Table of Contents

Prospectus Supplement to Prospectus, dated June 18, 2003

$1,343,121,000

SLM Private Credit Student Loan Trust 2003-B

Issuer

SLM Education Credit Funding LLC

Depositor

Sallie Mae Servicing L.P.

Servicer

Student Loan-Backed Notes

On June 27, 2003, the trust will issue:

| Class A Notes | ||||||||||||

| Class A-1 Notes | Class A-2 Notes | Class A-3 Notes | Class A-4 Notes | Class B Notes | Class C Notes | |||||||

Principal | $580,000,000 | $440,506,000 | $109,000,000 | $109,000,000 | $43,871,000 | $60,744,000 | ||||||

Interest Rate | 3-month LIBOR plus 0.10% | 3-month LIBOR plus 0.40% | Auction | Auction | 3-month LIBOR plus 0.70% | 3-month LIBOR plus 1.60% | ||||||

Maturity | September 15, 2017 | March 15, 2022 | March 15, 2033 | March 15, 2033 | March 15, 2033 | March 15, 2033 | ||||||

The trust will make payments primarily from collections on a pool of private credit student loans. Private credit student loans are education loans to students or parents of students that are not guaranteed or reinsured under the Federal Family Education Loan Program or any other federal student loan program.

Credit enhancement will include overcollateralization, cash on deposit in a reserve account and, for the class A notes, the subordination of the class B and class C notes and, for the class B notes, the subordination of the class C notes, as described in this prospectus supplement. The trust will also enter into one or more basis swaps and an interest rate cap and will make a deposit into a cash capitalization account, which will be available for a limited period of time.

We are offering the notes through the underwriters at the prices shown below, when and if issued. We have applied for a listing of the floating rate notes on the Luxembourg Stock Exchange.

| You should consider carefully the risk factors beginning on page S-22 of this supplement and on page 20 of the prospectus.

The notes are asset-backed

The notes are not guaranteed | Price to Public | Underwriting Discount | Proceeds to the Depositor | ||||||||||

Per Class A-1 Note | 100.00000 | % | 0.30 | % | 99.70000 | % | |||||||

Per Class A-2 Note | 100.00000 | % | 0.40 | % | 99.60000 | % | |||||||

Per Class A-3 Note | 100.00000 | % | 0.25 | % | 99.75000 | % | |||||||

Per Class A-4 Note | 100.00000 | % | 0.25 | % | 99.75000 | % | |||||||

Per Class B Note | 100.00000 | % | 0.50 | % | 99.50000 | % | |||||||

Per Class C Note | 99.47476 | % | 0.75 | % | 98.72476 | % | |||||||

We expect the proceeds to the depositor to be $1,338,079,989 before deducting expenses payable by the depositor estimated to be $1,229,666.

Neither the SEC nor any state securities commission has approved or disapproved the securities or determined whether this supplement or the prospectus is accurate or complete. Any contrary representation is a criminal offense.

Joint Book-Runners

Citigroup Deutsche Bank Securities Merrill Lynch & Co.

June 18, 2003 | |||||||||||||

Table of Contents

Prospectus Supplement

| Page | ||

The Information in this Prospectus Supplement and the Accompanying Prospectus | S-3 | |

| S-4 | ||

· Issuer | S-4 | |

| S-4 | ||

· Dates | S-4 | |

| S-5 | ||

| S-5 | ||

| S-6 | ||

| S-6 | ||

| S-9 | ||

| S-9 | ||

· Trustee | S-9 | |

| S-9 | ||

| S-9 | ||

| S-9 | ||

| S-10 | ||

| S-10 | ||

| S-10 | ||

| S-13 | ||

| S-13 | ||

| S-15 | ||

| S-15 | ||

| S-16 | ||

| S-16 | ||

| S-17 | ||

| S-17 | ||

| S-17 | ||

| S-18 | ||

| S-19 | ||

| S-20 | ||

| S-20 | ||

| S-20 | ||

| S-21 | ||

| S-21 | ||

| S-21 | ||

| S-21 | ||

| S-21 | ||

| Risk Factors | S-22 | |

| S-22 | ||

· TheTrust Will Not Have The Benefit of Any Guarantees or Insurance on the Trust Student Loans | S-23 | |

· Your Notes Will Have Basis Risk and the Swap Agreements Do Not Eliminate All of This Basis Risk | S-24 | |

· Failure to Pay Interest on the Subordinated Classes of Notes is Not an Event of Default | S-25 |

| Page | ||

| S-25 | ||

| S-26 | ||

· Risk of Bankruptcy Discharge of Private Credit Student Loans | S-26 | |

| S-26 | ||

| S-27 | ||

| S-28 | ||

| S-28 | ||

S-28 | ||

S-29 | ||

S-29 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | S-30 | |

| S-30 | ||

| S-30 | ||

| S-30 | ||

| S-30 | ||

| S-45 | ||

| S-45 | ||

| S-46 | ||

| S-46 | ||

| S-46 | ||

| S-47 | ||

| S-48 | ||

| S-48 | ||

| S-51 | ||

| S-52 | ||

| S-55 | ||

Priority of Payments Following Certain Events of Default Under the Indenture | S-57 | |

| S-58 | ||

| S-58 | ||

| S-59 | ||

| S-61 | ||

| S-61 | ||

| S-61 | ||

| S-66 | ||

| U.S. Federal Income Tax Consequences | S-70 | |

| S-70 | ||

| S-72 | ||

| S-73 | ||

| S-74 | ||

| S-77 | ||

| S-78 | ||

| S-78 | ||

| S-79 |

S-2

Table of Contents

TABLE OF CONTENTS

Prospectus

Page | ||

Prospectus Summary | 7 | |

Risk Factors | 20 | |

Formation of the Trusts | 33 | |

Use of Proceeds | 34 | |

The Depositor, the Sellers, the Servicer and the Administrator | 34 | |

The Student Loan Pools | 40 | |

Transfer and Servicing Agreements | 44 | |

Servicing and Administration | 47 | |

Trading Information | 56 | |

Description of the Notes | 59 | |

Description of the Certificates | 65 | |

Certain Information Regarding the Securities | 66 | |

Certain Legal Aspects of the Student Loans | 73 | |

U.S. Federal Income Tax Consequences | 76 | |

State Tax Consequences | 82 | |

ERISA Considerations | 83 |

Page | ||

Available Information | 85 | |

Reports to Securityholders | 86 | |

Incorporation of Certain Documents by Reference | 86 | |

The Plan of Distribution | 87 | |

Legal Matters | 88 | |

Appendix A: Federal Family Education Loan Program | A-1 | |

Appendix B: Signature Education Loan® Program | B-1 | |

Appendix C: LAWLOANS® Program | C-1 | |

Appendix D: MBALoans® Program | D-1 | |

Appendix E: MEDLOANSSM Program | E-1 | |

Appendix F: Global Clearance, Settlement and Tax Documentation Procedures | F-1 |

THE INFORMATION IN THIS PROSPECTUS SUPPLEMENT

AND THE ACCOMPANYING PROSPECTUS

We provide information to you about the notes in two separate sections of this document that provide progressively more detailed information. These two sections are:

(a) the accompanying prospectus, which begins after the end of this prospectus supplement and which provides general information, some of which may not apply to your particular class of notes, and

(b) this prospectus supplement, which describes the specific terms of the notes being offered.

For your convenience, we include cross-references in this prospectus supplement and in the prospectus to captions in these materials where you can find related information. The Table of Contents on pages S-2 and S-3 provide the pages on which you can find these captions.

The notes may not be offered or sold to persons in the United Kingdom in a transaction that results in an offer to the public within the meaning of the securities laws of the United Kingdom.

We have applied for a listing of the floating rate notes on the Luxembourg Stock Exchange. We cannot assure you that the application will be granted. You should consult with The Bank of New York (Luxembourg) S.A., the Luxembourg listing agent for the floating rate notes, to determine their status.

S-3

Table of Contents

This summary highlights selected information about the notes. It does not contain all of the information you might find important in making your investment decision. It provides only an overview to aid your understanding. You should read the full description of the information appearing elsewhere in this document and in the prospectus.

SLM Private Credit Student Loan Trust 2003-B.

The trust is issuing the following securities:

The Notes:

The trust will issue the following classes of notes:

| · | Floating Rate Class A-1 Student Loan-Backed Notes in the amount of $580,000,000; |

| · | Floating Rate Class A-2 Student Loan-Backed Notes in the amount of $440,506,000; |

| · | Auction Rate Class A-3 Student Loan-Backed Notes in the amount of $109,000,000; |

| · | Auction Rate Class A-4 Student Loan-Backed Notes in the amount of $109,000,000; |

| · | Floating Rate Class B Student Loan-Backed Notes in the amount of $43,871,000; and |

| · | Floating Rate Class C Student Loan-Backed Notes in the amount of $60,744,000. |

The floating rate notes consist of the class A-1, class A-2, class B and classC notes. The auction rate notes consist of the class A-3 and class A-4 notes.

The Certificates:

The trust will also issue certificates. They are not being offered under this prospectus supplement. We describe them because they are relevant to understanding the notes.

The notes and certificates will receive payments primarily from collections on a pool of trust student loans.

The closing date for this offering will be June 27, 2003.

The cutoff date for the pool of trust student loans was May 12, 2003.

A distribution date for the floating rate notes is the 15th of each March, June, September and December, beginning in September 2003. If any March 15, June 15, September 15 or December 15 is not a business day, the distribution date will be the next business day. We sometimes refer to these distribution dates as quarterly distribution dates.

A distribution date for a class of auction rate notes is (a) the business day following the end of each auction period for that class of auction rate notes and

S-4

Table of Contents

(b) for a class of auction rate notes with an auction period in excess of 90 days, in addition to the days referred to in clause (a), the quarterly distribution dates referred to above. We sometimes refer to a distribution date for auction rate notes as an auction rate distribution date.

Interest and principal will be payable to holders of record as of the close of business on the record date, which is:

| · | for the floating rate notes, the day before the related distribution date and |

| · | for the auction rate notes, |

| · | for payments of interest at the applicable interest rate and for payments of principal, two business days before the related distribution date, and |

| · | for payments of carry-over amounts and interest accrued thereon, the record date relating to the distribution date for which the carry-over amount accrued. |

The notes are debt obligations of the trust.

Interest will accrue generally on the principal balance of the floating rate notes during three-month accrual periods and will be paid on quarterly distribution dates.

An accrual period for the floating rate notes begins on a quarterly distributiondate and ends on the day before the next quarterly distribution date. The first accrual period for the floating rate notes, however, will begin on the closing date and end on September 14, 2003, the day before the first quarterly distribution date.

Interest Rates. The floating rate notes will bear interest at the annual rates listed below:

| · | The class A-1 rate will be three-month LIBOR (except for the first accrual period) plus 0.10%; |

| · | The class A-2 rate will be three-month LIBOR (except for the first accrual period) plus 0.40%; |

| · | The class B rate will be three-month LIBOR (except for the first accrual period) plus 0.70%; and |

| · | The class C rate will be three-month LIBOR (except for the first accrual period) plus 1.60%. |

For the floating rate notes, LIBOR for the first accrual period will be determined by the following formula:

x + [19/33* (y-x)]

where

x = two-month LIBOR, and

y = three-month LIBOR.

The administrator will determine LIBOR on the second business day before the start of the applicable accrual period. The administrator will calculate interest for the floating rate notes based on the actual number of days elapsed in each accrual period divided by 360.

S-5

Table of Contents

Interest will accrue generally on the principal balance of the auction rate notes during the related accrual period and will be paid on the related distribution date.

An accrual period for a class of auction rate notes begins on a distribution date for that class and ends on the day before the next distribution date for that class. The first accrual period for a class of auction rate notes, however, will begin on the closing date and end on the initial auction date for that class.

Interest Rates. The interest rate for each class of auction rate notes is determined at auction. The initial interest rate on the auction rate notes will be determined on the business day before the closing date. The initial auction date and the initial rate adjustment date occurring after the closing date for each class of auction rate notes are set forth below:

Class: | Initial Auction Date | Initial Rate Adjustment Date | ||

A-3 | July 18, 2003 | July 21, 2003 | ||

A-4 | July 23, 2003 | July 24, 2003 |

For each auction period, the interest rate for the auction rate notes will equal the least of:

| · | the rate determined pursuant to the auction procedures described under“Description of the Notes—The Auction Rate Notes”; |

| · | a maximum rate, equal to the least of: |

| · | LIBOR for a period comparable to the auction period plus amargin generally expected to be 1.50%; |

| · | 18%; and |

| · | the maximum rate permitted by law; and |

| · | the auction student loan rate, which is the weighted average interest rate of the trust student loans minus administrative expenses. |

For the auction rate notes, we will calculate interest based on the actual number of days elapsed in each accrual period divided by 360.

After the initial auction period, the period between auctions for the auction rate notes will generally be 28 days, subject to adjustment if the auction period would begin or end on a non-business day. The length of the auction period or the auction date for any class of auction rate notes may change as described under“Description of the Notes—The Auction Rate Notes.”

If, on the first day of any auction period, a payment default on the auction rate notes has occurred and is continuing, the rate for the accrual period will be the non-payment rate, which is one-month LIBOR plus 1.50%.

If in any auction all the auction rate notes subject to the auction are subject to hold orders, the interest rate for that accrual period will equal the all-hold rate, which is the LIBOR rate for a period comparable to the auction period less 0.20%.

Interest Payments. Interest accrued on the outstanding principal balance of the

S-6

Table of Contents

notes during each accrual period will be payable on the related distribution date.

Principal Payments. Principal will be payable or allocable to the notes on each quarterly distribution date in an amount generally equal to the principal distribution amount for that quarterly distribution date. Principal will not be paid to a class of auction rate notes on a quarterly distribution date unless it is also a distribution date for that class. Instead, principal will be allocable to the applicable class. Principal allocable but not payable to the auction rate notes on a quarterly distribution date will be set aside in the future distribution account and then paid on the applicable auction rate distribution date.

Unless the principal balances of the class A-1, class A-2, class A-3 and class A-4 notes have been reduced to zero, the class B and class C notes will not be entitled to any payments of principal until the June 2008 quarterly distribution date or during any period thereafter in which cumulative realized losses on the trust student loans exceed specified levels. During these periods, principal will be paid or allocated only to the class A-1 notes until their balance is reduced to zero, then to the class A-2 notes until their balance is reduced to zero and then, pro rata, in lots of $50,000, to the class A-3 and class A-4 notes until their balance is reduced to zero.

In general, on and after the June 2008 quarterly distribution date and so long as cumulative realized losses on the trust student loans do not exceed specified levels, principal on the notes will be paidor allocated sequentially on each quarterly distribution date:

| · | first, to the class A-1 notes until their share of the principal distribution amount is paid in full; |

| · | second, to the class A-2 notes until their share of the principal distribution amount is paid in full; |

| · | third, pro rata in lots of $50,000, to the class A-3 and class A-4 notes until their share of the principal distribution amount is paid in full; |

| · | fourth, to the class B notes until their share of the principal distribution amount is paid in full; and |

| · | fifth, to the class C notes until their share of the principal distribution amount is paid in full. |

On each quarterly distribution date described in the preceding paragraph, the class A, class B and class C notes generally will be allocated a share of the principal distribution amount sufficient to cause the class A, class B and class C notes, as applicable, to equal specified percentages of the asset balance.

See “Description of the Notes—Distributions” and “—Principal Distributions.”

Maturity Dates.

| · | The class A-1 notes will mature no later than September 15, 2017; |

| · | The class A-2 notes will mature no later than March 15, 2022; |

S-7

Table of Contents

| · | The class A-3 and class A-4 notes will mature no later than March 15, 2033; |

| · | The class B notes will mature no later than March 15, 2033; and |

| · | The class C notes will mature no later than March 15, 2033. |

The actual maturity of the notes could occur earlier if, for example:

| · | there are prepayments on the trust student loans; |

| · | the servicer exercises its option to purchase delinquent trust student loans; |

| · | the servicer exercises its option to purchase all remaining trust student loans; or |

| · | the indenture trustee auctions all remaining trust student loans (which, absent an event of default under the indenture, will not occur until the pool balance is 10% or less of the initial pool balance). |

Denominations. The floating rate notes will be available for purchase in multiples of $1,000. The auction rate notes will be available for purchase in multiples of $50,000. The notes will be available only in DTC book-entry form through The Depository Trust Company, Clearstream, Luxembourg and the Euroclear System. You will not receive a certificate representing your notes except in very limited circumstances.

Security for the Notes. The notes will be secured by the assets of the trust, primarily the trust student loans.

Subordination of the Class B and Class C Notes.

| · | Payments of interest on the class B notes will be subordinate to the payment of interest on the class A notes and, in some circumstances, to payments of principal. |

| · | Payments of principal on the class B notes will be subordinate to the payment of both interest and principal on the class A notes. |

| · | Payments of interest on the class C notes will be subordinate to the payment of interest on the class A and class B notes and, in some circumstances, to payments of principal. |

| · | Payments of principal on the class C notes will be subordinate to the payment of both interest and principal on the class A and class B notes. |

See “Description of the Notes—Credit Enhancement—Subordination” and “—Priority of the Notes.”

Overcollateralization. On the closing date, the asset balance of the trust (which does not give effect to the reserve account described below) will be approximately 100.50% of the aggregate balance of the notes. Over-collateralization is intended to provide

S-8

Table of Contents

credit enhancement for the notes. The amount of overcollateralization will vary from time to time depending on the rate and timing of principal payments on the trust student loans, capitalization of interest and of certain insurance fees and the incurrence of losses on the trust student loans. In general, overcollateralization will not exceed the specified overcollateralization amount.See “Description of the Notes—Credit Enhancement—Overcollateralization.’’

INFORMATION ABOUT THE CERTIFICATES

The certificates are not being offered by this prospectus supplement. Any description of the certificates in this prospectus supplement is for informational purposes only.

The certificates represent ownership interests in the trust. The certificates will not bear interest and will not have a principal balance.

Distributions on the Certificates. In general, distributions on the certificates will be made only after all of the notes have received or been allocated allamounts due or allocable on a quarterly distribution date.See “Description of the Notes—Distributions” and“—Principal Distributions.”

Subordination of the Certificates.

Distributions on the certificates will be subordinate to the payment of both interest and principal on the notes and all other amounts payable or allocable by the trust on a quarterly distribution date.See “Description of the Notes—Distributions” and“—Credit Enhancement.”

The trust will issue the notes under an indenture to be dated as of June 1, 2003.

Under the indenture, JPMorgan Chase Bank will act as indenture trustee for the benefit of and to protect the interests of the noteholders and will act as paying agent for the notes.

The trust will be created under a trust agreement to be dated as of June 1, 2003. Chase Manhattan Bank USA, National Association will be the trustee under the trust agreement.

The Bank of New York will act as auction agent with respect to the auction rate notes.

As long as the rules of the Luxembourg Stock Exchange require a Luxembourg paying agent, the depositor will cause a paying agent to be appointed. Initially, The Bank of New York (Luxembourg) S.A. will act as the Luxembourg paying agent with respect to the floating rate notes listed on the Luxembourg Stock Exchange.

Sallie Mae, Inc., a Delaware corporation and wholly owned subsidiary of SLM

S-9

Table of Contents

Corporation, will act as the administrator of the trust under an administration agreement. Under some circumstances, Sallie Mae, Inc. may transfer its obligations as administrator. See “Servicing and Administration—Administration Agreement” in the prospectus.

The trust will be a Delaware statutory trust.

The only activities of the trust will be acquiring, owning and managing the trust student loans and the other assets of the trust, issuing and making payments on the securities and other related activities. See “Formation of the Trust—The Trust.”

SLM Education Credit Funding LLC, as depositor, after acquiring the student loans from SLM Education Credit Management Corporation under a purchase agreement, will sell them to the trust on the closing date under a sale agreement. The depositor is a wholly owned subsidiary of SLM Education Credit Management Corporation.

The assets of the trust will include:

| · | the trust student loans; the trust student loans consist of private credit student loans, which are education loans made to students or parents ofstudents that arenot guaranteed or reinsured under the Federal Family Education Loan Program, also known as FFELP, or under any other federal student loan program; |

| · | collections and other payments on the trust student loans; |

| · | funds it will hold in its trust accounts, including a collection account, a cash capitalization account, a future distribution account and a reserve account; |

| · | its rights under the swap agreements described under“—Swap Agreements”below; and |

| · | its rights under the interest rate cap agreements described under“—Interest Rate Cap Agreement”below. |

The rest of this section describes the trust student loans and trust accounts more fully.

| · | Trust Student Loans.All of the trust student loans are private credit student loans made to students and parents of students that are not guaranteed or reinsured under FFELP or any other federal student loan program. The loan programs under which these education loans were made and underwritten are the Signature Education Loan® Program, the LAWLOANS® Program, the MBALoans® Program and the MEDLOANSSM Program. They are summarized in Appendices B, C, D and E to the prospectus. |

The trust student loans had an initial pool balance of approximately $1,247,280,318 as of the cutoff date.

S-10

Table of Contents

As of the cutoff date, the weighted average annual interest rate of the trust student loans was approximately 5.05% and their weighted average remaining term to scheduled maturity was approximately 189 months.

SLM Education Credit Management Corporation acquired the trust student loans in the ordinary course of its business from its affiliate, Student Loan Marketing Association. Student Loan Marketing Association purchased the loans from commercial banks that originated the loans.

The trust student loans are insured for the benefit of the lender under surety bonds issued by HEMAR Insurance Company of America, an affiliate of the depositor, also known as HICA.However, the trust will not have the benefit of any guarantees or insurance policies, including the HICA surety bonds. The trust student loans are also not guaranteed, insured or reinsured by the United States or any state-sponsored guarantee agency.

The trust student loans have been selected from the private credit student loans owned by SLM Education Credit Management Corporation or one of its affiliates based on the criteria established by the depositor. The criteria are described in this prospectus supplement.

| · | Collection Account. The administrator will deposit collectionson the trust student loans and any payments received from the swap counterparties described below into the collection account as described in this prospectus supplement and the prospectus. |

| · | Cash Capitalization Account. The administrator will establish and maintain the cash capitalization account in the name of the indenture trustee as an asset of the trust. On the closing date, the trust will make an initial deposit from the net proceeds from the sale of the notes into the cash capitalization account. The deposit will be in cash or eligible investments equal to $102,590,156. |

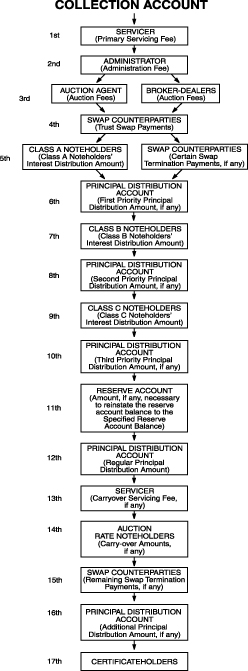

Sallie Mae, Inc., as administrator, will instruct the indenture trustee to withdraw funds on deposit in the cash capitalization account to cover shortfalls, if any, in payments described in items 1st through 10th in the chart on page S-15 of this prospectus supplement. Funds in the cash capitalization account will not be replenished. To the extent funds are available in the cash capitalization account, they will be drawn prior to drawing on the reserve account as described below.

Part of the funds in the cash capitalization account may be released to the collection account starting on the June 2004 quarterly distribution date if certain conditions are met, as described under “Description of the Notes—Cash Capitalization Account.”

S-11

Table of Contents

All remaining funds in the cash capitalization account on the December 2006 quarterly distribution date will be deposited in the collection account and distributed as part of available funds.

The cash capitalization account enhances the likelihood of timely interest payments and certain principal payments to noteholders through the December 2006 quarterly distribution date. Because it will not be replenished, in some circumstances the cash capitalization account could be depleted before that date. This depletion could result in shortfalls in interest and principal distributions to noteholders.

See“Description of the Notes—Cash Capitalization Account.”

| · | Future Distribution Account. The administrator will establish and maintain the future distribution account as an asset of the trust in the name of the indenture trustee. The indenture trustee will deposit specified amounts on deposit in the collection account into the future distribution account as set forth under“—Administration of the Trust.” |

| · | Reserve Account. The administrator will establish and maintain the reserve account as an asset of the trust in the name of the indenture trustee. On the closing date, the trust will make an initial deposit from the net proceeds of the initial sale of the notes into the |

reserve account. The initial deposit will be in cash or eligible investments equal to $3,118,201. Funds in the reserve account may be replenished on each quarterly distribution date by additional funds available after all prior required distributions have been made. The amount required to be on deposit in the reserve account at any time, or the specified reserve account balance, is the lesser of $3,118,201 and the outstanding balance of the notes. See“Description of the Notes—Distributions.”

The administrator will instruct the indenture trustee to withdraw funds from the reserve account to cover (a) shortfalls, if any, in the payments described in items 1st through 5th, 7th and 9th in the chart on page S-15 of this prospectus supplement, to the extent such shortfalls are not covered by amounts on deposit in the cash capitalization account or in the collection account, and (b) items 6th, 8th and 10th on the respective maturity dates of each class of notes, to cover the unpaid principal balance of the maturing class of notes to the extent such principal payment is not covered by amounts on deposit in the cash capitalization account or the collection account.

The reserve account further enhances the likelihood of payment to the noteholders of interest on and, in some limited circumstances, principal of, the notes. In some circumstances, however, the reserve account could be depleted. This

S-12

Table of Contents

depletion could result in shortfalls in distributions to you. |

If the market value of the reserve account on any quarterly distribution date is sufficient, when taken together with amounts on deposit in the collection account, to pay the remaining principal on the notes and the interest accrued on the notes, any payments owing to the swap counterparties and any unpaid primary servicing and administration fees, amounts on deposit in the reserve account will be so applied on that quarterly distribution date.See “Description of the Notes—Credit Enhancement—Reserve Account.”

On or prior to the fifth business day of each month, the administrator will instruct the indenture trustee to make the following allocations on or before the fifteenth calendar day of the same month with funds on deposit in the collection account:

| · | first, deposit into the future distribution account for the servicer and administrator, pro rata, the amounts of the servicing fee and administration fee that will accrue for the related calendar month plus previously accrued and unpaid or set aside amounts; |

| · | second, deposit into the future distribution account, pro rata, for theauction agent and the broker-dealers, an amount equal to their auction fees expected to be payable from the calendar day after the current calendar month’s quarterly distribution date or monthly servicing payment date through the following month’s quarterly distribution date or monthly servicing payment date, as the case may be, plus previously accrued and unpaid or set aside amounts; |

| · | third, deposit into the future distribution account, for the swap counterparties an amount equal to swap payments to the swap counterparties expected to accrue from the calendar day after the current calendar month’s quarterly distribution date or monthly servicing payment date through the following month’s quarterly distribution date or monthly servicing payment date, as the case may be, plus previously accrued and unpaid or set aside amounts net of payments expected to accrue for this period from the swap counterparties; and |

| · | fourth, deposit into the future distribution account, pro rata, for (a) each class of class A notes an amount equal to interest expected to accrue on the class A notes from the calendar day after the current calendar month’s quarterly distribution date or monthly servicing payment date through the following month’s quarterly distribution date or monthly servicing payment date, as the case may be, plus previously accrued and unpaid or set aside amounts and (b) the swap counterparties certain swap termination payments due. |

S-13

Table of Contents

The administrator will instruct the indenture trustee to withdraw funds on deposit in the collection account and the various accounts described below. These funds will be applied monthly to the payment of the primary servicing fee and on each quarterly distribution date generally as shown in the chart on the following page. To the extent a class of auction rate notes does not have a distribution date on a quarterly distribution date, it will not be allocated or paid interest payments on the quarterly distribution date.

On each auction rate distribution date that is not a quarterly distribution date, the indenture trustee will make the following distributions:

| · | first, from amounts deposited in the future distribution account that were allocated to the auction agent and the broker-dealers, and then from amounts on deposit in the collection account, pro rata, to the auction agent and the broker-dealers, the auction fees of the auction agent and the broker-dealers, and |

| · | second, from amounts deposited in the future distribution account that were allocated to the auction rate notes with a distribution date on this auction rate distribution date, and then from amounts on deposit in the collection account, pro rata, to the auction rate notes with a distribution date on this auction rate distribution date, an amount equal to interest payable thereon. |

Amounts on deposit in the future distribution account with respect to principal and carry-over amounts allocated to the auction rate notes will be paid to the auction rate notes on their auction rate distribution dates.

On each quarterly distribution date that is not a distribution date for one or more classes of auction rate notes, in lieu of making payments on that date of principal and carry-over amounts to these classes of auction rate notes, these amounts will be deposited into the future distribution account.

S-14

Table of Contents

A collection period is a three-month period ending on the last day of February, May, August or November, in each case for the quarterly distribution date in the following month. However, the first collection period will be theperiod from the cutoff date through August 31, 2003.

Amounts deposited in the principal distribution account, as shown in the above chart, will be allocated as described under“Description of the Notes —Principal Distributions.”

Transfer of the Assets to the Trust

Under a purchase agreement, the depositor will purchase the trust student loans from SLM Education Credit Management Corporation.

If SLM Education Credit Management Corporation breaches a representation under the purchase agreement regarding a trust student loan, generally it will have to cure the breach, repurchase or replace that trust student loan or reimburse the depositor for losses resulting from the breach.

Under a sale agreement, the depositor will sell the trust student loans to the trust.

If the depositor breaches a representation under the sale agreement regarding a trust student loan, generally it will have to cure the breach, repurchase or replace that trust student loan or reimburse the trust for losses resulting from the breach.

Under a servicing agreement, Sallie Mae Servicing L.P., as servicer, will be responsible for servicing, maintaining custody of and making collections on the trust student loans.

S-15

Table of Contents

The servicer, one of our affiliates, manages and operates the loan servicing functions for the SLM Corporation family of companies.See “Servicing and Administration— Servicing Procedures” and “—Administration Agreement” in the prospectus.The servicer may enter into subservicing arrangements with respect to some or all of its servicing obligations, but these arrangements will not affect the servicer’s obligations to the trust. Under some circumstances, the servicer may transfer its obligations as servicer.See “Servicing and Administration—Certain Matters Regarding the Servicer” in the prospectus.

If the servicer breaches a covenant under the servicing agreement regarding a trust student loan, generally it will have to cure the breach, purchase that trust student loan or reimburse the trust for losses resulting from the breach. See “Servicing and Administration—Servicer Covenants” in the prospectus.

Optional Purchase of Delinquent Loans

The servicer has the option, but not the obligation, to purchase from the trust any trust student loan that becomes 180 or more days delinquent. There can be no assurances that the servicer will exercise its option.

Under the servicing agreement, the servicer will receive two separate fees: a primary servicing fee and a carryover servicing fee.

The primary servicing fee paid on any monthly servicing payment date is equal to1/12th of an amount not to exceed 0.70% of the outstanding principal balance of the trust student loans as of the first day of the preceding calendar month.

The primary servicing fee will be payable in arrears out of amounts on deposit in the collection account, the cash capitalization account, the future distribution account and the reserve account on the 15th of each month or, if the 15th of any month is not a business day, the next business day, beginning July 15, 2003. Fees will include amounts from any prior monthly servicing payment dates that remain unpaid.

The carryover servicing fee will be payable to the servicer on each quarterly distribution date out of available funds remaining after all payments owing on the notes have been made.

The carryover servicing fee is the sum of:

| · | the amount of specified increases in the costs incurred by the servicer; |

| · | the amount of specified conversion, transfer and removal fees; |

| · | any amounts described in the first two bullets that remain unpaid from prior distribution dates; and |

| · | interest on any unpaid amounts. |

See “Description of the Notes—Distributions” and “—Servicing Compensation.”

S-16

Table of Contents

The trust will terminate upon:

| · | the maturity or other liquidation of the last trust student loan and the disposition of any amount received upon its liquidation; and |

| · | the payment of all amounts required to be paid to the holders of the securities. |

See “The Student Loan Pools—Termination” in the prospectus.

Optional Purchase of the Trust Assets

The servicer may purchase or arrange for the purchase of all remaining trust student loans on any quarterly distribution date when the pool balance is 10% or less of the initial pool balance. The servicer’s exercise of this purchase option will result in the early retirement of the remaining notes and the certificates. The purchase price will equal the amount required to repay in full, including all accrued interest, the remaining trust student loans as of the end of the preceding collection period, but not less than the prescribed minimum purchase amount described below plus any amount owing to the swap counterparties.

This prescribed minimum purchase amount is the amount that would be sufficient to:

| · | reduce the outstanding principal amount of each class of notes then outstanding on the related distribution date to zero; |

| · | pay to noteholders the interest payable on the related distribution date; and |

| · | in the case of the auction rate notes, pay any carry-over amounts and interest on any carry-over amounts. |

The indenture trustee is required to offer for sale all remaining trust student loans at the end of the collection period when the pool balance is 10% or less of the initial pool balance. The trust auction date will be the 3rd business day before the related quarterly distribution date. The servicer may exercise its optional purchase right described above at any time until an auction is complete. The depositor and its affiliates, including SLM Education Credit Management Corporation and the servicer, and unrelated third parties may offer bids to purchase the trust student loans on the trust auction date. The depositor or its affiliates may not submit a bid representing greater than fair market value of the trust student loans.

If at least two bids are received, the indenture trustee will solicit and re-solicit new bids from all participating bidders until only one bid remains or the remaining bidders decline to resubmit bids. The indenture trustee will accept the highest of the remaining bids if it equals or exceeds (a) the minimum purchase amount described under “—Optional Purchase of the Trust Assets”above or (b) the fair market value of the trust student loans as of the end of the related collection period, whichever is higher. If at least two bids

S-17

Table of Contents

are not received or the highest bid after the re-solicitation process does not equal or exceed that amount, the indenture trustee will not complete the sale. The indenture trustee may, and at our direction, will be required to, consult with a financial advisor, which could be an underwriter of the notes or the administrator, to determine if the fair market value of the trust student loans has been offered.

The net proceeds of any auction sale will be used to retire any outstanding notes on the related quarterly distribution date.

If the sale is not completed, the indenture trustee may, but will not be under any obligation to, solicit bids for sale of the trust student loans after future collection periods upon terms similar to those described above, including the waiver of the servicer’s option to purchase remaining trust student loans.

If the trust student loans are not sold as described above, on each subsequent quarterly distribution date, the administrator will direct the indenture trustee to distribute, as accelerated payments of note principal, all amounts that would have otherwise been paid to the holder of the certificates. The indenture trustee may or may not succeed in soliciting acceptable bids for the trust student loans either on the trust auction date or subsequently.

The trust will enter into basis swap agreements as of the closing date with Citibank, N.A. and Merrill Lynch Derivative Products AG.

Under the swap agreements, each swap counterparty will pay to the trust, on or before the third business day preceding each quarterly distribution date, its percentage share (50% each) of an amount equal to the product of:

| · | three-month LIBOR (determined as of the same time and in the same manner as for the floating rate notes for the related accrual period); |

| · | the aggregate principal balance, as of the last day of the collection period preceding the related accrual period (or for the initial distribution date, the cutoff date), of the trust student loans bearing interest based upon the prime rate (provided that at no time will such balance exceed the aggregate balance of the notes outstanding as of the end of the first day of the related accrual period); and |

| · | a fraction, the numerator of which is the actual number of days elapsed in the related accrual period and the denominator of which is 360. |

Each swap agreement is scheduled to terminate on the June 2018 quarterly distribution date.

On each quarterly distribution date, each swap counterparty will be paid from the collection account and, if necessary, the cash capitalization account, the future distribution account and the reserve account, prior to interest payments on the class A notes, its percentage share of an amount equal to the product of:

S-18

Table of Contents

| · | the prime rate published inThe Wall Street Journal in the “Credit Markets” section, “Money Rates” table as of the 15th of the immediately preceding December, March, June or September (or ifThe Wall Street Journal is not published on that date, the first preceding day for which that rate is published inThe Wall Street Journal) minus 2.63%; |

| · | the aggregate principal balance, as of the last day of the collection period preceding the related accrual period (or, for the initial distribution date, the cutoff date), of the trust student loans bearing interest based upon the prime rate (provided that at no time will such balance exceed the aggregate balance of the notes outstanding as of the end of the first day of the related accrual period); and |

| · | a fraction, the numerator of which is the actual number of days elapsed in the related accrual period and the denominator of which is 365 or 366, as the case may be. |

See “Description of the Notes—Swap Agreements.”

The trust will enter into an agreement as of the closing date with Merrill Lynch Capital Services, Inc. to purchase an interest rate cap.

On the closing date, the trust will pay the counterparty an upfront payment fromthe net proceeds from the sale of the notes equal to $609,000. Under the interest rate cap agreement, on the third business day before each quarterly distribution date to and including the June 2006 quarterly distribution date, the counterparty will pay to the trust an amount, calculated on a quarterly basis, equal to the product of:

| · | the excess, if any, of: |

| (1) | three-month LIBOR, except for the first accrual period, as determined for the accrual period related to the applicable quarterly distribution date, over |

| (2) | (a) 4.00% for each accrual period related to each quarterly distribution date from and including the September 2003 quarterly distribution date through and including the June 2004 quarterly distribution date, (b) 6.00% for each accrual period related to each quarterly distribution date from and including the September 2004 quarterly distribution date through and including the June 2005 quarterly distribution date and (c) 7.50% for each accrual period related to each quarterly distribution date from and including the September 2005 quarterly distribution date through and including the June 2006 quarterly distribution date; and |

| · | a notional amount equal to $870,000,000. |

S-19

Table of Contents

LIBOR for the first accrual period will be determined using the same formula as applies to the floating rate notes.

See “Description of the Notes—Interest Rate Cap Agreement.”

Subject to important considerations described in the prospectus:

| · | Federal tax counsel for the trust is of the opinion that the notes will be characterized as debt for federal income tax purposes. |

| · | Federal tax counsel is also of the opinion that, for federal income tax purposes, the trust will not be taxable as a corporation. |

| · | In the opinion of Delaware tax counsel for the trust, the same characterizations would apply for Delaware state income tax purposes as for federal income tax purposes. Delaware tax counsel is also of the opinion that holders of the notes who are not otherwise subject to Delaware taxation on income will not become subject to Delaware tax as a result of their ownership of the notes or the certificates. |

See “U.S. Federal Income Tax Consequences” in this prospectus supplement and the prospectus.

Subject to important considerations and conditions described in this prospectus supplement and the prospectus, the notes may, in general, be purchased by or on behalf of an employee benefit plan or other retirement arrangement,including an insurance company general account, only if (a) an exemption from the prohibited transaction provisions of Section 406 of the Employee Retirement Income Security Act of 1974, as amended, and Section 4975 of the Internal Revenue Code of 1986, as amended, applies, so that the purchase and holding of the notes will not result in a non-exempt prohibited transaction and (b) such purchase will not cause a non-exempt violation of any substantially similar federal, state, local or foreign laws. Each fiduciary who purchases any note will be deemed to represent that such an exemption exists and applies to it and that no non-exempt violations of any substantially similar laws will occur.

See “ERISA Considerations” in this prospectus supplement and the prospectus for additional information concerning the application of ERISA.

The notes are required to be rated as follows:

| · | Class A notes: The highest rating category from at least two of Fitch Ratings, Moody’s Investors Service, Inc. and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. |

| · | Class B notes: One of the three highest rating categories from at least two of Fitch, Moody’s or S&P. |

| · | Class C notes: One of the four highest rating categories from at least two of Fitch, Moody’s or S&P. |

See “Ratings of the Securities.”

S-20

Table of Contents

We have applied to the Luxembourg Stock Exchange to list the floating rate notes. We cannot assure you that the application will be granted. You should consult with The Bank of New York (Luxembourg) S.A., the Luxembourg listing agent for the floating rate notes, to determine their status. You can contact the listing agent at Aerogolf Centre, 1A, Hoehenhofz

L-1736, Senningerberg, Luxembourg.

The floating rate notes have been accepted for clearance and settlement by Clearstream, Luxembourg and Euroclear.

Some of the factors you should consider before making an investment in these notes are described in this prospectus supplement and in the prospectus under “Risk Factors.”

| · | Class A-1 notes: 78443C AL8 |

| · | Class A-2 notes: 78443C AM6 |

| · | Class A-3 notes: 78443C AN4 |

| · | Class A-4 notes: 78443C AP9 |

| · | Class B notes: 78443C AQ7 |

| · | Class C notes: 78443C AR5 |

INTERNATIONAL SECURITIES IDENTIFICATION NUMBERS (ISIN)

| · | Class A-1 notes: US78443C AL81 |

| · | Class A-2 notes: US78443C AM64 |

| · | Class A-3 notes: US78443C AN48 |

| · | Class A-4 notes: US78443C AP95 |

| · | Class B notes: US78443C AQ78 |

| · | Class C notes: US78443C AR51 |

| · | Class A-1 notes: 017143719 |

| · | Class A-2 notes: 017143735 |

| · | Class A-3 notes: N/A |

| · | Class A-4 notes: N/A |

| · | Class B notes: 017143930 |

| · | Class C notes: 017143999 |

S-21

Table of Contents

You should carefully consider the following factors in deciding whether to purchase any note. The prospectus describes additional risk factors that you should also consider, beginning on page 20. These risk factors could affect your investment in or return on the notes.

S-22

Table of Contents

S-23

Table of Contents

S-24

Table of Contents

S-25

Table of Contents

S-26

Table of Contents

the auction procedures, interest will be paid on the auction rate notes at the maximum rate even though there may be sufficient available funds to pay interest at the auction rate.

For a distribution date on which the interest rate for a class of auction rate notes is equal to the auction student loan rate, the excess of (a) the lower of (1) the amount of interest at the auction rate determined pursuant to the auction procedures for the auction rate notes and (2) the amount of interest at the maximum auction rate which would have been applied if the auction student loan rate were not a component of the maximum auction rate over (b) the auction student loan rate will become a carry-over amount, and will be allocated to the applicable auction rate notes on succeeding quarterly distribution dates (and paid on the succeedingauction rate distribution date), but only to the extent that there are funds available for that purpose and other conditions are met. It is possible that such carry-over amount may never be paid. Any carry-over amount not paid at the time of redemption of an auction rate note will be extinguished.See “Description of the Notes—The Notes—The Auction Rate Notes—Maximum Auction Rate and Interest Carry-Overs.” | ||

The transaction documents provide that certain actions may be taken based upon receipt by the indenture trustee of confirmation from each of the rating agencies that the outstanding ratings assigned by such rating agencies to the notes will not be impaired by those actions. To the extent those actions are taken after issuance of the notes, investors in the notes will be depending on the evaluation by the rating agencies of those actions and their impact on credit quality. |

S-27

Table of Contents

In later sections, we use a few terms that we define in the Glossary at the end of this prospectus supplement. These terms appear inbold face on their first use and in initial capital letters thereafter.

The SLM Private Credit Student Loan Trust 2003-B will be a statutory trust newly formed under Delaware law and under a trust agreement to be dated as of June 1, 2003 between the depositor and the trustee. After its formation, the trust will not engage in any activity other than:

| · | acquiring, holding and managing the trust student loans and the other assets of the trust and related proceeds; |

| · | issuing the certificates and the notes; |

| · | making payments on them; |

| · | entering into the swap agreements and making the payments required under those agreements; |

| · | entering into the interest rate cap agreement and making the upfront payment required under that agreement; and |

| · | engaging in other activities that are necessary, suitable or convenient to accomplish, or are incidental to, the foregoing. |

The trust was initially capitalized with equity of $100, excluding amounts to be deposited in the reserve account and the cash capitalization account by the trust on the closing date. The trust will use the proceeds from the sale of the notes to make the initial deposits in the cash capitalization account and the reserve account, to make the upfront payment on the interest rate cap agreement and to purchase the trust student loans. It will purchase the trust student loans from the depositor under a sale agreement to be dated as of the closing date between the depositor and the trust. The depositor will use the net proceeds it receives from the sale of the trust student loans to pay to SLM Education Credit Management Corporation the purchase price of the trust student loans acquired from it under a purchase agreement dated as of the closing date.

The property of the trust will consist of:

| (a) | the pool of trust student loans; |

| (b) | all funds collected on trust student loans on or after the cutoff date; |

| (c) | all moneys and investments on deposit in the collection account, the cash capitalization account, the future distribution account and the reserve account; |

| (d) | its rights under the swap agreements and the related documents; and |

| (e) | its rights under the interest rate cap agreement and the related documents. |

S-28

Table of Contents

The notes will be secured by the property of the trust. The collection account, the cash capitalization account, the future distribution account and the reserve account will be maintained in the name of the indenture trustee for the benefit of the noteholders. To facilitate servicing and to minimize administrative burden and expense, the servicer will act as custodian of the promissory notes representing the trust student loans.

The trust’s principal offices are in Newark, Delaware, in care of Chase Manhattan Bank USA, National Association, Christiana Center/OPS4, 500 Stanton Christiana Road, Newark, Delaware 19713, as trustee.

The following table illustrates the capitalization of the trust as of the cutoff date, as if the issuance and sale of the securities had taken place on that date:

Floating Rate Class A-1 Student Loan-Backed Notes | $ | 580,000,000 | |

Floating Rate Class A-2 Student Loan-Backed Notes | 440,506,000 | ||

Auction Rate Class A-3 Student Loan-Backed Notes | 109,000,000 | ||

Auction Rate Class A-4 Student Loan-Backed Notes | 109,000,000 | ||

Floating Rate Class B Student Loan-Backed Notes | 43,871,000 | ||

Floating Rate Class C Student Loan-Backed Notes | 60,744,000 | ||

Overcollateralization | 6,749,474 | ||

Equity | 100 | ||

Total | $ | 1,349,870,574 |

The overcollateralization amount represents the amount by which the initialPool Balanceof the trust student loans plus amounts on deposit in the cash capitalization account exceeds the initial note balance. On the closing date, we will deposit $3,118,201 into the reserve account.

Chase Manhattan Bank USA, National Association is the trustee for the trust under the trust agreement. Chase Manhattan Bank USA, National Association is a national banking association whose principal offices are located at Christiana Center/OPS4, 500 Stanton Christiana Road, Newark, Delaware 19713.

The trustee’s liability in connection with the issuance and sale of the notes is limited solely to the express obligations of the trustee in the trust agreement and the sale agreement.See “Description of the Notes” in this prospectus supplement and “Transfer and Servicing Agreements” in the prospectus.SLM Education Credit Management Corporation and SLM Corporation, its parent, maintain banking relations with the trustee.

S-29

Table of Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Sources of Capital and Liquidity

The trust’s primary sources of capital will be the net proceeds from the sale of the securities.See “Formation of the Trust—Capitalization of the Trust.”

The trust’s primary sources of liquidity will be collections on the trust student loans, as supplemented by payments, if any, from the counterparty with respect to the interest rate cap agreement and the swap counterparties with respect to the swap agreements and amounts on deposit in the reserve account and, through the December 2006 quarterly distribution date, the cash capitalization account.

The trust will be newly formed and, accordingly, has no results of operations as of the date of this prospectus supplement. Because the trust does not have any operating history, we have not included in this prospectus supplement any historical or pro forma ratio of earnings to fixed charges. The earnings on the trust student loans and other assets owned by the trust and the interest costs of the notes will determine the trust’s results of operations in the future. The income generated from the trust’s assets will pay operating costs and expenses of the trust and interest and principal on the notes and distributions to the holders of the certificates. The principal operating expenses of the trust are expected to be, but are not limited to, servicing, administration and auction fees.

The trust will use the net proceeds from the sale of the notes of $1,338,079,989 to make the initial deposits to the cash capitalization account and the reserve account, to purchase the trust student loans from the depositor on the closing date and to make the upfront payment on the interest rate cap agreement. The depositor will, then, use the proceeds paid to it by the trust to pay SLM Education Credit Management Corporation the purchase price for the trust student loans purchased by the depositor. Expenses incurred to establish the trust and to issue the notes (other than commissions that are due to the underwriters) are payable by the depositor.

The trustee, on behalf of the trust, will purchase the pool of trust student loans from us as of May 12, 2003, the cutoff date.

We will purchase the trust student loans from SLM Education Credit Management Corporation under the purchase agreement.

S-30

Table of Contents

The trust student loans were selected by employing several criteria, including requirements that each trust student loan as of the cutoff date:

| · | contains terms in accordance with those required by the loan program under which it was originated, whether the Signature Education Loan Program, the LAWLOANS Program, the MBALoans Program or the MEDLOANS Program, the loan purchase agreements, the HICA surety bonds and other applicable requirements; |

| · | is not more than 60 days past due; and |

| · | does not have a borrower who is noted in the related records of the servicer as being currently involved in a bankruptcy proceeding. |

No trust student loan, as of the cutoff date, was subject to our or any seller’s prior obligation to sell that loan to a third party. No trust student loan, as of the cutoff date, had ever had a claim paid by HEMAR Insurance Company of America, also known as HICA.

For a description of each loan program under which the private credit student loans were originated, see Appendices B, C, D and E to the prospectus.

The following tables provide a description of specified characteristics of the trust student loans as of the cutoff date. The aggregate outstanding principal balance of the trust student loans in each of the following tables includes the principal balance due from borrowers, plus accrued interest of $33,696,137 as of the cutoff date to be capitalized upon commencement of repayment. Percentages and dollar amounts in any table may not total 100% or the trust student loan balance, as applicable, due to rounding.

The distribution by interest rates applicable to the trust student loans on any date following the cutoff date may vary significantly from that in the following tables as a result of variations in the rates of interest applicable to the trust student loans. Moreover, the information below about the remaining terms to maturity of the trust student loans as of the cutoff date may vary significantly from the actual terms to maturity of the trust student loans as a result of defaults or prepayments or of the granting of deferral and forbearance periods.

S-31

Table of Contents

COMPOSITION OF THE TRUST STUDENT LOANS

AS OF THE CUTOFF DATE

Aggregate Outstanding Principal Balance—Treasury Bill | $ | 253,845,947 |

| |

Aggregate Outstanding Principal Balance—Prime | $ | 989,669,707 |

| |

Aggregate Outstanding Principal Balance—Fixed | $ | 3,764,664 |

| |

Number of Borrowers |

| 103,358 |

| |

Average Outstanding Principal Balance Per Borrower | $ | 12,068 |

| |

Number of Loans |

| 143,265 |

| |

Weighted Average Remaining Term to Maturity |

| 189 months |

| |

Weighted Average Annual Interest Rate |

| 5.05 | % | |

Weighted Average Margin—Treasury Bill |

| 3.28 | % | |

Weighted Average Margin—Prime |

| 0.91 | % | |

Weighted Average Annual Borrower Interest Rate—Fixed |

| 10.71 | % |

We determined the weighted average remaining term to maturity shown in the table above from the cutoff date to the stated maturity dates of the trust student loans without giving effect to any deferral or forbearance periods that may be granted in the future.

DISTRIBUTION OF THE TRUST STUDENT LOANS

BY LOAN PROGRAM AS OF THE CUTOFF DATE

Loan Program | Number of Loans | Aggregate Outstanding Principal Balance | Percent of Pool by Outstanding Principal Balance | |||||

Signature Education Loans Program1 | 108,361 | $ | 951,183,050 | 76.3 | % | |||

LAWLOANS Program | 24,043 |

| 177,860,139 | 14.3 |

| |||

MBALoans Program | 3,906 |

| 55,885,315 | 4.5 |

| |||

MEDLOANS Program | 6,955 |

| 62,351,814 | 5.0 |

| |||

Total | 143,265 | $ | 1,247,280,318 | 100.0 | % | |||

1 Includes approximately $37,934,135 of Signature Loans for students attending 2-year institutions.

DISTRIBUTION OF THE TRUST STUDENT LOANS

BY INTEREST RATES AS OF THE CUTOFF DATE

Interest Rates | Number of Loans | Aggregate Outstanding Principal Balance | Percent of Pool by Outstanding Principal Balance | |||||

Less than 4.50% | 43,837 | $ | 423,074,668 | 33.9 | % | |||

4.50% to 5.74% | 70,828 |

| 576,151,387 | 46.2 |

| |||

5.75% to 7.25% | 24,164 |

| 209,337,428 | 16.8 |

| |||

Greater than 7.25% | 4,436 |

| 38,716,835 | 3.1 |

| |||

Total | 143,265 | $ | 1,247,280,318 | 100.0 | % | |||

S-32

Table of Contents

We determined the interest rates shown in the table using the interest rates applicable to the trust student loans as of the cutoff date. Because most of the trust student loans bear interest at rates that reset quarterly, the above information will not necessarily remain applicable to the trust student loans on the closing date or any later date.

DISTRIBUTION OF THE TRUST STUDENT LOANS

BY OUTSTANDING PRINCIPAL BALANCE PER BORROWER AS OF THE CUTOFF DATE

Range of Outstanding Principal Balance | Number of Borrowers | Aggregate Outstanding Principal Balance | Percent of Pool by Outstanding Principal Balance | |||||

Less than $5,000 | 25,829 | $ | 77,416,145 | 6.2 | % | |||

$5,000 to $9,999 | 32,116 |

| 231,022,700 | 18.5 |

| |||

$10,000 to $14,999 | 18,259 |

| 220,455,178 | 17.7 |

| |||

$15,000 to $19,999 | 10,531 |

| 180,982,623 | 14.5 |

| |||

$20,000 to $24,999 | 6,161 |

| 136,321,808 | 10.9 |

| |||

$25,000 to $29,999 | 3,538 |

| 96,372,864 | 7.7 |

| |||

$30,000 to $34,999 | 2,202 |

| 70,934,809 | 5.7 |

| |||

$35,000 to $39,999 | 1,427 |

| 53,191,724 | 4.3 |

| |||

$40,000 to $44,999 | 924 |

| 39,140,943 | 3.1 |

| |||

$45,000 to $49,999 | 693 |

| 32,790,559 | 2.6 |

| |||

$50,000 to $54,999 | 479 |

| 25,081,874 | 2.0 |

| |||

$55,000 to $59,999 | 365 |

| 20,928,875 | 1.7 |

| |||

$60,000 to $64,999 | 250 |

| 15,625,514 | 1.3 |

| |||

$65,000 to $69,999 | 170 |

| 11,453,510 | 0.9 |

| |||

$70,000 to $74,999 | 130 |

| 9,410,470 | 0.8 |

| |||

$75,000 to $79,999 | 59 |

| 4,573,212 | 0.4 |

| |||

$80,000 to $84,999 | 66 |

| 5,429,104 | 0.4 |

| |||

$85,000 to $89,999 | 34 |

| 2,966,714 | 0.2 |

| |||

$90,000 to $94,999 | 37 |

| 3,431,661 | 0.3 |

| |||

$95,000 to $99,999 | 20 |

| 1,938,914 | 0.2 |

| |||

$100,000 and greater | 68 |

| 7,811,118 | 0.6 |

| |||

Total | 103,358 | $ | 1,247,280,318 | 100.0 | % | |||

S-33

Table of Contents

DISTRIBUTION OF THE TRUST STUDENT LOANS

BY REMAINING TERM TO SCHEDULED MATURITY AS OF THE CUTOFF DATE

Number of Months Remaining to Scheduled Maturity | Number of Loans | Aggregate Outstanding Principal Balance | Percent of Pool by Outstanding Principal Balance | |||||

1 to 84 | 10,525 | $ | 30,018,169 | 2.4 | % | |||

85 to 144 | 15,289 |

| 107,367,904 | 8.6 |

| |||

145 to 192 | 43,829 |

| 429,807,985 | 34.5 |

| |||

193 to 228 | 64,148 |

| 592,425,074 | 47.5 |

| |||

229 to 276 | 8,474 |

| 73,450,058 | 5.9 |

| |||

277 to 348 | 999 |

| 14,205,058 | 1.1 |

| |||

349 and greater | 1 |

| 6,069 | * |

| |||

Total | 143,265 | $ | 1,247,280,318 | 100.0 | % | |||

| * | Represents a percentage greater than 0% but less than 0.05%. |

We have determined the numbers of months remaining to scheduled maturity shown in the table from the cutoff date to the stated maturity dates of the applicable trust student loans without giving effect to any deferral or forbearance periods that may be granted in the future.See“Risk Factors—You Will Bear Prepayment And Extension Risk Due To Actions Taken By Individual Borrowers And Other Variables Beyond Our Control” in the prospectus.

DISTRIBUTION OF THE TRUST STUDENT LOANS BY CURRENT

BORROWER PAYMENT STATUS AS OF THE CUTOFF DATE

Current Borrower Payment Status | Number of Loans | Aggregate Outstanding Principal Balance | Percent of Pool by Outstanding Principal Balance | |||||

In-School | 82,728 | $ | 764,860,398 | 61.3 | % | |||

Grace | 12,478 |

| 90,559,819 | 7.3 |

| |||

Deferral | 9 |

| 110,497 | * |

| |||

Forbearance | 3,499 |

| 29,418,915 | 2.4 |

| |||

Repayment | ||||||||

First year in repayment | 6,482 |

| 51,135,881 | 4.1 |

| |||

Second year in repayment | 11,421 |

| 120,426,643 | 9.7 |

| |||

Third year in repayment | 6,167 |

| 56,164,251 | 4.5 |

| |||

More than 3 years in repayment | 20,481 |

| 134,603,916 | 10.8 |

| |||

Total | 143,265 | $ | 1,247,280,318 | 100.0 | % | |||

| * | Represents a percentage greater than 0% but less than 0.05%. |

S-34

Table of Contents

Current borrower payment status refers to the status of the borrower of each trust student loan as of the cutoff date. The borrower:

| · | may still be attending school—in-school; |

| · | may be in a grace period after completing school and prior to repayment commencing—grace; |

| · | may be currently required to repay the loan—repayment;or |

| · | may have temporarily ceased repaying the loan through adeferral or a forbearance period. |

The weighted average number of months in repayment for all trust student loans currently in repayment is approximately 35, calculated as the term to scheduled maturity at the commencement of repayment less the number of months remaining to scheduled maturity as of the cutoff date.

SCHEDULED WEIGHTED AVERAGE REMAINING MONTHS IN

STATUS OF THE TRUST STUDENT LOANS BY CURRENT

BORROWER PAYMENT STATUS AS OF THE CUTOFF DATE

Scheduled Remaining Months in Status | ||||||||||

Current Borrower Payment Status | In-School | Grace | Deferral | Forbearance | Repayment | |||||

In-School | 21.4 | 6.0 | — | — | 179.9 | |||||

Grace | — | 2.6 | — | — | 173.9 | |||||

Deferral | — | — | 5.5 | — | 176.6 | |||||

Forbearance | — | — | — | 6.2 | 172.7 | |||||

Repayment | — | — | — | — | 155.4 | |||||

We have determined the scheduled months in status shown in the table without giving effect to any deferral or forbearance periods that may be granted in the future.

S-35

Table of Contents

GEOGRAPHIC DISTRIBUTION OF THE

TRUST STUDENT LOANS AS OF THE CUTOFF DATE

State | Number of Loans | Aggregate Outstanding Principal Balance | Percent of Pool by Outstanding Principal Balance | |||||

Alabama | 1,592 | $ | 11,088,256 | 0.9 | % | |||

Alaska | 139 |

| 1,111,057 | 0.1 |

| |||

Arizona | 2,232 |

| 21,032,547 | 1.7 |

| |||

Arkansas | 499 |

| 3,172,334 | 0.3 |

| |||

California | 18,085 |

| 171,544,550 | 13.8 |

| |||

Colorado | 1,936 |

| 16,137,900 | 1.3 |

| |||

Connecticut | 2,947 |

| 28,317,689 | 2.3 |

| |||

Delaware | 398 |

| 3,461,140 | 0.3 |

| |||

District of Columbia | 1,009 |

| 9,814,577 | 0.8 |

| |||

Florida | 8,295 |

| 76,247,195 | 6.1 |

| |||

Georgia | 3,531 |

| 30,845,026 | 2.5 |

| |||

Hawaii | 422 |

| 3,512,003 | 0.3 |

| |||

Idaho | 340 |

| 2,484,163 | 0.2 |

| |||

Illinois | 7,117 |

| 56,601,293 | 4.5 |

| |||

Indiana | 3,084 |

| 22,240,787 | 1.8 |

| |||

Iowa | 748 |

| 5,220,476 | 0.4 |

| |||

Kansas | 1,104 |

| 7,180,245 | 0.6 |

| |||

Kentucky | 896 |

| 6,210,779 | 0.5 |

| |||

Louisiana | 1,667 |

| 12,199,579 | 1.0 |

| |||

Maine | 667 |

| 5,680,196 | 0.5 |

| |||

Maryland | 3,791 |

| 33,600,458 | 2.7 |

| |||

Massachusetts | 5,427 |

| 53,945,307 | 4.3 |

| |||

Michigan | 3,813 |

| 28,876,440 | 2.3 |

| |||

Minnesota | 1,703 |

| 12,899,036 | 1.0 |

| |||

Mississippi | 632 |

| 4,026,209 | 0.3 |

| |||

Missouri | 2,268 |

| 18,299,596 | 1.5 |

| |||

Montana | 248 |

| 1,705,179 | 0.1 |

| |||

Nebraska | 359 |

| 2,806,517 | 0.2 |

| |||

Nevada | 683 |

| 5,733,334 | 0.5 |

| |||

New Hampshire | 909 |

| 8,730,332 | 0.7 |

| |||

New Jersey | 6,615 |

| 66,083,884 | 5.3 |

| |||

New Mexico | 265 |

| 2,140,234 | 0.2 |

| |||

New York | 15,802 |

| 161,744,629 | 13.0 |

| |||

North Carolina | 2,753 |

| 20,876,686 | 1.7 |

| |||

North Dakota | 94 |

| 719,251 | 0.1 |

| |||

Ohio | 5,864 |

| 44,951,238 | 3.6 |

| |||

Oklahoma | 1,158 |

| 8,743,369 | 0.7 |

| |||

Oregon | 2,056 |

| 15,190,550 | 1.2 |

| |||

Pennsylvania | 10,000 |

| 82,773,644 | 6.6 |

| |||

Rhode Island | 773 |

| 6,951,032 | 0.6 |

| |||

South Carolina | 1,145 |

| 8,787,248 | 0.7 |

| |||

South Dakota | 143 |

| 1,076,959 | 0.1 |

| |||

Tennessee | 1,886 |

| 14,837,066 | 1.2 |

| |||

Texas | 7,804 |

| 61,029,830 | 4.9 |

| |||

Utah | 402 |

| 3,665,861 | 0.3 |

| |||

Vermont | 283 |

| 2,287,151 | 0.2 |

| |||

Virginia | 3,971 |

| 33,237,809 | 2.7 |

| |||

Washington | 2,798 |

| 22,202,101 | 1.8 |

| |||

West Virginia | 714 |

| 4,839,727 | 0.4 |

| |||

Wisconsin | 1,332 |

| 10,132,203 | 0.8 |

| |||

Wyoming | 80 |

| 704,692 | 0.1 |

| |||

Other | 786 |

| 9,580,953 | 0.8 |

| |||

Total | 143,265 | $ | 1,247,280,318 | 100.0 | % | |||

S-36

Table of Contents

We have based the geographic distribution shown in the table on the billing addresses of the borrowers of the trust student loans shown on the servicer’s records as of the cutoff date.

Each of the trust student loans provides or will provide for the amortization of its outstanding principal balance over a series of regular payments. Except as described below, each regular payment consists of an installment of interest which is calculated on the basis of the outstanding principal balance of the trust student loan. The amount received is applied first to interest accrued to the date of payment and the balance of the payment, if any, is applied to reduce the unpaid principal balance. Accordingly, if a borrower pays a regular installment before its scheduled due date, the portion of the payment allocable to interest for the period since the preceding payment was made will be less than it would have been had the payment been made as scheduled, and the portion of the payment applied to reduce the unpaid principal balance will be correspondingly greater. Conversely, if a borrower pays a monthly installment after its scheduled due date, the portion of the payment allocable to interest for the period since the preceding payment was made will be greater than it would have been had the payment been made as scheduled, and the portion of the payment applied to reduce the unpaid principal balance will be correspondingly less.

In either case, subject to any applicable deferral periods or forbearance periods, and except as provided below, the borrower pays a regular installment until the final scheduled payment date, at which time the amount of the final installment is increased or decreased as necessary to repay the then outstanding principal balance of that trust student loan.

SLM Education Credit Management Corporation makes available to some of its borrowers payment terms that may lengthen the remaining term of the student loans. For example, not all of the loans owned by SLM Education Credit Management Corporation provide for level payments throughout the repayment term of the loans. Some student loans provide for interest only payments to be made for a designated portion of the term of the loans, with amortization of the principal of the loans occurring only when payments increase in the latter stage of the term of the loans. Other loans provide for a graduated phase in of the amortization of principal with a greater portion of principal amortization being required in the latter stages than would be the case if amortization were on a level payment basis. SLM Education Credit Management Corporation also offers an income-sensitive repayment plan, under which repayments are based on the borrower’s income. Under that plan, ultimate repayment may be delayed up to five years. Borrowers under trust student loans will continue to be eligible for these graduated payment and income-sensitive repayment plans.See “The Depositor, the Sellers, the Servicer and the Administrator—SLM Education Credit Management Corporation’s Student Loan Financing Business” in the prospectus.

S-37

Table of Contents

The following table provides certain information about trust student loans subject to the repayment terms described in the preceding paragraphs.

DISTRIBUTION OF THE TRUST

STUDENT LOANS BY REPAYMENT TERMS AS OF THE