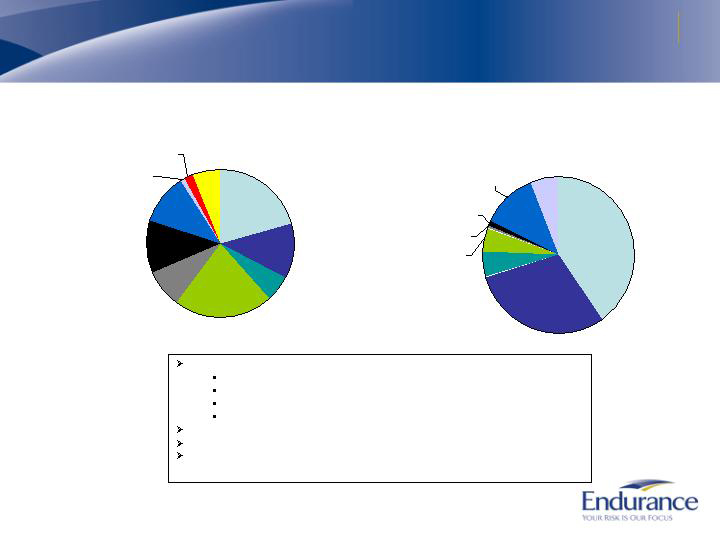

Investment Portfolio Details Updated to 9/30/08(*)

Investment Portfolio Details

Total cash and invested assets of $5.5 billion

$4.5 billion Fixed Income Investment Portfolio

Average credit rating of AAA

$2.5 billion of AAA-rated & Agency Structured Fixed Income

Agency MBS $1.2 billion

AAA Non-Agency RMBS $468 million (no subprime)

AAA Non-Agency CMBS $594 million

AAA Auto loan backed $114 million

AAA Credit card backed $109 million

$1.2 billion Government and Agency Debentures

$668 million of Corporate Debt and $104 million of Municipals

Predominately senior indebtedness

Unsecured debt of Financial Institutions - $241 million

(59 individual issuers, none greater than $36 million)

High Yield $44 million

$55 million Below AAA-rated Structured Fixed Income

RMBS $5 million

CMBS $18 million

ABS $31 million

$338 million of Other Investments

Diversified portfolio of hedge funds and high yield bank loan funds

$667 million of Cash and Cash equivalents

Consists primarily of bank deposits, US Government/Agency

securities, and money market funds invested in US Government /

Agency securities

Portfolio Commentary

No exposure to Fannie Mae and Freddie

Mac preferred equity or subordinated debt

or any security issued by Washington

Mutual

No sub-prime mortgage backed securities.

No credit or interest rate derivatives

Immaterial exposure to other troubled

financial institutions (Lehman- $6.5 million

pre-write down book value, and AIG - $3.5

million pre-write down book value)

Expected realized losses, other-than-

temporary impairment charges and

alternative investment losses in the 3rd

quarter of approximately $64 million and

within risk management tolerances (~1%

of 9/30/08 Cash/Invested Assets and < 3%

of Shareholders equity).

Portfolio experienced approximately $70

million to $75 million increase in net unrealized

loss during quarter ended 9/30/08 (less than

1.4% of Cash and Invested Assets)

(*) Data estimated as of September 30, 2008.

7