March 23, 2017

Larry Spirgel

Associate Director

Securities and Exchange Commission

Washington, D.C. 20549/USA

Re: DragonWave Inc. (the “Company”)

Form 20-F for Fiscal Year Ended February 29, 2016

Filed May 31, 2016

File No. 001-34491

Dear Mr. Spirgel:

Please find below our responses to your letter dated February 24, 2017 in regards to the SEC’s comments on our Form 20-F for fiscal year ended February 29, 2016.

We will comply with these comments in future filings. We will provide more detailed explanations on significant revenue variances, and we will also include the material agreements you noted to the list of exhibits.

Response to your specific inquiries:

1. Please discuss in more detail the underlying reasons or drivers for the decline in revenues, which you state is across all sales channels and appears to be across geographic regions. For example, please explain what is driving the decreased demand for your products in the United States and with Tier 1 carriers in India. Also disclose why revenues from your Nokia channel have declined. While you point to Nokia’s combination with Alcatel-Lucent in January 2016, we note that you were experiencing declines in this channel prior to the combination, resulting in your entering into an agreement with Nokia in August 2015 to address this reduced demand.

Decreased demand from the United States

We address the North American market in three different sales strategies:

1. Direct engagement with major Tier 1 Mobile operators who are continually investing and maintaining their nation wide networks

2. Direct engagement with Tier 2 network operators who have various projects and network investments. These projects are timed to align with their internal capital budgets

3. Working with four major distributors who seek small to medium size opportunities. These distributors interact with the end users and supply both equipment, services and ongoing maintenance

The decline in revenues during FY16 was seen in each of these three sales groups

DragonWave Inc. 600-411 Legget Drive, Ottawa, ON, Canada K2K 3C9 (t) 613.599.9991 (f) 613.599.4225 www.dragonwaveinc.com

1. Sales to Sprint declined versus the previous year as some of their network initiatives slowed down, and they began the planning process to launch a new network wide upgrade with new technology. DragonWave was selected for this new modernization effort which we announced in October 2016.

2. Saw a decrease of 33% from six different Tier 2 operators. This was due mostly to project based timing, as well as competitive pressures from other microwave vendors.

3. Distribution channel decreased 30% versus the prior year. Although there is a multitude of end customers behind our sales thru distribution, the decline can be attributed to increased competition from other microwave vendors, delivery times, and transition from one product generation to another, and the end customer’s acceptance of the new products.

Decreased demand from a Tier 1 carrier in India

The decreased demand from a Tier 1 carrier in India is related to the scope and timing of the project. During fiscal 2015 and the first half of fiscal 2016, we supplied a total of 18,400 radios to a Tier 1 carrier in India to support a network deployment in specific provinces for the first phase of the carrier’s project. This phase is mostly complete and we must now compete to win more business for the future phases.

Revenue decrease from the Nokia channel

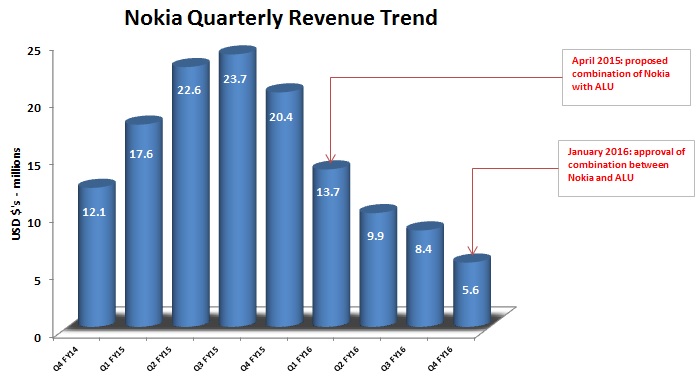

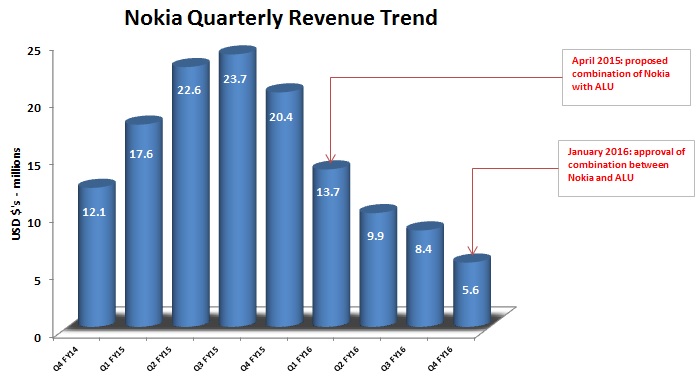

The following chart shows the historical trend of our quarterly revenue with Nokia.

We experienced the first major decline in the Nokia channel at the beginning of fiscal 2016 which was impacted by the following announcement. In our first quarter of fiscal 2016, Nokia announced its proposed combination with Alcatel-Lucent (ALU), which has a vertically integrated microwave business unit. Even

though the combination still needed to be approved by the authorities, Nokia decreased their demand for our products immediately, in part because Nokia’s customers were uncertain of Nokia’s product roadmap and availability which resulted in lower product demand. The decrease in the Nokia channel continued over the remainder of fiscal 2016 and the approved combination between Nokia and ALU in January 2016 only made the situation worse.

2. Please file as exhibits the agreements related to your credit facility (including the forbearance agreements) and your material agreements with Nokia. Please refer to Instruction 4(a) and (b) in the Instructions as to Exhibits in Form 20-F.

We will file the agreements related to the credit facility and the forbearance agreements in our 20-F for the year ended February 28, 2017.

The Master Acquisition Agreement with Nokia was filed as Exhibit 99.1 on Form 6-K filed with the SEC on November 15, 2011.

The Amended and Restated Master Acquisition Agreement with Nokia was filed as Exhibit 99.1 on Form 6-K filed with the SEC on May 11, 2012.

We will incorporate both of these agreements by reference in future filings.

Best regards,

Patrick Houston

Chief Financial Officer

phouston@dragonwaveinc.com

613-599-9991 ext 2278