Paratek Business Overview & Financial Update January 2019 Recognizing the serious threat of bacterial infections, Paratek is dedicated to providing solutions that enable positive outcomes and lead to better patient stories. Exhibit 99.1

Third-party industry and market information included herein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed by, has not been independently verified by, and should not be construed as a representation by, Paratek. The information contained in this presentation is accurate only as of the date hereof. “Paratek” and the Paratek logo are trademarks and service marks of Paratek. All other trademarks, service marks, trade names, logos and brand names identified in this presentation are the property of their respective owners. Certain statements in this presentation, including responses to questions, contain or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of such statements include, but are not limited to, statements about our strategy, future operations, short and long term product revenue guidance, funding projections, prospects, including plans, objectives of management, availability of data from our clinical studies, potential use of our product candidates, including Omadacycline and Sarecycline, the market acceptance of our product candidates, the strength of, and protection offered by, our intellectual property position, the potential clinical risks and efficacy of, and market opportunities for, our product candidates, the timing and stability of our supply chain, the timing of clinical development of, and regulatory approval for, our product candidates, and the nature and timing of our collaboration agreements with respect to our product candidates. The words “anticipate,” “estimate,” “expect,” “potential,” “will,” “project” and similar terms and phrases are used to identify forward-looking statements. These statements are based on current information and belief and are not guarantees of future performance. Our ability to predict results, financial or otherwise, or the actual effect of future plans or strategies, is inherently uncertain and actual results may differ from those predicted depending on a variety of factors. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations or whether the forward-looking statements ultimately prove to be correct. Except as required by law, we undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Among the risks and uncertainties that could cause actual results to differ materially from those indicated by such forward-looking statements include: delays in clinical trials or unexpected results; the risk that data to date and trends may not be predictive of future results; the failure of collaborators to perform obligations under our collaboration agreements; our failure to obtain regulatory approval for our product candidates; if we obtain regulatory approval for our product candidates, the risk that the terms of such approval may limit how we manufacture and market our product candidates; delays in our supply chain, delays in undertaking or completing clinical trials; our products not gaining the anticipated acceptance in the marketplace or acceptance being delayed; our products not receiving reimbursement from healthcare payors; the effects of competition; our inability to protect our intellectual property and proprietary technology through patents and other means; the need for substantial additional funding to complete the development and commercialization of our product candidates; and the other risks described in the “Risk Factors” section and elsewhere in our Annual Report on Form 10-Q for the quarter ending September 30, 2018, our Form 10-K for the year ended December 31, 2017, and our other filings with the SEC. PARATEK® and the Hexagon Logo are registered trademarks of Paratek Pharmaceuticals, Inc. NUZYRATM and its design logo are trademarks of Paratek Pharmaceuticals, Inc. Safe Harbor Statement

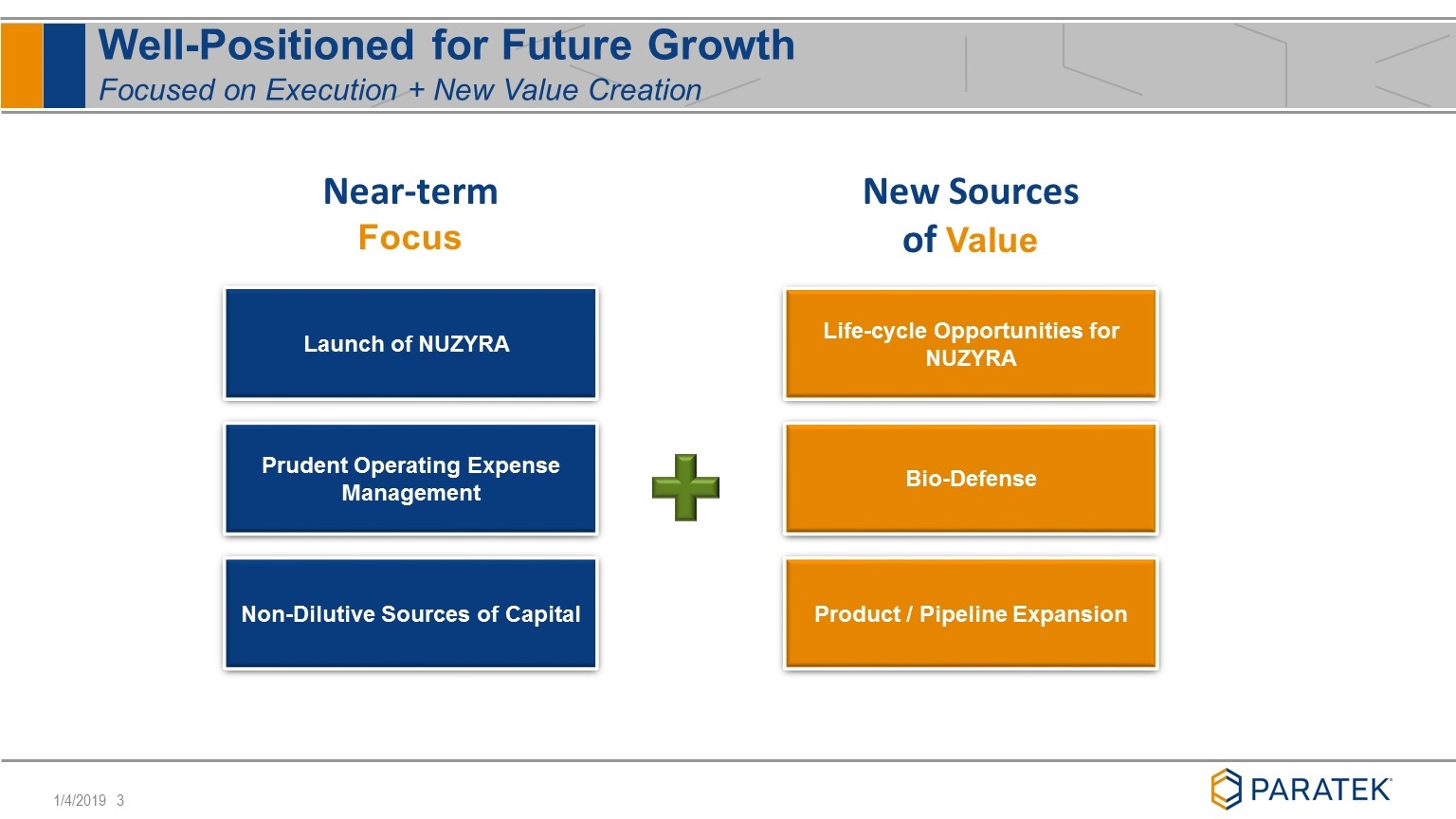

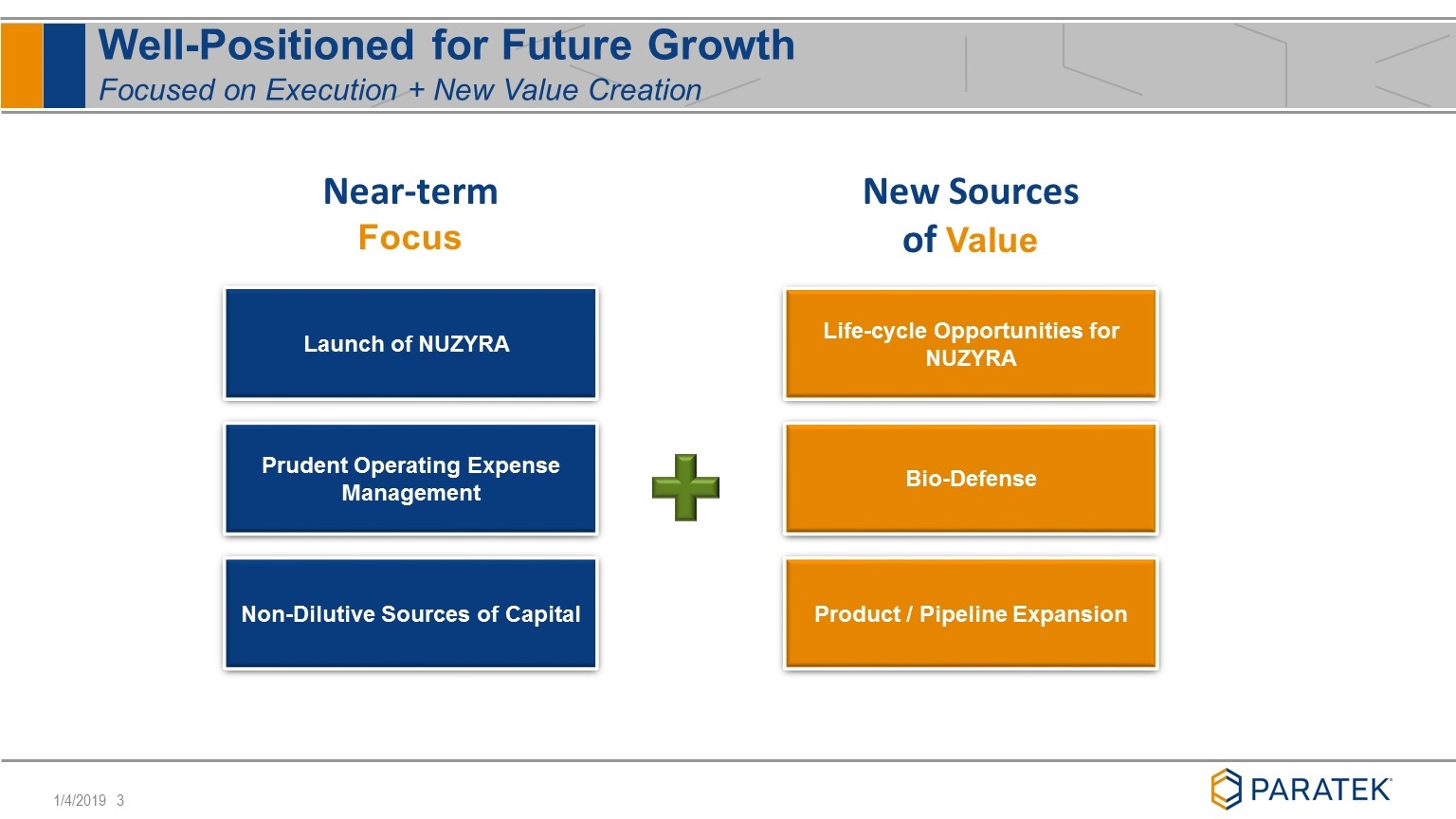

Well-Positioned for Future Growth Focused on Execution + New Value Creation Near-term Focus New Sources of Value Launch of NUZYRA Prudent Operating Expense Management Non-Dilutive Sources of Capital Life-cycle Opportunities for NUZYRA Bio-Defense Product / Pipeline Expansion

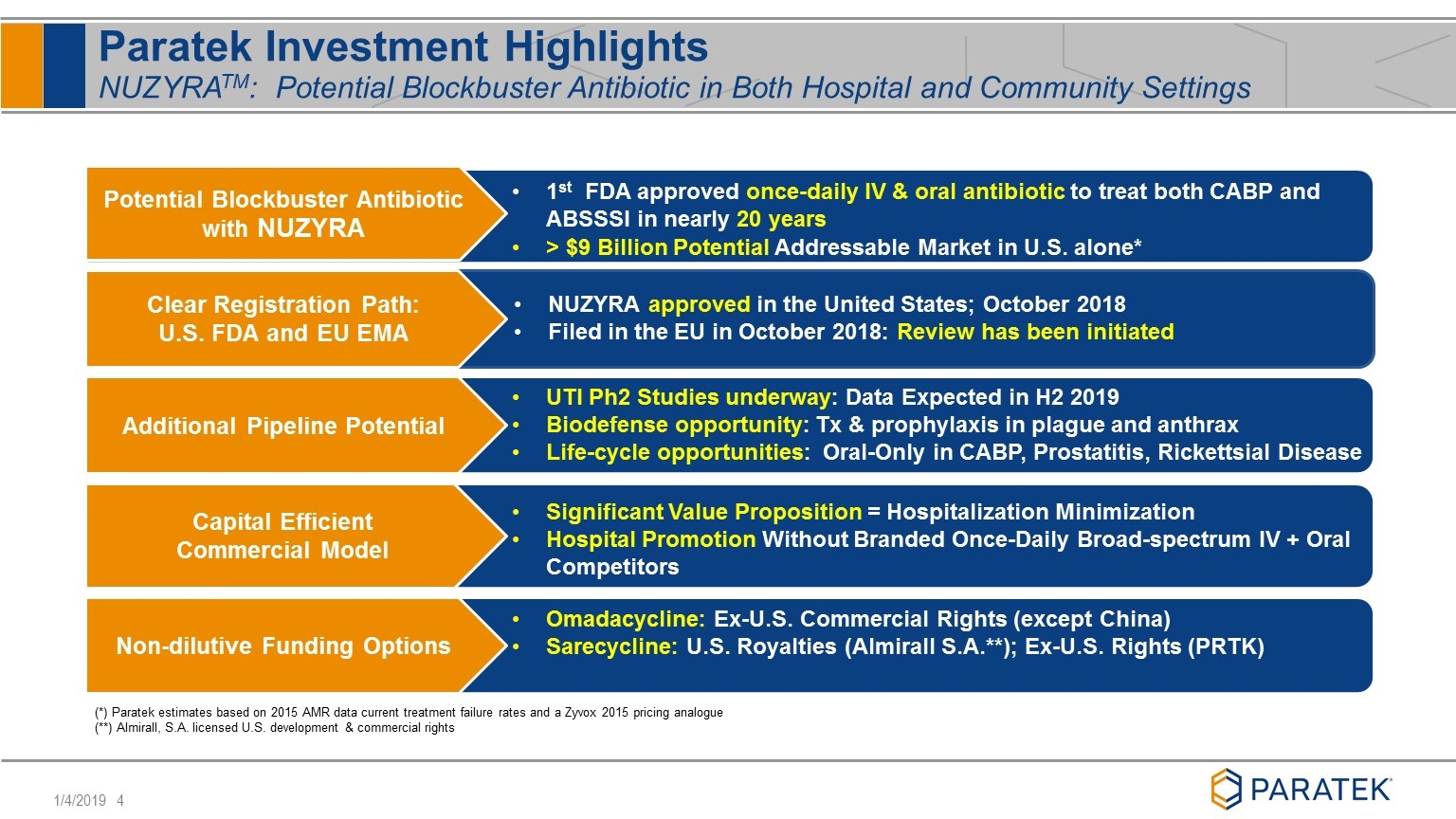

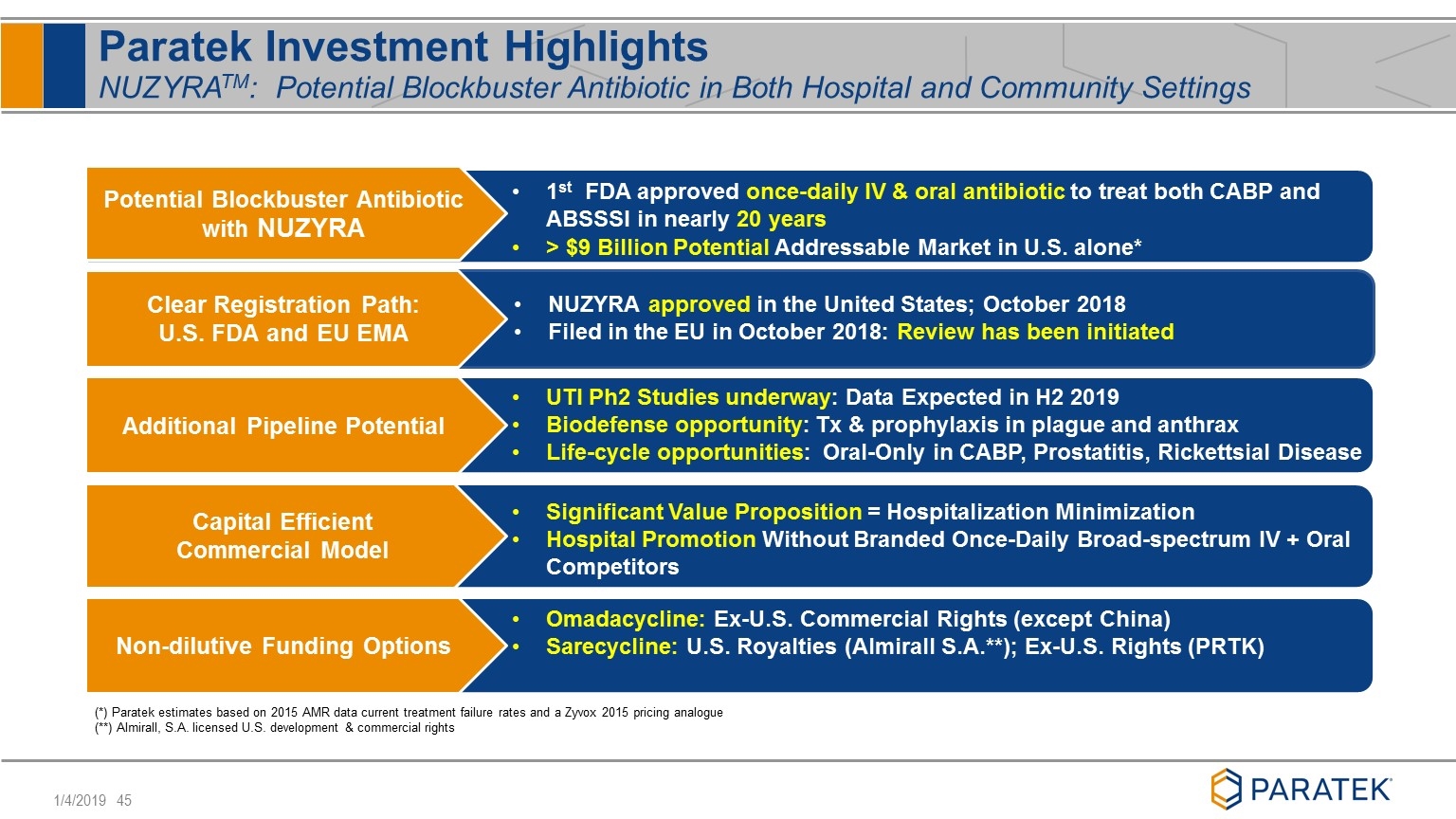

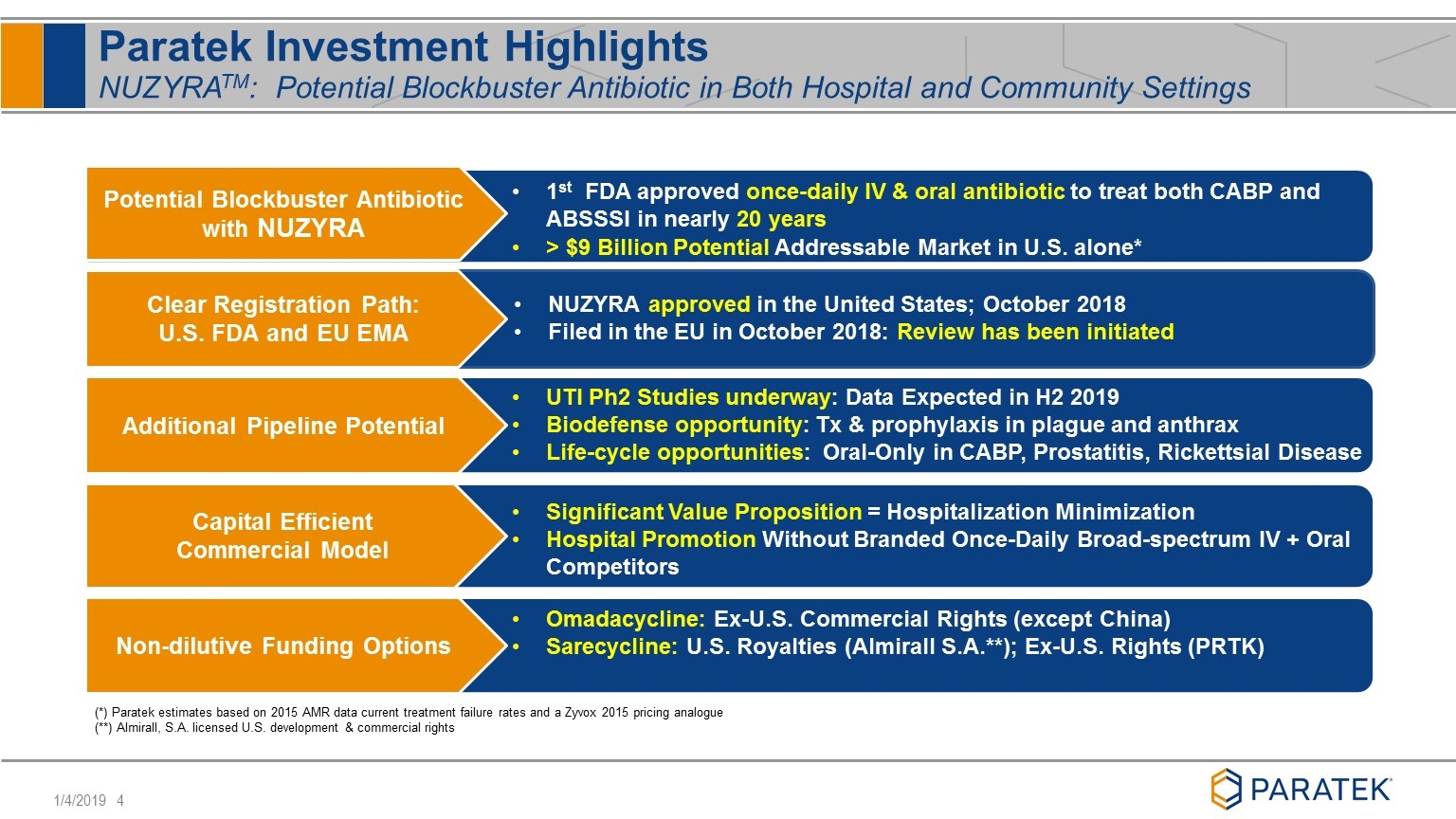

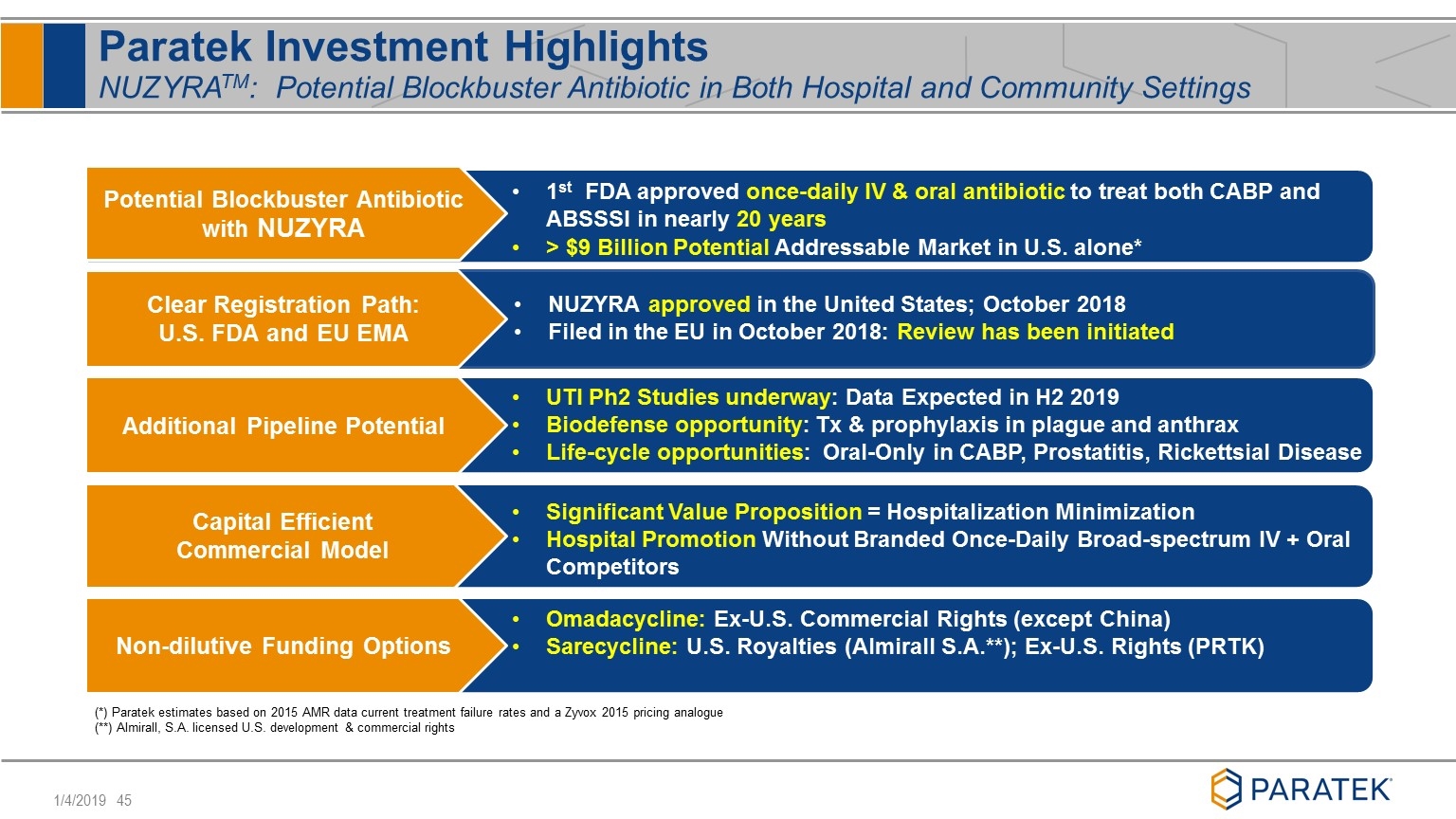

Paratek Investment Highlights NUZYRATM: Potential Blockbuster Antibiotic in Both Hospital and Community Settings Potential Blockbuster Antibiotic with NUZYRA Clear Registration Path: U.S. FDA and EU EMA NUZYRA approved in the United States; October 2018 Filed in the EU in October 2018: Review has been initiated 1st FDA approved once-daily IV & oral antibiotic to treat both CABP and ABSSSI in nearly 20 years > $9 Billion Potential Addressable Market in U.S. alone* Additional Pipeline Potential Non-dilutive Funding Options UTI Ph2 Studies underway: Data Expected in H2 2019 Biodefense opportunity: Tx & prophylaxis in plague and anthrax Life-cycle opportunities: Oral-Only in CABP, Prostatitis, Rickettsial Disease Capital Efficient Commercial Model Significant Value Proposition = Hospitalization Minimization Hospital Promotion Without Branded Once-Daily Broad-spectrum IV + Oral Competitors (*) Paratek estimates based on 2015 AMR data current treatment failure rates and a Zyvox 2015 pricing analogue (**) Almirall, S.A. licensed U.S. development & commercial rights Omadacycline: Ex-U.S. Commercial Rights (except China) Sarecycline: U.S. Royalties (Almirall S.A.**); Ex-U.S. Rights (PRTK)

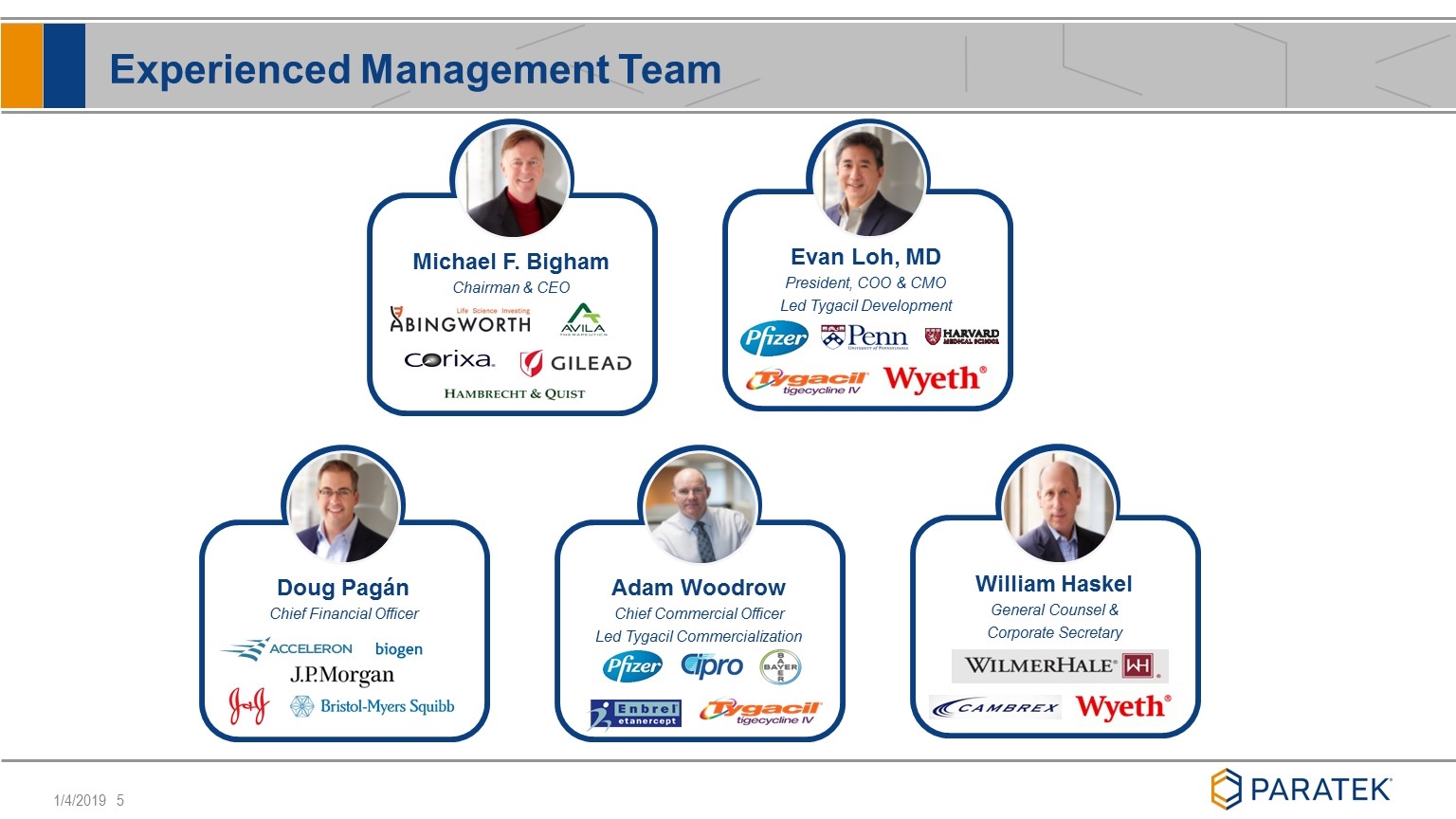

Experienced Management Team Michael F. Bigham Chairman & CEO Evan Loh, MD President, COO & CMO Led Tygacil Development Doug Pagán Chief Financial Officer Adam Woodrow Chief Commercial Officer Led Tygacil Commercialization William Haskel General Counsel & Corporate Secretary

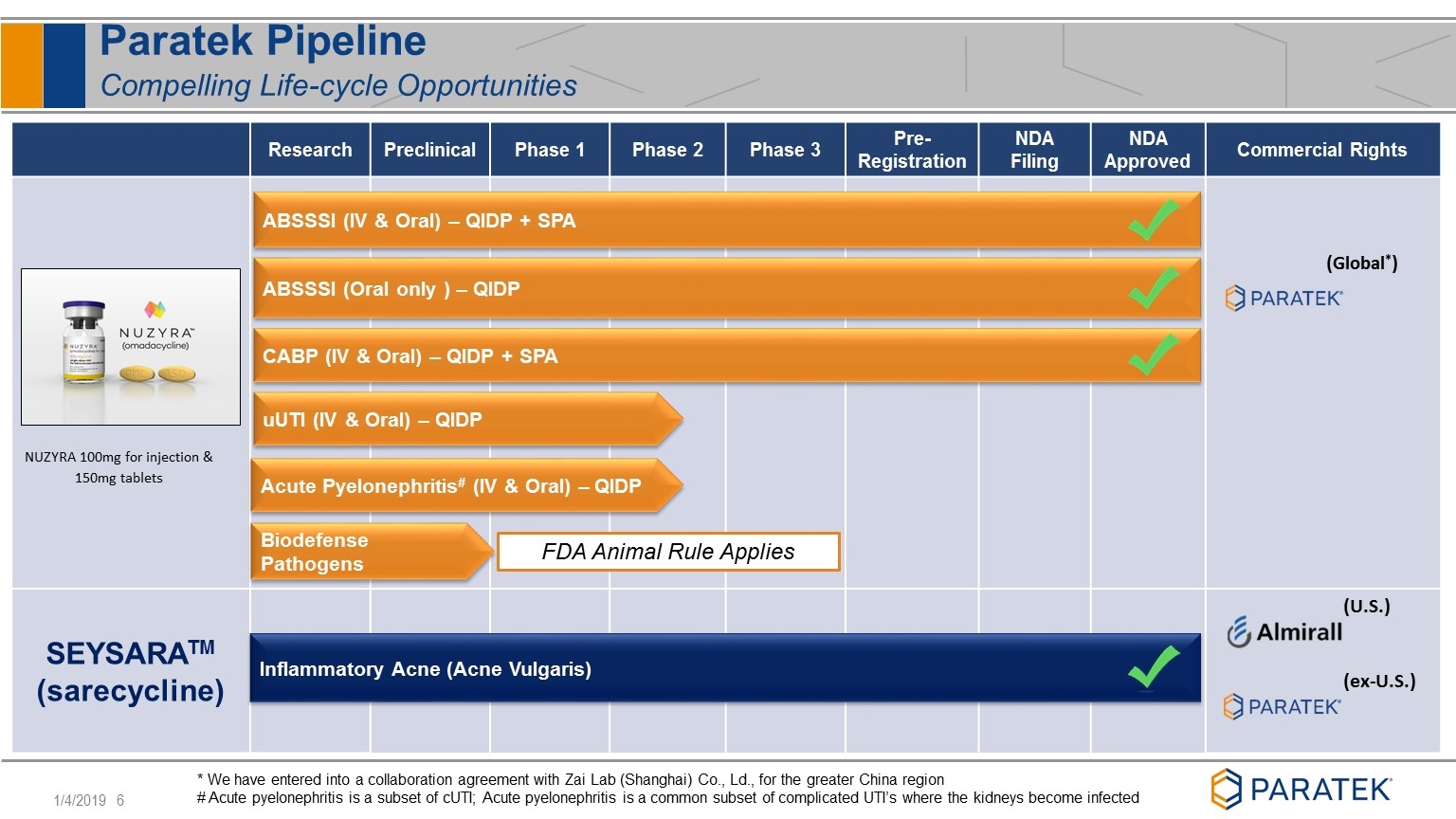

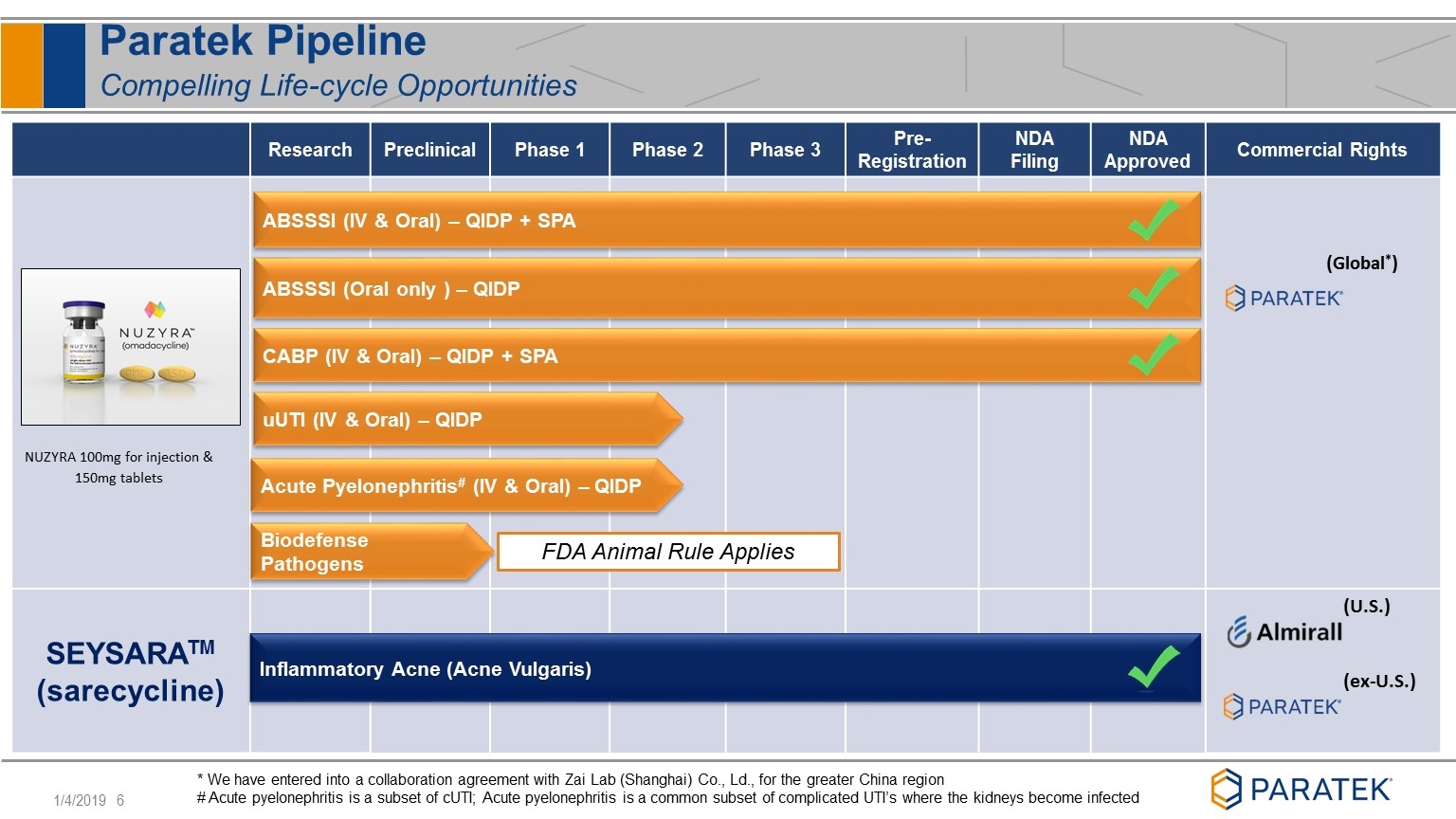

Paratek Pipeline Compelling Life-cycle Opportunities Research Preclinical Phase 1 Phase 2 Phase 3 Pre-Registration NDA Filing NDA Approved Commercial Rights SEYSARATM (sarecycline) (U.S.) (ex-U.S.) (Global*) uUTI (IV & Oral) – QIDP ABSSSI (IV & Oral) – QIDP + SPA CABP (IV & Oral) – QIDP + SPA Inflammatory Acne (Acne Vulgaris) * We have entered into a collaboration agreement with Zai Lab (Shanghai) Co., Ld., for the greater China region # Acute pyelonephritis is a subset of cUTI; Acute pyelonephritis is a common subset of complicated UTI’s where the kidneys become infected ABSSSI (Oral only ) – QIDP Biodefense Pathogens NUZYRA 100mg for injection & 150mg tablets FDA Animal Rule Applies Acute Pyelonephritis# (IV & Oral) – QIDP

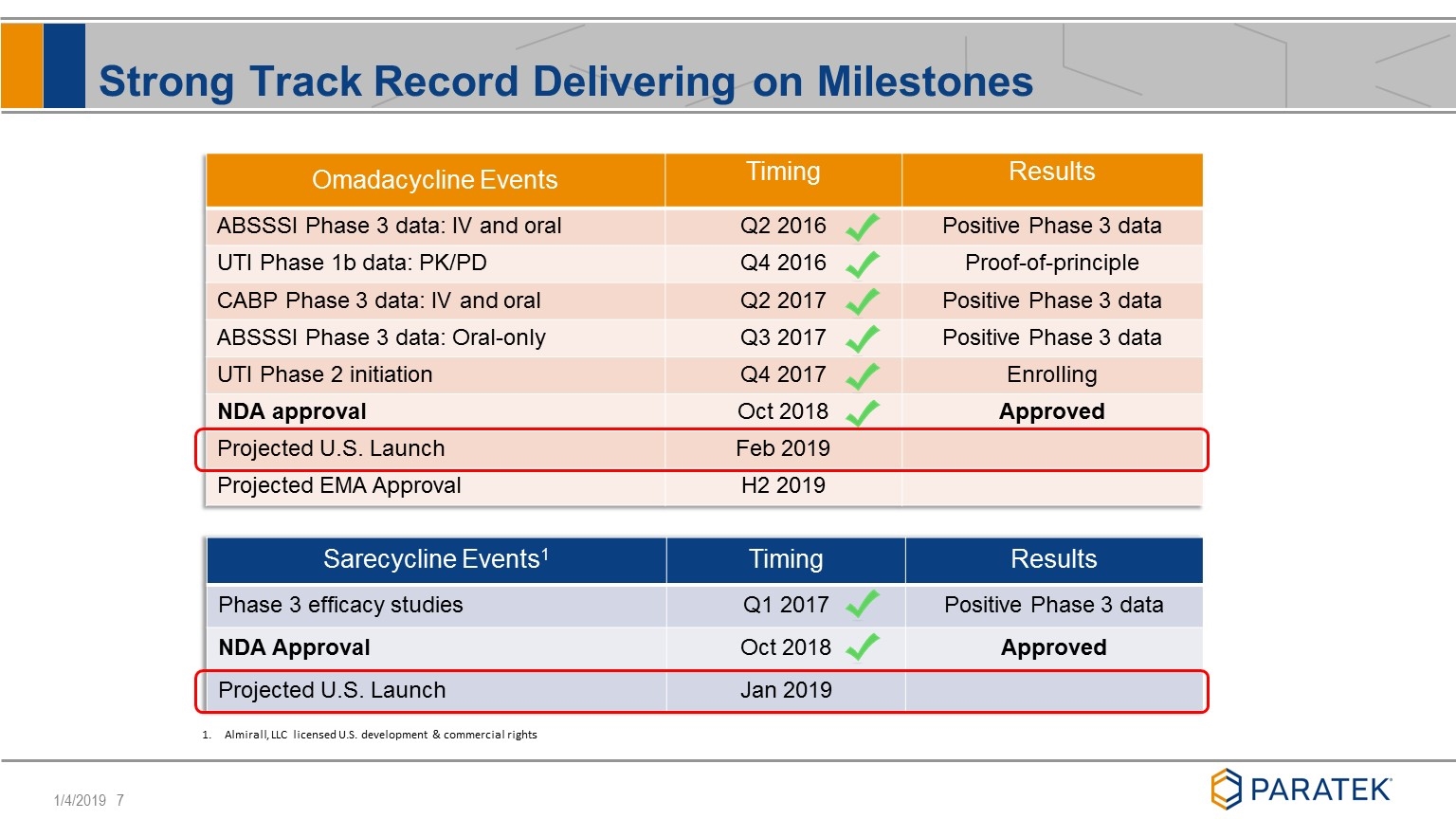

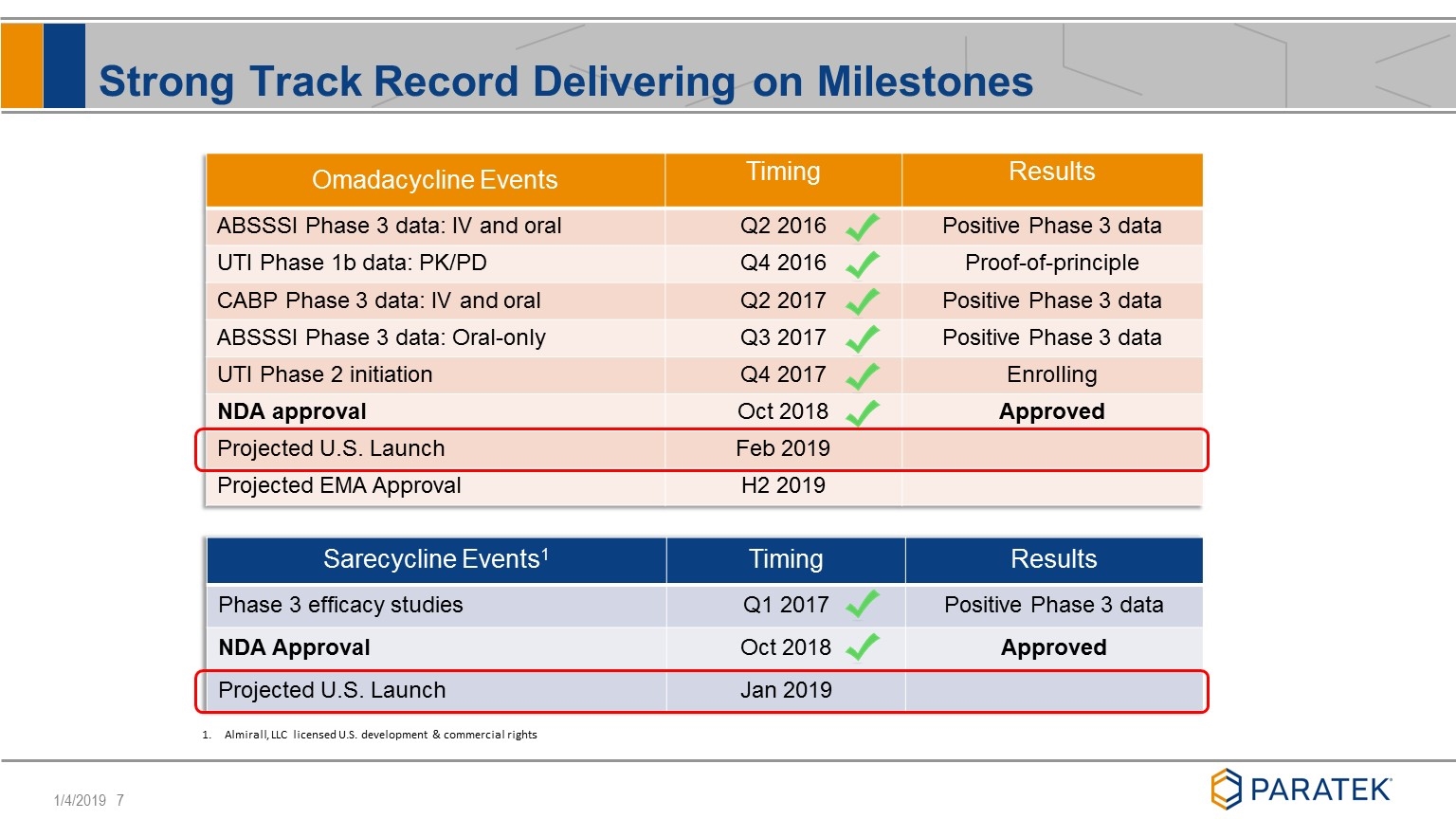

Strong Track Record Delivering on Milestones Omadacycline Events Timing Results ABSSSI Phase 3 data: IV and oral Q2 2016 Positive Phase 3 data UTI Phase 1b data: PK/PD Q4 2016 Proof-of-principle CABP Phase 3 data: IV and oral Q2 2017 Positive Phase 3 data ABSSSI Phase 3 data: Oral-only Q3 2017 Positive Phase 3 data UTI Phase 2 initiation Q4 2017 Enrolling NDA approval Oct 2018 Approved Projected U.S. Launch Feb 2019 Projected EMA Approval H2 2019 Sarecycline Events1 Timing Results Phase 3 efficacy studies Q1 2017 Positive Phase 3 data NDA Approval Oct 2018 Approved Projected U.S. Launch Jan 2019 Almirall, LLC licensed U.S. development & commercial rights

NUZYRA Commercial Opportunity Potential Blockbuster Antibiotic in Both Hospital and Community Settings

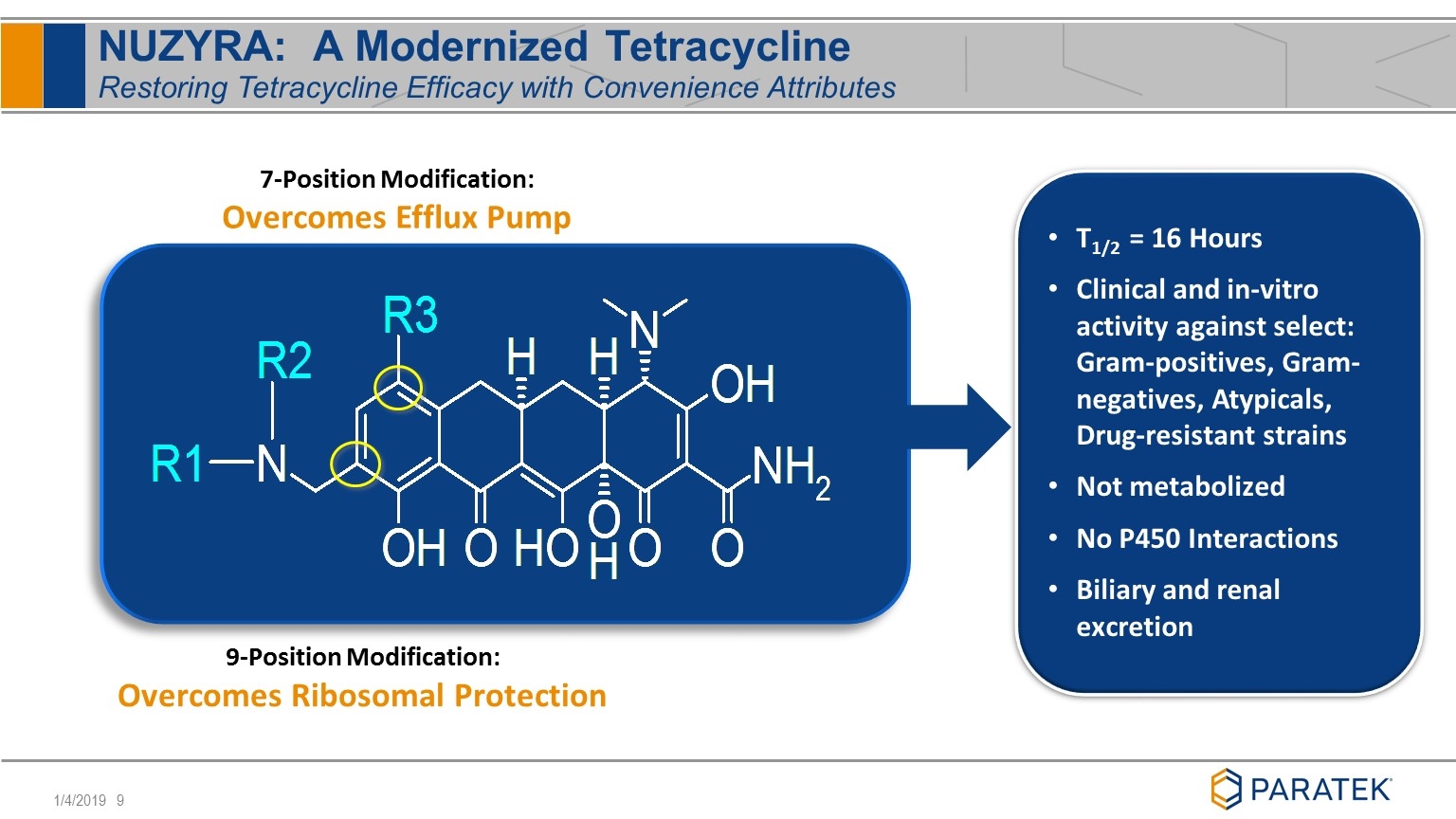

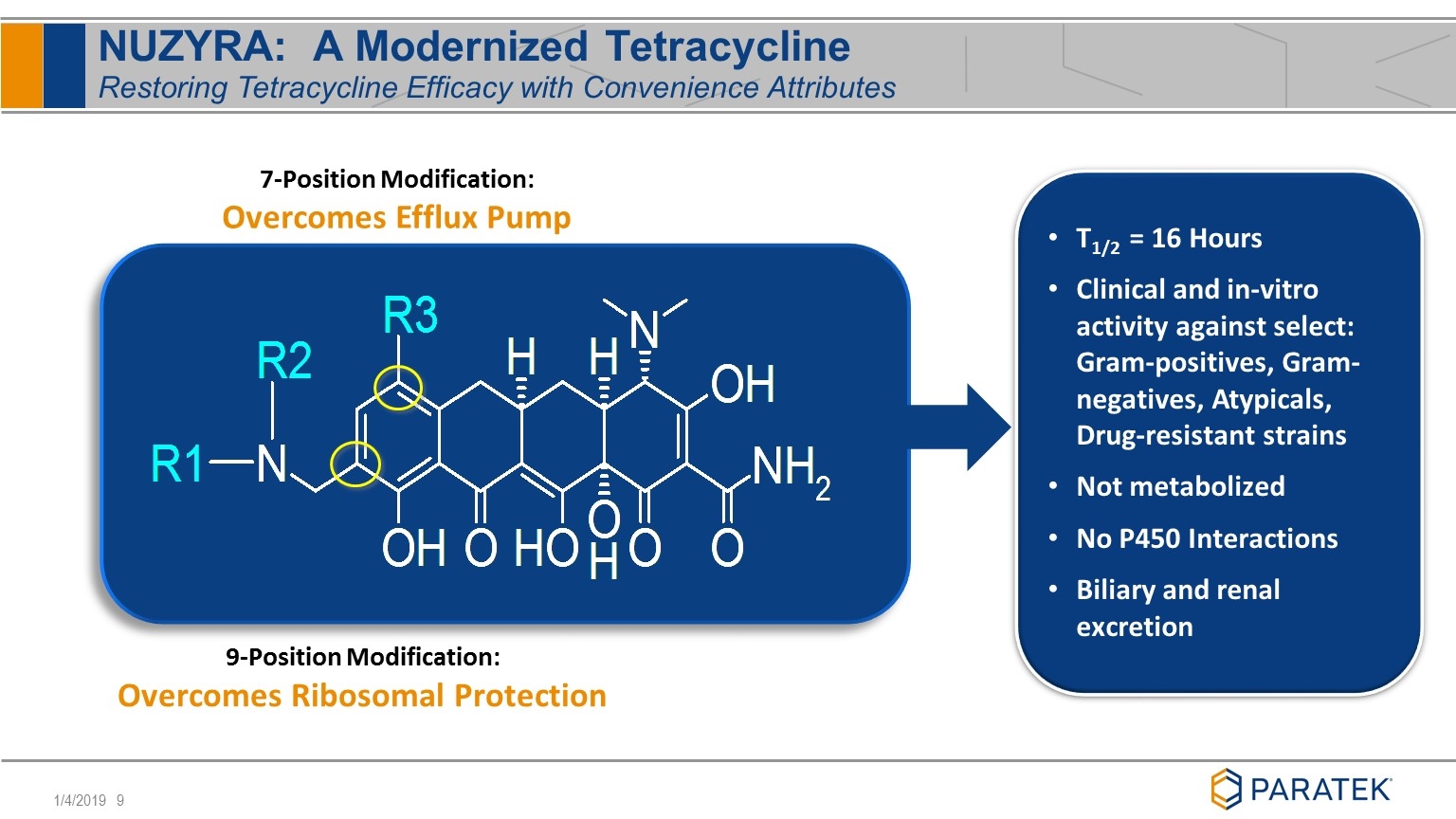

NUZYRA: A Modernized Tetracycline Restoring Tetracycline Efficacy with Convenience Attributes 9-Position Modification: Overcomes Ribosomal Protection 7-Position Modification: Overcomes Efflux Pump T1/2 = 16 Hours Clinical and in-vitro activity against select: Gram-positives, Gram-negatives, Atypicals, Drug-resistant strains Not metabolized No P450 Interactions Biliary and renal excretion

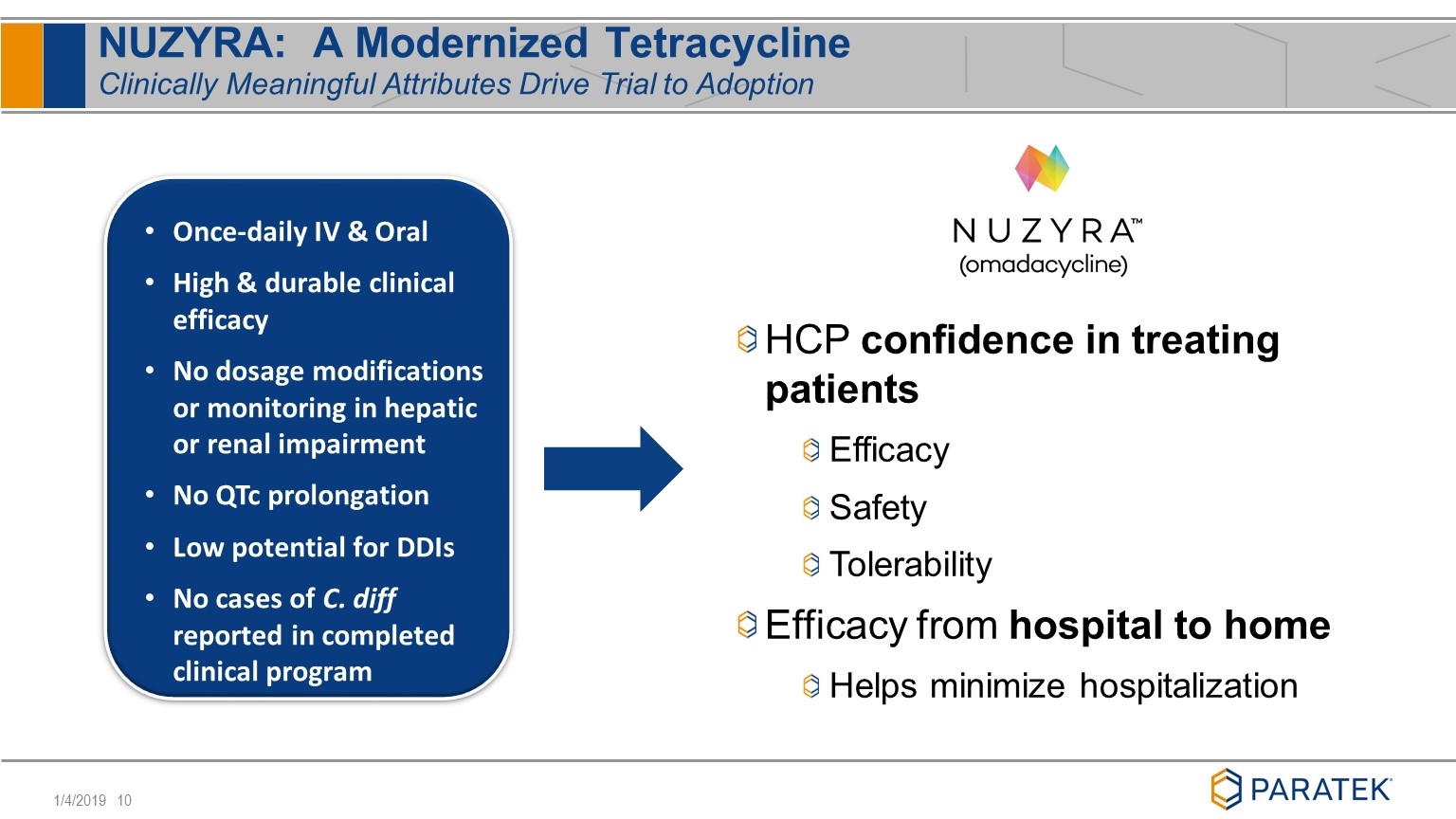

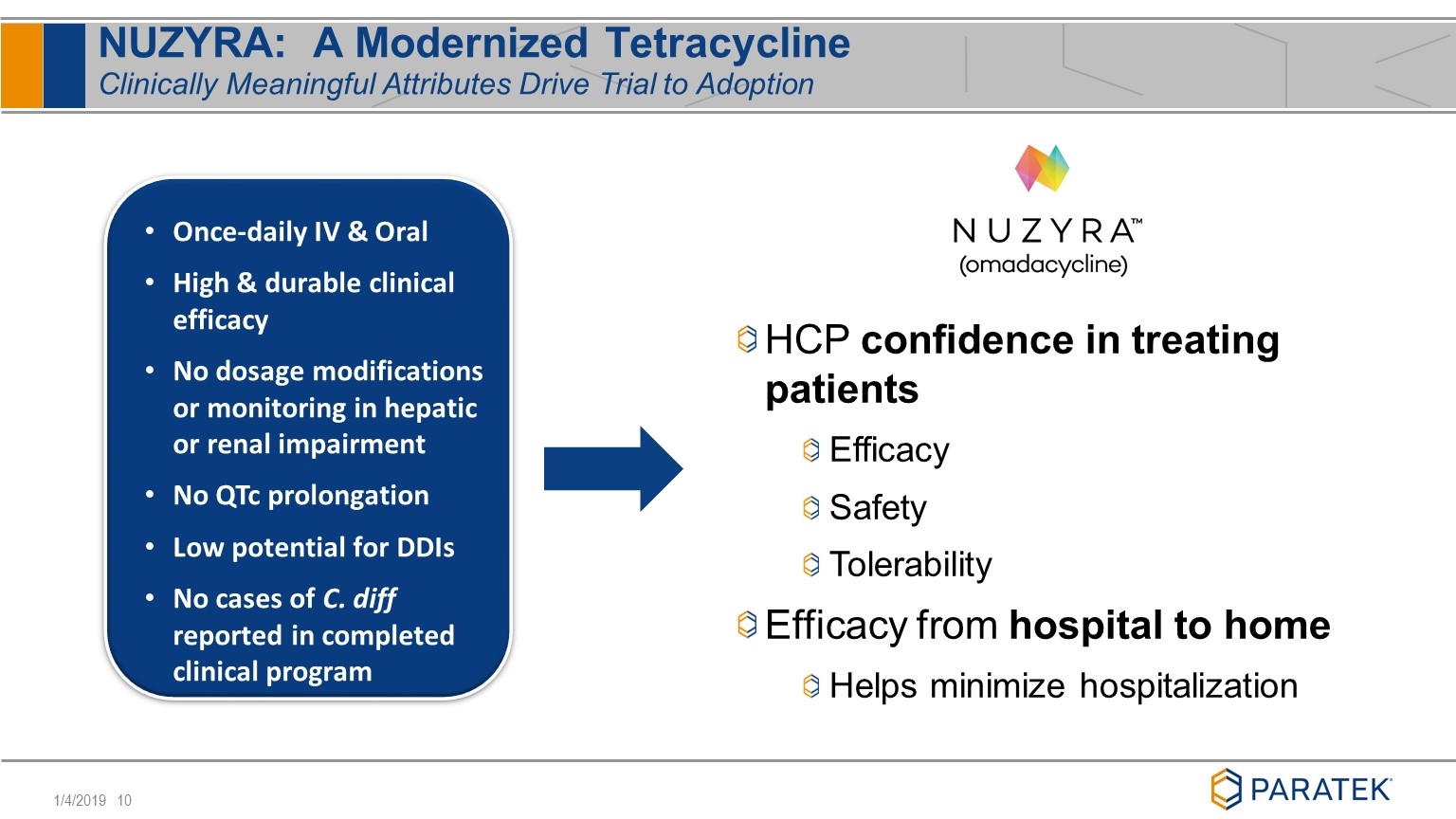

NUZYRA: A Modernized Tetracycline Clinically Meaningful Attributes Drive Trial to Adoption Once-daily IV & Oral High & durable clinical efficacy No dosage modifications or monitoring in hepatic or renal impairment No QTc prolongation Low potential for DDIs No cases of C. diff reported in completed clinical program HCP confidence in treating patients Efficacy Safety Tolerability Efficacy from hospital to home Helps minimize hospitalization

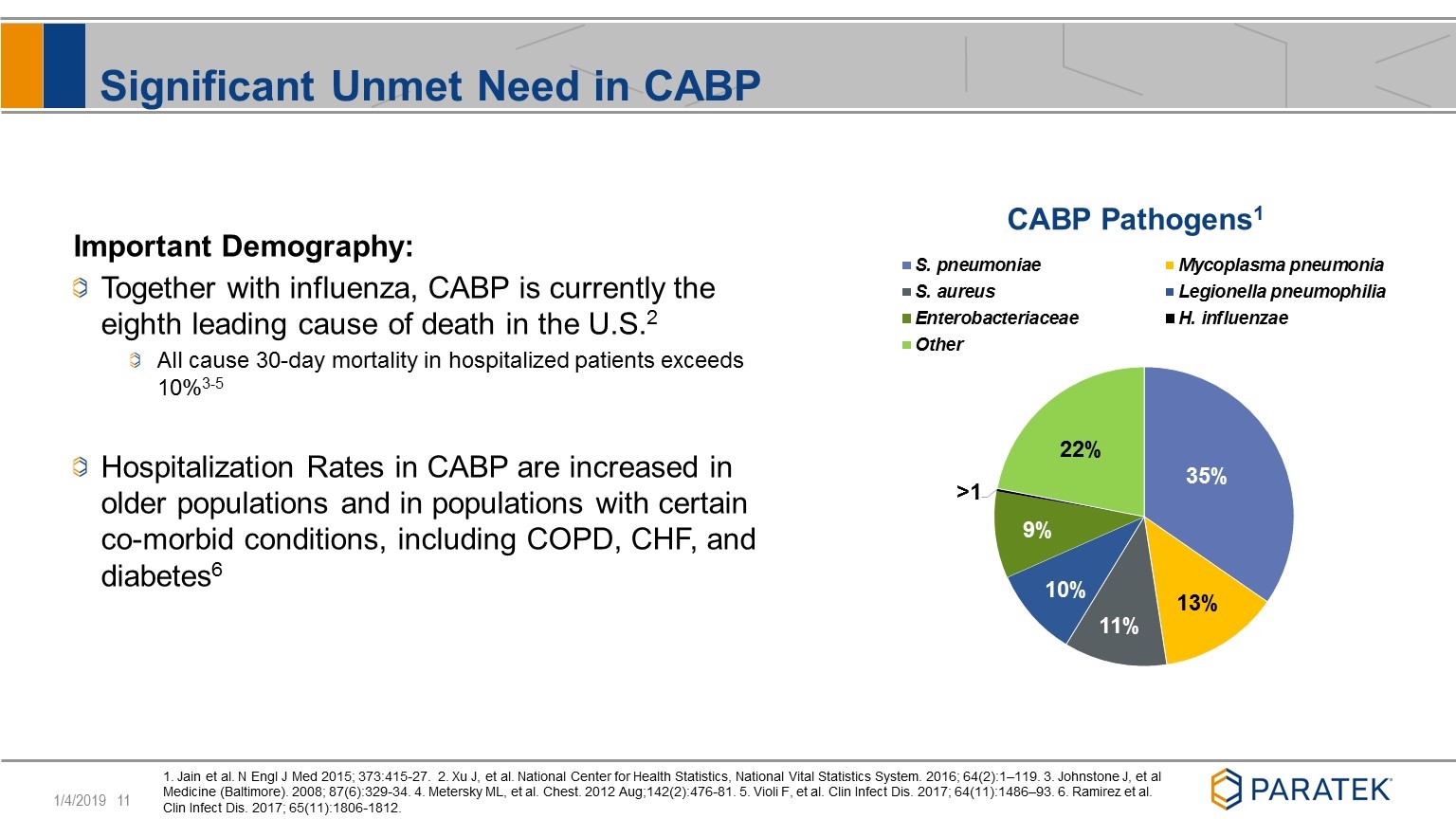

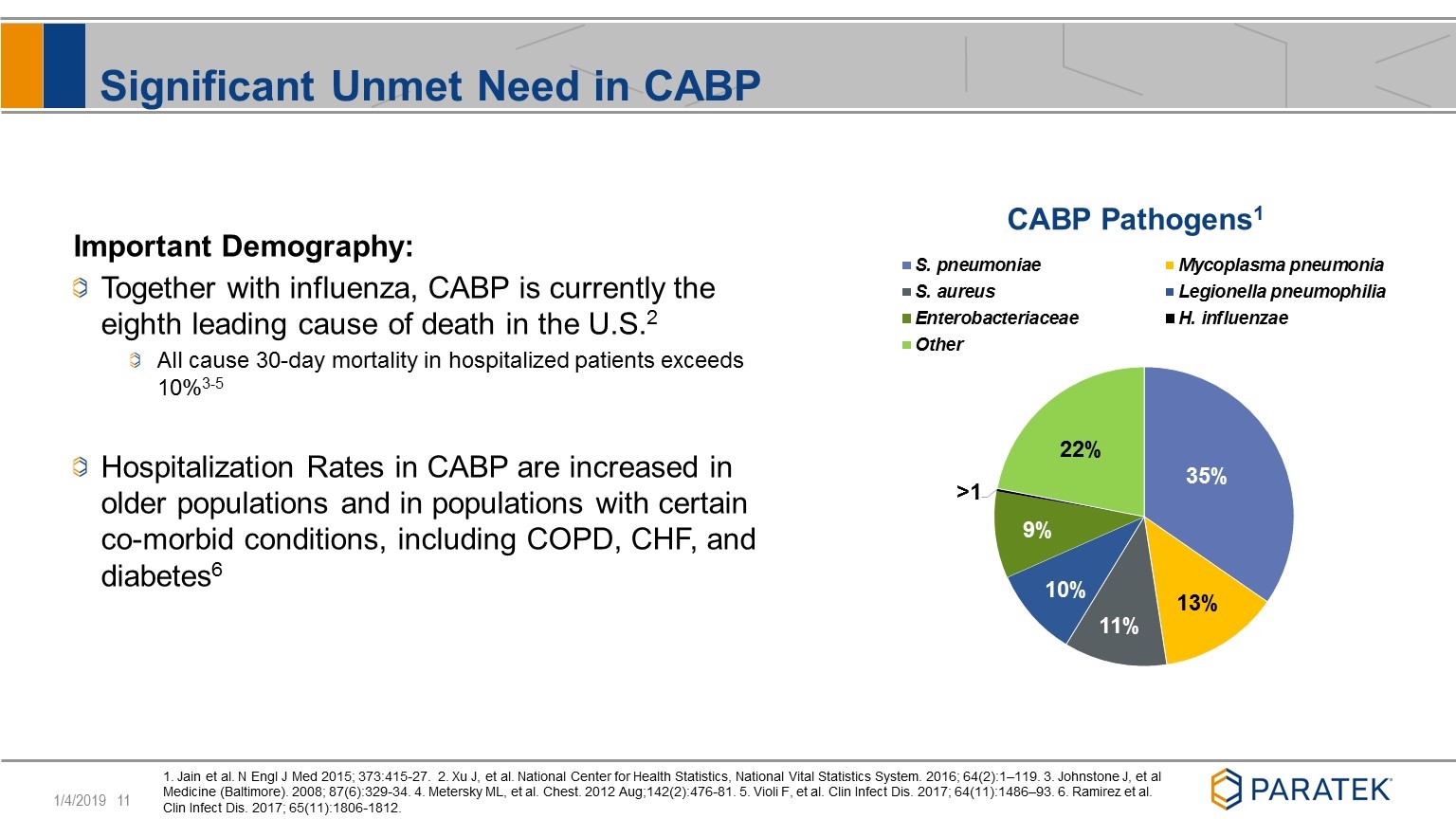

Significant Unmet Need in CABP Important Demography: Together with influenza, CABP is currently the eighth leading cause of death in the U.S.2 All cause 30-day mortality in hospitalized patients exceeds 10%3-5 Hospitalization Rates in CABP are increased in older populations and in populations with certain co-morbid conditions, including COPD, CHF, and diabetes6 1. Jain et al. N Engl J Med 2015; 373:415-27. 2. Xu J, et al. National Center for Health Statistics, National Vital Statistics System. 2016; 64(2):1–119. 3. Johnstone J, et al Medicine (Baltimore). 2008; 87(6):329-34. 4. Metersky ML, et al. Chest. 2012 Aug;142(2):476-81. 5. Violi F, et al. Clin Infect Dis. 2017; 64(11):1486–93. 6. Ramirez et al. Clin Infect Dis. 2017; 65(11):1806-1812.

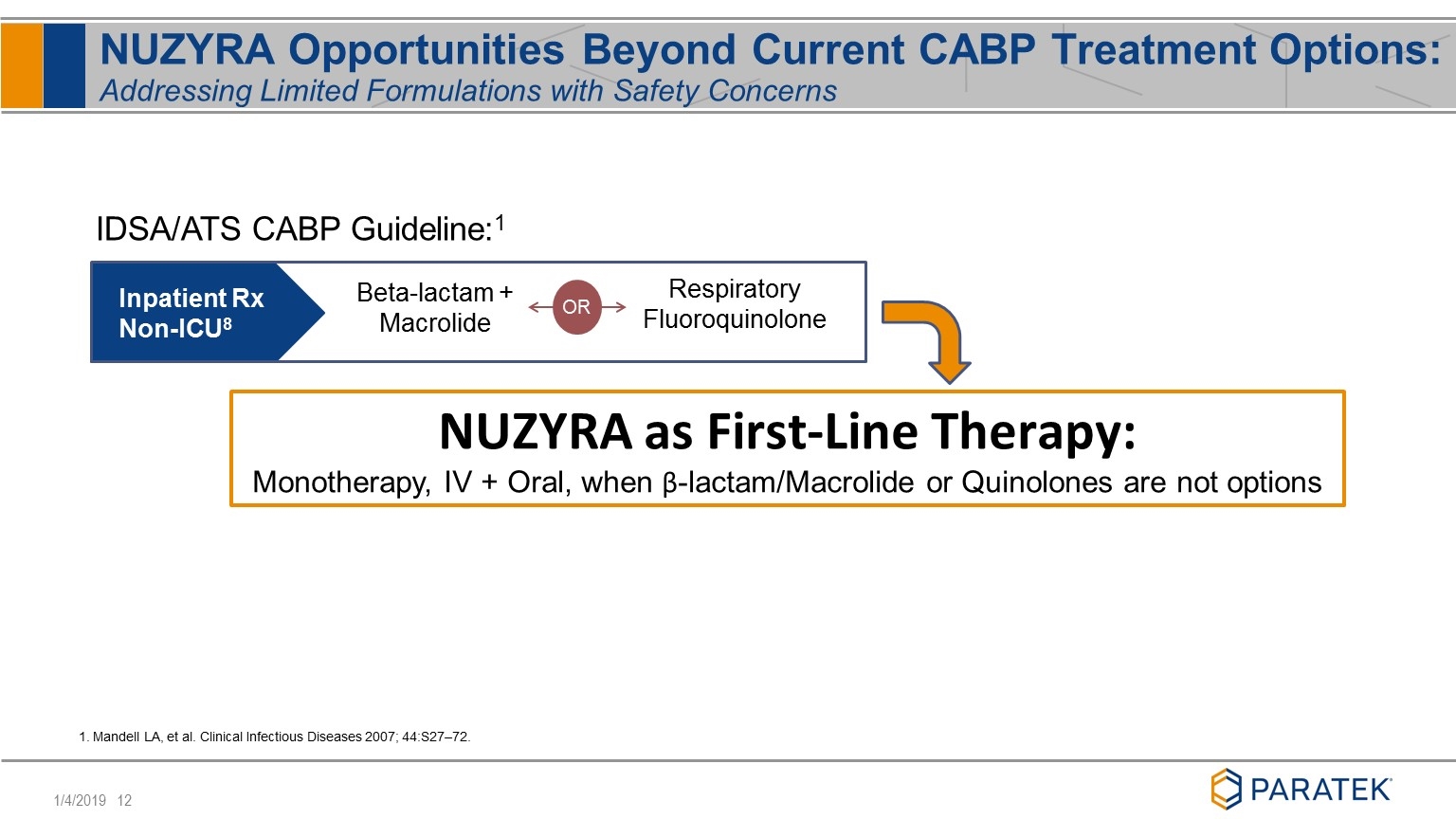

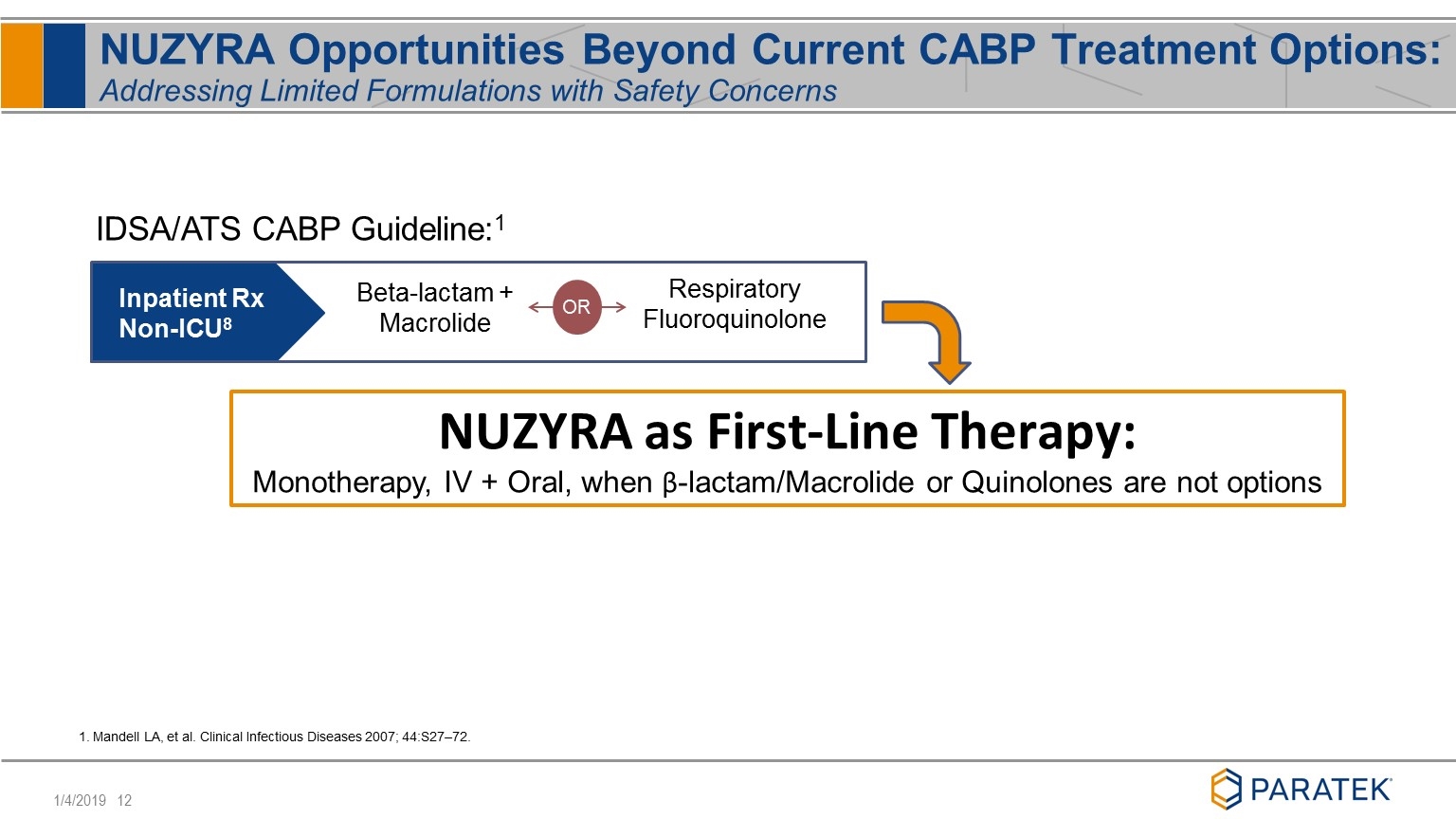

NUZYRA Opportunities Beyond Current CABP Treatment Options: Addressing Limited Formulations with Safety Concerns Beta-lactam + Macrolide Respiratory Fluoroquinolone Inpatient Rx Non-ICU8 OR NUZYRA as First-Line Therapy: Monotherapy, IV + Oral, when β-lactam/Macrolide or Quinolones are not options IDSA/ATS CABP Guideline:1 1. Mandell LA, et al. Clinical Infectious Diseases 2007; 44:S27–72.

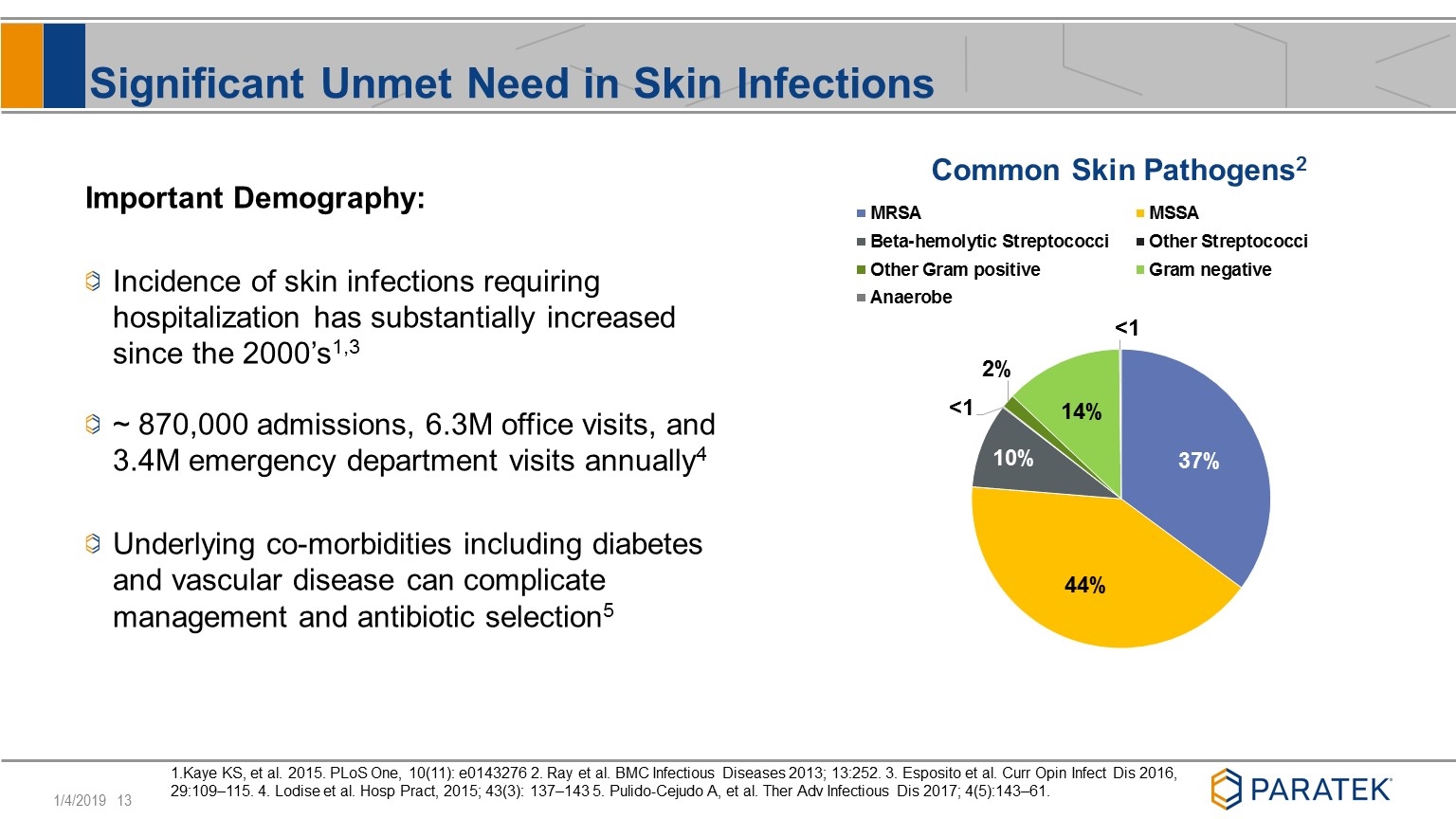

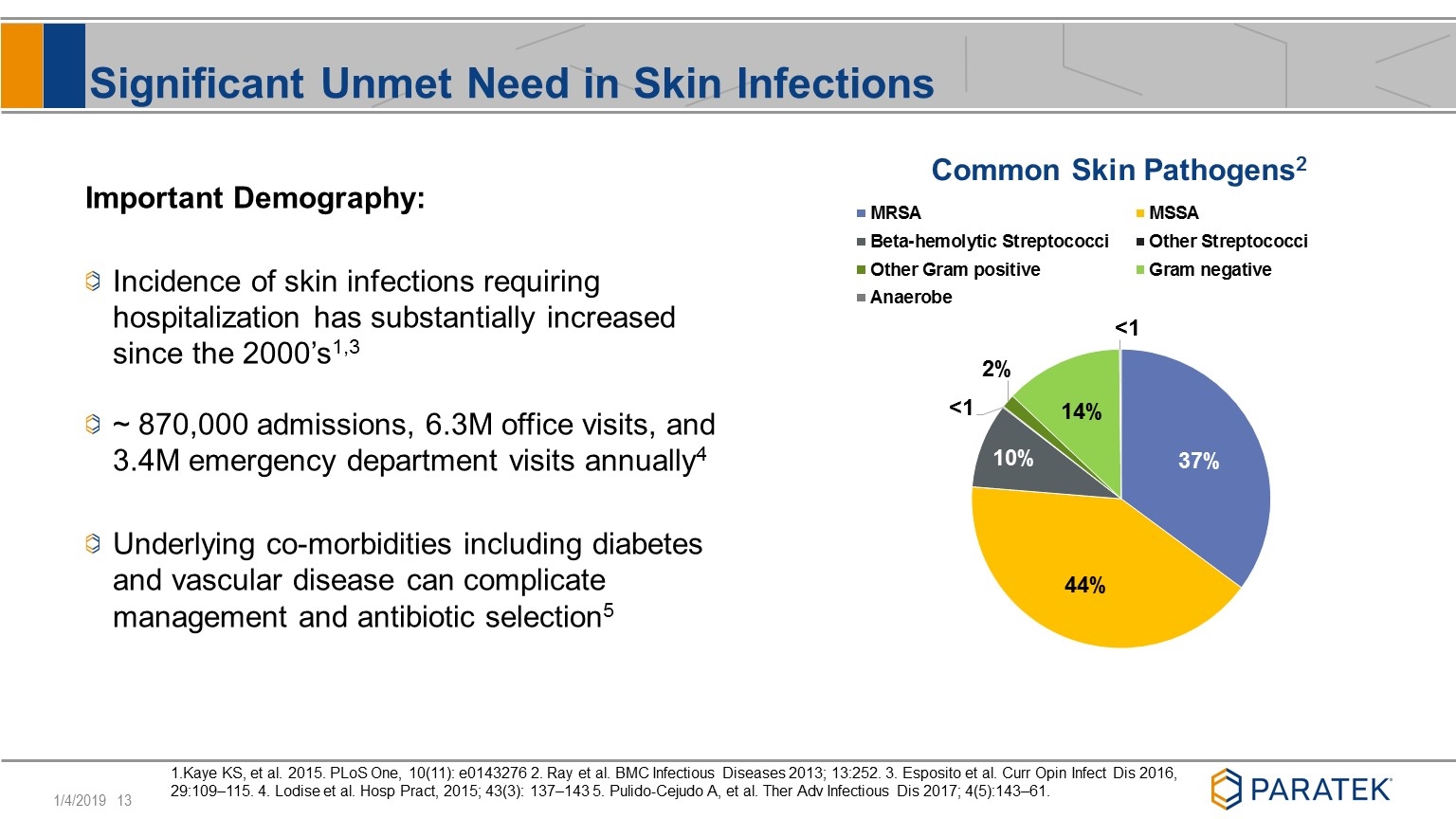

Significant Unmet Need in Skin Infections Important Demography: Incidence of skin infections requiring hospitalization has substantially increased since the 2000’s1,3 ~ 870,000 admissions, 6.3M office visits, and 3.4M emergency department visits annually4 Underlying co-morbidities including diabetes and vascular disease can complicate management and antibiotic selection5 1.Kaye KS, et al. 2015. PLoS One, 10(11): e0143276 2. Ray et al. BMC Infectious Diseases 2013; 13:252. 3. Esposito et al. Curr Opin Infect Dis 2016, 29:109–115. 4. Lodise et al. Hosp Pract, 2015; 43(3): 137–143 5. Pulido-Cejudo A, et al. Ther Adv Infectious Dis 2017; 4(5):143–61.

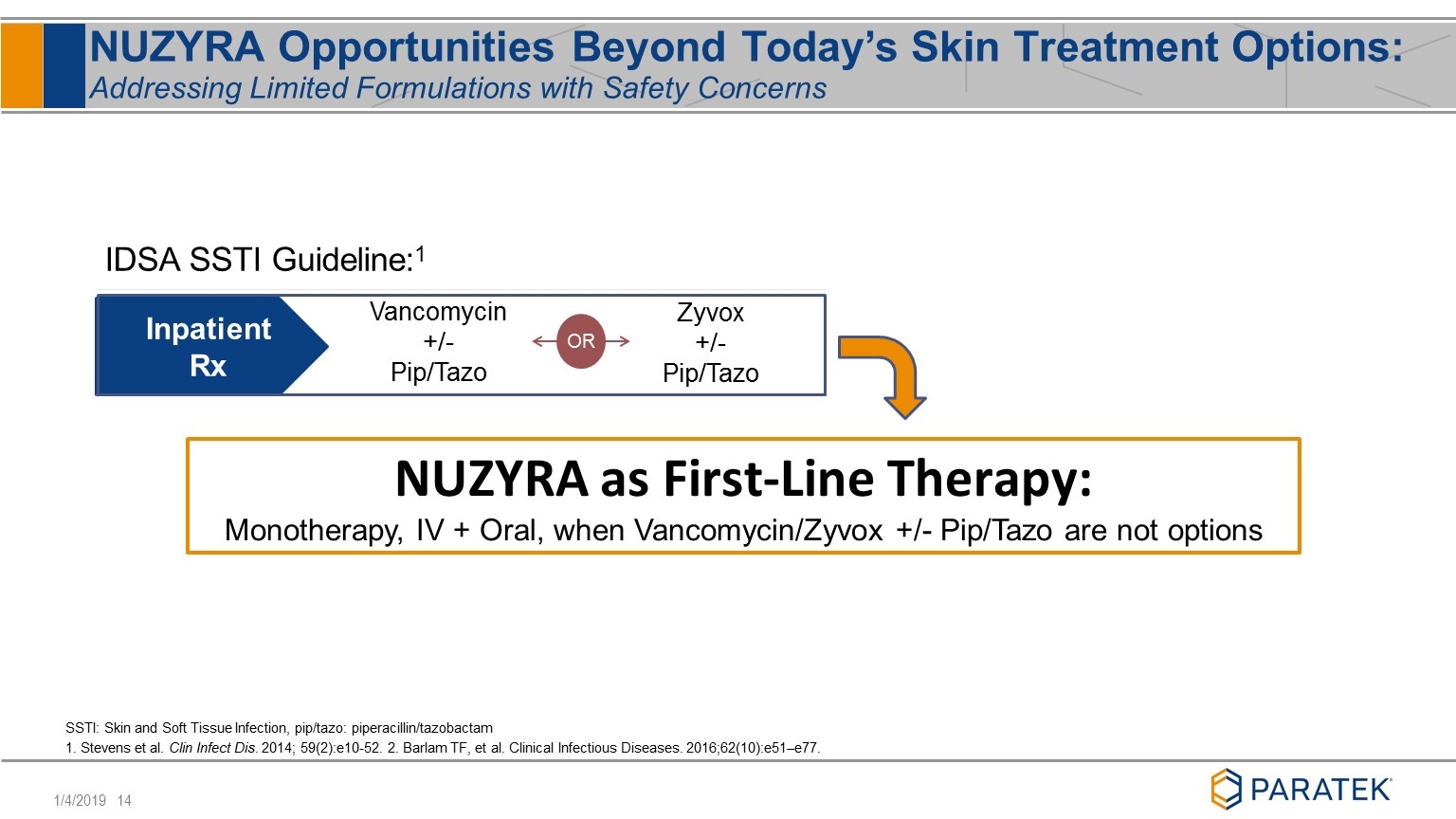

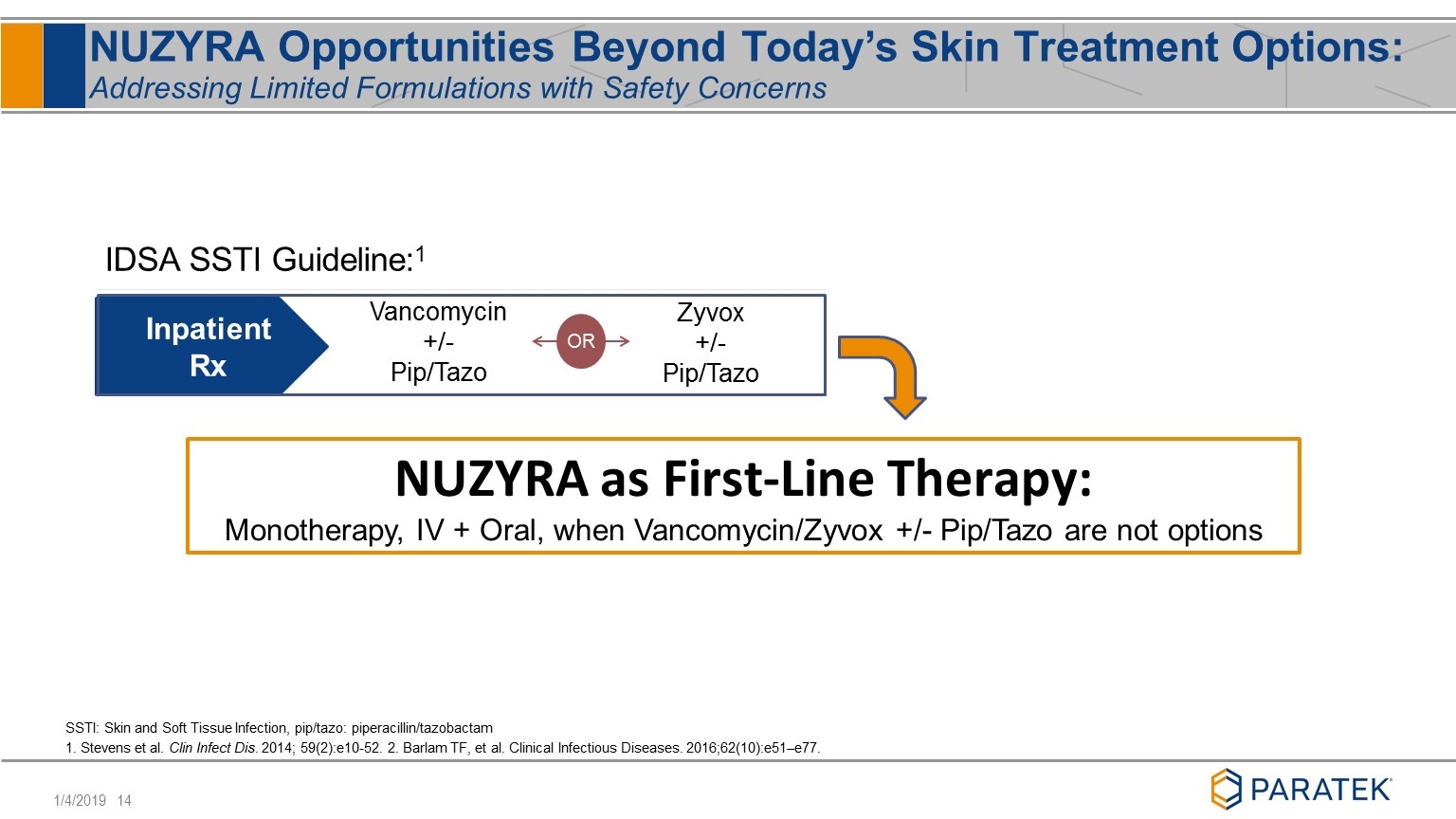

NUZYRA Opportunities Beyond Today’s Skin Treatment Options: Addressing Limited Formulations with Safety Concerns Vancomycin +/- Pip/Tazo Zyvox +/- Pip/Tazo Inpatient Rx OR NUZYRA as First-Line Therapy: Monotherapy, IV + Oral, when Vancomycin/Zyvox +/- Pip/Tazo are not options IDSA SSTI Guideline:1 SSTI: Skin and Soft Tissue Infection, pip/tazo: piperacillin/tazobactam 1. Stevens et al. Clin Infect Dis. 2014; 59(2):e10-52. 2. Barlam TF, et al. Clinical Infectious Diseases. 2016;62(10):e51–e77.

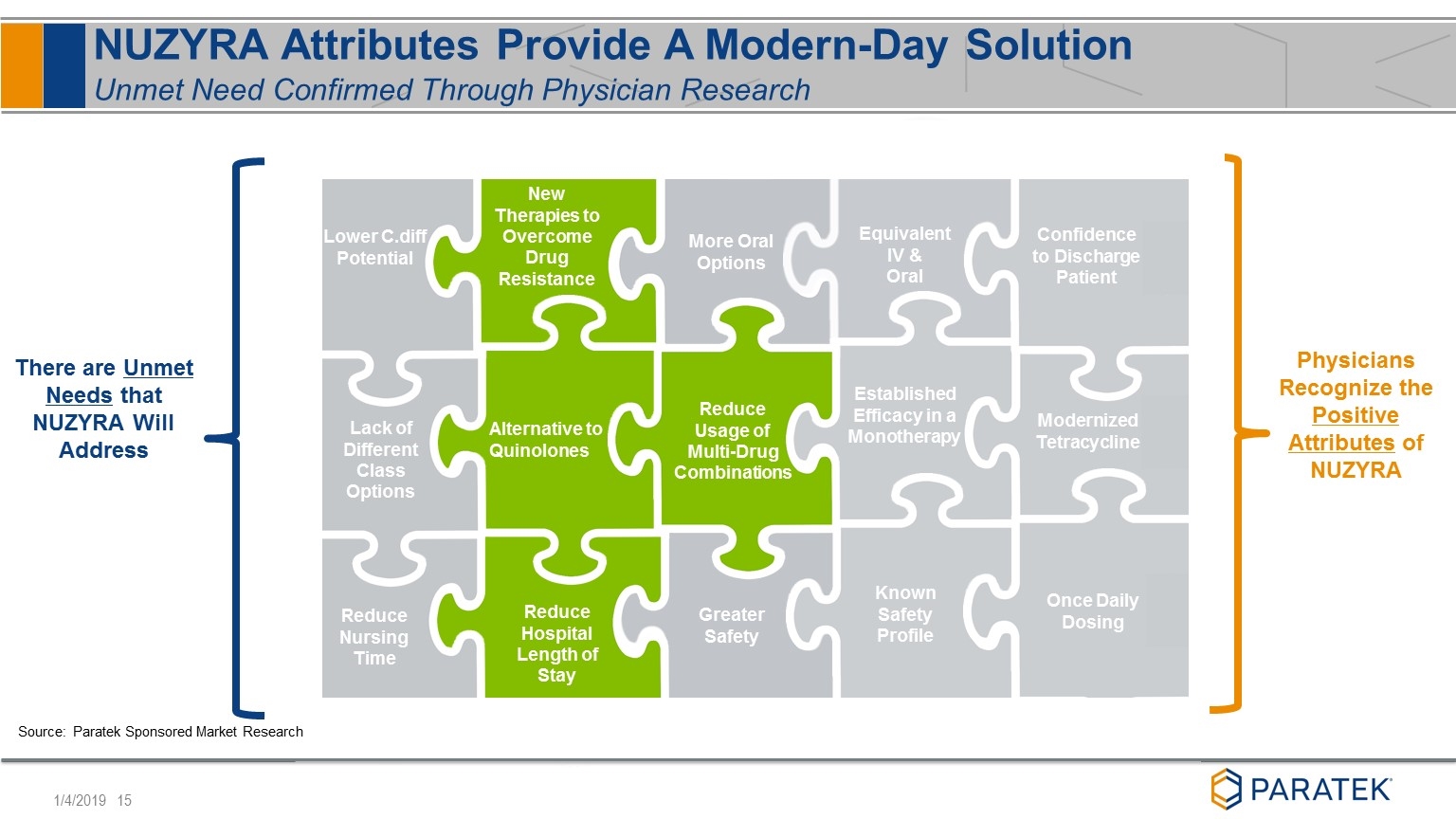

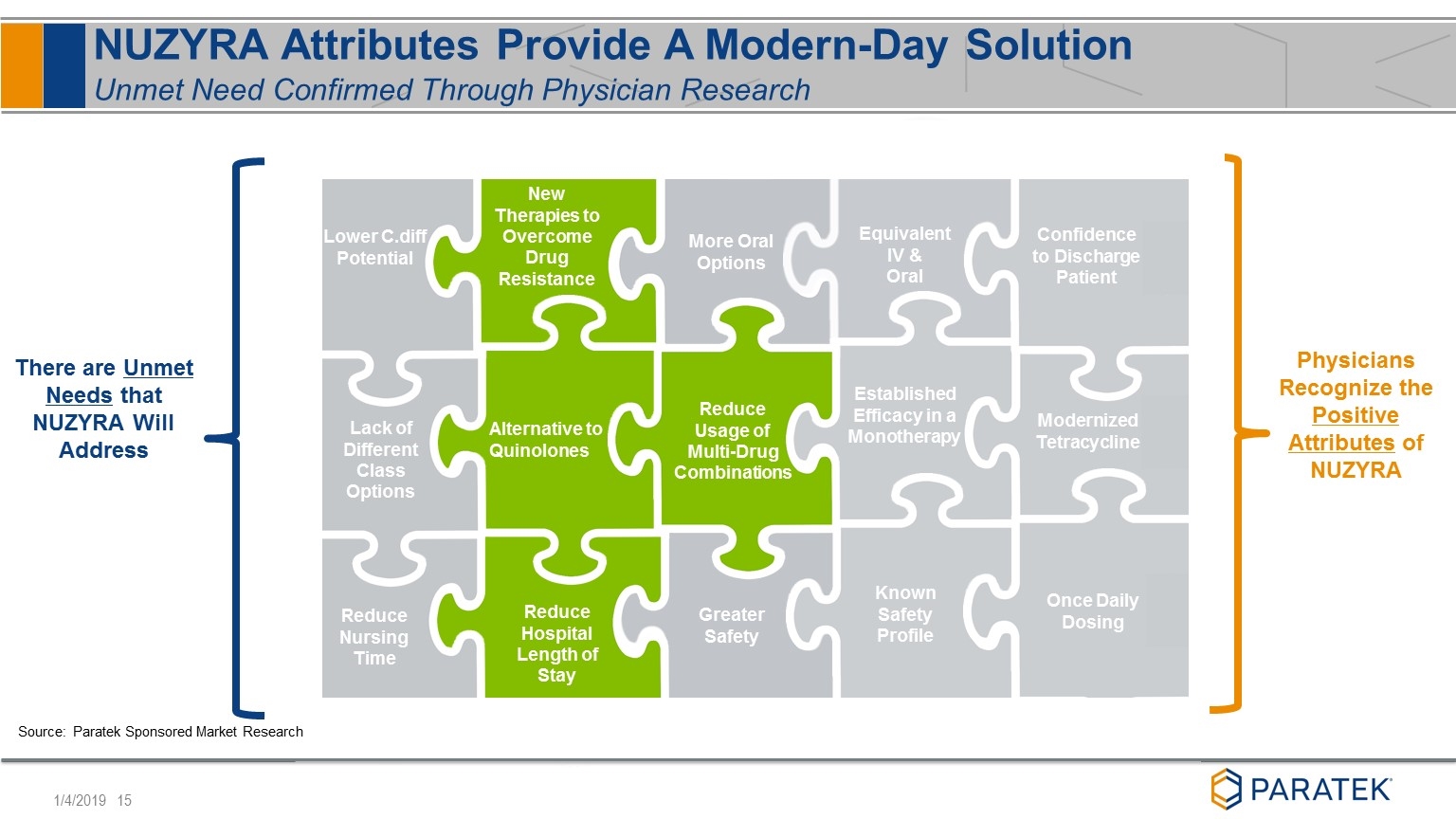

More Oral Options New Therapies to Overcome Drug Resistance Greater Safety Alternative to Quinolones There are Unmet Needs that NUZYRA Will Address Reduce Hospital Length of Stay Reduce Nursing Time Lack of Different Class Options Reduce Usage of Multi-Drug Combinations NUZYRA Attributes Provide A Modern-Day Solution Unmet Need Confirmed Through Physician Research Known Safety Profile Established Efficacy in a Monotherapy Equivalent IV & Oral Physicians Recognize the Positive Attributes of NUZYRA Modernized Tetracycline Confidence to Discharge Patient Once Daily Dosing Reduce Nursing Time Lower C.diff Potential Source: Paratek Sponsored Market Research Reduce Usage of Multi-Drug Combinations

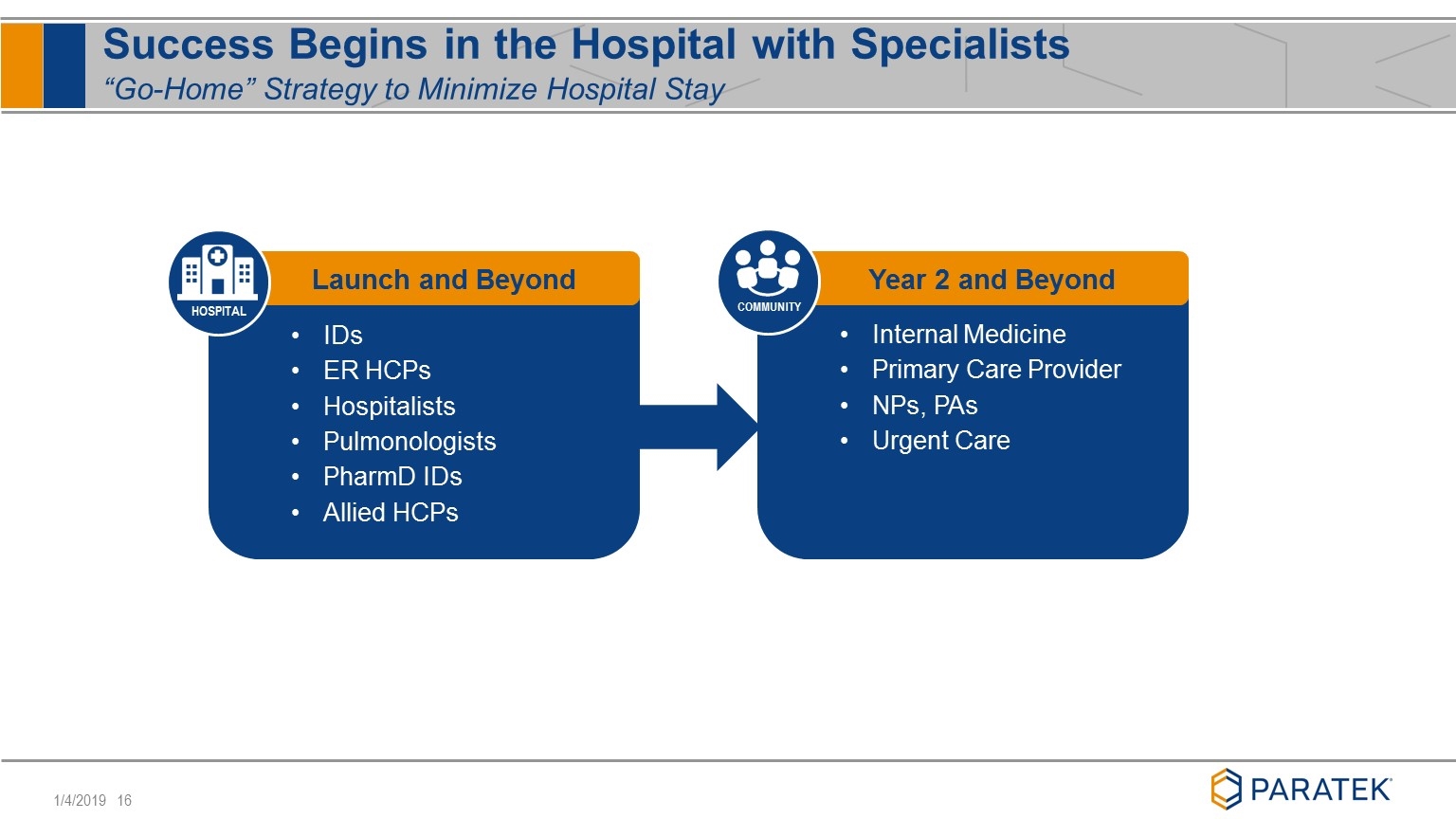

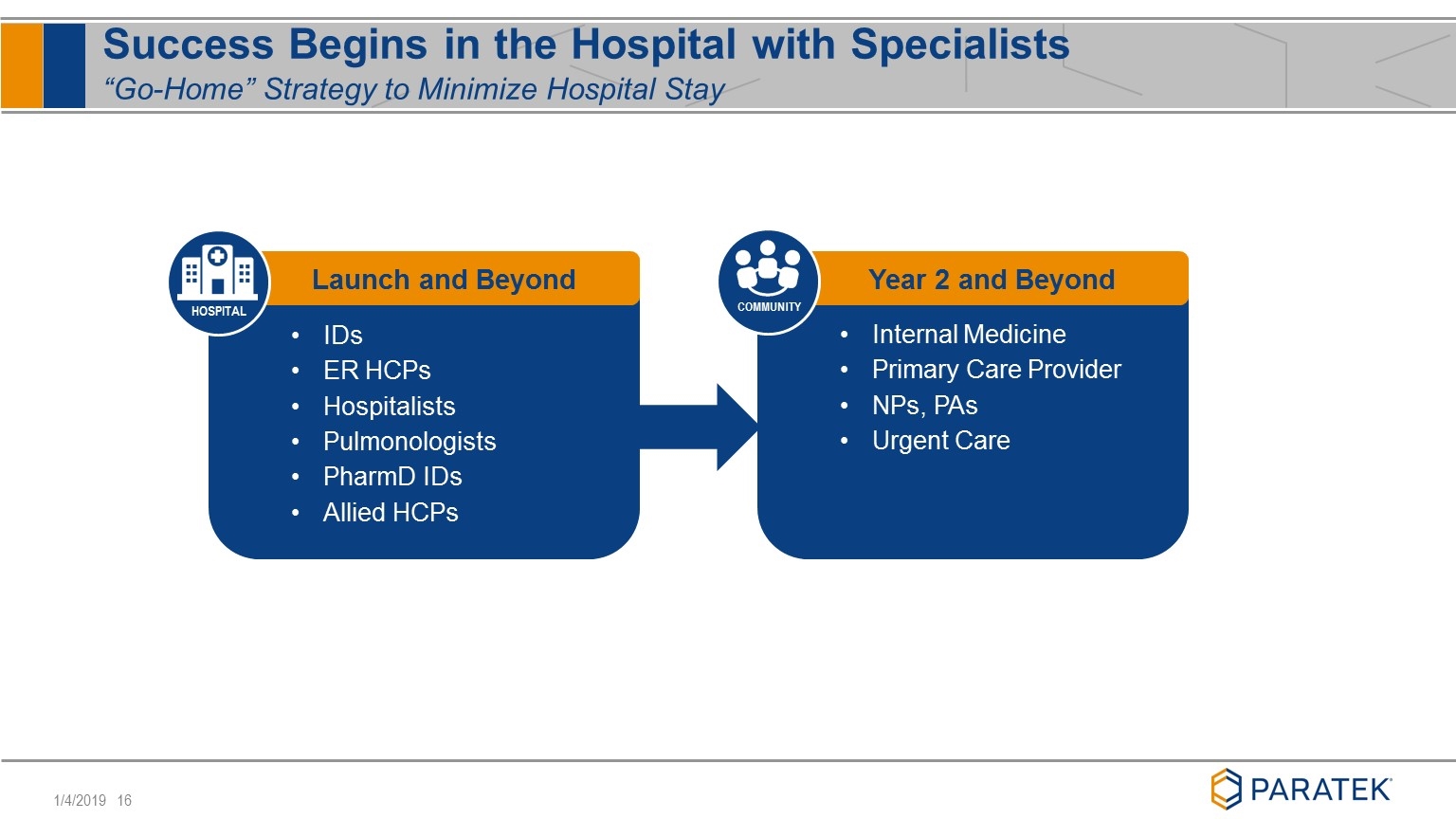

Success Begins in the Hospital with Specialists “Go-Home” Strategy to Minimize Hospital Stay IDs ER HCPs Hospitalists Pulmonologists PharmD IDs Allied HCPs Launch and Beyond HOSPITAL Internal Medicine Primary Care Provider NPs, PAs Urgent Care Year 2 and Beyond COMMUNITY

Paving The Path For a Successful Launch Market Access Followed by Commercial Execution for Demand Generation 2018 2019 2020 Oct ‘18 – Jan ‘19 Execution by Select Customer-Facing Team Contract negotiations Pre-orders Qualify key accounts Appointments February ‘19 - Forward Execution by Sales Force & Market Access Customer-Facing Teams Continue institutional access Demand generation

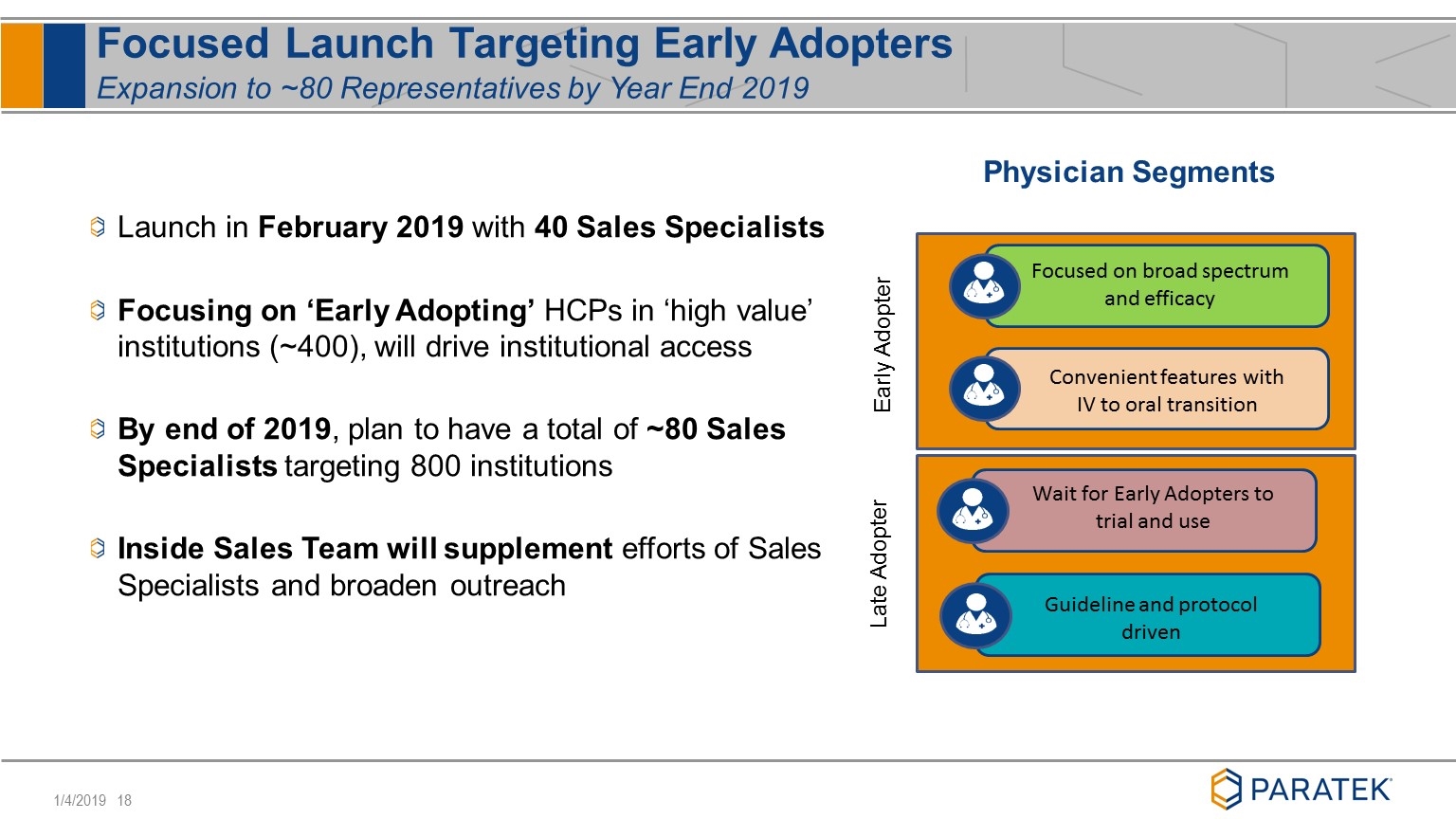

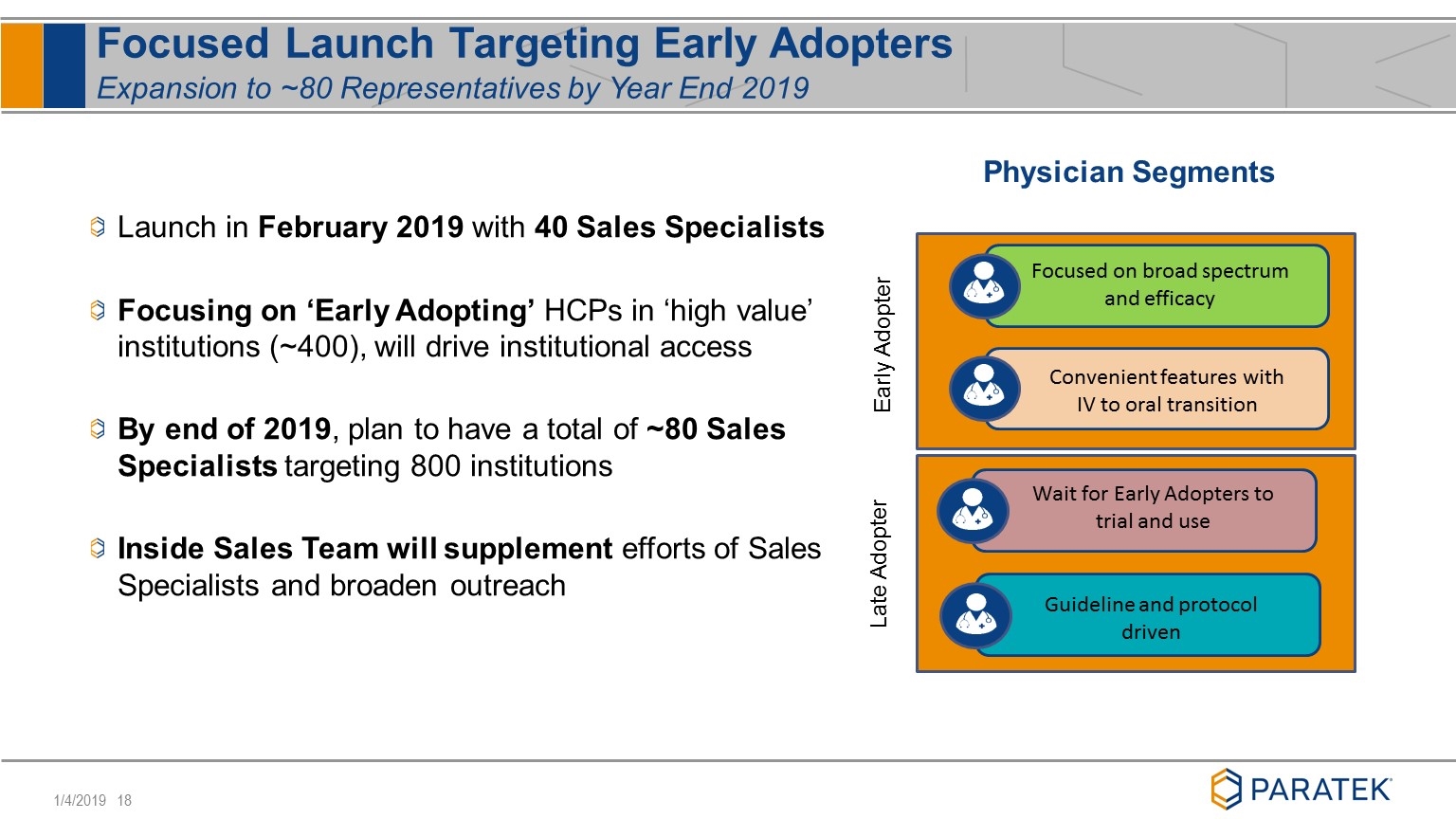

Focused Launch Targeting Early Adopters Expansion to ~80 Representatives by Year End 2019 Physician Segments Guideline and protocol driven Wait for Early Adopters to trial and use Convenient features with IV to oral transition Focused on broad spectrum and efficacy Launch in February 2019 with 40 Sales Specialists Focusing on ‘Early Adopting’ HCPs in ‘high value’ institutions (~400), will drive institutional access By end of 2019, plan to have a total of ~80 Sales Specialists targeting 800 institutions Inside Sales Team will supplement efforts of Sales Specialists and broaden outreach Early Adopter Late Adopter

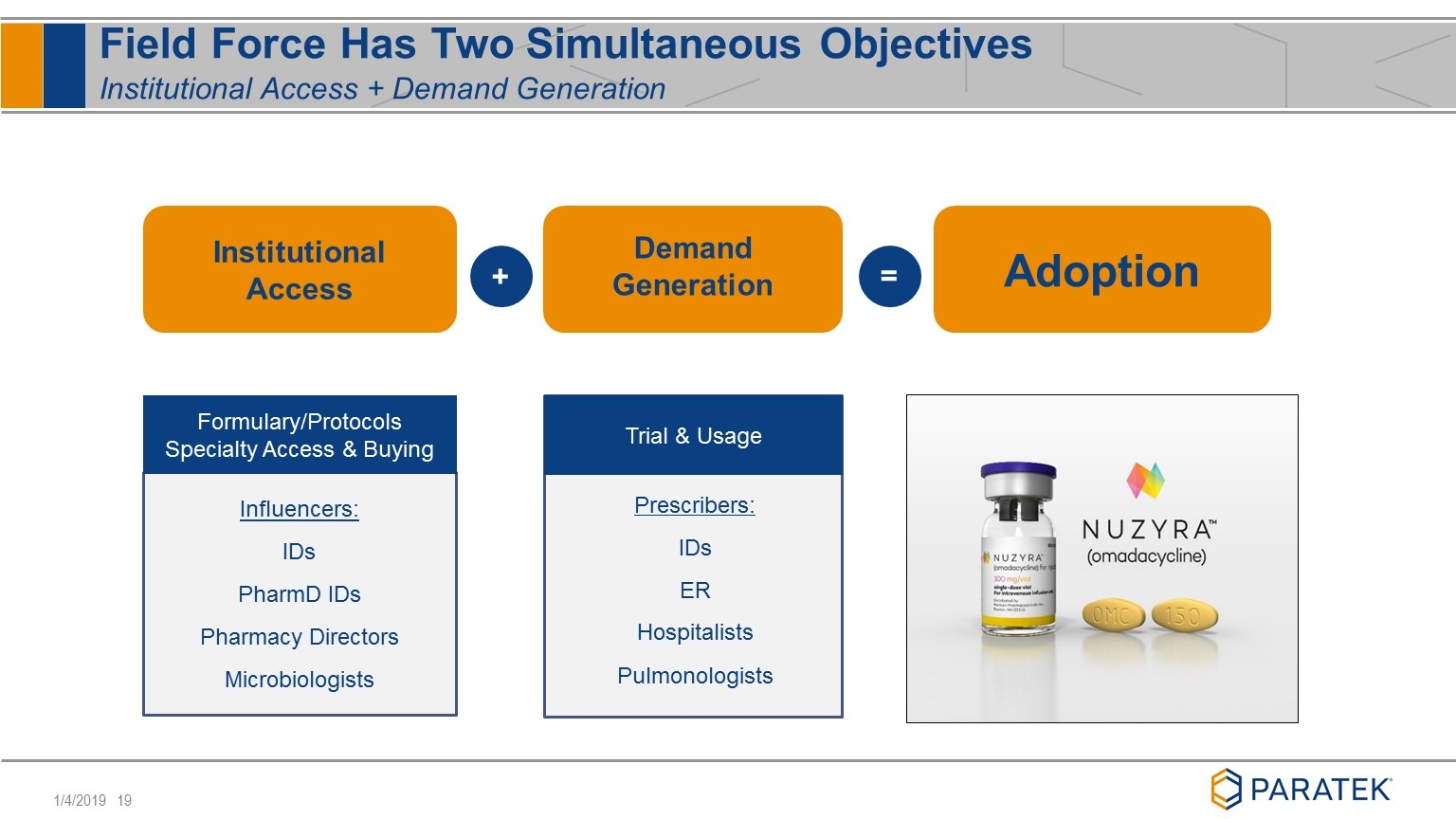

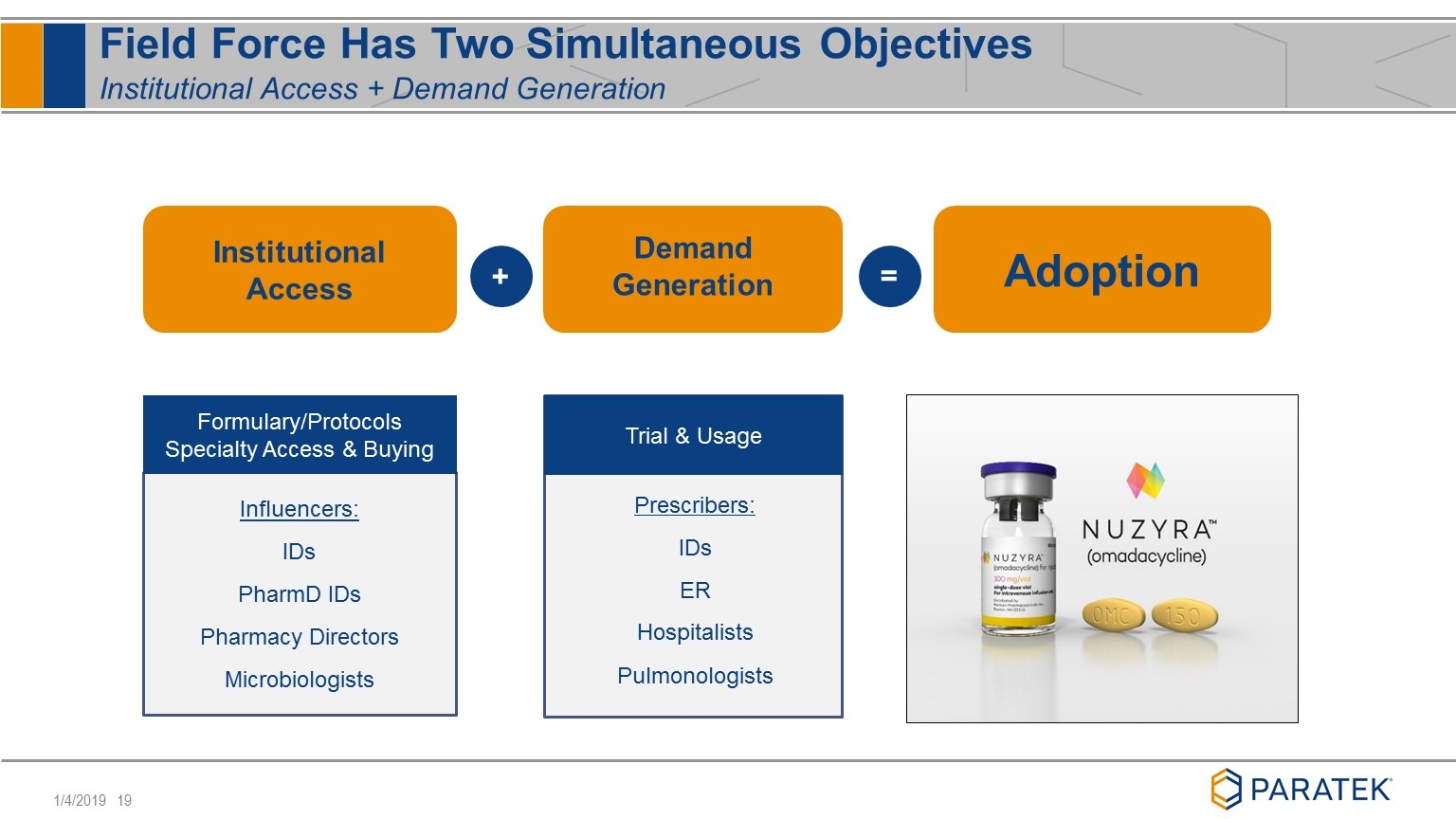

Influencers: IDs PharmD IDs Pharmacy Directors Microbiologists = Field Force Has Two Simultaneous Objectives Institutional Access + Demand Generation Adoption Formulary/Protocols Specialty Access & Buying + Institutional Access Prescribers: IDs ER Hospitalists Pulmonologists Trial & Usage Demand Generation

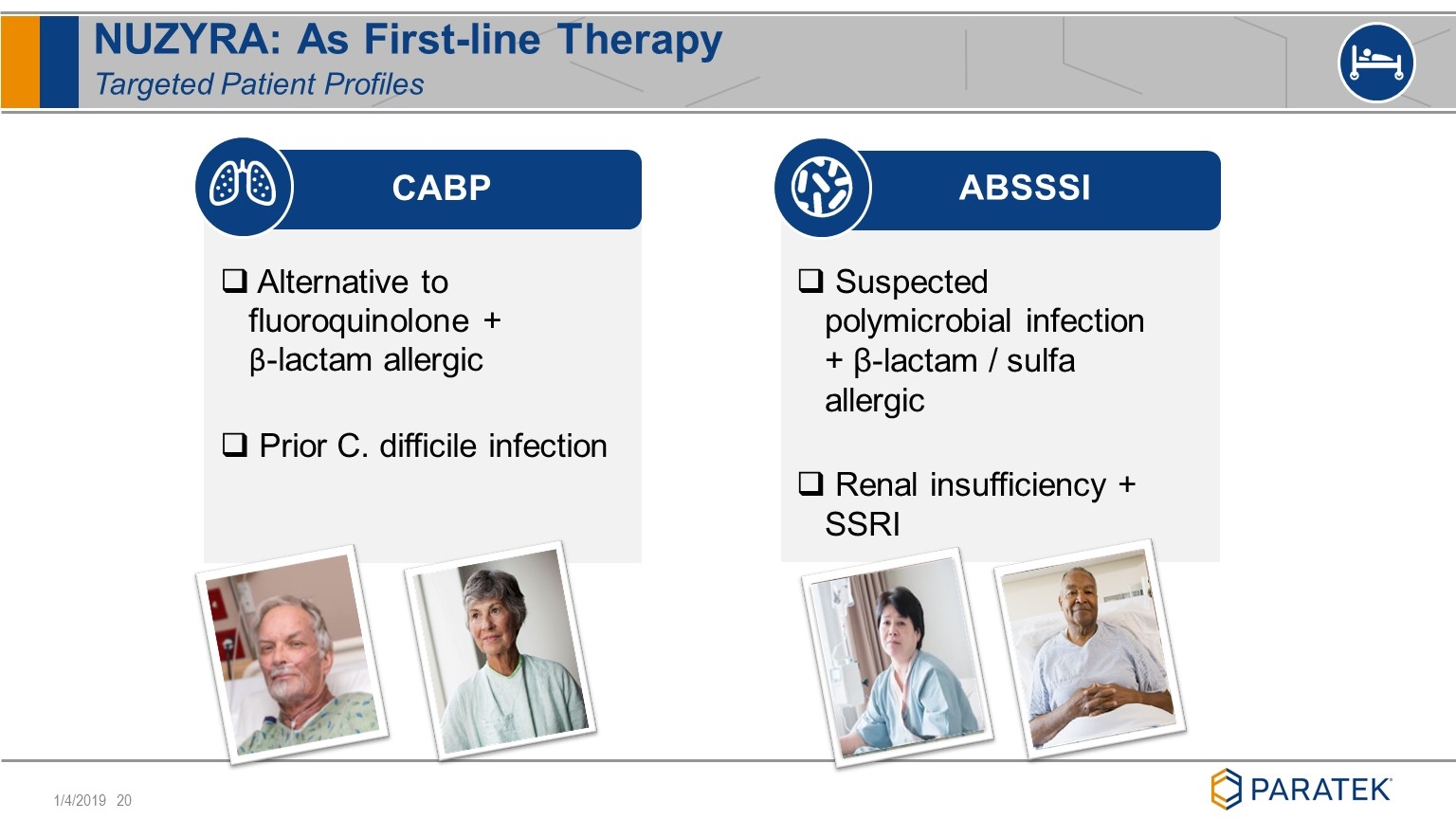

NUZYRA: As First-line Therapy Targeted Patient Profiles CABP ABSSSI Alternative to fluoroquinolone + β-lactam allergic Prior C. difficile infection Suspected polymicrobial infection + β-lactam / sulfa allergic Renal insufficiency + SSRI

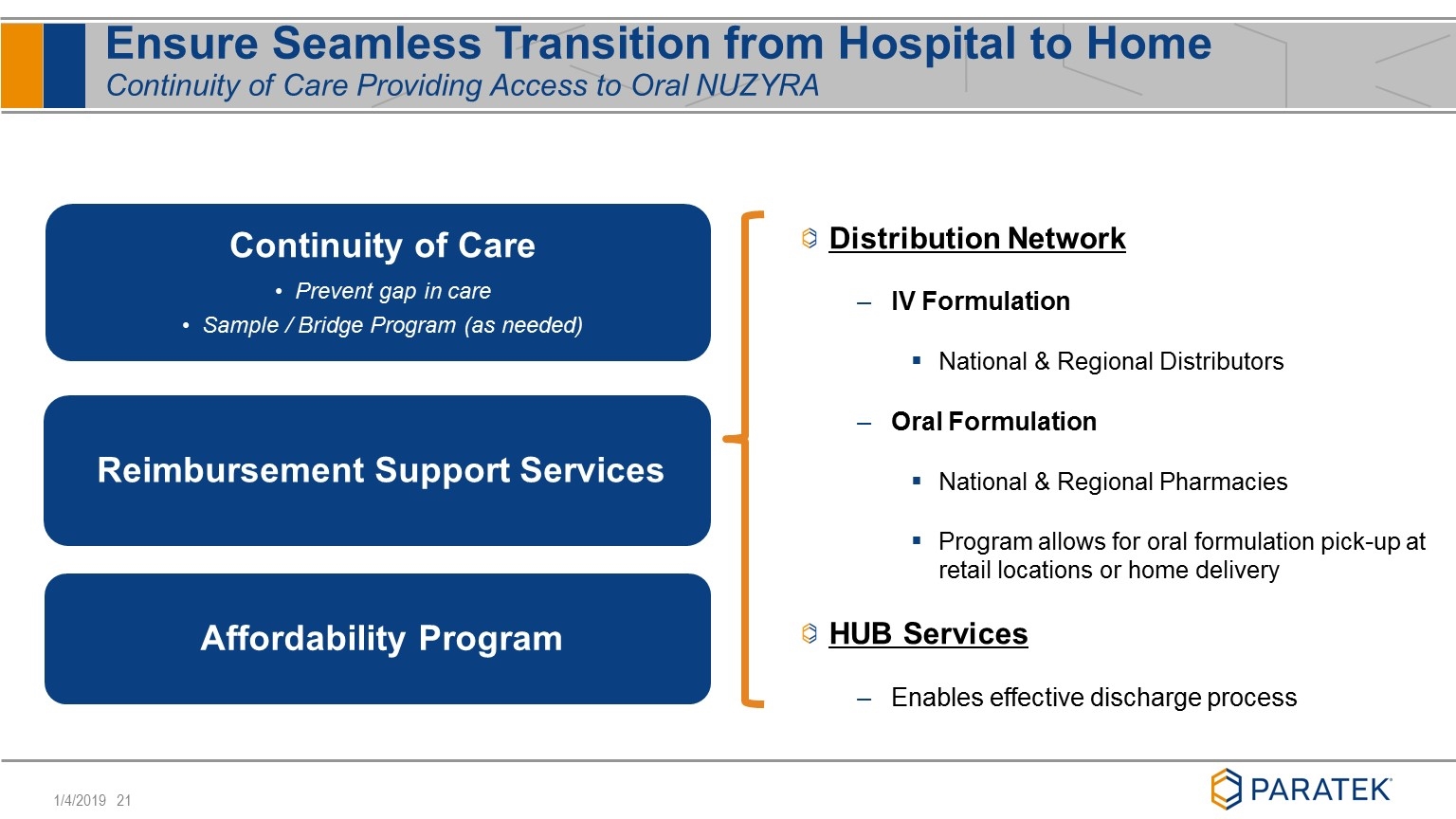

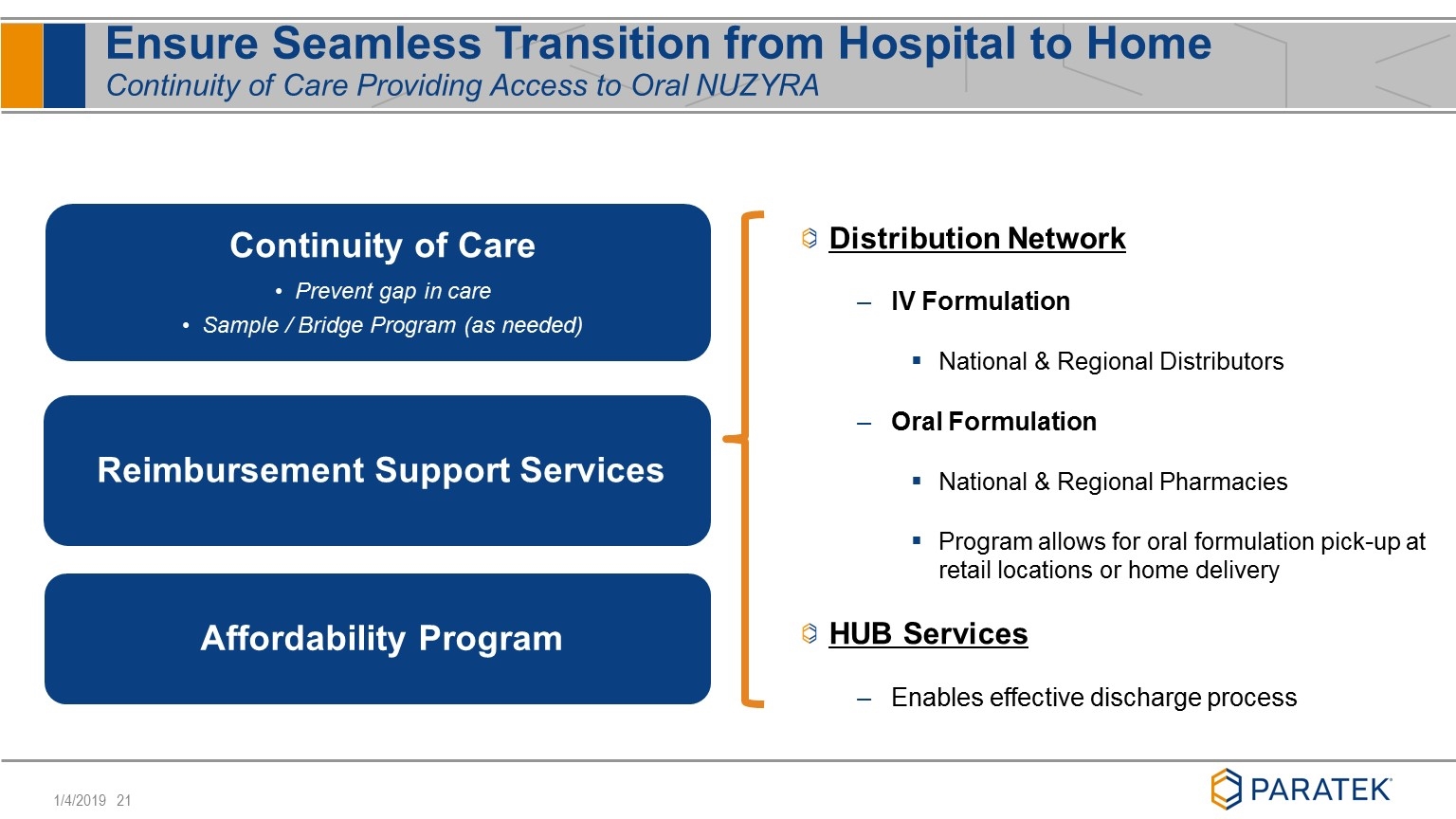

Ensure Seamless Transition from Hospital to Home Continuity of Care Providing Access to Oral NUZYRA Continuity of Care Prevent gap in care Sample / Bridge Program (as needed) Reimbursement Support Services Affordability Program 3 Distribution Network IV Formulation National & Regional Distributors Oral Formulation National & Regional Pharmacies Program allows for oral formulation pick-up at retail locations or home delivery HUB Services Enables effective discharge process

IV & Oral NUZYRA Packaging Easy-to-Use Packs Designed for Patient Convenience

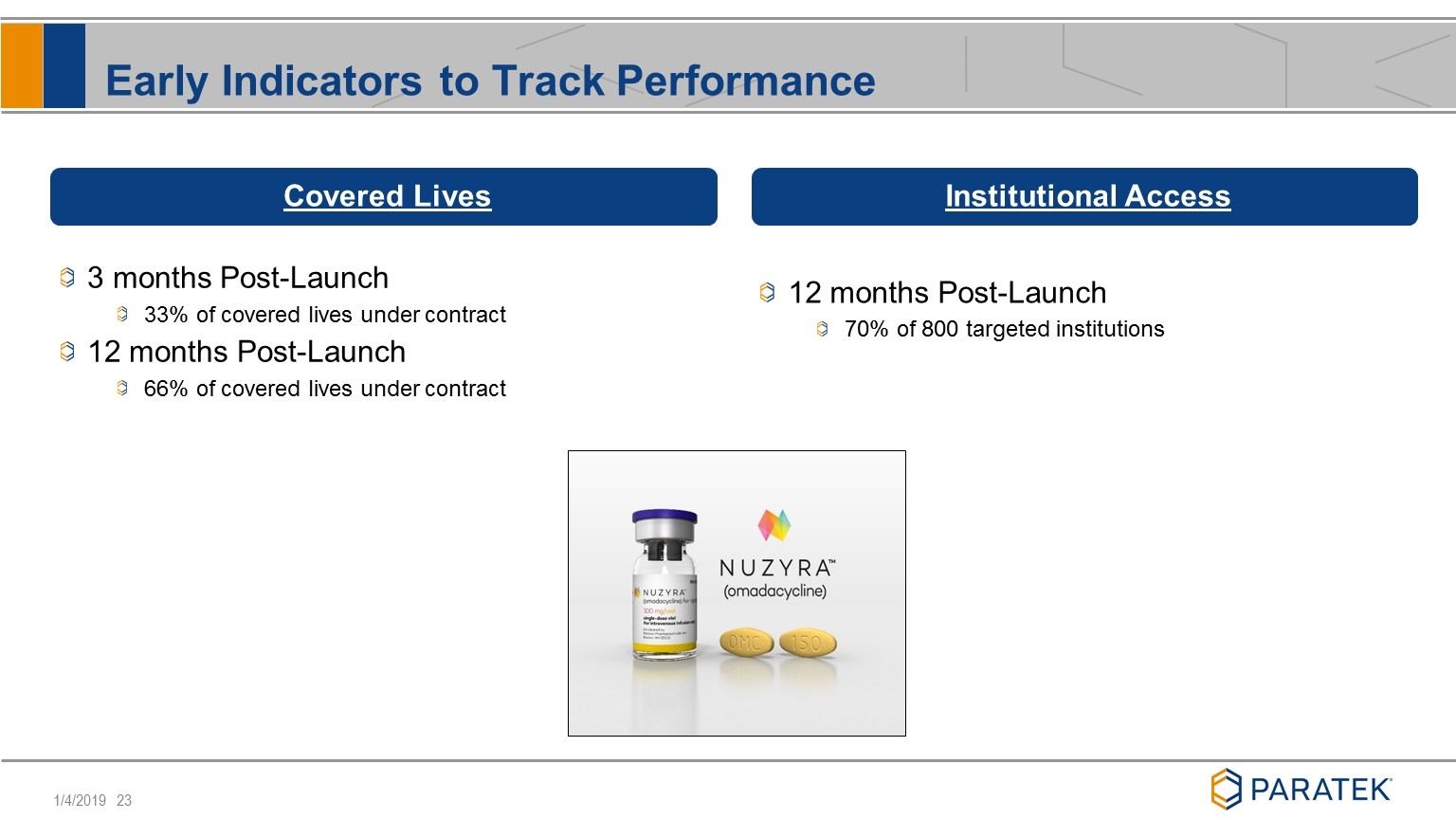

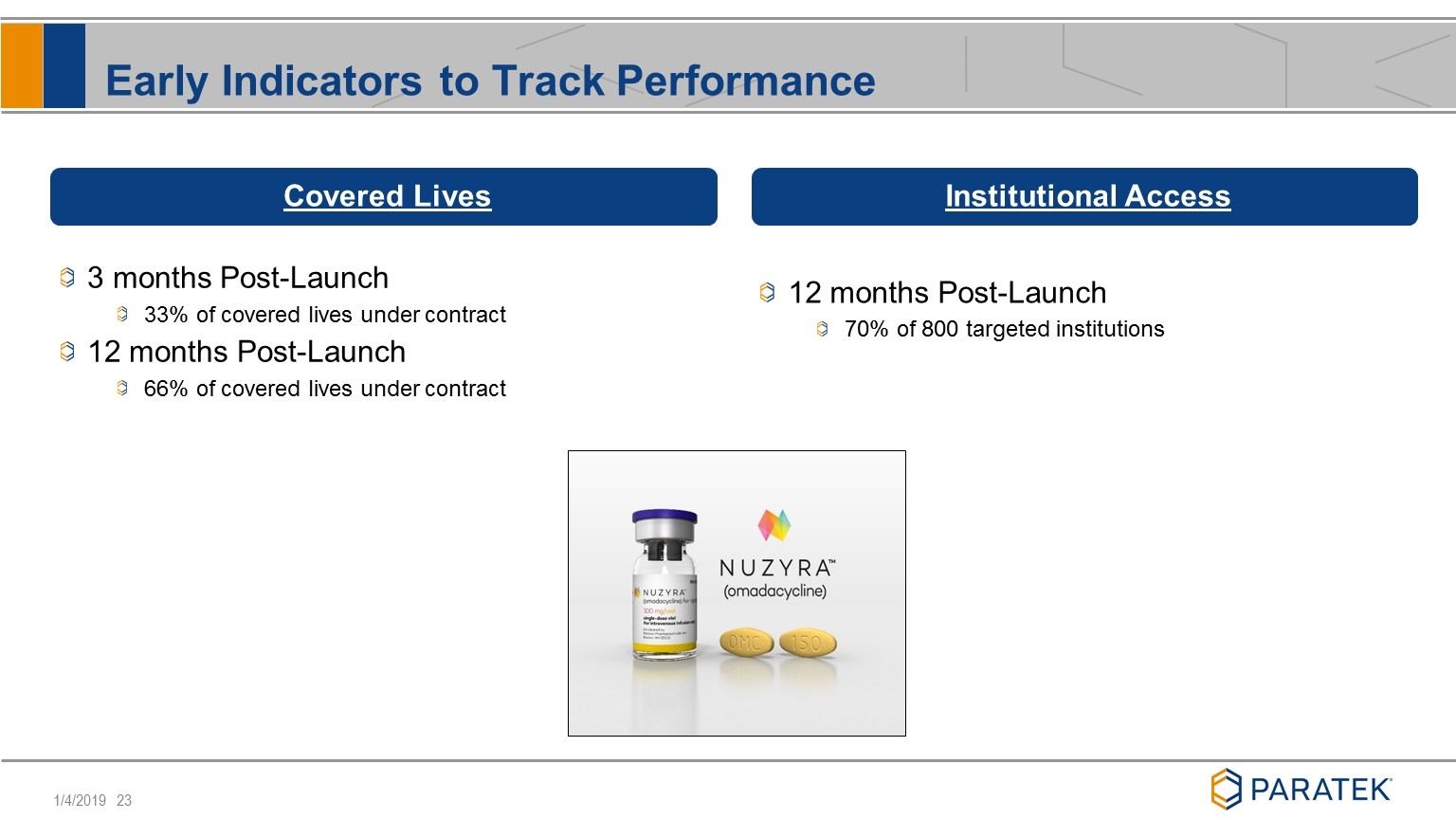

Early Indicators to Track Performance 1 Covered Lives Institutional Access 3 months Post-Launch 33% of covered lives under contract 12 months Post-Launch 66% of covered lives under contract 12 months Post-Launch 70% of 800 targeted institutions

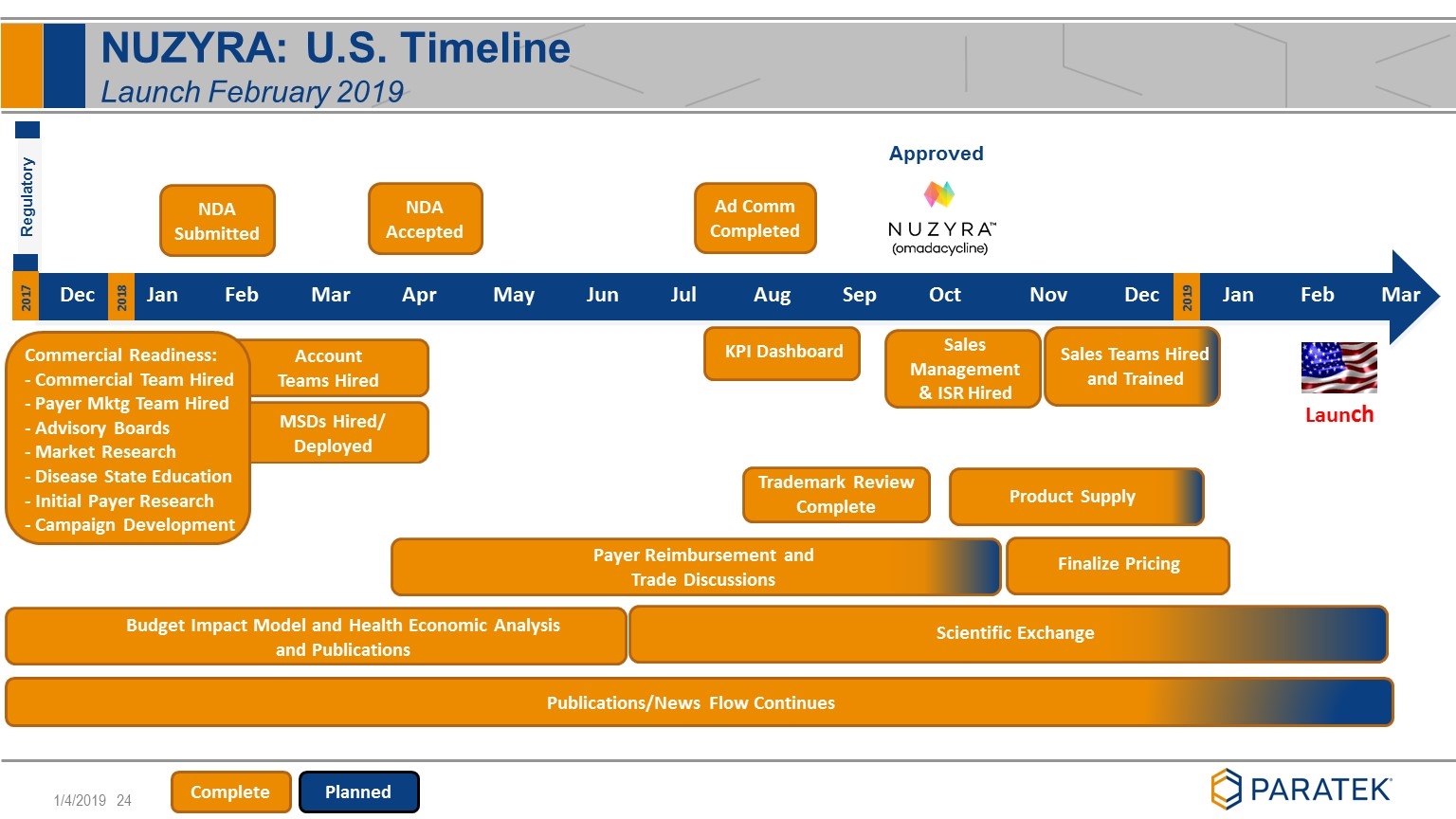

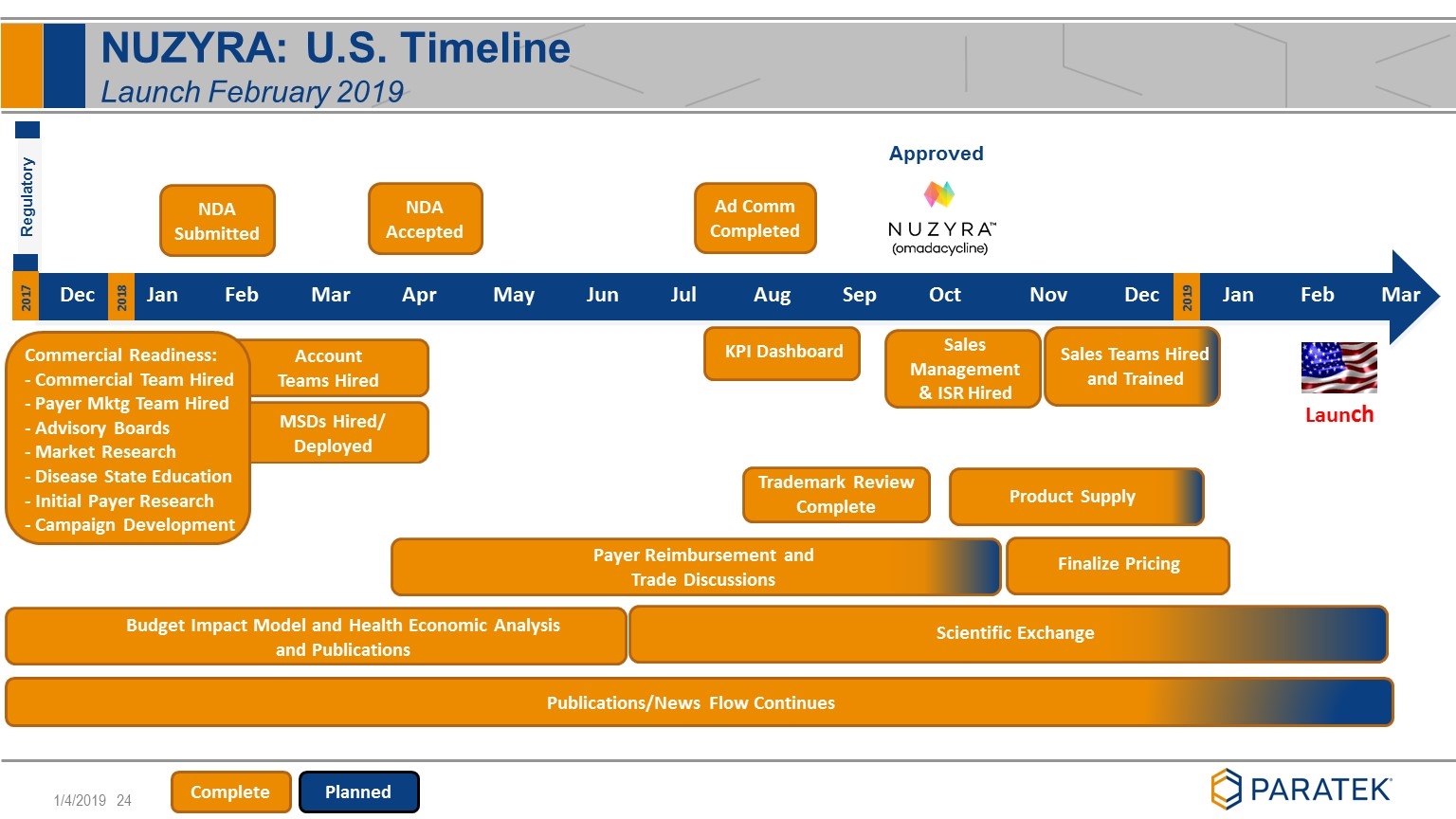

MSDs Hired/ Deployed NDA Submitted NDA Accepted Payer Reimbursement and Trade Discussions Finalize Pricing Scientific Exchange Account Teams Hired Publications/News Flow Continues KPI Dashboard Budget Impact Model and Health Economic Analysis and Publications Sales Teams Hired and Trained Regulatory Product Supply Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 2017 2018 2019 Commercial Readiness: - Commercial Team Hired - Payer Mktg Team Hired - Advisory Boards - Market Research - Disease State Education - Initial Payer Research - Campaign Development Launch Complete Planned NUZYRA: U.S. Timeline Launch February 2019 Trademark Review Complete Sales Management & ISR Hired Approved Ad Comm Completed

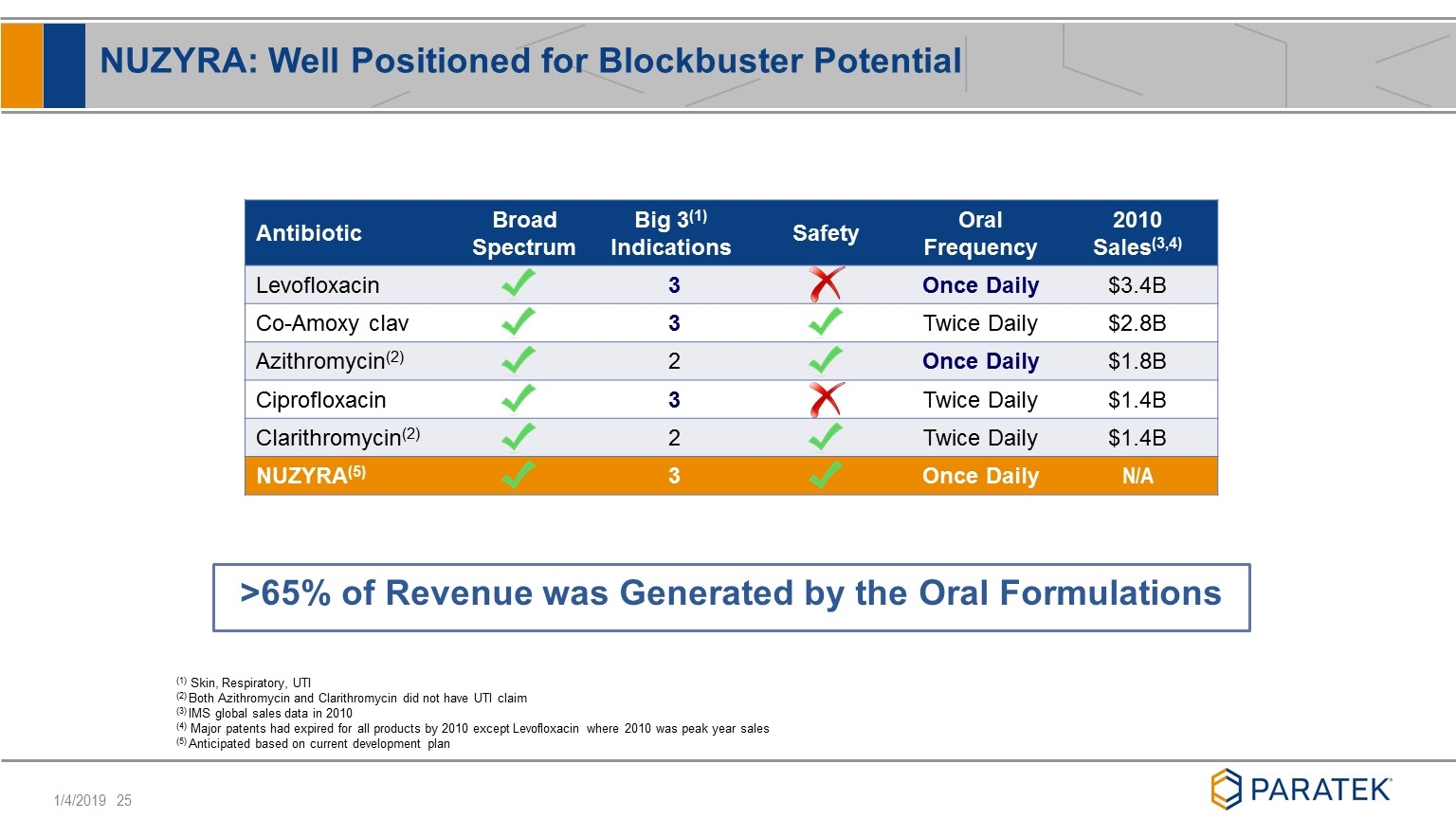

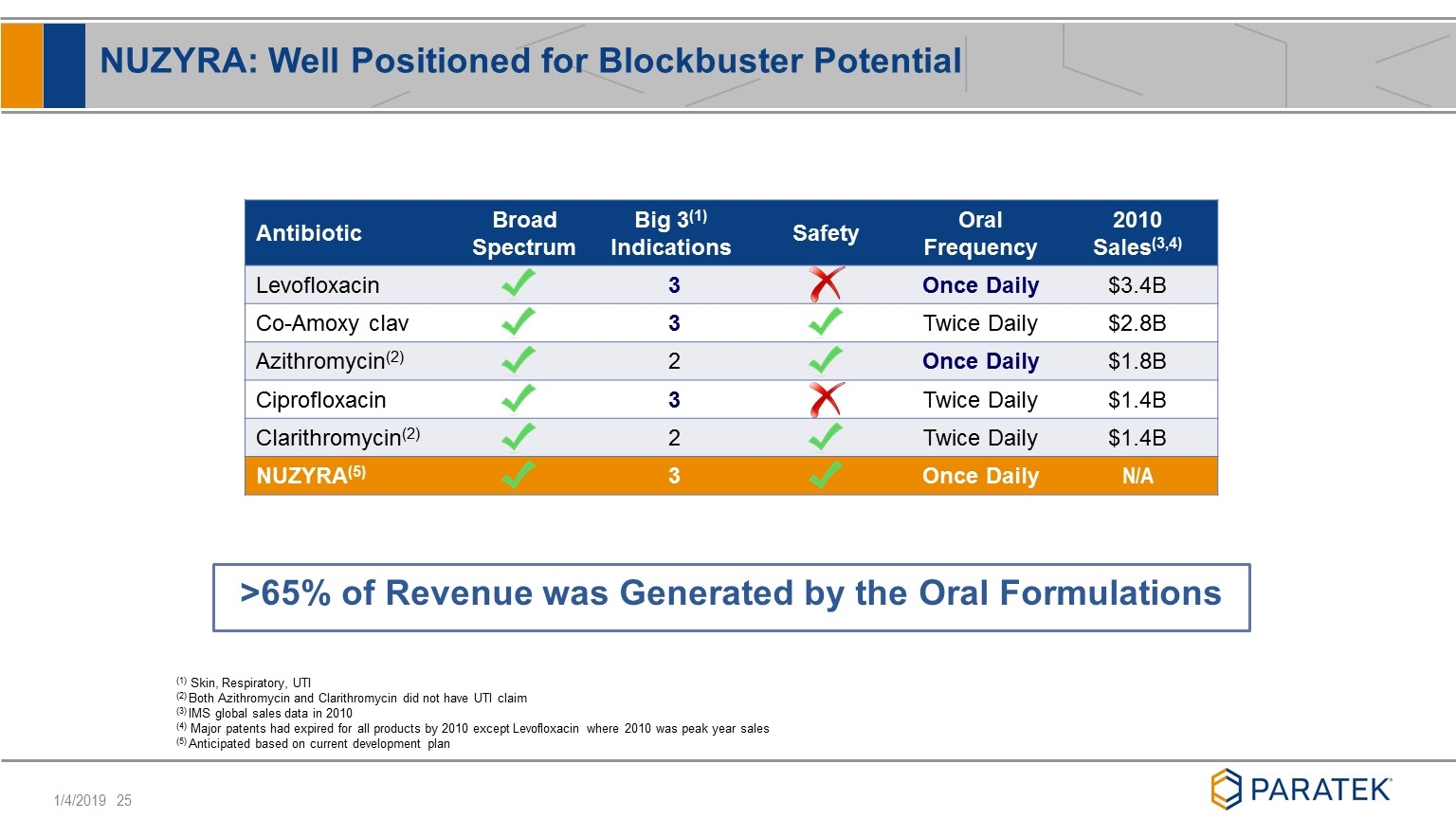

NUZYRA: Well Positioned for Blockbuster Potential Antibiotic Broad Spectrum Big 3(1) Indications Safety Oral Frequency 2010 Sales(3,4) Levofloxacin 3 Once Daily $3.4B Co-Amoxy clav 3 Twice Daily $2.8B Azithromycin(2) 2 Once Daily $1.8B Ciprofloxacin 3 Twice Daily $1.4B Clarithromycin(2) 2 Twice Daily $1.4B NUZYRA(5) 3 Once Daily N/A (1) Skin, Respiratory, UTI (2) Both Azithromycin and Clarithromycin did not have UTI claim (3) IMS global sales data in 2010 (4) Major patents had expired for all products by 2010 except Levofloxacin where 2010 was peak year sales (5) Anticipated based on current development plan >65% of Revenue was Generated by the Oral Formulations

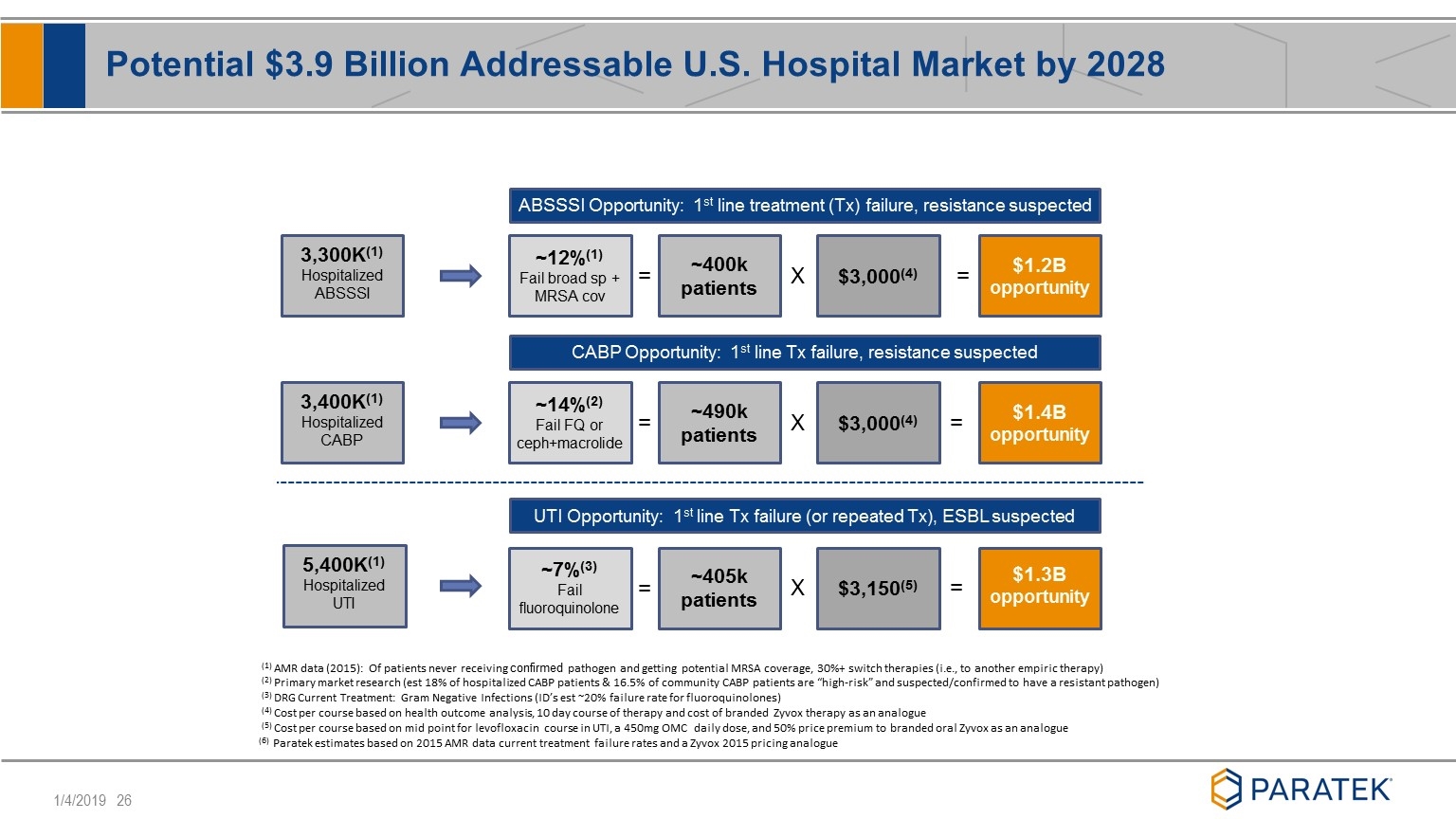

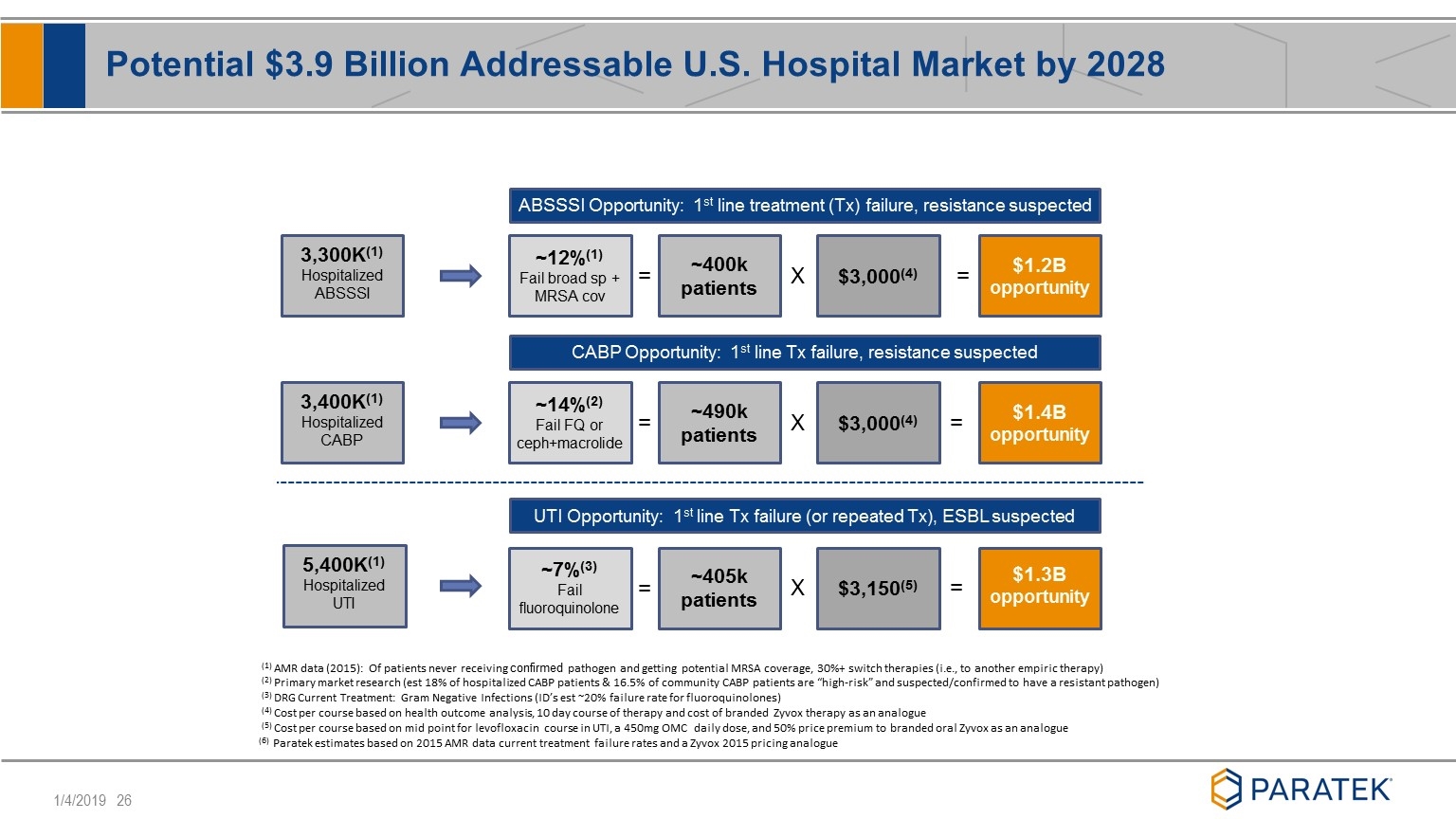

Potential $3.9 Billion Addressable U.S. Hospital Market by 2028 ABSSSI Opportunity: 1st line treatment (Tx) failure, resistance suspected CABP Opportunity: 1st line Tx failure, resistance suspected UTI Opportunity: 1st line Tx failure (or repeated Tx), ESBL suspected = = X = X = = X = ~12%(1) Fail broad sp + MRSA cov ~14%(2) Fail FQ or ceph+macrolide ~7%(3) Fail fluoroquinolone ~400k patients ~490k patients ~405k patients $3,000(4) $3,000(4) $3,150(5) $1.2B opportunity $1.4B opportunity $1.3B opportunity (1) AMR data (2015): Of patients never receiving confirmed pathogen and getting potential MRSA coverage, 30%+ switch therapies (i.e., to another empiric therapy) (2) Primary market research (est 18% of hospitalized CABP patients & 16.5% of community CABP patients are “high-risk” and suspected/confirmed to have a resistant pathogen) (3) DRG Current Treatment: Gram Negative Infections (ID’s est ~20% failure rate for fluoroquinolones) (4) Cost per course based on health outcome analysis, 10 day course of therapy and cost of branded Zyvox therapy as an analogue (5) Cost per course based on mid point for levofloxacin course in UTI, a 450mg OMC daily dose, and 50% price premium to branded oral Zyvox as an analogue (6) Paratek estimates based on 2015 AMR data current treatment failure rates and a Zyvox 2015 pricing analogue 3,300K(1) Hospitalized ABSSSI 3,400K(1) Hospitalized CABP 5,400K(1) Hospitalized UTI

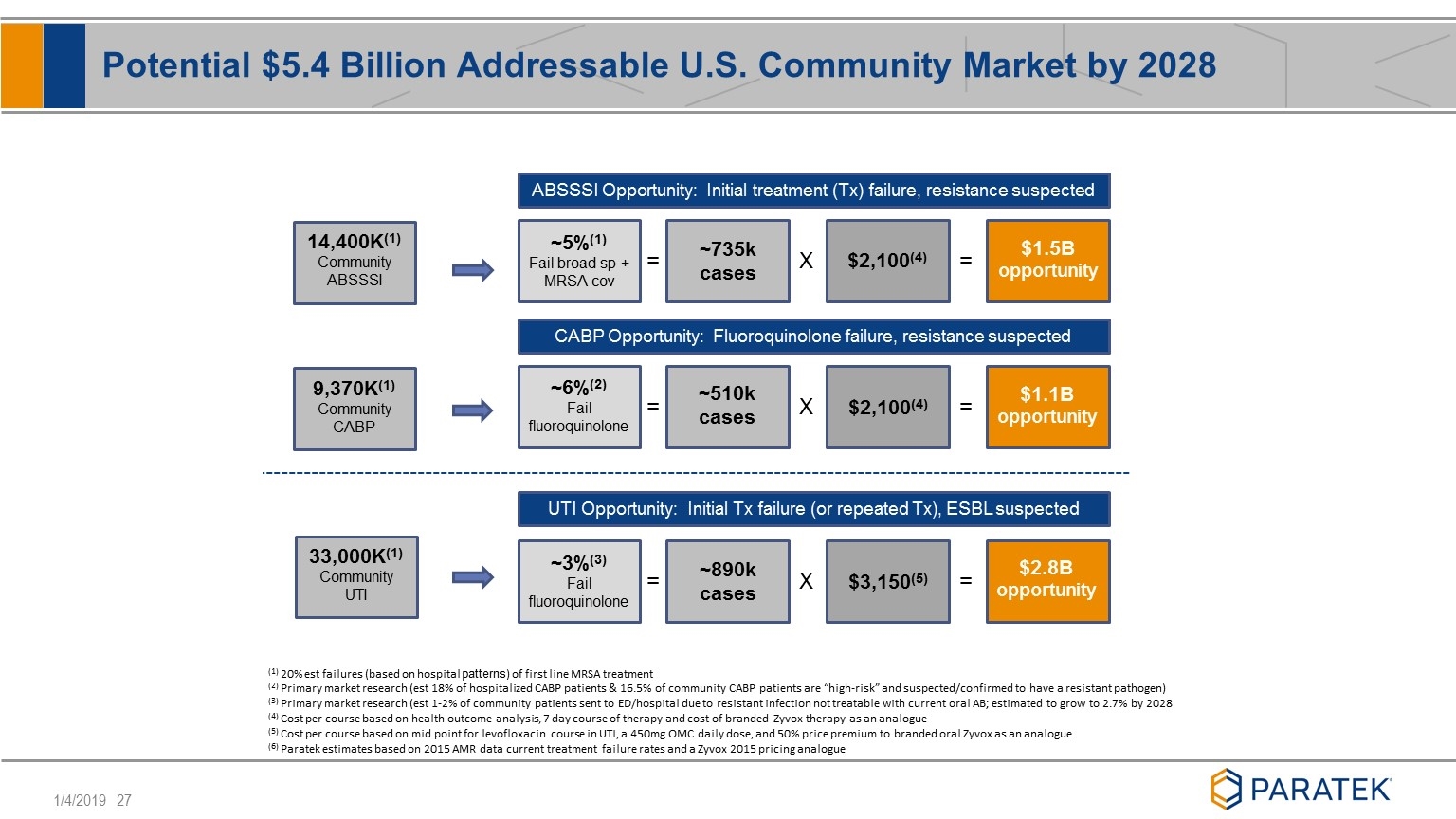

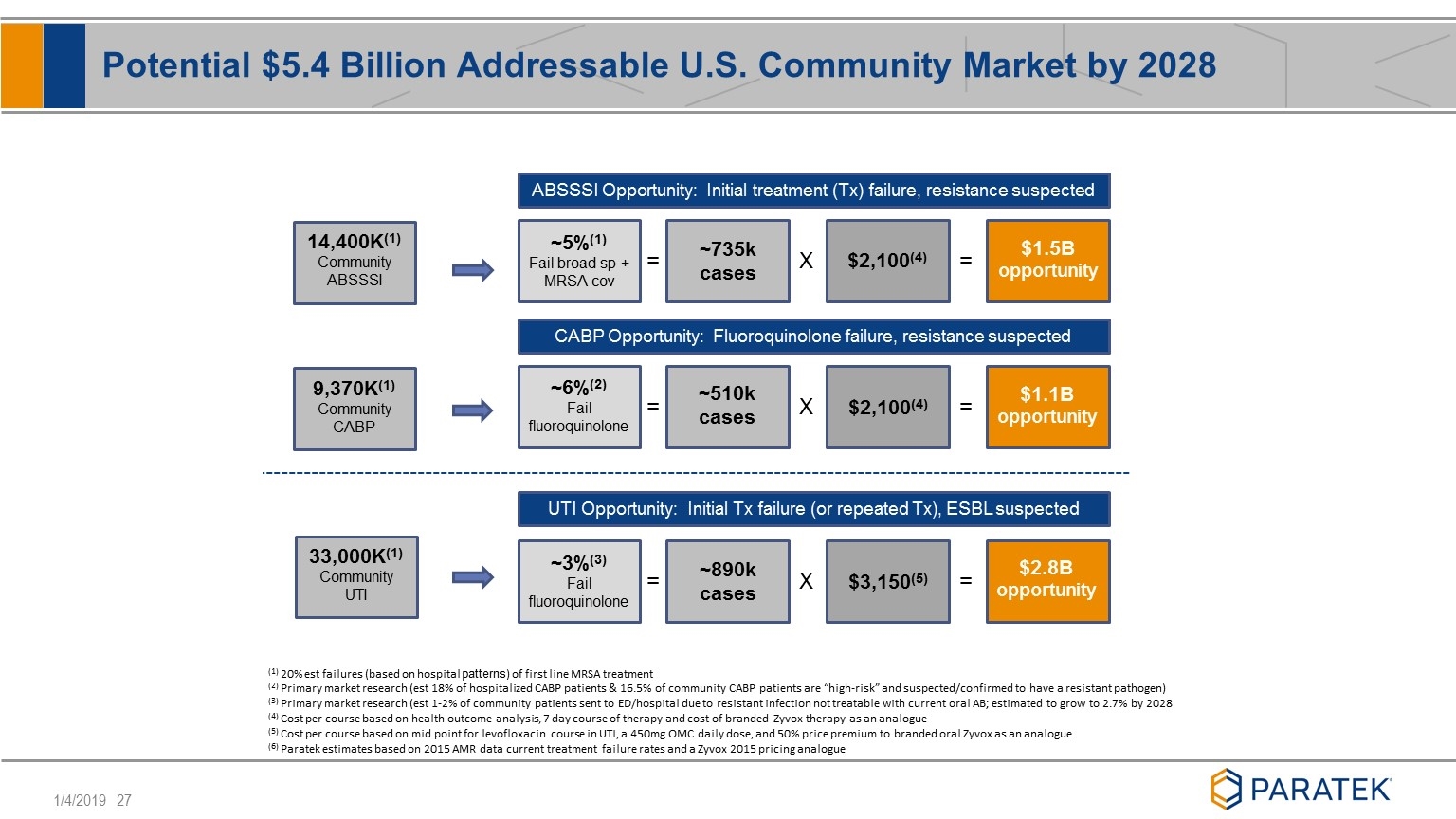

ABSSSI Opportunity: Initial treatment (Tx) failure, resistance suspected CABP Opportunity: Fluoroquinolone failure, resistance suspected UTI Opportunity: Initial Tx failure (or repeated Tx), ESBL suspected = X = = X = = X = ~5%(1) Fail broad sp + MRSA cov ~6%(2) Fail fluoroquinolone ~3%(3) Fail fluoroquinolone ~735k cases ~510k cases ~890k cases $3,150(5) $2,100(4) $2,100(4) $1.5B opportunity $1.1B opportunity $2.8B opportunity (1) 20% est failures (based on hospital patterns) of first line MRSA treatment (2) Primary market research (est 18% of hospitalized CABP patients & 16.5% of community CABP patients are “high-risk” and suspected/confirmed to have a resistant pathogen) (3) Primary market research (est 1-2% of community patients sent to ED/hospital due to resistant infection not treatable with current oral AB; estimated to grow to 2.7% by 2028 (4) Cost per course based on health outcome analysis, 7 day course of therapy and cost of branded Zyvox therapy as an analogue (5) Cost per course based on mid point for levofloxacin course in UTI, a 450mg OMC daily dose, and 50% price premium to branded oral Zyvox as an analogue (6) Paratek estimates based on 2015 AMR data current treatment failure rates and a Zyvox 2015 pricing analogue 14,400K(1) Community ABSSSI 9,370K(1) Community CABP 33,000K(1) Community UTI Potential $5.4 Billion Addressable U.S. Community Market by 2028

NUYZRA Product Guidance and Cash Position

History Can Repeat Itself… Today: Slower starts…But with the Right Attributes, a Strong Finish Recent AB Launches: antibiotics launched since 2010 that have at least 36 months of data - Avycaz, Dalvance, Orbactiv, Sivextro, Teflaro, & Zerbaxa (does not include Dificid or new formulations/line extensions) *MAT = 12-month rolling total

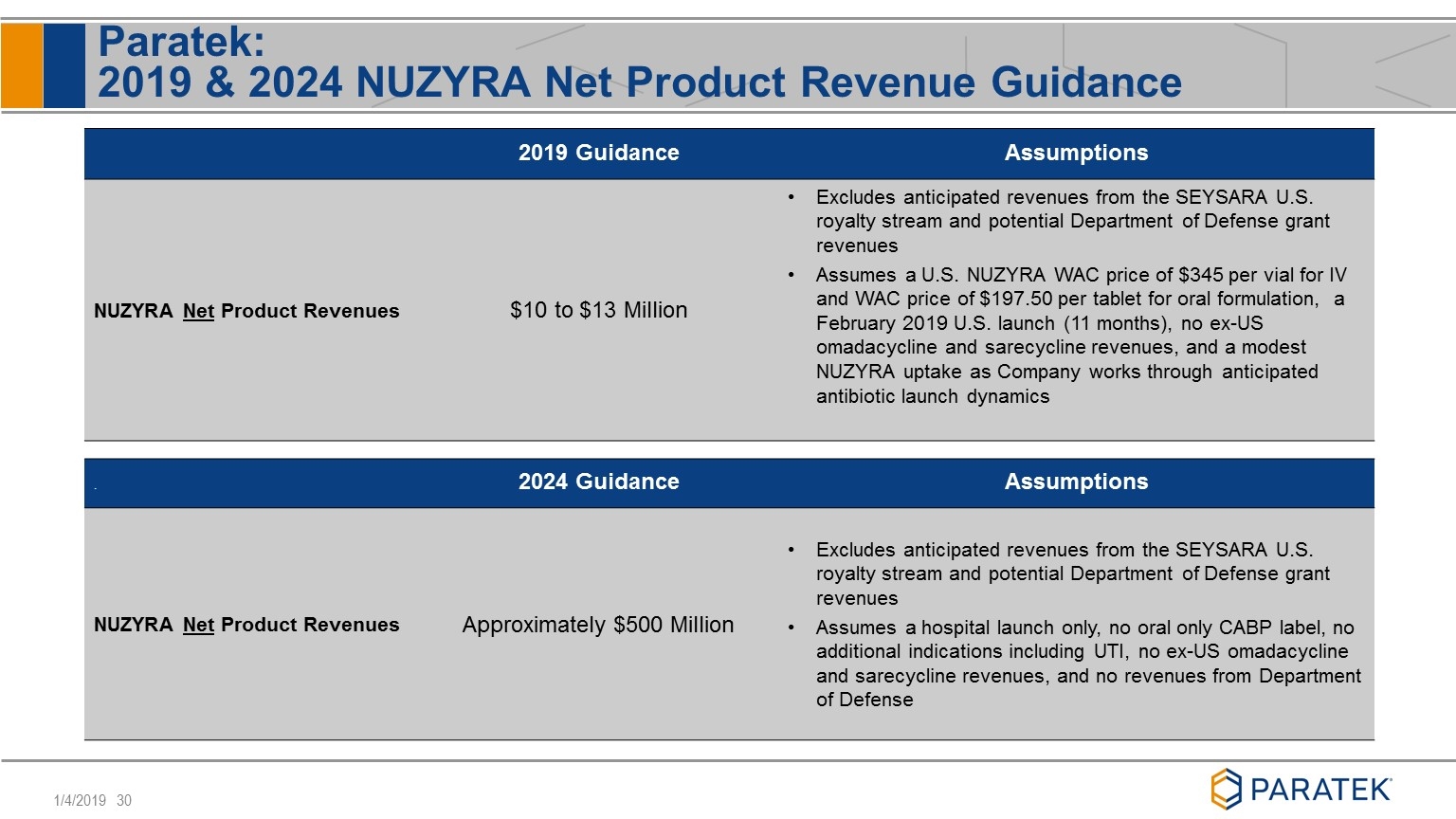

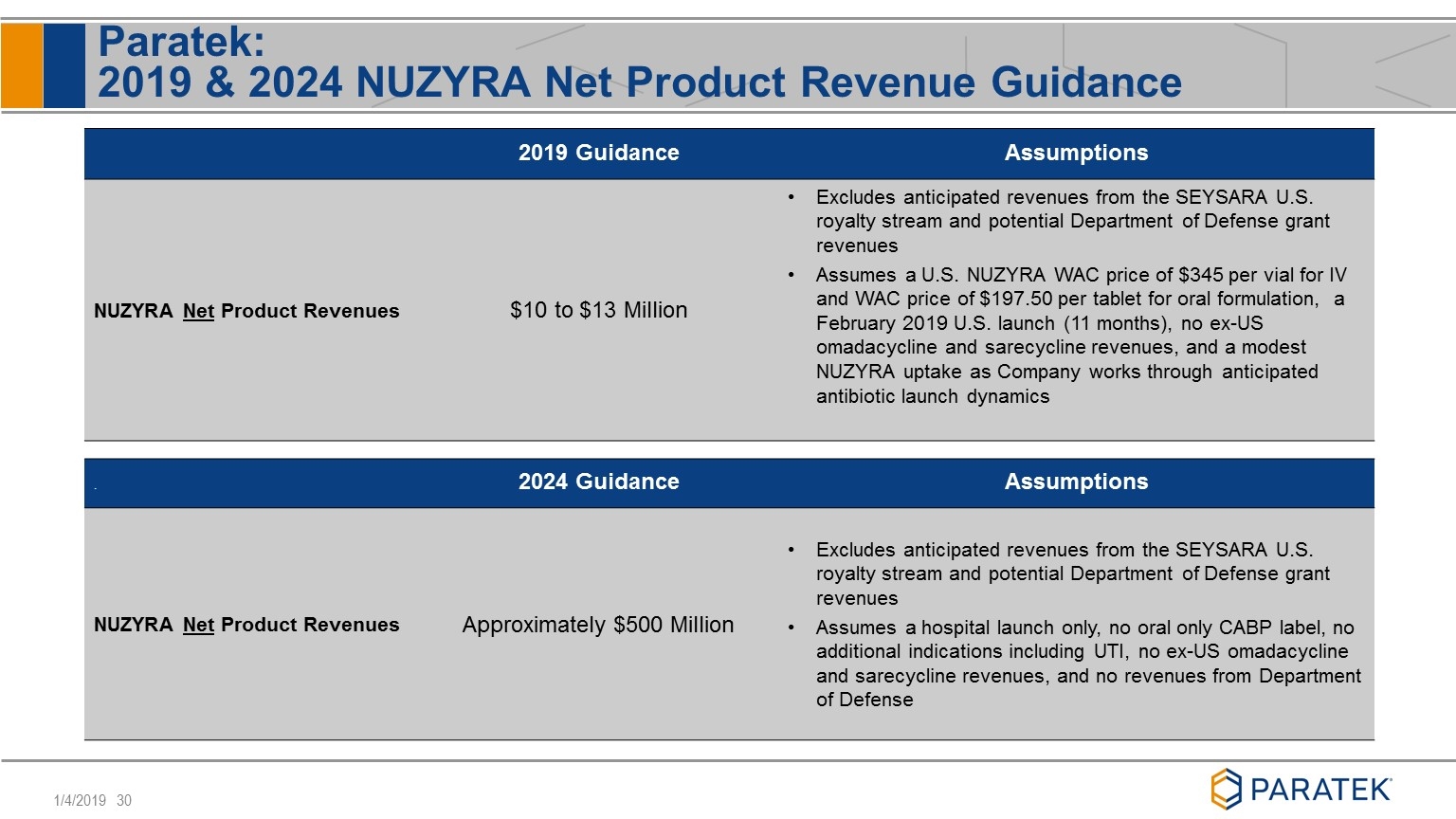

Paratek: 2019 & 2024 NUZYRA Net Product Revenue Guidance 2019 Guidance Assumptions NUZYRA Net Product Revenues $10 to $13 Million Excludes anticipated revenues from the SEYSARA U.S. royalty stream and potential Department of Defense grant revenues Assumes a U.S. NUZYRA WAC price of $345 per vial for IV and WAC price of $197.50 per tablet for oral formulation, a February 2019 U.S. launch (11 months), no ex-US omadacycline and sarecycline revenues, and a modest NUZYRA uptake as Company works through anticipated antibiotic launch dynamics . 2024 Guidance Assumptions NUZYRA Net Product Revenues Approximately $500 Million Excludes anticipated revenues from the SEYSARA U.S. royalty stream and potential Department of Defense grant revenues Assumes a hospital launch only, no oral only CABP label, no additional indications including UTI, no ex-US omadacycline and sarecycline revenues, and no revenues from Department of Defense

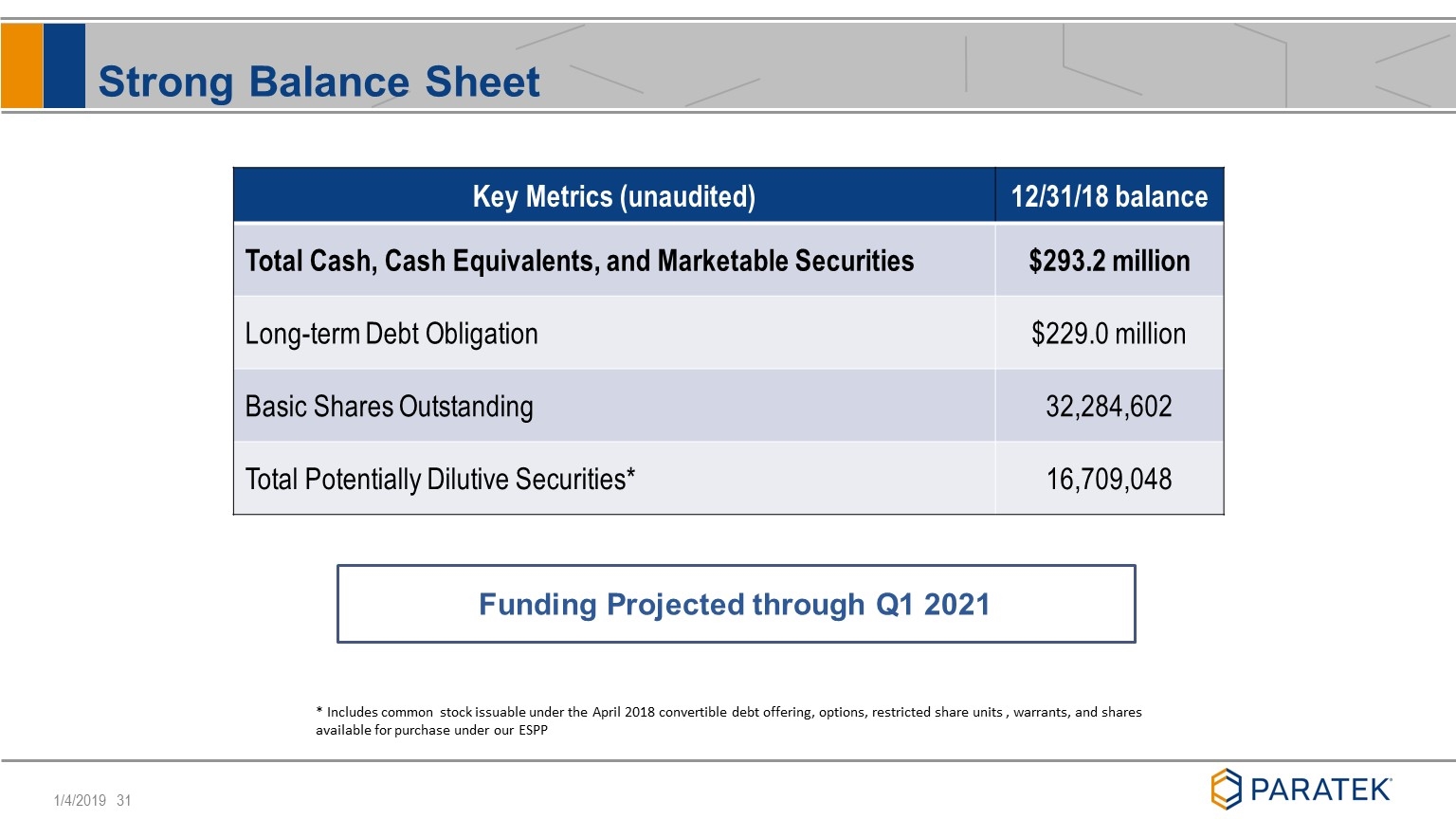

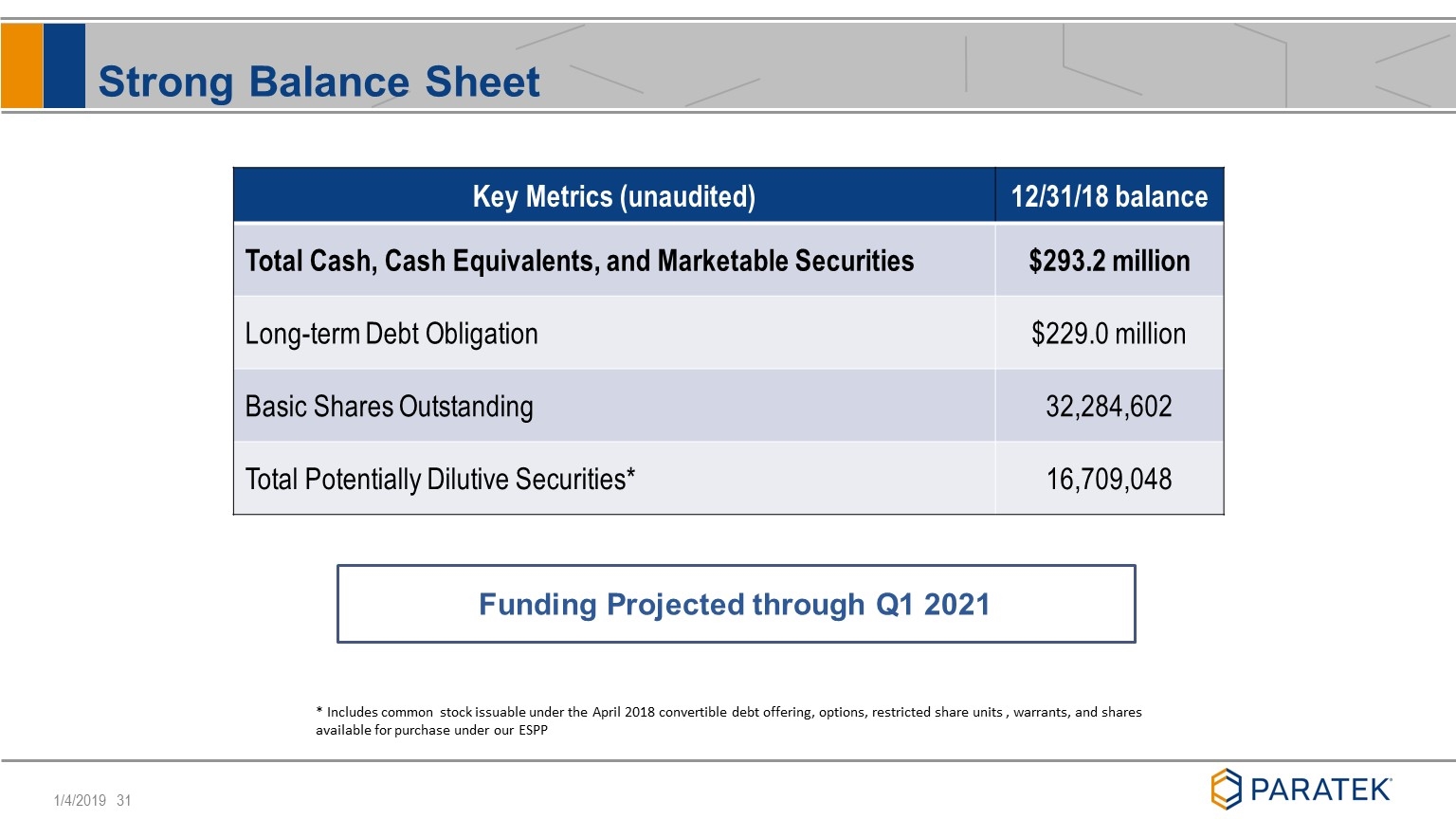

Strong Balance Sheet Key Metrics (unaudited) 12/31/18 balance Total Cash, Cash Equivalents, and Marketable Securities $293.2 million Long-term Debt Obligation $229.0 million Basic Shares Outstanding 32,284,602 Total Potentially Dilutive Securities* 16,709,048 Funding Projected through Q1 2021 * Includes common stock issuable under the April 2018 convertible debt offering, options, restricted share units , warrants, and shares available for purchase under our ESPP

NUZYRA Efficacy and Safety in ABSSSI and CABP Positive Benefit / Risk Profile

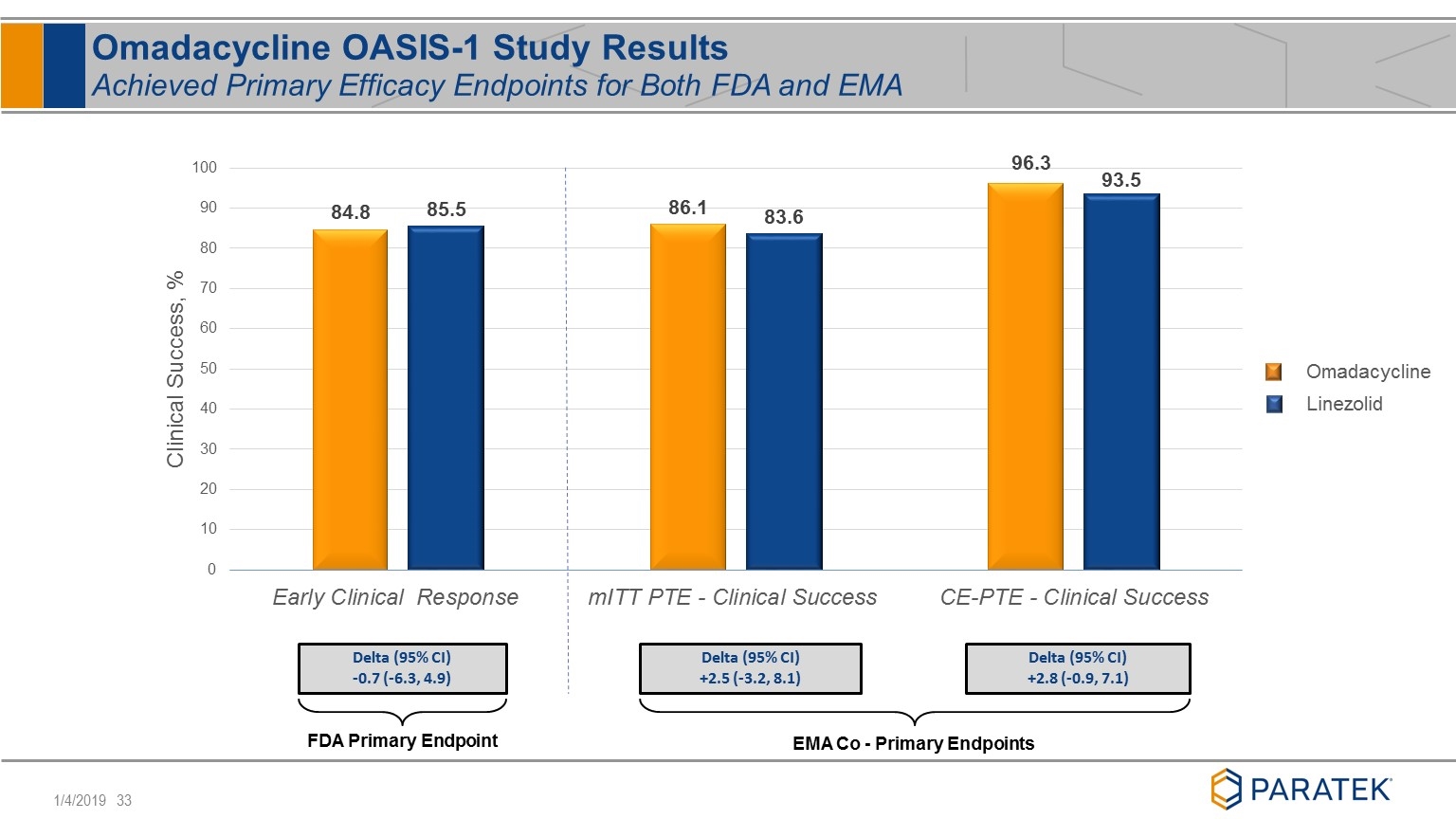

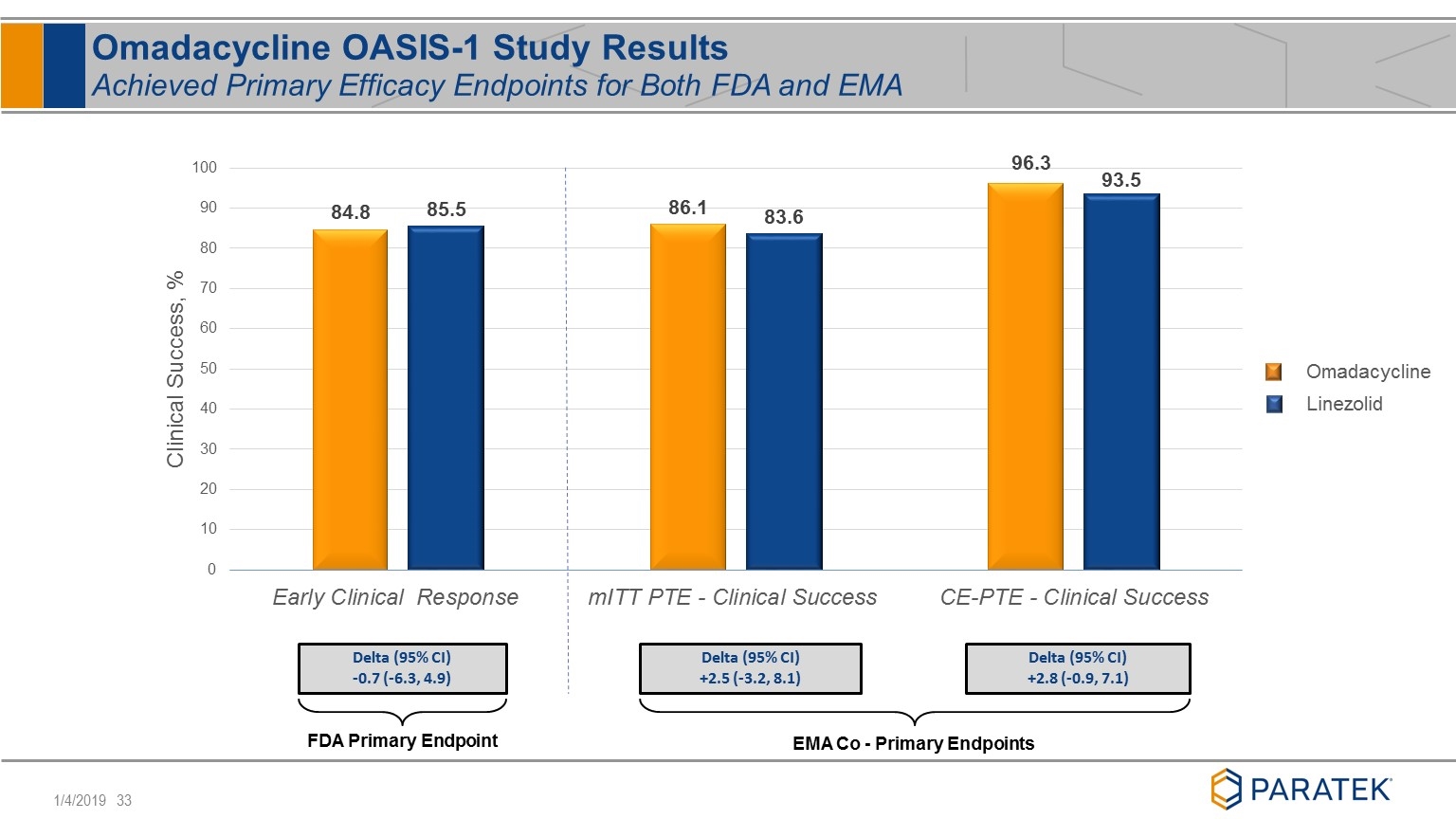

Omadacycline OASIS-1 Study Results Achieved Primary Efficacy Endpoints for Both FDA and EMA EMA Co - Primary Endpoints Delta (95% CI) -0.7 (-6.3, 4.9) Delta (95% CI) +2.5 (-3.2, 8.1) Delta (95% CI) +2.8 (-0.9, 7.1) FDA Primary Endpoint Omadacycline Linezolid

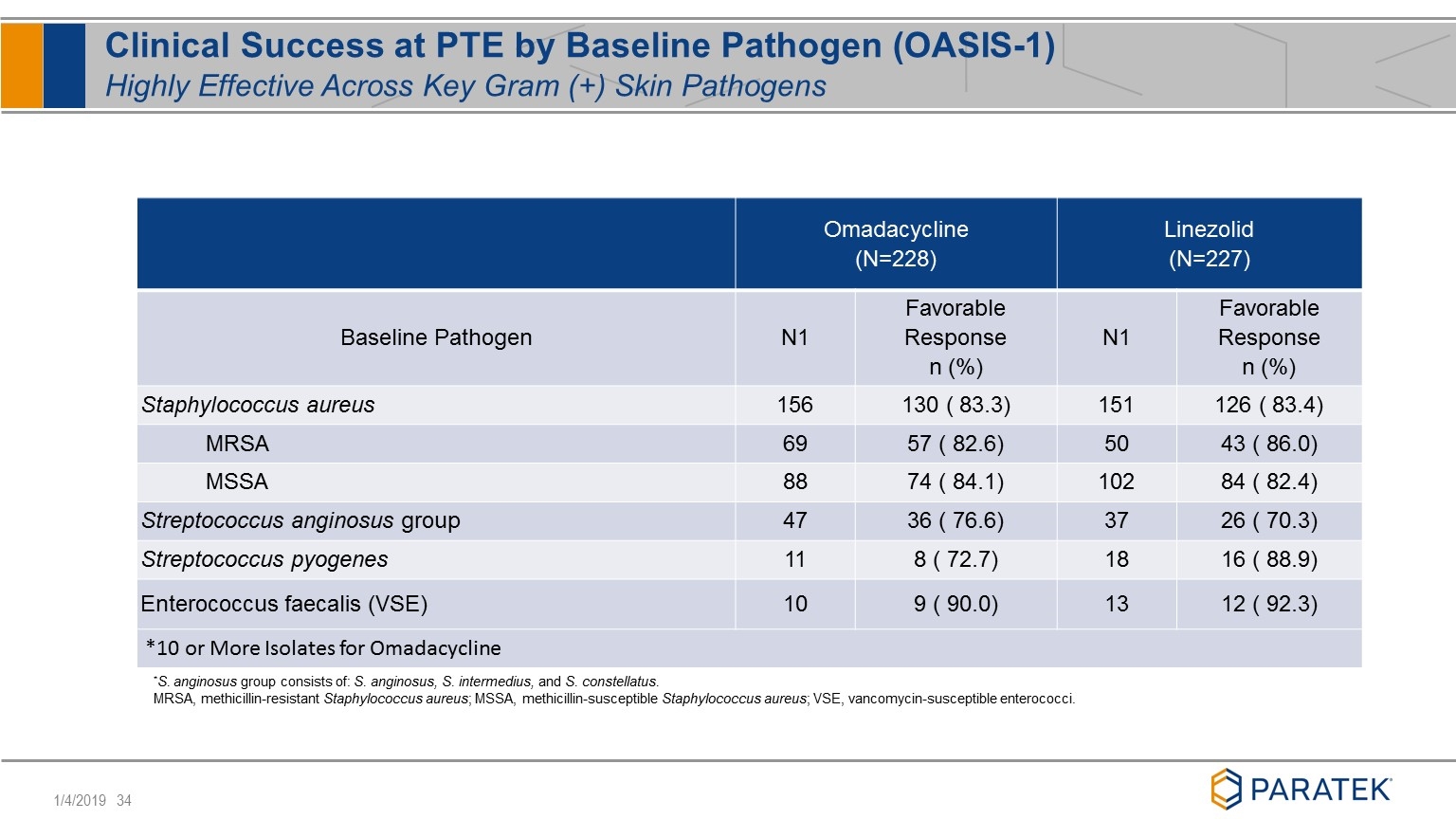

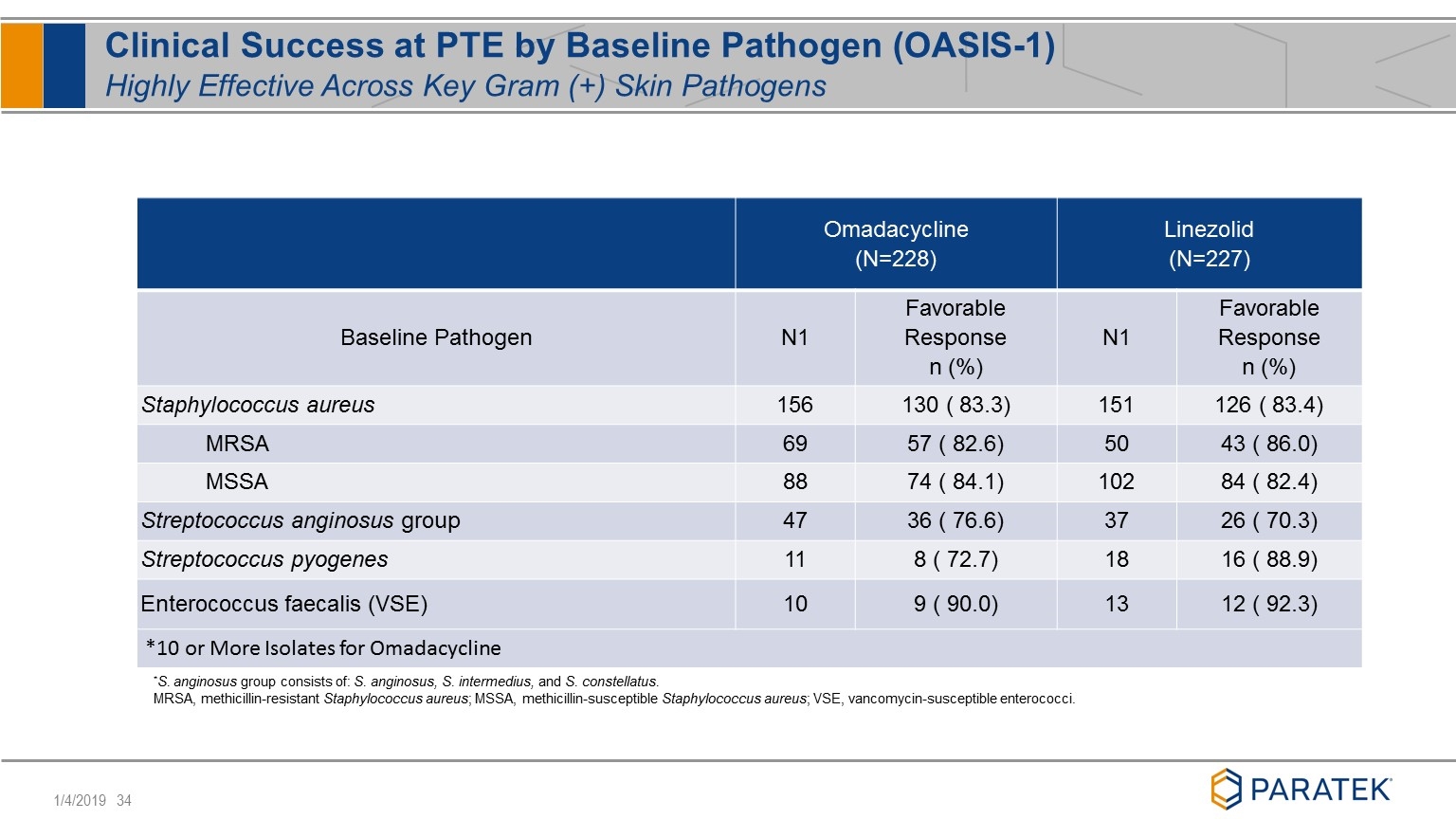

*S. anginosus group consists of: S. anginosus, S. intermedius, and S. constellatus. MRSA, methicillin-resistant Staphylococcus aureus; MSSA, methicillin-susceptible Staphylococcus aureus; VSE, vancomycin-susceptible enterococci. Clinical Success at PTE by Baseline Pathogen (OASIS-1) Highly Effective Across Key Gram (+) Skin Pathogens Omadacycline (N=228) Linezolid (N=227) Baseline Pathogen N1 Favorable Response n (%) N1 Favorable Response n (%) Staphylococcus aureus 156 130 ( 83.3) 151 126 ( 83.4) MRSA 69 57 ( 82.6) 50 43 ( 86.0) MSSA 88 74 ( 84.1) 102 84 ( 82.4) Streptococcus anginosus group 47 36 ( 76.6) 37 26 ( 70.3) Streptococcus pyogenes 11 8 ( 72.7) 18 16 ( 88.9) Enterococcus faecalis (VSE) 10 9 ( 90.0) 13 12 ( 92.3) *10 or More Isolates for Omadacycline

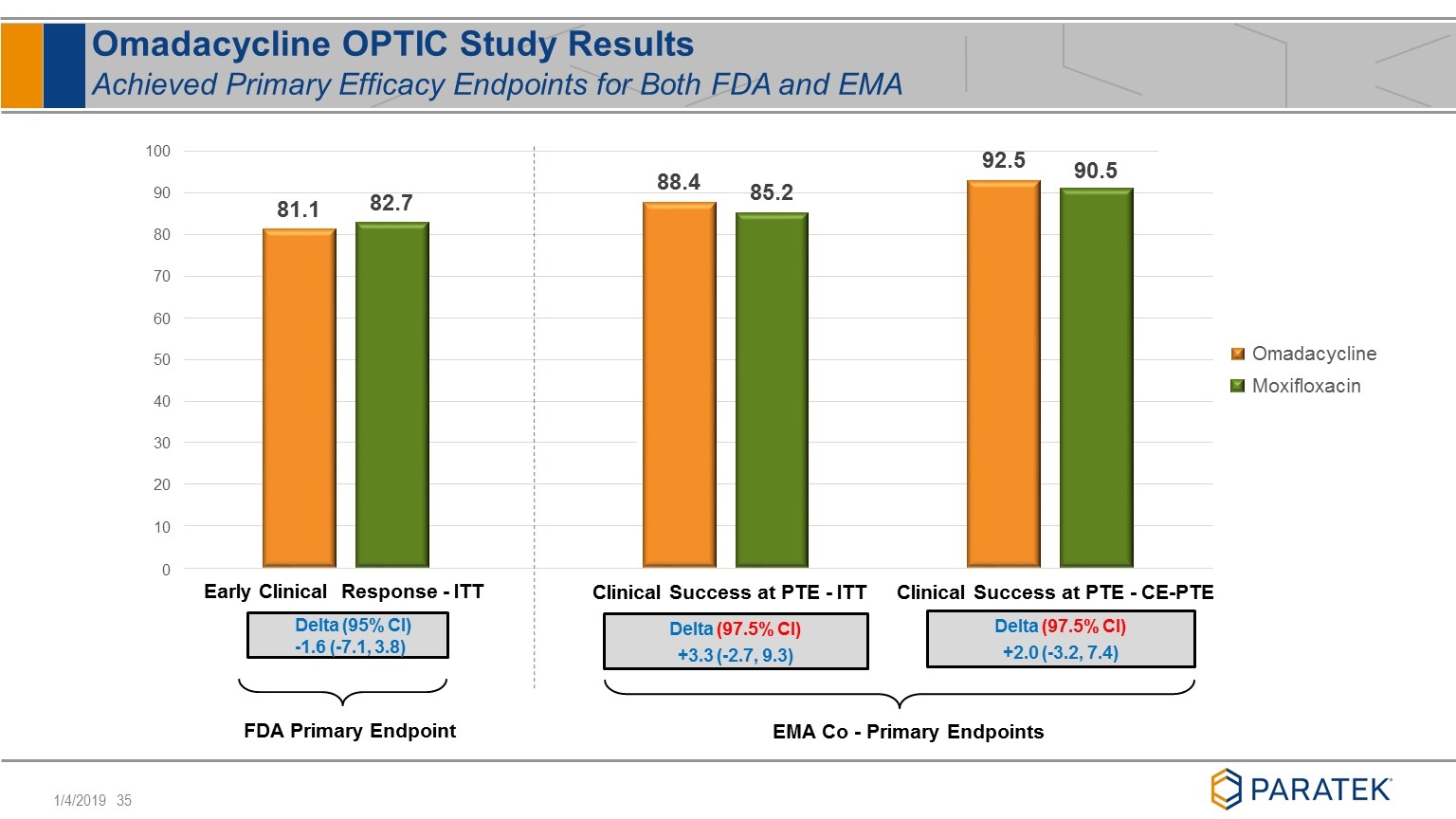

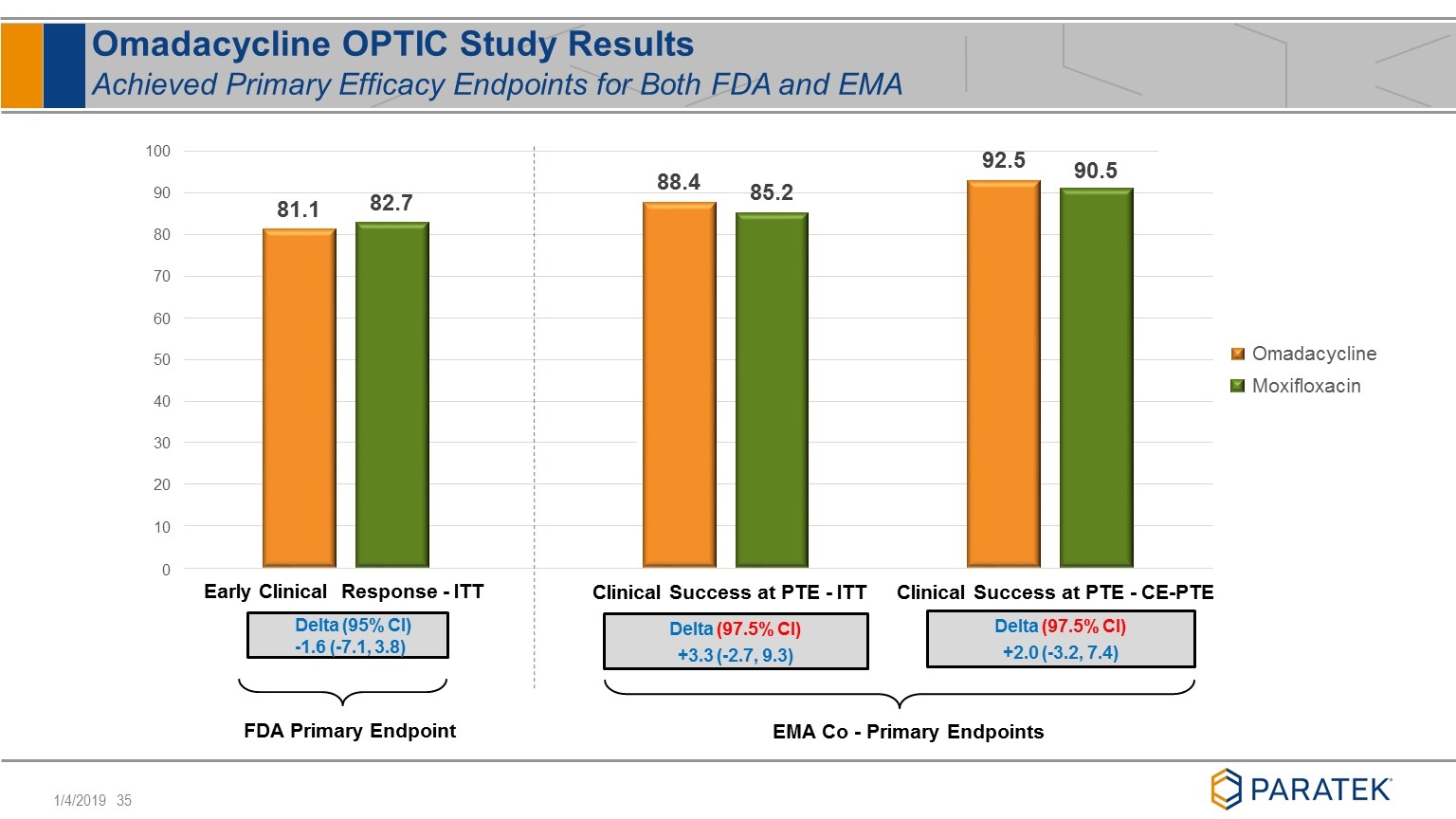

FDA Primary Endpoint 81.1 88.4 92.5 82.7 85.2 90.5 30 20 10 0 40 50 80 70 60 90 100 Early Clinical Response - ITT Omadacycline Moxifloxacin Delta (95% CI) -1.6 (-7.1, 3.8) Clinical Success at PTE - ITT Clinical Success at PTE - CE-PTE Delta (97.5% CI) +3.3 (-2.7, 9.3) Delta (97.5% CI) +2.0 (-3.2, 7.4) EMA Co - Primary Endpoints Omadacycline OPTIC Study Results Achieved Primary Efficacy Endpoints for Both FDA and EMA

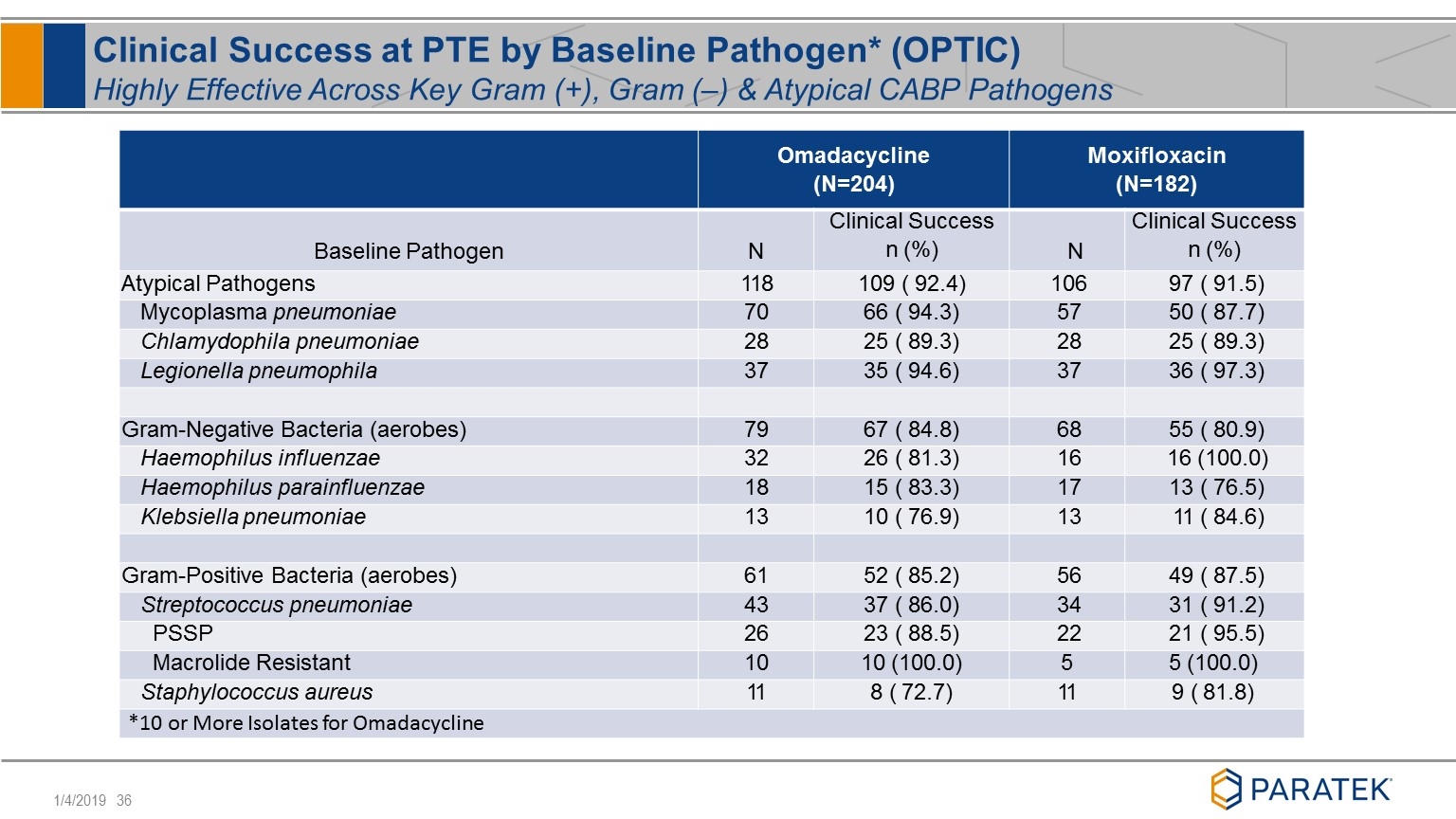

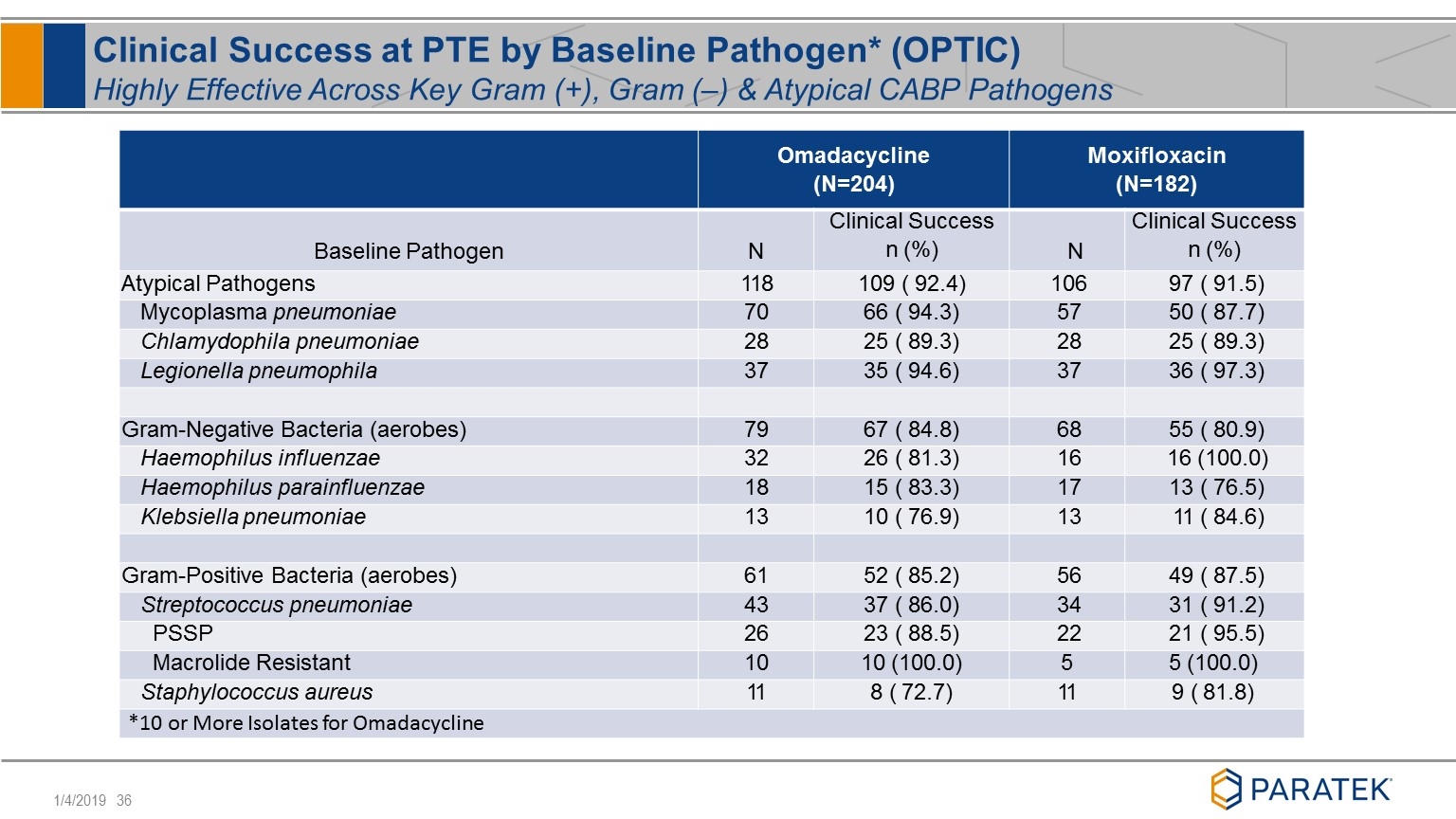

Clinical Success at PTE by Baseline Pathogen* (OPTIC) Highly Effective Across Key Gram (+), Gram (–) & Atypical CABP Pathogens Omadacycline (N=204) Moxifloxacin (N=182) Baseline Pathogen N Clinical Success n (%) N Clinical Success n (%) Atypical Pathogens 118 109 ( 92.4) 106 97 ( 91.5) Mycoplasma pneumoniae 70 66 ( 94.3) 57 50 ( 87.7) Chlamydophila pneumoniae 28 25 ( 89.3) 28 25 ( 89.3) Legionella pneumophila 37 35 ( 94.6) 37 36 ( 97.3) Gram-Negative Bacteria (aerobes) 79 67 ( 84.8) 68 55 ( 80.9) Haemophilus influenzae 32 26 ( 81.3) 16 16 (100.0) Haemophilus parainfluenzae 18 15 ( 83.3) 17 13 ( 76.5) Klebsiella pneumoniae 13 10 ( 76.9) 13 11 ( 84.6) Gram-Positive Bacteria (aerobes) 61 52 ( 85.2) 56 49 ( 87.5) Streptococcus pneumoniae 43 37 ( 86.0) 34 31 ( 91.2) PSSP 26 23 ( 88.5) 22 21 ( 95.5) Macrolide Resistant 10 10 (100.0) 5 5 (100.0) Staphylococcus aureus 11 8 ( 72.7) 11 9 ( 81.8) *10 or More Isolates for Omadacycline

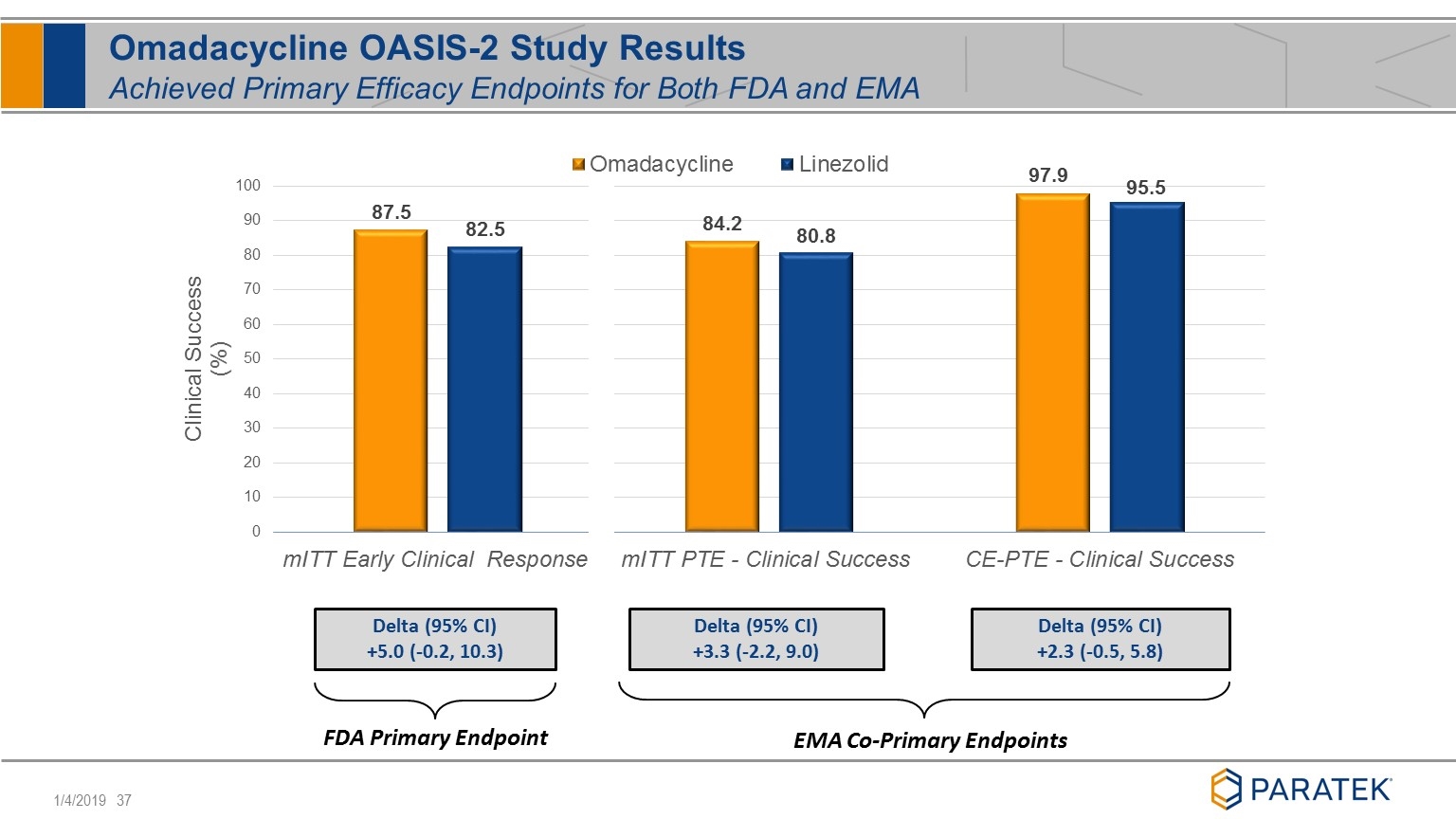

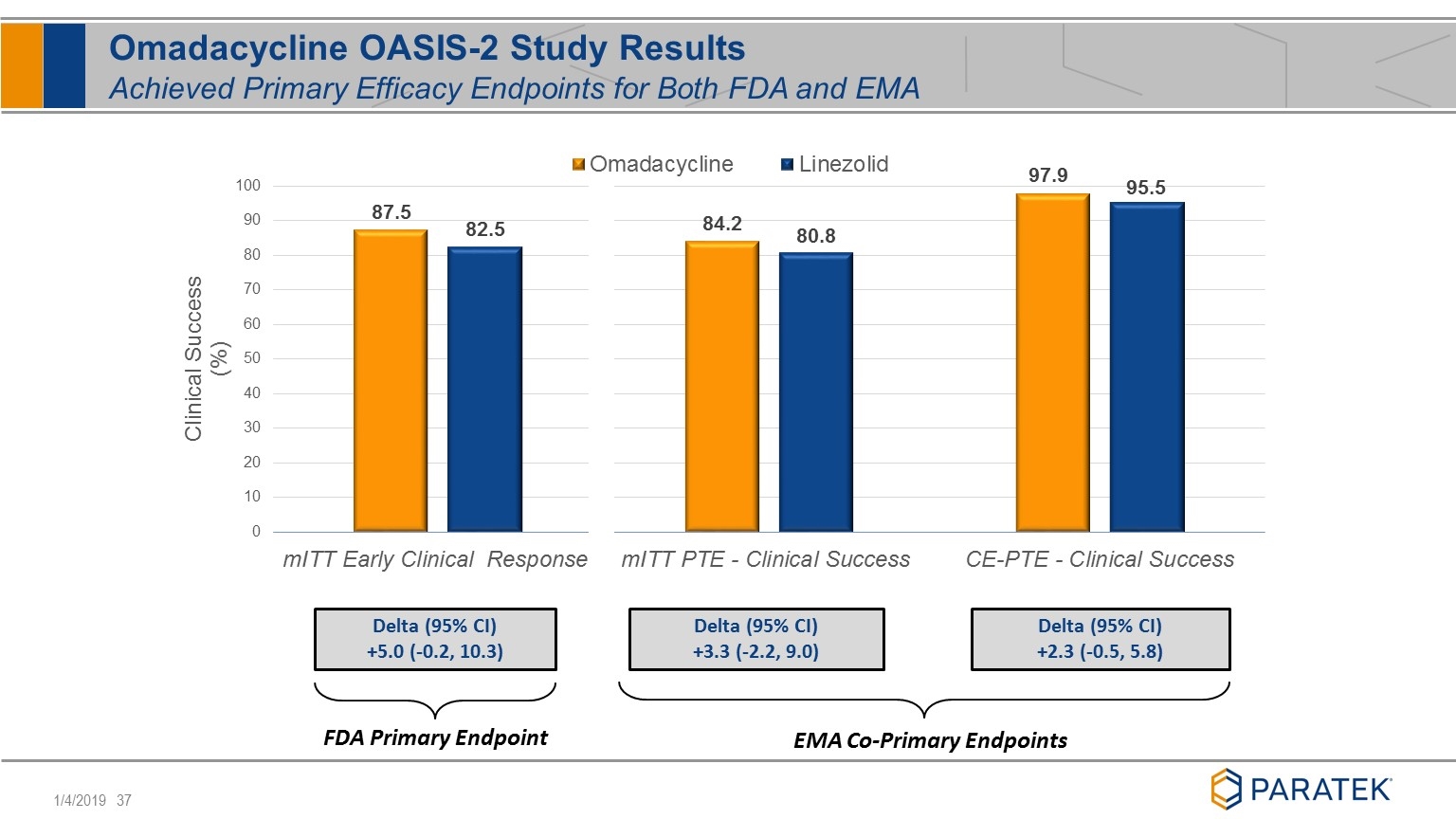

EMA Co-Primary Endpoints Delta (95% CI) +5.0 (-0.2, 10.3) Delta (95% CI) +3.3 (-2.2, 9.0) Delta (95% CI) +2.3 (-0.5, 5.8) FDA Primary Endpoint Omadacycline OASIS-2 Study Results Achieved Primary Efficacy Endpoints for Both FDA and EMA

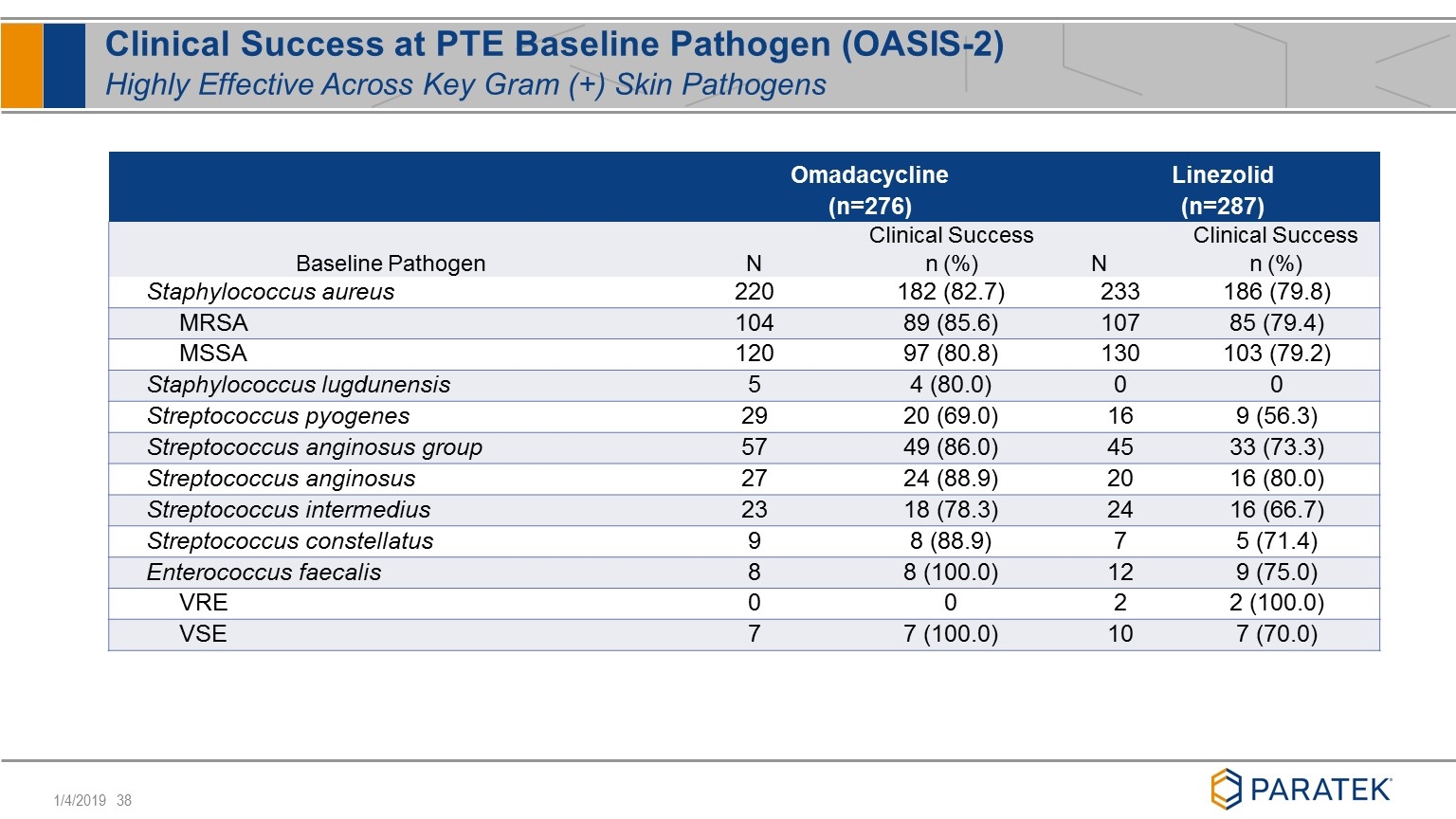

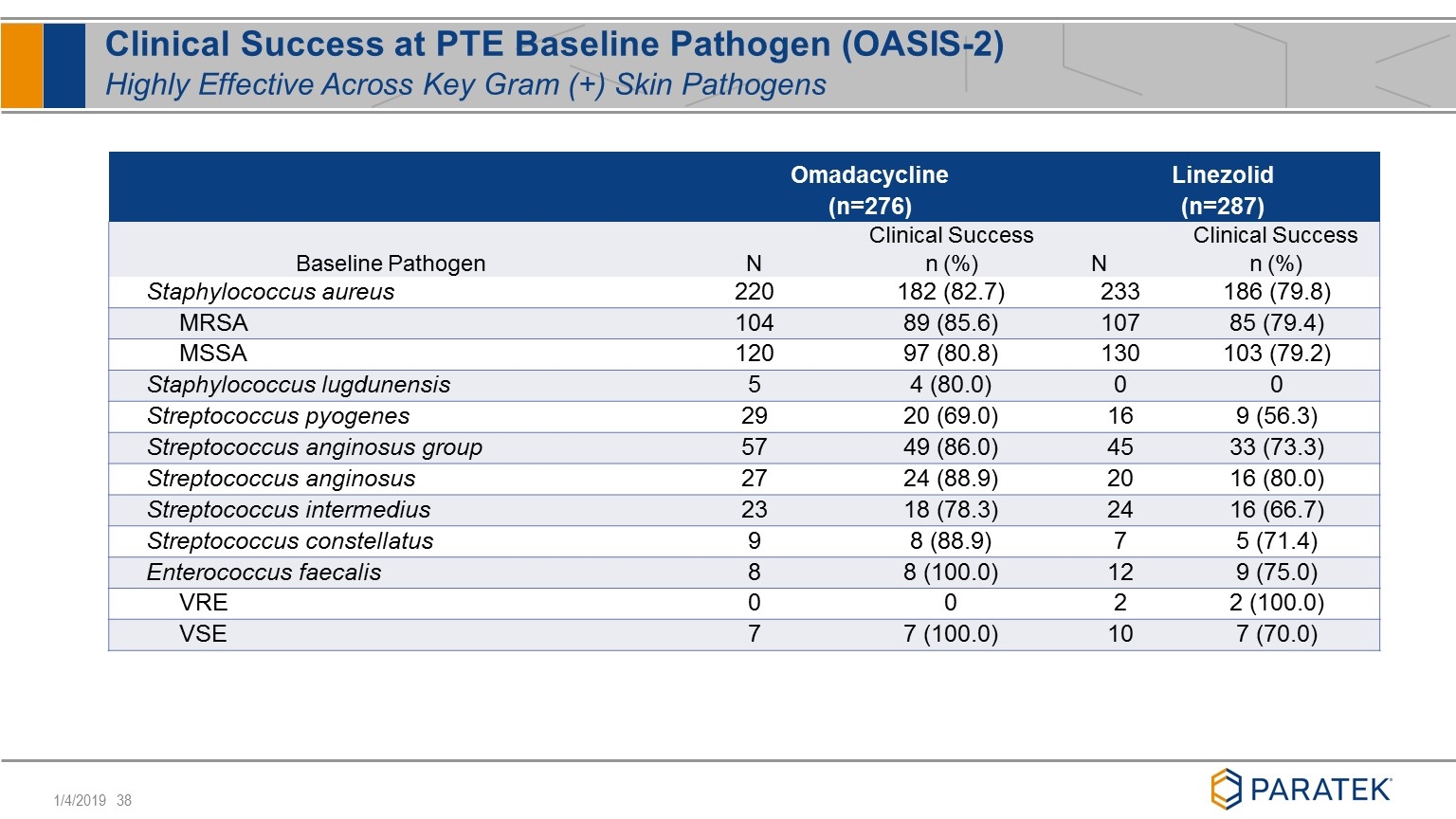

Clinical Success at PTE Baseline Pathogen (OASIS-2) Highly Effective Across Key Gram (+) Skin Pathogens Omadacycline (n=276) Linezolid (n=287) Baseline Pathogen N Clinical Success n (%) N Clinical Success n (%) Staphylococcus aureus 220 182 (82.7) 233 186 (79.8) MRSA 104 89 (85.6) 107 85 (79.4) MSSA 120 97 (80.8) 130 103 (79.2) Staphylococcus lugdunensis 5 4 (80.0) 0 0 Streptococcus pyogenes 29 20 (69.0) 16 9 (56.3) Streptococcus anginosus group 57 49 (86.0) 45 33 (73.3) Streptococcus anginosus 27 24 (88.9) 20 16 (80.0) Streptococcus intermedius 23 18 (78.3) 24 16 (66.7) Streptococcus constellatus 9 8 (88.9) 7 5 (71.4) Enterococcus faecalis 8 8 (100.0) 12 9 (75.0) VRE 0 0 2 2 (100.0) VSE 7 7 (100.0) 10 7 (70.0)

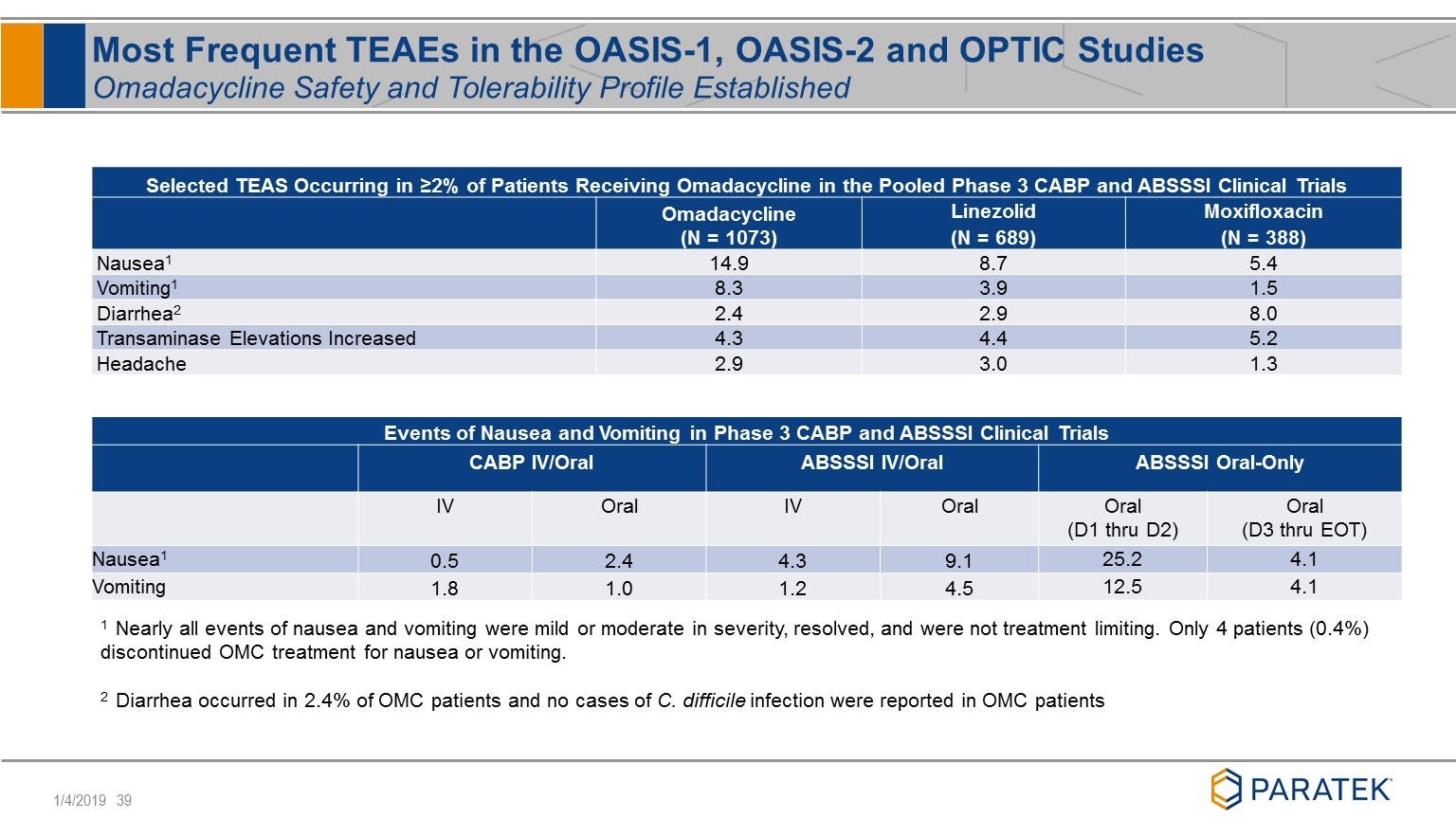

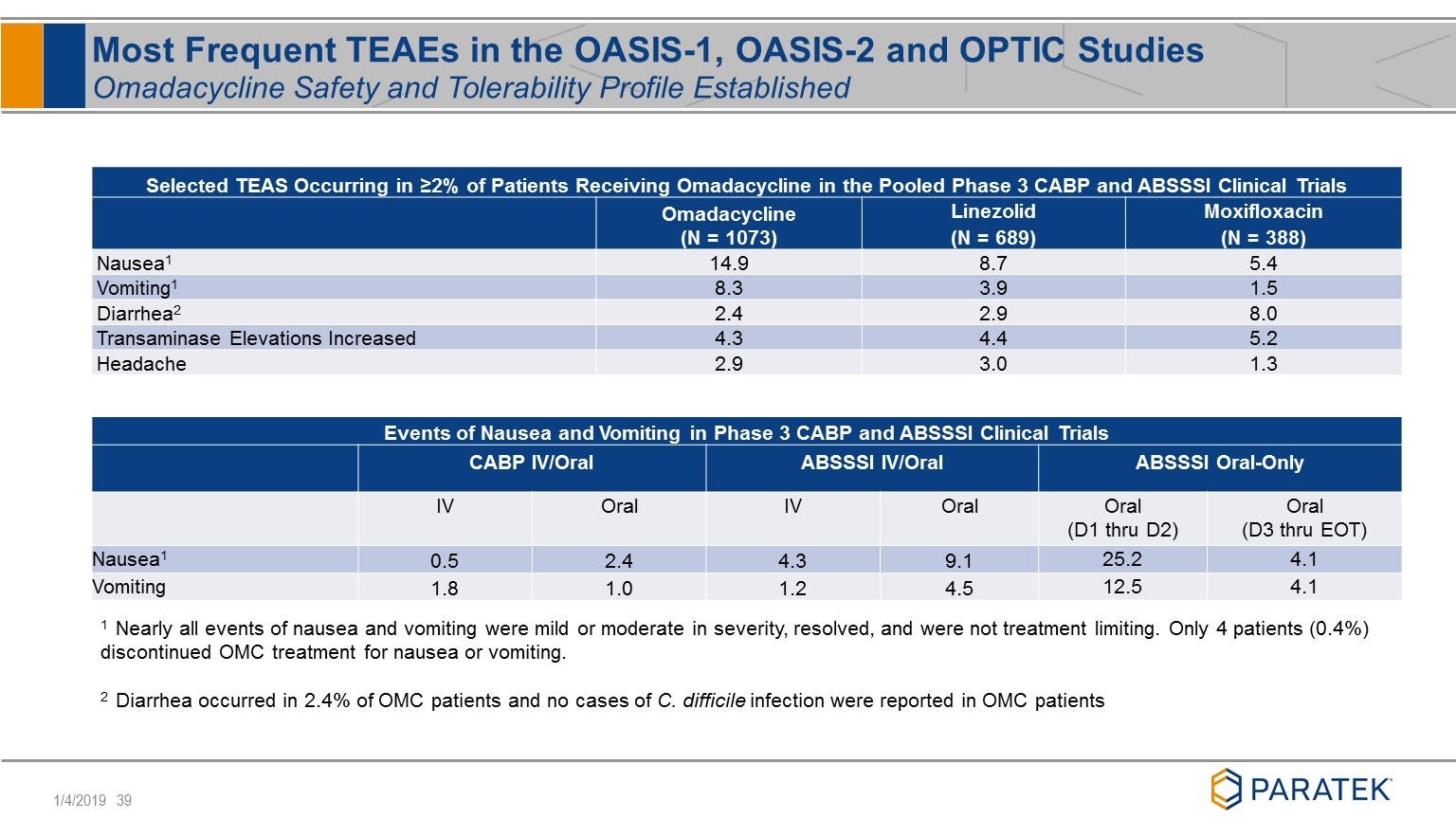

Selected TEAS Occurring in ≥2% of Patients Receiving Omadacycline in the Pooled Phase 3 CABP and ABSSSI Clinical Trials Omadacycline (N = 1073) Linezolid (N = 689) Moxifloxacin (N = 388) Nausea1 14.9 8.7 5.4 Vomiting1 8.3 3.9 1.5 Diarrhea2 2.4 2.9 8.0 Transaminase Elevations Increased 4.3 4.4 5.2 Headache 2.9 3.0 1.3 Events of Nausea and Vomiting in Phase 3 CABP and ABSSSI Clinical Trials CABP IV/Oral ABSSSI IV/Oral ABSSSI Oral-Only IV Oral IV Oral Oral (D1 thru D2) Oral (D3 thru EOT) Nausea1 0.5 2.4 4.3 9.1 25.2 4.1 Vomiting 1.8 1.0 1.2 4.5 12.5 4.1 Most Frequent TEAEs in the OASIS-1, OASIS-2 and OPTIC Studies Omadacycline Safety and Tolerability Profile Established 1 Nearly all events of nausea and vomiting were mild or moderate in severity, resolved, and were not treatment limiting. Only 4 patients (0.4%) discontinued OMC treatment for nausea or vomiting. 2 Diarrhea occurred in 2.4% of OMC patients and no cases of C. difficile infection were reported in OMC patients

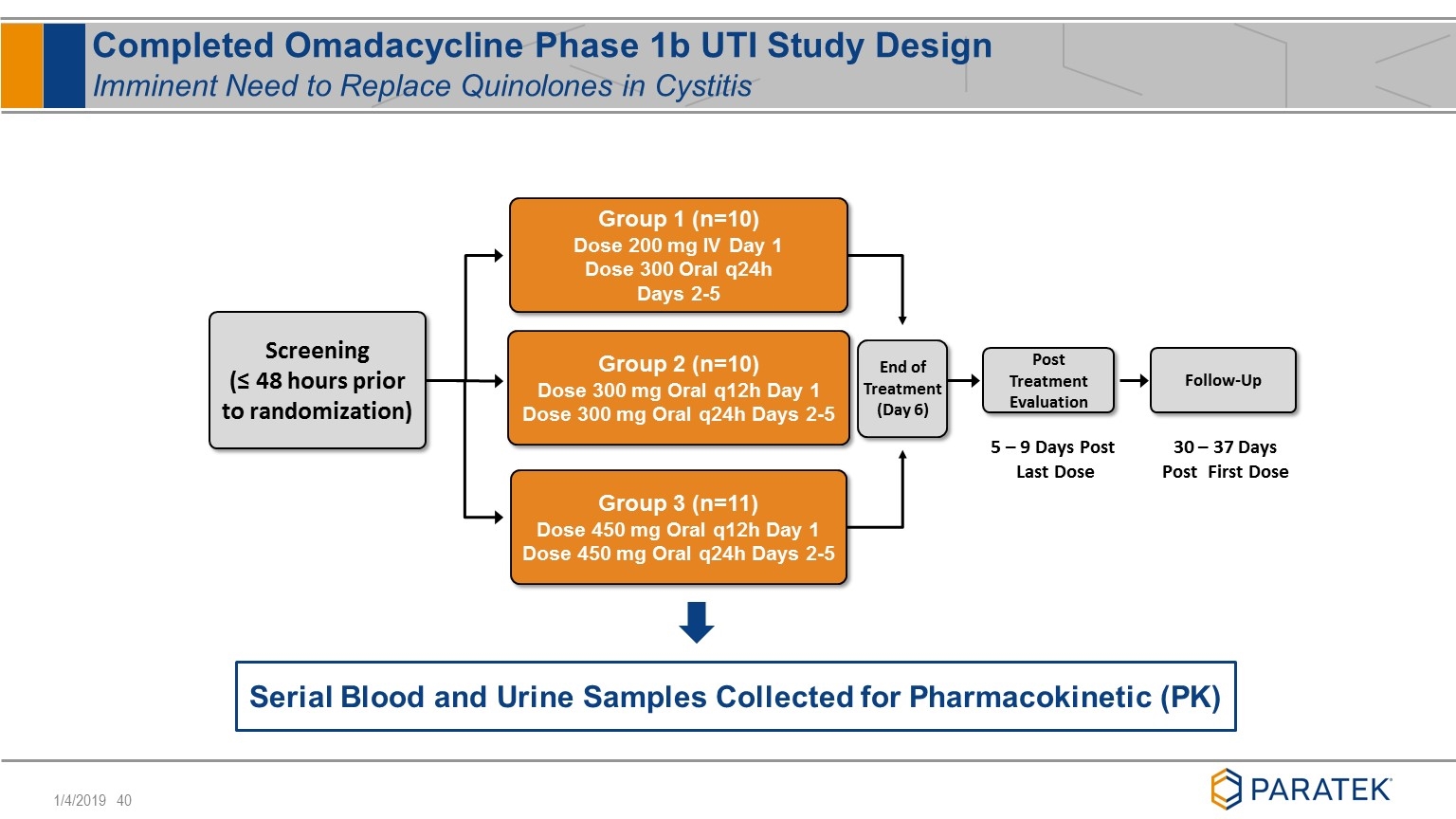

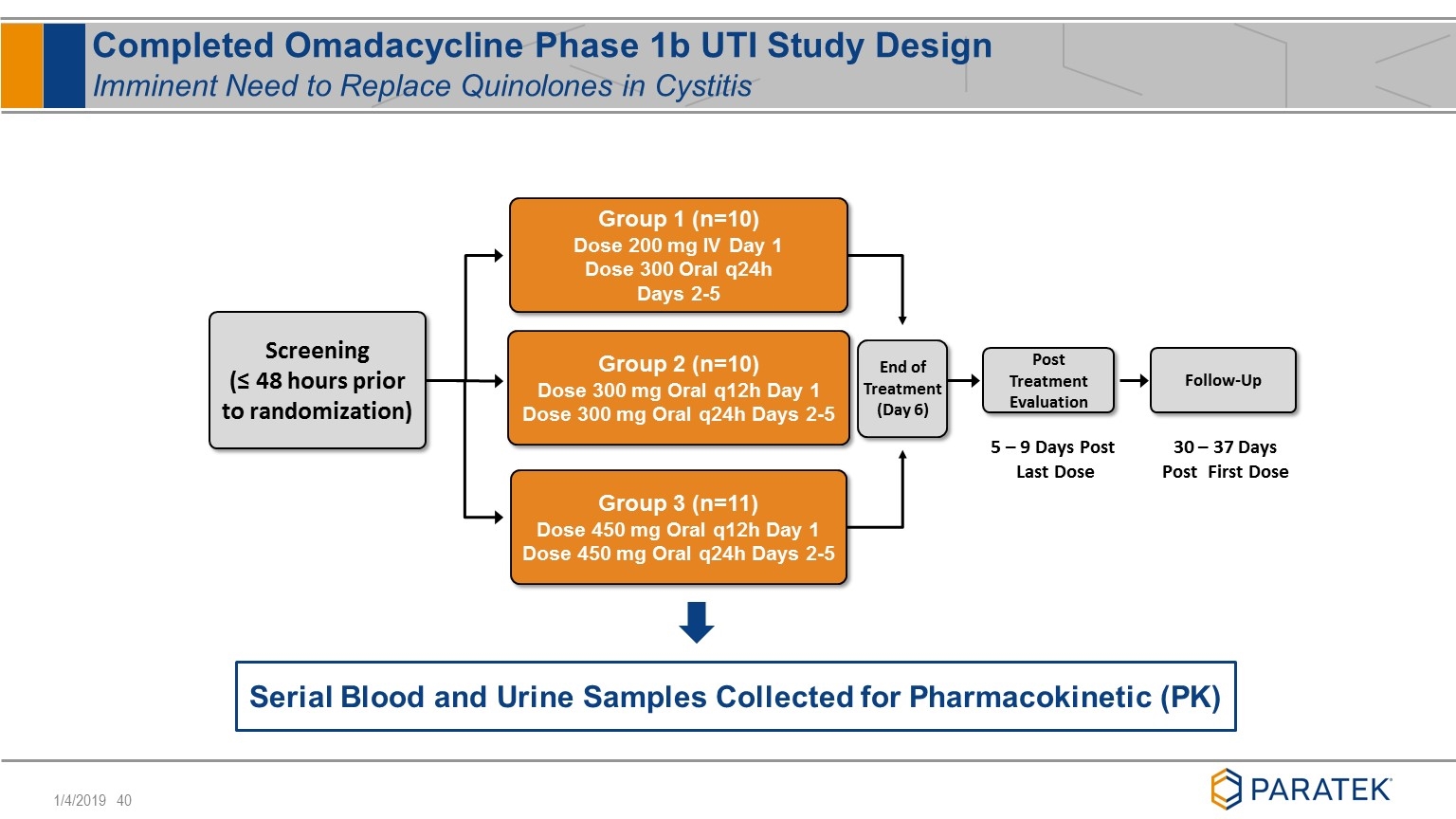

Completed Omadacycline Phase 1b UTI Study Design Imminent Need to Replace Quinolones in Cystitis Group 1 (n=10) Dose 200 mg IV Day 1 Dose 300 Oral q24h Days 2-5 Screening (≤ 48 hours prior to randomization) End of Treatment (Day 6) Post Treatment Evaluation Follow-Up Group 2 (n=10) Dose 300 mg Oral q12h Day 1 Dose 300 mg Oral q24h Days 2-5 Group 3 (n=11) Dose 450 mg Oral q12h Day 1 Dose 450 mg Oral q24h Days 2-5 5 – 9 Days Post Last Dose 30 – 37 Days Post First Dose Serial Blood and Urine Samples Collected for Pharmacokinetic (PK)

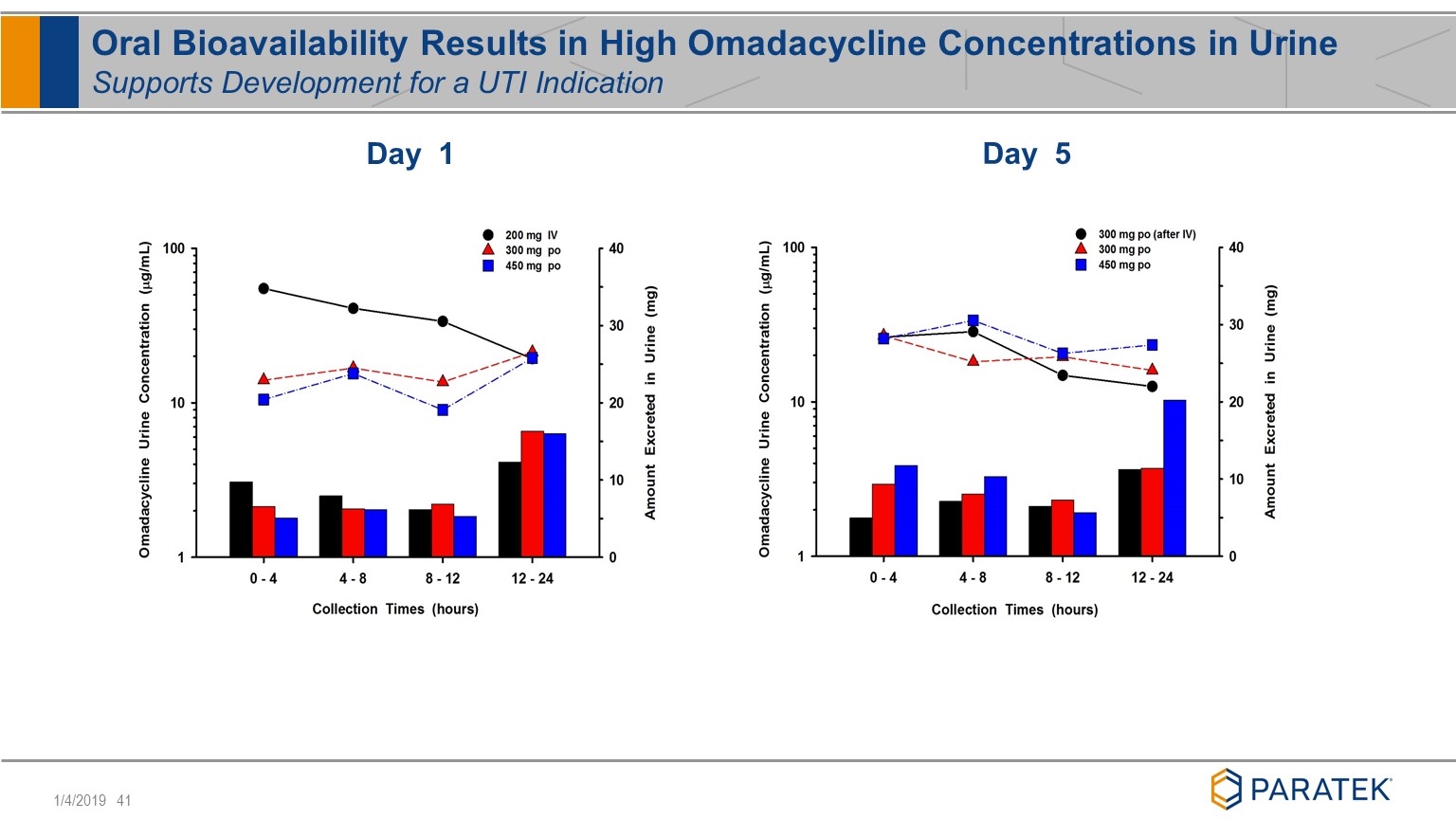

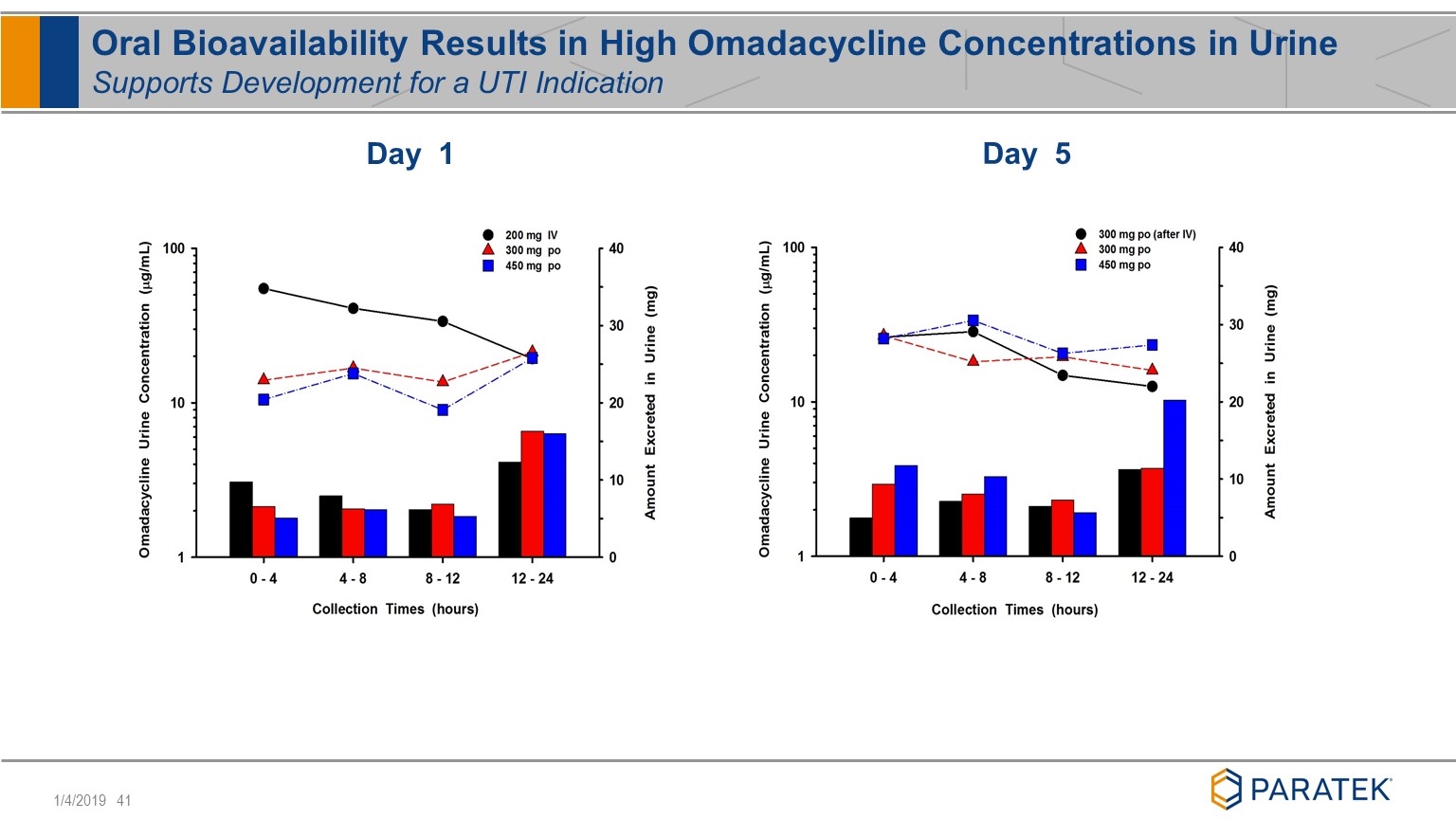

Oral Bioavailability Results in High Omadacycline Concentrations in Urine Supports Development for a UTI Indication Day 5 Day 1

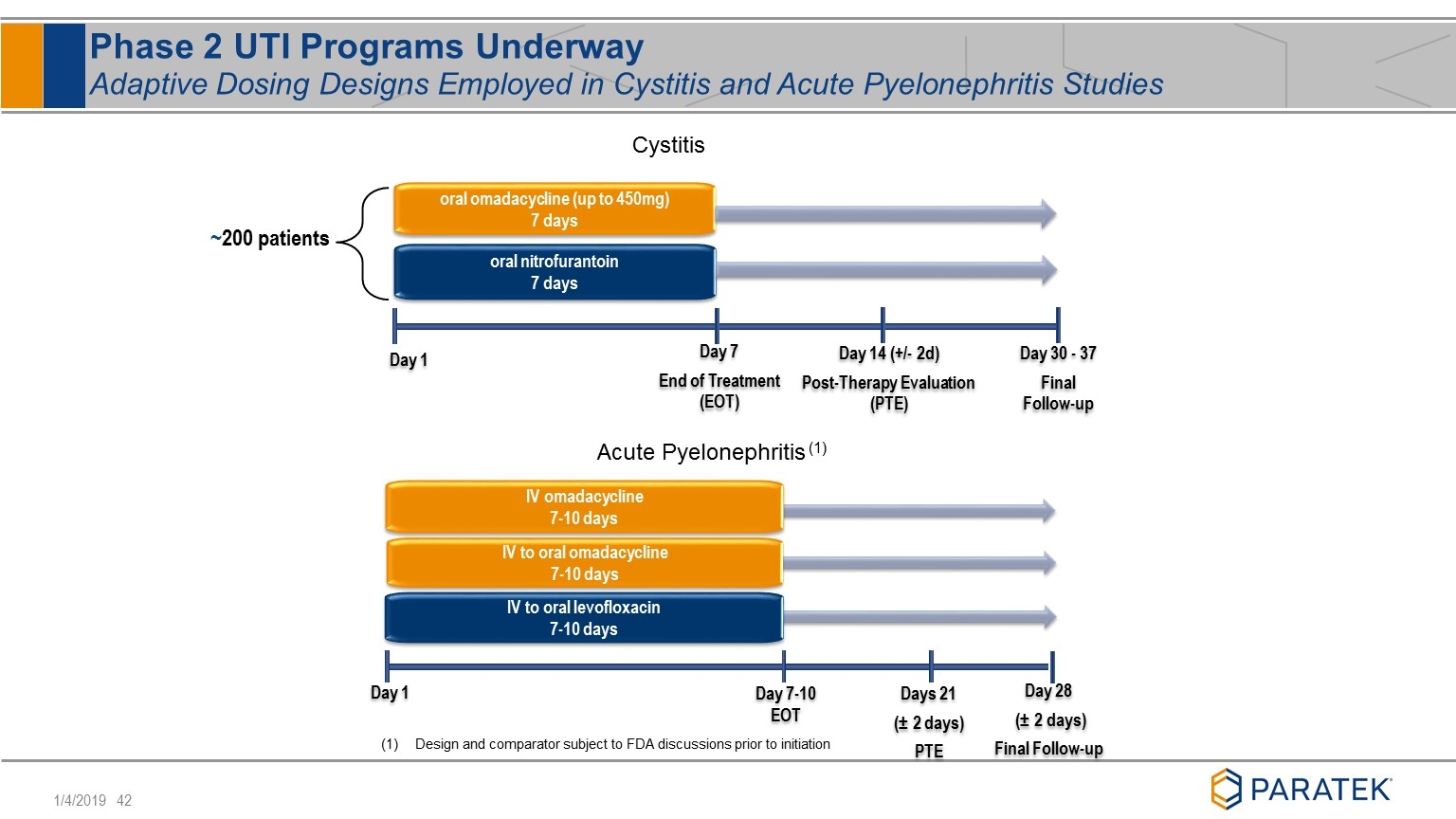

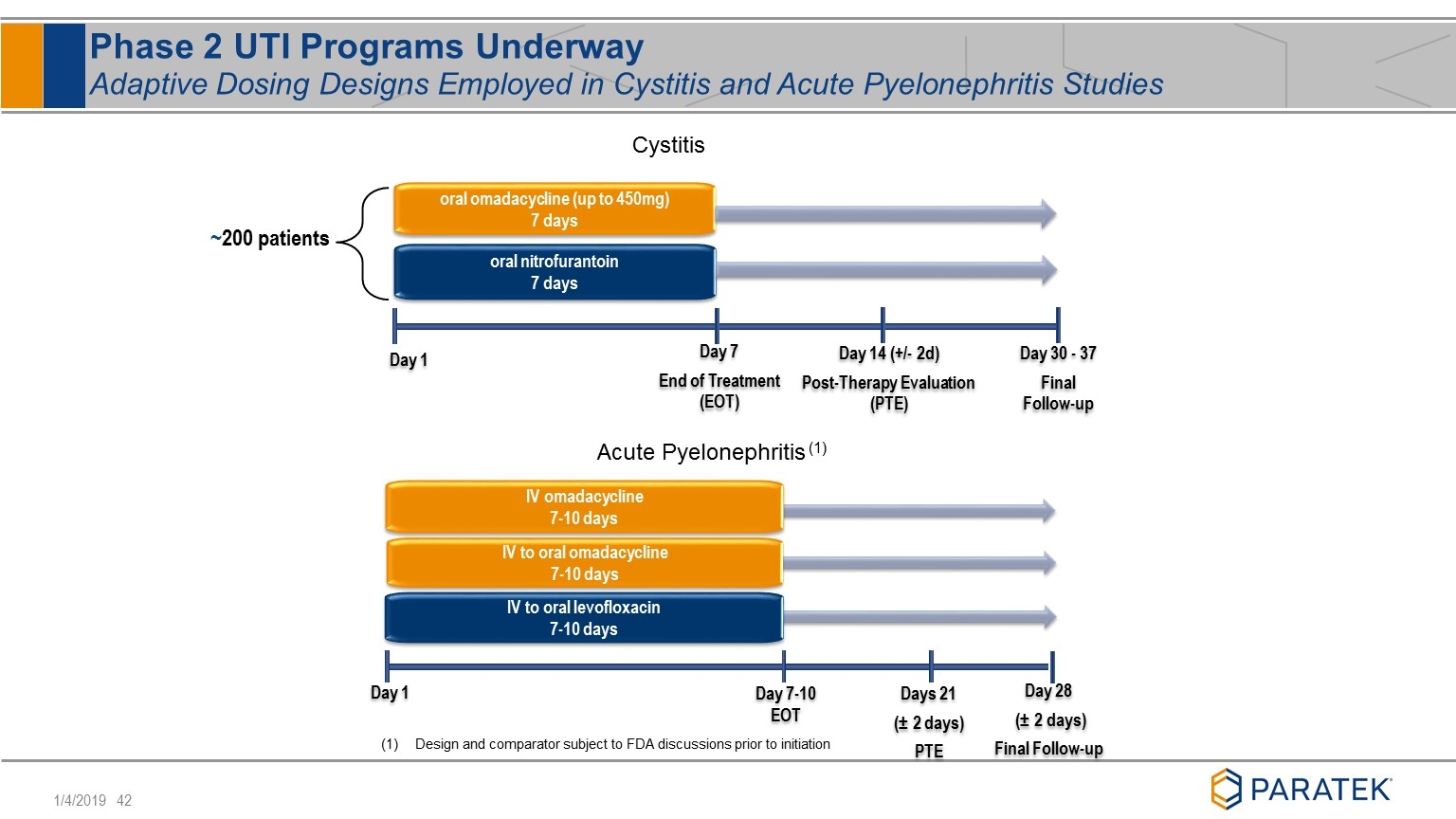

Phase 2 UTI Programs Underway Adaptive Dosing Designs Employed in Cystitis and Acute Pyelonephritis Studies ~200 patients oral omadacycline (up to 450mg) 7 days oral nitrofurantoin 7 days Day 14 (+/- 2d) Post-Therapy Evaluation (PTE) Day 1 Day 7 End of Treatment (EOT) Day 30 - 37 Final Follow-up Cystitis IV omadacycline 7-10 days IV to oral levofloxacin 7-10 days Days 21 (± 2 days) PTE Day 1 Day 7-10 EOT Day 28 (± 2 days) Final Follow-up IV to oral omadacycline 7-10 days Acute Pyelonephritis (1) Design and comparator subject to FDA discussions prior to initiation

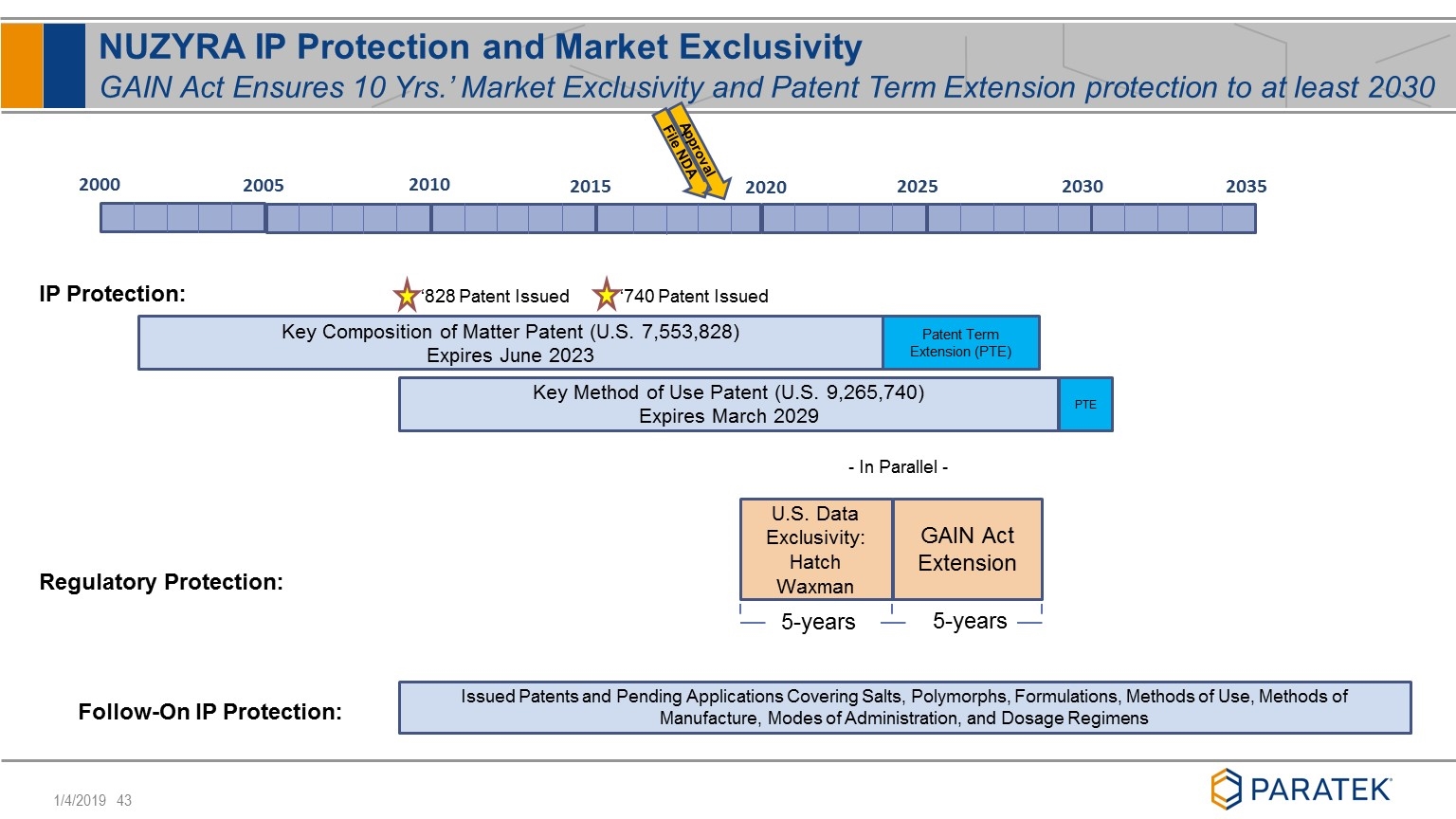

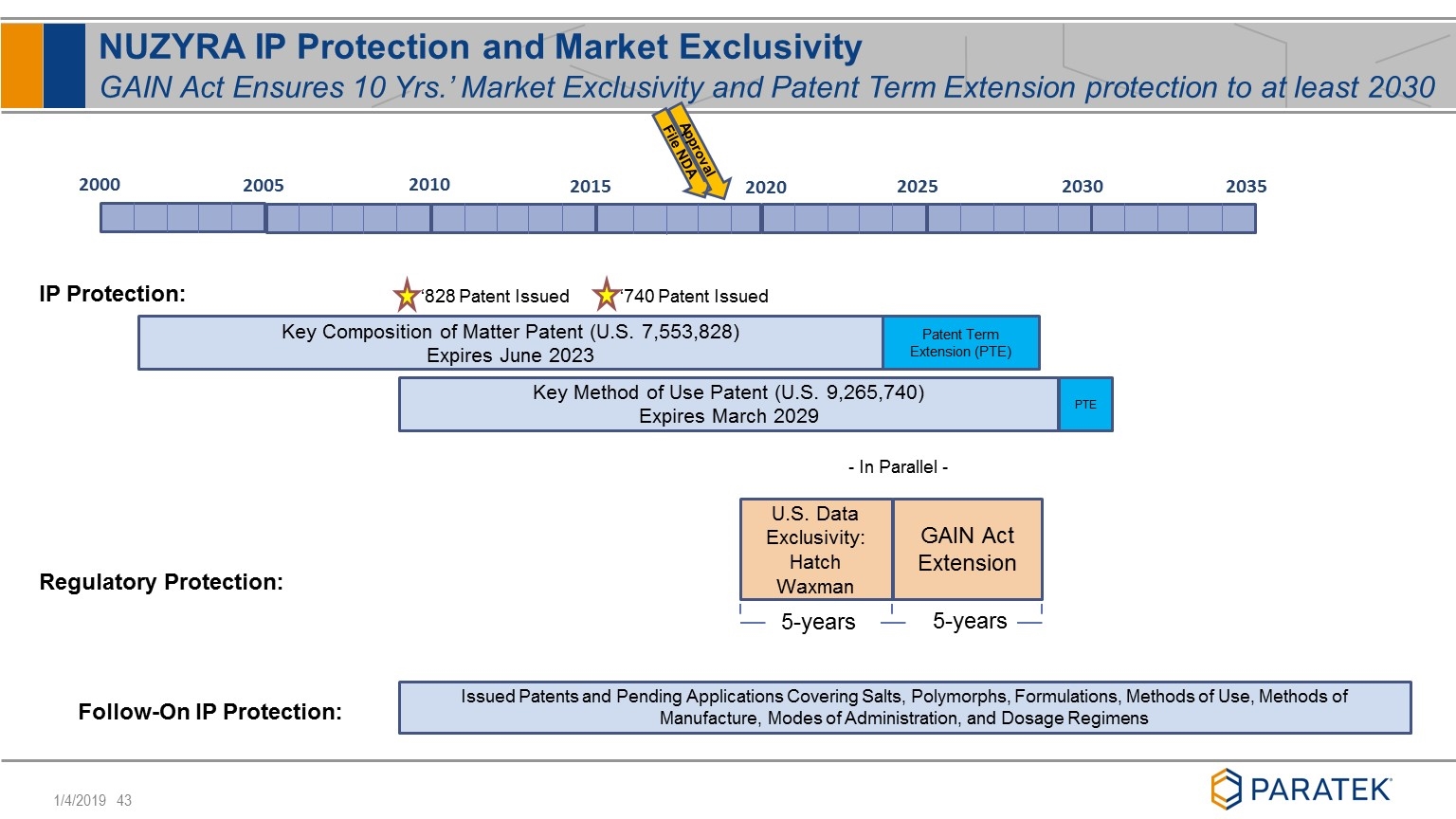

NUZYRA IP Protection and Market Exclusivity GAIN Act Ensures 10 Yrs.’ Market Exclusivity and Patent Term Extension protection to at least 2030 Patent Term Extension (PTE) Key Composition of Matter Patent (U.S. 7,553,828) Expires June 2023 2000 2005 2010 2015 2020 2025 2030 ‘828 Patent Issued File NDA Approval GAIN Act Extension - In Parallel - U.S. Data Exclusivity: Hatch Waxman 5-years 5-years IP Protection: Regulatory Protection: Issued Patents and Pending Applications Covering Salts, Polymorphs, Formulations, Methods of Use, Methods of Manufacture, Modes of Administration, and Dosage Regimens Follow-On IP Protection: 2035 PTE Key Method of Use Patent (U.S. 9,265,740) Expires March 2029 ‘740 Patent Issued

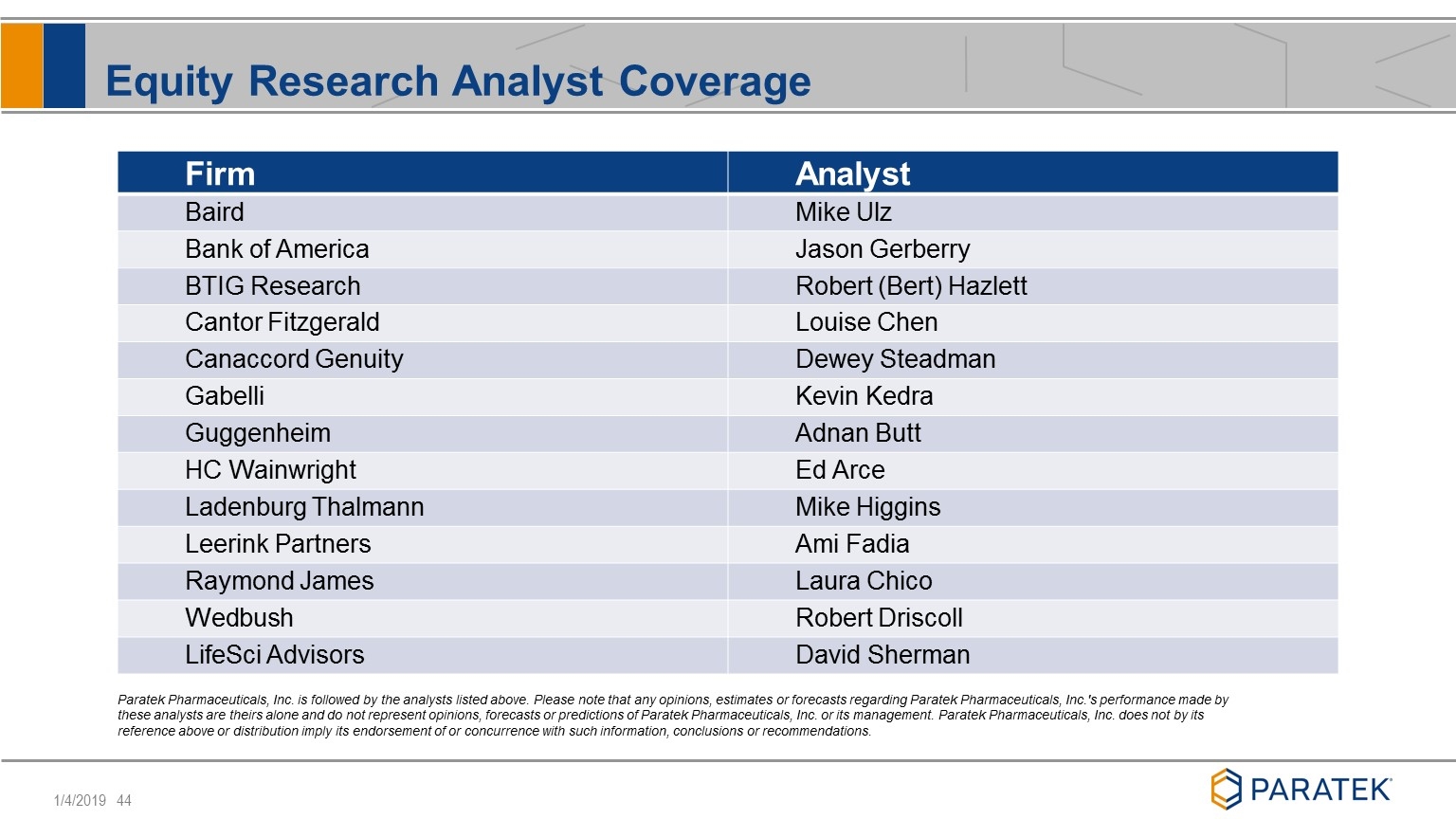

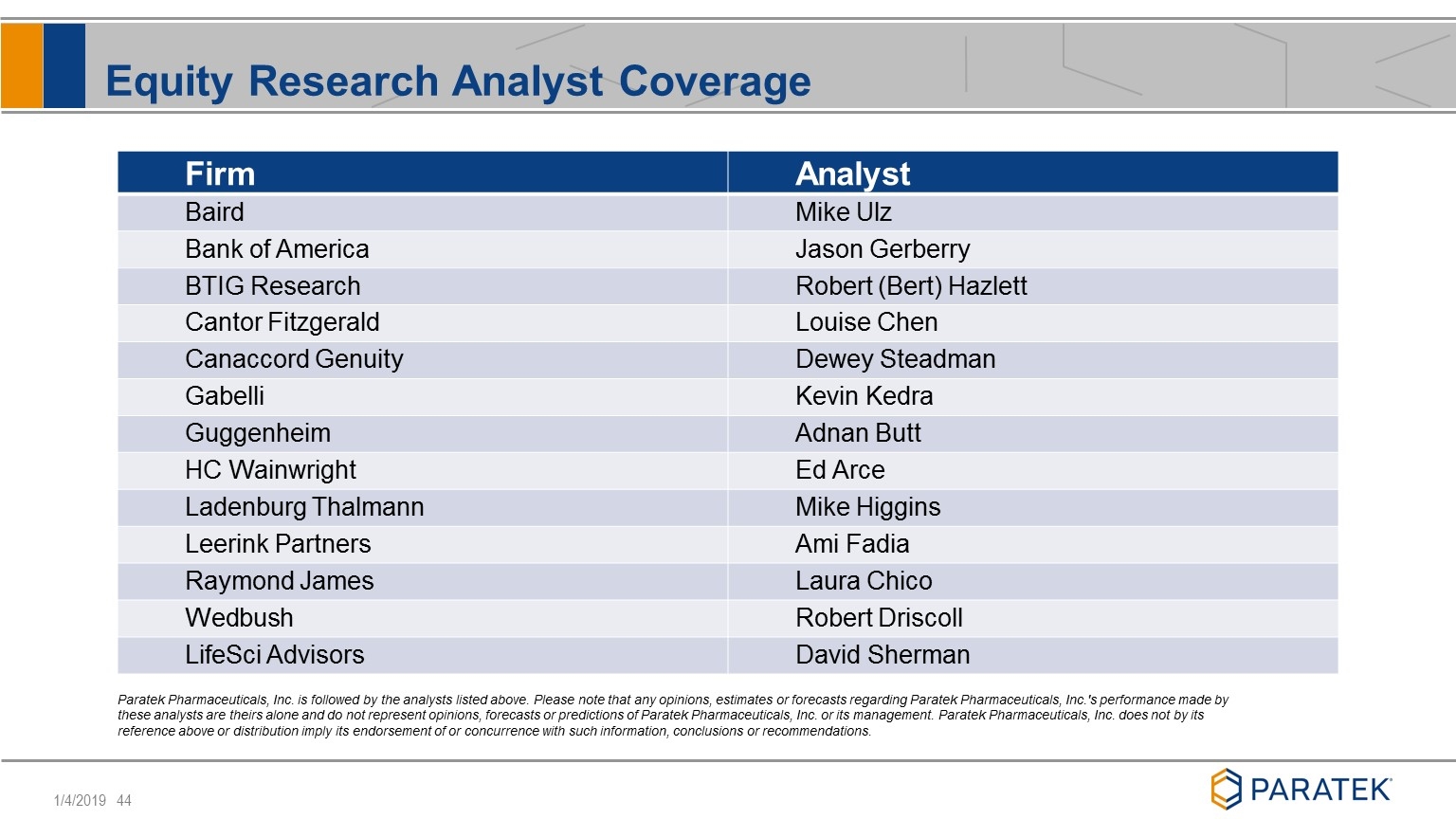

Equity Research Analyst Coverage Paratek Pharmaceuticals, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding Paratek Pharmaceuticals, Inc.'s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Paratek Pharmaceuticals, Inc. or its management. Paratek Pharmaceuticals, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Firm Analyst Baird Mike Ulz Bank of America Jason Gerberry BTIG Research Robert (Bert) Hazlett Cantor Fitzgerald Louise Chen Canaccord Genuity Dewey Steadman Gabelli Kevin Kedra Guggenheim Adnan Butt HC Wainwright Ed Arce Ladenburg Thalmann Mike Higgins Leerink Partners Ami Fadia Raymond James Laura Chico Wedbush Robert Driscoll LifeSci Advisors David Sherman

Paratek Investment Highlights NUZYRATM: Potential Blockbuster Antibiotic in Both Hospital and Community Settings Potential Blockbuster Antibiotic with NUZYRA Clear Registration Path: U.S. FDA and EU EMA NUZYRA approved in the United States; October 2018 Filed in the EU in October 2018: Review has been initiated 1st FDA approved once-daily IV & oral antibiotic to treat both CABP and ABSSSI in nearly 20 years > $9 Billion Potential Addressable Market in U.S. alone* Additional Pipeline Potential Non-dilutive Funding Options UTI Ph2 Studies underway: Data Expected in H2 2019 Biodefense opportunity: Tx & prophylaxis in plague and anthrax Life-cycle opportunities: Oral-Only in CABP, Prostatitis, Rickettsial Disease Capital Efficient Commercial Model Significant Value Proposition = Hospitalization Minimization Hospital Promotion Without Branded Once-Daily Broad-spectrum IV + Oral Competitors (*) Paratek estimates based on 2015 AMR data current treatment failure rates and a Zyvox 2015 pricing analogue (**) Almirall, S.A. licensed U.S. development & commercial rights Omadacycline: Ex-U.S. Commercial Rights (except China) Sarecycline: U.S. Royalties (Almirall S.A.**); Ex-U.S. Rights (PRTK)