Insurance - Our Fastest Growing Segment

Continue to expand the U.S. insurance platform

Attract and retain experienced staff and teams with demonstrated underwriting

discipline, market knowledge, and broker relationships

Develop new business through organic growth and targeted acquisitions

Expand distribution

Added six underwriting teams in 2007

Cherry Hill NJ – Professional

Long Island, NY – E&S Package

Stamford, CT – E&S Package

Completed the ARMtech acquisition

Independent agent distribution

Technical underwriting expertise

Adds product and geographic diversification

Seattle, WA - Property

Atlanta, GA - Professional

St. Louis, MO - Healthcare

9

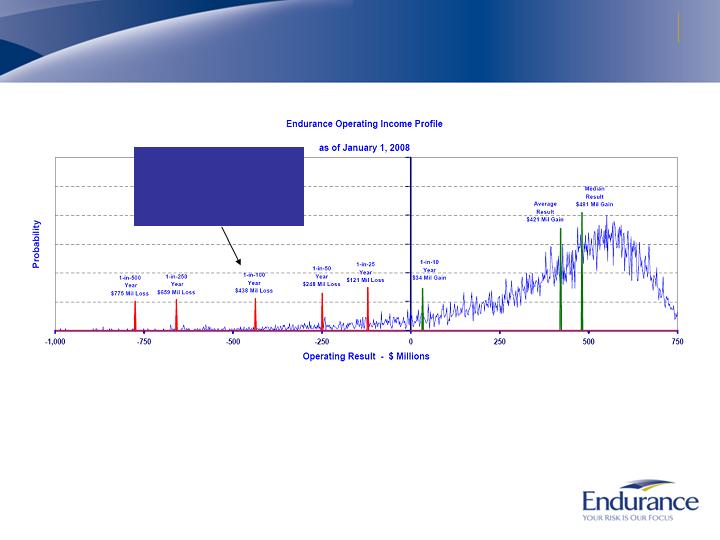

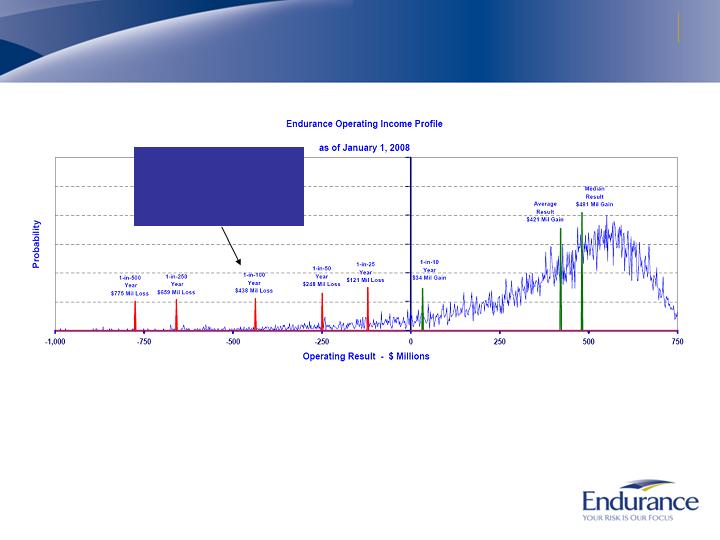

Strong Risk Management Focus -

Portfolio Expected Risk Curve (January 1, 2008)

Stated tolerance is to limit

our loss in a 1-in-100 year

to 25% of our capital or

less, our current level is

18.9% of capital

The above chart represents a cumulative analysis of our in-force underwriting portfolio on a full year basis based on thousands of

potential scenarios. Loss years are driven largely by the occurrence of natural catastrophes and incorrect pricing of other property and

casualty exposures. The operating income depicted includes net premiums earned plus net investment income, acquisition expenses

and G&A expenses. The operating income depicted excludes the effects of income tax (expenses) benefits, amortization of intangibles

and interest expense. Forecasted investment income, acquisition and G&A expenses are held constant across all scenarios. Losses

included above are net of reinsurance including collateralized reinsurance and ILW purchases. Our stated objective is to maintain a risk

management tolerance that limits our loss in a 1-in-100 year year to be no more than 25% of our equity capital. We base our budget

and forecasts on the average result, although the nature of the curve places the median result further to the right.

Changes in Endurance's underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual results to

vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance, please see "Risk Factors"

in our Annual Report on Form 10K for the year ended December 31, 2007.

10

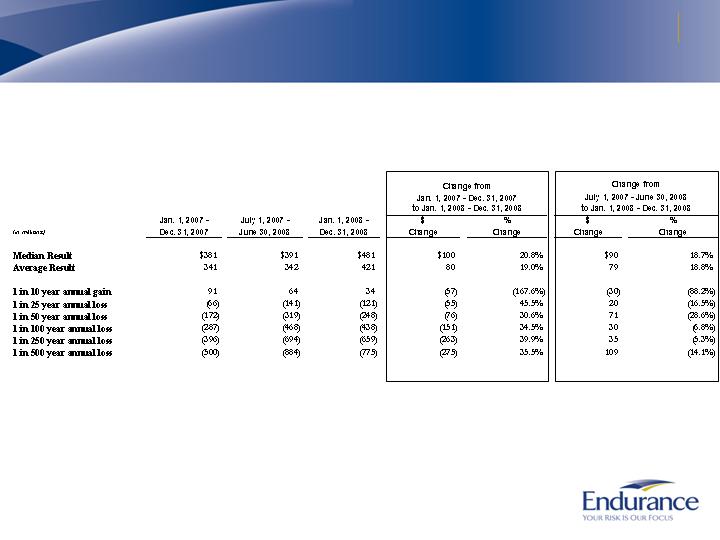

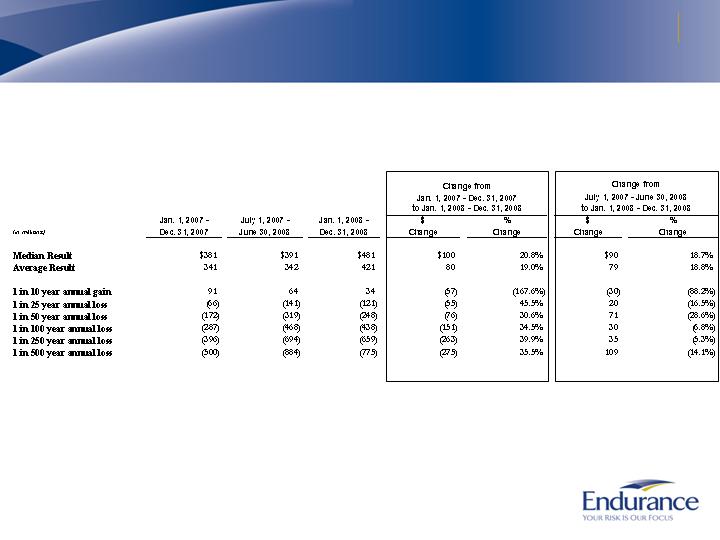

Changes in Portfolio Expected Risk Curve

Changes in Endurance's underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual results

to vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance, please see

"Risk Factors" in our Annual Report on Form 10K for the year ended December 31, 2007.

11

Portfolio Management Has Generated Stable Premiums

Gross Written Premiums*

Net Earned Premiums*

(in millions)

(in millions)

* Includes deposit premiums

12

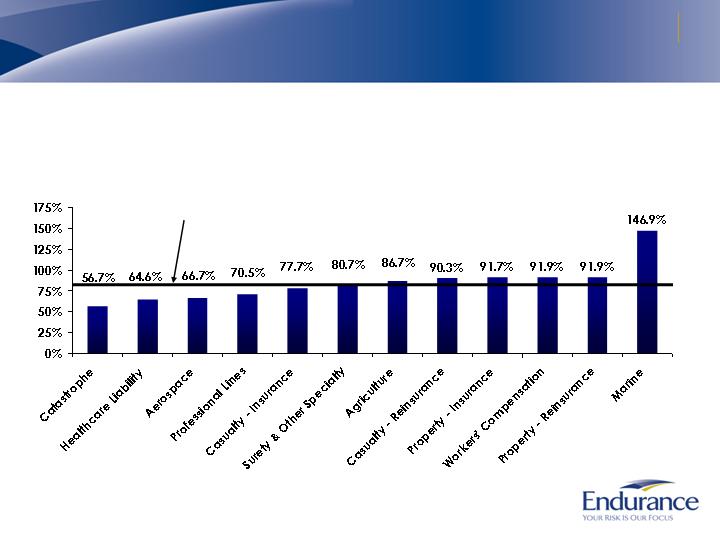

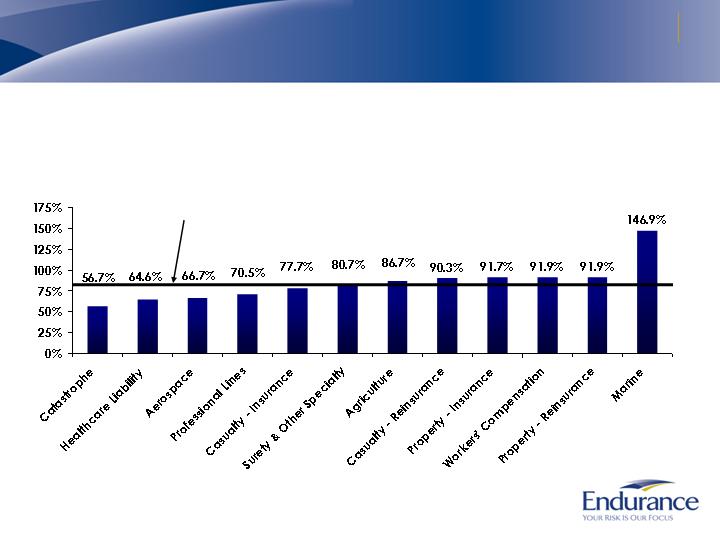

Overall Underwriting Has Been Strong

Inception to Date Underwriting Ratio*

* Underwriting ratio is defined as losses and acquisition expenses divided by earned

premium, as of 12/31/07 and is before deposit accounting adjustments.

Inception to Date Underwriting

Ratio is 82.0%*

13

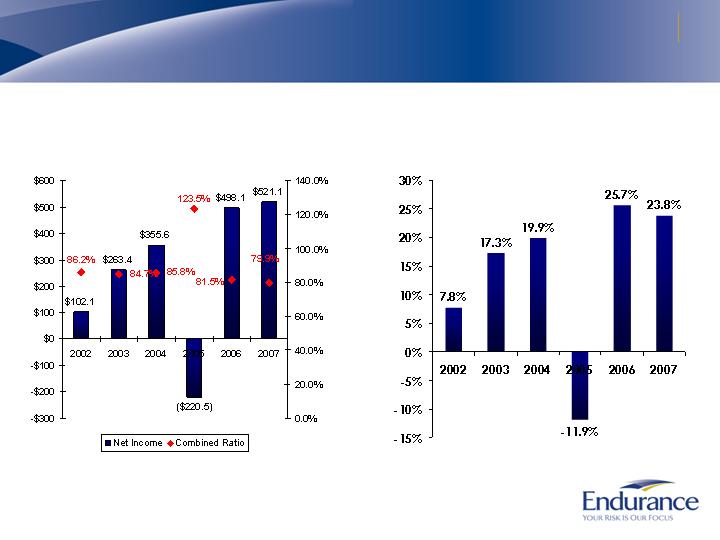

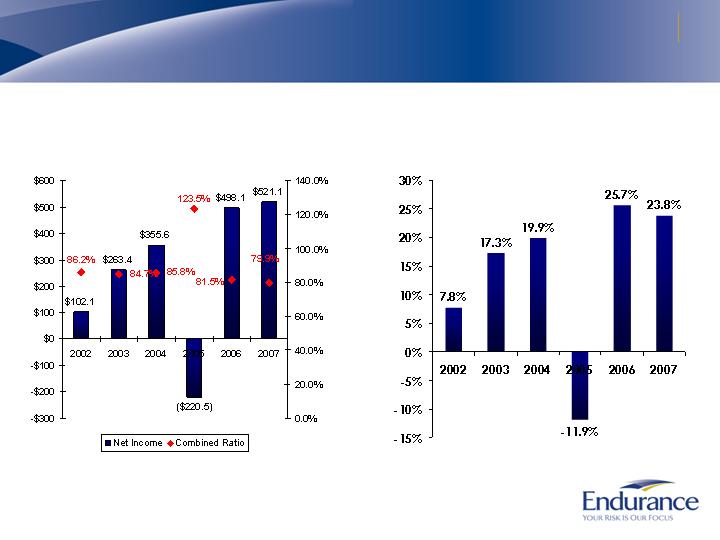

Strong Financial Performance

Net Income and Combined Ratio

(in millions)

Annualized Operating

Return on Average Equity

Inception to 12/31/07 combined ratio of 91.9%

Inception to 12/31/07 ROE of 15.2%

14

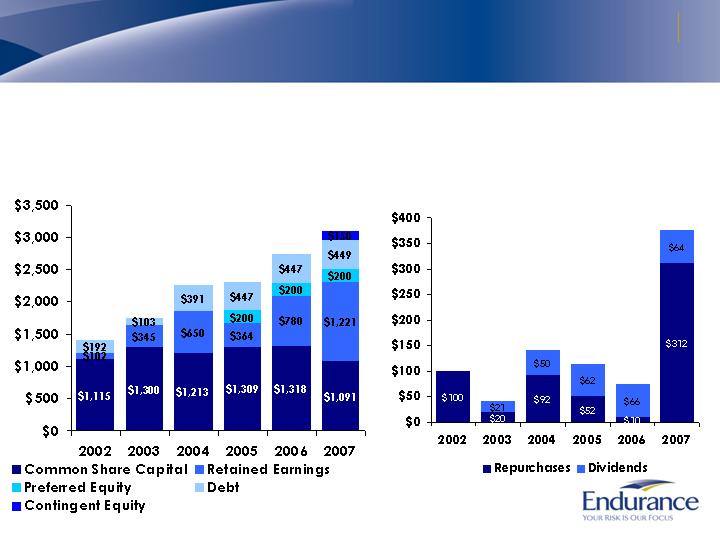

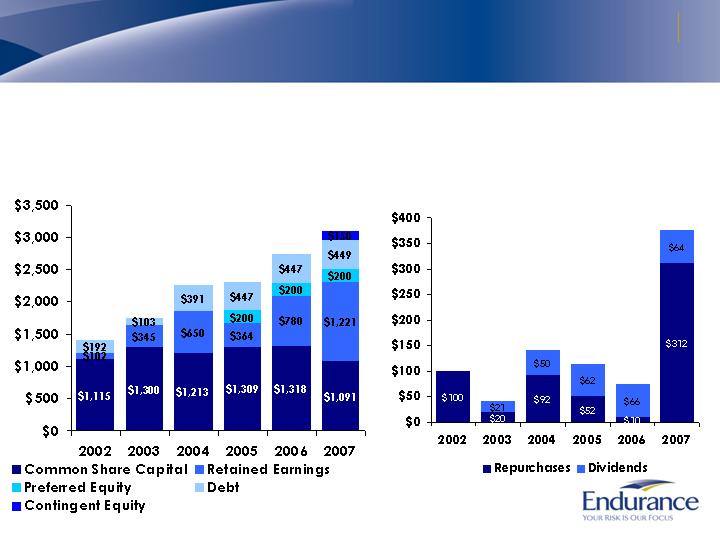

Results of Capital Management

Strong and Flexible

Capital Structure

$, Millions

$1,409

$1,748

$2,254

$2,320

$2,745

$, Millions

$848 Million of

Capital Returned

to Shareholders

$100

$41

$142

$113

$76

$376

$3,111

15

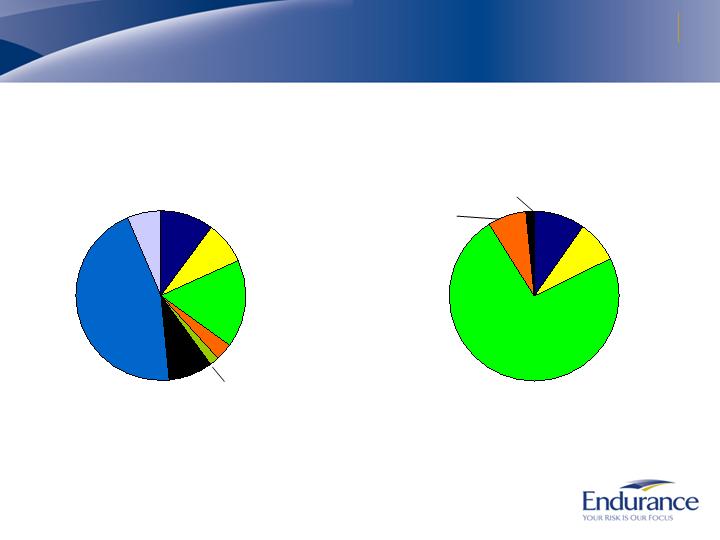

High Quality Investment Portfolio

Total Investment Portfolio of $5.6 Billion*

Cash and

Other

10.2%

Mortgage-backed

45.4%

By Investment Type

* As of December 31, 2007

Fixed Maturity Ratings

$4.7 Billion*

U.S. Government

and agencies

8.2%

Corporate

16.5%

Foreign Government

3.5%

Asset-backed

8.2%

Alternatives

6.4%

U.S. Government

and agencies

9.8%

AAA/Aaa and

agency RMBS

73.3%

BBB or Below

1.6%

AA/Aa

7.3%

A/A

8.0%

Municipals

1.6%

16

2007 Loss Development Triangles

Comprehensive overview of reserves as of December 31,

2007 was disclosed with earnings release

Consistent with our goal of being an industry leader in transparency

Includes both triangles and summary exhibits highlighting gross,

ceded, and net reserves by accident year ..

Select observations

64% of gross loss and LAE reserves arise from long tail casualty

lines of business

Long tail casualty IBNR reserves represent over 81% of total gross

long tail reserves

Additional case reserves account for 32% of the reported claim

reserves within the casualty lines of business

Overall inception to date gross ultimate loss and LAE ratio is 61%

The complete report is available on Endurance’s web site

17

Conclusion

Maintaining discipline in an increasingly competitive

market

Shrinking our reinsurance business as we non-renew business

that no longer meets our price targets

Growing in areas where profit margins remain strong

Well positioned with strong management team,

diversified product portfolio, and excellent financial

strength

Creating shareholder value through active capital

management coupled with strong returns to generate

15%+ ROE through underwriting cycles

Achieved inception to date ROE of 15.2%

18