Forward looking statements & regulation G disclaimer

Safe Harbor for Forward Looking Statements

Some of the statements in this presentation include forward-looking statements which reflect our current views with respect to future events and financial performance. Such

statements include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment

matters. Statements which include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “seek,” “will,” and similar statements of a future or forward-looking nature

identify forward-looking statements in this presentation for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ from

those indicated in the forward-looking statements. These factors include, but are not limited to, developments in the world’s financial and capital markets that could adversely

affect the performance of Endurance’s investment portfolio or access to capital, changes in the composition of Endurance’s investment portfolio, competition, possible terrorism or

the outbreak of war, the frequency or severity of unpredictable catastrophic events, changes in demand for insurance or reinsurance, rating agency actions, uncertainties in our

reserving process, a change in our tax status, acceptance of our products, the availability of reinsurance or retrocessional coverage, retention of key personnel, political

conditions, the impact of current legislation and regulatory initiatives, changes in accounting policies, changes in general economic conditions and other factors described in our

most recent Annual Report on Form 10-K.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation publicly to update or revise any forward-looking statement,

whether as a result of new information, future developments or otherwise.

Regulation G Disclaimer

In presenting the Company’s results, management has included and discussed certain non-GAAP measures. Management believes that these non-GAAP measures, which may

be defined differently by other companies, better explain the Company’s results of operations in a manner that allows for a more complete understanding of the underlying trends

in the Company’s business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-

GAAP measures and reconciliations, please review the Investor Financial Supplement on our web site at www.endurance.bm.

The combined ratio is the sum of the loss, acquisition expense and general and administrative expense ratios. Endurance presents the combined ratio as a measure that is

commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information. The combined ratio, excluding prior year

net loss reserve development, enables investors, analysts, rating agencies and other users of its financial information to more easily analyze Endurance’s results of underwriting

activities in a manner similar to how management analyzes Endurance’s underlying business performance. The combined ratio, excluding prior year net loss reserve

development, should not be viewed as a substitute for the combined ratio.

Net premiums written (prior to deposit accounting adjustments) is a non-GAAP internal performance measure used by Endurance in the management of its operations. Net

premiums written (prior to deposit accounting adjustments) represents net premiums written and deposit premiums, which are premiums on contracts that are deemed as either

transferring only significant timing risk or transferring only significant underwriting risk and thus are required to be accounted for under GAAP as deposits. Endurance believes

these amounts are significant to its business and underwriting process and excluding them distorts the analysis of its premium trends. In addition to presenting gross premiums

written determined in accordance with GAAP, Endurance believes that net premiums written (prior to deposit accounting adjustments) enables investors, analysts, rating agencies

and other users of its financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes Endurance’s

underlying business performance. Net premiums written (prior to deposit accounting adjustments) should not be viewed as a substitute for gross premiums written determined in

accordance with GAAP.

Return on Average Equity (ROAE) is comprised using the average common equity calculated as the arithmetic average of the beginning and ending common equity balances for

stated periods. Return on Beginning Equity (ROBE) is comprised using the beginning common equity for stated periods. The Company presents various measures of Return on

Equity that are commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information.

2

Investor value proposition

Deep expertise across business units

Specialty focus and strong diversification has the

potential to generate higher returns for shareholders,

with lower volatility

Strong balance sheet supported by conservative

investment portfolio and prudent reserve balances

Meaningfully improved the risk management and

diversification of our business over the past three

years

Proven track record of success: superior ROE,

underwriting expertise, extensive distribution

capabilities, risk management culture

Well positioned to fill gaps left by weakened

incumbents

Established global specialty franchise with full

range of capabilities

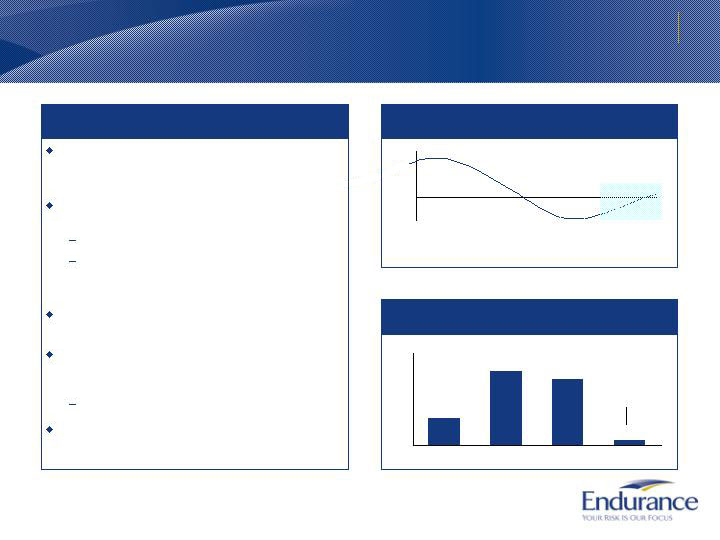

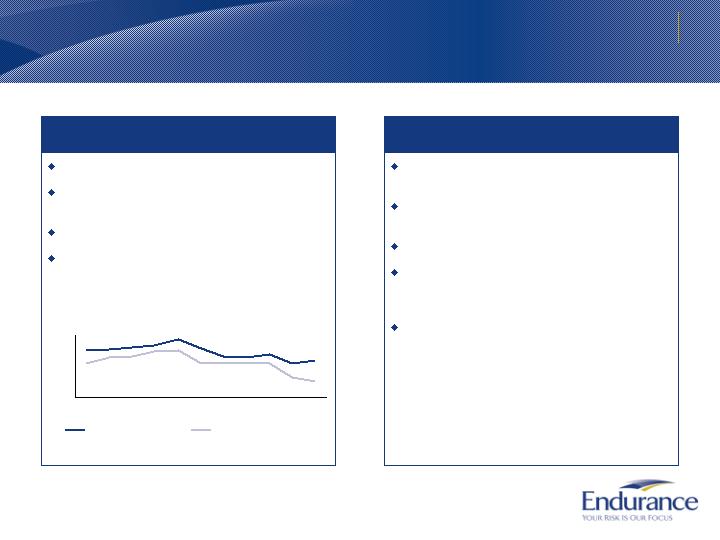

0%

20%

40%

60%

80%

100%

120%

140%

5%

10%

15%

20%

25%

Price/Book vs. ROE

3-year average operating ROAE

Endurance

1.

Common stock price as a percentage of book value per share as of March 31, 2009

Note: Composite peer median based on SNL data. Includes Allied World, Arch, Ren Re, IPC Re, Axis, Transatlantic, Everest, Partner Re,

Montpelier, Platinum and Max Capital

Compelling

investment

opportunity

We believe Endurance offers investors significant upside potential

3

Introduction to Endurance Specialty Holdings

Strong Market Positioning

Widely diversified, global specialty insurance and reinsurance provider

Over 700 employees in global offices across the United States, Bermuda, Europe, and Asia

Domiciled in Bermuda

Traded on the New York Stock Exchange (ENH)

Excellent Operating Results

14.1% annualized operating ROE since inception

10.7% annualized growth in book value per share plus dividends since inception

92.2% combined ratio inception to date

Solid Financial Foundation

Excellent financial strength with nearly $7.8 BN in assets, $2.7 BN in total capital and $2.3

BN in shareholders’ equity as of March 31, 2009

High quality, liquid investment portfolio

Prudent loss reserves

Rated “A” by A.M. Best and Standard and Poor’s and A2 by Moody’s with stable outlooks

Received the highest ERM ranking of “Excellent” from Standard and Poor’s

Endurance is poised to generate superior returns on equity over time

4

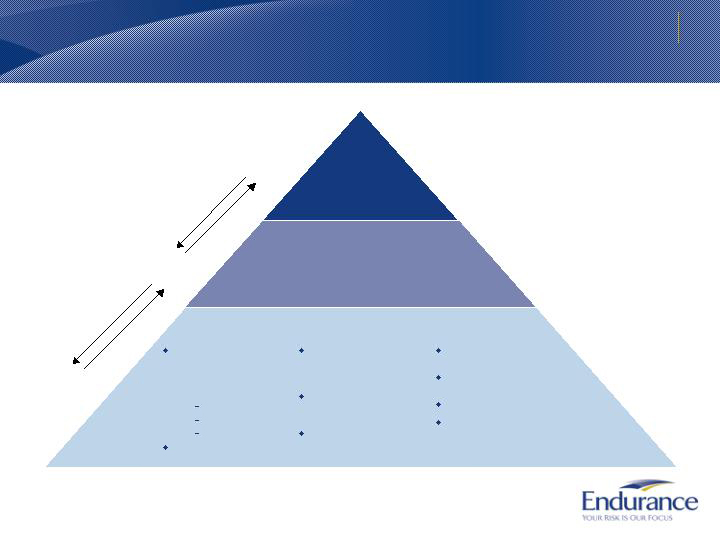

Our strategy is focused on delivering superior results for shareholders

Our vision

Our commitments

Our strategy

Growth in book value

Superior returns on equity across underwriting cycles

Ethics, integrity, and transparency

To become

the best specialty

insurance and

reinsurance company

in the world

Growth through

specialization

Maximizing returns through

focused portfolio

management

Balance sheet

strength and durability

Aggressively deploy capital to

opportunities where we can

maintain a competitive

advantage based on

specialized:

Products

Technology

Distribution

Invest to ensure that business

model is scalable

Manage pricing cyclicality

through broad access to

distribution and focus on

returns-based underwriting

Manage loss volatility through

a diversified portfolio of

businesses

Leverage strengths across the

businesses, e.g. dynamic

capital allocation

Maintain strong balance sheet

and reserves

Nurture conservative risk

culture

Leverage best-in-class ERM

Employ disciplined capital

management across our

underwriting and investment

activities

5

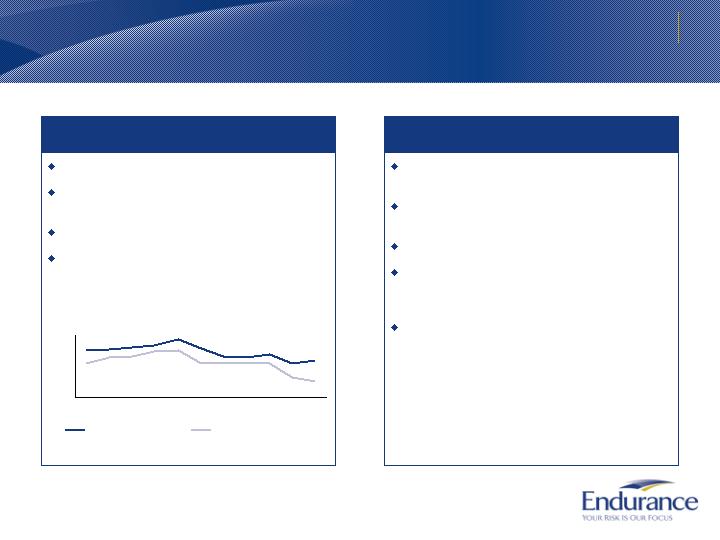

More attractive margins

Better retention driven by deeper relationships

and expertise

High barriers to entry

Stable earnings

How specialization leads to success

Why Endurance is well-positioned to succeed

Deep underwriting knowledge of markets and

distribution across major specialty lines

Technological advantage which improves our

pricing ability and efficiency

Customized operating model by market type

Active portfolio management to deploy and

retract capital in response to changing

market conditions

Strong balance sheet positions us well to

compete, particularly against those who

have faltered

Source: AM Best US Surplus Lines, 2008 Market Review

60%

80%

100%

120%

1997

1999

2001

2003

2005

2007

Industry combined ratio

Surplus Lines combined ratio

One example of the success of specialization:

Excess and surplus lines outperform the overall

P&C industry

Growth through specialization

Specialty businesses are an attractive market where Endurance is well-poised to succeed

6

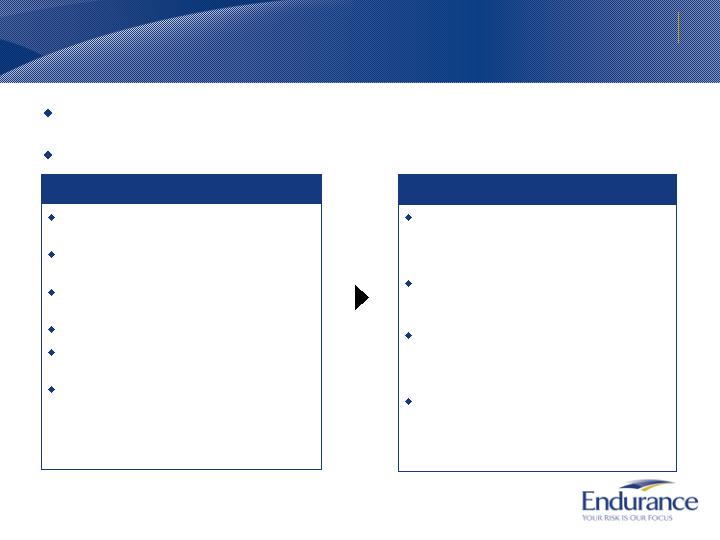

Rapid entry into workers’ compensation as the

market became attractive in 2006; managed

exit from the business as margins tightened

in 2008

Exiting the UK property business when it

did not meet our business mix and

profitability requirements

Introduction of surety, aerospace, and

agriculture businesses which have different

risk profiles than catastrophe to create a more

diversified portfolio

Exiting offshore energy and national property

accounts in 2005 following Katrina, given

unanticipated volatility and lack of model

clarity; decision validated by 2008 results

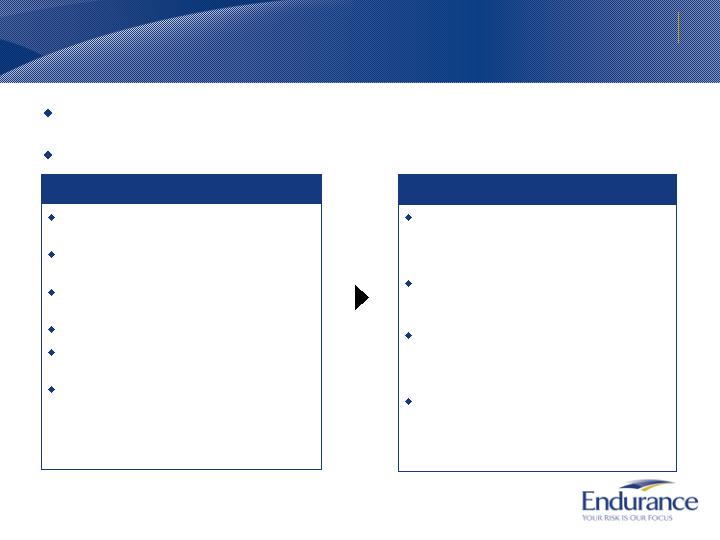

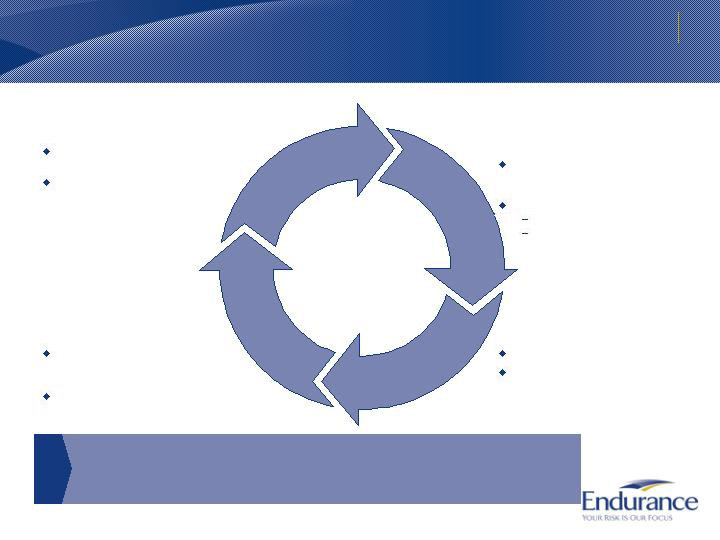

Maximizing returns through focused portfolio management

Levers we employ in portfolio management

Thoughtfully but aggressively entering markets

when conditions are attractive

Diversify risks through the introduction of low

correlation businesses

Actively monitor and react to changing market

conditions

Reduce exposures during soft markets

Increase/decrease the amount of ceded

business as necessary

Exit selected business lines when

fundamentals dictate doing so

Some examples

While growing through specialization and building robust businesses that withstand both hard and

soft cycles, we also maximize our returns through active portfolio management

Organizational agility underpins our ability to allocate capital dynamically

7

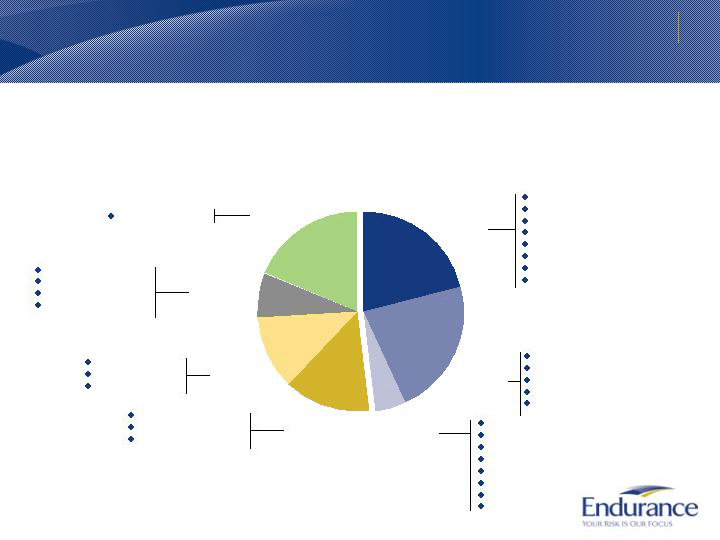

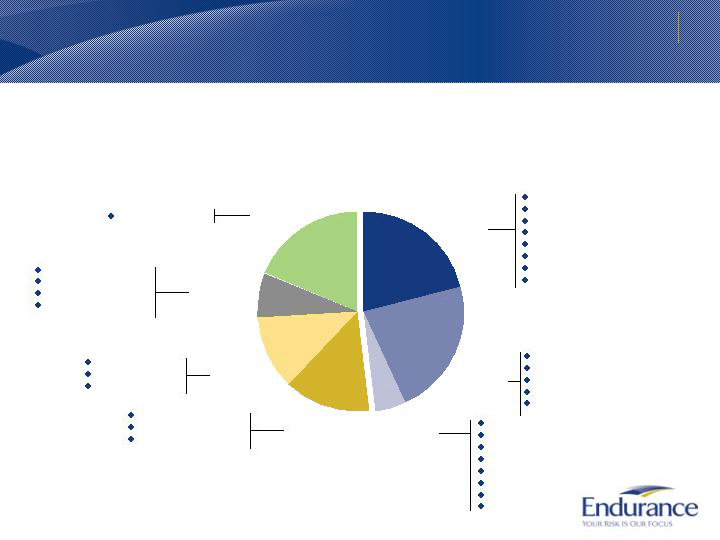

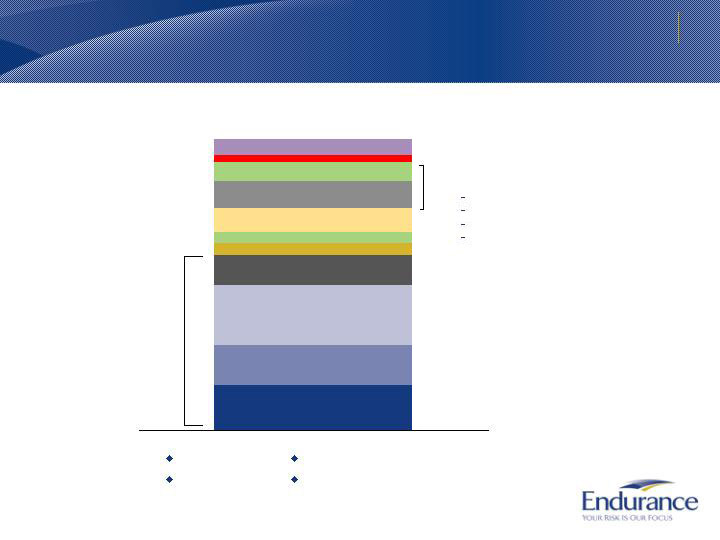

Business overview

Endurance’s business units

2008 Net premiums written: $1.78 BN

Reinsurance

Insurance

Agriculture

Personal Accident

Surety

Casualty & Workers’ Compensation

Professional Liability

Property Per Risk

Small Business

Direct Treaty

Aerospace

Casualty Clash

International Property Catastrophe

US Property Catastrophe

Workers’ Compensation Catastrophe

ARMtech Agriculture

US Property

US Casualty

US Miscellaneous E&O

UK Property

Healthcare

Excess Casualty

Professional Lines

Workers’ Compensation

Habitational

Environmental

International

5%

Fortune 1000

12%

Middle Market

12%

21%

Bermuda

21%

US

19%

Program

10%

Casualty

Marine

Motor

Personal Accident

Professional Indemnity

Property

Surety

Trade Credit

Small Risk

8

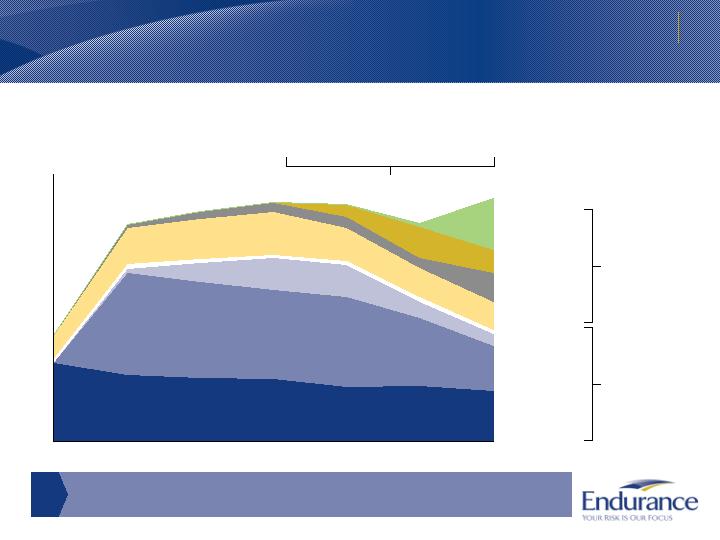

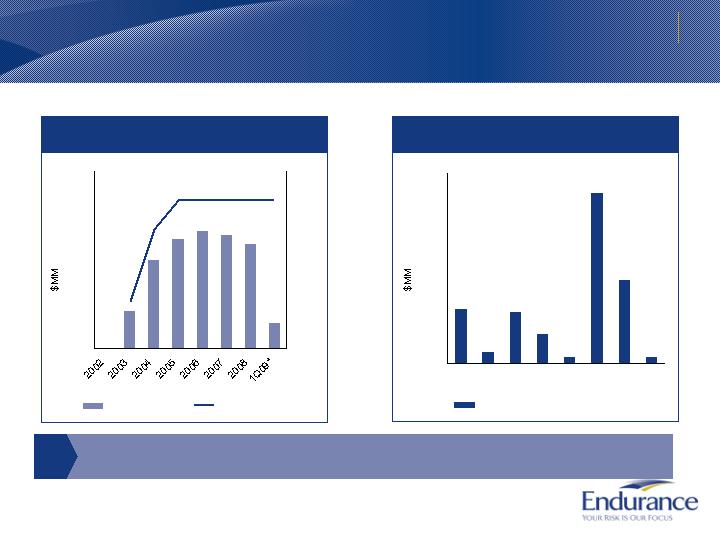

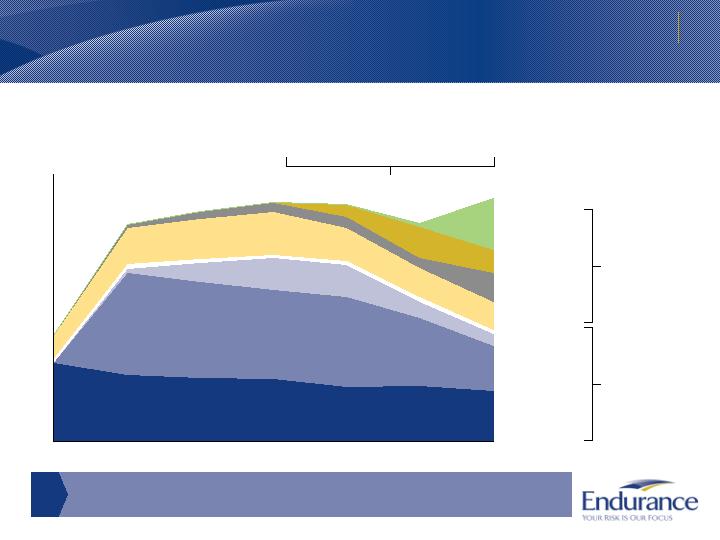

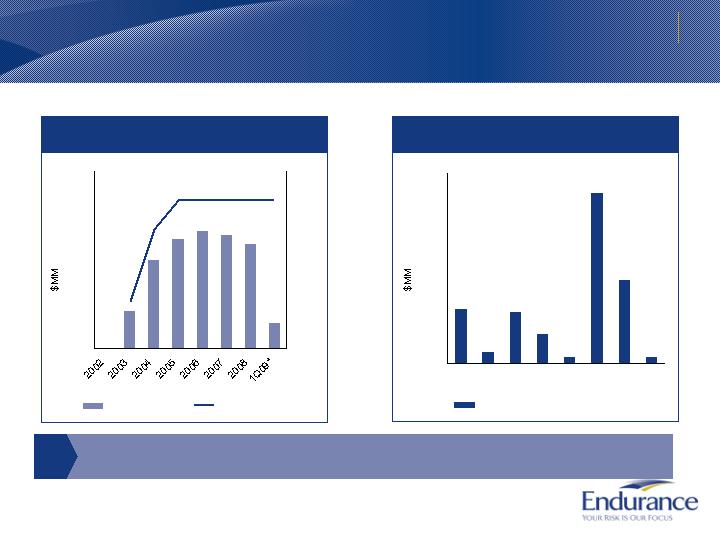

Endurance is expanding its capabilities into a range of attractive businesses

2002

2003

2004

2005

2006

2007

2008

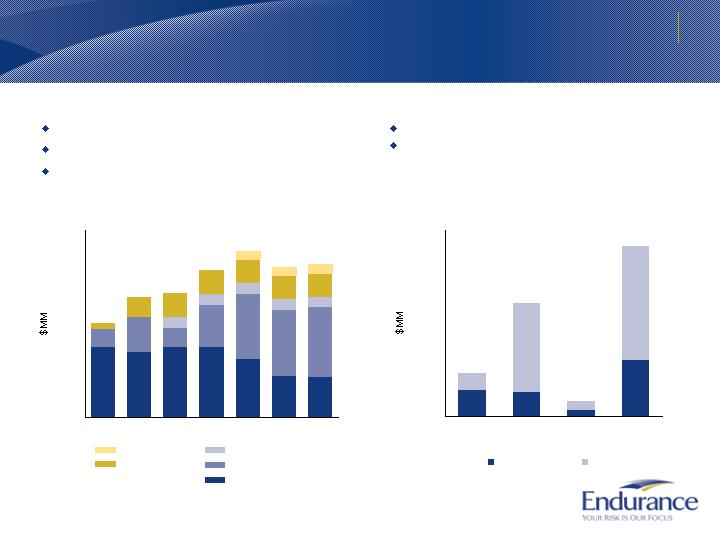

Growth curve of our business1

2002-2008

1. Based on net premiums written

Small Risk

Program

Middle Market

International

Fortune 1000

US

Bermuda

Reinsurance

Insurance

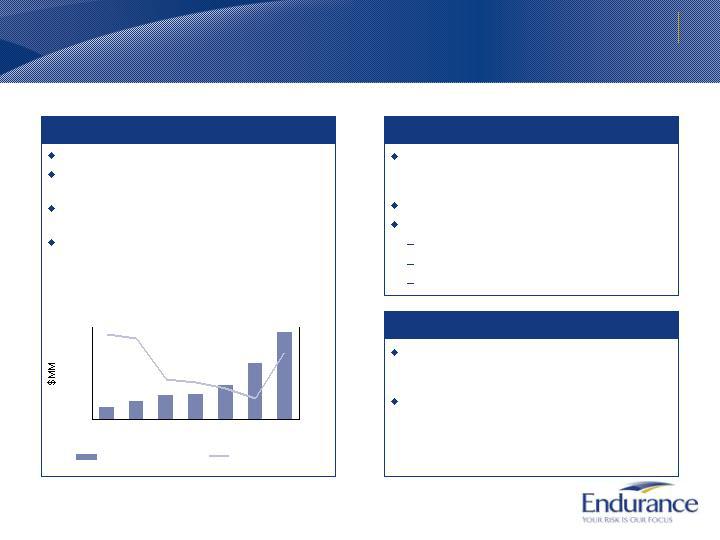

Meaningfully improved risk

management and diversification

of our business since 2005

We have successfully identified new opportunities while remaining

disciplined in softening markets

9

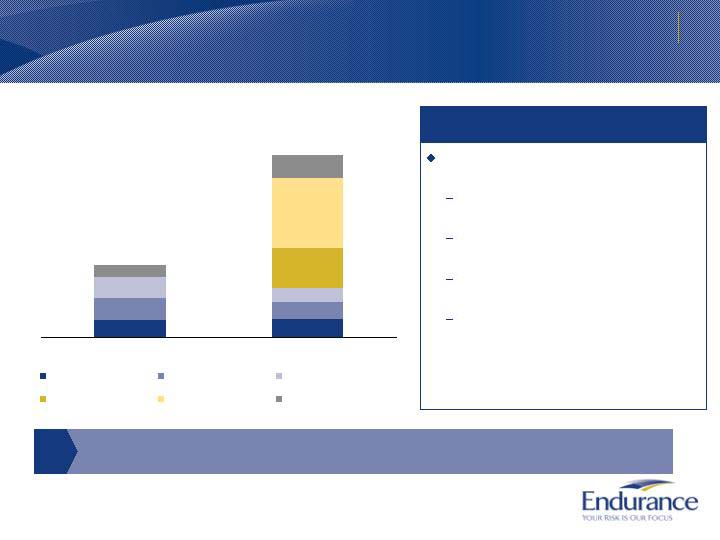

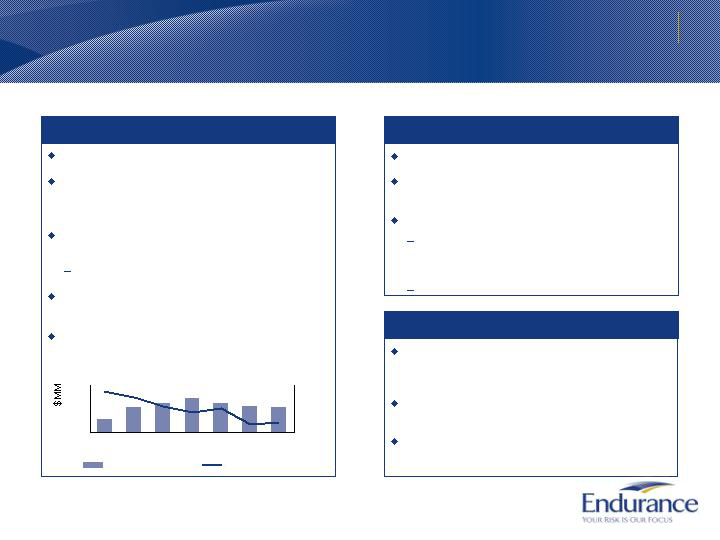

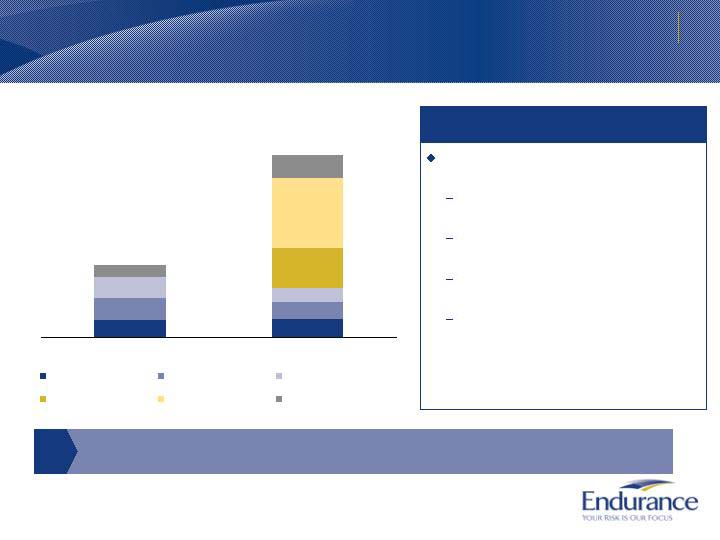

Continue to expand insurance capabilities while maintaining discipline

2005

2008

Property

Casualty

Healthcare

Workers’ compensation

Agriculture

Professional lines

$387.7

$980.6

Over the past three years we have meaningfully grown our insurance business

through the addition of new capabilities and distribution relationships

Expanding the insurance portfolio

We have significantly broadened our

insurance capabilities.

Added agriculture line of business

through the acquisition of ARMtech

Opportunistically grew in workers’

compensation

Expanded professional lines through

addition of underwriting teams

Meaningfully expanded our

distribution relationships

Insurance net premiums written

10

Reinsurance book has reduced due to cycle management but is highly scaleable

2005

2008

Casualty

Property

Catastrophe

Agriculture

Aerospace and Marine

Surety and other

$1,375.0

$808.8

During the softening market of the past three years we have been disciplined in

writing reinsurance business

Managing the reinsurance portfolio

Active portfolio management has enhanced

reinsurance portfolio:

Portfolio reduced where pricing, terms or

data quality have not met our requirements

Casualty declined 57%

Property declined 46%

Aerospace and Marine declined 67%

Improved deployment of catastrophe

capacity has improved risk adjusted returns

We have maintained our underwriting expertise

and are well positioned to grow as opportunities

arise

Reinsurance net premiums written*

* Prior to deposit accounting adjustments

11

Our results

Summary

Strong growth in book value since inception

105% Increase in diluted book value per share plus dividends since inception (10.7%

annualized)

Superior returns on equity

19.3% average operating ROE from 2006 through 2008, and better than peer median

throughout the cycle

14.1% inception to date operating ROE

Exceptional underwriting performance

Inception to date combined ratio of 92.2%

2008 Ike and Gustav losses were below peer averages

Disciplined capital management approach exemplified by

Attractive dividend yield of ~3-4%

$1.1 billion of capital returned to shareholders since inception

Performance across key metrics compares favorably to peers

12

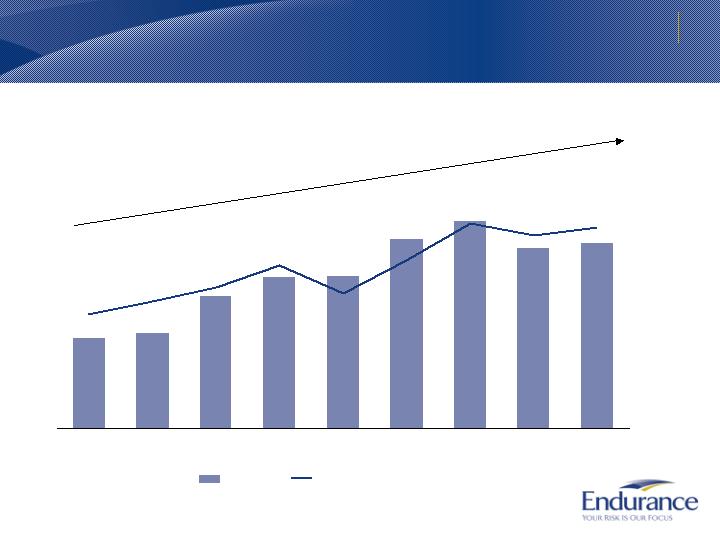

Our results

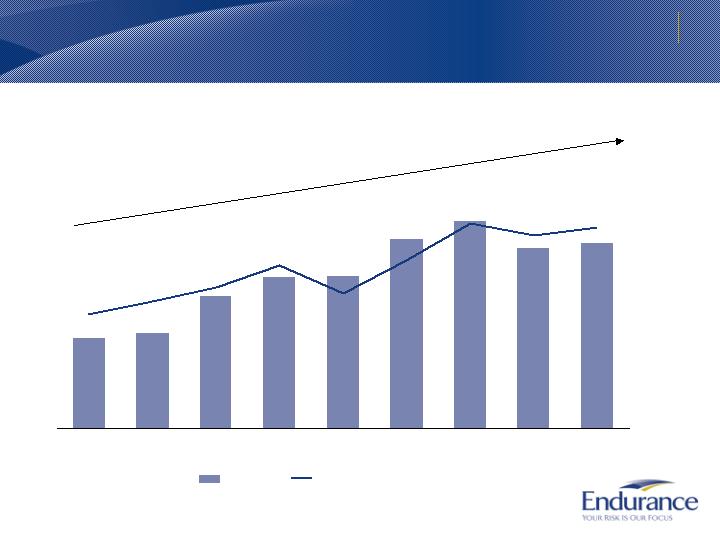

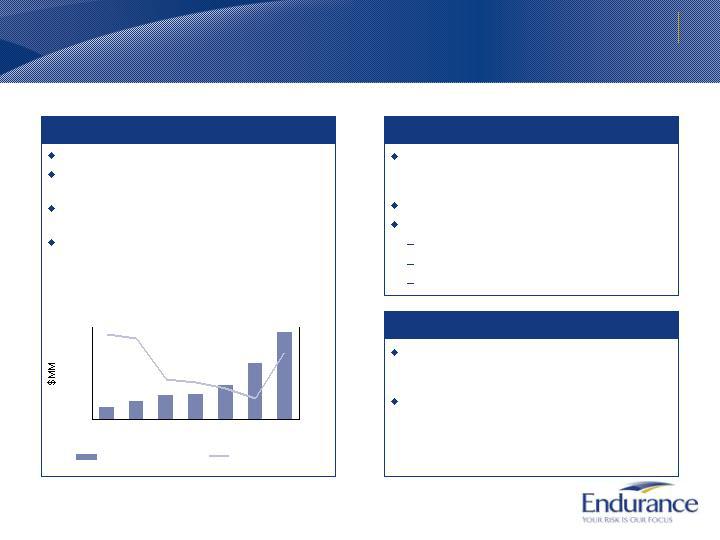

Diluted book value per common share has grown 105% since inception*

Book Value ($MM) and Diluted Book Value

Per Common Share ($)

From December 31, 2001 - March 31, 2009

1,162

1,218

1,645

1,862

1,873

2,298

2,512

2,207

2,254

$19.37

$24.03

$35.05

$33.06

$34.34

$28.87

$21.73

$27.91

$23.17

2001

2002

2003

2004

2005

2006

2007

2008

1Q09

Book Value

Diluted Book Value Per Share

Note: Diluted Book Value Per Share calculated on weighted number of average diluted shares outstanding.

* Diluted book value growth plus dividends

10.7% CAGR, diluted book

value per common share*

13

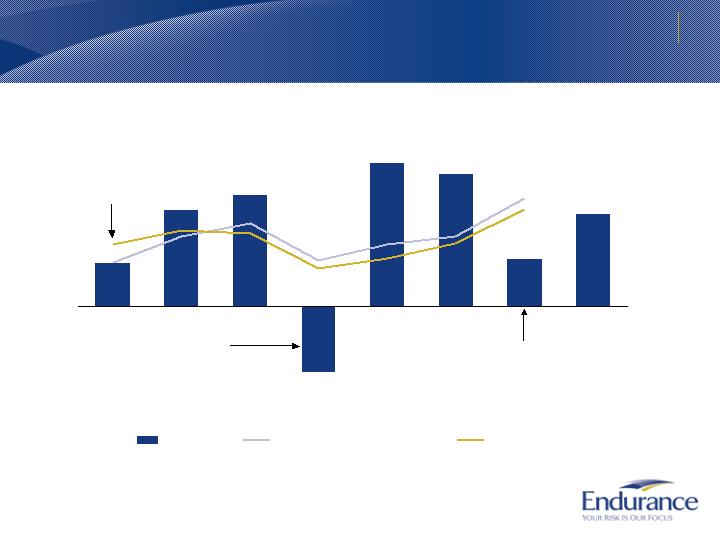

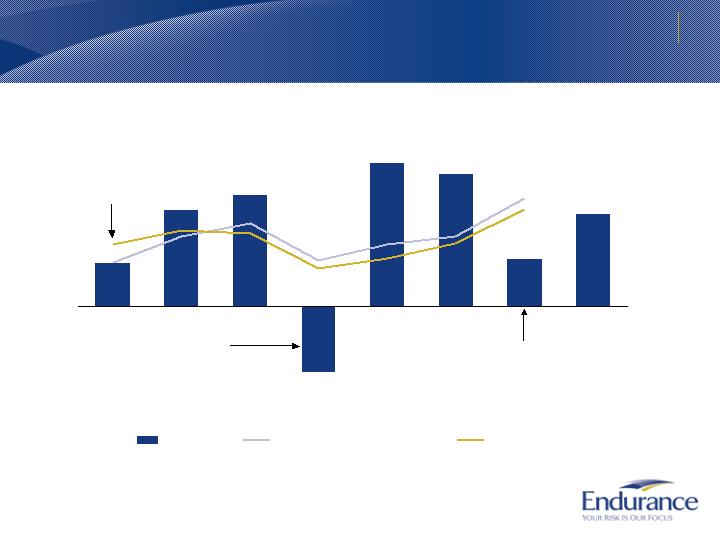

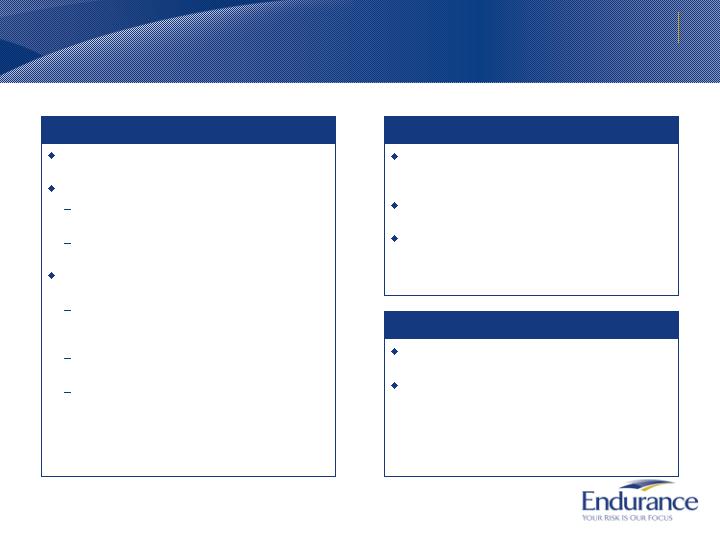

16.6%

-11.9%

7.8%

17.3%

19.9%

25.7%

23.8%

8.5%

2002

2003

2004

2005

2006

2007

2008

1Q09

Operating ROE(%)1

From 2002-2008

1. ROE is defined as 3-yr rolling average operating ROAE

2. Composite peer median based on SNL data. Includes Allied World, Arch, Ren Re, IPC re, Axis, Transatlantic, Everest, PartnerRe, Platinum,

Montpelier and Max Capital

Impact of Hurricanes Gustav and Ike

claims and mark to market accounting

impact from investment portfolio

Impact of Hurricanes

Katrina, Rita, and

Wilma claims

Endurance

ENH 3-year rolling average ROE

19%

Median peer 3-year rolling average ROE

First year after

inception; capital not

yet fully deployed

18%

8.4%

6.9%

Our results

We have outperformed peers throughout the cycle1

14

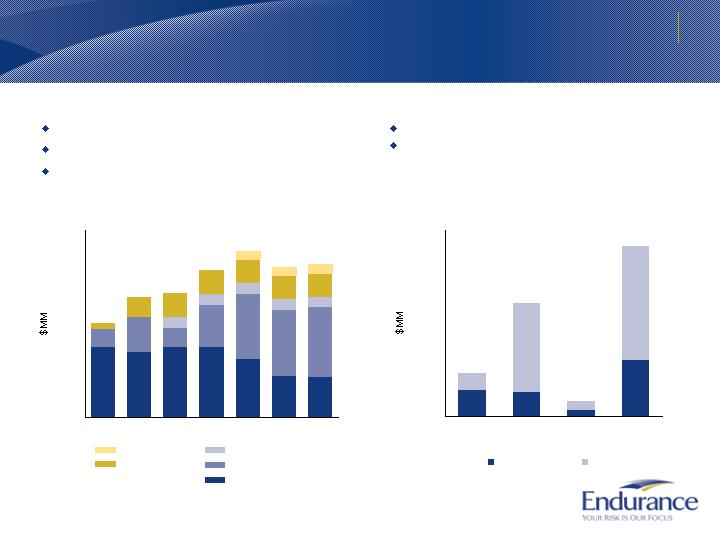

Balance sheet strength at March 31, 2009

Strong and flexible capital structure

IBNR represents 68% of company reserves

79% of long tail reserves are IBNR

Prudent and strong reserves

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Short Tail

Long Tail

Other

Total

Case Reserves

IBNR

1,300

1,213

1,309

1,318

1,091

762

749

345

650

364

780

1,221

1,245

1,305

200

200

200

200

200

103

391

447

447

449

447

447

150

150

150

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2003

2004

2005

2006

2007

2008

1Q09

Established history and growth

Rated “A” by A.M. Best and S&P; A2 by Moody’s

Debt to total capital of 16.6%

Common Share Capital

Retained Earnings

Preferred Equity

Debt

Contingent Equity

Reserves as of March 31, 2009

15

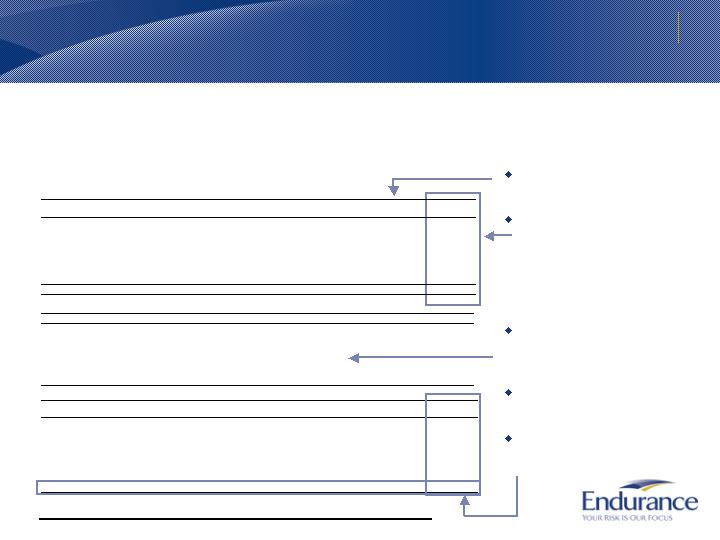

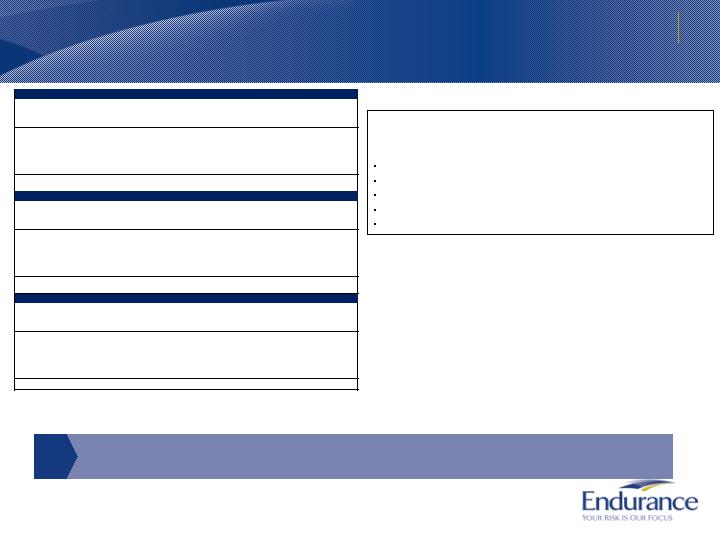

Timely published loss triangles—an example of our commitment to transparency

Industry-leading practice: loss triangles published annually in February

provide a transparent view of Endurance’s loss development

Composition of Ultimate Loss &

Loss Adjustment Expense (LAE)

for each accident year

Ultimate Loss & LAE ratios

represent latest available

estimate of loss and expenses as

a percentage of earned premiums

What to look for:

Loss emergence shows the

change in total expected losses

over time

Negative total development figures

represent reserves that have been

released into earnings

Changes in reserves at end of

each 12-month period for each

accident year are reflected in

Ultimate Loss & LAE

Ultimate Loss

& LAE Ratio

Ultimate Loss

& LAE

Additional Case

Reserves

Case Reserves

& ALAE

Paid Loss &

ALAE

Earned

Premium

Accident

Year

62%

6,821,449

63,717

2,032,628

109,925

1,069,639

3,545,538

10,934,196

77%

1,661,170

22,757

687,581

18,324

443,097

489,409

2,164,829

2008

54%

961,097

17,466

447,286

19,887

162,789

313,668

1,763,709

2007

46%

858,200

8,539

328,621

12,215

105,119

403,706

1,878,301

2006

101%

1,801,464

7,102

225,370

27,078

211,331

1,330,584

1,788,208

2005

52%

847,145

3,981

180,870

12,837

71,612

577,846

1,635,212

2004

41%

513,376

2,865

124,598

10,258

56,153

319,503

1,241,128

2003

39%

178,677

1,007

38,278

9,326

19,539

110,528

461,490

2002

24%

320

0

24

0

0

295

1,320

2001

ULAE

IBNR

Gross

ITD summary

Endurance Specialty Holdings LTD.

Accident Year Global Development Triangles

Valuation date: December 31, 2008

Value in Thousands USD(1.4629 USD/GBP)

Ultimate Loss & LAE

1,661,170

2008

961,097

976,391

2007

858,200

908,165

989,294

2006

1,801,464

1,833,851

1,863,194

1,804,173

2005

847,145

879,490

908,496

993,890

1,095,479

2004

513,376

528,584

538,247

556,093

628,688

736,190

2003

178,677

182,052

189,694

195,440

182,184

209,542

240,931

2002

320

277

319

322

398

2001

96

84

72

60

48

36

24

12

(682,181)

43

(3,417)

(22,853)

(47,830)

(65,584)

(264,654)

(277,884)

7,503,628

Total

1,661,170

2008

(15,295)

(15,295)

976,391

2007

(131,094)

(49,965)

(81,129)

989,294

2006

(2,710)

(32,387)

(29,343)

59,020

1,804,173

2005

(248,334)

(32,345)

(29,006)

(85,394)

(101,589)

1,095,479

2004

(222,814)

(15,207)

(9,664)

(17,845)

(72,595)

(107,502)

736,190

2003

(62,254)

(3,375)

(7,643)

(5,746)

13,256

(27,357)

(31,389)

240,931

2002

320

43

(42)

(3)

(75)

398

2001

Total

Development

84 - 96

72 - 84

60 - 72

48 - 60

36 - 48

24 - 36

12 - 24

@ 12

Loss Emergence

Calendar Year Emergence

2003

2004

2005

2006

2007

2008

Total Development

(31,389)

(134,462)

(161,003)

(49,969)

(156,826)

(148,531)

(682,180)

16

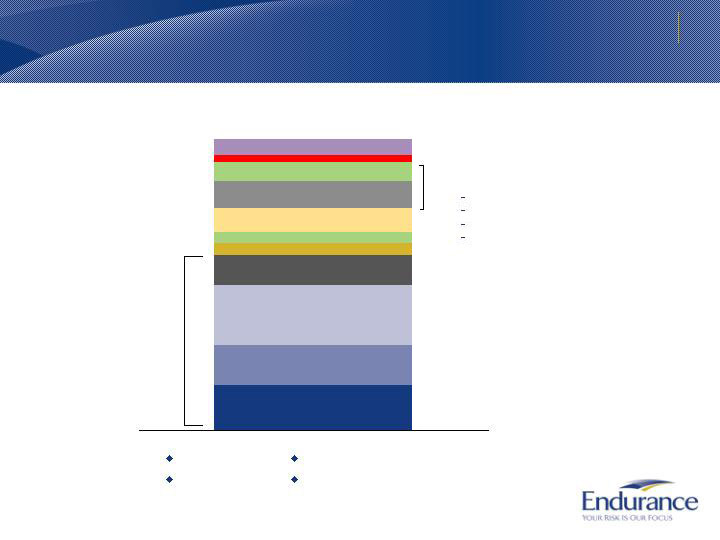

Cash and equivalents, $877mm1

Government and agency debt,

$722mm

Agency MBS, $1,124mm

Government guaranteed Corporates,

$568mm

ABS, $225mm

Foreign government, $199mm

Investment grade and high-yield

corporates and munis, $467mm

Non-agency CMBS, $513mm

Non-agency RMBS, $326mm

Short term, $140mm

Other, $286mm

Alternatives are limited and carefully selected

Currently carried at an average of 78% of amortized cost:

96% of CMBS are super-senior and senior issues

67% of RMBS are vintage 2005 or older

No subprime MBS

No credit or interest rate derivatives

Investment portfolio composition at March 31, 2009

Market yield: 5.0%

Book yield: 4.6%

Average rating: Aaa/AAA

Duration: 2.06 years

60% of

investments are in

cash, U.S.

Government or

U.S. Government

backed securities

(1) Net of investments pending settlement

17

Senior non-agency RMBS portfolio as of 3/31/09

The RMBS portfolio is trading $143mm below face value (69%). The current discount to face

value would be realized through actual writedowns on the securities under the following

approximate cumulative default and severity scenarios:

’06 and ‘07 Prime – 60% cumulative defaults / 75% loss severity

‘05 and Earlier Prime – 45% cumulative defaults / 60% loss severity

‘06 Alt-A – 70% cumulative defaults / 80% loss severity

‘05 Alt-A – 55% cumulative defaults / 70% loss severity

‘04 and Earlier Alt-A – 40% cumulative defaults / 60% loss severity

Vintage

Face Amount

Market Value

Average Credit

Enhancement

Average 60+

Delinquency

Collateral

Cumulative Loss

to Date

2007

$99,503

$62,904

7.5%

4.9%

0.3%

2006

$69,747

$40,286

10.4%

7.6%

0.7%

2005

$48,716

$34,691

6.1%

2.8%

0.1%

2004 and Earlier

$144,888

$109,479

7.8%

1.6%

0.1%

Total

$362,854

$247,360

8.0%

3.8%

0.3%

Vintage

Face Amount

Market Value

Average Credit

Enhancement

Average 60+

Delinquency

Collateral

Cumulative Loss

to Date

2007

$0

$0

2006

$5,950

$3,796

8.8%

20.3%

1.6%

2005

$60,806

$44,461

7.2%

8.5%

0.5%

2004 and Earlier

$32,772

$23,815

14.4%

6.5%

0.4%

Total

$99,528

$72,072

9.7%

8.5%

0.5%

Vintage

Face Amount

Market Value

Average Credit

Enhancement

Average 60+

Delinquency

Collateral

Cumulative Loss

to Date

2007

$99,503

$62,904

7.5%

4.9%

0.3%

2006

$75,697

$44,082

10.2%

8.7%

0.8%

2005

$109,522

$79,152

6.7%

6.0%

0.3%

2004 and Earlier

$177,660

$133,294

9.0%

2.5%

0.1%

Total

$462,382

$319,432(1)

8.3%

4.9%

0.3%

Prime

Alt-A

Total

(1) Does not include $7 million of notes that are non-US RMBS.

Current market valuation of the non-agency RMBS portfolio implies a significantly worse

underlying loan default rate than the current delinquency rate of 4.9%

18

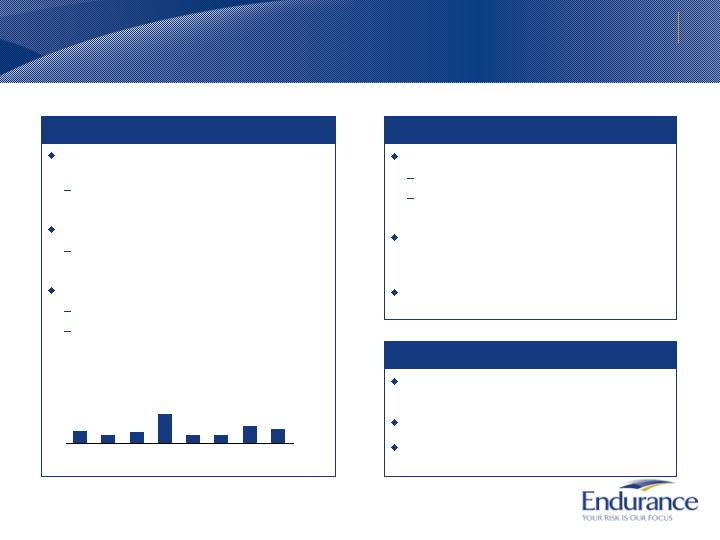

The CMBS portfolio is trading $125mm below face value (80%). The current discount to

face value would be realized through actual writedowns on the securities under the following

approximate cumulative default and severity scenarios:

‘06 and ‘07 Vintage – 95% cumulative defaults / 50% loss severity

‘05 Vintage – 80% cumulative defaults / 45% loss severity

$0

$20

$40

$60

$80

$100

$120

2007

2006

2005

2004 and Earlier

Vintage

Defeased Adjusted Credit Enhancement

Between 10% and 20%

Between 20% and 30%

Greater than 30%

The analysis above excludes a seasoned CMBS portfolio (88% 2004 and earlier) with an

aggregate market value of $19mm and the following average characteristics:

Loan Age

Defeased Adjusted

Credit Enhancement

Current Delinquencies

Collateral Cum Loss to

Date

9.4 years

26.4%

2.9%

1.5%

Vintage

Face Amount

Market Value

Average Credit

Enhancement

Average 60+

Delinquency

Collateral

Cumulative Loss

to Date

2007

$148,337

$100,070

30.6%

2.2%

0.00%

2006

$145,910

$101,831

30.5%

1.7%

0.00%

2005

$117,892

$95,027

29.2%

1.1%

0.04%

2004 and Earlier

$204,180

$194,044

33.8%

1.3%

0.48%

Total

$616,319

$490,972

31.6%

1.5%

0.2%

CMBS

Senior non-agency CMBS portfolio as of 3/31/09

(1)

(1)

Current market valuation of the non-agency CMBS portfolio implies a significantly worse

underlying loan default rate than the current delinquency rate of 1.5%

19

Conclusion

Endurance is a compelling investment opportunity

Endurance offers investors significant upside potential, based on combination of:

Strong franchise positions in attractive specialty markets

Globally diversified portfolio of insurance and reinsurance units operated with deep and distinctive expertise

Superior distribution capabilities with strong access to independent agent, middle market and retail

distribution networks

Active portfolio management actions have maintained strong risk adjusted return potential while reducing

overall volatility

Excellent balance sheet strength and liquidity

High quality fixed income investment portfolio offers upside potential from current market values

Prudent reserving philosophy and strong reserve position; Strong history of favorable development

Industry leading ERM

The future outlook is attractive

Outlook for P&C insurance sector overall is attractive;

Pricing in most lines is stable or improving with opportunities to continue generating attractive returns

Endurance is well-positioned to fill gaps left by weakened incumbents

Relative value vs. peers

ENH currently trading at a discount to book and peers, which appears unwarranted given strong absolute

and relative performance and strong positioning

P&C stock prices have fallen in line with other financials, which appears unwarranted given the industry’s

financial performance and improving market conditions

20

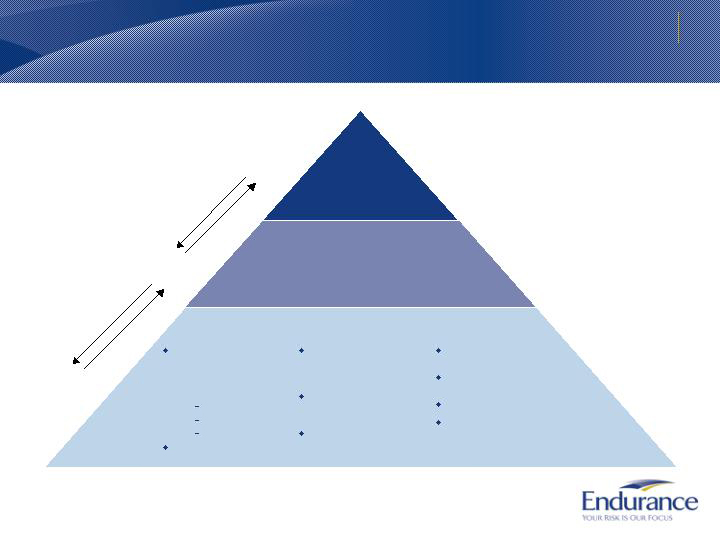

Appendix

Growth through specialization

We have a strong track record of entering new businesses to meet our strategic aims

Buy

Build

Partner

2008

2006

2001

2002

2003

2004

2005

2007

Acquired

LaSalle

portfolio

Acquired

HartRe

Acquired

ARMtech

Partnered with

leading California

workers’ comp

provider

Acquired XL

Surety

reinsurance

Established

US

reinsurance

Established

UK/Europe

reinsurance

Established

Fortune

1000

insurance

Established

UK Middle

Market

insurance

Established

US

Middle

Market

insurance

Established

Agriculture

reinsurance

Partnered with

leading

environmental

contractor provider

Established

operations

Partnered with

leading habitational

risk provider

Established

catastrophe

reinsurance

22

Balance sheet strength and durability

Our commitment to ERM supports superior performance

Best-in-class

ERM

Optimally manage capital and risks

Manage towards a required return on

risk-adjusted capital

Quantify risks taken and limit ones

that threaten solvency/viability

Clearly defined risk tolerances

and controls

Asset management: approach

incorporates capital-at-risk limits,

stress testing and ratings triggers

Liability management

Concentration management

Delegated authorities

Strong governance structure

Senior management understands and

values ERM as a source of

competitive advantage

Board of Directors highly skilled in

insurance and finance

Corporate culture

Ownership mentality

Transparency and communication of

ERM strategies

“Excellent” ERM rating by S&P in 2008

Youngest company and one of only four P&C companies in the U.S. and

Bermuda to achieve the highest designation

23

Business organization and competitive advantages

1. % of net written premiums in 2008

Each of our

businesses

are led by

industry

leading

professionals

with market

expertise and

maintain the

following

sources of

competitive

advantage

Endurance

Insurance

55%1

Middle Market

Small Risk

Program

Bermuda

US

Fortune 1000

International

Reinsurance

45%

Diverse mix of access to exposure, split

between insurance and reinsurance,

and across customer segments

Service and

technology-based

distribution

strategy

Strong local

presences

Strong product

development

Cost-efficient

production

Professional

team with

extremely strong

underwriting

experience

Long-term

relationships

(over 20 years)

with key brokers

Very strong

reinsurance

relationships

Individual risk

underwriting

model, as

opposed to

market share

approach

Very low

historical loss

ratio based on

superior

underwriting

Deep

distribution

management

capabilities

Utilize

technology to

enhance control

environment

Multi-disciplined

teams of

professionals

dedicated to

program

management

and oversight

Access to

business

through

combination of

insurance and

reinsurance

networks

3-pronged

underwriting

approach

Specialized

Relationship-

based

Opportunistic

Dedicated

professional

teams with skills

tailored to each

approach

Face-to-face

service model

and access to

global network

of clients

Industry leading

underwriting

margins

Aggressive

portfolio

management

Industry leading

technology and

modeling

Distinctive

footprint and

lean

underwriting

approach vs.

most Bermuda

competitors

Shifting focus of

business to

Zurich and

Singapore

Strong local

market

presence with

experienced

professionals

24

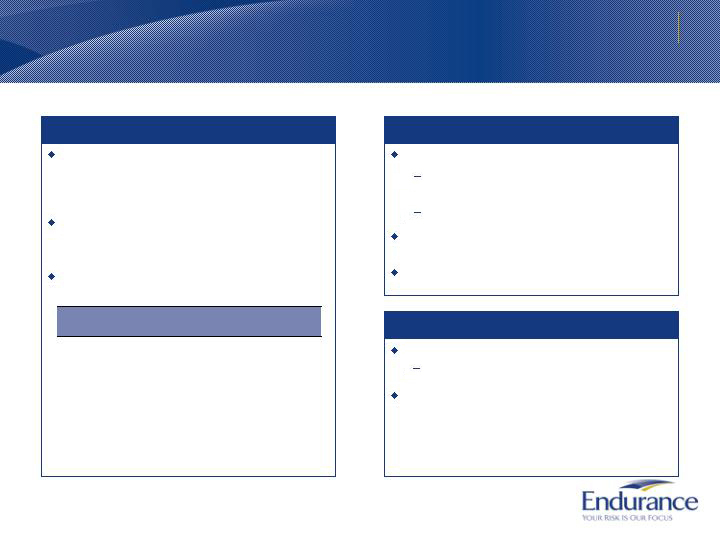

Case study: ARMtech represents a successful entry into Agriculture

1.

As of October 9, 2008

2.

Premiums and loss ratios are net of cessions to the FCIC only

Acquired in December 2007

Traditional multi peril crop insurer with a 6.1%

market share of the $4.7 BN MPCI market1

Endurance’s portfolio currently includes over

50,000 clients and 100,000+ individual policies

Agriculture insurance is an attractive and growing

segment

Overview of Small Risk – ARMtech

Strong local presence of field representatives that

deliver technology driven products to independent

agents

Product development expertise

Expense advantage – low cost manufacturer

Leverage technology

Centralized and scaleable back office

Well distributed sales and claims staff

Competitive advantage

We will leverage our exceptional customer

service, scalable operating platform, and low cost

structure to grow the market share

Continue to grow in the small risk space utilizing

strong local presence and distribution, product

development, and technology

Go forward strategy and outlook

0

100

200

300

400

2002

2003

2004

2005

2006

2007

2008

60%

80%

100%

Net written premium

Net loss ratio

ARMtech performance from 2002-20082

25

We are now building a similarly differentiated specialized portfolio within Middle Market

Endurance began investing and organically

growing it’s US middle market business in 2005

Developed a well established branch network

Provide admitted and non-admitted policy

forms

World class policy administration system that

allows for rapid integration of new products

Middle Market represents a large but fragmented

opportunity with attractive margins. This space:

Reflects less concentrated single risk

exposures, which balances our Fortune 1000

business

Represents business which is often poorly

served by standard carriers

Has historical results better than industry

Overview of Middle Market

Our credible underwriting staff with extensive

experience managing through hard and soft

markets

Long term relationships with key producers who

are leaders in the wholesale distribution system

Proven ability to attract underwriters and find

niche pockets of attractive business, e.g.

successfully opened 10 branch locations

Competitive advantage

Extend our existing US business model

geographically and by product

Continue to organically build through leveraging

existing capabilities and hiring new teams to take

advantage of current market opportunities

Go forward strategy and outlook

26

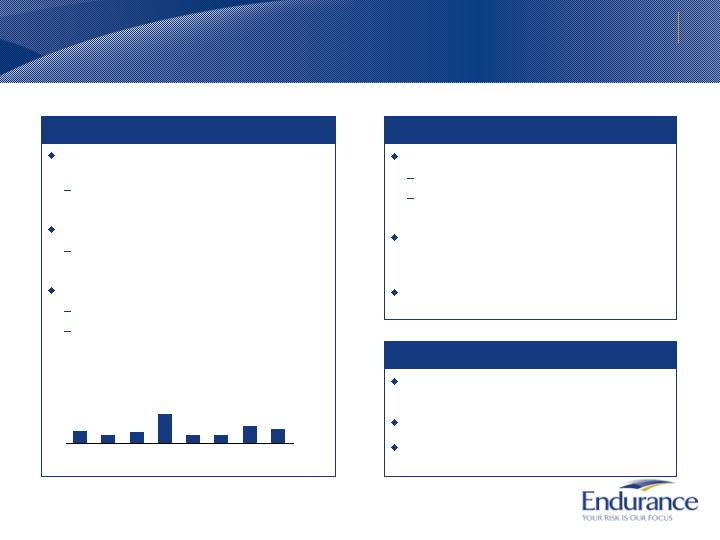

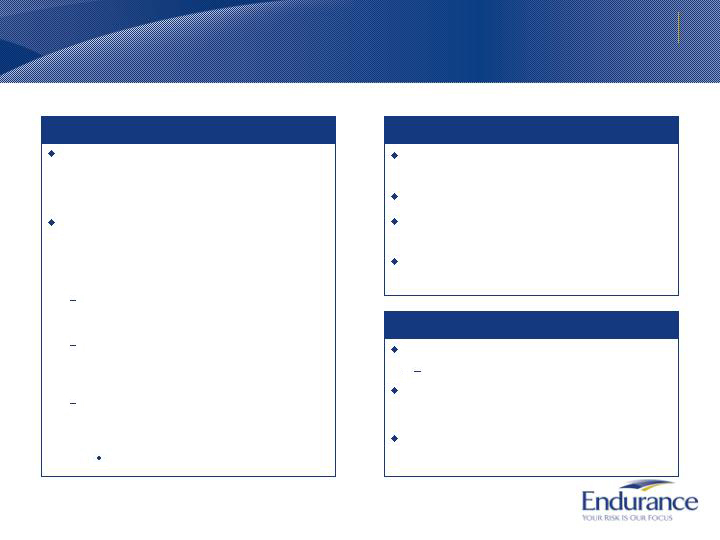

Case study: Strong performance in Bermuda Cat driven by strategy and cycle management

This business is one of the highest margin

businesses through the underwriting cycle

Rating agency constraints and market

behaviors put floor on cycle

Success requires active portfolio management

Key is to maintain proper infrastructure and

set of internal controls

Track record of attractive underwriting margins

Inception to date underwriting ratio of 59.5%

Our performance in 2008 with Ike and Gustav

was significantly better than peers1

Overview of Bermuda Catastrophe

Industry leading technical underwriter

Recognized as Excellent in ERM by S&P

Face-to-face contact with clients aids risk

selection

Seasoned industry participant that has leveraged

active client management to move towards more

attractive accounts

Global reinsurance network provides greater

access to clients

Competitive advantage

Continue to write quality business through both

hard and soft cycles

Attract internal and external sources of capital

Portfolio manage concentrations and leverage

global network to seek out diversifying exposures

Go forward strategy and outlook

52.0%

34.0%

44.0%

126.0%

36.6%

33.3%

74.9%

58.2%

2002

2003

2004

2005

2006

2007

2008

1Q09

1. Composite peer median based on SNL data. Includes Platinum, Allied World, Arch, Ren Re, IPC re, Axis, Transatlantic, Everest, PartnerRe,

Montpelier and Max Capital

Underwriting Ratio from 2002-1Q09

27

51%

76%

101%

126%

151%

176%

1998

2000

2002

2004

2006

2008

Case study: Our California Workers’ Comp insurance play represents a successful, replicable business model

California market identified as an opportunity,

especially in small business niche markets (small,

regional company focus through independent agents)

Entered the business in 2006 with a partner who

provided technology and distribution expertise

Partner was a successful reinsurance client

Relationship parlayed into primary insurance

partnership; serves as template for future

opportunities

Ramped up the business to over 100,000 policies in

three years

In late 2008, concluded that expected loss cost

trends would continue to erode and competitive

pressures would increase

Exited the business in early 2009

From 2006 to 2008, we wrote $541 MM in net

premiums and the business has generated returns

above initial expectations

Overview of California Workers’ Compensation

$

$50

$100

$150

$200

$250

$300

2006

2007

2008

2009

Net premiums written

Workers’ Comp insurance industry performance1

1995-2008

1. Source: WCIRB estimated accident year combined loss and expense ratios

Note: 2008 industry combined ratios projected based on market trends and Endurance’s performance

Exited

business

Endurance spotted an historic

opportunity to enter what is generally

considered a difficult market

28

Historically a high margin business

Comprised of large risk casualty business which

includes, healthcare, excess casualty, and

professional lines insurance

Endurance is expanding market share by opening

2 new offices

US healthcare team and US professional lines

Challenges faced by large distressed carriers

creating opportunities

This business has generated economic margins

of ~30% (includes underwriting and investment

returns)

Overview of Fortune 1000

Strong distribution management capabilities

Demonstrated low underwriting ratio as

compared to peers

Endurance is a technical risk underwriter

Actuarial models built around exposure

management based on proprietary

information gained from client knowledge

Strong reliance on pricing tools

Competitive advantage

Continue to selectively expand our footprint from

Bermuda to the United States to better align with

evolving distribution model

Leverage our distribution management

capabilities

We believe the combination of underwriting

excellence and expanded operational capabilities

positions us very well for the next 5 years

Go forward strategy and outlook

Fortune 1000 – business overview

Fortune 1000 Performance

0

100

200

300

400

2002

2003

2004

2005

2006

2007

2008

50%

90%

Net premiums written

Underwriting Ratio

29

Program business overview

Represents a large opportunity for Endurance in

today’s marketplace as the weakening of

incumbents will increase available share of new

program businesses

To be individually underwritten in a cost effective

way this business is better accessed through

distribution partnerships

We have two distinct partnership models

depending on the type of risk:

Overview of Program Business

Broad underwriting capabilities

Better qualified to monitor underwritten

business

Ability and discipline to be selective

Underwriting mature books of business that are

susceptible to analysis

Demonstrated successful experience in this

business model

Competitive advantage

Capitalize on weakness of large incumbents

Flight to more stable business partners

Leverage in-house underwriting expertise

Go forward strategy and outlook

Details

Example

Ongoing where

partner underwrites

using Endurance’s

underwriting

technology platform

Entry in 2006 when

the business was

attractive, exit in

2009 as cost trends

eroded and

competitive

pressures increased

Environmental

insurance

California Worker’s

compensation

Ongoing

partnership

Opportunistic

entry and exit

30

US Reinsurance is the broadest and deepest

reinsurance market with a wide variety of risks,

aggressive competitors and pronounced

underwriting cycles

Historically, reinsurers in the US have competed

using market tracking and market share

strategies. However, Endurance aspires to

generate higher margins by using a three-

pronged approach

Specialized underwriting: Stable, well-respected

underwriting teams that operate as specialists

within their niche

Opportunistic/capabilities underwriting:

Opportunistic approach to identifying and targeting

attractive businesses while maintaining discipline

to exit and enter markets as the cycle dictates

Relationship underwriting: Focused strategy of

working with best of breed companies that have

strong franchises and are less susceptible to

competition

Technical underwriters similar to Endurance

Overview of US Reinsurance

Distinctive combination of cycle management and

comprehensive underwriting capabilities

Experienced team with broad expertise

Specialist underwriters supported by claims and

actuarial teams

Flexible technology platform

Competitive advantage

Expand specialty underwriting products

Surety and direct lines of business

Opportunistically enter markets that are

experiencing greater diversification due to

counterparty risk

Expand relationships where clients are proving to

be strategically positioned to withstand market

pressures

Go forward strategy and outlook

US Reinsurance business overview

31

Global operations in London, Zurich, and

Singapore

Broadly bifurcated market approach to serve both

London and local markets

Maintain capabilities to serve in both markets

Deep and broad relationships with clients

Positioning resources to replicate strategy

employed in the US

Represents a large opportunity for Endurance in

today’s marketplace as the weakening of large

incumbents will increase available share of new

business

Overview of International Reinsurance

Differentiated operating model which combines

specialized underwriting skills with operational

efficiency

Local senior underwriters

Lean focused multi-disciplinary team

Leverage of assembled network of expertise to

draw from the Bermuda catastrophe and New

York specialist teams

Competitive advantage

Leverage relationships into other lines of

business

We have widely dispersed cat clients and

contract base

Build network through face to face contact and

ability to respond quickly to market opportunities

Go forward strategy and outlook

International Reinsurance business overview

32

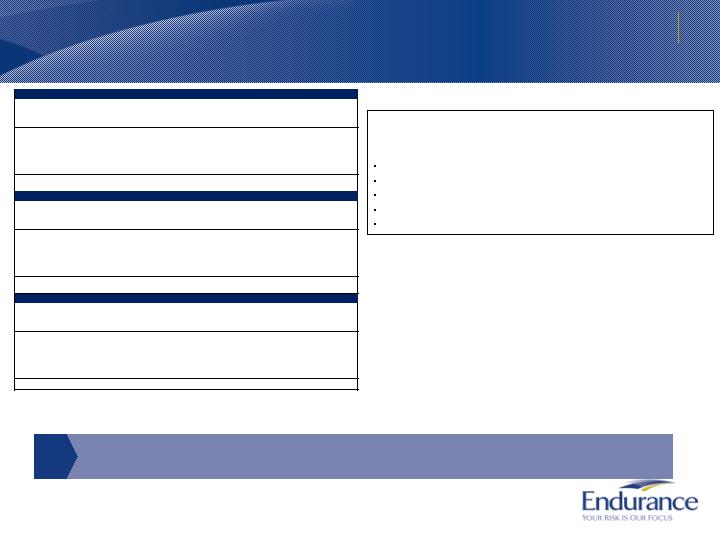

Financial results for first quarter 2009

9.7

0.11

1.13

1.24

Fully diluted net income EPS

(1.5)

(1.3)

89.5

88.2

Operating income

0.6

0.5

77.8

78.3

Net income

6.9

(42.2)

37.7

1.7

(9.0)

% Change

0.09

(24.2)

17.7

6.3

(57.9)

$ Change

1.31

1.40

Fully diluted operating EPS

57.4

33.2

Net underwriting income

46.9

64.6

Net investment income

372.0

378.3

Net premiums earned

640.8

582.9

Net premiums written

March 31,

2008

March 31,

2009

$MM (except per share data and %)

Financial highlights

$36.00

$34.34

Book value per share

84.4%

92.2%

Combined ratio

2.40

2.73

Investment leverage

13.5%

15.9%

General and administrative expense ratio

20.0%

18.1%

Acquisition expense ratio

50.9%

58.2%

Net loss ratio

14.7%

16.6%

Operating ROE

March 31,

2008

March 31,

2009

Key operating ratios

33

Net written premiums

164.3

18.4

11.2

29.6

Professional lines

0.4

0.9

222.4

223.3

Agriculture

(9.5)

(77.7)

4.2

18.5

16.7

% Change

33.7

(59.0)

0.7

2.8

2.5

$ Change

356.1

322.4

Total insurance

75.9

16.9

Workers’ compensation

16.5

17.2

Healthcare liability

15.1

17.9

Casualty

15.0

17.5

Property

March 31,

2008

March 31,

2009

In $MM

Insurance Segment

(11.7)

(3.2)

27.3

24.1

Surety and other specialty

(66.7)

(24.4)

36.6

12.2

Aerospace and marine

(8.3)

(55.0)

4.0

1.9

6.8

% Change

(23.9)

(6.0)

4.2

0.7

4.8

$ Change

286.7

262.8

Total reinsurance

10.9

4.9

Agriculture

105.2

109.4

Catastrophe

36.2

36.9

Property

70.5

75.3

Casualty

March 31,

2008

March 31,

2009

In $MM

Reinsurance Segment*

15.0

(0.3)

(2.0)

(2.3)

Deposit accounting adjustments

(9.0)

% Change

(57.9)

$ Change

640.8

582.9

Total

March 31,

2008

March 31,

2009

In $MM

Total

* Prior to deposit accounting adjustments

34

Financial overview: historical

$1.24

74

78

65

33

378

583

March 31,

2009

$1.31

83

99

130

111

1,766

1,784

2008

($3.60)

(223)

(220)

180

(410)

1,724

1,619

2005

$6.73

483

498

257

304

1,639

1,586

2006

$7.13

506

521

281

322

1,595

1,575

2007

$4.00

263

263

71

179

1,174

1,598

2003

$5.28

356

356

122

232

1,633

1,697

2004

1,644

102

Net income available to

common shareholders

1,697

102

Net income before

preferred dividend

1,149

822

10,278

11,207

2002

through

1Q09

$1.73

43

51

369

765

2002

Diluted EPS

Net investment income

Net underwriting income

Net premiums earned

Net premiums written

In $MM

Financial highlights since 2002

$34.34

16.6%

92.2%

March 31,

2009*

$33.06

8.5%

93.5%

2008

$35.05

23.8%

79.9%

2007

$28.87

25.7%

81.5%

2006

$27.91

19.9%

85.8%

2004

$23.17

(11.9%)

123.5%

2005

$24.03

17.3%

84.7%

2003

$21.73

7.8%

86.2%

2002

Book value per share

14.1%

Operating ROE

92.3%

Combined ratio

Inception-

to-date

Key operating ratios

* Operating ROE is annualized

35

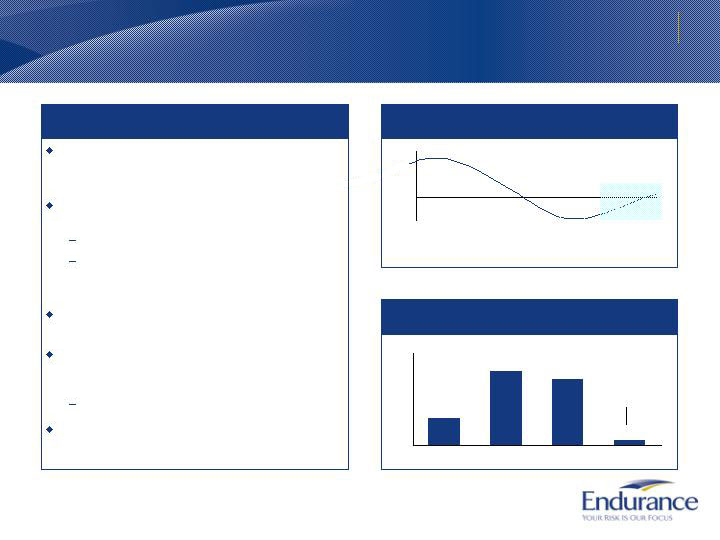

0

20

40

60

80

100

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

Dividends paid

Annual dividend/share

0

50

100

150

200

250

300

350

2002

2003

2004

2005

2006

2007

2008

1Q09

Share repurchases

Pay an attractive dividend yield

Return capital as market conditions soften

Note: Dividend yield based on common shares. Endurance also issues a $1.94 dividend to its preferred shares on an annual basis.

Capital management

We have maintained a disciplined capital management approach

* Annual dividend per share is annualized for 2009

Actively manage capital and have returned approximately $1.1BN in capital to

shareholders, inception-to-date

36