Endurance Specialty Holdings Ltd.

Third Quarter 2007

Forward Looking Statements

Statements contained in this presentation that are not based on current or historical fact are forward-looking in nature. Such forward-looking statements are based on current plans, estimates and expectations and are made pursuant to the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on known and unknown risks, assumptions, uncertainties and other factors. The Company’s actual results, performance, or achievements may differ materially from

any future results, performance, or achievements expressed or implied by such forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statement.

2

Philosophy & Strategy

Endurance was built in the aftermath of 9/11 to be an underwriter of volatile

specialty risks – key to our business are the following principles:

Focus on business segments that

reward our specialized knowledge

and relationships

Supported by

investments in enabling

technology and

disciplined, technical

underwriting approach

Portfolio managed with key risk

management concepts –

diversification, value at risk and

data quality

Portfolio

Management

Technology and

Discipline

Specialization

Capital Management

3

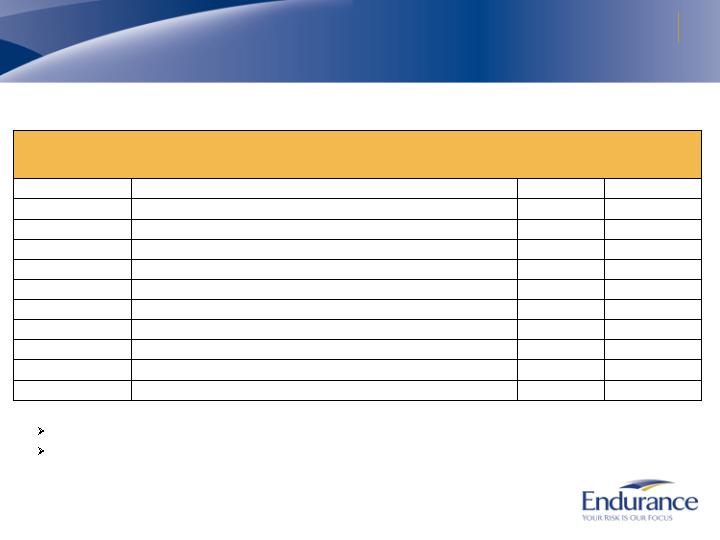

Seasoned Management Team

5

2

2

4

4

4

2

2

5

4

5

Years of

Endurance

Experience

25

Executive Vice President, Endurance Specialty Holdings Ltd.

Tom Bell

21

Chief Investment Officer

Mark Silverstein

18

General Counsel

John Del Col

22

President, Endurance Services Limited

John O’Connor

32

President and Chief Executive Officer, global insurance operations

Michael Fujii

26

President and Chief Executive Officer, global reinsurance operations

William Jewett

34

Chief Operating Officer

Daniel Izard

22

Chief Actuary and Chief Risk Officer

Michael Angelina

16

Chief Underwriting Officer

David Cash

13

Chief Financial Officer

Michael McGuire

28

Chairman, President & Chief Executive Officer

Kenneth LeStrange

Years of

Industry Experience

Position

Name

Executive Team has proven its ability to execute challenging strategies

Built a culture focused on risk and capital management

4

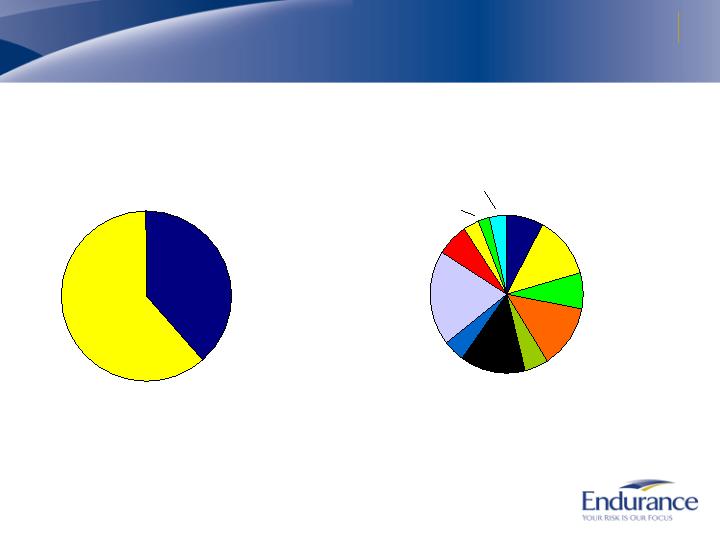

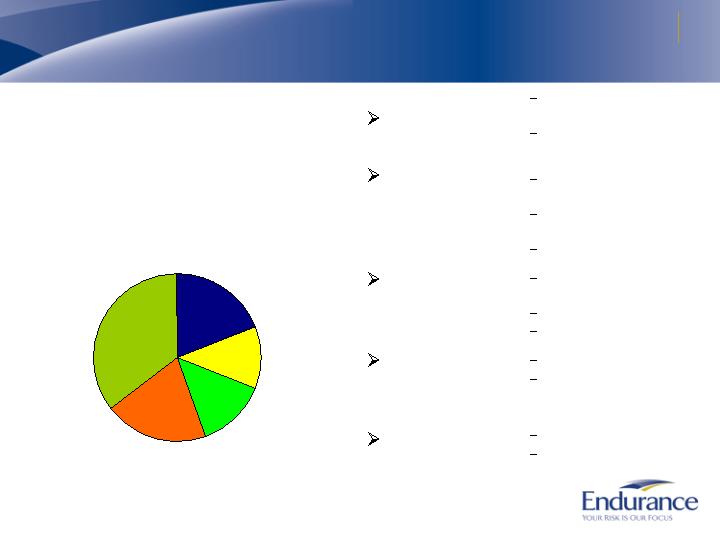

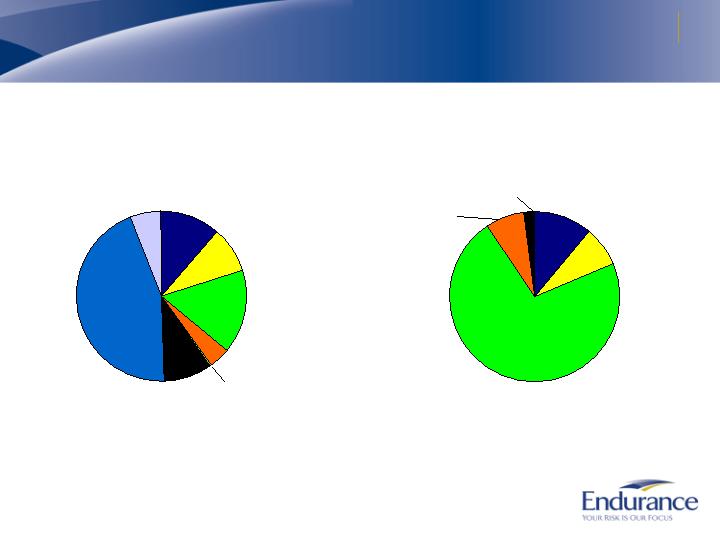

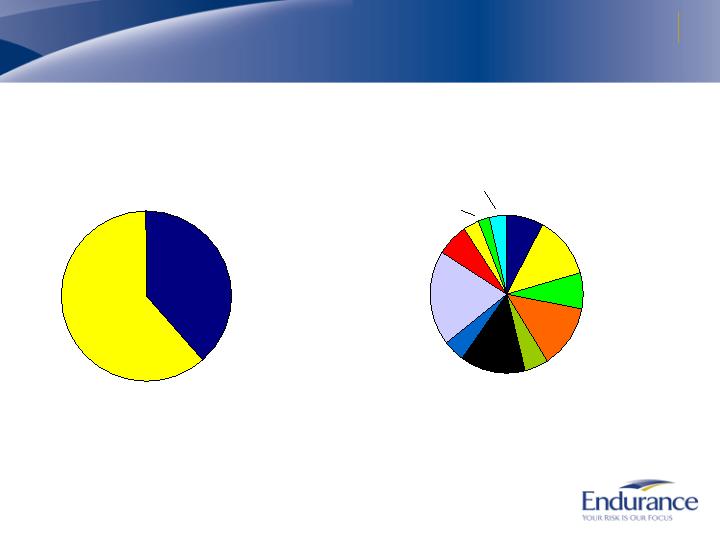

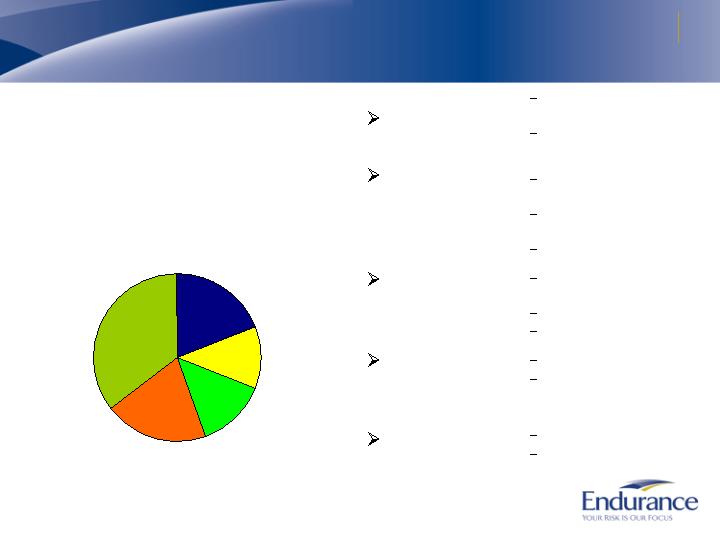

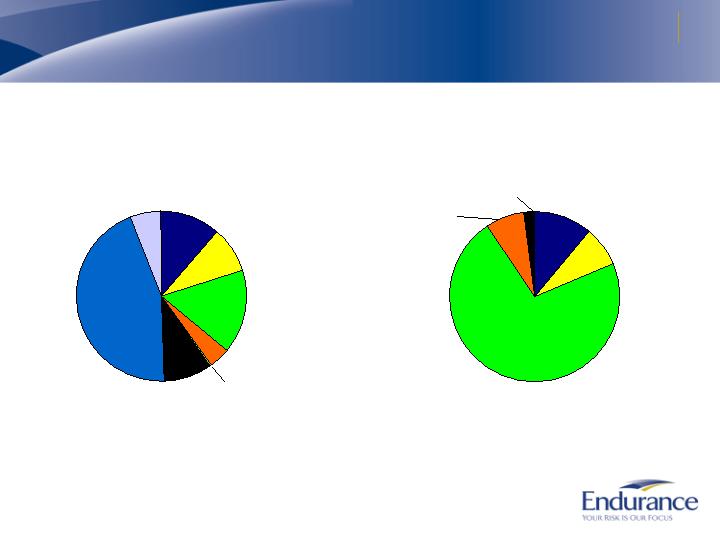

Maintain a Diversified Book of Business

Total Written Premiums of $1.83 Billion*

Insurance

39%

Reinsurance

61%

By Segment

* Includes deposit premiums, based on the twelve months ended September 30, 2007

By Line of Business

Property - Insurance

Property - Reinsurance

Casualty -

Reinsurance

Casualty - Insurance

Healthcare Liability

Workers’

Compensation

Professional Lines

Catastrophe

Agriculture

Marine

Aerospace

Surety and Other Specialty

5

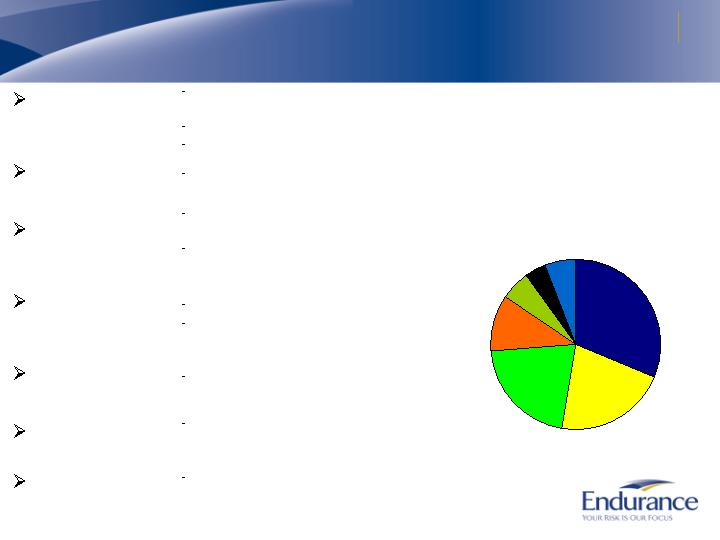

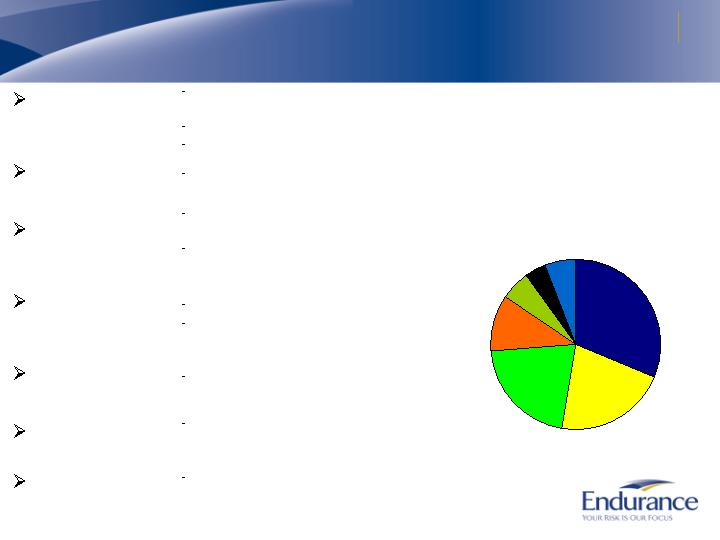

Reinsurance – Disciplined Approach to the Market

Reinsurance Total Written

Premiums of $1.1 billion*

By Line of Business

Catastrophe

Property

Casualty

Agriculture

Marine

Aerospace

Surety and

Other Specialty

Industry leading tools and

technology

Leader in Bermuda

Covers all perils

Highly specialized relationships

Auto liability, D&O, workers comp

and clash

Non-renewed large proportional

contracts in 1Q07

Multiple peril crop insurance

Industry leading tools and

technology

Covers brown and blue water hull

Provides aviation and space

coverages

Other unique opportunities

including growing surety business

* Includes deposit premiums, based on the twelve months ended September 30, 2007

Catastrophe

31.3%

Property

21.2%

Agriculture

10.9%

Casualty

21.1%

Marine

5.6%

Aerospace

4.0%

Surety and

other specialty

5.9%

6

Insurance - Our Fastest Growing Segment

Insurance Total Written

Premiums of $706 million*

By Line of Business

Casualty

Professional

Lines

Healthcare

Liability

Property

Workers’

Compensation

Large account excess

liability written in Bermuda

Small account casualty

written in US

Includes E&O and D&O

products

Financial institutions

specialists

Leader in Bermuda

Hospital professional

liability

Strong relationships

Leader in Bermuda market

Written out of US and UK

Growing US specialty

business

Opportunistic strategy

Converted from

reinsurance in 2006

Casualty

19.2%

Professional

Lines

11.9%

Healthcare

Liability

13.3%

Property

19.9%

Workers’

Compensation

35.7%

* Based on the twelve months ended September 30, 2007

7

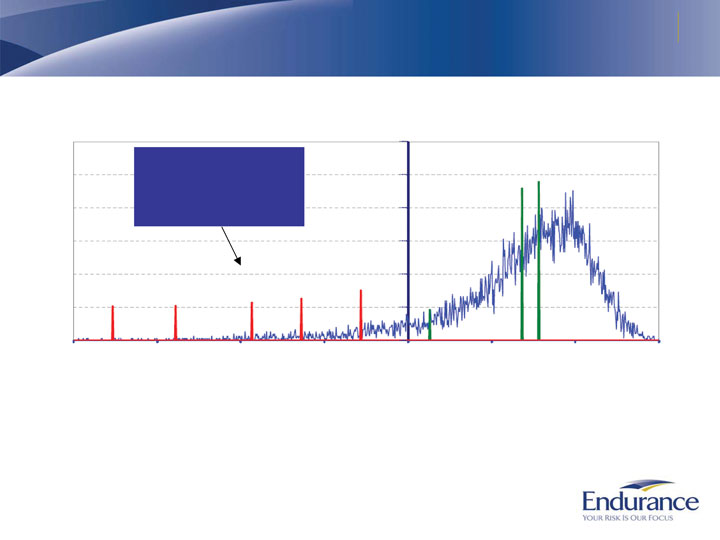

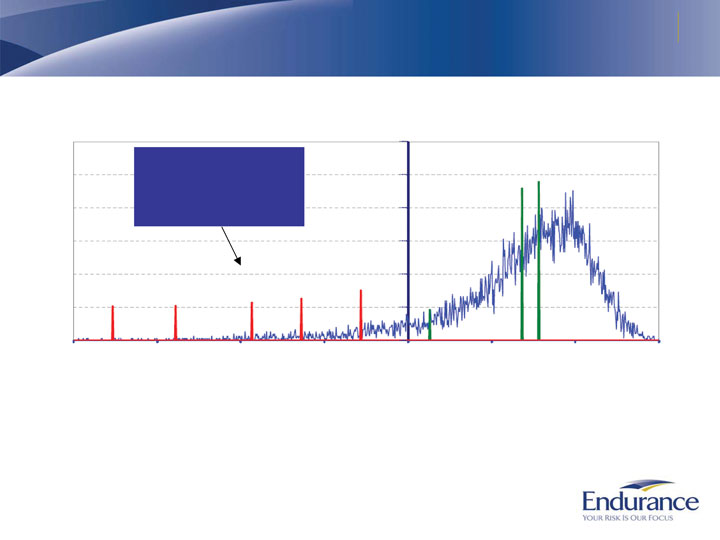

Strong Risk Management Focus -

Portfolio Expected Risk Curve (July 1, 2007)

Stated tolerance is to limit

our loss in a 1-in-100 year

to 25% of our capital or

less, our current level is

21.5% of capital

The above chart represents a cumulative analysis of our in-force underwriting portfolio on a full year basis based on thousands of potential

scenarios. Loss years are driven largely by the occurrence of natural catastrophes and incorrect pricing of other property and casualty exposures.

The operating income depicted includes net premiums earned plus net investment income, acquisition expenses and G&A expenses. Forecasted

investment income, acquisition and G&A expenses are held constant across all scenarios. Losses included above are net of reinsurance including

collateralized reinsurance and ILW purchases. Our stated objective is to maintain a risk management tolerance that limits our loss in a 1-in-100 year

year to be no more than 25% of our equity capital. We base our budget and forecasts on the average result, although the nature of the curve places

the median result further to the right.

Changes in Endurance's underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual results

to vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance, please see

"Risk Factors" in our Annual Report on Form 10K for the year ended December 31, 2006.

Probability

1-in-500

Year

$884 Mil

Loss

1-in-250

Year

$694 Mil

Loss

1-in-100

Year

$468 Mil

Loss

1-in-50

Year

$319 Mil

Loss

1-in-25

Year

$141 Mil

Loss

1-in-10

Year

$64 Mil

Loss

Average

Result

$342 Mil

Gain

Median

Result

$391Mil

Gain

-1,000

-750

-500

-250

0

250

500

750

Operating Result - $ Millions

Endurance Operating Income Profile

as of July 1, 2007

8

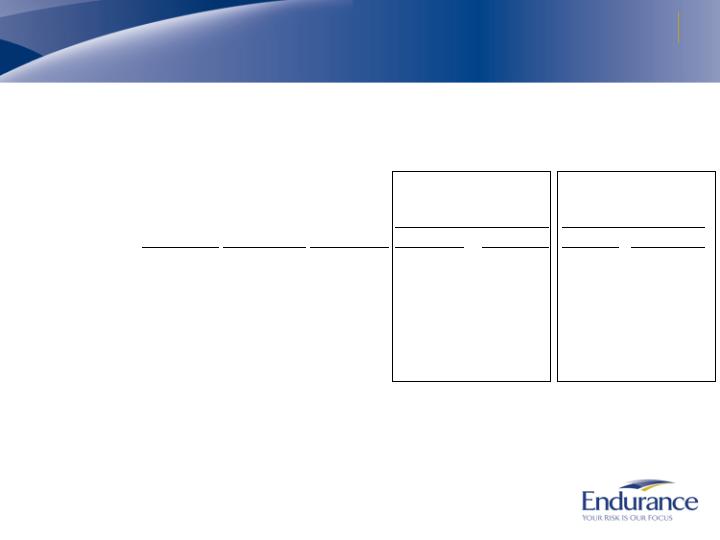

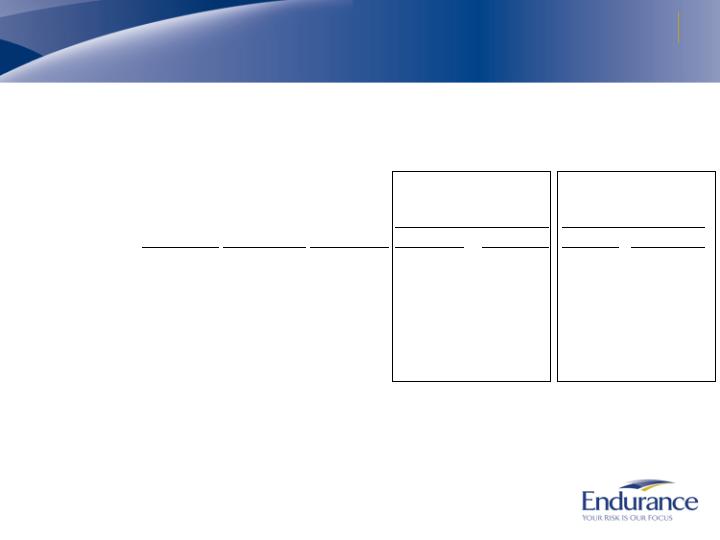

Changes in Portfolio Expected Risk Curve

Changes in Endurance's underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual results

to vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance, please see

"Risk Factors" in our Annual Report on Form 10K for the year ended December 31, 2006.

Change from

Change from

July 1, 2006 - June 30, 2007 to

Jan. 1, 2007 - Dec. 31, 2007

July 1, 2007 - June 30, 2008

July 1, 2007 - June 30, 2008

July 1, 2006 -

Jan. 1, 2007 -

July 1, 2007 -

$

%

$

%

(in millions)

June 30, 2007

Dec. 31, 2007

June 30, 2008

Change

Change

Change

Change

Median Result

$400

$381

$391

($9)

(2.3%)

$10

2.6%

Average Result

342

341

342

0

0.0%

1

0.3%

1 in 10 year annual gain

64

91

64

0

0.0%

(27)

(42.2%)

1 in 25 year annual loss

(182)

(66)

(141)

41

(29.1%)

(75)

53.2%

1 in 50 year annual loss

(334)

(172)

(319)

15

(4.7%)

(147)

46.1%

1 in 100 year annual loss

(486)

(287)

(468)

18

(3.8%)

(181)

38.7%

1 in 250 year annual loss

(707)

(396)

(694)

13

(1.9%)

(298)

42.9%

1 in 500 year annual loss

(904)

(500)

(884)

20

(2.3%)

(384)

43.4%

9

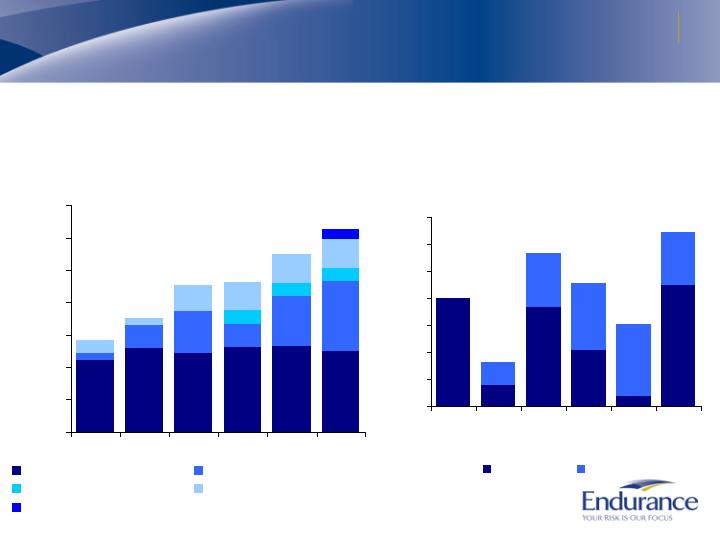

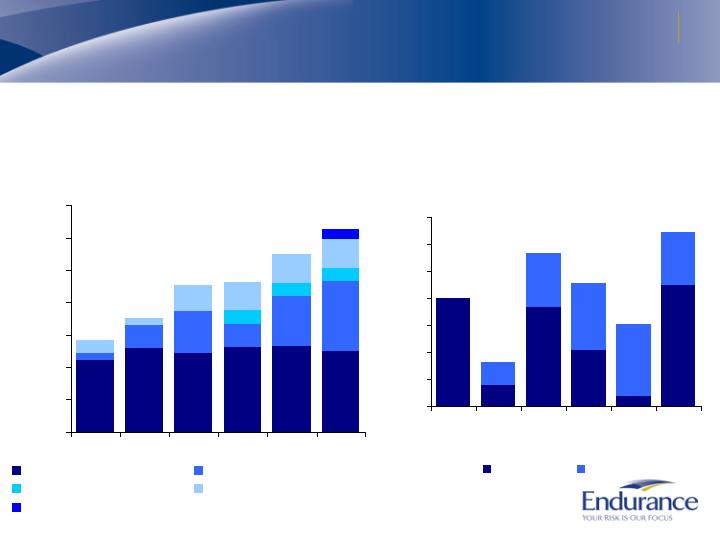

Diversification Has Led to Stable Premium Growth

$798.8

$1,602.0

$1,711.4

$1,812.2

$1,948.6

$1,527.1

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2002

2003

2004

2005

2006

3Q07

YTD

Gross Written Premiums*

Net Earned Premiums*

(in millions)

$369.5

$1,173.9

$1,632.6

$1,818.9

$1,256.5

$1,803.4

$0

$500

$1,000

$1,500

$2,000

2002

2003

2004

2005

2006

3Q07

YTD

(in millions)

* Includes deposit premiums

10

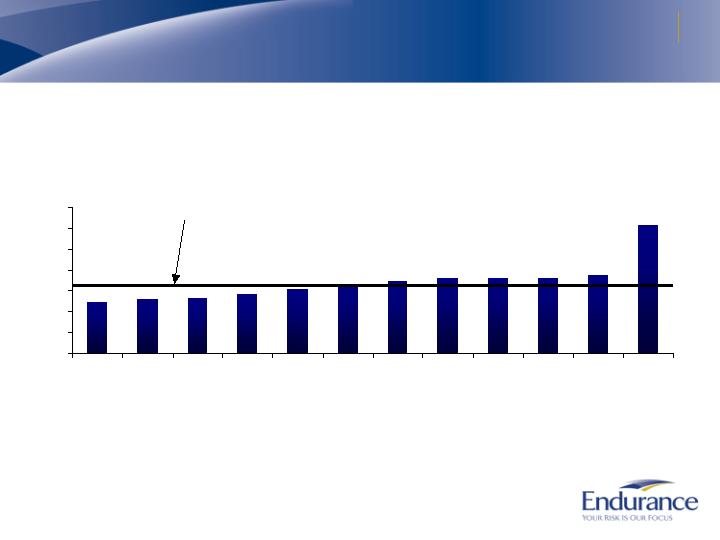

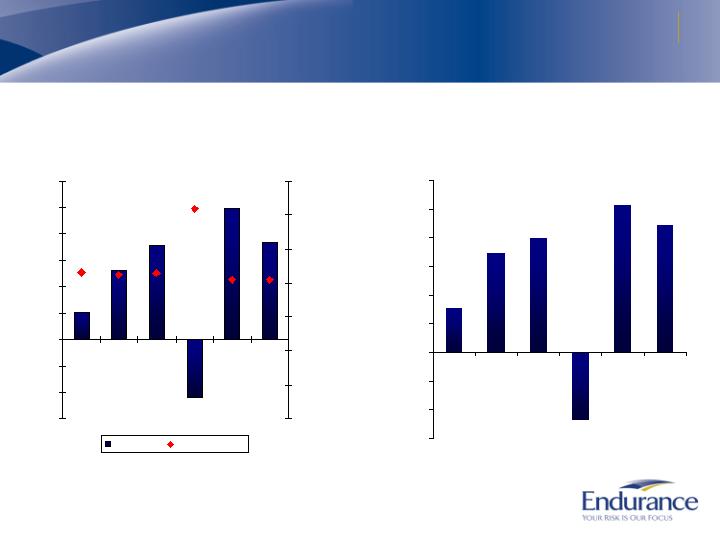

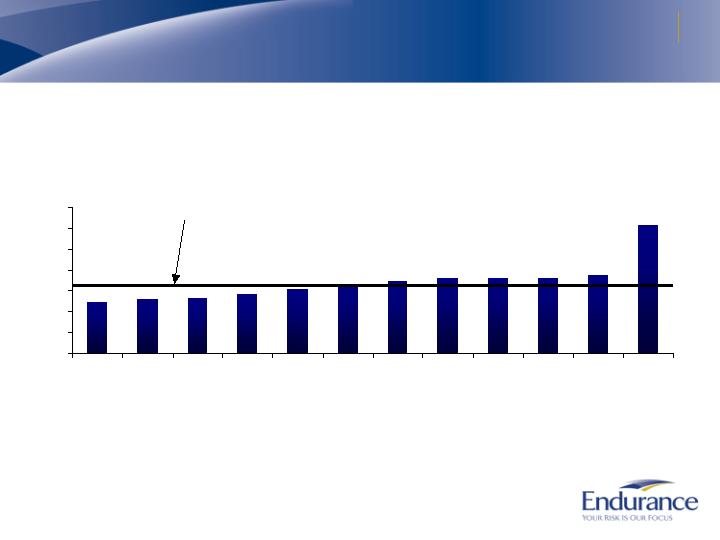

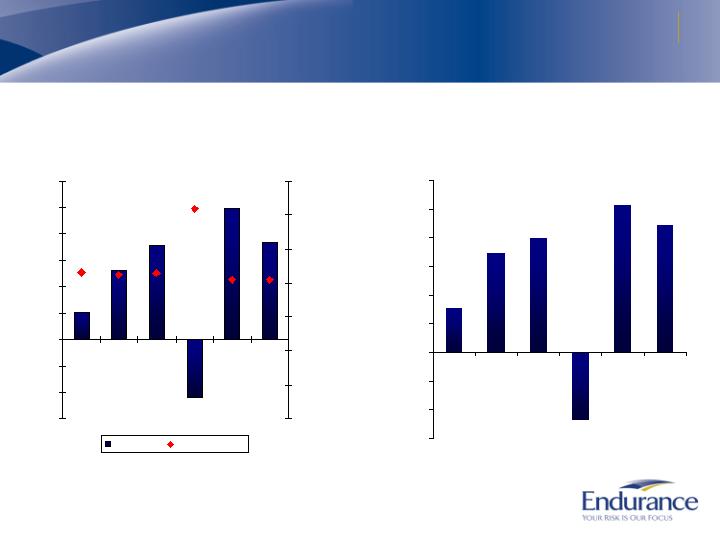

Overall Underwriting Has Been Strong

90.1%

90.3%

90.6%

93.6%

153.7%

65.5%

60.7%

66.5%

86.3%

81.7%

77.6%

70.6%

0%

25%

50%

75%

100%

125%

150%

175%

Inception to Date Underwriting Ratio*

* Underwriting ratio is defined as losses and acquisition expenses divided by earned

premium, as of 9/30/07 and is before deposit accounting adjustments.

Inception to Date Underwriting

Ratio is 83.3%*

Catastrophe

Healthcare

Liability

Aerospace

Professional

Lines

Casualty -

Insurance

Surety &

Other

Specialty

Agriculture

Casualty -

Reinsurance

Property -

Insurance

Workers'

Compensation

Property -

Reinsurance

Marine

11

Strong Financial Performance

$102.1

$263.4

$355.6

($220.5)

$498.1

$368.6

81.6%

84.7%

85.8%

81.5%

123.5%

86.2%

-$300

-$200

-$100

$0

$100

$200

$300

$400

$500

$600

2002

2003

2004

2005

2006

3Q07

YTD

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

Net Income

Combined Ratio

Net Income and Combined Ratio

(in millions)

7.8%

17.3%

19.9%

-11.9%

25.7%

22.2%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

2002

2003

2004

2005

2006

3Q07

YTD

Annualized Operating

Return on Average Equity

Inception to 9/30/07 combined ratio of 92.9%

Inception to 9/30/07 ROE of 14.6%

12

High Quality Investment Portfolio

Total Investment Portfolio of $5.8 Billion*

Cash and

Other

11.3%

Mortgage-backed

44.6%

By Investment Type

* As of September 30, 2007

Fixed Maturity Ratings

$5.1 Billion*

U.S. Government

and agencies

9.1%

Corporate

15.8%

Foreign Government

3.7%

Asset-backed

9.3%

Alternatives

5.9%

U.S. Government

and agencies

11.0%

AAA/Aaa and

agency RMBS

72.2%

BBB or Below

2.0%

AA/Aa

7.3%

A/A

7.5%

Municipals

0.3%

13

Efficient Capital Management

$1,115

$1,300

$1,213

$1,309

$1,318

$1,239

$102

$345

$650

$364

$780

$1,087

$200

$200

$200

$192

$103

$391

$447

$447

$447

$150

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2002

2003

2004

2005

2006

3Q07

Common Share Capital

Retained Earnings

Preferred Equity

Debt

Contingent Equity

Strong and Flexible

Capital Structure

$, Millions

$1,409

$1,748

$2,254

$2,320

$2,745

$100

$20

$92

$52

$10

$112

$21

$50

$62

$66

$49

$0

$25

$50

$75

$100

$125

$150

$175

2002

2003

2004

2005

2006

3Q07

YTD

Repurchases

Dividends

$, Millions

$633 Million of

Capital Returned

to Shareholders

$100

$41

$142

$113

$76

$161

$3,123

14

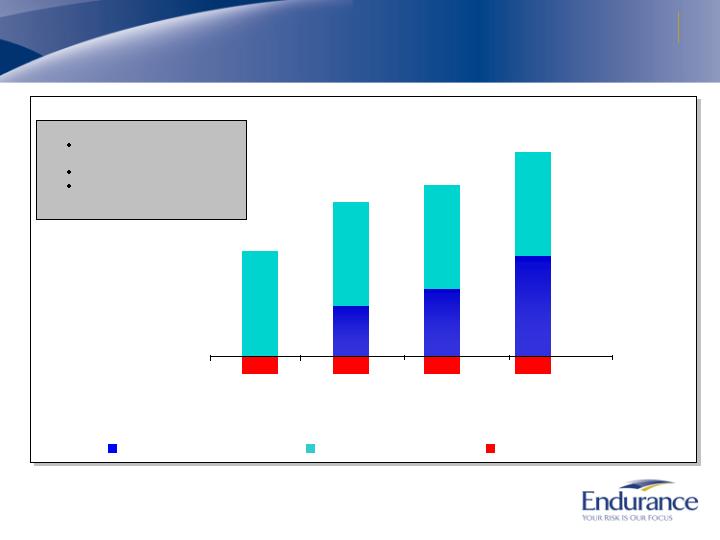

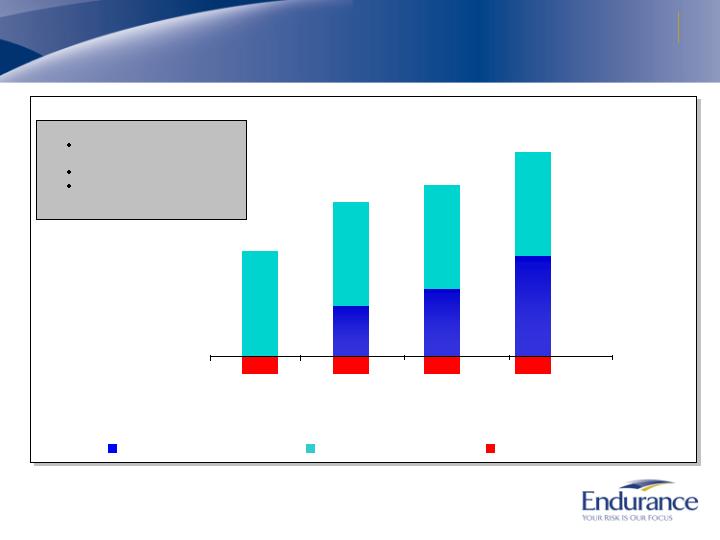

Sensitivity of ROE

* The Return on Equity Sensitivity Analysis is purely illustrative and should not be construed

as guidance for future performance. Changes in Endurance’s underwriting portfolio, investment portfolio, risk

control mechanisms, market conditions and other factors may cause our actual results to vary considerably from

those indicated above. For a listing of risks related to Endurance, please see “Risk Factors” in our Annual Report

on Form 10-K for the year ended December 31, 2006.

Operating Assumptions

2.6:1.0 Investment Leverage at

4.75% yield

0.75:1.0 Operating Leverage

Interest expense and preferred

dividends of 2.2% of common

equity

ROE = 10.2%

ROE = 17.7%

ROE = 21.5%

ROE = 15.8%

ROE from Underwriting Activity

ROE from Investing Activity

Financing Costs

Return On Equity Sensitivity Analysis*

2.2%

2.2%

2.2%

2.2%

12.4%

5.6%

7.5%

11.3%

12.4%

12.4%

12.4%

100%

Combined

Ratio

92.5%

Combined

Ratio

90%

Combined

Ratio

85%

Combined

Ratio

15

Conclusion

Disciplined technical underwriting culture with focus on

underwriting margin and risk adjusted returns

Well positioned with strong management team, diversified portfolio, and excellent financial strength

Create shareholder value through active capital

management coupled with strong returns to generate 15%+ ROE through underwriting cycles

16