Endurance Specialty Holdings Ltd.

3rd Quarter 2008

2

Forward Looking Statements & Regulation G Disclaimer

Safe Harbor for Forward Looking Statements

Some of the statements in this presentation include forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. Statements which include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “seek,” “will,” and similar statements of a future or forward-looking nature identify forward-looking statements in this presentation for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ from those indicated in the forward-looking statements. These factors include, but are not limited to, developments in the world’s financial and capital markets that could adversely affect the performance of Endurance’s investment portfolio or access to capital, changes in the composition of Endurance’s investment portfolio, competition, possible terrorism or the outbreak of war, the frequency or severity of unpredictable catastrophic events, changes in demand for insurance or reinsurance, rating agency actions, uncertainties in our reserving process, a change in our tax status, acceptance of our products, the availability of reinsurance or retrocessional coverage, retention of key personnel, political conditions, the impact of current legislation and regulatory initiatives, changes in accounting policies, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2007.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation publicly to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Regulation G Disclaimer

In presenting the Company’s results, management has included and discussed certain non-GAAP measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company’s results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-GAAP measures and reconciliations, please review the Investor Financial Supplement on our web site at www.endurance.bm.

The combined ratio is the sum of the loss, acquisition expense and general and administrative expense ratios. Endurance presents the combined ratio as a measure that is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information. The combined ratio, excluding prior year net loss reserve development, enables investors, analysts, rating agencies and other users of its financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes Endurance’s underlying business performance. The combined ratio, excluding prior year net loss reserve development, should not be viewed as a substitute for the combined ratio.

Total premiums written is a non-GAAP internal performance measure used by Endurance in the management of its operations. Total premiums written represents gross premiums written and deposit premiums, which are premiums on contracts that are deemed as either transferring only significant timing risk or transferring only significant underwriting risk and thus are required to be accounted for under GAAP as deposits. Endurance believes these amounts are significant to its business and underwriting process and excluding them distorts the analysis of its premium trends. In addition to presenting gross premiums written determined in accordance with GAAP, Endurance believes that total premiums written enables investors, analysts, rating agencies and other users of its financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes Endurance’s underlying business performance. Total premiums written should not be viewed as a substitute for gross premiums written determined in accordance with GAAP.

Return on Average Equity (ROAE) is comprised using the average common equity calculated as the arithmetic average of the beginning and ending common equity balances for stated periods. Return on Beginning Equity (ROBE) is comprised using the beginning common equity for stated periods. The Company presents various measures of Return on Equity that are commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information.

Agenda

Appendix

4.

Review of Financial Results

3.

Financial Strength Summary

2.

Endurance Overview

1.

Endurance Overview

We have a high quality balance

sheet with excellent capitalization,

liquidity and ratings

Financial results have been strong

Endurance is well positioned with a

strong, scaleable and globally

diversified franchise

Established specialty operations in the United

States, Bermuda, United Kingdom,

Continental Europe and Asia

Strong diversification by product line,

geography, and distribution source

We are leveraging our investments in people,

technology and infrastructure to capitalize on

current market opportunities

$2.9 Billion of total capital, with low cost

structure, conservative investments and

reserves, and active capital management

Excellent Liquidity with > $1 Billion of annual

portfolio cash flows and $1.33 Billion of credit

and equity facilities

A (Excellent) ratings from AM Best and S&P.

Endurance received highest ERM ranking of

“Excellent” from Standard & Poor’s

Inception to date annualized ROE of ~14%

Inception to date combined ratio of 92.6%

Diluted Book Value per share

has grown 40% since 2003

Endurances is Well Positioned to Benefit From Market Changes

Drivers of a Hardening Market

Endurance is Poised to Benefit

Industry Capital Position has been

significantly reduced, with increased

appreciation of risk

> $25 Billion of Catastrophe and

large risk losses

$50 - $100+ Billion of

investment portfolio declines

Replacement capital is not

available Reinsurance may

be only capital alternative

Significant impairment of several

large industry participants

Increasing focus on

counterparty risk and limit

concentration

Broader syndication of risk will

result

Florida market changes likely to

create more demand for private

reinsurance

We have exceptional financial

strength, liquidity and capital

resources

Established global reinsurance

operations located throughout the

U.S., U.K., Continental Europe and

Asia.

We have well established insurance

operations located throughout the

U.S., U.K., and Bermuda that are

particularly well positioned in specialty

lines dominated by impaired

competitors

Clients and distribution partners view

Endurance as a “go to” market

We are ready to capitalize on potential

emerging opportunities

Leveraging Our Core Strengths

Focus on business segments that

reward our specialized knowledge

and relationships

Supported by investments in

enabling technology and

disciplined, technical

underwriting approach

Portfolio managed with key risk

management concepts –

diversification, value at risk and data

quality

Portfolio

Management

Technology

and

Discipline

OUR GOAL:

To become the best

specialty insurance

and reinsurance

company in the

world

Capital

Management

Specialization

Actively manage capital to maintain

efficient capital level and enhance

returns on equity

“We’ll know we’ve reached our goal when we

have achieved industry leading returns on

equity over time, share price multiples and

ratings at the top of our peer group and when

we are considered by our employees and

customers as the best in the business.”

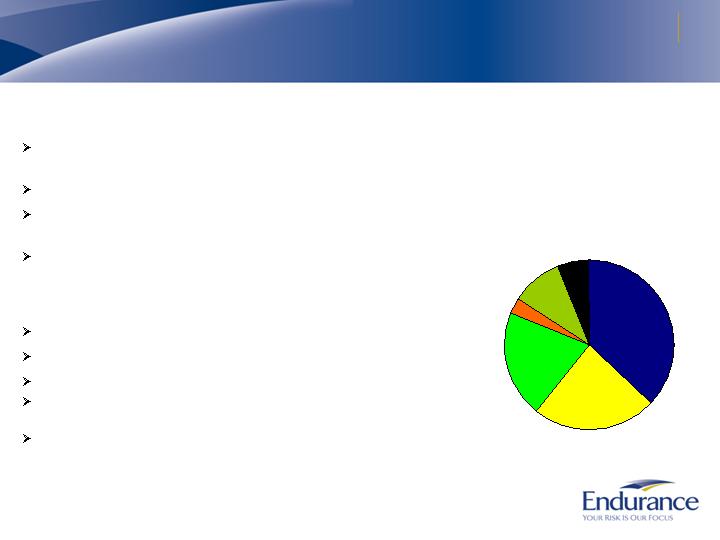

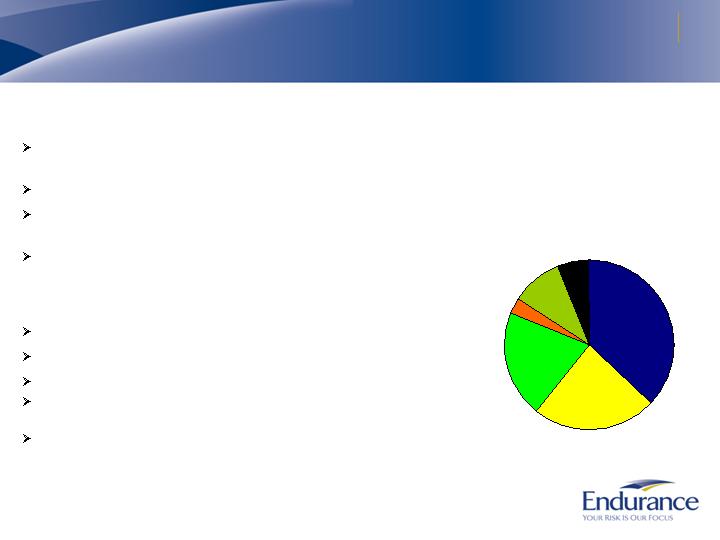

Our Book of Business is Well Diversified

Total Written Premiums of $2.3 Billion*

By Segment

* Includes deposit premiums, based on the 12 months ended September 30, 2008

By Line of Business

Property - Insurance

Property - Reinsurance

Casualty -

Reinsurance

Casualty - Insurance

Healthcare Liability

Workers’

Compensation

Professional Lines

Catastrophe

Agriculture Reinsurance

Aerospace and Marine

Surety and Other Specialty

Agriculture Insurance

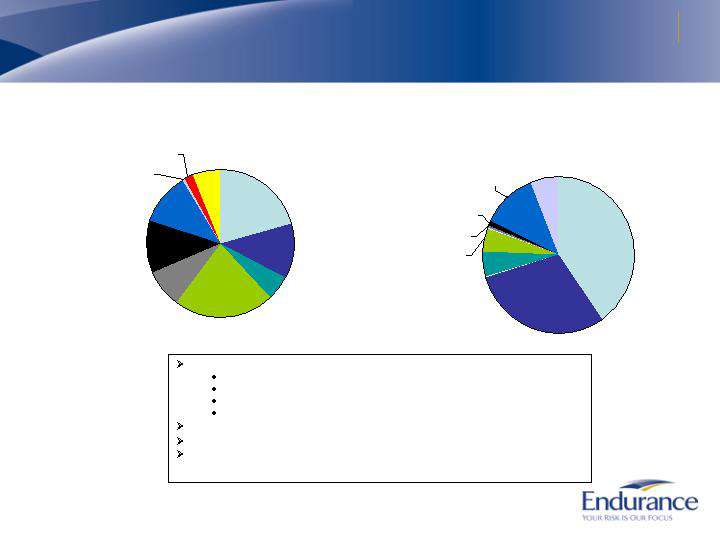

Reinsurance Segment Differentiation

Reinsurance Total Written

Premiums of $849 million*

By Line of Business

* Includes deposit premiums, based on the 12 months ended September 30, 2008

Catastrophe

37.0%

Property

23.4%

Agriculture

3.2%

Casualty

20.6%

Aerospace and Marine

9.7%

Surety and other specialty

6.1%

Endurance differentiates its reinsurance by:

Focusing on clients that are at the forefront of their

specialty

Having industry experts head each business unit

Leading the market in performance of value added claims

and underwriting audits

Strategically located in key global reinsurance markets

(Bermuda, NY, London, Zurich, Singapore)

Property catastrophe business

Leading underwriter of world wide catastrophe risk

Proprietary modeling technology

Cycle exists, but market remains technically driven

Peak exposures include US Wind, CA Earthquake,

European Wind/Flood

Excellent long term profitability even with large cats

Insurance Segment Differentiation

Insurance Total Written

Premiums of $1.4 billion*

By Line of Business

Casualty

8.2%

Professional

Lines

7.9%

Healthcare

Liability

5.9%

Property

10.9%

Workers’

Compensation

18.5%

Agriculture

48.6%

* Based on the 12 months ended September 30, 2008

Technology, expertise and distribution will

allow us to optimize cycle performance

Bermuda

Excess casualty, D&O and healthcare:

Leading market providers

Mature portfolio

Volatile classes of casualty insurance require highly

specialized underwriting and have produced strong

historical results

U.S. Based Insurance

Specialty excess and surplus insurance, workers’

compensation and agriculture

Diversification, capital utilization and return potential

significantly enhanced by ARMtech acquisition

Specialized teams of underwriters added to further

expand and diversify E&S operations

UK Property Business

Lead Market for UK Middle Market Property Insurance

New Construction Unit

Industry Leading Risk Management and Transparency

Enterprise Risk Management has been a focus of Endurance

since inception

Risk management is infused in our culture

Integrated underwriting system measures company wide

exposure at the contract level to identify concentration risk

Significant emphasis placed on pricing, reserving and claims

monitoring

Completion of extensive client audits

Investment portfolio is prudently managed to avoid excess risk

Endurance’s ERM was rated “Excellent” by S&P in 2008

First class of 2001 and youngest company to achieve the

designation

Only 4% of companies in the U.S. and Bermuda have achieved

the top recognition of excellent

Management is committed to providing industry leading

transparency

Detailed investment information provided in financial

supplement and in SEC documents

Complete global loss triangles reported in early February 2008

S&P ERM Scores for North

America and Bermuda Companies

Adequate,

71%

Excellent,

4%

Weak, 5%

Strong,

10%

Adequate

with

Positive

Trend,

10%

Source: Standard and Poor’s (as of April 2008)

10

Agenda

Appendix

4

Review of Financial Results

3

Financial Strength

Summary

2

Endurance Overview

1

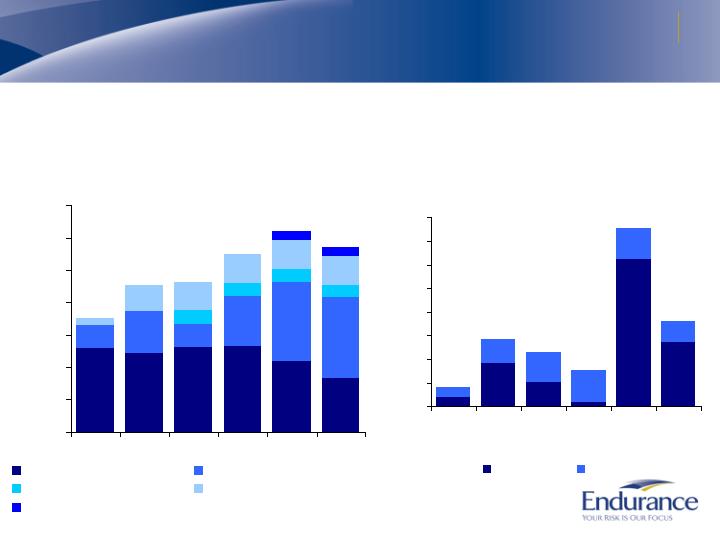

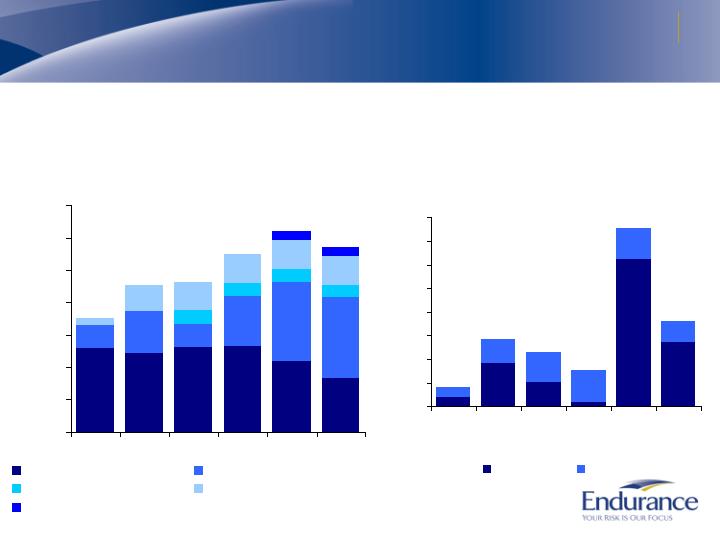

Strong Balance Sheet with Active Capital Management

$1,300

$1,213

$1,309

$1,318

$1,091

$822

$345

$650

$364

$780

$1,221

$1,247

$200

$200

$200

$200

$103

$391

$447

$447

$449

$447

$150

$150

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2003

2004

2005

2006

2007

3Q08

Common Share Capital

Retained Earnings

Preferred Equity

Debt

Contingent Equity

Strong and Flexible

Capital Structure

$, Millions

$1,748

$2,254

$2,320

$2,745

$20

$92

$52

$10

$312

$135

$21

$50

$62

$66

$64

$45

$0

$50

$100

$150

$200

$250

$300

$350

$400

2003

2004

2005

2006

2007

3Q08

YTD

Repurchases

Dividends

$, Millions

$1.0 Billion of Capital

Returned to Shareholders

(Inception to date)

$41

$142

$114

$76

$376

$3,111

$2,866

$180

12

Endurance’s Balance Sheet Strength as of September 30, 2008

High quality assets with low counterparty risk

Cash and invested assets of $5.5 Billion (*)

Average credit rating of AAA

Limited investments in troubled financial institutions

Conservative portfolio strategy has protected balance sheet

Very low exposure to reinsurance counterparties or other credit risk

Significant reserve base and careful attention to setting of reserves

Total reserves of $3.3 Billion

IBNR represents 66% of total reserves (> 80% of long tail casualty reserves are

IBNR)

Global schedule P reserve analysis disclosed annually highlights reserve

position and commitment to transparency

Efficient and stable capital structure, with low leverage

Total capital of $2.9 Billion

Common Equity $2.1 Billion

Preferred Equity $0.20 Billion

Long Term Debt $0.45 Billion

Contingent Common Equity $0.15 Billion

Excellent Financial Strength Ratings:

S&P: A (stable) Upgraded December 2006. ERM considered “Excellent”.

AM Best A (stable) Upgraded December 2007.

Moody’s: A2 (stable)

(*) = Includes investments pending settlement, net

Endurance’s Reserve Strength as of September 30, 2008

(in millions)

$106.1

$1,194.8

$302.3

$1,603.2

$1,758.5

$841.5

$840.6

$76.4

Insurance Segment

Reinsurance Segment

Endurance maintains prudent reserve levels*

IBNR represents 66% of company reserves

81% of long tail reserves are IBNR

* Prior to deposit accounting adjustments

Maintain Excellent Liquidity Position

Cash and cash equivalents of $667 million at 9/30/08 (*)

Consists primarily of bank deposits, US Government/Agency securities, and money market

funds invested in US Government / Agency securities

High quality fixed income investment portfolio, including fixed maturity securities,

short term investments and hybrid preferred equities, of $4.5 billion at 9/30/08 with

strong cash flows

Portfolio generates annual principal and interest payments of > $1 billion

Short duration of 3.2 years

$1.2 billion credit facility (matures 2012)

Provides capacity for very low cost borrowings (LIBOR + max of 38 bps) and letters of credit

> $600 million of unused capacity at 9/30/08

Widely syndicated facility with 16 participant banks

$150 million variable forward sale of equity can be drawn upon quickly through 2010

Positive operating cash flows provide additional flexibility

(*) Includes investments pending settlement, net

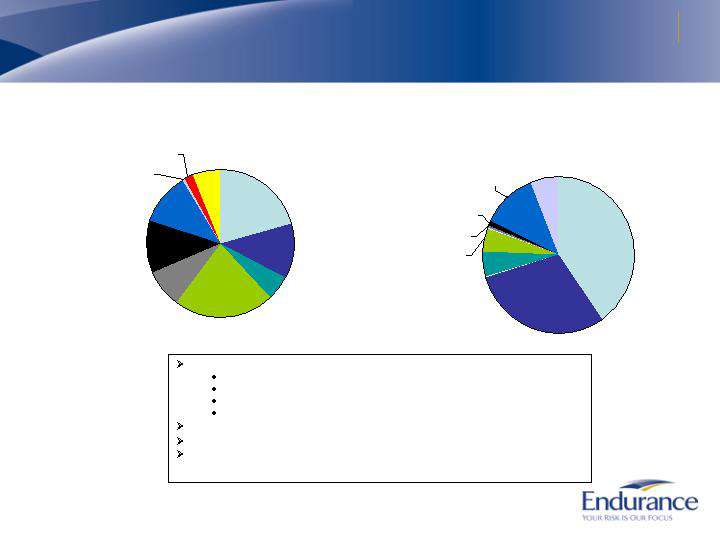

Investment Portfolio Composition as of September 30, 2008

Cash and Cash

Equivalents 12%

ABS 5%

Agency RMBS 22%

Non-Agency RMBS

9%

CMBS 11%

Government &

Agency 21%

Other Investments

6%

Municipals 2%

Investment Grade

Corporates 11%

High Yield

Corporates 1%

AAA 30%

US

Government

& Agency

40%

Other

Investments

6%

Cash and

Cash

Equivalents

12%

AA 5%

A 5%

BBB 1%

High Yield 1%

Diversified, high quality, short duration fixed income portfolio

Average rating – Aaa/AAA

Duration – 3.2 years

Book Yield – 4.9%

Market yield – 5.6%

No sub-prime mortgage backed securities.

No credit or interest rate derivatives.

No exposure to Fannie Mae and Freddie Mac preferred equity or

subordinated debt or any security issued by Washington Mutual

NOTES: (a) “Other Investments” includes hedge funds and high yield bank loan funds

(b) Includes investments pending settlement, net

(c) Includes agency RMBS

Total Invested Assets $5.5 Billion

Total Portfolio Rating Allocation

Total Portfolio Sector Allocation

(a)

(b)

(a)

(c)

(b)

16

Agenda

Appendix

4

Review of Financial

Results

3

Financial Strength Summary

2

Endurance Overview

1

Strong Financial Performance

Combined Ratio

Annualized Operating

Return on Average Equity

Inception to 9/30/08 combined ratio of 92.6%

Inception to 9/30/08 Operating ROE of 14.2%**

* Composite peer median based on SNL data, Platinum, Allied World, Arch, Ren Re, IPC re, Axis,

Transatlantic, Everest, Partner Re, Montpelier and Max Capital

** Inception to 9/30/08 Net Income ROE of 13.5%.

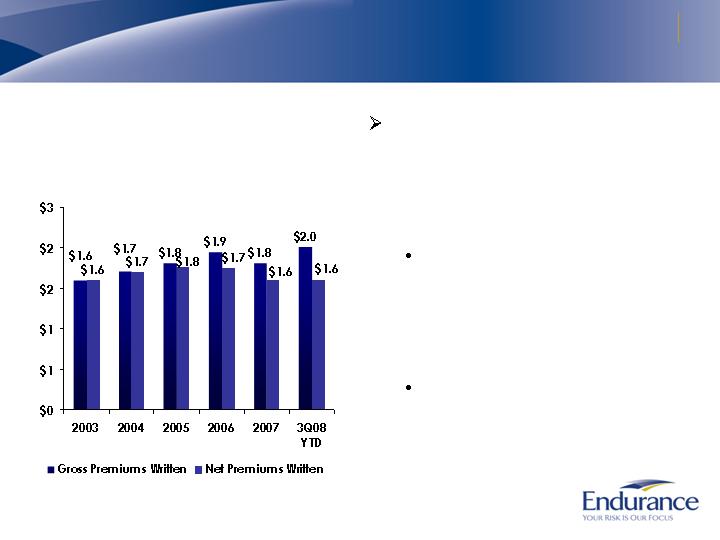

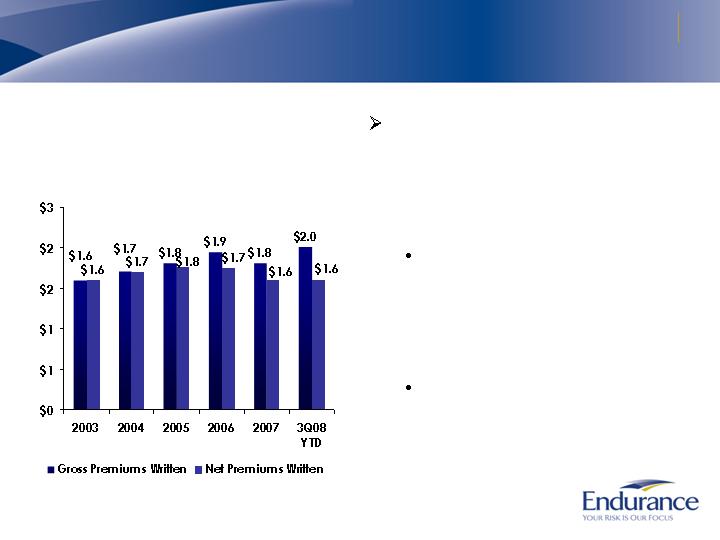

Portfolio Management Has Generated Stable Premiums

Premiums Written*

(in millions)

* Includes deposit premiums

We actively manage the

portfolio by entering new

attractive business while

exiting or reducing premiums

in less attractive lines

Disciplined cycle

management has resulted

in underlying product mix

shifting significantly over

time

Result of active portfolio

and cycle management

and well timed acquisitions

has been stable premiums

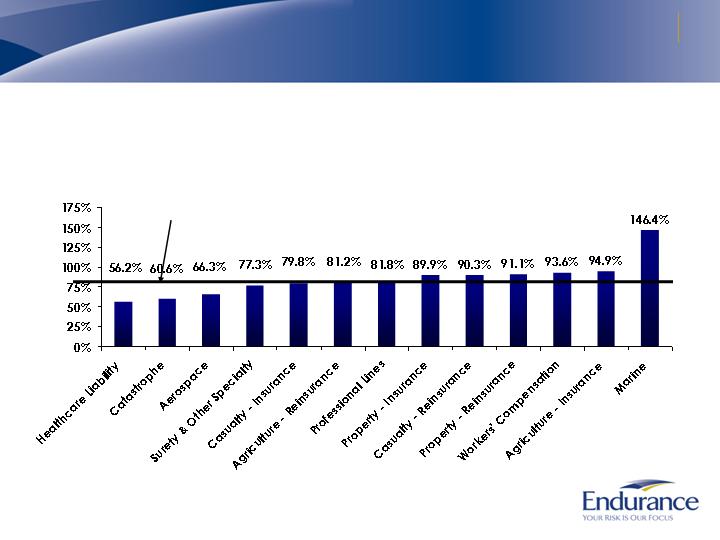

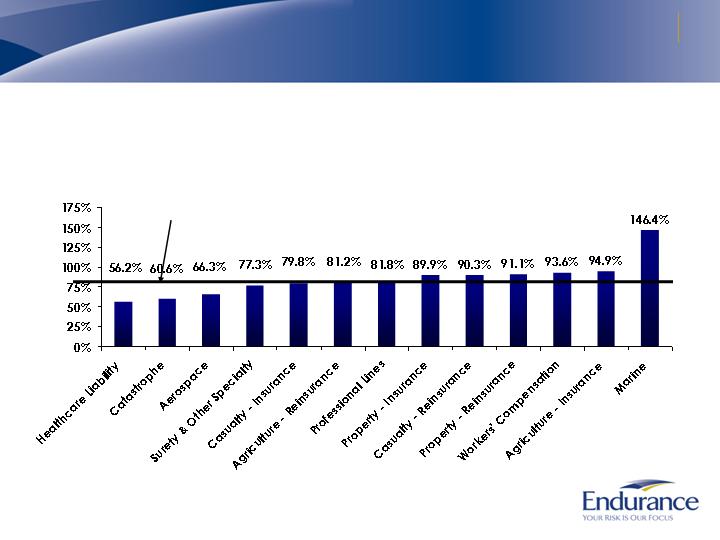

Underwriting Has Been Strong

Inception to Date Underwriting Ratio*

* Underwriting ratio is defined as losses and acquisition expenses divided by earned

premium, from inception through 9/30/08 and is before deposit accounting adjustments.

Inception to Date Underwriting

Ratio is 82.4%*

Delivering Shareholder Value

$, Millions

Fully Diluted Book Value Per

Common Share

$24.03

$27.91

$23.17

$28.87

$35.05

$33.68

Since 2003, fully diluted book value

per share has grown nearly 40%

For the first nine months of 2008,

book value per share has declined

3.9%

Adversely impacted by the hurricanes

and credit markets

Peers* have experienced an average

decline in book value of 4.8% year to

date

Endurance has paid $4.88 per share

in dividends to shareholders since the

beginning of 2003

* Composite peer average based on peer data, Platinum, Allied World, Arch, Ren Re, IPC re, Axis,

Transatlantic, Everest, Partner Re, Montpelier and Max Capital

Conclusion

Endurance is well positioned to take advantage of market opportunities

Our insurance and reinsurance operations are firmly established in

Bermuda, the US, UK, Continental Europe, and Asia

Our infrastructure is scaleable

Experienced underwriters who fully comprehend cycle dynamics

We have a high quality balance sheet with excellent capitalization,

liquidity and ratings

Our clients and brokers see Endurance as source of strength and

transparency and a “go to” market

We have generated strong underwriting and investment returns coupled

with active capital management

Achieved success across market cycles and through periods of historic

catastrophe losses

Agenda

Appendix

4

Review of Financial Results

3

Financial Strength Summary

2

Endurance Overview

1

Appendix – Consolidated Statements of Income - YTD

SEPT. 30, 2008

SEPT. 30, 2007

SEPT. 30, 2006

DEC. 31, 2007

DEC. 31, 2006

UNDERWRITING REVENUES

Gross premiums written

$2,010,798

$1,503,365

$1,498,847

$1,781,115

$1,789,642

Premiums ceded

(406,603)

(143,858)

(161,738)

(206,140)

(204,078)

Net premiums written

$1,604,195

$1,359,507

$1,337,109

$1,574,975

$1,585,564

Change in unearned premiums

(269,438)

(165,169)

(102,250)

19,825

53,010

Net premiums earned

$1,334,757

$1,194,338

$1,234,859

$1,594,800

$1,638,574

Other underwriting (loss) income

(1,519)

(7,442)

(328)

1,602

1,390

Total underwriting revenues

$1,333,238

$1,186,896

$1,234,531

$1,596,402

$1,639,964

UNDERWRITING EXPENSES

Losses and loss expenses

$910,328

$604,229

$696,210

$749,081

$827,630

Acquisition expenses

220,608

218,075

236,302

307,576

317,489

General and administrative expenses

160,308

152,614

138,494

217,269

190,373

Total underwriting expenses

$1,291,244

$974,918

$1,071,006

$1,273,926

$1,335,492

Underwriting income

$41,994

$211,978

$163,525

$322,476

$304,472

OTHER OPERATING REVENUE

Net investment income

$134,770

$215,966

$185,416

$281,276

$257,449

Interest expense

(22,603)

(22,593)

(22,513)

(30,125)

(30,041)

Amortization of intangibles

(7,913)

(3,381)

(3,474)

(5,286)

(4,600)

Total other operating revenue

$104,254

$189,992

$159,429

$245,865

$222,808

INCOME BEFORE OTHER ITEMS

$146,248

$401,970

$322,954

$568,341

$527,280

OTHER

Net foreign exchange (losses) gains

($12,963)

($1,241)

$11,250

($7,970)

$21,021

Net realized losses on investments

(45,566)

(14,177)

(18,434)

(18,302)

(20,342)

Income tax expense

(5,962)

(17,975)

(16,454)

(20,962)

(29,833)

NET INCOME

$81,757

$368,577

$299,316

$521,107

$498,126

Diluted earnings per common share

$1.10

$5.02

$4.03

$7.17

$6.73

YEAR ENDED

NINE MONTHS ENDED

24

Appendix – Consolidated Balance Sheets

SEPT. 30, 2008

JUNE 30, 2008

MAR. 31, 2008

DEC. 31, 2007

SEPT. 30, 2007

ASSETS

Cash and cash equivalents

$514,875

$656,158

$549,692

$567,825

$600,042

Fixed income investments available for sale, at fair value

(1)

4,398,816

4,604,653

4,710,467

4,647,590

4,791,313

Short term investments available for sale, at fair value

136,624

---

---

12,646

12,495

Other investments

338,151

366,886

369,347

358,128

343,926

Premiums receivable, net

1,130,184

1,101,610

1,088,998

723,832

768,162

Deferred acquisition costs

202,912

194,390

184,646

168,968

212,000

Securities lending collateral

134,256

153,062

241,343

173,041

195,727

Prepaid reinsurance premiums

205,284

205,454

268,442

122,594

92,466

Losses recoverable

281,074

270,053

150,665

187,354

96,008

Accrued investment income

32,893

37,930

33,650

38,543

36,075

Goodwill and intangible assets

202,682

205,635

208,202

206,632

69,388

Deferred tax assets

31,978

14,788

17,702

---

46,926

Receivable on pending investment sales

196,481

2,070

2,131

3,209

81,546

Other assets

63,002

73,667

50,630

60,791

50,852

TOTAL ASSETS

$7,869,212

$7,886,356

$7,875,915

$7,271,153

$7,396,926

LIABILITIES

Reserve for losses and loss expenses

$3,278,934

$3,080,274

$2,928,427

$2,892,224

$2,841,810

Reserve for unearned premiums

1,201,292

1,222,830

1,269,318

855,085

999,046

Deposit liabilities

85,701

89,718

105,115

108,943

130,272

Reinsurance balances payable

320,615

272,901

224,223

162,899

153,815

Securities lending payable

135,853

153,062

241,343

173,041

195,727

Debt

447,413

448,793

448,978

448,753

447,235

Payable on penidng investment purchases

44,621

3,902

704

426

28,485

Deferred tax liability

---

---

---

922

---

Other liabilities

86,066

80,981

119,633

116,601

74,915

TOTAL LIABILITIES

$5,600,495

$5,352,461

$5,337,741

$4,758,894

$4,871,305

TOTAL SHAREHOLDERS’ EQUITY

$2,268,717

$2,533,895

$2,538,174

$2,512,259

$2,525,621

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$7,869,212

$7,886,356

$7,875,915

$7,271,153

$7,396,926

check

Book value per common share

$36.55

$39.97

$39.83

$38.94

$36.21

Diluted book value per common share (treasury stock method)

$33.68

$36.72

$36.00

$35.05

$32.81

25

Appendix – Total Gross Written Premiums by Line of

Business

SEPT. 30, 2008

SEPT. 30, 2007

SEPT. 30, 2006

DEC. 31, 2007

DEC. 31, 2006

INSURANCE SEGMENT

Property

$119,116

$96,256

$129,024

$134,161

$173,292

Casualty

107,642

99,273

92,957

125,124

128,933

Healthcare liability

69,987

77,105

89,921

92,361

106,988

Workers’ compensation

195,076

189,173

31,424

262,228

93,779

Agriculture

660,193

-

-

42,242

-

Professional lines

78,029

63,239

52,835

85,440

73,753

TOTAL INSURANCE

$1,230,043

$525,046

$396,161

$741,556

$576,745

REINSURANCE SEGMENT

Casualty

$159,434

$185,730

$349,700

$201,032

$400,111

Property

184,214

214,584

296,713

228,796

318,883

Catastrophe

301,277

331,689

272,843

345,187

291,755

Agriculture

20,185

124,095

109,228

131,325

107,104

Aerospace and Marine

70,600

81,223

154,064

92,882

180,203

Surety and other specialty

47,382

64,754

72,028

68,892

73,833

TOTAL REINSURANCE

$783,092

$1,002,075

$1,254,576

$1,068,114

$1,371,889

TOTAL COMPANY SUBTOTAL

$2,013,135

$1,527,121

$1,650,737

$1,809,670

$1,948,634

DEPOSIT ACCOUNTING ADJUSTMENT

[a]

(2,337)

(23,756)

(151,890)

(28,555)

(158,992)

REPORTED TOTALS

$2,010,798

$1,503,365

$1,498,847

$1,781,115

$1,789,642

FOR THE NINE MONTHS ENDED

FOR THE YEARS ENDED

[a]

For internal management reporting purposes, underwriting results by segment are presented on the basis of applying reinsurance accounting to all reinsurance contracts written. However, for financial statement presentation purposes, management determined that certain reinsurance contracts written during the period were more appropriately accounted for under the deposit method of accounting specified by AICPA SOP 98-7 whereby net premiums due on such contracts were recorded as deposit liabilities. The adjustment herein reconciles the Company’s gross premiums written by segment to the Company’s financial statement presentation.

26

Appendix – Consolidated Segment Data

Total

Deposit

Company

Accounting

Reported

Insurance

Reinsurance

Sub-total

Adjustment [a]

Totals

UNDERWRITING REVENUES

Gross premiums written

$1,230,043

$783,092

$2,013,135

($2,337)

$2,010,798

Net premiums written

$839,132

$767,400

$1,606,532

($2,337)

$1,604,195

Net premiums earned

$683,662

$656,712

$1,340,374

($5,617)

$1,334,757

Other underwriting loss

---

---

---

(1,519)

(1,519)

Total underwriting revenues

$683,662

$656,712

$1,340,374

($7,136)

$1,333,238

UNDERWRITING EXPENSES

Losses and loss expenses

$513,598

$405,451

$919,049

($8,721)

$910,328

Acquisition expenses

76,182

143,185

219,367

1,241

220,608

General and administrative expenses

77,308

83,000

160,308

---

160,308

Total expenses

$667,088

$631,636

$1,298,724

($7,480)

$1,291,244

UNDERWRITING INCOME

$16,574

$25,076

$41,650

$344

$41,994

GAAP RATIOS

Loss ratio

75.1%

61.7%

68.6%

155.3%

68.2%

Acquisition expense ratio

11.2%

21.8%

16.4%

(22.1)%

16.5%

General and administrative expense ratio

11.3%

12.7%

11.9%

---

12.0%

Combined ratio

97.6%

96.2%

96.9%

133.2%

96.7%

For the nine months ended September 30, 2008

[a]

For internal management reporting purposes, underwriting results by segment are presented on the basis of applying reinsurance accounting to all reinsurance contracts written. However, for financial statement presentation purposes, management determined that certain reinsurance contracts written during the period were more appropriately accounted for under the deposit method of accounting specified by AICPA SOP 98-7 whereby net premiums due on such contracts were recorded as

deposit liabilities. The adjustment herein reconciles the Company’s underwriting results by segment to the Company’s financial statement presentation.

27

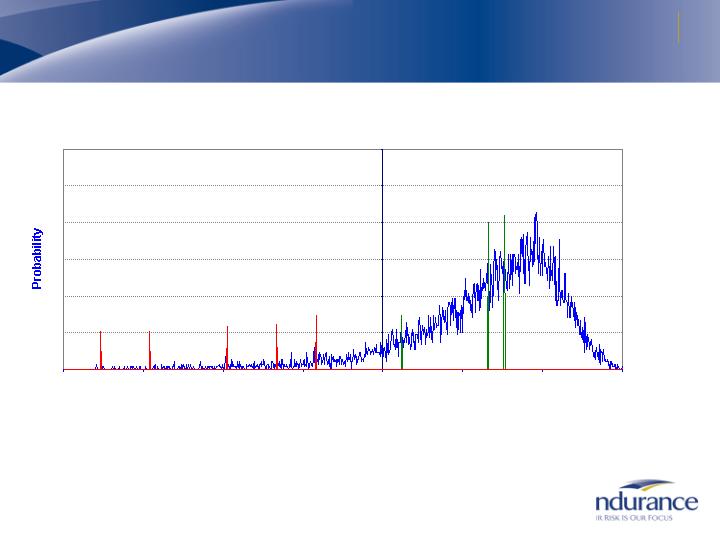

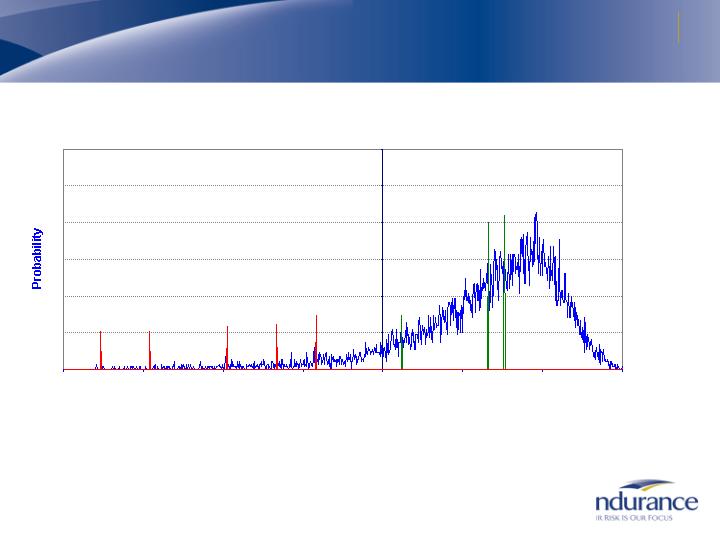

The above chart represents a cumulative analysis of our in-force underwriting portfolio on a full year basis based on thousands of potential

scenarios. Loss years are driven largely by the occurrence of natural catastrophes and incorrect pricing of other property and casualty exposures.

The operating income depicted includes net premiums earned plus net investment income, acquisition expenses and G&A expenses. The

operating income depicted excludes the effects of income tax (expenses) benefits, amortization of intangibles and interest expense. Forecasted

investment income, acquisition and G&A expenses are held constant across all scenarios. Losses included above are net of reinsurance. Our

stated objective is to maintain a risk management tolerance that limits our loss in a 1-in-100 year year to be no more than 25% of our shareholders’

equity.

Changes in Endurance’s underwriting portfolio, investment portfolio, risk control mechanisms, market conditions and other factors may cause actual

results to vary considerably from those indicated by our value at risk curve. For a listing of risks related to Endurance and its future performance,

please see “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2007 and in our Quarterly Report on Form 10-Q for

the quarter ended September 30, 2008.

Appendix – Annual Aggregate Risk Curve

Endurance Operating Income Profile

as of July 1, 2008

-1000

-750

-500

-250

0

250

500

750

Operating Result - $ Millions

1-in-500

Year

$882 Mil

Loss

1-in-250

Year

$729 Mil

Loss

1-in-100

Year

$487 Mil

Loss

1-in-50

Year

$330 Mil

Loss

1-in-25

Year

$209 Mil

Loss

1-in-10

Year

$61 Mil

Gain

Average

Result

$330 Mil

Gain

Median

Result

$380 Mil

Gain

28

Appendix - Investment Portfolio Details as of September 30, 2008

Investment Portfolio Details

Total cash and invested assets of $5.5 billion

$4.5 billion Fixed Income Investment Portfolio

Average credit rating of AAA

$2.6 billion of AAA-rated & Agency Structured Fixed Income

Agency MBS $1.2 billion

AAA Non-Agency RMBS $480 million (no subprime)

AAA Non-Agency CMBS $594 million

AAA Auto loan backed $114 million

AAA Credit card backed $109 million

$1.2 billion Government and Agency Debentures

$668 million of Corporate Debt and $104 million of Municipals

Predominately senior indebtedness

Unsecured debt of Financial Institutions - $241 million (59

individual issuers, none greater than $36 million)

High Yield $44 million

Hybrid Perpetual Preferred Equity $40 million

$55 million Below AAA-rated Structured Fixed Income

RMBS $5 million

CMBS $18 million

ABS $32 million

$338 million of Other Investments

Diversified portfolio of hedge funds and high yield bank loan funds

$667 million of Cash and Cash equivalents

Consists primarily of bank deposits, US Government/Agency securities,

and money market funds invested in US Government / Agency securities

Portfolio Commentary

No exposure to Fannie Mae and Freddie

Mac preferred equity or subordinated debt

or any security issued by Washington

Mutual.

No sub-prime mortgage backed securities.

No credit or interest rate derivatives.

Immaterial exposure to other troubled

financial institutions (Lehman- $6.5 million

pre-write down book value, and AIG - $3.5

million pre-write down book value)

Realized losses, other-than-temporary

impairment charges and alternative

investment losses in the 3 rd quarter of

approximately $70 million and within risk

management tolerances (1.3% of 9/30/08

Cash/Invested Assets and 3.1% of

Shareholders equity).

Portfolio experienced $72 million increase

in net unrealized loss during quarter ended

9/30/08 (1.3% of Cash and Invested

Assets)

Appendix – Twenty-Five Largest Corporate Holdings

As of September 30, 2008

Amortized

Unrealized

Credit

ISSUER (1) (2) (4)

Cost

Fair Value

Gain (Loss)

Quality (3)

CITIGROUP INC

$35,519

$33,416

($2,032)

AA

JPMORGAN CHASE & CO

25,767

24,620

(1,147)

A

WELLS FARGO & COMPANY

23,077

22,766

(311)

AA

PRUDENTIAL FINANCIAL INC

20,969

20,653

(316)

A

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED

19,150

18,323

(1,113)

A

ORACLE CORPORATION

17,634

17,128

(506)

A

ING GROEP NV

15,909

14,673

(1,236)

A

GENERAL ELECTRIC CO

15,434

14,297

(1,349)

AAA

HBOS PLC

15,714

13,573

(1,965)

A

ROYAL BANK OF SCOTLAND GROUP PLC

15,951

13,507

(2,390)

A

VERIZON COMMUNICATIONS INC.

13,715

13,397

(318)

A

HSBC HOLDINGS PLC

13,933

13,291

(643)

AA

AT&T INC

12,909

12,798

(111)

A

VODAFONE GROUP PLC

12,595

12,459

(136)

A

BANK OF AMERICA CORP

11,329

10,940

(513)

AA

SIEMENS AG

9,412

9,436

24

AA

MIDAMERICAN ENERGY COMPANY

8,622

8,586

(37)

A

METLIFE INC

8,519

8,315

(231)

AA

DEERE & CO

8,046

8,162

116

A

ASTRAZENECA PLC

8,164

8,083

(77)

AA

CISCO SYSTEMS, INC.

8,216

8,033

(183)

A

GENWORTH FINANCIAL INC.

9,000

7,920

(1,080)

A

GOLDMAN SACHS GROUP INC/THE

8,743

7,784

(959)

AA

TOTAL SA

6,848

6,942

22

AA

HARTFORD FINANCIAL SERVICES GROUP

6,478

6,399

(79)

A

(1) Corporate issuers exclude government-backed, government-sponsored enterprises, covered bonds and cash and cash equivalents.

(2) Credit exposures represent only direct exposure to fixed maturities and short term investments of the parent issuer and its major subsidiaries.

These exposures exclude asset and mortgage-backed securities that were issued, sponsored or serviced by the parent.

(3) Represents weighted average credit quality of underlying issues.

(4) Excludes fixed income preferred securities.

30

Appendix – Operating Income (Loss) Reconciliation

QUARTERS ENDED

NINE MONTHS ENDED

SEPTEMBER 30,

SEPTEMBER 30,

2008

2007

2008

2007

Net (loss) income

($99,392)

$131,401

$81,757

$368,577

Add (Less) after-tax items:

Net foreign exchange losses (gains)

15,400

(546)

12,798

(918)

Net realized losses on investments

27,934

3,013

43,456

12,583

Operating (loss) income before preferred dividends

($56,058)

$133,868

$138,011

$380,242

Preferred dividends

(3,875)

(3,875)

(11,625)

(11,625)

Operating (loss) income (attributable) available

to common shareholders

($59,933)

$129,993

$126,386

$368,617

Weighted average common shares outstanding

Basic

57,570

64,468

58,314

65,530

Dilutive

57,570

70,431

63,633

71,126

Basic per common share data

Net (loss) income available to common shareholders

($1.79)

$1.98

$1.20

$5.45

Add (Less) after-tax items:

Net foreign exchange losses (gains)

0.27

(0.01)

0.22

(0.01)

Net realized losses on investments

0.48

0.05

0.75

0.19

Operating (loss) income (attributable) available

to common shareholders

($1.04)

$2.02

$2.17

$5.63

Diluted per common share data

Net (loss) income available to common shareholders

($1.79)

$1.81

$1.10

$5.02

Add (Less) after-tax items:

Net foreign exchange losses (gains)

0.27

---

0.20

(0.01)

Net realized losses on investments

0.48

0.04

0.69

0.17

Operating (loss) income (attributable) available

to common shareholders

($1.04)

$1.85

$1.99

$5.18

Earnings Per Share Information – As Reported, GAAP

31

Appendix – Book Value Per Share

DEC. 31,

2008

2007

2007

DILUTIVE COMMON

Price per share at period end

$30.92

$41.55

$41.73

SHARES OUTSTANDING:

AS-IF CONVERTED [a]

Basic common shares outstanding

[b]

56,597

64,223

59,384

Add: unvested restricted shares and restricted share units

1,098

1,039

1,041

Add: dilutive warrants outstanding

5,595

7,202

7,095

Weighted average exercise price per share

$15.12

$16.12

$15.87

Add: dilutive options outstanding

2,012

2,169

2,045

Weighted average exercise price per share

$17.68

$18.18

$18.12

Book Value

[c]

$2,068,717

$2,325,621

$2,312,259

Add: proceeds from converted warrants

84,596

116,102

112,593

Add: proceeds from converted options

35,572

39,439

37,059

Pro forma book value

$2,188,885

$2,481,162

$2,461,911

Dilutive shares outstanding

65,302

74,634

69,564

Basic book value per common share

$36.55

$36.21

$38.94

Diluted book value per common share

$33.52

$33.24

$35.39

DILUTIVE COMMON

Price per share at period end

$30.92

$41.55

$41.73

SHARES OUTSTANDING:

TREASURY STOCK

Basic common shares outstanding

[b]

56,597

64,223

59,384

METHOD

Add: unvested restricted shares and restricted share units

1,098

1,039

1,041

Add: dilutive warrants outstanding

5,595

7,202

7,095

Weighted average exercise price per share

$15.12

$16.12

$15.87

Less: warrants bought back via treasury method

(2,736)

(2,794)

(2,698)

Add: dilutive options outstanding

2,012

2,169

2,045

Weighted average exercise price per share

$17.68

$18.18

$18.12

Less: options bought back via treasury method

(1,151)

(950)

(889)

Dilutive shares outstanding

61,415

70,891

65,978

Basic book value per common share

$36.55

$36.21

$38.94

Diluted book value per common share

$33.68

$32.81

$35.05

SEPTEMBER 30,

[a]

The as-if converted method assumes that the proceeds received upon exercise of options and warrants will be retained by the Company and the resulting common shares from exercise will remain outstanding.

[b]

Basic common shares includes vested restricted share units.

[c]

Excludes the $200 million liquidation value of the preferred shares.

32