(b) There are substantial risks incident to the purchase of Interests, including those summarized in the Memorandum.

(c) There are substantial restrictions on the transferability of the Interests under the Partnership Agreement and under applicable law; there is no established market for the Interests and no public market for the Interests will develop; the Interests will not be, and investors in the Partnership have no rights to require that the Interests be, registered under the 1933 Act or the securities laws of the various states and therefore cannot be resold, pledged, assigned or otherwise disposed of unless subsequently registered or unless an exemption from such registration is available; the Subscriber may have to hold the Interest herein subscribed for and bear the economic risk of this investment indefinitely and it may not be possible for the Subscriber to liquidate its investment in the Partnership.

(d) With respect to the tax and other legal consequences of an investment in the Interest, the Subscriber is relying solely upon the advice of its own tax and legal advisors, upon the legal opinions of counsel to the Partnership delivered in connection with the First Closing and not upon the general discussion of such matters set forth in the Memorandum.

(e) The General Partner and its Affiliates will receive substantial compensation in connection with the Partnership irrespective of the success of its operation and, to the extent permitted by the Partnership Agreement, the General Partner and its Affiliates are (and in the future may continue to be) engaged in businesses that are competitive with that of the Partnership. Subject to the restrictions contained in the Partnership Agreement, the Subscriber agrees and consents to these activities of the General Partner and its Affiliates even though there are conflicts of interest inherent in such activities and even though the Subscriber will have no interest in such activities except as set forth in the Partnership Agreement.

(f) The Subscriber will be subject to the default provisions set forth in the Partnership Agreement in the event the Subscriber fails to make capital contributions as required under the Partnership Agreement.

(g) By submitting its subscription for the Interest, the Subscriber agrees to comply with and be bound by the terms of the Partnership Agreement, including, without limitation, the irrevocable appointment of the General Partner, and the successors and assigns of the General Partner, as the Subscriber’s true and lawful attorney-in-fact with the power and authority set forth in Sections 4.04(E) and 8.03 of the Partnership Agreement.

(a) The General Partner is empowered, authorized and qualified to enter into this Subscription Agreement, individually and on behalf of the Partnership, and the Partnership Agreement, and to become the general partner of the Partnership, and the person signing this

Subscription Agreement and the Partnership Agreement on behalf of the General Partner has been duly authorized by the General Partner to do so.

(b) The execution and delivery of this Subscription Agreement and the Partnership Agreement by the General Partner and the performance of its duties and obligations hereunder and thereunder do not result in a breach of any of the terms, conditions or provisions of, or constitute a default under, any indenture, mortgage, deed of trust, credit agreement, note or other evidence of indebtedness, or any lease or other agreement, or any license, permit, franchise or certificate, to which the General Partner is a party or by which it is bound or to which any of its properties are subject, or require any authorization or approval under or pursuant to any of the foregoing, or violate in any material respect any statute, regulation, law, order, writ, injunction or decree to which the General Partner is subject.

(c) The General Partner is not in default (nor has any event occurred which with notice, lapse of time, or both, would constitute a default) under any representation or warranty, or in the performance of any obligation, agreement or condition contained in this Subscription Agreement or in the Partnership Agreement, any indenture, mortgage, deed of trust, credit agreement, note or other evidence of indebtedness or any lease or other agreement or understanding, or any license, permit, franchise or certificate, to which it is a party or by which it is bound or to which its properties are subject, nor is it in violation of any statute, regulation, law, order, writ, injunction, judgment or decree to which it is subject, which default or violation would materially adversely affect the business or financial condition of the General Partner or the Partnership or impair the General Partner’s ability to carry out its obligations under this Subscription Agreement or in the Partnership Agreement.

(d) There is no litigation, investigation or other proceeding pending or, to the knowledge of the General Partner, threatened against the General Partner or its Affiliates which, if adversely determined, would materially adversely affect the business or financial condition of the General Partner or the ability of the General Partner to perform its obligations under this Subscription Agreement or the Partnership Agreement.

Section 4. SECTION 4

4.1. Conditions to Closing. The Subscriber’s obligations hereunder are subject to the fulfillment (or waiver by the Subscriber), prior to or at the time of the First Closing, of the following conditions:

(a) Partnership Agreement. The Partnership Agreement shall have been authorized, executed and delivered by or on behalf of the General Partner and all filings shall have been made as required by the Delaware Revised Uniform Limited Partnership Act.

(b) Capital Commitments. The Capital Commitment of the General Partner, when combined with that of other Affiliates of the General Partner, shall at all times be at least equal to 10% of the aggregate Capital Commitments of all Partners; provided, however, the Capital Commitment of the General Partner, when combined with that of other Affiliates of the General Partner, shall not be more than $25,000,000.

NYA 745442.1

(c) Performance. The Partnership and the General Partner shall have duly performed and complied in all material respects with all agreements and conditions contained in this Subscription Agreement required to be performed or complied with by them prior to or at the First Closing.

(d) Opinions of Counsel. The Partnership shall have received the opinions, dated the date of the First Closing, from counsel to Berkshire Multifamily Value Fund, L.P. substantially in the forms attached hereto as Exhibit A.

Section 5. SECTION 5

5.1. Indemnity. Each of the General Partner and the Subscriber agrees, to the fullest extent permitted by law, to indemnify and hold harmless the other and, in the case of indemnification by the Subscriber, the Partnership and each other person, if any, who controls the other or any person who is a partner in the other (or, in the case of indemnification by the Subscriber, the Partnership) within the meaning of Section 15 of the 1933 Act against any and all losses, liabilities, claims, damages and expenses whatsoever (including attorneys’ fees and disbursements, judgments, fines and amounts paid in settlement) arising out of or based upon any breach or failure by the General Partner or the Subscriber, as the case may be, to comply with any representation, warranty, covenant or agreement made by it herein or in any other document, other than the Partnership Agreement, furnished by it to any of the foregoing pursuant to this Subscription Agreement.

5.2. | Acceptance or Rejection. |

(a) At any time prior to the First Closing and notwithstanding the Subscriber’s prior receipt of a notice of acceptance of the Subscriber’s subscription, the General Partner shall have the right to accept or reject this subscription for any reason whatsoever. If this subscription is not accepted by the General Partner on the First Closing Date, this subscription shall be deemed to be rejected.

(b) If this subscription is accepted, the General Partner shall notify the Subscriber promptly of such acceptance and the General Partner will execute a copy of this Subscription Agreement and the Partnership Agreement and return a copy to the undersigned.

(c) In the event of rejection of this subscription or if, for any reason whatsoever, the formation of the Partnership is not completed prior to the last date specified for the First Closing in Section 1.2, the General Partner promptly thereupon shall return to the Subscriber the copies of this Subscription Agreement and the Partnership Agreement and any other documents submitted herewith, and this Subscription Agreement and the Partnership Agreement shall have no further force or effect thereafter.

5.3. Modification. Neither this Subscription Agreement nor any provisions hereof shall be modified, changed, discharged or terminated except by an instrument in writing signed by the party against whom any waiver, change, discharge or termination is sought.

NYA 745442.1

5.4. Revocability. Except as otherwise provided herein, this Subscription Agreement may not be withdrawn or revoked by the Subscriber in whole or in part without the consent of the General Partner.

5.5. Notices. All notices, consents, requests, demands, offers, reports and other communications required or permitted to be given pursuant to this Subscription Agreement shall be in writing and shall be considered properly given and received when personally delivered to the party entitled thereto, or when sent by facsimile with confirmation of transmission received, or by overnight courier when delivered to the address set forth below, or seven business days after being sent by certified United States mail, return receipt requested, in a sealed envelope, with postage prepaid, addressed, if to the Partnership or the General Partner, c/o Berkshire Multifamily Value Fund, GP, L.L.C., One Beacon Street, Suite 1500, Boston, Massachusetts, Attention: Frank Apeseche, telephone (617) 556-8120, facsimile (617) 423-8916, and, if to the Subscriber, to the address set forth below the Subscriber’s signature on the counterpart of this Subscription Agreement which the Subscriber originally executed and delivered to the Partnership; provided, however, that any notice sent by facsimile shall be promptly followed by a copy of such notice sent by mail or overnight courier in the manner described herein. The Partnership or the Subscriber may change its address by giving notice to the other.

5.6. Counterparts. This Subscription Agreement may be executed in multiple counterpart copies, each of which shall be considered an original and all of which constitute one and the same instrument binding on all the parties, notwithstanding that all parties are not signatories to the same counterpart.

5.7. Successors. Except as otherwise provided herein, this Subscription Agreement and all of the terms and provisions hereof shall be binding upon and inure to the benefit of the parties and their respective heirs, executors, administrators, successors, trustees and legal representatives. If the Subscriber is more than one person, the obligation of the Subscriber shall be joint and several and the agreements, representations, warranties and acknowledgements herein contained shall be deemed to be made by and be binding upon each such person and such person’s heirs, executors, administrators, successors, trustees and legal representatives.

5.8. Assignability. This Subscription Agreement is not transferable or assignable by the Subscriber. Any purported assignment of this Subscription Agreement shall be null and void.

5.9. Entire Agreement. This Subscription Agreement, the Annexes attached hereto and the Partnership Agreement contain the entire agreement of the parties with respect to the subject matter hereof and thereof, and supersede all other prior agreements and undertakings, both written and oral, among the parties, or any of them, with respect to the subject matter hereof and thereof.

5.10. APPLICABLE LAW. THIS SUBSCRIPTION AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE

NYA 745442.1

STATE OF NEW YORK WITHOUT GIVING EFFECT TO PRINCIPLES RELATING TO CONFLICT OR CHOICE OF LAWS.

5.11. Survival. The representations and warranties in Sections 2.1, 2.2 and 3.1 and the provisions of Section 5.1 shall, in the event this subscription is accepted, survive such acceptance and the formation and dissolution of the Partnership.

[Signature page to the Subscription Agreement follows.]

NYA 745442.1

IN WITNESS WHEREOF, the undersigned has executed this Subscription Agreement as of ___________________, 2005.

| Signature of Subscriber

(if individual) ___________________________________________ Name: (Print Name of Subscriber) |

Amount of Commitment: $____________________ (an amount to be completed by the General Partner, which amount shall be adjusted from time to time by the General Partner such that the sum of the General Partner’s Capital Commitment and the Subscriber’s Capital Commitment equals the lesser of (i) 10% of the total Capital Commitments of the Partnership and (ii) $25 million) | Signature of Subscriber

(if other than individual) Name: |

| |

| Name of Subscriber: By: __________________________________ Name: Title: (Print Name and Title of Person Signing on Behalf of Subscriber) |

| |

Subscriber’s Name, Mailing Address and Tax Identification Number: (Name) ____________________________________________________________________ (Street) ____________________________________________________________________ (City) _______________________________ (State) ________ (Zip Code) _________ (Telephone Number) (______) ___________________________ (Facsimile Number) (______) ___________________________ (Tax Identification or Social Security Number) ____________________________ |

[SIGNATURE PAGE TO SUBSCRIPTION AGREEMENT] |

NYA 745442.1

The foregoing subscription is hereby accepted by the General Partner on behalf of the Partnership, and the terms of the foregoing Subscription Agreement are agreed to by the Partnership and the General Partner, as of ___________________, 2005.

Berkshire Multifamily Value Fund, L.P. |

By: Berkshire Multifamily Value Fund, GP, L.L.C., its General Partner

Name:

Title:

Berkshire Multifamily Value Fund, GP, L.L.C.

Name:

Title:

[SIGNATURE PAGE TO SUBSCRIPTION AGREEMENT] |

NYA 745442.1

ANNEX I

TO THE SUBSCRIPTION AGREEMENT OF

BERKSHIRE MULTIFAMILY VALUE FUND, L.P.

The funds that the Subscriber is using or will use to purchase the Interest hereby subscribed for are assets of an employee benefit plan as defined in Section 3(3) of ERISA, whether or not such plan is subject to ERISA, or a plan described in Section 4975(e)(1) of the Code, or a plan or governmental unit described in Sections 401(a)(24) and 818(a)(6) of the Code.

Yes No (Please check either yes or no). |

If yes, such funds are assets of an employee benefit plan subject to the fiduciary responsibility provisions of ERISA or a plan described in Section 4975(e)(1) of the Code or a “governmental plan” subject to federal or state laws, rules or regulations that are substantially the same as the fiduciary responsibility provisions of ERISA or Section 4975 of the Code.

Yes No (Please check either yes or no). |

The Subscriber is an entity exempt from U.S. federal income taxation and subject to taxation on “unrelated business taxable income” under Sections 511 and 512 of the Code.

Yes No (Please check either yes or no). |

The Subscriber is not subject to U.S. federal backup withholding either because the Subscriber has not been notified that it is subject to U.S. federal backup withholding as a result of a failure to report all interest or dividends, or the U.S. Internal Revenue Service has notified the Subscriber that it is no longer subject to backup withholding.

Yes No (Please check either yes or no).

[ERISA/TAX CERTIFICATION] |

NYA 745442.1

ANNEX II

TO THE SUBSCRIPTION AGREEMENT OF

BERKSHIRE MULTIFAMILY VALUE FUND, L.P.

CERTIFICATION OF NON-FOREIGN STATUS

Section 1445 of the Internal Revenue Code provides that a purchaser of a U.S. real property interest must withhold tax if the seller is a foreign person. Section 1446 of the Internal Revenue Code provides that a partnership must pay a withholding tax to the Internal Revenue Service with respect to a partner’s allocable share of the partnership’s effectively connected taxable income, if the partner is a foreign person. To inform (i) a purchaser of a U.S. real property interest from the Partnership that withholding of tax is not required based on the status of the Subscriber and (ii) the Partnership that the provisions of Section 1446 do not apply, the Subscriber hereby certifies the following:

1. The Subscriber is not a nonresident alien for purposes of U.S. federal income taxation and is not a foreign corporation, foreign partnership, foreign trust or foreign estate (as those terms are defined in the Internal Revenue Code and U.S. Treasury).

2. | The Subscriber’s Tax Identification or Social Security Number is ___________________________________. |

3. | The Subscriber’s principal address is: |

The undersigned, on behalf of the Subscriber, (i) agrees to notify the Partnership 60 days of the date the Subscriber becomes a foreign person and (ii) understands that this certification may be disclosed to the Internal Revenue Service by a purchaser of a U.S. real property interest from the Partnership, or by the Partnership itself, and that any false statement made herein could be punished by fine, imprisonment or both.

NYA 745442.1

Under penalties of perjury, the undersigned, on behalf of the Subscriber, declares that he has examined this certification and to the best of his knowledge and belief it is true, correct and complete.

Signature of Subscriber |

| (if individual) | |

| | |

________________________________________ |

Name: | |

(Print Name of Subscriber) | |

| | |

Signature of Subscriber

(if other than individual) |

Name: | |

(Print Name of Subscriber) |

By: | /s/ David C. Quade |

| Name: | |

| Title: | |

| | | |

(Print Name and Title of Person Signing |

on Behalf of Subscriber)

NYA 745442.1

ANNEX III

TO THE SUBSCRIPTION AGREEMENT OF

BERKSHIRE MULTIFAMILY VALUE FUND, L.P.

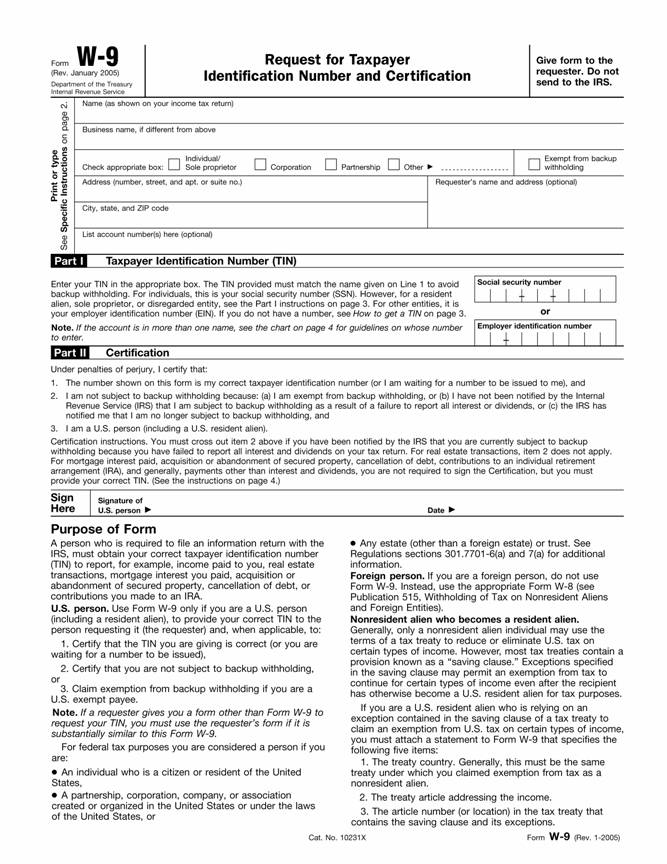

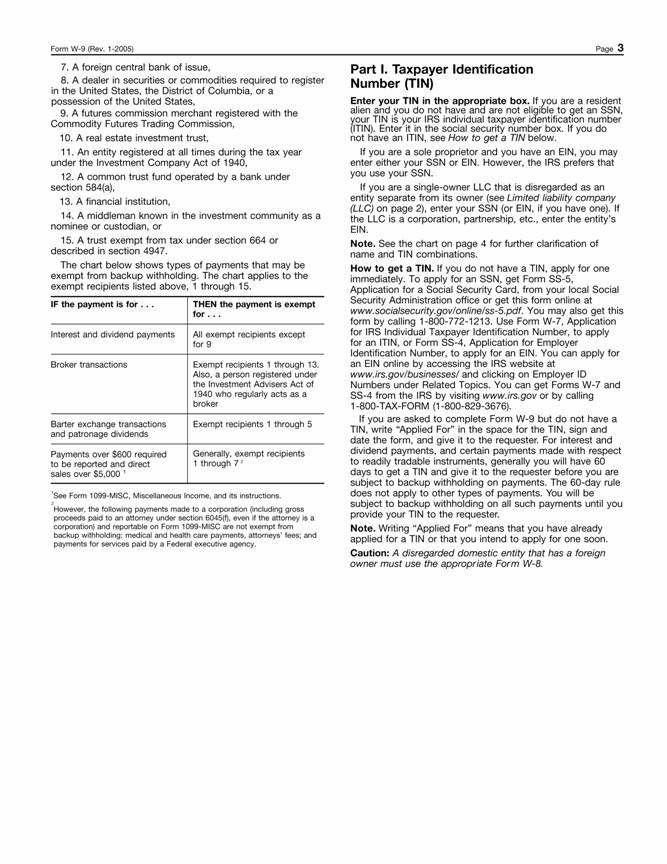

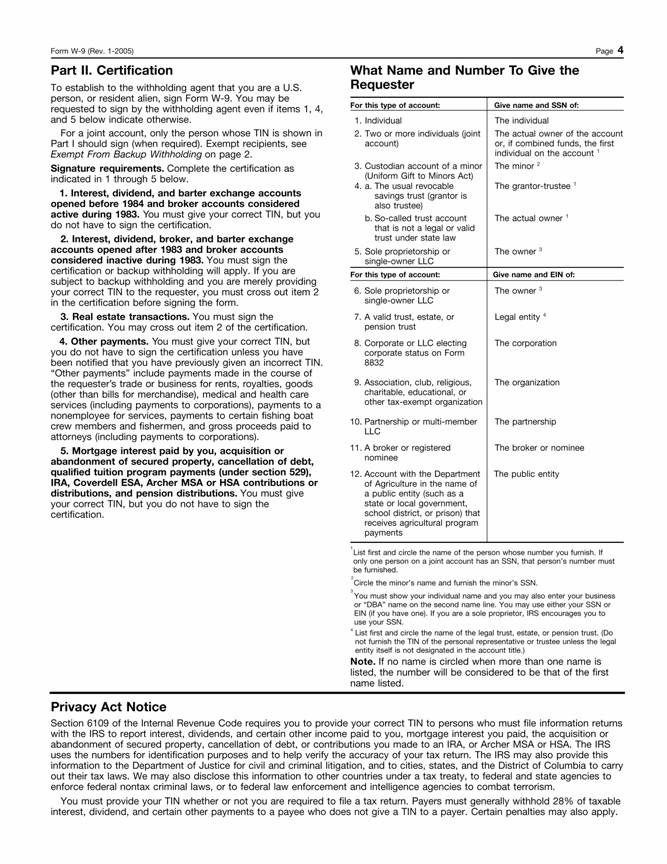

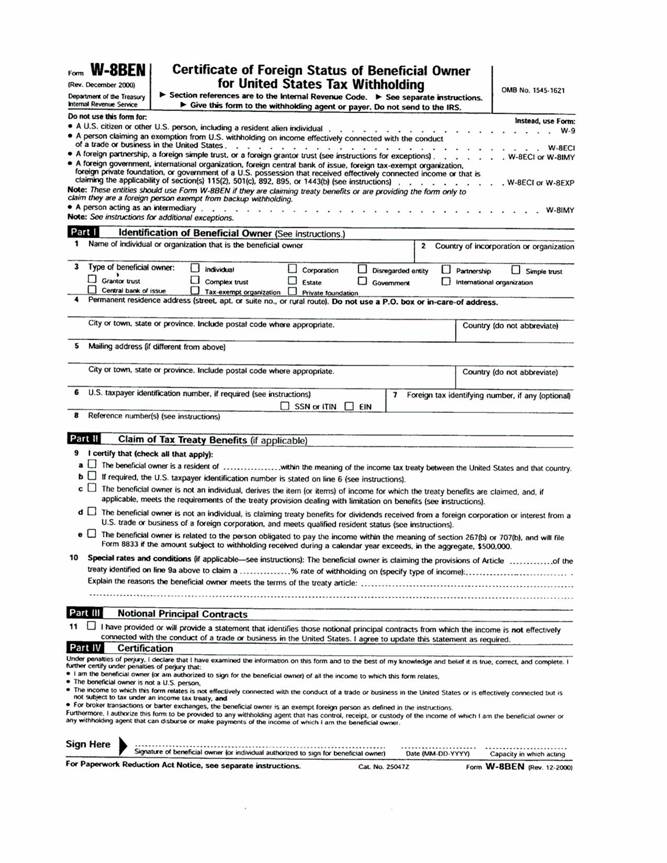

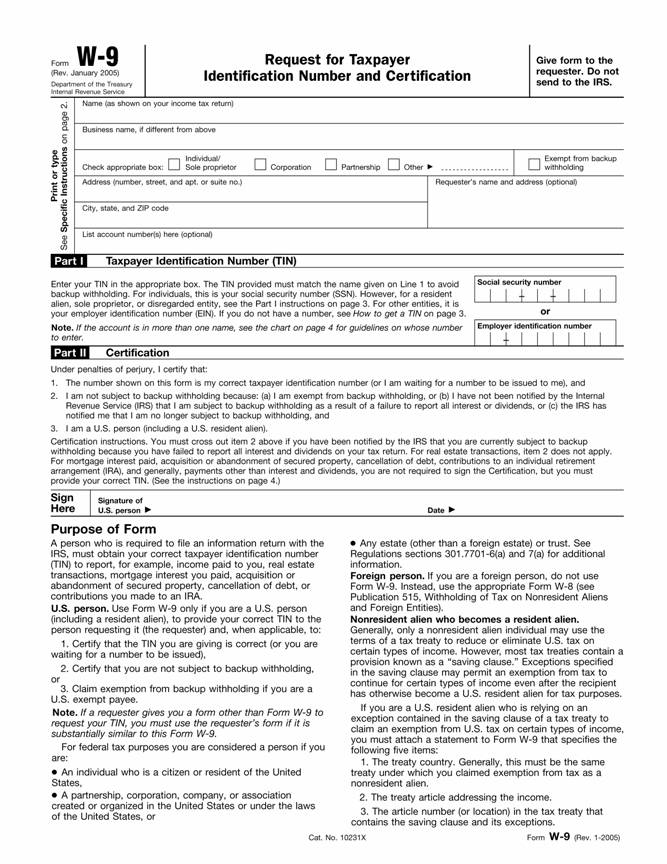

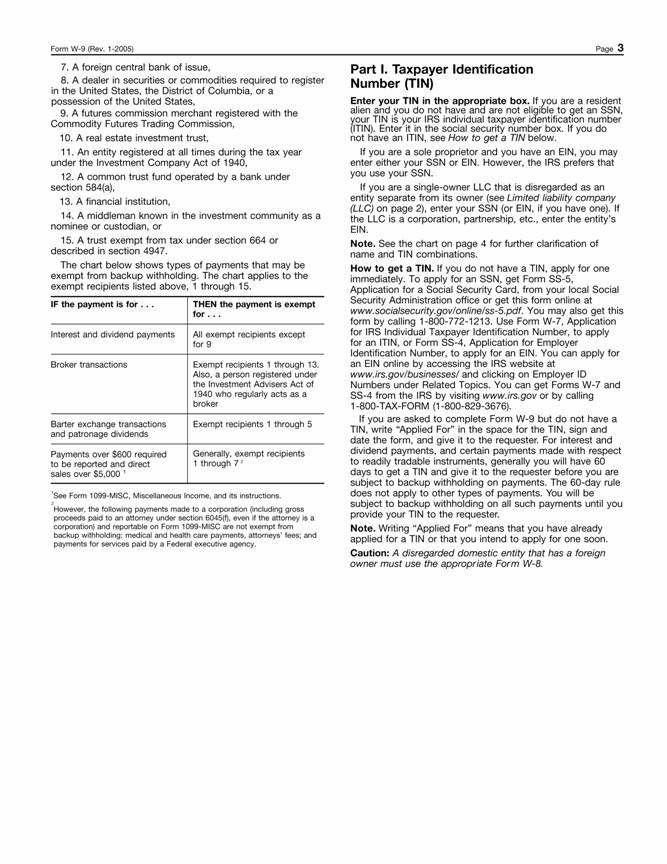

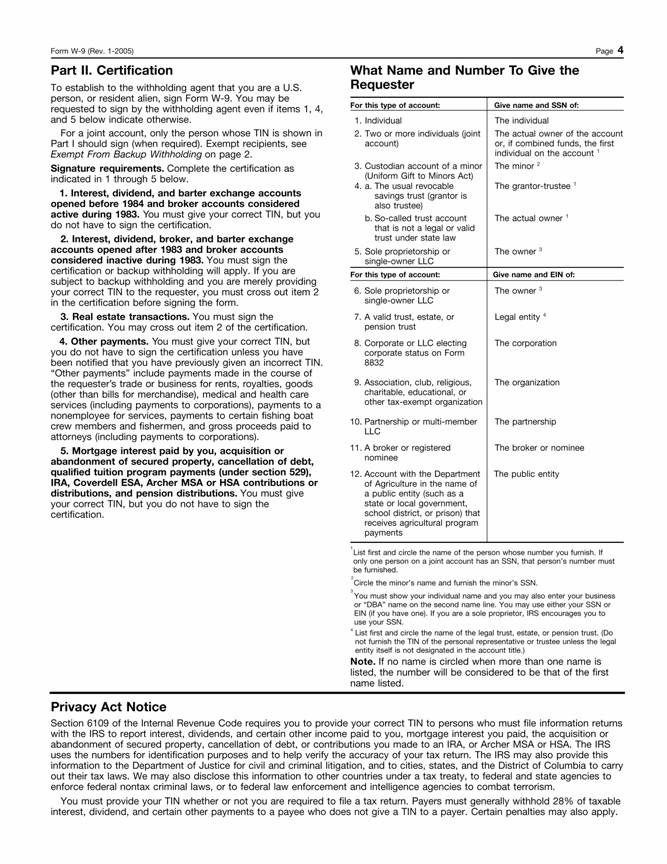

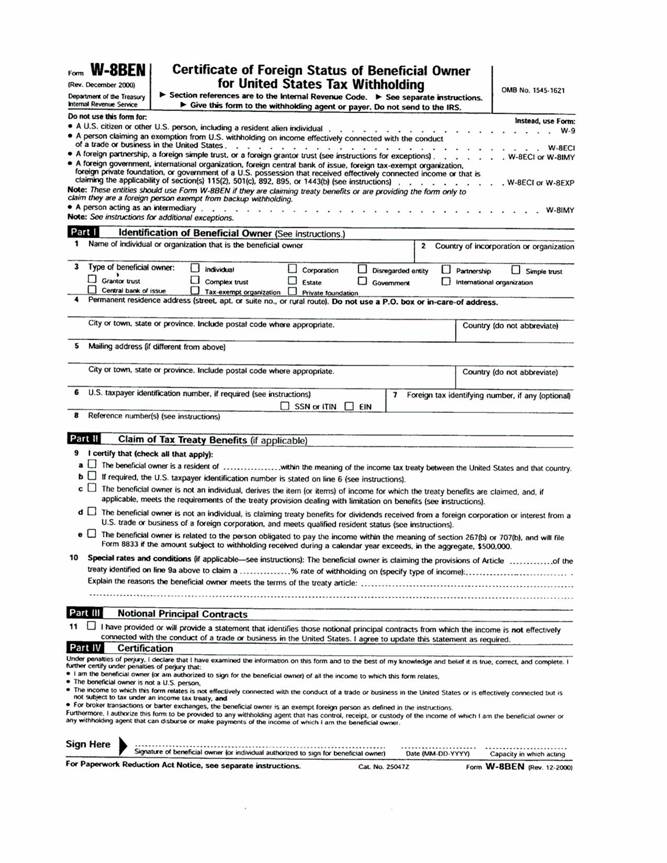

IRS FORM W-9 OR W-8

Subscribers who are United States persons should complete and execute the attached IRS Form W-9. Subscribers who are not United States persons should complete and execute the attached IRS Form W-8 BEN, W-8 ECI and/or any IRS Form W-8 required by the Code and the United States Treasury Regulations promulgated thereunder.

NYA 745442.1

NYA 745442.1

NYA 745442.1

NYA 745442.1

NYA 745442.1

NYA 745442.1

SIGNATURE PAGE

FOR

BERKSHIRE MULTIFAMILY VALUE FUND L.P.

AGREEMENT OF LIMITED PARTNERSHIP

The undersigned (the “Limited Partner”) hereby agrees to all of the terms of the Agreement of Limited Partnership (the “Partnership Agreement”) of Berkshire Multifamily Value Fund L.P. (the “Partnership”).

IN WINESS WHEREEOF, the undersigned has executed this Signature Page for Agreement of Limited Partnership as of ____________, 2005.

| Signature of Limited Partner

(if individual) ___________________________________________ Name: (Print Name of Limited Partner) |

Amount of Commitment: $____________________ (an amount to be completed by the General Partner, which amount shall be adjusted from time to time by the General Partner such that the sum of the General Partner’s Capital Commitment and the Subscriber’s Capital Commitment equals the lesser of (i) 10% of the total Capital Commitments of the Partnership and (ii) $25 million) | Signature of Limited Partner

(if other than individual) Name: (Print Name of Limited Partner) |

| |

| By: /s/ David C. Quade Name: Title: (Print Name and Title of Person Signing on Behalf of Limited Partner) |

| |

NYA 745442.1

Subscriber’s Name, Mailing Address and Tax Identification Number: (Name) ____________________________________________________________________ (Street) ____________________________________________________________________ (City) _______________________________ (State) ________ (Zip Code) _________ (Telephone Number) (______) ___________________________ (Facsimile Number) (______) ___________________________ (Tax Identification or Social Security Number) ____________________________ |

NYA 745442.1