Endurance Specialty Holdings Ltd.

Goldman Sachs Small Cap Growth Conference

Kenneth J. LeStrange

Chief Executive Officer

March 10, 2005

Forward Looking Statements

Statements contained in this presentation that are not based on

current or historical fact are forward-looking in nature. Such forward-

looking statements are based on current plans, estimates and

expectations and are made pursuant to the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are based

on known and unknown risks, assumptions, uncertainties and other

factors. The Company’s actual results, performance, or achievements

may differ materially from any future results, performance, or

achievements expressed or implied by such forward-looking

statements. The Company undertakes no obligation to publicly update

or revise any forward-looking statement.

2

Return driven focus

Underwriting margin

Capital management

Specialized segment underwriting supported by centralized, leading

edge technical resources

Diversification

Micro-cycle management

Data, analysis driven

Execution excellence

Endurance Strategy

3

Established one of the leading insurance/reinsurance markets in the

industry

Global reinsurance

Bermuda based insurance products

Property insurance U.K./Europe

U.S. based specialty insurance

Management team with strong execution skills

Manages the key drivers of financial performance

Organic development of specialty lines of business

Strong capital management experience

Completed three value enhancing acquisitions without legacy risk

Delivering sustainable, industry leading returns on equity and increases

in shareholder value

Generated a return on equity of 17% in 2003 and 20% in 2004

Goal is to generate 15%+ growth in book value throughout the P&C

cycle

What We Have Achieved

4

What We Have Achieved (cont’d)

Proven track record of significant

shareholder value creation

5

Exceeded all financial objectives in 2003 and 2004

FY 2003

FY 2004

Gross premiums

$1.6 billion

$1.7 billion

Assets

$3.5 billion

$5.2 billion

Shareholders’ equity

$1.6 billion

$1.9 billion

Net income

$263 million

$356 million

Developed strong, technical, underwriting based culture

Built strong systems, controls, and infrastructure

Successfully executed three acquisitions

Implemented value-enhancing capital management initiatives

One of handful of companies to be upgraded by A.M. Best in 2003

“Positive Outlook” by Standard & Poor’s

Endurance Specialty Insurance, Ltd. – 2002 (Bermuda)

LASALLE RE

PORTFOLIO ACQUISITION

PROPERTY CATASTROPHE REINSURANCE

CASUALTY REINSURANCE

AVIATION REINSURANCE

HEALTHCARE INSURANCE

PROFESSIONAL LINES INSURANCE

EXCESS CASUALTY INSURANCE

PROPERTY INSURANCE

6

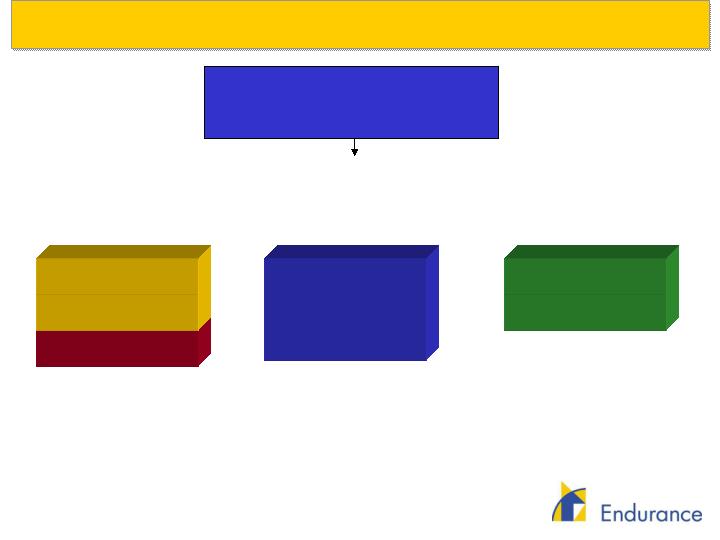

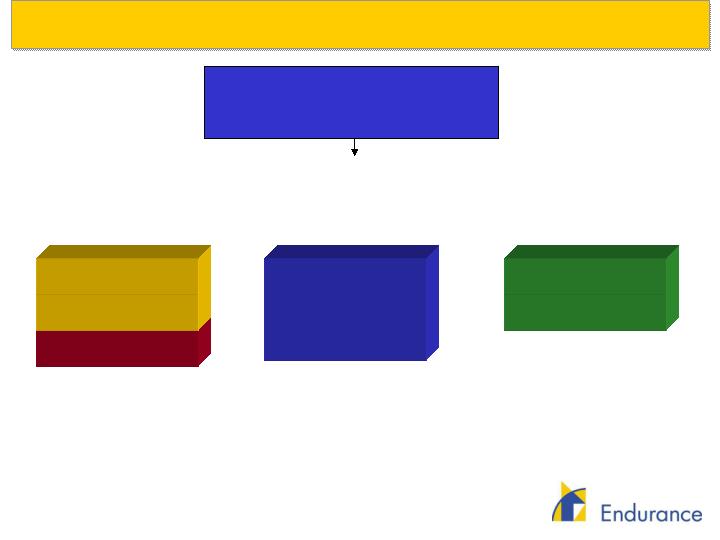

2003

- IPO 2/28/03

ESIL

Endurance Reinsurance

Corporation of America

(New York)

Endurance Specialty

Insurance Ltd.

(Bermuda)

Endurance Worldwide

Insurance Ltd.

(London)

PROPERTY TREATY REINSURANCE

PROPERTY INSURANCE

HARTFORD RE

PORTFOLIO ACQUISITION

PROPERTY REINSURANCE

CASUALTY REINSURANCE

ENDURANCE SPECIALTY HOLDINGS LTD.

7

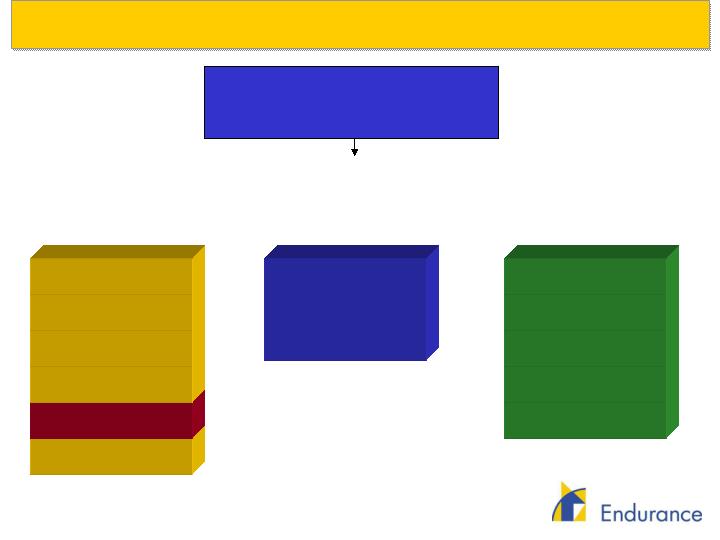

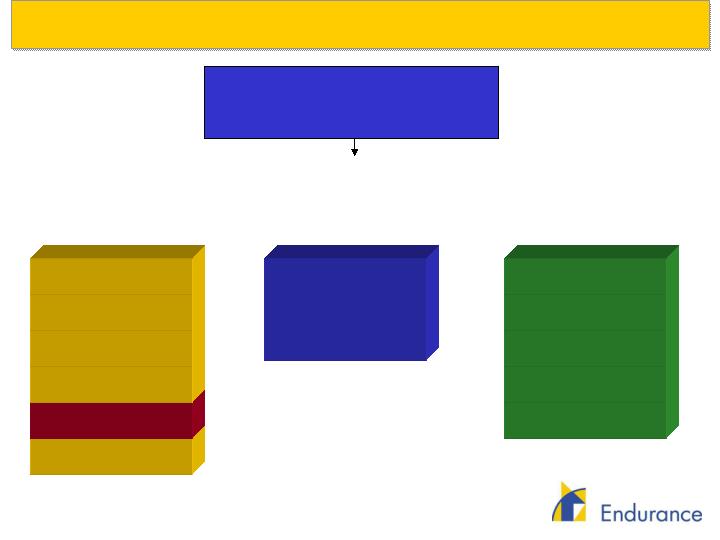

2004

- IPO 2/28/03

Endurance Reinsurance

Corporation of America

(New York)

Endurance Specialty

Insurance Ltd.

(Bermuda)

Endurance Worldwide

Insurance Ltd.

(London)

PERSONAL ACCIDENT REINSURANCE

CASUALTY REINSURANCE

AGRICULTRUAL REINSURANCE

XL SURETY REINSURANCE

ACQUISITION

MARINE REINSURANCE

PERSONAL ACCIDENT REINSURANCE

PROPERTY REINSURANCE

CASUALTY REINSURANCE

MARINE REINSURANCE

PROPERTY TREATY REINSURANCE

PROPERTY INSURANCE

ENDURANCE SPECIALTY HOLDINGS LTD.

ESIL

8

2005

ENDURANCE SPECIALTY HOLDINGS LTD.

- IPO 2/28/03

Endurance Reinsurance

Corporation of America

(New York)

Endurance Specialty

Insurance Ltd.

(Bermuda)

Endurance Worldwide

Insurance Ltd.

(London)

ERCA

ESIL

EWIL

SPECIALTY INSURANCE

Endurance Specialty

Insurance US

(California)

CASUALTY INSURANCE

PROPERTY INSURANCE

9

Our Value Creation Levers

Specialist underwriting driven culture built around deep infrastructure,

intellectual capital and technical skills

Strong execution

Portfolio approach achieves capital efficiency and lower volatility of

results

Scaleable systems

Proactively allocate capital by line of business to maximize return

through changing market conditions

Focus on profit, not revenue

10

Strategy

Identify business segments with sufficient opportunities to apply expertise

Only underwrite risks that are susceptible to underwriting and actuarial

analysis

Reallocate capital as different businesses become relatively less attractive

Culture

Understand the risk correlations within each segment and across portfolio

to determine required margins

Identify risks within each segment that meet return thresholds

Apply technical resources at the front end to evaluate and select business

Control

Focus on target returns, not premiums

Monitor underwriting decisions on a live basis

Monitor emergence of results to corroborate assumptions

Underwriting Philosophy

Philosophy that is disciplined, consistent

and embraced by underwriting teams

11

Risk Review – Portfolio Expected Risk Curve

In-Force Portfolio as of December 31, 2004

Endurance – Underwriting Income Profile

Underwriting Income - Amounts in Millions of USD

Expected

Result

U/W Ratio

80.1%

$353 M

Profit

U/W

Ratio

93.7%

1-in-10

Year

$119 M

Profit

U/W

Ratio

104.2%

1-in-25

Year

$63 M

Loss

U/W

Ratio

112.0%

1-in-50

Year

$201 M

Loss

U/W

Ratio

120.0%

1-in-100

Year

$342 M

Loss

U/W

Ratio

131.1%

1-in-250

Year

$542 M

Loss

U/W

Ratio

141.1%

1-in-500

Year

$722 M

Loss

12

($ in thousands)

Year Ended Year Ended Year Ended

December 31, 2002 December 31, 2003 December 31, 2004

Income Statement

Balance Sheet

Summary Financial Performance

13

Total Investments and Cash

$1,663,249

$2,674,232

$3,940,353

Reserve for Losses & Loss Exp.

200,840

833,158

1,549,661

Reserve for Unearned Prem.

403,305

824,685

897,605

Total Shareholders’ Equity

1,217,500

1,644,815

1,862,455

Debt / Total Capitalization

13.6%

5.9%

17.4%

Gross Written Premiums

$798,760

$1,601,997

$1,711,357

Net Earned Premiums

369,489

1,173,947

1,632,600

Operating income

93,024

247,938

348,443

Combined Ratio

86.2%

84.7%

85.8%

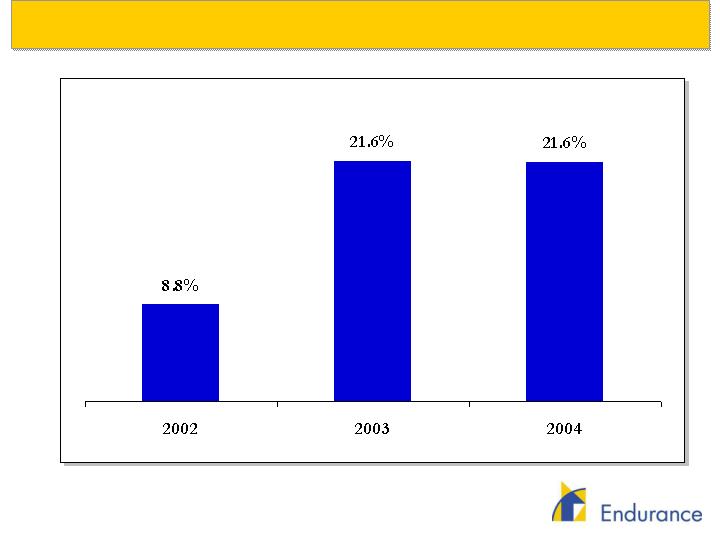

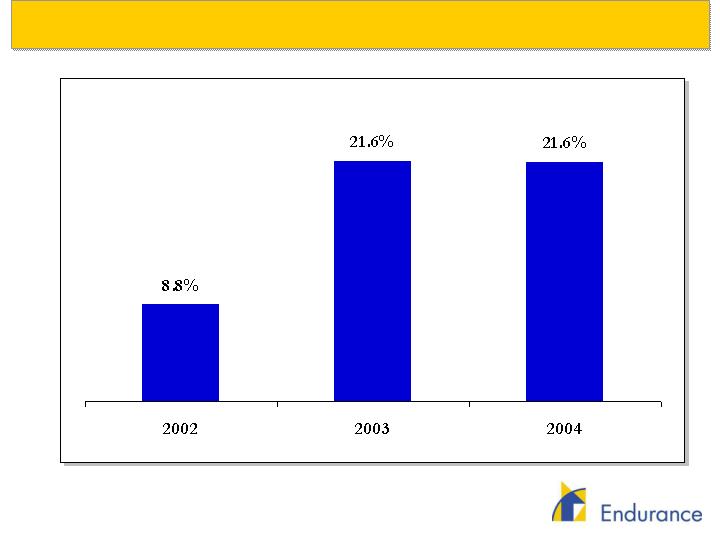

Operating ROAE

7.8%

17.3%

19.9%

Return on Beginning Equity

14

Conclusion

Exceeded all strategic and financial objectives

Built strong, technical, underwriting based culture that is focused on

profit, not revenue

Created robust controls, systems, and infrastructure

Value enhancement through capital management and enhancing

acquisitions

Goal is to generate 15%+ growth in book value throughout the cycle

Demonstrated ability to create significant shareholder value with

significant future upside

15