UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended: December 31, 2006

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 000-51967

NOVACEA, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 33-0960223 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

601 Gateway Boulevard, Suite 800

South San Francisco, California 94080

(650) 228-1800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of exchange on which registered |

| Common Stock, par value $0.01 per share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock of the registrant held by non-affiliates of the registrant on June 30, 2006, the last business day of the registrant’s second fiscal quarter was: $210,189,160.

As of March 28, 2007 there were 23,001,311 shares of the registrant’s common stock outstanding.

Documents incorporated by reference: Items 10, 11, 12, 13, and 14 of Part III incorporate information by reference from the Proxy Statement to be filed with the Commission within 120 days of the end of our fiscal year pursuant to General Instruction G(3) to Form 10-K.

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

We have made statements in this Annual Report on Form 10-K in Item 1—“Business”, Item 1A—“Risk Factors”, Item 3—“Legal Proceedings”, Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operation” and in other sections of this Annual Report on Form 10-K that are forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| | • | | delays or unfavorable results from our current and planned clinical trials; |

| | • | | our ability to enter into and maintain relationships with third parties who are conducting our clinical trials; |

| | • | | our ability to enroll patients for our clinical trials; |

| | • | | our ability to implement and manage our sales and commercialization initiatives; |

| | • | | the impact of competition and technological change; |

| | • | | our relationships with our licensors; |

| | • | | our relationships with our key suppliers; |

| | • | | the timing of necessary regulatory clearances; |

| | • | | coverage and reimbursement policies of governmental and private third-party payors, including the Medicare and Medicaid programs; |

| | • | | general economic and business conditions, both nationally and in our markets; |

| | • | | our ability to manage our growth and development; |

| | • | | our ability to attract and retain key management and scientific personnel; |

| | • | | existing and future regulations that affect our business; and |

| | • | | other risk factors included under “Risk Factors” in this prospectus. |

In addition, in this Annual Report on Form 10-K, the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan,” “predict,” “potential” and similar expressions, as they relate to Novacea, Inc., our business and our management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements speak only as of the date the statements are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

1

PART I

ITEM 1. BUSINESS

Overview

We are a biopharmaceutical company focused on in-licensing, developing and commercializing novel therapies for the treatment of cancer. We currently have two clinical-stage oncology product candidates. Our lead product candidate, Asentar™, is in a Phase 3 clinical trial for the treatment of androgen-independent prostate cancer, or AIPC, which is also very similar to hormone refractory prostate cancer. AIPC is the stage of prostate cancer when the disease is no longer controlled by deprivation of male hormones and tends to progress rather rapidly, uniformly leading to death. Our second product candidate, AQ4N, advanced into a Phase 1/2 clinical trial in glioblastoma multiforme, the most aggressive form of brain cancer, in combination with radiation and chemotherapy in the fourth quarter of 2006.

Our experienced team uses its expertise in oncology product development to identify, license and develop novel therapeutics with the potential to improve clinical outcomes for cancer patients. We also seek to develop anti-cancer agents that may reduce the toxicities associated with current treatments. In addition, we attempt to mitigate development risks for our product candidates by licensing product candidates with well-characterized mechanisms of action and supportive pre-clinical or clinical data. We believe that our oncology development expertise enables our team to design efficient clinical development and commercialization programs that could provide cancer patients with improved treatment options over current standards of care.

We were incorporated in Delaware in 2001. The terms “Novacea,” “our,” “us” and “we” refer to Novacea, Inc.

Product Development Programs

We continue to advance our product candidates through clinical development. The following chart shows our existing clinical trials, with the lead indication, program status and commercial rights for each of our product candidates:

| | | | | | |

Product Candidate | | Lead Cancer Indication | | Program Status | | Our Commercial Rights |

Asentar™ | | Androgen-independent prostate cancer | | Phase 3 | | Worldwide |

| | | |

AQ4N | | Glioblastoma multiforme | | Phase 1/2 | | United States, Canada & Mexico |

We expect each of our product candidates to have clinical application across multiple tumor types. We also plan to initiate studies in additional cancer indications for our product candidates. Our total research and development expenses for the years ended December 31, 2002, 2003, 2004, 2005 and 2006 were $4.0 million, $10.9 million, $14.7 million, $17.8 million and $21.8 million, respectively.

Our Lead Product Candidate, Asentar™

Asentar™ Background

Asentar™ is a proprietary, convenient-to-use, high-dose oral formulation of calcitriol designed for cancer therapy. Calcitriol is a naturally occurring hormone and the most biologically active form of vitamin D. At normal levels in the body, the primary role of calcitriol is to act on the intestine, bone and kidney to increase serum calcium and decrease phosphate levels. Commercially available low-dose formulations of calcitriol have been used systemically for the management of calcium levels in end-stage renal disease since 1978.

While calcitriol has been used primarily for its calcium regulatory activities, it is also involved in a variety of other physiological processes. Calcitriol acts by binding to the vitamin D receptor, or VDR, a member of the

2

nuclear receptor super family of transcription factors. VDR is found in over 30 tissues, including intestine, kidney, bone, brain, stomach, heart, pancreas, skin, colon, ovary, breast, prostate and activated lymphocytes. Once activated by calcitriol, VDR regulates transcription of a wide variety of genes, including several responsible for the growth and differentiation of normal and malignant cells.

Accordingly, calcitriol has exhibited effective anti-cancer activity at high dosage levels in multiple pre-clinical tumor models. These anti-cancer effects appear to result from calcitriol’s ability to induce differentiation, anti-proliferative activity, cell cycle arrest, decreased invasiveness, decreased metastases, and apoptosis. In addition, pre-clinical data indicate that transient high plasma levels are sufficient to induce anti-cancer activities in multiple tumor cell lines and in animal models of cancer including prostate, breast, colon, head and neck, lymphoma and myeloma. Severalin vitro andin vivo pre-clinical evaluations have also demonstrated that high doses of calcitriol can be effective alone or in combination with widely-used chemotherapeutic agents, including the taxanes, the platinums, dexamethasone, doxorubicin, mitoxantrone, and gemcitabine, as well as nonsteroidal anti-inflammatory drugs.

In spite of these encouraging pre-clinical observations, the known side effects of high doses of calcitriol, primarily life-threatening excessive levels of calcium in the blood, or hypercalcemia, have prevented investigators from studying calcitriol in humans at the high dosage levels that appear to be required to induce anti-cancer effects. For example, previous studies for the treatment of cancer evaluated daily dosing of a marketed formulation of calcitriol known as Rocaltrol®, or Rocaltrol, which is used in the treatment of renal disease, but the dose of Rocaltrol could be escalated only modestly when administered on consecutive days before the development of hypercalcemia in patients was observed.

Investigators at Oregon Health & Science University, or OHSU, overcame this obstacle in 1998 with the discovery of a novel and proprietary dosing regimen capable of delivering the high concentrations of calcitriol necessary to achieve an anti-cancer effect without inducing hypercalcemia. The proprietary dosing regimen used high doses of calcitriol administered once a week in order to achieve the transient levels of calcitriol in plasma necessary for an anti-cancer effect. This dosing regimen allowed the body to clear calcitriol before inducing hypercalcemia. In one of OHSU’s Phase 2 clinical trials, high-dose calcitriol was administered weekly to 37 AIPC patients in combination with weekly Taxotere® or Taxotere. This combination trial not only showed that transient high concentrations of calcitriol could be delivered in humans safely, but also that levels of Prostate Specific Antigen, or PSA, a biomarker of prostate cancer, declined by 50% or greater in 81% of the patients. Activity in measurable disease and survival also suggested that the high-dose calcitriol and Taxotere combination may be more active than Taxotere alone, with a comparable safety profile. OHSU has patented and has patent applications pending for methods relating to the treatment of hyperproliferative diseases, which are diseases characterized by abnormal proliferation of cells, with the dosing regimen for calcitriol and analogs using its novel and proprietary dosing regimen capable of administering high doses of calcitriol without inducing hypercalcemia, which we refer to as high-dose pulse administration technology for calcitriol, or HDPA. Additionally, we refer to this method as an intermittent, dose intense administration of calcitriol.

The OHSU trials demonstrated that HDPA allows for the delivery of therapeutic doses of calcitriol. However, there are significant limitations with commercially available formulations of calcitriol, including lack of convenient administration, inconsistent absorption and gastric complications. For example, during the OHSU trials, AIPC patients were required to ingest a high number of Rocaltrol capsules (e.g. 60 to 90) to achieve therapeutic doses, resulting in gastric and absorption complications.

We licensed exclusive, worldwide rights from OHSU to HDPA for use with calcitriol and its analogs, and we subsequently developed Asentar™ as our proprietary formulation that we believe is capable of delivering in a single pill a predictable therapeutic level of calcitriol without the gastrointestinal and absorption complications associated with delivering high-dose pulse administration of commercially available formulations. We filed an investigational new drug application, or IND, for Asentar™ in February 2002.

3

Asentar™ in the Treatment of AIPC

Market Opportunity

According to the American Cancer Society, prostate cancer is the second leading cause of cancer death in men with approximately 218,890 new cases and 27,050 deaths in the United States expected in 2007. The mortality from this disease is expected to rise significantly in the United States with the aging of the “baby boomer” generation. The Prostate Cancer Foundation forecasts that without new interventions the number of deaths from prostate cancer in the United States will grow to approximately 68,000 annually by 2025.

We believe the annual deaths from prostate cancer is a reasonable estimate for the number of new AIPC patients each year as patients rarely die of prostate cancer in the early stages of the disease.

Current Treatment

Prostate cancer is usually diagnosed by a PSA blood test or a digital rectal exam, followed by a biopsy. PSA is a substance produced primarily, if not solely, in the prostate gland, a high level of which may indicate the presence of cancer. Primary treatment of prostate cancer is usually either surgical removal or ablation through radiation of the prostate. When the disease is diagnosed early, primary treatment is most often curative. After primary treatment, patients continue to be followed by their physicians. If high levels of PSA are detected in periodic blood tests, it is an indication that cancerous cells may have spread beyond the prostate and that the cancer is recurrent.

For recurrent prostate cancer, androgen ablation therapy by surgical castration or medical intervention is often prescribed to retard the growth of the cancer at this stage of the disease and is generally effective in reducing PSA to or near undetectable levels. Androgen ablation therapy is generally effective for 12 to 18 months of treatment, when patients may again experience a rise in their PSA levels indicating that the prostate cancer is progressing. Upon progression to this stage, the patient is considered androgen-independent, which is referred to as androgen-independent prostate cancer, or AIPC. At this stage, patients become eligible for their initial treatment or first-line chemotherapy with Taxotere. The mortality of prostate cancer is primarily associated with patients at the AIPC-stage of the disease, as AIPC is uniformly fatal.

A number of treatments have been approved for AIPC. In 1981, estramustine was approved for palliative treatment of patients with metastatic and/or progressive carcinoma of the prostate. Beginning in 1996, the combination of mitoxantrone and prednisone was used for the palliation of symptoms related to progressive castrate metastatic disease and zoledronic acid was approved in 2001 for the palliative treatment of patients with documented bone metastases from solid tumors, in conjunction with standard hormone therapy. However, none of these approved agents have been shown in prospective randomized comparisons to prolong life.

In May 2004, Taxotere became the first agent approved in the United States for the treatment of AIPC that demonstrated an improvement in survival in a randomized Phase 3 clinical trial. The combination of Taxotere and prednisone was approved based on the results of an international, multicenter, Phase 3 clinical trial called TAX327 sponsored by Sanofi-Aventis S.A., or Sanofi-Aventis, in subjects with metastatic AIPC. The regimen of Taxotere every three weeks resulted in an observed median survival of 18.9 months and an estimated 32% improvement in overall survival compared to the mitoxantrone regimen. With Taxotere now established as the standard of care for first-line treatment in AIPC, a key focus of clinical research is to identify new approaches to build on the clinical benefits of Taxotere in this patient population.

The Opportunity for Asentar™

Based on the results of our ASCENT clinical trial, we believe that the use of Asentar™ in combination with weekly Taxotere will provide AIPC patients with an innovative cancer therapy that has favorable risk-to-benefit profile, prolonging survival while mitigating the toxicities and complications normally associated with

4

chemotherapy and the morbidity of the underlying disease. In our ASCENT-2 clinical trial, we seek to confirm the survival and safety benefits attributed to the addition of Asentar™ to weekly Taxotere that were observed in our ASCENT clinical trial.

We believe that Asentar™ may offer the following therapeutic and commercial benefits:

| | • | | clinically meaningful overall survival improvement and favorable safety profile in patients with AIPC; |

| | • | | anti-cancer activity in multiple tumor types, including pancreatic, prostate, breast and colon, as suggested by pre-clinical data; |

| | • | | enhanced anti-cancer activity with multiple chemotherapy agents as suggested by pre-clinical data; |

| | • | | novel mechanism of action via a nuclear receptor, a member of a proven family of targets for drugs; |

| | • | | convenient, proprietary high-dose oral capsules; and |

| | • | | exclusive worldwide rights protected by a multi-layer patent portfolio with significant remaining patent life. |

Development Status and Strategy

Our ongoing ASCENT-2 clinical trial is designed to confirm the survival and safety benefits observed in our ASCENT clinical trial. Our ASCENT-2 clinical trial is a randomized, open-label, multicenter trial in which we expect to enroll approximately 900 patients, or 450 patients per arm, at centers primarily in the United States, Canada and Europe. Our ASCENT-2 clinical trial will compare the weekly dosing regimen of Asentar™ and Taxotere, used in our ASCENT clinical trial, with the currently approved regimen for Taxotere, dosed every three weeks in combination with prednisone. We currently expect to complete enrollment for ASCENT-2 by the end of 2007 and anticipate that data from the clinical trial will be available in approximately two years.

The primary endpoint of our ASCENT-2 clinical trial is Overall Survival, which is defined as the time between the date of randomization and the date of death, regardless of cause. We believe an improvement in Overall Survival is recognized as the most meaningful outcome in AIPC and was the endpoint used as the basis for approval by the FDA in 2004 of Taxotere, which is the current chemotherapeutic standard of care for the first-line treatment of AIPC.

We have established the secondary endpoints for our ASCENT-2 trial based on the safety and efficacy results observed in our ASCENT clinical trial. The secondary endpoints are: (i) Thromboembolic Event Rate, which is defined as a myocardial infarction, cerebrovascular infarction, pulmonary embolism, deep venous thrombosis, or an arterial thrombosis, and (ii) Duration of Skeletal Related Event-Free Survival. Skeletal related events are defined as pathologic bone fracture, spinal cord compression, surgery to the bone, or radiation therapy to the bone. To evaluate the safety and tolerability of the Asentar™ arm, the serious adverse event rate and gastrointestinal event rate are prespecified as safety endpoints.

We believe the similarity of the designs of our ASCENT-2 clinical trial, our ASCENT clinical trial and Sanofi-Aventis’s TAX327 trial allowed us to use the results of the latter two trials to estimate the size and statistical power of our ongoing ASCENT-2 clinical trial with reasonable confidence.

Our ASCENT Clinical Trial

Our ASCENT clinical trial evaluated Asentar™ in combination with weekly administration of Taxotere for the treatment of AIPC. We reported the results of our 250-patient, double-blind, placebo-controlled, multicenter ASCENT clinical trial at the American Society of Clinical Oncology meeting in May 2005.

The two trial treatment arms were:

| | • | | Asentar™ Arm. Once weekly Asentar™ in a combination regimen with weekly Taxotere. |

| | • | | Placebo Arm. Once weekly placebo in a combination regimen with weekly Taxotere. |

5

The primary endpoint for the ASCENT trial was a 50% reduction in PSA Response by six months. In patients with AIPC, many clinicians use increasing levels of PSA as an indicator of disease progression. The ASCENT trial was designed to detect an increase in the frequency of PSA Response from 45% of the patients in the placebo arm to 65% of the patients in the Asentar™ arm. Although PSA Response rate may not be predictive of a clinical benefit for AIPC patients and has not been an acceptable registration endpoint for the FDA, we chose this as our primary endpoint in order to confirm and extend the results of OHSU’s Phase 2 clinical trial. However, we also included in our ASCENT clinical trial several clinically meaningful secondary endpoints that have been acceptable registration endpoints for the FDA, including Overall Survival and Duration of Skeletal Related Event-Free Survival. Other secondary endpoints included time to PSA Response, Tumor Response in patients with measurable disease, as well as safety and tolerability of the study treatment.

Results From Our ASCENT Clinical Trial

In July 2004, after the last randomized subject had been followed for six months, we conducted the primary efficacy analysis, which showed that a PSA Response was achieved by 58% of the subjects in the Asentar™ arm compared to 49% in the placebo arm. This demonstrated a favorable trend toward the Asentar™ arm, but this primary endpoint did not reach statistical significance, with a p-value equal to 0.160. A p-value is a statistical measure of significance, with a p-value of less than 0.050 indicating a statistically significant difference. The odds ratio for PSA Response was 0.70, supporting this favorable trend. An odds ratio of less than 1.0 favors the Asentar™ arm as compared to the placebo arm. Based on the fact that we did not achieve statistical significance with our primary endpoint, the FDA has indicated to us that they consider all secondary endpoints from our ASCENT clinical trial to be exploratory.

In evaluating the meaning of these PSA Response data, we considered what has been learned about this endpoint since the ASCENT study was designed in 2001. Analyses of the results from TAX327 and another large clinical trial in AIPC patients where survival benefit was measured in treatment regimens containing Taxotere as compared to a mitoxantrone regimen demonstrated that PSA response was a strong correlate for survival, but did not explain all of the survival benefit. Thus, the limitations of the PSA Response as a predictor of a survival benefit have become more apparent.

In April 2005, we completed the final analysis of our secondary endpoints. In our ASCENT clinical trial we observed a trend in favor of the Asentar™ group in comparison to the placebo group in all pre-specified endpoints. Overall Survival for the Asentar™ group over the placebo group did show a statistically significant improvement. The hazard ratio is a statistical measure of the risk ratio of deaths between the Asentar™ group and the placebo group of the ASCENT trial. A hazard ratio of less than 1.0 indicates a reduction in the risk of death in the Asentar™ group relative to the placebo group. The multivariate hazard ratio included pre-specified adjustments for patients’ baseline measurements for hemoglobin and Eastern Cooperative Oncology Group performance status. The median survival in the placebo group was 16.4 months. The median survival in the Asentar™ group was not reached, but is estimated to be 24.5 months using the multivariate hazard ratio. Serious adverse events (SAEs) were reported in 27% of subjects in the Asentar™ group and 41% of subjects in the placebo group, with an odds ratio of 0.54 and a p-value of 0.023. In addition, from an exploratory analysis, there was a significant reduction in the frequency of both serious gastrointestinal events, with a p-value of 0.017, and serious thromboembolic events, with a p-value of 0.031.

6

The data on the survival endpoint is summarized in the following table:

| | | | | | |

Overall Survival Endpoint(1) | | Placebo + Taxotere (n = 125) | | Asentar™ + Taxotere (n = 125) | | p-value |

Hazard ratio—multivariate | | | | 0.67 | | 0.035 |

Median survival (in months)—observed, and estimated using multivariate hazard ratio | | 16.4 (observed) | | 24.5 (estimated) | | |

| (1) | Based on final secondary endpoint analysis in April 2005 |

The Kaplan-Meier plot of the duration of overall survival is depicted in the figure below:

In the Kaplan-Meier plot above, the vertical axis reflects the probability of survival. The horizontal axis displays the number of months from randomization to death for the patients in the trial. The point at which either the Asentar™ group or placebo group curve or line reaches median survival, i.e. the 0.50 probability of survival, corresponds to the time in months on the horizontal axis at which half of the subjects have died in either the Asentar™ or placebo group. As was noted above, the observed median survival for the placebo group was 16.4 months, and an observed median survival was not reached for the Asentar™ group. The hazard ratio compares the Overall Survival curve of the Asentar™ group to that of the placebo group and assumes its consistency over time. It is a better representation of the overall risk of death of a patient on the Asentar™ arm compared to the placebo arm than median survival.

Other efficacy results and findings from our analysis in April 2005 trended in favor of the Asentar™ group as compared to the placebo group, including: skeletal morbidity-free survival, with a hazard ratio of 0.78, and a p-value equal to 0.130; and tumor response rates, with an odds ratio of 0.74, and a p-value equal to 0.510. Skeletal Morbidity-Free Survival was defined as the time between the date of first dose received and the date on which the skeletal-related event occurs or the date of death from any cause, whichever occurs first.

7

Safety Observations of ASCENT Clinical Trial

We made the following overall safety observations about Asentar™:

| | • | | produced only low grade, or mild, levels of elevated blood calcium or hypercalcemia that were asymptomatic in all patients; |

| | • | | added no detectable toxicities to Taxotere; and |

| | • | | appeared to mitigate the toxicities associated with Taxotere and the morbidity of the underlying disease. |

| | | | | | | | | | |

| | | Placebo +

Taxotere (n = 125) | | Asentar™ +

Taxotere (n = 125) | | p-value

(1) |

Serious Adverse Event Class | | % | | # | | % | | # | |

Subjects reporting at least one event | | 41 | | 51 | | 27 | | 34 | | 0.023 |

Gastrointestinal | | 10 | | 12 | | 2 | | 3 | | 0.017 |

Thromboembolic | | 7 | | 9 | | 2 | | 2 | | 0.031 |

Pulmonary | | 6 | | 7 | | 2 | | 3 | | 0.200 |

Infection | | 10 | | 12 | | 6 | | 7 | | 0.230 |

Central Nervous System | | 0 | | 0 | | 1 | | 1 | | 0.310 |

Multifactorial (2) | | 24 | | 30 | | 17 | | 21 | | 0.160 |

Bleeding | | 3 | | 4 | | 5 | | 6 | | 0.520 |

Neuropathic | | 0 | | 0 | | 0 | | 0 | | 1.000 |

| (1) | The p-value is for the comparison of the % of patients experiencing one or more Severe Adverse Events in the two trial arms of the ASCENT trial |

(2) | Multifactorial consists of all SAEs not otherwise classified above |

These safety differences were initially observed by an independent Data Safety Monitoring Board early in the trial and subsequently by us during our safety analysis. In order to analyze the potential safety benefit of Asentar™ an exploratory analysis was conducted in which the adverse events were grouped into certain clinically relevant categories to assess potential differences in the two trial arms.

Although the mechanisms by which observed beneficial effects of Asentar™ on safety have not been fully elucidated, the reduction in thromboembolic events may be explained through the modulation of the extrinsic coagulation pathway by calcitriol. Calcitriol has been shown to up-regulate thrombomodulin, an anticoagulant, and down-regulate tissue factor, a procoagulant. The biological rationale for this activity by calcitriol was first characterized by a study in 1998. In addition, in studies of vitamin D receptor deficient “knockout” mice, the animals were observed to have a predisposition to thrombosis. Thus, the actions of calcitriol might be expected to reduce the incidence of complications of coagulation in an at-risk patient population. Given this body of data, we postulate that the differences observed in the frequency of thromboembolic events in the Asentar™ group as compared to placebo group could represent the pharmacological effects of Asentar™ on vascular events associated with thrombosis.

Given that Taxotere is known to cause gastrointestinal, or GI, adverse events in many treated patients, we sought a rationale to explain how Asentar™ might prevent or reduce the severity of Taxotere-induced GI adverse events. One mechanism whereby Asentar™ may reduce or prevent the GI toxicity of Taxotere is to reduce the rate of growth or induce temporary cell cycle arrest in the rapidly proliferative cells of the gastrointestinal tract rendering them less sensitive to the cytotoxic effects of Taxotere chemotherapy. Epidemiological and other studies have shown that higher levels of vitamin D metabolites are associated with reduced proliferation of epithelial cells in the gastrointestinal system.

In our ASCENT-2 clinical trial, we are attempting to confirm the results of our ASCENT clinical trial.

8

Asentar™ in Other Cancer Indications

Beyond our ongoing ASCENT-2 clinical trial in AIPC, we will seek to develop Asentar™ broadly as a non-toxic, oral anti-cancer therapy and study its potential in multiple cancers and in combination with several chemotherapeutic agents. Currently, our plans include an additional company-sponsored Phase 2 clinical trial in pancreatic cancer during 2007 and investigator-sponsored trials for Asentar™ during 2007.

In June 2006, we announced preliminary results from our non-small cell lung cancer Phase 1/2 clinical trial. In both stages of this trial, Asentar™ was well tolerated at all doses. We plan to present an analysis from this clinical trial at an upcoming scientific meeting in 2007.

We have also studied Asentar™ in a Phase 2 clinical trial in Myelodysplastic Syndrome, a group of stem cell disorders. While Asentar™ appeared to be safe and well-tolerated in these patients, only two patients demonstrated a meaningful response and we terminated this clinical trial.

Our Second Product Candidate, AQ4N

We are developing AQ4N as a novel, tumor-selective prodrug with applicability to multiple tumor types, both in combination with a number of chemotherapeutic agents and as a monotherapy for hematological malignancies. AQ4N is an inert, oxidized derivative of AQ4, a well-characterized Topoisomerase II inhibitor which exhibits potent cytotoxicity comparable to other marketed Topoisomerase II inhibitors such as Novantrone® mitoxantrone and Adriamycin® doxorubicin.

AQ4N Background

The oxidation of, or presence of oxygen on, the two nitrogens within the chemical structure of AQ4N modifies the positive charge on the tertiary nitrogens causing AQ4 to be inert and inactive, as the positive charges are necessary for AQ4 binding to DNA and for the inhibition of Topoisomerase II activity. AQ4N remains inactive in the body unless it is in the presence of severely reduced oxygen levels called severe hypoxia. Hypoxia exists in some portions or regions in solid tumors that are greater than two millimeters in size. These hypoxic regions of solid tumors have distinctive characteristics that are associated with poor perfusion of oxygen and nutrients, increased production of lactic acid, poor growth, and resistance to the damaging effects of irradiation or chemotherapy. These characteristics stem from the disordered vasculature, or arrangement of the blood vessels, and blood flow that is characteristic of solid tumors. When AQ4N encounters a severely hypoxic region in a tumor, the oxygens of AQ4N are enzymatically removed, releasing AQ4 that subsequently produces cytotoxic effects at the site of activation.

Since normal tissues in the body do not exhibit severe hypoxia, AQ4N does not undergo appreciable activation in normal tissues, thereby enabling it to potentially behave as a “tumor selective” prodrug. For reasons that are not completely understood, certain cells derived from malignant hematological malignancies also appear to activate AQ4N, even in the absence of severe hypoxia. These malignant cells are much more sensitive to the cytotoxic effects of AQ4 and other Topoisomerase II inhibitors than cells derived from solid tumors.

The Opportunity for AQ4N

We believe AQ4N may offer the following therapeutic and commercial benefits:

| | • | | novel, proprietary anti-cancer agent with tumor-selective activation at the cellular level in hypoxic tumor cells and lymphoid tissues to yield cytotoxic concentrations of AQ4; |

| | • | | minimizes systemic toxicity by selectively activating only in hypoxic tumors; |

| | • | | potent Topoisomerase II inhibitor and DNA intercalator; |

| | • | | long half-life and schedule independence; |

9

| | • | | demonstrated in vivo anti-tumor activity as monotherapy in solid tumor and lymphoma models; |

| | • | | clinical data demonstrating additive benefit to radiation and chemotherapy regimens; and |

| | • | | superior safety profile to conventional cytotoxics in humans and animals due to AQ4N’s activation only in tumor cells. |

We believe that AQ4N has the potential to work on multiple solid tumor types as a monotherapy and in combination with other chemotherapies and radiation treatments. We are pursuing a development strategy that we believe may provide the quickest regulatory pathway for AQ4N.

AQ4N is a Tumor Targeting Prodrug. AQ4N is designed to be an intravenously-administered, tumor-selective, prodrug that is activated preferentially in hypoxic cells or some hematological cells. Data collected to date shows that AQ4N is soluble in water and fat and diffuses into most, if not all, of the various tissues and cells in the body, effectively delivering the prodrug to all tissues, normal and malignant, even crossing the blood brain barrier.

AQ4N Targets Hypoxic Tumors. Hypoxia is an important distinguishing characteristic of tumors that limits the effectiveness of radiation and chemotherapy treatments.In vitro data indicate that the level of response to radiation and/or chemotherapy in hypoxic cells is one-third that of normally oxygenated, or normoxic, cells, thus limiting the effectiveness of these therapies. This lower response can be attributed to the fact that hypoxic cells replicate slower than normoxic cells making them less vulnerable to the chemotherapeutic agents that target rapidly dividing cells. In addition, oxygen plays a key role in the response of tumors to radiation and/or chemotherapy by facilitating the free radical damage that kills cells after radiation and some chemotherapies. Given that normal levels of oxygen play an important role in killing malignant cells, hypoxic cells are more likely to survive and then regrow, leading to treatment failure. AQ4N potentially addresses a significant unmet medical need, as few treatments effectively target the hypoxic cell populations of tumors.

AQ4N Appears to Have a Favorable Safety Profile. We believe that an important differentiating feature of AQ4N is that, since its activation is primarily intracellular, the opportunity for systemic toxicity should be reduced significantly in comparison to most cytotoxic chemotherapies. When not activated, AQ4N diffuses out of the tissues and is excreted as the inactive agent in the bile and urine. In clinical trials to date, AQ4N has demonstrated a relatively safe profile. The most notable side effect observed to date is a transient blue discoloration to patients’ skin.

AQ4, the Potent Cytotoxic Agent of AQ4N. When AQ4N is converted into its active form, AQ4 is designed to act as a Topoisomerase II inhibitor, a class of anti-cancer agents that have been used for many years for the treatment of tumors. Topoisomerase II inhibitors act as chemotherapies by inhibiting Topoisomerase II, a DNA processing enzyme crucial to cell division. Many malignancies, such as breast cancer, ovarian cancer, non-Hodgkin’s lymphoma, acute myeloid leukemia, non-small cell lung cancer and colorectal cancer, have been found to over express Topoisomerase II and should be appropriate indications for AQ4N treatment. While Topoisomerase II inhibitors such as doxorubicin, daunorubicin, and mitoxantrone are commonly used to treat breast cancer, leukemia, and lymphoma, their use is limited by toxicities such as myelosuppression.

AQ4N Appears to Enhance the Effect of Radiation and Chemotherapy. Pre-clinical experiments have demonstrated in hypoxic conditions that adding AQ4N to radiation or platinum chemotherapy treatment doubled the time it takes for a fixed number of cells to increase by two fold as compared to applying either treatment modality alone.

In addition, because AQ4 has a relatively long half-life, which is the time required for half the amount of AQ4 in the system to be eliminated naturally, we believe that AQ4 should produce long-lasting anti-cancer effects in those cells in which AQ4N has become activated. This should lead to a favorable pharmacological property known as “schedule independence”, which means that physicians would have flexibility in administering AQ4N in combination with other therapies, including radiation and chemotherapy.

10

AQ4N Development Status and Strategy

We are responsible for the development and commercialization of AQ4N in North America, although we coordinate our related activities and share the resulting data with AstraZeneca PLC, or AstraZeneca (AstraZeneca acquired KuDOS Pharmaceuticals Limited, or KuDOS, in 2006). Together, we have completed four Phase 1 clinical trials. We have demonstrated that both weekly and every three week dosing has been well tolerated in advanced solid tumor malignancies and in patients with refractory B-cell malignancies, some of whom have a decreased bone marrow reserve. KuDOS has completed a Phase 1 two-dose, dose escalation clinical trial in combination with fractionated radiation in esophageal carcinoma at two sites in the U.K. KuDOS has completed several biopsy studies in patients with a variety of tumor types and has also conducted safety and activity seeking studies with AQ4N in combination with chemotherapy. We believe that, based on the combined studies to date, the safety and dosing of AQ4N have been confirmed.

Based on these findings, the severity of the unmet medical need and the potential for a rapid route to approval, we started a Phase 1/2 clinical trial in the fourth quarter of 2006 that will evaluate AQ4N in the treatment of glioblastoma multiforme. This trial will combine AQ4N with radiation and temozolomide chemotherapy. In addition, we plan to initiate additional Phase 1 or Phase 2 clinical trials in additional tumor types, including hematological malignancies.

Prior and Ongoing Phase 1 Studies of AQ4N

We are studying AQ4N as a monotherapy and in combination with other chemotherapy agents and/or radiation. We and our collaborator, AstraZeneca, have conducted safety and dosing studies of AQ4N both as a monotherapy and in combination with chemotherapy and/or radiation. To date, three Phase 1 studies of AQ4N alone and one Phase 1 study of AQ4N in combination with irradiation are complete. There are two ongoing studies in patients with bladder cancer: one with AQ4N in combination with cisplatin chemotherapy, and; one with AQ4N in combination with radiation therapy. The results of the four completed Phase 1 studies were presented at scientific meetings in 2005 and 2006.

One of the Phase 1 studies noted above was a pharmacodynamic study in which the purpose was to assess the amount of tumor-selective activation of AQ4N to AQ4 and also to assess the degree of activation and deposition of AQ4 within malignant tissue. In this study, a single dose of 200 milligrams per meter squared of AQ4N was administered on the day before patients were scheduled to undergo a surgical resection, or removal, of their primary tumor for medical reasons. At the time of the surgical procedure, samples of the tumors, adjacent normal organs, and skin were obtained to assess the amounts of AQ4 and AQ4N that were present in the tissues, as determined by quantitative validated assays. In addition, the location of AQ4 was assessed by immunofluorescence in the tumor tissue and correlated with the presence or absence of immunochemical determinations of markers indicative of hypoxia such as Glucose transporter-1, or GLUT-1, protein expression and carbonic anhydrase IX expression.

The quantitative analyses for AQ4N and AQ4 from samples from eight patients with brain tumors demonstrated the tumor selective activation of AQ4N, producing several fold greater amounts of AQ4 in the brain tumor samples, as compared to the adjacent normal brain tissues. The amounts of AQ4 in the brain tumor samples approached or exceeded those that produced cytotoxicity in a variety of solid tumor cell lines in tissue culture assays. The immunofluorescence studies of the brain tumors showed that AQ4 fluorescence was heterogeneous or “patchy” and occurred primarily in regions that were also characterized by the expression of GLUT-1.

Our Ongoing AQ4N Clinical Trial in Glioblastoma Multiforme, or GBM

The study described above provides evidence that AQ4N appears to cross the blood brain barrier, to penetrate into the brain tumor, and to undergo activation to AQ4. Previous preclinical studies show that AQ4N can combine with irradiation or chemotherapy to enhance the antitumor effects of these treatment modalities.

11

Glioblastoma multiforme is one of the most aggressive and rapidly progressing tumors, with the median survival for newly diagnosed cases of less than one year despite intensive treatment with irradiation and chemotherapy with temozolomide, a chemotherapy.

We believe that AQ4N may add significantly to the standard treatment of patients with GBM and we initiated in late 2006 a multicenter, Phase1b/2a open-label clinical trial of AQ4N, in combination with radiotherapy and temozolomide, for safety, tolerability and activity in patients with newly diagnosed GBM. The primary objective of the first part of the trial will be to evaluate safety and tolerability of three dose levels: 200, 400 and 750 milligrams per meter squared. The second part of the trial will further evaluate safety and tolerability as well as efficacy at the highest safe and tolerated dose of the AQ4N treatment determined in the first part of the trial.

Our Potential AQ4N Clinical Trials in Hematological Malignancies

We are currently investigating why, some malignant cells obtained from leukemias or lymphoid organs activate AQ4N to AQ4 in the absence of severe hypoxia. These cells are also relatively sensitive to AQ4 as compared to cells derived from solid tumors. Additionally, a completed Phase 1 study of AQ4N in patients with refractory B-cell malignancies showed that AQ4N appears well-tolerated, with one patient achieving a partial response. Taken together, preclinical studies and the limited human experience provide rationale for the future evaluation of AQ4N as therapy in patients with hematological malignancies.

Market Opportunity

The large majority of solid tumors have hypoxic areas, which are relatively resistant to standard anti-cancer treatment, including radiation therapy and chemotherapy. An agent that treats the hypoxic areas of tumors and effectively combines with other agents to enhance their anti-cancer activities should increase the overall efficiency of cancer cell killing, reduce tumor recurrence and improve the prognosis for a significant number of patients with cancer.

According to the American Cancer Society, an estimated 20,500 new cases and 12,740 deaths from brain and other nervous system tumors will occur in the United States in 2007. Brain tumors account for 85% to 90% of all primary central nervous system tumors and GBM is the most commonly diagnosed brain tumor. GBM is one of the most aggressive and rapidly progressing tumors, with the median survival for newly diagnosed cases of less than one year. Given the aggressive nature of GBM, the relatively small patient population and the lack of effective therapies, we believe that AQ4N may provide us with an accelerated development path as a first-line therapy in an orphan drug indication.

Vinorelbine Oral

We provided written notice to Pierre Fabre Medicament, or Pierre Fabre of our election, as of October 31, 2006, to terminate each of : (i) the Patent and Know-How License Agreement, or the License Agreement, dated as of July 19, 2005, by and among Novacea, Inc. and Pierre Fabre, pursuant to Section 17.4(b) of the License Agreement, (ii) the Supply Agreement, dated as of July 19, 2005, by and among Novacea and Pierre Fabre, pursuant to Section 6.2.3 of the Supply Agreement, and (iii) the Trademark License Agreement, or the Trademark Agreement, dated as of July 19, 2005, by and among Novacea, Inc. and Pierre Fabre, pursuant to Section 9.2.3 of the Trademark Agreement. The License Agreement, Supply Agreement and Trademark Agreement are collectively referred to herein as the PF Agreements.

According to the applicable provisions of the PF Agreements, the termination of each of the PF Agreements was automatically effective on December 30, 2006, sixty days following delivery of the written notice. We have not incurred any early termination penalties as a result of the termination of the PF Agreements. However, pursuant to the terms of the PF Agreements, we are required to, among other things, promptly return certain

12

intellectual property and other information relating to vinorelbine oral to Pierre Fabre and to transfer all investigational new drug applications and certain related materials to Pierre Fabre.

Pursuant to the PF Agreements, in July 2005, we acquired from Pierre Fabre an exclusive royalty-bearing license under certain patents and know-how to vinorelbine formulated in a soft gelatin capsule, or vinorelbine oral, for all human therapeutic, prophylactic and diagnostic uses in the United States and Canada in the field of cancer. We also acquired Pierre Fabre’s rights to a third party’s formulation and certain manufacturing patents in the United States and Canada.

Under the terms of the PF Agreements prior to their termination in December 2006, we made an upfront license payment and certain milestone payments to Pierre Fabre. Following our termination of the PF Agreements in December 2006, we have no further payments or other financial obligations to Pierre Fabre.

Corporate Strategy

Our goal is to reduce death and suffering of cancer patients through treatment with our novel, proprietary product candidates. Key elements of our strategy include:

| | • | | Obtain regulatory approval for our lead product candidate, Asentar™, for AIPC. We are devoting most of our efforts to completing the clinical development of, and obtaining regulatory approval for, Asentar™ in combination with Taxotere for the treatment of AIPC. |

| | • | | Expand the development of Asentar™ for the treatment of multiple tumor types and for use with multiple anti cancer. We plan to broaden the use of Asentar™ by studying it in other cancer types and with other chemotherapy agents. |

| | • | | Rapidly advance the clinical development of AQ4N. We will seek to develop AQ4N as an adjunct to standard radiation and chemotherapy in the treatment of cancer. |

| | • | | Establish our North American oncology commercialization capabilities. We intend to build a specialized North American sales and marketing infrastructure to commercialize Asentar™ and our other future products. However, we will be opportunistic in evaluating opportunities for corporate partners to assist us in our commercialization efforts. |

| | • | | Identify new opportunities to license, co-develop or acquire products and product candidates that complement our existing portfolio. We will use our expertise in oncology product development to identify, license and develop product candidates and products with one of the following profiles: |

| | • | | clinical agents that enhance the benefits and safety of established treatments; |

| | • | | targeted therapies with a well-characterized mechanism of action; and |

| | • | | chemotherapeutic agents with novel activity. |

| | • | | Expand our proprietary technology and intellectual property position. Our patent portfolio, on a worldwide basis, includes 28 issued patents and approximately 126 pending patent applications. We intend to expand our intellectual property position. |

Sales and Marketing

We have worldwide rights to Asentar™ and North American rights to AQ4N. We intend to build a North American sales and marketing infrastructure to specifically target medical oncologists, the primary prescribers for each of our product candidates. Initially, we believe that our products can be effectively marketed in North America with an adequately sized marketing and sales organization. We currently have limited marketing, sales or distribution capabilities. In order to commercialize any of our product candidates, we plan to develop these capabilities internally or through collaborations with third parties.

13

Outside of North America, we remain open to establishing our own sales and marketing organization or collaborating with an established industry leader to market and sell our products that receive regulatory approval.

License and Collaboration Agreements

Aventis Pharmaceuticals, Inc.

In each of August 2002 and 2003, we entered into agreements with Aventis Pharmaceuticals, Inc., or Aventis, under which Aventis agreed to provide grant revenue payments to us totaling up to $3.0 million and up to $0.4 million, respectively. The grant revenues provide for partial reimbursement of approved costs incurred, as defined in the agreements, and are contingent upon the achievement of milestones regarding the progress of two clinical trials involving Asentar™ and Aventis’ Taxotere® oncology product. We are required to provide Aventis with a final report for both of the clinical trials upon their completion. Under the agreements, Aventis has no product rights to Asentar™. However, Aventis does have co-ownership rights to certain inventions that arose from our Phase 2 clinical trial involving the use of Asentar™ and Taxotere in the treatment of patients with androgen-independent prostate cancer.

We recorded revenue under the two agreements with Aventis of $0.4 million, $1.3 million, $1.1 million, $0.1 million, $0.4 million and $3.3 million for the years ended December 31, 2002, 2003, 2004, 2005 and 2006 and for the period from inception (February 27, 2001) to December 31, 2006, respectively. From inception, the costs incurred under the collaboration agreements have exceeded the revenues recognized.

Oregon Health & Science University

In June 2001, we entered into an exclusive, worldwide license with Oregon Health & Science University, or OHSU, to utilize specific technology under patent rights and know-how related to the use of calcitriol and its analogs. In connection with entering into this license, we issued 228,571 shares of our common stock to OHSU. Because the technology licensed related to a patent application for a method of use utilized in research and development and there was no alternative future use for the technology, we recorded the fair value of the licensed technology as $120,000, based on the fair value of the shares issued, as research and development expense. As of December 31, 2006 and under the terms of the agreement, we may be obligated in the future to make certain milestone payments to OHSU of up to an aggregate of $0.6 million, which milestone payments are contingent upon the occurrence of certain clinical development and regulatory events related to Asentar™. Payments to OHSU that relate to pre-approval development milestones are recorded as research and development expense when incurred. We are obligated to pay to OHSU certain royalties on net sales of Asentar™, which royalty rate may be reduced in the event that we must pay certain additional royalties under patent licenses entered into with third parties in order to manufacture, use or sell Asentar™. We have agreed to pay OHSU a certain percentage of any sub-license revenues that we receive. We have also agreed to reimburse OHSU for all reasonable fees and costs related to the preparation, filing, prosecution and maintenance of the patent rights underlying the agreement, and we have agreed to indemnify OHSU and certain of its affiliates against liability arising out of the exercise of patent rights under the agreement. Furthermore, in addition to customary termination provisions for breach or bankruptcy, OHSU may also terminate the license agreement if we do not proceed reasonably with the development and practical application of the products and processes covered under the license or does not keep the products and processes covered under the license reasonably available to the public after commencing commercial use.

University of Pittsburgh

In July 2002, we acquired an exclusive, worldwide license from the University of Pittsburgh of the Commonwealth System of Higher Education, or University of Pittsburgh, to utilize specific technology under certain patent rights and know-how related to the use of calcitriol, and its derivatives and analogs, with certain chemotherapies. In exchange for this license, we issued 14,285 shares of common stock and paid cash consideration of $100,000 to the University of Pittsburgh. We recorded the value of the issuance of the common

14

stock as $9,000, based on the fair value of the shares on the date of issuance. We capitalized the licensed patent rights of $109,000, included in “Other assets” on the accompanying balance sheet, and are amortizing the asset on a straight-line basis over the estimated useful life of the patents, or approximately 15 years. The carrying value of the licensed patent rights at December 31, 2006 and 2005 was $80,000 and $87,000, respectively. The amortization expense of the licensed patent rights was $7,000 for each of the years ended December 2004, 2005 and 2006 and is expected to remain $7,000 per year through 2011. In addition, we are obligated to issue an additional 14,285 shares of our common stock to the University of Pittsburgh upon the issuance of certain claims included in one of several U.S. patents that are subject to this license. Under the terms of the agreement, we are obligated to pay the University of Pittsburgh certain royalties on net sales of Asentar™ when used in combination with certain chemotherapies. The royalty rate may be reduced in the event that we must pay certain additional royalties under patent licenses entered into with third parties in order to manufacture, use or sell Asentar™. As of December 31, 2006 and under the terms of the agreement, we may be obligated through 2009 to make certain minimum royalty payments to the University of Pittsburgh of up to an aggregate of $0.7 million, which royalty payments are contingent upon continuation of the license agreement and are creditable against our royalty obligations that are actually due in any calendar year. This minimum royalty payment obligation began in July 2003. Minimum royalty payments to the University of Pittsburgh in advance of Asentar™ marketing approval are recorded as research and development expense when incurred. We have agreed to pay the University of Pittsburgh a certain percentage of any sub-license revenues that we receive. We have also agreed to reimburse the University of Pittsburgh for all reasonable fees and costs related to the filing prosecution and maintenance of the patent rights underlying the agreement.

KuDOS Pharmaceuticals Limited

In December 2003, we entered into a license agreement with KuDOS Pharmaceuticals Limited, or KuDOS, which was acquired in early 2006 by AstraZeneca PLC. Under this license agreement, we obtained exclusive, royalty-bearing licenses to certain KuDOS patents and know-how acquired or to be acquired by KuDOS from a third party to our AQ4N product candidate for all human therapeutic, prophylactic and diagnostic uses in the United States, Canada and Mexico. We also received a sub-license to certain patents relating to AQ4N from a third party licensor to KuDOS. Upon signing the agreement in December 2003, we paid KuDOS an up-front fee of $1.0 million, which was recorded as research and development expense in the period because the licensed technology was incomplete and had no alternative future use. As of December 31, 2006 and under the terms of the agreement, we may be obligated in the future to make certain milestone payments to KuDOS of up to an aggregate of $5.0 million, which milestone payments are contingent upon the occurrence of certain clinical development and regulatory events related to AQ4N. Payments to KuDOS that relate to pre-approval development milestones are recorded as research and development expense when incurred. In addition to the foregoing payments, we are obligated to pay to KuDOS certain annual royalties on net sales of AQ4N, which royalty rate may be reduced in the event that we must pay certain additional royalties under patent licenses to third parties in order to manufacture, use or sell AQ4N in the United States, Canada and Mexico. We have agreed to pay KuDOS a certain percentage of any sub-license revenues that we may receive. Generally, we and KuDOS will each bear our separate costs of development and commercialization, although certain manufacturing process development costs will be shared equally by KuDOS and us. Furthermore, in addition to customary termination provisions, including for breach and bankruptcy, KuDOS may terminate the license agreement if we directly or indirectly oppose or assist any third party in opposing KuDOS’ patents in the United States, Canada or Mexico. In addition, KuDOS may take actions related to its agreement with the primary licensor, which could result in the termination of our rights under our license agreement with KuDOS.

Pierre Fabre Medicament

We provided written notice to Pierre Fabre Medicament, or Pierre Fabre of our election, as of October 31, 2006, to terminate each of : (i) the Patent and Know-How License Agreement, or the License Agreement, dated as of July 19, 2005, by and among Novacea, Inc. and Pierre Fabre, pursuant to Section 17.4(b) of the License Agreement, (ii) the Supply Agreement, dated as of July 19, 2005, by and among Novacea and Pierre Fabre,

15

pursuant to Section 6.2.3 of the Supply Agreement, and (iii) the Trademark License Agreement, or the Trademark Agreement, dated as of July 19, 2005, by and among Novacea, Inc. and Pierre Fabre, pursuant to Section 9.2.3 of the Trademark Agreement. The License Agreement, Supply Agreement and Trademark Agreement are collectively referred to herein as the PF Agreements.

According to the applicable provisions of the PF Agreements, the termination of each of the PF Agreements was automatically effective on December 30, 2006, sixty days following delivery of the written notice. We have not incurred any early termination penalties as a result of the termination of the PF Agreements. However, pursuant to the terms of the PF Agreements, we are required to, among other things; promptly return certain intellectual property and other information relating to vinorelbine oral to Pierre Fabre and to transfer all investigational new drug applications and certain related materials to Pierre Fabre.

Pursuant to the PF Agreements, in July 2005, we acquired from Pierre Fabre an exclusive royalty-bearing license under certain patents and know-how to vinorelbine formulated in a soft gelatin capsule, or vinorelbine oral, for all human therapeutic, prophylactic and diagnostic uses in the United States and Canada in the field of cancer. We also acquired Pierre Fabre’s rights to a third party’s formulation and certain manufacturing patents in the United States and Canada.

Under the terms of the PF Agreements prior to their termination in December 2006, we made an upfront license payment and certain milestone payments to Pierre Fabre. Following our termination of the PF Agreements in December 2006, we have no further payments or other financial obligations to Pierre Fabre.

Intellectual Property

Our success depends in part on our ability to obtain and maintain proprietary protection for our product candidates, technology and know-how, to operate without infringing on the proprietary rights of others and to prevent others from infringing our proprietary rights. We actively seek to protect the proprietary technology that we consider important to our business, including chemical species, compositions and forms, their methods of use and processes for their manufacture. Our policy is to protect our proprietary position by, among other methods, filing United States and foreign patent applications related to our technology, inventions and improvements that are important to the development of our business. We also rely on trade secrets, know-how, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position.

Individual patents extend for varying periods depending on the date of filing of the patent application or the date of patent issuance and the legal term of patents in the countries in which they are obtained. Generally, patents issued in the United States are effective for:

| | • | | the longer of 17 years from the issue date or 20 years from the earliest non-provisional filing date, if the patent application was filed prior to June 8, 1995; and |

| | • | | 20 years from the earliest non-provisional filing date, if the non-provisional patent application was filed on or after June 8, 1995. |

The duration of foreign patents varies in accordance with provisions of applicable local law, but typically is 20 years from the earliest foreign filing date. Under the Hatch-Waxman Act in the United States, and similar laws in Europe, in certain instances, a patent term can be extended for up to five years to recapture a portion of the term effectively lost as a result of the FDA regulatory review period. Although we believe that our product candidates will meet the criteria for patent term extensions, there can be no assurance that we will obtain such extensions. Our patent estate, based on patents existing now and expected by us to issue based on pending applications, will expire on dates ranging from 2010 to 2026.

16

Asentar™

We own or have rights to three issued U.S. patents and seven pending U.S. patent applications related to Asentar™ and its use in the United States and applications and patents in 35 foreign countries as well as patent application filings under the Patent Cooperation Treaty, the European Patent Convention and the Eurasian Patent Convention.

In June 2001, we entered into a license agreement with OHSU, whereby we acquired exclusive worldwide rights to OHSU’s patents, applications and know-how claiming methods for the treatment of hyperproliferative diseases, such as cancer, utilizing HDPA with calcitriol and its analogs. We are the exclusive licensee from OHSU of one issued U.S. patent, one pending U.S. patent application, one foreign patent and four foreign pending patent applications. The issued U.S. patent covers methods of treating hyperproliferative diseases by high-dose pulse administration of calcitriol in doses from about 0.12 micrograms per kilogram of patient weight (or 9 micrograms per day for a 75kg patient) to about 2.8 micrograms per kilogram of patient weight (or 210 micrograms per day for a 75kg patient), and expires in March 2019.

In July 2002, we acquired an exclusive, worldwide license from the University of Pittsburgh to utilize specific technology under certain patent rights and know-how related to methods of using calcitriol, and its derivatives and analogs, with certain chemotherapies. We are the exclusive licensee from the University of Pittsburgh of two issued U.S. patents, two pending U.S. patent applications, 18 foreign patents (under the European Patent Convention), and six pending foreign applications. One of the issued U.S. patents claims a method of killing cells such as cancer cells with any vitamin D derivative together with paclitaxel or cyclophosphamide, and expires in August 2017. The second issued patent claims a method of killing neoplastic cells with any vitamin D derivative together with carboplatin, cisplatin, paclitaxel or Taxotere, and expires in August 2017.

We also own four pending U.S. patent applications; one issued foreign patent and 35 pending foreign applications related to our formulation for calcitriol and other active vitamin D compounds. The four pending patent applications, if issued, should expire in December 2022.

In addition, we have eight pending U.S. patent applications, 24 foreign applications and four patent application filings under the Patent Cooperation Treaty related to our use of Asentar™ in the treatment of cancer and other diseases and medical conditions.

AQ4N

We own or have rights to four issued patents and thirteen pending patent applications related to AQ4N in the United States, Canada, Mexico and under the Patent Cooperation Treaty.

In December 2003, we entered into a license with KuDOS related to AQ4N. Pursuant to this license agreement, we obtained exclusive, royalty-bearing licenses to certain KuDOS patents and know-how and an exclusive license to certain patents and know-how acquired or to be acquired by KuDOS from a third party to our AQ4N product candidate for all human therapeutic, prophylactic and diagnostic uses in the United States, Canada and Mexico. We also received a sub-license to certain patents relating to AQ4N from a third-party licensor to KuDOS. In the event that the third party terminates its license with KuDOS, the third party has agreed to provide us with a substantially similar license for the North American market. In addition, we acquired an exclusive royalty-free right, but not the obligation, to use in the United States, Canada and Mexico any trademarks hereafter owned, controlled, used or proposed to be used by KuDOS in connection with the marketing of AQ4N.

Competition

The development and commercialization of new drugs are highly competitive. Our major competitors are large pharmaceutical, specialty pharmaceutical and biotechnology companies, both in the United States and

17

abroad. Any product candidates that we successfully develop and commercialize will compete with existing and new drugs and therapies in the field of cancer. Many of these entities developing and marketing potentially competing products have substantially greater financial resources and expertise in the areas of manufacturing, product development, clinical trials, regulatory submissions, and marketing. These entities also compete with us in recruiting and retaining qualified scientific and management personnel, as well as in acquiring products and technologies complementary to, our programs.

Our ability to compete successfully will depend largely on our ability to:

| | • | | advance the development of our lead programs, including the enrollment of patients for our clinical trials; |

| | • | | gain regulatory approval for our product candidates in their respective first indications as well as expand into additional indications; |

| | • | | commercialize our lead products successfully, including convincing physicians, insurers and other third-party payors of the advantages of our products over current standard therapies; |

| | • | | obtain intellectual property protection and protect the exclusivity for our products; and |

| | • | | acquire other product candidates to expand our pipeline. |

Noted below is some of the existing and potential competition for each of our products under development.

Asentar™

The main treatment options for advanced prostate cancer are hormonal therapy, chemotherapy, palliative treatments for cancer that has spread to the bones or other organs and palliative local radiation therapy.

Other marketed products that are used in the treatment of advanced prostate cancer include Emcyt®; Novantrone®, Paraplatin®, Taxol®, and Thalomid®. We believe the potentially competitive products, including those in clinical development, can be categorized broadly as follows: (a) agents potentially useful in combination therapy with Taxotere, such as Avastin®, Thalomid, Velcade®, GVAX® GM-CSF immuno-therapy, Provenge® immuno-therapy, Eloxatin®, VEGF-Trap, (b) other formulations of calcitriol, calcitriol analogs, such as Zemplar®, Hectorol®, inecalcitol and seocalcitol, cytotoxic monotherapies such as satraplatin, and (c) non-cytotoxic monotherapies.

Although a composition of matter patent protection claim is not available for calcitriol, the active ingredient in Asentar™, our issued and pending patents relating to the methods of use and pharmaceutical compositions should provide broad intellectual property rights that should help mitigate or deter competition in AIPC from other calcitriol and related analog formulations, such as currently marketed low-dose formulations for the treatment of chronic renal disease and psoriasis.

In addition, we believe that the currently marketed low-dose oral formulations of calcitriol for the treatment of chronic renal disease, such as Rocaltrol, are not viable substitutes for high-dose administration in AIPC due to some of the following reasons: lack of clinically-demonstrated survival benefit or safety profile; limited bioavailability; non-linear dose-related increase in maximum plasma concentration, and cumulative exposure; inter-patient variability; and lack of convenience due to the number of pills required to achieve such high-dose levels.

AQ4N

In the United States, most physicians have been treating GBM patients with surgery followed by radiation therapy and often chemotherapy, such as temozolomide or procarbazine, or a combination of these therapies. Cintredekin besudotox has received orphan drug designation in the US and Europe and fast track drug development program status from the FDA. In addition, cintredekin besudotox has been selected to participate in

18

the FDA’s Continuous Marketing Application Pilot 2 program. Several agents and approaches remain in various stages of investigation and include Avastin®, which is currently undergoing phase 3 trial in combination with chemotherapy.

Government Regulation

The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, pre-market approval, manufacture, marketing and distribution of pharmaceutical and biological products. These agencies and other federal, state and local entities regulate research and development activities and the testing, approval, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, advertising and promotion of our product candidates. Failure to comply with applicable FDA or other requirements may result in civil or criminal penalties, recall or seizure of products, partial or total suspension of production or withdrawal of a product from the market.

In the United States, the FDA regulates drug products under the Federal Food, Drug, and Cosmetic Act, or FFDCA, its implementing regulations. The process required by the FDA before our drug and biologic product candidates may be marketed in the United States generally involves the following:

| | • | | completion of extensive pre-clinical laboratory tests, pre-clinical animal studies and formulation studies all performed in accordance with FDA’s current Good Laboratory Practice, or cGLP, regulations; |

| | • | | submission to the FDA of an IND which must become effective before human clinical trials may begin; |

| | • | | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the product candidate for each proposed indication; |

| | • | | submission to the FDA of a new drug application, or NDA; |

| | • | | satisfactory completion of an FDA preapproval inspection of the manufacturing facilities at which the product is produced to assess compliance with current Good Manufacturing Practice, or cGMP, regulations; and |

| | • | | FDA review and approval of the NDA prior to any commercial marketing, sale or shipment of the drug. |

The testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for our product candidates will be granted on a timely basis, if at all.

Pre-clinical tests include laboratory evaluation of product chemistry, formulation and stability, as well as studies to evaluate toxicity in animals. The results of pre-clinical tests, together with manufacturing information and analytical data, are submitted as part of an IND to the FDA. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30 day time period, raises concerns or questions about the conduct of the clinical trial, including concerns that human research subjects will be exposed to unreasonable health risks. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. Our IND submissions, or those of our collaborators, may not result in FDA authorization to commence a clinical trial. A separate submission to an existing IND must also be made for each successive clinical trial conducted during product development, and the FDA must grant permission before each clinical trial can begin. Further, an independent institutional review board, or IRB, for each medical center proposing to conduct the clinical trial must review and approve the plan for any clinical trial before it commences at that center and it must monitor the study until completed. The FDA, the IRB, or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk. Clinical testing also must satisfy extensive good clinical practices, or GCPs, regulations and regulations for informed consent.

19

Clinical Trials

For purposes of NDA submission and approval, human clinical trials are typically conducted in the following three sequential phases, which may overlap:

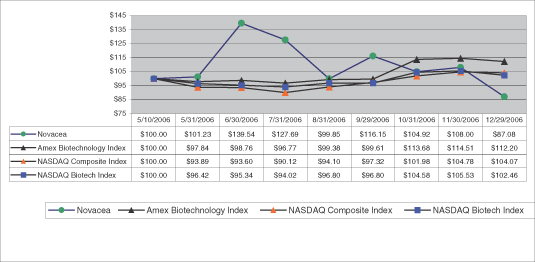

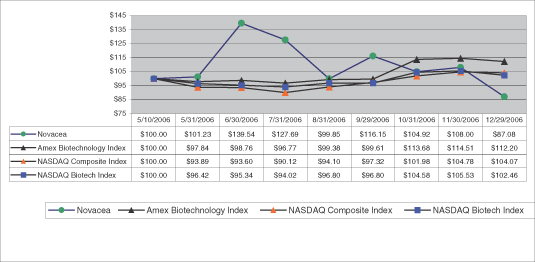

| | • | | Phase 1 Clinical Trials.Studies are initially conducted in a limited population to test the product candidate for safety, dose tolerance, absorption, metabolism, distribution and excretion in healthy humans or, on occasion, in patients, such as cancer patients. In some cases, particularly in clinical trials assessing a product candidate for the treatment of cancer, a sponsor may decide to conduct what is referred to as a “Phase 1b” evaluation, which is a second, safety-focused Phase 1 clinical trial typically designed to evaluate the impact of the drug candidate in combination with currently approved drugs; |