Endurance Specialty Holdings Ltd.

Balance Sheet Quality and Financial Strength

Forward Looking Statements

Some of the statements in this presentation include forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. Statements which include the words "expect," "intend," "plan," "believe," "project," "anticipate," "seek," "will," and similar statements of a future or forward-looking nature identify forward-looking statements in this presentation for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ from those indicated in the forward-looking statements. These factors include, but are not limited to, developments in the world’s financial and capital markets that could adversely affect the performance of Endurance’s investment portfolio or access to capital, changes in the composition of Endurance's investment portfolio, competition, possible terrorism or the outbreak of war, the frequency or severity of unpredictable catastrophic events, changes in demand for insurance or reinsurance, rating agency actions, uncertainties in our reserving process, a change in our tax status, acceptance of our products, the availability of reinsurance or retrocessional coverage, retention of key personnel, political conditions, the impact of current legislation and regulatory initiatives, changes in accounting policies, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2007.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation publicly to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Highlights of Endurance’s Balance Sheet Strength as of

September 30, 2008

High quality assets with low counterparty risk

Cash and invested assets of $5.5 Billion (*)

Average credit rating of AAA

Limited investments in troubled financial institutions

Conservative portfolio strategy has protected balance sheet

Very low exposure to reinsurance counterparties or other credit risk

Significant reserve base and careful attention to setting of reserves

Total reserves of $3.3 Billion

IBNR represents 66% of total reserves ( > 80% of long tail casualty reserves are IBNR)

Global schedule P reserve analysis disclosed annually highlights reserve position and

commitment to transparency

Efficient and stable capital structure, with low leverage

Total capital of $2.9 Billion

Common Equity $2.1 Billion

Preferred Equity $0.20 Billion

Long Term Debt $0.45 Billion

Contingent Common Equity $0.15 Billion

Excellent Financial Strength Ratings:

S&P: A (stable). Upgraded December 2006. ERM considered “Excellent”.

AM Best A (stable). Upgraded December 2007.

Moody’s: A2 (stable).

(*) = Includes investments pending settlement, net

Excellent Liquidity Position

Cash and cash equivalents of $667 million at 9/30/08 (*)

Consists primarily of bank deposits, US Government/Agency securities, and money market

funds invested in US Government / Agency securities

High quality fixed income investment portfolio, including fixed maturity securities, short term

investments and hybrid preferred equities, of $4.5 billion at 9/30/08 with strong cash flows

Portfolio generates annual principal and interest payments of > $1 billion

Short duration of 3.2 years

$1.2 billion credit facility (matures 2012)

Provides capacity for very low cost borrowings (LIBOR + max of 38 bps) and letters of credit

> $600 million of unused capacity at 9/30/08

Widely syndicated facility with 16 participant banks

$150 million variable forward sale of equity can be drawn upon quickly through 2010

Positive operating cash flows provide additional flexibility

(*) Includes investments pending settlement, net

Strong Capital Base

Low leverage: Debt/Total Capital of

16.5% at 9/30/08

Balance sheet financed with long

duration liabilities / hybrid capital

$250M 10 year senior notes (due 2015,

6.15% coupon)

$200M 30 year senior notes (due 2034,

7.00% coupon)

$200M perpetual preferred stock (no

maturity, 7.75% coupon)

$150M contingent equity provides quick

source of common equity through 2010

Excellent risk based capital management

maintains strong rating agency capital

position while providing capacity for

capital management and growth

Approximately $180M of share

repurchases and common share

dividends paid through first nine months

of 2008

Strong and Flexible

Capital Structure

$, Millions

$1,748

$2,254

$2,320

$2,745

$3,111

$2,866

Investment Portfolio Composition as of September 30, 2008

Cash and Cash

Equivalents 12%

ABS 5%

Agency RMBS 22%

Non-Agency RMBS

9%

CMBS 11%

Government &

Agency 21%

Other Investments

6%

Municipals 2%

Investment Grade

Corporates 11%

High Yield

Corporates 1%

AAA 30%

US

Government

& Agency

40%

Other

Investments

6%

Cash and

Cash

Equivalents

12%

AA 5%

A 5%

BBB 1%

High Yield 1%

Diversified, high quality, short duration fixed income portfolio

Average rating – Aaa/AAA

Duration – 3.2 years

Book Yield – 4.9%

Market yield – 5.6%

No sub-prime mortgage backed securities.

No credit or interest rate derivatives.

No exposure to Fannie Mae and Freddie Mac preferred equity or

subordinated debt or any security issued by Washington Mutual

NOTES: (a) “Other Investments” includes hedge funds and high yield bank loan funds

(b) Includes investments pending settlement, net

(c) Includes agency RMBS

Total Invested Assets $5.5 Billion

Total Portfolio Rating Allocation

Total Portfolio Sector Allocation

(a)

(b)

(a)

(c)

(b)

6

Investment Portfolio Details as of September 30, 2008

Investment Portfolio Details

Total cash and invested assets of $5.5 billion

$4.5 billion Fixed Income Investment Portfolio

Average credit rating of AAA

$2.6 billion of AAA-rated & Agency Structured Fixed Income

Agency MBS $1.2 billion

AAA Non-Agency RMBS $480 million (no subprime)

AAA Non-Agency CMBS $594 million

AAA Auto loan backed $114 million

AAA Credit card backed $109 million

$1.2 billion Government and Agency Debentures

$668 million of Corporate Debt and $104 million of Municipals

Predominately senior indebtedness

Unsecured debt of Financial Institutions - $241 million (59

individual issuers, none greater than $36 million)

High Yield $44 million

Hybrid Perpetual Preferred Equity $40 million

$55 million Below AAA-rated Structured Fixed Income

RMBS $5 million

CMBS $18 million

ABS $32 million

$338 million of Other Investments

Diversified portfolio of hedge funds and high yield bank loan funds

$667 million of Cash and Cash equivalents

Consists primarily of bank deposits, US Government/Agency securities,

and money market funds invested in US Government / Agency

securities

Portfolio Commentary

No exposure to Fannie Mae and Freddie Mac

preferred equity or subordinated debt or any

security issued by Washington Mutual.

No sub-prime mortgage backed securities.

No credit or interest rate derivatives.

Immaterial exposure to other troubled

financial institutions (Lehman- $6.5 million

pre-write down book value, and AIG - $3.5

million pre-write down book value)

Realized losses, other-than-temporary

impairment charges and alternative investment

losses in the 3rd quarter of approximately $70

million and within risk management tolerances

(1.3% of 9/30/08 Cash/Invested Assets and

3.1% of Shareholders equity).

Portfolio experienced $72 million increase

in net unrealized loss during quarter

ended 9/30/08 (1.3% of Cash and

Invested Assets)

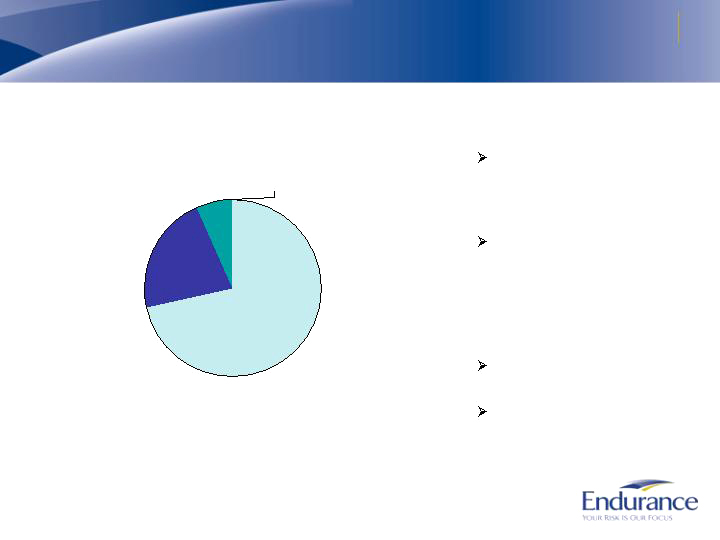

RMBS Portfolio Allocation 09/30/08

US Gov’t Agency-

backed

(FN/FH/GN) 71.5%

AAA Non-Agency

Prime 21.8%

AAA Non-Agency

Alt-A 6.4%

<AAA Non-Agency

0.3%

RMBS Sector Commentary

Primarily US Agency exposure,

backed by Fannie Mae, Freddie

Mac and Ginnie Mae – 72%

Non-agency bonds in the

portfolio are the most senior in

the issue’s capital structure,

protected by significant

subordination

No sub-prime collateral

Less than AAA-rated exposure is

immaterial

Total RMBS $1.7 Billion

8

Conclusion

Endurance has excellent financial strength and liquidity

Strong and stable ratings

High quality assets and exceptional liquidity

Strong and flexible capital base

Enterprise Risk Management is competitive advantage for Endurance

ERM guides underwriting and asset management philosophy

Endurance one of very few insurers to receive “Excellent” ERM rating from

Standard & Poor’s

Endurance ready to meet client needs

Dedicated industry specialists

Stable and consistent market

Underwriting and pricing transparency