| | STATE OF NEVADA | |

ROSS MILLER Secretary of State |  | SCOTT W. ANDERSON Deputy Secretary for Commercial Recordings |

| | OFFICE OF THE SECRETARY OF STATE | |

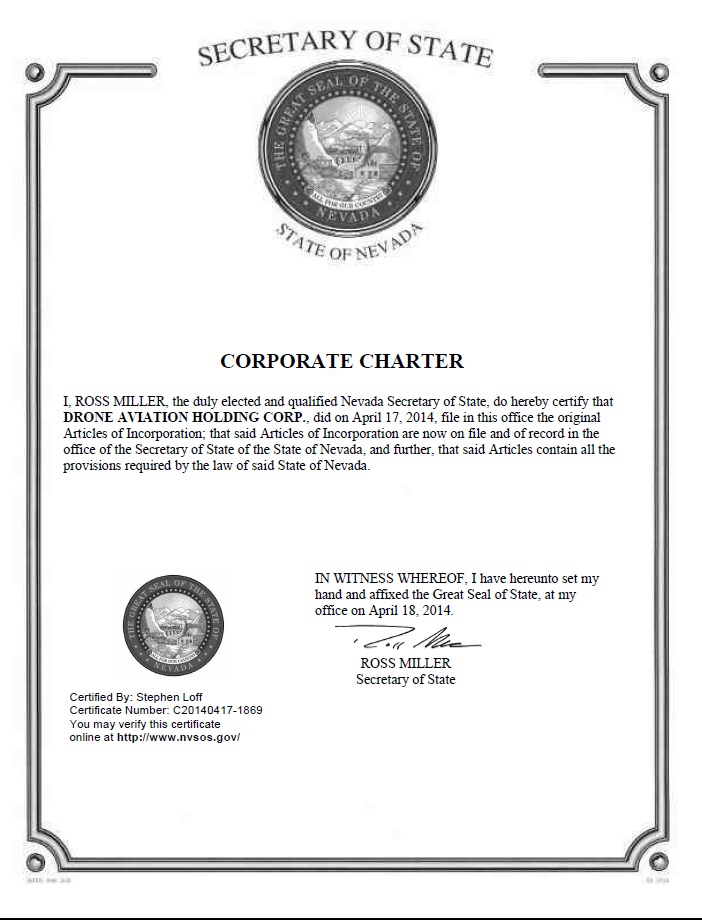

Certified Copy

April 17, 2014

Job Number: C20140417-1869

Reference Number: Expedite:

Through Date:

The undersigned filing officer hereby certifies that the attached copies are true and exact copies of all requested statements and related subsequent documentation filed with the Secretary of State’s Office, Commercial Recordings Division listed on the attached report.

| Document Number(s) | Description | Number of Pages | |

| | | | |

| 20140282266-73 | Articles of Incorporation | 5 Pages/1 Copies | |

| | Respectfully | |

| | | | |

| | | /s/ ROSS MILLER | |

| | | ROSS MILLER | |

| | | Secretary of State | |

| | | |

| Certified By: Stephen Loff | | | |

| Certificate Number: C20140417-1869 | | | |

| You may verify this certificate | | | |

| online at http://www.nvsos.gov/ | | | |

| | | | |

Commercial Recording Division

202 N. Carson Street

Carson City, Nevada 89701-4069

Telephone (775) 684-5708

Fax (775) 684-7138

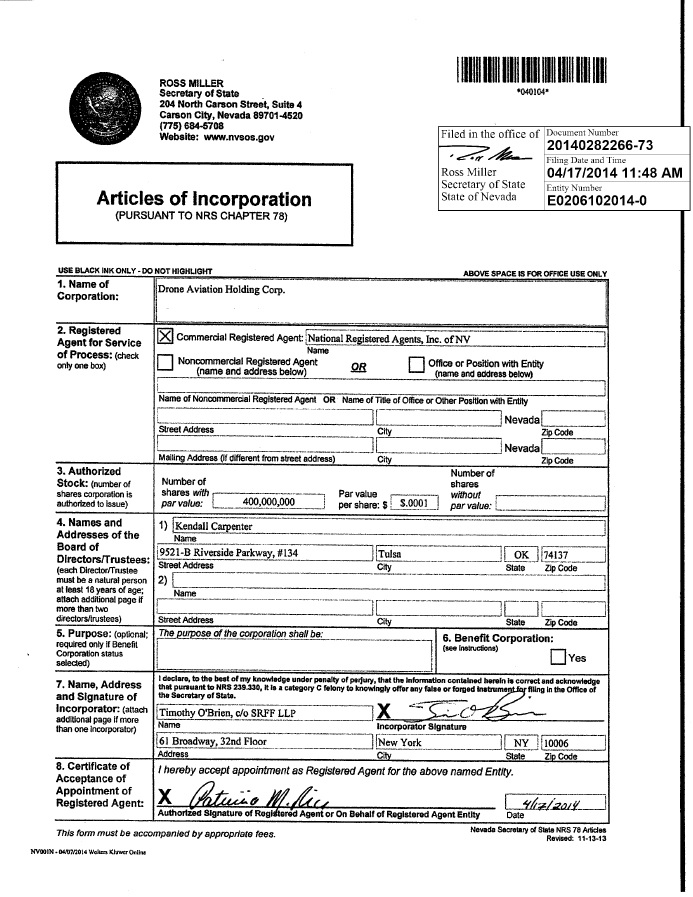

ARTICLES OF INCORPORATION

OF

DRONE AVIATION HOLDING CORP.

A Nevada Corporation

ARTICLE I

NAME

The name of the corporation is Drone Aviation Holding Corp. (the "Corporation").

ARTICLE II

RESIDENT AGENT AND REGISTERED OFFICE

The name of the Corporation's resident agent for service of process is National Registered Agents, Inc. of NV, located at 311 S. Division Street, Carson City, NV 89703.

ARTICLE III

CAPITAL STOCK

3.01 Authorized Capital Stock The total number of shares of stock this Corporation is authorized to issue shall be four hundred million (400,000,000) shares, par value $.0001 per share. This stock shall be divided into two classes to be designated as "Common Stock" and "Blank Check Preferred Stock" ("Preferred Stock").

3.02 Common Stock The total number of authorized shares of Common Stock shall be three hundred million (300,000,000).

3.03 Blank Check Preferred Stock The total number of authorized shares of Preferred Stock shall be one hundred million (100,000,000) shares. The board of directors shall have the authority to authorize the issuance of the Preferred Stock from time to time in one or more classes or series, and to state in the resolution or resolutions from time to time adopted providing for the issuance thereof the following:

(a) Whether or not the class or series shall have voting rights, full or limited, the nature and qualifications, limitations and restrictions on those rights, or whether the class or series will be without voting rights;

(b) The number of shares to constitute the class or series and the designation thereof;

(c) The preferences and relative, participating, optional or other special rights, if any, and the qualifications, limitations, or restrictions thereof, if any, with respect to any class or series;

(d) Whether or not the shares of any class or series shall be redeemable and if redeemable, the redemption price or prices, and the time or times at which, and the terms and conditions upon which, such shares shall be redeemable and the manner of redemption;

(e) Whether or not the shares of a class or series shall be subject to the operation of retirement or sinking funds to be applied to the purchase or redemption of such shares for retirement, and if such retirement or sinking funds be established, the amount and the terms and provisions thereof;

(f) The dividend rate, whether dividends are payable in cash, stock of the Corporation, or other property, the conditions upon which and the times when such dividends are payable, the preference to or the relation to the payment of dividends payable on any other class or classes or series of stock, whether or not such dividend shall be cumulative or noncumulative, and if cumulative, the date or dates from which such dividends shall accumulate;

(g) The preferences, if any, and the amounts thereof which the holders of any class or series thereof are entitled to receive upon the voluntary or involuntary dissolution of, or upon any distribution of assets of, the Corporation;

(h) Whether or not the shares of any class or series are convertible into, or exchangeable for, the shares of any other class or classes or of any other series of the same or any other class or classes of stock of the Corporation and the conversion price or prices or ratio or ratios or the rate or rates at which such exchange may be made, with such adjustments, if any, as shall be stated and expressed or provided for in such resolution or resolutions; and

(i) Such other rights and provisions with respect to any class or series as may to the board of directors seem advisable.

The shares of each class or series of the Preferred Stock may vary from the shares of any other class or series thereof in any respect. The Board of Directors may increase the number of shares of the Preferred Stock designated for any existing class or series by a resolution adding to such class or series authorized and unissued shares of the Preferred Stock not designated for any existing class or series of the Preferred Stock and the shares so subtracted shall become authorized, unissued and undesignated shares of the Preferred Stock.

ARTICLE IV

DIRECTORS

The number of directors comprising the board of directors shall be fixed and may be increased or decreased from time to time in the manner provided in the bylaws of the Corporation, except that at no time shall there be less than one director.

ARTICLE V

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under Nevada Revised Statutes ("NRS").

ARTICLE VI

DIRECTORS' AND OFFICERS' LIABILITY

The individual liability of the directors and officers of the Corporation is hereby eliminated to the fullest extent permitted by the NRS, as the same may be amended and supplemented. Any repeal or modification of this Article by the stockholders of the Corporation shall be prospective only, and shall not adversely affect any limitation on the personal liability of a director or officer of the Corporation for acts or omissions prior to such repeal or modification.

ARTICLE VII

INDEMNITY

Every person who was or is a party to, or is threatened to be made a party to, or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he, or a person of whom he is the legal representative, is or was a director or officer of the Corporation, or is or was serving at the request of the Corporation as a director or officer of another corporation, or as its representative in a partnership, joint venture, trust or other enterprise, shall be indemnified and held harmless to the fullest extent legally permissible under the laws of the State of Nevada from time to time against all expenses, liability and loss (including attorneys' fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by him in connection therewith. Such right of indemnification shall be a contract right which may be enforced in any manner desired by such person. The expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the Corporation as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified by the Corporation. Such right of indemnification shall not be exclusive of any other right which such directors, officers or representatives may have or hereafter acquire, and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification under any bylaw, agreement, vote of stockholders, provision of law, or otherwise, as well as their rights under this Article.

Without limiting the application of the foregoing, the board of directors may adopt bylaws from time to time with respect to indemnification, to provide at all times the fullest indemnification permitted by the laws of the State of Nevada, and may cause the Corporation to purchase and maintain insurance on behalf of any person who is or was a director or officer of the Corporation, or is or was serving at the request of the Corporation as director or officer of another corporation, or as its representative in a partnership, joint venture, trust or other enterprises against any liability asserted against such person and incurred in any such capacity or arising out of such status, whether or not the Corporation would have the power to indemnify such person.

The indemnification provided in this Article shall continue as to a person who has ceased to be a director, officer, employee or agent, and shall inure to the benefit of the heirs, executors and administrators of such person.

| | | |

| | | | |

| Dated: April 17, 2014 | By: | /s/ Timothy A. O'Brien, | |

| | | Timothy A. O'Brien, Sole Incorporator | |

| | | c/o Sichenzia Ross Friedman Ference LLP | |

| | | 61 Broadway, 32nd Floor | |

| | | New York, NY 10006 | |

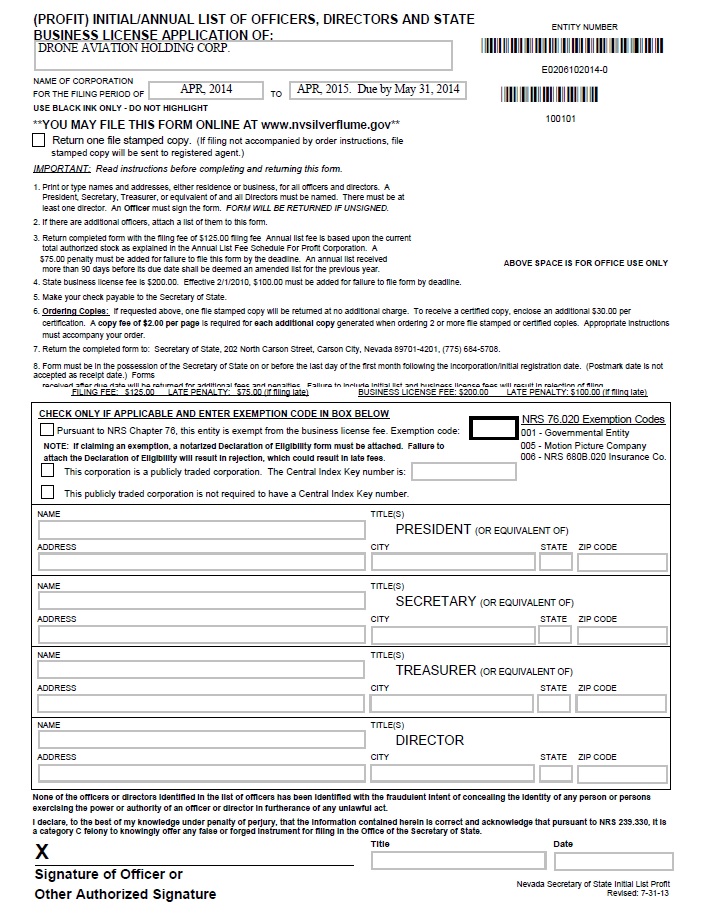

Nevada Secretary of State List InstructionsRevised: 8-8-13 | ROSS MILLER Secretary of State 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov www.nvsilverflume.gov | Instructions for Initial List/Annual List and State Business License Application | |

ATTENTION: You may now file your Initial/Annual List and State Business License online at www.nvsilverflume.gov

IMPORTANT: READ ALL INSTRUCTIONS CAREFULLY BEFORE COMPLETING FORM. TYPE or PRINT the following information on the Initial List and Registered Agent Form:

| 1. | The NAME and ENTITY NUMBER of the entity EXACTLY as it is registered with this office. |

| 2. | The FILING PERIOD is the month and year of filing TO the month and year 12 months from that date. Example: if the entity date was 1/12/99 the filing period would be 1/1999 to 1/2000. |

| 3. | The names and addresses as required on the list should be entered in the boxes provided on the form. |

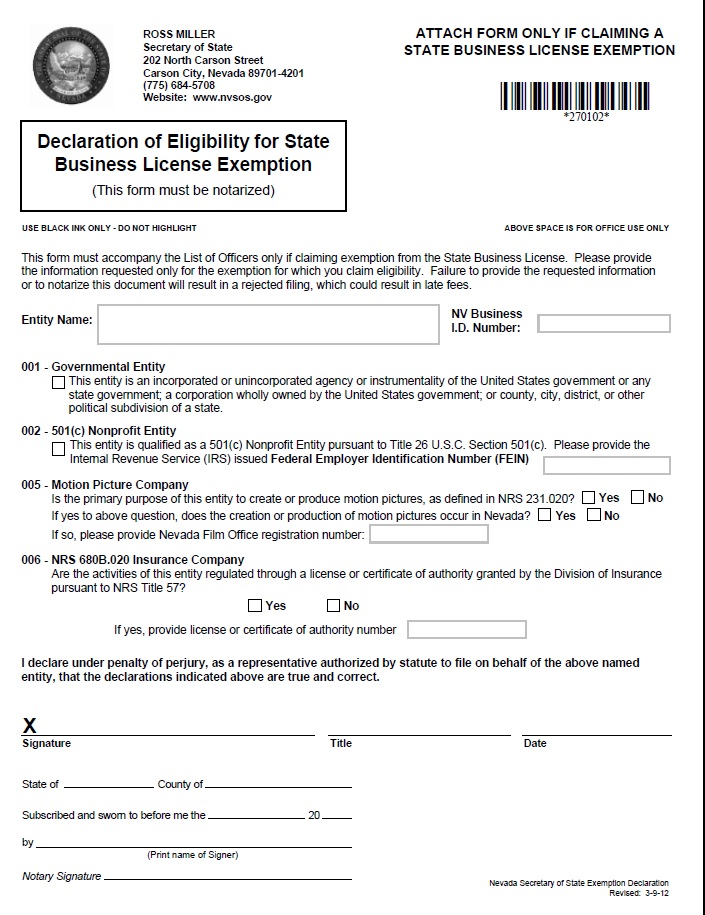

| 4. | If qualified for a statutory exemption from the State Business License, enter the applicable code in the area provided. If claiming exemption, a Declaration of Eligibility for State Business License Exemption must accompany initial list. Entities claiming exemption cannot file online. |

| 5. | The SIGNATURE, including the signers title and date signed MUST be included in the areas provided at the bottom of the form. Signature may be that of an officer or equivalent or that of another person authorized by the entity to sign the list. |

| 6. | Completed FORM, FEES and applicable PENALTIES must be returned to the Secretary of State. Pursuant to NRS 225.085, all Initial and Annual Lists must be in the care, custody and control of the Secretary of State by the close of the business on the due date. Lists received after the due date will be returned unfiled, and will require any associated fees and penalties as a result of being late. Trackable delivery methods such as Express Mail, Federal Express, UPS Overnight may be acceptable if the package was guaranteed to be delivered on or before the due date yet failed to be timely delivered. |

FILING FEES: The annual filing fee for corporations will be based on the amount represented by the total number of shares provided for in the articles. See fee schedule or contact our office. Annual lists for nonprofit corporations without shares are $25.00. Nonprofit corporations and corporations sole are not required to maintain a State Business License or pay the additional fee.

ADDITIONAL FORMS may be obtained on our website at www.nvsos.gov or by calling 775-684-5708.

FILE STAMPED COPIES: To receive one file stamped copy, please mark the appropriate check box on the list. Additional copies require $2.00 per page and appropriate order instructions.

CERTIFIED COPIES: To order a certified copy, enclose an additional $30.00 and appropriate instructions. A copy fee of $2.00 per page is required for each copy generated when ordering 2 or more certified copies.

EXPEDITE FEE: Filing may be expedited for an additional $125.00 fee for 24-hour service, $500.00 for 2-hour service and $1000.00 for 1-hour service.

Filing may be submitted at the office of the Secretary of State or by mail at the following addresses:

MAIN OFFICE: Regular and Expedited Filings | | SATELLITE OFFICE: Expedited Filings Only |

Secretary of State Status Division 202 North Carson Street Carson City NV 89701-4201 Phone: 775-684-5708 Fax: 775-684-7123 | | Secretary of State – Las Vegas Commercial Recordings Division 555 East Washington Ave, Suite 5200 Las Vegas NV 89101 Phone: 702-486-2880 Fax: 702-486-2888 |

10