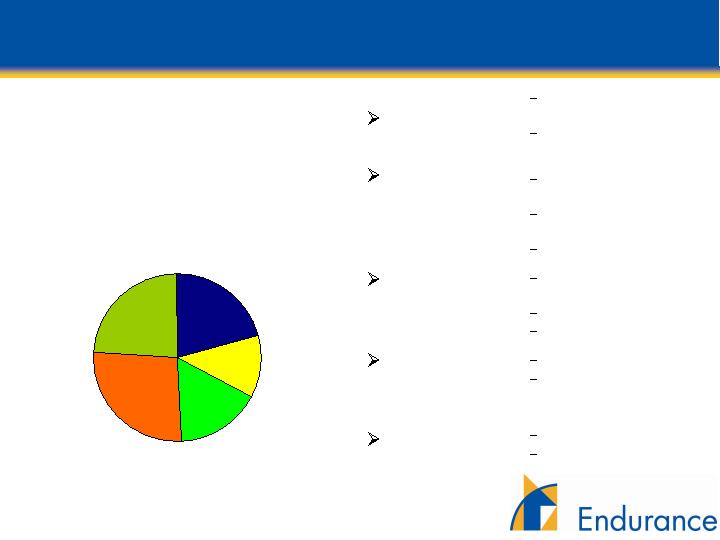

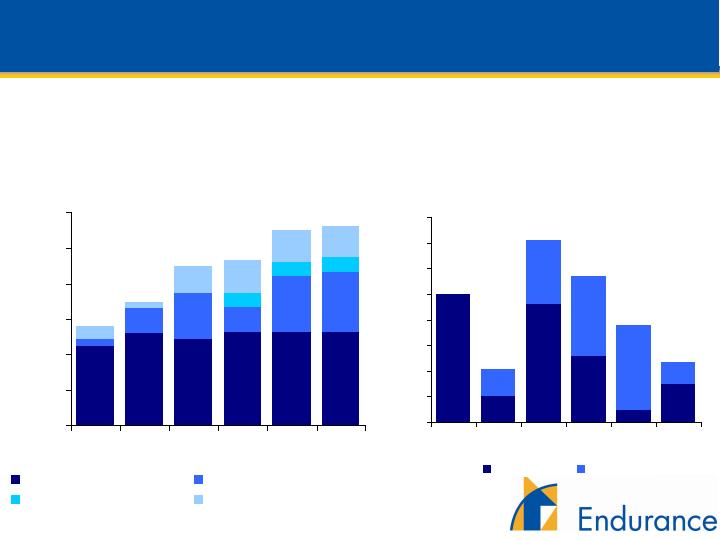

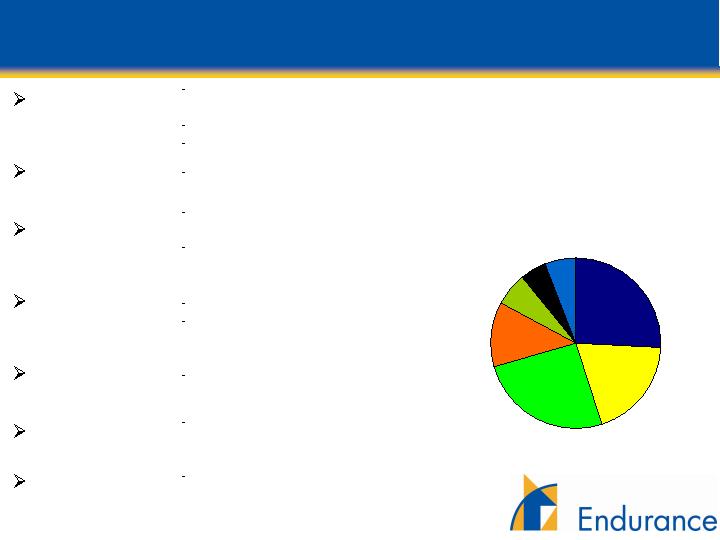

Reinsurance - Expanding Product Offering

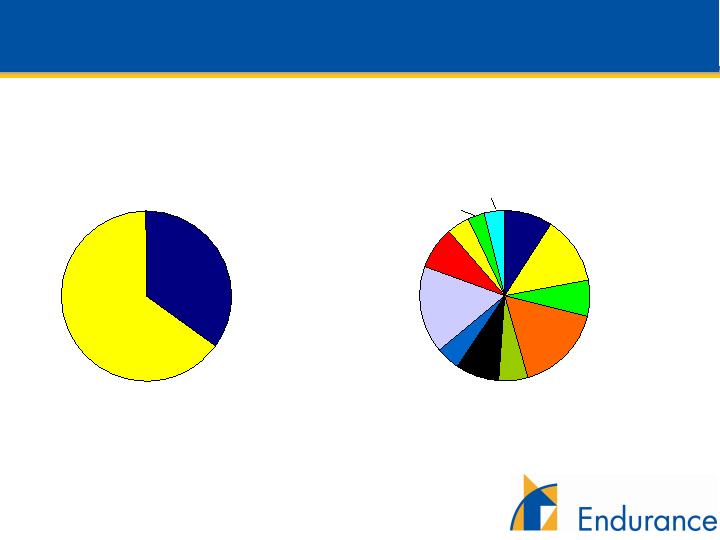

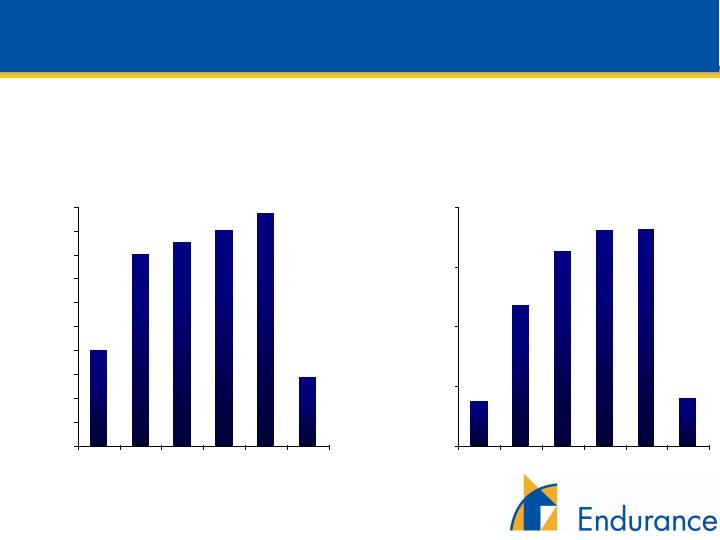

Reinsurance Total Written

Premiums of $1.2 billion*

By Line of Business

Catastrophe

Property

Casualty

Agriculture

Marine

Aerospace

Surety and

Other Specialty

Industry leading tools and

technology

Leader in Bermuda

Covers all perils

Highly specialized relationships

Auto liability, D&O, workers comp

and clash

Non-renewed large proportional

contracts in 1Q07

Multiple peril crop insurance

Industry leading tools and

technology

Covers brown and blue water hull

Provides aviation and space

coverages

Other unique opportunities

including growing surety business

* Includes deposit premiums, based on the twelve months ended March 31, 2007

Catastrophe

25.7%

Property

19.2%

Agriculture

12.4%

Casualty

25.3%

Marine

6.5%

Aerospace

5.0%

Surety and

other specialty

5.8%

6

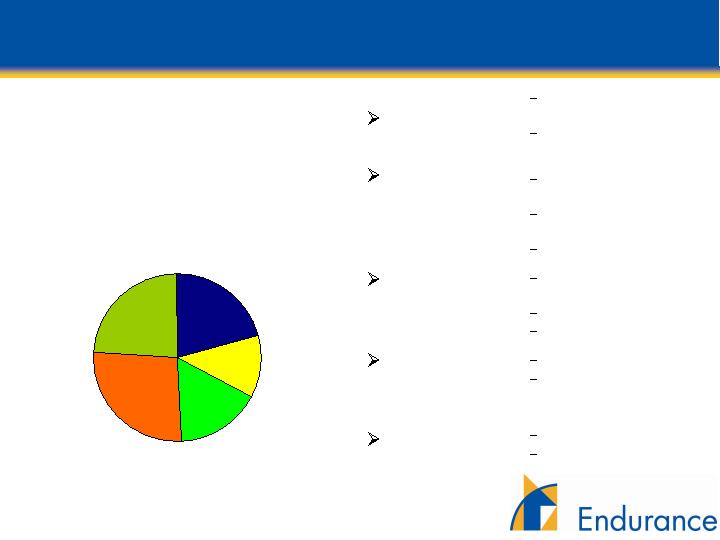

Insurance - Our Fastest Growing Segment

Insurance Total Written

Premiums of $644 million*

By Line of Business

Casualty

Professional

Lines

Healthcare

Liability

Property

Workers’

Compensation

Large account excess

liability written in Bermuda

Small account casualty

written in US

Includes E&O and D&O

products

Financial institutions

specialists

Leader in Bermuda

Hospital professional

liability

Strong relationships

Leader in Bermuda market

Written out of US and UK

Growing US specialty

business

Opportunistic strategy

Converted from

reinsurance in 2006

Casualty

20.8%

Professional

Lines

12.1%

Healthcare

Liability

16.3%

Property

26.7%

Workers’

Compensation

24.1%

* Based on the twelve months ended March 31, 2007

7

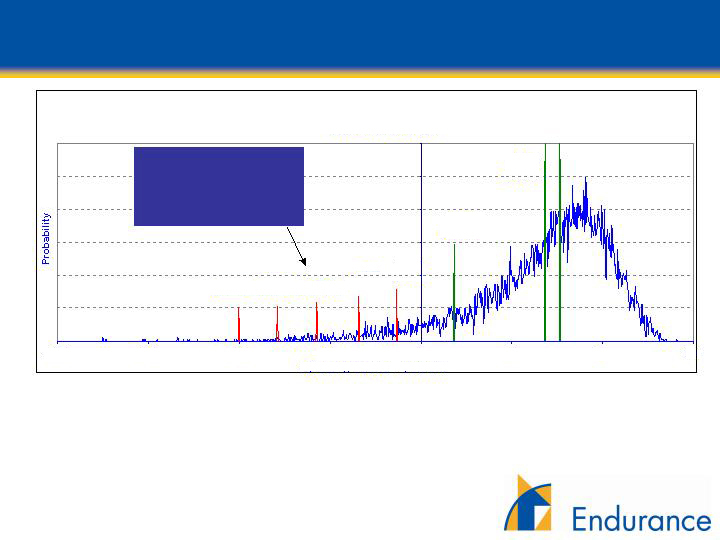

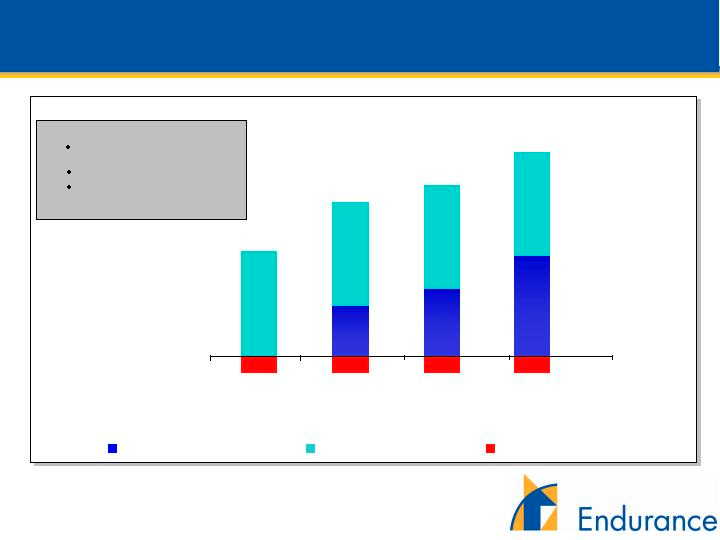

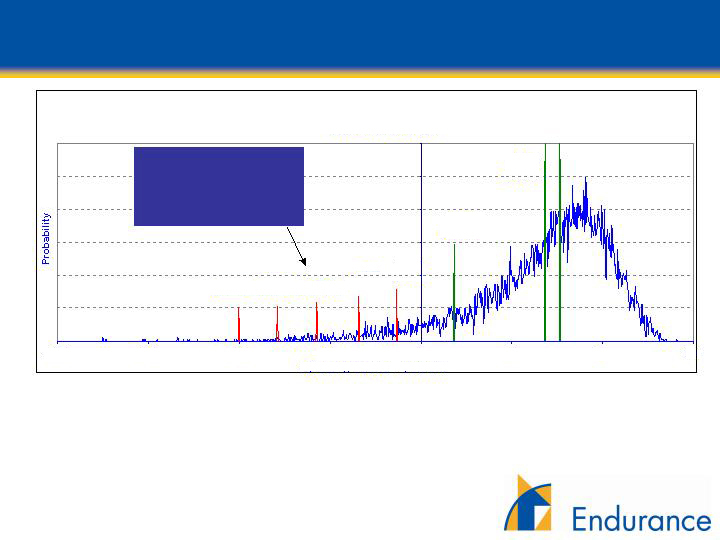

Strong Risk Management Focus -

Portfolio Expected Risk Curve (January 1, 2007)

Stated tolerance is to limit

our loss in a 1-in-100 year

to 25% of our capital or

less, our current level is

12.1% of capital

Median Result

$381 Mil Gain

The above chart represents a cumulative analysis of our in-force underwriting portfolio on a full year basis based on thousands of potential

scenarios. Loss years are driven largely by the occurrence of natural catastrophes and incorrect pricing of other property and casualty exposures.

The operating income depicted includes net premiums earned plus net investment income, acquisition expenses and G&A expenses. Forecasted

investment income, acquisition and G&A expenses are held constant across all scenarios. Losses included above are net of reinsurance including

collateralized reinsurance and ILW purchases. Our stated objective is to maintain a risk management tolerance that limits our loss in a 1-in-100 year

year to be no more than 25% of our equity capital. We base our budget and forecasts on the average result, although the nature of the curve places

the median result further to the right.

Changes in Endurance’s underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may

cause actual results to vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance

and its future performance, please see “Risk Factors” in our Annual Report on Form 10K for the year ended December 31, 2006.

Endurance Operating Income Profile

as of January 1, 2007

-1,000

-750

-500

-250

0

250

500

750

Operating Income - $ Millions

Year

$500 Mil Loss

1-in-250

$396 Mil Loss

1-in-100

$287 Mil Loss

1-in-50

$172 Mil Loss

1-in-25

$66 Mil Loss

1-in-10

$91 Mil Gain

Average

$341 Mil Gain

Year

Year

Year

Year

Year

Result

1-in-500

8

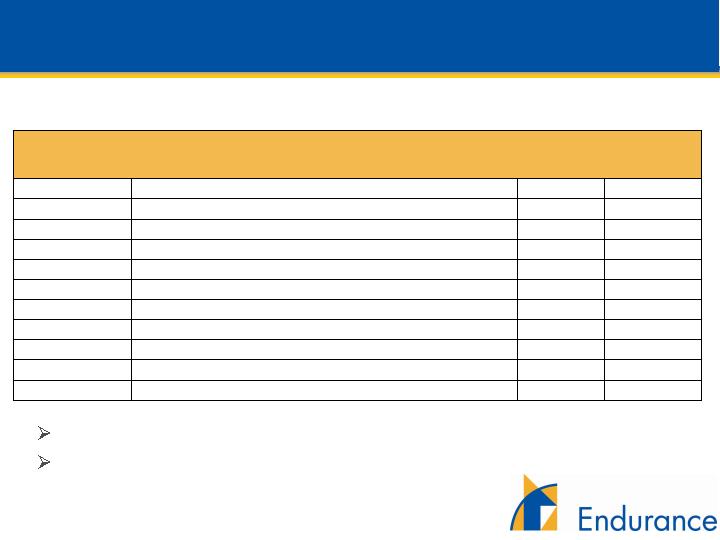

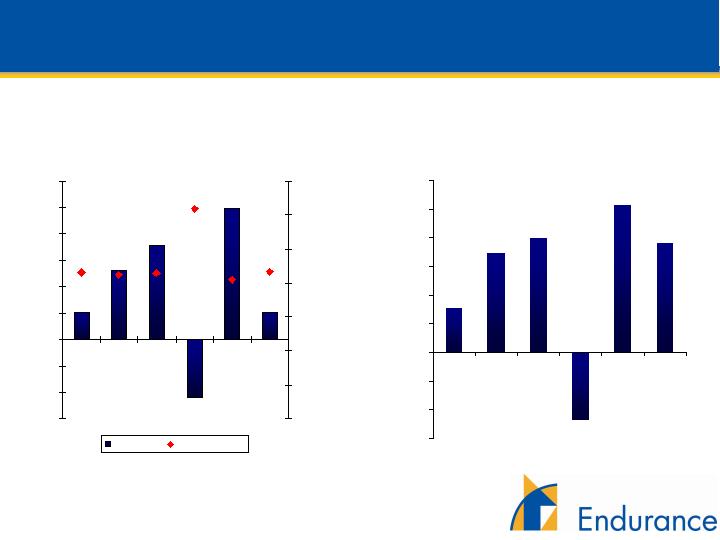

Impact of 2006 Risk Management Initiatives

Annual Aggregate Risk Curve Comparison

July 1, 2006 to

January 1, 2007 to

$

%

(in millions)

June 30, 2007

December 31, 2007

Change

Change

Median Result

$400

$381

($19)

(5.0%)

Average Result

342

341

(1)

(0.3%)

1 in 10 year annual gain

64

91

27

29.7%

1 in 25 year annual loss

(182)

(66)

116

(175.8%)

1 in 50 year annual loss

(334)

(172)

162

(94.2%)

1 in 100 year annual loss

(486)

(287)

199

(69.3%)

1 in 250 year annual loss

(707)

(396)

311

(78.5%)

1 in 500 year annual loss

(904)

(500)

404

(80.8%)

Changes in Endurance’s underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual results

to vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance, please see

“Risk Factors” in our Annual Report on Form 10K for the year ended December 31, 2006.

9

Portfolio Changes – Property Catastrophe LOB

77,000,000

57,000,000

32,000,000

18,000,000

Florida

1,359,000,000

1,380,000,000

1,434,000,000

1,721,000,000

Total

US Property Catastrophe Portfolio*

158,000,000

36,000,000

104,000,000

173,000,000

642,000,000

906,000,000

2004

140,000,000

33,000,000

75,000,000

220,000,000

551,000,000

663,000,000

2005

42,000,000

54,000,000

National

46,000,000

44,000,000

Regional [ex Florida]

165,000,000

155,000,000

Total

Written Premiums

339,000,000

310,000,000

Florida

710,000,000

692,000,000

Regional [ex Florida]

310,000,000

378,000,000

National

Wind Exposed Limits

2007

2006

Risk

Measure

Portfolio shifted away from higher attaching complex

national account style risks towards lower attaching

smaller regional risks.

Reduced exposure to extreme

tail events, Increased

exposure to smaller events.

* Endurance is exposed to natural catastrophe perils in other portions of its business and the above

amounts do not represent Endurance’s full portfolio at risk to hurricane losses. Endurance’s actual results

may vary considerably from those indicated above. For a listing of risks related to Endurance and its

future performance, please see “Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2006.

10

Catastrophe Risk – 2004 and 2005 “Then and Now”

300,000,000

70,000,000

0

0

0

30,000,000

200,000,000

2007

Portfolio*

966,000,000

0

107,000,000

162,000,000

61,000,000

304,000,000

332,000,000

Actual

Losses

2005 Hurricanes

2004 Hurricanes

0

2,000,000

Energy

0

14,000,000

Fortune 1000 All Risk

75,000,000

0

Middle Market DIC

500,000,000

204,000,000

Total

Insurance

0

8,000,000

Marine

75,000,000

111,000,000

Property

350,000,000

69,000,000

Catastrophe

Reinsurance

2007

Portfolio*

Actual

Losses

Business

Unit

The result of the portfolio shift is to reduce the company’s exposure to extreme tail events while

increasing the company’s exposure to smaller personal lines events such as the 2004 hurricanes.

*These columns represent estimates of expected losses with our current portfolio were the 2004 and 2005

hurricane seasons to be experienced in 2007. There are numerous factors that could impact this estimate

and cause Endurance’s actual results to be significantly different from the results listed above. For a listing of

risks related to Endurance and its future performance, please see “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2006.

11

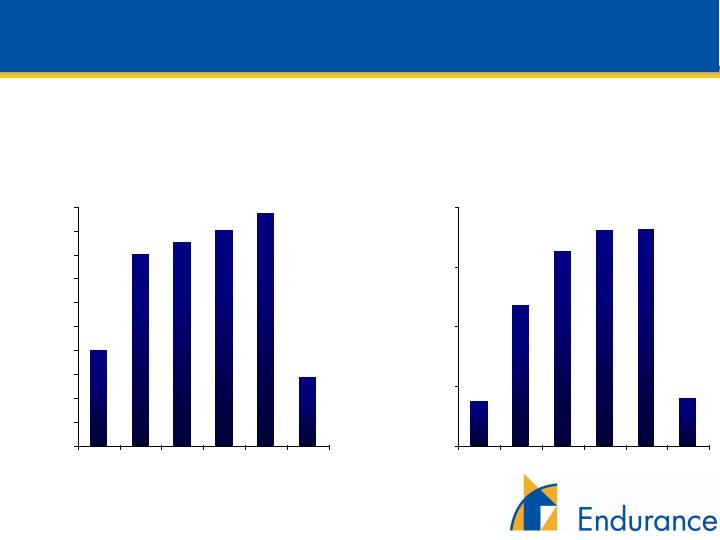

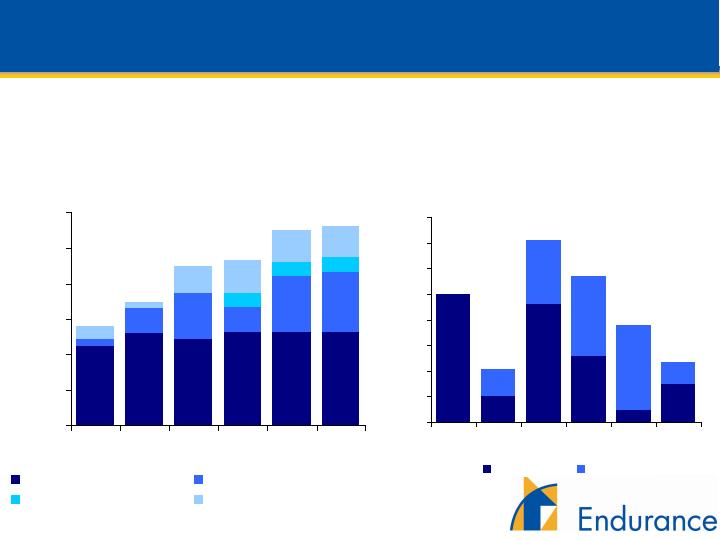

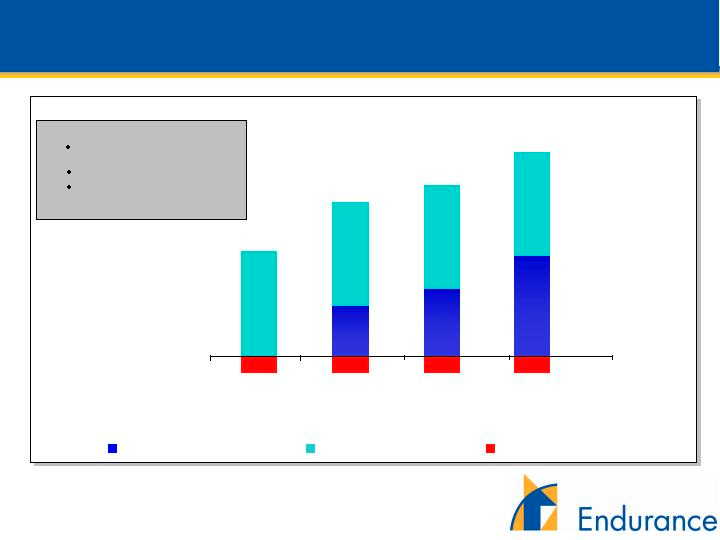

Diversification Has Led to Stable Premium Growth

$798.8

$1,602.0

$1,711.4

$1,812.2

$1,948.6

$576.5

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2002

2003

2004

2005

2006

1Q07

Gross Written Premiums*

Net Earned Premiums*

(in millions)

$369.5

$1,173.9

$1,632.6

$1,818.9

$401.7

$1,803.4

$0

$500

$1,000

$1,500

$2,000

2002

2003

2004

2005

2006

1Q07

(in millions)

* Includes deposit premiums

12

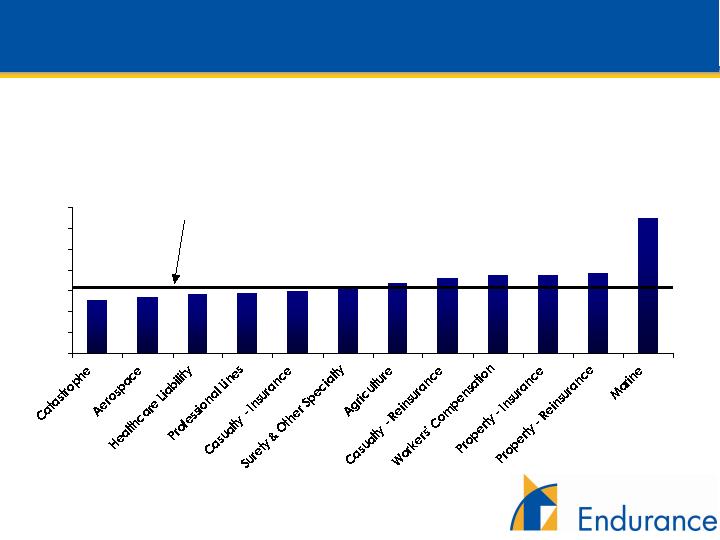

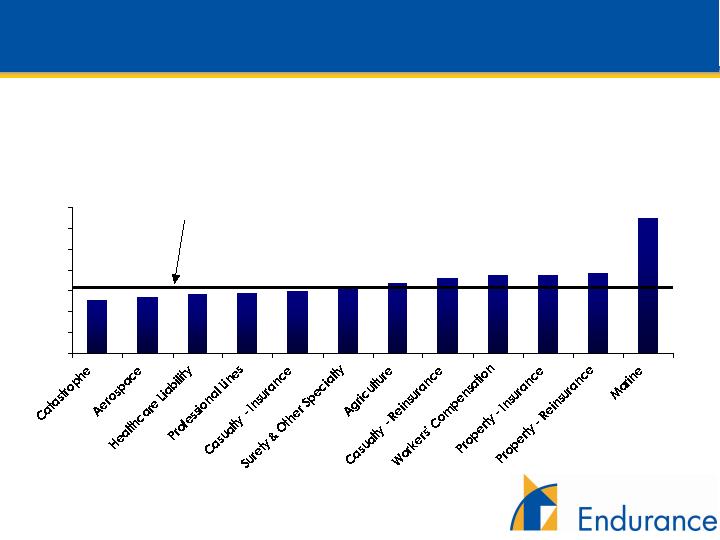

Overall Underwriting Has Been Strong

90.3%

93.7%

94.1%

95.8%

162.4%

67.4%

63.9%

71.0%

84.3%

79.9%

74.4%

73.0%

0%

25%

50%

75%

100%

125%

150%

175%

Inception to Date Underwriting Ratio*

* Underwriting ratio is defined as losses and acquisition expenses

divided by earned premium, as of 3/31/07.

Inception to Date Underwriting

Ratio is 85.1%*

13

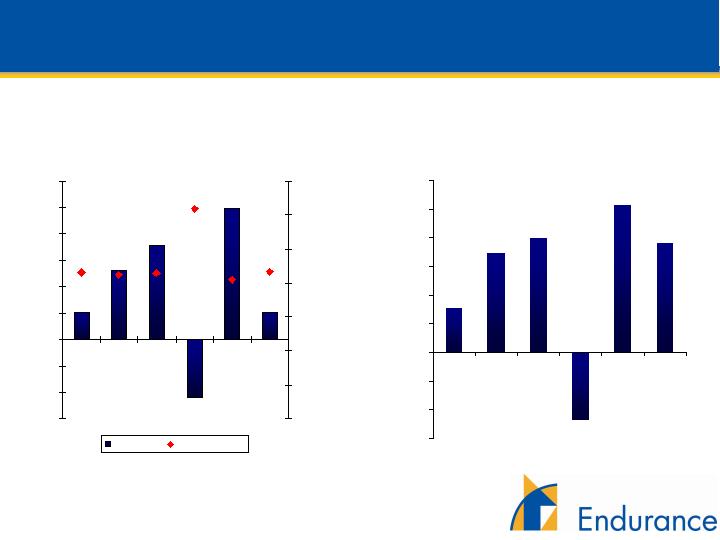

Strong Financial Performance

$102.1

$263.4

$355.6

($220.5)

$498.1

$101.8

86.7%

84.7%

85.8%

81.5%

123.5%

86.2%

-$300

-$200

-$100

$0

$100

$200

$300

$400

$500

$600

2002

2003

2004

2005

2006

1Q07

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

Net Income

Combined Ratio

Net Income and Combined Ratio

(in millions)

7.8%

17.3%

19.9%

-11.9%

25.7%

19.0%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

2002

2003

2004

2005

2006

1Q07

Annualized Operating

Return on Average Equity

Inception to 12/31/06 combined ratio of 94.4%

Inception to 12/31/06 ROE of 12%

14

Efficient Capital Management

$1,115

$1,300

$1,213

$1,309

$1,318

$1,306

$102

$345

$650

$364

$780

$861

$200

$200

$200

$192

$103

$391

$447

$447

$447

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2002

2003

2004

2005

2006

1Q07

Common Share Capital

Retained Earnings

Preferred Equity

Debt

Strong and Flexible

Capital Structure

$, Millions

$1,409

$1,748

$2,254

$2,320

$2,745

$100

$20

$92

$52

$10

$30

$21

$50

$62

$66

$17

$0

$20

$40

$60

$80

$100

$120

$140

$160

2002

2003

2004

2005

2006

1Q07

Repurchases

Dividends

$, Millions

$520 Million of

Capital Returned

to Shareholders

$100

$41

$142

$113

$76

$47

$2,814

15

Sensitivity of ROE

* The Return on Equity Sensitivity Analysis is purely illustrative and should not be construed

as guidance for future performance. Changes in Endurance’s underwriting portfolio, investment portfolio, risk

control mechanisms, market conditions and other factors may cause our actual results to vary considerably from

those indicated above. For a listing of risks related to Endurance, please see “Risk Factors” in our Annual Report

on Form 10-K for the year ended December 31, 2006.

Operating Assumptions

2.8:1.0 Investment Leverage at

4.75% yield

0.85:1.0 Operating Leverage

Interest expense and preferred

dividends of 2.2% of common

equity

ROE = 11.1%

ROE = 19.6%

ROE = 23.9%

ROE = 17.5%

ROE from Underwriting Activity

ROE from Investing Activity

Financing Costs

Return On Equity Sensitivity Analysis*

2.2%

2.2%

2.2%

2.2%

13.3%

6.4%

8.5%

12.8%

13.3%

13.3%

13.3%

100%

Combined

Ratio

92.5%

Combined

Ratio

90%

Combined

Ratio

85%

Combined

Ratio

16

Conclusion

Disciplined technical underwriting culture with focus on

underwriting margin and risk adjusted returns

Well positioned with strong management team, diversified

portfolio, and excellent financial strength

Committed to generate 15%+ ROE through cycles with

demonstrated ability to generate shareholder value

17