Forward Looking Statements

Statements contained in this presentation that are not based on

current or historical fact are forward-looking in nature. Such forward-

looking statements are based on current plans, estimates and

expectations and are made pursuant to the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are based

on known and unknown risks, assumptions, uncertainties and other

factors. The Company’s actual results, performance, or achievements

may differ materially from any future results, performance, or

achievements expressed or implied by such forward-looking

statements. The Company undertakes no obligation to publicly update

or revise any forward-looking statement.

2

Overview

3

Return driven focus

Underwriting margin

Capital management

Specialized segment underwriting supported by centralized, leading

edge technical resources

Diversification

Micro-cycle management

Data, analysis driven

Execution excellence

Endurance Strategy

4

Established one of the leading insurance/reinsurance markets in the

industry

Global reinsurance

Bermuda based insurance products

Property insurance U.K./Europe

U.S. based specialty insurance

Management team with strong execution skills

Manages the key drivers of financial performance

Organic development of specialty lines of business

Strong capital management experience

Completed three value enhancing acquisitions without legacy risk

Delivering sustainable, industry leading returns on equity and increases

in shareholder value

Generated a return on equity of 17% in 2003 and 20% in 2004

Goal is to generate 15%+ growth in book value throughout the P&C

cycle

What We Have Achieved

5

What We Have Achieved (cont’d)

Proven track record of significant

shareholder value creation

6

Exceeded all financial objectives in 2003 and 2004

FY 2003

FY 2004

Gross premiums

$1.6 billion

$1.7 billion

Assets

$3.5 billion

$5.2 billion

Shareholders’ equity

$1.6 billion

$1.9 billion

Net income

$263 million

$356 million

Developed strong, technical, underwriting based culture

Built strong systems, controls, and infrastructure

Successfully executed three acquisitions

Implemented value-enhancing capital management initiatives

One of handful of companies to be upgraded by A.M. Best in 2003

“Positive Outlook” by Standard & Poor’s

Our Value Creation Levers

Specialist underwriting driven culture built around deep infrastructure,

intellectual capital and technical skills

Strong execution

Portfolio approach achieves capital efficiency and lower volatility of

results

Scaleable systems

Proactively allocate capital by line of business to maximize return

through changing market conditions

Focus on profit, not revenue

7

Underwriting & Strategy

8

Strategy

Identify business segments with sufficient opportunities to apply expertise

Only underwrite risks that are susceptible to underwriting and actuarial

analysis

Reallocate capital as different businesses become relatively less attractive

Culture

Understand the risk correlations within each segment and across portfolio

to determine required margins

Identify risks within each segment that meet return thresholds

Apply technical resources at the front end to evaluate and select business

Control

Focus on target returns, not premiums

Monitor underwriting decisions on a live basis

Monitor emergence of results to corroborate assumptions

Underwriting Philosophy

Philosophy that is disciplined, consistent

and embraced by underwriting teams

9

Severity Driven Risks

Property-Cat & Per Risk Treaty

Severity Driven Casualty Treaty

Excess Casualty

Professional Liability / E&O

Healthcare

Aviation

North American Direct Property

Underwriters: 34

Actuaries and Cat modelers: 17

Total Staff: 122

Non-U.S. Risks

International Property Treaty

International Casualty Treaty

European Direct Property

Marine and Energy

Underwriters: 27

Actuaries and Cat modelers: 5

Total Staff: 55

Frequency Driven Risks

Property Reinsurance

Casualty Reinsurance

Eight specialty reinsurance

segments

Underwriters: 41

Actuaries and Cat modelers: 12

Total Staff: 123

Endurance Specialty

Insurance Ltd.

(Bermuda)

Endurance Reinsurance

Corporation of America

(U.S.)

Endurance Worldwide

Insurance Limited

(U.K.)

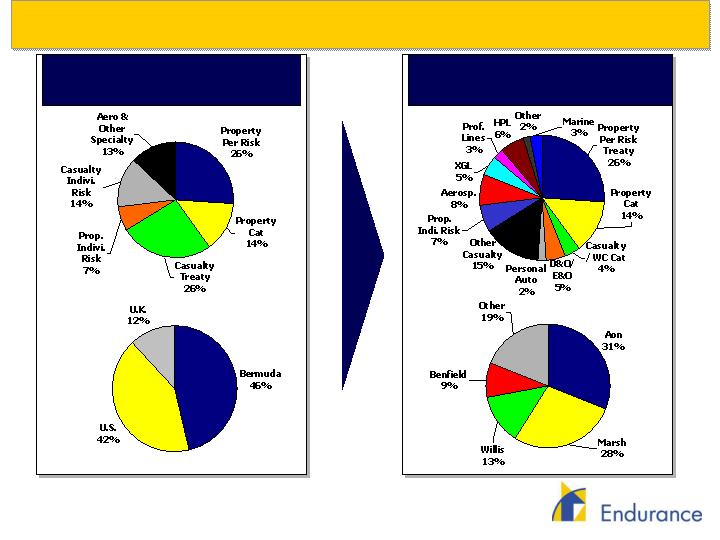

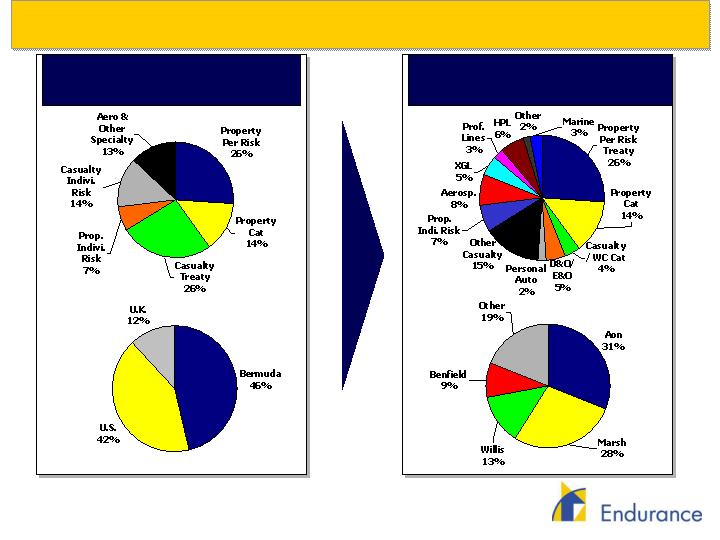

Lines of Business: 2004 GPW = $1,711M

Risk Exposure: 2004 GPW = $1,711M

The Platforms and Business Lines

10

Underwriting – Summary Results

($ in thousands)

2004 Underwriting Results

Gross Written Premiums

Net Earned Premiums

Unearned Prem. Reserves

GAAP Combined Ratio

Stat. Combined Ratio

Property

Per Risk

Treaty

$441,370

$253,881

$464,024

95.1

%

95.5

%

Property

Catastrophe

$247,009

$55,947

$234,961

47.7

%

48.4

%

Property

Individual

Risk

$112,900

$58,096

$102,780

68.1

%

67.2

%

Casualty

Treaty

$441,256

$282,948

$378,894

102.5

%

101.4

%

Casualty

Individual

Risk

$246,802

$114,452

$235,621

82.1

%

80.3

%

Aerospace

and Other

Specialty

$222,020

$132,281

$216,320

90.3

%

90.2

%

Total

$1,711,357

$897,605

$1,632,600

85.8

%

85.4

%

2003 Underwriting Results

Gross Written Premiums

Net Earned Premiums

GAAP Combined Ratio

Stat. Combined Ratio

$296,551

$469,290

93.9

%

91.2

%

$174,158

$183,594

38.5

%

37.7

%

$65,408

$85,863

58.6

%

56.7

%

$284,843

$390,265

97.5

%

95.7

%

$173,266

$214,392

89.1

%

87.8

%

$179,721

$258,593

99.5

%

98.2

%

$1,173,947

$1,601,997

84.7

%

83.5

%

11

Price Monitoring

12

SEC Segment & Subs. Distribution

2004 Premiums = $1,711 mm

Risk Exposures

Major Lines & Distribution

2004 Premiums = $1,711 mm

13

Risk Review – Portfolio Expected Risk Curve

In-Force Portfolio as of December 31, 2004

Endurance – Underwriting Income Profile

Underwriting Income - Amounts in Millions of USD

Expected

Result

U/W Ratio

80.1%

$353 M

Profit

U/W

Ratio

93.7%

1-in-10

Year

$119 M

Profit

U/W

Ratio

104.2%

1-in-25

Year

$63 M

Loss

U/W

Ratio

112.0%

1-in-50

Year

$201 M

Loss

U/W

Ratio

120.0%

1-in-100

Year

$342 M

Loss

U/W

Ratio

131.1%

1-in-250

Year

$542 M

Loss

U/W

Ratio

141.1%

1-in-500

Year

$722 M

Loss

14

Financial Review

15

($ in thousands)

Year Ended

Year Ended

Year Ended

December 31, 2002

December 31, 2003

December 31, 2004

Income Statement

Balance Sheet

Summary Financial Performance

16

Total Investments and Cash

$1,663,249

$2,674,232

$3,940,353

Reserve for Losses & Loss Exp.

200,840

833,158

1,549,661

Reserve for Unearned Prem.

403,305

824,685

897,605

Total Shareholders’ Equity

1,217,500

1,644,815

1,862,455

Debt / Total Capitalization

13.6%

5.9%

17.4%

Gross Written Premiums

$798,760

$1,601,997

$1,711,357

Net Earned Premiums

369,489

1,173,947

1,632,600

Operating income

93,024

247,938

348,443

Combined Ratio

86.2%

84.7%

85.8%

Operating ROAE

7.8%

17.3%

19.9%

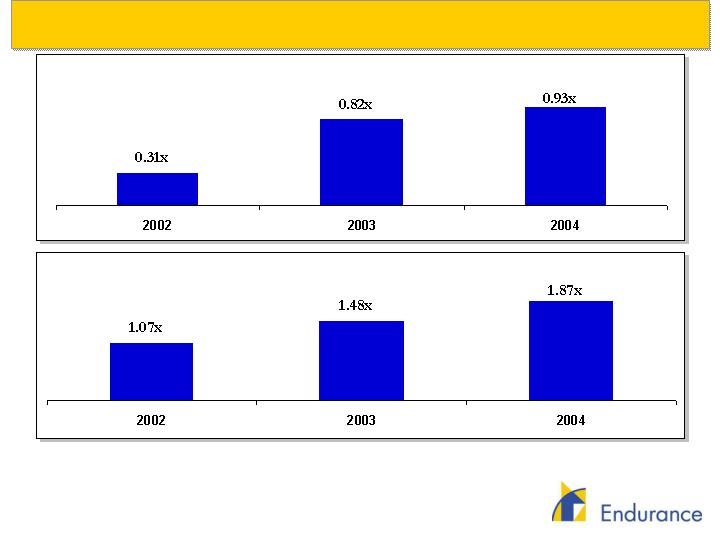

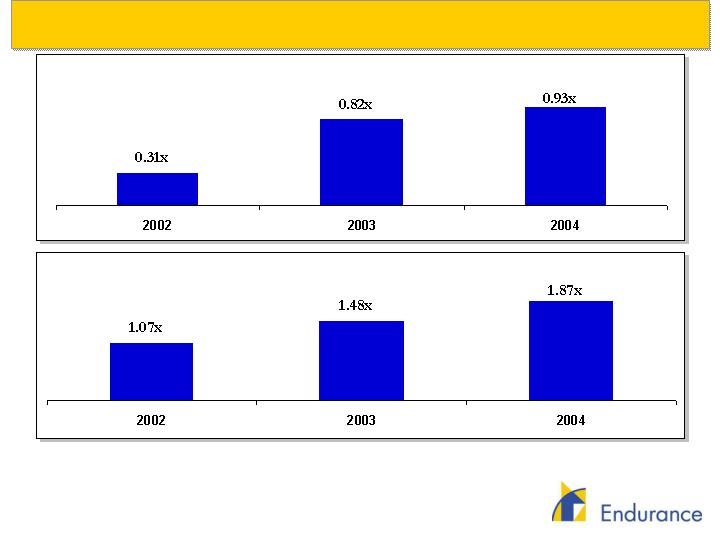

Optimizing Operating Leverage

Operating Leverage (a)

Investment Leverage (b)

(a)

Operating leverage is calculated by dividing net premiums earned by average equity.

(b)

Investment leverage is calculated by dividing average invested assets by average equity.

17

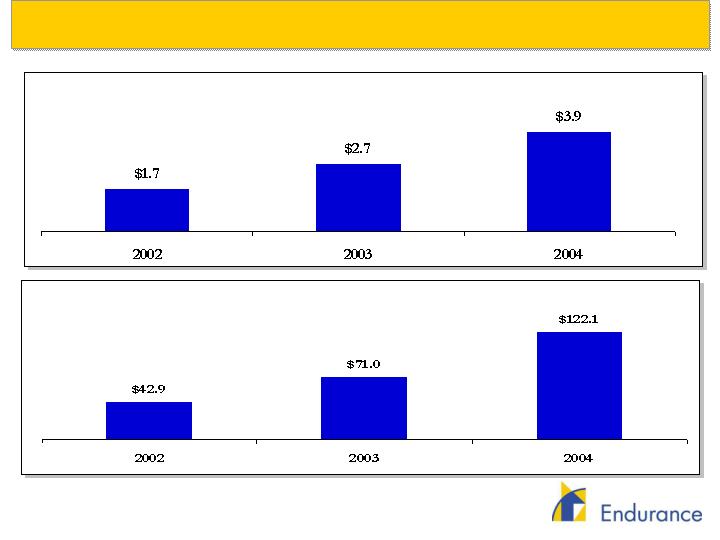

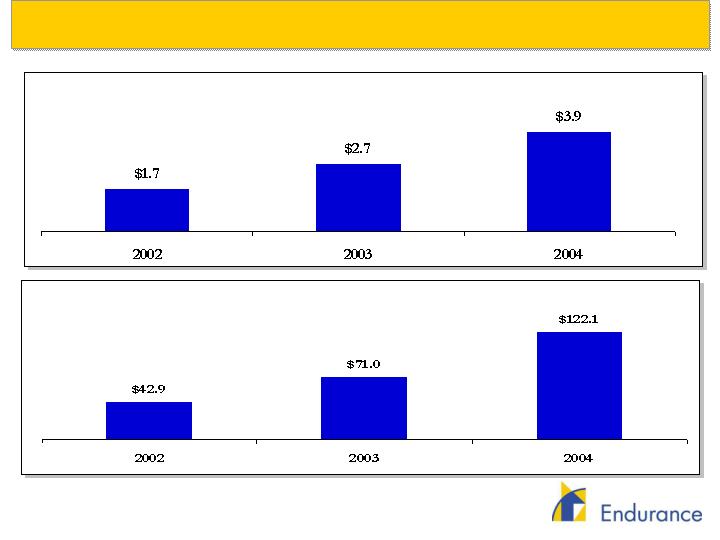

Investment Income Growth

Cash and Invested Assets ($, billions)

Investment Income ($, millions)

18

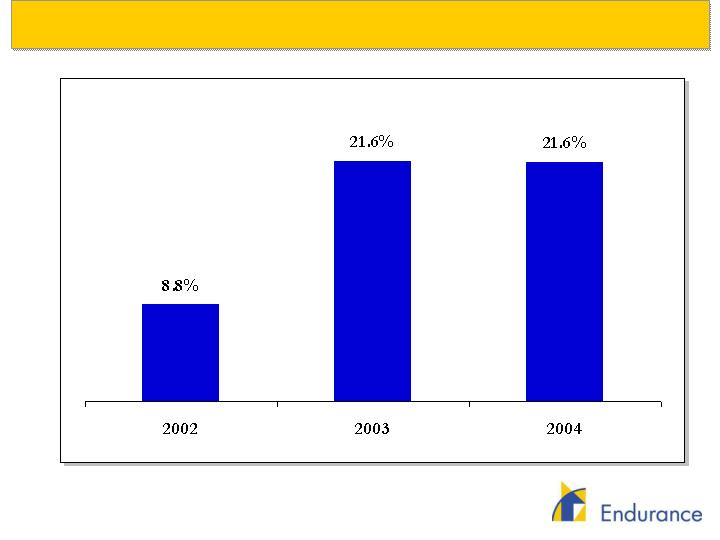

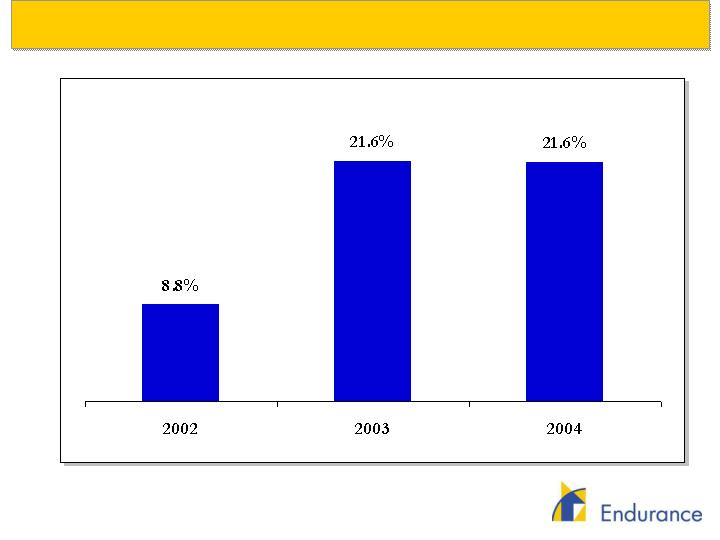

Return on Beginning Equity

19

1.9:1.0 Investment Leverage

at 3.80% yield

Achieving Our Targets

Mid to High Teens Returns

0.9:1.0 Operating Leverage

Operating Assumptions

Unlevered Return On Capital

ROE Component Build-Up

16% +

9.0%

7.2%

90.0% Combined Ratio

20

Capital Management Strategy

Increasing capital utilization

Strong organic growth

5 renewal rights/team transactions

Understanding capital utilization

Catastrophe exposure

Actuarial

Rating agency

Reducing Cost of Capital

$850 million multi-year debt facility

$250 million 30-year debt transaction

Significant increase in float (secondary, Aon block trade)

Returning excess capital

$212 million in stock repurchased

3.2 million share repurchase authorization

$71 million in dividends paid as of 12/31/2004

21

The best measure of shareholder value creation is growth in book

value per share

The price book multiple cannot be controlled

P/B versus ROE regression is biased towards stock buybacks

Stock buybacks above book value depress book value per share

growth due to premium offset by reducing shares outstanding

Investors have no more than a two to three year time horizon

Breakeven point for P/B multiple for a buyback is two to three times

expected ROE

Above that point, better to pay a special dividend

Analysis favors dividends when stock trades above 1.3x to 1.4x book

Dividends Versus Stock Buyback Philosophy

22

Conclusion

23

Conclusion

Exceeded all strategic and financial objectives

Built strong, technical, underwriting based culture that is focused on

profit, not revenue

Created robust controls, systems, and infrastructure

Value enhancement through capital management and enhancing

acquisitions

Goal is to generate 15%+ growth in book value throughout the cycle

Demonstrated ability to create significant shareholder value with

significant future upside

24