Exhibit 99.1

Exhibit 99.1

Ryan, Beck & Co.

Financial Institutions Investor Conference

Wednesday, October 27, 2004

Driving Revenue by Building Commercial Lending Capability 1

Forward Looking Statements

Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity.

The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2

Strategic Business Drivers

Long-range Strategic Goal: Achieve and sustain 50-50 Mix of Commercial and Retail Loans

Concentrated emphasis on building market share in middle-market C & I lending (ideal borrower size: $20 million in sales)

Emphasis on multi-family and single-family Construction lending

Realization that permanent Commercial Mortgage market is highly competitive 3

Competing in the Commercial Lending Arena: A Continual Building Process

Continued Building of Lending Team & Talent

Market Penetration and Expansion

Constant Focus on Credit Standards and Asset Quality

Steady Portfolio Growth

Dedicated to Building Total Relationships with Commercial Customers 4

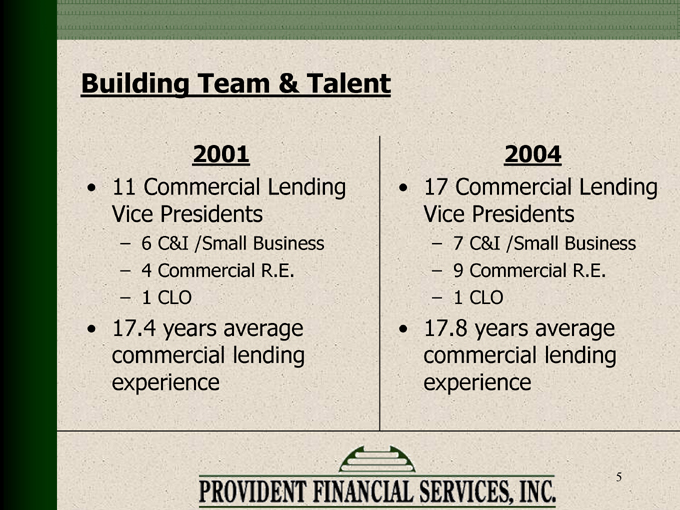

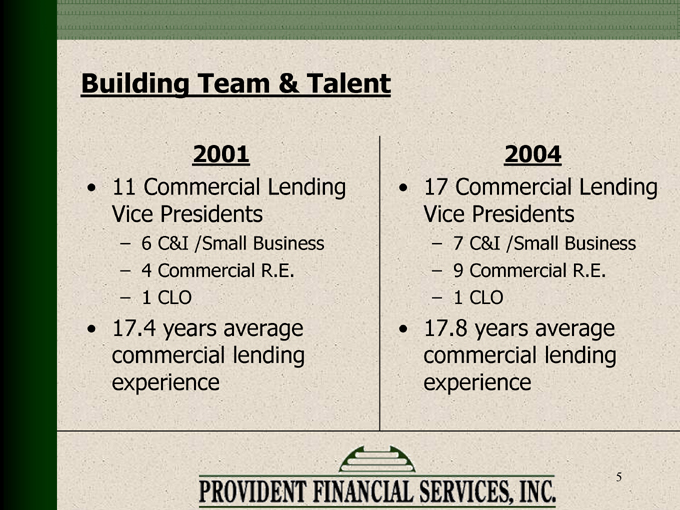

Building Team & Talent

2001

11 Commercial Lending Vice Presidents

6 C&I /Small Business

4 Commercial R.E.

1 CLO

17.4 years average commercial lending experience

2004

17 Commercial Lending Vice Presidents

7 C&I /Small Business

9 Commercial R.E.

1 CLO

17.8 years average commercial lending experience 5

Building Market Recognition & Market Reach

Lending Area = entire State of New Jersey

We have achieved State-wide reputation as a Commercial Real estate lender

Continually building reputation as a C & I lender

Large borrowers think of us as a resource as rapidly as they do much larger institutions

Acquisition of FSLA has added:

New facility in center of our market area where all lending operations are consolidated

22 new branches for:

generation of leads

enhanced brand recognition

more facilities for commercial customers to do all of their banking

Recognition

Reach 6

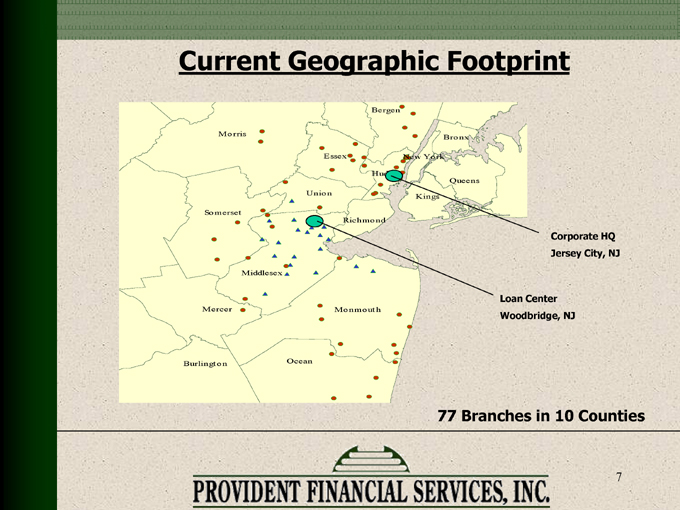

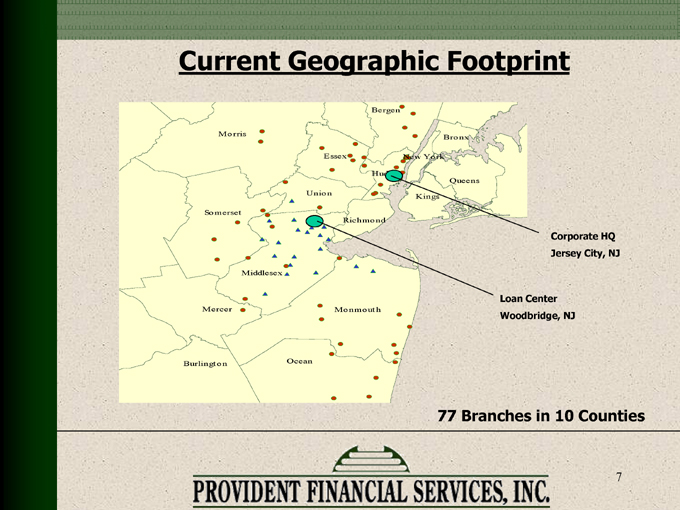

Current Geographic Footprint

Loan Center

Woodbridge, NJ

Corporate HQ

Jersey City, NJ

77 Branches in 10 Counties

7

Origination Standards— Commercial & Industrial Loans

Majority of loans are floating rate

Some fixed interest for 5 years or less

Less than $100,000—use Fair Isaac credit score system

Largest credit = $35 million participation in $400 million syndicated line of credit 8

Origination Standards— Construction Loans

Terms of 3 years or less

Outside engineering firm reviews plans & costs and construction advances

Conditions of advances:

For rental property, require significant pre-leasing

For single-family or condo projects, significant percent of units must be under contract 9

Origination Standards— Commercial R.E. & Multi-family

75% maximum LTV

1.2X minimum debt service coverage

Rate adjusted after 5 years

Property inspection every 18 months for loans $1 million +

Largest single loan: $25 million secured by hotel ($5 million recently participated out) 10

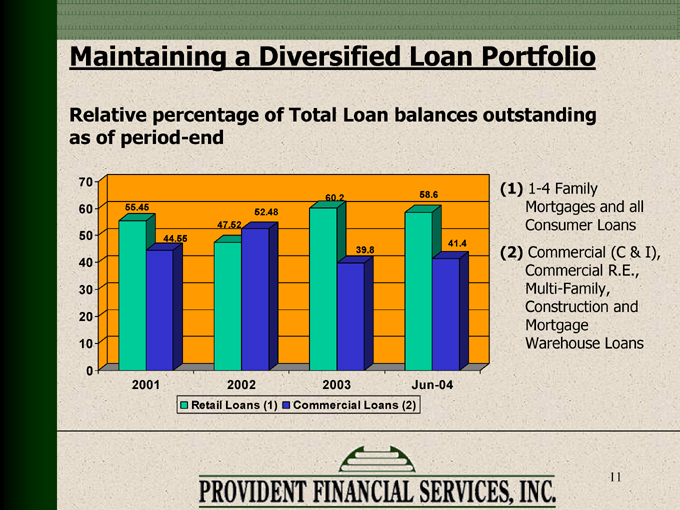

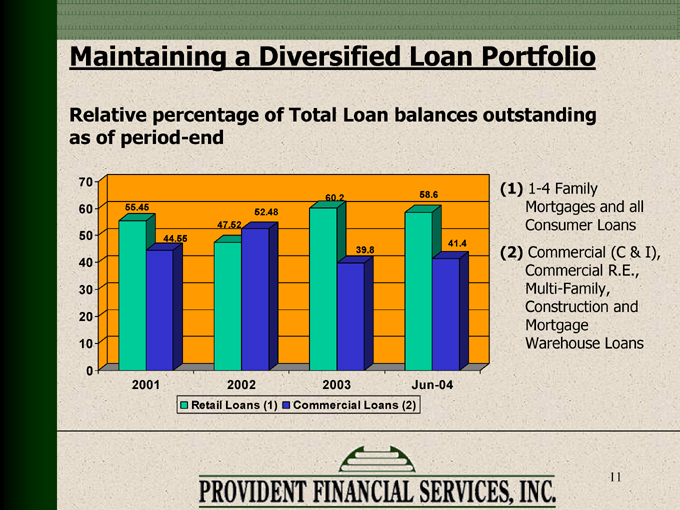

(1) 1-4 Family Mortgages and all Consumer Loans

(2) Commercial (C & I), Commercial R.E., Multi-Family, Construction and Mortgage Warehouse Loans

Maintaining a Diversified Loan Portfolio

Relative percentage of Total Loan balances outstanding as of period-end

55.45 44.55 47.52 52.48 60.2 39.8 58.6 41.4 0 10 20 30 40 50 60 70

2001

2002

2003

Jun-04

Retail Loans (1)

Commercial Loans (2)

11

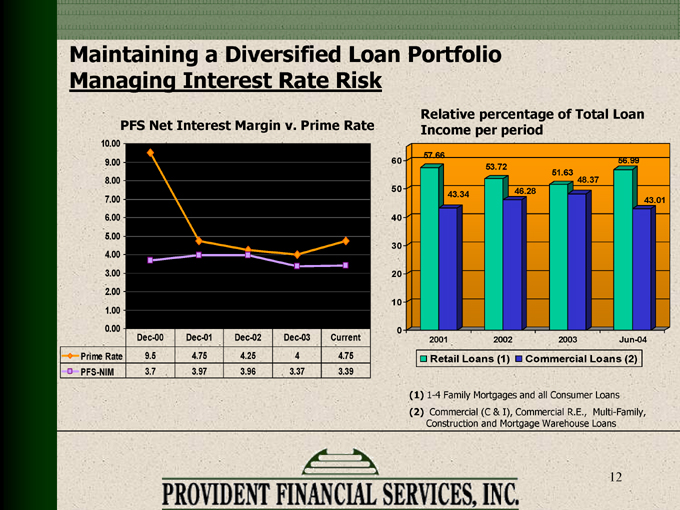

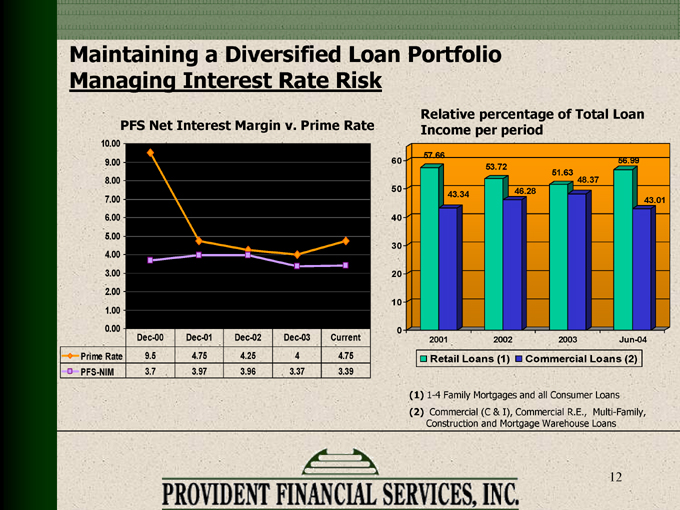

Maintaining a Diversified Loan Portfolio Managing Interest Rate Risk

PFS Net Interest Margin v. Prime Rate

10.00 9.00 8.00 7.00 6.00 5.00 4.00 3.00 2.00 1.00 0.00

Dec-00 Dec-01 Dec-02 Dec-03 Current

Prime Rate 9.5 4.75 4.25 4 4.75

PFS-NIM 3.7 3.97 3.96 3.37 3.39

Relative percentage of Total Loan Income per period

(1) 1-4 Family Mortgages and all Consumer Loans

(2) Commercial (C & I), Commercial R.E., Multi-Family, Construction and Mortgage Warehouse Loans

57.66 43.34 53.72 46.28 51.63 48.37 56.99 43.01

0 10 20 30 40 50 60

2001

2002

2003

Jun-04

Retail Loans (1)

Commercial Loans (2)

12

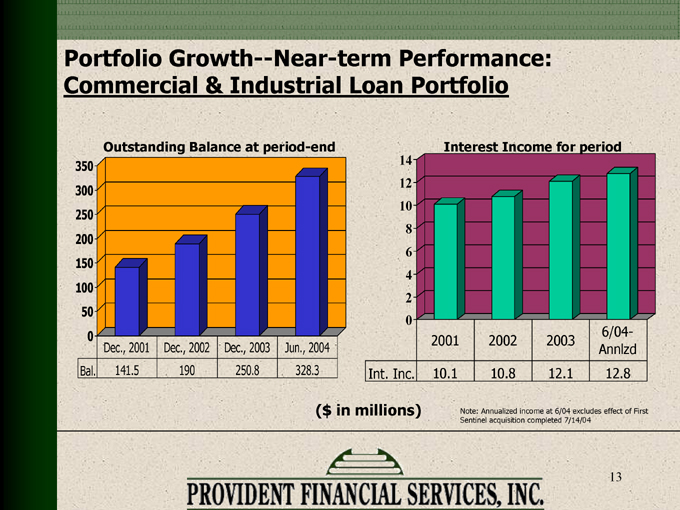

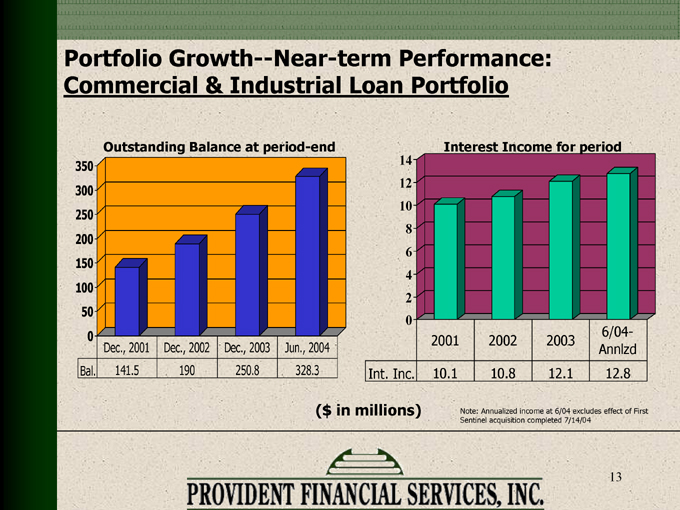

Portfolio Growth—Near-term Performance: Commercial & Industrial Loan Portfolio

($ in millions)

Outstanding Balance at period-end

Interest Income for period

Note: Annualized income at 6/04 excludes effect of First Sentinel acquisition completed 7/14/04

0 50 100 150 200 250 300 350

Bal.

141.5 190 250.8 328.3

Dec., 2001

Dec., 2002

Dec., 2003

Jun., 2004

13

14 12 10 8 6 4 2

Int. Inc.

10.1 10.8 12.1 12.8

2001 2002 2003 6/04-Annlzd

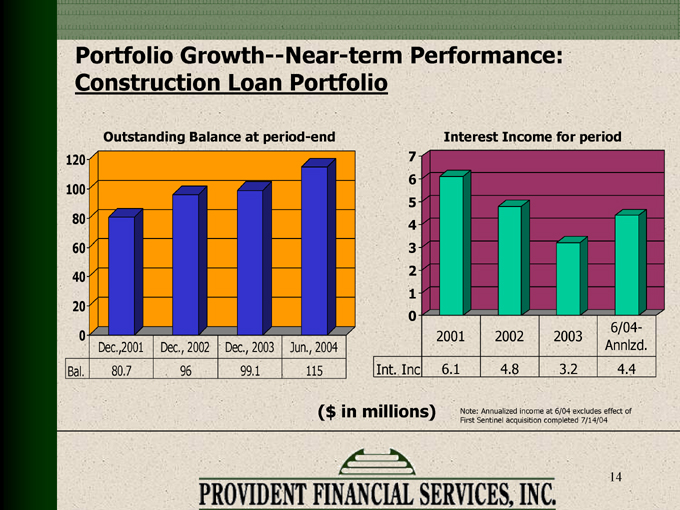

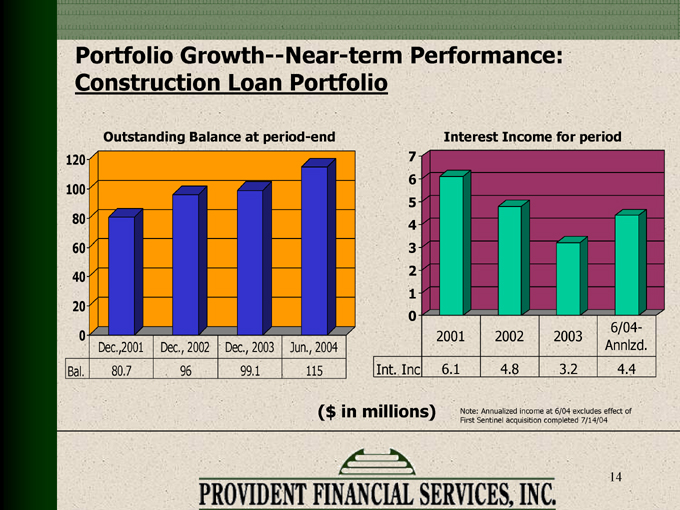

Portfolio Growth—Near-term Performance: Construction Loan Portfolio

($ in millions)

Outstanding Balance at period-end

Interest Income for period

Note: Annualized income at 6/04 excludes effect of First Sentinel acquisition completed 7/14/04

0 20 40 60 80 100 120

Bal.

80.7 96 99.1 115

Dec.,2001

Dec., 2002

Dec., 2003

Jun., 2004

14

7 6 5 4 3 2 1 0

Int. Inc 6.1 4.8 3.2 4.4

2001 2002 2003 6/04-Annlzd.

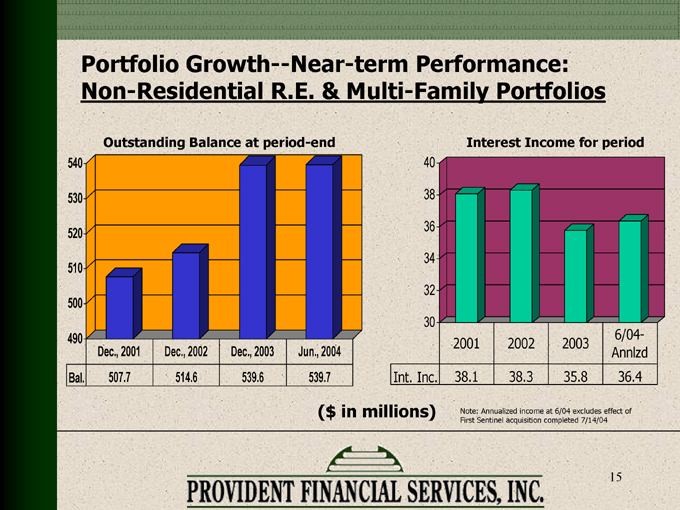

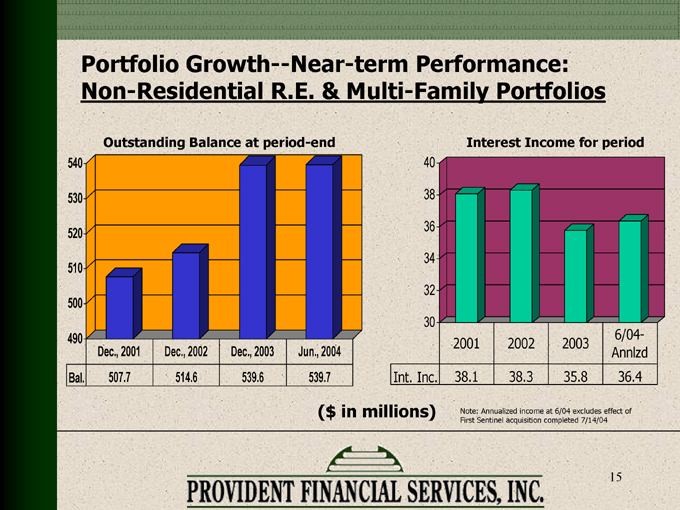

Portfolio Growth—Near-term Performance: Non-Residential R.E. & Multi-Family Portfolios

($ in millions)

Outstanding Balance at period-end

Interest Income for period

40 38 36 34 32 30

2001 2002 2003 6/04-Annlzd

Int. Inc. 38.1 38.3 35.8 36.4

Note: Annualized income at 6/04 excludes effect of First Sentinel acquisition completed 7/14/04

490 500 510 520 530 540

Bal.

507.7 514.6 539.6 539.7

Dec., 2001

Dec., 2002

Dec., 2003

Jun., 2004

15

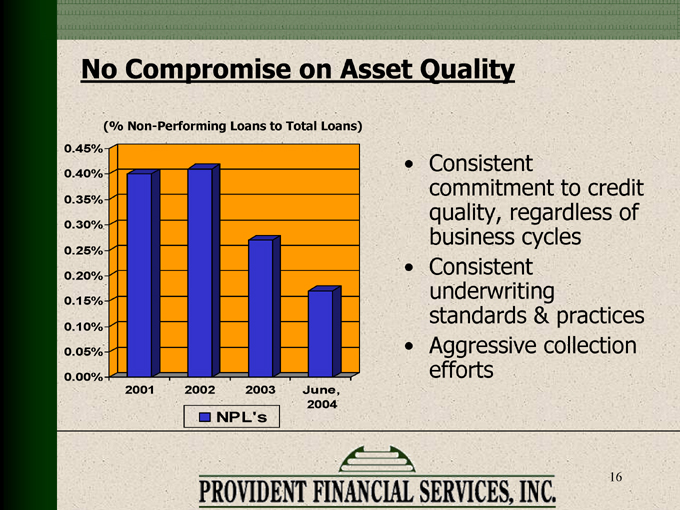

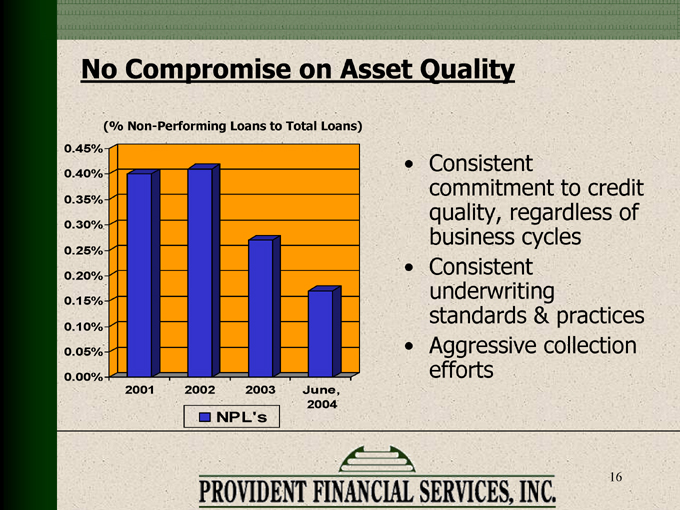

No Compromise on Asset Quality

Consistent commitment to credit quality, regardless of business cycles

Consistent underwriting standards & practices

Aggressive collection efforts

(% Non-Performing Loans to Total Loans)

0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45%

2001

2002

2003

June,

2004

NPL’s

16

Building Relationships

Our goal is to obtain a true relationship with the borrower, i.e., maximum share of wallet

Loan officers routinely market every product: corporate deposits, personal business, cash management & other services based on customer’s need

Commercial clients develop rapport not only with their Relationship Manager but also with their Corporate Cash Management Representative and local branch manager

Commercial clients also have ready access to Executive Management

17

COMPETITIVE ADVANTAGES

Responsiveness

Flexibility in structure and price

Local decision-making

No regional bank bureaucracy

Exceptional customer service

Loyal customer base

18

19