- PFS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Provident Financial Services (PFS) 8-KRegulation FD Disclosure

Filed: 10 Nov 04, 12:00am

Exhibit 99.1

Sandler O’Neill & Partners, L.P.

Financial Services Conference

November 11, 2004

1

Forward Looking Statements

Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity.

The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

2

Characteristics and Milestones

Rich heritage: Bank founded 1839

Completed full conversion and initial public offering January 15, 2003

Listed on NYSE (PFS)

Completed acquisition of First Sentinel Bancorp, Inc. July 14, 2004

Combination creates

New Jersey’s 8th largest bank in deposit market share*

3rd largest headquartered in-state*

*Source: FDIC—SOD as of 6/30/04

excludes brokerage/institutional deposits

3

Key Business Drivers

Focused Operating Strategy

Range and depth of offerings for Retail and Commercial Clients

Effective Delivery with constant emphasis on Customer Service and Satisfaction

Strong franchise in a market with superior demographics

77 branches in 10 New Jersey counties

NJ median household income (HHI) exceeds US median by 31.3%*

7 of 10 counties in Provident market exceed state HHI median*

Sales Team Culture

Solid Reputation and Brand Recognition

Consistent Commitment to Asset Quality and Risk Management

*Source: U.S. Census Bureau data

4

Key Strategic Initiatives

Retention and expansion of customer relationships

Rational franchise expansion

In-market de-novo branching

Acquisitions considered if accretive to earnings

Achieve 50/50 mix of Commercial (C&I and C.R.E.) and Retail (1-4 Family and Consumer) loan portfolios

Optimize proportion of Core Deposits

Improve operating efficiency

5

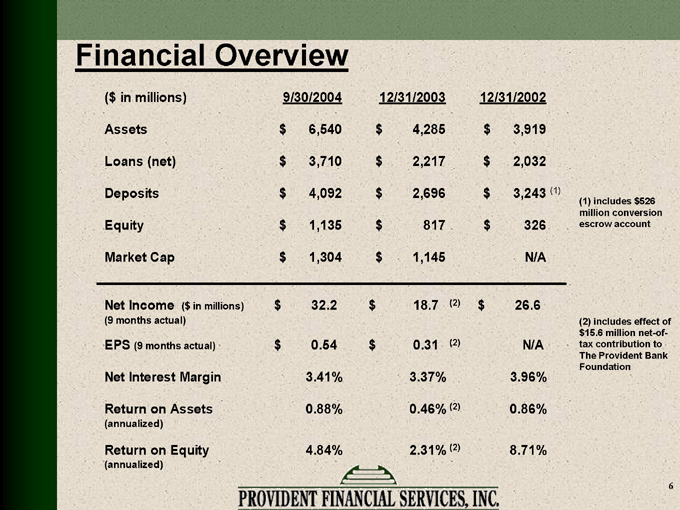

Financial Overview

($in millions) 9/30/2004 12/31/2003 12/31/2002

Assets $ 6,540 $ 4,285 $ 3,919

Loans (net) $ 3,710 $ 2,217 $ 2,032

Deposits $ 4,092 $ 2,696 $ 3,243 (1)

Equity $ 1,135 $ 817 $ 326

Market Cap $ 1,304 $ 1,145 N/A

Net Income ($in millions) $ 32.2 $ 18.7 (2) $ 26.6

(9 months actual)

EPS (9 months actual) $ 0.54 $ 0.31 (2) N/A

Net Interest Margin 3.41% 3.37% 3.96%

Return on Assets 0.88% 0.46% (2) 0.86%

(annualized)

Return on Equity 4.84% 2.31% (2) 8.71%

(annualized)

(1) includes $526 million conversion escrow account

(2) includes effect of $15.6 million net-of-tax contribution to The Provident Bank Foundation

6

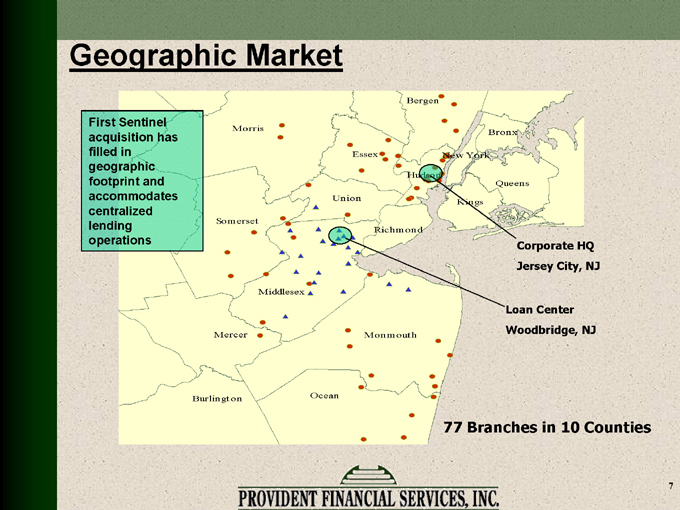

Geographic Market

Corporate HQ Jersey City, NJ

Loan Center Woodbridge, NJ

77 Branches in 10 Counties

First Sentinel acquisition has filled in geographic footprint and accommodates centralized lending operations

Middlesex

Somerset

Monmouth

Mercer

Burlington

Ocean

Fairfield

Bergen

Essex

Hudson

Morris

Passaic

Sussex

Union

Bronx

Kings

New York

Queens

Richmond

Rockland

Westchester

Bucks

Monroe

Montgomery

Philadelphia

7

Key Factors for Competitive Success

Continuing evolution from traditional thrift to full-service community bank

Emphasis on core deposits (especially Business DDA) to build relationships and manage interest rate risk

Consistent expansion of commercial lending expertise

“Business Advantage” suite of products for commercial clients

Commitment to brand promise: “Hassle-free banking for busy people”®

8

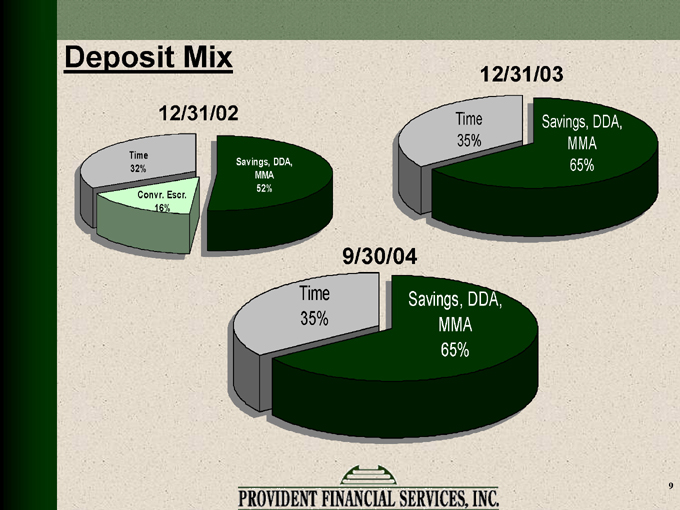

Deposit Mix

12/31/02

12/31/03

9/30/04

Savings, DDA, MMA 65%

Time 35%

Convr. Escr. 16%

Time 32%

Savings, DDA, MMA 52%

Time 35%

Savings, DDA, MMA 65%

9

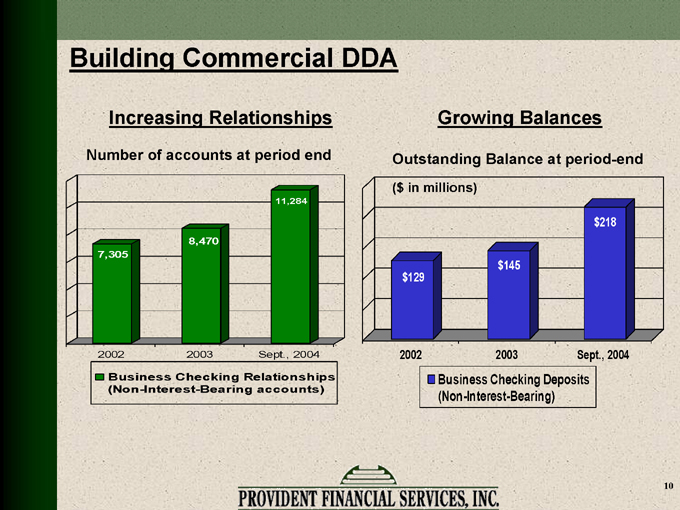

Building Commercial DDA

Number of accounts at period end

Outstanding Balance at period-end

($in millions)

Increasing Relationships

Growing Balances

7,305

8,470

11,284

2002

2003

Sept., 2004

Business Checking Relationships

(Non-Interest-Bearing accounts)

$129

$145

$218

2002

2003

Sept., 2004

Business Checking Deposits

(Non-Interest-Bearing)

10

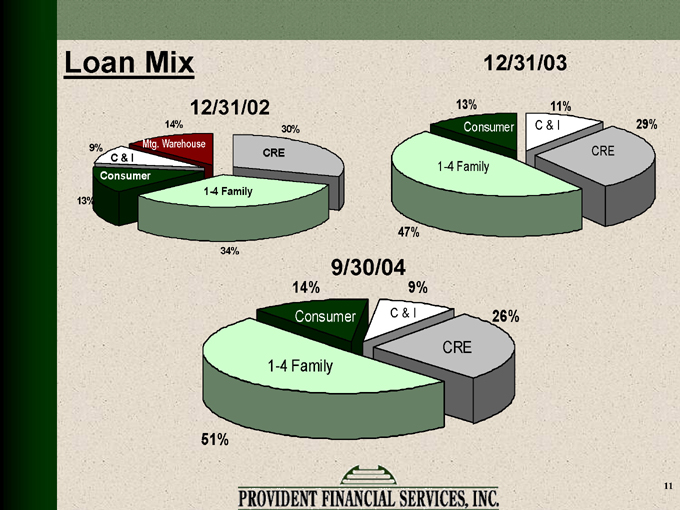

Loan Mix

12/31/02

12/31/03

9/30/04

CRE

C & I

Consumer

1-4 Family

13%

11%

29%

47%

14%

9%

13%

34%

30%

CRE

Mtg. Warehouse

C & I

Consumer

1-4 Family

14%

9%

26%

51%

CRE

C & I

Consumer

1-4 Family

11

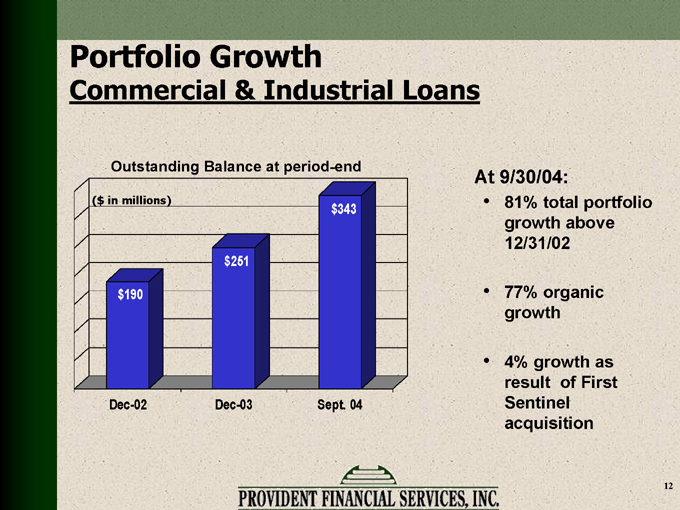

Portfolio Growth

Commercial & Industrial Loans

Outstanding Balance at period-end

($in millions)

At 9/30/04:

81% total portfolio growth above 12/31/02

77% organic growth

4% growth as result of First Sentinel acquisition

$190

$251

$343

Dec-02

Dec-03

Sept. 04

12

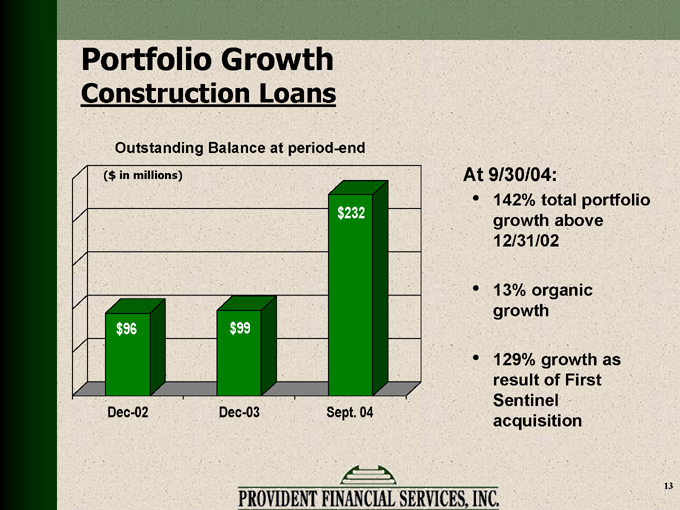

Portfolio Growth

Construction Loans

Outstanding Balance at period-end

($in millions)

At 9/30/04:

142% total portfolio growth above 12/31/02

13% organic growth

129% growth as result of First Sentinel acquisition

$96

$99

$232

Dec-02

Dec-03

Sept. 04

13

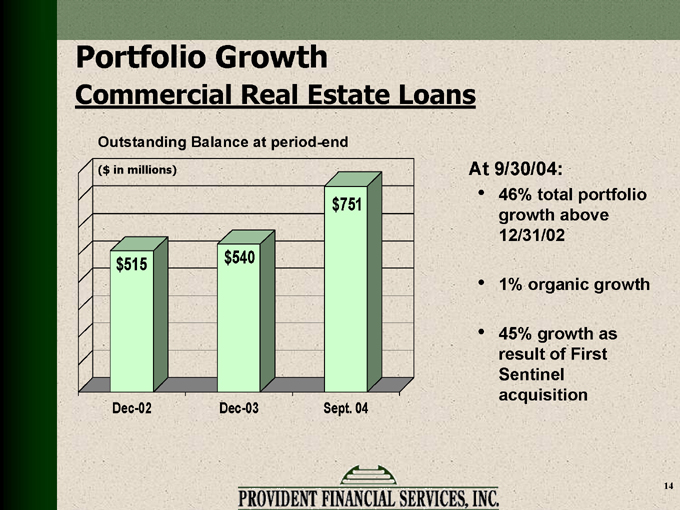

Portfolio Growth

Commercial Real Estate Loans

Outstanding Balance at period-end

($in millions)

At 9/30/04:

46% total portfolio growth above 12/31/02

1% organic growth

45% growth as result of First Sentinel acquisition

$515

$540

$751

Dec-02

Dec-03

Sept. 04

14

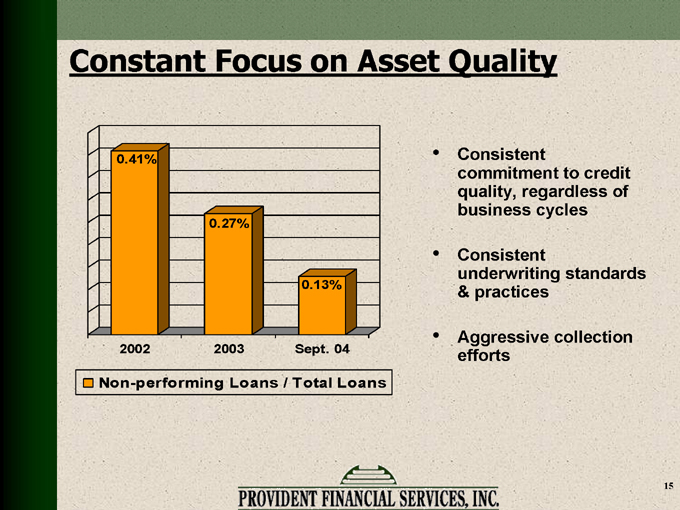

Constant Focus on Asset Quality

Consistent commitment to credit quality, regardless of business cycles

Consistent underwriting standards & practices

Aggressive collection efforts

0.41%

0.27%

0.13%

2002

2003

Sept. 04

Non-performing Loans / Total Loans

15

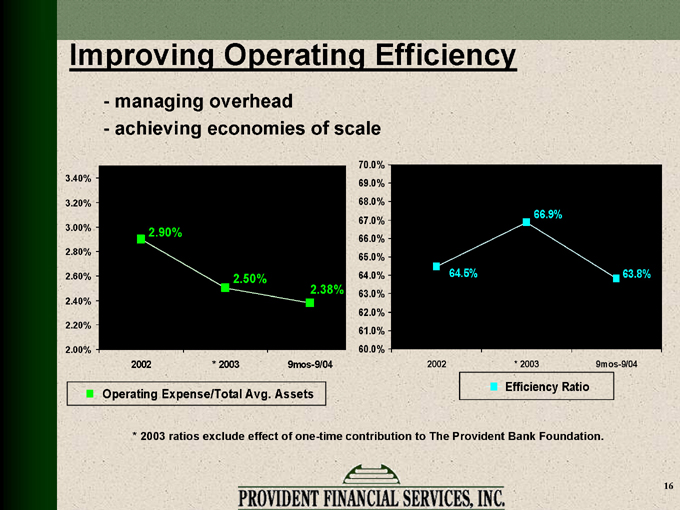

Improving Operating Efficiency

- managing overhead

- achieving economies of scale

2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 3.20% 3.40%

2002 * 2003 9mos-9/04

Operating Expense/Total Avg. Assets

60.0% 61.0% 62.0% 63.0% 64.0% 65.0% 66.0% 67.0% 68.0% 69.0% 70.0%

2002 * 2003 9mos-9/04

Efficiency Ratio

* 2003 ratios exclude effect of one-time contribution to The Provident Bank Foundation.

16

Capital Management

Stock repurchase

1st buyback program approved January, 2004

purchase activity constrained pending acquisition

program expanded post-acquisition to total of approx. 4 million (5%) of outstanding shares

at 9/30/04, 738 thousand shares left to repurchase

next program to be determined

Dividends

cash dividend declared after 1st quarter as public company

consistent payout ratio

dividend yield (9/30/04 closing price $17.25) 1.39%

17

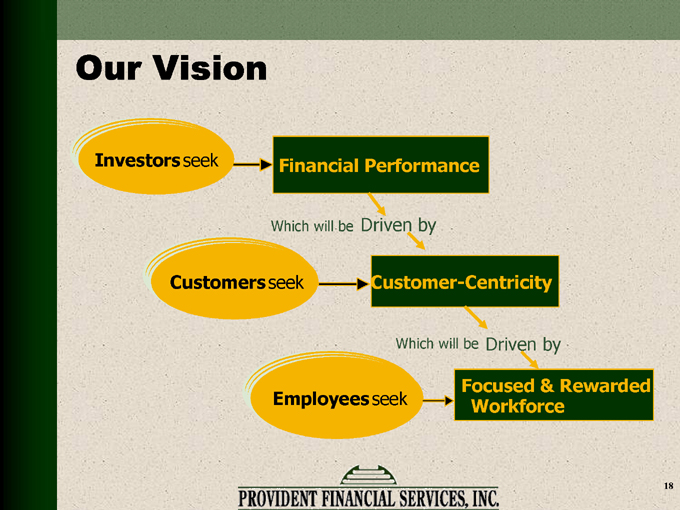

Our Vision

Investors seek

Financial Performance

Which will be Driven by

Customers seek

Customer-Centricity

Which will be Driven by

Employees seek

Focused & Rewarded Workforce

18