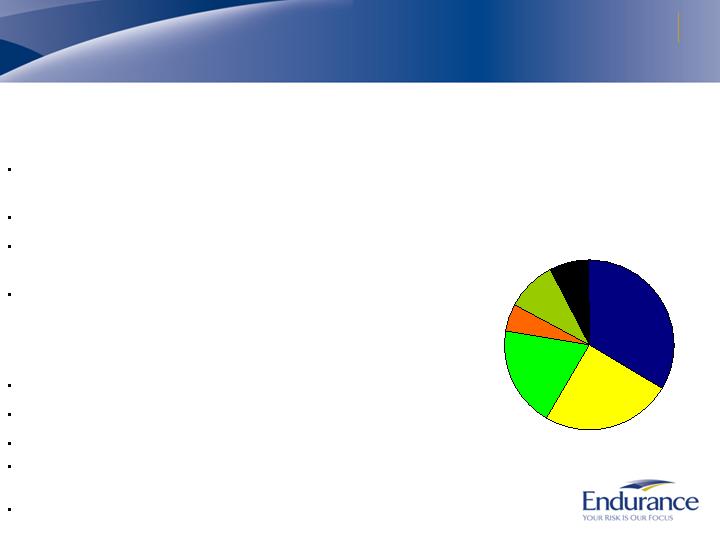

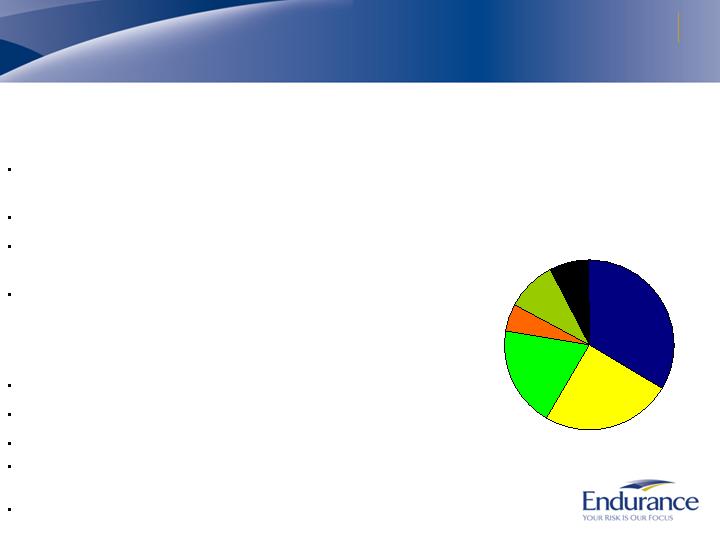

Reinsurance Segment Differentiation

Reinsurance Total Written

Premiums of $924 million*

By Line of Business

* Includes deposit premiums, based on the 12 months ended March 31, 2008

Catastrophe

33.6%

Property

24.7%

Agriculture

5.3%

Casualty

19.3%

Aerospace and Marine

9.7%

Surety and other specialty

7.4%

Endurance differentiates its

reinsurance by:

Focusing on clients that are leading experts in their

specialty

Having industry experts lead each business unit

Leading market in performance of value added claims

and underwriting audits

Strategically located in key global reinsurance markets

(Bermuda, NY, London, Zurich, Singapore)

Property catastrophe business

Leading underwriter of world wide catastrophe risk

Proprietary modeling technology

Cycle exists, but market remains technically driven

Peak exposures include US Wind, CA Earthquake,

European Wind/Flood

Excellent long term profitability even with large cats

8

Insurance Segment Differentiation

Insurance Total Written

Premiums of $1.2 billion*

By Line of Business

Casualty

10.5%

Professional

Lines

7.5%

Healthcare

Liability

7.6%

Property

11.7%

Workers’

Compensation

24.1%

Agriculture

38.6%

* Based on the 12 months ended March 31, 2008

Technology, expertise and distribution will

allow us to optimize cycle performance

Bermuda

Excess casualty, D&O and healthcare:

Leading market providers

Mature portfolio

Volatile classes of casualty insurance require highly

specialized underwriting and have produced strong

historical results

U.S. Based Insurance

Specialty excess and surplus insurance, workers

compensation and agriculture

Diversification, capital utilization and return potential

significantly enhanced by ARMtech acquisition

Specialized teams of underwriters added to further

expand and diversify E&S operations

UK Property Business

Lead Market for UK Middle Market Property Insurance

New Construction Unit

9

A History of Innovative Acquisitions

Endurance has completed several attractive transactions since its

inception

Avoid legacy issues

Accretive to earnings

Key acquisition criteria

Insurance or reinsurance business

Can be effectively integrated

Endurance controls acquired business

Failure will not threaten viability of Endurance

Quickly accretive to earnings

Provides specialty expertise

Transfers minimal legacy liabilities

Does not create significant risk aggregations

LaSalle Re

Property Cat

Renewal Rights

$170M in premium

Hart Re

Reinsurance Business

Renewal Rights

$800M in premium

XL Re

Surety Business

Renewal Rights

$45M in premium

ARMtech

Agriculture Business

Acquisition

$500M+ in premium

2002

2003

2004

2007

10

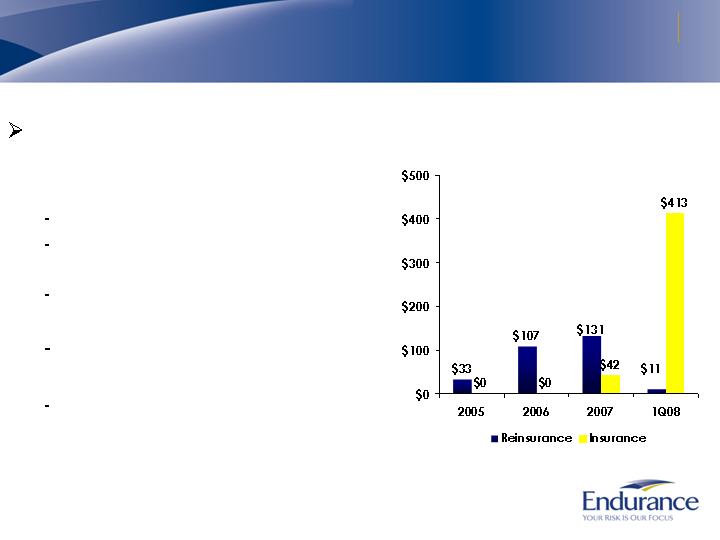

Agriculture Insurance/Reinsurance Case Study

Agriculture industry

Fast growing part of the economy

Core product is MPCI (multi peril crop insurance) which is part of federal crop insurance

program

Underwriting is specialized, technical and data intensive

Intrinsically profitable

Reinsurance has steadily become more competitive over last four years

Insurance results are typically better than reinsurance

ARMtech overview

5th largest writer of Ag insurance in the U.S.

Industry leading customer service and technology

Serves approximately 100,000 customers

Geographically diversified portfolio of MPCI business with some concentration in Texas

Offers both revenue and yield products

Is most significantly impacted by drought risk which is lightly correlated with Endurance

book of business

Opportunistic purchaser of reinsurance

Reduces volatility

Proprietary federal cessions technology

Purchases excess of loss and quota share from third parties at attractive terms

11

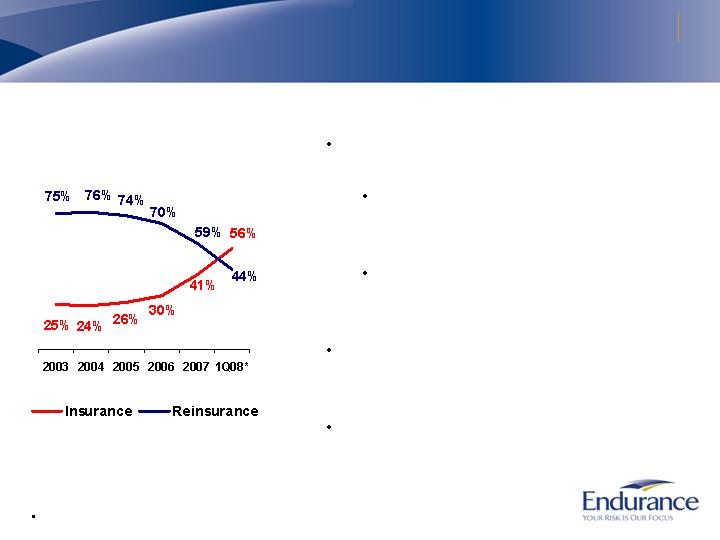

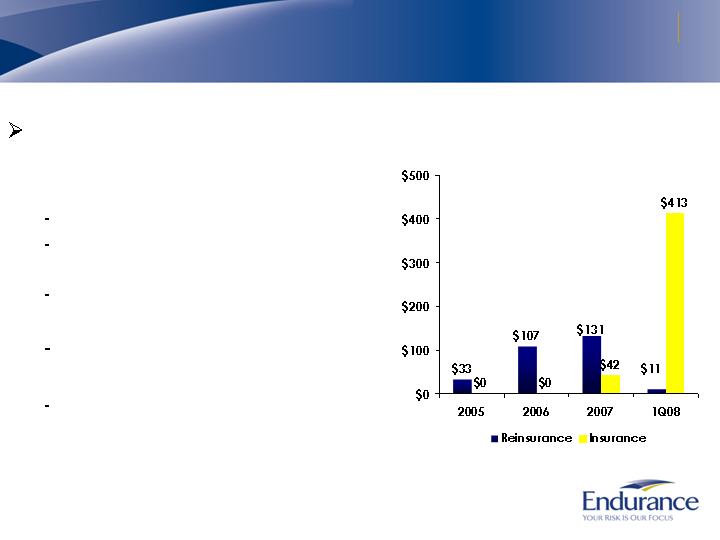

Agriculture Insurance/Reinsurance Case Study, Continued

Effectively switched from

being a reinsurance to an

insurance provider

Meaningful book of business

Higher profitability with lower

volatility

More sustainable book of

business; 100,000 customers

Insurance rates are set by

federal program

Reinsurance rates impacted by

competitive forces

(in millions)

Gross Written Premiums*

* Includes deposit premiums

12

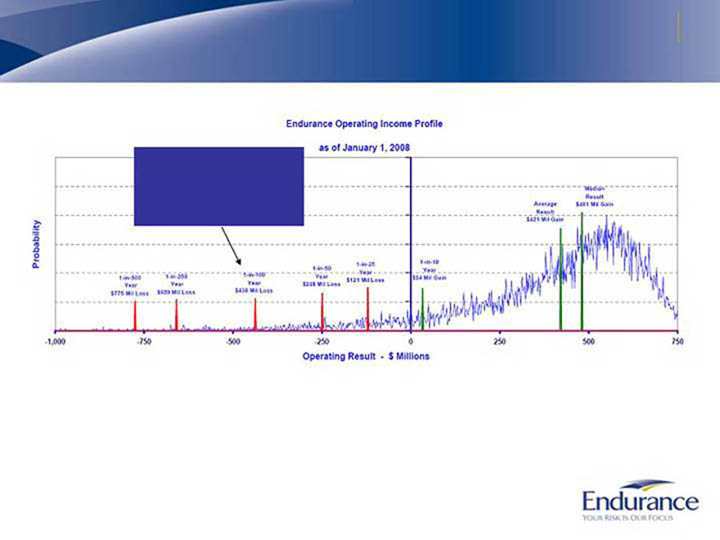

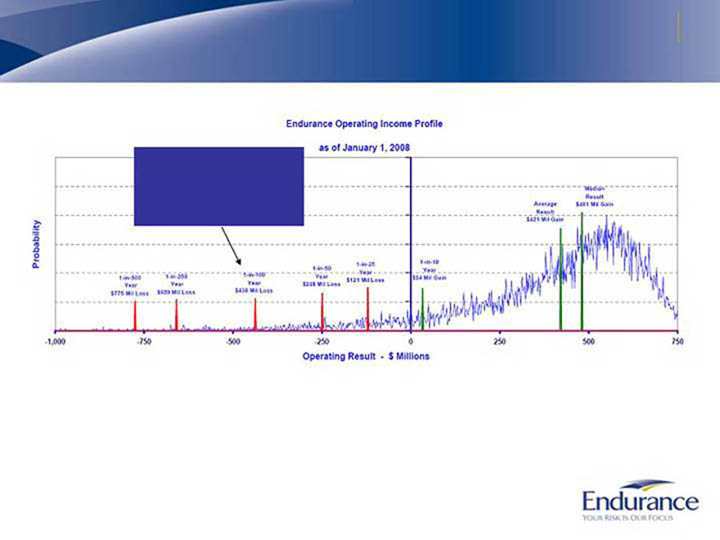

Strong Risk Management Focus -

Portfolio Expected Risk Curve (January 1, 2008)

Stated tolerance is to limit

our loss in a 1-in-100 year

to 25% of our capital or

less, our current level is

18.7% of capital

The above chart represents a cumulative analysis of our in-force underwriting portfolio on a full year basis based on thousands of

potential scenarios. Loss years are driven largely by the occurrence of natural catastrophes and incorrect pricing of other property and

casualty exposures. The operating income depicted includes net premiums earned plus net investment income, acquisition expenses

and G&A expenses. The operating income depicted excludes the effects of income tax (expenses) benefits, amortization of intangibles

and interest expense. Forecasted investment income, acquisition and G&A expenses are held constant across all scenarios. Losses

included above are net of reinsurance including collateralized reinsurance and ILW purchases. Our stated objective is to maintain a risk

management tolerance that limits our loss in a 1-in-100 year year to be no more than 25% of our equity capital.

Changes in Endurance's underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual results to

vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance, please see "Risk Factors"

in our Annual Report on Form 10-K for the year ended December 31, 2007.

13

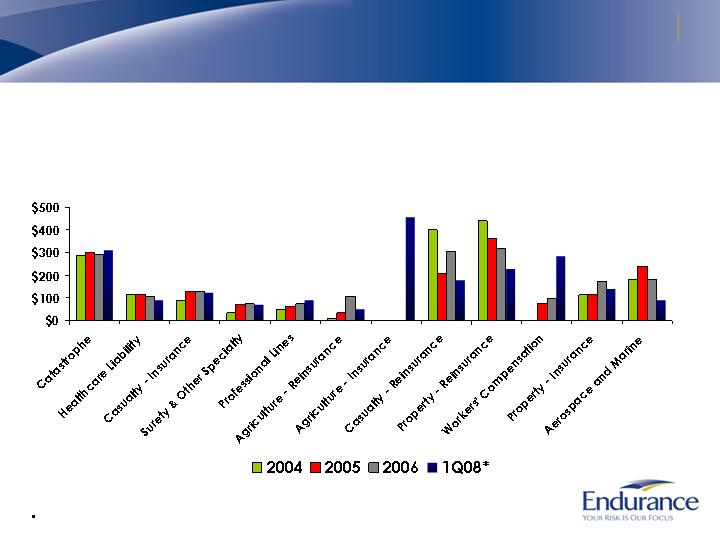

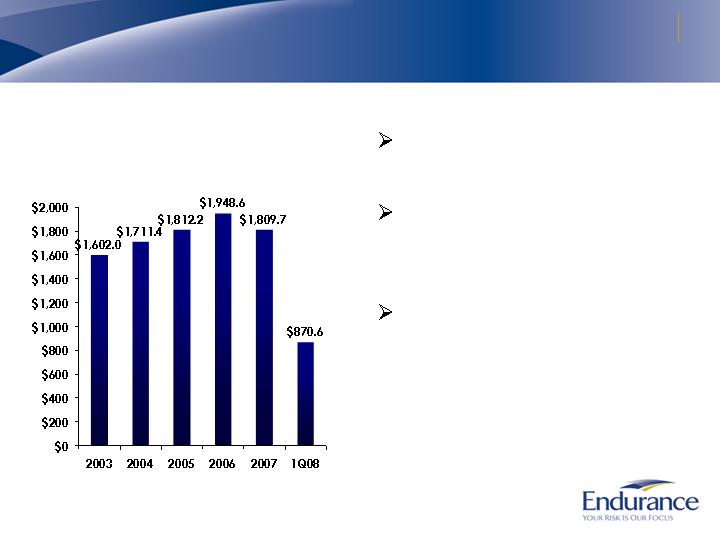

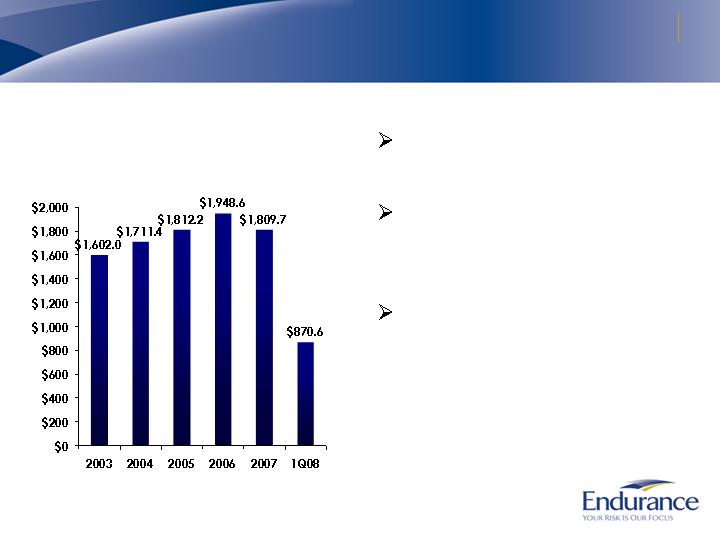

Portfolio Management Has Generated Stable Premiums

Gross Written Premiums*

(in millions)

* Includes deposit premiums

Premiums have been fairly

stable with modest growth

Underlying product mix has

shifted significantly over

time

Actively managing the

portfolio by entering new

attractive business while

exiting or reducing

premiums in less attractive

lines

14

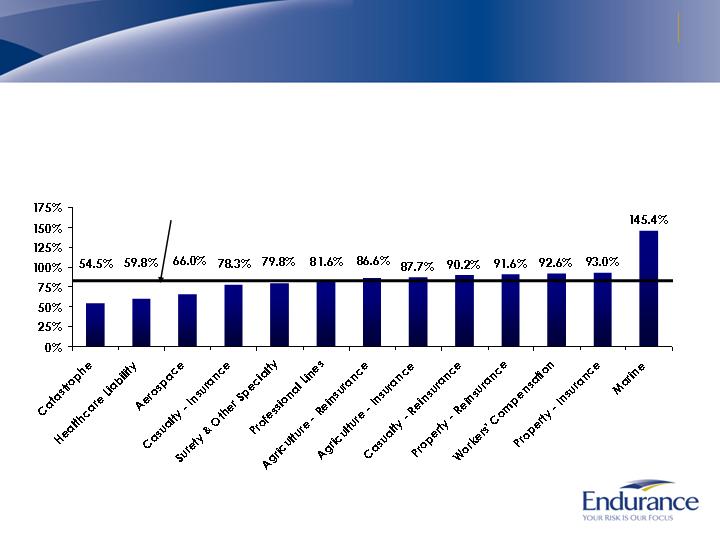

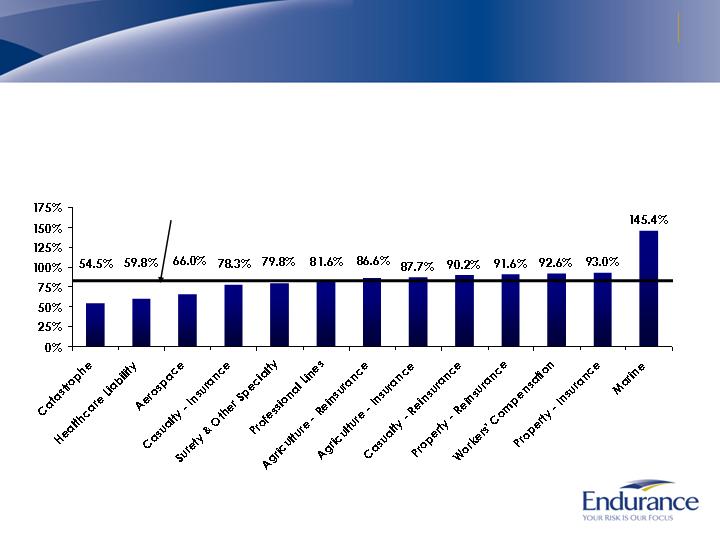

Overall Underwriting Has Been Strong

Inception to Date Underwriting Ratio*

* Underwriting ratio is defined as losses and acquisition expenses divided by earned

premium, from inception through 3/31/08 and is before deposit accounting adjustments.

Inception to Date Underwriting

Ratio is 81.6%*

15

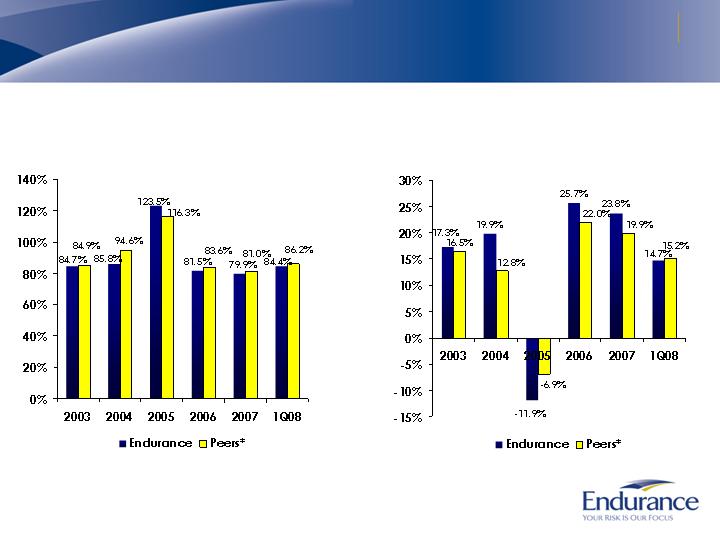

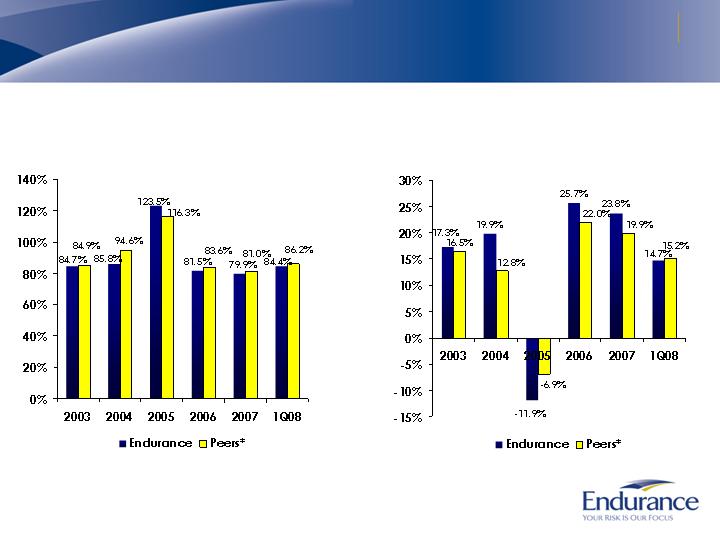

Strong Financial Performance

Combined Ratio

Annualized Operating

Return on Average Equity

Inception to 3/31/08 combined ratio of 91.3%

Inception to 3/31/08 ROE of 15.1%

* Composite peer median based on SNL data, peers include; Platinum, Allied World, Arch, Ren Re,

IPC re, Axis, Transatlantic, Everest, Partner Re, Montpelier and Max Re

16

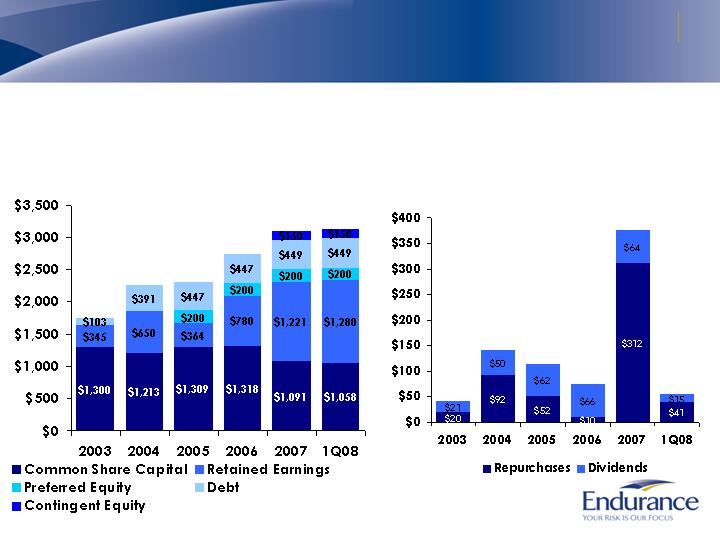

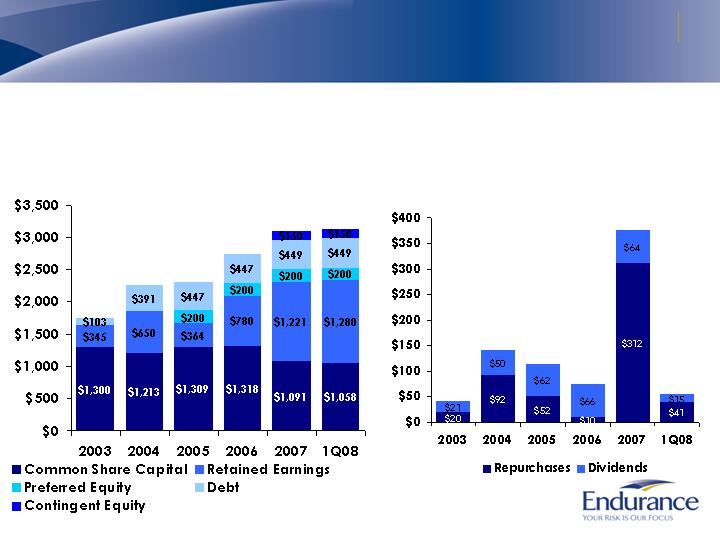

Results of Capital Management

Strong and Flexible

Capital Structure

$, Millions

$1,748

$2,254

$2,320

$2,745

$, Millions

$894 Million of Capital

Returned to Shareholders

(Inception to date)

$41

$142

$113

$76

$376

$3,111

$3,137

$56

17

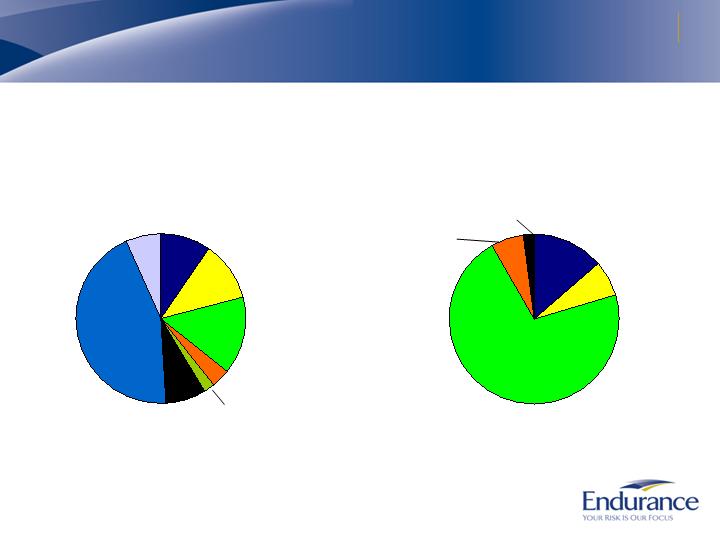

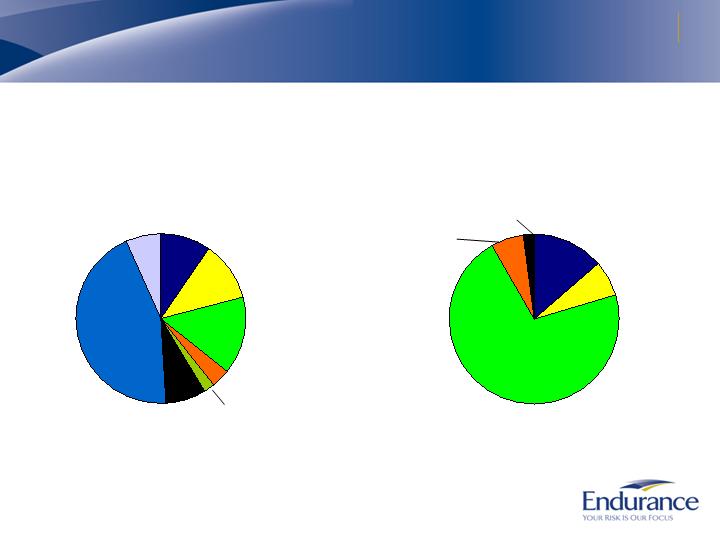

High Quality Investment Portfolio

Total Investment Portfolio of $5.6 Billion*

Cash and Other

9.8%

Mortgage-backed

44.5%

By Investment Type

* As of March 31, 2008

Fixed Maturity Ratings

$4.7 Billion*

U.S. Government

and agencies

11.3%

Corporate

14.6%

Foreign Government

3.5%

Asset-backed

7.4%

Alternatives

6.6%

U.S. Government

and agencies

13.6%

AAA/Aaa and

agency RMBS

71.1%

BBB or Below

1.8%

AA/Aa

6.6%

A/A

6.9%

Municipals

2.3%

18

Conclusion

Managing the micro cycles within the insurance/reinsurance

industry

Shrinking portions of our portfolio as we non-renew business that no

longer meets our price targets

Growing in select areas where profit margins remain strong

Continue to execute on attractive acquisition opportunities

that create shareholder value

Well positioned with strong management team, diversified

product portfolio, and excellent financial strength

Creating shareholder value through strong underwriting and

investment returns coupled with active capital management

to generate 15%+ ROE through underwriting cycles

Achieved inception to date ROE of 15.1%

19