Table of Contents

Neuberger Berman Municipal Fund Inc.

Neuberger Berman California Municipal Fund Inc.

Neuberger Berman New York Municipal Fund Inc.

1290 Avenue of the Americas

New York, New York 10104

June 1, 2023

Dear Stockholders:

You are being asked to vote on the proposed reorganizations of each of Neuberger Berman California Municipal Fund Inc. (“California Municipal”) and Neuberger Berman New York Municipal Fund Inc. (“New York Municipal”) into Neuberger Berman Municipal Fund Inc. (the “Acquiring Fund”) (each a “Fund” and together, the “Funds”). As described in more detail below, if stockholders approve the proposed reorganizations, each of California Municipal and New York Municipal would reorganize into the Acquiring Fund and their stockholders would become stockholders of the Acquiring Fund. The respective Boards of Directors of the Funds have called a joint special meeting of the stockholders of the Funds to be held on Friday, July 7, 2023, at the offices of Neuberger Berman Investment Advisers LLC, 1290 Avenue of the Americas, New York, New York 10104 at 3:00 p.m. Eastern time, in order to vote on the proposed reorganizations. The attached Joint Proxy Statement/Prospectus provides more information about the proposed reorganizations, including how to vote.

California Municipal and New York Municipal seek to provide high current income exempt from both federal and state (and, for New York Municipal, New York City) taxes while the Acquiring Fund seeks to provide high current income exempt from federal tax. If stockholders of California Municipal and/or New York Municipal become stockholders of the Acquiring Fund they will lose the favorable tax treatment in their respective states and may be subject to additional state and local taxes on distributions received from the Acquiring Fund. Despite the difference in tax treatment, the Funds’ investment adviser recommended the proposed reorganization(s) to each Fund’s Board of Directors because the investment adviser believes that they provide anticipated benefits, including a higher tax-equivalent yield that is currently projected to outweigh the loss of favorable state tax treatment. The tax-equivalent yield for a Fund generally represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis and was calculated assuming that stockholders pay the highest tax rate in their respective state (and New York City for New York Municipal). All other things being equal, an investment with a higher tax-equivalent yield would provide a greater yield to a stockholder after taking the stockholder’s expected tax liability into account.

In addition to the higher tax-equivalent yield, other anticipated benefits to stockholders of the Funds from the proposed reorganizations include (i) lower relative net operating expenses as certain fixed costs are spread over a larger asset base, which may result in an overall relative lower expense ratio; (ii) increased flexibility relating to portfolio management and leverage due to the significantly larger asset base of the combined fund and the Acquiring Fund’s ability to invest in municipal obligations of any U.S. state or territory; (iii) the potential for a more liquid trading market for shares of common stock of Acquiring Fund as a result of the combined fund’s greater share volume; (iv) the potential for increased demand in the secondary market for shares of common stock of the combined fund, which could result in a narrower trading discount; and (v) the continued investment in a fund that, other than with respect to state tax benefits, has a similar investment objective, similar investment strategies, policies and restrictions, and has the same investment adviser and portfolio managers as the Funds.

Accordingly, after careful consideration, the Board of Directors of each Fund believes that the respective reorganization(s) is in the best interests of that Fund and its stockholders and unanimously recommends that you vote “FOR” each proposal.

The enclosed materials explain the reorganizations to be voted on at the joint special meeting of stockholders in more detail, and you are encouraged to review them carefully. No matter how large or small your Fund holdings, your vote is extremely important. To vote, simply date, sign and return the proxy card in the enclosed postage-paid envelope or follow the instructions on the proxy card for voting by touch-tone telephone or on the Internet. If you should have any questions about the stockholder meeting agenda or voting, please call our proxy agent, AST Fund Solutions, LLC at 1-866-387-0017. Please note, at a reasonable time after the mailing has completed and our records indicate that you have not voted at that time, you may be contacted by AST Fund Solutions, LLC to confirm receipt of the proxy materials and review your voting options.

It is important that your vote be received no later than the time of the joint special meeting of stockholders.

| | Sincerely, |

| | |

| |  |

| | |

| | Joseph V. Amato |

| | President and CEO |

| | Neuberger Berman California Municipal Fund Inc. |

| | Neuberger Berman Municipal Fund Inc. |

| | Neuberger Berman New York Municipal Fund Inc. |

Important Notice to Stockholders of

Neuberger Berman California Municipal Fund Inc. (“California Municipal”)

Neuberger Berman New York Municipal Fund Inc. (“New York Municipal”)

and

Neuberger Berman Municipal Fund Inc. (“Acquiring Fund”)

(Each, A “Fund” and Together, the “Funds”)

June 1, 2023

Although we recommend that you read the complete Joint Proxy Statement/Prospectus, for your convenience, we have provided a brief overview of the proposals to be voted on in Question and Answer format.

| Q. | Why am I receiving the enclosed Joint Proxy Statement/Prospectus? |

| A. | You are receiving the Joint Proxy Statement/Prospectus as a holder of shares of California Municipal or New York Municipal (each a “Target Fund”), or a holder of shares of the Acquiring Fund. The Funds are soliciting proxies for use at the joint special meeting of stockholders of the Funds (the “Meeting”). |

At the Meeting, stockholders of the Funds will be asked to vote on the following proposals, which vary depending on the Fund:

Acquiring Fund Stockholders

| Voting Proposals | | Stockholders Entitled to Vote |

| • | Approval of Reorganization of California Municipal into Acquiring Fund, including the issuance of additional Acquiring Fund common stock to California Municipal common stockholders | | Common and preferred (voting together as a class) |

| • | Approval of Reorganization of New York Municipal into Acquiring Fund, including the issuance of additional Acquiring Fund common stock to New York Municipal common stockholders | | Common and preferred (voting together as a class) |

California Municipal Stockholders

| Voting Proposal | | Stockholders Entitled to Vote |

| • | Approval of Reorganization of California Municipal into Acquiring Fund | | Common and preferred (voting together as a class) |

New York Municipal Stockholders

| Voting Proposal | | Stockholders Entitled to Vote |

| • | Approval of Reorganization of New York Municipal into Acquiring Fund | | Common and preferred (voting together as a class) |

Each Fund’s Board of Directors (“Board”) unanimously recommends that you vote “FOR” the proposal(s) as applicable to your Fund.

| Q. | As a result of the Reorganizations, will common stockholders of a Target Fund receive new shares of common stock of the Acquiring Fund? |

| A. | Yes. Upon the closing of each Reorganization, the respective Target Fund common stockholders will become common stockholders of the Acquiring Fund. Holders of common stock of each Target Fund consummating a Reorganization will receive newly issued shares of common stock of the Acquiring Fund, with cash generally being distributed in lieu of fractional shares of common stock. The number of shares of common stock received will be determined using an exchange ratio based on the relative net asset value per share of common stock of each Fund calculated immediately prior to the consummation of the respective Reorganization. As a result, Target Fund common stockholders may receive a different number of shares of Acquiring Fund common stock than the shares of Target Fund common stock they held prior to the respective Reorganization. However, the aggregate net asset value of the Acquiring Fund shares received (including, for this purpose, any fractional Acquiring Fund shares), would equal the aggregate net asset value of the Target Fund common stock held by such stockholders as of the time the exchange ratio is calculated. Fractional shares of Acquiring Fund common stock that Target Fund common stockholders would otherwise receive in a Reorganization may be aggregated and sold on the open market to provide Target Fund common stockholders with cash in lieu of such fractional shares. |

Although the shares of Acquiring Fund common stock received in a Reorganization would have the same total net asset value as the shares of Target Fund common stock held at the time the exchange ratio is calculated (disregarding fractional shares), the Acquiring Fund stock price on the NYSE American at that time may be greater or less than that of the shares of Target Fund common stock.

Following the Reorganizations, common stockholders of each Fund will hold a smaller percentage of the outstanding shares of common stock of the combined fund as compared to their percentage holdings of their respective Fund prior to the Reorganizations.

| Q. | Do the Funds have similar investment objectives, policies and risks? |

| A. | Other than with respect to the state and local (for New York Municipal) tax treatment, the Funds have similar investment objectives, policies and risks. |

| | The principal similarities and differences between the Funds’ investment objectives, policies and risks are as follows: |

| • | The Target Funds are state-specific municipal funds that seek to provide current income exempt from both regular federal income taxes and state (and New York City, with respect to New York Municipal) income tax, while the Acquiring Fund is a national municipal fund that seeks to provide current income exempt from regular federal income tax. |

| • | Under normal circumstances, the Target Funds invest primarily in municipal bonds of a specific state and are subject to economic, political, regulatory and other risks of a single state, while the Acquiring Fund may invest in municipal obligations of any U.S. state or territory. As such, if the Reorganizations are consummated and a stockholder in either Target Fund becomes a stockholder in the Acquiring Fund, such stockholder would lose the state and, with respect to New York Municipal, local, tax-exempt nature of his/her investment in the Target Fund that he/she enjoyed prior to such Reorganization. However, see below under “Will the Reorganizations impact distributions to common stockholders of the Target Funds?” |

| • | Each Fund is a diversified, closed-end management investment company, managed by the same portfolio managers, and currently employs leverage through the issuance of preferred stock. |

See “Proposals—A. Summary—Comparison of the Acquiring Fund and the Target Funds—Investment Objectives and Policies” and “Proposals—A. Summary—Comparative Risk Information” for more information.

| Q. | Will the Reorganizations impact distributions to common stockholders of the Target Funds? |

| A. | In considering the Reorganizations, each Target Fund’s Board took into account potential future distribution levels as well as information from NBIA indicating that the Acquiring Fund has historically paid higher distributions per share of common stock than each Target Fund. It was noted that distributions for California Municipal are exempt from federal and California income taxes and distributions for New York Municipal are exempt from federal, New York State and New York City personal income taxes, while distributions for the Acquiring Fund are exempt from federal income tax only. Even though the Acquiring Fund’s distributions may be subject to state and local income tax, as shown below, as of February 28, 2023, the Acquiring Fund’s tax-equivalent yield is higher than the tax-equivalent yields of each Target Fund. The tax-equivalent yield for a Fund generally represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. All other things being equal, a higher tax-equivalent yield generally provides a higher overall yield after taking the stockholder’s expected tax liability into account. |

The most recent monthly distribution per common share was $0.0254 for California Municipal, $0.024233 for New York Municipal and $0.03774 for the Acquiring Fund. The annualized distribution rate (expressed as a percentage of net asset value as of February 28, 2023) was 2.43% for California Municipal, 2.62% for New York Municipal and 3.86% for the Acquiring Fund. The higher historical distribution rate of the Acquiring Fund is primarily attributable to certain lower expenses per share of common stock and the Acquiring Fund���s greater investment flexibility to invest in municipal obligations any U.S. state or territory. Assuming the highest marginal federal tax rate for the Acquiring Fund and the highest marginal state (and city, with respect to New York Municipal) and federal tax rates for the Target Funds, the tax-equivalent yield as of February 28, 2023 was 4.91% for California Municipal, 5.46% for New York Municipal and 6.13% for the Acquiring Fund.

There is no assurance that distribution rates of the Funds will continue at historical levels. While distributions from the combined fund following the Reorganizations are generally expected to be exempt from federal income tax, such distributions may be subject to state and local income tax, including without limitation California or New York State or New York City income tax, as applicable.

| Q. | How will the Reorganizations impact fees and expenses of the Target Funds? |

| A. | As reflected in the Comparative Fee Table in the Joint Proxy Statement/Prospectus, as of February 28, 2023, the Reorganizations are expected to result in a combined fund with a lower expense ratio than that of each Target Fund. The pro forma expense ratio of the combined fund following the Reorganizations is estimated by NBIA to be 36 basis points (0.36%) lower than the total expense ratio of California Municipal and 43 basis points (0.43%) lower than the total expense ratio of New York Municipal. Each Target Fund’s Board considered that, due to the greater asset base of the combined fund, its Reorganization is expected to result in economies of scale and a resulting reduction in certain operating expenses. The Comparative Fee Table includes the estimated costs of leverage of the combined fund following the Reorganizations. Leverage costs will vary over time. |

See the Comparative Fee Table in the enclosed Joint Proxy Statement/Prospectus for more detailed information regarding fees and expenses.

| Q. | Will stockholders of the Funds have to pay any fees or expenses in connection with the Reorganizations? |

| A. | Yes. The Funds, and indirectly their common stockholders, will bear the costs of the Reorganizations, whether or not the Reorganizations are consummated. However, you will not pay any sales loads or commissions in connection with the Reorganizations. Reorganization costs specific to a particular Fund will be paid by such Fund, while non-specific costs will be allocated on a pro rata basis based upon each Fund’s net assets. NBIA estimates the costs |

| | of the Reorganizations to be $514,803, of which $109,589 is expected to be allocated to California Municipal, $96,078 is expected to be allocated to New York Municipal and $309,136 is expected to be allocated to the Acquiring Fund, or in each case about $0.02 per share of common stock. The actual costs associated with the Reorganizations may be more or less than the estimated costs discussed herein. These costs represent the estimated nonrecurring expenses of the Funds in carrying out their obligations under the Agreements and consist of management’s estimate of professional service fees, printing costs and mailing charges related to the proposed Reorganizations. |

| Q. | Will the Reorganizations constitute a taxable event for a Target Fund’s stockholders? |

| A. | No. As a non-waivable condition to closing, each Fund participating in a Reorganization will receive an opinion of counsel, subject to certain representations, assumptions and conditions, substantially to the effect that the proposed Reorganization will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. It is expected that stockholders of a Target Fund who receive Acquiring Fund stock pursuant to a Reorganization will recognize no gain or loss for federal income tax purposes as a direct result of the Reorganization, except to the extent that a Target Fund common stockholder receives cash in lieu of a fractional share of Acquiring Fund common stock. |

Prior to the closing of its Reorganization, each Target Fund expects to declare a distribution of all of its net realized capital gains, if any. All or a portion of such distribution made by a Target Fund may be taxable to that Target Fund’s stockholders for federal income tax purposes.

To the extent the Acquiring Fund sells securities received from a Target Fund following the Reorganizations, the Acquiring Fund may recognize gains or losses, which may result in taxable distributions to Acquiring Fund stockholders (including former stockholders of a Target Fund who hold shares of the Acquiring Fund following the Reorganizations). Following the Reorganizations, the Acquiring Fund’s ability to use its own or a Target Fund’s capital loss carry forwards realized prior to each Reorganization may be reduced. Stockholders are urged to consult their own tax advisers as to the specific tax consequences to them as a result of the Reorganizations.

| Q. | Why has each Fund’s Board recommended the respective Reorganization proposal? |

| A. | NBIA, the Funds’ investment adviser, recommended the Reorganization proposals to the Funds’ Boards as it believes, including for reasons noted below, that the transactions would be in the best interest of each Fund and each Fund’s stockholders. Each Fund’s Board considered its Fund’s Reorganization(s) and determined that the Reorganization(s) would be in |

the best interests of its Fund and that the interests of the stockholders of its Fund will not be diluted with respect to net asset value as a result of the Reorganization(s).

Based on information provided by NBIA, each Fund’s Board considered that its Fund’s proposed Reorganization may benefit the stockholders of its Fund in a number of ways, including, among other things:

| • | The potential for higher common stock net earnings and distribution levels and higher tax-equivalent yields following the proposed Reorganization notwithstanding that the Target Fund stockholders may be subject to additional state and local taxes on distributions; |

| • | Lower relative net operating expenses as certain fixed costs are spread over a larger asset base, which may result in an overall lower relative expense ratio; |

| • | The potential for greater secondary market liquidity and improved secondary market trading for shares of common stock of Acquiring Fund as a result of the combined fund’s greater share volume; |

| • | The potential for increased demand in the secondary market for shares of common stock of the combined fund, which could result in a narrower trading discount; |

| • | Increased flexibility relating to portfolio management and leverage due to the significantly larger asset base of the combined fund and, when compared with the Target Funds, the Acquiring Fund’s ability to invest in municipal obligations of any U.S. state or territory; and |

| • | The continued investment in a fund that, other than with respect to state tax benefits, has a similar investment objective, similar investment strategies, policies and restrictions, and has the same investment adviser and portfolio managers as the Target Funds. |

| Q. | What will happen if the required stockholder approvals are not obtained? |

| A. | If the required stockholder approval is not obtained, or a Reorganization is not consummated for any other reason, the Board of the Target Fund related to that Reorganization may take such actions as it deems in the best interests of the Fund, including conducting additional solicitations with respect to the Reorganization proposal or continuing to operate the Target Fund as a standalone fund. Whether or not each Reorganization and related issuance of common stock is ultimately approved by stockholders and consummated, the Acquiring Fund will continue its legal existence and operations going forward. |

The closing of each Reorganization is subject to the satisfaction or waiver of certain closing conditions, which include customary closing conditions. In order for a Reorganization to occur, all requisite stockholder approvals must be obtained at the applicable Fund’s stockholder meeting and any consents, confirmations and/or waivers needed from third parties must also be obtained. It is possible that a Reorganization will not occur even if stockholders of a Fund entitled to vote approve the Reorganization and a Fund satisfies all of its closing conditions if the other Fund party to that Reorganization does not obtain its requisite stockholder approvals or satisfy (or obtain the waiver of) its closing conditions.

Additionally, the Target Funds’ preferred stockholder will be asked to provide written consents in connection with the Reorganizations.

| Q. | Are the Reorganizations contingent on each other? |

| A. | No. The closing of each Reorganization is not contingent on the closing of the other Reorganization. If only one Reorganization is approved by the relevant stockholders, that Reorganization will be completed. |

| Q. | Why is the vote of the Acquiring Fund stockholders being solicited in connection with the Reorganizations? |

| A. | Maryland law and the rules of the NYSE American (on which the Acquiring Fund’s common stock is listed) require the Acquiring Fund’s stockholders to approve the Reorganizations and the issuance of additional shares of Acquiring Fund common stock, respectively, because the number of shares of Acquiring Fund common stock to be issued in each proposed Reorganization would be (based on recent relative valuations), upon issuance, in excess of 20 percent of the number of shares of Acquiring Fund common stock outstanding prior to the Reorganization. |

| Q. | What is the timetable for the Reorganizations? |

| A. | If the stockholder approvals and other conditions to closing are satisfied (or waived), the Reorganizations are expected to take effect during the third quarter of 2023, or such other time as the parties may agree. |

| Q. | How does each Board recommend that stockholders vote on the respective Reorganization proposal(s)? |

| A. | After careful consideration, each Board has determined that its Reorganization proposal(s) is in the best interests of its Fund and recommends that you vote “FOR” such proposal. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call AST Fund Solutions, LLC (“AST”), the proxy solicitor hired by your Fund, at 1-866-387-0017 on weekdays during its business hours of 9 a.m. to 10 p.m. and Saturdays 10 a.m. to 6 p.m. Eastern Time or call NBIA at 877-461-1899. Please have your proxy materials available when you call. |

| A. | You may vote by attending the Meeting, or by mail, by telephone or over the Internet: |

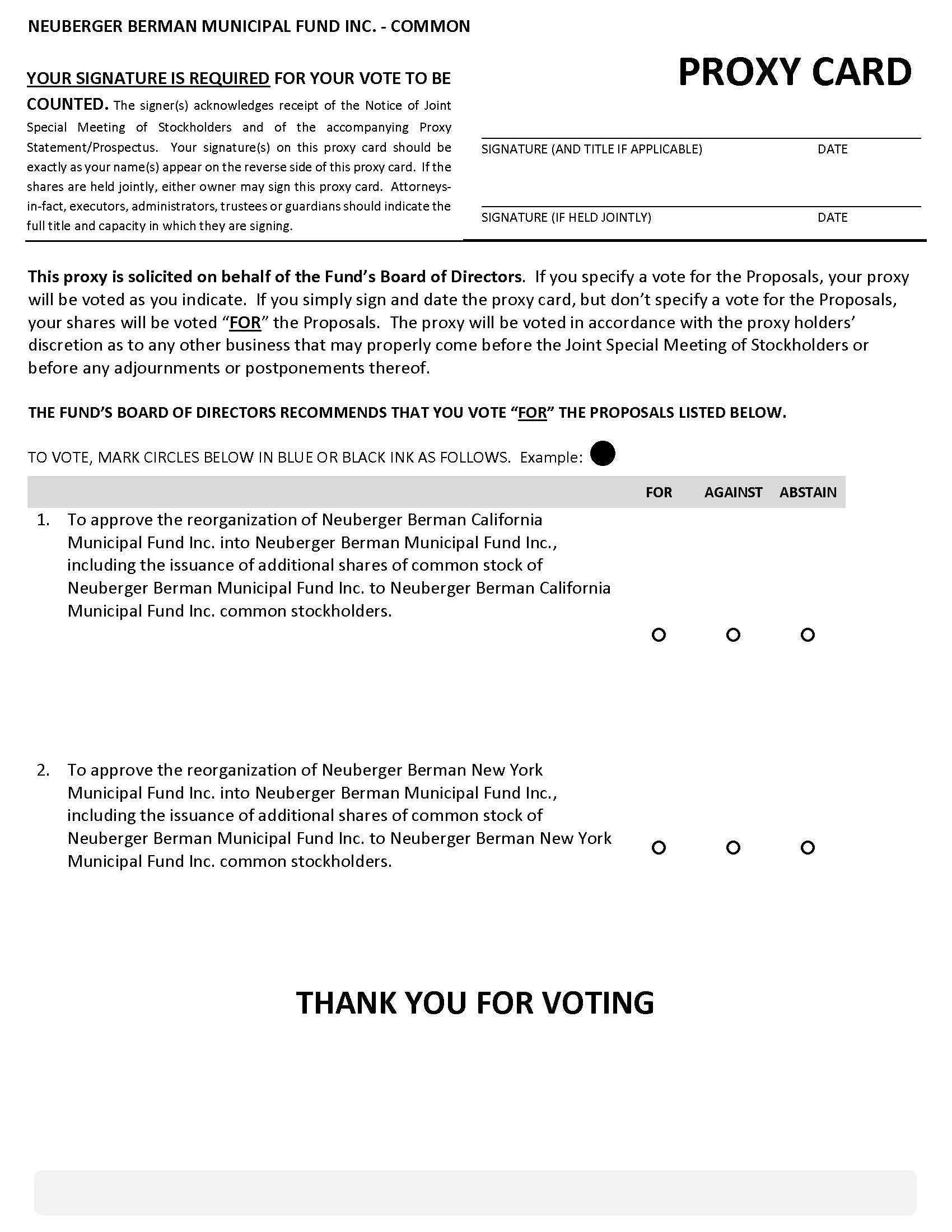

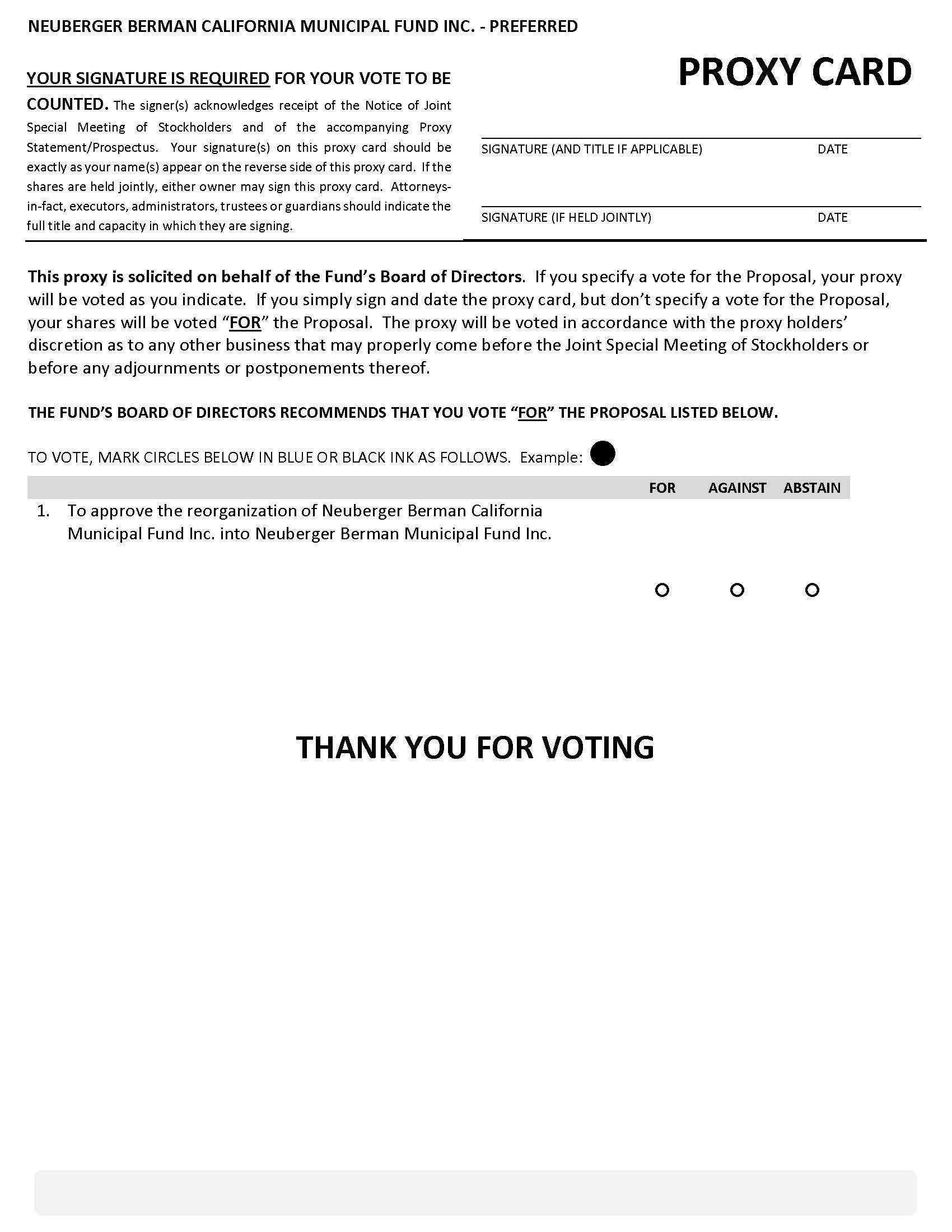

By Mail: You may vote by completing, dating, signing and returning the enclosed proxy card(s) in the postage paid envelope. Please note that if you sign and date the proxy card but give no voting instructions, your shares will be voted “FOR” the Agreement.

By Phone: You may vote by telephone by calling the number on your proxy card(s).

Via the Internet: You may vote through the Internet by visiting the website listed on your proxy card(s).

In Person: If you plan to attend the Meeting, you may vote in person.

If you vote, you can revoke your vote at any time before a vote is taken on a proposal by filing with that Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date or by attending and voting at the Meeting. A prior proxy can also be revoked by voting again through the toll-free number or the Internet address listed in the proxy card or by contacting the Fund’s Secretary. However, merely attending the Meeting will not revoke any previously submitted proxy.

| Q. | Will anyone contact me? |

| A. | You may receive a call from AST, the proxy solicitor hired by your Fund, to verify that you received your proxy materials, to answer any questions you may have about the Reorganizations and to encourage you to vote your proxy. |

We recognize the inconvenience of the proxy solicitation process and would not impose on you if we did not believe that the matter being proposed was important. Once your vote has been registered with the proxy solicitor, your name will be removed from the solicitor’s follow-up contact list.

Your vote is very important. We encourage you as a stockholder to participate in your Fund’s governance by returning your vote as soon as possible, even if you only hold a small number of shares. If enough stockholders fail to cast their votes, a Fund may not be able to hold its Meeting or the vote on the respective Reorganization proposal, and will be required to incur additional solicitation costs in order to obtain sufficient stockholder participation.

June 1, 2023

Neuberger Berman California Municipal Fund Inc. (NBW)

Neuberger Berman New York Municipal Fund Inc. (NBO)

Neuberger Berman Municipal Fund Inc. (NBH)

(Each, A “Fund” and Together, the “Funds”)

NOTICE OF JOINT SPECIAL MEETING OF STOCKHOLDERS

To Be Held on July 7, 2023

To the Stockholders:

NOTICE IS HEREBY GIVEN that the Joint Special Meeting of Stockholders of Neuberger Berman California Municipal Fund Inc. (“California Municipal”), Neuberger Berman New York Municipal Fund Inc. (“New York Municipal”) and Neuberger Berman Municipal Fund Inc. (the “Acquiring Fund”) will be held on July 7, 2023 at 3:00 p.m., Eastern time (the “Meeting”) at the offices of Neuberger Berman Investment Advisers LLC (“NBIA”), 1290 Avenue of the Americas, New York, New York 10104 for the following purposes:

The Acquiring Fund

| Voting Proposals | | Stockholders Entitled to Vote |

| • | Approval of Reorganization of California Municipal into Acquiring Fund, including the issuance of additional Acquiring Fund common stock to California Municipal common stockholders | | Common and preferred (voting as a class) |

| • | Approval of Reorganization of New York Municipal into Acquiring Fund, including the issuance of additional Acquiring Fund common stock to New York Municipal common stockholders | | Common and preferred (voting as a class) |

California Municipal

| Voting Proposal | | Stockholders Entitled to Vote |

| • | Approval of Reorganization of California Municipal into Acquiring Fund | | Common and preferred (voting together as a class) |

New York Municipal

| Voting Proposal | | Stockholders Entitled to Vote |

| • | Approval of Reorganization of New York Municipal into Acquiring Fund | | Common and preferred (voting together as a class) |

| 2. | To transact such other business as may properly come before the Meeting. |

You are entitled to vote at the Meeting and any adjournments thereof if you owned Fund shares at the close of business on April 10, 2023 (“Record Date”). If you attend the Meeting, you may vote your shares in person. If you do not expect to attend the Meeting, please review the enclosed materials and follow the instructions that appear on the enclosed proxy card(s). If you have any questions about the proposals or the voting instructions, please call 877-461-1899. The appointed proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof.

Each Fund will admit to the Meeting: (1) all stockholders of record of the Fund as of the Record Date, (2) persons holding proof of beneficial ownership thereof at the Record Date, such as a letter or account statement from a broker, (3) persons who have been granted proxies, and (4) such other persons that the Fund, in its sole discretion, may elect to admit. All persons wishing to be admitted to the Meeting must present photo identification. If you plan to attend the Meeting, please call 877-461-1899.

Unless proxy cards submitted by corporations and partnerships are signed by the appropriate persons as indicated in the voting instructions on the proxy cards, they will not be voted. For ease of reading, “stock” and “stockholders” have been used in certain places in this notice to describe, respectively, the shares of the Funds and the stockholders of the Funds.

| | By order of each Board, |

| | |

| |  |

| | |

| | Claudia A. Brandon |

| | Secretary |

| | Neuberger Berman California Municipal Fund Inc. |

| | Neuberger Berman New York Municipal Fund Inc. |

| | Neuberger Berman Municipal Fund Inc. |

June 1, 2023

New York, New York

The “Neuberger Berman” name and logo and “Neuberger Berman Investment Advisers LLC” name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this document are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC. © 2023 Neuberger Berman Investment Advisers LLC. All rights reserved.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Funds involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Any party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| Registration | | Valid Signature |

| | | |

| Corporate Accounts | | |

| (1) ABC Corp. | | ABC Corp. |

| (2) ABC Corp. | | John Doe, Treasurer |

(3) ABC Corp.

c/o John Doe, Treasurer | | John Doe |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| | | |

| Trust Accounts | | |

| (1) ABC Trust | | Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| | | |

| Custodian or Estate Accounts | | |

(1) John B. Smith, Cust. f/b/o

John B. Smith, Jr. UGMA | | John B. Smith |

| (2) John B. Smith | | John B. Smith, Jr., Executor |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY

SHARES OF STOCK YOU OWN.

PLEASE RETURN YOUR PROXY CARD(S) PROMPTLY.

You may receive more than one proxy card depending on how you hold shares of a Fund. Please fill out and return each proxy card.

Stockholders are invited to attend the Meeting in person. Any stockholder who does not expect to attend the Meeting is urged to review the enclosed materials and follow the instructions that appear on the enclosed proxy card(s).

To avoid the additional expense to the Funds of further solicitation, we ask your cooperation in voting your proxy promptly, no matter how large or small your holdings may be.

This page is intentionally left blank.

The information contained in this Joint Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Joint Proxy Statement/Prospectus is not an offer to sell these securities, and it is not a solicitation of an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion,

Dated June 1, 2023

Joint Proxy Statement/Prospectus

Neuberger Berman California Municipal Fund Inc. (NBW)

Neuberger Berman New York Municipal Fund Inc. (NBO)

and

Neuberger Berman Municipal Fund Inc. (NBH)

(Each, A “Fund” and Together, The “Funds”)

June 1, 2023

This Joint Proxy Statement/Prospectus is being furnished in connection with the solicitation of proxies by the Boards of Directors (each a “Board” and together, the “Boards”) of Neuberger Berman California Municipal Fund Inc. (“California Municipal” or a “Target Fund”), Neuberger Berman New York Municipal Fund Inc. (“New York Municipal” or a “Target Fund”) and Neuberger Berman Municipal Fund Inc. (the “Acquiring Fund” and together with the Target Funds, the “Funds” or each individually, a “Fund”) for a Joint Special Meeting of Stockholders of the Funds (the “Meeting”) and at any and all adjournments or postponements thereof. The Meeting will be held on July 7, 2023 at 3:00 p.m., Eastern time, at the offices of Neuberger Berman Investment Advisers LLC (“NBIA”), 1290 Avenue of the Americas, New York, New York 10104, to consider the proposals described below and discussed in greater detail elsewhere in this Joint Proxy Statement/Prospectus. Each Fund is organized as a Maryland corporation. The enclosed proxy card and this Joint Proxy Statement/Prospectus are first being sent to stockholders of the Funds on or about June 2, 2023. Stockholders of record of each Fund as of the close of business on April 10, 2023 are entitled to notice of and to vote at the Meeting and any and all adjournments or postponements thereof.

This Joint Proxy Statement/Prospectus explains concisely what you should know before voting on the proposals described in this Joint Proxy Statement/Prospectus or investing in the Acquiring Fund. Please read it carefully and keep it for future reference.

The securities offered by this Joint Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (“SEC”), nor has the SEC passed upon the accuracy or adequacy of this Joint Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

As more fully discussed in this Joint Proxy Statement/Prospectus, the stockholders of the Target Funds and Acquiring Fund will be asked to vote on the following proposals:

For stockholders of California Municipal:

Common and preferred stockholders, voting together as a single class, will vote on a proposal to approve an Agreement and Plan of Reorganization pursuant to which California Municipal would transfer its assets to the Acquiring Fund in exchange for shares of common stock and preferred stock of the Acquiring Fund and the assumption by the Acquiring Fund of California Municipal’s liabilities and California Municipal would dissolve under Maryland law.

For stockholders of New York Municipal:

Common and preferred stockholders, voting together as a single class, will vote on a proposal to approve an Agreement and Plan of Reorganization pursuant to which New York Municipal would transfer its assets to the Acquiring Fund in exchange for shares of common stock and preferred stock of the Acquiring Fund and the assumption by the Acquiring Fund of New York Municipal’s liabilities and New York Municipal would dissolve under Maryland law.

For stockholders of the Acquiring Fund:

Common and preferred stockholders, voting together as a single class, will vote on a) a proposal to approve the Agreement and Plan of Reorganization with respect to California Municipal, including the related issuance of additional shares of common stock of the Acquiring Fund pursuant to that Agreement and Plan of Reorganization, and b) a proposal to approve the Agreement and Plan of Reorganization with respect to New York Municipal, including the related issuance of additional shares of common stock of the Acquiring Fund pursuant to that Agreement and Plan of Reorganization.

Provided a quorum is present, to be approved, each proposal must be approved by holders of a majority (more than 50%) of the respective Funds’ shares of common stock and preferred stock. A quorum of stockholders of each Fund is required for that Fund’s stockholders to vote at the Meeting. For each Fund, the presence at the Meeting, in person or by proxy, of stockholders entitled to vote at least 33 1/3% of its shares outstanding and entitled to vote at the Meeting is required for a quorum. Votes cast in person or by proxy at the Meeting will be tabulated by the inspector of election appointed for the Meeting. The inspector of election will determine whether or not a quorum is present at the Meeting. “Broker non-votes” are shares held by brokers or nominees, typically in “street name,” for which the broker or nominee properly submits a proxy but that are not voted because instructions have not been received from beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary authority to vote such shares on a particular

matter. For purposes of holding a meeting, all properly submitted proxies, including abstentions and broker non-votes, if any, will be counted as present for purposes of determining whether a quorum is present.

On the matters coming before the Meeting as to which a choice has been specified by stockholders on the accompanying proxy card, the shares will be voted accordingly where such proxy card is properly executed, timely received and not properly revoked (pursuant to the instructions below). If a proxy is returned and no choice is specified, the shares will be voted “FOR” each proposal. Stockholders of a Fund who execute proxies or provide voting instructions by telephone or by Internet may revoke them at any time before a vote is taken on a proposal by filing with that Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date or by attending and voting at the Meeting. A prior proxy can also be revoked by voting again through the toll-free number or the Internet address listed in the proxy card. However, merely attending the Meeting will not revoke any previously submitted proxy.

Additional Information

A Statement of Additional Information relating to this Joint Proxy Statement/Prospectus and the proposed Reorganizations, dated June 1, 2023 (the “Reorganization SAI”) has been filed with the SEC and is incorporated herein by reference. Copies of the Reorganization SAI may be obtained without charge by calling (877) 461-1899, or by writing to a Fund at 1290 Avenue of the Americas, New York, New York 10104-0002. In addition, each Fund will furnish, without charge, a copy of its most recent annual or semi-annual report to stockholders upon request.

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith file reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Funds, including the Registration Statement on Form N-14 relating to the shares of common stock of the Acquiring Fund of which this Joint Proxy Statement/Prospectus is a part, may be obtained through the EDGAR database on the SEC’s website at http://www.sec.gov. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following email address: publicinfo@sec.gov.

Reports, proxy statements and other information concerning the Funds can be inspected at the offices of the NYSE American, 11 Wall Street, New York, New York 10005.

This Joint Proxy Statement/Prospectus serves as a prospectus of the Acquiring Fund in connection with the issuance of the shares of common stock of the Acquiring Fund in the Reorganizations. No person has been authorized to give any information or make any representation not contained in this Joint Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Joint Proxy Statement/ Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

The date of the Joint Proxy Statement/Prospectus is June 1, 2023.

TABLE OF CONTENTS

PROPOSALS—REORGANIZATION OF EACH TARGET FUND INTO THE ACQUIRING FUND

The following is a summary of certain information contained elsewhere in this Joint Proxy Statement/Prospectus with respect to the proposed Reorganizations. More complete information is contained elsewhere in this Joint Proxy Statement/Prospectus, including and appendices hereto, and in the Reorganization SAI. Stockholders should read the entire Joint Proxy Statement/Prospectus carefully.

Background and Reasons for the Reorganizations

Neuberger Berman Investment Advisers LLC (“NBIA”), the Funds’ investment adviser, recommended the Reorganization proposals to the Funds’ Boards as it believes, including for reasons noted below, that the transactions would be in the best interest of each Fund and each Fund’s stockholders. Each Fund’s Board, including the Directors who are not “interested persons” of any of the respective Funds (as defined in Section 2(a)(19) of the 1940 Act (the “Independent Directors”), considered its Fund’s Reorganization(s) and determined that the Reorganization(s) would be in the best interests of its Fund and that the interests of the stockholders of each Fund will not be diluted with respect to NAV as a result of the Reorganization(s). Based on information provided by NBIA, each Fund’s Board believes that its Fund’s proposed Reorganization may benefit the stockholders of its Fund in a number of ways, including, among other things.

(i) the potential for higher common share net earnings and distribution levels and higher tax-equivalent yields following the proposed Reorganization notwithstanding that the Target Fund stockholders may be subject to additional state and local taxes on distributions;

(ii) lower relative net operating expenses as certain fixed costs are spread over a larger asset base, which may result in an overall lower relative expense ratio;

(iii) the potential for greater secondary market liquidity and improved secondary market trading for shares of common stock of Acquiring Fund as a result of the combined fund’s greater share volume;

(iv) the potential for increased demand in the secondary market for shares of common stock of the combined fund, which could result in a narrower trading discount;

(v) increased flexibility relating to portfolio management and leverage due to the significantly larger asset base of the combined fund and, when compared with the Target Funds, the Acquiring Fund’s ability to invest in municipal obligations of any U.S. state or territory; and

(vi) the continued investment in a fund that, other than with respect to state focus and related state tax benefits, has a similar investment objective, similar investment strategies, policies and restrictions, and has the same investment adviser and portfolio managers as the Funds.

The closing of each Reorganization is subject to the satisfaction or waiver of certain closing conditions, which include customary closing conditions. In order for a Reorganization to occur, all requisite stockholder approvals must be obtained at the Meeting, and any consents, confirmations and/or waivers needed from third parties must also be obtained. Because the closing of each Reorganization is contingent upon the applicable Target Fund and the Acquiring Fund obtaining such stockholder approvals, it is possible that a Reorganization will not occur even if stockholders of a Fund entitled to vote approve the Reorganization if the other Fund party to that Reorganization does not obtain its requisite stockholder approval. If a Reorganization is not consummated, the Board of the Target Fund involved in that Reorganization may take such actions as it deems in the best interests of the Fund, including conducting additional solicitations with respect to the Reorganization proposal or continuing to operate the Target Fund as a standalone fund. The closing of each Reorganization is not contingent on the closing of the other Reorganization.

For a fuller discussion of the Boards’ considerations regarding the approval of the Reorganizations, see “C. Information About the Reorganizations—Reasons for the Reorganizations.”

Material Federal Income Tax Consequences of the Reorganizations

As a non-waivable condition to closing, each Fund will receive an opinion of K&L Gates LLP, subject to certain representations, assumptions and conditions, substantially to the effect that each proposed Reorganization will qualify as a “reorganization” under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that none of the Funds will generally recognize gain or loss for federal income tax purposes as a direct result of the Reorganizations. It is also expected that stockholders of a Target Fund who receive Acquiring Fund shares pursuant to a Reorganization will recognize no gain or loss for federal income tax purposes as a result of such exchange, except to the extent a common stockholder of a Target Fund receives cash in lieu of a fractional Acquiring Fund common share. Following the Reorganizations, the Acquiring Fund’s ability to use capital loss carry forwards realized prior to the Reorganization may be reduced.

The foregoing discussion and the tax opinion discussed above to be received by the Funds regarding certain aspects of the Reorganizations, including that the Reorganizations will qualify as reorganizations under Section 368(a) of the Code, will rely on the position that the Acquiring Fund VMTPS to be issued in the Reorganizations will constitute equity of the Acquiring Fund for federal income tax purposes. See “C. Information About the Reorganizations—Material Federal Income Tax Consequences of the Reorganizations.”

Comparison of the Acquiring Fund and the Target Funds

General. The Acquiring Fund and the Target Funds are diversified, closed-end management investment companies organized as Maryland corporations on July 29, 2022. Set forth below is certain comparative information about the capitalization and operation of the Funds as of December 31, 2022.

CAPITALIZATION—COMMON STOCK |

Fund | Authorized Shares | Shares Outstanding | Par

Value Per

Share | Preemptive, Conversion or Exchange Rights | Rights to Cumulative Voting | Exchange on

which Common Shares are Listed |

| California Municipal | 999,996,410 | 5,551,044 | $0.0001 | None | None | NYSE American |

| New York Municipal | 999,996,517 | 5,077,417 | $0.0001 | None | None | NYSE American |

| Acquiring Fund | 999,990,206 | 18,843,164 | $0.0001 | None | None | NYSE American |

As of December 31, 2022, the Funds had outstanding the following series of preferred stock, each with a term redemption date of December 15, 2024. The Acquiring Fund’s VMTPS are expected to remain outstanding following the completion of the Reorganizations:

| CALIFORNIA MUNICIPAL—PREFERRED STOCK |

| |

| Series | Shares

Outstanding | Par Value

Per Share | Liquidation Preference

Per Share |

| Series A Variable Rate Municipal Term Preferred Shares | 457 | $0.0001 | $100,000 |

| | | | |

| NEW YORK MUNICIPAL—PREFERRED STOCK |

| |

| Series | Shares

Outstanding | Par Value

Per Share | Liquidation Preference

Per Share |

| Series A Variable Rate Municipal Term Preferred Shares | 365 | $0.0001 | $100,000 |

| | | | |

| ACQUIRING FUND—PREFERRED STOCK |

| |

| Series | Shares

Outstanding | Par Value

Per Share | Liquidation Preference

Per Share |

| Series A Variable Rate Municipal Term Preferred Shares | 1,457 | $0.0001 | $100,000 |

Each Fund’s VMTPS are entitled to one vote per share with respect to the Reorganizations. The VMTPS of the Acquiring Fund to be issued in connection with the Reorganizations will have substantially similar terms and equal priority with each other and with the Acquiring Fund’s other outstanding VMTPS as to the payment of dividends and the distribution of assets upon dissolution, liquidation or winding up of the affairs of the Acquiring Fund. In addition, the VMTPS of the Acquiring Fund, including any VMTPS of the Acquiring Fund to be issued in connection with the Reorganizations, will be senior in priority to the

Acquiring Fund’s common stock as to payment of dividends and the distribution of assets upon dissolution, liquidation or winding up of the affairs of the Acquiring Fund. Any VMTPS of the Acquiring Fund to be issued in connection with the Reorganizations will have rights and preferences, including liquidation preferences, that are substantially similar to those of the corresponding Target Fund VMTPS. The number of VMTPS currently outstanding may change due to market or other conditions.

Investment Objectives and Policies. The primary difference between the Funds is that California Municipal and New York Municipal seek to provide high current income exempt from both federal and state (and, for New York Municipal, New York City) taxes while the Acquiring Fund seeks to provide high current income exempt from federal tax. If stockholders of California Municipal and/or New York Municipal become stockholders of the Acquiring Fund they will lose the favorable tax treatment in their respective states. Certain similarities and differences between the Funds’ investment objectives and policies are described below.

California Municipal is a state-specific municipal fund that seeks to provide a high level of current income exempt from regular federal income tax and California personal income tax. Because California Municipal invests primarily in municipal securities of California issuers it is more vulnerable to unfavorable economic, political and regulatory developments in California than are funds that invest in municipal securities of many states.

New York Municipal is a state-specific municipal fund that seeks to provide a high level of current income exempt from federal income tax and New York State and New York City personal income taxes. Because New York Municipal invests primarily in municipal securities of New York issuers it is more vulnerable to unfavorable economic, political and regulatory developments in New York than are funds that invest in municipal securities of many states. The economic and financial condition of New York State, New York City and other municipalities of New York are closely related, and any financial difficulty in these jurisdictions may have an adverse effect on New York municipal securities held by the Fund.

In contrast, the Acquiring Fund is a national municipal fund that seeks to provide a high level of current income exempt from regular federal income tax. It does not seek to provide income exempt from any specific state or local income tax. The Acquiring Fund may, but is not required to, invest greater than 25% of its total assets in municipal obligations of issuers located in any single state or U.S. territory, unlike the Target Funds which do invest a substantial portion of their assets in municipal securities of issuers of a single state.

Each Fund seeks to achieve its investment objective by normally investing at least 80% of its total assets (including proceeds from the issuance of any preferred stock and the proceeds of any borrowings for investment purposes) in securities of municipal issuers that provide interest income that is exempt from federal income tax and California personal income tax, with respect to California Municipal, and

New York State and New York City personal income taxes, with respect to New York Municipal; however, each Fund may invest without limit in municipal securities the interest on which may be an item of tax preference for purposes of the federal alternative minimum tax (“Tax Preference Item”). Each Fund’s distributions are generally exempt from federal income tax and California personal income taxes, with respect to California Municipal, and New York State and New York City personal income tax, with respect to New York Municipal, although stockholders may have to pay an alternative minimum tax on income deemed to be a Tax Preference Item.

Each Fund considers municipal securities that provide interest income that is exempt from federal income tax to include securities issued by state and local governments, including U.S. territories and possessions, political subdivisions, agencies and public authorities. The Target Funds consider municipal securities that provide interest income exempt from California personal income tax, with respect to California Municipal, and New York State and New York City personal income taxes, with respect to New York Municipal, to include securities issued by the respective state, any of its political subdivisions, agencies, or instrumentalities, or by U.S. territories and possessions, such as Guam, the U.S. Virgin Islands, and Puerto Rico, and their political subdivisions and public corporations.

Each Fund’s investment objective is not fundamental and may be changed by the Fund’s Board of Directors without stockholder approval, however, stockholders would be provided at least 60 days’ notice of any changes. Each Fund’s policy of investing at least 80% of its total assets (including proceeds from the issuance of any preferred stock and the proceeds of any borrowings for investment purposes) in municipal securities that provide interest income that is exempt from federal income tax and California personal income tax, with respect to California Municipal, and New York State and New York City personal income taxes, with respect to New York Municipal, is a fundamental policy that may not be changed without the approval of the holders of a majority of the outstanding voting securities of the Fund (as defined in the 1940 Act).

Each Fund may invest in municipal obligations of any maturity or duration and does not have a target maturity or duration. Under normal market conditions, each Fund will invest at least 70% of its total assets in municipal securities that, at the time of investment, are rated within the four highest rating categories by at least one independent credit rating agency or, if unrated, are determined by the Fund’s portfolio managers to be of comparable quality. Each Fund may invest up to 30% of its total assets in municipal securities that, at the time of investment, are rated Ba/BB or B by Moody’s, S&P or Fitch or that are unrated but judged to be of comparable quality by the Fund’s portfolio managers. Each Fund will not invest more than 25% of its total assets in any industry and the Acquiring Fund normally will not invest more than 5% of its total assets in the securities of any single issuer, while the Target Funds may. Each Fund may invest more than 25% of its total assets in industrial development bonds and the Acquiring Fund may, and the Target Funds currently do, invest more than 25% of their total assets in issuers

located in the same state. Each Fund may invest up to 20% of its total assets in securities the interest income on which is subject to federal income tax and, with respect to the Target Funds, the relevant state and city personal income taxes. All percentage and ratings limitations on securities in which each Fund may invest apply at the time of making an investment and shall not be considered violated as a result of subsequent market movements or if an investment rating is subsequently downgraded to a rating that would have precluded the Fund’s initial investment in such security.

Each Fund uses leverage to pursue its investment objective and has issued preferred stock in the form of VMTPS. Under the 1940 Act, each Fund is permitted to issue debt up to 33 1/3% of its total managed assets or equity securities (e.g., VMTPS) up to 50% of its total managed assets. Each Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, each Fund may be subject to certain asset coverage, leverage or portfolio composition requirements imposed by any preferred stock’s governing instruments or by agencies rating such preferred stock, which may be more stringent than those imposed by the 1940 Act.

Each Fund may invest in all types of municipal bonds, including general obligation bonds, revenue bonds and pre-refunded bonds. Each Fund may invest in zero coupon bonds, which are issued at substantial discounts from their value at maturity and pay no cash income to their holders until they mature.

Each Fund may purchase municipal bonds that are additionally secured by insurance, bank credit agreements, or escrow accounts. The credit quality of companies that provide such credit enhancements will affect the value of those securities. Although the insurance feature reduces certain financial risks, the premiums for insurance and the higher market price paid for insured obligations may reduce a Fund’s income. The insurance feature does not guarantee the market value of the insured obligations or the net asset value of a Fund’s shares of common stock.

As part of their fundamental investment analysis each Fund’s portfolio managers consider Environmental, Social and Governance (ESG) factors they believe are financially material to individual investments, where applicable, as described below. While this analysis is inherently subjective and may be informed by both internally generated and third-party metrics, data and other information, the portfolio managers believe that the consideration of financially material ESG factors, alongside traditional financial metrics, may improve credit analysis, security selection, relative value analysis and enhance a Fund’s overall investment process. The specific ESG factors considered and scope of integration may vary depending on the specific investment and/or investment type. The consideration of ESG factors does not apply to certain instruments, such as certain derivative instruments, other registered investment companies, cash and cash equivalents. The consideration of ESG factors as part of the investment process does not mean that the Funds pursue a specific “impact” or “sustainable” investment strategy.

Leverage. Each Fund has issued and outstanding preferred stock, the VMTPS, and may utilize other forms of leverage. The table below sets forth key terms of each Fund’s VMTPS as of February 28, 2023.

Fund | Series | Term Redemption Date | Shares Outstanding | Aggregate Liquidation Preference |

| California Municipal | Series A | 12/15/2024 | 457 | | $ | 45,700,000 |

| New York Municipal | Series A | 12/15/2024 | 365 | | $ | 36,500,000 |

| Acquiring Fund | Series A | 12/15/2024 | 1,457 | | $ | 145,700,000 |

Directors and Officers. The Acquiring Fund and the Target Funds have the same Directors and officers. The management of each Fund, including general oversight of the duties performed by the Fund’s investment adviser under an investment management agreement between the investment adviser and such Fund (each, a “Management Agreement”), is the responsibility of its Board. Each Fund currently has nine (9) Directors, all but one of whom is not considered an “interested person,” as defined in the 1940 Act. The names and business addresses of the Directors and officers of each Fund and their principal occupations and other affiliations during the past five years are set forth under “Management of the Funds” in the Reorganization SAI.

Pursuant to each Fund’s Bylaws, the Board of the Fund is divided into three classes (Class I, Class II and Class III) with staggered multi-year terms, such that only the members of one of the three classes stand for election each year; provided, however, that holders of preferred stock are entitled as a class to elect two Directors at all times. The staggered board structure could delay for up to two years the election of a majority of the Board of each Fund. A single institutional investor is the sole preferred stockholder of each Fund and holds all of the outstanding preferred stock of the Funds. As such, the sole preferred stockholder of each Fund could exert influence on the selection of the Board as a result of the requirement that holders of preferred stock be entitled to elect two Directors at all times. The Acquiring Fund’s board structure will remain in place following the closing of the Reorganizations.

Investment Adviser. Neuberger Berman Investment Advisers LLC (“NBIA”) provides day-to-day investment management services to each Fund and serves as the Fund’s investment adviser. NBIA is located at 1290 Avenue of the Americas, New York, New York 10104-0002. As of March 31, 2023, Neuberger Berman and its affiliates had $436 billion in assets under management and continue an asset management history that began in 1939.

Unless earlier terminated as described below, each Fund’s Management Agreement with NBIA will remain in effect until October 31, 2023. Each Management Agreement continues in effect from year to year so long as such continuation is approved at least annually by: (1) the Board or the vote of a majority of the outstanding voting securities of the Fund; and (2) a majority of the Board Members who are not interested persons of any party to the Management Agreement,

cast in person at a meeting called for the purpose of voting on such approval. Each Management Agreement may be terminated at any time, without penalty, by either the Fund or NBIA upon 60 days’ written notice and is automatically terminated in the event of its assignment, as such term defined in the 1940 Act.

Pursuant to each Management Agreement, each Fund has agreed to pay NBIA an investment management fee computed at an annual rate of 0.25% of the Fund’s average daily Managed Assets. Managed Assets equal the total assets of a Fund, less liabilities other than the aggregate indebtedness entered into for purposes of leverage. For purposes of calculating Managed Assets, any VMTPS liquidation preference is not considered a liability. Each Fund retains NBIA as its administrator under an Administration Agreement. Each Fund pays NBIA an administration fee at an annual rate of 0.30% of its average daily Managed Assets under this agreement. Additionally, NBIA retains State Street bank and Trust Company (“State Street”) as its sub-administrator under a Sub-Administration Agreement. NBIA pays State Street a fee for all services received under the Sub-Administration Agreement.

In addition to the fees of NBIA, each Fund pays all other costs and expenses of its operations, including compensation of its Directors (other than those affiliated with NBIA), custodial expenses, transfer agency and distribution disbursing expenses, legal fees, expenses of independent auditors, expenses of repurchasing shares, leveraging expenses, expenses of preparing, printing and distributing prospectuses, stockholder reports, notices, proxy statements, reports to governmental agencies and taxes, if any.

A discussion regarding the basis for the approval of each Management Agreement by the respective Board is available in each Fund’s annual report to stockholders for the period ending October 31, 2022.

Portfolio Management. NBIA is responsible for execution of specific investment strategies and day-to-day investment operations and the following employees of NBIA have day-to-day management responsibility of each Fund’s portfolio:

James L. Iselin is a Managing Director of NBIA. He is the Head of the Municipal Fixed Income Team. Mr. Iselin joined NBIA in 2006. Previously, Mr. Iselin was a portfolio manager for another investment adviser working in the Municipal Fixed Income group beginning in 1993.

S. Blake Miller is a Managing Director of NBIA. He is a Senior Portfolio Manager for the Municipal Fixed Income team. Mr. Miller joined NBIA in 2008. Prior to that time, he was the head of Municipal Fixed Income investing at another firm where he worked beginning in 1986.

Comparative Risk Information

Risk is inherent in all investing. Investing in the Funds involves risk, including the risk that you may receive little or no return on your investment or that you may even lose part or all of your investment. An investment in the Funds is not a

deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Before you invest in a Fund, you should consider its principal risks.

Because each Fund invests primarily in municipal obligations the income from which is exempt from regular federal income tax, and, with respect to the Target Funds, the relevant state and city personal income tax, the principal risks of an investment in each Fund are similar. While investment in the Target Funds is subject to each of the principal risks of an investment in the Acquiring Fund, the stockholders of a Target Fund should also consider the differences between the Funds’ investment policies that may affect the comparative risk profile, including, primarily, the fact that the Acquiring Fund may invest in municipal obligations of any U.S. state or territory, whereas each Target Fund invests primarily in municipal obligations of a specific state and are subject to economic, political, regulatory and other risks of a single state.

The principal risks of investing in the Acquiring Fund are described in more detail below. See “B. Risk Factors.”

Comparative Expense Information

The purpose of the Comparative Fee Table is to assist you in understanding the various costs and expenses of investing in shares of common stock of the Funds. The information in the table reflects the fees and expenses of the Funds for the period ended February 28, 2023, and the pro forma fees and expenses of the combined fund following the Reorganizations for the period ended February 28, 2023, assuming both Reorganizations are completed and for each Reorganization separately.

The assets of the Funds will vary based on market conditions and other factors and may vary significantly during volatile market conditions. The figures in each Example are not necessarily indicative of past or future expenses, and actual expenses may be greater or less than those shown. The Funds’ actual rates of return may be greater or less than the hypothetical 5% annual return shown in each Example.

1. Comparative Fee Table(1)—Reorganizations of Both

California Municipal and New York Municipal

| | California

Municipal | New York

Municipal | Acquiring

Fund | Combined

Fund Pro

Forma(3) |

| Annual Expenses (as a percentage of net assets attributable to common stock) | | | | |

| Management Fees(2) | 0.91% | 0.91% | 0.91% | 0.91% |

| Distributions on Preferred Stock(4) | 2.64% | 2.61% | 2.64% | 2.64% |

| Other Expenses(5) | 0.49% | 0.59% | 0.18% | 0.13% |

| Total Annual Expenses | 4.04% | 4.11% | 3.73% | 3.68% |

| (1) | The table presented above estimates what the annual expenses of the combined fund following the Reorganizations would be stated as a percentage of the combined fund’s net assets attributable to common stock including the costs of leverage for the period ended February 28, 2023. |

| (2) | Management fees include both the management fees and administration fees. |

| (3) | Assumes the issuance of preferred stock in the amounts set forth in the capitalization table. Such amounts may change prior to the closing date. Please see “C. Information About the Reorganizations—Capitalization” below. |

| (4) | Distribution rates on shares of preferred stock are set as set forth in the respective Articles Supplementary by reference to a reference rate. Prevailing interest rate, yield curve and market circumstances at the time at which the rate on Preferred Shares for the next dividend period are set substantially influence the rate. As these factors change over time, so too do the distribution rates set. The Funds’ use of leverage will increase the amount of management fees paid to the Adviser. |

| (5) | Other Expenses are estimated based on actual expenses from the prior fiscal reporting period. In connection with the Reorganizations, there are certain other transaction expenses not reflected in “Other Expenses” which include, but are not limited to: costs related to the preparation, printing and distributing of this Proxy Statement/Prospectus to stockholders; costs related to preparation and distribution of materials distributed to the Boards; expenses incurred in connection with the preparation of the Agreement and the registration statement on Form N-14; SEC filing fees; legal and audit fees; portfolio transfer taxes (if any); and any similar expenses incurred in connection with the Reorganizations. |

Example: The following examples illustrate the expenses that a common stockholder would pay on a $1,000 investment that is held for the time periods provided in the table. The examples assume that all distributions and dividends are reinvested and that Total Annual Expenses remain the same. The examples also assume a 5% annual return. The examples should not be considered a representation of future expenses. Actual expenses may be greater or lesser than those shown.

| | 1 Year | 3 Years | 5 Years | 10 Years |

| California Municipal | $41 | $123 | $207 | $424 |

| New York Municipal | $41 | $125 | $210 | $430 |

| Acquiring Fund | $38 | $114 | $193 | $398 |

| Combined Fund Pro Forma | $37 | $113 | $190 | $393 |

2. Comparative Fee Table(1)—Reorganization of California Municipal Only

| | California

Municipal | Acquiring

Fund | Combined

Fund Pro

Forma(3) |

| Annual Expenses (as a percentage of net assets attributable to common stock) | | | |

| Management Fees(2) | 0.91% | 0.91% | 0.91% |

| Distributions on Preferred Stock(4) | 2.64% | 2.64% | 2.64% |

| Other Expenses(5) | 0.49% | 0.18% | 0.14% |

| Total Annual Expenses | 4.04% | 3.73% | 3.69% |

| (1) | The table presented above estimates what the annual expenses of the combined fund following the Reorganization would be stated as a percentage of the combined fund’s net assets attributable to common stock including the costs of leverage for the period ended February 28, 2023. |

| (2) | Management fees include both the management fees and administration fees. |

| (3) | Assumes the issuance of preferred stock in the amounts set forth in the capitalization table. Such amounts may change prior to the closing date. Please see “C. Information About the Reorganizations—Capitalization” below. |

| (4) | Distribution rates on shares of preferred stock are set as set forth in the respective Articles Supplementary by reference to a reference rate. Prevailing interest rate, yield curve and market circumstances at the time at which the rate on Preferred Shares for the next dividend period are set substantially influence the rate. As these factors change over time, so too do the distribution rates set. The Funds’ use of leverage will increase the amount of management fees paid to the Adviser. |

| (5) | Other Expenses are estimated based on actual expenses from the prior fiscal reporting period. In connection with the Reorganization, there are certain other transaction expenses not reflected in “Other Expenses” which include, but are not limited to: costs related to the preparation, printing and distributing of this Proxy Statement/Prospectus to stockholders; costs related to preparation and distribution of materials distributed to the Boards; expenses incurred in connection with the preparation of the Agreement and the registration statement on Form N-14; SEC filing fees; legal and audit fees; portfolio transfer taxes (if any); and any similar expenses incurred in connection with the Reorganizations. |

Example: The following examples illustrate the expenses that a common stockholder would pay on a $1,000 investment that is held for the time periods provided in the table. The examples assume that all distributions and dividends are reinvested and that Total Annual Expenses remain the same. The examples also assume a 5% annual return. The examples should not be considered a representation of future expenses. Actual expenses may be greater or lesser than those shown.

| | 1 Year | 3 Years | 5 Years | 10 Years |

| California Municipal | $41 | $123 | $207 | $424 |

| Acquiring Fund | $38 | $114 | $193 | $398 |

| Combined Fund Pro Forma | $37 | $113 | $191 | $394 |

3. Comparative Fee Table(1)—Reorganization of New York Municipal Only

| | New York

Municipal | Acquiring

Fund | Combined

Fund Pro

Forma(3) |

| Annual Expenses (as a percentage of net assets attributable to common stock) | | | |

| Management Fees(2) | 0.91% | 0.91% | 0.91% |

| Distributions on Preferred Stock(4) | 2.61% | 2.64% | 2.63% |

| Other Expenses(5) | 0.59% | 0.18% | 0.15% |

| Total Annual Expenses | 4.11% | 3.73% | 3.69% |

| (1) | The table presented above estimates what the annual expenses of the combined fund following the Reorganization would be stated as a percentage of the combined fund’s net assets attributable to common stock including the costs of leverage for the period ended February 28, 2023. |

| (2) | Management fees include both the management fees and administration fees. |

| (3) | Assumes the issuance of preferred stock in the amounts set forth in the capitalization table. Such amounts may change prior to the closing date. Please see “C. Information About the Reorganizations—Capitalization” below. |

| (4) | Distribution rates on shares of preferred stock are set as set forth in the respective Articles Supplementary by reference to a reference rate. Prevailing interest rate, yield curve and market circumstances at the time at which the rate on Preferred Shares for the next dividend period are |

| | set substantially influence the rate. As these factors change over time, so too do the distribution rates set. The Funds’ use of leverage will increase the amount of management fees paid to the Adviser. |

| (5) | Other Expenses are estimated based on actual expenses from the prior fiscal reporting period. In connection with the Reorganization, there are certain other transaction expenses not reflected in “Other Expenses” which include, but are not limited to: costs related to the preparation, printing and distributing of this Proxy Statement/Prospectus to stockholders; costs related to preparation and distribution of materials distributed to the Boards; expenses incurred in connection with the preparation of the Agreement and the registration statement on Form N-14; SEC filing fees; legal and audit fees; portfolio transfer taxes (if any); and any similar expenses incurred in connection with the Reorganizations. |

Example: The following examples illustrate the expenses that a common stockholder would pay on a $1,000 investment that is held for the time periods provided in the table. The examples assume that all distributions and dividends are reinvested and that Total Annual Expenses remain the same. The examples also assume a 5% annual return. The examples should not be considered a representation of future expenses. Actual expenses may be greater or lesser than those shown.

| | 1 Year | 3 Years | 5 Years | 10 Years |

| New York Municipal | $41 | $125 | $210 | $430 |

| Acquiring Fund | $38 | $114 | $193 | $398 |

| Combined Fund Pro Forma | $37 | $113 | $191 | $394 |

An investment in the Acquiring Fund may not be appropriate for all investors. The Acquiring Fund is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Acquiring Fund will achieve its investment objective. Investors should consider their long-term investment goals and financial needs when making an investment decision with respect to shares of the Acquiring Fund. An investment in the Acquiring Fund is intended to be a long-term investment, and you should not view the Fund as a trading vehicle. Your shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions, if applicable.

The principal risks of investing in the Acquiring Fund are described below. The risks and special considerations listed below should be considered by common stockholders of a Target Fund in their evaluation of the applicable Reorganization.

General Risks of Investing in the Acquiring Fund

This section contains a discussion of principal risks of investing in the Acquiring Fund. The NAV per share and market price of, and distributions paid on, Acquiring Fund’s shares of common stock will fluctuate with and be affected by, among other things, the risks more fully described below. As with any fund, there

can be no guarantee that the Acquiring Fund will meet its investment objective or that the Acquiring Fund’s performance will be positive for any period of time. Each of the following risks, which are described in alphabetical order and not in order of importance, can significantly affect the Acquiring Fund’s performance. The relative importance of, or potential exposure as a result of, each of these risks will vary based on market and other investment-specific considerations. The Acquiring Fund may be subject to other risks in addition to those identified below. See “Investment Strategies, Techniques and Risks” in the Reorganization SAI. Each of the risks noted below is also applicable to the Target Funds.