- PFS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Provident Financial Services (PFS) 8-KRegulation FD Disclosure

Filed: 27 Sep 04, 12:00am

Exhibit 99

Exhibit 99

INVESTOR PRESENTATIONS

September 2004

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Provident Financial Services (“Provident” or “PFS”) and First Sentinel Bancorp, Inc. (“First Sentinel” or “FSLA”), including future financial and operating results, cost savings and accretion to reported earnings that may be realized from the merger; (ii) Provident’s and First Sentinel’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. These forward-looking statements are based upon the current beliefs and expectations of Provident’s and First Sentinel’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Provident and First Sentinel may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of First Sentinel or Provident may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) difficulties associated with achieving expected future financial results; (10) competition from other financial services companies in Provident’s and First Sentinel’s markets; (11) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Provident’s and First Sentinel’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available at the SEC’s Internet site (http://www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Provident or First Sentinel or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Provident and First Sentinel do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

1

Our Company Profile

(as of June 30, 2004)

$4.3 billion in Assets

$2.7 billion in Deposits

$2.4 billion in Loans

54 branches in 10 counties in northern and central New Jersey

A full-service bank:

Full Range of Retail and Commercial Deposit Products

Retail and Commercial Lending

Trust Services and Investment Services

2

Our Company Profile

On July 14, 2004, we completed the acquisition of First Sentinel Bancorp, Inc. and the merger of its wholly-owned subsidiary First Savings Bank, with and into The Provident Bank

3

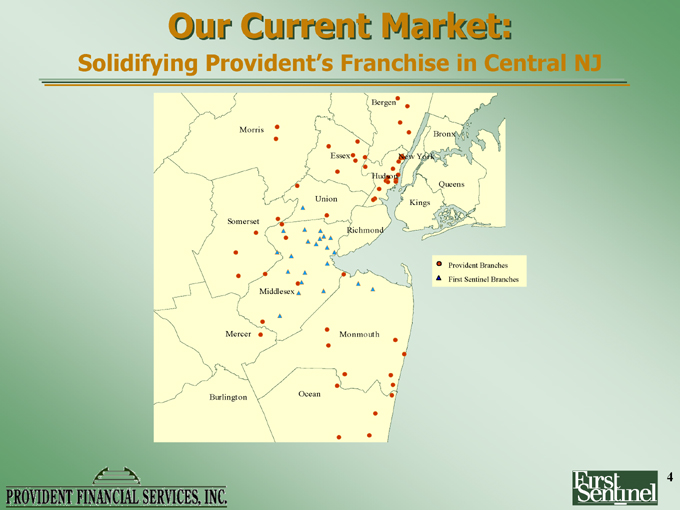

Our Current Market:

Solidifying Provident’s Franchise in Central NJ

Morris

Somerset

Middlesex

Mercer

Burlington

Union

Essex

Bergen

Hudson

Richmond

Monmouth

Ocean

New York

Bronx

Queens

Kings

Provident Branches

First Sentinel Branches

4

OUR STRENGTHS:

Tradition, Commitment, Focus

Tradition of Safe & Sound Management

New Jersey’s Oldest Bank; Established 1839

Commitment to Profitable Growth

Commitment to Prudently Deploy Capital

Commitment to Maintain Asset Quality

Unwavering Customer Focus

5

Our Strategic Initiatives

Grow the Balance Sheet and Market Share

M&A Activity, De Novo Branching, and Organic Growth

Sustain and Increase Brand Awareness

Customer Relationship Management

Maximize Net Interest Income without Compromising Asset Quality

Focus on Accelerating Revenue Growth and Slowing Operating Expense Growth

6

Our Business Drivers

Reinforce Pay-for-Performance Sales Culture

Maintain Diversified Loan Portfolio Composition

Continue to Increase proportion of Core Deposits to Total Deposits

Customer Relationship Management Process:

Maximize Product Penetration among Current Households

Continually Reduce Attrition

Increase New Customer Acquisition

Integrate Consistent Sales Process and Customer Treatment across all Delivery Channels

7

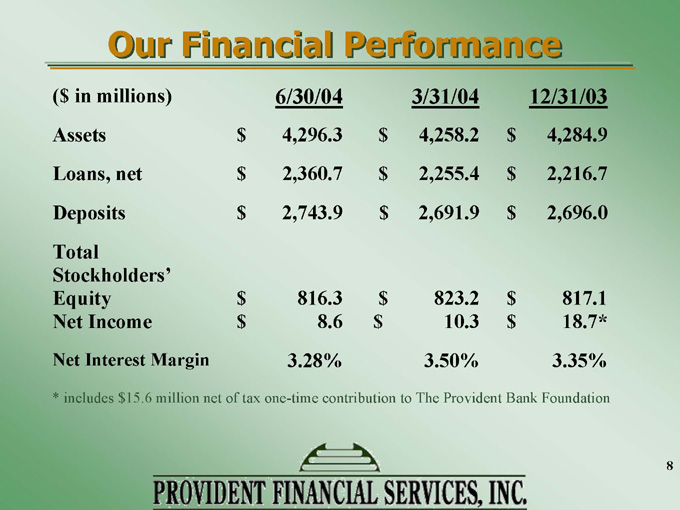

Our Financial Performance

($in millions) 6/30/04 3/31/04 12/31/03

Assets $4,296.3 $4,258.2 $4,284.9

Loans, net $2,360.7 $2,255.4 $2,216.7

Deposits $2,743.9 $2,691.9 $2,696.0

Total Stockholders’ Equity $816.3 $823.2 $817.1

Net Income $8.6 $10.3 $18.7*

Net Interest Margin 3.28% 3.50% 3.35%

* includes $15.6 million net of tax one-time contribution to The Provident Bank Foundation

8

Loan Diversification Strategy

Long-term Strategy—Maintain even balance between Retail Loan Portfolio and Commercial Loan Portfolio.

Substantially all Warehouse Lines of Credit have been sold. Assets re-deployed into 1-4 family residential loans.

Near-term Strategy will favor Retail Loans.

9

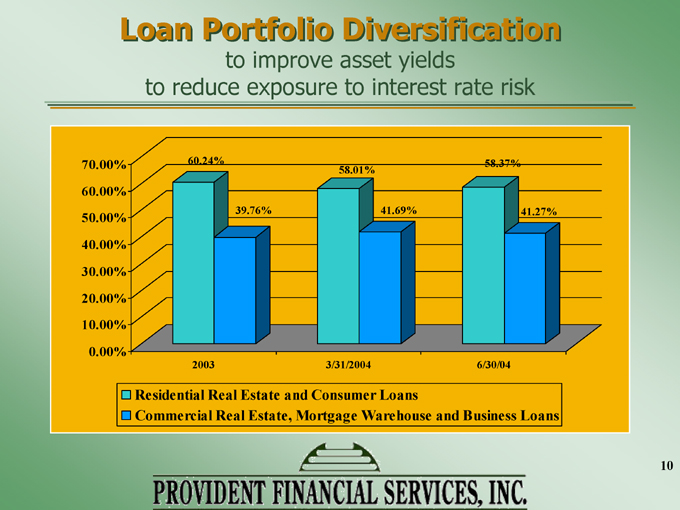

Loan Portfolio Diversification

to improve asset yields to reduce exposure to interest rate risk

70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

60.24%

39.76%

58.01%

41.69%

58.37%

41.27%

2003

3/31/2004

6/30/04

Residential Real Estate and Consumer Loans

Commercial Real Estate, Mortgage Warehouse and Business Loans

10

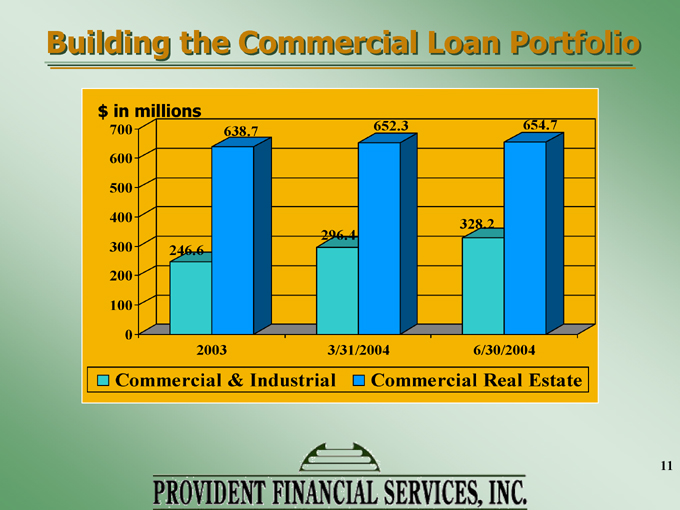

Building the Commercial Loan Portfolio $ in millions

700 600

500

400

300 200

100

0

246.6

638.7

296.4

652.3

328.2

654.7

2003

3/31/2004

6/30/2004

Commercial & Industrial

Commercial Real Estate

11

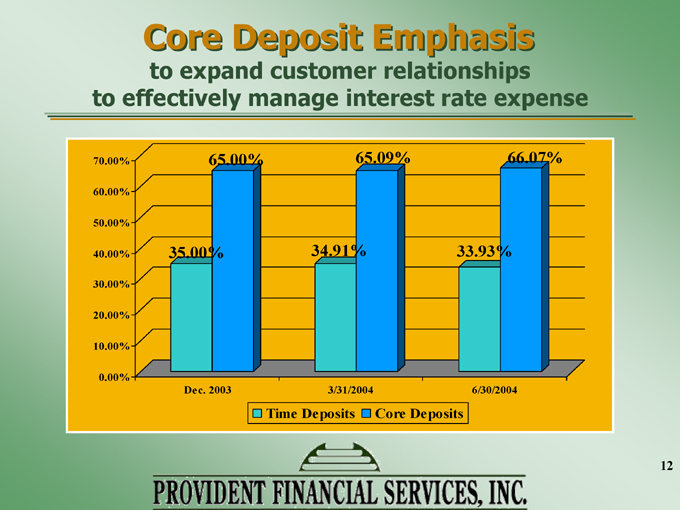

Core Deposit Emphasis

to expand customer relationships to effectively manage interest rate expense

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

35.00%

65.00%

Dec. 2003

34.91%

65.09%

3/31/2004

33.93%

66.07%

6/30/2004

Time Deposits Core Deposits

12

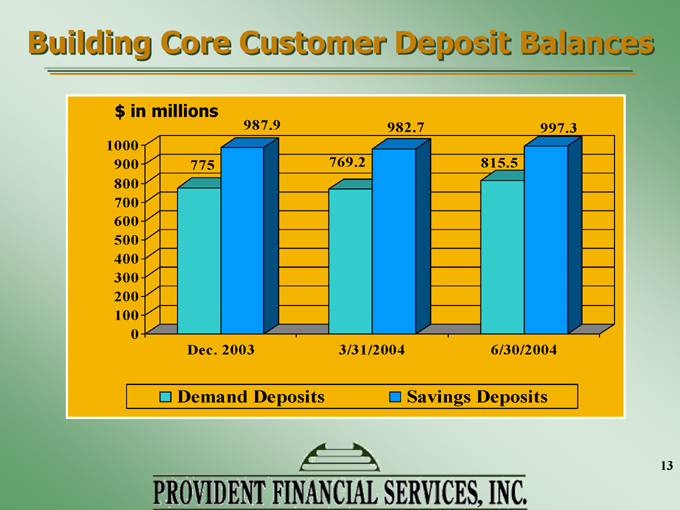

Building Core Customer Deposit Balances $ in millions

1000 900 800 700 600 500 400 300 200 100 0

Dec. 2003

775

987.9

3/31/2004

769.2

982.7

6/30/2004

815.5

997.3

Demand Deposits Savings Deposits

13

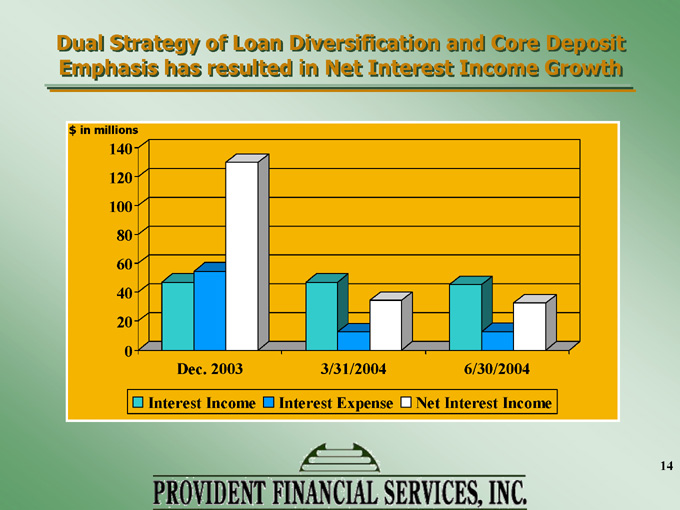

Dual Strategy of Loan Diversification and Core Deposit

Emphasis has resulted in Net Interest Income Growth

$ in millions

140 120 100 80 60 40 20 0

Dec. 2003

3/31/2004

6/30/2004

Interest Income Interest Expense Net Interest Income

14

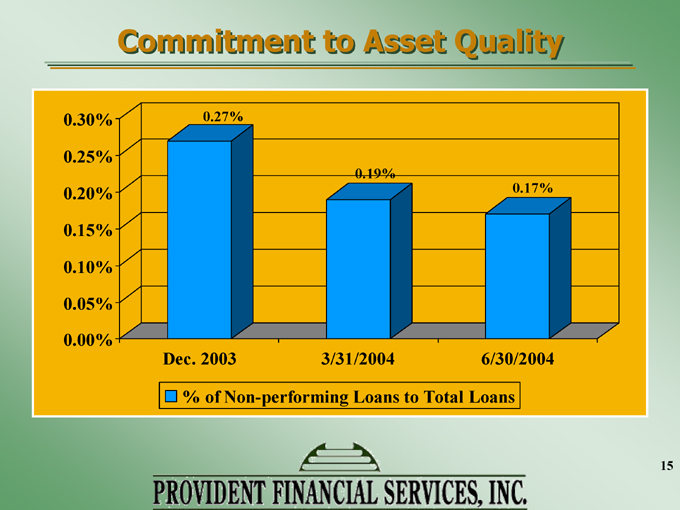

Commitment to Asset Quality

0.30% 0.25% 0.20% 0.15% 0.10%

0.05% 0.00%

0.27%

Dec. 2003

0.19%

3/31/2004

0.17%

6/30/2004

% of Non-performing Loans to Total Loans

15

Capital Management Strategies for Earnings per Share Growth

Declaration of Cash Dividend after first quarter of operation as a public company. Second increase recently announced.

Stock buy-backs commenced in 2003 to fund stockholder-approved benefit plans

Corporate stock buy-backs approved for 2004

Opportunities limited by merger announcement

Continuing assessment of merger opportunities

Leverage strategies where warranted

16

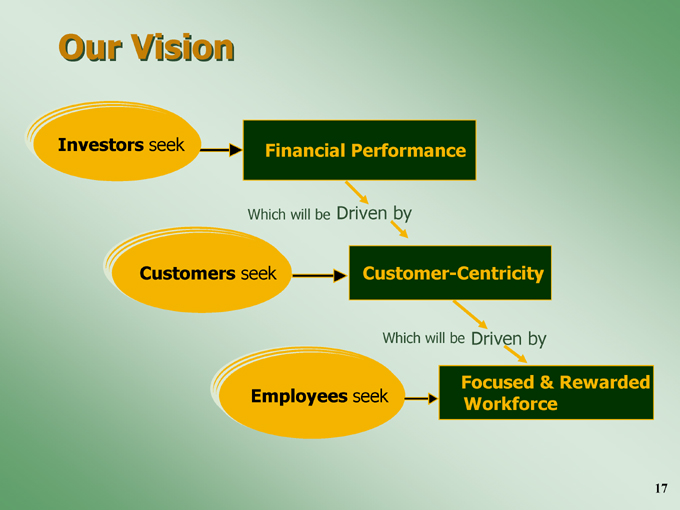

Our Vision

Investors seek

Financial Performance

Which will be Driven by

Customers seek

Customer-Centricity

Which will be Driven by

Employees seek

Focused & Rewarded Workforce

17

Strategic Growth in New Jersey’s Most Attractive Markets

18

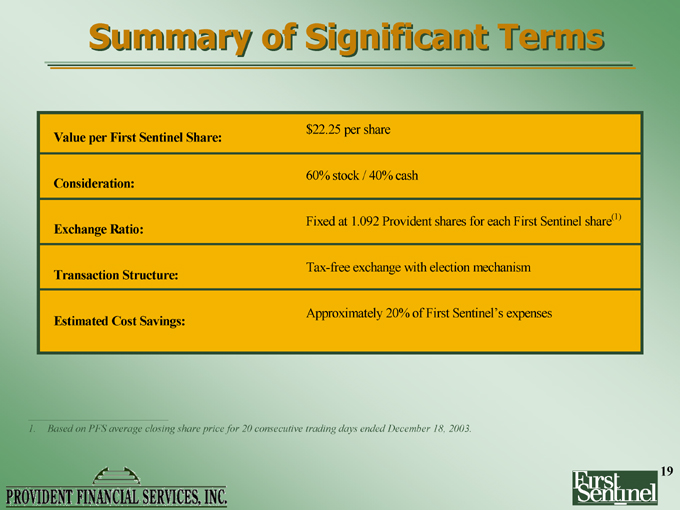

Summary of Significant Terms

$22.25 per share

Value per First Sentinel Share:

60% stock / 40% cash

Consideration:

Fixed at 1.092 Provident shares for each First Sentinel share(1)

Exchange Ratio:

Tax-free exchange with election mechanism

Transaction Structure:

Approximately 20% of First Sentinel’s expenses

Estimated Cost Savings:

1. Based on PFS average closing share price for 20 consecutive trading days ended December 18, 2003.

19

Summary

Adds highly attractive franchise in one of New Jersey’s best banking markets

Highly accretive to EPS with solid internal rate of return

In-market transaction with conservative cost savings assumptions

First Sentinel possesses strong fundamentals

Management additive

Effective deployment of conversion proceeds

Consistent with Provident’s expansion strategy

20