GOVERNANCE PRESENTATION FEBRUARY 25, 2022

Our Business and Strategy………………………………………………………………….........2 Corporate Governance and Oversight of Risk…………………………………….........10 Executive Compensation…………………………………………………………………………..14 ESG and Corporate Social Responsibility…………………………………………………...16 Appendix: Non GAAP Disclosure Reconciliation…………………………….............20 Forward‐Looking Statements…………………………………………………………………….22 TOPICS FOR DISCUSSION 1 INDEX

OUR BUSINESS AND STRATEGY 2

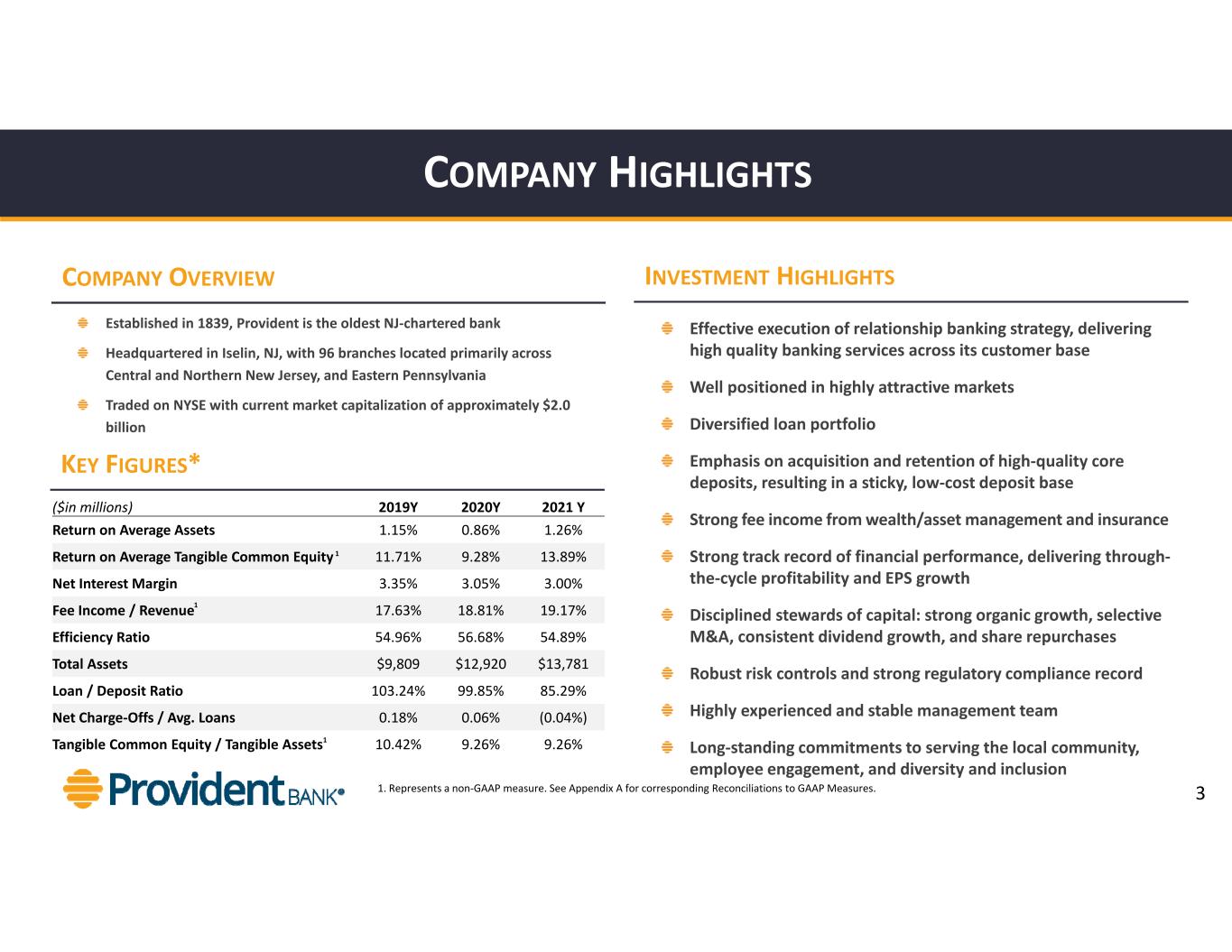

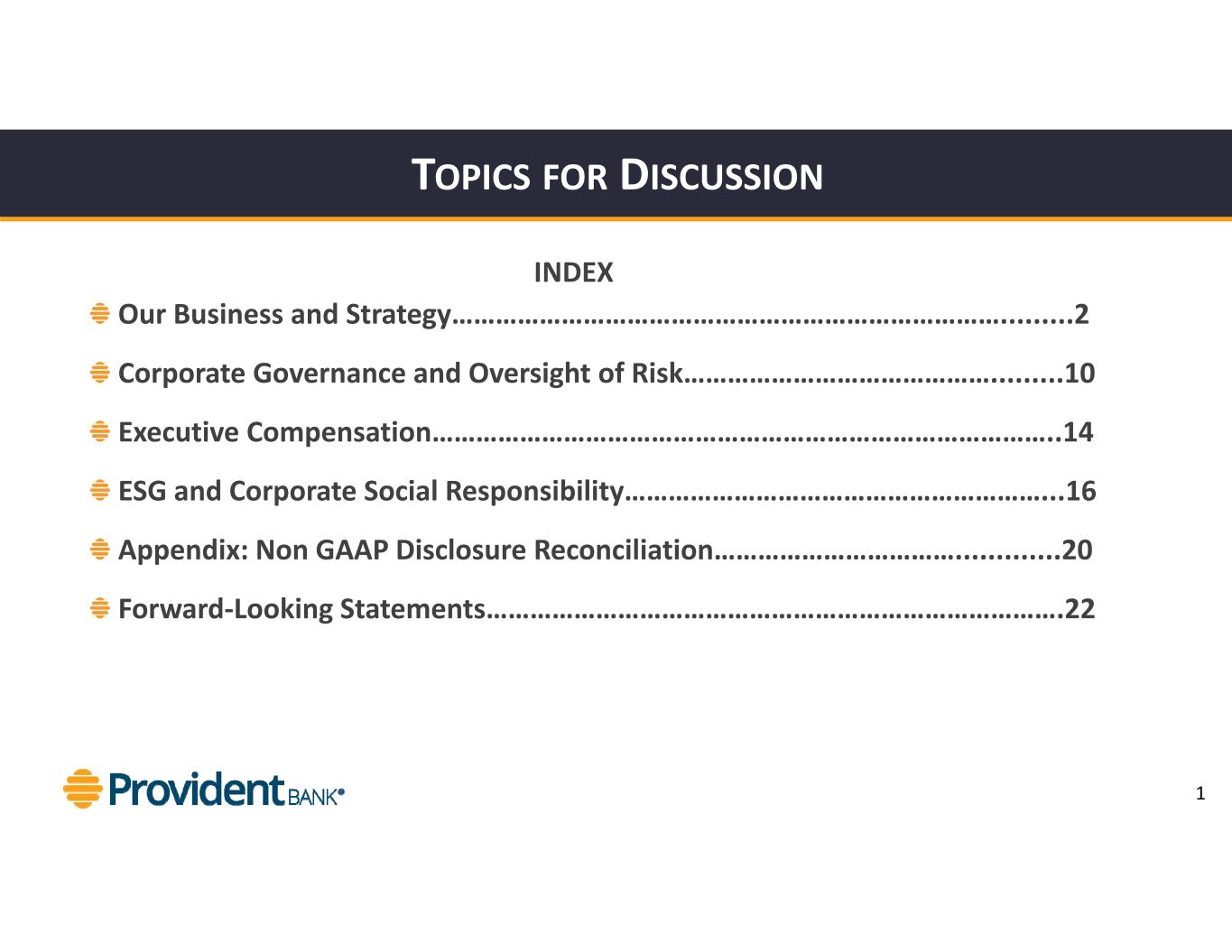

COMPANY OVERVIEW COMPANY HIGHLIGHTS INVESTMENT HIGHLIGHTS KEY FIGURES* Effective execution of relationship banking strategy, delivering high quality banking services across its customer base Well positioned in highly attractive markets Diversified loan portfolio Emphasis on acquisition and retention of high‐quality core deposits, resulting in a sticky, low‐cost deposit base Strong fee income from wealth/asset management and insurance Strong track record of financial performance, delivering through‐ the‐cycle profitability and EPS growth Disciplined stewards of capital: strong organic growth, selective M&A, consistent dividend growth, and share repurchases Robust risk controls and strong regulatory compliance record Highly experienced and stable management team Long‐standing commitments to serving the local community, employee engagement, and diversity and inclusion Established in 1839, Provident is the oldest NJ‐chartered bank Headquartered in Iselin, NJ, with 96 branches located primarily across Central and Northern New Jersey, and Eastern Pennsylvania Traded on NYSE with current market capitalization of approximately $2.0 billion ($in millions) 2019Y 2020Y 2021 Y Return on Average Assets 1.15% 0.86% 1.26% Return on Average Tangible Common Equity 11.71% 9.28% 13.89% Net Interest Margin 3.35% 3.05% 3.00% Fee Income / Revenue 17.63% 18.81% 19.17% Efficiency Ratio 54.96% 56.68% 54.89% Total Assets $9,809 $12,920 $13,781 Loan / Deposit Ratio 103.24% 99.85% 85.29% Net Charge‐Offs / Avg. Loans 0.18% 0.06% (0.04%) Tangible Common Equity / Tangible Assets 10.42% 9.26% 9.26% 31. Represents a non‐GAAP measure. See Appendix A for corresponding Reconciliations to GAAP Measures. 1 1 1

($in millions; except HHI) Metropolitan Market 2021 2021 ‐ 2026 HHI 2021 Statistical Area Rank Branches Deposits Median HHI Projected Growth Population New York‐Newark‐Jersey City 22 89 $10,094 $86,466 11.67% 19,200,306 Allentown‐Bethlehem‐Easton 18 4 $309 $70,959 9.11% 847,822 Philadelphia‐Camden‐Wilmington 70 2 $128 $75,304 9.40% 6,117,909 Trenton‐Princeton 15 1 $111 $86,188 6.13% 366,892 Weighted Average: MSA $85,879 11.51% National $67,761 9.01% BRANCH FOOTPRINT WELL POSITIONED IN HIGHLY ATTRACTIVE MARKETS HIGHLY ATTRACTIVE DEMOGRAPHICS 4 Provident has supported these communities through its Foundation, established in 2003 to give back to local communities by supporting not‐for‐profit groups, institutions, schools and other 501(c)(3) organizations

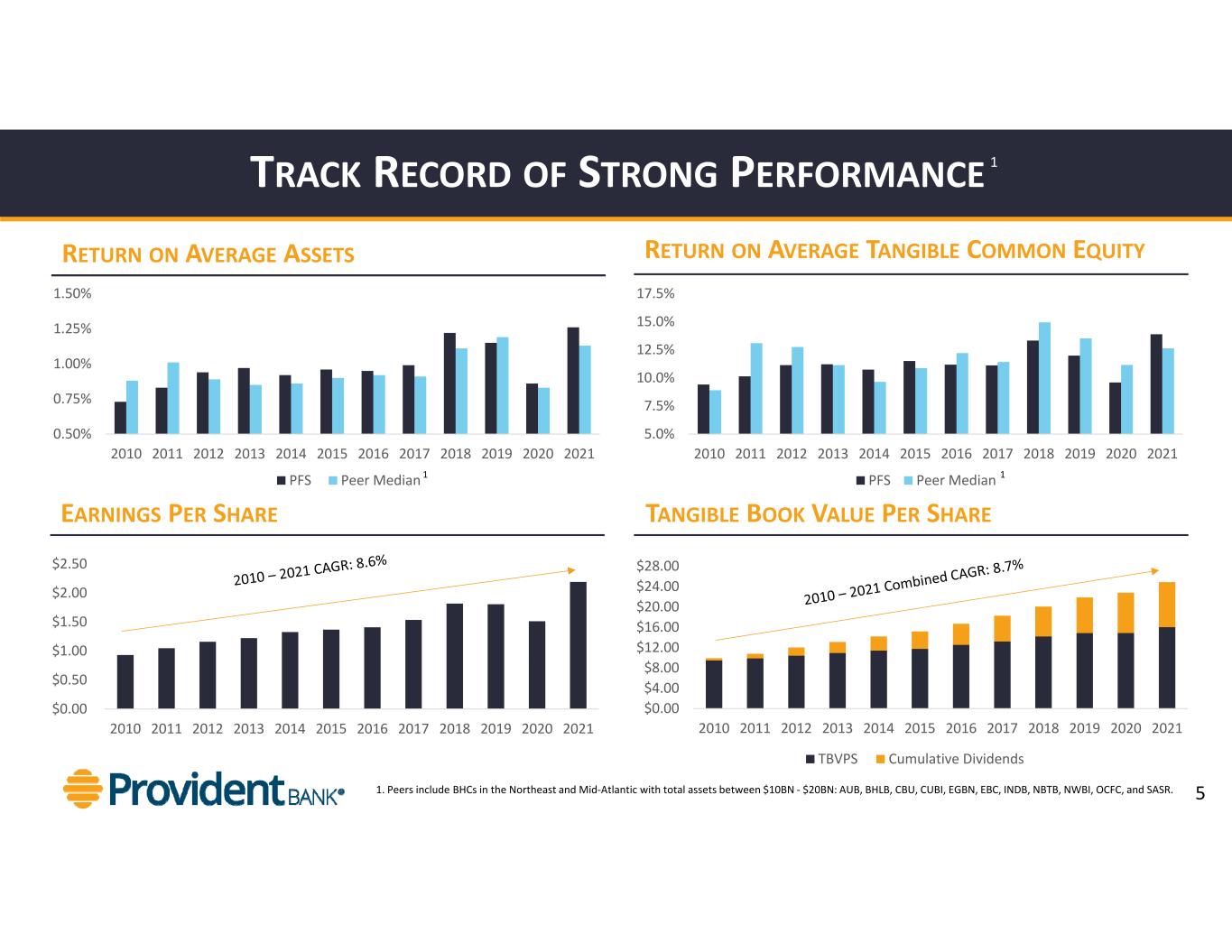

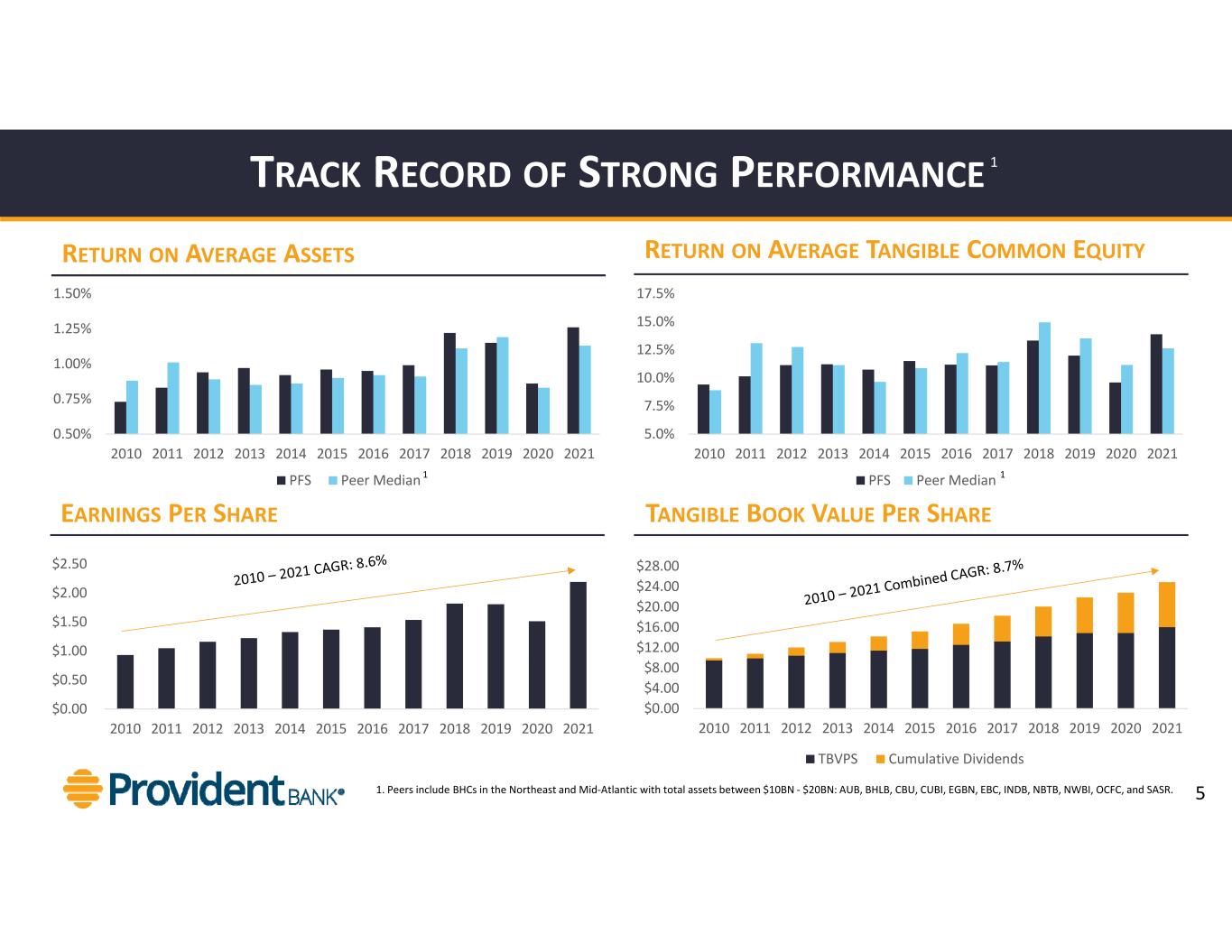

0.50% 0.75% 1.00% 1.25% 1.50% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 PFS Peer Median TRACK RECORD OF STRONG PERFORMANCE RETURN ON AVERAGE ASSETS RETURN ON AVERAGE TANGIBLE COMMON EQUITY 5.0% 7.5% 10.0% 12.5% 15.0% 17.5% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 PFS Peer Median 1 EARNINGS PER SHARE $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 TANGIBLE BOOK VALUE PER SHARE $0.00 $4.00 $8.00 $12.00 $16.00 $20.00 $24.00 $28.00 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 TBVPS Cumulative Dividends 1. Peers include BHCs in the Northeast and Mid‐Atlantic with total assets between $10BN ‐ $20BN: AUB, BHLB, CBU, CUBI, EGBN, EBC, INDB, NBTB, NWBI, OCFC, and SASR. 5 1 1

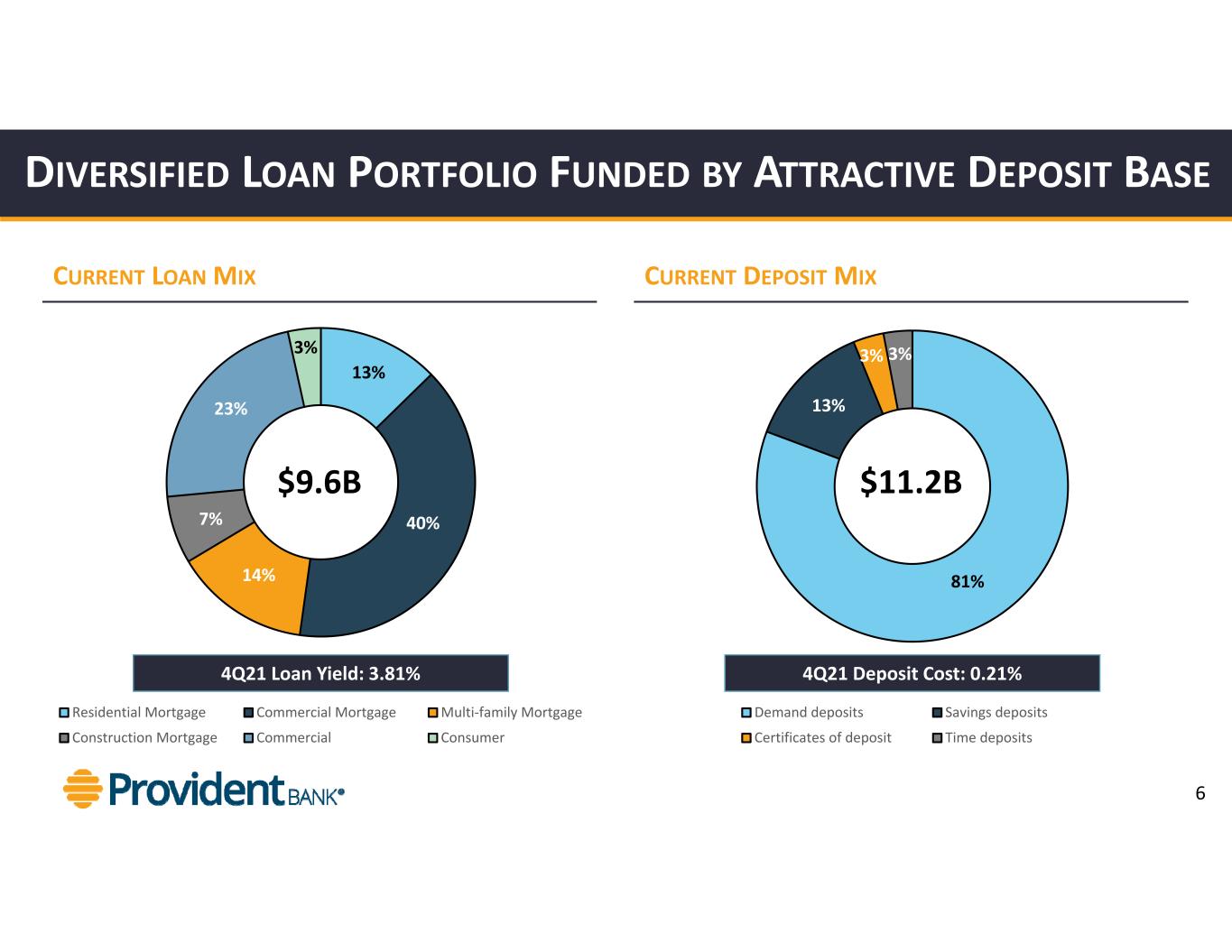

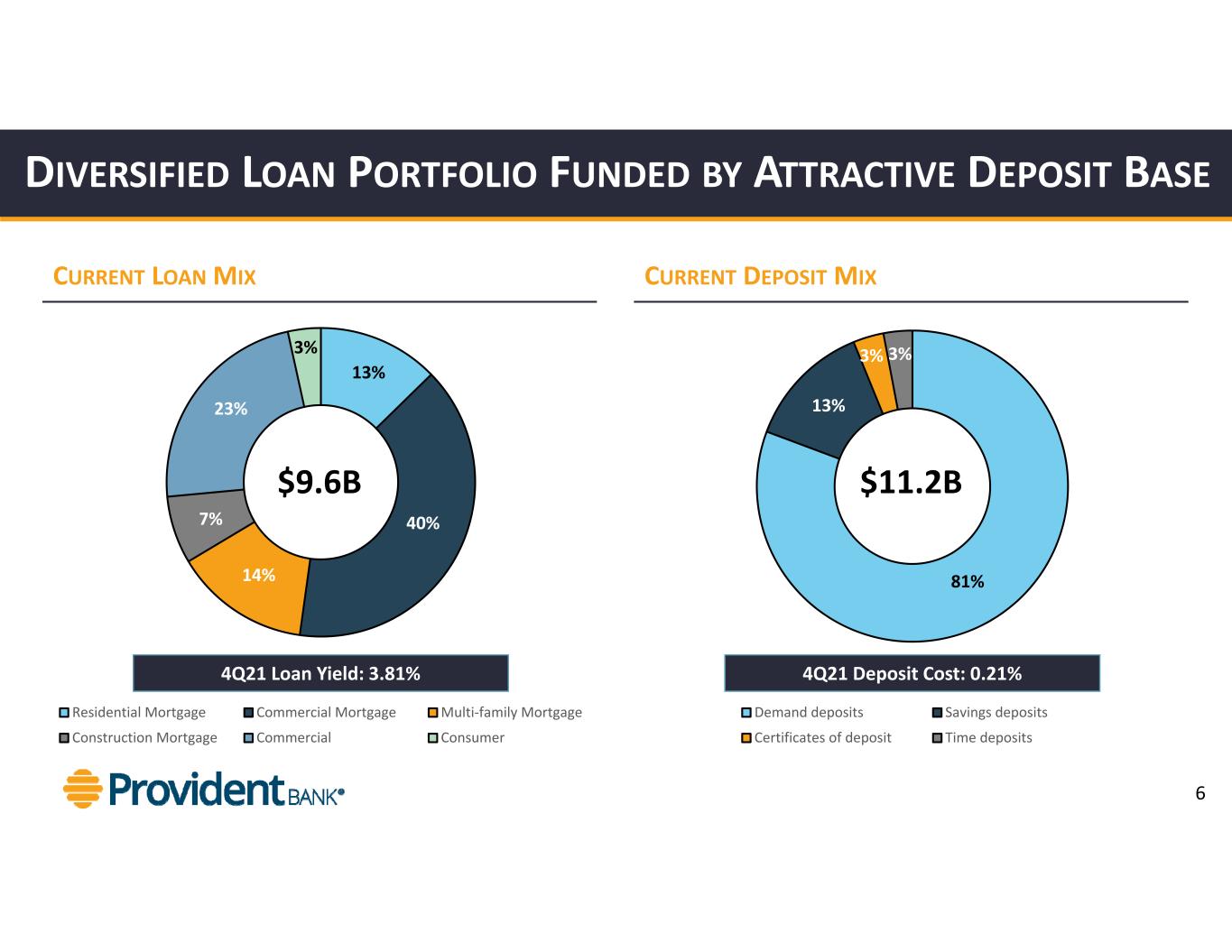

81% 13% 3% 3% Demand deposits Savings deposits Certificates of deposit Time deposits DIVERSIFIED LOAN PORTFOLIO FUNDED BY ATTRACTIVE DEPOSIT BASE CURRENT LOAN MIX 13% 40% 14% 7% 23% 3% Residential Mortgage Commercial Mortgage Multi‐family Mortgage Construction Mortgage Commercial Consumer 4Q21 Loan Yield: 3.81% CURRENT DEPOSIT MIX 4Q21 Deposit Cost: 0.21% $9.6B $11.2B 6

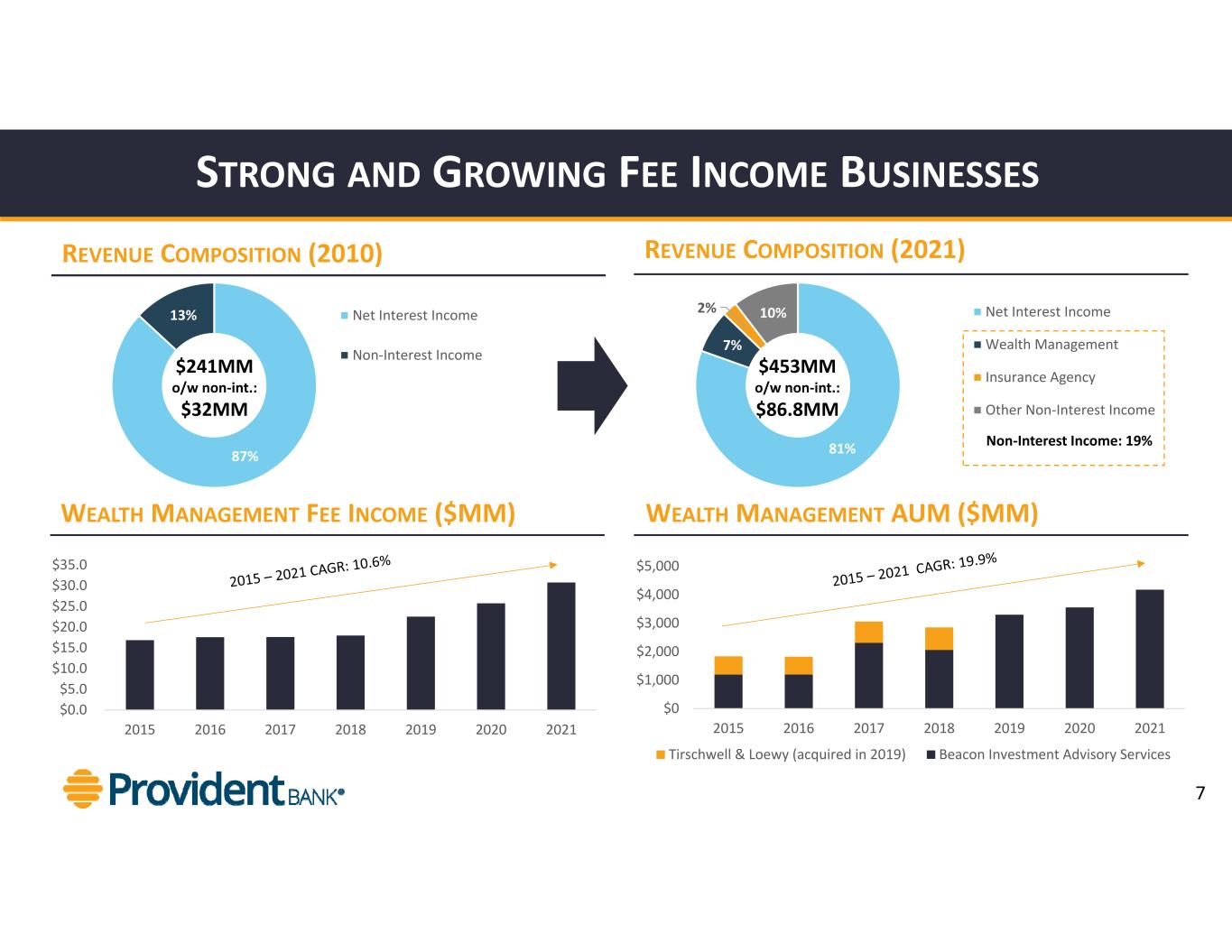

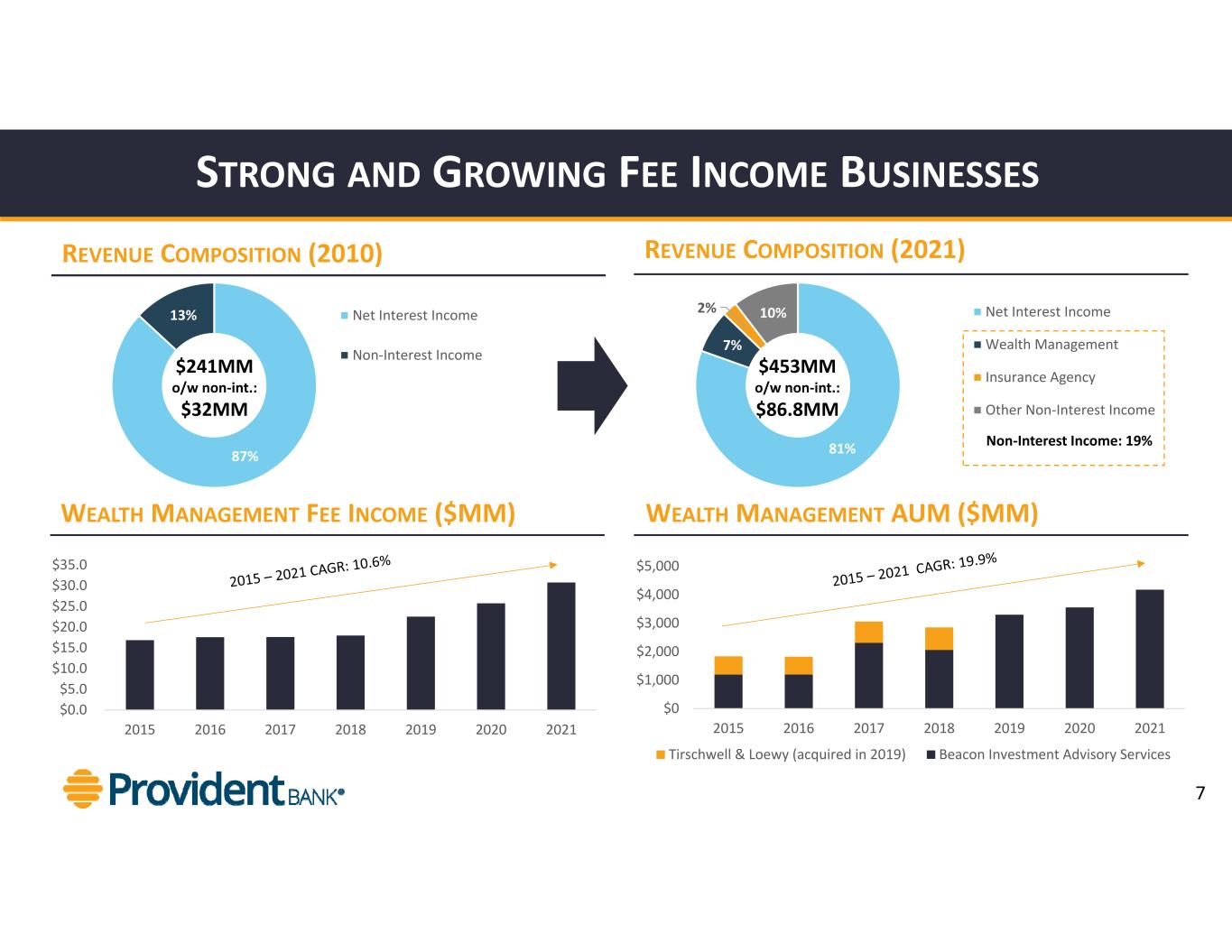

STRONG AND GROWING FEE INCOME BUSINESSES REVENUE COMPOSITION (2010) REVENUE COMPOSITION (2021) WEALTH MANAGEMENT FEE INCOME ($MM) WEALTH MANAGEMENT AUM ($MM) $0 $1,000 $2,000 $3,000 $4,000 $5,000 2015 2016 2017 2018 2019 2020 2021 Tirschwell & Loewy (acquired in 2019) Beacon Investment Advisory Services 7 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 2015 2016 2017 2018 2019 2020 2021 87% 13% Net Interest Income Non‐Interest Income 81% 7% 2% 10% Net Interest Income Wealth Management Insurance Agency Other Non‐Interest Income $241MM o/w non‐int.: $32MM $453MM o/w non‐int.: $86.8MM Non‐Interest Income: 19%

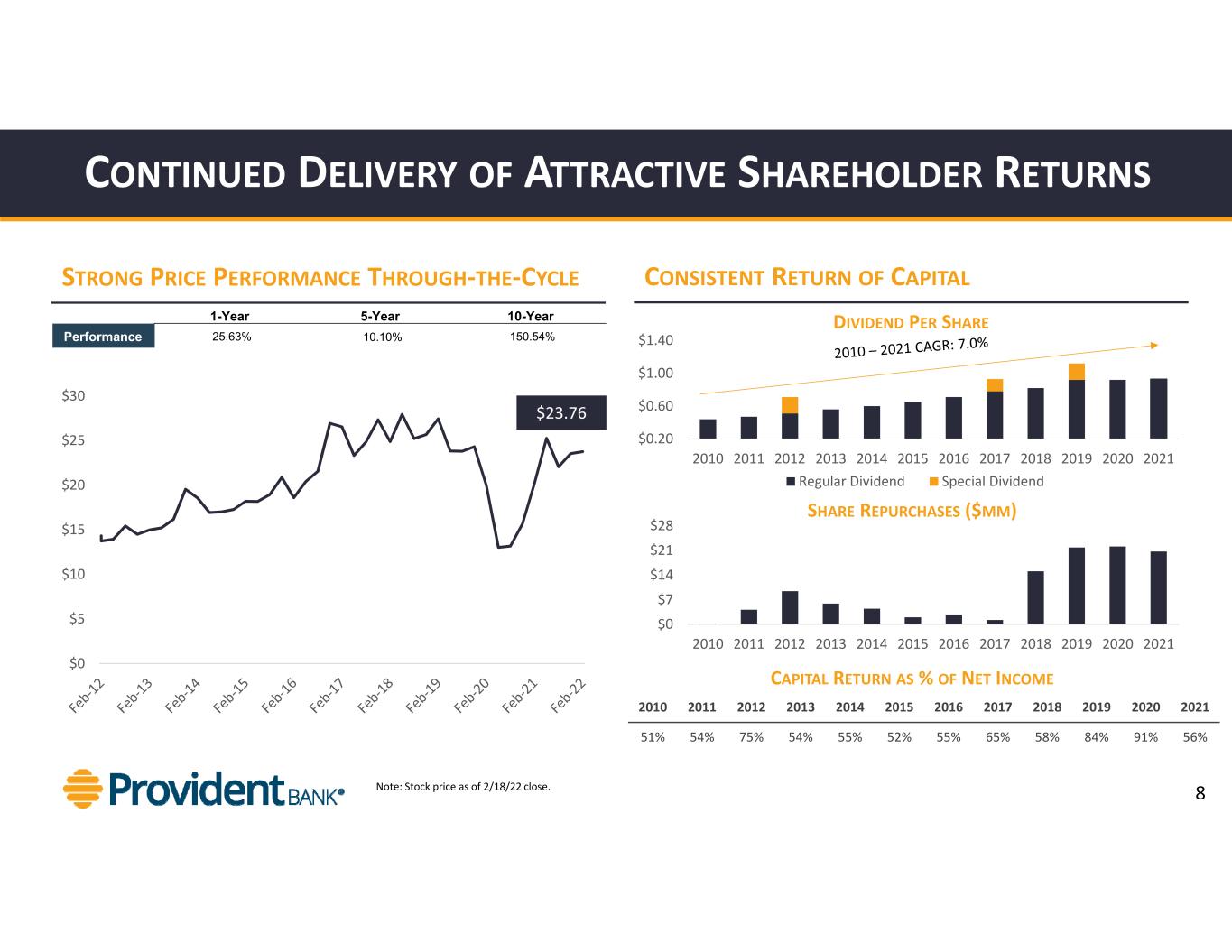

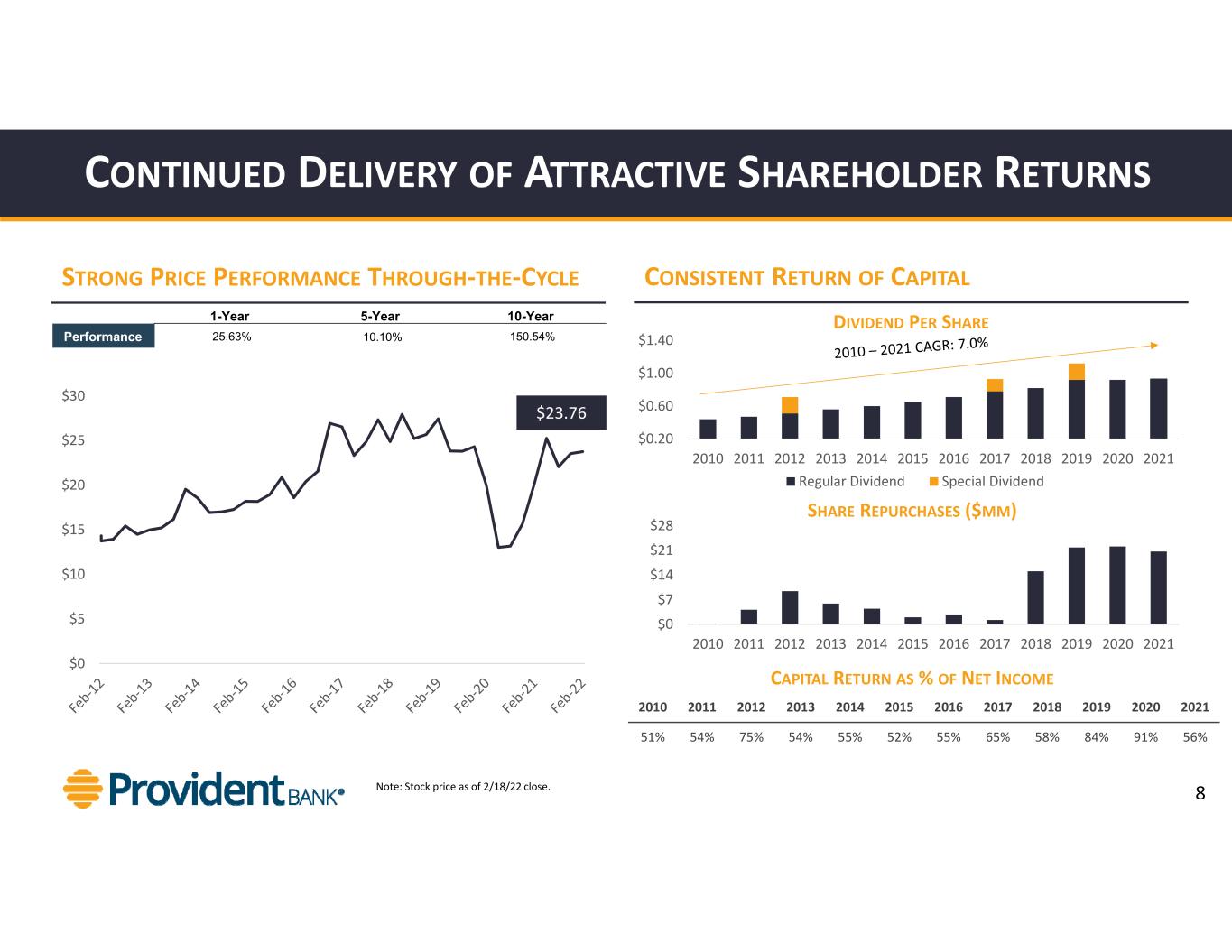

$0 $7 $14 $21 $28 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 CONTINUED DELIVERY OF ATTRACTIVE SHAREHOLDER RETURNS Note: Stock price as of 2/18/22 close. STRONG PRICE PERFORMANCE THROUGH‐THE‐CYCLE CONSISTENT RETURN OF CAPITAL $0.20 $0.60 $1.00 $1.40 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Regular Dividend Special Dividend DIVIDEND PER SHARE SHARE REPURCHASES ($MM) CAPITAL RETURN AS % OF NET INCOME 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 51% 54% 75% 54% 55% 52% 55% 65% 58% 84% 91% 56% 8 $0 $5 $10 $15 $20 $25 $30 $23.76 1-Year 5-Year 10-Year Performance 25.63% 10.10% 150.54%

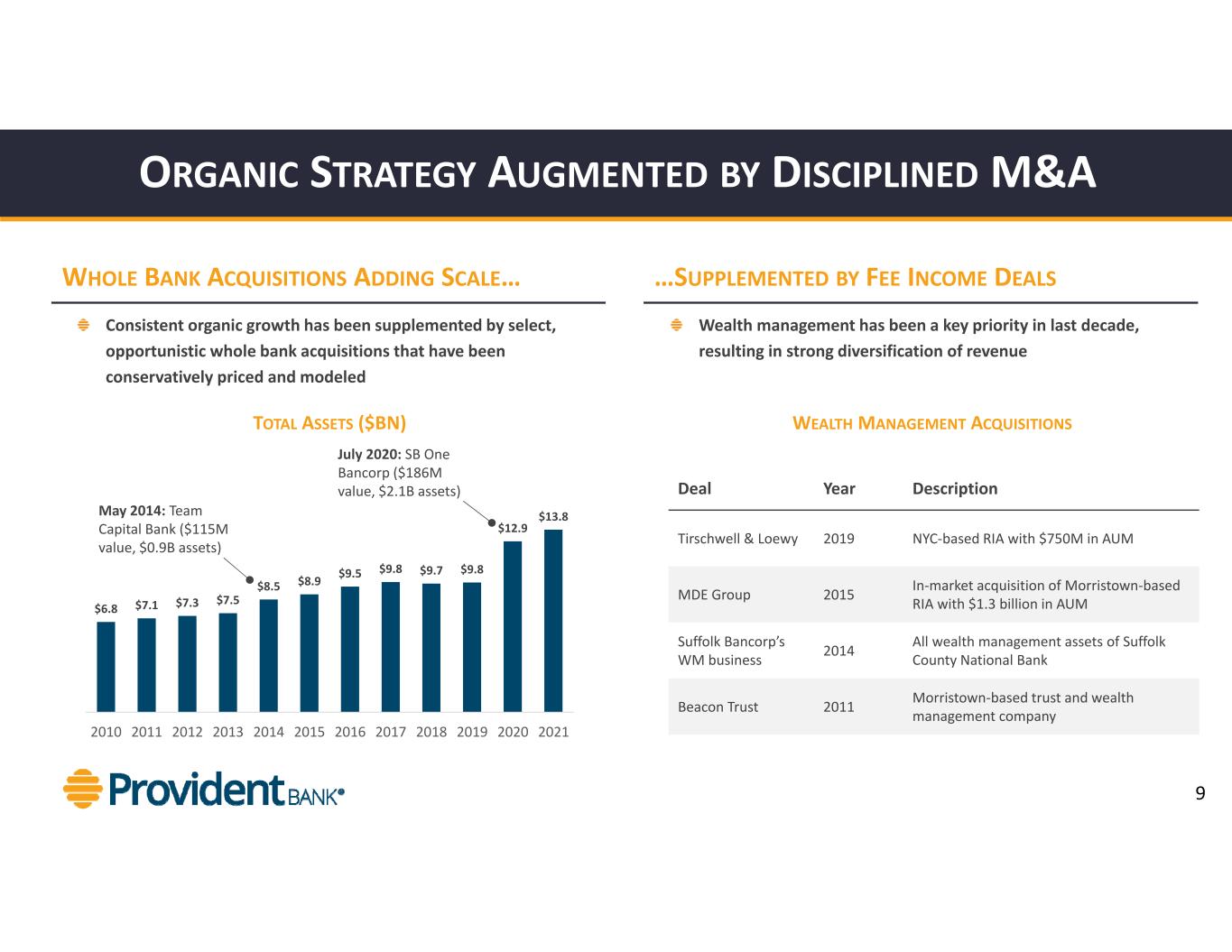

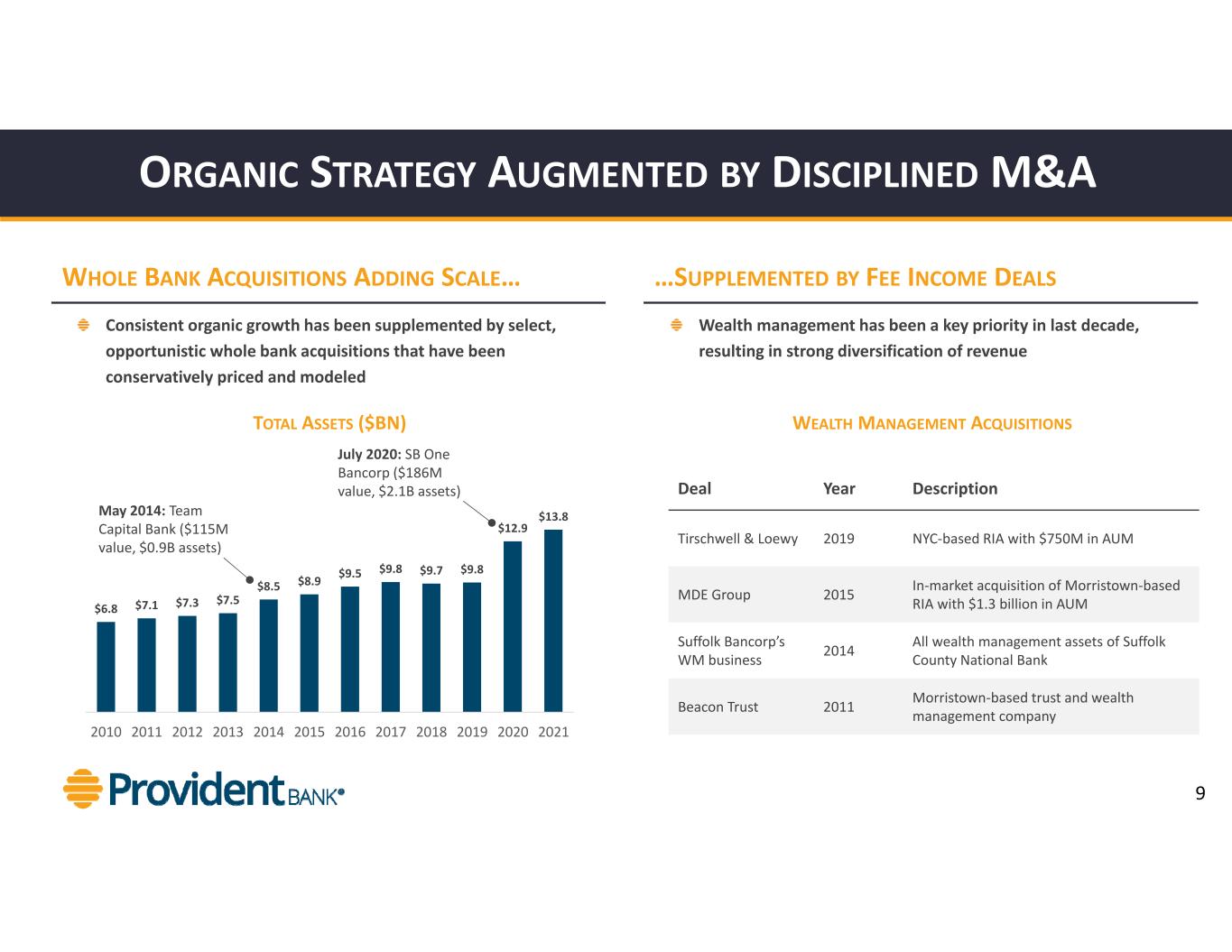

ORGANIC STRATEGY AUGMENTED BY DISCIPLINED M&A $6.8 $7.1 $7.3 $7.5 $8.5 $8.9 $9.5 $9.8 $9.7 $9.8 $12.9 $13.8 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 WHOLE BANK ACQUISITIONS ADDING SCALE… …SUPPLEMENTED BY FEE INCOME DEALS July 2020: SB One Bancorp ($186M value, $2.1B assets) May 2014: Team Capital Bank ($115M value, $0.9B assets) Consistent organic growth has been supplemented by select, opportunistic whole bank acquisitions that have been conservatively priced and modeled Wealth management has been a key priority in last decade, resulting in strong diversification of revenue TOTAL ASSETS ($BN) WEALTH MANAGEMENT ACQUISITIONS Deal Year Description Tirschwell & Loewy 2019 NYC‐based RIA with $750M in AUM MDE Group 2015 In‐market acquisition of Morristown‐based RIA with $1.3 billion in AUM Suffolk Bancorp’s WM business 2014 All wealth management assets of Suffolk County National Bank Beacon Trust 2011 Morristown‐based trust and wealth management company 9

CORPORATE GOVERNANCE AND OVERSIGHT OF RISK 10

WE HAVE AN INDEPENDENT, DIVERSE BOARD COMMITTED TO REFRESHMENT Christopher Martin (Executive Chairman) Age: 65 Director Since: 2005 Committees: N/A E 2 12 86% Independent Average Tenure~9 yr 5 Directors added in the last 3 years 21% Gender or Ethnically Diverse Anthony J. Labozzetta (President & CEO) Age: 58 Director Since: 2020 Committees: N/A E Edward “Ed” J. Leppert Age: 61 Director Since: 2020 Committees: Audit and Compensation I Robert “Bob” Adamo Age: 67 Director Since: 2016 Committees: Audit and Risk I James “Jim” P. Dunigan Age: 69 Director Since: 2018 Committees: Audit, Compensation and Risk (Chair) I Terence “Terry” M. Gallagher Age: 65 Director Since: 2010 Committees: Compensation, Governance & Nominating and Technology I Nadine Leslie Age: 58 Director Since: 2021 Committees: Audit I Robert McNerney Age: 62 Director Since: 2020 Committees: Risk I Thomas W. Berry Age: 74 Director Since: 2005 Committees: Governance & Nominating and Risk I Frank L. Fekete Age: 70 Director Since: 19951 Committees: Audit (Chair) and Governance & Nominating I Ursuline Foley Age: 60 Director Since: 2019 Committees: Risk and Technology I Matthew K. Harding Age: 58 Director Since: 2013 Committees: Compensation (Chair) and Technology I Carlos Hernandez (Lead Indep. Director) Age: 72 Director Since: 19961 Committees: Governance & Nominating (Chair) L John Pugliese Age: 62 Director Since: 2014 Committees: Compensation, Governance & Nominating and Technology (Chair) I Independent DirectorI E Executive Director Lead Independent DirectorL Added in the last 3 years 3 11 1. Reflects initial appointment to the board of directors of Provident Bank, prior to appointment to the board of directors of the Company in 2003. BOARD COMPOSITION 11

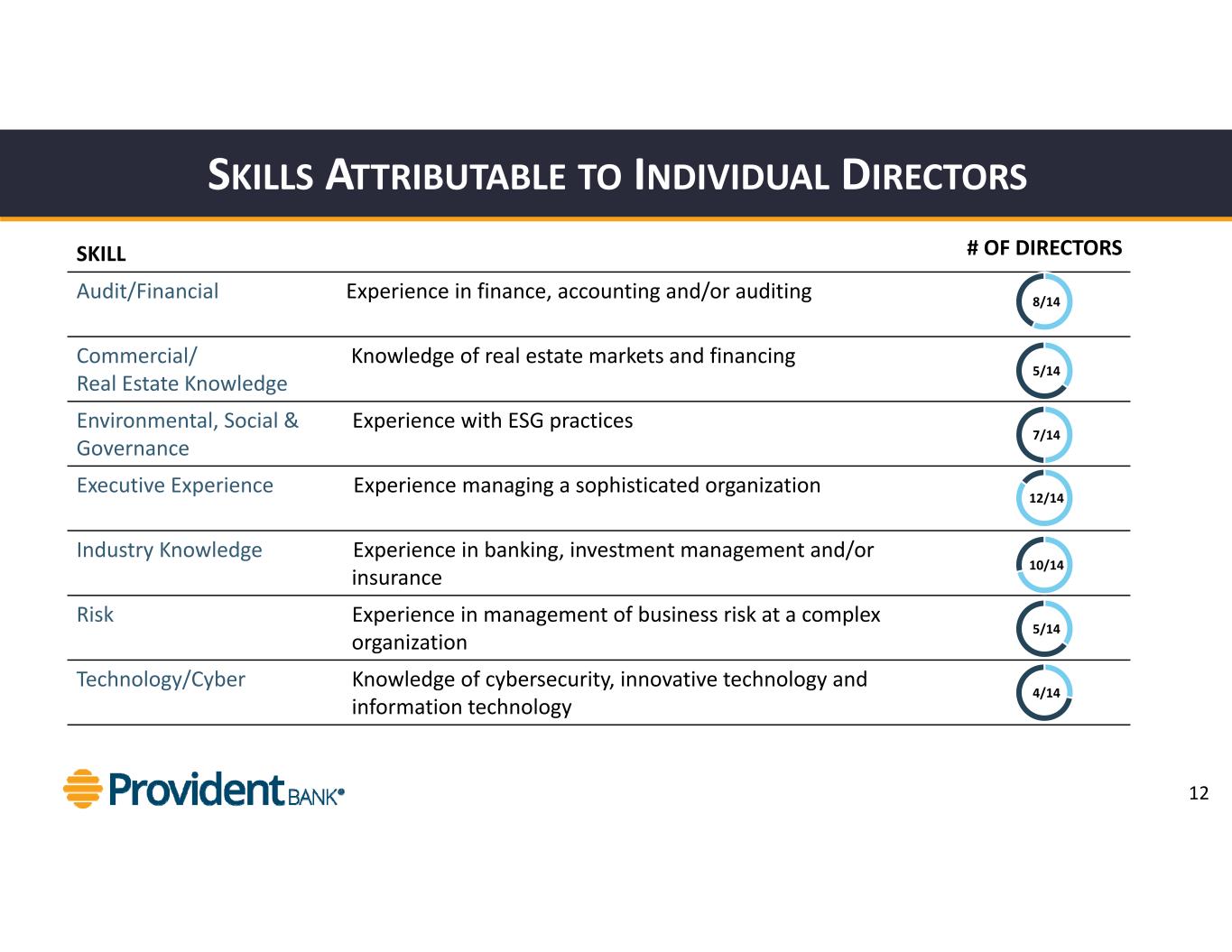

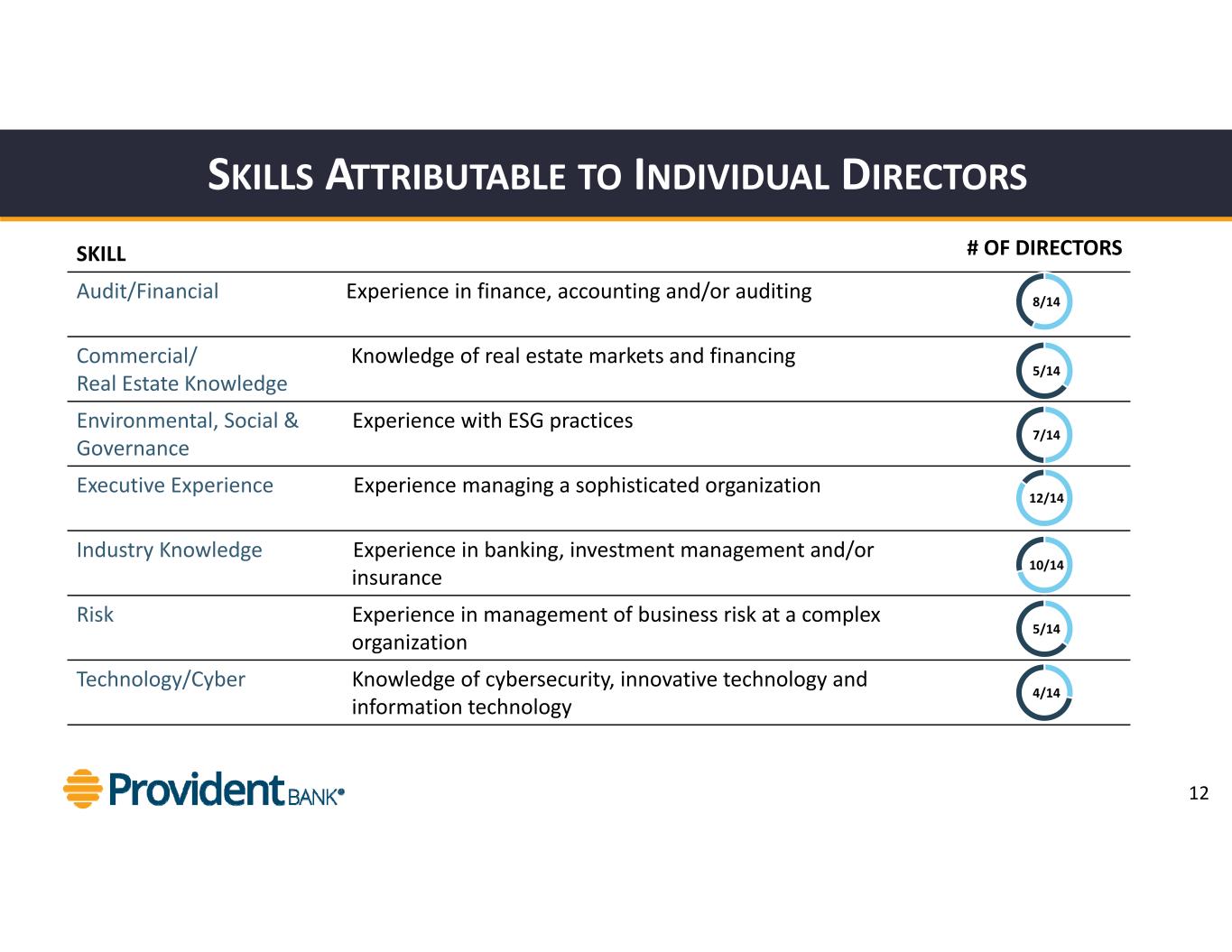

SKILLS ATTRIBUTABLE TO INDIVIDUAL DIRECTORS Audit/Financial Experience in finance, accounting and/or auditing Commercial/ Knowledge of real estate markets and financing Real Estate Knowledge Environmental, Social & Experience with ESG practices Governance Executive Experience Experience managing a sophisticated organization Industry Knowledge Experience in banking, investment management and/or insurance Risk Experience in management of business risk at a complex organization Technology/Cyber Knowledge of cybersecurity, innovative technology and information technology 5/14 10/14 4/14 12/14 SKILL # OF DIRECTORS 12 8/14 7/14 5/14

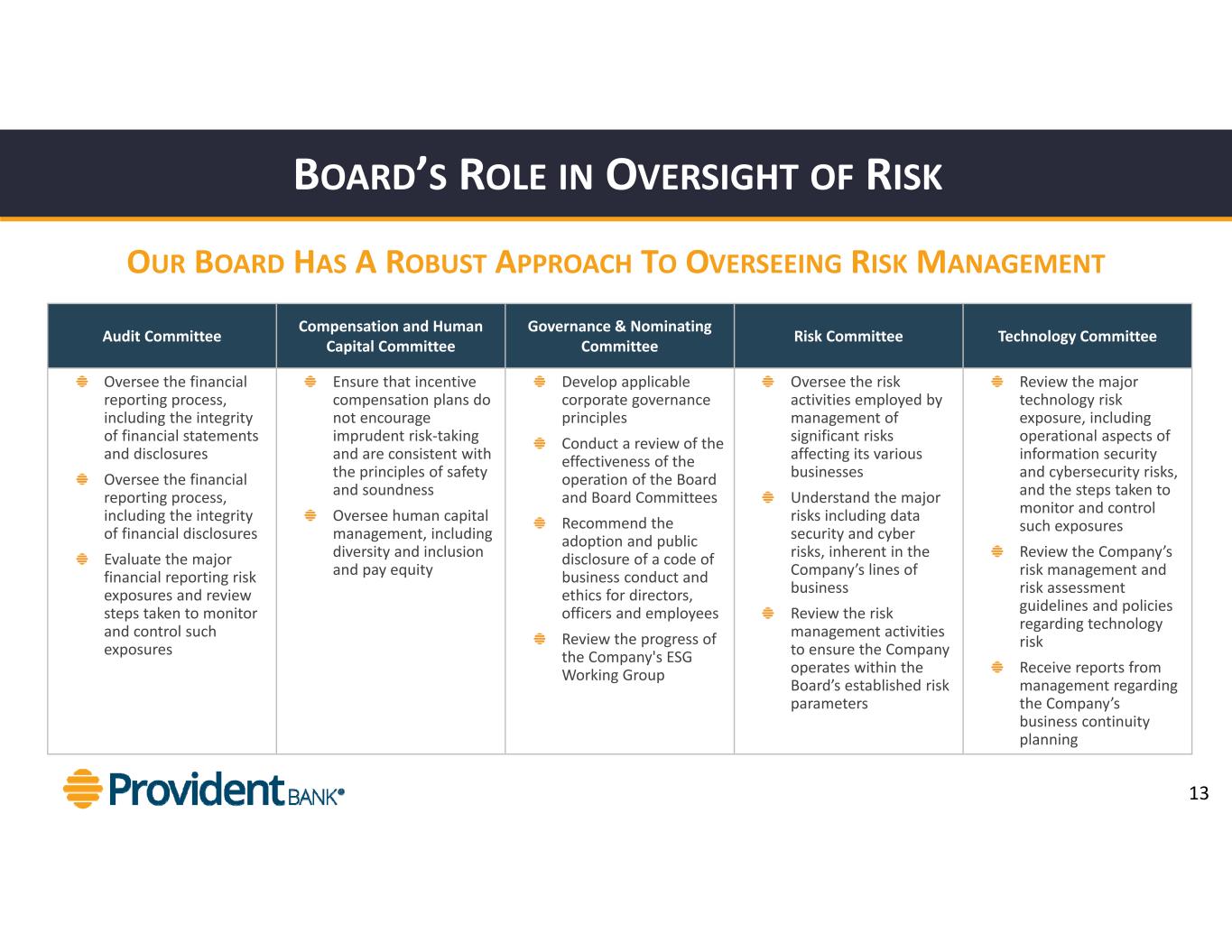

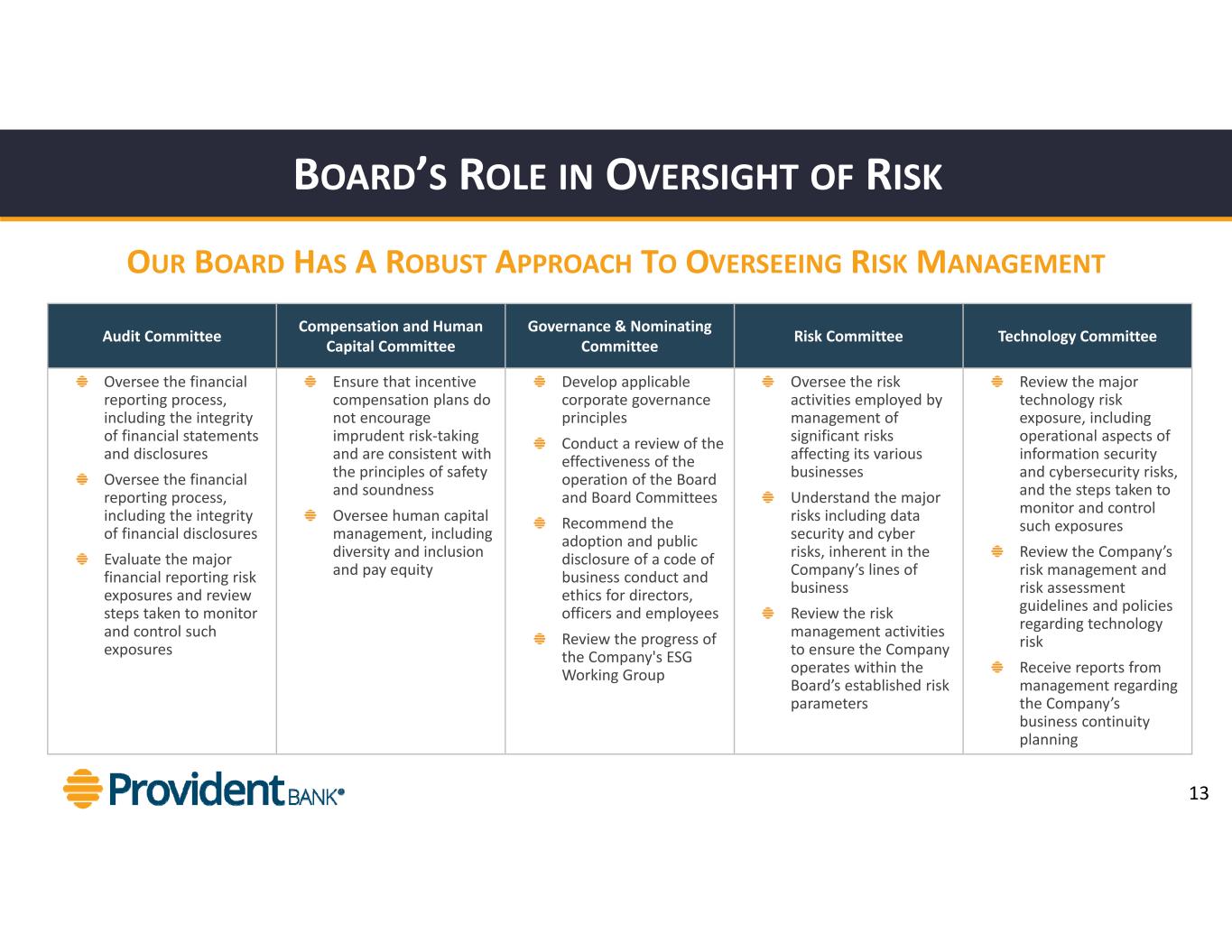

OUR BOARD HAS A ROBUST APPROACH TO OVERSEEING RISK MANAGEMENT BOARD’S ROLE IN OVERSIGHT OF RISK Audit Committee Compensation and Human Capital Committee Governance & Nominating Committee Risk Committee Technology Committee Oversee the financial reporting process, including the integrity of financial statements and disclosures Oversee the financial reporting process, including the integrity of financial disclosures Evaluate the major financial reporting risk exposures and review steps taken to monitor and control such exposures Ensure that incentive compensation plans do not encourage imprudent risk‐taking and are consistent with the principles of safety and soundness Oversee human capital management, including diversity and inclusion and pay equity Develop applicable corporate governance principles Conduct a review of the effectiveness of the operation of the Board and Board Committees Recommend the adoption and public disclosure of a code of business conduct and ethics for directors, officers and employees Review the progress of the Company's ESG Working Group Oversee the risk activities employed by management of significant risks affecting its various businesses Understand the major risks including data security and cyber risks, inherent in the Company’s lines of business Review the risk management activities to ensure the Company operates within the Board’s established risk parameters Review the major technology risk exposure, including operational aspects of information security and cybersecurity risks, and the steps taken to monitor and control such exposures Review the Company’s risk management and risk assessment guidelines and policies regarding technology risk Receive reports from management regarding the Company’s business continuity planning 13

EXECUTIVE COMPENSATION 14

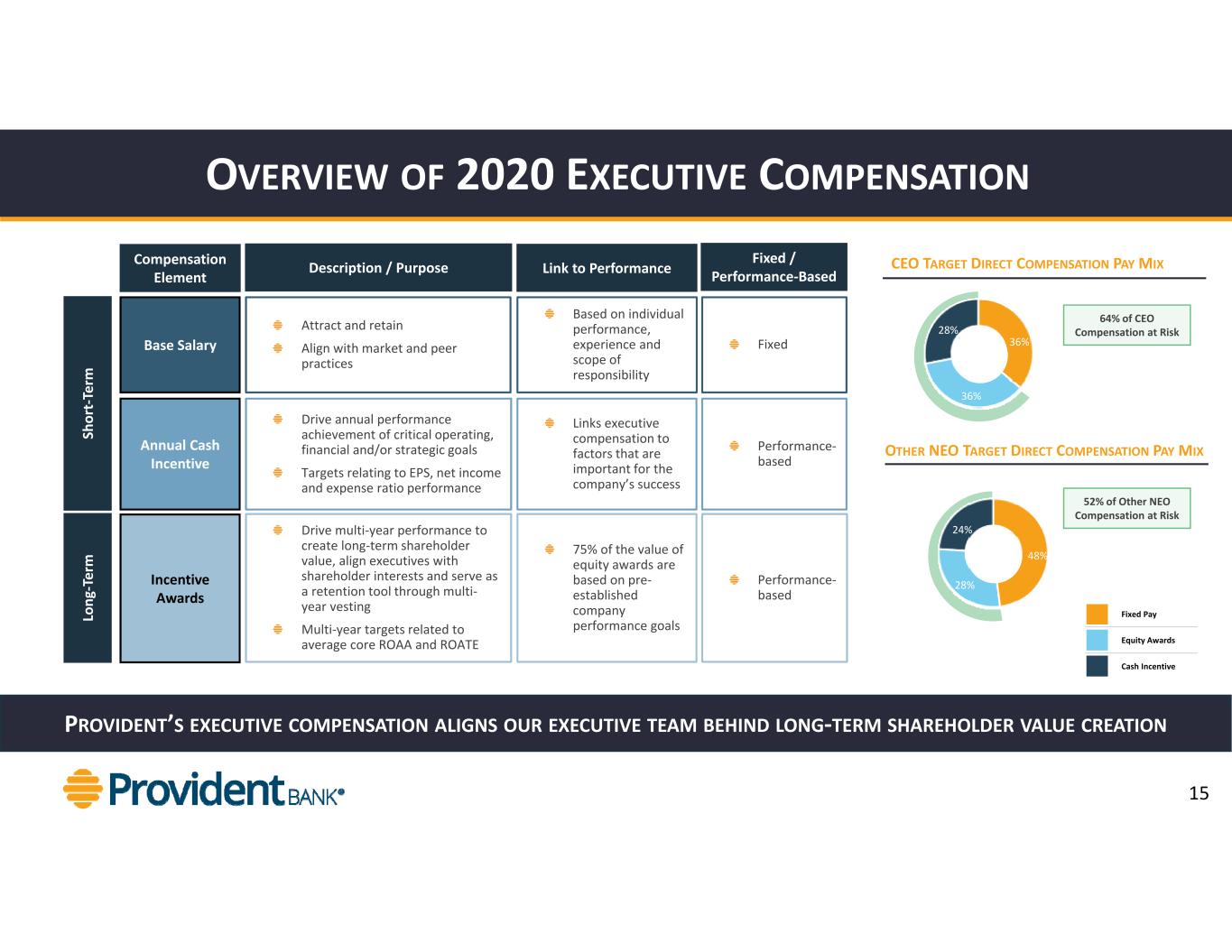

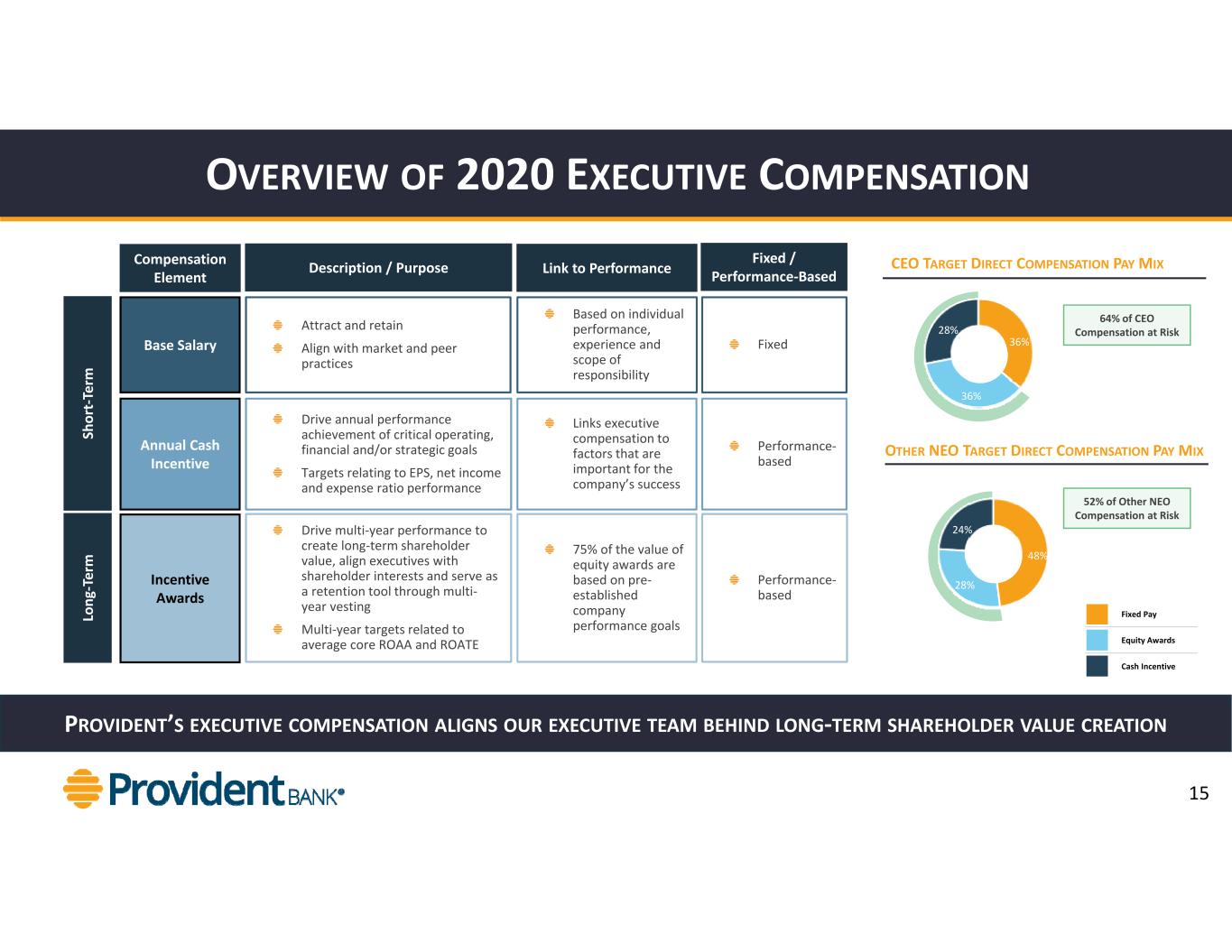

OVERVIEW OF 2020 EXECUTIVE COMPENSATION Sh or t‐ Te rm Lo ng ‐T er m Base Salary Annual Cash Incentive Incentive Awards Description / Purpose Link to PerformanceCompensation Element Fixed / Performance‐Based PROVIDENT’S EXECUTIVE COMPENSATION ALIGNS OUR EXECUTIVE TEAM BEHIND LONG‐TERM SHAREHOLDER VALUE CREATION Attract and retain Align with market and peer practices Based on individual performance, experience and scope of responsibility Fixed Drive annual performance achievement of critical operating, financial and/or strategic goals Targets relating to EPS, net income and expense ratio performance Links executive compensation to factors that are important for the company’s success Performance‐ based Drive multi‐year performance to create long‐term shareholder value, align executives with shareholder interests and serve as a retention tool through multi‐ year vesting Multi‐year targets related to average core ROAA and ROATE 75% of the value of equity awards are based on pre‐ established company performance goals Performance‐ based CEO TARGET DIRECT COMPENSATION PAY MIX 64% of CEO Compensation at Risk28% 36% 36% OTHER NEO TARGET DIRECT COMPENSATION PAY MIX 52% of Other NEO Compensation at Risk 24% 28% 48% Fixed Pay Equity Awards Cash Incentive 15

ESG AND CORPORATE SOCIAL RESPONSIBILITY 16

ESG AND CORPORATE SOCIAL RESPONSIBILITY Diversity, Equity and Inclusion Provident is committed to fostering a safe working environment, which promotes diversity and is free from harassment or discrimination of any kind. We are proud of our diverse workforce, including women holding 64% of all managerial positions. In 2021, the company hired its first Senior HR and Diversity Business Partner as part of its ongoing commitment to advance diversity, equity, and inclusion initiatives. Some of the initiatives include but are not limited to partnering with organizations that will help to expand diverse talent pools and create an internal pipeline. We promote diversity and inclusion as important elements in building and sustaining a successful organization and positive, results‐driven culture, including participation in the Diversity Regional Reception hosted jointly by the NJ Chamber of Commerce and the African American Chamber of Commerce of NJ. 14% of our board of directors are women and 14% are racially or ethnically diverse. We recognize the importance of maintaining a socially and culturally diverse employee base. Diversity in the workplace provides a unique opportunity to obtain a variety of perspectives, experiences and resources that better reflect the customers and communities we serve. It is the company’s expectation that our continued actions and behaviors result in a working environment which encourages and respects diversity and provides an equal opportunity for employment, development and advancement for those qualified. We base employment decisions on merit, considering qualifications, skills and achievements. 17

ESG AND CORPORATE SOCIAL RESPONSIBILITY Internal ESG Efforts We have established a standing group of senior representatives tasked with building the Bank’s ESG program. The group reports on its progress to the Board’s Governance & Nominating Committee. The following areas, among others, are under review: Climate Change Human Capital Management Diversity, Equity and Inclusion Vendor Management Social Impact, including CRA, PPP Data Privacy and Cybersecurity Provident Bank’s information security department is headed by its Chief Information Security Officer (CISO) who reports to the Bank’s Chief Risk Officer (CRO). Provident employees are required to secure and protect confidential nonpublic information they may create, process, or have access to. Provident Bank’s Information Security program and policy is audited annually by internal & external audit, as well as federal regulators, and the program is presented annually to the Risk Committee of the Board of Directors for approval. Provident employees receive specialized information security training on a regular basis. Provident Bank’s incident management team is coordinated by the CISO and its actions are governed by policies and procedures. 18 Foundation and Employee Volunteering Activities Corporate Governance Disclosure Best Practices Pandemic Response

ESG AND CORPORATE SOCIAL RESPONSIBILITY Community Building The Bank established the Provident Bank Foundation in 2003 with the intent of supporting not‐for‐profit groups, institutions, schools and other 501(c)(3) organizations that provide valuable services to the communities served by Provident Bank. Since inception, The Provident Bank Foundation has funded more than $28 million in grants, including $1,200,000 in 2021 Over 4,000 grants have been made in support of over 1,400 organizations across all 18 NJ, NY and PA counties in Provident Bank’s marketplace Provident Bank supports local non‐profit organizations through the New Jersey Department of Community Affairs, Neighborhood Revitalization Tax Credit (NRTC) Program. Funding through this program is used to implement revitalization plans that address housing and economic development, provide opportunities for entrepreneurs to start businesses and job training for local residents, as well as complementary activities such as social services, recreation activities, and open space improvements. To name a few, we support the Garden State Episcopal Community Development Corporation, the Lincoln Park Coast Cultural District, New Brunswick Tomorrow and Paterson Habitat for Humanity Since 2014, Provident Bank has proudly supported two organizations in the Lehigh Valley of Pennsylvania whose missions are to provide assistance to the communities served in the form of housing for low‐ to moderate‐income persons, job training to local residents and students, and guidance to entrepreneurs on starting a small business, as well as assist with infrastructure initiatives to improve low income neighborhoods. Together, Provident Bank and The Provident Bank Foundation are committed to helping the communities we serve, including: The Sussex Elks Lodge in support of The Moving Wall, which is dedicated to those who died in the Vietnam War The Annual Sussex County Fireman's Association Inspection Day & Parade The Domestic Abuse & Sexual Assault Intervention Services (DASI) walk The Pennsylvania Coalition Against Domestic Violence (PCADV) in partnership with Turning Point of Lehigh Valley The Hunterdon Helpline and Hunterdon Healthcare Foundation in Flemington, NJ In 2019, a $100,000 Signature Grant from The Provident Bank Foundation supported the construction of the Social Impact Incubator of the Ignite Institute for Business Innovation at the Frank J. Guarini School of Business at Saint Peter’s University in Jersey City, NJ, with the goal of accelerating career advancement opportunities for students while building sustainable capacity for small businesses, nonprofits, and social enterprises in Jersey City. In 2015, Saint Peter’s University received its first $100,000 Signature Grant from PBF in support of the Ignite Institute to help launch businesses that contribute to market growth and sustainable local neighborhood economies 19

APPENDIX: NON‐GAAP DISCLOSURE RECONCILIATION 20

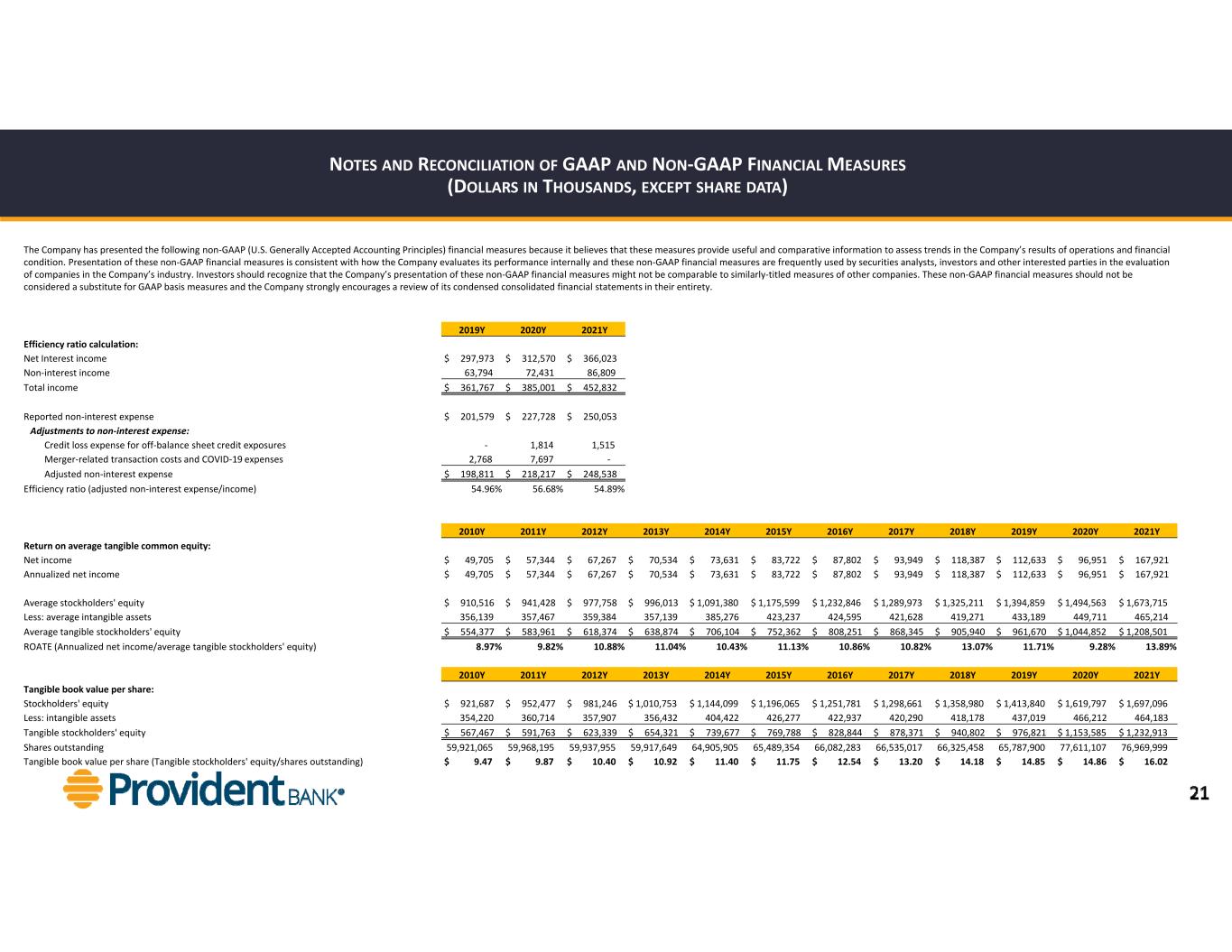

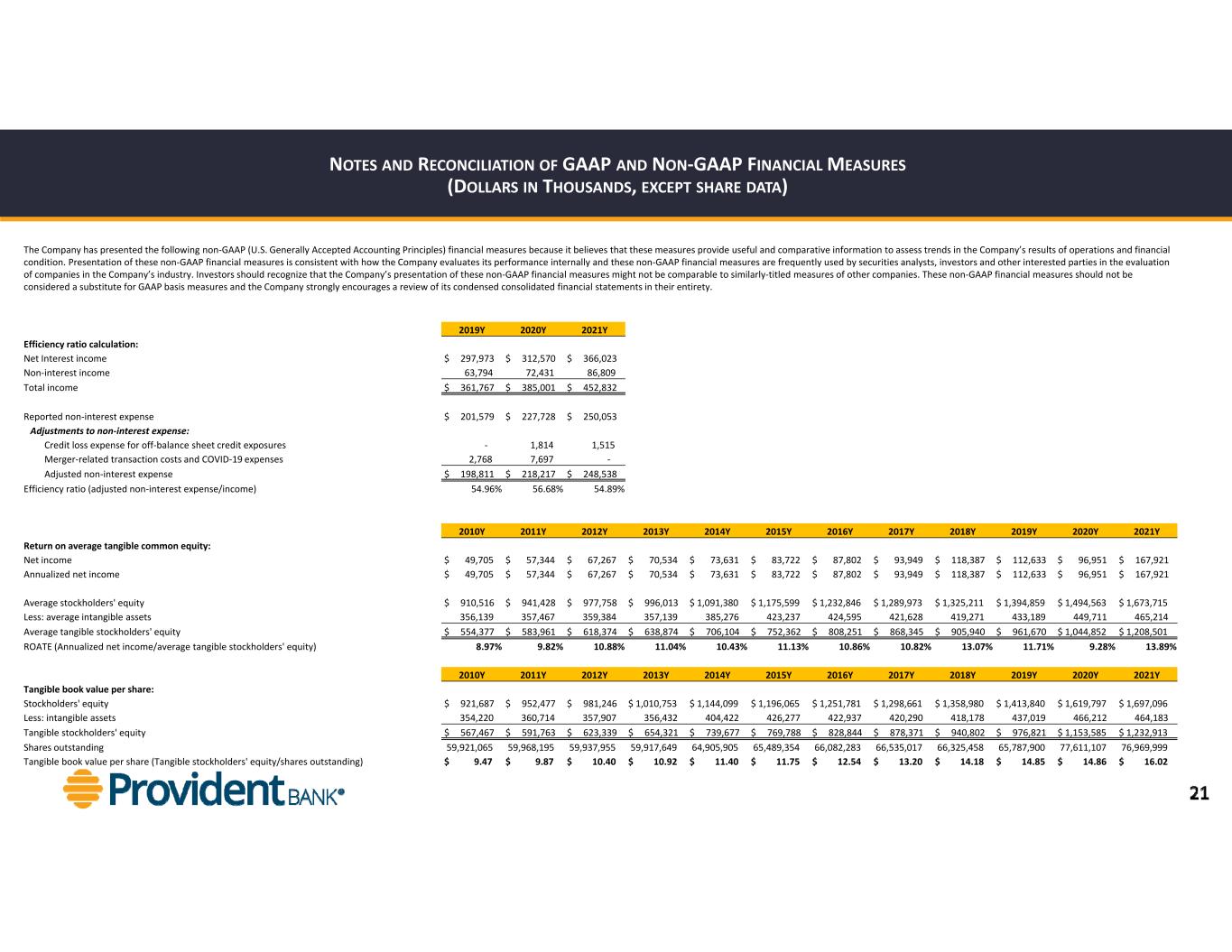

The Company has presented the following non‐GAAP (U.S. Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non‐GAAP financial measures is consistent with how the Company evaluates its performance internally and these non‐GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non‐GAAP financial measures might not be comparable to similarly‐titled measures of other companies. These non‐GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its condensed consolidated financial statements in their entirety. 2019Y 2020Y 2021Y Efficiency ratio calculation: Net Interest income $ 297,973 $ 312,570 $ 366,023 Non‐interest income 63,794 72,431 86,809 Total income $ 361,767 $ 385,001 $ 452,832 Reported non‐interest expense $ 201,579 $ 227,728 $ 250,053 Adjustments to non‐interest expense: Credit loss expense for off‐balance sheet credit exposures ‐ 1,814 1,515 Merger‐related transaction costs and COVID‐19 expenses 2,768 7,697 ‐ Adjusted non‐interest expense $ 198,811 $ 218,217 $ 248,538 Efficiency ratio (adjusted non‐interest expense/income) 54.96% 56.68% 54.89% 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y Return on average tangible common equity: Net income $ 49,705 $ 57,344 $ 67,267 $ 70,534 $ 73,631 $ 83,722 $ 87,802 $ 93,949 $ 118,387 $ 112,633 $ 96,951 $ 167,921 Annualized net income $ 49,705 $ 57,344 $ 67,267 $ 70,534 $ 73,631 $ 83,722 $ 87,802 $ 93,949 $ 118,387 $ 112,633 $ 96,951 $ 167,921 Average stockholders' equity $ 910,516 $ 941,428 $ 977,758 $ 996,013 $ 1,091,380 $ 1,175,599 $ 1,232,846 $ 1,289,973 $ 1,325,211 $ 1,394,859 $ 1,494,563 $ 1,673,715 Less: average intangible assets 356,139 357,467 359,384 357,139 385,276 423,237 424,595 421,628 419,271 433,189 449,711 465,214 Average tangible stockholders' equity $ 554,377 $ 583,961 $ 618,374 $ 638,874 $ 706,104 $ 752,362 $ 808,251 $ 868,345 $ 905,940 $ 961,670 $ 1,044,852 $ 1,208,501 ROATE (Annualized net income/average tangible stockholders' equity) 8.97% 9.82% 10.88% 11.04% 10.43% 11.13% 10.86% 10.82% 13.07% 11.71% 9.28% 13.89% 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y Tangible book value per share: Stockholders' equity $ 921,687 $ 952,477 $ 981,246 $ 1,010,753 $ 1,144,099 $ 1,196,065 $ 1,251,781 $ 1,298,661 $ 1,358,980 $ 1,413,840 $ 1,619,797 $ 1,697,096 Less: intangible assets 354,220 360,714 357,907 356,432 404,422 426,277 422,937 420,290 418,178 437,019 466,212 464,183 Tangible stockholders' equity $ 567,467 $ 591,763 $ 623,339 $ 654,321 $ 739,677 $ 769,788 $ 828,844 $ 878,371 $ 940,802 $ 976,821 $ 1,153,585 $ 1,232,913 Shares outstanding 59,921,065 59,968,195 59,937,955 59,917,649 64,905,905 65,489,354 66,082,283 66,535,017 66,325,458 65,787,900 77,611,107 76,969,999 Tangible book value per share (Tangible stockholders' equity/shares outstanding) $ 9.47 $ 9.87 $ 10.40 $ 10.92 $ 11.40 $ 11.75 $ 12.54 $ 13.20 $ 14.18 $ 14.85 $ 14.86 $ 16.02 NOTES AND RECONCILIATION OF GAAP AND NON‐GAAP FINANCIAL MEASURES (DOLLARS IN THOUSANDS, EXCEPT SHARE DATA)

FORWARD‐LOOKING STATEMENTS Certain statements contained herein are “forward‐looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward‐looking statements may be identified by reference to a future period or periods, or by the use of forward‐looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” "project," "intend," “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward‐looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in Item 1A of the Company's Annual Report on Form 10‐K, as supplemented by its Quarterly Reports on Form 10‐Q, and those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in accounting policies and practices that may be adopted by the regulatory agencies and the accounting standards setters, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset‐liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. In addition, the COVID‐19 pandemic continues to have an uncertain impact on the Company, its customers and the communities it serves. Given its ongoing and dynamic nature, including potential variants, it is difficult to predict the continuing impact of the pandemic on the Company's business, financial condition or results of operations. The extent of such impact will depend on future developments, which remain highly uncertain, including when the pandemic will be controlled and abated, and the extent to which the economy can remain open, as well as government responses to the COVID‐19 pandemic, including vaccine mandates, which may affect our workforce, human capital resources and infrastructure. As the result of the pandemic and the related adverse local and national economic consequences, the Company could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations: the demand for our products and services may decline, making it difficult to grow assets and income; if the economy is unable to remain substantially open, and higher levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; our allowance for credit losses may increase if borrowers experience financial difficulties, which will adversely affect our net income; the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; as the result of the decline in the Federal Reserve Board’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest‐bearing liabilities, reducing our net interest margin and spread and reducing net income; our wealth management revenues may decline with continuing market turmoil; we may face the risk of a goodwill write‐down due to stock price decline; and our cyber security risks are increased as the result of an increased number of employees working remotely. The Company cautions readers not to place undue reliance on any such forward‐looking statements which speak only as of the date made. The Company advises readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not have any obligation to update any forward‐looking statements to reflect events or circumstances after the date of this statement. 22