Brookfield Place, 181 Bay Street, Suite 3910

Toronto, Ontario, M5J 2T3

416-368-9932

|

|

ANNUAL INFORMATION FORM for the year ended December 31, 2017 |

March 23, 2018

TABLE OF CONTENTS

|

| |

| PRELIMINARY NOTES | |

| GLOSSARY OF TECHNICAL TERMS | |

| CORPORATE STRUCTURE | |

| Name and Incorporation | |

| Intercorporate Relationships | |

| GENERAL DEVELOPMENT OF THE BUSINESS | |

| Three-Year History | |

| Risk Factors | |

| MINERAL PROPERTIES | |

| YOUNG-DAVIDSON MINE | |

| Summary | |

| Property Description, Location and Access | |

| History | |

| Geological Setting, Mineralization and Deposit Types | |

| Exploration | |

| Drilling | |

| Sampling, Analysis and Data Verification | |

| Mineral Processing and Metallurgical Testing | |

| Mineral Reserve and Mineral Reserve Estimation | |

| Mining Operations | |

| Milling Operations | |

| Infrastructure, Permitting and Compliance Activities | |

| Capital and Operating Costs | |

| ISLAND GOLD MINE | |

| Summary | |

| Property Description, Location and Access | |

| History | |

| Geological Setting, Mineralization and Deposit Types | |

| Exploration | |

| Drilling | |

| Sampling, Analysis and Data Verification | |

| Mineral Processing and Metallurgical Testing | |

| Mineral Reserve and Mineral Reserve Estimation | |

| Mining Operations | |

| Processing and Recovery Operations | |

| Infrastructure, Permitting and Compliance Activities | |

| Capital and Operating Costs | |

| 2018 Outlook | |

| MULATOS MINE | |

| Summary | |

| Project Description, Location and Access | |

|

| |

| History | |

| Geological Setting, Mineralization and Deposit Types | |

| Exploration | |

| Drilling | |

| 2018 Exploration Outlook for Mulatos | |

| Sampling, Analysis and Data Verification | |

| Mineral Processing and Metallurgical Testing | |

| Mineral Resource and Mineral Reserve Estimates | |

| Mining Operations | |

| Processing and Recovery Operations | |

| Infrastructure, Permitting and Compliance Activities | |

| Capital and Operating Costs | |

| OTHER MINERAL PROPERTIES | |

| El Chanate (Mexico) | |

| Kirazlı, Aği Daği, and Çamyurt (Turkey) | |

| Lynn Lake (Manitoba, Canada) | |

| December 31, 2017 Reserves and Resources | |

| Qualified Person(s) Disclosure | |

| Uses of Gold | |

| Sales and Refining | |

| Employees | |

| DIVIDENDS | |

| DESCRIPTION OF CAPITAL STRUCTURE | |

| MARKET FOR SECURITIES | |

| PRIOR SALES | |

| DIRECTORS AND OFFICERS | |

| AUDIT COMMITTEE | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | |

| TRANSFER AGENT AND REGISTRAR | |

| LEGAL PROCEEDINGS | |

| MATERIAL CONTRACTS | |

| INTERESTS OF EXPERTS | |

| ADDITIONAL INFORMATION | |

| SCHEDULE “A” | |

ANNUAL INFORMATION FORM - 2017

ANNUAL INFORMATION FORM

(“AIF”)

ALAMOS GOLD INC.

(the “Company”)

PRELIMINARY NOTES

Effective Date of Information

The information in this AIF is current as of March 23, 2018, unless otherwise stated herein.

Currency and Exchange Rates

All dollar amounts in this AIF are expressed in United States dollars, unless otherwise indicated (“CAD” denotes Canadian dollars). The following table sets forth the value of the Canadian dollar expressed in United States dollars on December 31 of each year and the average, high and low exchange rates during the year indicated based on the daily exchange rate as reported by the Bank of Canada.

|

| | | | | | | | | |

| Canadian Dollars into United States Dollars | 2017 |

| 2016 |

| 2015 |

|

| Closing |

| $0.7971 |

|

| $0.745 |

|

| $0.723 |

|

| Average |

| $0.7708 |

|

| $0.755 |

|

| $0.783 |

|

| High |

| $0.8245 |

|

| $0.797 |

|

| $0.862 |

|

| Low |

| $0.7276 |

|

| $0.685 |

|

| $0.714 |

|

The exchange rate on March 23, 2018, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was USD$0.78 equals CAD$1.00.

Imperial Equivalents

For ease of reference, the following factors for converting metric measurements to imperial equivalents are provided:

|

| | |

| To Convert From Metric | To Imperial | Multiply by |

| Hectares | Acres | 2.471 |

| Metres | Feet (ft.) | 3.281 |

| Kilometres (km) | Miles | 0.621 |

| Tonnes | Tons (2000 pounds) | 1.102 |

| Grams/tonne | Ounces (troy/ton) | 0.029 |

Forward-Looking Statements

This AIF contains forward-looking statements within the meaning of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Canadian securities laws, concerning the Company’s plans for its properties and other matters. All statements other than statements of historical fact included in this AIF, including, without limitation, statements regarding forecasted gold production, gold grades, achieving projected recovery rates, anticipated production rates and mine life, operating efficiencies, costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable reserves, waste-to-ore ratios, expected project development timelines (including permitting timelines) and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable, and assumptions of management.

ANNUAL INFORMATION FORM - 2017

Exploration results that include geophysics, sampling, and drill results on wide spacing may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category of resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable reserves.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual events or results to differ from those reflected in the forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include risks related to the on-going business of the Company, including risks related to international operations; the actual results of current exploration activities; conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of gold and silver, as well as those risk factors described in the section entitled “Risk Factors” in this AIF. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Mineral Reserve and Resource Estimates

Unless otherwise indicated, all resource and reserve estimates included in this AIF have been prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ materially from the definitions in SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. Under SEC (defined below) Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101 and the CIM Standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the U.S. Securities and Exchange Commission (the “SEC”). Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre–feasibility studies, except in very limited circumstances. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Non-GAAP Measures and Additional GAAP Measures

ANNUAL INFORMATION FORM - 2017

The Company has included certain non-GAAP financial measures to supplement its Consolidated Financial Statements, which are presented in accordance with IFRS, including the following:

| |

| • | total cash cost per ounce of gold sold; |

| |

| • | mine-site all-in sustaining cost per ounce of gold sold; and |

| |

| • | all-in sustaining cost (“AISC”) per ounce of gold sold. |

The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-GAAP financial measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Management's determination of the components of non-GAAP and additional measures are evaluated on a periodic basis influenced by new items and transactions, a review of investor uses and new regulations as applicable. Any changes in the measures are dully noted and retrospectively applied as applicable.

Total Cash Costs per ounce

Total cash costs per ounce is a non-GAAP term typically used by gold mining companies to assess the level of gross margin available to the Company by subtracting these costs from the unit price realized during the period. This non-GAAP term is also used to assess the ability of a mining company to generate cash flow from operations. Total cash costs per ounce includes mining and processing costs plus applicable royalties, and net of by-product revenue and net realizable value adjustments. Total cash costs per ounce is exclusive of exploration costs.

Total cash costs per ounce is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

All-in Sustaining Cost per ounce and Mine-site All-in Sustaining Cost

The Company adopted an “all-in sustaining costs per ounce” non-GAAP performance measure in accordance with the World Gold Council published in June 2013. The Company believes the measure more fully defines the total costs associated with producing gold; however, this performance measure has no standardized meaning. Accordingly, there may be some variation in the method of computation of “all-in sustaining costs per ounce” as determined by the Company compared with other mining companies. In this context, “all-in sustaining costs per ounce” for the consolidated Company reflects total mining and processing costs, corporate and administrative costs, share-based compensation, exploration costs, sustaining capital, and other operating costs.

For the purposes of calculating “mine-site all-in sustaining costs” at the individual mine-sites, the Company does not include an allocation of corporate and administrative costs and share-based compensation.

Sustaining capital expenditures are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects as well as certain expenditures at the Company’s operating sites that are deemed expansionary in nature. For each mine-site reconciliation, corporate and administrative costs, and non-site-specific costs are not included in the all-in sustaining cost per ounce calculation.

All-in sustaining costs per gold ounce is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

ANNUAL INFORMATION FORM - 2017

Detailed reconciliations of the non-GAAP measures to IFRS measures for the years ended December 31, 2017 and December 31, 2016 can be found in the Company’s MD&A for the year ended December 31, 2017 as available on the Alamos website at www.alamosgold.com and on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com.

GLOSSARY OF TECHNICAL TERMS

In this AIF unless otherwise defined or unless there is something in the subject matter or context inconsistent therewith, the following terms have the meanings set forth herein or therein:

|

| |

“Ag” | Silver. |

“Au” | Gold. |

“CIM Definition Standards” | Mineral Resources and Mineral Reserves prepared by the CIM Standing Committee on Reserve Definitions adopted by CIM Council on May 10, 2014. |

“dacite” | The extrusive (volcanic) equivalent of quartz-diorite. |

“dome” | An uplift or anticlinal structure, either circular or elliptical in outline, in which the rocks dip gently away in all directions. |

“doré” | Unrefined gold and silver bullion bars, which will be further refined to almost pure metal. |

“grade” | Term used to indicate the concentration of an economically desirable mineral or element in its host rock as a function of its relative mass. With gold, this term may be expressed as grams per tonne (“g/t”) or ounces per tonne (“opt”). |

“g/t Au” | Grams per tonne of gold. |

“HQ diameter” | 2.4 inch diameter drill hole. |

“IFRS” | International financial reporting standards, the accounting principles used by the Company. |

“indicated resource” or “indicated mineral resource” | That part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

“inferred resource” or “inferred mineral resource” | That part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

“km” | Kilometres. |

“leaching” | The separation, selective removal or dissolving-out of soluble constituents from a rock or ore body by the natural actions of percolating solutions. |

“m” | Metres. |

“measured resource” or “measured mineral resource” | That part of a mineral resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

“Mineral Reserve” | The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economics and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that occur when the material is mined and processed. |

ANNUAL INFORMATION FORM - 2017

|

| |

“Mineral Resource” | A concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. The term “mineral resource” covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which mineral reserves may subsequently be defined by the consideration and application of technical, economic, legal, environmental, socio-economic and governmental factors. The phrase “reasonable prospects for economic extraction” implies a judgment by the Qualified Person in respect of the technical and economic factors likely to influence the prospect of economic extraction. A mineral resource is an inventory of mineralization that under realistically assumed and justifiable technical and economic conditions might become economically extractable. The term “mineral resource” used in this AIF is a Canadian mining term as defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards. |

“Modifying Factors” | Considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

“NSR” | Net smelter return royalty, consisting of a payment made by a producer of metals based on the value of the gross metal production from the property, less deduction of certain limited costs including, but not necessarily limited to, smelting, refining, transportation and insurance costs. |

“NI 43-101” | National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators. |

“NQ diameter” | 1.75 inch diameter drill hole. |

“ore” | A natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit, or from which some part may be profitably separated. |

“ounces” or “oz” | A measure of weight in gold and other precious metals, correctly troy ounces, which weigh 31.2 grams as distinct from an imperial ounce which weighs 28.4 grams. |

“ppm” | Parts per million. |

“ppb” | Parts per billion. |

“PQ diameter” | 3.2-inch drill hole diameter. |

“Probable Mineral Reserve” | The economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. |

“Proven Mineral Reserve” | The economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. |

“QA/QC” | Quality assurance/quality control. |

“Qualified Person” | Has the meaning given to such term in NI 43-101. |

“RQD” | Rock quality designation. |

“tpd” | Tonnes per day. |

CORPORATE STRUCTURE

Name and Incorporation

The name of the Company is Alamos Gold Inc. The Company’s principal place of business and registered office is Brookfield Place, 181 Bay Street, Suite 3910, Toronto, Ontario M5J 2T3.

AuRico Gold Inc. (“AuRico”) amalgamated with Alamos Gold Inc. (“Former Alamos”) under section 182 of the Business Corporations Act (Ontario) (“OBCA”) pursuant to Articles of Arrangement dated July 2, 2015 with the resulting amalgamated company continuing under the name Alamos Gold Inc. (“Alamos” or the “Company”).

Alamos is a public company listed on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”) under the symbol “AGI” and has a quoted market value of approximately CAD$2.710 billion as of March 23, 2018.

ANNUAL INFORMATION FORM - 2017

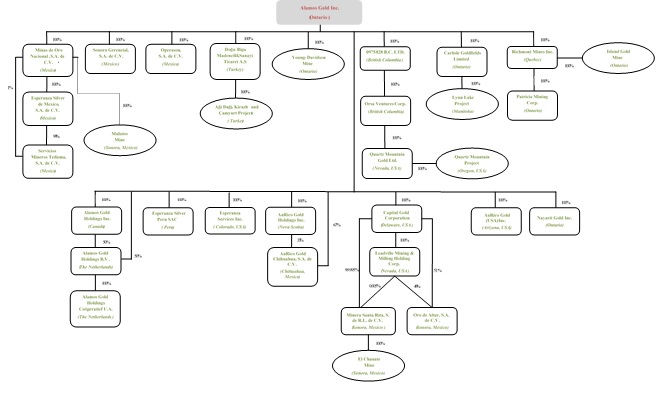

Intercorporate Relationships

In this AIF, unless the context otherwise requires, the terms “we”, “us”, “our”, and similar terms as well as references to “Alamos” or the “Company” refer to Alamos Gold Inc. The following diagram sets forth the Company’s intercorporate relationships with its active subsidiaries including the jurisdiction of incorporation or organization and the Company’s respective percentage ownership of each subsidiary.

GENERAL DEVELOPMENT OF THE BUSINESS

Alamos is a mining company engaged in the mining and extraction of, and exploration for, precious metals, primarily gold. Alamos owns and operates the Young-Davidson mine (the “Young-Davidson Mine”), and the Island Gold mine (the “Island Gold Mine”) in Ontario, Canada and the Mulatos mine (the “Mulatos Mine”) and El Chanate mine (the “El Chanate Mine”) in the state of Sonora, Mexico. In 2017, the Young-Davidson Mine produced 200,000 ounces of gold, the Island Gold Mine produced 98,600 ounces of gold (9,000 ounces attributable to Alamos following completion of the Richmont Mines Inc. (“Richmont”) acquisition on November 23, 2017), the Mulatos Mine produced 160,000 ounces of gold and the El Chanate Mine produced 60,400 ounces of gold for total gold production of 429,400 ounces. Alamos also owns the development-stage Ağı Dağı, Kirazlı and Çamyurt Projects in the Biga district of northwestern Turkey (acquired in 2010); the Esperanza Gold Project in Morelos State, Mexico (acquired in 2013), the Quartz Mountain Property in Oregon, USA (acquired in 2013), and the Lynn Lake Gold Project in Lynn Lake, Manitoba (acquired in 2016).

Three-Year History

| |

| • | On April 13, 2015, AuRico and Former Alamos announced that they had entered into a definitive agreement to combine their respective companies. Under the terms of the merger, holders of Former Alamos shares received, for each share held, 1 Alamos share and USD$0.0001 in cash, and holders of AuRico shares received, for each AuRico share held, 0.5046 Alamos shares. Upon completion of the merger, Former Alamos and AuRico shareholders each owned approximately 50% of Alamos. In addition, a new company named AuRico Metals Inc. (“AuRico Metals”), was created |

ANNUAL INFORMATION FORM - 2017

to hold AuRico’s Kemess project, a 1.5% net smelter return royalty (“NSR”) on the Young-Davidson Mine and AuRico’s Fosterville and Stawell royalties, and was capitalized with USD$20 million of cash. Upon completion of the merger, Alamos owned a 4.9% equity interest in AuRico Metals. The remaining shares of AuRico Metals were distributed approximately 50% each to Former Alamos and AuRico shareholders.

| |

| • | AuRico amalgamated with Former Alamos under section 182 of the OBCA pursuant to Articles of Arrangement dated July 2, 2015 with the resulting amalgamated company continuing under the name “Alamos Gold Inc.” |

| |

| • | On January 7, 2016 Alamos completed the acquisition of Carlisle Goldfields Limited (“Carlisle”), and its 100% ownership of the Lynn Lake Gold Project located in Lynn Lake, Manitoba. Alamos issued approximately 5.5 million shares and issued approximately 5.5 million share purchase warrants in consideration for Carlisle. |

| |

| • | On March 22, 2016, the Company amended and restated its existing $150 million senior secured credit facility, extending the maturity from April 26, 2016 to February 29, 2020. The facility consists of a committed $150 million revolving credit facility (the “Facility”), with an option to draw an additional $70 million, subject to commitments from existing and/or new lenders. The terms of the Facility resulted in more favorable pricing and removal of a minimum tangible net worth test and a proven and probable reserves test, compared to the previous facility. The Facility is secured by a first-ranking lien on all present and future material assets, property and undertaking of the Company, with certain exclusions. |

| |

| • | On September 12, 2016, the Company reported a significant interim increase in mineral resources for its La Yaqui Project. |

| |

| • | On October 6, 2016, Alamos reported it has received final approval of the Environmental Impact Assessment (“EIA”) for Phase I of its La Yaqui Project. |

| |

| • | On January 5, 2017, the Company announced the receipt of Forestry Permits for its Kirazlı Project, Turkey. |

| |

| • | On January 6, 2017, the Company announced production of 392,000 ounces of gold for 2016. |

| |

| • | On February 9, 2017, the Company completed a USD$250 million bought-deal equity financing, along with an announcement that it would use proceeds of such financing (along with current cash reserves) to retire the $315 million 7.75% Senior Secured Notes in full. |

| |

| • | On February 22, 2017, the Company announced updated positive studies on each of its Turkish Projects, including feasibility studies on both its Kirazlı and Ağı Dağı Projects; as well, a preliminary economic assessment on its Çamyurt Project. |

| |

| • | On February 23, 2017, the Company reported its updated mineral reserves and resources as of December 31, 2016. |

| |

| • | On March 31, 2017, the Company filed a technical report for its Kirazlı gold project, located in the Canakkale Province in northwestern Turkey in accordance with NI 43-101. |

| |

| • | On April 3, 2017, the Company completed the redemption of its outstanding USD$315 million 7.75% Senior Secured Second Lien Notes (the “Notes”) due in 2020. This resulted in annual interest savings of USD$24.4 million. The Notes were redeemed at a price of 103.875% of the principal amount plus accrued interest to the date of redemption. The Notes were retired with net proceeds of USD$239 million from the equity financing completed in February 2017 along with existing cash. |

| |

| • | On April 7, 2017, the Company filed a technical report for its Ağı Dağı and Çamyurt gold projects, located in the Canakkale Province in northwestern Turkey. The report included results from the feasibility study conducted on Ağı Dağı and preliminary economic assessment completed on Çamyurt. The report was prepared in accordance with NI 43-101. |

ANNUAL INFORMATION FORM - 2017

| |

| • | On September 7, 2017, the Company announced that construction of the first phase of the La Yaqui mine was complete, on budget, and ahead of schedule. |

| |

| • | On September 21, 2017, the Company announced that it had secured amendments to its existing undrawn revolving credit facility (the “Facility”) including an increase in the size of the Facility from USD$150 million to USD$400 million on more favourable terms. The maturity date of the Facility was extended to September 20, 2021. |

| |

| • | On November 23, 2017, the Company announced the completion of the previously announced plan of arrangement (the “Transaction”) whereby Alamos acquired all of the issued and outstanding shares of Richmont. Under the terms of the Transaction, all Richmont issued and outstanding common shares were exchanged on the basis of 1.385 Alamos common shares for each Richmont common share. |

Risk Factors

The following is a discussion of risk factors relevant to the Company’s operations and future financial performance. Additional risks not currently known by the Company, or that the Company currently deems immaterial, may also impair the Company’s operations. You should carefully consider the risks and uncertainties described below as well as the other information contained and incorporated by reference in this AIF.

The financing, exploration, development and mining of any of the Company’s properties is subject to a number of risk factors, including, among other things, the price of gold, laws and regulations, political conditions, currency fluctuations, and the ability to hire qualified people and to obtain necessary services in jurisdictions where the Company operates. Before deciding to invest in securities of the Company, investors should consider carefully such risks and uncertainties.

Commodity and Currency Risk

In recent years financial conditions have been characterized by volatility, which in turn has resulted in volatility in commodity prices and foreign exchange rates, tightening of the credit market, increased counterparty risk, and volatility in the prices of publicly traded entities. The volatility in commodity prices and foreign exchange rates directly impacts the Company’s revenues, earnings and cash flow.

The volatility of the price of gold and the price of other metals could have a negative impact on the Company’s future operations.

The value of the Company’s mineral resources and future operating profit and loss is significantly impacted by fluctuations in gold prices, over which the Company has no control. A reduction in the price of gold may prevent the Company’s properties from being economically mined or result in the write-off of assets whose value is impaired as a result of low gold prices. The price of gold may also have a significant influence on the market price of the Company’s common shares. The price of gold is affected by numerous factors beyond the Company’s control, such as the level of inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, sale of gold by central banks and the political and economic conditions of major gold producing countries throughout the world.

In addition to adversely affecting the Company’s reserve and resource estimates and financial condition, declining metal prices can impact operations by requiring a reassessment of the feasibility of a particular project, and the Company may determine that it is not feasible to continue commercial production at some or all of its current projects. Even if a project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays and/or may interrupt operations until the reassessment can be completed, which may have a material adverse effect on the results of operations and financial condition.

From time to time the Company may engage in commodity hedging transactions intended to reduce the risk associated with fluctuations in commodity prices, but there is no assurance that any such commodity-hedging transactions designed to reduce the risk associated with fluctuations in metal prices will be successful. Hedging may not protect adequately against declines in the price of the hedged metal. Furthermore, although hedging may protect the Company from a decline in the price of the metal being hedged, it may also prevent it from benefiting from price increases.

The Company is subject to currency fluctuations that may adversely affect the financial position of the Company.

The Company is subject to currency risks. The Company’s functional currency is the U.S. dollar, which is exposed to fluctuations against other currencies. The Company’s mining operations are located in Canada and Mexico, with additional development

ANNUAL INFORMATION FORM - 2017

stage assets in Canada, the United States, Mexico and Turkey, and as such many of its expenditures and obligations are denominated in Canadian dollars, Mexican pesos, Turkish lira and Euros. The Company maintains its principal office in Toronto (Canada), maintains cash accounts in U.S. dollars, Mexican pesos, Turkish lira and Canadian dollars and has monetary assets and liabilities in U.S. dollars and Canadian dollars, Mexican pesos and Turkish lira.

The Company’s operating results and cash flow are significantly affected by changes in the U.S./Canadian dollar and U.S./Mexican peso exchange rates. Revenues are denominated in U.S. dollars, while most expenses are currently denominated in Canadian dollars and Mexican pesos. Exchange rate movements can therefore have a significant impact on most of the Company’s costs. The appreciation of non-U.S. dollar currencies against the U.S. dollar can increase the costs of production at Alamos’ mines, making these mines less profitable.

From time to time the Company may engage in foreign exchange hedging transactions intended to reduce the risk associated with fluctuations in foreign exchange rates, but there is no assurance that any such hedging transactions designed to reduce the risk associated with fluctuations in exchange rates will be successful and as such, operating costs and capital expenditures may be adversely impacted.

Financial, Finance and Tax Risks

The Company’s activities expose it to a variety of financial risks including interest rate risk, credit risk and liquidity risk. The Company’s risk management program focuses on the unpredictability of financial markets and seeks to minimize potential adverse effects on the Company’s financial performance. The Company may use derivative financial instruments to hedge certain risk exposures. The Company does not purchase derivative financial instruments for speculative investment purposes.

The Company’s revolving credit facility contains a number of restrictive covenants that impose significant operating and financial restrictions on the Company and may limit its ability to engage in acts that may be in the Company’s long-term best interest.

The Company’s failure to comply with covenants in its revolving credit facility could result in an event of default which, if not cured or waived, could result in funds not being available or the acceleration of any outstanding debt, if any. The restrictions include, without limitation, restrictions on its ability to:

| |

| • | Incur additional indebtedness; |

| |

| • | Pay dividends or make other distributions or repurchase or redeem its capital stock; |

| |

| • | Prepay, redeem or repurchase certain debt; |

| |

| • | Make loans and investments; |

| |

| • | Sell, transfer or otherwise dispose of assets; |

| |

| • | Incur or permit to exist certain liens; |

| |

| • | Enter into transactions with affiliates; |

| |

| • | Enter into agreements restricting its subsidiaries’ ability to pay dividends; and |

| |

| • | Consolidate, amalgamate, merge or sell all or substantially all of the Company’s assets. |

Liquidity Risk

Liquidity risk arises through the excess of financial obligations due over available financial assets at any point in time. The Company’s objective in managing liquidity risk is to maintain sufficient readily available cash reserves and credit in order to meet its liquidity requirements at any point in time. The total cost and planned timing of acquisitions and/or other development or construction projects is not currently determinable and it is not currently known whether the Company will require external financing in future periods.

In order to finance future operations, the Company may raise funds through the issuance of shares or the issuance of debt instruments or other securities convertible into shares.

The Company cannot predict the potential need or size of future issuances of common shares or the issuance of debt instruments or other securities convertible into shares or the effect, if any, that this would have on the market price of the Company’s common shares. Any transaction involving the issuance of shares, or securities convertible into shares, could result in dilution, possibly substantial, to present and prospective security holders.

ANNUAL INFORMATION FORM - 2017

The Company is subject to taxation in multiple jurisdictions and adverse changes to the taxation laws of such jurisdictions could have a material adverse effect on its profitability.

The Company has operations and conducts business in multiple jurisdictions and it is subject to the taxation laws of each such jurisdiction. These taxation laws are complicated and subject to change. The Company may also be subject to review, audit and assessment in the ordinary course. Any such changes in taxation law or reviews and assessments could result in higher taxes being payable or require payment of taxes due from previous years, which could adversely affect the Company’s profitability. Taxes may also adversely affect the Company’s ability to repatriate earnings and otherwise deploy its assets.

The Company may not be able to obtain the external financing necessary to continue its exploration and development activities on its mineral properties.

The ability of the Company to continue the exploration and development of its property interests will be dependent upon its ability to increase revenues from its existing production and planned expansions, and potentially raise significant additional financing thereafter. The sources of external financing that the Company may use for these purposes may include project debt, corporate debt or equity offerings. There is no assurance that the financing alternative chosen by the Company will be available to the Company, on favourable terms or at all. Depending on the alternative chosen, the Company may have less control over the management of its projects. There is no assurance that the Company will successfully increase revenues from existing and expanded production. Should the Company not be able to obtain such financing and increase its revenues, it may become unable to acquire and retain its exploration properties and carry out exploration and development on such properties, and its title interests in such properties may be adversely affected or lost entirely.

Production, Mining and Operating Risks

The Company is, and expects to continue to be, dependent on four mines for all of its commercial production.

The Young-Davidson, Island Gold, Mulatos and El Chanate Mines accounted for all of the Company’s commercial production in 2017 and are expected to continue to account for all of its commercial production in the near term. Any adverse condition affecting mining, processing conditions, expansion plans or ongoing permitting at Young-Davidson, Island Gold, Mulatos or El Chanate could have a material adverse effect on the Company’s financial performance and results of operations.

Forecasts of future production are estimates based on interpretation and assumptions and actual production may be less than estimated.

The Company prepares estimates of future production for its operating mines. The Company cannot give any assurance that it will achieve its production estimates. The failure of the Company to achieve its production estimates could have a material and adverse effect on future cash flows, profitability, results of operations and financial condition. These production estimates are dependent on, among other things, the accuracy of mineral reserve estimates, leach pad inventory, the accuracy of assumptions regarding ore grades and recovery rates, ground conditions, physical characteristics of ores, such as hardness and the presence or absence of particular metallurgical characteristics and the accuracy of estimated rates and costs of mining and processing.

The Company’s actual production may vary from its estimates for a variety of reasons, including: actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; short-term operating factors such as the need for sequential development of orebodies and the processing of new or different ore grades from those planned; mine failures, slope failures or equipment failures; industrial accidents; natural phenomena such as inclement weather conditions, floods, droughts, rock slides and earthquakes; encountering unusual or unexpected geological conditions; changes in power costs and potential power shortages; shortages of principal supplies needed for operation, including explosives, fuels, chemical reagents, water, equipment parts and lubricants; labour shortages or strikes; civil disobedience and protests; and restrictions or regulations imposed by government agencies or other changes in the regulatory environments. Such occurrences could result in damage to mineral properties, interruptions in production, injury or death to persons, damage to property of the Company or others, monetary losses and legal liabilities. These factors may cause a mineral deposit that has been mined profitably in the past to become unprofitable, forcing the Company to cease production. It is not unusual in new mining operations to experience unexpected problems during the start-up phase. Depending on the price of gold or other minerals, the Company may determine that it is impractical to commence or, if commenced, to continue commercial production at a particular site.

Mining operations and facilities are intensive users of electricity and carbon-based fuels. Energy prices can be affected by numerous factors beyond the Company’s control, including global and regional supply and demand, political and economic conditions, and applicable regulatory regimes. The prices of various sources of energy may increase significantly from current

ANNUAL INFORMATION FORM - 2017

levels. An increase in energy prices for which the Company is not hedged could materially adversely affect the results of operations and financial condition.

The Company’s production costs are also affected by the prices of commodities consumed or used in operations, such as lime, cyanide and explosives. The prices of such commodities are influenced by supply and demand trends affecting the mining industry in general and other factors outside the Company’s control. Increases in the price for materials consumed in mining and production activities could materially adversely affect the Company’s results of operations and financial condition.

Risks and costs relating to development, ongoing construction and changes to existing mining operations and development projects.

The Company’s ability to meet development and production schedules and cost estimates for its development and expansion projects cannot be assured. Without limiting the generality of the foregoing, the Company is in the process of completing a ramp-up and expansion at both the Young-Davidson and Island Gold Mines and development at its Cerro Pelon and La Yaqui deposits near the Mulatos Mine in Mexico. In addition, the Company is undertaking permitting efforts with respect to expanded tailings dam facilities at the Young-Davidson Mine and expansion of the mill at Island Gold. Technical considerations, delays in obtaining governmental approvals, inability to obtain financing or other factors - including specifically to the foregoing - could cause delays in current mining operations or in developing properties. Such delays could materially affect the financial performance of the Company.

The Company prepares estimates of operating costs and/or capital costs for each operation and project. No assurance can be given that such estimates will be achieved. Failure to achieve cost estimates or material increases in costs could have an adverse impact on future cash flows, profitability, results of operations and financial condition.

Development projects are uncertain and it is possible that actual capital and operating costs and economic returns will differ significantly from those estimated for a project prior to production.

Alamos has a number of development stage projects in Canada, Mexico, the United States and Turkey. Mine development projects require significant expenditures during the development phase before production is possible. Development projects are subject to the completion of successful feasibility studies and environmental assessments, issuance of necessary governmental permits and availability of adequate financing. The economic feasibility of development projects is based on many factors such as: estimation of mineral reserves, anticipated metallurgical recoveries, environmental considerations and permitting, future gold prices, and anticipated capital and operating costs of these projects. Our development projects have no operating history upon which to base estimates of future production and cash operating costs. Particularly for development projects, estimates of proven and probable mineral reserves and cash operating costs are, to a large extent, based upon the interpretation of geologic data obtained from drill holes and other sampling techniques, and feasibility studies that derive estimates of cash operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of gold from the ore, estimated operating costs, anticipated climatic conditions and other factors. As a result, it is possible that actual capital and operating costs and economic returns will differ significantly from those currently estimated for a project prior to production.

Any of the following events, among others, could affect the profitability or economic feasibility of a project: unanticipated changes in grade and tonnes of ore to be mined and processed, unanticipated adverse geological conditions, unanticipated metallurgical recovery problems, incorrect data on which engineering assumptions are made, availability of labour, costs of processing and refining facilities, availability of economic sources of power, adequacy of water supply, availability of surface on which to locate processing and refining facilities, adequate access to the site, unanticipated transportation costs, government regulations (including regulations with respect to the environment, prices, royalties, duties, taxes, permitting, restrictions on production, quotas on exportation of minerals, environmental), fluctuations in gold prices, and accidents, labour actions and force majeure events.

It is not unusual in new mining operations to experience unexpected problems during the start-up phase, and delays can often occur at the start of production. It is likely that actual results for our projects will differ from current estimates and assumptions, and these differences may be material. In addition, experience from actual mining or processing operations may identify new or unexpected conditions that could reduce production below, or increase capital or operating costs above, current estimates. If actual results are less favourable than currently estimated, our business, results of operations, financial condition and liquidity could be materially adversely affected.

ANNUAL INFORMATION FORM - 2017

The figures for the Company’s reserves and resources are estimates based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

The Company must continually replace reserves depleted by production to maintain production levels over the long term. Reserves can be replaced by expanding known orebodies, locating new deposits or making acquisitions. Exploration is highly speculative in nature. Alamos’ exploration projects involve many risks and are frequently unsuccessful. Once a site with mineralization is discovered, it may take several years from the initial phases of drilling until production is possible, during which time the economic feasibility of production may change.

The Company’s mineral reserve and mineral resource estimates are estimates only and no assurance can be given that any particular level of recovery of gold or other minerals from mineral resources or mineral reserves will in fact be realized. There can also be no assurance that an identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be economically exploited. Additionally, no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. These estimates may require adjustments or downward revisions based upon further exploration or development work or actual production experience.

Estimates of mineral resources and mineral reserves can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ dramatically from that indicated by results of drilling, sampling and other similar examinations. Short term factors relating to mineral resources and mineral reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations.

Material changes in mineral resources and mineral reserves, grades, stripping ratios or recovery rates may affect the economic viability of projects. There is a risk that depletion of reserves will not be offset by discoveries, acquisitions or the conversion of mineral resources into mineral reserves. The mineral base of Alamos’ mines may decline if reserves are mined without adequate replacement and the Company may not be able to sustain production beyond the current mine lives, based on current production rates.

Mineral resources and mineral reserves are reported as general indicators of mine life. Mineral resources and mineral reserves should not be interpreted as assurances of mine life or of the profitability of current or future operations. There is a degree of uncertainty attributable to the calculation and estimation of mineral resources and mineral reserves and corresponding grades being mined or dedicated to future production. Until ore is actually mined and processed, mineral reserves and grades must be considered as estimates only.

In addition, the quantity of mineral resources and mineral reserves may vary depending on mineral prices. Extended declines in market prices for gold and silver may render portions of the Company’s mineralization uneconomic and result in reduced reported mineralization. Any material change in mineral resources and mineral reserves, grades or stripping ratios may affect the economic viability of the Company’s projects.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. The SEC does not permit mining companies in their filings with the SEC to disclose estimates other than mineral reserves. However, because the Company prepares its reserve and resource estimates in accordance with Canadian disclosure requirements, it contains resource estimates, which are required by NI 43-101. Mineral resource estimates for properties that have not commenced production are based, in many instances, on limited and widely spaced drill hole information, which is not necessarily indicative of the conditions between and around drill holes. Accordingly, such mineral resource estimates may require revision as more drilling information becomes available or as actual production experience is gained. No assurance can be given that any part or all of mineral resources constitute or will be converted into reserves.

Legal, Permitting, Regulatory, Title and Political Risk

The Company’s operating and development properties are located in jurisdictions that are subject to changes in economic and political conditions and regulations in those countries.

The economics of the mining and extraction of precious metals are affected by many factors, including the costs of mining and processing operations, variations of grade of ore discovered or mined, fluctuations in metal prices, foreign exchange rates and the prices of goods and services, applicable laws and regulations, including regulations relating to royalties, allowable production and importing and exporting goods and services. Depending on the price of minerals, the Company may determine that it is neither profitable nor advisable to acquire or develop properties, or to continue mining activities.

ANNUAL INFORMATION FORM - 2017

The Company’s mineral properties are located in Canada, Mexico, Turkey and the USA. Economic and political conditions in these countries could adversely affect the business activities of the Company. These conditions are beyond the Company’s control, and there can be no assurances that any mitigating actions by the Company will be effective.

Changing laws and regulations relating to the mining industry or shifts in political conditions may increase the costs related to the Company’s activities including the cost of maintaining its properties. Operations may also be affected to varying degrees by changes in government regulations with respect to restrictions on production, price controls, export controls, income taxes, royalties, expropriation of property, environmental legislation (including specifically legislation enacted to address climate change) and mine safety. The effect of these factors cannot be accurately predicted. Economic instability could result from current global economic conditions and could contribute to currency volatility and potential increases to income tax rates, both of which could significantly impact the Company’s profitability.

The Company’s activities are subject to extensive laws and regulations governing worker health and safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters. Regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards.

Risk factors specific to certain jurisdictions are described throughout, including specifically: “Risks related to development stage assets in Turkey”, “Water Management at the Company’s Mining operations”, “Security in Mexico” and “The Company will be unable to undertake its required drilling and other development work on its properties if all necessary permits and licenses are not granted.” The occurrence of the various factors and uncertainties related to economic and political risks of operating in the Company’s jurisdictions cannot be accurately predicted and could have a material adverse effect on our operations or profitability.

Risk related to development stage assets in Turkey.

The Company has development stage mineral properties located in Turkey. Economic and political conditions in Turkey could adversely affect the business activities of the Company.

These conditions are beyond the Company’s control, and there can be no assurances that any mitigating actions by the Company will be effective. Turkey has recently experienced significant political, social, legal and regulatory instability. The impact of the change in political climate in Turkey in recent years is at this point largely unknown, but will in instances likely include heightened control of the judiciary, bureaucracy, media and the private business sector. Changes to existing governmental regulations may affect the Company’s ability to conduct business, mineral exploration and mining activities more broadly and the Company’s ability to generate cash flow and profits from operations. Associated risks include, but are not limited to, resource nationalism, terrorism, corruption, extreme fluctuations in currency exchange rates and high rates of inflation.

Changing laws and regulations relating to the mining industry or shifts in political conditions may increase the costs related to the Company’s activities including the cost of maintaining its properties. Operations may also be affected to varying degrees by changes in government regulations with respect to restrictions on production, price controls, export controls, income taxes, royalties, expropriation of property, environmental legislation (including specifically legislation enacted to address climate change) and mine safety. The effect of these factors cannot be accurately predicted. Economic instability could result from current economic conditions and could contribute to currency volatility and potential increases to income tax rates, both of which could significantly impact the Company’s profitability.

The Company’s activities are subject to extensive laws and regulations governing worker health and safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters. Regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards.

Security in Mexico

In recent years, criminal activity and violence has increased and continues to increase in parts of Mexico. The mining sector has not been immune to the impact of criminal activity and violence, including in the form of kidnapping for ransom and extortion by organized crime, as well as direct armed robberies of mining operations. The Company takes measures to protect employees, property and production facilities from these and other security risks. There can be no assurance, however, that security incidents, in the future, will not have a material adverse effect on our operations.

ANNUAL INFORMATION FORM - 2017

The Company will be unable to undertake its required drilling and other development work on its properties if all necessary permits and licenses are not granted.

A number of approvals, licenses and permits are required for various aspects of exploration, development and expansion projects. The Company is uncertain if all necessary permits will be maintained or obtained on acceptable terms or in a timely manner. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively impact current or planned exploration and development activities or any other projects with which the Company becomes involved. Any failure to comply with applicable laws and regulations or failure to obtain or maintain permits, even if inadvertent, could result in the interruption of production, exploration or development, or material fines, penalties or other liabilities. It remains uncertain if the Company’s existing permits may be affected in the future or if the Company will have difficulties in obtaining all necessary permits that it requires for its proposed or existing mining activities.

On January 5, 2017, the Company announced that it had received its forestry permit in connection with its Kirazlı Project in Turkey. The Company continues to pursue the GSM (Business Opening and Operation) permit which is granted by the Çanakkale Governorship. The Company cannot provide assurance it will be able to maintain its existing permits and/or obtain all additional permits that it requires for its proposed mining activities. There can be no certainty with respect to permitting timelines.

In order to maintain mining concessions in good standing, concession holders must advance their projects efficiently, including by obtaining the necessary permits prior to stipulated deadlines. The Company has implemented plans to obtain all necessary permits prior to the relevant deadlines. While the Company is confident in its ability to meet all required deadlines or milestones so as to maintain its concessions in good standing, there is risk that the relevant permitting and licensing authorities will not respond in a timely manner. If these deadlines are not met, the Company believes that extensions to deadlines for obtaining the required approvals and permits could be negotiated so that the concessions would remain in good standing. However, there is no guarantee that the Company will be able to obtain the approvals and permits as planned or, if unable to meet such deadlines, that negotiations for an extension will be successful in order to maintain its concessions in good standing. If the concessions were to expire, this could have a material adverse impact on the Company and its ability to control and develop its Turkish projects.

Litigation could be brought against the Company and the resolution of current or future legal proceedings or disputes may have a material adverse effect on the Company’s future cash flows, results of operations or financial condition.

The Company could be subject to legal claims and/or complaints and disputes with other parties that result in litigation, including unexpected environmental remediation costs, arising out of the normal course of business. The results of ongoing litigation cannot be predicted with certainty. The costs of defending and settling litigation can be significant, even for claims that Alamos believes have no merit. There is a risk that if such claims are determined adversely to the Company, they could have a material adverse effect on the Company’s financial performance, cash flow and results of operations.

Some of the Company’s mineral assets are located outside Canada and are held indirectly through foreign affiliates.

It may be difficult if not impossible to enforce judgments obtained in Canadian courts predicated upon the civil liability provisions of the securities laws of certain provinces against substantially all of the Company’s assets which are located outside Canada.

Failure of the Company to comply with laws and regulations could negatively impact current or planned mining activities and exploration and developmental activities.

The Company’s mining, exploration and development activities are subject to extensive laws and regulations concerning the environment, worker health and safety, employment standards, waste disposal, mine development, mine operation, mine closure and reclamation and other matters. The Company requires permits and approvals from various regulatory authorities for many aspects of mine development, operation, closure and reclamation. In addition to meeting the requirements necessary to obtain such permits and approvals, they may be invalidated if the applicable regulatory authority is legally challenged that it did not lawfully issue such permits and approvals. The ability of the Company to obtain and maintain permits and approvals and to successfully develop and operate mines may be adversely affected by real or perceived impacts associated with its activities that affect the environment and human health and safety at its development projects and operations and in the surrounding communities. The real or perceived impacts of the activities of other mining companies may also adversely affect our ability to obtain and maintain permits and approvals. The Company is uncertain as to whether all necessary permits will be maintained on acceptable terms or in a timely manner. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively affect current or planned mining, exploration and developmental activities on the projects in which the Company is or may become involved. Any failure to comply with applicable laws and regulations or to

ANNUAL INFORMATION FORM - 2017

obtain or maintain permits, even if inadvertent, could result in the interruption of mining, exploration and developmental operations or in material fines, penalties, clean-up costs, damages and the loss of key permits or approvals. While the Company has taken great care to ensure full compliance with its legal obligations, there can be no assurance that the Company has been or will be in full compliance with all of these laws and regulations, or with all permits and approvals that it is required to have. Environmental and regulatory review has also become a long, complex and uncertain process that can cause potentially significant delays.

The Company cannot guarantee that title to its properties will not be challenged.

The validity of the Company’s mining claims and access rights can be uncertain and may be contested. Although the Company is satisfied it has taken reasonable measures to acquire the rights needed to undertake its operations and activities as currently conducted, some risk exists that some titles and access rights may be defective. No assurance can be given that such claims are not subject to prior unregistered agreements or interests or to undetected or other claims or interests which could be materially adverse to the Company. While the Company has used its best efforts to ensure title to all its properties and secured access to surface rights, these titles or rights may be disputed, which could result in costly litigation or disruption of operations. From time to time, a land possessor may dispute the Company’s surface access rights, and as a result the Company may be barred from its legal occupation rights. Surface access issues have the potential to result in the delay of planned exploration programs, and these delays may be significant. The Company expects that it will be able to resolve these issues, however, there can be no assurance that this will be the case.

Additional future property acquisitions, relocation benefits, legal and related costs may be material. The Company may need to enter into negotiations with landowners and other groups in the host communities where our projects are located in order to conduct future exploration and development work. The Company cannot currently determine the expected timing, outcome of such negotiations or costs associated with the relocation of property owners and possessors and potential land acquisitions. There is no assurance that future discussions and negotiations will result in agreements with landowners or other local community groups so as to enable the Company to conduct exploration and development work on these projects.

The Company provides significant economic and social benefits to our host communities and countries, which facilitates broad stakeholder support for our operations and projects. There is no guarantee however that local residents will support our operations or projects.

Relationships with Key Stakeholders

Aboriginal title claims, rights to consultation/accommodation, and the Company’s relationship with local communities may affect the Company’s existing operations and development projects.

Governments in many jurisdictions must consult with aboriginal peoples with respect to grants of mineral rights and the issuance or amendment of project authorizations. Consultation and other rights of Aboriginal people may require accommodations, including undertakings regarding employment, royalty payments and other matters. This may affect the Company’s ability to acquire, within a reasonable time frame, effective mineral titles in these jurisdictions, including in some parts of Canada, in which aboriginal title is claimed, and may affect the timetable and costs of development of mineral properties in these jurisdictions. The risk of unforeseen aboriginal title claims also could affect existing operations as well as development projects. These legal requirements may also affect the Company’s ability to expand or transfer existing operations or to develop new projects.

The Company’s relationship with the communities in which it operates are critical to ensure the future success of its existing operations and the construction and development of its projects. There is an increasing level of public concern relating to the perceived effect of mining activities on the environment and on communities impacted by such activities. Adverse publicity relating to the mining industry generated by non-governmental organizations and others could have an adverse effect on the Company’s reputation or financial condition and may impact its relationship with the communities in which it operates. While the Company is committed to operating in a socially responsible manner, there is no guarantee that the Company’s efforts in this regard will mitigate this potential risk.

The inability of the Company to maintain positive relationships with local communities may result in additional obstacles to permitting, increased legal challenges, or other disruptive operational issues at any of our operating mines, and could have a significant adverse impact on the Company’s ability to generate cash flow, with a corresponding adverse impact to the Company’s share price and financial condition.

ANNUAL INFORMATION FORM - 2017

The Company’s directors and officers may have interests that conflict with the Company’s interests.

Certain of the Company’s directors and officers serve as directors or officers of other public companies and as such it is possible that a conflict may arise between their duties as the Company’s directors or officers and their duties as directors or officers of these other companies.

Exploration, development and production at the Company’s mining operations are dependent upon the efforts of its key personnel and its relations with its employees and any labor unions that represent employees.

The Company’s success is heavily dependent on its key personnel and on the ability to motivate, retain and attract highly skilled employees.

Relations between the Company and its employees may be affected by changes in the scheme of labour relations that may be introduced by Mexican or Canadian governmental authorities in whose jurisdictions the Company carries on operations. Changes in such legislation or in the relationship between the Company and its employees may have a material adverse effect on the Company’s business, results of operations and financial condition.

In addition, the Company anticipates that as it expands its existing production and brings additional properties into production, and as the Company acquires additional mineral rights, the Company may experience significant growth in its operations. This growth may create new positions and responsibilities for management personnel and increase demands on its operating and financial systems, as well as require the hiring of a significant number of additional operations personnel. There can be no assurance that the Company will successfully meet these demands and effectively attract and retain any such additional qualified personnel. The failure to attract and retain such qualified personnel to manage growth effectively could have a material adverse effect on the Company’s business, financial condition or results of operations.

As a result of social media and other web-based applications, companies today are at much greater risk of losing control over how they are perceived.

Damage to the Company’s reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. Although the Company places a great emphasis on protecting its image and reputation, it does not ultimately have direct control over how it is perceived by others. Reputation loss may lead to increased challenges in developing and maintaining community relations, decreased investor confidence and act as an impediment to the Company’s overall ability to advance its projects, thereby having a material adverse impact on financial performance, cash flows and growth prospects.

Environmental Risks

The Company’s activities are subject to environmental laws and regulations that may increase its costs of doing business and restrict its operations.

The Company’s exploration and production activities are subject to regulation by governmental agencies under various environmental laws. These laws address noise, emissions, water discharges, waste management, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Environmental legislation in many countries is evolving and the trend has been towards stricter standards and enforcement, increased fines, penalties and potential for facilities to be shut-down for non- compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on behalf of the Company and may cause material changes or delays in the Company’s intended activities. There can be no assurance that future changes in environmental regulations will not adversely affect the Company’s business, and it is possible that future changes in these laws or regulations could have a significant adverse impact on some portion of the Company’s business, causing the Company to re-evaluate those activities at that time.

Failure to comply with such laws and regulations can have serious consequences, including damage to the Company’s reputation, stopping the Company from proceeding with the development of a project, negatively impacting the operation or further development of a mine, increasing the cost of development or production and litigation and regulatory actions against the Company. The Company cannot give any assurance that, notwithstanding its precautions, breaches of environmental laws (whether inadvertent or not) or environmental pollution will not materially and adversely affect its financial condition and its results from operations. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Company’s operations. Environmental hazards may exist on the properties on which the Company holds interests which are

ANNUAL INFORMATION FORM - 2017

unknown to the Company at present and which have been caused by previous or existing owners or operators of the properties. The Company may also acquire properties with known or undiscovered environmental risks. Any indemnification from the entity from which the Company has acquired such properties may not be adequate to pay all the fines, penalties and costs (such as clean-up and restoration costs) incurred related to such properties. Some of the Company’s properties also have been used for mining and related operations for many years before acquisition and were acquired as is or with assumed environmental liabilities from previous owners or operators.

The Company’s failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its operations and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.