Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995

Some of the statements in this financial supplement may include forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. Statements which include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “seek,” “will,” and similar statements of a future or forward-looking nature identify forward-looking statements in this financial supplement for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only to the date on which they are made. We undertake no obligation to publicly update or review any forward looking statement, when as a result of new information, future developments or otherwise.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ from those indicated in the forward-looking statements. These factors include, but are not limited to, competition, possible terrorism or the outbreak of war, the frequency or severity of unpredictable catastrophic events, changes in demand for insurance or reinsurance, rating agency actions, uncertainties in our reserving process, a change in our tax status, acceptance of our products, the availability of reinsurance or retrocessional coverage, retention of key personnel, political conditions, the impact of current regulatory investigations, changes in accounting policies, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2005.

Regulation G

In presenting the Company’s results, management has included and discussed certain non-GAAP measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company's results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP.

ENDURANCE SPECIALTY HOLDINGS LTD.

SEGMENT REORGANIZATION

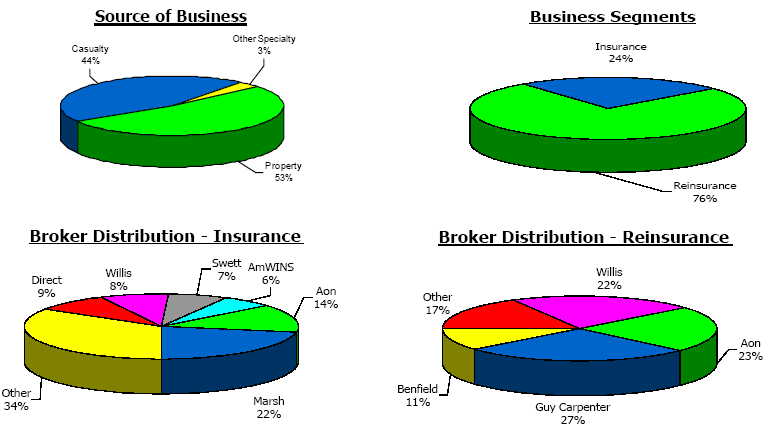

As a result of a shift in our operational structure and the implementation of certain strategic initiatives during 2006, the Company is changing its operating segments to reflect the current manner by which the chief operating decision maker views and manages the business. As a result, we will now report two business segments:

• Insurance– The Insurance business segment is to be comprised of five lines of business: property, excess casualty, healthcare liability, workers' compensation and professional lines.

• Reinsurance – The Reinsurance business segment is to be comprised of seven lines of business: casualty, property, catastrophe, agriculture, marine, aerospace and surety and other specialty.

Data included herein for all periods presented, reflects the current segment reporting, Insurance and Reinsurance.

Table of Contents

| | | Page |

| i. Basis of Presentation | | i |

| | | |

| I. Segment Data | | |

| a. Segment Data | | 1 |

| b. Segment Distribution | | 9 |

| c. Deposit Accounting Adjustment Impacts on Segment Data | | 10 |

| | | |

| II. Loss Reserve Analysis | | |

| a. Activity in Reserve for Losses and Loss Expenses by Segment | | 12 |

| b. Activity in Reserve for Losses and Loss Expenses by Tail | | 13 |

| c. Analysis of Unpaid Losses and Loss Expense | | 14 |