Corporate Overview January 2017 Exhibit 99.1

Safe Harbor Statement Third-party industry and market information included herein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed by, has not been independently verified by, and should not be construed as a representation by, Paratek. The information contained in this presentation is accurate only as of the date hereof. “Paratek” and the Paratek logo are trademarks and service marks of Paratek. All other trademarks, service marks, trade names, logos and brand names identified in this presentation are the property of their respective owners. Certain statements in this presentation, including responses to questions, contain or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of such statements include, but are not limited to, statements about our strategy, future operations, prospects, plans, objectives of management, availability of data from our clinical studies, potential use of our product candidates, including Omadacycline and Sarecycline, the market acceptance of our product candidates, the strength of, and protection offered by, our intellectual property position, the potential clinical risks and efficacy of, and market opportunities for, our product candidates, the timing of clinical development of, and regulatory approval for, our product candidates, and the nature and timing of our collaboration agreements with respect to our product candidates. The words “anticipate,” “estimate,” “expect,” “potential,” “will,” “project” and similar terms and phrases are used to identify forward-looking statements. These statements are based on current information and belief and are not guarantees of future performance. Our ability to predict results, financial or otherwise, or the actual effect of future plans or strategies, is inherently uncertain and actual results may differ from those predicted depending on a variety of factors. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations or whether the forward-looking statements ultimately prove to be correct. Except as required by law, we undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Among the risks and uncertainties that could cause actual results to differ materially from those indicated by such forward-looking statements include: delays in clinical trials or unexpected results; the risk that data to date and trends may not be predictive of future results; the failure of collaborators to perform obligations under our collaboration agreements; our failure to obtain regulatory approval for our product candidates; if we obtain regulatory approval for our product candidates, the risk that the terms of such approval may limit how we manufacture and market our product candidates; delays in undertaking or completing clinical trials; our products not gaining the anticipated acceptance in the marketplace or acceptance being delayed; our products not receiving reimbursement from healthcare payors; the effects of competition; our inability to protect our intellectual property and proprietary technology through patents and other means; the need for substantial additional funding to complete the development and commercialization of our product candidates; and the other risks described in the “Risk Factors” section and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2015, and our other filings with the SEC.

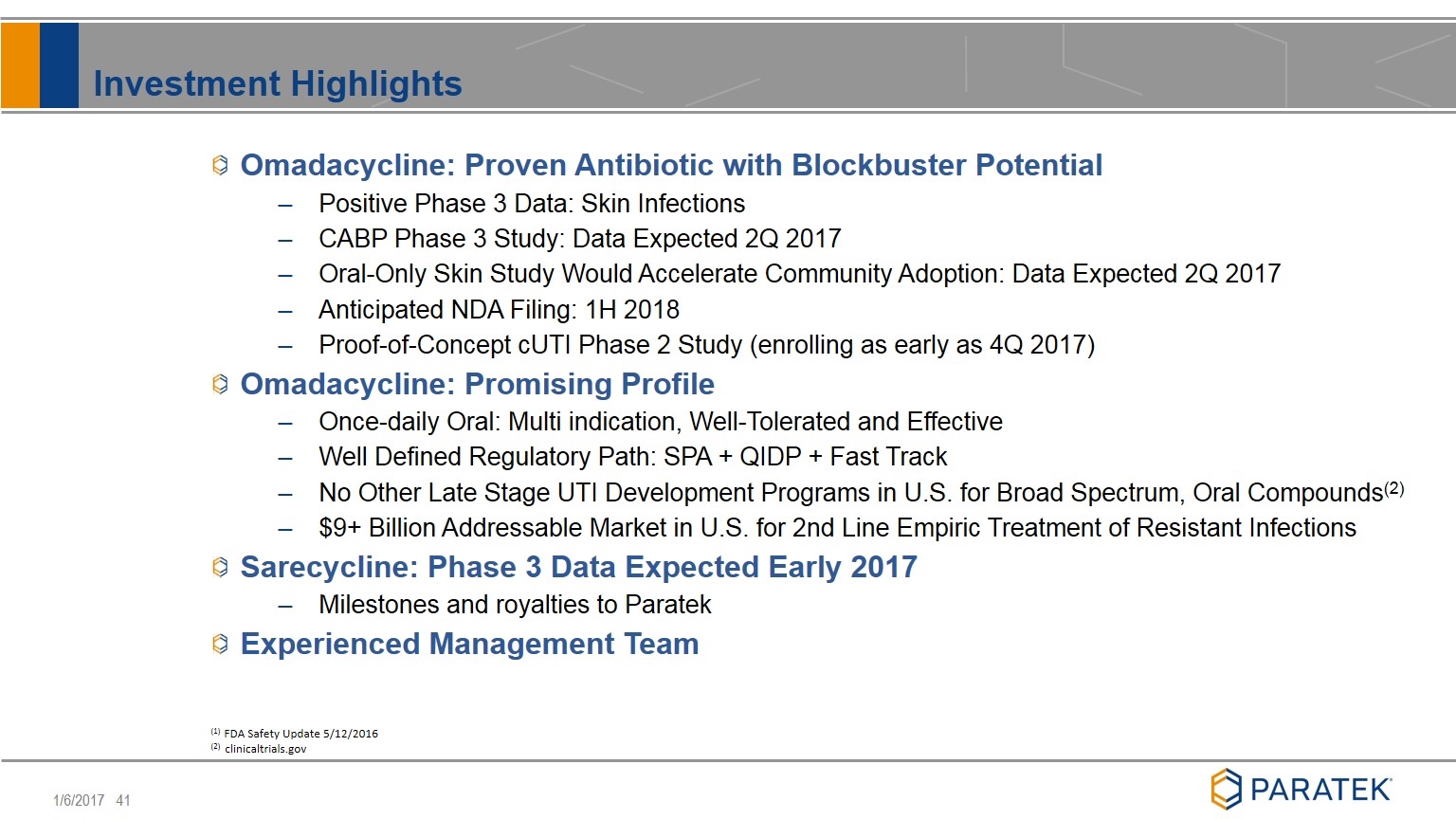

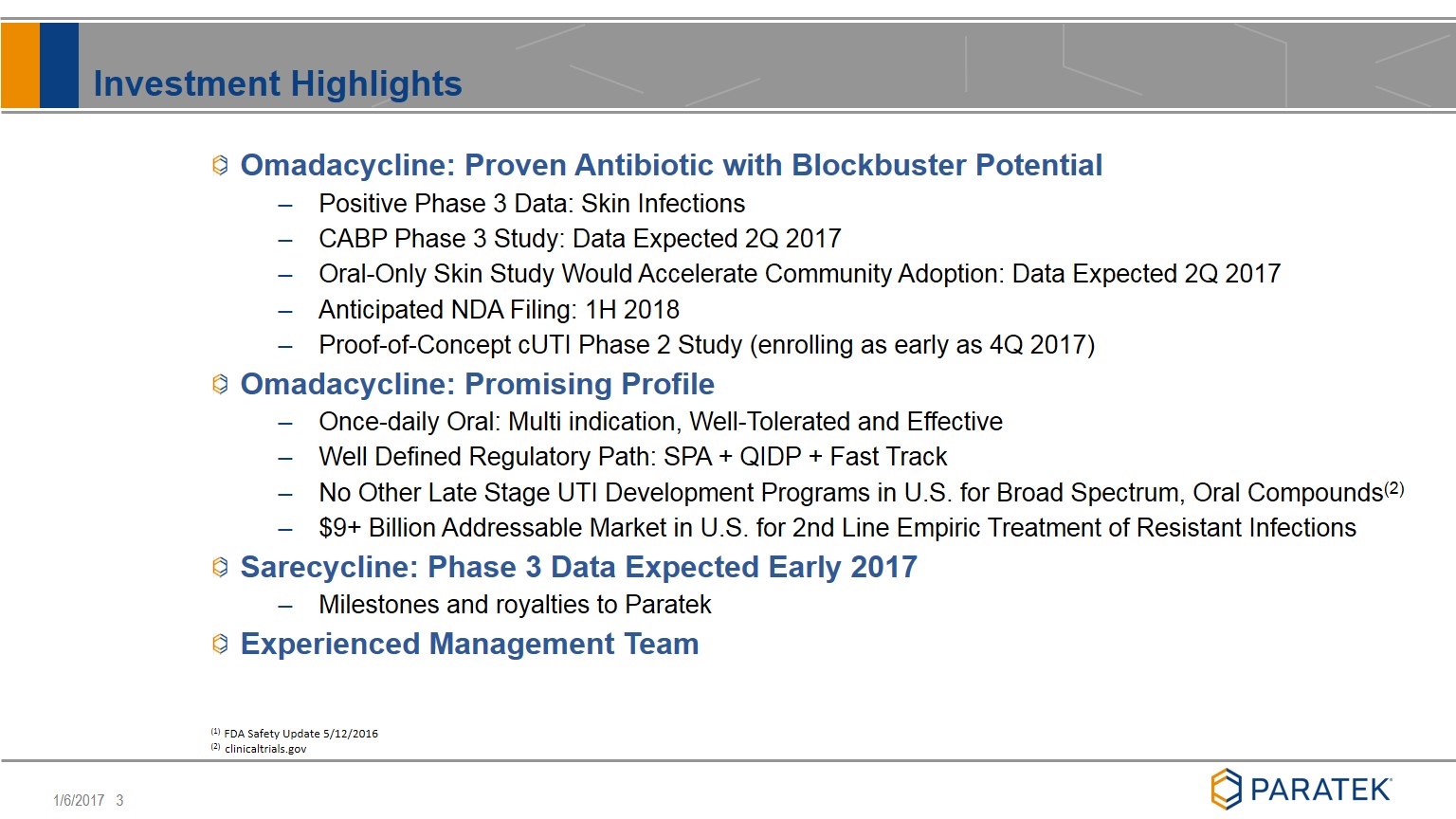

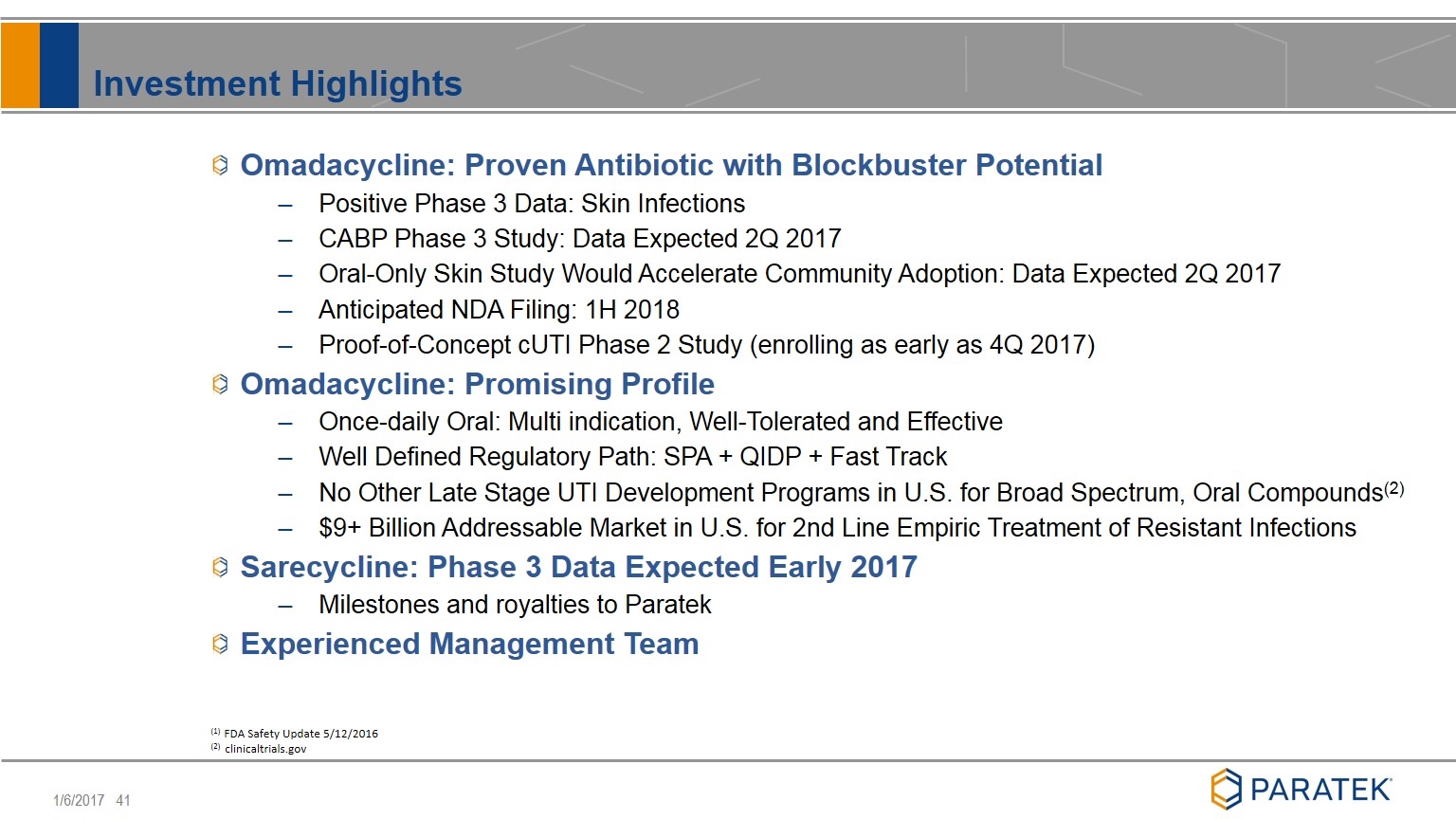

Omadacycline: Proven Antibiotic with Blockbuster Potential Positive Phase 3 Data: Skin Infections CABP Phase 3 Study: Data Expected 2Q 2017 Oral-Only Skin Study Would Accelerate Community Adoption: Data Expected 2Q 2017 Anticipated NDA Filing: 1H 2018 Proof-of-Concept cUTI Phase 2 Study (enrolling as early as 4Q 2017) Omadacycline: Promising Profile Once-daily Oral: Multi indication, Well-Tolerated and Effective Well Defined Regulatory Path: SPA + QIDP + Fast Track No Other Late Stage UTI Development Programs in U.S. for Broad Spectrum, Oral Compounds(2) $9+ Billion Addressable Market in U.S. for 2nd Line Empiric Treatment of Resistant Infections Sarecycline: Phase 3 Data Expected Early 2017 Milestones and royalties to Paratek Experienced Management Team Investment Highlights (1) FDA Safety Update 5/12/2016 (2) clinicaltrials.gov

Evan Loh, MD President CCO & CMO Led Tygacil Development Experienced Senior Management Team Michael F. Bigham Chairman & CEO Evan Loh, MD President, Led Tygacil Development Doug Pagán Chief Financial Officer Adam Woodrow Chief Commercial Officer Led Tygacil Commercialization William Haskel SVP, General Counsel & Corporate Secretary Michael F. Bigham Chairman & CEO Doug Pagán Chief Financial Officer William Haskel SVP, General Counsel & Corporate Secretary

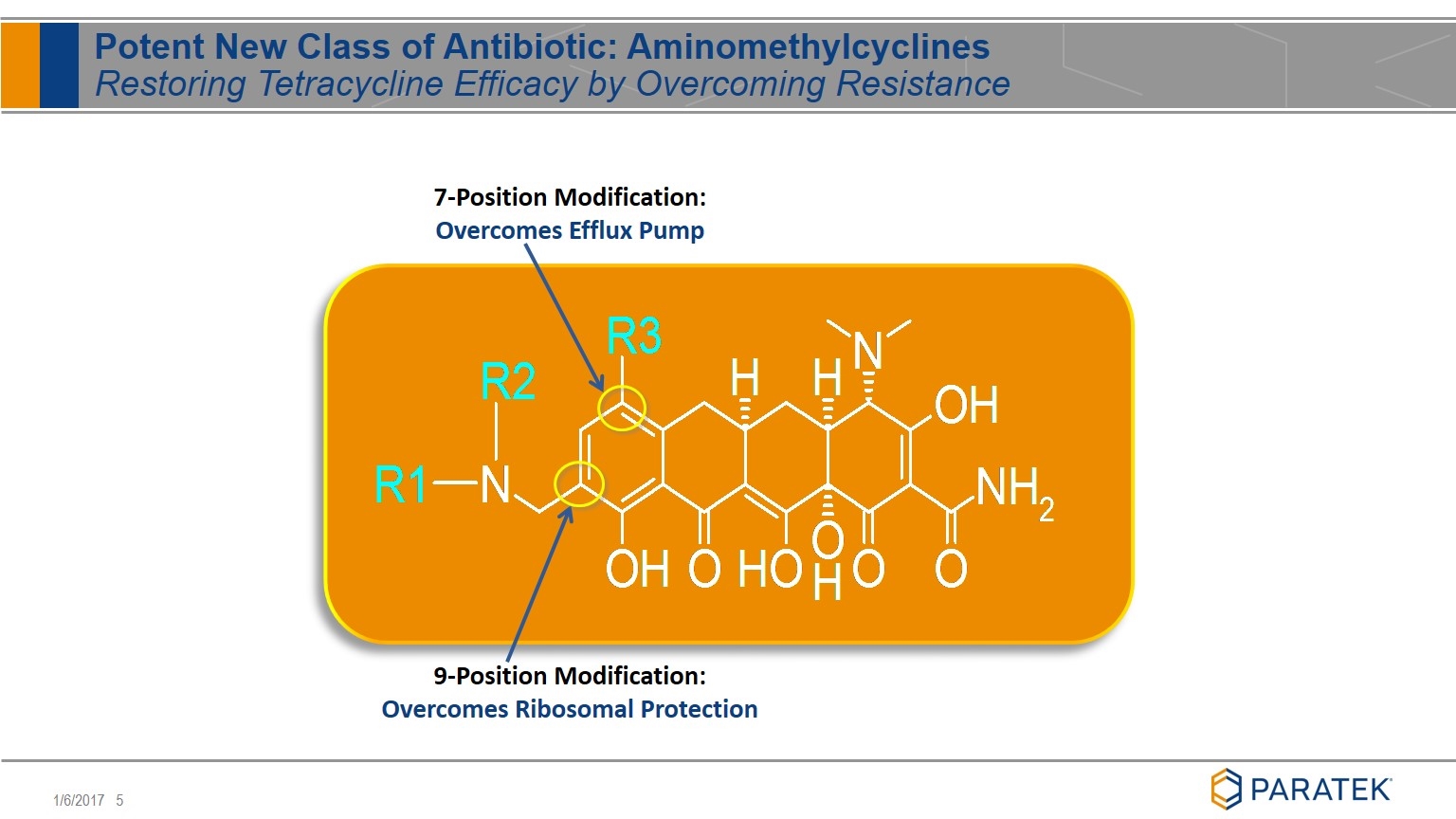

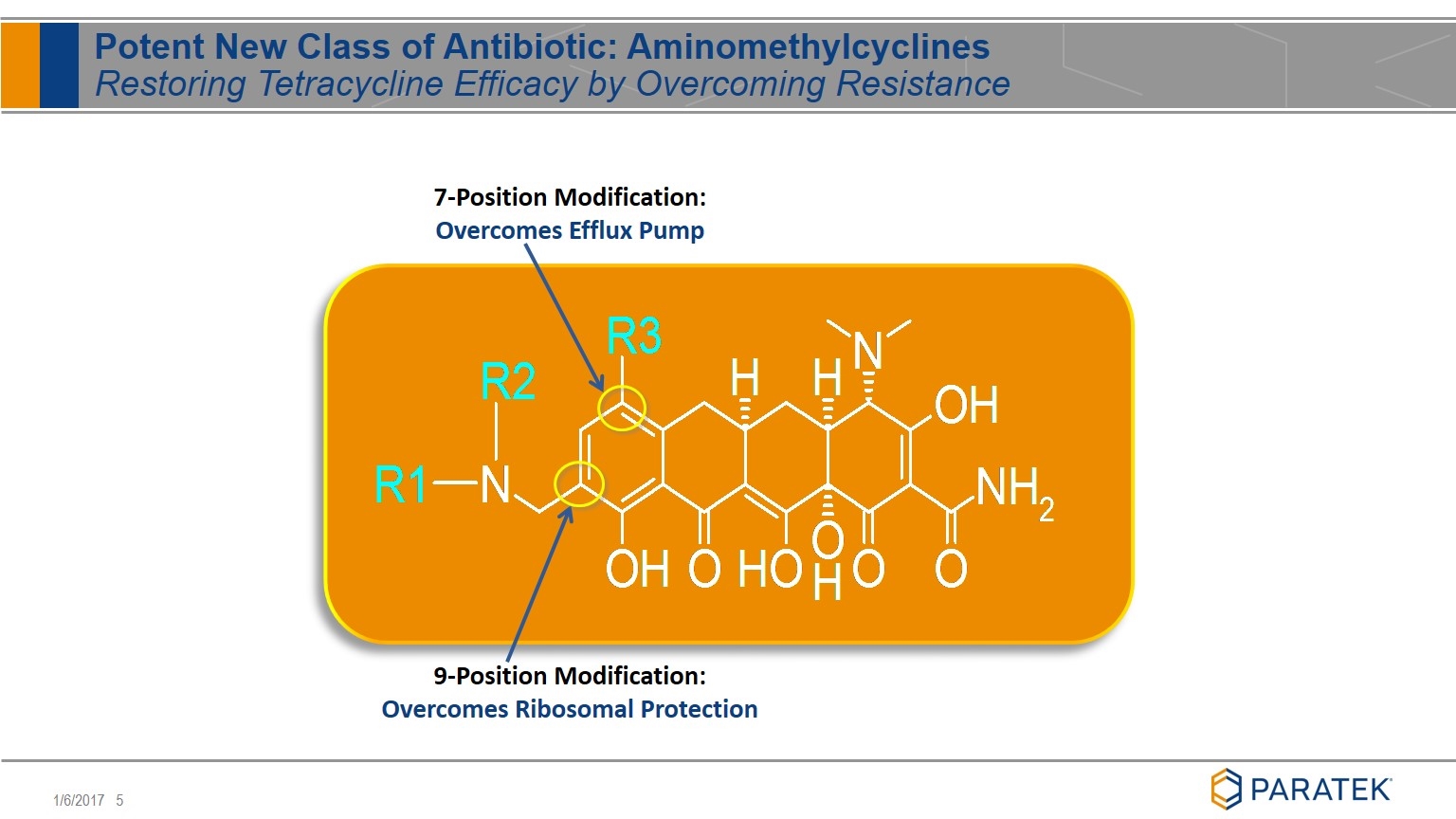

Potent New Class of Antibiotic: Aminomethylcyclines Restoring Tetracycline Efficacy by Overcoming Resistance 9-Position Modification: Overcomes Ribosomal Protection 7-Position Modification: Overcomes Efflux Pump

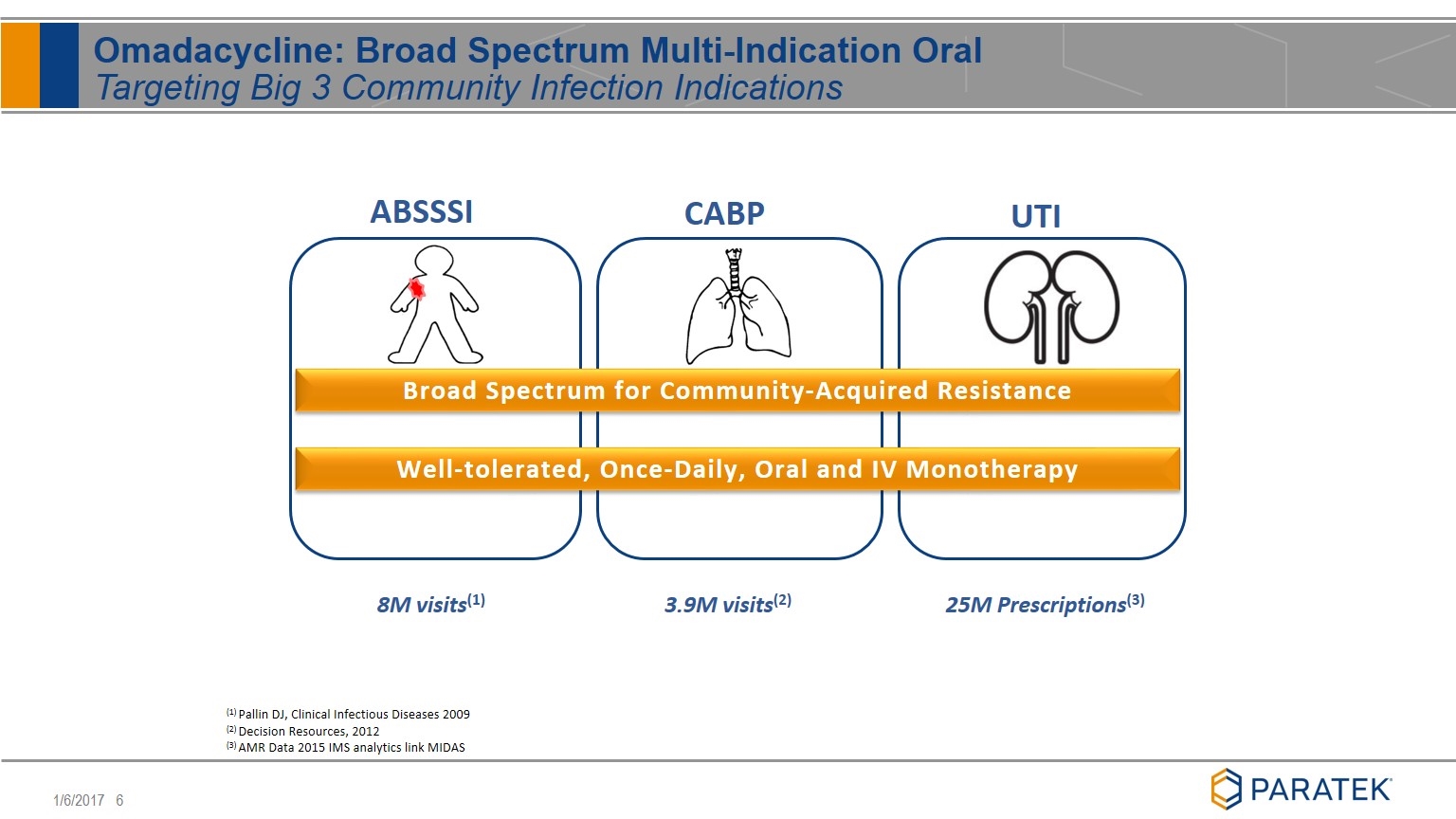

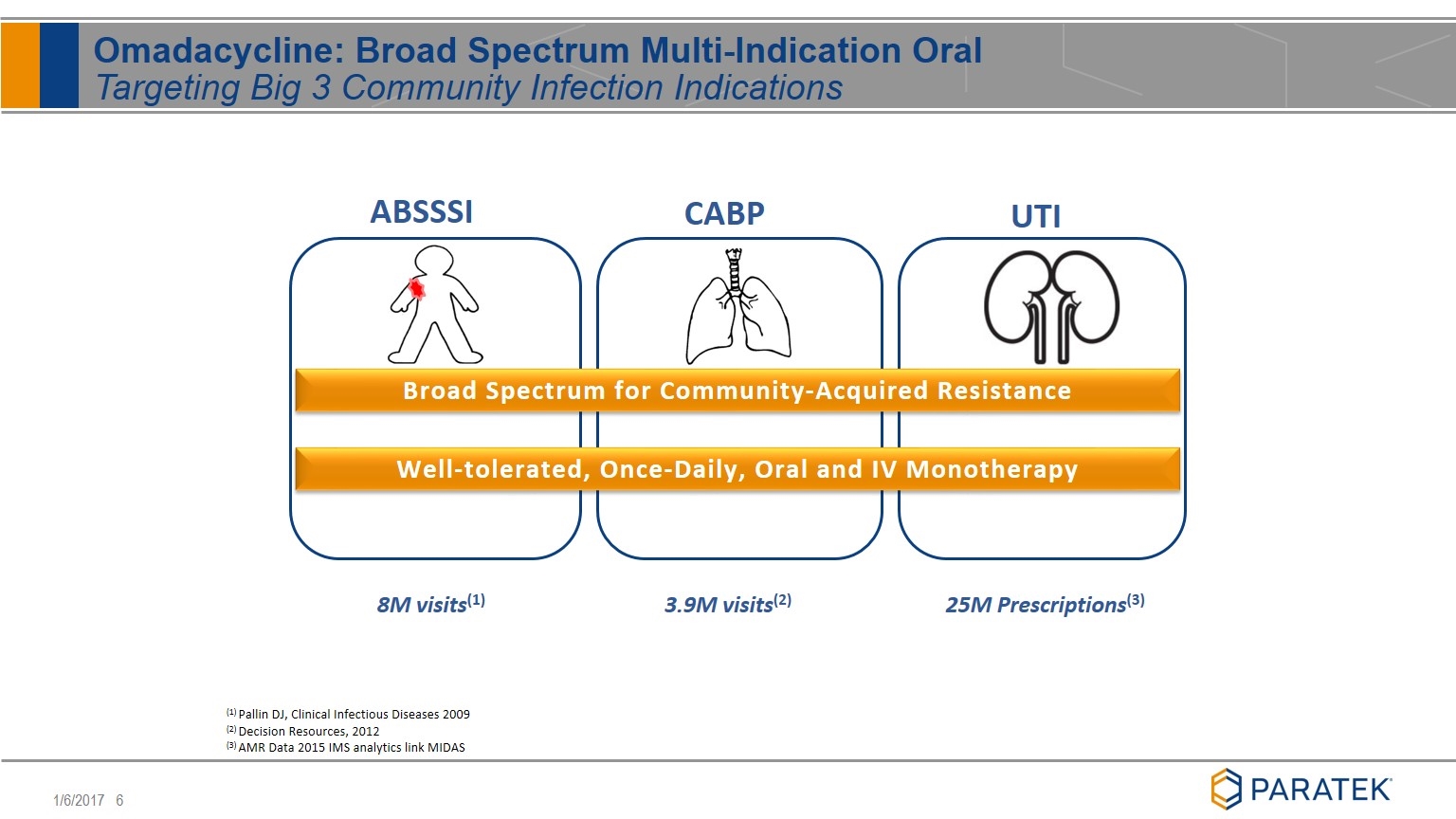

Omadacycline: Broad Spectrum Multi-Indication Oral Targeting Big 3 Community Infection Indications (1) Pallin DJ, Clinical Infectious Diseases 2009 (2) Decision Resources, 2012 (3) AMR Data 2015 IMS analytics link MIDAS ABSSSI CABP UTI Broad Spectrum for Community-Acquired Resistance Well-tolerated, Once-Daily, Oral and IV Monotherapy 8M visits(1) 3.9M visits(2) 25M Prescriptions(3)

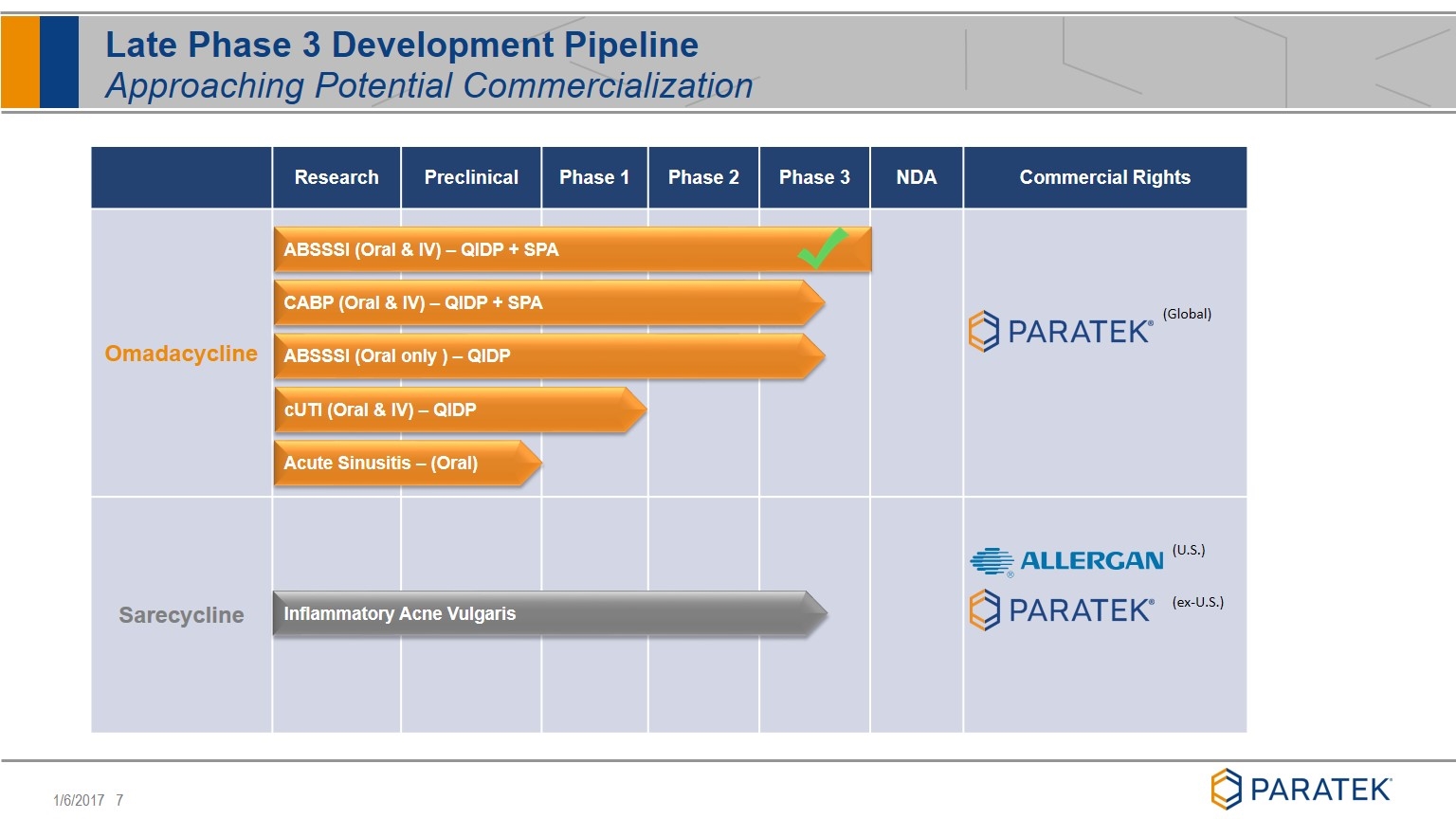

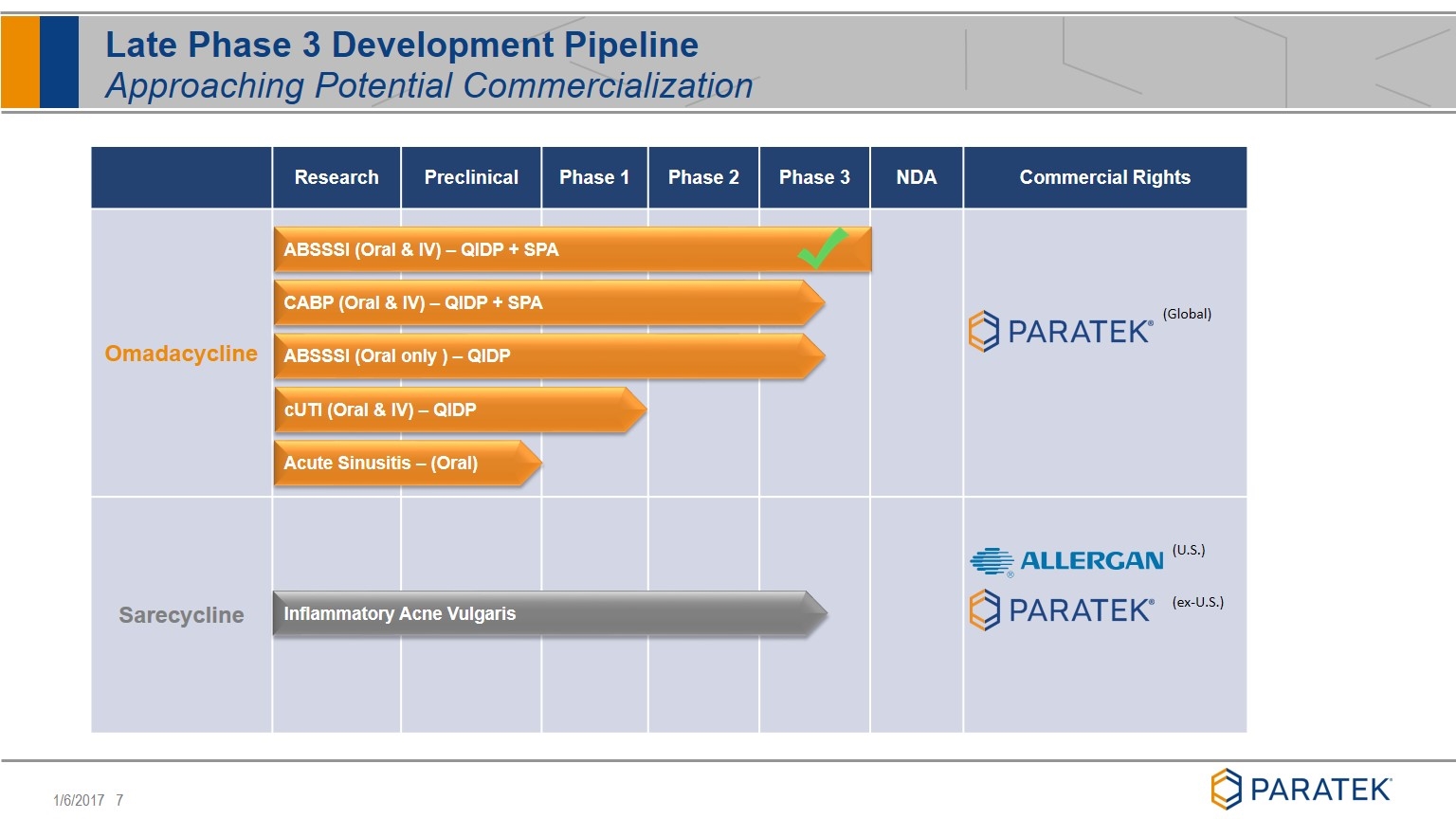

Late Phase 3 Development Pipeline Approaching Potential Commercialization Research Preclinical Phase 1 Phase 2 Phase 3 NDA Commercial Rights Omadacycline Sarecycline (U.S.) (ex-U.S.) (Global) CABP (Oral & IV) – QIDP + SPA cUTI (Oral & IV) – QIDP Acute Sinusitis – (Oral) Inflammatory Acne Vulgaris ABSSSI (Oral & IV) – QIDP + SPA ABSSSI (Oral only ) – QIDP

Omadacycline Clinical Update

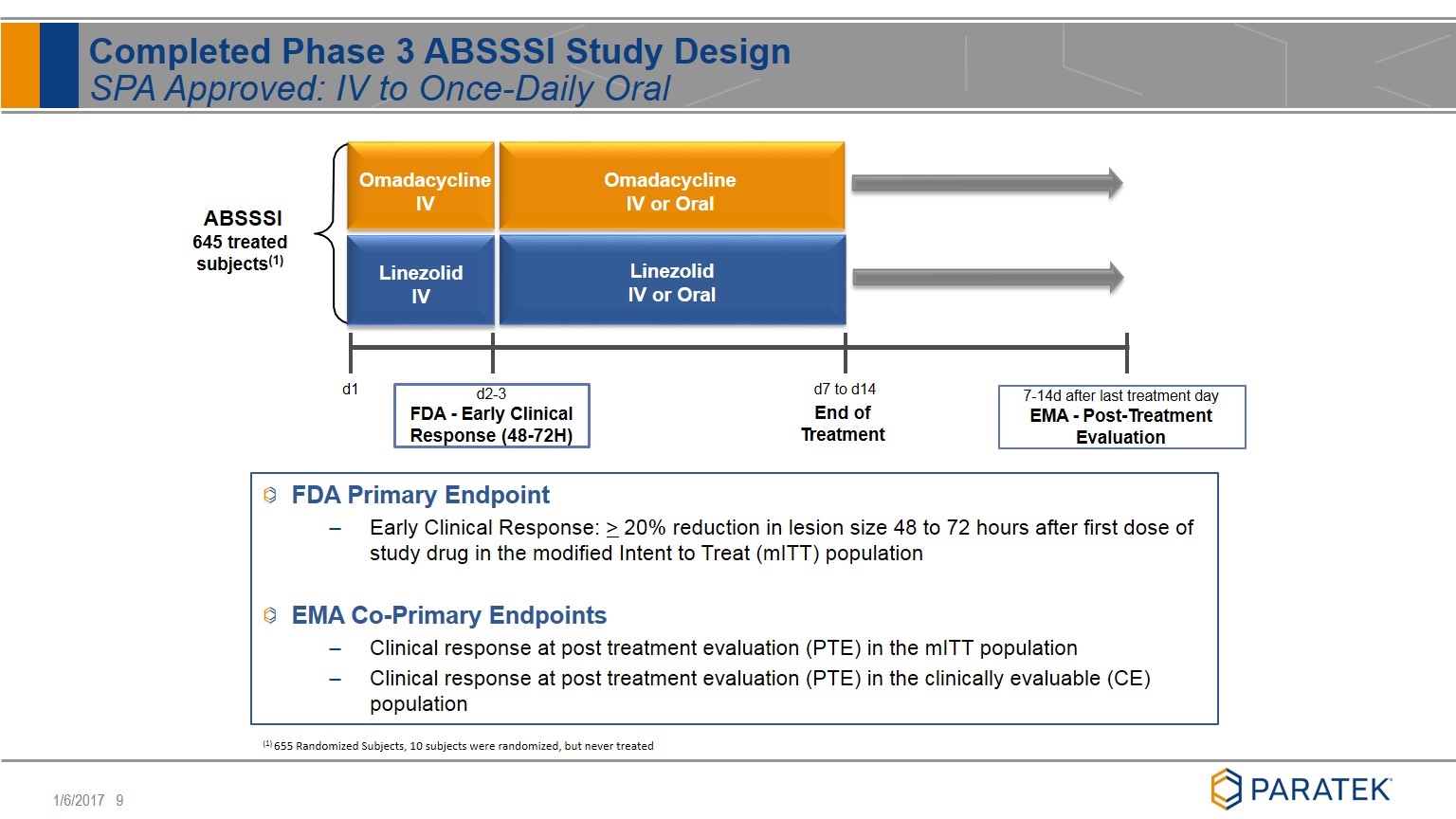

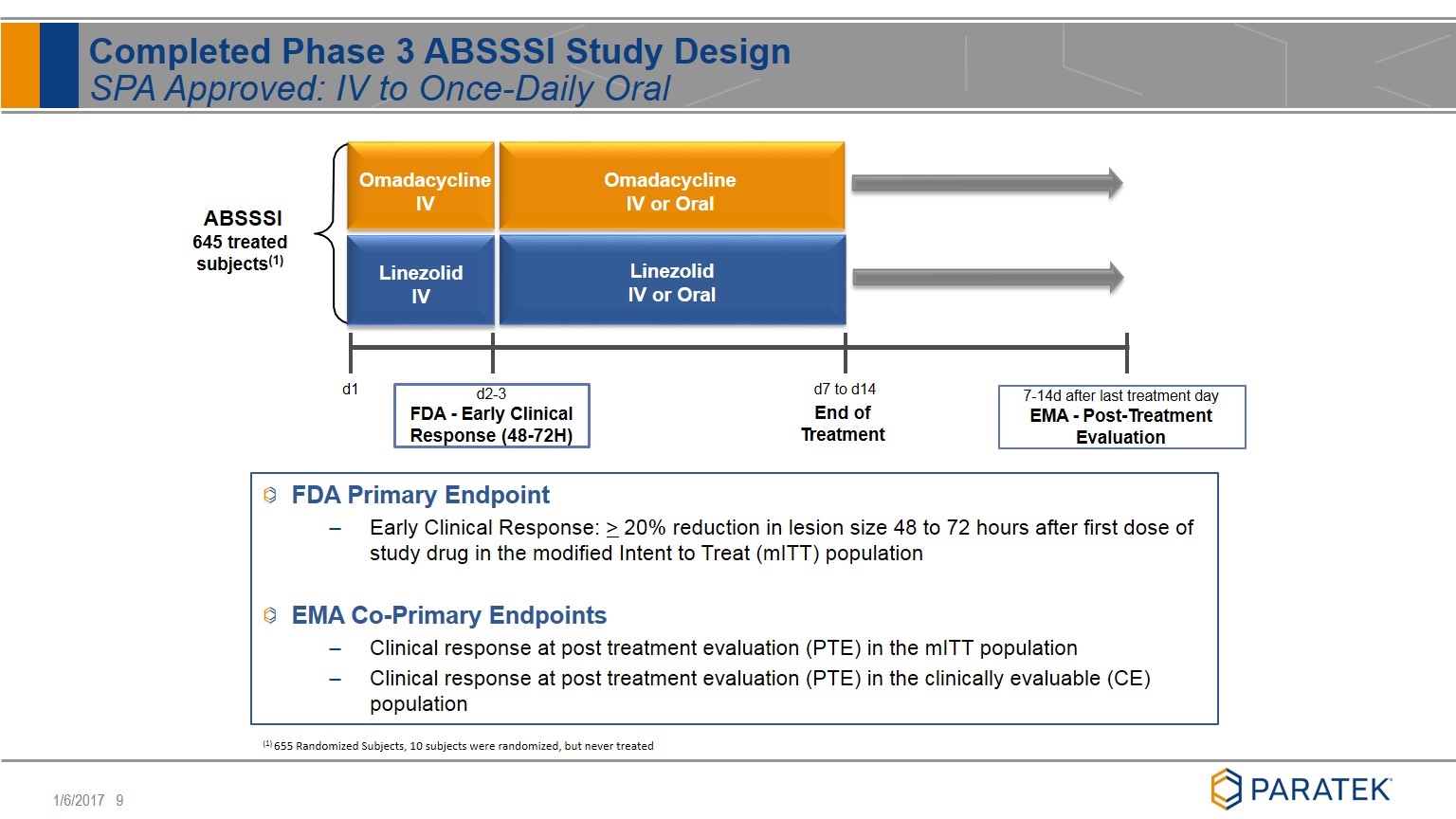

FDA Primary Endpoint Early Clinical Response: > 20% reduction in lesion size 48 to 72 hours after first dose of study drug in the modified Intent to Treat (mITT) population EMA Co-Primary Endpoints Clinical response at post treatment evaluation (PTE) in the mITT population Clinical response at post treatment evaluation (PTE) in the clinically evaluable (CE) population Completed Phase 3 ABSSSI Study Design SPA Approved: IV to Once-Daily Oral d2-3 FDA - Early Clinical Response (48-72H) d7 to d14 End of Treatment d1 Omadacycline IV Omadacycline IV or Oral Linezolid IV Linezolid IV or Oral ABSSSI 645 treated subjects(1) 7-14d after last treatment day EMA - Post-Treatment Evaluation (1) 655 Randomized Subjects, 10 subjects were randomized, but never treated

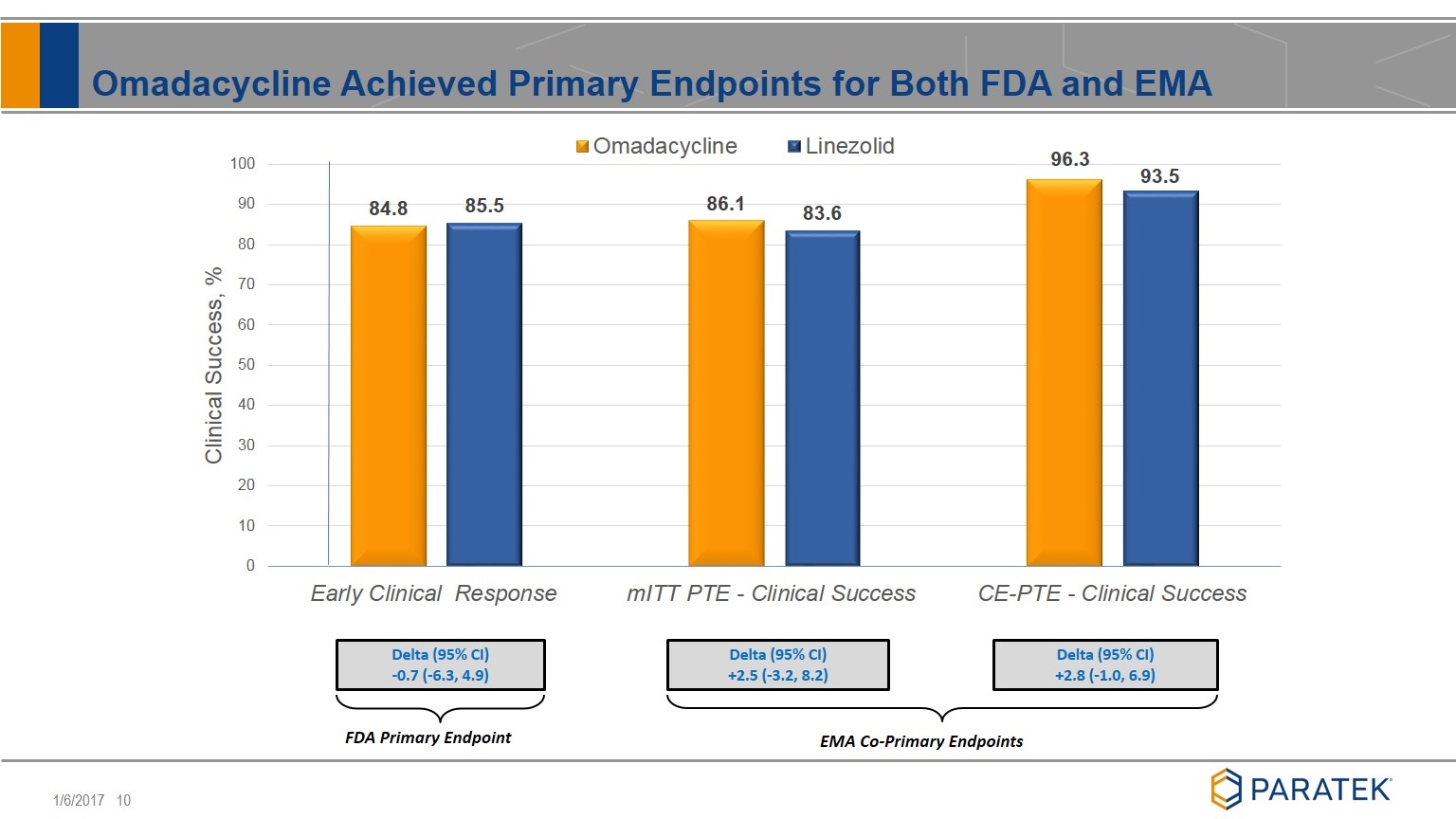

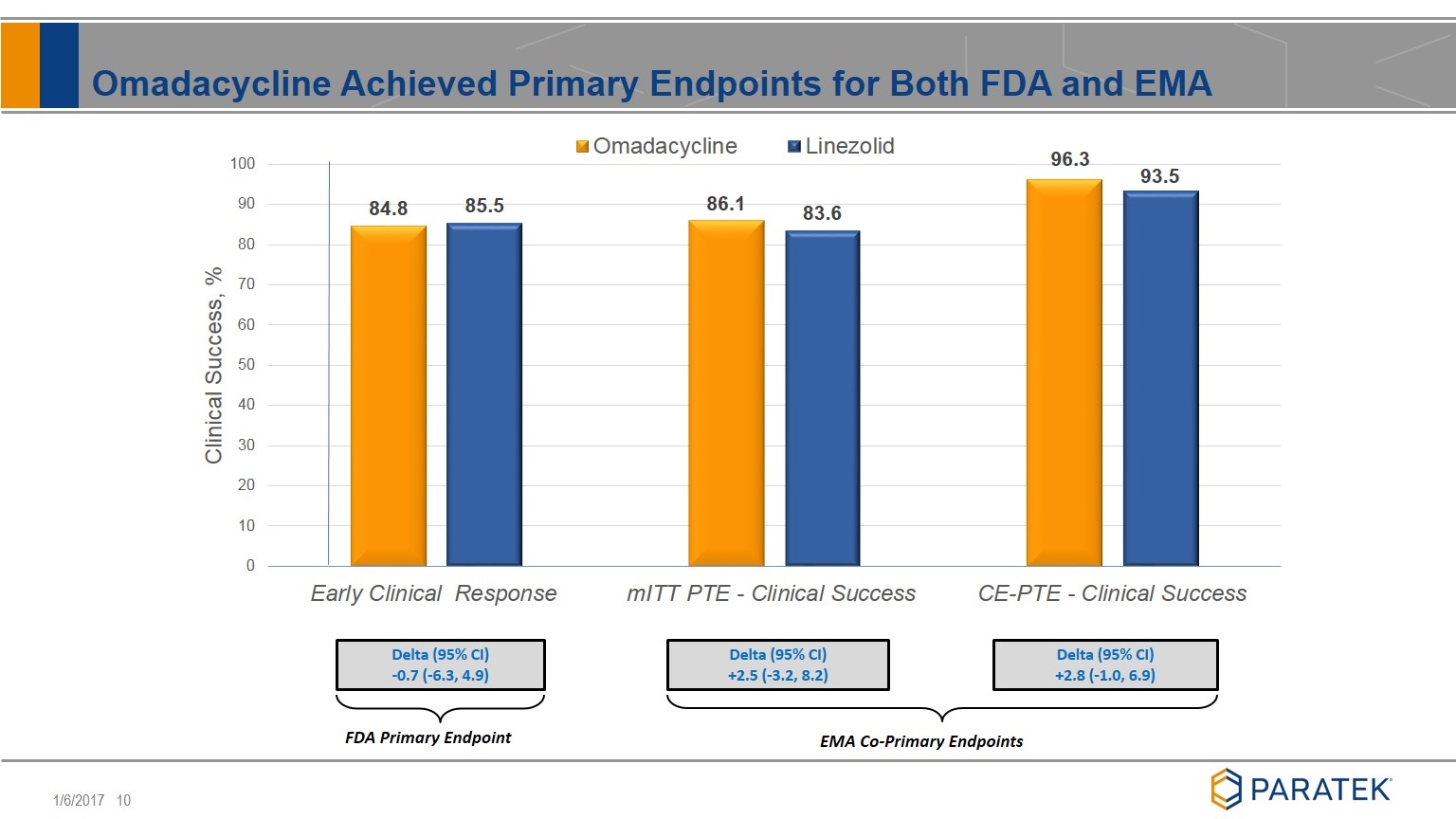

Omadacycline Achieved Primary Endpoints for Both FDA and EMA EMA Co-Primary Endpoints Delta (95% CI) -0.7 (-6.3, 4.9) Delta (95% CI) +2.5 (-3.2, 8.2) Delta (95% CI) +2.8 (-1.0, 6.9) FDA Primary Endpoint

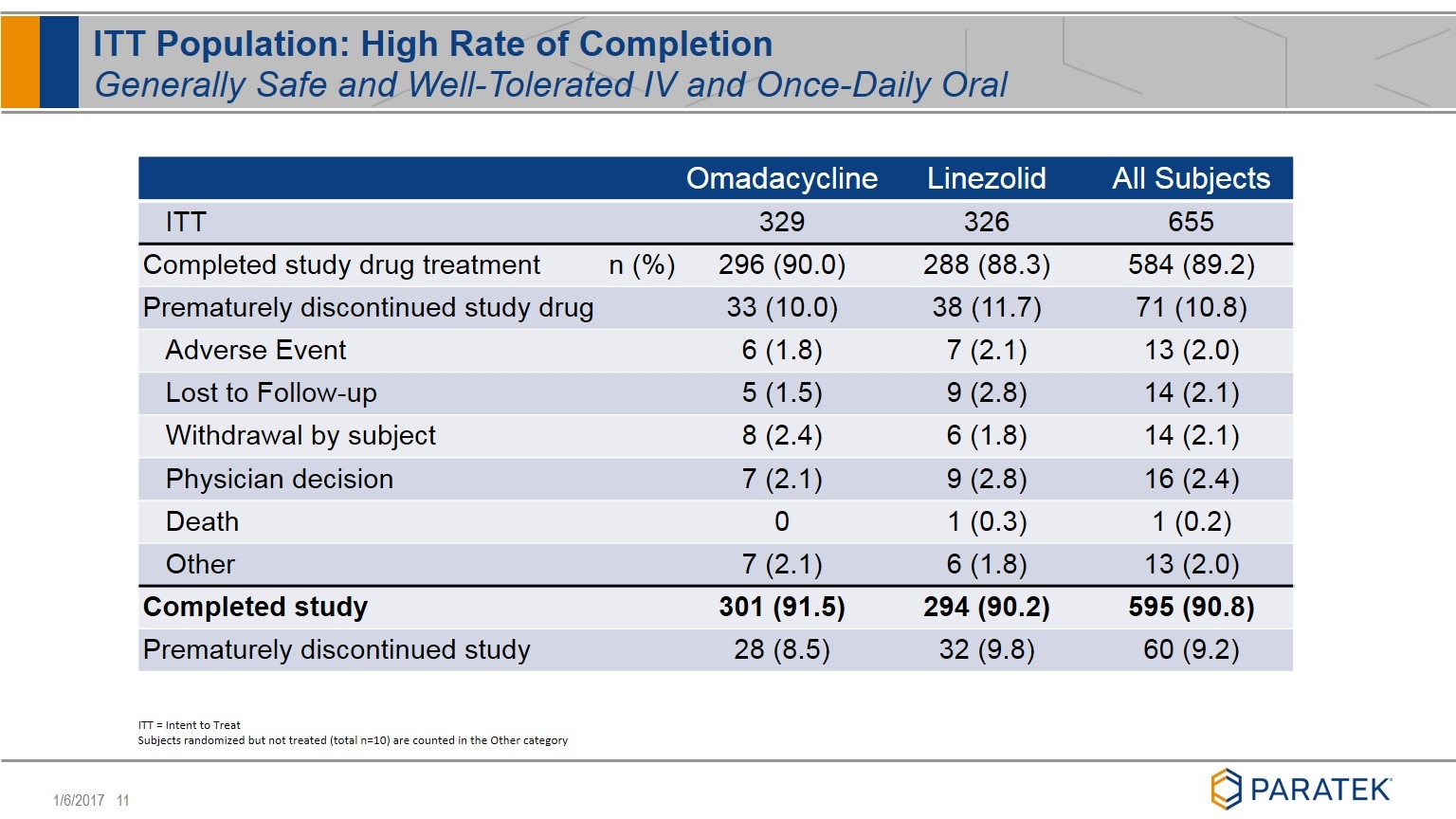

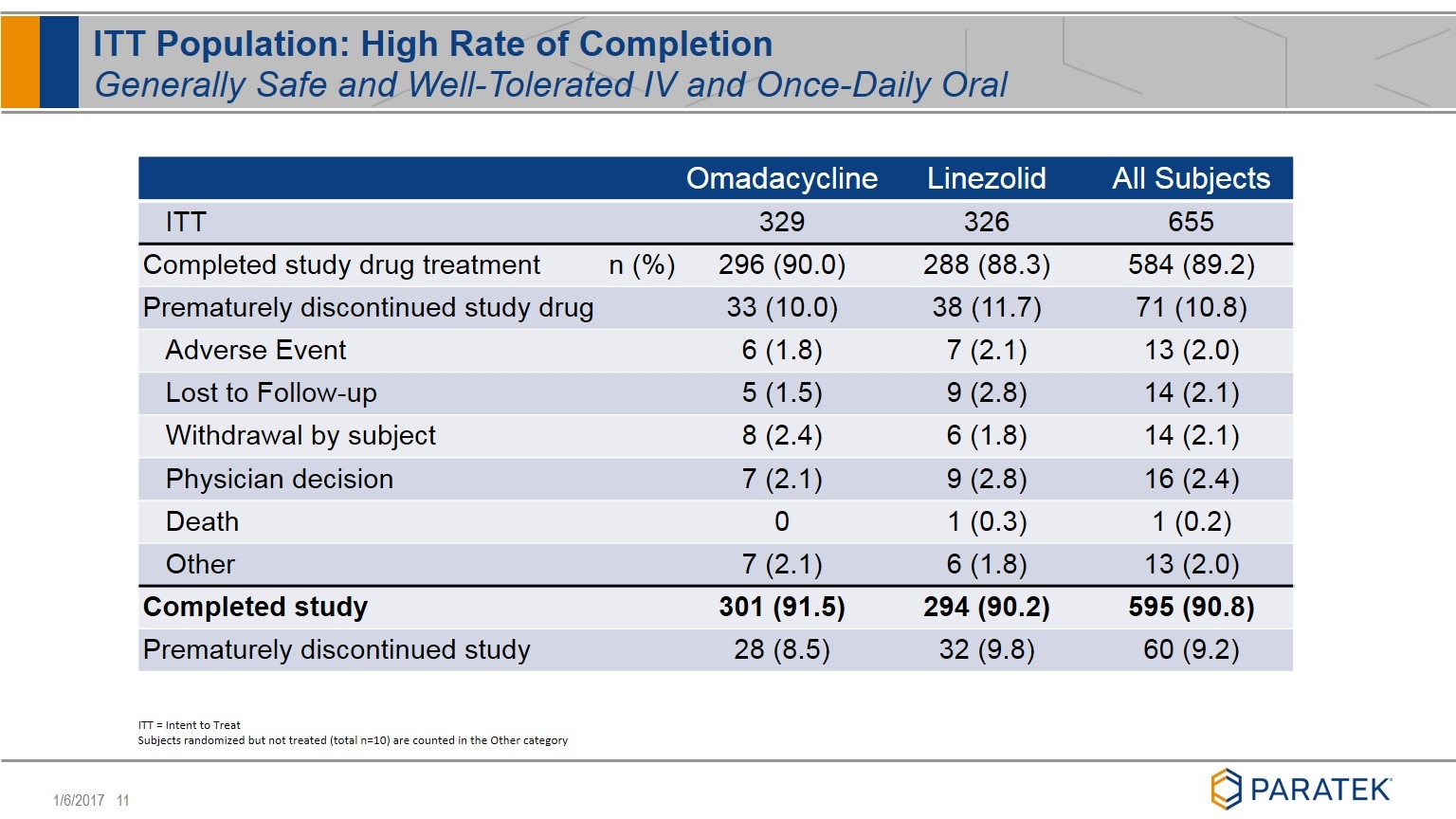

Omadacycline Linezolid All Subjects ITT 329 326 655 Completed study drug treatment n (%) 296 (90.0) 288 (88.3) 584 (89.2) Prematurely discontinued study drug 33 (10.0) 38 (11.7) 71 (10.8) Adverse Event 6 (1.8) 7 (2.1) 13 (2.0) Lost to Follow-up 5 (1.5) 9 (2.8) 14 (2.1) Withdrawal by subject 8 (2.4) 6 (1.8) 14 (2.1) Physician decision 7 (2.1) 9 (2.8) 16 (2.4) Death 0 1 (0.3) 1 (0.2) Other 7 (2.1) 6 (1.8) 13 (2.0) Completed study 301 (91.5) 294 (90.2) 595 (90.8) Prematurely discontinued study 28 (8.5) 32 (9.8) 60 (9.2) ITT = Intent to Treat Subjects randomized but not treated (total n=10) are counted in the Other category ITT Population: High Rate of Completion Generally Safe and Well-Tolerated IV and Once-Daily Oral

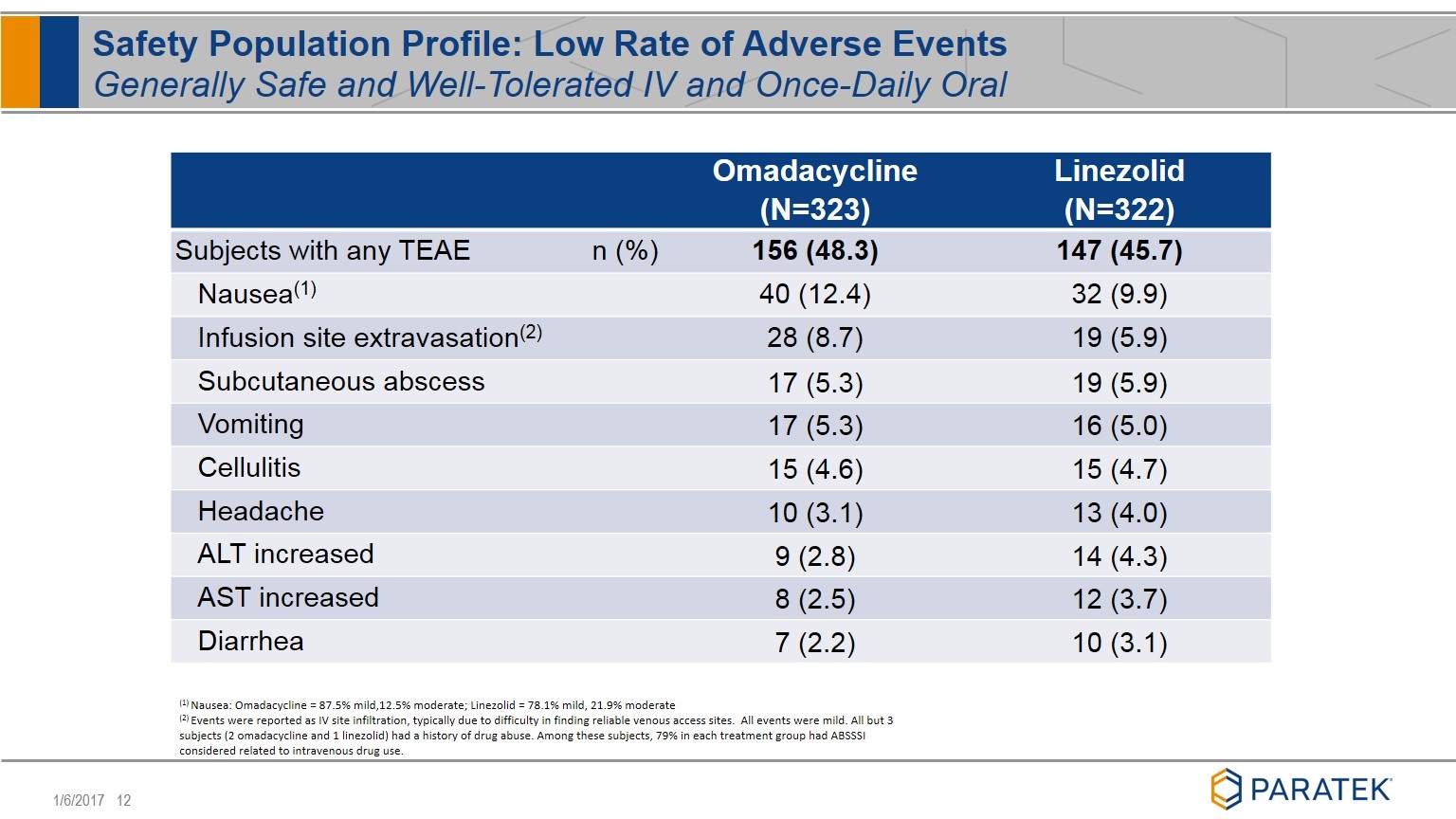

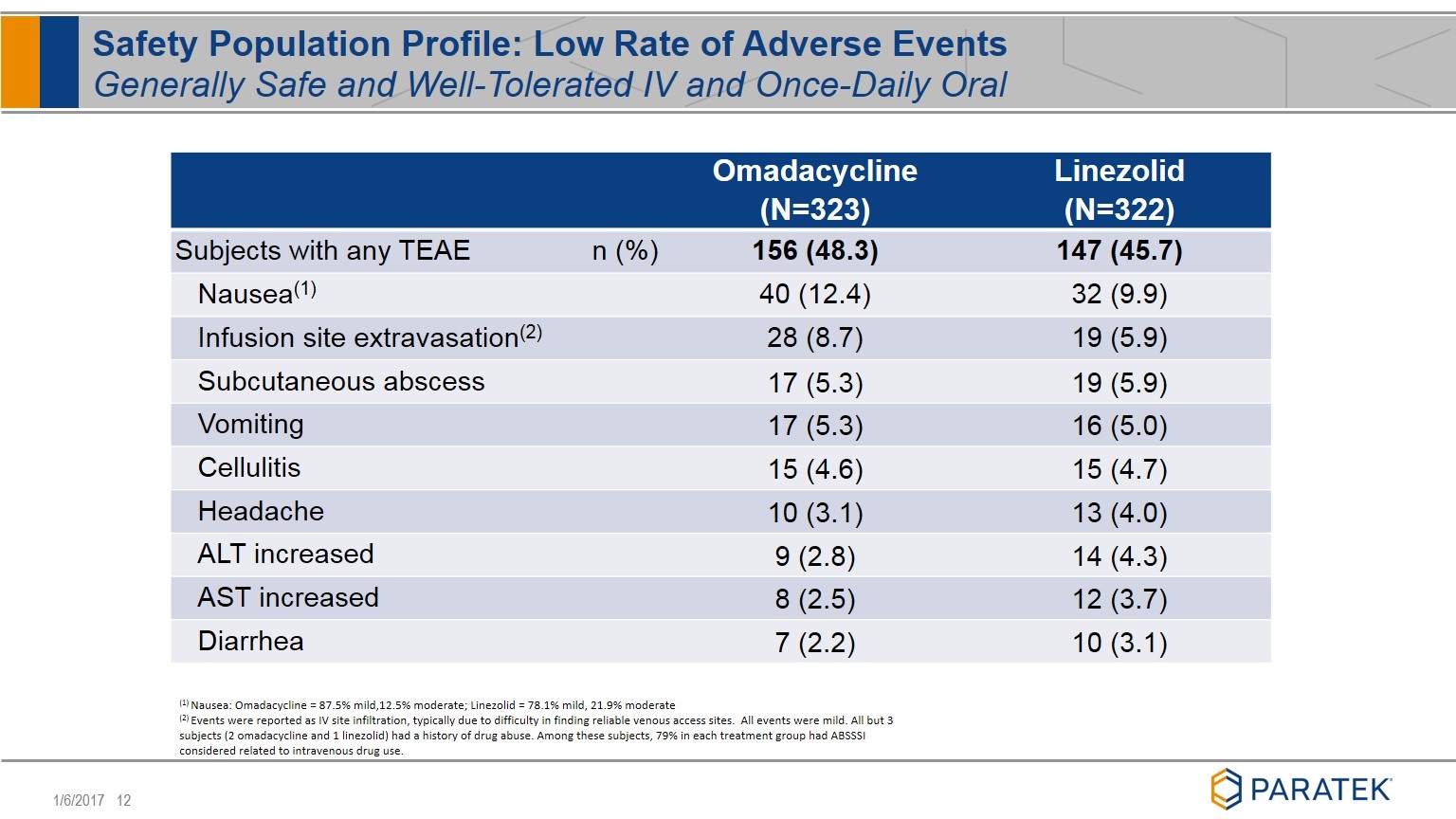

Omadacycline (N=323) Linezolid (N=322) Subjects with any TEAE n (%) 156 (48.3) 147 (45.7) Nausea(1) 40 (12.4) 32 (9.9) Infusion site extravasation(2) 28 (8.7) 19 (5.9) Subcutaneous abscess 17 (5.3) 19 (5.9) Vomiting 17 (5.3) 16 (5.0) Cellulitis 15 (4.6) 15 (4.7) Headache 10 (3.1) 13 (4.0) ALT increased 9 (2.8) 14 (4.3) AST increased 8 (2.5) 12 (3.7) Diarrhea 7 (2.2) 10 (3.1) Safety Population Profile: Low Rate of Adverse Events Generally Safe and Well-Tolerated IV and Once-Daily Oral (1) Nausea: Omadacycline = 87.5% mild,12.5% moderate; Linezolid = 78.1% mild, 21.9% moderate (2) Events were reported as IV site infiltration, typically due to difficulty in finding reliable venous access sites. All events were mild. All but 3 subjects (2 omadacycline and 1 linezolid) had a history of drug abuse. Among these subjects, 79% in each treatment group had ABSSSI considered related to intravenous drug use.

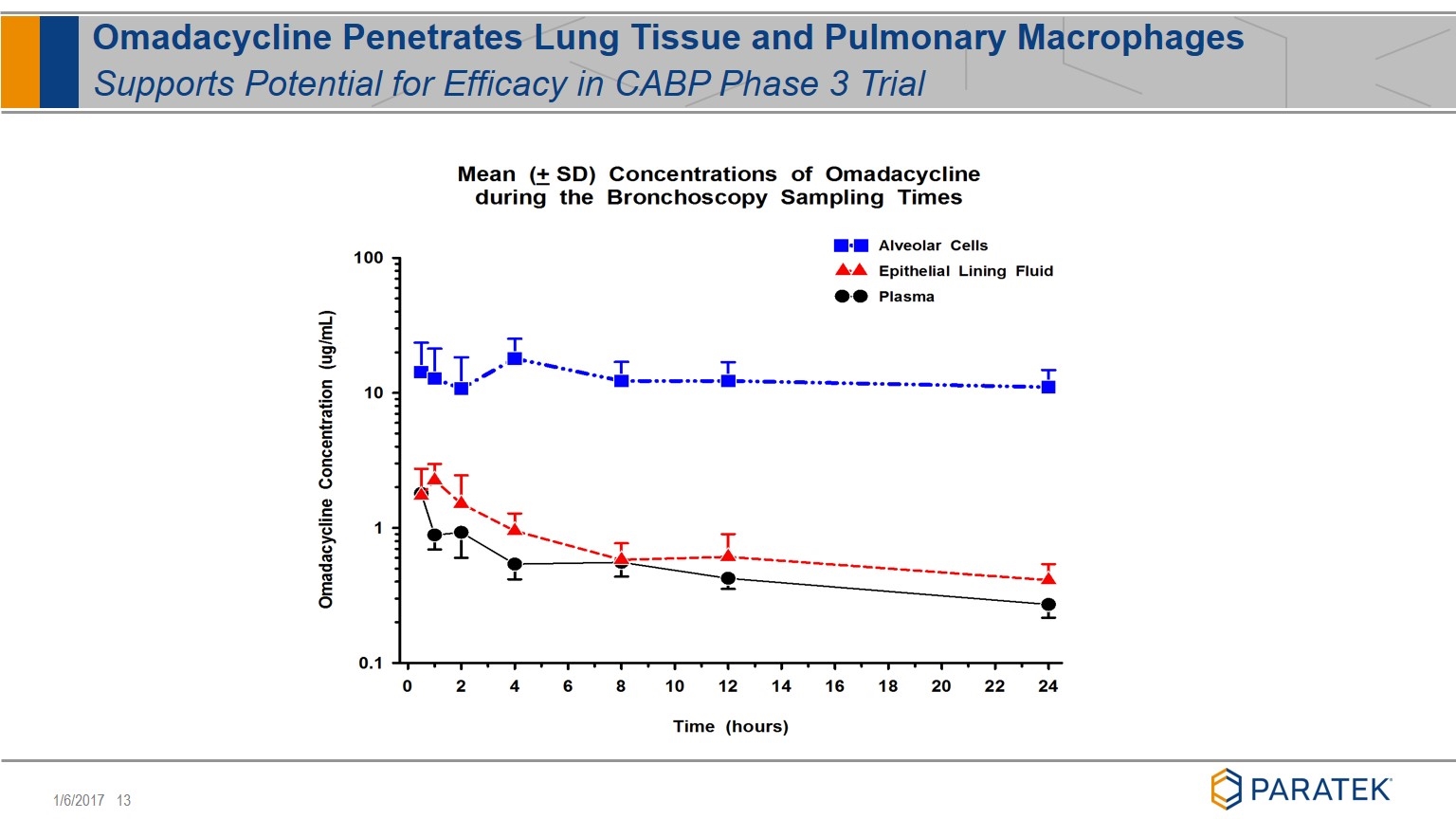

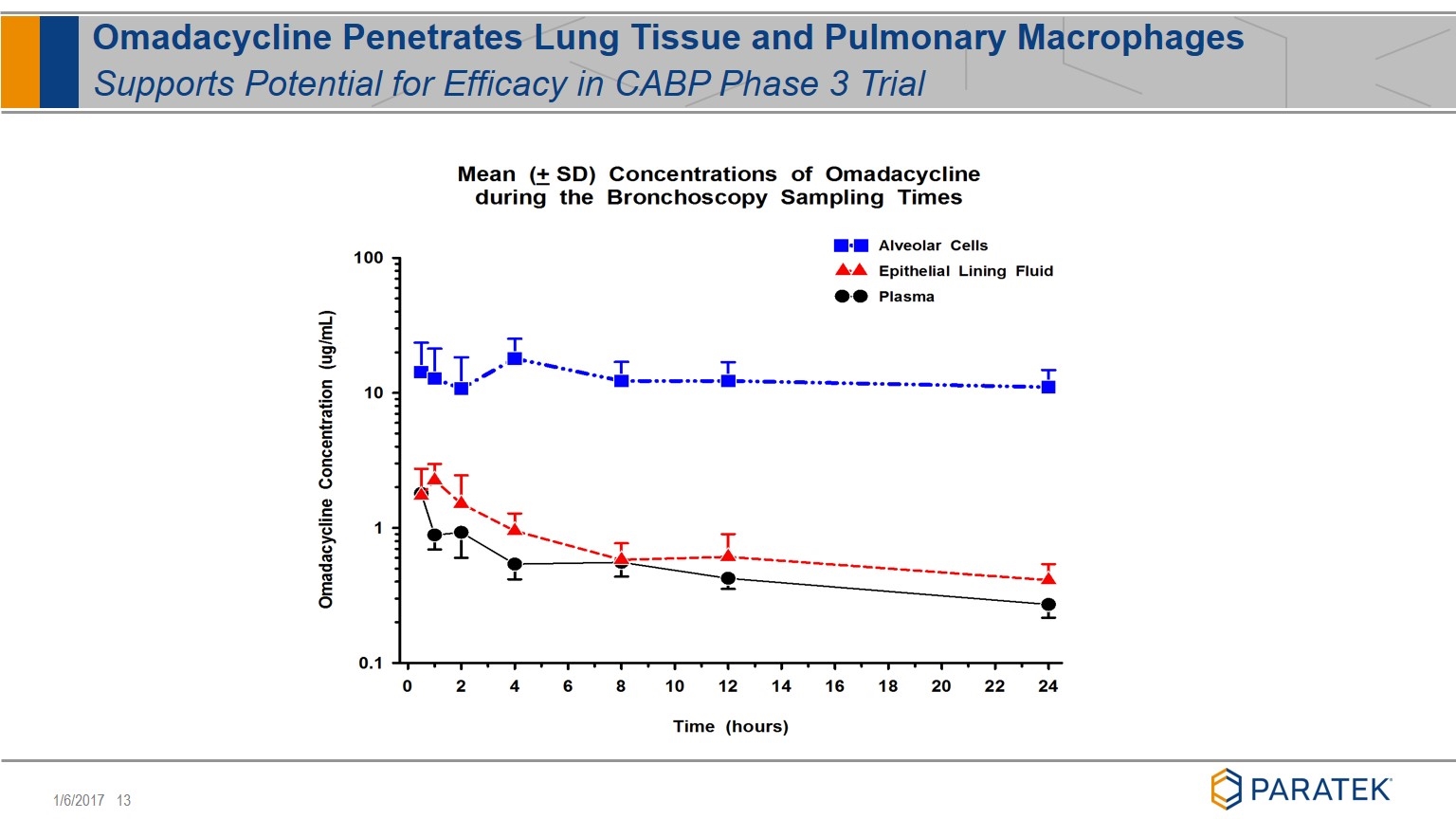

Omadacycline Penetrates Lung Tissue and Pulmonary Macrophages Supports Potential for Efficacy in CABP Phase 3 Trial

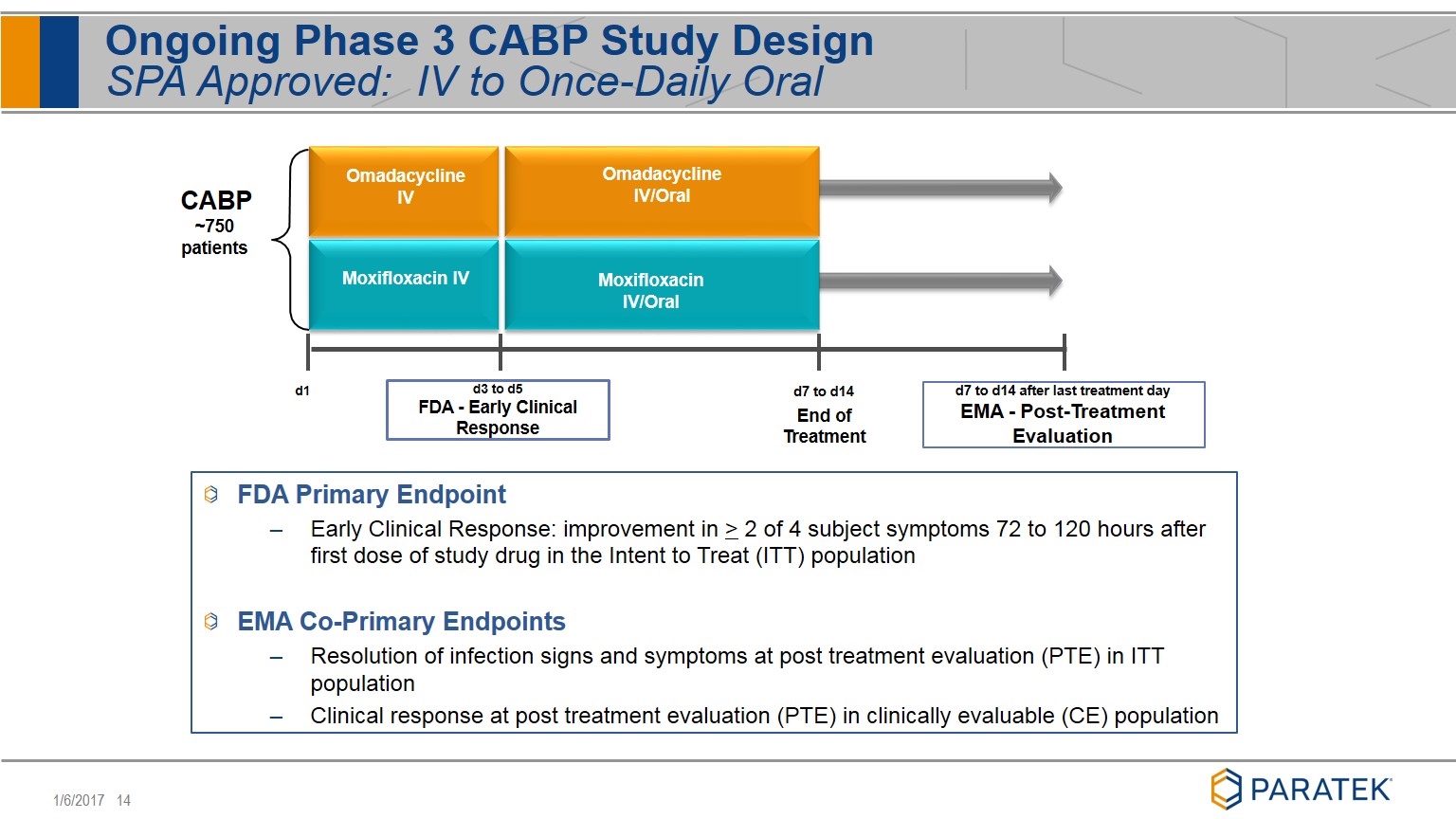

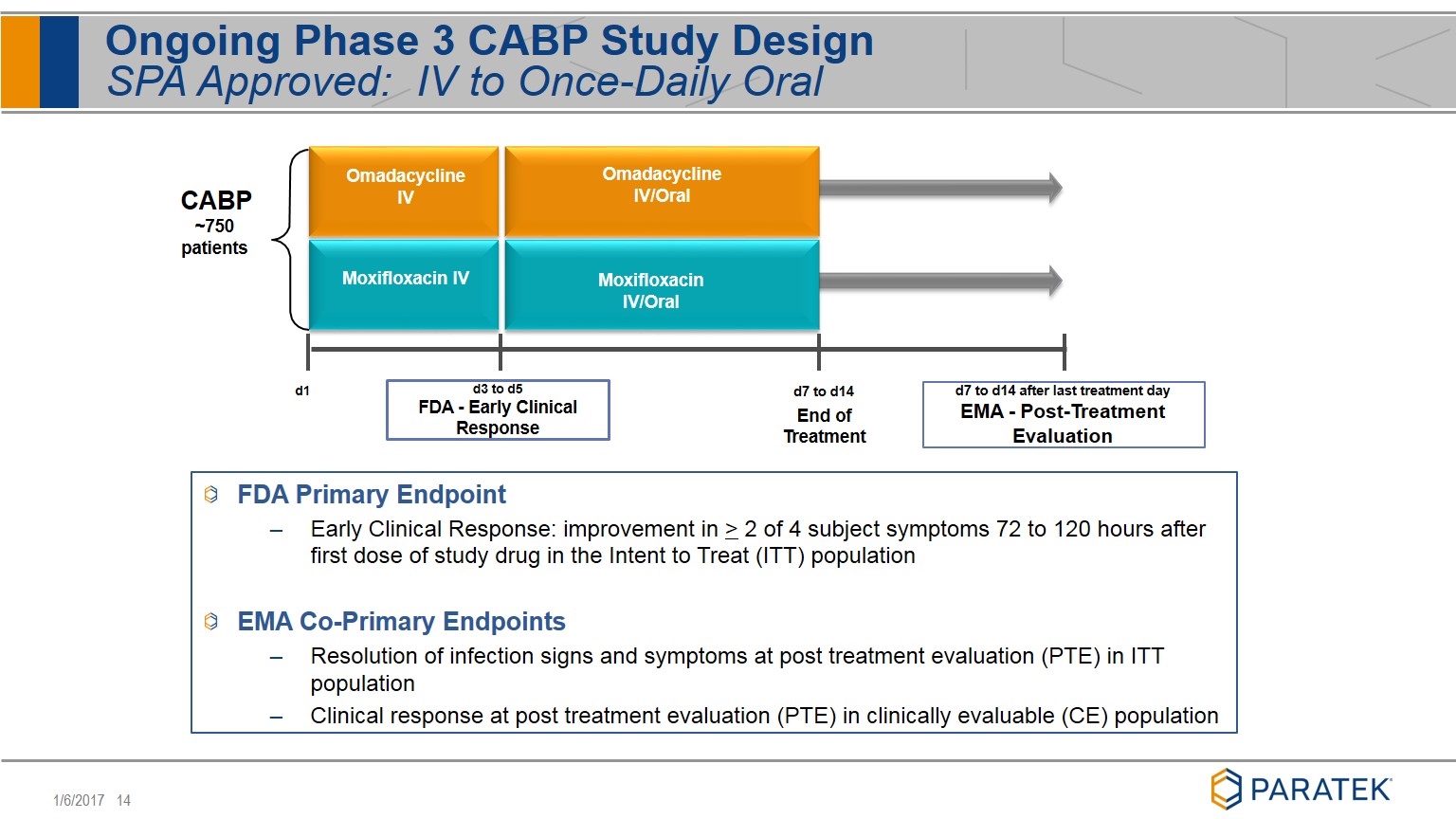

Ongoing Phase 3 CABP Study Design SPA Approved: IV to Once-Daily Oral FDA Primary Endpoint Early Clinical Response: improvement in > 2 of 4 subject symptoms 72 to 120 hours after first dose of study drug in the Intent to Treat (ITT) population EMA Co-Primary Endpoints Resolution of infection signs and symptoms at post treatment evaluation (PTE) in ITT population Clinical response at post treatment evaluation (PTE) in clinically evaluable (CE) population Omadacycline IV Omadacycline IV/Oral Moxifloxacin IV Moxifloxacin IV/Oral d1 d7 to d14 End of Treatment CABP ~750 patients d3 to d5 FDA - Early Clinical Response d7 to d14 after last treatment day EMA - Post-Treatment Evaluation

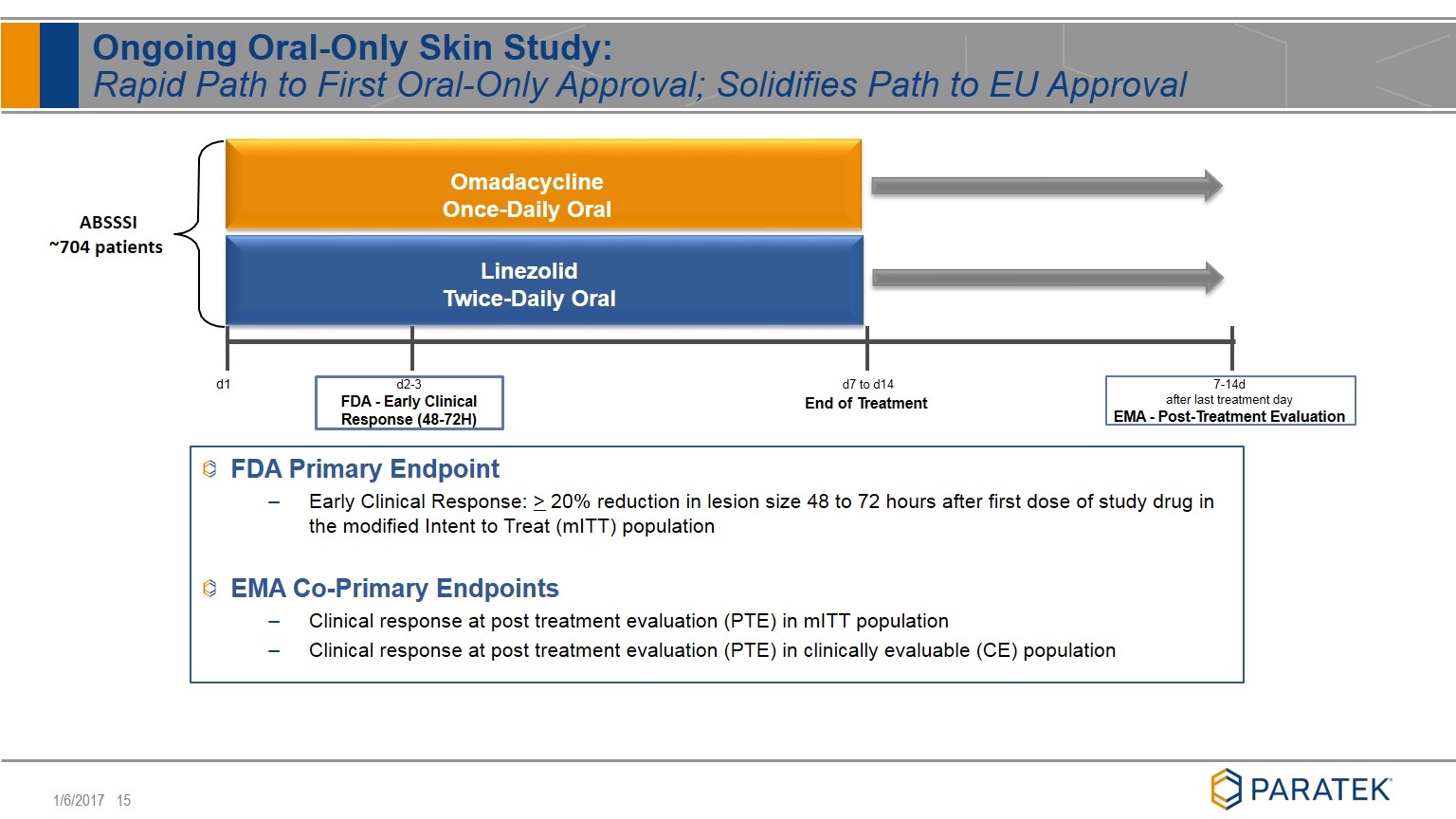

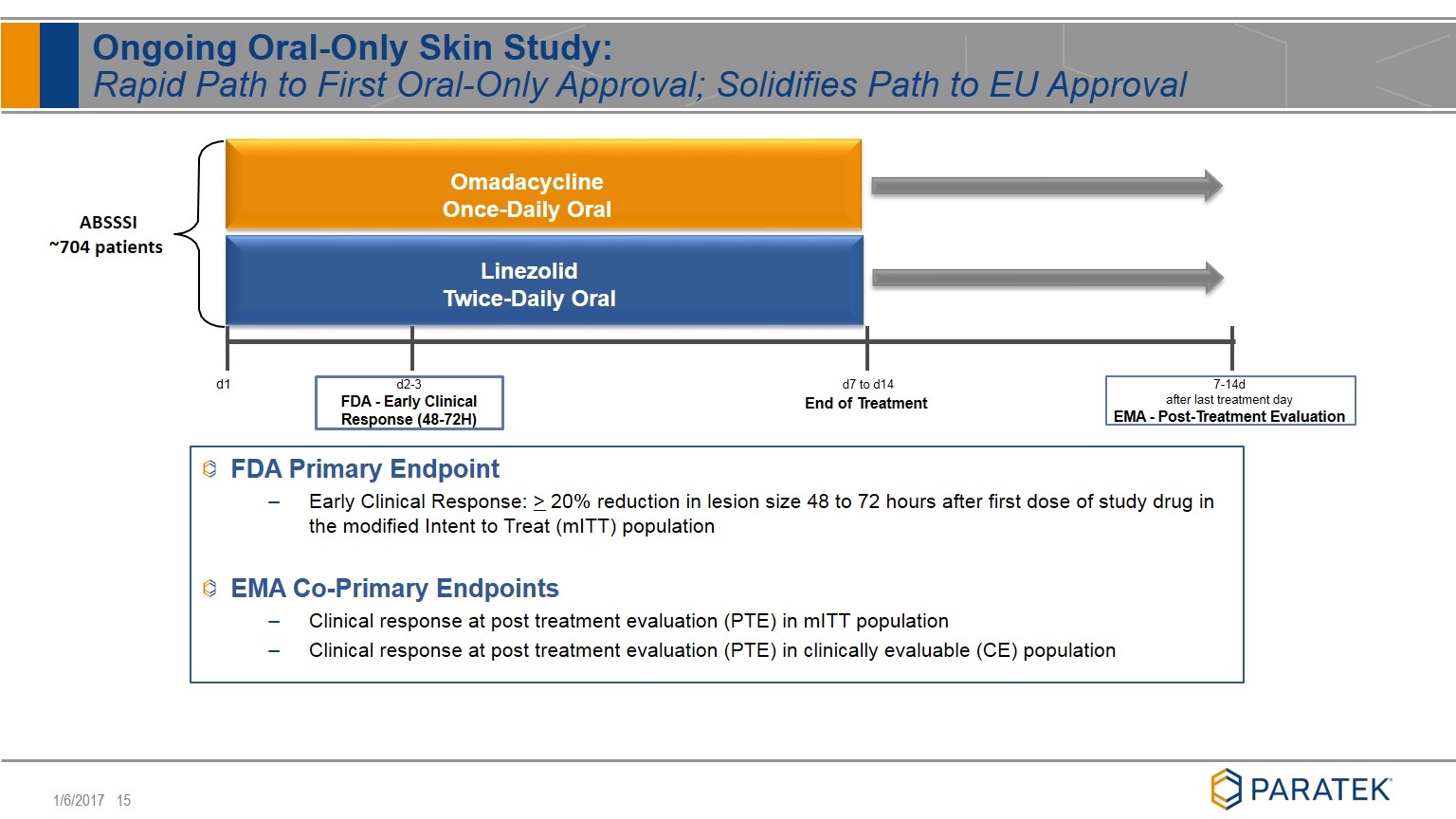

FDA Primary Endpoint Early Clinical Response: > 20% reduction in lesion size 48 to 72 hours after first dose of study drug in the modified Intent to Treat (mITT) population EMA Co-Primary Endpoints Clinical response at post treatment evaluation (PTE) in mITT population Clinical response at post treatment evaluation (PTE) in clinically evaluable (CE) population Ongoing Oral-Only Skin Study: Rapid Path to First Oral-Only Approval; Solidifies Path to EU Approval ABSSSI ~704 patients Omadacycline Once-Daily Oral Linezolid Twice-Daily Oral d2-3 FDA - Early Clinical Response (48-72H) d7 to d14 End of Treatment d1 7-14d after last treatment day EMA - Post-Treatment Evaluation

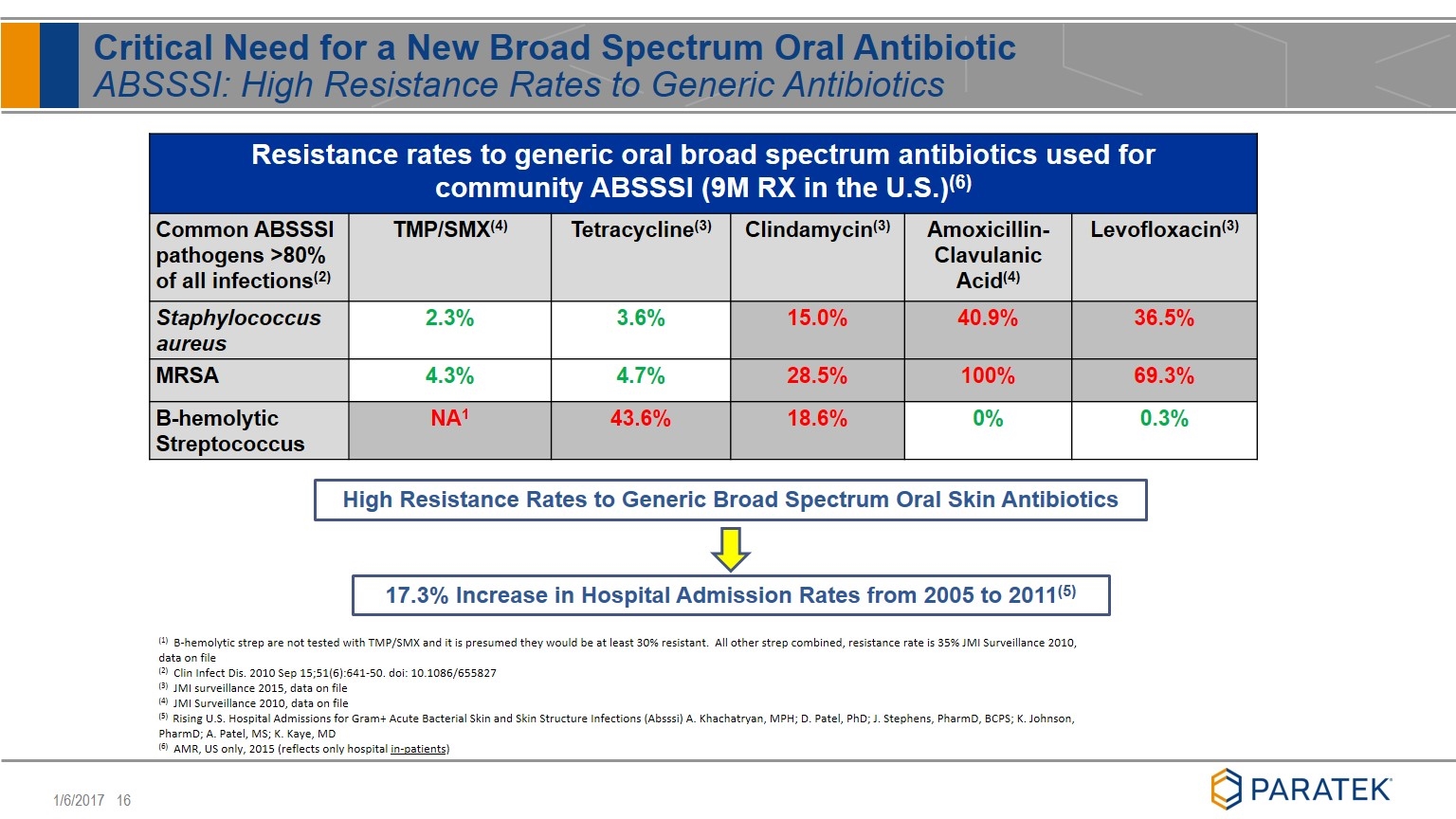

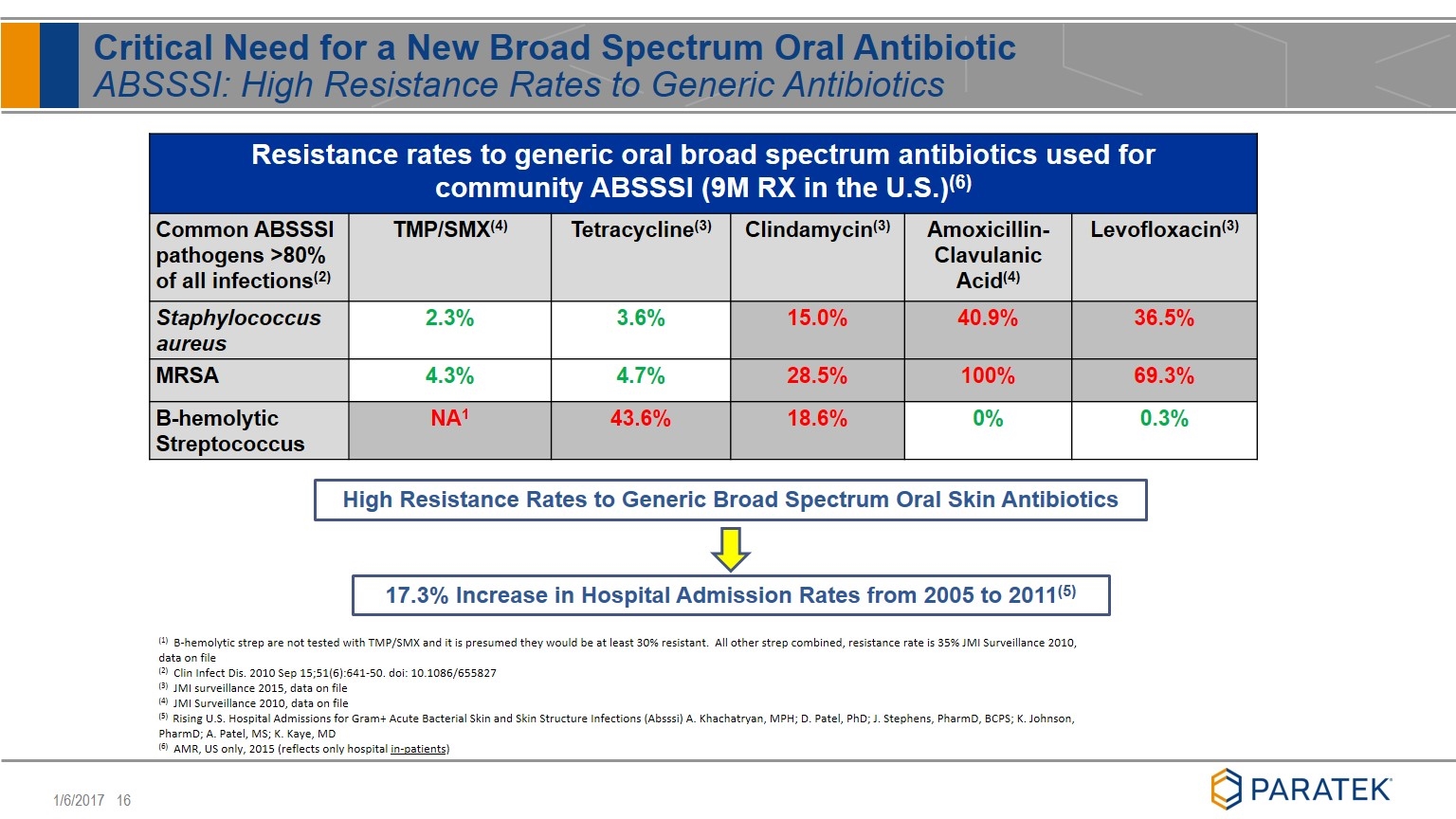

Critical Need for a New Broad Spectrum Oral Antibiotic ABSSSI: High Resistance Rates to Generic Antibiotics Resistance rates to generic oral broad spectrum antibiotics used for community ABSSSI (9M RX in the U.S.)(6) Common ABSSSI pathogens >80% of all infections(2) TMP/SMX(4) Tetracycline(3) Clindamycin(3) Amoxicillin-Clavulanic Acid(4) Levofloxacin(3) Staphylococcus aureus 2.3% 3.6% 15.0% 40.9% 36.5% MRSA 4.3% 4.7% 28.5% 100% 69.3% B-hemolytic Streptococcus NA1 43.6% 18.6% 0% 0.3% (1) B-hemolytic strep are not tested with TMP/SMX and it is presumed they would be at least 30% resistant. All other strep combined, resistance rate is 35% JMI Surveillance 2010, data on file (2) Clin Infect Dis. 2010 Sep 15;51(6):641-50. doi: 10.1086/655827 (3) JMI surveillance 2015, data on file (4) JMI Surveillance 2010, data on file (5) Rising U.S. Hospital Admissions for Gram+ Acute Bacterial Skin and Skin Structure Infections (Absssi) A. Khachatryan, MPH; D. Patel, PhD; J. Stephens, PharmD, BCPS; K. Johnson, PharmD; A. Patel, MS; K. Kaye, MD (6) AMR, US only, 2015 (reflects only hospital in-patients) 17.3% Increase in Hospital Admission Rates from 2005 to 2011(5) High Resistance Rates to Generic Broad Spectrum Oral Skin Antibiotics

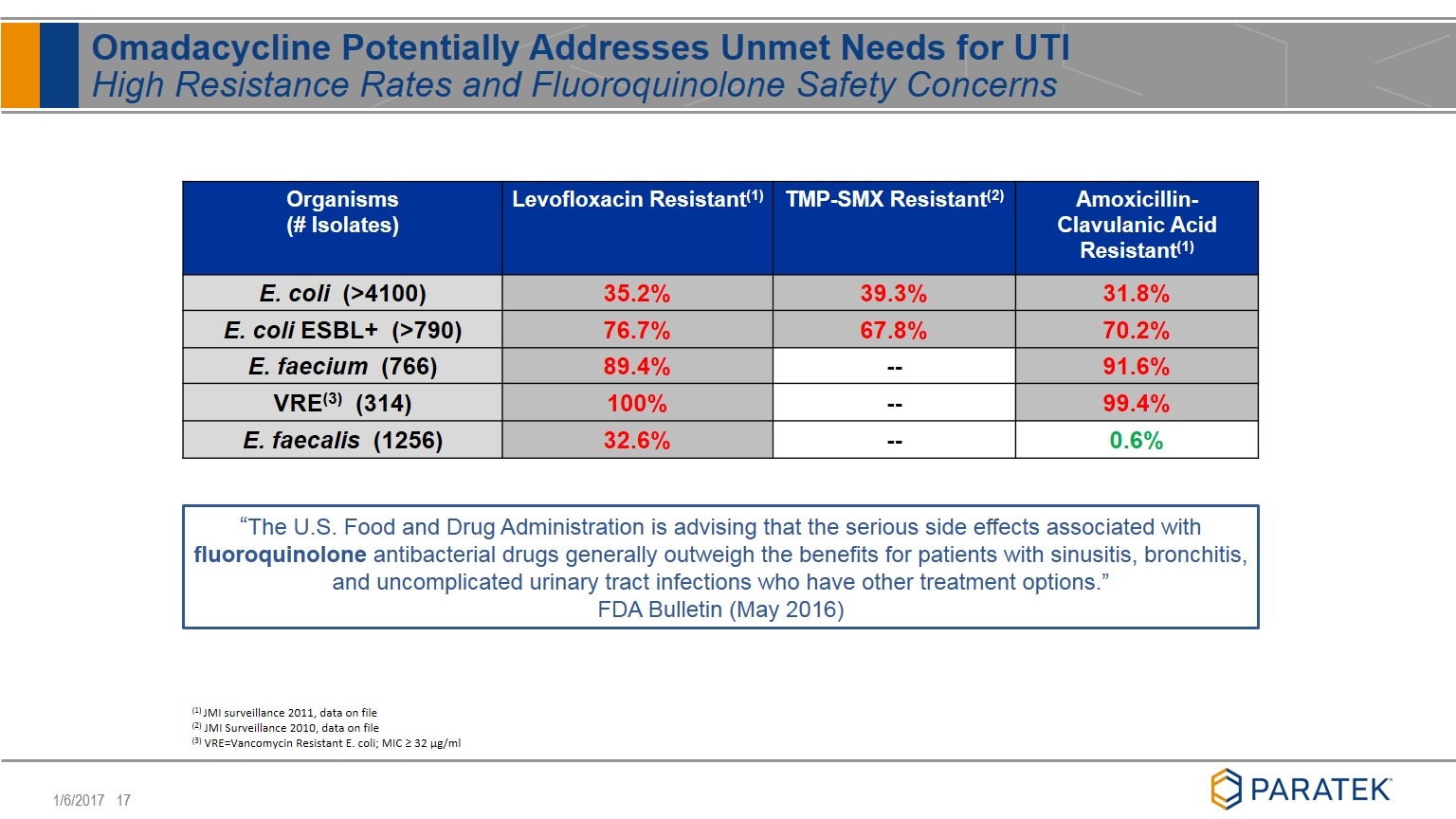

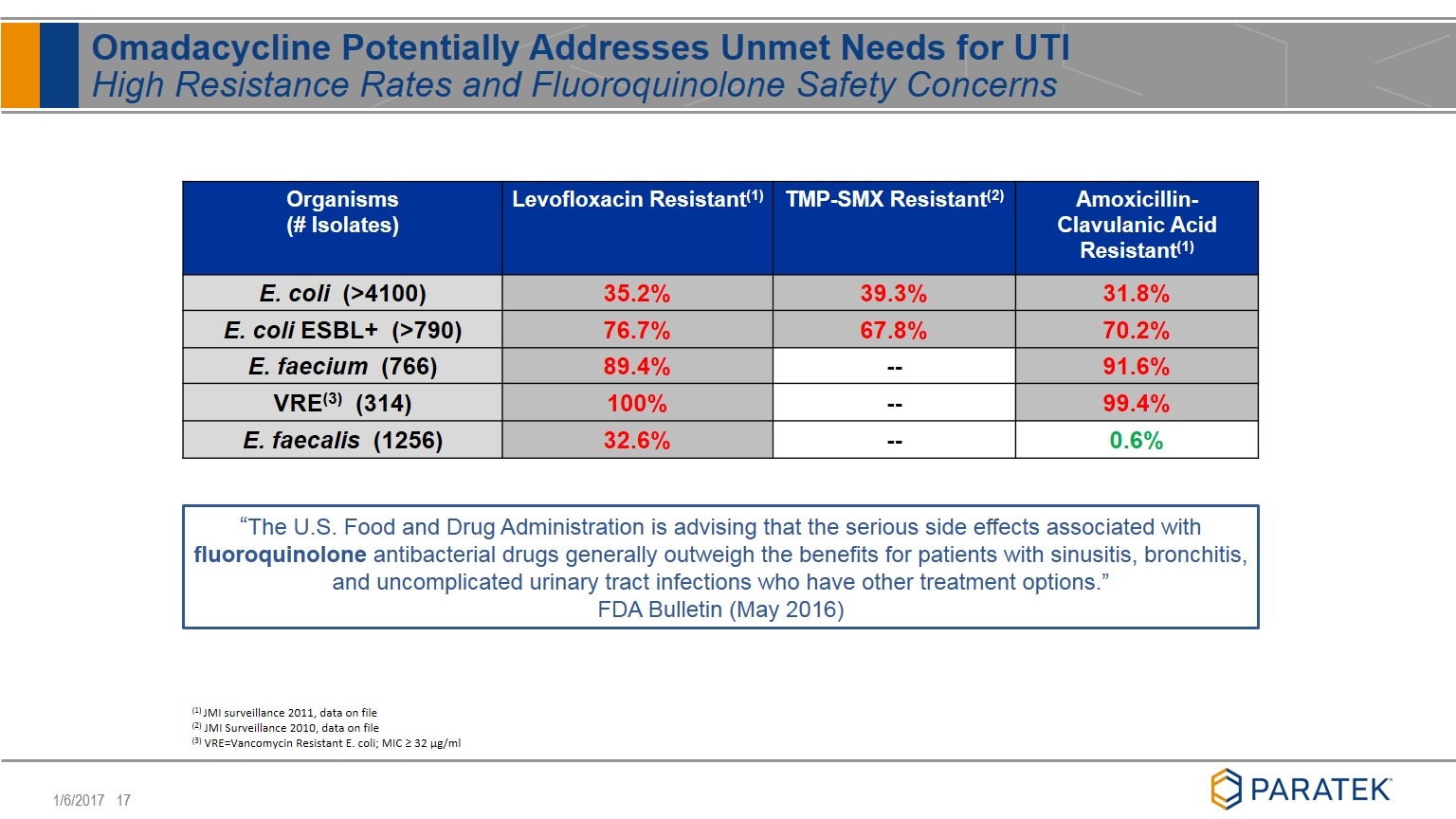

Omadacycline Potentially Addresses Unmet Needs for UTI High Resistance Rates and Fluoroquinolone Safety Concerns Organisms (# Isolates) Levofloxacin Resistant(1) TMP-SMX Resistant(2) Amoxicillin-Clavulanic Acid Resistant(1) E. coli (>4100) 35.2% 39.3% 31.8% E. coli ESBL+ (>790) 76.7% 67.8% 70.2% E. faecium (766) 89.4% -- 91.6% VRE(3) (314) 100% -- 99.4% E. faecalis (1256) 32.6% -- 0.6% (1) JMI surveillance 2011, data on file (2) JMI Surveillance 2010, data on file (3) VRE=Vancomycin Resistant E. coli; MIC ≥ 32 µg/ml “The U.S. Food and Drug Administration is advising that the serious side effects associated with fluoroquinolone antibacterial drugs generally outweigh the benefits for patients with sinusitis, bronchitis, and uncomplicated urinary tract infections who have other treatment options.” FDA Bulletin (May 2016)

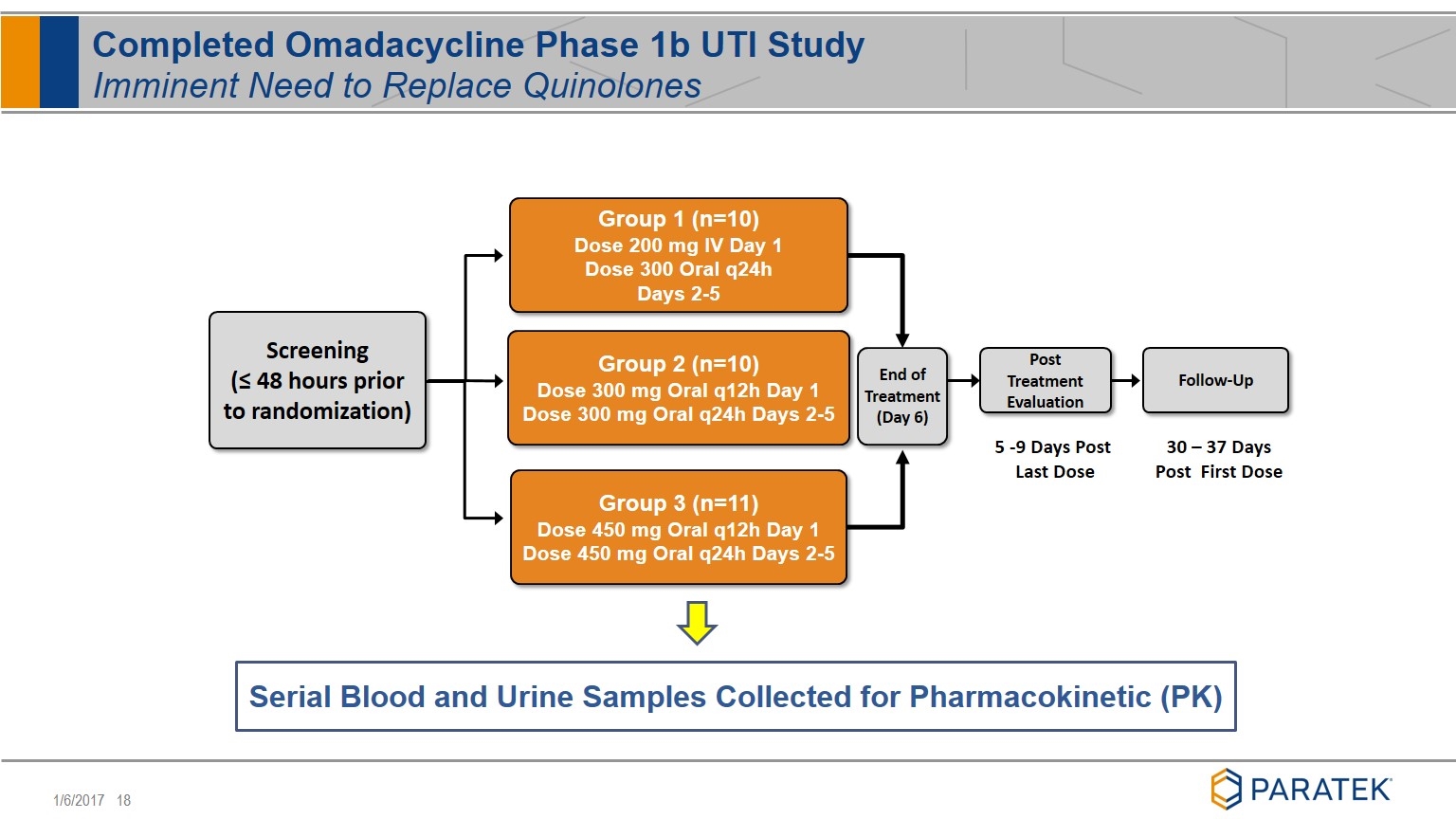

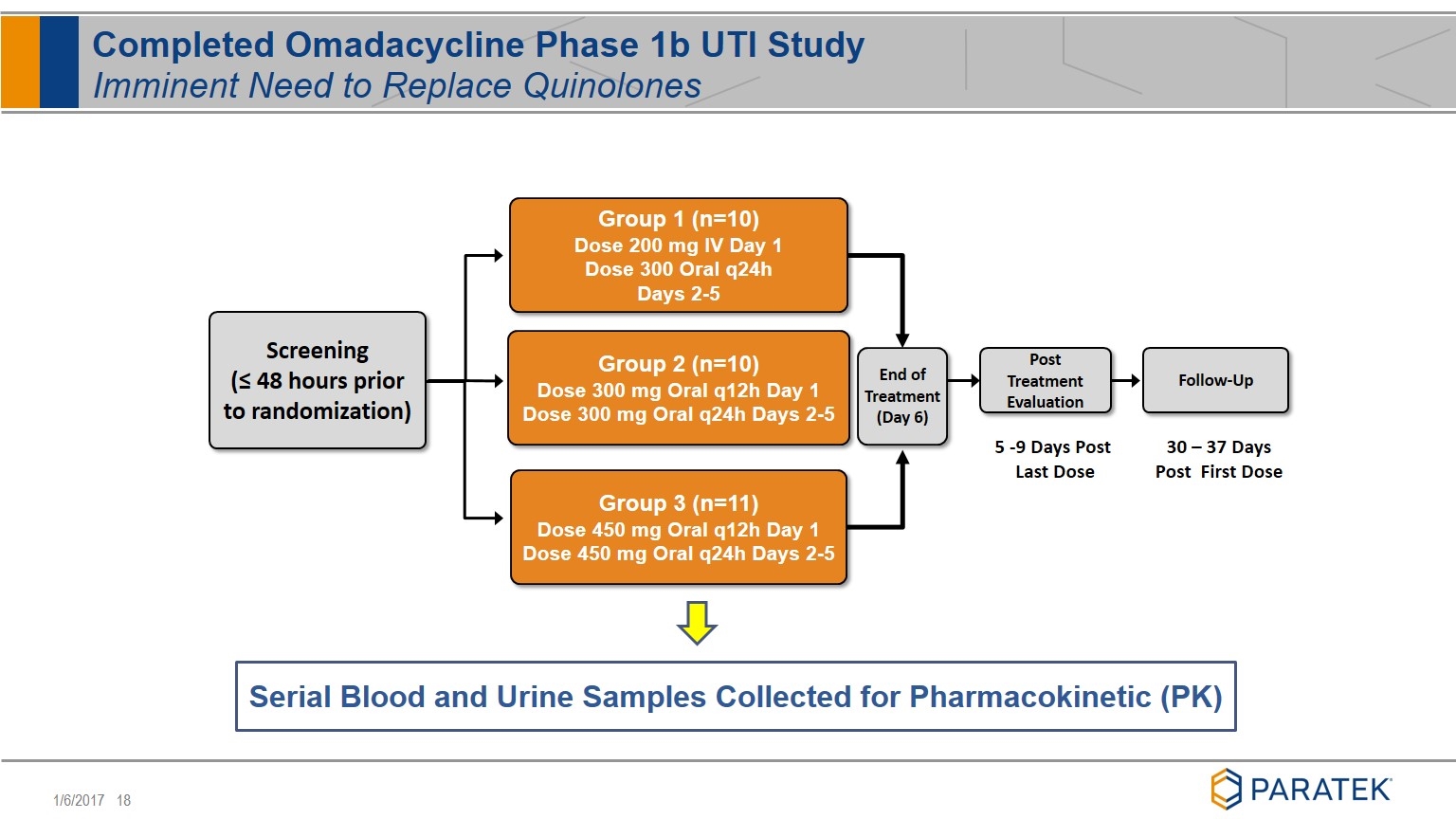

Completed Omadacycline Phase 1b UTI Study Imminent Need to Replace Quinolones Group 1 (n=10) Dose 200 mg IV Day 1 Dose 300 Oral q24h Days 2-5 Screening (≤ 48 hours prior to randomization) End of Treatment (Day 6) Post Treatment Evaluation Follow-Up Group 2 (n=10) Dose 300 mg Oral q12h Day 1 Dose 300 mg Oral q24h Days 2-5 Group 3 (n=11) Dose 450 mg Oral q12h Day 1 Dose 450 mg Oral q24h Days 2-5 5 -9 Days Post Last Dose 30 – 37 Days Post First Dose Serial Blood and Urine Samples Collected for Pharmacokinetic (PK)

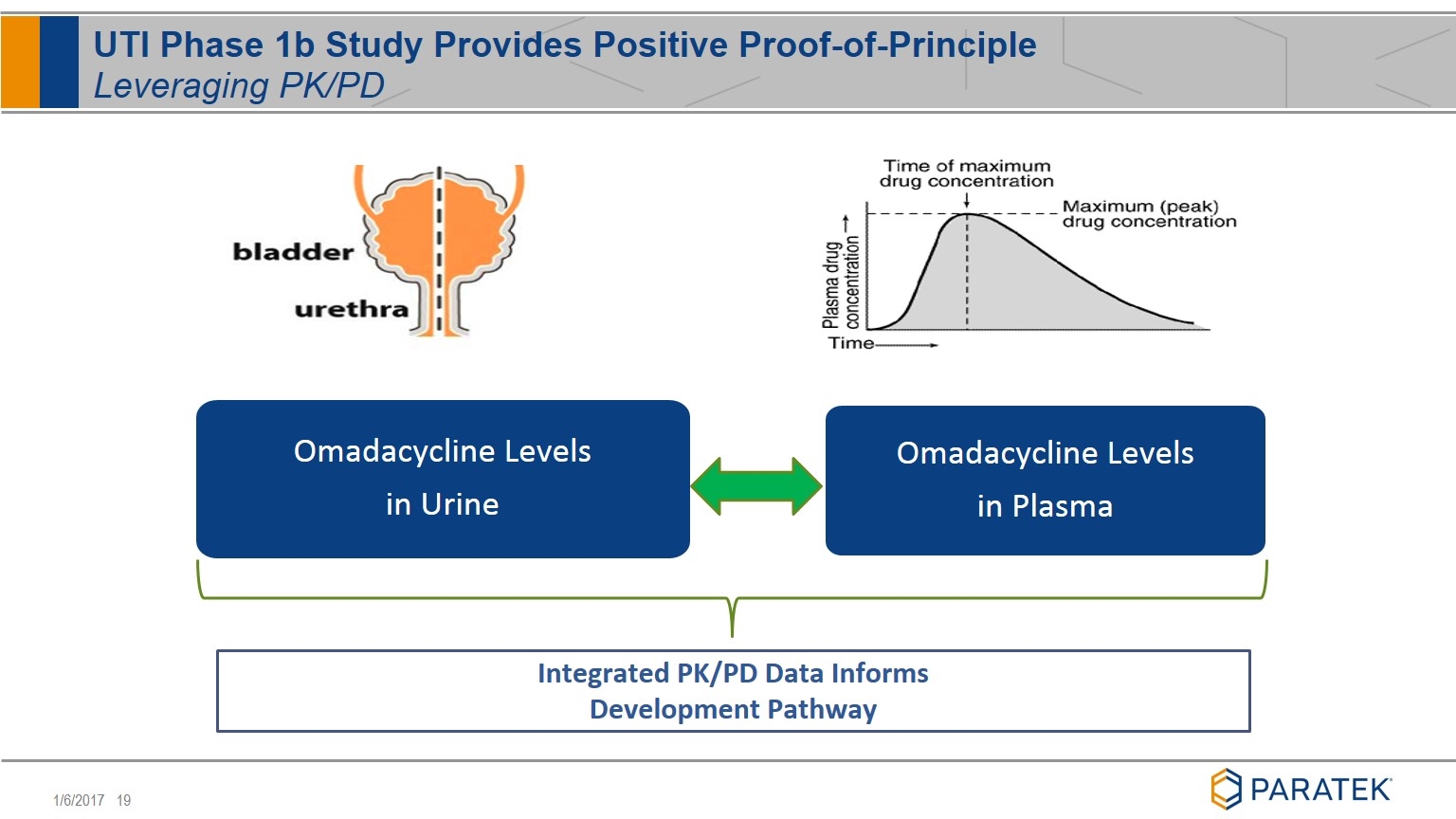

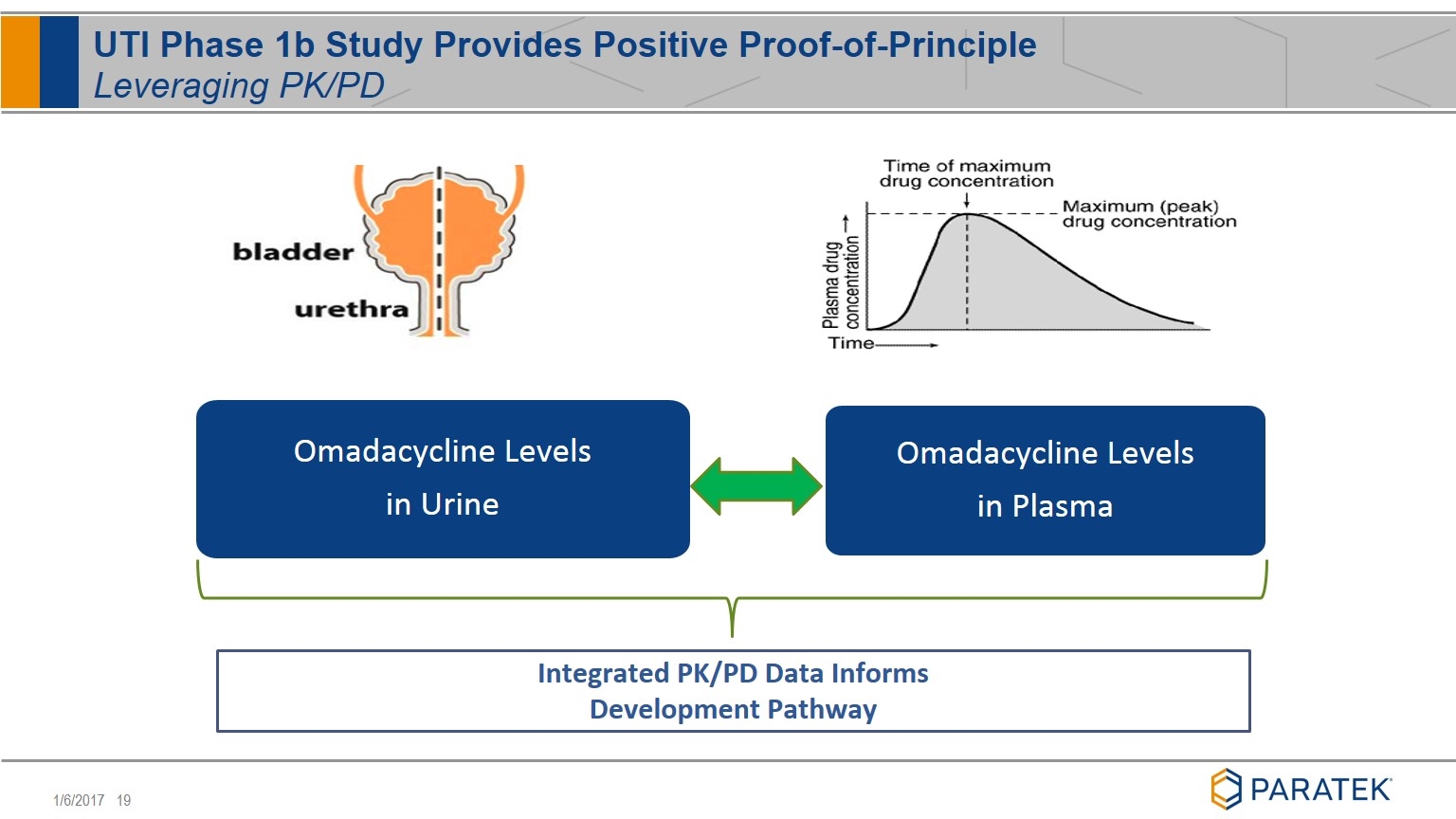

UTI Phase 1b Study Provides Positive Proof-of-Principle Leveraging PK/PD Omadacycline Levels in Urine Omadacycline Levels in Plasma Integrated PK/PD Data Informs Development Pathway

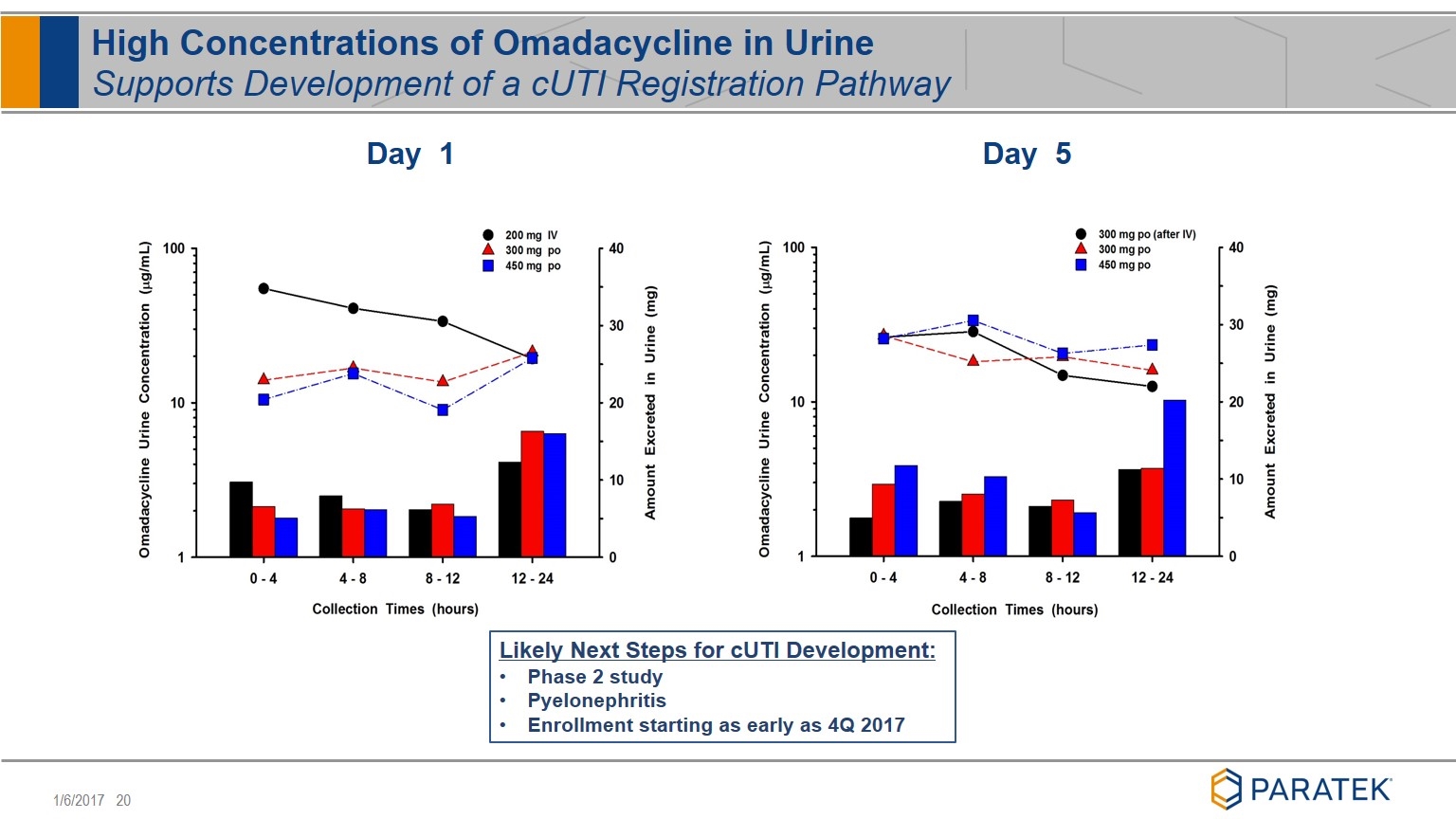

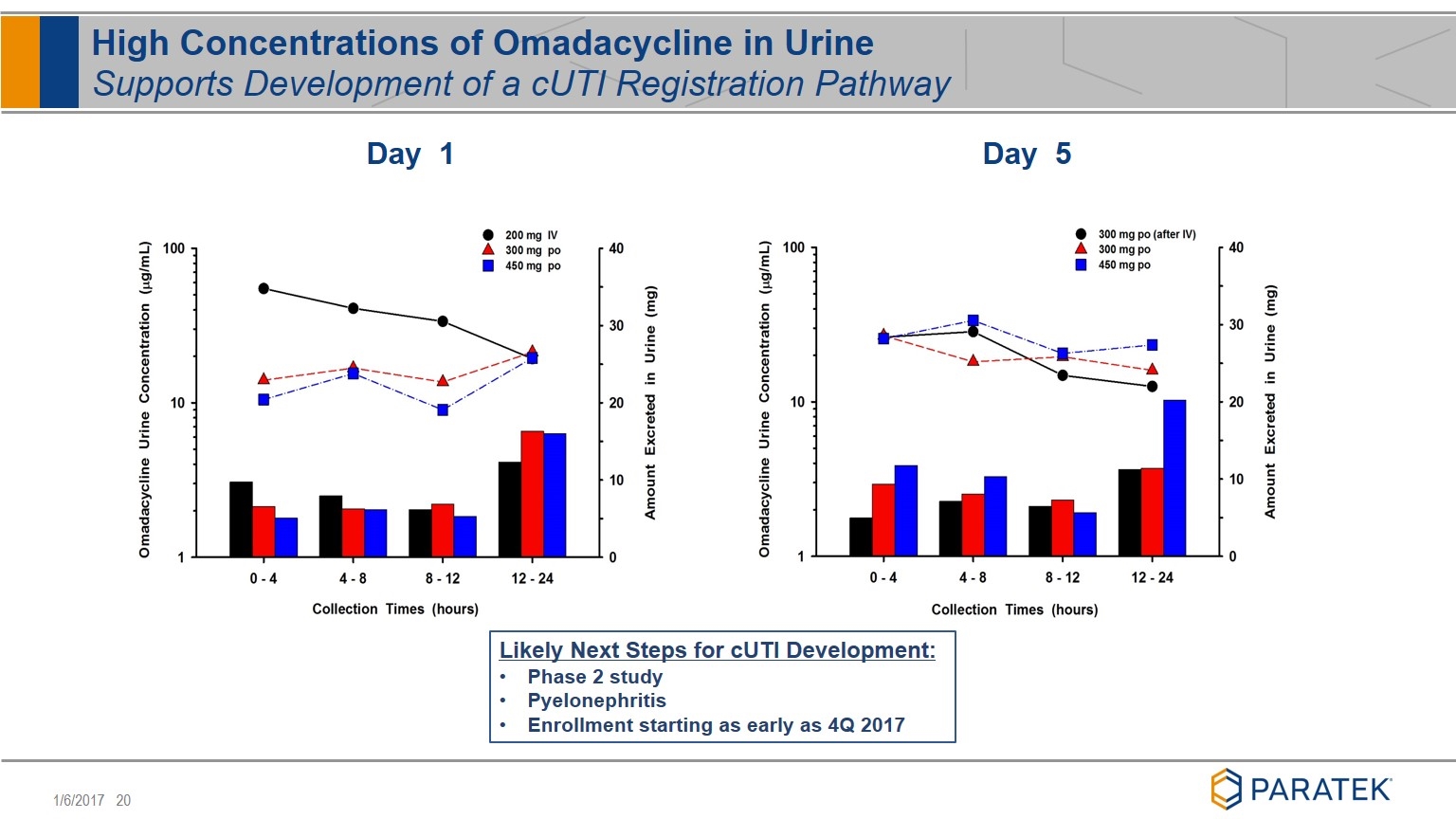

High Concentrations of Omadacycline in Urine Supports Development of a cUTI Registration Pathway Day 5 Day 1 Likely Next Steps for cUTI Development: Phase 2 study Pyelonephritis Enrollment starting as early as 4Q 2017

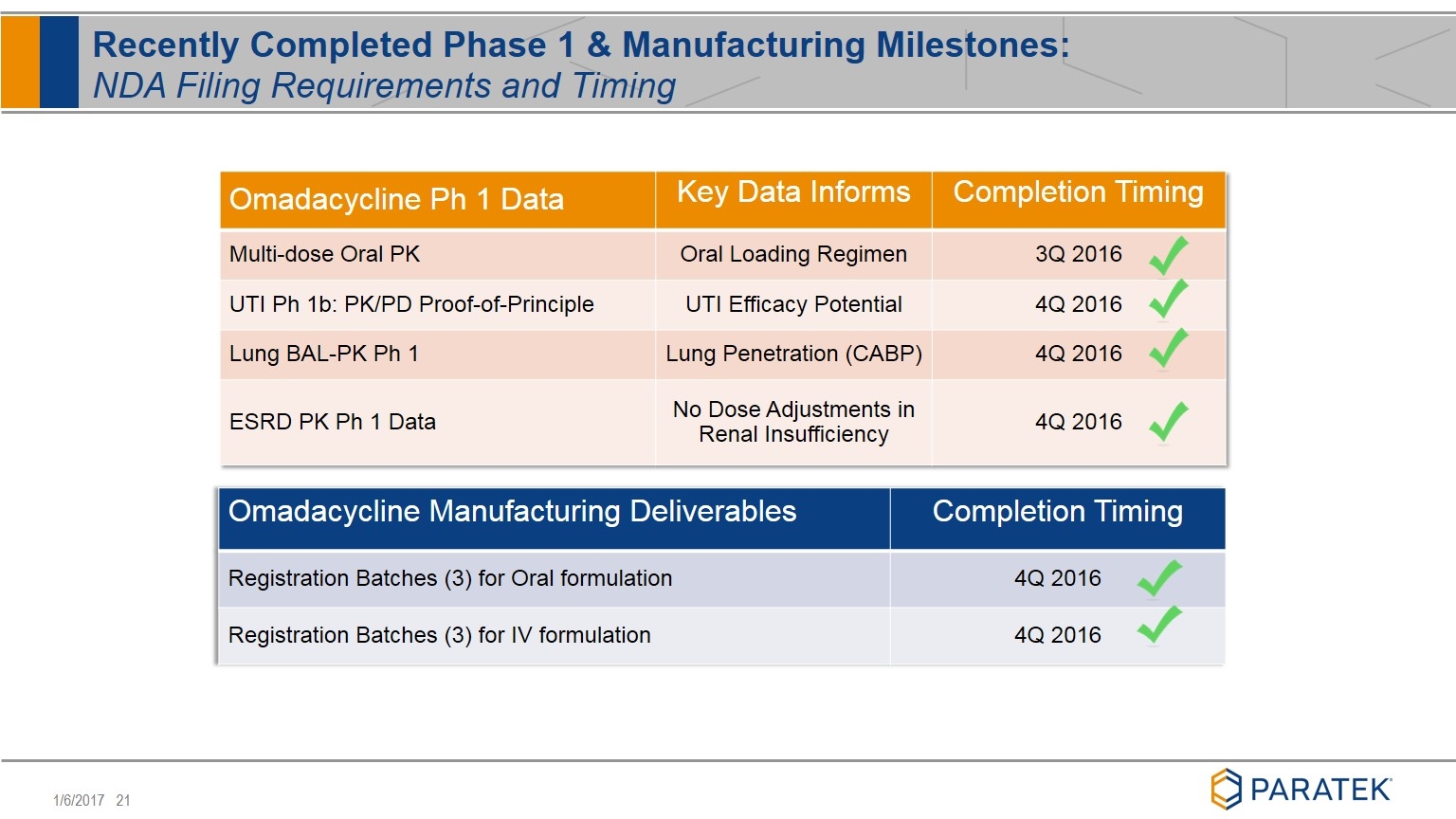

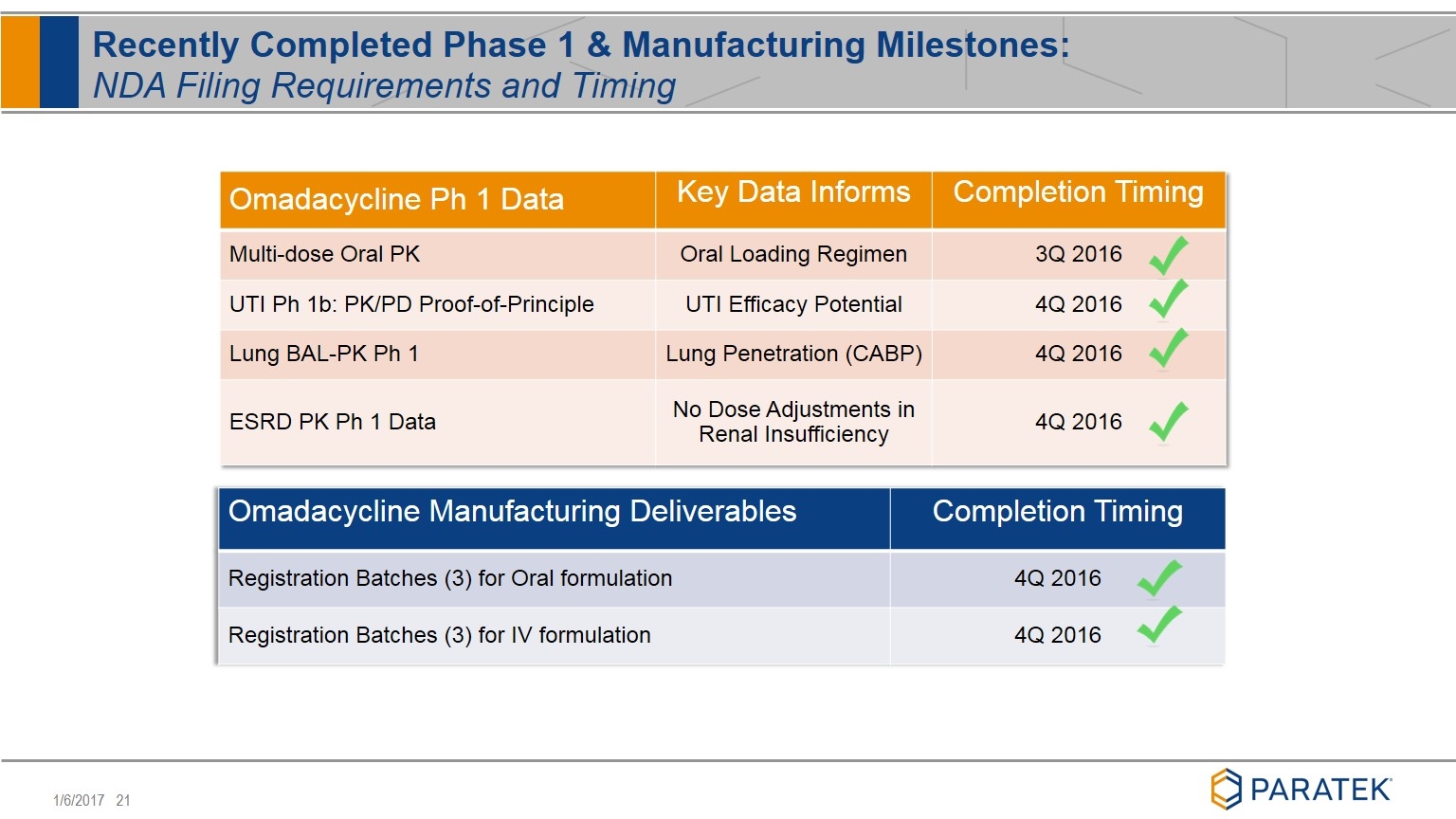

Recently Completed Phase 1 & Manufacturing Milestones: NDA Filing Requirements and Timing Omadacycline Ph 1 Data Key Data Informs Completion Timing Multi-dose Oral PK Oral Loading Regimen 3Q 2016 UTI Ph 1b: PK/PD Proof-of-Principle UTI Efficacy Potential 4Q 2016 Lung BAL-PK Ph 1 Lung Penetration (CABP) 4Q 2016 ESRD PK Ph 1 Data No Dose Adjustments in Renal Insufficiency 4Q 2016 Omadacycline Manufacturing Deliverables Completion Timing Registration Batches (3) for Oral formulation 4Q 2016 Registration Batches (3) for IV formulation 4Q 2016

Omadacycline Commercial Opportunity

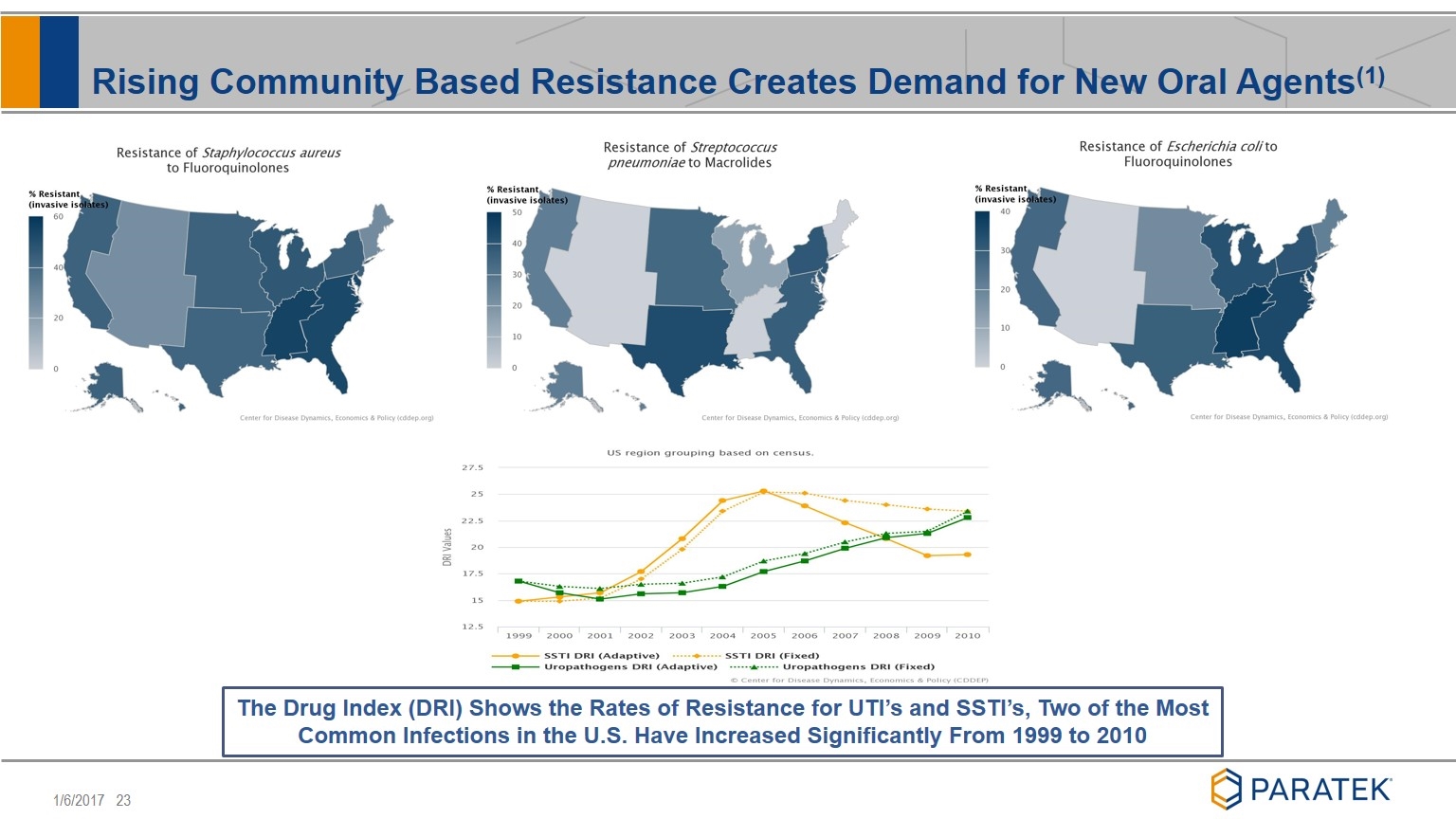

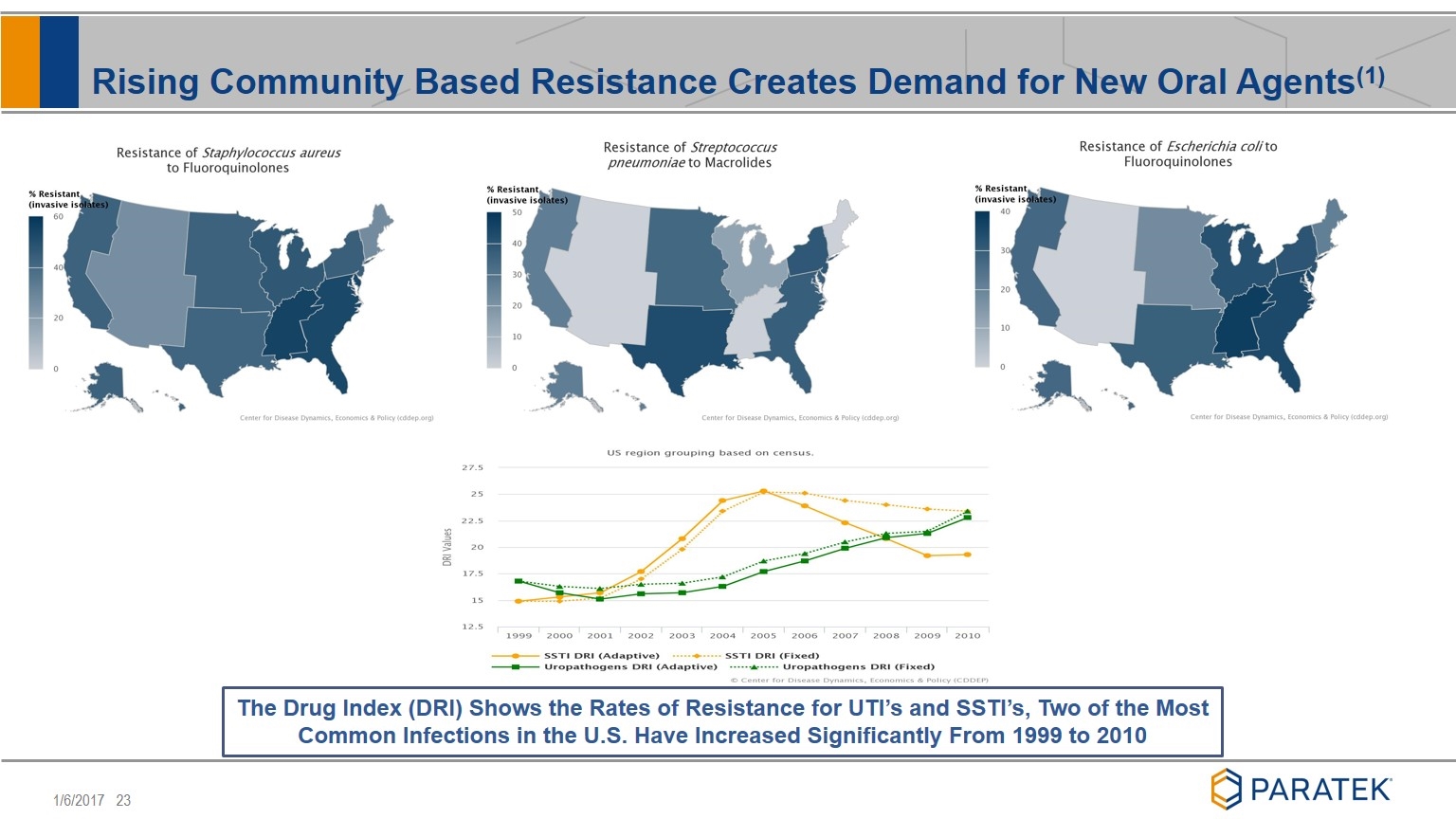

Rising Community Based Resistance Creates Demand for New Oral Agents(1) 9 The Drug Index (DRI) Shows the Rates of Resistance for UTI’s and SSTI’s, Two of the Most Common Infections in the U.S. Have Increased Significantly From 1999 to 2010

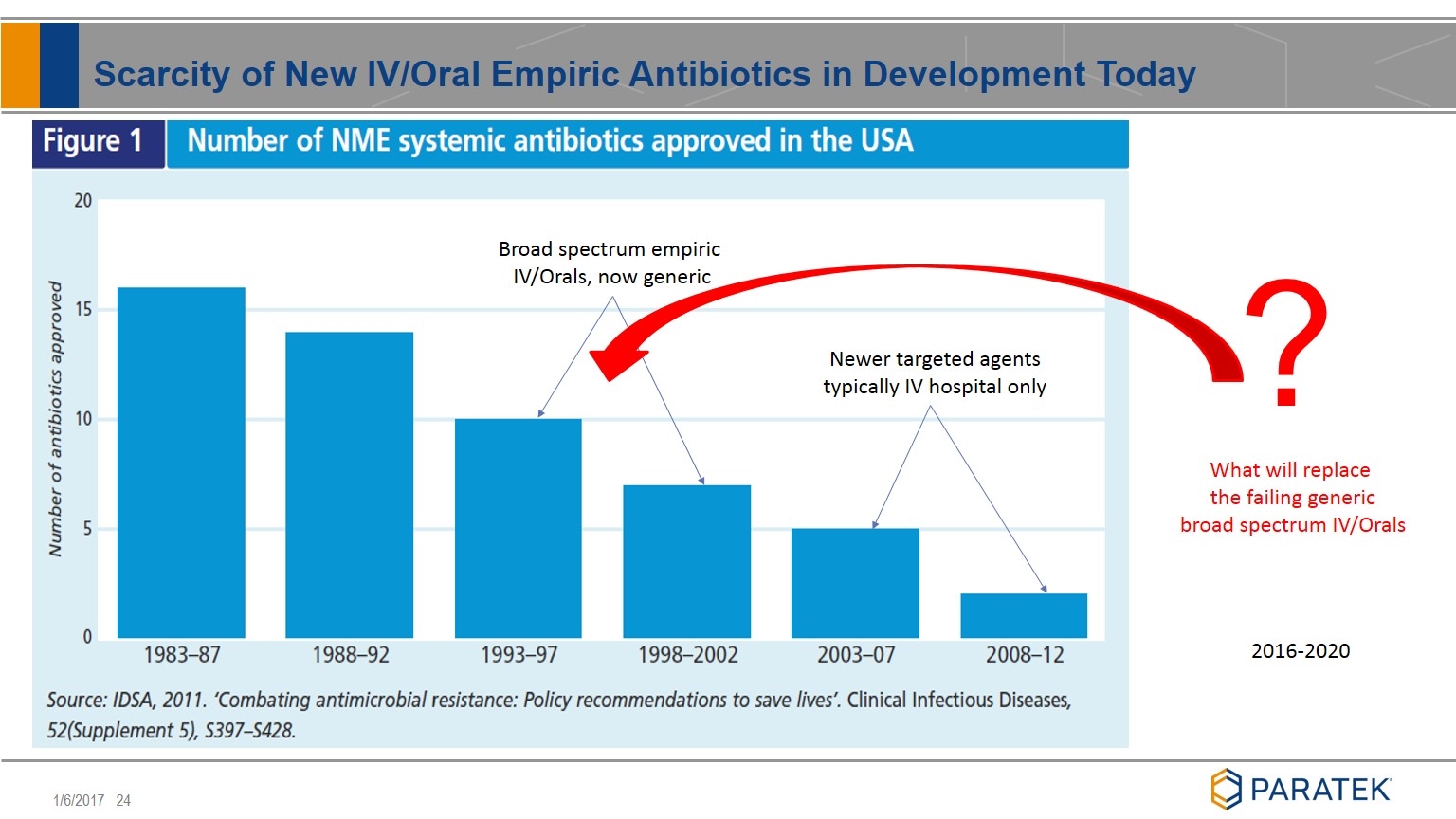

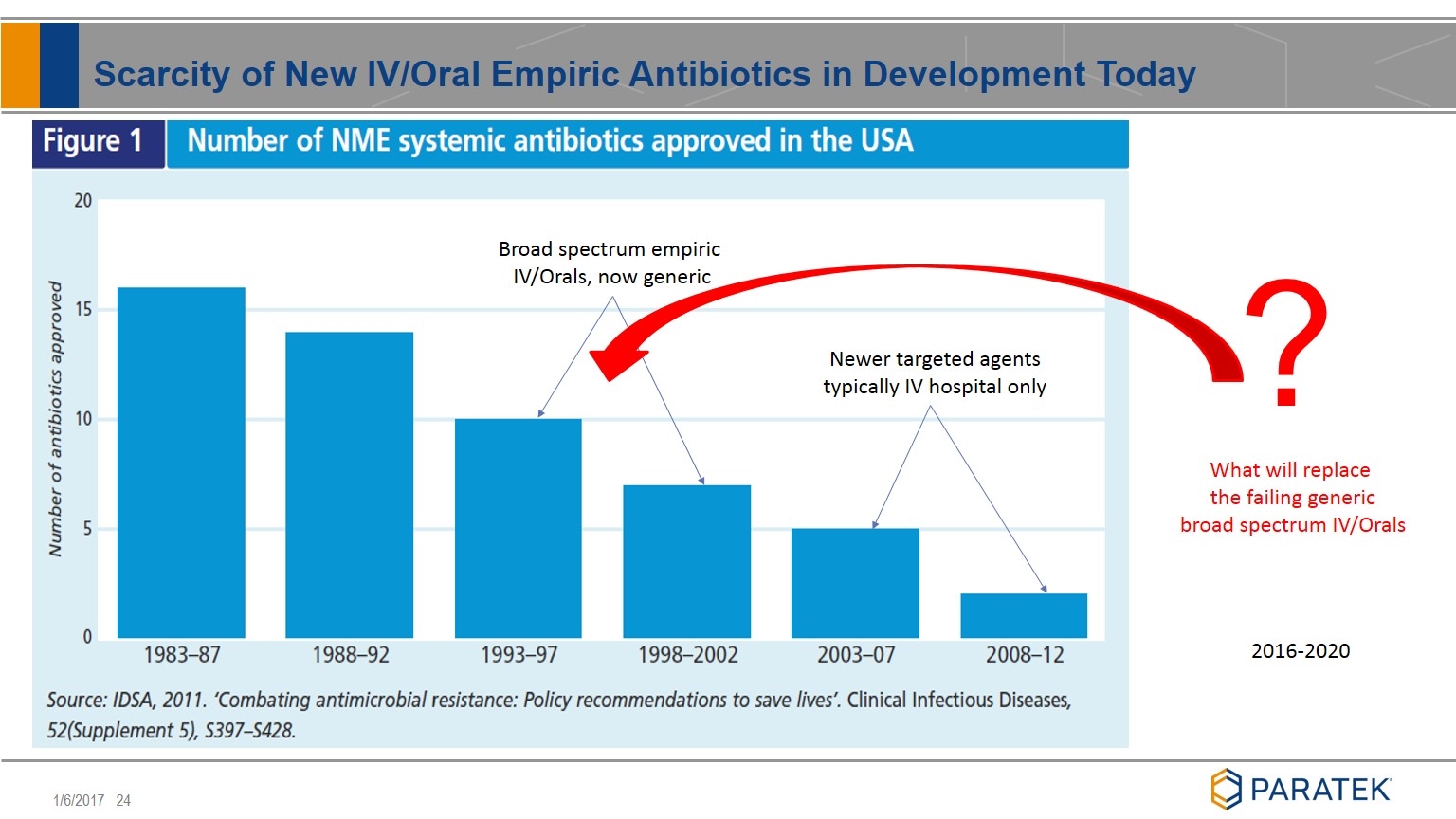

Scarcity of New IV/Oral Empiric Antibiotics in Development Today Broad spectrum empiric IV/Orals, now generic Newer targeted agents typically IV hospital only What will replace the failing generic broad spectrum IV/Orals 2016-2020 ?

Omadacycline: Well Positioned for Blockbuster Potential Profile Similar to Best Selling Antibiotics Antibiotic Broad Spectrum Oral Frequency Favorable Tolerability Big 3(1) Indications 2010 Sales(3,4) Levofloxacin Once Daily 3 $3.4B Co-Amoxy clav Twice Daily 3 $2.8B Azithromycin(2) Once Daily 2 $1.8B Ciprofloxacin Twice Daily 3 $1.4B Clarithromycin(2) Twice Daily 2 $1.4B Omadacycline(5) Once Daily 3 N/A (1) Skin, Respiratory, UTI (2) Both Azithromycin and Clarithromycin did not have UTI claim (3) IMS global sales data in 2010 (4) Major patents had expired for all products by 2010 except Levofloxacin (5) Anticipated based on current development plan

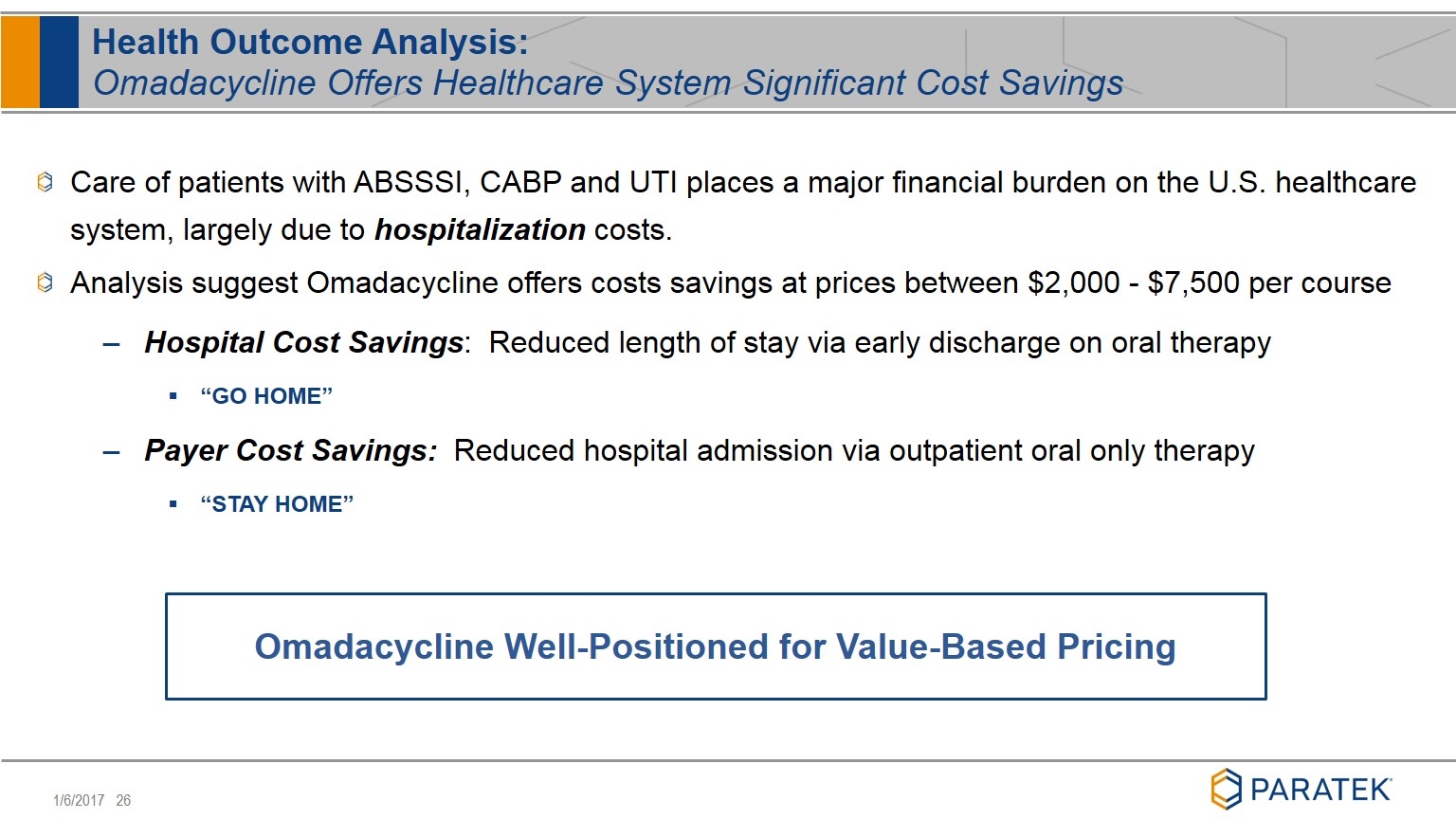

Care of patients with ABSSSI, CABP and UTI places a major financial burden on the U.S. healthcare system, largely due to hospitalization costs. Analysis suggest Omadacycline offers costs savings at prices between $2,000 - $7,500 per course Hospital Cost Savings: Reduced length of stay via early discharge on oral therapy “GO HOME” Payer Cost Savings: Reduced hospital admission via outpatient oral only therapy “STAY HOME” Health Outcome Analysis: Omadacycline Offers Healthcare System Significant Cost Savings Omadacycline Well-Positioned for Value-Based Pricing

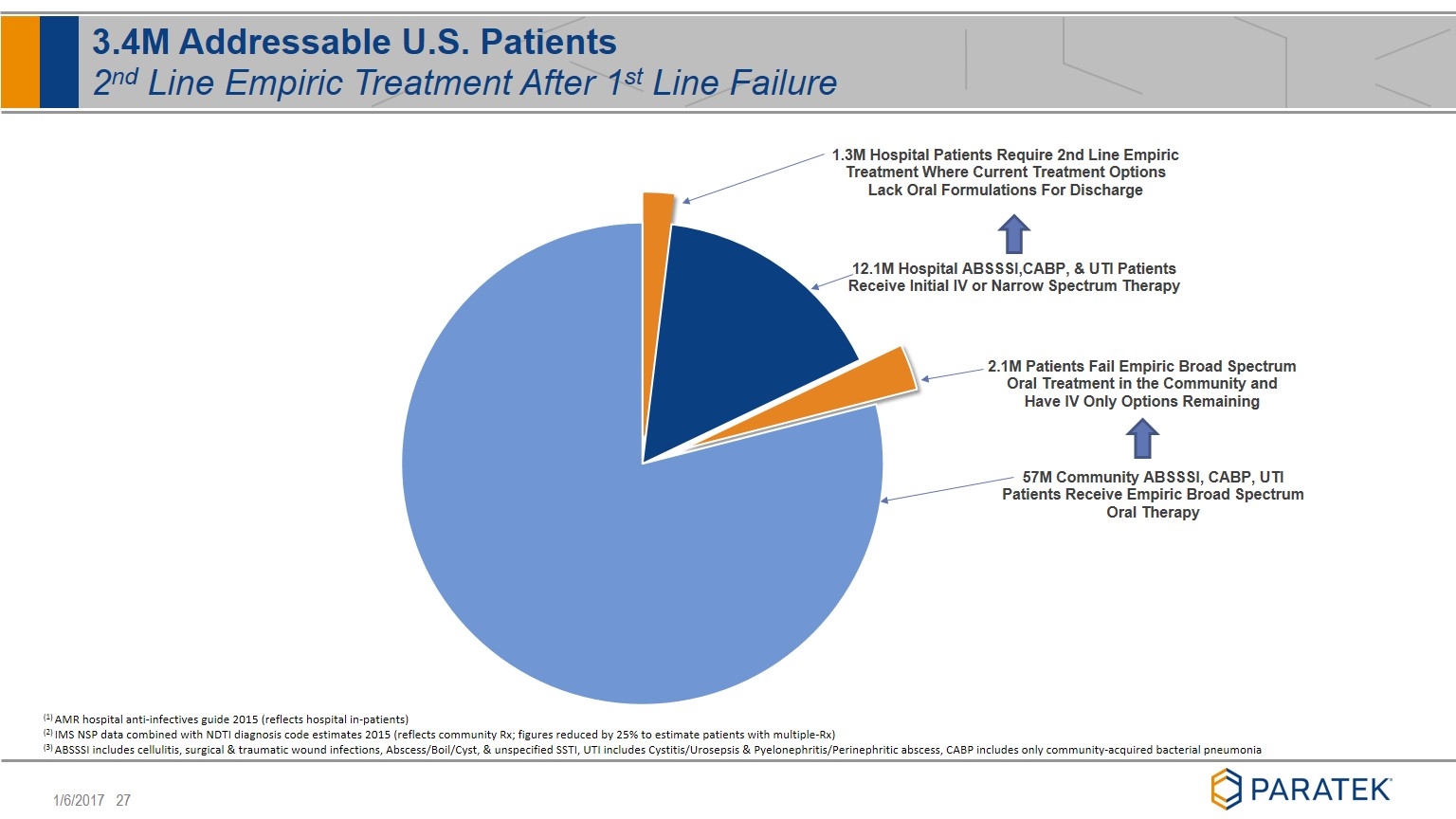

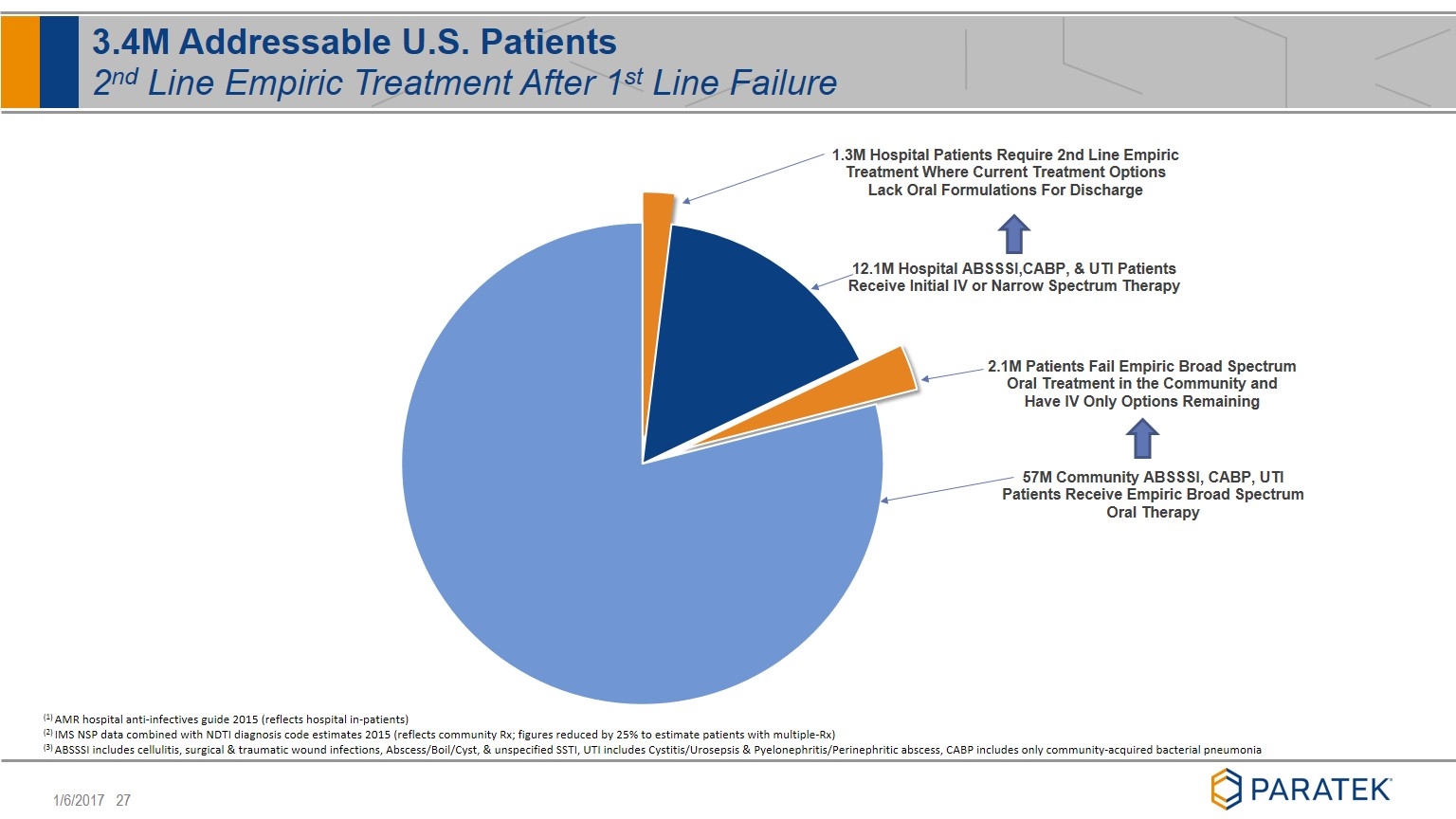

3.4M Addressable U.S. Patients 2nd Line Empiric Treatment After 1st Line Failure (1) AMR hospital anti-infectives guide 2015 (reflects hospital in-patients) (2) IMS NSP data combined with NDTI diagnosis code estimates 2015 (reflects community Rx; figures reduced by 25% to estimate patients with multiple-Rx) (3) ABSSSI includes cellulitis, surgical & traumatic wound infections, Abscess/Boil/Cyst, & unspecified SSTI, UTI includes Cystitis/Urosepsis & Pyelonephritis/Perinephritic abscess, CABP includes only community-acquired bacterial pneumonia

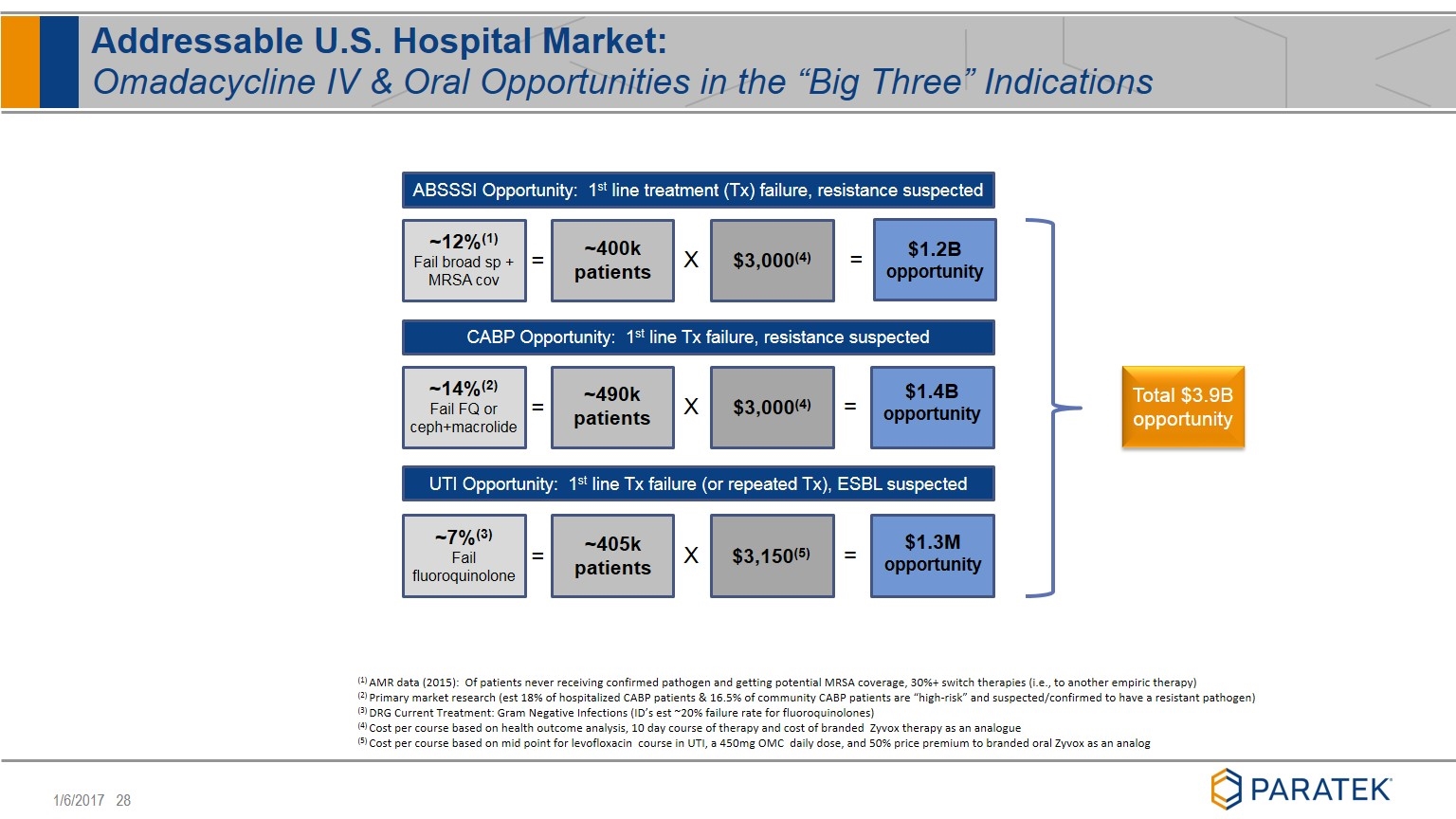

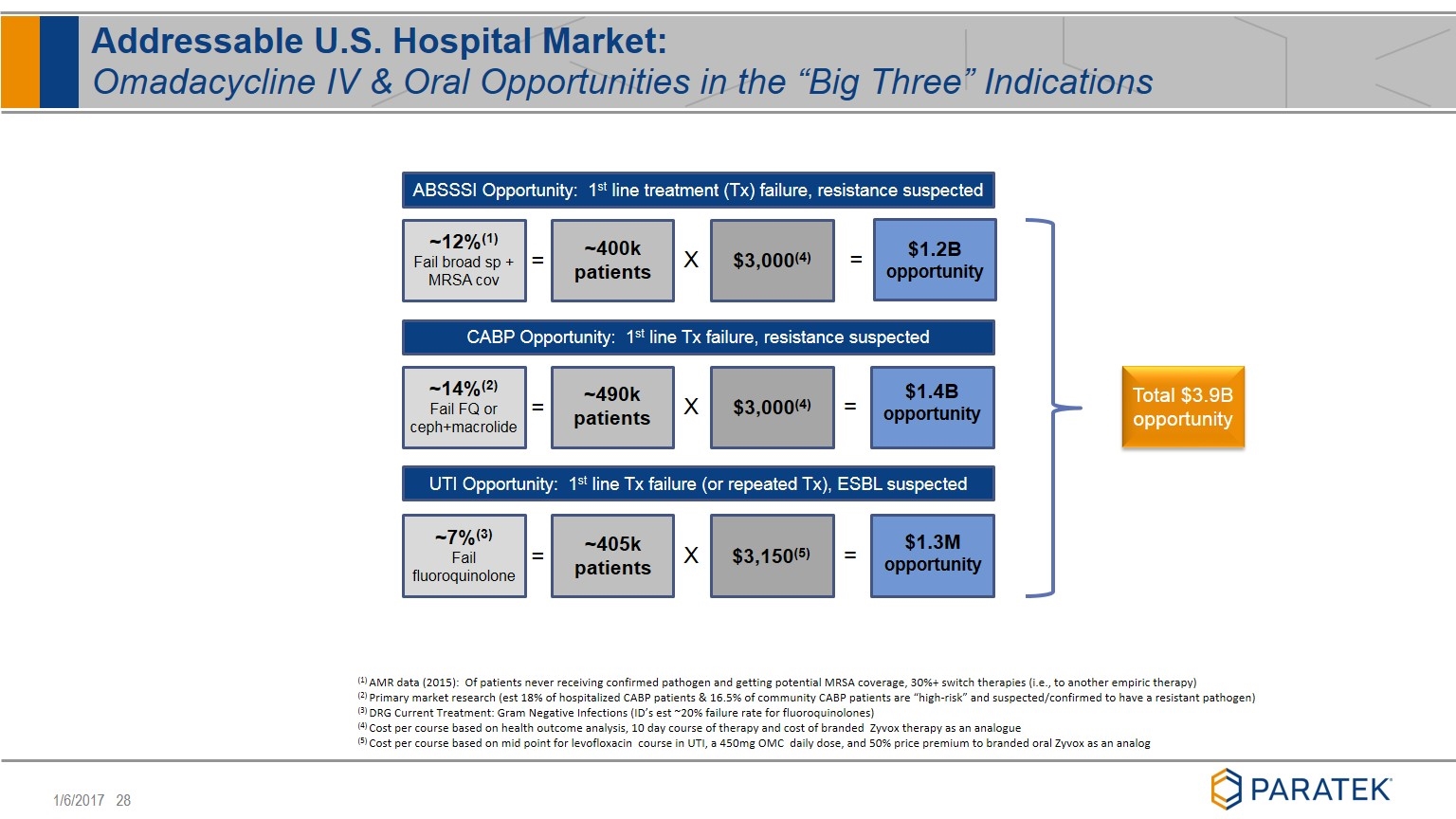

Addressable U.S. Hospital Market: Omadacycline IV & Oral Opportunities in the “Big Three” Indications ABSSSI Opportunity: 1st line treatment (Tx) failure, resistance suspected CABP Opportunity: 1st line Tx failure, resistance suspected UTI Opportunity: 1st line Tx failure (or repeated Tx), ESBL suspected = = X = X = = X = ~12%(1) Fail broad sp + MRSA cov ~14%(2) Fail FQ or ceph+macrolide ~7%(3) Fail fluoroquinolone ~400k patients ~490k patients ~405k patients $3,000(4) $3,000(4) $3,150(5) $1.2B opportunity $1.4B opportunity $1.3M opportunity (1) AMR data (2015): Of patients never receiving confirmed pathogen and getting potential MRSA coverage, 30%+ switch therapies (i.e., to another empiric therapy) (2) Primary market research (est 18% of hospitalized CABP patients & 16.5% of community CABP patients are “high-risk” and suspected/confirmed to have a resistant pathogen) (3) DRG Current Treatment: Gram Negative Infections (ID’s est ~20% failure rate for fluoroquinolones) (4) Cost per course based on health outcome analysis, 10 day course of therapy and cost of branded Zyvox therapy as an analogue (5) Cost per course based on mid point for levofloxacin course in UTI, a 450mg OMC daily dose, and 50% price premium to branded oral Zyvox as an analog Total $3.9B opportunity

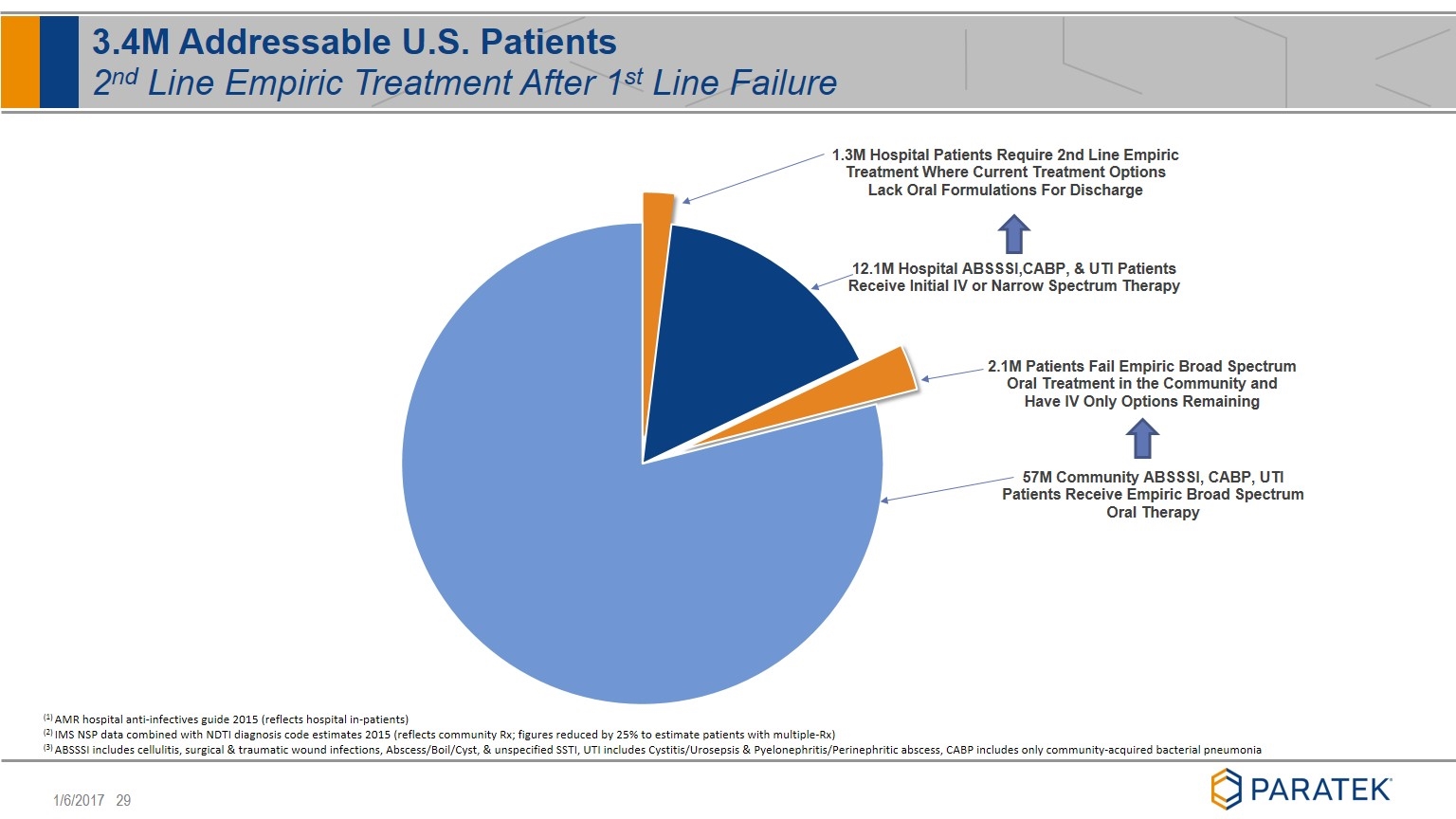

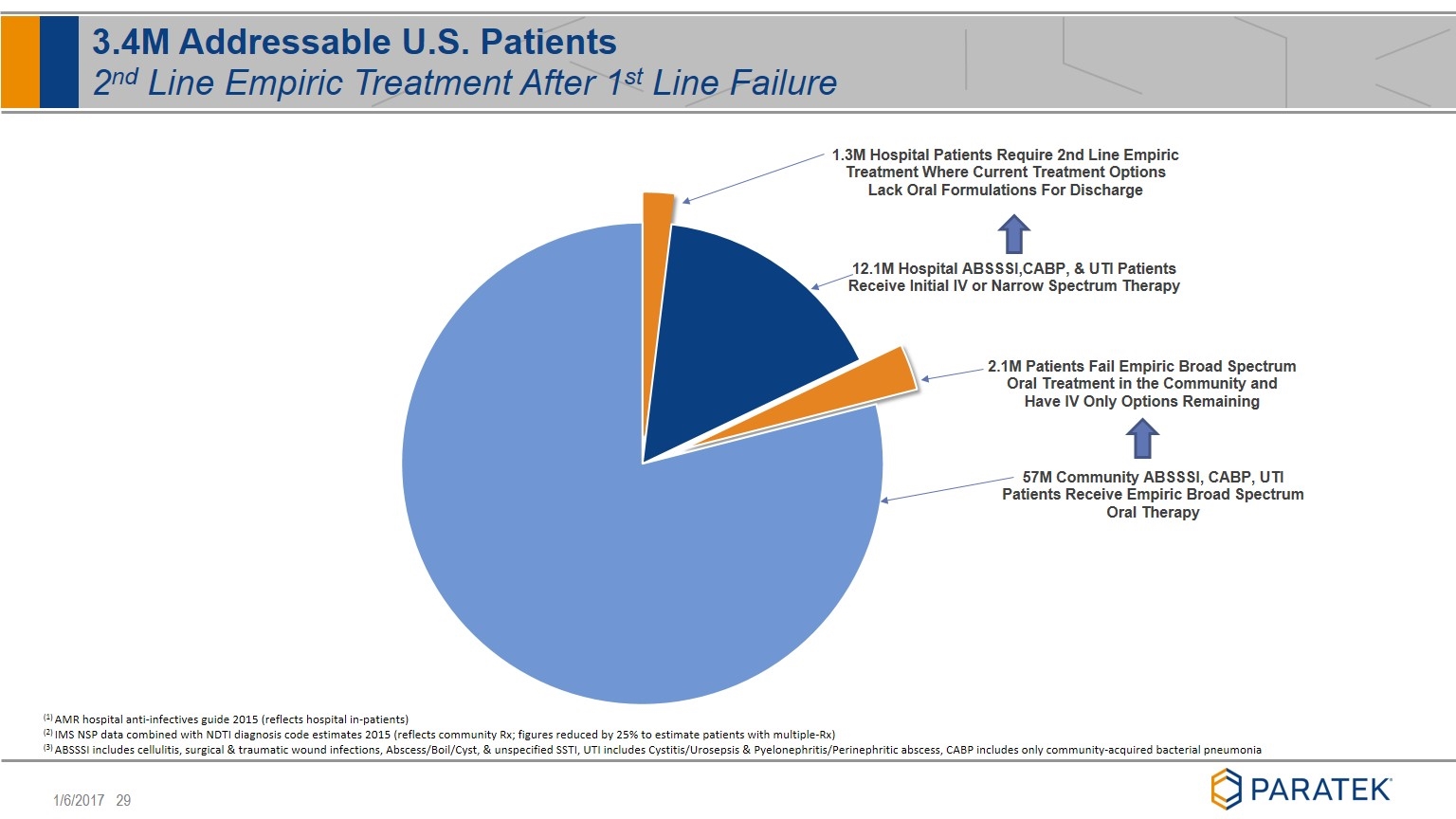

3.4M Addressable U.S. Patients 2nd Line Empiric Treatment After 1st Line Failure (1) AMR hospital anti-infectives guide 2015 (reflects hospital in-patients) (2) IMS NSP data combined with NDTI diagnosis code estimates 2015 (reflects community Rx; figures reduced by 25% to estimate patients with multiple-Rx) (3) ABSSSI includes cellulitis, surgical & traumatic wound infections, Abscess/Boil/Cyst, & unspecified SSTI, UTI includes Cystitis/Urosepsis & Pyelonephritis/Perinephritic abscess, CABP includes only community-acquired bacterial pneumonia

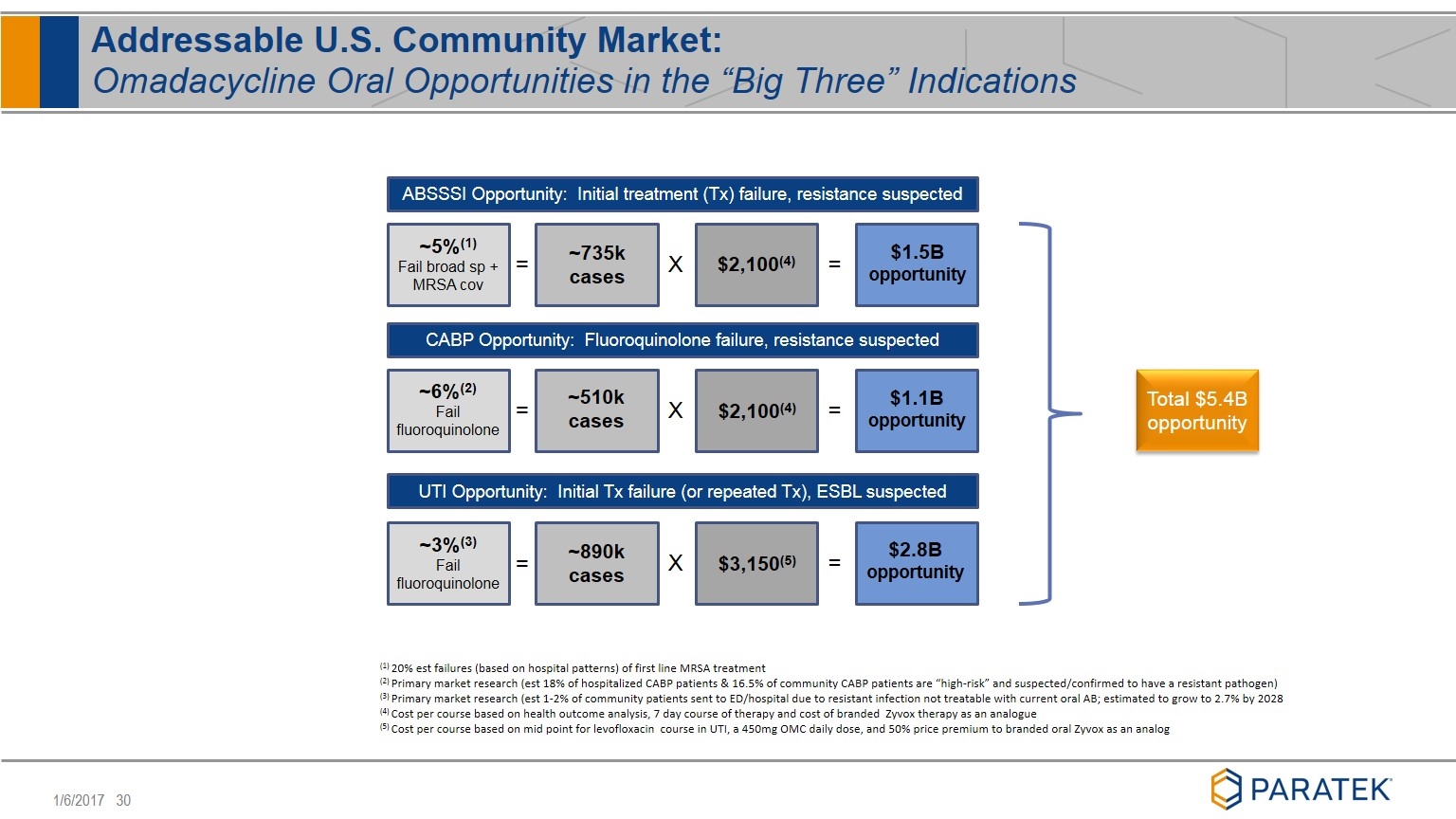

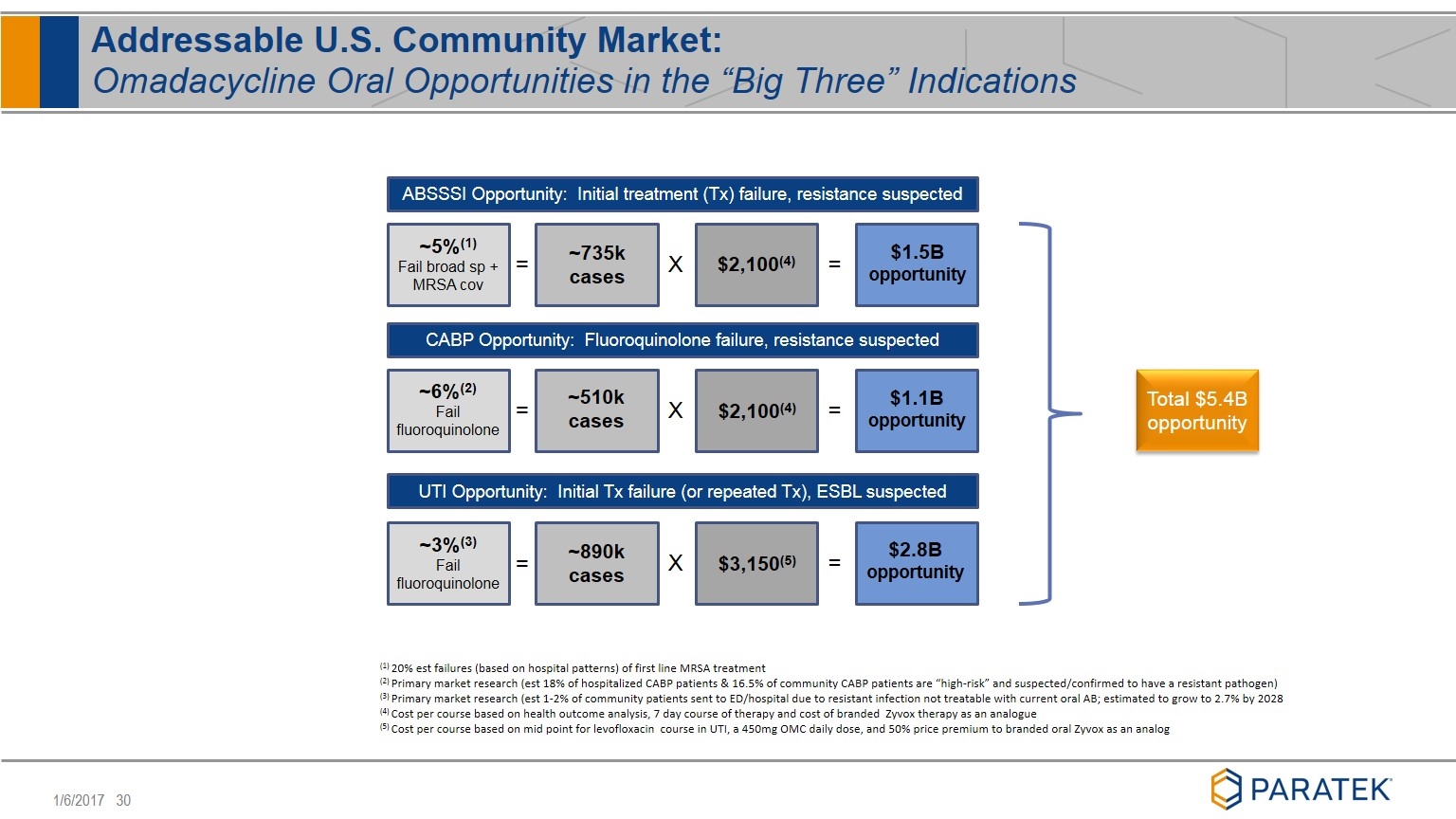

Addressable U.S. Community Market: Omadacycline Oral Opportunities in the “Big Three” Indications ABSSSI Opportunity: Initial treatment (Tx) failure, resistance suspected CABP Opportunity: Fluoroquinolone failure, resistance suspected UTI Opportunity: Initial Tx failure (or repeated Tx), ESBL suspected = X = = X = = X = ~5%(1) Fail broad sp + MRSA cov ~6%(2) Fail fluoroquinolone ~3%(3) Fail fluoroquinolone ~735k cases ~510k cases ~890k cases $3,150(5) $2,100(4) $2,100(4) $1.5B opportunity $1.1B opportunity $2.8B opportunity (1) 20% est failures (based on hospital patterns) of first line MRSA treatment (2) Primary market research (est 18% of hospitalized CABP patients & 16.5% of community CABP patients are “high-risk” and suspected/confirmed to have a resistant pathogen) (3) Primary market research (est 1-2% of community patients sent to ED/hospital due to resistant infection not treatable with current oral AB; estimated to grow to 2.7% by 2028 (4) Cost per course based on health outcome analysis, 7 day course of therapy and cost of branded Zyvox therapy as an analogue (5) Cost per course based on mid point for levofloxacin course in UTI, a 450mg OMC daily dose, and 50% price premium to branded oral Zyvox as an analog Total $5.4B opportunity

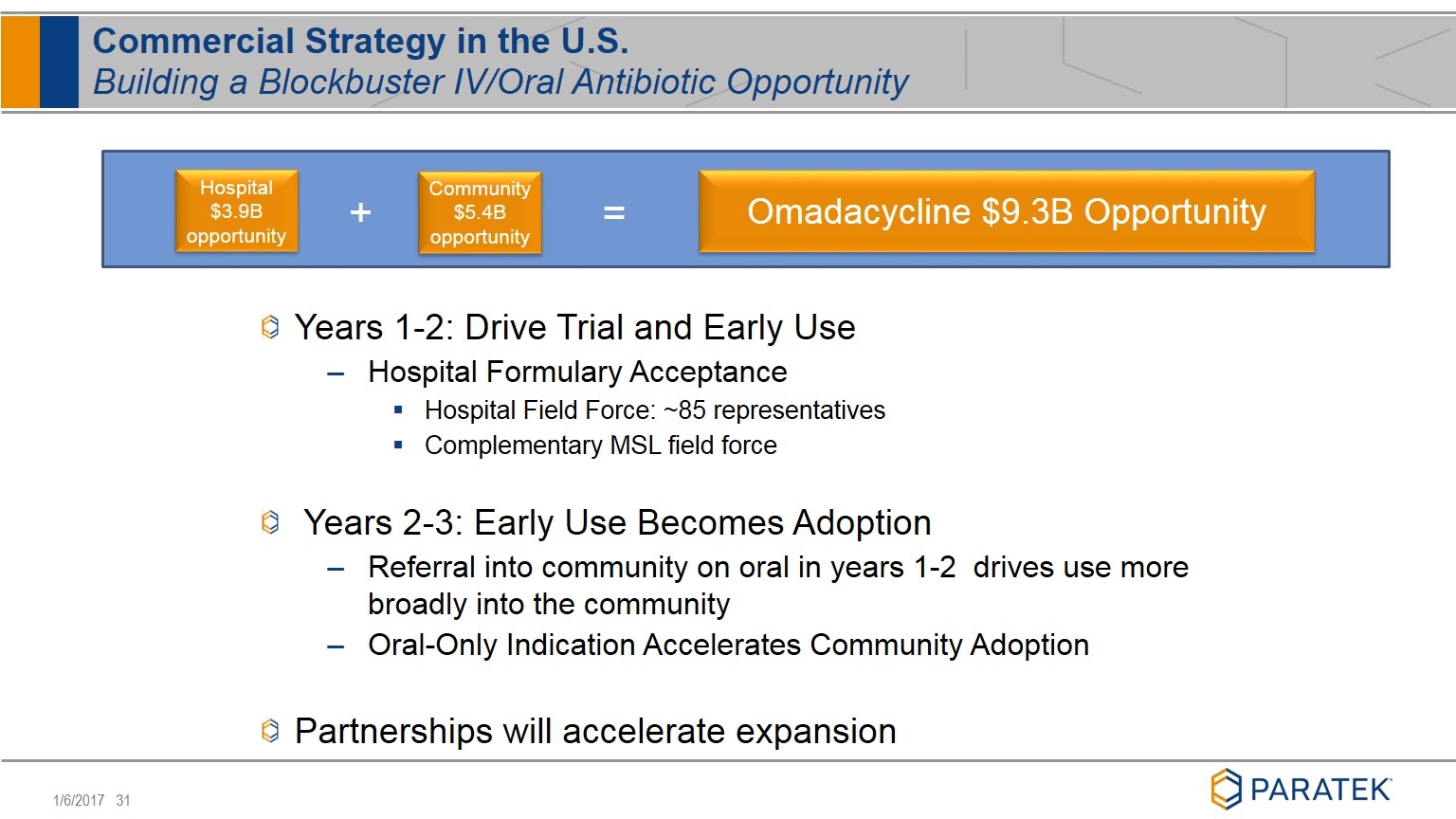

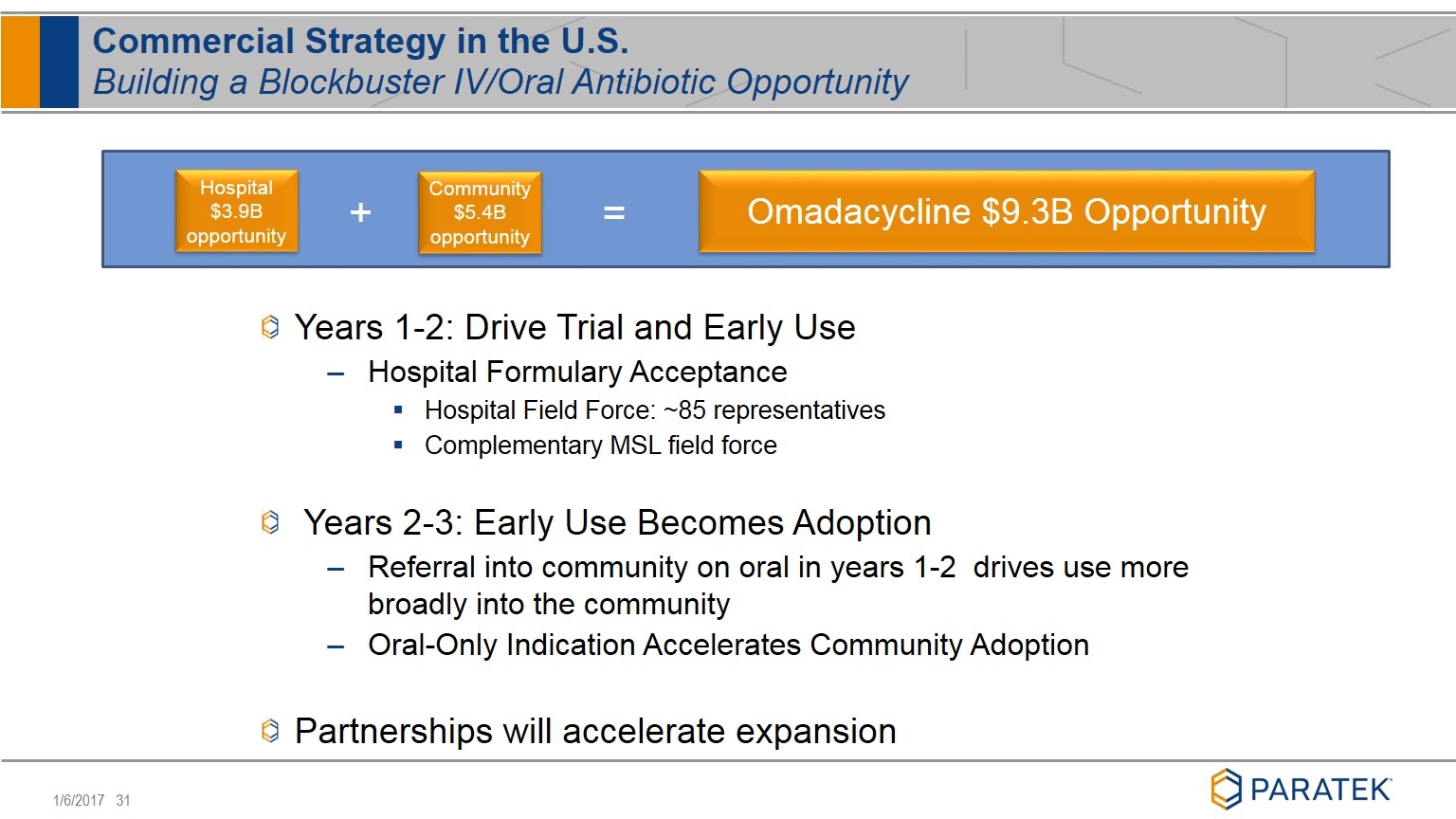

Years 1-2: Drive Trial and Early Use Hospital Formulary Acceptance Hospital Field Force: ~85 representatives Complementary MSL field force Years 2-3: Early Use Becomes Adoption Referral into community on oral in years 1-2 drives use more broadly into the community Oral-Only Indication Accelerates Community Adoption Partnerships will accelerate expansion Commercial Strategy in the U.S. Building a Blockbuster IV/Oral Antibiotic Opportunity Omadacycline $9.3B Opportunity Hospital $3.9B opportunity Community$5.4B opportunity + =

Omadacycline CMC/Intellectual Property

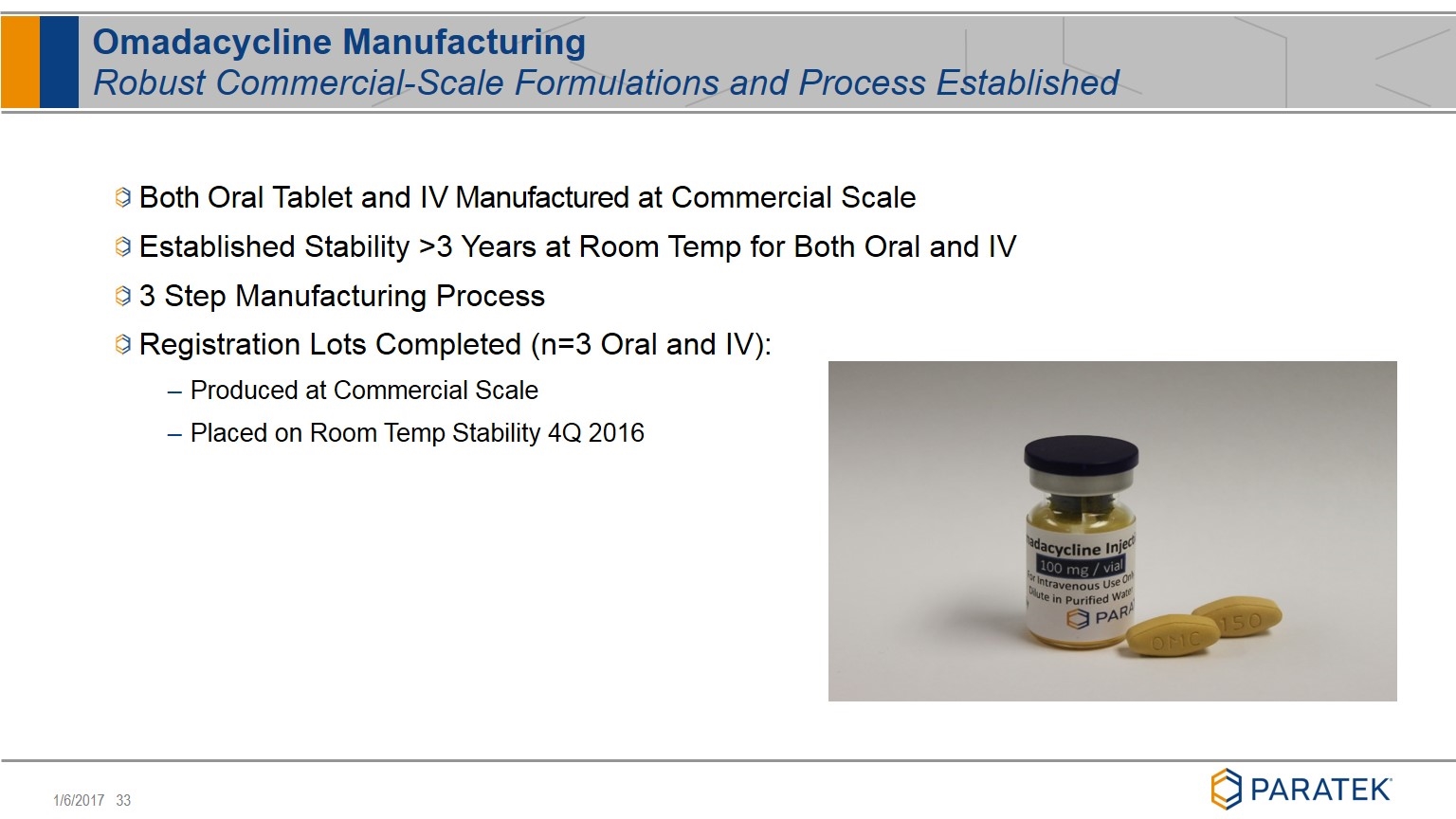

Omadacycline Manufacturing Robust Commercial-Scale Formulations and Process Established Both Oral Tablet and IV Manufactured at Commercial Scale Established Stability >3 Years at Room Temp for Both Oral and IV 3 Step Manufacturing Process Registration Lots Completed (n=3 Oral and IV): Produced at Commercial Scale Placed on Room Temp Stability 4Q 2016

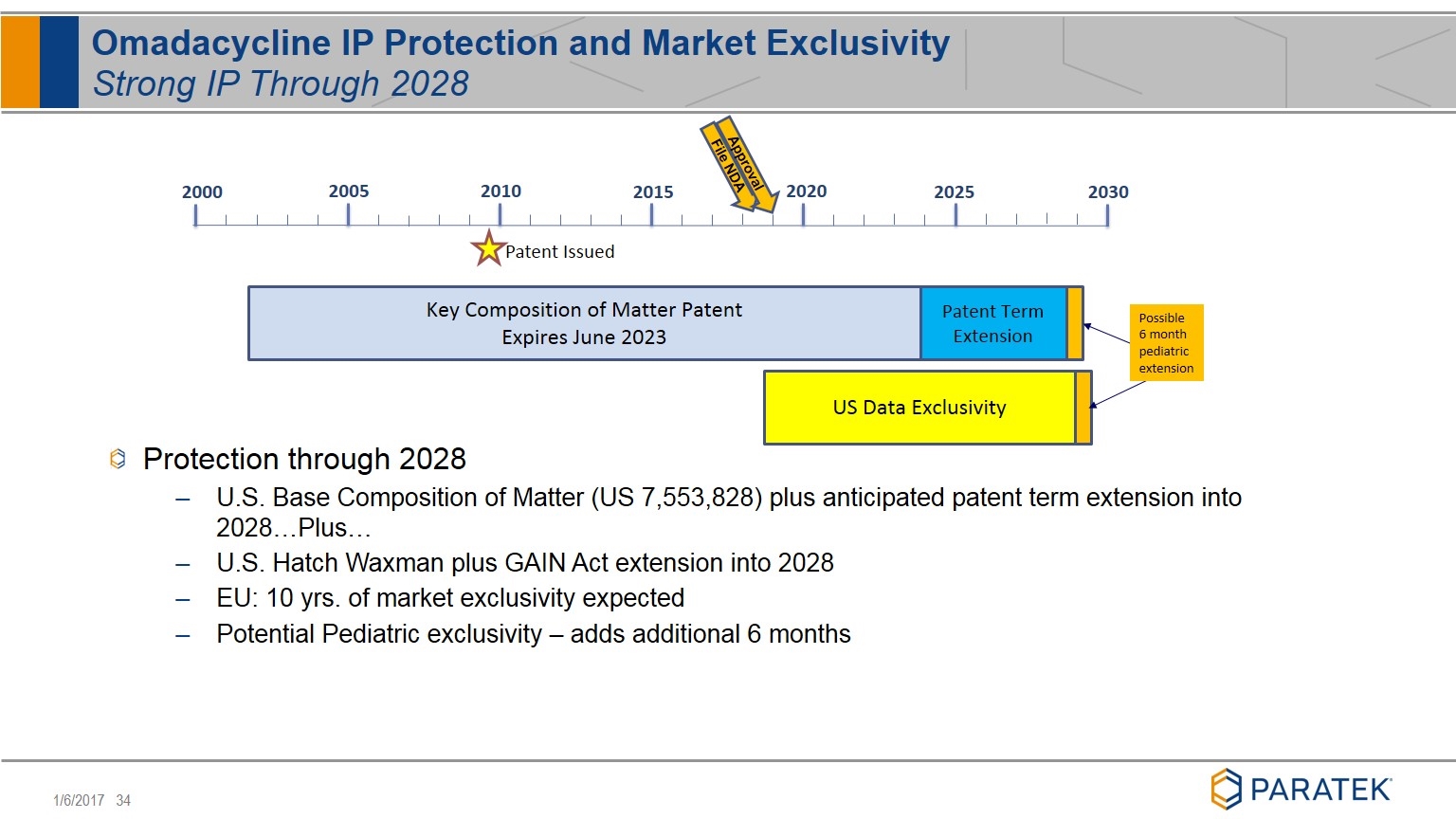

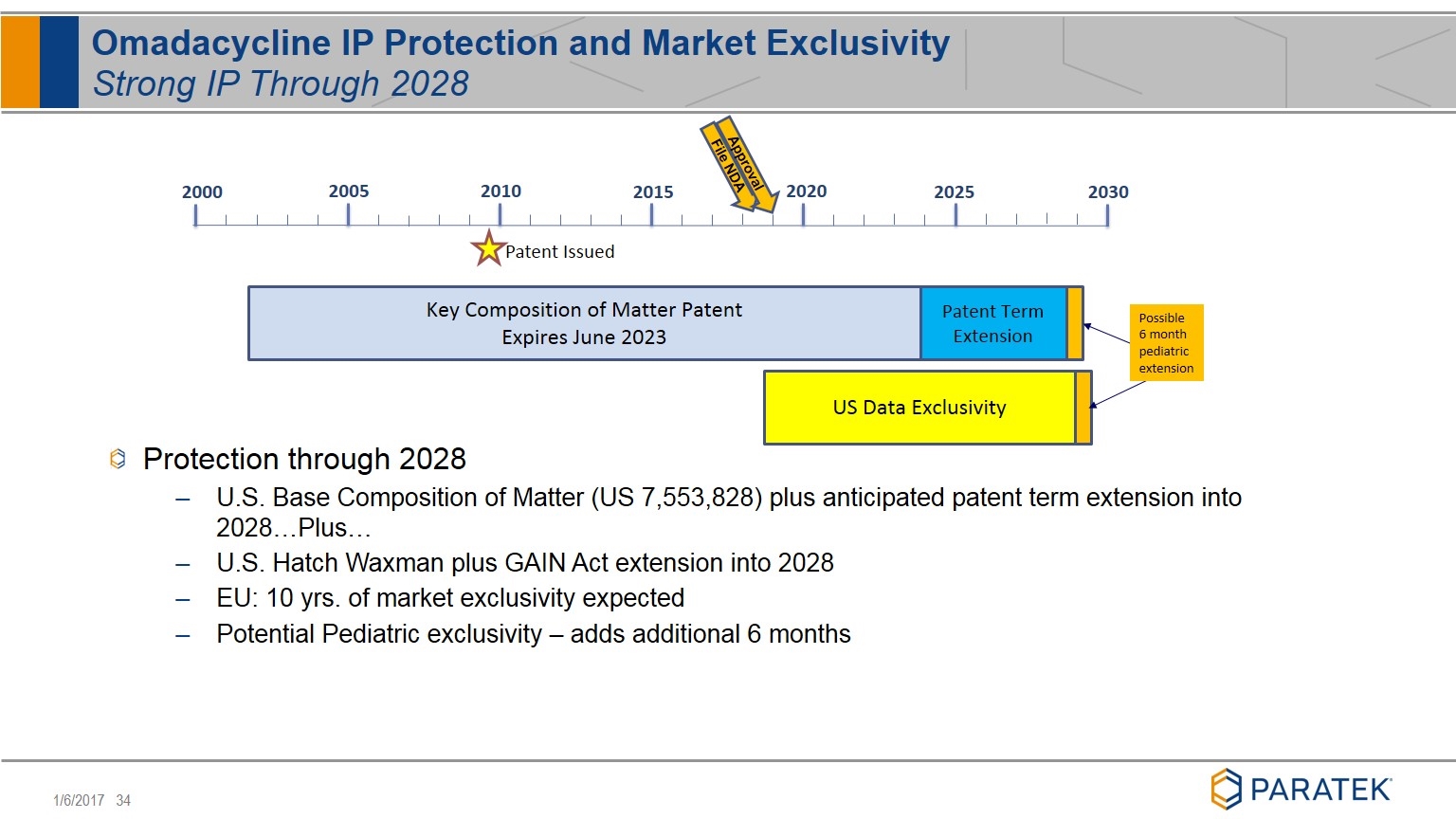

Omadacycline IP Protection and Market Exclusivity Strong IP Through 2028 Patent Term Extension Key Composition of Matter Patent Expires June 2023 US Data Exclusivity Possible 6 month pediatric extension 2000 2005 2010 2015 2020 2025 2030 Patent Issued File NDA Approval Protection through 2028 U.S. Base Composition of Matter (US 7,553,828) plus anticipated patent term extension into 2028…Plus… U.S. Hatch Waxman plus GAIN Act extension into 2028 EU: 10 yrs. of market exclusivity expected Potential Pediatric exclusivity – adds additional 6 months

Sarecycline Overview

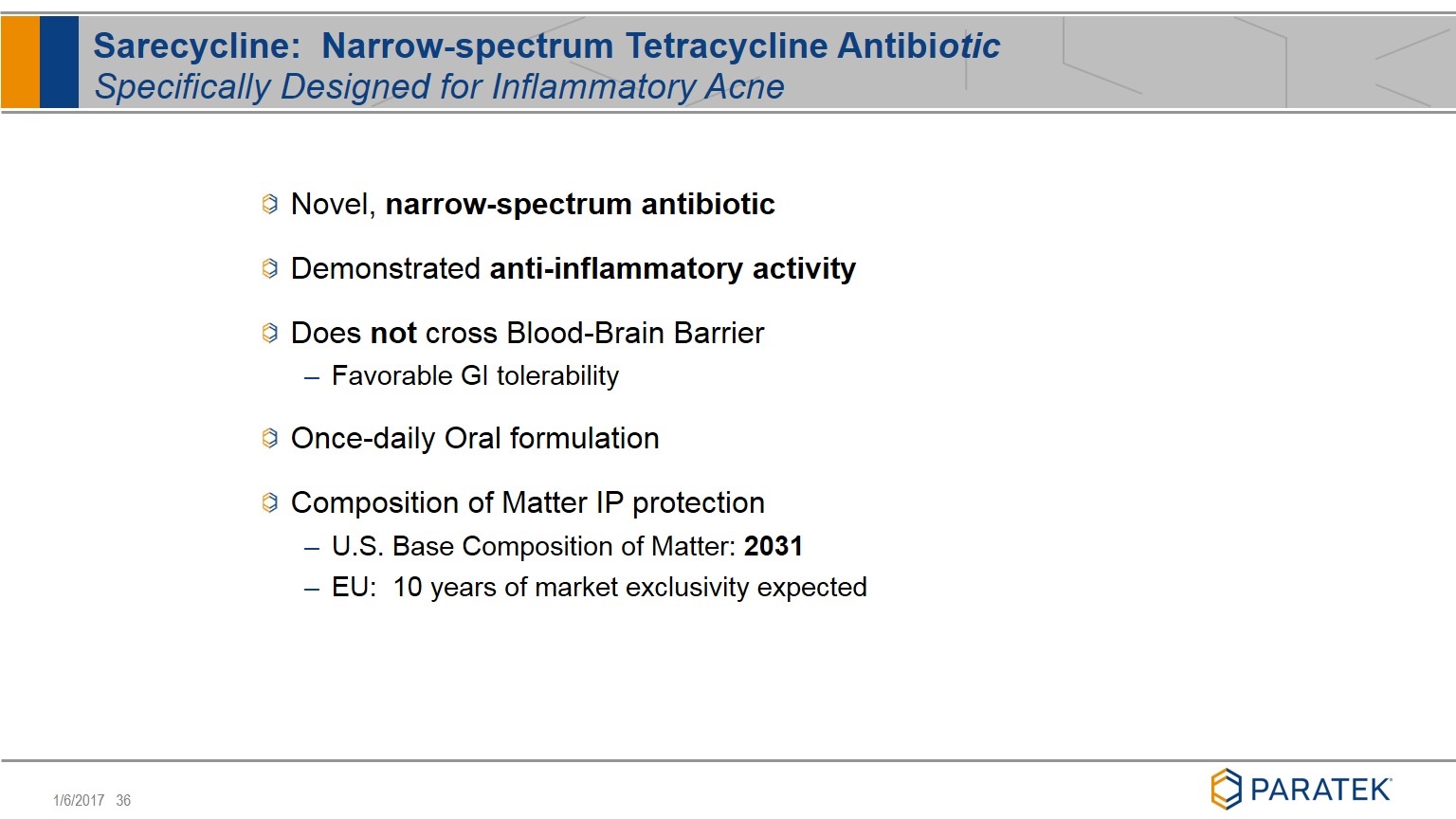

Novel, narrow-spectrum antibiotic Demonstrated anti-inflammatory activity Does not cross Blood-Brain Barrier Favorable GI tolerability Once-daily Oral formulation Composition of Matter IP protection U.S. Base Composition of Matter: 2031 EU: 10 years of market exclusivity expected Sarecycline: Narrow-spectrum Tetracycline Antibiotic Specifically Designed for Inflammatory Acne

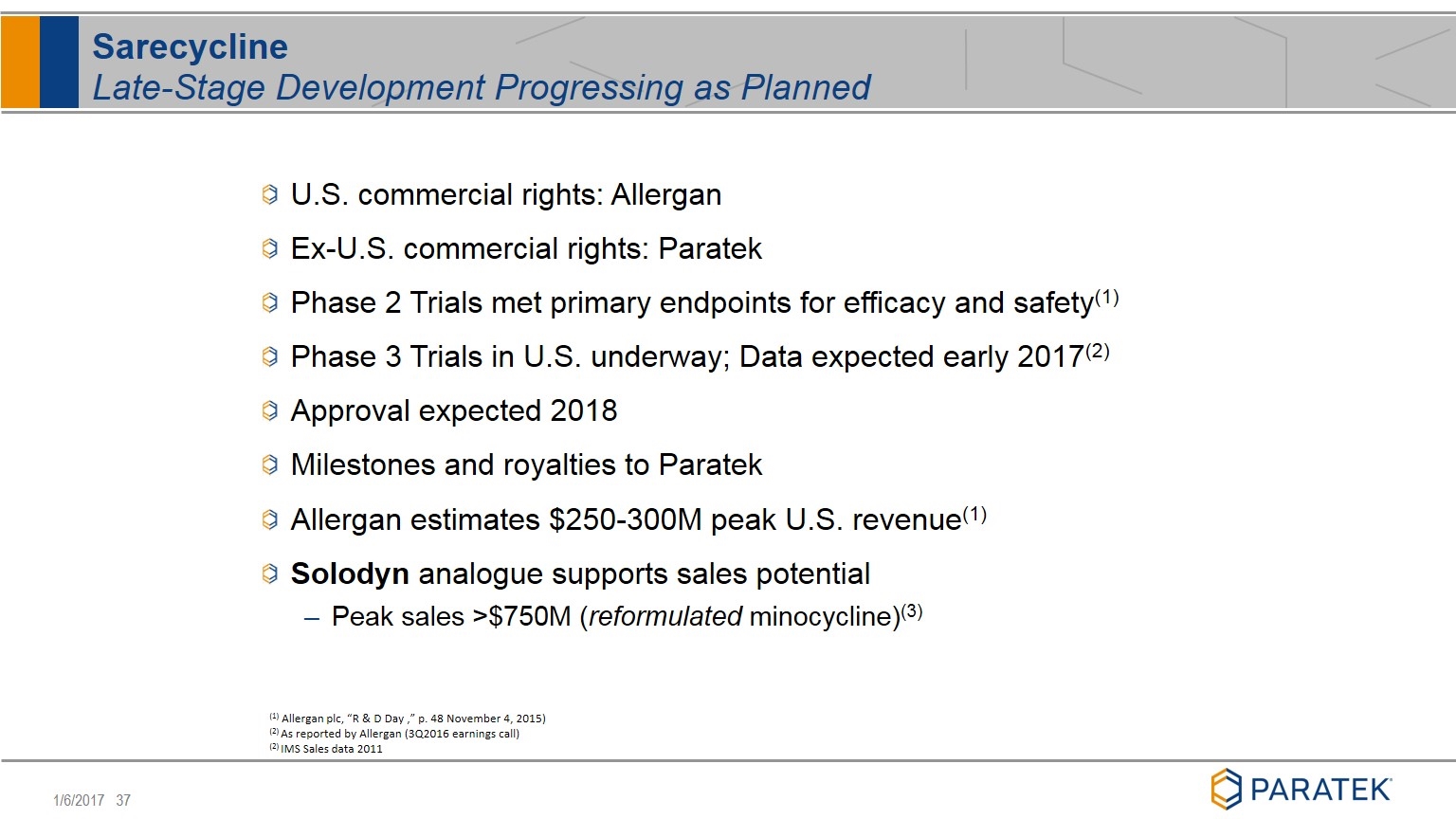

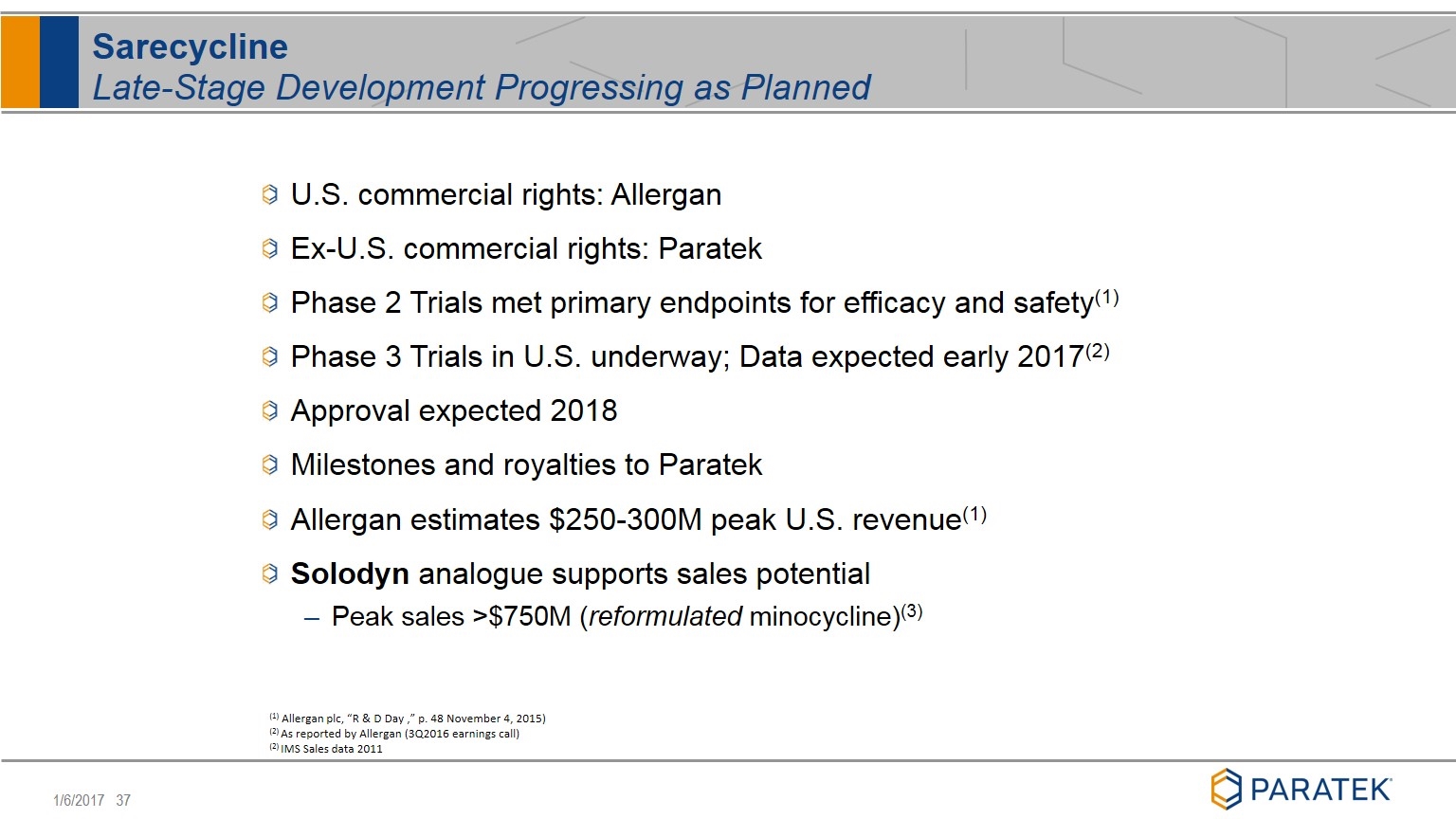

(1) Allergan plc, “R & D Day ,” p. 48 November 4, 2015) (2) As reported by Allergan (3Q2016 earnings call) (2) IMS Sales data 2011 Sarecycline Late-Stage Development Progressing as Planned U.S. commercial rights: Allergan Ex-U.S. commercial rights: Paratek Phase 2 Trials met primary endpoints for efficacy and safety(1) Phase 3 Trials in U.S. underway; Data expected early 2017(2) Approval expected 2018 Milestones and royalties to Paratek Allergan estimates $250-300M peak U.S. revenue(1) Solodyn analogue supports sales potential Peak sales >$750M (reformulated minocycline)(3)

PRTK Financials

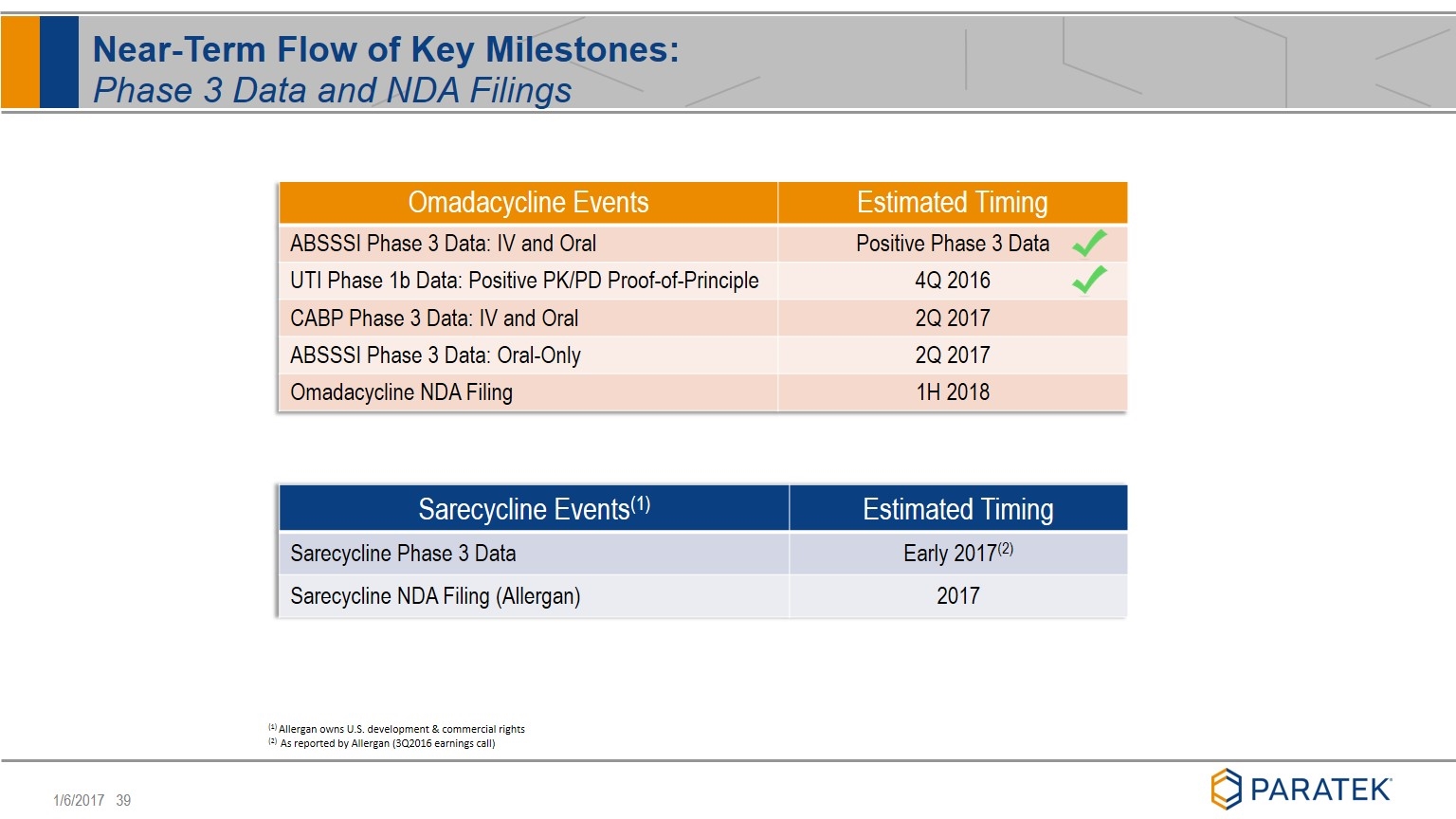

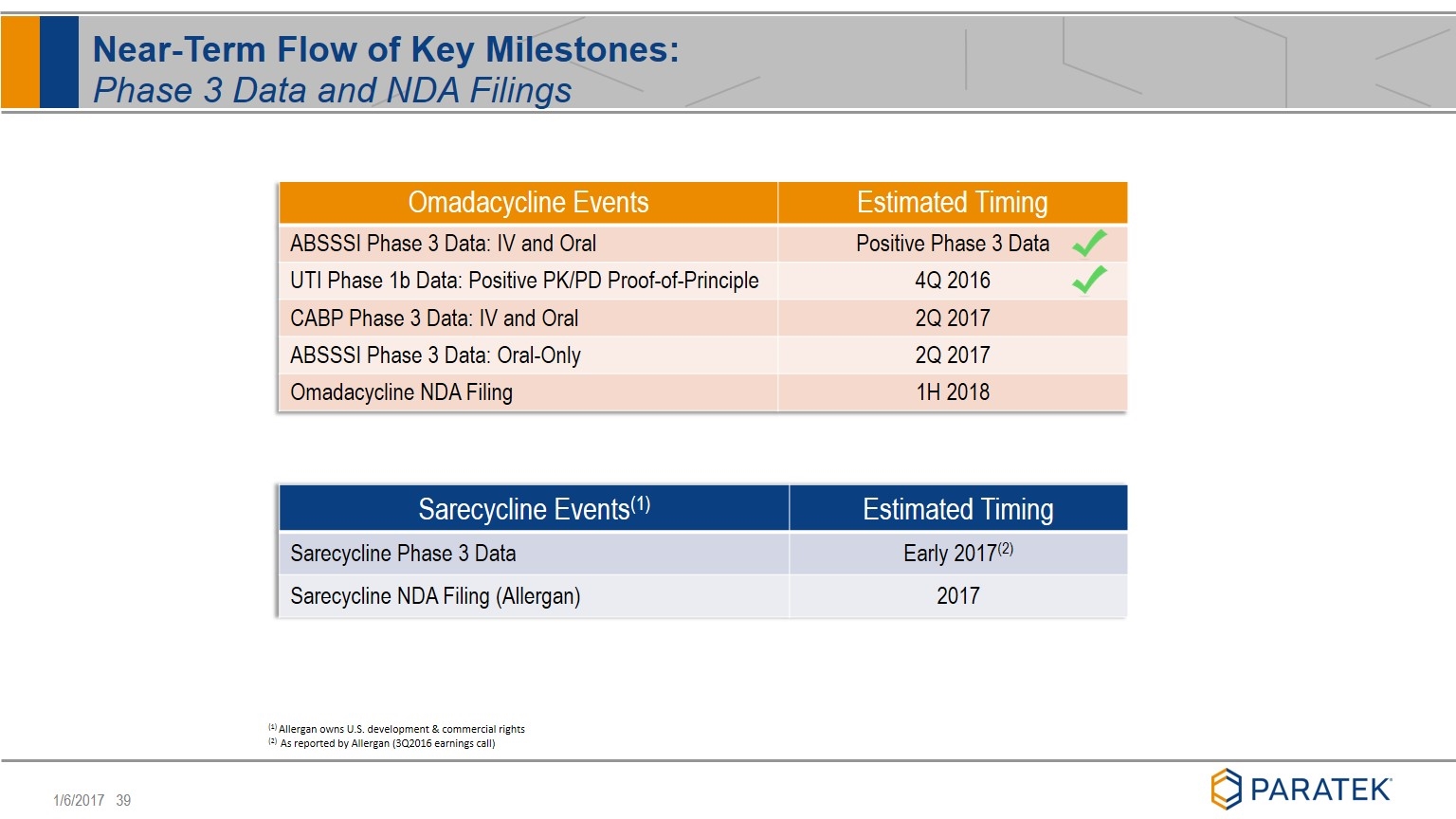

Near-Term Flow of Key Milestones: Phase 3 Data and NDA Filings Omadacycline Events Estimated Timing ABSSSI Phase 3 Data: IV and Oral Positive Phase 3 Data UTI Phase 1b Data: Positive PK/PD Proof-of-Principle 4Q 2016 CABP Phase 3 Data: IV and Oral 2Q 2017 ABSSSI Phase 3 Data: Oral-Only 2Q 2017 Omadacycline NDA Filing 1H 2018 Sarecycline Events(1) Estimated Timing Sarecycline Phase 3 Data Early 2017(2) Sarecycline NDA Filing (Allergan) 2017 (1) Allergan owns U.S. development & commercial rights (2) As reported by Allergan (3Q2016 earnings call)

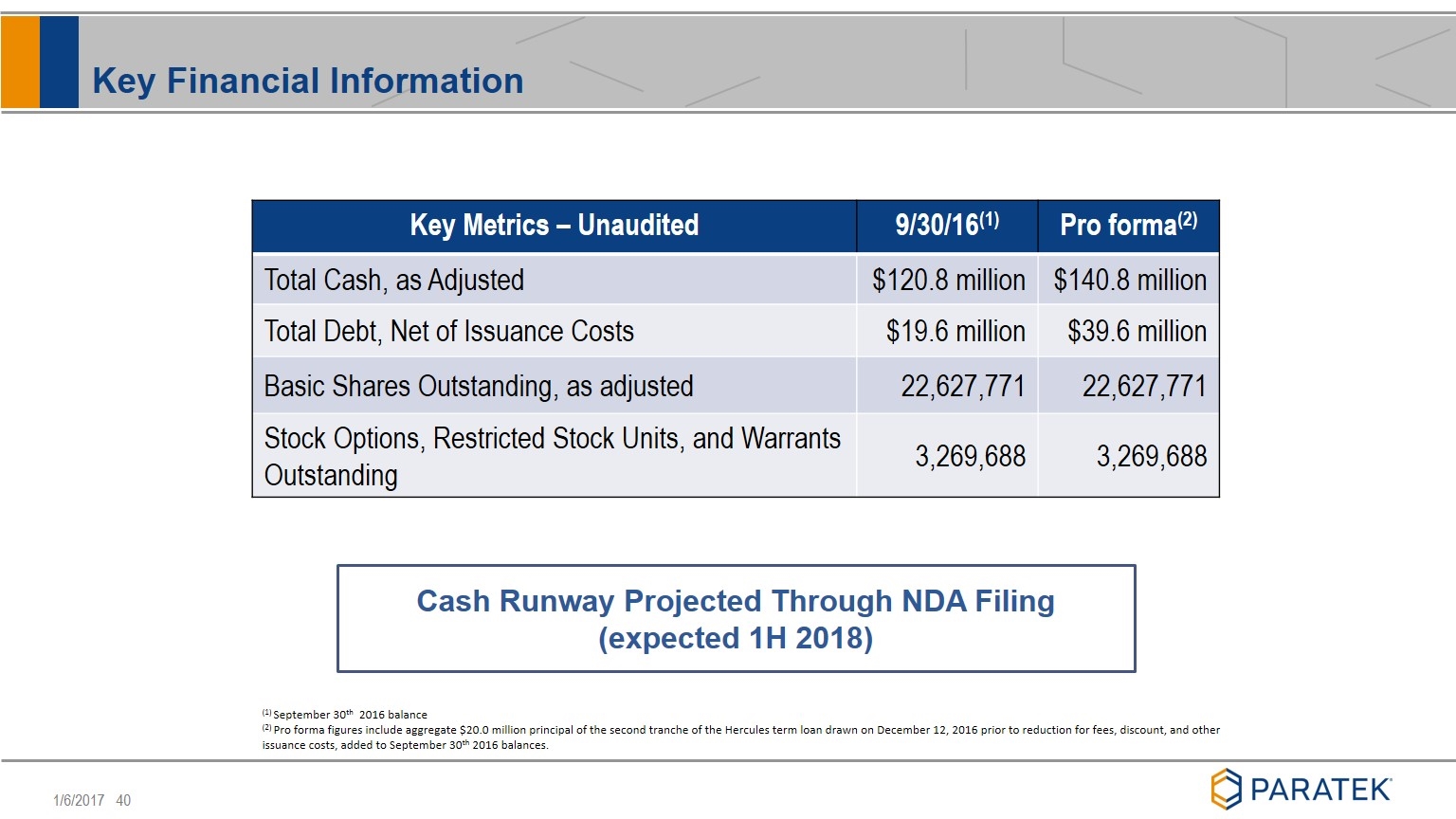

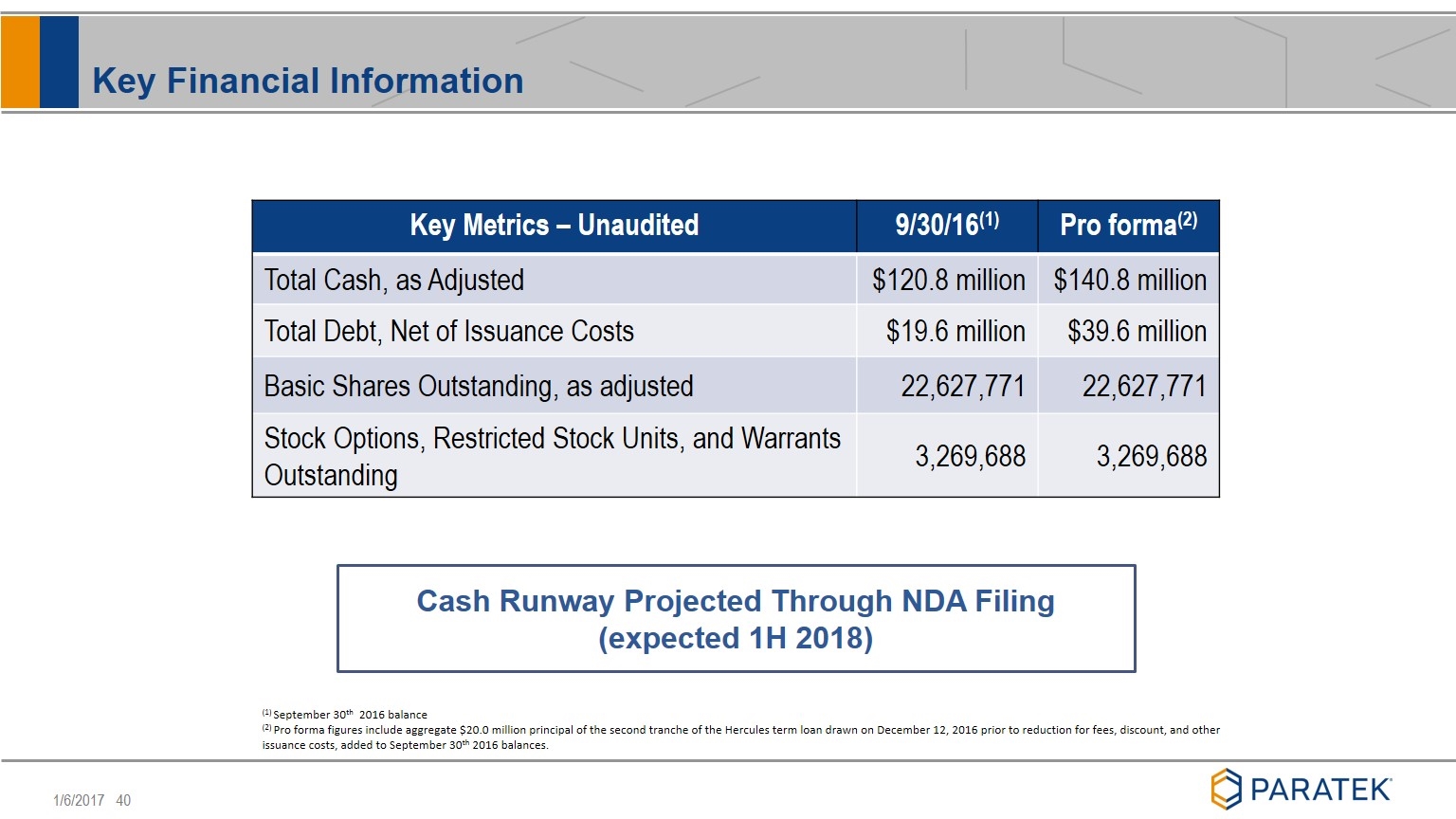

Key Financial Information Key Metrics – Unaudited 9/30/16(1) Pro forma(2) Total Cash, as Adjusted $120.8 million $140.8 million Total Debt, Net of Issuance Costs $19.6 million $39.6 million Basic Shares Outstanding, as adjusted 22,627,771 22,627,771 Stock Options, Restricted Stock Units, and Warrants Outstanding 3,269,688 3,269,688 (1) September 30th 2016 balance (2) Pro forma figures include aggregate $20.0 million principal of the second tranche of the Hercules term loan drawn on December 12, 2016 prior to reduction for fees, discount, and other issuance costs, added to September 30th 2016 balances. Cash Runway Projected Through NDA Filing (expected 1H 2018)

Omadacycline: Proven Antibiotic with Blockbuster Potential Positive Phase 3 Data: Skin Infections CABP Phase 3 Study: Data Expected 2Q 2017 Oral-Only Skin Study Would Accelerate Community Adoption: Data Expected 2Q 2017 Anticipated NDA Filing: 1H 2018 Proof-of-Concept cUTI Phase 2 Study (enrolling as early as 4Q 2017) Omadacycline: Promising Profile Once-daily Oral: Multi indication, Well-Tolerated and Effective Well Defined Regulatory Path: SPA + QIDP + Fast Track No Other Late Stage UTI Development Programs in U.S. for Broad Spectrum, Oral Compounds(2) $9+ Billion Addressable Market in U.S. for 2nd Line Empiric Treatment of Resistant Infections Sarecycline: Phase 3 Data Expected Early 2017 Milestones and royalties to Paratek Experienced Management Team Investment Highlights (1) FDA Safety Update 5/12/2016 (2) clinicaltrials.gov

Omadacycline Commercial Strategy -back-up

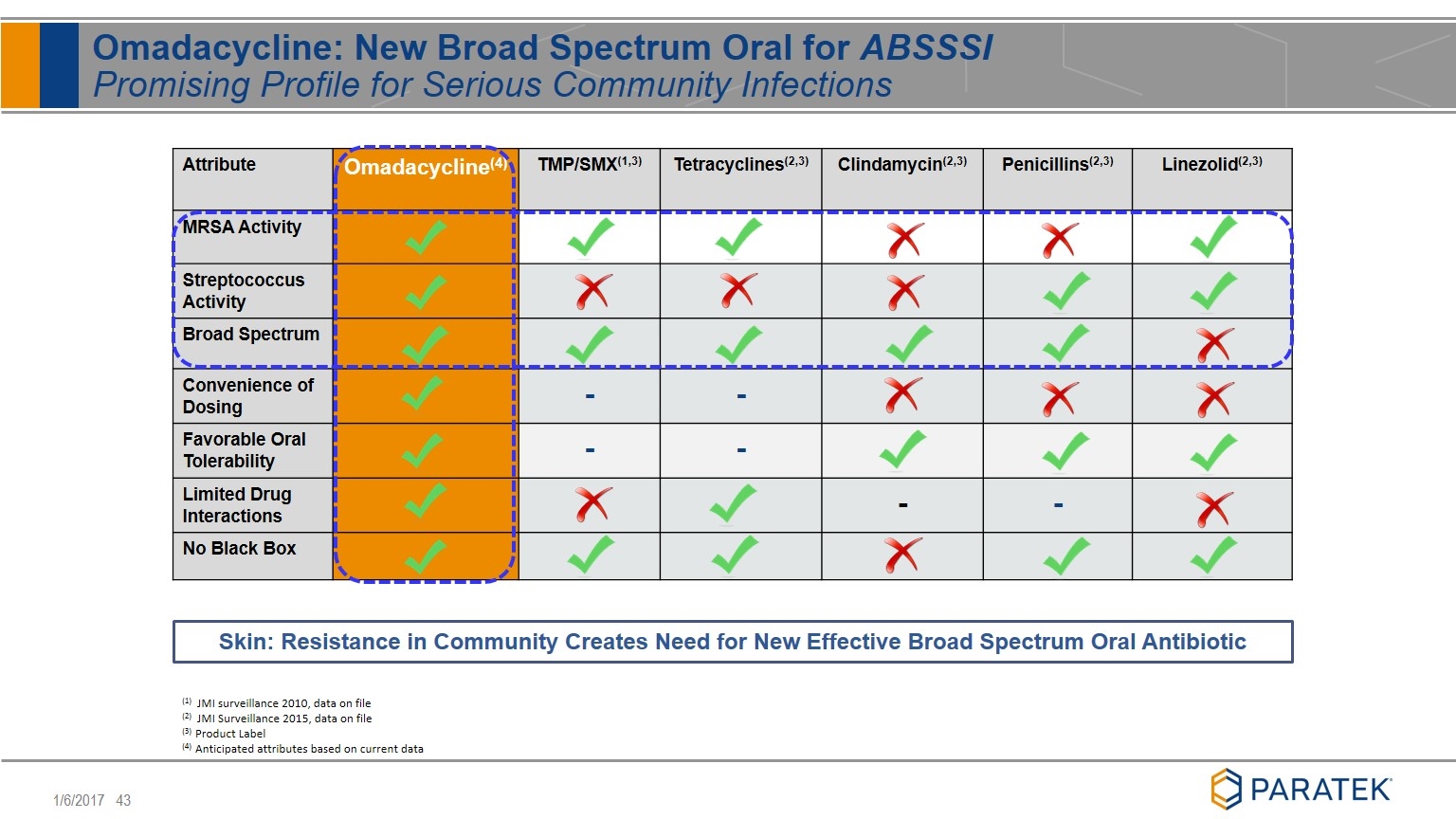

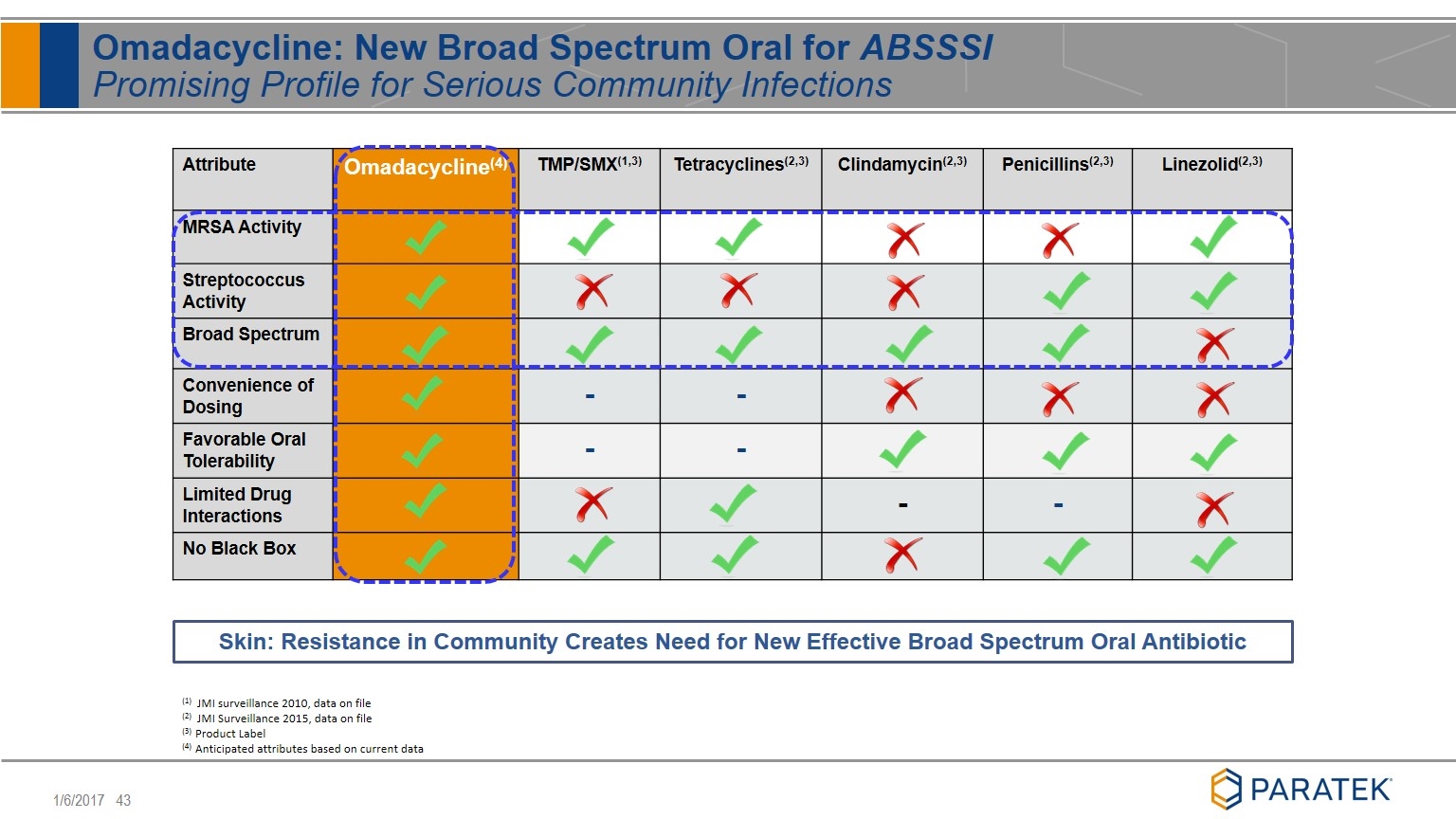

Attribute Omadacycline(4) TMP/SMX(1,3) Tetracyclines(2,3) Clindamycin(2,3) Penicillins(2,3) Linezolid(2,3) MRSA Activity Streptococcus Activity Broad Spectrum Convenience of Dosing - - Favorable Oral Tolerability - - Limited Drug Interactions - - No Black Box Omadacycline: New Broad Spectrum Oral for ABSSSI Promising Profile for Serious Community Infections (1) JMI surveillance 2010, data on file (2) JMI Surveillance 2015, data on file (3) Product Label (4) Anticipated attributes based on current data Skin: Resistance in Community Creates Need for New Effective Broad Spectrum Oral Antibiotic

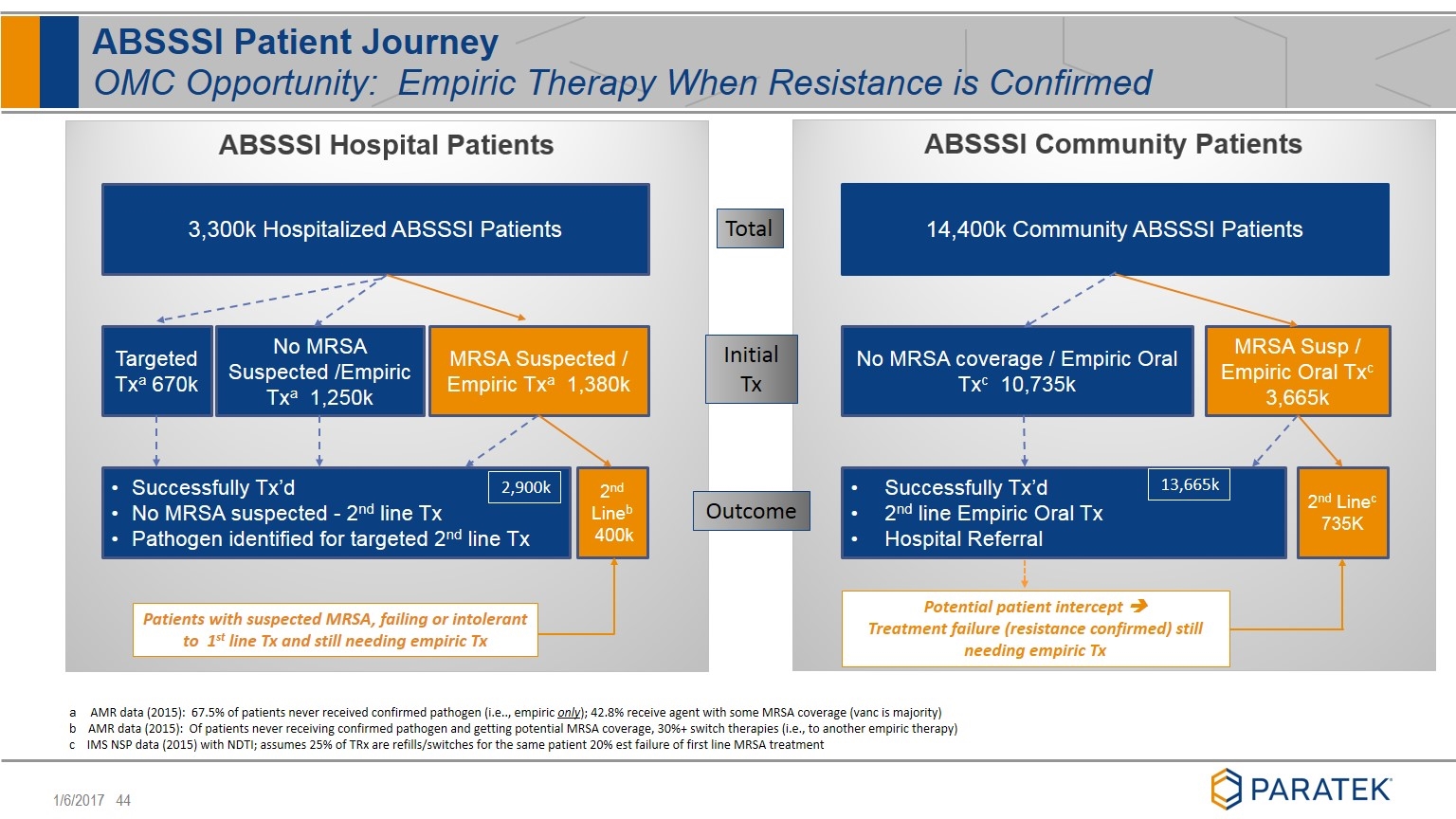

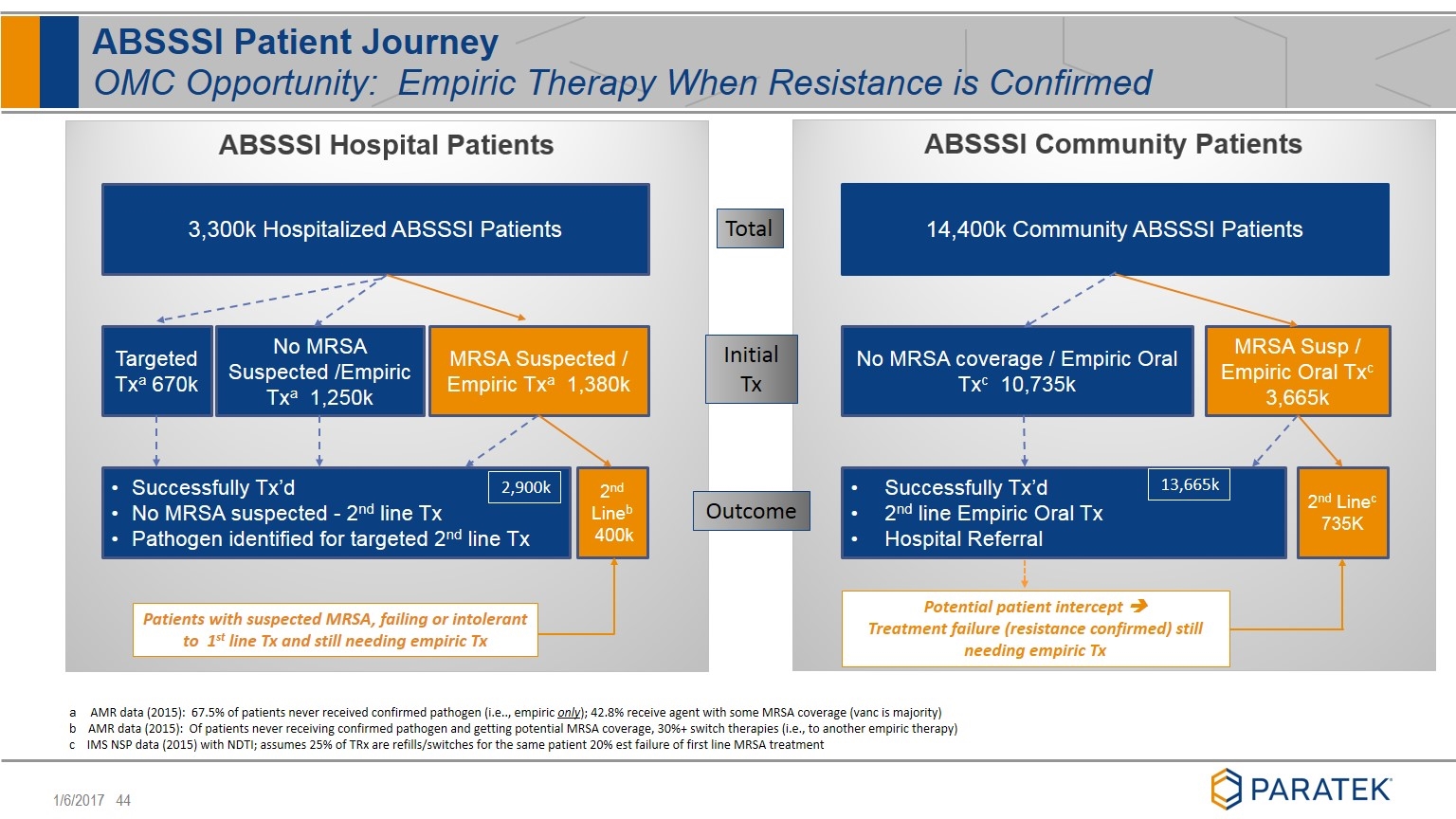

ABSSSI Patient Journey OMC Opportunity: Empiric Therapy When Resistance is Confirmed Total Outcome a AMR data (2015): 67.5% of patients never received confirmed pathogen (i.e.., empiric only); 42.8% receive agent with some MRSA coverage (vanc is majority) b AMR data (2015): Of patients never receiving confirmed pathogen and getting potential MRSA coverage, 30%+ switch therapies (i.e., to another empiric therapy) c IMS NSP data (2015) with NDTI; assumes 25% of TRx are refills/switches for the same patient 20% est failure of first line MRSA treatment 3,300k Hospitalized ABSSSI Patients MRSA Suspected / Empiric Txa 1,380k No MRSA Suspected /Empiric Txa 1,250k Targeted Txa 670k 2nd Lineb 400k Successfully Tx’d No MRSA suspected - 2nd line Tx Pathogen identified for targeted 2nd line Tx 2,900k Patients with suspected MRSA, failing or intolerant to 1st line Tx and still needing empiric Tx Initial Tx 14,400k Community ABSSSI Patients MRSA Susp / Empiric Oral Txc 3,665k No MRSA coverage / Empiric Oral Txc 10,735k 2nd Linec 735K Successfully Tx’d 2nd line Empiric Oral Tx Hospital Referral Potential patient intercept è Treatment failure (resistance confirmed) still needing empiric Tx 13,665k

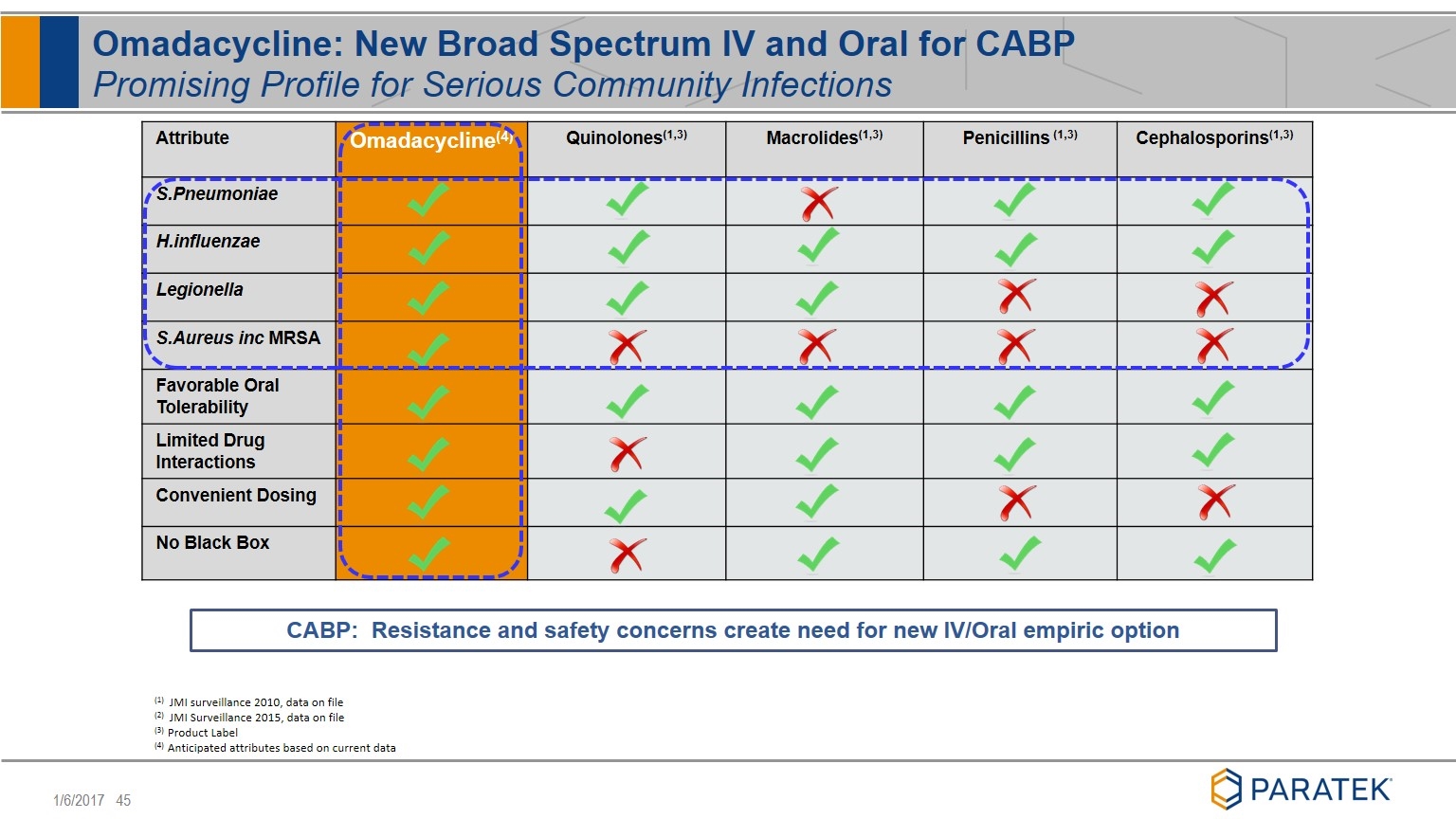

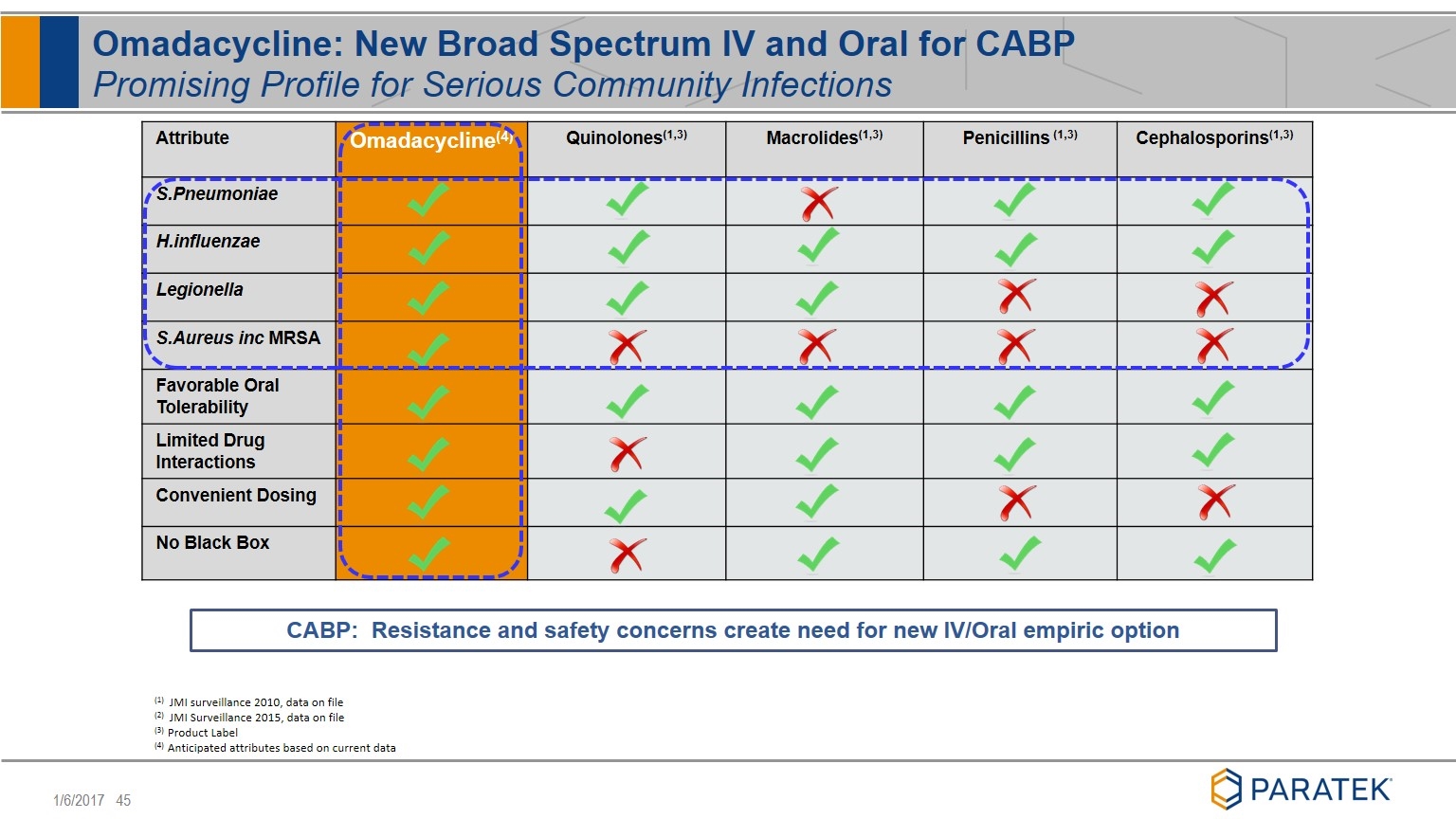

Attribute Omadacycline(4) Quinolones(1,3) Macrolides(1,3) Penicillins (1,3) Cephalosporins(1,3) S.Pneumoniae H.influenzae Legionella S.Aureus inc MRSA Favorable Oral Tolerability Limited Drug Interactions Convenient Dosing No Black Box Omadacycline: New Broad Spectrum IV and Oral for CABP Promising Profile for Serious Community Infections (1) JMI surveillance 2010, data on file (2) JMI Surveillance 2015, data on file (3) Product Label (4) Anticipated attributes based on current data CABP: Resistance and safety concerns create need for new IV/Oral empiric option

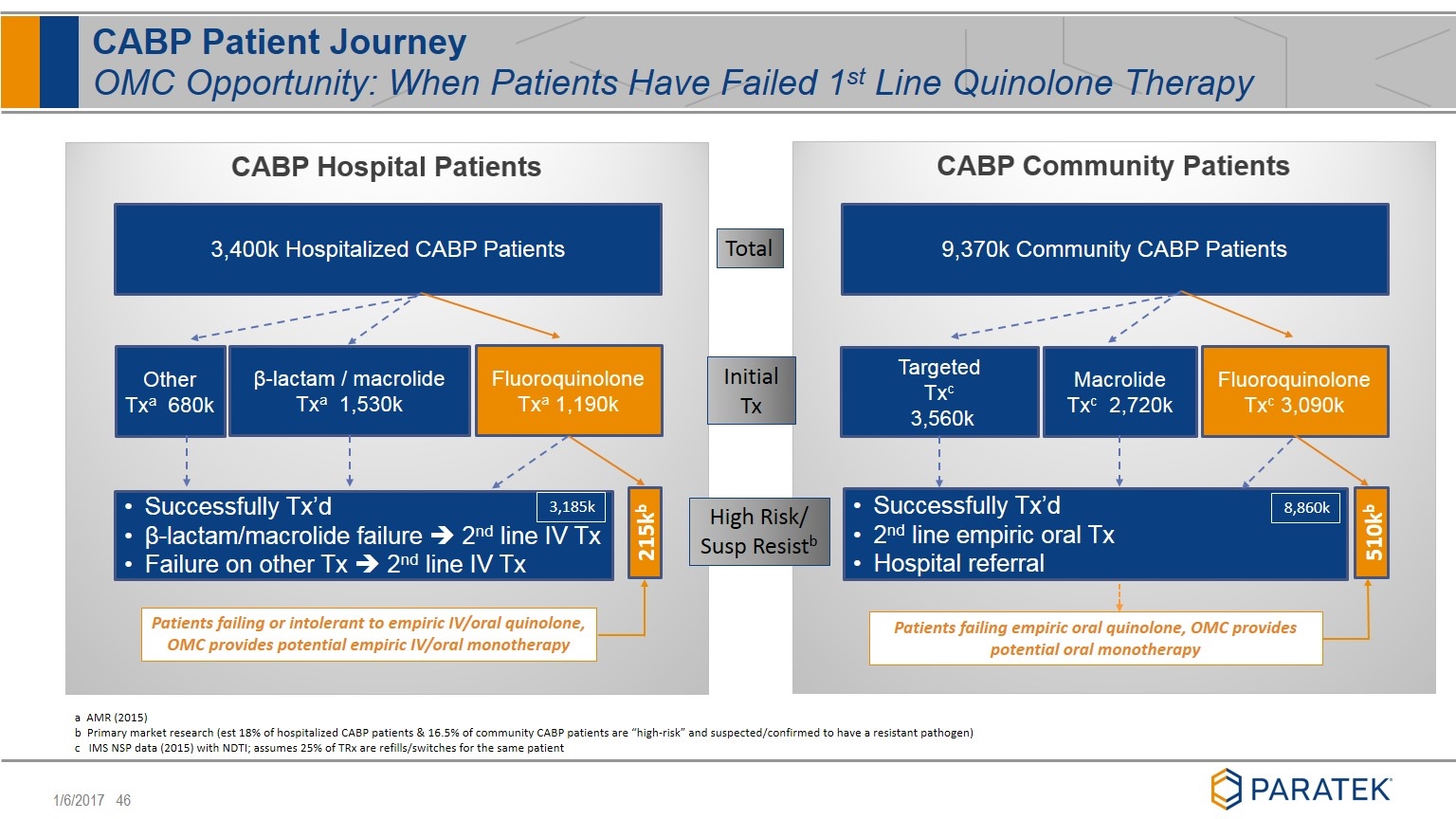

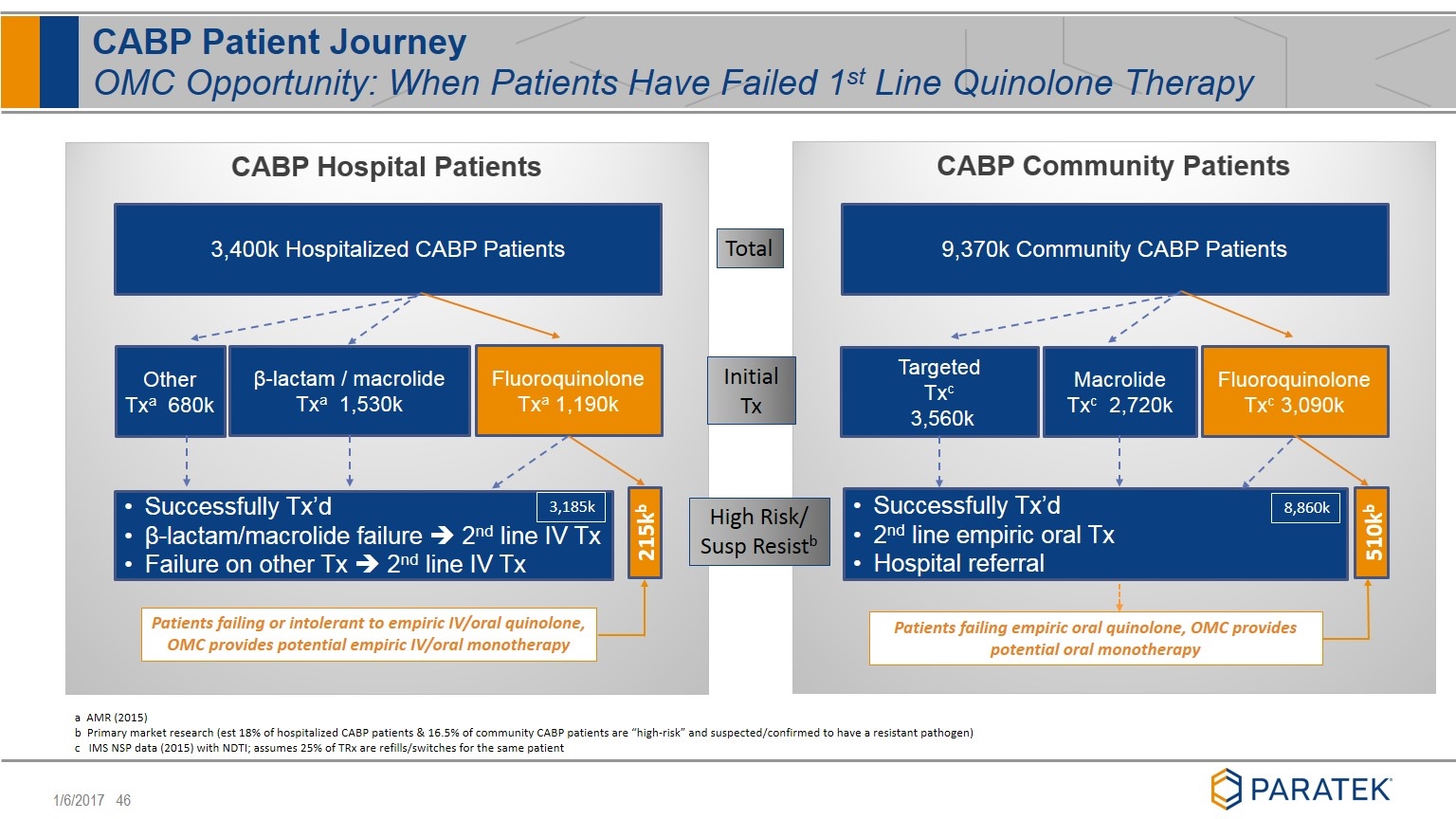

CABP Patient Journey OMC Opportunity: When Patients Have Failed 1st Line Quinolone Therapy Total Initial Tx High Risk/ Susp Resistb a AMR (2015) b Primary market research (est 18% of hospitalized CABP patients & 16.5% of community CABP patients are “high-risk” and suspected/confirmed to have a resistant pathogen) c IMS NSP data (2015) with NDTI; assumes 25% of TRx are refills/switches for the same patient 3,400k Hospitalized CABP Patients 9,370k Community CABP Patients Fluoroquinolone Txa 1,190k β-lactam / macrolide Txa 1,530k Other Txa 680k Fluoroquinolone Txc 3,090k Macrolide Txc 2,720k Targeted Txc 3,560k 215kb 510kb Patients failing or intolerant to empiric IV/oral quinolone, OMC provides potential empiric IV/oral monotherapy Patients failing empiric oral quinolone, OMC provides potential oral monotherapy Successfully Tx’d β-lactam/macrolide failure è 2nd line IV Tx Failure on other Tx è 2nd line IV Tx Successfully Tx’d 2nd line empiric oral Tx Hospital referral 3,185k 8,860k

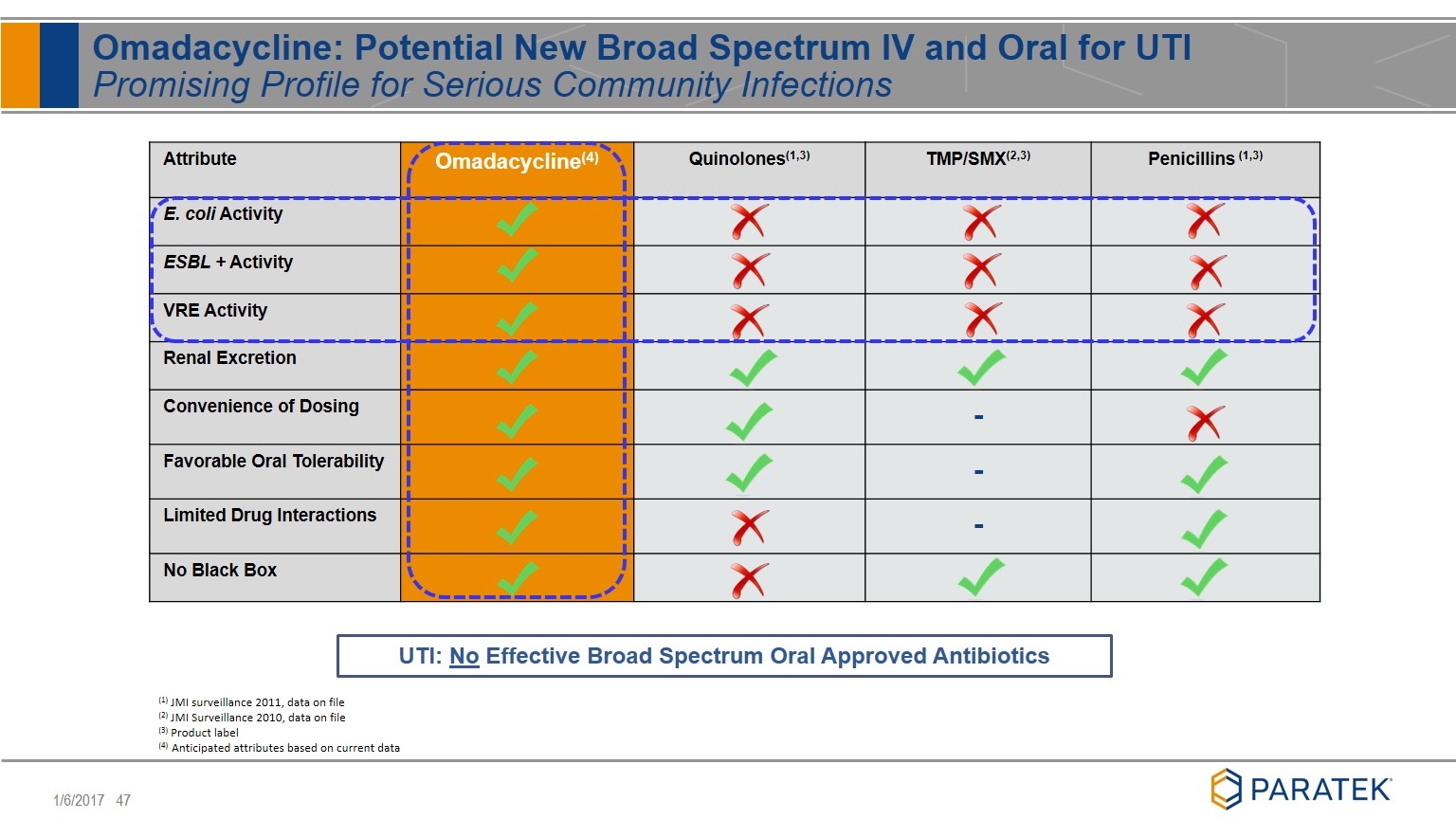

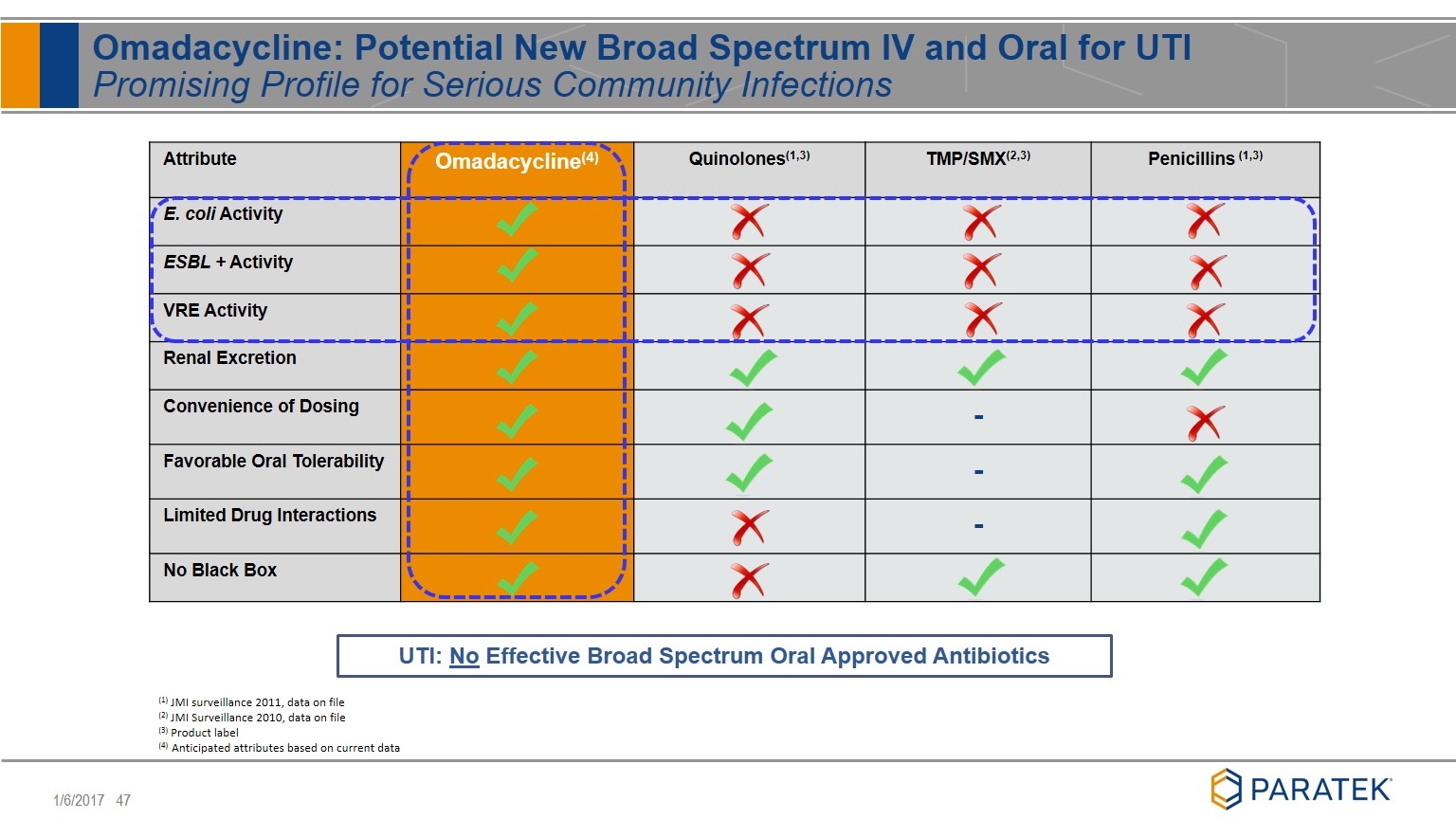

Attribute Omadacycline(4) Quinolones(1,3) TMP/SMX(2,3) Penicillins (1,3) E. coli Activity ESBL + Activity VRE Activity Renal Excretion Convenience of Dosing - Favorable Oral Tolerability - Limited Drug Interactions - No Black Box (1) JMI surveillance 2011, data on file (2) JMI Surveillance 2010, data on file (3) Product label (4) Anticipated attributes based on current data UTI: No Effective Broad Spectrum Oral Approved Antibiotics Omadacycline: Potential New Broad Spectrum IV and Oral for UTI Promising Profile for Serious Community Infections

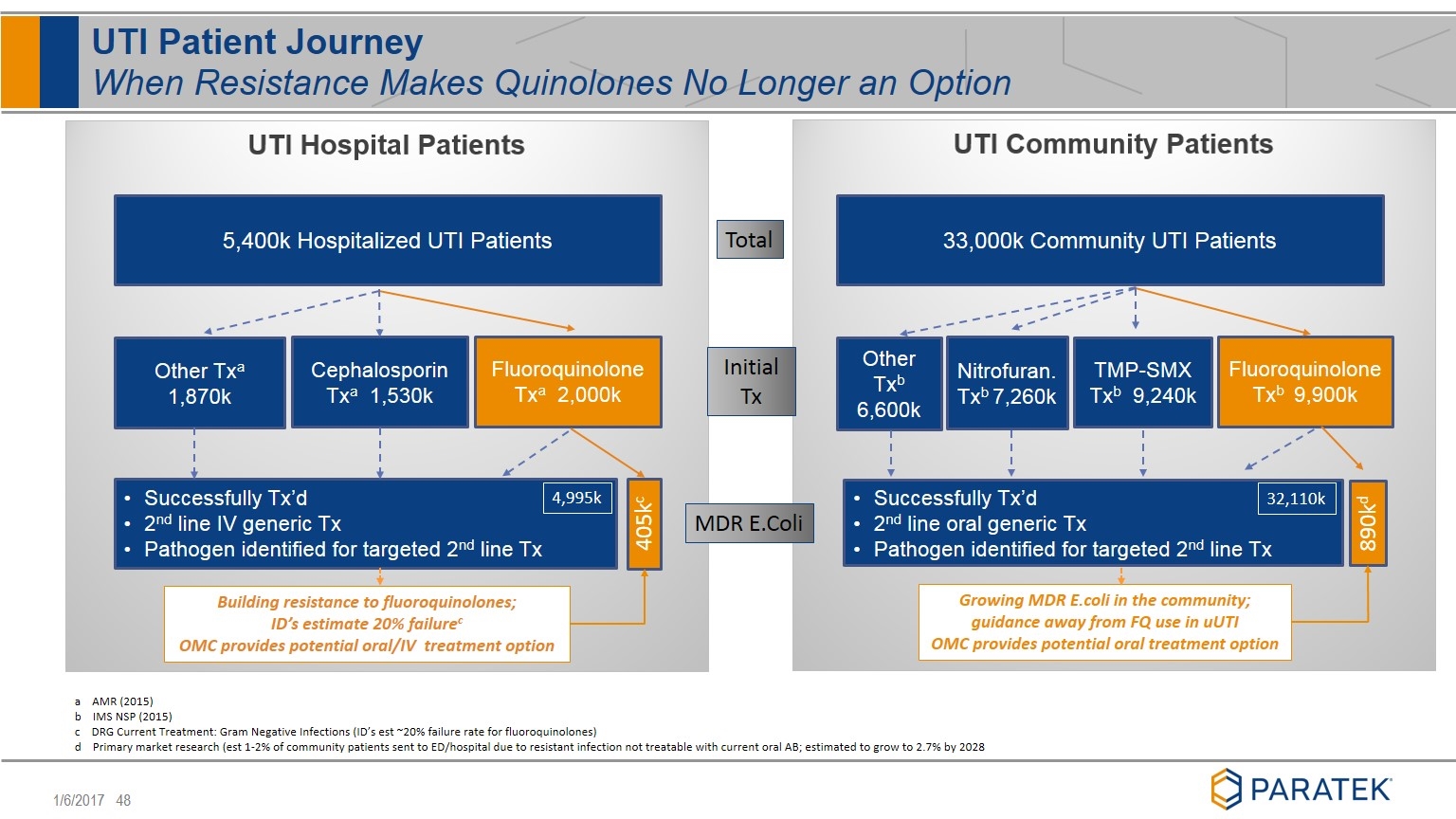

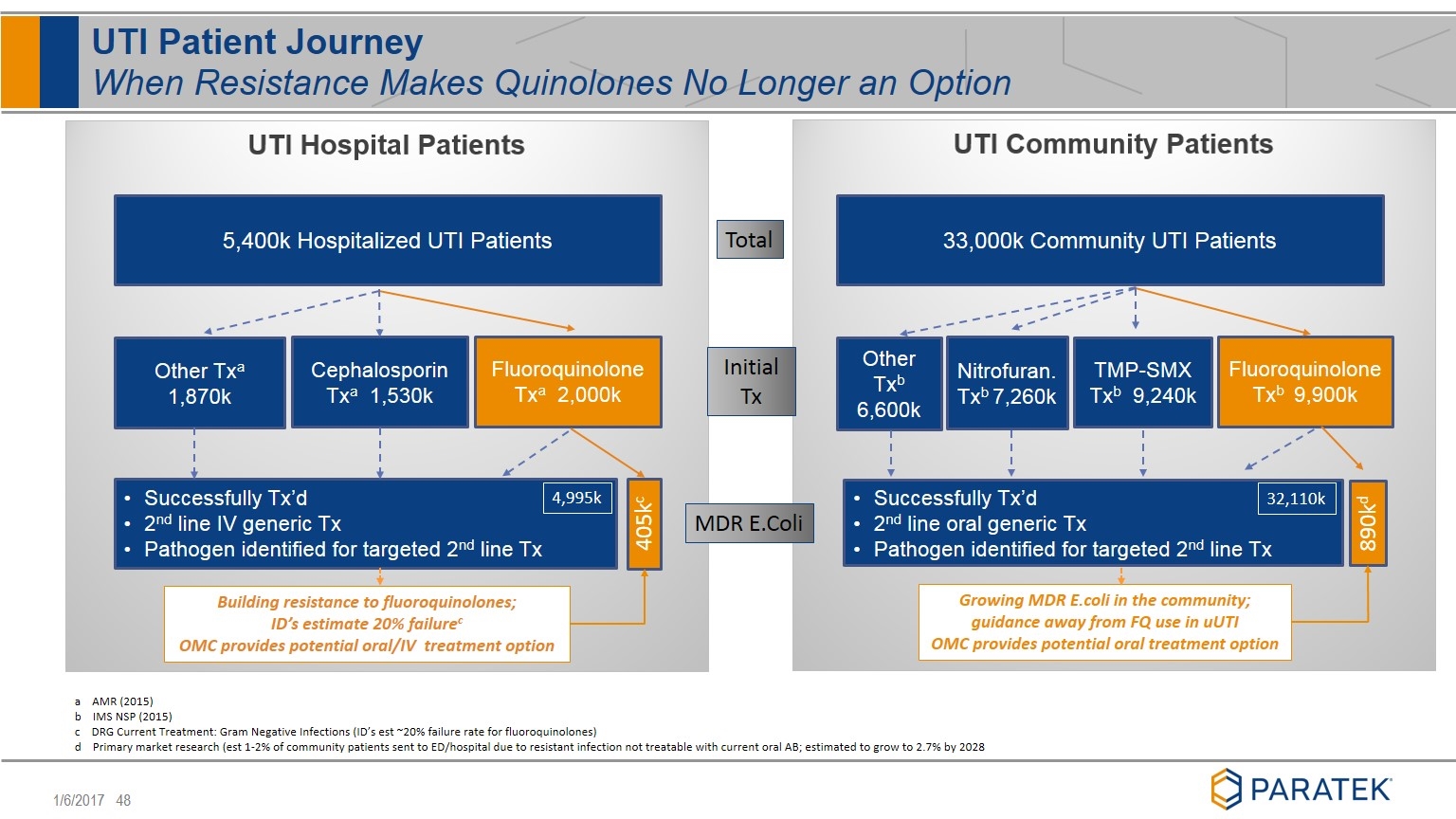

UTI Patient Journey When Resistance Makes Quinolones No Longer an Option Total MDR E.Coli a AMR (2015) b IMS NSP (2015) c DRG Current Treatment: Gram Negative Infections (ID’s est ~20% failure rate for fluoroquinolones) d Primary market research (est 1-2% of community patients sent to ED/hospital due to resistant infection not treatable with current oral AB; estimated to grow to 2.7% by 2028 5,400k Hospitalized UTI Patients Fluoroquinolone Txa 2,000k Cephalosporin Txa 1,530k Other Txa 1,870k 405kc Building resistance to fluoroquinolones; ID’s estimate 20% failurec OMC provides potential oral/IV treatment option Initial Tx 33,000k Community UTI Patients Fluoroquinolone Txb 9,900k TMP-SMX Txb 9,240k Other Txb 6,600k Nitrofuran. Txb 7,260k 890kd Growing MDR E.coli in the community; guidance away from FQ use in uUTI OMC provides potential oral treatment option Successfully Tx’d 2nd line IV generic Tx Pathogen identified for targeted 2nd line Tx Successfully Tx’d 2nd line oral generic Tx Pathogen identified for targeted 2nd line Tx 4,995k 32,110k