As filed with the Securities and Exchange Commission onMarch 12, 2003

Registration No. 333-98287

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WILLIAM LYON HOMES | | WILLIAM LYON HOMES, INC. |

|

[See Table of Additional Registrants On Following Page] |

(Exact Name of Registrant as Specified in Its Charter) |

|

Delaware | | California |

(State or Other Jurisdiction of Incorporation or Organization) |

33-0864902 | | 33-0253855 |

(I.R.S. Employer Identification Number) |

4490 Von Karman Avenue

Newport Beach, California 92660

(949) 833-3600

(Address, Including Zip Code, and Telephone Number, Including Area Code,

of Registrant’s Principal Executive Offices)

Wade H. Cable

President

William Lyon Homes

William Lyon Homes, Inc.

4490 Von Karman Avenue

Newport Beach, California 92660

(949) 833-3600

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent for Service)

With copies to:

Meredith Jackson, Esq. Irell & Manella LLP 1800 Avenue of the Stars, Suite 900

Los Angeles, California 90067 (310) 277-1010 | | Richard M. Sherman, Jr., Esq. Irell & Manella LLP 840 Newport Center Drive, Suite 400 Newport Beach, California 92660

(949) 760-0991 | | Daniel J. Zubkoff, Esq. Cahill Gordon & Reindel

80 Pine Street New York, New York 10005 (212) 701-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum Offering Price

Per Unit | | Proposed Maximum Aggregate Offering Price (1) | | Amount of Registration Fee (2) |

|

% Senior Notes due 2013 | | $250,000,000 | | 100% | | $250,000,000 | | $22,445 |

Guarantees of % Senior Notes due 2013 | | N/A | | N/A | | N/A | | N/A |

| (1) | | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

| (2) | | Fee of $18,400 previously paid. No additional consideration is being received for the guarantees and, therefore, no additional fee is required pursuant to Rule 457(n). |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Name of Guarantor Registrant | | Jurisdiction of Organization or Incorporation | | IRS Employer Identification Number |

|

California Equity Funding, Inc. | | California | | 33-0830016 |

Carmel Mountain Ranch | | California | | 33-0013333 |

Duxford Financial, Inc. | | California | | 33-0640824 |

HSP, Inc. | | California | | 33-0636045 |

Mountain Gate Ventures, Inc. | | Arizona | | 94-3344980 |

OX I Oxnard, L.P. | | California | | 33-0960120 |

PH-LP Ventures | | California | | 33-0799119 |

PH-Rielly Ventures | | California | | 33-0827710 |

PH Ventures-San Jose | | California | | 33-0785089 |

Presley CMR, Inc. | | California | | 33-0603862 |

Presley Homes | | California | | 33-0905035 |

St. Helena Westminster Estates, LLC | | Delaware | | 33-0842940 |

Sycamore CC, Inc. | | California | | 33-0981307 |

William Lyon Southwest, Inc. | | Arizona | | 86-0978474 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | MARCH 11, 2003 |

$250,000,000

% Senior Notes due 2013

COMPANY

| Ø | | We are primarily engaged in the design, construction and sale of single family detached and attached homes in California, Arizona and Nevada. Since the founding of our predecessor in 1956, we, including our unconsolidated joint ventures, have sold over 56,000 homes. |

NOTES

| Ø | | William Lyon Homes, Inc., our principal operating company, is offering $250,000,000 aggregate principal amount of its % Senior Notes due 2013. |

| Ø | | We will pay interest on the notes semi-annually in arrears on and of each year, commencing on , 2003. |

| Ø | | The notes will mature on , 2013. |

| Ø | | We will use the gross proceeds of this offering to (1) repay our existing senior notes, (2) repay certain other debt, and (3) pay related fees, commissions and other expenses. |

REDEMPTIONAND REPURCHASE

| Ø | | We may redeem the notes, in whole or in part, at any time on or after , 2008 at a redemption price equal to 100% of the principal amount plus a premium declining ratably to par, plus accrued and unpaid interest. |

| Ø | | At any time on or before , 2006, we may redeem up to 35% of the aggregate principal amount of the notes with the proceeds of qualified equity offerings at a redemption price equal to % of the principal amount, plus accrued and unpaid interest. |

| Ø | | If we experience a change of control, we may be required to offer to purchase the notes at a purchase price equal to 101% of the principal amount, plus accrued and unpaid interest. In addition, if our consolidated tangible net worth falls below a specific level, we may be required to purchase up to 10% of the notes at a purchase price equal to 100% of the outstanding principal amount, plus accrued and unpaid interest. |

RANKINGAND GUARANTEE

| Ø | | The notes will be senior unsecured obligations. |

| Ø | | William Lyon Homes, a New York Stock Exchange listed, publicly traded company, which is the parent holding company of the issuer, and all of its existing and certain of its future restricted subsidiaries will guarantee the notes on a senior unsecured basis. |

| Ø | | The notes and the guarantees will rank equally with all of our and the guarantors’ existing and future senior unsecured debt. |

| Ø | | The notes and the guarantees will rank senior to all of our and the guarantors’ debt that is expressly subordinated to the notes and the guarantees, but will be effectively subordinated to all of our and the guarantors’ senior secured indebtedness to the extent of the value of the assets securing that indebtedness. |

LISTING

| Ø | | We intend to apply for listing of the notes on the New York Stock Exchange. |

Investing in the notes involves risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | Per Note | | Total |

|

Price to Public | | | | % | | $ |

|

Underwriting Discount | | | | % | | $ |

|

Proceeds to William Lyon Homes, Inc. | | | | % | | $ |

We currently expect to deliver the notes to the underwriters in book-entry form only through The Depository Trust Company on or about , 2003.

UBS Warburg | Salomon Smith Barney |

You should rely only on the information contained in or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. We are not making any offer of these securities in any state where the offer is not permitted. You should not assume the information provided by this prospectus is accurate as of any date other than the date on the front of this prospectus.

Table of contents

i

Forward-Looking Statements

You are cautioned that certain statements contained in this prospectus, as well as some statements by us in periodic press releases and some oral statements by company officials to securities analysts and investors during presentations about us are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements which are predictive in nature, which depend upon or refer to future events or conditions, or which include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, “hopes”, and similar expressions constitute forward-looking statements. In addition, any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future actions by us, which may be provided by management are also forward-looking statements. Forward-looking statements are based upon expectations and projections about future events and are subject to assumptions, risks and uncertainties about, among other things, the company, economic and market factors and the homebuilding industry.

Actual events and results may differ materially from those expressed or forecasted in the forward-looking statements due to a number of factors. The principal factors that could cause our actual performance and future events and actions to differ materially from such forward-looking statements include, but are not limited to, changes in general economic conditions either nationally or in regions in which we operate (including, but not limited to changes directly or indirectly related to the tragic events of September 11, 2001 and thereafter), a war or other hostilities involving the United States, whether an ownership change occurs which could, under certain circumstances, result in the further limitation of our ability to utilize the tax benefits associated with our net operating loss carryforwards, changes in home mortgage interest rates, changes in generally accepted accounting principles or interpretations of those principles, changes in prices of homebuilding materials, labor shortages, adverse weather conditions, the occurrence of events such as landslides, soil subsidence and earthquakes that are uninsurable, not economically insurable or not subject to effective indemnification agreements, changes in governmental laws and regulations, whether we are able to refinance the outstanding balances of our debt obligations at their maturity, the timing of receipt of regulatory approvals and the opening of projects and the availability and cost of land for future growth. While it is impossible to identify all such factors, factors which could cause actual results to differ materially from those estimated by us include, but are not limited to, those factors or conditions described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our past performance or past or present economic conditions in our housing markets are not indicative of future performance or conditions. You are urged not to place undue reliance on forward-looking statements. In addition, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events or changes to projections over time unless required by federal securities law.

Market Data

Market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Global Insight provides economic and financial data, market analysis and forecasting, and analytical consulting services. The Meyers Group provides market research and consulting services for the United States residential development industry. The Meyers Group provides comprehensive market reports with leading economic and business indicators and housing market analysis compiled and reviewed by local Meyers Group analysts and independent consultants. The Ryness Company provides marketing, consulting and trend analysis services to the Southern and Northern California residential development industry. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness.

ii

Prospectus summary

The following summary highlights information contained elsewhere in this prospectus and should be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial statements (including the accompanying notes) appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially the risks of investing in the notes discussed under the “Risk factors” section beginning on page 8. Unless otherwise noted, the terms “we,” “our” and “us” refer to William Lyon Homes and its subsidiaries. In this prospectus, “California Lyon” refers to William Lyon Homes, Inc., a California corporation, and “Delaware Lyon” refers to its parent corporation, William Lyon Homes, a Delaware corporation. Unless the context indicates otherwise, “on a pro forma basis” or “pro forma” means after giving effect to the offering of the notes and the application of proceeds therefrom as described in this prospectus and “on a combined basis’’ means the total of operations in wholly-owned projects and in unconsolidated joint venture projects.

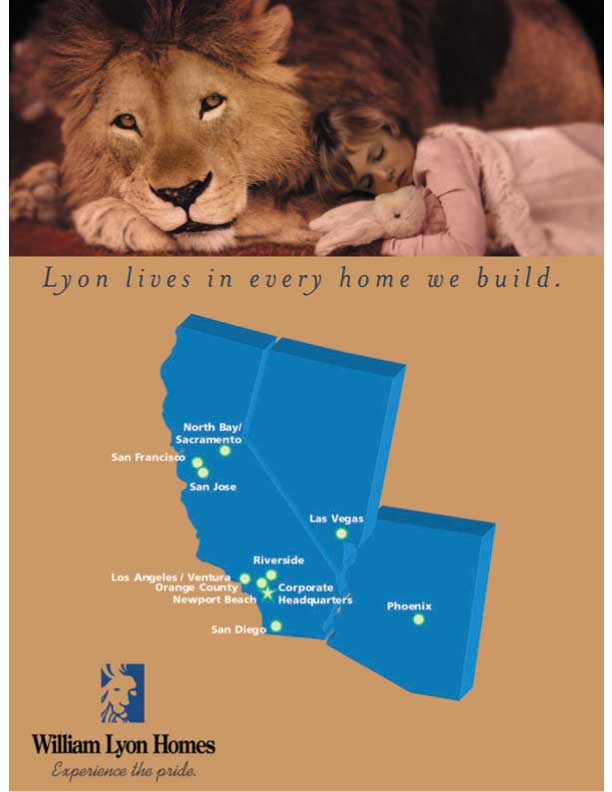

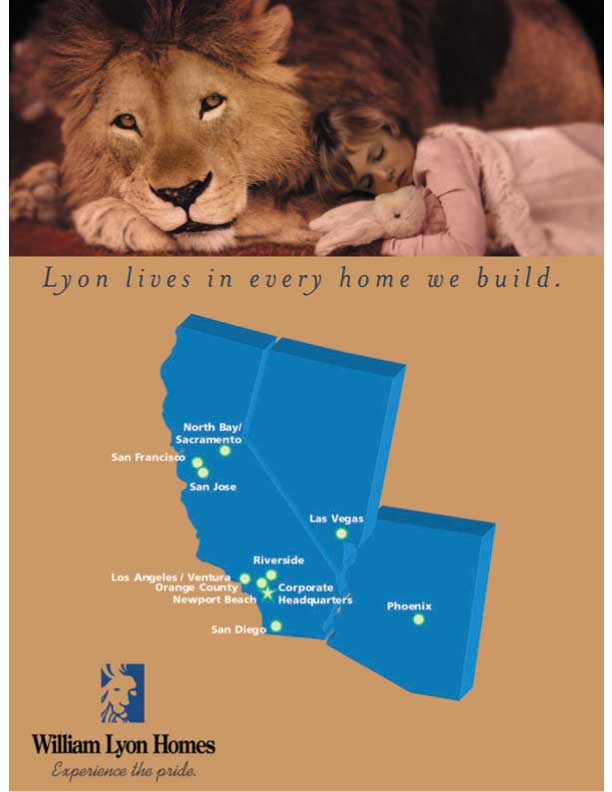

THE COMPANY

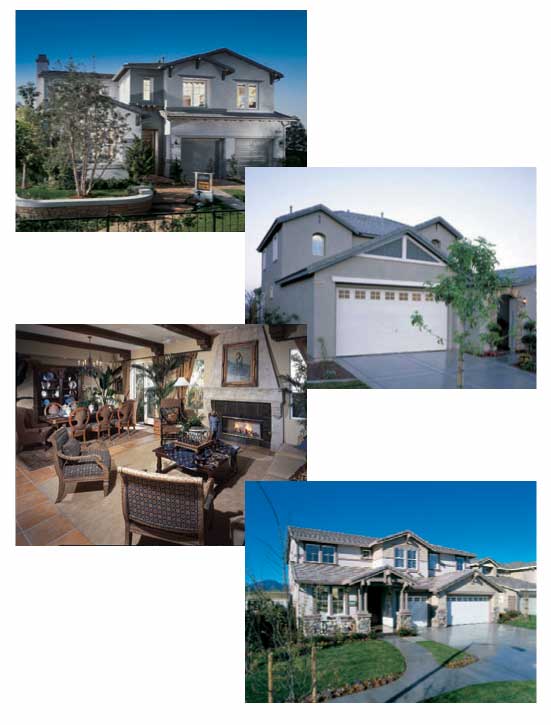

We are primarily engaged in the design, construction and sale of single family detached and attached homes in California, Arizona and Nevada. Since the founding of our predecessor in 1956, on a combined basis we have sold over 56,000 homes. We believe that we are one of the largest homebuilders in California in terms of both sales and homes delivered on a combined basis in 2002. We conduct our homebuilding operations through five geographic divisions: Southern California, San Diego, Northern California, Arizona and Nevada. We believe that we are well positioned for future growth in all of our markets. According to Global Insight, California, Arizona and Nevada were the 3rd, 6th, and 14th largest states, respectively, by single family housing starts in 2001. For the year ended December 31, 2002, on a combined basis we had revenues from home sales of $956.5 million and delivered 2,522 homes. For the same period, our consolidated EBITDA, which includes cash distributions of income from unconsolidated joint ventures, was $94.1 million.

We consider ourselves an opportunistic niche builder with expertise in all aspects of the homebuilding industry. We design, construct and sell a wide range of homes designed to meet the specific needs of each of our markets. We primarily emphasize sales to entry-level and move-up home buyers and we believe that this diversified product strategy enables us to best serve a wide range of buyers and adapt quickly to a variety of market conditions. As of December 31, 2002, we marketed our homes through 36 sales locations in both our wholly-owned projects and projects being developed in unconsolidated joint ventures. For the year ended December 31, 2002, the average sales price for homes delivered on a combined basis was $379,200, with base sales prices ranging from $110,000 to $1,035,000 and with square footage ranging from 1,183 to 4,695.

Our land acquisition strategy, as a merchant homebuilder, is to undertake projects with life-cycles of 24-36 months, in order to reduce development and market risk. We believe our inventory of owned lots is adequate to supply our homebuilding operations at current levels for approximately two years. As of December 31, 2002, on a combined basis, we controlled 13,723 lots, of which 6,110 were owned.

For the year ended December 31, 2002, on a combined basis we generated 2,607 net new home orders, a 3% increase over the 2,541 net new home orders generated for the year ended December 31, 2001. The dollar amount of our backlog of homes sold but not closed as of December 31, 2002 was $259.1 million, a 47% increase over the $176.5 million as of December 31, 2001.

1

BUSINESS STRATEGY

Our business strategies focus on the following:

Focus On High Growth Core Markets

Our housing markets are located in three rapidly growing Sunbelt states, California, Arizona and Nevada, which we believe offer us attractive opportunities for long-term growth. In California, we operate in the markets of: San Diego County, Riverside County, Orange County, Los Angeles County, Ventura County, San Francisco East Bay, San Jose, Sacramento County and other central California counties. In Arizona and Nevada, we primarily operate in the Phoenix and Las Vegas markets, respectively. These areas are generally characterized by high job growth and in-migration trends, creating strong demand for new housing.

On a combined basis, we believe that we have been one of the largest homebuilders in California in both homes delivered and sales volume for the last twenty years and continue to command a significant market share. In Ventura County, California, we ranked as the largest homebuilder and in prestigious Orange County, California, we ranked as the fourth largest homebuilder in 2002, based on the number of homes sold, according to the Meyers Group. In California, we believe that our strong reputation and long-standing relationships provide us with a significant competitive advantage, particularly as it relates to dealings with land sellers, subcontractors and material suppliers. In addition to our strength in California, we believe there are significant opportunities for us to grow in Arizona and Nevada.

Maintain Conservative Financial Position and Improve Credit Profile

We operate with a conservative approach to capital and inventory risk and focus on decreasing our reliance on leverage. We successfully de-leveraged our balance sheet over the past five years while growing our stockholders’ equity (deficit) from $(5.7) million as of December 31, 1997 to $181.7 million as of December 31, 2002. We plan to continue to diminish our reliance on leverage and use our cash flow from operations for on-balance sheet inventory investment. We believe that our operating and financial performance will also benefit from our enhanced focus on wholly-owned projects and limiting our use of joint venture structures, in which our joint venture partners have historically required returns on their invested capital in excess of 20%.

Acquire Strong Land Positions Through Disciplined Acquisition Strategies

We believe that, next to our people, land is our most valuable asset and that our long-standing relationships with land sellers give us a competitive advantage in the acquisition of well positioned lots, particularly in California. We believe that our strategy as a merchant homebuilder, versus that of a master-planned community developer, allows us to limit exposure to land investment and entitlement risk, as we focus on the development of entitled parcels that can be completed within a two to three-year period. We attempt to minimize our exposure to land risk through disciplined management of completed housing inventory, as well as the use of land options and flexible land acquisition arrangements.

Maintain Low Cost Structure

Throughout our history, we have focused on minimizing construction costs and overhead, and we believe this strategy has been critical to maintaining competitive margins and profitability. We reduce costs by:

| Ø | | Obtaining favorable pricing from subcontractors through long-term relationships and high volume; |

| Ø | | Reducing interest carry costs by acquiring entitled lots, minimizing our inventory of unsold or speculative homes and shortening the construction cycle; |

| Ø | | Minimizing overhead by centralizing certain administrative activities; and |

| Ø | | Monitoring homebuilding production, scheduling and budgeting through the effective use of management information systems. |

2

Leverage Experienced Management Team with Significant Equity Ownership

Our executive officers and divisional presidents average more than 25 years of experience in the homebuilding and development industries within California and the Southwest. We combine decentralized management in those aspects of our business where detailed knowledge of local market conditions is important (such as governmental processing, construction, land development and sales and marketing), with centralized management in those functions where, we believe, central control is required (such as approval of land acquisitions, financial, treasury, human resources and legal matters). We plan to continue to seek experienced professionals with deep market expertise while retaining our existing employees. In addition, our management owns a substantial portion of our outstanding common stock, aligning management’s incentives with those of our stockholders.

MARKET OVERVIEW

The following is a brief overview of the trends in the three growing Sunbelt states of California, Arizona, and Nevada and the metropolitan areas within those states in which we operate. Most of these markets have experienced compound annual growth rates (CAGR) in population and employment that exceed the overall rates in the nation. We believe the growth characteristics of the markets in which we operate represent a significant opportunity for us. The following table, which was derived from data compiled by Global Insight from U.S. Bureau of Labor Statistics and U.S. Census Bureau statistics, presents actual data for the years 1996 to 2001 and projected data for the years 2002 to 2006 for these trends for the areas listed below.

| | | | | | | | | | | Single-Family Housing Activity

|

| | | Population

| | Employment(1)

| | Starts

| | Permits

|

| | | 1996-2001 CAGR (%) | | 2001-2006 CAGR (%) | | 1996-2001 CAGR (%) | | 2001-2006 CAGR (%) | | 1996-2001 CAGR (%) | | 2001-2006 CAGR (%) | | 1996-2001 CAGR (%) | | 2001-2006 CAGR (%) |

|

U.S.(2) | | 1.15 | | 0.99 | | 2.07 | | 1.13 | | 1.76 | | 0.70 | | | | |

California | | 1.61 | | 1.49 | | 2.90 | | 1.02 | | 8.15 | | 6.55 | | | | |

Los Angeles | | 1.08 | | 0.74 | | 1.56 | | 0.59 | | | | | | 11.99 | | 2.85 |

Orange County | | 1.75 | | 1.01 | | 3.67 | | 1.29 | | | | | | (3.17) | | 10.54 |

Riverside | | 2.60 | | 2.06 | | 5.08 | | 2.44 | | | | | | 15.20 | | 3.05 |

Sacramento | | 2.29 | | 1.74 | | 3.89 | | 1.48 | | | | | | 12.85 | | 3.06 |

San Diego | | 1.53 | | 1.40 | | 3.96 | | 1.95 | | | | | | 9.69 | | 5.48 |

San Francisco | | 0.45 | | 0.49 | | 2.47 | | 0.25 | | | | | | (2.07) | | 15.41 |

San Jose | | 0.72 | | 1.02 | | 2.93 | | (0.01) | | | | | | (16.65) | | 20.17 |

Ventura | | 1.63 | | 1.23 | | 3.33 | | 1.17 | | | | | | 8.52 | | 4.63 |

Nevada | | 4.70 | | 2.53 | | 4.57 | | 2.44 | | (1.65) | | (2.50) | | | | |

Las Vegas | | 5.41 | | 2.73 | | 5.64 | | 3.00 | | | | | | 3.14 | | (1.74) |

Arizona | | 2.95 | | 2.34 | | 3.67 | | 1.44 | | 0.03 | | 2.53 | | | | |

Phoenix | | 3.37 | | 2.39 | | 3.98 | | 1.67 | | | | | | 4.46 | | 1.25 |

|

SOURCE: Global Insight

| (1) | | Refers to private sector non-farm employment. |

| (2) | | 2002 U.S. employment data is actual. |

Our principal executive offices are located at 4490 Von Karman Avenue, Newport Beach, California 92660 and our telephone number is (949) 833-3600.

3

The offering

The following summary is not intended to be complete. For a more detailed description of the notes, see “Description of the notes.”

Issuer | | William Lyon Homes, Inc. |

| | | |

Securities Offered | | $250,000,000 aggregate principal amount of % Senior Notes due 2013. |

| | | |

Maturity Date | | , 2013. |

| | | |

Interest Rate and Payment Dates | | The notes will accrue interest from the date of their issuance at the rate of % per year. Interest on the notes will be payable semi-annually in arrears on and of each year commencing on , 2003. |

| | | |

Optional Redemption

| | We may redeem the notes, in whole or part, at any time on or after , 2008 at a redemption price equal to 100% of the principal amount plus a premium declining ratably to par, plus accrued and unpaid interest, if any. In addition, on or before 2006, we may redeem up to 35% of the aggregate principal amount of the notes with the proceeds of qualified equity offerings at a redemption price equal to % of the principal amount, plus accrued and unpaid interest, if any. |

| | | |

Change of Control | | If we experience a change of control, we may be required to offer to purchase the notes at a purchase price equal to 101% of the principal amount, plus accrued and unpaid interest, if any. |

| | | |

Consolidated Tangible Net Worth | | If our consolidated tangible net worth falls below $75 million for any two consecutive fiscal quarters, we will be required to make an offer to purchase up to 10% of the notes originally issued at a purchase price equal to 100% of the principal amount, plus accrued and unpaid interest. |

| | | |

Ranking and Guarantees

| | William Lyon Homes, a New York Stock Exchange listed, publicly traded company, which is the parent holding company of the issuer, and all of its existing and certain of its future restricted subsidiaries will guarantee the notes on a senior unsecured basis. The notes and the guarantees will rank equally with all of our and the guarantors’ existing and future senior unsecured debt. The notes and the guarantees will rank senior to all of our and the guarantors’ debt that is expressly subordinated to the notes and the guarantees, but will be |

4

| | | effectively subordinated to all of our and the guarantors’ senior secured indebtedness to the extent of the value of the assets securing that indebtedness. As of December 31, 2002, on a pro forma basis, we and the guarantors would have had approximately $5.8 million of secured indebtedness outstanding and approximately $147.1 million of additional secured indebtedness available to be borrowed under our credit facilities, as limited by our borrowing base formulas. |

| | | |

Restrictive Covenants

| | The indenture governing the notes will contain covenants that will limit our ability to, among other things: Ø incur additional indebtedness; Ø pay dividends or make other distributions or repurchase or redeem our stock; Ø make investments; Ø sell assets; Ø incur liens; Ø enter into agreements restricting our subsidiaries’ ability to pay dividends; Ø enter into transactions with affiliates; and Ø consolidate, merge or sell all or substantially all of our assets. These covenants are subject to important exceptions and qualifications, which are described under the heading “Description of the notes” in this prospectus. |

| | | |

Absence of a Public Market | | The notes will generally be freely transferable but are a new issue of securities and there is currently no established market for them. We intend to apply for listing of the notes on the New York Stock Exchange. However, there can be no assurance as to the development or liquidity of any market for the notes. |

| | | |

Use of Proceeds | | We will use the gross proceeds of this offering to (1) repay our existing senior notes, (2) repay certain other debt, and (3) pay related fees, commissions and other expenses. See “Use of proceeds.” |

| | | |

RISK FACTORS This investment involves risks. Before you invest in the notes, you should carefully consider the matters set forth under the heading “Risk factors,” and all other information contained in this prospectus. |

5

Summary financial and operating data

The following summary financial and operating data should be read in conjunction with, and is qualified in its entirety by reference to, “Selected historical consolidated financial data,” “Management’s discussion and analysis of financial condition and results of operations” and our audited historical financial statements, including the notes and introductory paragraphs thereto, appearing elsewhere in this prospectus.

| | | Three Months Ended December 31,

| | | As of and for the

Year Ended

December 31,

| |

| | | 2002 | | | 2001 | | | 2002 | | | 2001 | | | 2000 | |

|

| | | (unaudited) | | | | | | | | | | |

| | | (dollars in thousands) | |

Statement of Income Data: | | | | | | | | | | | | | | | | | | | | |

Operating revenue | | | | | | | | | | | | | | | | | | | | |

Home sales | | $ | 200,376 | | | $ | 173,750 | | | $ | 593,762 | | | $ | 452,002 | | | $ | 403,850 | |

Lots, land and other sales | | | 1,470 | | | | — | | | | 8,648 | | | | 7,054 | | | | 3,016 | |

Management fees | | | 4,967 | | | | 4,165 | | | | 10,892 | | | | 9,127 | | | | 10,456 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 206,813 | | | | 177,915 | | | | 613,302 | | | | 468,183 | | | | 417,322 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating costs | | | | | | | | | | | | | | | | | | | | |

Cost of sales—homes | | | (167,242 | ) | | | (150,631 | ) | | | (504,330 | ) | | | (382,608 | ) | | | (335,891 | ) |

Cost of sales—lots, land and other | | | (1,848 | ) | | | (778 | ) | | | (9,404 | ) | | | (5,158 | ) | | | (3,378 | ) |

Sales and marketing | | | (6,989 | ) | | | (5,193 | ) | | | (22,862 | ) | | | (18,149 | ) | | | (16,515 | ) |

General and administrative | | | (13,721 | ) | | | (11,853 | ) | | | (39,366 | ) | | | (37,171 | ) | | | (35,348 | ) |

Amortization of goodwill | | | — | | | | (311 | ) | | | — | | | | (1,242 | ) | | | (1,244 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | (189,800 | ) | | | (168,766 | ) | | | (575,962 | ) | | | (444,328 | ) | | | (392,376 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Equity in income of unconsolidated joint ventures | | | 17,062 | | | | 10,297 | | | | 27,748 | | | | 22,384 | | | | 24,416 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income | | | 34,075 | | | | 19,446 | | | | 65,088 | | | | 46,239 | | | | 49,362 | |

Interest expense, net of amounts capitalized | | | — | | | | — | | | | — | | | | (227 | ) | | | (5,557 | ) |

Other income, net | | | 1,096 | | | | 3,385 | | | | 2,693 | | | | 7,513 | | | | 7,324 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before provision for income taxes and extraordinary item | | | 35,171 | | | | 22,831 | | | | 67,781 | | | | 53,525 | | | | 51,129 | |

Provision for income taxes | | | (9,555 | ) | | | (2,530 | ) | | | (18,270 | ) | | | (5,847 | ) | | | (12,357 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before extraordinary item | | | 25,616 | | | | 20,301 | | | | 49,511 | | | | 47,678 | | | | 38,772 | |

Extraordinary item—gain from retirement of debt, net of applicable taxes | | | — | | | | — | | | | — | | | | — | | | | 496 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | $ | 25,616 | | | $ | 20,301 | | | $ | 49,511 | | | $ | 47,678 | | | $ | 39,268 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | | | | | | | | $ | 16,694 | | | $ | 19,751 | | | $ | 14,711 | |

Real estate inventories | | | | | | | | | | | 491,952 | | | | 307,335 | | | | 233,700 | |

Investments in and advances to unconsolidated joint ventures | | | | | | | | | | | 65,404 | | | | 66,753 | | | | 49,966 | |

Total assets | | | | | | | | | | | 617,581 | | | | 433,709 | | | | 330,280 | |

Total debt | | | | | | | | | | | 266,065 | | | | 221,470 | | | | 166,910 | |

Minority interest | | | | | | | | | | | 80,647 | | | | 784 | | | | — | |

Stockholders’ equity | | | | | | | | | | | 181,676 | | | | 150,617 | | | | 102,512 | |

6

| | | Three Months Ended December 31,

| | | As of and for the

Year Ended

December 31,

| |

| | | 2002 | | | 2001 | | | 2002 | | | 2001 | | | 2000 | |

|

| | | (unaudited) | | | | | | | | | | |

| | | (dollars in thousands) | |

|

Other Financial Data (unaudited): | | | | | | | | | | | | | | | | | | | | |

EBITDA(1) | | $ | 37,835 | | | $ | 27,656 | | | $ | 94,118 | | | $ | 72,828 | | | $ | 81,529 | |

Cash flow provided by (used in) operating activities | | | 70,353 | | | | 62,438 | | | | 16,191 | | | | (2,298 | ) | | | 9,341 | |

Ratio of EBITDA to interest incurred(2) | | | 4.13 | x | | | 5.37 | x | | | 3.51 | x | | | 3.32 | x | | | 3.13 | x |

Ratio of debt to EBITDA | | | | | | | | | | | 2.83 | x | | | 3.04 | x | | | 2.05 | x |

Ratio of earnings to fixed charges(3) | | | | | | | | | | | 3.46 | x | | | 3.21 | x | | | 3.02 | x |

|

Operating Data (including unconsolidated joint ventures) (unaudited): | | | | | | | | | | | | | | | | | | | | |

Number of net new home orders | | | 405 | | | | 483 | | | | 2,607 | | | | 2,541 | | | | 2,603 | |

Number of homes closed | | | 887 | | | | 970 | | | | 2,522 | | | | 2,566 | | | | 2,666 | |

Average sales price of homes closed | | $ | 413 | | | $ | 326 | | | $ | 379 | | | $ | 299 | | | $ | 289 | |

Backlog at end of period, number of homes(4) | | | | | | | | | | | 627 | | | | 542 | | | | 567 | |

Backlog at end of period, aggregate sales value(4) | | | | | | | | | | $ | 259,123 | | | $ | 176,531 | | | $ | 171,650 | |

| (1) | | EBITDA means net income plus (i) provision for income taxes, (ii) interest expense, (iii) amortization of capitalized interest included in cost of sales, (iv) depreciation and amortization and (v) cash distributions of income from unconsolidated joint ventures less equity in income of unconsolidated joint ventures. EBITDA is a widely utilized financial indicator of a company’s ability to service and/or incur debt; however, other companies may calculate EBITDA differently. EBITDA should not be considered as an alternative for net income, cash flows from operating activities and other consolidated income or cash flow statement data prepared in accordance with accounting principles generally accepted in the United States or as a measure of profitability or liquidity. A reconciliation of net income and cash flow provided by (used in) operating activities to EBITDA is included in the section entitled “Selected historical consolidated financial data.” |

| (2) | | Interest incurred is the amount of interest paid and the net amount accrued (whether expensed or capitalized) during such period excluding amortization of capitalized interest included in cost of sales. |

| (3) | | Ratio of earnings to fixed charges is calculated by dividing earnings, as defined, by fixed charges, as defined. For this purpose, “earnings” means income before provision for income taxes and extraordinary items plus (i) fixed charges reduced by the amount of interest capitalized, (ii) amortization of capitalized interest included in cost of sales and (iii) cash distributions of income from unconsolidated joint ventures reduced by equity in income of unconsolidated joint ventures. For this purpose, “fixed charges” means interest incurred, whether expensed or capitalized. |

| (4) | | Backlog consists of homes sold under pending sales contracts that have not yet closed, some of which are subject to contingencies, including mortgage loan approval and the sale of existing homes by customers. There can be no assurance that homes sold under pending sales contracts will close. Of the total homes sold subject to pending sales contracts as of December 31, 2002, 512 represent homes under construction and 115 represent homes not yet under construction. Backlog as of all dates is unaudited. |

7

Risk factors

An investment in the notes involves a high degree of risk. You should carefully consider the following risk factors in addition to the other information contained or incorporated by reference in this prospectus. The risks described below are not the only ones we face. Other risks, including those that we do not currently consider material or may not currently anticipate, may impair our business.

RISKS RELATED TO OUR BUSINESS

Our revenues may decrease and our results of operations and the value of the notes may be adversely affected if demand for housing declines as a result of changes in economic and business conditions.

The residential homebuilding industry is cyclical and is highly sensitive to changes in general economic conditions such as levels of employment, consumer confidence and income, availability of financing for acquisitions, construction and permanent mortgages, interest rate levels, inflation, in-migration trends and demand for housing. For example, California, where many of our projects are located, underwent a significant recession in the early 1990s that affected demand for our homes. Furthermore, demand for our homes decreased in the fourth quarter of 2001 partially as a result of the tragic events of September 11, 2001. Should current economic and business conditions decline, demand for our homes could be significantly affected. An important segment of our customer base consists of move-up buyers, who often purchase homes subject to contingencies related to the sale of their existing homes. The difficulties facing these buyers in selling their homes during recessionary periods may adversely affect our sales. Moreover, during such periods, we may need to reduce our sales prices and offer greater incentives to buyers to compete for sales that may result in reduced margins. Increases in the rate of inflation could adversely affect our margins by increasing our costs and expenses. In times of high inflation, demand for housing may decline and we may be unable to recover our increased costs through higher sales.

Fluctuations in real estate values may require us to write-down the book value of our real estate assets.

The homebuilding industry is subject to significant variability and fluctuations in real estate values. As a result, we may be required to write-down the book value of our real estate assets in accordance with generally accepted accounting principles, and some of those write-downs could be material. Any material write-downs of assets could have a material adverse effect on our financial condition and earnings.

Interest rates and the unavailability of mortgage financing can adversely affect demand for our homes.

In general, housing demand is adversely affected by increases in interest rates and housing costs and the unavailability of mortgage financing. Most of our buyers finance their home purchases through third-party lenders providing mortgage financing. If mortgage interest rates increase and, consequently, the ability of prospective buyers to finance home purchases is adversely affected, home sales, gross margins and cash flow may also be adversely affected and the impact may be material. Our homebuilding activities also depend upon the availability and costs of mortgage financing for buyers of homes owned by potential customers, as those customers (move-up buyers) often need to sell their existing residences before they purchase our homes. Any reduction of financing availability could adversely affect home sales.

Changes in federal income tax laws may also affect demand for new homes. Various proposals have been publicly discussed to limit mortgage interest deductions and to limit the exclusion of gain from the sale of a principal residence. Enactment of such proposals may have an adverse effect on the homebuilding

8

Risk factors

industry in general. No meaningful prediction can be made as to whether any such proposals will be enacted and, if enacted, the particular form such laws would take.

We face potentially substantial inventory risk.

We must continuously acquire land for replacement and expansion of land inventory within our current markets. The risks inherent in purchasing and developing land increase as consumer demand for housing decreases. Thus, we may have bought and developed land on which we cannot profitably build and sell homes. The market value of land, building lots and housing inventories can fluctuate significantly as a result of changing market conditions. We cannot assure you that the measures we employ to manage inventory risks will be successful.

In addition, inventory carrying costs can be significant and can result in losses in a poorly performing project or market. In the event of significant changes in economic or market conditions, we may have to sell homes at significantly low margins or at a loss.

Our financial position, future results and prospects may be adversely affected by a variety of risks, many of which are beyond our control.

As a homebuilder, we are subject to numerous risks, many of which are beyond our control, including: adverse weather conditions such as droughts, floods, or wildfires, which could damage our projects, cause delays in completion of our projects, or reduce consumer demand for our projects; shortages in labor or materials, which could delay completion of our projects and cause increases in the prices that we pay for labor or materials, thereby affecting our sales and profitability; and landslides, soil subsidence, earthquakes and other geologic events, which could damage our projects, cause delays in the completion of our projects or reduce consumer demand for our projects. Many of our projects are located in California, which has experienced significant earthquake activity. In addition to directly damaging our projects, earthquakes or other geologic events could damage roads and highways providing access to those projects, thereby adversely affecting our ability to market homes in those areas and possibly increasing the costs of completion.

There are some risks of loss for which we may be unable to purchase insurance coverage. For example, losses associated with landslides, earthquakes and other geologic events may not be insurable and other losses, such as those arising from terrorism, may not be economically insurable. A sizeable uninsured loss could adversely affect our business, results of operations and financial condition, which could adversely affect the value of the notes or our ability to service the notes.

Our geographic concentration would adversely affect us if the homebuilding industry in our current markets should decline.

We presently conduct all of our business in five geographical areas: Southern California, San Diego, Northern California, Arizona and Nevada. For 2002, approximately 75% of our home closings were derived from our California operations. Because our operations are concentrated in these geographic areas, a prolonged economic downturn in these markets could have a material adverse effect on our business, results of operations, and financial condition, which could adversely affect the value of the notes or our ability to service the notes. There can be no assurance that home sale prices in these areas will not decline in the future.

We may not be able to compete effectively against our competitors in the homebuilding industry.

The homebuilding industry is highly competitive. Homebuilders compete for, among other things, desirable properties, financing, raw materials and skilled labor. We compete both with large

9

Risk factors

homebuilding companies, some of which have greater financial, marketing and sales resources than we, and with smaller local builders. The consolidation of some homebuilding companies may create competitors that have greater financial, marketing and sales resources than we and thus are able to compete more effectively against us. In addition, there may be new entrants in the markets in which we currently conduct business. We also compete for sales with individual resales of existing homes and with available rental housing.

Our operating results are variable, which may cause the value of the notes to decline.

We have historically experienced, and in the future expect to continue to experience, variability in our operating results on a quarterly and an annual basis. Factors expected to contribute to this variability include, among other things:

| Ø | | the timing of land acquisitions and zoning and other regulatory approvals; |

| Ø | | the timing of home closings, land sales and level of sales; |

| Ø | | our ability to continue to acquire additional land or options thereon at acceptable terms; |

| Ø | | the condition of the real estate market and the general economy; |

| Ø | | delays in construction due to acts of God, adverse weather, reduced subcontractor availability, and strikes; |

| Ø | | changes in prevailing interests rates and the availability of mortgage financing; and |

| Ø | | costs of material and labor. |

Many of the factors affecting our results are beyond our control and may be difficult to predict. Fluctuations in our results may cause the value of the notes to decline.

Difficulty in obtaining sufficient capital could result in increased costs and delays in completion of projects.

The homebuilding industry is capital intensive and requires significant up-front expenditures to acquire land and begin development. Land acquisition, development and construction activities may be adversely affected by any shortage or increased cost of financing or the unwillingness of third parties to engage in joint ventures with us. Any difficulty in obtaining sufficient capital for planned development expenditures could cause project delays and any such delay could result in cost increases and may adversely affect future results of operations and cash flows.

Our success depends on key executive officers and personnel.

Our success is dependent upon the efforts and abilities of our executive officers and other key employees, many of whom have significant experience in the homebuilding industry and in our regional markets. The loss of the services of any of these executives or key personnel, for any reason, could have a material adverse effect upon our business, operating results and financial condition.

Construction defect, soil subsidence and other building-related claims may be asserted against us, and we may be subject to liability for such claims.

California law provides that consumers can seek redress for patent (i.e., observable) defects in new homes within three or four years (depending on the type of claim asserted) from when the defect is discovered or should have been discovered. If the defect is latent (i.e., non-observable), consumers must

10

Risk factors

still seek redress within three or four years from the date when the defect is discovered or should have been discovered, but in no event later than ten years after the date of substantial completion of our work on the construction. Consumers purchasing homes in Arizona and Nevada may also be able to obtain redress under state laws for either patent or latent defects in their new homes. Although we have obtained insurance for construction defect and subsidence claims, there can be no assurance that we will not be liable for damages, the cost of repairs, and/or the expense of litigation surrounding possible claims or that claims will not arise out of uninsurable events, such as landslides or earthquakes, or circumstances not covered by insurance and not subject to effective indemnification agreements with our subcontractors.

Governmental laws and regulations may increase our expenses, limit the number of homes that we can build or delay completion of our projects.

We are subject to numerous local, state, federal and other statutes, ordinances, rules and regulations concerning zoning, development, building design, construction and similar matters which impose restrictive zoning and density requirements in order to limit the number of homes that can eventually be built within the boundaries of a particular area. Projects that are not entitled may be subjected to periodic delays, changes in use, less intensive development or elimination of development in certain specific areas due to government regulations. We may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or “slow-growth” or “no-growth” initiatives that could be implemented in the future in the states in which we operate. Local and state governments also have broad discretion regarding the imposition of development fees for projects in their jurisdiction. Projects for which we have received land use and development entitlements or approvals may still require a variety of other governmental approvals and permits during the development process and can also be impacted adversely by unforeseen health, safety, and welfare issues, which can further delay these projects or prevent their development.

We are subject to environmental laws and regulations, which may increase our costs, limit the areas in which we can build homes and delay completion of our projects.

We are also subject to a variety of local, state, federal and other statutes, ordinances, rules and regulations concerning the environment. The particular environmental laws which apply to any given homebuilding site vary according to the site’s location, its environmental conditions and the present and former uses of the site, as well as adjoining properties. Environmental laws and conditions may result in delays, may cause us to incur substantial compliance and other costs, and can prohibit or severely restrict homebuilding activity in environmentally sensitive regions or areas. Under various environmental laws, current or former owners of real estate, as well as certain other categories of parties, may be required to investigate and clean up hazardous or toxic substances or petroleum product releases, and may be held liable to a governmental entity or to third parties for property damage and for investigation and clean up costs incurred by such parties in connection with the contamination. In addition, in those cases where an endangered species is involved, environmental rules and regulations can result in the elimination of development in identified environmentally sensitive areas.

We may not be able to acquire desirable lots for residential buildout.

Our future growth depends upon our ability to acquire attractive properties for development. There is increasing competition for desirable lots in all of our markets, particularly in California, as the number of properties available for residential development decreases. Shortages in available properties could cause us to incur additional costs to acquire such properties or could limit our future projects and our growth. Our financial position, future results and prospects may be adversely affected if properties at desirable prices and locations are not continually available.

11

Risk factors

Utility shortages or price increases could have an adverse impact on our operations.

In prior years, the areas in which we operate in northern and southern California have experienced power shortages, including mandatory periods without electrical power, as well as significant increases in utility costs. We may incur additional costs and may not be able to complete construction on a timely basis if such power shortages and utility rate increases continue. Furthermore, power shortages and rate increases may adversely affect the regional economies in which we operate, which may reduce demand for our homes. Our operations may be adversely impacted if further rate increases and/or power shortages occur in California or in our other markets.

We depend on the availability and skill of subcontractors.

Substantially all of our construction work is done by subcontractors with us acting as the general contractor. Accordingly, the timing and quality of our construction depends on the availability and skill of our subcontractors. We do not have long-term contractual commitments with our subcontractors or suppliers. However, we generally have been able to obtain sufficient materials and subcontractors during times of material shortages. Although we believe that our relationships with our suppliers and subcontractors are good, there can be no assurance that skilled subcontractors will continue to be available at reasonable rates and in the areas in which we conduct our operations. The inability to contract with skilled subcontractors at reasonable costs on a timely basis could have a material adverse effect on our business and results of operations.

Terrorist attacks or acts of war may seriously harm our business.

Terrorist attacks or acts of war may cause damage or disruption to the economy, our company, our employees, our facilities and our customers, which could impact our revenues, costs and expenses, and financial condition. The terrorist attacks that took place in the United States on September 11, 2001 were unprecedented events that adversely affected our operations in the fourth quarter of 2001. The potential for future terrorist attacks or a war or other hostilities involving the United States has created many economic and political uncertainties, some of which may have additional material adverse affects on our business, results of operations, and financial condition.

An ownership change may have occurred or another event may occur with the result that our ability to use our tax net operating loss carryforwards may have been or will be severely limited.

On November 11, 1999, we implemented transfer restrictions with respect to shares of our stock. In general, these transfer restrictions prohibited, without the prior approval of our board of directors, the direct or indirect sale, transfer, disposition, purchase or acquisition of any of our stock by or to any holder who beneficially owned directly or through attribution 5% or more of our stock; or who, upon the direct or indirect sale, transfer, disposition, purchase or acquisition of any of our stock, would beneficially own directly or through attribution 5% or more of our stock. These transfer restrictions were intended to help reduce, but not eliminate, the risk of unfavorable ownership changes which could have severely limited our use of tax benefits from our tax net operating loss carryforwards for use in offsetting taxable income. At December 31, 2002, we had net operating loss carryforwards for federal tax purposes of approximately $5.2 million, which expire in 2009. In addition, unused recognized built-in losses in the amount of $23.9 million are available to offset future income and expire between 2009 and 2011. The utilization of these losses is limited to $3.2 million of taxable income per year; however, any portion of such permitted amount of the loss utilization that is not used in any year may be carried forward to increase permitted utilization in future years through 2011. It is possible that the tax authorities could take the position that the transfer restrictions did not provide the intended effect or adequate remedies for tax purposes. Thus, transactions could have occurred that would severely limit our ability to have used the tax benefits

12

Risk factors

associated with our net operating loss carryforwards. We learned that one stockholder unknowingly violated the transfer restrictions. The stockholder divested itself of the requisite number of shares in February and March, 2002 so that it was no longer out of compliance with our certificate of incorporation. In addition, further shifts in ownership, under certain circumstances, may reduce the limitation on the use of our remaining losses. Pursuant to our certificate of incorporation, the transfer restrictions terminated on November 11, 2002.

Neither the amount of the net operating loss carryforwards nor the amount of limitation on such carryforwards claimed by us has been audited or otherwise validated by the Internal Revenue Service, and it could challenge either amount that we have calculated. It is possible that legislation or regulations will be adopted that would limit our ability to use the tax benefits associated with our current tax net operating loss carryforwards.

Our principal stockholders are General William Lyon and the William Harwell Lyon Trust, of which William H. Lyon is the sole beneficiary, and their interests may not be aligned with yours.

Over 50% of the outstanding shares of our common stock are beneficially owned by General William Lyon and the William Harwell Lyon Trust, of which his son, William H. Lyon, is the sole beneficiary. As a result of their stock ownership, General William Lyon and the trust control us and have the power to elect all of our directors and approve any action requiring the majority approval of the holders of our equity. General William Lyon and the trust’s interests may not be fully aligned with yours and this could lead to a strategy that is not in your best interests.

We face reduced coverages and increased costs of insurance.

Recently, lawsuits have been filed against builders asserting claims of personal injury and property damage caused by the presence of mold in residential dwellings. Some of these lawsuits have resulted in substantial monetary judgments or settlements against these builders. Our insurance may not cover all of the claims, including personal injury claims, arising from the presence of mold or such coverage may become prohibitively expensive. If we are unable to obtain adequate insurance coverage, a material adverse effect on our business, financial condition and results of operations could result if we are exposed to claims arising from the presence of mold in the homes that we sell.

Partially as a result of the September 11 terrorist attacks, the cost of insurance has risen, deductibles and retentions have increased and the availability of insurance has diminished. Significant increases in our cost of insurance coverage or significant limitations on coverage could have a material adverse effect on our business, financial condition and results of operations.

RISKS ASSOCIATED WITH THE NOTES AND THE OFFERING

Our substantial level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations on the notes.

As of December 31, 2002, on a pro forma basis, we would have had$273.9 million of indebtedness. In addition, subject to restrictions in the indenture for the notes, we may incur substantial additional indebtedness. The high level of our indebtedness could have important consequences to you, including the following:

| Ø | | our ability to obtain additional financing for working capital, land acquisition costs, building costs, other capital expenditures, or general corporate purposes may be impaired; |

13

Risk factors

| Ø | | we will need to use a substantial portion of our cash flow from operations to pay interest and principal on the notes and other indebtedness, which will reduce the funds available to us for other purposes; |

| Ø | | we will have a higher level of indebtedness than some of our competitors, which may put us at a competitive disadvantage and reduce our flexibility in planning for, or responding to, changing conditions in our industry, including increased competition; and |

| Ø | | we will be more vulnerable to economic downturns and adverse developments in our business. |

We expect to obtain the money to pay our expenses and to pay the principal and interest on the notes, our other indebtedness and other debt from cash flow from our operations. Our ability to meet our expenses thus depends on our future performance, which will be affected by financial, business, economic and other factors. We will not be able to control many of these factors, such as economic conditions in the markets where we operate and pressure from competitors. We cannot be certain that our cash flow will be sufficient to allow us to pay principal and interest on our debt, including the notes, support our operations, and meet our other obligations. If we do not have enough money, we may be required to refinance all or part of our existing debt, including the notes, sell assets or borrow more money. We cannot guarantee that we will be able to do so on terms acceptable to us, if at all. In addition, the terms of existing or future debt agreements, including our credit facilities and the indenture, may restrict us from pursuing any of these alternatives.

California Lyon is the general partner in our unconsolidated partnership joint ventures and may be liable for joint venture obligations.

At December 31, 2002, eleven of our active joint ventures were organized as limited partnerships. California Lyon is the general partner in each of these and may serve as the general partner in future joint ventures. As a general partner, California Lyon may be liable for a joint venture’s liabilities and obligations should the joint venture fail or be unable to pay these liabilities or obligations. As of December 31, 2002, these joint ventures had $90.1 million of outstanding indebtedness. In addition, Delaware Lyon has provided unsecured environmental indemnities to some of the lenders who provide loans to the partnerships. Delaware Lyon has also provided completion guarantees and repayment guarantees for some of the limited partnerships under their credit facilities. The repayment guarantees only become effective upon repayment of our outstanding 12 1/2% Senior Notes. We anticipate that the lender who holds these repayment guarantees will terminate them prior to consummation of this offering.

We may be obligated in connection with guarantees provided by California Lyon.

In January, 2003 California Lyon and two unaffiliated parties formed a limited liability company (“Development LLC”) for the purpose of acquiring land in Irvine and Tustin, California (formerly part of the Tustin Marine Corps Air Station) and developing the land into residential homesites. California Lyon has an indirect, minority interest in the Development LLC. Under specified conditions, California Lyon or an affiliate will be obligated to purchase from the Development LLC approximately 50% in value of the developed lots. In order to secure such obligations, California Lyon has posted a letter of credit equal to approximately $5 million. The letter of credit also secures the Development LLC’s repayment obligations under a $35 million revolving line of credit, under which the Development LLC had outstanding indebtedness of approximately $30.6 million at January 31, 2003. California Lyon and the other indirect and direct members of the Development LLC, including certain affiliates and parents of such other members, further (i) have guaranteed to the bank, under certain circumstances, repayment of the Development LLC’s indebtedness under the line of credit, payment of necessary loan remargining obligations, completion of certain infrastructure improvements to the property, and the Development LLC’s performance under certain environmental covenants and indemnities, and (ii) have entered into a

14

Risk factors

Reimbursement and Indemnity Agreement to allocate any liability arising from these guaranty obligations to the bank, including, the posting and pledge to the bank of the letters of credit by the parties. Delaware Lyon has entered into a joinder agreement to be jointly and severally liable for California Lyon’s obligations under the Reimbursement and Indemnity Agreement. As a result of these agreements and guarantees, Delaware Lyon and California Lyon may be liable in specified circumstances for the full amount of the obligations guaranteed to the bank. California Lyon and Delaware Lyon’s obligations are unsecured obligations, pari passu with their obligations as issuer and a guarantor of the notes. California Lyon and Delaware Lyon may enter into similar guarantees in connection with future land acquisition arrangements. If any such existing or future guarantees are called upon, payment under such guarantees or our inability to make payments under such guarantees may have a material adverse effect on our results of operations.

The notes will be unsecured, and effectively subordinated to our secured indebtedness.

The notes will not be secured. Our credit facilities and construction loans are secured by liens on the real estate under development that is financed by those facilities or loans. If we become insolvent or are liquidated, or if payment under any of our secured indebtedness was accelerated, the holders of our secured indebtedness would be entitled to repayment from their collateral before those assets could be used to satisfy any unsecured claims, including claims under the notes. As a result, the notes will be effectively subordinated to our secured indebtedness to the extent of the value of the assets securing that indebtedness, and the holders of the notes will likely recover ratably less than our secured creditors. As of December 31, 2002, after giving effect to the sale of the notes and the application of the proceeds therefrom as described under “Use of proceeds,” our pro forma secured indebtedness outstanding would have been $5.8 million, and we would have had commitments available to permit us to borrow an additional $147.1 million of secured indebtedness under our credit facilities, as limited by our borrowing base formulas.

The guarantees of our subsidiaries may be avoidable as fraudulent transfers and any new guarantees may be avoidable as preferences.

The notes will be the obligations of California Lyon and will be guaranteed by Delaware Lyon and by all of its existing and certain of its future restricted subsidiaries. The guarantees by subsidiaries may be subject to review under U.S. bankruptcy law and comparable provisions of state fraudulent conveyance laws. Under these laws, if a court were to find that, at the time any subsidiary guarantor issued a guarantee of the notes:

| Ø | | it issued the guarantee to delay, hinder or defraud present or future creditors; or |

| Ø | | it received less than reasonably equivalent value or fair consideration for issuing the guarantee at the time it issued the guarantee and: |

| | Ø | | it was insolvent or rendered insolvent by reason of issuing the guarantee; or |

| | Ø | | it was engaged, or about to engage, in a business or transaction for which its assets constituted unreasonably small capital to carry on its business; or |

| | Ø | | it intended to incur, or believed that it would incur, debts beyond its ability to pay as they mature; |

then the court could avoid the obligations under the guarantee, subordinate the guarantee of the notes to that of the guarantor’s other debt, require holders of the notes to return amounts already paid under that guarantee, or take other action detrimental to holders of the notes and the guarantees of the notes.

The measures of insolvency for purposes of fraudulent transfer laws vary depending upon the law of the jurisdiction that is being applied in any proceeding to determine whether a fraudulent transfer had occurred. Generally, however, a person would be considered insolvent if, at the time it incurred the debt:

| Ø | | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

15

Risk factors

| Ø | | it could not pay its debts as they become due. |

We cannot be sure what standard a court would use to determine whether or not a guarantor was solvent at the relevant time, or, regardless of the standard that the court uses, that the issuance of the guarantee would not be avoided or the guarantee would not be subordinated to the guarantors’ other debt. If such a case were to occur, the guarantee could also be subject to the claim that, since the guarantee was incurred for the benefit of the issuer of the notes, and only indirectly for the benefit of the guarantor, the obligations of the applicable guarantor were incurred for less than fair consideration.

In addition, if we are required to grant additional subsidiary guarantees for the notes at a time in the future when a guarantor was insolvent, those guarantees may also be avoidable as preferences under U.S. bankruptcy law or comparable provisions of state law.

The indenture for the notes imposes significant operating and financial restrictions, which may prevent us from capitalizing on business opportunities and taking some corporate actions.

The indenture for the notes imposes significant operating and financial restrictions on us. These restrictions will limit the ability of us and our subsidiaries, among other things, to:

| Ø | | incur additional indebtedness; |

| Ø | | pay dividends or make other distributions or repurchase or redeem our stock; |

| Ø | | enter into agreements restricting our subsidiaries’ ability to pay dividends; |

| Ø | | enter into transactions with affiliates; and |

| Ø | | consolidate, merge or sell all or substantially all of our assets. |

Our other debt agreements contain additional restrictions. In addition, we may in the future enter into other agreements governing indebtedness which impose yet additional restrictions. We cannot assure you that these restrictions will not adversely affect our ability to finance our future operations or capital needs or to pursue available business opportunities. A breach of any of these covenants could result in a default in respect of the related indebtedness. If a default occurs, the relevant lenders could elect to declare the indebtedness, together with accrued interest and other fees, to be immediately due and payable and proceed against any collateral securing that indebtedness.

We may not be able to satisfy our obligations to holders of the notes upon a change of control.

Upon the occurrence of a “change of control,” as defined in the indenture, each holder of the notes will have the right to require us to purchase the notes at a price equal to 101% of the principal amount, together with any accrued and unpaid interest, to the date of purchase. Our failure to purchase, or give notice of purchase of, the notes would be a default under the indenture, which could in turn be a default under our other indebtedness. In addition, a change of control may constitute an event of default under our credit facilities. A default under our credit facilities could result in an event of default under the indenture if the lenders accelerate the debt under our credit facilities.

16

Risk factors

If this event occurs, we may not have enough assets to satisfy all obligations under the indenture and our other indebtedness. In order to satisfy our obligations, we could seek to refinance the indebtedness under the notes and our other indebtedness or obtain a waiver from the holders of our indebtedness. We cannot assure you that we would be able to obtain a waiver or refinance our indebtedness on terms acceptable to us, if at all.

There is no established trading market for the notes; and you may not be able to sell them quickly or at the price that you paid.

The notes are a new issue of securities and there is no established trading market for the notes. We intend to apply for the notes to be listed on the New York Stock Exchange.

We cannot assure you that you will be able to sell your notes at a particular time or that the prices that you receive when you sell the notes will be favorable. We also cannot assure you as to the level of liquidity of the trading market for the notes. Future trading prices of the notes will depend on many factors, including our operating performance and financial condition and the market for similar securities.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused volatility in prices. It is possible that the market for the notes will be subject to disruptions. Any disruptions may have a negative effect on noteholders, regardless of our prospects and financial performance.

17

Use of proceeds

We intend to use the gross proceeds of $250.0 million from the offering of the notes to redeem the $70.3 million of our outstanding 12½% Senior Notes, to repay certain other debt, and to pay related fees, commissions and other expenses.

The following sets forth the anticipated uses of the proceeds of this offering (dollars in thousands):

Repayment of revolving credit facilities debt(1) | | $ | 112,267 |

Repayment of construction notes payable(2) | | | 25,218 |

Repayment of purchase money notes payable—land acquisitions(3) | | | 28,861 |

Repayment of unsecured line of credit(4) | | | 5,500 |

Repayment of 12 1/2% Senior Notes due July 1, 2003(5) | | | 70,279 |

Expenses of the offering of the notes | | | 7,875 |

| | |

|

|

| | | $ | 250,000 |

| | |

|

|

| (1) | | Represents amounts to be repaid under our existing revolving credit facilities, which are collateralized by real estate inventories. These facilities bear interest at varying rates from LIBOR plus 2.40% to the prime rate plus 0.375% (weighted-average rate of 4.331% at December 31, 2002), and mature, in each case, upon the earlier of the sale of the financed home or the termination of the facilities, with the facilities maturing on varying dates from June 13, 2003 to September 24, 2006. |

| (2) | | Represents amounts outstanding under various construction notes payable, which are collateralized by real estate inventories. These notes bear interest at varying rates from the prime rate plus 0.25% to 14% (weighted-average rate of 5.206% at December 31, 2002) and mature upon the earliest of (i) the completion of the development of the lots, (ii) the sale of the financed home or (iii) the maturity of the notes payable, with the notes maturing on varying dates from March 5, 2003 to June 11, 2004. |

| (3) | | Represents amounts outstanding under various purchase money notes payable, which are collateralized by real estate inventories. These notes bear interest at varying rates from the prime rate plus 2% to 12.50% (weighted-average rate of 8.896% at December 31, 2002) and mature at varying dates from September 1, 2003 to July 1, 2005. |

| (4) | | Represents amount outstanding under an unsecured line of credit which bears interest at the prime rate plus 1% (5.25% at December 31, 2002) and matures on June 30, 2003. |

| (5) | | Represents amount outstanding under our 12 1/2% Senior Notes due July 1, 2003. The amounts outstanding which will be repaid from the proceeds of this offering include the following: (i) $30.0 million owned by General William Lyon, our Chairman and Chief Executive Officer, and a trust for which his son, William H. Lyon is the sole beneficiary; (ii) $2.32 million owned by Wade H. Cable, our President and Chief Operating Officer; and (iii) $1.0 million owned by William H. McFarland, a member of our Board of Directors. |

18

Capitalization

The following table sets forth (1) our capitalization as of December 31, 2002 and (2) our capitalization as of December 31, 2002 after giving effect to the sale of the notes and the application of the proceeds therefrom as described under “Use of proceeds.”

| | | December 31, 2002

|

| | | Actual | | As Adjusted |

|

| | | (dollars in thousands) |

Cash and cash equivalents | | $ | 16,694 | | $ | 16,694 |

| | |

|

| |

|

|

|

Debt: | | | | | | |

Revolving credit facilities | | $ | 118,068 | | $ | 5,801 |

Construction notes payable | | | 25,218 | | | — |

Purchase money notes payable—land acquisitions | | | 28,861 | | | — |

Unsecured line of credit | | | 5,500 | | | — |

12 1/2% Senior Notes due 2003 | | | 70,279 | | | — |

Senior Notes offered hereby | | | — | | | 250,000 |

| | |

|

| |

|

|

Total homebuilding debt | | | 247,926 | | | 255,801 |