This report is for information purposes only. It should be read in conjunction with other documents filed by Endurance Specialty Holdings Ltd. pursuant to the Securities Act of 1933 and the Securities Exchange Act of 1934.

Financial Supplement Table of Contents

| | Page |

| i. Basis of Presentation | i |

| ii. Organizational Chart of Executive Management | ii |

| iii. Organizational Chart of Corporate Structure | ii |

| | |

| I. Financial Highlights | 1 |

| | |

| II. Consolidated Financial Statements | |

| a. Consolidated Statements of Income | 2 |

| b. Consolidated Balance Sheets | 3 |

| c. Segment Distribution | 4 |

| d. Consolidated Segment Data | 5 |

| e. Deposit Accounting Adjustment Impacts on Segment Data | 7 |

| | |

| III. Other Financial Information | |

| a. Return on Equity Analysis | 9 |

| b. ROE Component Analysis - Operating and Investment Leverage | 10 |

| c. Investment Portfolio Information | 11 |

| d. Unrealized Gains and Operating Cash Flow | 12 |

| | |

| IV. Loss Reserve Analysis | |

| a. Activity in Reserve for Losses and Loss Expenses | 13 |

| b. Analysis of Unpaid Losses and Loss Expense | 14 |

| | |

| V. Share Analysis | |

| a. Weighted Average Dilutive Shares Outstanding | 15 |

| b. Operating Income Reconciliation | 16 |

| c. Dilutive Shares Sensitivity Analysis | 17 |

| d. Book Value Per Share Analysis | 18 |

| e. Growth in Book Value Per Share Analysis | 19 |

| | |

| VI. Regulation G | 20 |

Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995:

Some of the statements in this financial supplement may include forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. Statements which include the words “expect,” “intend,”“plan,” “believe,” “project,” “anticipate,”“seek,” “will,” and similar statements of a future or forward-looking nature identify forward-looking statements in this financial supplement for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only to the date on which they are made. We undertake no obligation to publicly update or review any forward looking statement, when as a result of new information, future developments or otherwise.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ from those indicated in the forward-looking statements. These factors include, but are not limited to, competition, possible terrorism or the outbreak of war, the frequency or severity of unpredictable catastrophic events, changes in demand for insurance or reinsurance, rating agency actions, uncertainties in our reserving process, a change in our tax status, acceptance of our products, the availability of reinsurance or retrocessional coverage, retention of key personnel, political conditions, the impact of current regulatory investigations, changes in accounting policies, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2004.

ENDURANCE SPECIALTY HOLDINGS LTD.

BASIS OF PRESENTATION

DEFINITIONS AND PRESENTATION

| • | All financial information contained herein is unaudited, except the balance sheet and income statement data for the years ended December 31, 2004 and December 31, 2003, which was derived from the Company’s audited financial statements. |

| • | Unless otherwise noted, all data is in thousands, except for per share, percentage and ratio information. |

| • | As used in this financial supplement, “common shares” refers to our ordinary shares and class A shares, collectively. |

| • | Endurance Specialty Holdings Ltd., along with others in the industry, uses underwriting ratios as measures of performance. The loss ratio is the ratio of claims and claims adjustment expense to earned premiums. The acquisition expense ratio is the ratio of underwriting expenses (commissions, taxes, licenses and fees, as well as other underwriting expenses) to earned premiums. The general and administrative expense ratio is the ratio of general and administrative expenses to earned premiums. The combined ratio is the sum of the loss ratio, the acquisition expense ratio and the general and administrative expense ratio. These ratios are relative measurements that describe for every $100 of net premiums earned or written, the cost of losses and expenses, respectively. The combined ratio presents the total cost per $100 of earned premium. A combined ratio below 100% demonstrates underwriting profit; a combined ratio above 100% demonstrates underwriting loss. |

| • | GAAP combined ratios differ from statutory combined ratios primarily due to the deferral of certain third party acquisition expenses for GAAP reporting purposes and the use of net premiums earned rather than net premiums written in the denominator when calculating the acquisition expense and the general & administrative expense ratios. |

| • | NM — Not meaningful; NA — Not Applicable; LTM — Latest twelve months. |

i

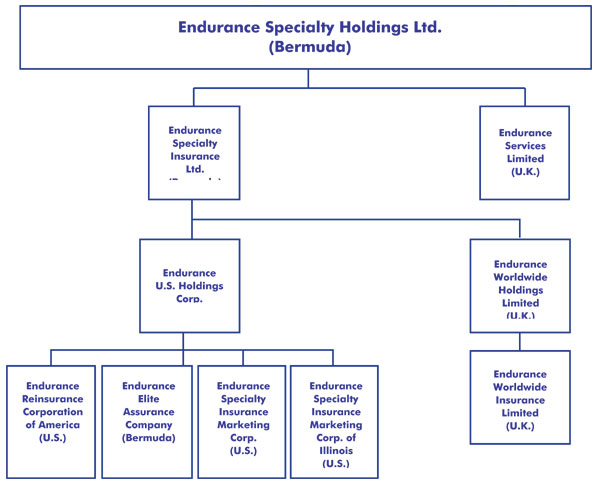

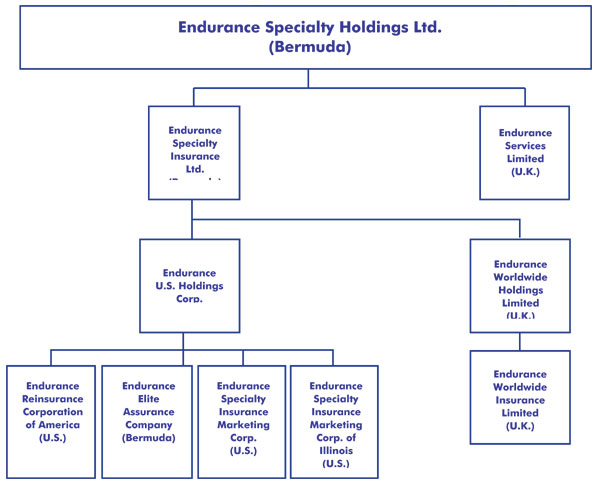

ENDURANCE SPECIALTY HOLDINGS LTD.

ORGANIZATION CHART

ii

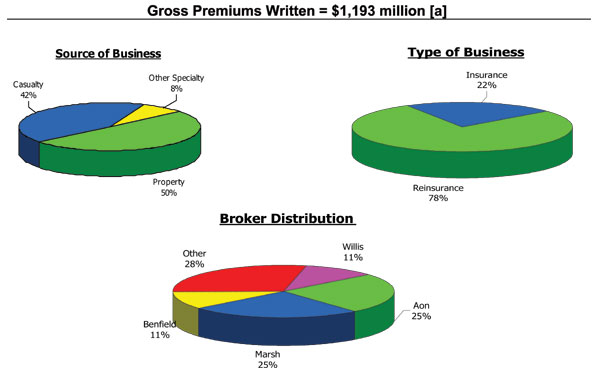

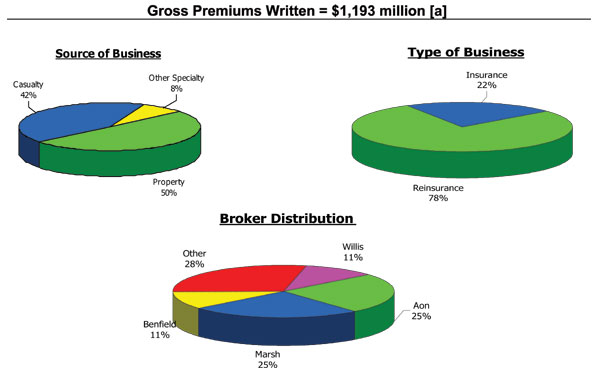

ENDURANCE SPECIALTY HOLDINGS LTD.

CORPORATE ORGANIZATION CHART

iii

ENDURANCE SPECIALTY HOLDINGS LTD.

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | QUARTER ENDED

JUNE 30, | | SIX MONTHS ENDED

JUNE 30, | | Previous

Quarter

Change | | Previous

Year to Date

Change | |

|

|

| 2005 | | 2004 | 2005 | | 2004 |

| |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | | | | | |

| HIGHLIGHTS | | Net income | $ | 110,017 | | $ | 114,756 | | $ | 206,276 | | $ | 215,628 | | (4.1 | )% | (4.3 | )% |

| | Operating income [a] | | 111,787 | | | 117,885 | | | 214,459 | | | 216,571 | | (5.2 | )% | (1.0 | )% |

| | Gross premiums written | | 403,189 | | | 350,661 | | | 1,105,680 | | | 1,071,292 | | 15.0 | % | 3.2 | % |

| | Net premiums earned | | 437,921 | | | 395,987 | | | 875,519 | | | 811,813 | | 10.6 | % | 7.8 | % |

| | Total assets | | 5,809,713 | | | 4,421,619 | | | 5,809,713 | | | 4,421,619 | | 31.4 | % | 31.4 | % |

| | Total shareholders’ equity | | 1,987,125 | | | 1,731,271 | | | 1,987,125 | | | 1,731,271 | | 14.8 | % | 14.8 | % |

|

| PER SHARE | | Basic earnings per share | | | | | | | | | | | | | | | | |

| AND SHARES DATA | | Net income (as reported) | $ | 1.81 | | $ | 1.81 | | $ | 3.38 | | $ | 3.38 | | 0.1 | % | (0.0 | )% |

| | Operating income (as reported) [a] | $ | 1.84 | | $ | 1.86 | | $ | 3.52 | | $ | 3.40 | | (0.9 | )% | 3.5 | % |

| | Diluted earnings per share | | | | | | | | | | | | | | | | |

| | Net income (as reported) | $ | 1.67 | | $ | 1.69 | | $ | 3.11 | | $ | 3.16 | | (1.4 | )% | (1.5 | )% |

| | Operating income (as reported) [a] | $ | 1.69 | | $ | 1.74 | | $ | 3.24 | | $ | 3.17 | | (2.5 | )% | 2.0 | % |

| As Reported | | Weighted average common shares outstanding | | 60,632 | | | 63,334 | | | 60,960 | | | 63,709 | | (4.3 | )% | (4.3 | )% |

| | Weighted average common shares outstanding | | | | | | | | | | | | | | | | |

| | and dilutive potential common shares | | 66,063 | | | 67,919 | | | 66,276 | | | 68,244 | | (2.7 | )% | (2.9 | )% |

| Book Value | | Book value [b] | $ | 33.01 | | $ | 27.83 | | $ | 33.01 | | $ | 27.83 | | 18.6 | % | 18.6 | % |

| Per Share | | Diluted book value (treasury stock method) [b] | $ | 30.01 | | $ | 25.81 | | $ | 30.01 | | $ | 25.81 | | 16.3 | % | 16.3 | % |

| | | | | | | | | | | | | | | | | | | |

|

| FINANCIAL RATIOS | | Return on average equity (ROAE), net income [c] | | 5.7 | % | | 6.6 | % | | 10.7 | % | | 12.8 | % | (0.9 | )% | (2.1 | )% |

| | ROAE, operating income [a] [c] | | 5.8 | % | | 6.7 | % | | 11.1 | % | | 12.8 | % | (1.0 | )% | (1.7 | )% |

| | | Return on beginning equity (ROBE), net income | | 5.8 | % | | 6.5 | % | | 11.1 | % | | 13.1 | % | (0.7 | )% | (2.0 | )% |

| | | ROBE, operating income [a] | | 5.9 | % | | 6.7 | % | | 11.5 | % | | 13.2 | % | (0.7 | )% | (1.7 | )% |

| | | Annualized ROAE, net income [c] | | 22.7 | % | | 26.3 | % | | 21.4 | % | | 25.5 | % | (3.5 | )% | (4.1 | )% |

| | Annualized ROAE, operating income [a] [c] | | 23.1 | % | | 27.0 | % | | 22.3 | % | | 25.7 | % | (3.9 | )% | (3.4 | )% |

| | | Annualized ROBE, net income | | 23.4 | % | | 26.0 | % | | 22.2 | % | | 26.2 | % | (2.7 | )% | (4.1 | )% |

| | | Annualized ROBE, operating income [a] | | 23.8 | % | | 26.7 | % | | 23.0 | % | | 26.3 | % | (3.0 | )% | (3.3 | )% |

| | | Annualized investment yield | | 3.8 | % | | 3.9 | % | | 3.8 | % | | 3.8 | % | (0.1 | )% | 0.0 | % |

| | | | | | | | | | | | | | | | | | | |

| | Loss ratio | | 52.3 | % | | 47.8 | % | | 54.8 | % | | 50.7 | % | 4.5 | % | 4.1 | % |

| GAAP | | Acquisition expense ratio | | 20.4 | % | | 20.9 | % | | 20.1 | % | | 20.7 | % | (0.5 | )% | (0.6 | )% |

| | General and administrative expense ratio | | 9.2 | % | | 8.2 | % | | 8.4 | % | | 7.9 | % | 1.0 | % | 0.5 | % |

| |

| |

| |

| |

| |

| |

| |

| | | Combined ratio | | 81.9 | % | | 76.9 | % | | 83.3 | % | | 79.3 | % | 5.0 | % | 4.0 | % |

| STAT | | Acquisition expense ratio | | 19.5 | % | | 20.2 | % | | 18.9 | % | | 20.1 | % | (0.7 | )% | (1.2 | )% |

| | | General and administrative expense ratio | | 10.2 | % | | 9.3 | % | | 6.8 | % | | 6.0 | % | 0.9 | % | 0.8 | % |

| |

| |

| |

| |

| |

| |

| |

| | | Combined ratio | | 82.0 | % | | 77.3 | % | | 80.5 | % | | 76.8 | % | 4.7 | % | 3.7 | % |

| |

| | | |

| | | | | | | |

| [a] | Operating income represents after-tax operational results excluding, as applicable, after-tax net realized capital gains or losses and after-tax net foreign exchange gains or losses. Please see page 16 for a reconciliation to net income. |

| [b] | For detailed calculations please refer to page 18. |

| [c] | Average equity is calculated as the arithmetic average of the beginning and ending equity balances for the stated periods. |

1

ENDURANCE SPECIALTY HOLDINGS LTD.

CONSOLIDATED STATEMENTS OF INCOME

| QUARTER ENDED

JUNE 30, | | SIX MONTHS ENDED

JUNE 30, | | YEAR ENDED

DEC. 31, 2004 | |

|

|

| 2005 | | 2004 | 2005 | | 2004 |

|

| |

| |

| |

| |

| |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 403,189 | | $ | 350,661 | | $ | 1,105,680 | | $ | 1,071,292 | | $ | 1,711,357 | |

| Premiums ceded | | (8,599 | ) | | (62 | ) | | (11,912 | ) | | (3,686 | ) | | (14,337 | ) |

|

| |

| |

| |

| |

| |

| Net premiums written | | 394,590 | | | 350,599 | | | 1,093,768 | | | 1,067,606 | | | 1,697,020 | |

| Change in unearned premiums | | 43,331 | | | 45,388 | | | (218,249 | ) | | (255,793 | ) | | (64,420 | ) |

|

| |

| |

| |

| |

| |

| Net premiums earned | $ | 437,921 | | $ | 395,987 | | $ | 875,519 | | $ | 811,813 | | $ | 1,632,600 | |

| Other underwriting (losses) income | | (145 | ) | | — | | | 26 | | | — | | | — | |

|

| |

| |

| |

| |

| |

| Total underwriting revenues | $ | 437,776 | | $ | 395,987 | | $ | 875,545 | | $ | 811,813 | | $ | 1,632,600 | |

|

| |

| |

| |

| |

| |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 228,916 | | $ | 189,208 | | $ | 479,975 | | $ | 411,217 | | $ | 937,330 | |

| Acquisition expenses | | 89,334 | | | 82,667 | | | 176,109 | | | 168,185 | | | 329,784 | |

| General and administrative expenses | | 40,432 | | | 32,537 | | | 73,978 | | | 64,304 | | | 133,725 | |

|

| |

| |

| |

| |

| |

| Total underwriting expenses | | 358,682 | | | 304,412 | | | 730,062 | | | 643,706 | | | 1,400,839 | |

|

| |

| |

| |

| |

| |

| Underwriting income | $ | 79,094 | | $ | 91,575 | | $ | 145,483 | | $ | 168,107 | | $ | 231,761 | |

|

| |

| |

| |

| |

| |

| OTHER OPERATING REVENUE/EXPENSES | | | | | | | | | | | | | | | |

| Net investment income | $ | 39,696 | | $ | 28,944 | | $ | 79,707 | | $ | 53,619 | | $ | 122,059 | |

| Interest expense | | (5,612 | ) | | (834 | ) | | (11,083 | ) | | (1,662 | ) | | (9,959 | ) |

| Amortization of intangibles | | (1,158 | ) | | (944 | ) | | (2,378 | ) | | (1,888 | ) | | (3,990 | ) |

|

| |

| |

| |

| |

| |

| Total other operating revenue/expenses | $ | 32,926 | | $ | 27,166 | | $ | 66,246 | | $ | 50,069 | | $ | 108,110 | |

|

| |

| |

| |

| |

| |

| INCOME BEFORE OTHER ITEMS | | 112,020 | | | 118,741 | | | 211,729 | | | 218,176 | | | 339,871 | |

| | | | | | | | | | | | | | | | |

| OTHER | | | | | | | | | | | | | | | |

| Net foreign exchange (losses) | | ($1,742 | ) | | ($2,879 | ) | | ($4,163 | ) | | ($6,038 | ) | | ($214 | ) |

| Net realized (losses) gains on investments | | 592 | | | (614 | ) | | (3,861 | ) | | 4,562 | | | 6,130 | |

| Income tax benefit (expense) | | (853 | ) | | (492 | ) | | 2,571 | | | (1,072 | ) | | 9,797 | |

|

| |

| |

| |

| |

| |

| NET INCOME | $ | 110,017 | | $ | 114,756 | | $ | 206,276 | | $ | 215,628 | | $ | 355,584 | |

|

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| KEY RATIOS/PER SHARE DATA | | | | | | | | | | | | | | | |

| Loss ratio | | 52.3 | % | | 47.8 | % | | 54.8 | % | | 50.7 | % | | 57.4 | % |

| Acquisition expense ratio | | 20.4 | % | | 20.9 | % | | 20.1 | % | | 20.7 | % | | 20.2 | % |

| General and administrative expense ratio | | 9.2 | % | | 8.2 | % | | 8.4 | % | | 7.9 | % | | 8.2 | % |

|

| |

| |

| |

| |

| |

| Combined ratio | | 81.9 | % | | 76.9 | % | | 83.3 | % | | 79.3 | % | | 85.8 | % |

|

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| Weighted average basic shares outstanding | | 60,632 | | | 63,334 | | | 60,960 | | | 63,709 | | | 62,781 | |

| Weighted average dilutive shares outstanding | | 66,063 | | | 67,919 | | | 66,276 | | | 68,244 | | | 67,283 | |

| | | | | | | | | | | | | | | | |

| Basic EPS | $ | 1.81 | | $ | 1.81 | | $ | 3.38 | | $ | 3.38 | | $ | 5.66 | |

| Diluted EPS | $ | 1.67 | | $ | 1.69 | | $ | 3.11 | | $ | 3.16 | | $ | 5.28 | |

| | | | | | | | | | | | | | | | |

| ROAE [a] | | 5.7 | % | | 6.6 | % | | 10.7 | % | | 12.8 | % | | 20.3 | % |

| [a] | Average equity is calculated as the arithmetic average of the beginning and ending equity balances for the stated periods. |

2

ENDURANCE SPECIALTY HOLDINGS LTD.

CONSOLIDATED BALANCE SHEETS

| JUNE 30, 2005 | | DEC. 31, 2004 | |

|

| |

| |

| ASSETS | | | | | | |

| Cash and cash equivalents | $ | 457,285 | | $ | 271,143 | |

| Fixed maturity investments available for sale, at fair value | | 3,736,645 | | | 3,578,174 | |

| Investments in other ventures, under equity method | | 108,703 | | | 91,036 | |

| Premiums receivable, net | | 779,112 | | | 545,352 | |

| Deferred acquisition costs | | 225,647 | | | 195,419 | |

| Securities lending collateral | | 340,166 | | | 407,527 | |

| Prepaid reinsurance premiums | | 9,772 | | | 5,248 | |

| Losses recoverable | | 13,909 | | | 12,203 | |

| Accrued investment income | | 30,251 | | | 28,378 | |

| Intangible assets | | 51,272 | | | 47,107 | |

| Other assets | | 56,951 | | | 44,251 | |

|

| |

| |

| TOTAL ASSETS | $ | 5,809,713 | | $ | 5,225,838 | |

|

| |

| |

| | | | | | | |

| LIABILITIES | | | | | | |

| Reserve for losses and loss expenses | $ | 1,823,541 | | $ | 1,549,661 | |

| Reserve for unearned premiums | | 1,109,880 | | | 897,605 | |

| Deposit liabilities | | 56,341 | | | — | |

| Reinsurance balances payable | | 56,400 | | | 70,507 | |

| Securities lending payable | | 340,166 | | | 407,527 | |

| Debt | | 391,291 | | | 391,280 | |

| Other liabilities | | 44,969 | | | 46,803 | |

|

| |

| |

| TOTAL LIABILITIES | $ | 3,822,588 | | $ | 3,363,383 | |

|

| |

| |

| SHAREHOLDERS’ EQUITY | | | | | | |

| Common shares | | | | | | |

| 59,925 issued and outstanding (2004 - 61,255) | $ | 59,925 | | $ | 61,255 | |

| Additional paid-in capital | | 1,070,015 | | | 1,111,633 | |

| Accumulated other comprehensive income | | 31,433 | | | 39,473 | |

| Retained earnings | | 825,752 | | | 650,094 | |

|

| |

| |

| TOTAL SHAREHOLDERS’ EQUITY | $ | 1,987,125 | | $ | 1,862,455 | |

|

| |

| |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 5,809,713 | | $ | 5,225,838 | |

|

| |

| |

| | | | | | | |

| Book value per share | $ | 33.01 | | $ | 30.30 | |

| Diluted book value per share (treasury stock method) | $ | 30.01 | | $ | 27.91 | |

| | | | | | | |

| RATIOS | | | | | | |

| Debt-to-capital | | 16.5 | % | | 17.4 | % |

3

ENDURANCE SPECIALTY HOLDINGS LTD.

SEGMENT DISTRIBUTION

FOR THE SIX MONTHS ENDED JUNE 30, 2005

| [a] | Prior to deposit accounting adjustments. |

4

ENDURANCE SPECIALTY HOLDINGS LTD.

CONSOLIDATED SEGMENT DATA

FOR THE QUARTER ENDED JUNE 30, 2005

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company

Sub-total | | Deposit

Accounting

Adjustment [a] | | Reported

Totals | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 99,342 | | $ | 67,574 | | $ | 31,750 | | $ | 35,932 | | $ | 105,079 | | $ | 64,747 | | $ | 404,424 | | | ($1,235 | ) | $ | 403,189 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Net premiums written | $ | 99,268 | | $ | 67,574 | | $ | 31,048 | | $ | 32,410 | | $ | 103,520 | | $ | 62,005 | | $ | 395,825 | | | ($1,235 | ) | $ | 394,590 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Net premiums earned | $ | 114,487 | | $ | 61,926 | | $ | 106,317 | | $ | 26,318 | | $ | 63,642 | | $ | 79,154 | | $ | 451,844 | | | ($13,923 | ) | $ | 437,921 | |

| Other underwriting income | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (145 | ) | | (145 | ) |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Total underwriting revenues | $ | 114,487 | | $ | 61,926 | | $ | 106,317 | | $ | 26,318 | | $ | 63,642 | | $ | 79,154 | | $ | 451,844 | | | ($14,068 | ) | $ | 437,776 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 62,996 | | $ | 6,536 | | $ | 79,398 | | $ | 7,958 | | $ | 40,233 | | $ | 40,425 | | $ | 237,546 | | | ($8,630 | ) | $ | 228,916 | |

| Acquisition expenses | | 31,981 | | | 8,593 | | | 29,996 | | | 2,977 | | | 3,325 | | | 16,764 | | | 93,636 | | | (4,302 | ) | | 89,334 | |

| General and administrative expenses | | 8,599 | | | 5,877 | | | 7,840 | | | 3,585 | | | 7,659 | | | 6,872 | | | 40,432 | | | — | | | 40,432 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | 103,576 | | | 21,006 | | | 117,234 | | | 14,520 | | | 51,217 | | | 64,061 | | | 371,614 | | | (12,932 | ) | | 358,682 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING INCOME (LOSS) | $ | 10,911 | | $ | 40,920 | | | ($ 10,917 | ) | $ | 11,798 | | $ | 12,425 | | $ | 15,093 | | $ | 80,230 | | | ($1,136 | ) | $ | 79,094 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 55.0 | % | | 10.6 | % | | 74.7 | % | | 30.2 | % | | 63.2 | % | | 51.1 | % | | 52.6 | % | | 62.0 | % | | 52.3 | % |

| Acquisition expense ratio | | 27.9 | % | | 13.9 | % | | 28.2 | % | | 11.3 | % | | 5.2 | % | | 21.2 | % | | 20.7 | % | | 30.9 | % | | 20.4 | % |

| General and administrative expense ratio | | 7.5 | % | | 9.5 | % | | 7.4 | % | | 13.6 | % | | 12.0 | % | | 8.7 | % | | 8.9 | % | | — | | | 9.2 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 90.4 | % | | 34.0 | % | | 110.3 | % | | 55.1 | % | | 80.4 | % | | 81.0 | % | | 82.2 | % | | 92.9 | % | | 81.9 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| STATUTORY RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 55.0 | % | | 10.6 | % | | 74.7 | % | | 30.2 | % | | 63.2 | % | | 51.1 | % | | 52.6 | % | | 62.0 | % | | 52.3 | % |

| Acquisition expense ratio | | 28.5 | % | | 14.6 | % | | 37.0 | % | | 8.7 | % | | 6.2 | % | | 29.3 | % | | 19.5 | % | | — | | | 19.5 | % |

| General and administrative expense ratio | | 8.7 | % | | 8.7 | % | | 25.3 | % | | 11.1 | % | | 7.4 | % | | 11.1 | % | | 10.2 | % | | — | | | 10.2 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 92.2 | % | | 33.9 | % | | 137.0 | % | | 50.0 | % | | 76.8 | % | | 91.5 | % | | 82.3 | % | | 62.0 | % | | 82.0 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| [a] | For internal management reporting purposes, underwriting results by segment are presented on the basis of applying reinsurance accounting to all reinsurance contracts written. However, for financial statement presentation purposes, management determined that certain reinsurance contracts written during the period were more appropriately accounted for under the deposit method of accounting specified by AICPA SOP 98-7 whereby net premiums due on such contracts were recorded as deposit liabilities. The adjustment herein reconciles the Company’s underwriting results by segment to the Company’s financial statement presentation. |

5

ENDURANCE SPECIALTY HOLDINGS LTD.

CONSOLIDATED SEGMENT DATA

FOR THE SIX MONTHS ENDED JUNE 30, 2005

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company

Sub-total | | Deposit

Accounting

Adjustment [a] | | Reported

Totals | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 270,632 | | $ | 178,264 | | $ | 283,293 | | $ | 59,306 | | $ | 152,769 | | $ | 248,273 | | $ | 1,192,537 | | | ($86,857 | ) | $ | 1,105,680 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Net premiums written | $ | 270,558 | | $ | 178,264 | | $ | 280,831 | | $ | 55,560 | | $ | 151,300 | | $ | 244,112 | | $ | 1,180,625 | | | ($86,857 | ) | $ | 1,093,768 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Net premiums earned | $ | 233,072 | | $ | 120,825 | | $ | 224,362 | | $ | 53,514 | | $ | 124,106 | | $ | 144,220 | | $ | 900,099 | | | ($24,580 | ) | $ | 875,519 | |

| Other underwriting income | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 26 | | | 26 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Total underwriting revenues | $ | 233,072 | | $ | 120,825 | | $ | 224,362 | | $ | 53,514 | | $ | 124,106 | | $ | 144,220 | | $ | 900,099 | | | ($24,554 | ) | $ | 875,545 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 107,526 | | $ | 17,306 | | $ | 158,535 | | $ | 47,290 | | $ | 77,684 | | $ | 86,140 | | $ | 494,481 | | | ($14,506 | ) | $ | 479,975 | |

| Acquisition expenses | | 64,404 | | | 15,889 | | | 59,750 | | | 6,447 | | | 7,949 | | | 29,684 | | | 184,123 | | | (8,014 | ) | | 176,109 | |

| General and administrative expenses | | 15,214 | | | 10,683 | | | 17,145 | | | 5,809 | | | 10,752 | | | 14,375 | | | 73,978 | | | — | | | 73,978 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | 187,144 | | | 43,878 | | | 235,430 | | | 59,546 | | | 96,385 | | | 130,199 | | | 752,582 | | | (22,520 | ) | | 730,062 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING INCOME (LOSS) | $ | 45,928 | | $ | 76,947 | | | ($ 11,068 | ) | | ($ 6,032 | ) | $ | 27,721 | | $ | 14,021 | | $ | 147,517 | | | ($2,034 | ) | $ | 145,483 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 46.1 | % | | 14.3 | % | | 70.7 | % | | 88.4 | % | | 62.6 | % | | 59.7 | % | | 54.9 | % | | 59.1 | % | | 54.8 | % |

| Acquisition expense ratio | | 27.6 | % | | 13.2 | % | | 26.6 | % | | 12.0 | % | | 6.4 | % | | 20.6 | % | | 20.5 | % | | 32.6 | % | | 20.1 | % |

| General and administrative expense ratio | | 6.5 | % | | 8.8 | % | | 7.6 | % | | 10.9 | % | | 8.7 | % | | 10.0 | % | | 8.2 | % | | — | | | 8.4 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 80.2 | % | | 36.3 | % | | 104.9 | % | | 111.3 | % | | 77.7 | % | | 90.3 | % | | 83.6 | % | | 91.7 | % | | 83.3 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| STATUTORY RATIOS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 46.1 | % | | 14.3 | % | | 70.7 | % | | 88.4 | % | | 62.6 | % | | 59.7 | % | | 54.9 | % | | 59.0 | % | | 54.8 | % |

| Acquisition expense ratio | | 25.9 | % | | 12.5 | % | | 27.4 | % | | 9.9 | % | | 4.8 | % | | 21.7 | % | | 19.9 | % | | 32.6 | % | | 18.9 | % |

| General and administrative expense ratio | | 5.6 | % | | 6.0 | % | | 6.1 | % | | 10.5 | % | | 7.1 | % | | 5.9 | % | | 6.3 | % | | — | | | 6.8 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 77.6 | % | | 32.8 | % | | 104.2 | % | | 108.8 | % | | 74.5 | % | | 87.3 | % | | 81.1 | % | | 91.6 | % | | 80.5 | % |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| [a] | For internal management reporting purposes, underwriting results by segment are presented on the basis of applying reinsurance accounting to all reinsurance contracts written. However, for financial statement presentation purposes, management determined that certain reinsurance contracts written during the period were more appropriately accounted for under the deposit method of accounting specified by AICPA SOP 98-7 whereby net premiums due on such contracts were recorded as deposit liabilities. The adjustment herein reconciles the Company’s underwriting results by segment to the Company’s financial statement presentation. |

6

ENDURANCE SPECIALTY HOLDINGS LTD.

DEPOSIT ACCOUNTING ADJUSTMENT IMPACTS ON SEGMENT DATA

FOR THE QUARTER ENDED JUNE 30, 2005

INCLUDING DEPOSIT ACCOUNTING ADJUSTMENTS

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company | |

|

| |

| |

| |

| |

| |

| |

| |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 97,981 | | $ | 67,574 | | $ | 31,750 | | $ | 35,932 | | $ | 105,079 | | $ | 64,873 | | $ | 403,189 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums written | $ | 97,907 | | $ | 67,574 | | $ | 31,048 | | $ | 32,410 | | $ | 103,520 | | $ | 62,131 | | $ | 394,590 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums earned | $ | 105,911 | | $ | 61,927 | | $ | 101,336 | | $ | 26,317 | | $ | 63,642 | | $ | 78,788 | | $ | 437,921 | |

| Other underwriting income | | (373 | ) | | — | | | 173 | | | — | | | — | | | 55 | | | (145 | ) |

|

| |

| |

| |

| |

| |

| |

| |

| Total underwriting revenues | | 105,538 | | | 61,927 | | | 101,509 | | | 26,317 | | | 63,642 | | | 78,843 | | | 437,776 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 57,513 | | $ | 6,536 | | $ | 76,398 | | $ | 7,958 | | $ | 40,233 | | $ | 40,278 | | $ | 228,916 | |

| Acquisition expenses | | 29,663 | | | 8,593 | | | 28,093 | | | 2,977 | | | 3,325 | | | 16,683 | | | 89,334 | |

| General and administrative expenses | | 8,598 | | | 5,877 | | | 7,841 | | | 3,585 | | | 7,659 | | | 6,872 | | | 40,432 | |

|

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | 95,774 | | | 21,006 | | | 112,332 | | | 14,520 | | | 51,217 | | | 63,833 | | | 358,682 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING INCOME (LOSS) | $ | 9,764 | | $ | 40,921 | | | ($10,823 | ) | $ | 11,797 | | $ | 12,425 | | $ | 15,010 | | $ | 79,094 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP RATIOS | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 54.3 | % | | 10.6 | % | | 75.4 | % | | 30.2 | % | | 63.2 | % | | 51.1 | % | | 52.3 | % |

| Acquisition expense ratio | | 28.0 | % | | 13.9 | % | | 27.7 | % | | 11.3 | % | | 5.2 | % | | 21.2 | % | | 20.4 | % |

| General and administrative expense ratio | | 8.1 | % | | 9.5 | % | | 7.7 | % | | 13.6 | % | | 12.0 | % | | 8.7 | % | | 9.2 | % |

|

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 90.4 | % | | 34.0 | % | | 110.8 | % | | 55.1 | % | | 80.4 | % | | 81.0 | % | | 81.9 | % |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| EXCLUDING DEPOSIT ACCOUNTING ADJUSTMENTS | |

| | | | | | | | | | | | | | | | | | | | | | |

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company | |

|

| |

| |

| |

| |

| |

| |

| |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 99,342 | | $ | 67,574 | | $ | 31,750 | | $ | 35,932 | | $ | 105,079 | | $ | 64,747 | | $ | 404,424 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums written | $ | 99,268 | | $ | 67,574 | | $ | 31,048 | | $ | 32,410 | | $ | 103,520 | | $ | 62,005 | | $ | 395,825 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums earned | $ | 114,487 | | $ | 61,926 | | $ | 106,317 | | $ | 26,318 | | $ | 63,642 | | $ | 79,154 | | $ | 451,844 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 62,996 | | $ | 6,536 | | $ | 79,398 | | $ | 7,958 | | $ | 40,233 | | $ | 40,425 | | $ | 237,546 | |

| Acquisition expenses | | 31,981 | | | 8,593 | | | 29,996 | | | 2,977 | | | 3,325 | | | 16,764 | | | 93,636 | |

| General and administrative expenses | | 8,599 | | | 5,877 | | | 7,840 | | | 3,585 | | | 7,659 | | | 6,872 | | | 40,432 | |

|

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | 103,576 | | | 21,006 | | | 117,234 | | | 14,520 | | | 51,217 | | | 64,061 | | | 371,614 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING INCOME (LOSS) | $ | 10,911 | | $ | 40,920 | | | ($10,917 | ) | $ | 11,798 | | $ | 12,425 | | $ | 15,093 | | $ | 80,230 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP RATIOS | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 55.0 | % | | 10.6 | % | | 74.7 | % | | 30.2 | % | | 63.2 | % | | 51.1 | % | | 52.6 | % |

| Acquisition expense ratio | | 27.9 | % | | 13.9 | % | | 28.2 | % | | 11.3 | % | | 5.2 | % | | 21.2 | % | | 20.7 | % |

| General and administrative expense ratio | | 7.5 | % | | 9.5 | % | | 7.4 | % | | 13.6 | % | | 12.0 | % | | 8.7 | % | | 8.9 | % |

|

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 90.4 | % | | 34.0 | % | | 110.3 | % | | 55.1 | % | | 80.4 | % | | 81.0 | % | | 82.2 | % |

|

| |

| |

| |

| |

| |

| |

| |

7

ENDURANCE SPECIALTY HOLDINGS LTD.

DEPOSIT ACCOUNTING ADJUSTMENT IMPACTS ON SEGMENT DATA

FOR THE SIX MONTHS ENDED JUNE 30, 2005

INCLUDING DEPOSIT ACCOUNTING ADJUSTMENTS

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company | |

|

| |

| |

| |

| |

| |

| |

| |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 234,413 | | $ | 178,264 | | $ | 236,211 | | $ | 59,306 | | $ | 152,769 | | $ | 244,717 | | $ | 1,105,680 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums written | $ | 234,339 | | $ | 178,264 | | $ | 233,749 | | $ | 55,560 | | $ | 151,300 | | $ | 240,556 | | $ | 1,093,768 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums earned | $ | 216,672 | | $ | 120,825 | | $ | 216,701 | | $ | 53,514 | | $ | 124,106 | | $ | 143,701 | | $ | 875,519 | |

| Other underwriting income | | (233 | ) | | — | | | 191 | | | — | | | — | | | 68 | | | 26 | |

|

| |

| |

| |

| |

| |

| |

| |

| Total underwriting revenues | | 216,439 | | | 120,825 | | | 216,892 | | | 53,514 | | | 124,106 | | | 143,769 | | | 875,545 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 97,734 | | $ | 17,306 | | $ | 154,037 | | $ | 47,290 | | $ | 77,684 | | $ | 85,924 | | $ | 479,975 | |

| Acquisition expenses | | 59,635 | | | 15,889 | | | 56,645 | | | 6,447 | | | 7,949 | | | 29,544 | | | 176,109 | |

| General and administrative expenses | | 15,214 | | | 10,683 | | | 17,145 | | | 5,809 | | | 10,752 | | | 14,375 | | | 73,978 | |

|

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | 172,583 | | | 43,878 | | | 227,827 | | | 59,546 | | | 96,385 | | | 129,843 | | | 730,062 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING INCOME (LOSS) | $ | 43,856 | | $ | 76,947 | | | ($10,935 | ) | | ($6,032 | ) | $ | 27,721 | | $ | 13,926 | | $ | 145,484 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP RATIOS | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 45.1 | % | | 14.3 | % | | 71.1 | % | | 88.4 | % | | 62.6 | % | | 59.8 | % | | 54.8 | % |

| Acquisition expense ratio | | 27.5 | % | | 13.2 | % | | 26.1 | % | | 12.0 | % | | 6.4 | % | | 20.6 | % | | 20.1 | % |

| General and administrative expense ratio | | 7.0 | % | | 8.8 | % | | 7.9 | % | | 10.9 | % | | 8.7 | % | | 10.0 | % | | 8.4 | % |

|

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 79.6 | % | | 36.3 | % | | 105.1 | % | | 111.3 | % | | 77.7 | % | | 90.4 | % | | 83.3 | % |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| EXCLUDING DEPOSIT ACCOUNTING ADJUSTMENTS | |

| | | | | | | | | | | | | | | | | | | | | | |

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company | |

|

| |

| |

| |

| |

| |

| |

| |

| UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 270,632 | | $ | 178,264 | | $ | 283,293 | | $ | 59,306 | | $ | 152,769 | | $ | 248,273 | | $ | 1,192,537 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums written | $ | 270,558 | | $ | 178,264 | | $ | 280,831 | | $ | 55,560 | | $ | 151,300 | | $ | 244,112 | | $ | 1,180,625 | |

|

| |

| |

| |

| |

| |

| |

| |

| Net premiums earned | $ | 233,072 | | $ | 120,825 | | $ | 224,362 | | $ | 53,514 | | $ | 124,106 | | $ | 144,220 | | $ | 900,099 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | |

| Losses and loss expenses | $ | 107,526 | | $ | 17,306 | | $ | 158,535 | | $ | 47,290 | | $ | 77,684 | | $ | 86,140 | | $ | 494,481 | |

| Acquisition expenses | | 64,404 | | | 15,889 | | | 59,750 | | | 6,447 | | | 7,949 | | | 29,684 | | | 184,123 | |

| General and administrative expenses | | 15,214 | | | 10,683 | | | 17,145 | | | 5,809 | | | 10,752 | | | 14,375 | | | 73,978 | |

|

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | 187,144 | | | 43,878 | | | 235,430 | | | 59,546 | | | 96,385 | | | 130,199 | | | 752,582 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| UNDERWRITING INCOME (LOSS) | $ | 45,928 | | $ | 76,947 | | | ($11,068 | ) | | ($6,032 | ) | $ | 27,721 | | $ | 14,021 | | $ | 147,517 | |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| GAAP RATIOS | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | 46.1 | % | | 14.3 | % | | 70.7 | % | | 88.4 | % | | 62.6 | % | | 59.7 | % | | 54.9 | % |

| Acquisition expense ratio | | 27.6 | % | | 13.2 | % | | 26.6 | % | | 12.0 | % | | 6.4 | % | | 20.6 | % | | 20.5 | % |

| General and administrative expense ratio | | 6.5 | % | | 8.8 | % | | 7.6 | % | | 10.9 | % | | 8.7 | % | | 10.0 | % | | 8.2 | % |

|

| |

| |

| |

| |

| |

| |

| |

| Combined ratio | | 80.2 | % | | 36.3 | % | | 104.9 | % | | 111.3 | % | | 77.7 | % | | 90.3 | % | | 83.6 | % |

|

| |

| |

| |

| |

| |

| |

| |

8

ENDURANCE SPECIALTY HOLDINGS LTD.

RETURN ON EQUITY ANALYSIS

| SIX MONTHS ENDED

JUNE 30, 2005 | |

|

| |

| Average equity [a] | $ | 1,924,790 | |

| | | | |

| Net premiums earned | $ | 875,519 | |

| Combined ratio | | 83.3 | % |

| Operating margin | | 16.7 | % |

| Premium leverage | | 0.45x | |

|

| |

| Implied ROAE from underwriting activity | | 7.6 | % |

|

| |

| | | | |

| Average invested assets at amortized cost | $ | 4,110,391 | |

| Investment leverage | | 2.14x | |

| Year to date investment income yield, pretax | | 1.9 | % |

|

| |

| Implied ROAE from investment activity | | 4.1 | % |

|

| |

| | | | |

|

| |

| Implied Pre-tax Operating ROAE, for period | | 11.7 | % |

|

| |

| | | | |

|

| |

| Implied Pre-tax Operating ROAE, annualized | | 23.5 | % |

|

| |

| [a] | Average equity is calculated as the arithmetic average of the beginning and ending equity balances for the stated periods. |

9

ENDURANCE SPECIALTY HOLDINGS LTD.

ANNUALIZED OPERATING & INVESTMENT LEVERAGE

| 2Q 2004 | | 3Q 2004 | | 4Q 2004 | | 1Q 2005 | | 2Q 2005 | | Year Ended December 31, | |

|

| 2004 | | 2003 |

|

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| Average equity | $ | 1,747,187 | | $ | 1,751,048 | | $ | 1,816,640 | | $ | 1,872,548 | | $ | 1,934,883 | | $ | 1,753,635 | | $ | 1,431,158 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net premiums earned | $ | 395,987 | | $ | 409,487 | | $ | 411,300 | | $ | 437,598 | | $ | 437,921 | | $ | 1,632,600 | | $ | 1,173,947 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Operating leverage | | 0.23 | x | | 0.23 | x | | 0.23 | x | | 0.23 | x | | 0.23 | x | | 0.93 | x | | 0.82 | x |

| | | | | | | | | | | | | | | | | | | | | | |

|

| |

| |

| |

| Annualized operating leverage | | 0.91 | x | | 0.94 | x | | 0.91 | x | | 0.93 | x | | 0.91 | x | | 0.93 | x | | 0.82 | x |

|

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| Avg. invested assets at amortized cost | $ | 3,010,450 | | $ | 3,343,785 | | $ | 3,744,102 | | $ | 4,009,987 | | $ | 4,187,712 | | $ | 3,277,276 | | $ | 2,124,518 | |

| | | | | | | | | | | | | | | | | | | | | | |

|

| |

| |

| |

| Investment leverage | | 1.72 | x | | 1.91 | x | | 2.06 | x | | 2.14 | x | | 2.16 | x | | 1.87 | x | | 1.48 | x |

|

| |

| |

| |

10

ENDURANCE SPECIALTY HOLDINGS LTD.

INVESTMENT PORTFOLIO

AS OF JUNE 30, 2005

| Type of Investment | Fair Value | | Percentage | |

|

| |

| |

| Cash and equivalents | $ | 457,285 | | | 10.6 | % |

| U.S. government and agencies | | 743,125 | | | 17.3 | % |

| Corporate securities | | 672,966 | | | 15.6 | % |

| Foreign government | | 205,276 | | | 4.8 | % |

| Municipals | | 153,527 | | | 3.6 | % |

| Asset-backed securities | | 485,671 | | | 11.3 | % |

| Mortgage-backed securities | | 1,476,080 | | | 34.3 | % |

| Investments in other ventures | | 108,703 | | | 2.5 | % |

|

| |

| |

| Total | $ | 4,302,633 | | | 100.0 | % |

|

| |

| |

| | | | | | | |

| Ratings | Fair Value | | Percentage | |

|

| |

| |

| U.S. Government and agencies | $ | 743,125 | | | 17.3 | % |

| AAA/Aaa | | 2,836,912 | | | 65.9 | % |

| AA/Aa | | 218,042 | | | 5.1 | % |

| A/A | | 395,851 | | | 9.2 | % |

| BBB and below | | — | | | — | |

| Investments in other ventures/Not rated | | 108,703 | | | 2.5 | % |

|

| |

| |

| Total | $ | 4,302,633 | | | 100.0 | % |

|

| |

| |

| | | | | | | |

| Performance | | | | June 30, 2005 | |

| | |

| |

| Annualized yield, year to date [a] | | | | | 3.9 | % |

| Duration [b] | | | | | 2.42 | |

| | |

| | | | | | | |

| Investment Income | Quarter Ended

Mar. 31, 2005

| | Quarter Ended

June 30, 2005

| |

|

| |

| |

| Income from investments in other ventures | $ | 3,749 | | $ | 168 | |

| Total net investment income | $ | 40,011 | | $ | 39,696 | |

|

| |

| |

| Note: | Cash, cash equivalents and short terms are shown net of investments pending settlement. |

| [a] | Annualized yield excludes realized and unrealized gains and losses on fixed maturity investments |

| [b] | Duration excludes investments in other ventures |

11

ENDURANCE SPECIALTY HOLDINGS LTD.

PERIOD END UNREALIZED GAINS AND QUARTERLY OPERATING CASH FLOW

| 3Q 2004 | | 4Q 2004 | | 1Q 2005 | | 2Q 2005 | |

|

| |

| |

| |

| |

| | | | | | | | | | | | | |

| Unrealized holding gains (losses) on investments, period end | $ | 16,091 | | $ | 7,687 | | | ($31,797 | ) | $ | 14,519 | |

| | | | | | | | | | | | | |

| Operating cash flow | $ | 306,683 | | $ | 263,020 | | $ | 220,080 | | $ | 252,105 | |

12

ENDURANCE SPECIALTY HOLDINGS LTD.

ACTIVITY IN RESERVE FOR LOSSES AND LOSS EXPENSES

| QUARTER

ENDED

SEPT. 30, 2004

| | QUARTER

ENDED

DEC. 31, 2004

| | QUARTER

ENDED

MARCH 31, 2005

| | QUARTER

ENDED

JUNE 30, 2005

| |

|

| |

| |

| |

| |

| | | | | | | | | | | | | |

| Incurred related to: | | | | | | | | | | | | |

| Current year | $ | 359,187 | | $ | 243,542 | | $ | 297,060 | | $ | 256,664 | |

| Prior years | | (50,932 | ) | | (25,684 | ) | | (46,001 | ) | | (27,748 | ) |

|

| |

| |

| |

| |

| Total incurred | | 308,255 | | | 217,858 | | | 251,059 | | | 228,916 | |

|

| |

| |

| |

| |

| | | | | | | | | | | | | |

| Paid related to: | | | | | | | | | | | | |

| Current year | | (28,056 | ) | | (76,606 | ) | | ($ 3,021 | ) | | ($ 14,025 | ) |

| Prior years | | (21,801 | ) | | (36,557 | ) | | (86,769 | ) | | (94,706 | ) |

|

| |

| |

| |

| |

| Total paid | | (49,857 | ) | | (113,163 | ) | | (89,790 | ) | | (108,731 | ) |

|

| |

| |

| |

| |

13

ENDURANCE SPECIALTY HOLDINGS LTD.

ANALYSIS OF UNPAID LOSSES AND LOSS EXPENSE

| Property Per

Risk Treaty

Reinsurance | | Property

Catastrophe

Reinsurance | | Casualty

Treaty

Reinsurance | | Property

Individual

Risk | | Casualty

Individual

Risk | | Aerospace and

Other Specialty

Lines | | Total

Company

| | Deposit

Accounting

Adjustment [a] | | Reported

Totals | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| AT JUNE 30, 2005 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Case reserves | $ | 189,142 | | $ | 33,722 | | $ | 130,560 | | $ | 52,511 | | $ | 8,866 | | $ | 89,633 | | $ | 504,434 | | | ($2,377 | ) | $ | 502,057 | |

| Total reserves | | 391,239 | | | 60,699 | | | 606,885 | | | 95,659 | | | 377,968 | | | 304,684 | | | 1,837,134 | | | (13,593 | ) | $ | 1,823,541 | |

|

|

| Case reserves / Total reserves | | 48.3 | % | | 55.6 | % | | 21.5 | % | | 54.9 | % | | 2.3 | % | | 29.4 | % | | 27.5 | % | | 17.5 | % | | 27.5 | % |

|

|

|

|

| IBNR / Total reserves | | 51.7 | % | | 44.4 | % | | 78.5 | % | | 45.1 | % | | 97.7 | % | | 70.6 | % | | 72.5 | % | | 82.5 | % | | 72.5 | % |

|

|

| [a] | For internal management reporting purposes, underwriting results by segment are presented on the basis of applying reinsurance accounting to all reinsurance contracts written. However, for financial statement presentation purposes, management determined that certain reinsurance contracts written during the period were more appropriately accounted for under the deposit method of accounting specified by AICPA SOP 98-7 whereby net premiums due on such contracts were recorded as deposit liabilities. The adjustment herein reconciles the Company’s underwriting results by segment to the Company’s financial statement presentation. |

14

ENDURANCE SPECIALTY HOLDINGS LTD.

DILUTIVE SHARES FOR EPS CALCULATION

| | QUARTER ENDED

JUNE 30, | | SIX MONTHS ENDED

JUNE 30, | |

| |

| |

| |

| | 2005 | | 2004 | | 2005 | | 2004 | |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | |

| DILUTIVE SHARES | | Average market price per share | $ | 36.86 | | $ | 34.37 | | $ | 36.06 | | $ | 34.29 | |

| OUTSTANDING: | | | | | | | | | | | | | | |

| AS REPORTED | | Basic weighted average common shares outstanding | | 60,632 | | | 63,334 | | | 60,960 | | | 63,709 | |

| | | | | | | | | | | | | | | |

| | Add: weighted ave. unvested restricted share units | | 593 | | | 200 | | | 592 | | | 137 | |

| | Weighted average exercise price per share | | — | | | — | | | — | | | — | |

| | Proceeds from unrecognized restricted share unit expense | $ | 14,000 | | $ | 5,169 | | $ | 14,000 | | | 5,169 | |

| | Less: restricted share units bought back via treasury method | | (380 | ) | | (150 | ) | | (388 | ) | | (137 | ) |

| | | | | | | | | | | | | | | |

| | Add: weighted ave. dilutive warrants outstanding | | 7,202 | | | 7,243 | | | 7,202 | | | 7,243 | |

| | Weighted average exercise price per share | $ | 18.37 | | $ | 19.29 | | $ | 18.37 | | $ | 19.29 | |

| | Less: warrants bought back via treasury method | | (3,590 | ) | | (4,065 | ) | | (3,669 | ) | | (4,075 | ) |

| | | | | | | | | | | | | | | |

| | Add: weighted ave. dilutive options outstanding | | 3,205 | | | 3,390 | | | 3,225 | | | 3,409 | |

| | Weighted average exercise price per share | $ | 18.14 | | $ | 19.75 | | $ | 18.14 | | $ | 19.68 | |

| | Proceeds from unrecognized option expense | $ | 815 | | $ | 2,888 | | $ | 815 | | $ | 2,888 | |

| | Less: options bought back via treasury method | | (1,599 | ) | | (2,032 | ) | | (1,645 | ) | | (2,041 | ) |

| |

| |

| |

| |

| |

| | Weighted average dilutive shares outstanding | | 66,063 | | | 67,919 | | | 66,276 | | | 68,244 | |

| |

| |

| |

| |

| |

| Note: | | Warrants and options that are anti-dilutive are not included in the calculation of diluted shares outstanding. Restricted share units are included in the calculation of basic and diluted weighted shares outstanding. The treasury stock method assumes that the proceeds received from the exercise of options or warrants will be used to repurchase the Company’s common shares at the average market price during the period of calculation. SFAS No. 123 also requires that any unrecognized stock based compensation expense that will be recorded in future periods be included as proceeds for purposes of the treasury stock repurchases. |

15

ENDURANCE SPECIALTY HOLDINGS LTD.

OPERATING INCOME RECONCILIATION

EARNINGS PER SHARE INFORMATION - AS REPORTED, GAAP

| QUARTER ENDED

JUNE 30, | | SIX MONTHS ENDED

JUNE 30, | |

|

| |

| |

| 2005 | | 2004 | | 2005 | | 2004 | |

|

| |

| |

| |

| |

| Net income | $ | 110,017 | | $ | 114,756 | | $ | 206,276 | | $ | 215,628 | |

| Add (Less) after-tax items: | | | | | | | | | | | | |

| Net foreign exchange losses | | 2,201 | | | 2,693 | | | 4,492 | | | 5,109 | |

| Net realized losses (gains) on investments | | (431 | ) | | 436 | | | 3,691 | | | (4,166 | ) |

|

| |

| |

| |

| |

| Operating income | $ | 111,787 | | $ | 117,885 | | $ | 214,459 | | $ | 216,571 | |

|

| |

| |

| |

| |

| | | | | | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | | | | | |

| Basic | | 60,632 | | | 63,334 | | | 60,960 | | | 63,709 | |

| Dilutive | | 66,063 | | | 67,919 | | | 66,276 | | | 68,244 | |

| | | | | | | | | | | | |

| Basic per share data | | | | | | | | | | | | |

| Net income | $ | 1.81 | | $ | 1.81 | | $ | 3.38 | | $ | 3.38 | |

| Add (Less) after-tax items: | | | | | | | | | | | | |

| Net foreign exchange (gains) losses | | 0.04 | | | 0.04 | | | 0.07 | | | 0.08 | |

| Net realized (gains) losses on investments | | (0.01 | ) | | 0.01 | | | 0.06 | | | (0.07 | ) |

|

| |

| |

| |

| |

| Operating income | $ | 1.84 | | $ | 1.86 | | $ | 3.52 | | $ | 3.40 | |

|

| |

| |

| |

| |

| | | | | | | | | | | | |

| Diluted per share data | | | | | | | | | | | | |

| Net income | $ | 1.67 | | $ | 1.69 | | $ | 3.11 | | $ | 3.16 | |

| Add (Less) after-tax items: | | | | | | | | | | | | |

| Net foreign exchange (gains) losses | | 0.03 | | | 0.04 | | | 0.07 | | | 0.07 | |

| Net realized (gains) losses on investments | | (0.01 | ) | | 0.01 | | | 0.06 | | | (0.06 | ) |

|

| |

| |

| |

| |

| Operating income | $ | 1.69 | | $ | 1.74 | | $ | 3.24 | | $ | 3.17 | |

|

| |

| |

| |

| |

16

ENDURANCE SPECIALTY HOLDINGS LTD.

DILUTIVE SHARES SENSITIVITY ANALYSIS

| DILUTIVE SHARES OUSTANDING |

|

| Market Price per Share |

|

| $35.00 | $36.00 | $37.00 | $38.00 | $39.00 | $40.00 | $41.00 | $42.00 | $43.00 | $44.00 | $45.00 |

|

| 65,819 | 65,970 | 66,112 | 66,248 | 66,376 | 66,498 | 66,613 | 66,724 | 66,829 | 66,929 | 67,025 |

17

ENDURANCE SPECIALTY HOLDINGS LTD.

BOOK VALUE PER SHARE

| | JUNE 30, | | DEC. 31, 2004 | |

|

| 2005 | | 2004 |

| |

| |

| |

| |

| | | | | | | | | | | | | |

| DILUTIVE SHARES | | Price per share at period end | | $ | 37.82 | | $ | 34.80 | | $ | 34.20 | |

| OUTSTANDING: | | | | | | | | | | | | |

| AS-IF CONVERTED [a] | | Basic common shares outstanding [b] | | | 60,205 | | | 62,206 | | | 61,473 | |

| | Add: unvested restricted share units | | | 656 | | | 203 | | | 596 | |

| | Add: dilutive warrants outstanding | | | 7,202 | | | 7,243 | | | 7,202 | |

| | Weighted average exercise price per share | | $ | 18.37 | | $ | 19.29 | | $ | 18.87 | |

| | Add: dilutive options outstanding | | | 3,184 | | | 3,344 | | | 3,204 | |

| | Weighted average exercise price per share | | $ | 18.12 | | $ | 19.83 | | $ | 18.91 | |

| | | | | | | | | | | | | |

| | Book Value | | $ | 1,987,125 | | $ | 1,731,271 | | $ | 1,862,455 | |

| | Add: proceeds from converted warrants | | | 132,307 | | | 139,715 | | | 135,908 | |

| | Add: proceeds from converted options | | | 57,702 | | | 66,304 | | | 60,582 | |

| |

| |

| |

| |

| | Pro forma book value | | $ | 2,177,134 | | $ | 1,937,290 | | $ | 2,058,945 | |

| | Dilutive shares outstanding | | | 71,248 | | | 72,996 | | | 72,475 | |

|

| |

| | Basic book value per share | | $ | 33.01 | | $ | 27.83 | | $ | 30.30 | |

| | Diluted book value per share | | $ | 30.56 | | $ | 26.54 | | $ | 28.41 | |

|

| |

|

| DILUTIVE SHARES | | Price per share at period end | | $ | 37.82 | | $ | 34.80 | | $ | 34.20 | |

| OUTSTANDING: | | | | | | | | | | | | |

| TREASURY STOCK | | Basic common shares outstanding [b] | | | 60,205 | | | 62,206 | | | 61,473 | |

| METHOD | | | | | | | | | | | | |

| | Add: unvested restricted share units | | | 656 | | | 203 | | | 596 | |

| | Add: dilutive warrants outstanding | | | 7,202 | | | 7,243 | | | 7,202 | |

| | Weighted average exercise price per share | | $ | 18.37 | | $ | 19.29 | | $ | 18.87 | |

| | Less: warrants bought back via treasury method | | | (3,498 | ) | | (4,015 | ) | | (3,974 | ) |

| | Add: dilutive options outstanding | | | 3,184 | | | 3,344 | | | 3,204 | |

| | Weighted average exercise price per share | | $ | 18.12 | | $ | 19.83 | | $ | 18.91 | |

| | Less: options bought back via treasury method | | | (1,526 | ) | | (1,905 | ) | | (1,771 | ) |

| |

| |

| |

| |

| | Dilutive shares outstanding | | | 66,224 | | | 67,076 | | | 66,729 | |

|

| |

| | Basic book value per share | | $ | 33.01 | | $ | 27.83 | | $ | 30.30 | |

| | Diluted book value per share | | $ | 30.01 | | $ | 25.81 | | $ | 27.91 | |

|

| |

| [a] | The as-if converted method assumes that the proceeds received upon exercise of options and warrants will be retained by the Company and the resulting common shares from exercise will remain outstanding. |

| [b] | Basic common shares include vested restricted share units. |

18

ENDURANCE SPECIALTY HOLDINGS LTD.

GROWTH IN BOOK VALUE PER SHARE

| SIX MONTHS ENDED

JUNE 30, 2005

| | YEAR ENDED DECEMBER 31, | |

| 2004 | | 2003 | | 2002 |

|

| |

| |

| |

| |

| | | | | | | | | | | | | |

| Net Income | $ | 206,276 | | $ | 355,584 | | $ | 263,437 | | $ | 102,066 | |

| | | | | | | | | | | | | |

| Dividends Paid | | (30,180 | ) | | (50,346 | ) | | (20,505 | ) | | — | |

| | | | | | | | | | | | | |

| Shareholders’ Equity | | 1,987,125 | | | 1,862,455 | | | 1,644,815 | | | 1,217,500 | |

| | | | | | | | | | | | | |

| Return on Beginning Equity | | 11.1 | % | | 21.6 | % | | 21.6 | % | | | |

| | | | | | | | | | | | | |

| Dividend Payout Ratio [a] | | 1.6 | % | | 3.1 | % | | 1.7 | % | | | |

| | | | | | | | | | | | | |

| Dilutive Shares Outstanding | | 66,224 | | | 66,729 | | | 68,445 | | | 56,017 | |

| | | | | | | | | | | | | |

| Diluted Book Value Per Share | $ | 30.01 | | $ | 27.91 | | $ | 24.03 | | $ | 21.73 | |

| (treasury stock method) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

|

| Growth in Diluted Book Value Per Share | | 7.5 | % | | 16.1 | % | | 10.6 | % | | | |

|

|

| | | | | | | | | | | | | |

|

|

| Total Return to Shareholders [b] | | 9.1 | % | | 19.2 | % | | 12.3 | % | | | |

|

|

| [a] | Dividend Payout Ratio is calculated as dividends paid divided by beginning shareholders’ equity. |

| [b] | Total return to shareholders is calculated as the sum of Growth in Diluted Book Value Per Share and the Dividend Payout Ratio. |

19

ENDURANCE SPECIALTY HOLDINGS LTD.

REGULATION G

In presenting the Company’s results, management has included and discussed certain non-GAAP measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company’s results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP.

Operating income is an internal performance measure used by the Company in the management of its operations. Operating income represents after-tax operational results excluding, as applicable, after-tax net realized capital gains or losses and after-tax net foreign exchange gains or losses because the amount of these gains or losses is heavily influenced by, and fluctuates in part, according to the availability of market opportunities. The Company believes these amounts are largely independent of its business and underwriting process and including them distorts the analysis of trends in its operations. In addition to presenting net income determined in accordance with GAAP, the Company believes that showing operating income enables investors, analysts, rating agencies and other users of its financial information to more easily analyze the Company’s results of operations in a manner similar to how management analyzes the Company’s underlying business performance. Operating income should not be viewed as a substitute for GAAP net income. Please see page 16 for a reconciliation of operating income to net income.

Return on Equity (ROE) is comprised using the average equity calculated as the arithmetic average of the beginning and ending equity balances for stated periods. The Company presents ROE as a measure that it is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information.

Investment yield is provided by the Company’s investment managers and is calculated by dividing net investment income by average invested assets at amortized cost. The Company utilizes and presents the investment yield in order to better disclose the performance of the Company’s investments and to show the components of the Company’s ROE.

The Company has included diluted book value per share because it takes into account the effect of dilutive securities; therefore, the Company believes it is a better measure of calculating shareholder returns than book value per share. Please see page 18 for a reconciliation of diluted book value per share to basic book value per share.

20