr. Friesen has been a director of the Company since November 2001.

Philip Frost, M.D., Ph.D. - Director

Dr. Frost is the founder and Chief Scientific Officer of Primrose Therapeutics Inc. In 2005, Dr. Frost was appointed Executive Vice-President and Chief Scientific Officer at ImClone where he oversaw the company’s research, clinical and regulatory departments. He subsequently held the post of Interim Chief Executive Officer until December 2006. Prior to ImClone, Dr. Frost served as Vice President of Oncology and Co-Director of the Oncology Therapeutic Area Leadership Team at Wyeth, where he was responsible for the development of various oncology compounds and contributed to the approval and commercialization of Mylotarg® for the treatment of a specific form of acute myeloid leukemia. Dr. Frost has held the positions of Adjunct Professor of Cell Biology and Adjunct Professor of Medicine at The University of Texas M.D. Anderson Cancer Center. He is also a Director of Innovive Pharmaceuticals, a New York-based oncology company and a Director of Avalon Pharmaceuticals. Dr. Frost has been a director of the Company since 2007.

Nick Glover - President and Chief Operating Officer

Dr. Glover joined YM BioSciences as President and Chief Operating Officer in June 2010. Prior to this, he was providing life sciences consultancy services to the industry. From January 2004 until June 2008, Dr. Glover was President and Chief Executive Officer of Viventia Biotech Inc., having previously held the position of Vice President, Corporate Development and Product Operations. Dr. Glover was formerly an investment manager at MDS Capital, a life sciences venture capital funds. He holds a Ph.D. in chemistry from Simon Fraser University, British Columbia.

François Thomas, M.D. - Director

Dr. Thomas, a board certified medical oncologist, is a former member of the Board of Directors of Eurogentec, and formerly was a Director of DNA Therapeutics, Entomed, Neurotech, Newron, Novexel, Unibioscreen and CropDesign. Dr. Thomas is currently General Manager at Bioserve Ltd. (Cambridge, UK), a consultancy for the life sciences arena. Dr Thomas has been a Senior Advisor at Bryan Garnier, a Paris-based investment bank, and a Venture Partner at Atlas Venture, a venture capital firm in London (UK). He was previously Vice President Licensing, Medical Affairs and Pharmacogenomics at Genset (Paris, France), Vice President, Clinical Development at Ipsen (Paris, France) and Assistant Professor of Medical Oncology at Institut Gustave Roussy (Paris, Fr ance). Dr. Thomas has been a director of the Company since 2007.

Gilbert Wenzel, Ph.D. - Director

Dr. Wenzel is currently Chairman and Chief Executive Officer of Wenzel Healthcare Services AG, an investment company focused on investing in innovative healthcare delivery models in Europe. He is also the founder of QUISISANA AG, which imports, registers and commercializes generics for private label use by pharmacy chains and insurance companies in Europe. Dr. Wenzel joined Novartis Group, a global pharmaceutical manufacturer, in November 2000 where he served as Head of Strategic Planning and a Member of its Executive Committee until January 2003. Prior to joining Novartis in November 2000, Dr. Wenzel spent 15 years with McKinsey & Co., an international management consulting firm, and was a member of the European Leadership Group of its Pharma/Healthcare Sector and of the European New Venture Initiative. From 1981 to 1985, D r. Wenzel was at Hoechst AG in Germany and developed global strategies for generics and over-the-counter medicines. Dr. Wenzel has been a director of the Company since March 2001.

Tryon M. Williams, B.Sc. (Math) - Director

Mr. Williams is the Chairman, CEO and director of Bingo.com, Ltd., an internet technology company and Chairman and director of CellStop International Ltd., an automobile security device manufacturer. From 1993 to 2007, Mr. Williams was Adjunct Professor, Sauder School of Business, The University of British Columbia. Mr. Williams is also a director of several other private corporations. Mr. Williams has been a director of the Company since November 1995.

Regulatory Actions

None of our directors or executive officers is, as at the date of this Circular, or was within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company that was subject to an order that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer, or was subject to an order that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer with the exception of Thomas Allen, one of our directors.

Mr. Allen is a former director of Thomas Weisel Partners Group, Inc. (“TWPG”). On April 28, 2010, the U.S. Financial Industry Regulatory Authority (“FINRA”) commenced an administrative proceeding against TWPG. FINRA’s complaint relates to a transaction on January 29, 2008 in which approximately $15.7 million in auction rate securities were sold from TWPG’s account to the accounts of three customers, and charges TWPG with violations of various FINRA Rules and Section 10(b) of the United States Securities Exchange Act of 1934, as amended and SEC Rule 10b-5. On July 1, 2010, TWPG was acquired by Stifel Financial Corp. and ceased to be a public company, and Mr. Allen ceased to be a direc tor.

| 3. | Appointment and Remuneration of Auditors |

Management proposes the re-appointment of KPMG LLP, Chartered Accountants, Yonge Corporate Centre, 4100 Yonge Street, Suite 200, Toronto, Ontario M2P 2H3, as auditors of the Corporation and to authorize the directors to fix the auditors’ remuneration. In the absence of a contrary specification made in the form of proxy, the persons named in the enclosed form of proxy intend to vote for the appointment of KPMG LLP as auditors of the Corporation and to authorize the Board of Directors to fix their remuneration. KPMG was first appointed as auditors of the Corporation on September 25, 1995.

| 4. | Reconfirmation of Shareholders Rights Plan |

The Board of Directors first adopted a shareholder rights plan on October 19, 2004 (the “2004 Rights Plan”). The principal purpose of the rights plan is to provide shareholders with sufficient time to properly assess a take-over bid for YM BioSciences, if such a bid were to be made, and to provide the Board of Directors time to consider alternatives designed to allow the Corporation’s shareholders to receive full and fair value for their common shares. On October 22, 2007, the Corporation entered into an updated shareholder rights plan (the “Rights Plan”). The Rights Plan was approved by holders of Common Shares at the annual and special meeting of shareholders held on November 28, 2007. The Rights Plan has a term of 10 years, subject to reconfirmation by the shareholders every three years. A copy of the Rights Plan dated October 22, 2007 between the Corporation and CIBC Mellon Trust Company is available on SEDAR at www.sedar.com and may also be obtained by contacting the Secretary of the Corporation. A summary of certain key provisions of the Rights Plan is provided below.

Many Canadian public companies continue to have shareholders rights plans in effect. These plans have as their objectives provided shareholders of the companies involved, and the board of directors of such companies, with the time necessary to ensure that, in the event of a take-over bid for their corporations, alternatives to the bid are explored and developed which may be in the best interest of the particular corporation and its shareholders. Securities legislation in Canada currently permits a take-over bid to expire in 35 days. Our Board of Directors is of the view that this is not sufficient time to assess a take-over bid, were such a bid to be made, and if our Board of Directors deems appropriate, to explore and develop alternatives in our best interests and our shareholders. In the event that competing bids emerge, our Board of Directors also believes that current securities legislation in Canada does not provide a sufficient minimum period of time for a board of directors to assess a competing offer or for shareholders to make a reasoned decision about the merits of the competing bids. The Rights Plan is not intended to prevent a take-over bid or deter offers for our Common Shares or any other voting securities of YM BioSciences that might be issued in the future. It is designed to encourage anyone seeking to acquire control of YM BioSciences to proceed either by way of a “Permitted Bid” (as described below), which requires a take-over bid to satisfy certain minimum standards designed to promote the fair treatment of all holders of our voting shares, or with the concurrence of our Board of Directors.

Summary of Certain Key Provisions of the Rights Plan

This summary is qualified in its entirety by reference to the full text of the Rights Plan, including the definitions therein.

Term

The term of the Rights Plan ends on the date of the Corporation’s annual meeting of shareholders to be held in 2017, at which time the Rights will expire unless they are terminated, redeemed, or exchanged earlier by the Board of Directors.

Issue of Rights

To implement the Rights Plan, the Board of Directors authorized the issuance of share purchase rights (the “Rights”) to the shareholders of the Corporation at the rate of one Right for each common share outstanding as at the close of business at the November 28, 2007 meeting of shareholders (the “Record Time”). In addition, one Right has been and will be issued with each common share issued after the Record Time and prior to the earlier of the Separation Time (as defined below) and the redemption or expiration of the Rights. The Corporation has entered into a rights plan agreement, dated as of October 22, 2007, with CIBC Mellon Trust Company of Canada, as rights agent, which provides for the exercise of the Rights, the issue of certificates evidencing the Rights, and other related ma tters, including those described in this Management Proxy Circular.

Rights Exercise Privilege

The Rights will trigger (i.e. separate from the Corporation’s common shares) (the “Separation Time”) and will become exercisable eight (8) trading days after a person (an “Acquiring Person”) has acquired 20% or more of, or commences or announces a take-over bid for, the Corporation’s outstanding common shares (defined to include the common shares and any other shares that the Corporation may issue that carry voting rights relating to the election of directors), other than by acquisition pursuant to a Permitted Bid or a Competing Permitted Bid (each as defined below). The acquisition by an Acquiring Person of 20% or more of the common shares is referred to as a “Flip-In Event”.

Any rights held by an Acquiring Person will become void upon the occurrence of the Flip-In Event. By making any take-over bid other than a Permitted Bid or a Competing Permitted Bid prohibitively expensive for an Acquiring Person, the Rights Plan is designed to require any person interested in acquiring more than 20% of the Corporation’s common shares to do so by way of a Permitted Bid or a Competing Permitted Bid or to make a take-over bid which the Board of Directors considers to represent the full and fair value of the Corporation’s common shares.

Prior to the rights being triggered, they will have no value and no dilutive effect on the Corporation’s common shares.

Flip-In Event

A “Flip-In Event” is triggered in the event that a transaction occurs pursuant to which a person becomes an Acquiring Person (as defined in the Rights Plan). Upon the occurrence of the Flip-In Event, each Right (except for Rights Beneficially Owned by the Acquiring Person and certain other persons specified below) shall thereafter constitute the right to purchase from the Corporation upon exercise thereof in accordance with the terms of the Rights Plan that number of common shares of the Corporation having an aggregate Market Price (as defined in the Rights Plan) on the date of the consummation or occurrence of such Flip-In Event equal to twice the Exercise Price (as defined in the Rights Plan) for an amount in cash equal to the Exercise Price. Accordingly, if one assumes a market price of $10 p er share, then a shareholder could purchase for $50.00 ten shares, effectively acquiring the shares at half of the current Market Price.

The Rights Plan provides that the Rights that are beneficially owned by (i) an Acquiring Person or any affiliate or associate of an Acquiring Person, or any Person acting jointly or in concert with an Acquiring Person, or any affiliate or associate of such Acquiring Person; or (ii) a transferee or other successor in title of Rights of an Acquiring Person (or of an affiliate or associate of an Acquiring Person or of any person acting jointly or in concert with an Acquiring Person or any associate or affiliate of an Acquiring Person) who becomes a transferee or successor in title concurrently with or subsequent to the Acquiring Person becoming an Acquiring Person shall become null and void without any further action, and any holder of such Rights (including transferees or successors in title) shall not have any right whatsoever to exercise such Rights under any provision of the Rights Plan.

Acquiring Person

An “Acquiring Person” is a person who Beneficially Owns (as defined in the Rights Plan) twenty percent (20%) or more of the outstanding Voting Shares of the Corporation. An Acquiring Person does not, however, include the Corporation or any subsidiary of the Corporation, or any person who becomes the Beneficial Owner of twenty percent (20%) or more of the outstanding Voting Shares of the Corporation as a result of Permitted Bids, Competing Permitted Bids, and certain other exempt transactions.

Permitted Bids and Competing Permitted Bids

A “Permitted Bid” is a take-over bid made by take-over bid circular in compliance with the following additional provisions:

| | 1. | the bid must be made to all holders of record of common shares; |

| | 2. | the bid must be open for a minimum of 60 days following the date of the bid, and no shares may be taken up prior to such time; |

| | 3. | take-up and payment for shares may not occur unless the bid is accepted by persons holding more than fifty percent (50%) of the outstanding common shares exclusive of shares held by the person responsible for triggering the Flip-In Event or any person that has announced an intention to make, or who has made, a takeover bid for the shares of the Corporation and the respective affiliates and associates of such persons and persons acting jointly or in concert with such persons; |

| | 4. | shares may be deposited into or withdrawn from the bid at any time prior to the take-up date; and |

| | 5. | if the bid is accepted by the requisite percentage specified in (3) above, the bidder must extend the bid for a period of 10 business days to allow other shareholders to tender into the bid, should they so wish, and must make a public announcement to such effect. |

A “Competing Permitted Bid” is a take-over bid that satisfies all of the criteria of a Permitted Bid except that since it is made after a Permitted Bid has been made, the minimum deposit period and the time period for the take-up of and payment for shares tendered under a Competing Bid is not 60 days, but is instead the greater of 35 days (the minimum permitted by law) and the 60th day after the date on which the Permitted Bid then in existence was made.

Neither a Permitted Bid nor a Competing Permitted Bid need be approved by the Board of Directors and may be taken directly to the shareholders of the Corporation. Acquisitions of common shares made pursuant to a Permitted Bid or a Competing Permitted Bid do not give rise to a Flip-In Event.

Certificates and Transferability

Prior to separation, the Rights will be evidenced by a legend imprinted on the common share certificates of the Corporation and will not be transferable separately from the common shares. Common share certificates do not need to be exchanged to entitle a shareholder to these Rights. The legend will be on all new certificates issued by the Corporation. From and after separation, the Rights will be evidenced by Rights certificates and will be transferable separately from the Corporation’s Common Shares.

Redemption and Waiver

The Board of Directors may, at any time prior to the occurrence of a Flip-in event, and subject to shareholder approval, elect to redeem all but not less than all of the Rights at a redemption price of $0.0001 per Right (the “Redemption Price”), appropriately adjusted in certain events. Rights will be deemed to be automatically redeemed at the Redemption Price where a person that has made a Permitted Bid, a Competing Permitted Bid, or a take-over bid otherwise exempted by the Board of Directors takes up and pays for the Corporation’s shares under the terms of the bid. If the Board of Directors elects or is deemed to have elected to redeem the Rights, the right to exercise the Rights will terminate, and each Right will, after redemption, be null and void, and the only right thereafter of th e holders of Rights shall be to receive the Redemption Price. Under the Rights Plan, the Board of Directors has discretion to waive application of the Rights Plan to a take-over bid, subject to an automatic waiver with respect to all other take-over bids made while the waived take-over bid is outstanding. The Board of Directors of the Corporation may also waive the application of the Rights Plan to a Flip-in Event which occurs through inadvertence, subject to the “inadvertent” Acquiring person reducing its holding of the Corporation’s shares within an agreed time. Other waivers of the Rights Plan will require shareholder approval.

Amendment

Any amendments or supplements to the terms of the Rights Plan (other than for clerical errors or to maintain the Rights Plan’s validity as a result of changes in legislation) will require prior shareholder approval. Changes arising from changes in applicable legislation will require subsequent shareholder ratification.

Shareholder Approval

Shareholders of the Corporation will be asked at the Meeting to consider, and if thought advisable, to approve an ordinary resolution to reconfirm the Corporation’s Rights Plan. Unless otherwise specified, the persons named in the accompanying form of proxy intend to vote in favour of the resolution to reconfirm the Corporation’s Rights Plan.

In the event that the shareholders do not reconfirm the Rights Plan, the shareholders of the Corporation will, as of the date of the Meeting, cease to have the benefit of the Rights Plan.

Recommendation of the Board

The Board of Directors has determined that the current Rights Plan remains a valuable tool that can be utilized to enhance shareholder value in the face of an unsolicited take-over bid. Accordingly, our Board of Directors unanimously recommends that the shareholders vote at the meeting in favour of the resolution relating to the reconfirmation of the Rights Plan.

STATEMENT OF EXECUTIVE COMPENSATION

| 1. | Compensation Discussion and Analysis |

General

The Corporation’s compensation policies are designed to support the Corporation’s strategic objectives, ensure that incentive programs are designed to motivate senior managers to achieve or exceed corporate objectives and to enhance shareholder value and to ensure that there is reasonable consistency in the application of the compensation policy.

The executive compensation comprises base salary, discretionary bonus, indirect compensation (benefits) and long-term incentives in the form of stock options. In determining actual compensation levels, the total program is taken into consideration rather than any single element in isolation. Total compensation levels are set to reflect both the marketplace (to ensure competitiveness) and the responsibility of each position (to ensure internal equity).

The Corporation’s executive compensation program has the following objectives:

| • | to attract, retain and motivate qualified executives; |

| • | to provide incentives to executives to maximize productivity and enhance enterprise value by aligning the interests of the executives with those of the shareholders; |

| • | to foster teamwork and entrepreneurial spirit; |

| • | to establish a direct link between all elements of compensation and the performance of the Corporation, its subsidiaries and individual performance; and |

| • | to integrate compensation incentives with the development and successful execution of strategic and operating plans. |

Compensation Program

The key elements of the Corporation’s compensation program are salary and stock option grants. As the Corporation has finite financial resources, bonuses are paid strictly at the discretion of the Board on recommendation from the Compensation Committee in consultation with the Chief Executive Officer. In 2009, the Corporation retained a human resources consultant to assist management in revising the job description for each employee position and streamlining the performance review process. The intent was to create a transparent system that was suitable for a company of the size and structure of YM BioSciences.

The base salary for all executives is designed to be competitive and is adjusted for the realities of the market. The target salary is the mid-point, or just below the mid-point, of a salary range for an executive officer which is set at median levels in the comparator group to reflect similar positions in these companies using direct comparison of responsibilities. The comparator group consists of other publicly-traded Canadian and U.S. life sciences companies that either have a pipeline of products at similar stages of development or are comparable in terms of revenue and market capitalization. Companies include: AEterna Zentaris Inc., Angiotech Pharmaceuticals, Inc., Antisoma plc, Bioniche Life Sciences Inc., Cardiome Pharma Corp., Cyclacel Pharmaceuticals, Inc., EntreMed, Inc., Lorus Therapeutics, Inc. MethylGene Inc., OncoGenex Pharmaceuticals, Inc. Oncolytics Biotech Inc., OXiGENE, Inc., Pharmacyclics, Inc., Spectrum Pharmaceuticals Inc., SuperGen, Inc., Telik, Inc. and Theratechnologies Inc.

The compensation levels of the Chief Executive Officer are designed to recognize the Chief Executive Officer’s personal contributions and leadership. The Compensation Committee, in consultation with the Board of Directors, formally evaluates the performance of the Chief Executive Officer each year using both financial and non-financial measurements (including share price, revenues, product development and product pipeline as well as human resource management, representation of the Corporation in the market, integrity and the ability to respond to challenges of the business). On the recommendation of the Compensation Committee, the Board may approve an increase in the Chief Executive Officer’s total compensation to levels that are consistent with corporate and individual performance within the framework established by reference to the comparator group. The Board sets the Chief Executive Officer’s salary (and bonus, if any), with all other salaries being derived therefrom on the Chief Executive Officer’s recommendation and subject to consultation with and review by the Compensation Committee.

Prior to the fiscal year ended June 30, 2009, the compensation plan included an annual bonus based on achievement of objectives. This bonus plan was withdrawn early in fiscal 2009 and replaced with a discretionary and subjective approach to bonuses for fiscal 2010. General guidelines were adopted for fiscal 2011 to assist the Board in determining appropriate bonuses. Corporate goals and objectives are given weightings with the senior management bonuses weighted more heavily towards corporate objectives and more junior personnel bonuses being weighted towards individual performance, all within the context of enhancing shareholder value through the achievement of specified milestones in clinical development, research and development and product development.

The Board has adopted a less rigid and formulaic approach than that applied in more recent years and reverted to a more entrepreneurial focus. The compensation philosophy adopted by the Board of Directors holds that it is more appropriate and effective to tie any bonuses to revenues and activities that enhance shareholder value.

In September 2010, the Board approved a bonus plan for employees of the Corporation’s subsidiary, YM BioSciences Australia Pty Ltd. Pursuant to the plan, eligible employees will be entitled to receive rights at a notional price which may be redeemed at a later date for an amount equal to the difference between the price of the Corporation’s Common Shares on the date of redemption and the base price of the right. The rights will be awarded in three tranches beginning in the fourth calendar quarter of 2010.

Option Based Awards

The stock-based compensation program provides stock options that create a direct link between executive rewards and enhanced shareholder value since the full benefit of this compensation element cannot be realized unless stock appreciation occurs over a number of years. The Committee, at its discretion, may grant stock options annually to executives and employees under the Corporation’s stock option plan based on the employee’s position and annual compensation. In addition, special grants of stock options may be approved to recognize singular achievements or to retain and motivate executives in order to further align executive and shareholder interests and to motivate employees.

The Committee designates from time to time eligible persons to whom options are granted and determines the number of shares covered by such options. The underlying security of the options granted under the stock option plan is the Common Shares in the capital of the Corporation. During the fiscal year ended June 30, 2010, a total of 1,544,392 options were issued of which 1,234,392 were issued to management and employees, 240,000 were issued to directors and 70,000 were issued to third party consultants. The maximum number of shares available for issuance under the stock option plan is a rolling number equal to 15% of the issued and outstanding capital of the Corporation on the particular date of grant. See “Stock Option Plan”.

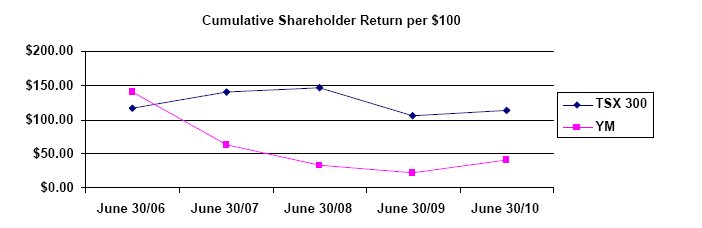

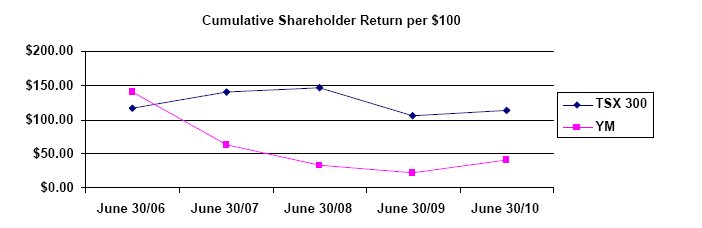

Performance Graph

The following graph compares the yearly change in the cumulative total shareholder return over the periods indicated of a $100 investment in the Corporation’s Common Shares with the return of the S&P/TSX Composite, assuming the reinvestment of dividends, where applicable, for the comparable period. The Corporation’s Common Shares were listed on the Toronto Stock Exchange on June 30, 2004.

The trend shown in the performance graph demonstrates a general decline in shareholder return between 2006 and 2009. This is primarily due to the announcement on January 30, 2007 that the Corporation was stopping the pivotal Phase III trial of tesmilifene in patients with metastatic or recurrent breast cancer. Since then the price of the Corporation’s shares has followed the downward trend experienced by the healthcare industry in general. The Corporation has continued to rationalize staffing levels and to streamline costs where possible. On August 4, 2010, the Corporation announced the discontinuance of further expenditures on AeroLef-related activities. In the first calendar quarter of 2010, the Corporation acquired Cytopia Limited, whose portfolio included the clinical-stage products CYT387 and CYT997 as well as a library of approximately 4,000 molecules and, subsequently, completed a financing of approximately US$17.5 million, and a further US$3.2 million in the second quarter. Senior management has overseen a greater focus on the development of the newly-acquired CYT387 as well as commenced a review of the Corporation’s extensive nimotuzumab development activities.

| 2. | Summary Compensation Table |

The following table sets forth all compensation earned during the fiscal year ended June 30, 2010 by each of the Corporation’s Chief Executive Officer, Vice President, Finance and Administration and three other most highly compensated officers of the Corporation who earn greater than $150,000 in total salary and bonus (collectively, “Named Executive Officers”):

| | | | | | Non-equity incentive plan compensation | | | |

| Name and Principal Position | Year | Salary ($) | Share-based awards ($) | Option-based awards ($)(1) | Annual incentive plans ($)(2) | Long term incentive plans ($) | Pension Value ($) | All other compen-sation ($)(3) | Total compen-sation ($) |

David G.P. Allan CEO | 2010 2009 | 452,342 435,625 | - - | 110,691 183,016 | 159,341 - | - - | - - | - - | 722,374 618,641 |

Leonard Vernon VP, Finance and Administration | 2010 2009 | 253,618 244,245 | - - | 66,415 61,389 | 57,432 - | - - | - - | - - | 377,465 305,634 |

Nick Glover (4) Chief Operating Officer | 2010 2009 | 25,885 - | - - | 341,209 - | - - | - - | - - | - - | 367,094 - |

Vincent Salvatori President and COO, CIMYM BioSciences Inc. | 2010 2009 | 280,475 279,114 | - - | 44,276 30,694 | 28,048 - | - - | - - | - - | 352,799 309,808 |

Sean Thompson (5) VP Business Development | 2010 2009 | 198,016 187,185 | - - | 44,276 30,694 | - - | - - | - - | - - | 242,292 217,879 |

| (1) | Value of share option awards determined using the Black-Scholes pricing model calculated as at the award date of September 30, 2009. |

| (2) | Amounts awarded at the discretion of the Board under the Corporation’s incentive plan. These bonuses were paid in the third calendar quarter of 2010. |

| (3) | NEO’s are entitled to the same health, dental, etc. as all employees; the aggregate value for any individual does not exceed $50,000. |

| (4) | Dr. Glover joined the Corporation as Chief Operating Officer on June 7, 2010. His annual salary is $325,000. |

| (5) | Mr. Thompson is no longer with the Corporation effective August 18, 2010. |

The base salaries for the executives are reviewed on an annual basis to monitor any substantive changes over a three year period. The salaries are set to industry and regional economic standards and also reflect any cost of living adjustments as determined to be appropriate by the Compensation Committee in consultation with management. Changes in salary amounts in 2010 were based on a cost of living increase with some minor adjustments in the Board’s discretion to acknowledge individual achievement. Bonuses were awarded at the discretion of the Board taking into consideration activities during the year that enhanced shareholder value.

Options were awarded as part of annual compensation with a view to aligning employees’ interests with those of the shareholders. Option grants made before June 30, 2010 were calculated as a percentage of the base salary based on a value ascribed by the Black-Scholes model. Percentages were positively correlated with seniority of the position of the employee or officer, as applicable.

Outstanding share-based awards and option-based awards as at June 30, 2010

| | Option Based Awards | Share Based Awards |

| Name | Number of securities underlying unexercised options (#) | Option Exercise Price ($) | Option Expiration Date | Value of unexercised in-the-money options ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) |

| David G.P. Allan | 7,500 | $2.00 | 4/30/2013 | | | |

Chief Executive Officer | 102,500 | $1.75 | 4/30/2013 | | | |

| 200,000 | $1.75 | 11/27/2013 | | | |

| | 50,000 | $3.15 | 4/17/2015 | | | |

| | 90,000 | $3.61 | 1/25/2016 | | | |

| | 200,000 | $4.36 | 6/15/2016 | | | |

| | 203,252 | $1.53 | 9/29/2017 | | | |

| | 596,250 | $0.50 | 9/29/2018 | 435,263 | NIL | NIL |

| | 100,000 | $1.58 | 09/30/2019 | | | |

| Leonard Vernon | 15,000 | $4.50 | 12/1/2010 | | | |

| VP, Finance andAdministration | 25,000 | $2.50 | 4/30/2013 | | | |

| 23,000 | $1.75 | 4/30/2013 | | | |

| | 20,000 | $3.15 | 4/17/2015 | | | |

| | 25,000 | $3.61 | 1/25/2016 | | | |

| | 75,000 | $4.36 | 6/15/2016 | | | |

| | 101,626 | $1.53 | 9/29/2017 | | | |

| | 200,000 | $0.50 | 9/29/2018 | 146,000 | NIL | NIL |

| | 60,000 | $1.58 | 09/30/2019 | | | |

| Nick Glover | 350,000 | $1.39 | 06/03/2020 | | | |

Chief Operating Officer | | | | | | |

| | | | | | |

| Vincent Salvatori | 14,500 | $1.75 | 4/30/2013 | | | |

President and COO, CIMYM BioSciences Inc. | 40,500 | $1.75 | 11/27/2013 | | | |

| 5,000 | $2.75 | 11/8/2014 | | | |

| 25,000 | $3.15 | 4/17/2015 | | | |

| 35,000 | $3.61 | 1/25/2016 | | | |

| 75,000 | $4.36 | 6/15/2016 | | | |

| 101,626 | $1.53 | 9/29/2017 | | | |

| 100,000 | $0.50 | 9/29/2018 | 73,000 | NIL | NIL |

| 40,000 | $1.58 | 09/30/2019 | | | |

Sean Thompson (1) | 13,000 | $1.75 | 03/31/2011 | | | |

VP, Business Development | 20,000 | $2.50 | 03/31/2011 | | | |

| 19,875 | $1.75 | 03/31/2011 | | | |

| | 12,500 | $3.15 | 03/31/2011 | | | |

| | 25,000 | $3.61 | 03/31/2011 | | | |

| | 50,000 | $4.36 | 03/31/2011 | | | |

| | 54,064 | $1.53 | 03/31/2011 | | | |

| | 33,333 | $0.50 | 03/31/2011 | 24,747 | NIL | NIL |

| | 40,000 | $1.58 | 03/31/2011 | | | |

| (1) | Mr. Thompson is no longer with the Corporation effective August 18, 2010. Stock options awarded to Mr. Thompson and vested as of December 31, 2010 are exercisable until March 31, 2011. |

Incentive plan awards - value vested or earned during the year

| Name | Option-based awards - Value vested during the year ($)(1) | Share-based awards - Value vested during the year ($) | Non-equity incentive plan compensation - Value earned during the year ($) |

David G.P. Allan CEO | 219,721 | NIL | NIL |

Leonard Vernon VP, Finance and Administration | 74,703 | NIL | NIL |

Nick Glover Chief Operating Officer | 28,000 | NIL | NIL |

Vincent Salvatori President and COO, CIMYM BioSciences Inc. | 38,369 | NIL | NIL |

Sean Thompson (2) VP Business Development | 38,028 | NIL | NIL |

| (1) | The aggregate dollar value that would have been realized if stock options had been exercised on the vesting date, computed as the excess of the market price over the strike price on the vesting date. |

| (2) | Mr. Thompson is no longer with the Corporation effective August 18, 2010. Stock options awarded to Mr. Thompson and vested as of December 31, 2010 are exercisable until March 31, 2011. |

Stock Option Plan

The stock-based compensation program provides stock options that create a direct link between executive rewards and enhanced shareholder value since the full benefit of this compensation element cannot be realized unless stock appreciation occurs over a number of years. The Committee, at its discretion, may grant stock options annually to executives and employees under the Corporation’s stock option plan based on the employee’s position and annual compensation. In addition, special grants of stock options may be approved to recognize singular achievements or to retain and motivate executives in order to further align executive and shareholder interests and to motivate employees.

The Committee designates from time to time eligible persons to whom options are granted and determines the number of shares covered by such options. The underlying security of the options granted under the stock option plan is the Common Shares in the capital of the Corporation. During the fiscal year ended June 30, 2010, a total of 1,544,392 options were issued of which 1,234,392 were issued to management and employees, 240,000 were issued to directors and 70,000 were issued to third party consultants. The maximum number of shares available for issuance under the stock option plan is a rolling number equal to 15% of the issued and outstanding capital of the Corporation on the particular date of grant.

During the fiscal year, 360,457 options expired or were cancelled. As at June 30, 2010, 7,582,971 options were outstanding.

| Plan Category | A. Number of securities to be issued on exercise of outstanding options | B. Weighted-average exercise price of outstanding options | C. Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column A) |

| Equity compensation plans approved by securityholders | 7,582,971 | $2.29 | 4,470,972 |

| Equity compensation plans not approved by securityholders | Nil | Nil | Nil |

| Total | 7,582,971 | $2.29 | 4,470,972 |

The material terms of the Option Plan are as follows:

| • | The persons eligible to receive Options under the Option Plan are the officers, directors, employees and service providers of the Corporation. |

| • | The Board may grant Options to any of the foregoing (an “Eligible Person”), as determined by the Board in its discretion. At the time of the grant of an Option the Board, in its discretion, must fix the number of shares being optioned to the Eligible Person, the exercise price of the Option, the time when the Option is exercisable (including any vesting provisions) and the expiration date of the Option. |

| • | The maximum number of common shares available for issuance under the Option Plan is a rolling number equal to 15% of the number of common shares issued and outstanding on the particular date of grant. |

| • | The number of common shares that may be reserved for issuance to our insiders (as defined in the Securities Act (Ontario)) and any affiliate and subsidiary thereof (collectively, “Insiders”) pursuant to the Plan, may not exceed 10% of the then outstanding issue. |

| • | In any one-year period, Options that may be granted to Insiders shall not exceed 10% of the outstanding issue. |

| • | In any one-year period, Options that may be granted to any one Insider, and such Insider’s associates, shall not exceed 5% of the outstanding issue. |

| • | The exercise price of an Option may not be less than the market price of the common shares on the date on which the grant of the Option is approved by the Board. For this purpose the market price is the closing price of the common shares on the last trading day preceding the date of grant on which the common shares are traded on the TSX or another exchange on which the common shares are listed. |

• The term of an Option may not exceed 10 years from the date of grant.

| • | Once granted, the Options may only be transferred or assigned between an Eligible Person and a related “Employee Corporation” (as defined in the Option Plan) provided the assignor gives notice to the Corporation prior to assignment. |

| • | The number of common shares that may be issued to any one person under the Option Plan shall not exceed 5% of the outstanding common shares. |

| • | An Option and all rights to purchase common shares pursuant thereto shall expire and terminate immediately upon the optionee who holds such Option ceasing to be an Eligible Person, except in the following circumstances: |

| | o | If, before the expiry of an Option in accordance with the terms thereof, an optionee shall cease to be an Eligible Person (an “Event of Termination”) for any reason other than his or her resignation or the termination for “cause” of his or her employment with the Corporation, or his or her resignation or failure to be re-elected as a director of the Corporation, then the optionee may: |

| | a) | exercise the Option to the extent that he or she was entitled to do so at the time of such Event of Termination, at any time up to and including, but not after, a date that is three (3) months (or such other longer period as may be determined by the Board in its sole discretion) following the date of such Event of Termination, or prior to the close of business on the expiration date of the Option, whichever is earlier; and |

| | b) | with the prior written consent of the Board or the compensation committee, which consent may be withheld in the Corporation’s sole discretion, exercise a further Option at any time up to and including, but not after, a date that is three (3) months (or such other longer period as may be determined by the Board in its sole discretion) following the date of such Event of Termination, or prior to the close of business on the expiration date of the Option, whichever is earlier, to purchase all or any of the optioned shares as the Board or the compensation committee may designate but not exceeding the number of optioned shares the optionee would have otherwise been entitled to purchase pursuant to the Option had the optionee’s status as an Eligible Person been maintained for the term of the Option. |

| | o | If an optionee dies before the expiry of an Option in accordance with the terms thereof, the optionee’s legal representative(s) may, subject to the terms of the Option and the Option Plan: |

| | a) | exercise the Option to the extent that the optionee was entitled to do so at the date of his or her death at any time up to and including, but not after, a date one year following the date of death of the optionee, or prior to the close of business on the expiration date of the Option, whichever is earlier; and |

| | b) | with the prior written consent of the Board or the compensation committee, exercise at any time up to and including, but not after, a date one year following the date of death of the optionee, a further Option to purchase all or any of the optioned shares as the Board or the compensation committee may designate but not exceeding the number of optioned shares the optionee would have otherwise been entitled to purchase had the optionee survived. |

| • | The Corporation has no security purchase agreement or stock appreciation rights plan, and the Corporation does not have authority to transform Options into stock appreciation rights. |

| • | By its terms, the Option Plan may be amended by the Board without the consent of the shareholders, including amendments necessary to ensure that the Option Plan complies with the applicable regulatory requirements, including the rules of the TSX, in place from time to time; amendments respecting the administration of the Option Plan and eligibility for participation under the Option Plan; amendments respecting the terms and conditions on which Options may be granted pursuant to the Option Plan, including provisions relating to the option price, the option period and the vesting schedule, provided however, that if the Board proposes to reduce the option price or extend the option period of options granted to insiders of the Corporation pursuant to the Option Plan, such amendments will require shareholder approval; and amendments that are of a housekeeping nature. It should also be noted that any amendment to increase the maximum percentage of the outstanding shares available for issuance under the Option Plan requires shareholder approval. |

| • | The Board may terminate the Option Plan at any time. |

| 4. | Termination and Change of Control Benefits |

Termination and change of control benefits

Mr. David Allan is entitled to receive twenty-four months salary upon his termination as Chief Executive Officer if such termination is caused by a change of control of the Corporation. Certain other Named Executive Officers, namely Messrs. Vincent Salvatori and Leonard Vernon, are entitled to receive six months salary upon termination if such termination is caused by a change of control of the corporation. Assuming a change of control occurred on June 30, 2010, Mr. Allan would have been entitled to a payment of $910,520 and Mr. Salvatori and Mr. Vernon would have each been entitled to a payment of $140,238 and $127,627, respectively. A “change of control” is defined as: (i) the acquisition by any person or group of persons acting jointly or in concert of more than 50% of the voting shares of the Corporati on; (ii) the sale of all or substantially all of the assets of the Corporation; or (iii) the individuals who at the commencement of the officer’s employment with the Corporation constitute the board of directors ceases to constitute at least a majority thereof, unless the election or the nomination for election, by the shareholders of each new Board member was approved by a majority of the Board members then still in office. These arrangements were put in place by a resolution of the Board of Directors. Other than the foregoing arrangements, the Corporation does not currently have employment agreements with any of the Named Executive Officers.

Director compensation table

The following table shows the compensation earned by the non-executive directors for the fiscal year ended June 30, 2010.

| Name | Fees Earned ($) | Share-based awards ($) | Option-based awards ($) (5) | Non-equity incentive plan compensation ($) | All other compensation ($) | Total ($) |

Thomas I.A. Allen (1) | 59,000 | NIL | 44,276 | NIL | | 103,276 |

Mark Entwistle (2) | 38,500 | NIL | 44,276 | NIL | | 82,776 |

| Henry Friesen, C.C., | 36,000 | NIL | 33,207 | NIL | | 69,207 |

| Philip Frost | 30,000 | NIL | 33,207 | NIL | 3,265 (6) | 66,472 |

| François Thomas | 31,500 | NIL | 33,207 | NIL | 32,719 (7) | 97,426 |

Gilbert Wenzel(4) | 37,500 | NIL | 33,207 | NIL | | 70,707 |

Tryon M. Williams (3) (4) | 51,000 | NIL | 44,276 | NIL | | 95,276 |

| | (1) | Earned a $10,000 annual retainer fee as Lead Director and a $4,000 annual retainer fee as Chair of the Corporate Governance and Nominating Committees. |

| | (2) | Earned a $4,000 annual retainer fee as Chair of the Compensation Committee. |

| | (3) | Earned a $6,000 annual retainer fee as chair of the Audit Committee. Mr. Williams was awarded 15,000 stock options in trust for an individual employee, in addition to the 40,000 stock options awarded to all Board members. |

| | (4) | Earned $6,000 for travel days related to board meetings. |

| | (5) | Value of share option awards determined using the Black-Scholes pricing model calculated as at the award date of September 30, 2009. |

| | (6) | Various consulting assignments principally relating to drug development and assessment of potential drug candidates. |

| | (7) | Various consulting assignments principally relating to drug development and assessment of potential drug candidates. |

Narrative Discussion

For fiscal 2011, the Compensation Committee recommended and the Board approved an increase to the annual retainer fee, attendance fees and travel fees payable to non-employee Directors of the Corporation as well as an increase in the annual retainer fee paid to the Lead Director and the Chairs of the Audit and Compensation Committees. In addition, the Board has approved an increase in the number of stock options that will be issued to non-employee Directors. All other Director compensation will remain unchanged.

Directors of the Corporation who are not full-time employees of the Corporation are entitled to receive an annual retainer fee of $24,000 plus an attendance fee of $2,500 per meeting (with the exception of informational meetings) and $1,500 per day spent traveling to attend the meeting, plus expenses. With respect to informational meetings, directors of the Corporation who are not full-time employees of the Corporation are entitled to an attendance fee of $500 per meeting and per day spent traveling to attend the meeting, plus expenses. In addition, the Chair of the Audit Committee is entitled to an annual retainer fee of $12,000, the Chair of the Compensation Committee is entitled to an annual retainer fee of $12,000 and the Chair of the Corporate Governance and Nominating Committee is entitled to an annual retainer fee of $6,0 00. Members of the Audit, Compensation, and Corporate Governance and Nominating Committees who are not full-time employees of the Corporation are entitled to an attendance fee of $2,500 per meeting and $1,500 per day spent traveling to attend the meeting, plus expenses. The Lead Director is entitled to an annual retainer fee of $12,000. As at June 30, 2010, the number of options held by non-executive directors is 1,370,613. Options are granted annually to non-executive members of the Board. A total of nine meetings of the board were held in fiscal 2010.

Share-based awards, option-based awards and non-equity incentive plan compensation

| Name | Option-based awards - Value vested during the year ($)(1) | Share-based awards - Value vested during the year ($) | Non-equity incentive plan compensation - Value earned during the year ($) |

| Thomas I.A. Allen | 19,688 | NIL | NIL |

| Mark Entwistle | 19,484 | NIL | NIL |

| Henry Friesen, C.C., | 19,113 | NIL | NIL |

| Philip Frost | 19,113 | NIL | NIL |

| François Thomas | 19,113 | NIL | NIL |

| Gilbert Wenzel | 19,113 | NIL | NIL |

| Tryon M. Williams | 25,553 | NIL | NIL |

| (1) | The aggregate dollar value that would have been realized if stock options had been exercised on the vesting date, computed as the excess of the market price over the strike price on the vesting date. |

CORPORATE GOVERNANCE DISCLOSURE STATEMENT

The Corporation’s Board of Directors has ultimate responsibility to supervise the management of the business and affairs of the Corporation and its subsidiaries. The Board considers good corporate governance to be central to the effective and efficient operation of the Corporation and regularly reviews, evaluates and modifies its governance program to ensure it is of the highest standard. The Board is satisfied that the Corporation’s governance plan meets and, in many cases, exceeds legal and stock exchange requirements.

In recent years, there have been several changes to the corporate governance disclosure requirements applicable to the Corporation. Specifically, the Canadian Securities Administrators introduced in final form National Instrument 58-101 - Disclosure of Corporate Governance Practices (“NI 58-101”) and National Policy 58-201 - Corporate Governance Guidelines, both of which came into force on June 30, 2005 and effectively replaced the corporate governance guidelines and disclosure policies of the Toronto Stock Exchange. Under NI 58-101, the Corporation is required to disclose certain information relating to its corporate governance practices. This information is set out in Schedule “A” to this management proxy circular. The Board of Directors has adopted a written mandate to formalize its responsibilities, a copy of which is attached to this circular as Appendix “1”.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

During fiscal 2010, Dr. François Thomas and Philip Frost, two of the director of the Corporation, provided consulting services to the Corporation and received from YM BioSciences consulting fees totaling $32,719 and $3,265, respectively.

OTHER INFORMATION

Additional information relating to the Corporation is available on SEDAR at www.sedar.com. Financial information relating to the Corporation is provided in the Corporation’s comparative financial statements and management’s discussion and analysis (“MD&A”) for the financial year ended June 30, 2010. Shareholders may contact the Corporation to request copies of these documents by mail to 5045 Orbitor Drive, Building 11, Suite 400, Mississauga, Ontario, L4W 4Y4.

CERTIFICATE

The contents and the distribution of this proxy circular have been approved by the Board of Directors of the Corporation.

October 8, 2010.

By Order of the Board

“David G.P. Allan”

David G.P.Allan

Chairman and Chief Executive Officer

SCHEDULE “A”

YM BIOSCIENCES INC.

Disclosure of Corporate Governance Practices

NATIONAL INSTRUMENT 58-101

DISCLOSURE OF CORPORATE GOVERNANCE PRACTICES

1. Board of Directors

Disclose the identity of the directors who are independent.

Of the nine current members of the Board of Directors, seven members are considered by the Board to be independent directors according to the definition of independence set out in Multilateral Instrument 52-110 Audit Committees. Of the nine proposed members of the Board of Directors, seven members are considered by the Board to be independent. In reaching this conclusion, the Board of Directors took the view that Thomas I.A. Allen, Mark Entwistle, François Thomas, Philip Frost, Henry Friesen, Gilbert Wenzel and Tryon M. Williams are independent directors.

Disclose the identity of directors who are not independent, and describe the basis for that determination.

David G.P. Allan, the Chief Executive Officer of the Corporation is a member of management and, accordingly, is not considered to be independent of the Corporation.

Nick Glover, the President and Chief Operating Officer of the Corporation and a nominee for election as a director, is a member of management and, accordingly, is not considered to be independent of the Corporation.

Disclose whether or not a majority of directors are independent. If a majority of directors are not independent, describe what the board of directors does to facilitate its exercise of independent judgment in carrying out its responsibilities.

The Board of Directors considers that seven of the nine proposed directors are independent.

If a director is presently a director of any other issuer that is a reporting issuer (or the equivalent) in a jurisdiction of Canada or a foreign jurisdiction, identify both the director and the other issuer.