Endurance Specialty Holdings Investor Presentation March 31, 2016 Exhibit 99.1

Forward-Looking Statements and Regulation G Disclaimer Safe Harbor for Forward-Looking Statements Some of the statements in this presentation may include, and Endurance may make related oral forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. Statements which include the words "should," “would,” "expect," "intend," "plan," "believe," "project,“ “target,” "anticipate," "seek," "will,“ ‘”deliver,” and similar statements of a future or forward-looking nature identify forward-looking statements in this presentation for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, but are not limited to, the effects of competitors’ pricing policies, greater frequency or severity of claims and loss activity, changes in market conditions in the agriculture insurance industry, termination of or changes in the terms of the U.S. multiple peril crop insurance program, a decreased demand for property and casualty insurance or reinsurance, changes in the availability, cost or quality of reinsurance or retrocessional coverage, our inability to renew business previously underwritten or acquired, our inability to maintain our applicable financial strength ratings, our inability to effectively integrate acquired operations, uncertainties in our reserving process, changes to our tax status, changes in insurance regulations, reduced acceptance of our existing or new products and services, a loss of business from and credit risk related to our broker counterparties, assessments for high risk or otherwise uninsured individuals, possible terrorism or the outbreak of war, a loss of key personnel, political conditions, changes in insurance regulation, changes in accounting policies, our investment performance, the valuation of our invested assets, a breach of our investment guidelines, the unavailability of capital in the future, developments in the world’s financial and capital markets and our access to such markets, government intervention in the insurance and reinsurance industry, illiquidity in the credit markets, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2015. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in Endurance’s most recent reports on Form 10-K and Form 10-Q and other documents of Endurance on file with the Securities and Exchange Commission. Any forward-looking statements made in this material are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Endurance will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Endurance or its business or operations. Except as required by law, Endurance undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Regulation G Disclaimer In this presentation, management has included and discussed certain non-GAAP measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company's results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-GAAP measures and reconciliations, please review the Investor Financial Supplement on our web site at www.endurance.bm. The combined ratio is the sum of the net loss, acquisition expense and general and administrative expense ratios. Endurance presents the combined ratio as a measure that is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information. The combined ratio, excluding prior year net loss reserve development, enables investors, analysts, rating agencies and other users of its financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes Endurance’s underlying business performance. The combined ratio, excluding prior year net loss reserve development, should not be viewed as a substitute for the combined ratio. Net premiums written is a non-GAAP internal performance measure used by Endurance in the management of its operations. Net premiums written represents net premiums written and deposit premiums, which are premiums on contracts that are deemed as either transferring only significant timing risk or transferring only significant underwriting risk and thus are required to be accounted for under GAAP as deposits. Endurance believes these amounts are significant to its business and underwriting process and excluding them distorts the analysis of its premium trends. In addition to presenting gross premiums written determined in accordance with GAAP, Endurance believes that net premiums written enables investors, analysts, rating agencies and other users of its financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes Endurance’s underlying business performance. Net premiums written should not be viewed as a substitute for gross premiums written determined in accordance with GAAP. Return on Equity (ROE) is comprised using the average common equity calculated as the arithmetic average of the beginning and ending common equity balances by quarter for stated periods. The Company presents various measures of Return on Equity that are commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information.

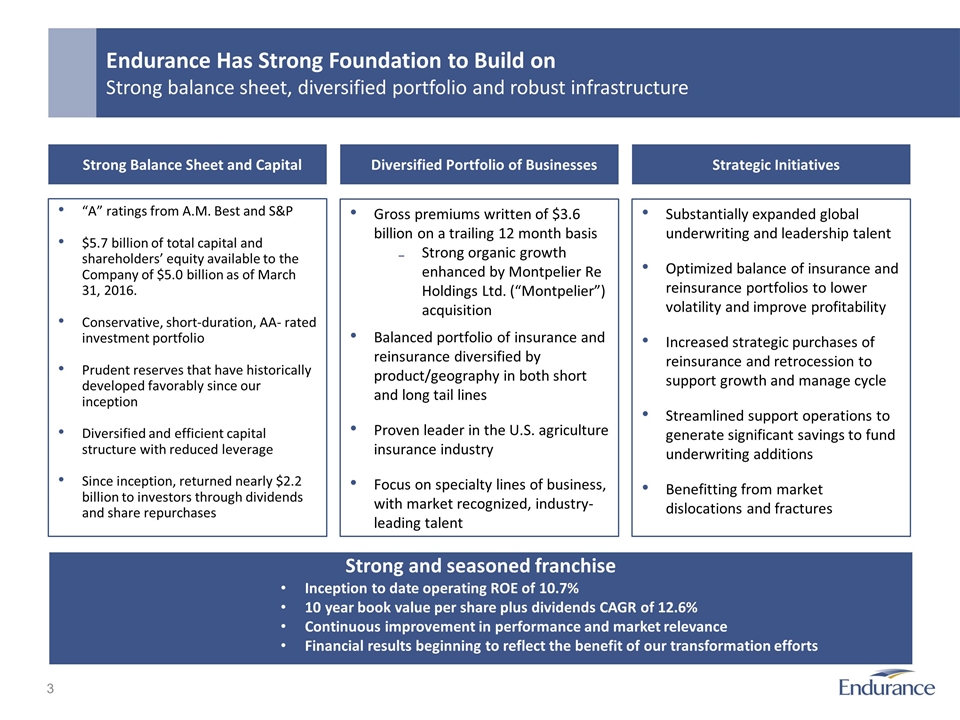

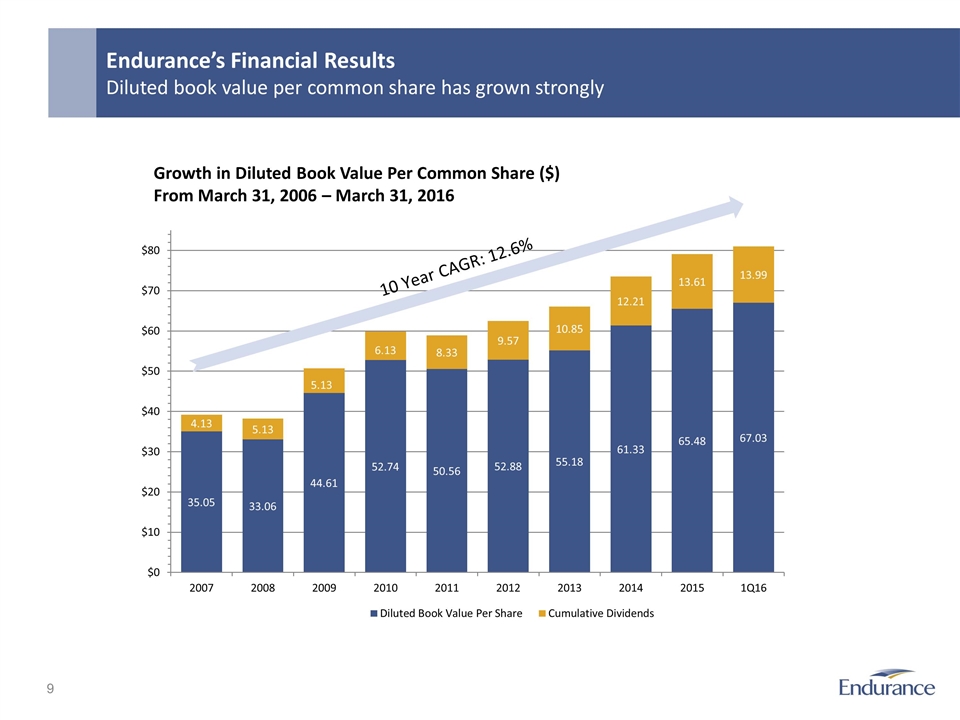

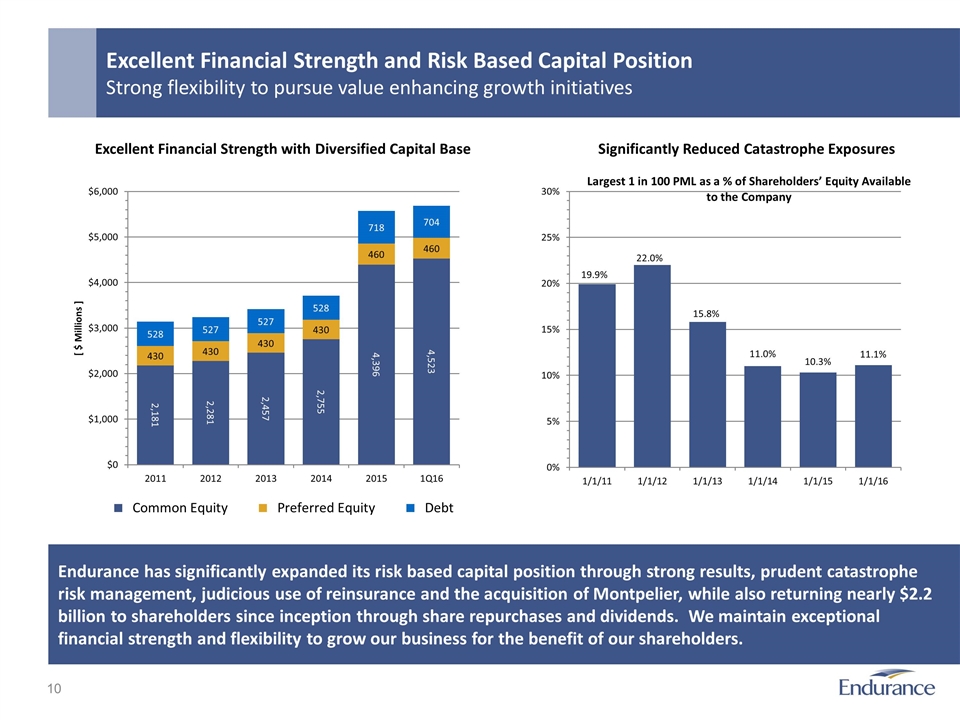

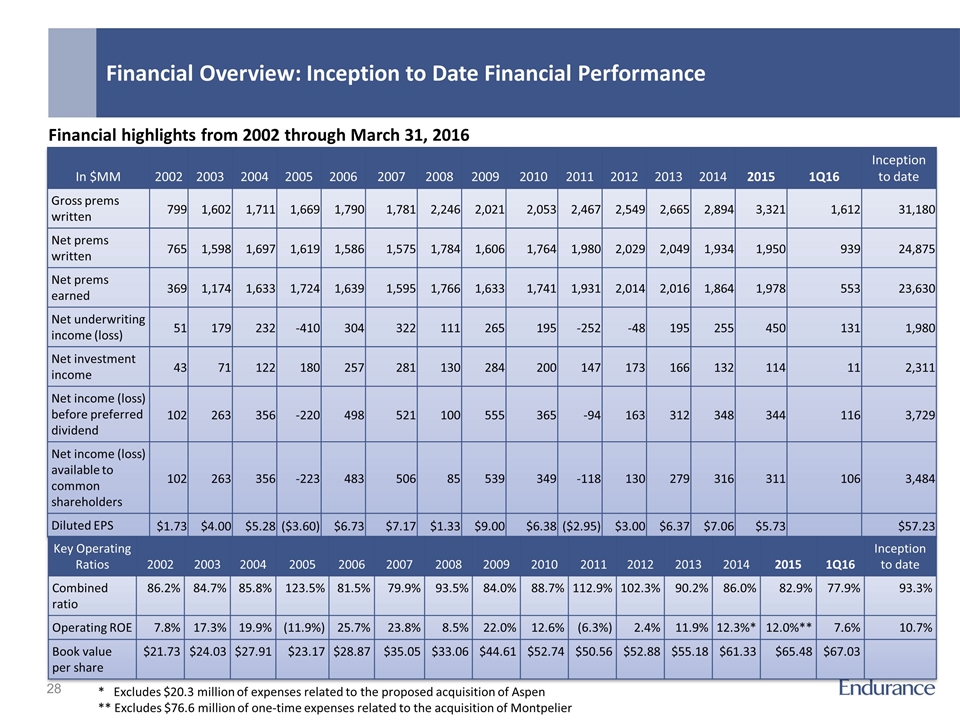

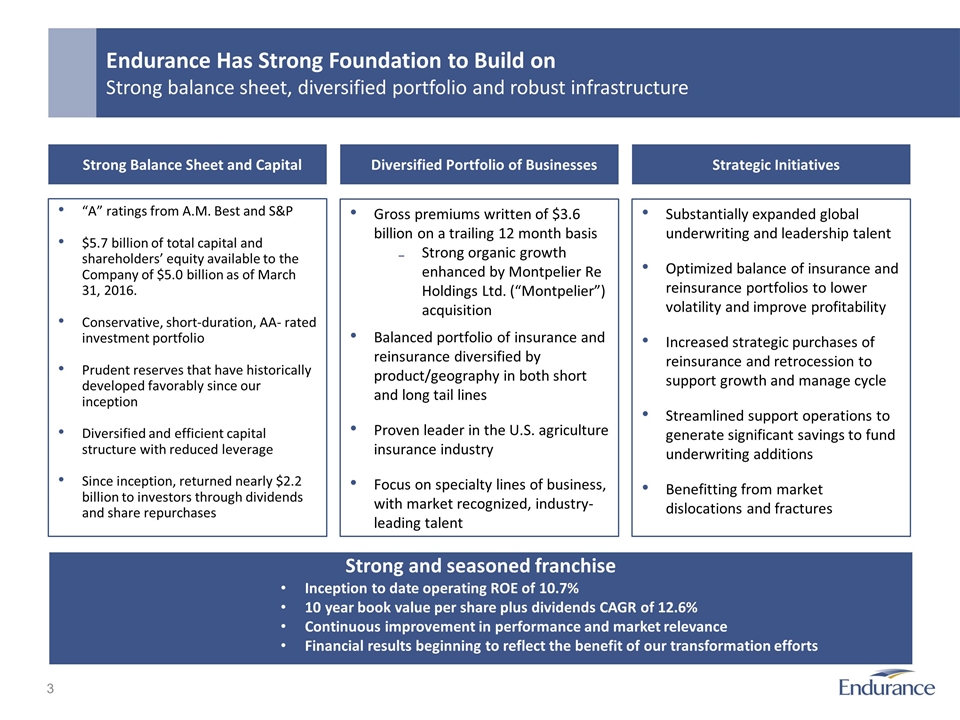

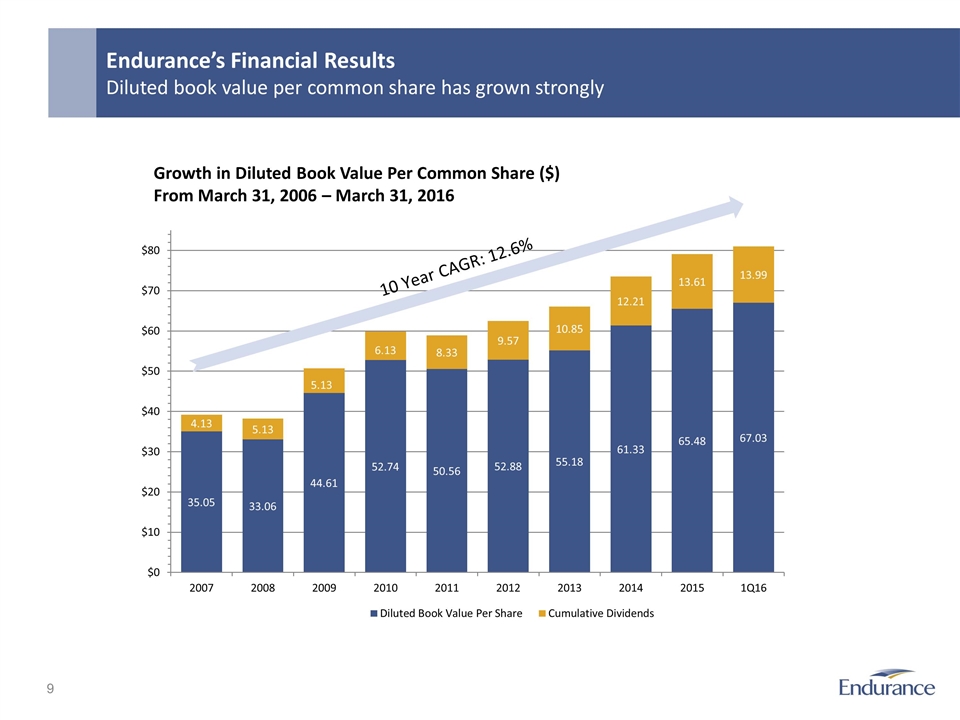

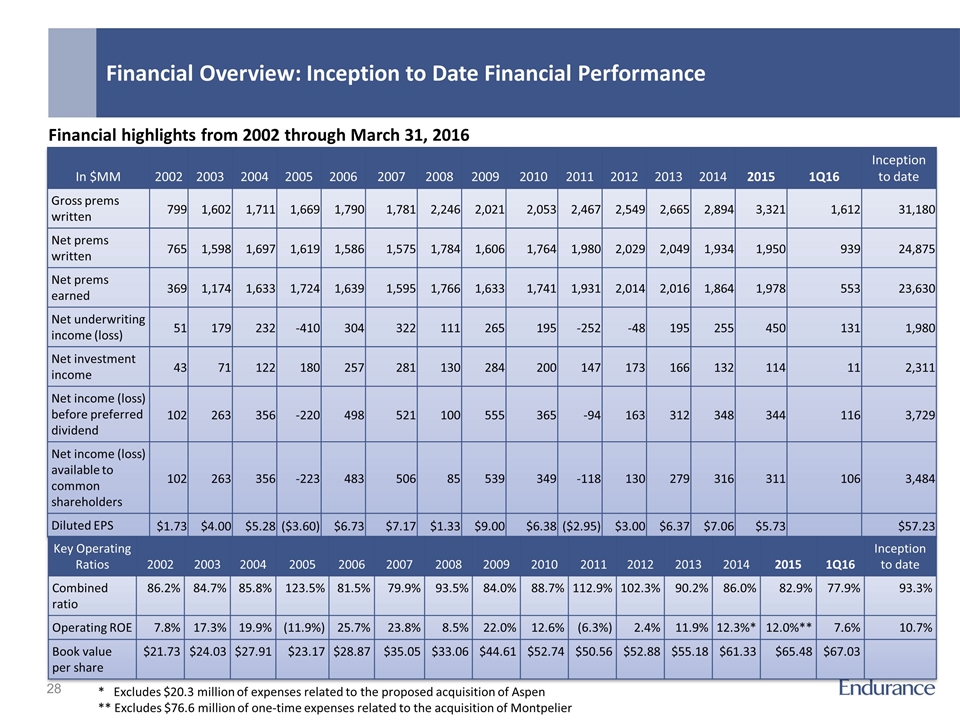

“A” ratings from A.M. Best and S&P $5.7 billion of total capital and shareholders’ equity available to the Company of $5.0 billion as of March 31, 2016. Conservative, short-duration, AA- rated investment portfolio Prudent reserves that have historically developed favorably since our inception Diversified and efficient capital structure with reduced leverage Since inception, returned nearly $2.2 billion to investors through dividends and share repurchases Endurance Has Strong Foundation to Build on Strong balance sheet, diversified portfolio and robust infrastructure Strategic Initiatives Substantially expanded global underwriting and leadership talent Optimized balance of insurance and reinsurance portfolios to lower volatility and improve profitability Increased strategic purchases of reinsurance and retrocession to support growth and manage cycle Streamlined support operations to generate significant savings to fund underwriting additions Benefitting from market dislocations and fractures Diversified Portfolio of Businesses Gross premiums written of $3.6 billion on a trailing 12 month basis Strong organic growth enhanced by Montpelier Re Holdings Ltd. (“Montpelier”) acquisition Balanced portfolio of insurance and reinsurance diversified by product/geography in both short and long tail lines Proven leader in the U.S. agriculture insurance industry Focus on specialty lines of business, with market recognized, industry-leading talent Strong Balance Sheet and Capital Strong and seasoned franchise Inception to date operating ROE of 10.7% 10 year book value per share plus dividends CAGR of 12.6% Continuous improvement in performance and market relevance Financial results beginning to reflect the benefit of our transformation efforts

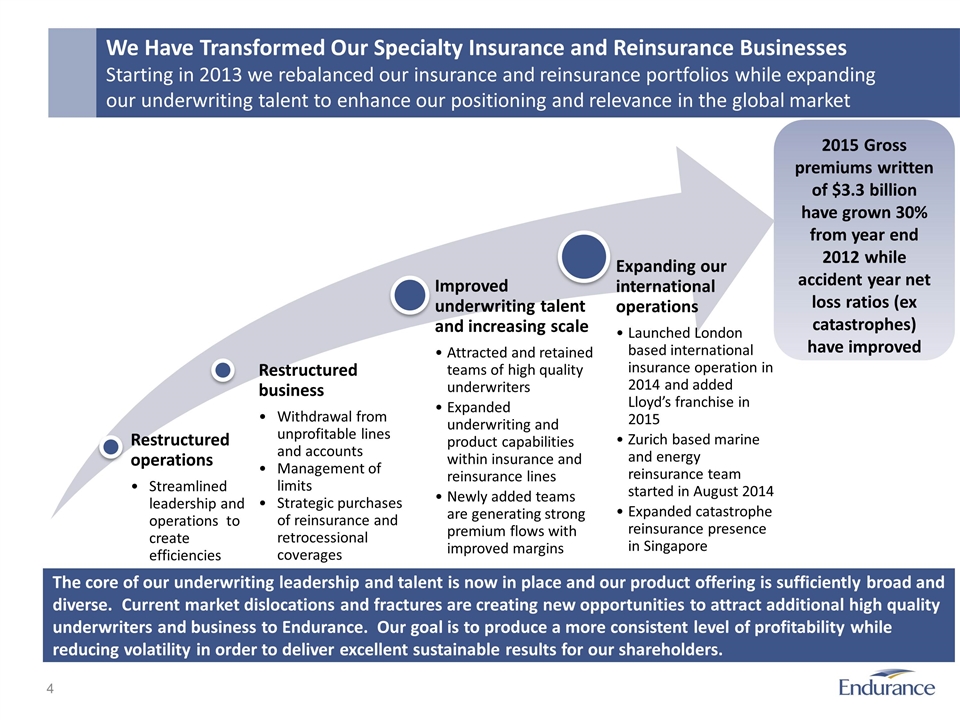

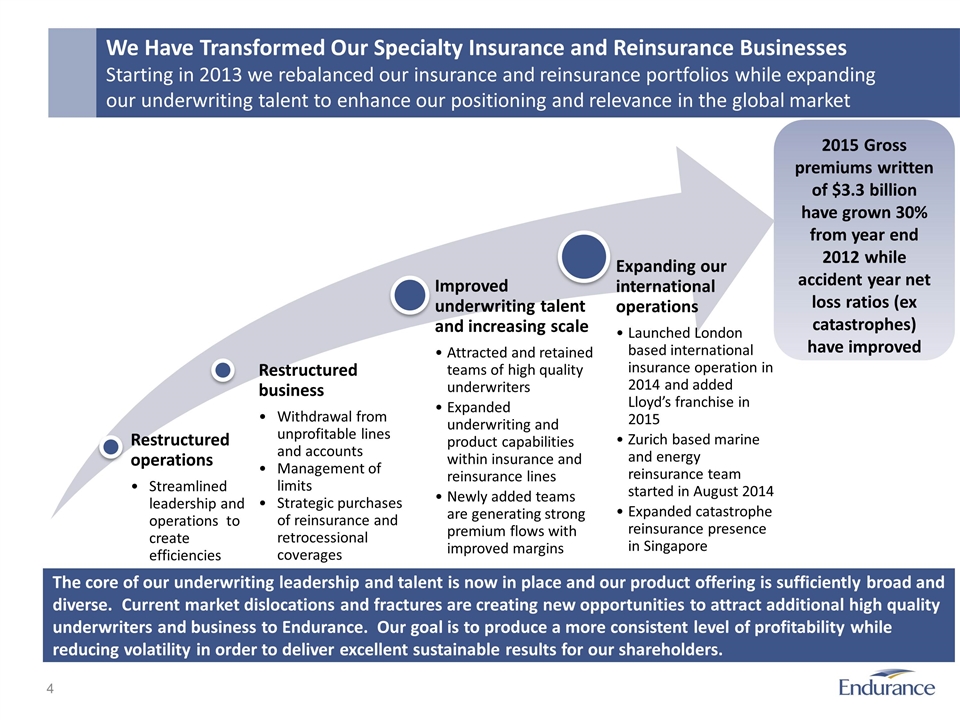

2015 Gross premiums written of $3.3 billion have grown 30% from year end 2012 while accident year net loss ratios (ex catastrophes) have improved We Have Transformed Our Specialty Insurance and Reinsurance Businesses Starting in 2013 we rebalanced our insurance and reinsurance portfolios while expanding our underwriting talent to enhance our positioning and relevance in the global market The core of our underwriting leadership and talent is now in place and our product offering is sufficiently broad and diverse. Current market dislocations and fractures are creating new opportunities to attract additional high quality underwriters and business to Endurance. Our goal is to produce a more consistent level of profitability while reducing volatility in order to deliver excellent sustainable results for our shareholders. Restructured business Withdrawal from unprofitable lines and accounts Management of limits Strategic purchases of reinsurance and retrocessional coverages Improved underwriting talent and increasing scale Attracted and retained teams of high quality underwriters Expanded underwriting and product capabilities within insurance and reinsurance lines Newly added teams are generating strong premium flows with improved margins Expanding our international operations Launched London based international insurance operation in 2014 and added Lloyd’s franchise in 2015 Zurich based marine and energy reinsurance team started in August 2014 Expanded catastrophe reinsurance presence in Singapore Restructured operations Streamlined leadership and operations to create efficiencies

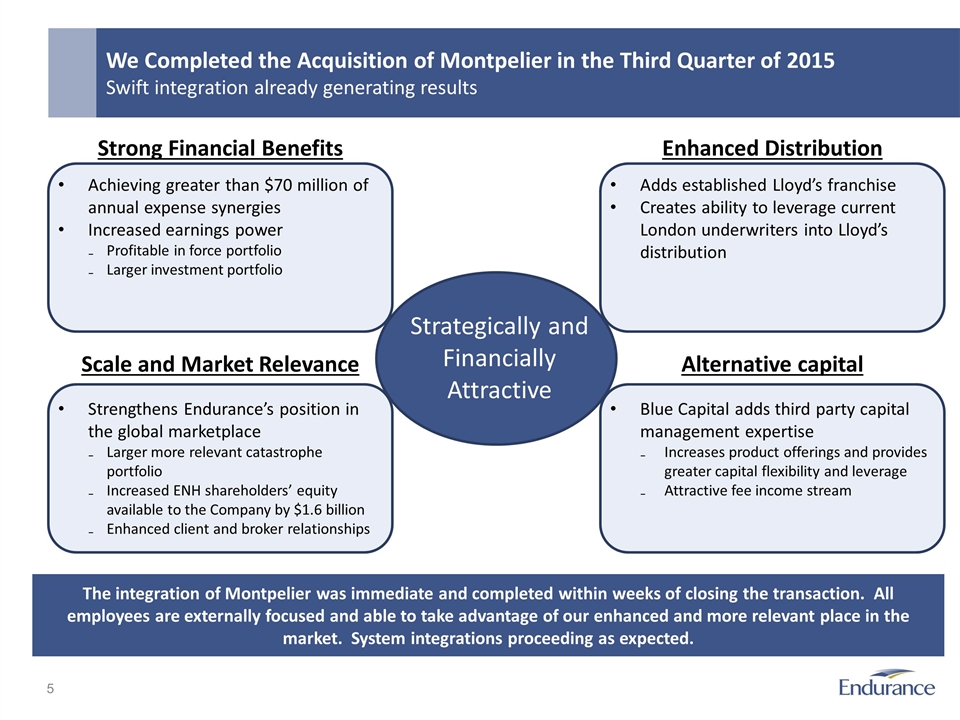

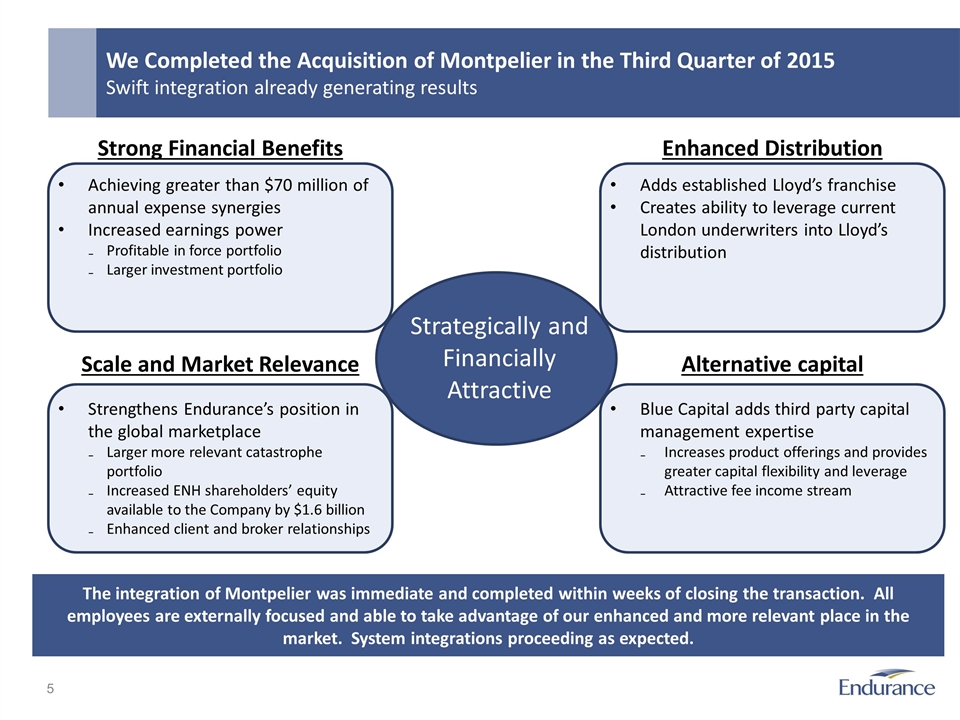

We Completed the Acquisition of Montpelier in the Third Quarter of 2015 Swift integration already generating results The integration of Montpelier was immediate and completed within weeks of closing the transaction. All employees are externally focused and able to take advantage of our enhanced and more relevant place in the market. System integrations proceeding as expected. Strategically and Financially Attractive Strong Financial Benefits Scale and Market Relevance Enhanced Distribution Alternative capital Achieving greater than $70 million of annual expense synergies Increased earnings power Profitable in force portfolio Larger investment portfolio Adds established Lloyd’s franchise Creates ability to leverage current London underwriters into Lloyd’s distribution Strengthens Endurance’s position in the global marketplace Larger more relevant catastrophe portfolio Increased ENH shareholders’ equity available to the Company by $1.6 billion Enhanced client and broker relationships Blue Capital adds third party capital management expertise Increases product offerings and provides greater capital flexibility and leverage Attractive fee income stream

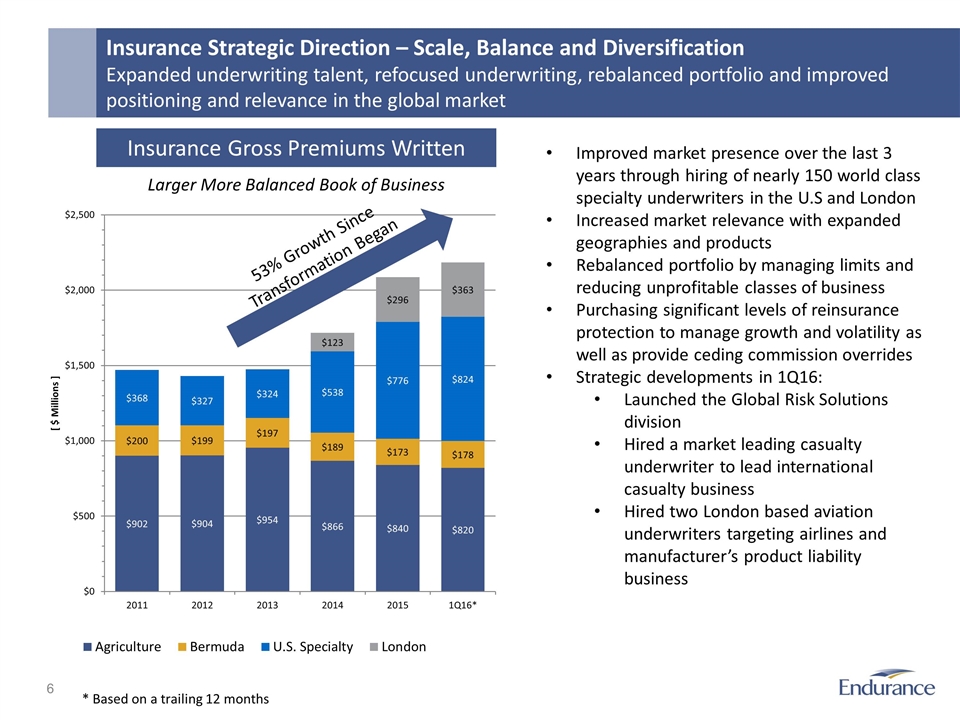

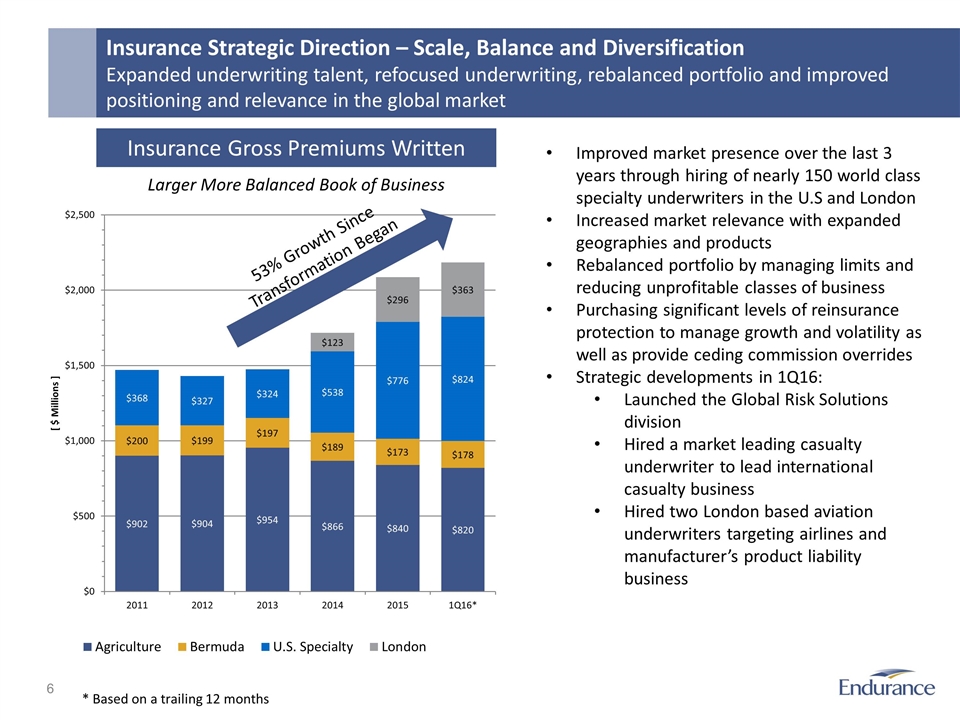

Insurance Strategic Direction – Scale, Balance and Diversification Expanded underwriting talent, refocused underwriting, rebalanced portfolio and improved positioning and relevance in the global market Insurance Gross Premiums Written Improved market presence over the last 3 years through hiring of nearly 150 world class specialty underwriters in the U.S and London Increased market relevance with expanded geographies and products Rebalanced portfolio by managing limits and reducing unprofitable classes of business Purchasing significant levels of reinsurance protection to manage growth and volatility as well as provide ceding commission overrides Strategic developments in 1Q16: Launched the Global Risk Solutions division Hired a market leading casualty underwriter to lead international casualty business Hired two London based aviation underwriters targeting airlines and manufacturer’s product liability business 53% Growth Since Transformation Began Larger More Balanced Book of Business * Based on a trailing 12 months

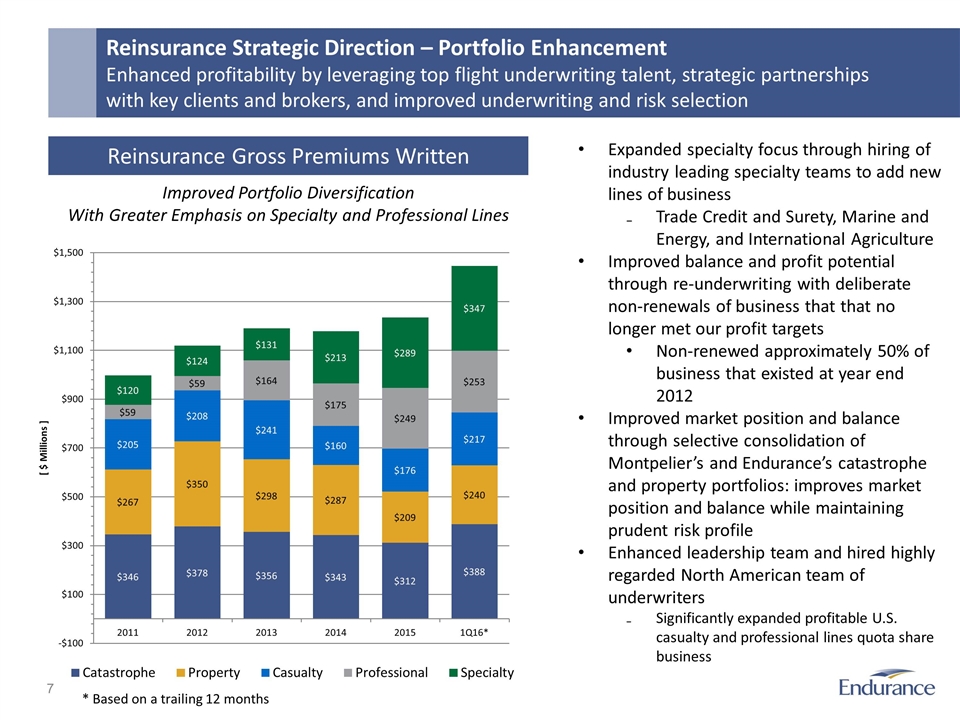

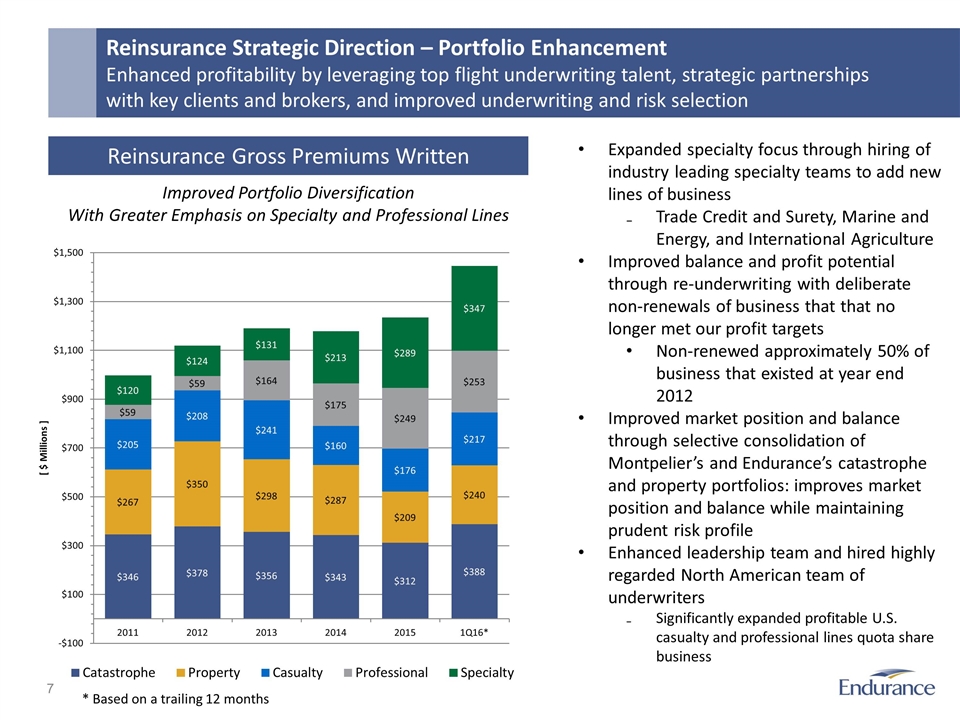

Reinsurance Strategic Direction – Portfolio Enhancement Enhanced profitability by leveraging top flight underwriting talent, strategic partnerships with key clients and brokers, and improved underwriting and risk selection Reinsurance Gross Premiums Written Expanded specialty focus through hiring of industry leading specialty teams to add new lines of business Trade Credit and Surety, Marine and Energy, and International Agriculture Improved balance and profit potential through re-underwriting with deliberate non-renewals of business that that no longer met our profit targets Non-renewed approximately 50% of business that existed at year end 2012 Improved market position and balance through selective consolidation of Montpelier’s and Endurance’s catastrophe and property portfolios: improves market position and balance while maintaining prudent risk profile Enhanced leadership team and hired highly regarded North American team of underwriters Significantly expanded profitable U.S. casualty and professional lines quota share business Improved Portfolio Diversification With Greater Emphasis on Specialty and Professional Lines * Based on a trailing 12 months

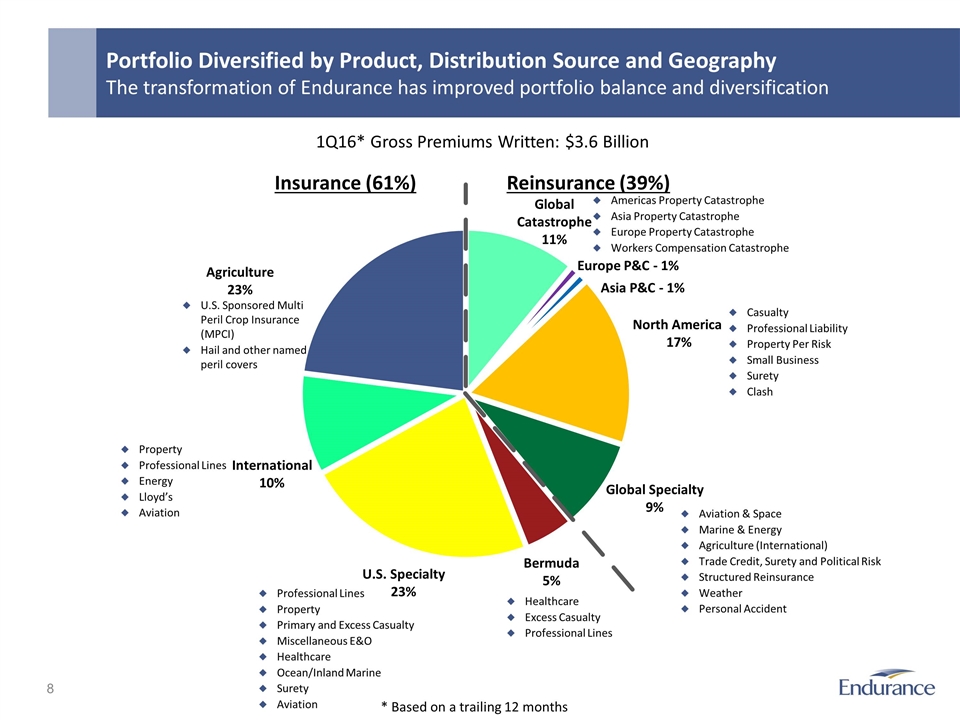

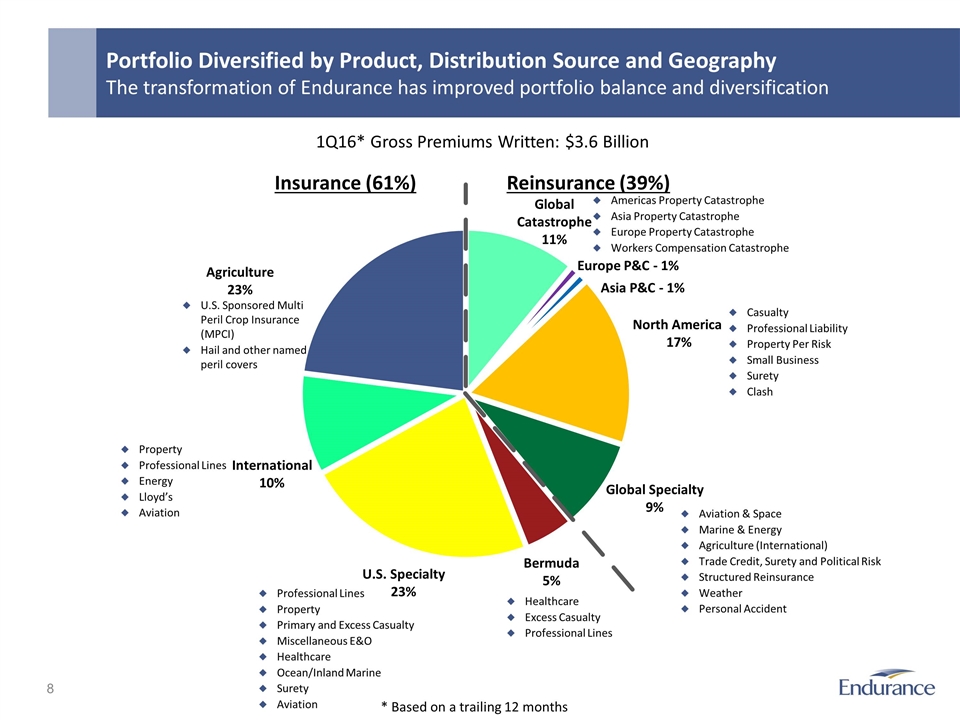

Portfolio Diversified by Product, Distribution Source and Geography The transformation of Endurance has improved portfolio balance and diversification 1Q16* Gross Premiums Written: $3.6 Billion Reinsurance (39%) Insurance (61%) Casualty Professional Liability Property Per Risk Small Business Surety Clash Americas Property Catastrophe Asia Property Catastrophe Europe Property Catastrophe Workers Compensation Catastrophe U.S. Sponsored Multi Peril Crop Insurance (MPCI) Hail and other named peril covers Professional Lines Property Primary and Excess Casualty Miscellaneous E&O Healthcare Ocean/Inland Marine Surety Aviation Healthcare Excess Casualty Professional Lines Europe P&C - 1% Bermuda 5% U.S. Specialty 23% Global Catastrophe 11% North America 17% Agriculture 23% Global Specialty 9% Aviation & Space Marine & Energy Agriculture (International) Trade Credit, Surety and Political Risk Structured Reinsurance Weather Personal Accident Asia P&C - 1% International 10% Property Professional Lines Energy Lloyd’s Aviation * Based on a trailing 12 months

Endurance’s Financial Results Diluted book value per common share has grown strongly Growth in Diluted Book Value Per Common Share ($) From March 31, 2006 – March 31, 2016

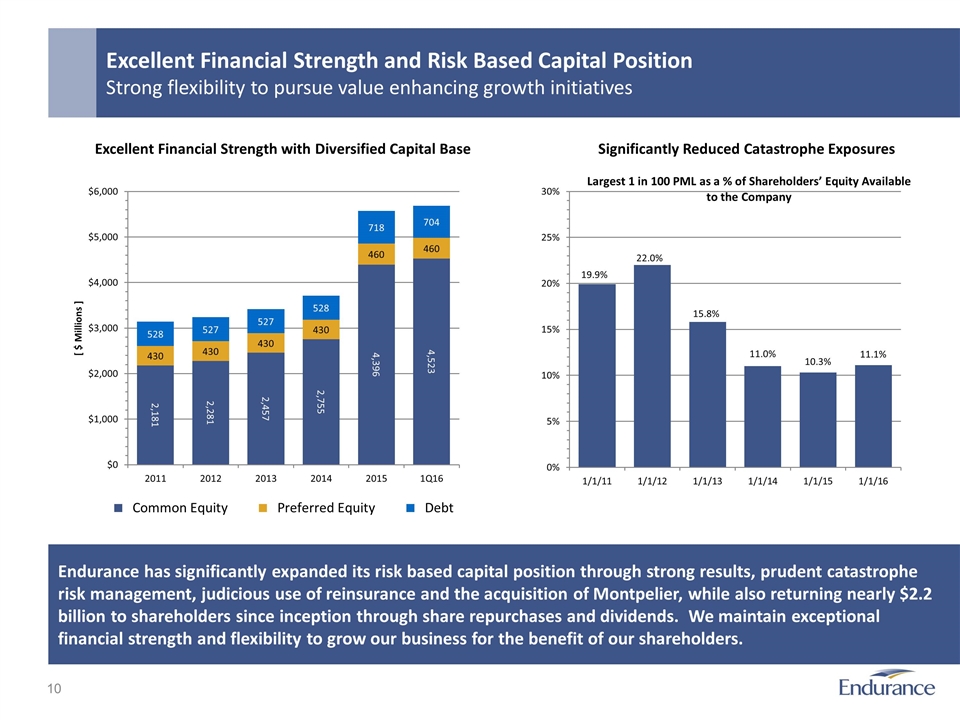

Excellent Financial Strength and Risk Based Capital Position Strong flexibility to pursue value enhancing growth initiatives Endurance has significantly expanded its risk based capital position through strong results, prudent catastrophe risk management, judicious use of reinsurance and the acquisition of Montpelier, while also returning nearly $2.2 billion to shareholders since inception through share repurchases and dividends. We maintain exceptional financial strength and flexibility to grow our business for the benefit of our shareholders. Significantly Reduced Catastrophe Exposures Excellent Financial Strength with Diversified Capital Base

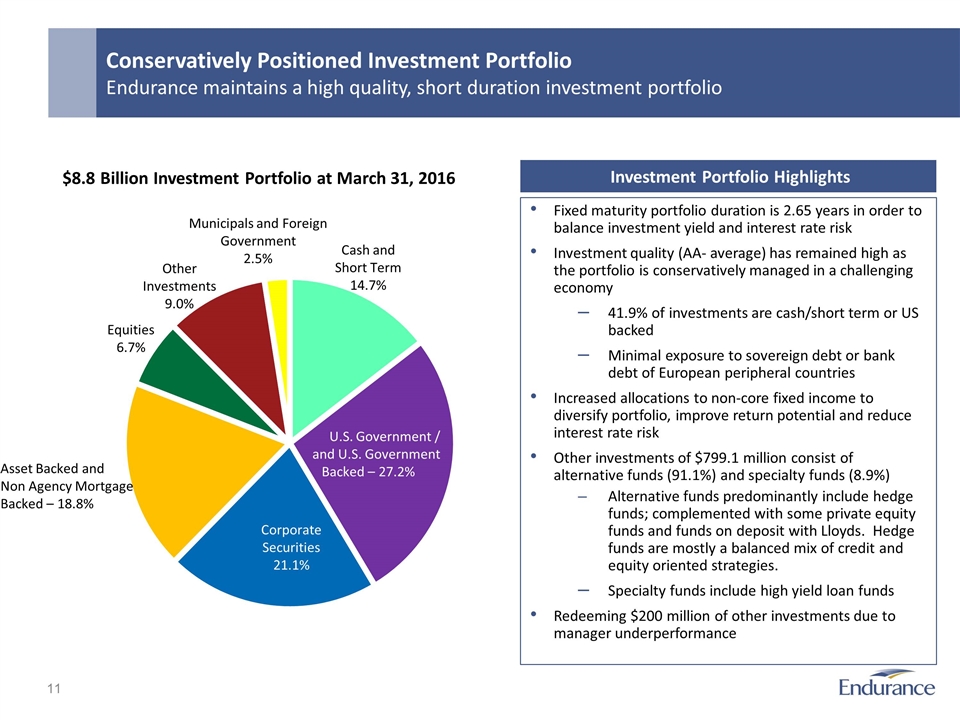

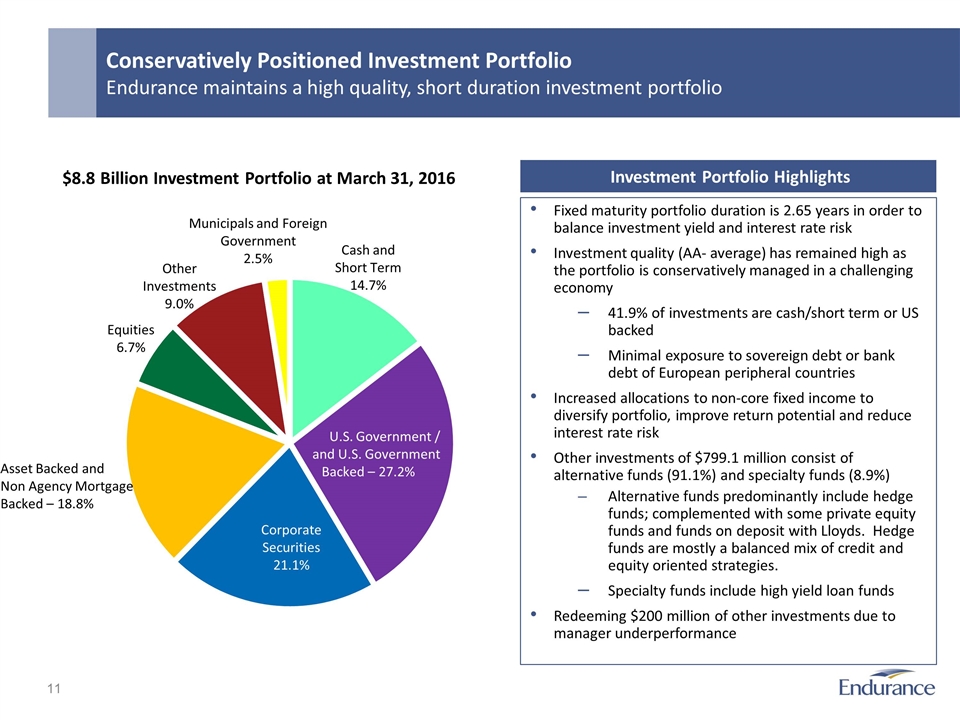

Fixed maturity portfolio duration is 2.65 years in order to balance investment yield and interest rate risk Investment quality (AA- average) has remained high as the portfolio is conservatively managed in a challenging economy 41.9% of investments are cash/short term or US backed Minimal exposure to sovereign debt or bank debt of European peripheral countries Increased allocations to non-core fixed income to diversify portfolio, improve return potential and reduce interest rate risk Other investments of $799.1 million consist of alternative funds (91.1%) and specialty funds (8.9%) Alternative funds predominantly include hedge funds; complemented with some private equity funds and funds on deposit with Lloyds. Hedge funds are mostly a balanced mix of credit and equity oriented strategies. Specialty funds include high yield loan funds Redeeming $200 million of other investments due to manager underperformance Conservatively Positioned Investment Portfolio Endurance maintains a high quality, short duration investment portfolio $8.8 Billion Investment Portfolio at March 31, 2016 Cash and Short Term 14.7% U.S. Government / and U.S. Government Backed – 27.2% Municipals and Foreign Government 2.5% Other Investments 9.0% Asset Backed and Non Agency Mortgage Backed – 18.8% Corporate Securities 21.1% Equities 6.7% Investment Portfolio Highlights

Endurance has undergone a fundamental transformation to improve profitability and enhance market relevance Since John Charman joined Endurance in 2nd Quarter 2013 as Chairman and CEO, Endurance has meaningfully expanded its global specialty insurance and reinsurance capabilities Endurance has rebalanced its insurance and reinsurance portfolios to lower volatility and improve profitability Endurance maintains excellent balance sheet strength and liquidity Capital levels meaningfully exceed rating agency minimums, providing support for growth High quality investment portfolio; fixed maturity investments have an average credit quality of AA- Prudent reserving philosophy and strong reserve position; strong, consistent history of favorable development While market conditions are increasingly competitive, the outlook for Endurance remains attractive Industry leading specialty underwriting talent driving growth and improved underwriting and risk selection; accident year net loss ratios improved in both segments during 2014 and remained relatively stable through 2015 and into 2016 Active management of exposures and reinsurance purchases has reduced expected portfolio volatility Expanded footprint of our specialty insurance and reinsurance franchise has improved our market presence and relevance Continuing to benefit from market fractures and dislocations Conclusion Endurance is a compelling investment opportunity

Appendix

Overview of ARMtech

Multi Peril Crop Insurance (MPCI) is an insurance product regulated by the USDA that provides farmers with yield or revenue protection Offered by 18 licensed companies Pricing is set by the government and agent compensation limits are also imposed - no pricing cycle exists Reduced downside risks due to Federally sponsored reinsurance and loss sharing Agriculture insurance provides strong return potential, diversification in Endurance’s portfolio of (re)insurance risks and is an efficient user of capital ARMtech is a leading specialty crop insurance business Approximate 8% market share in MPCI (with estimated 198,000 total agriculture policies in force) and is 5th largest of 18 MPCI industry participants MPCI 2016 crop year* estimated gross written premiums of $730 million and $73 million of Crop/Hail and Livestock premiums Portfolio is well diversified by geography and by crop Grown MPCI policy count by 62.8% since 2007 (year of acquisition of ARMtech by Endurance) ARMtech was founded by software developers and has maintained a strong focus on providing industry leading service through leveraging technology Overview of ARMtech ARMtech has been a strong contributor to Endurance since its acquisition * 2016 crop year is defined as July 1, 2015 through June 30, 2016

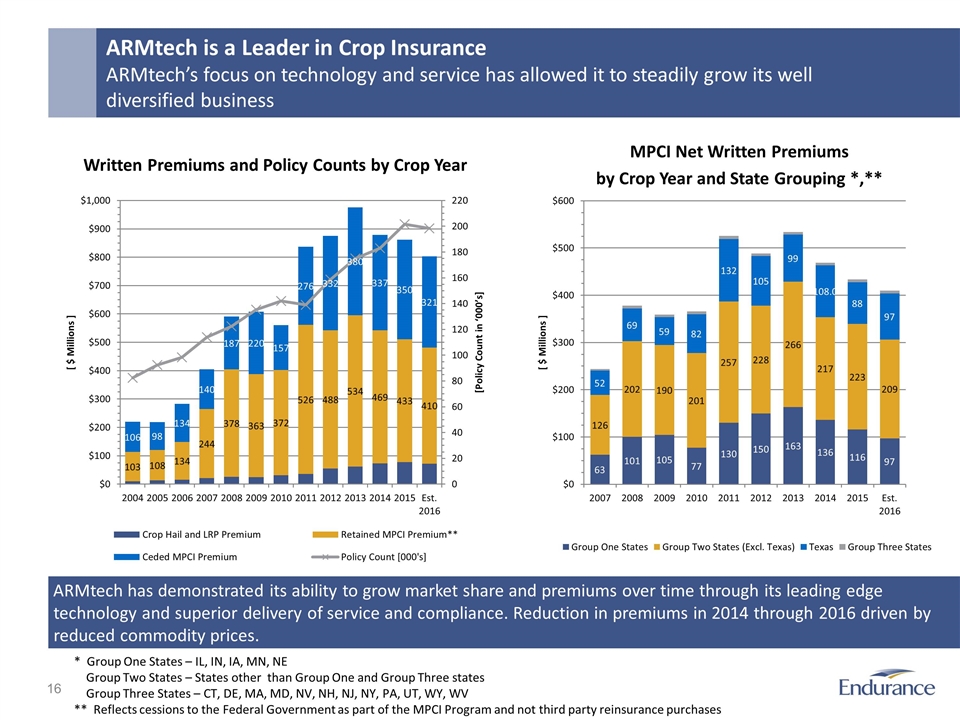

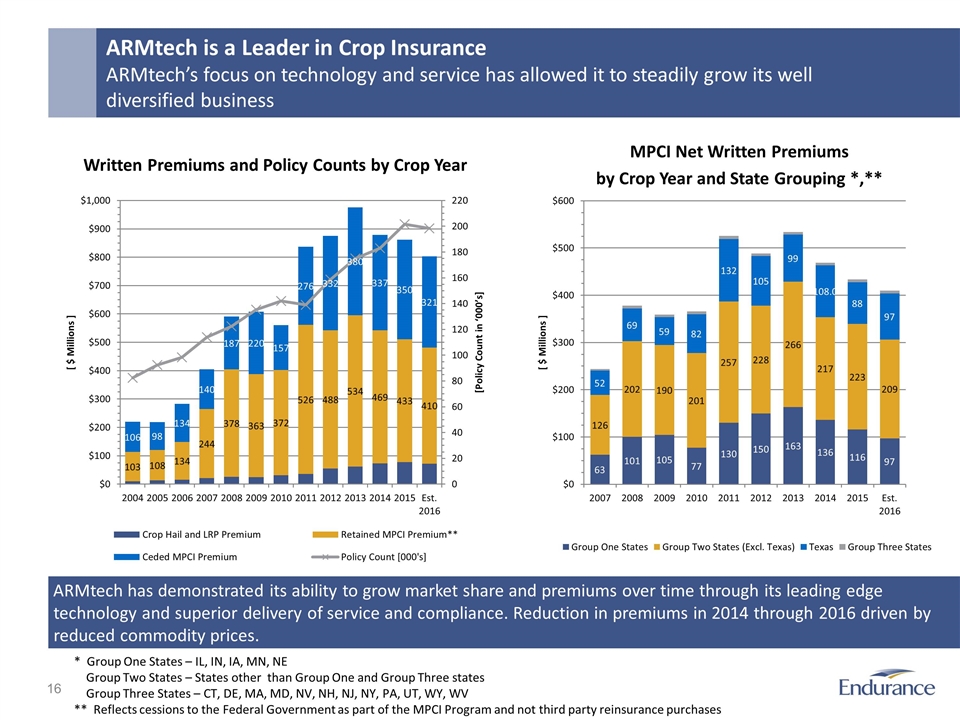

ARMtech is a Leader in Crop Insurance ARMtech’s focus on technology and service has allowed it to steadily grow its well diversified business Written Premiums and Policy Counts by Crop Year ARMtech has demonstrated its ability to grow market share and premiums over time through its leading edge technology and superior delivery of service and compliance. Reduction in premiums in 2014 through 2016 driven by reduced commodity prices. * Group One States – IL, IN, IA, MN, NE Group Two States – States other than Group One and Group Three states Group Three States – CT, DE, MA, MD, NV, NH, NJ, NY, PA, UT, WY, WV ** Reflects cessions to the Federal Government as part of the MPCI Program and not third party reinsurance purchases MPCI Net Written Premiums by Crop Year and State Grouping *,**

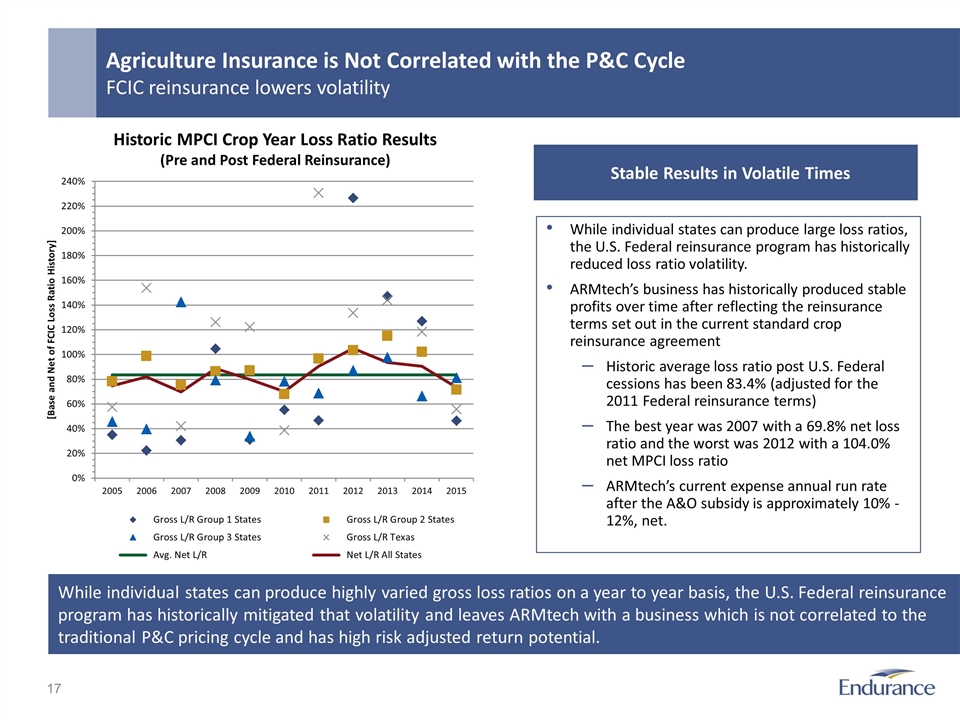

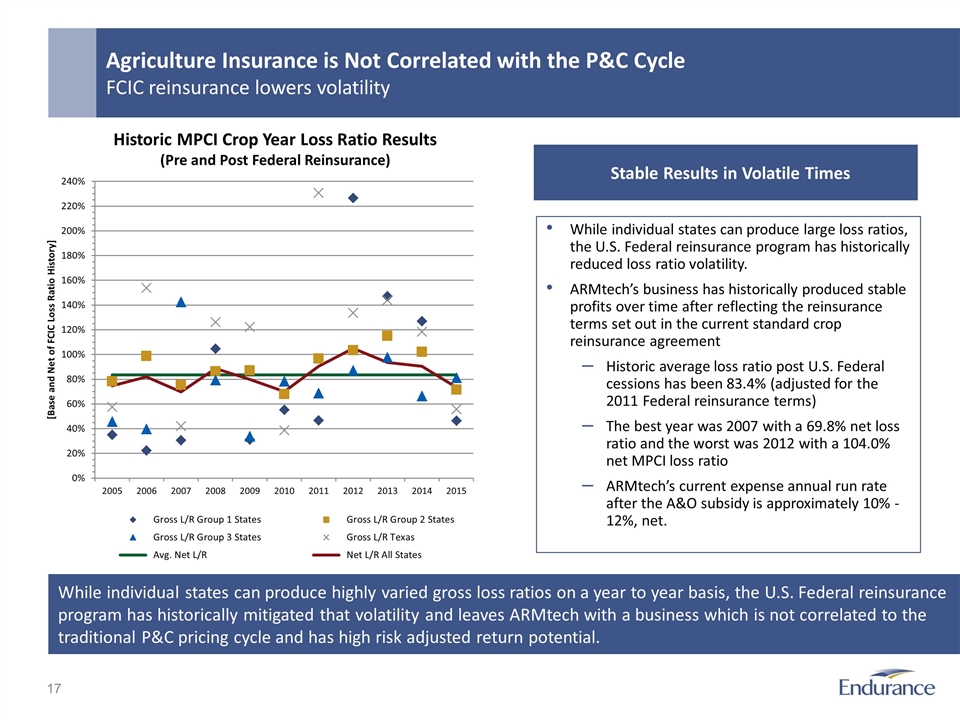

While individual states can produce large loss ratios, the U.S. Federal reinsurance program has historically reduced loss ratio volatility. ARMtech’s business has historically produced stable profits over time after reflecting the reinsurance terms set out in the current standard crop reinsurance agreement Historic average loss ratio post U.S. Federal cessions has been 83.4% (adjusted for the 2011 Federal reinsurance terms) The best year was 2007 with a 69.8% net loss ratio and the worst was 2012 with a 104.0% net MPCI loss ratio ARMtech’s current expense annual run rate after the A&O subsidy is approximately 10% - 12%, net. Agriculture Insurance is Not Correlated with the P&C Cycle FCIC reinsurance lowers volatility Stable Results in Volatile Times Historic MPCI Crop Year Loss Ratio Results (Pre and Post Federal Reinsurance) While individual states can produce highly varied gross loss ratios on a year to year basis, the U.S. Federal reinsurance program has historically mitigated that volatility and leaves ARMtech with a business which is not correlated to the traditional P&C pricing cycle and has high risk adjusted return potential.

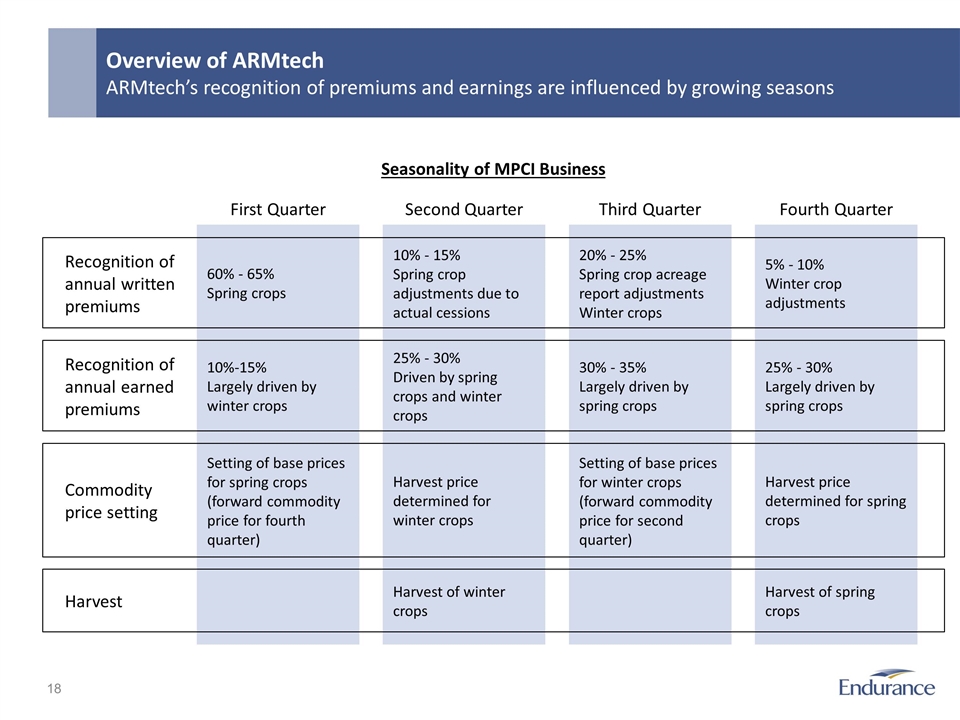

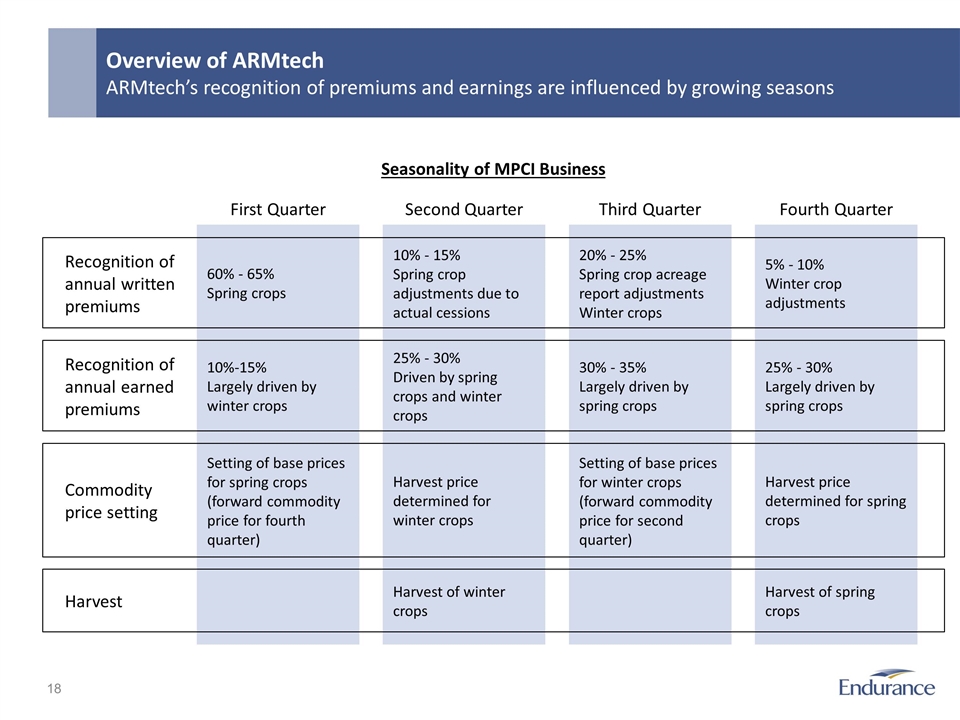

Overview of ARMtech ARMtech’s recognition of premiums and earnings are influenced by growing seasons Seasonality of MPCI Business First Quarter Third Quarter Second Quarter Recognition of annual written premiums 60% - 65% Spring crops 20% - 25% Spring crop acreage report adjustments Winter crops 10% - 15% Spring crop adjustments due to actual cessions 5% - 10% Winter crop adjustments Recognition of annual earned premiums 10%-15% Largely driven by winter crops 30% - 35% Largely driven by spring crops 25% - 30% Driven by spring crops and winter crops 25% - 30% Largely driven by spring crops Harvest Harvest of winter crops Harvest of spring crops Fourth Quarter Commodity price setting Setting of base prices for spring crops (forward commodity price for fourth quarter) Setting of base prices for winter crops (forward commodity price for second quarter) Harvest price determined for winter crops Harvest price determined for spring crops

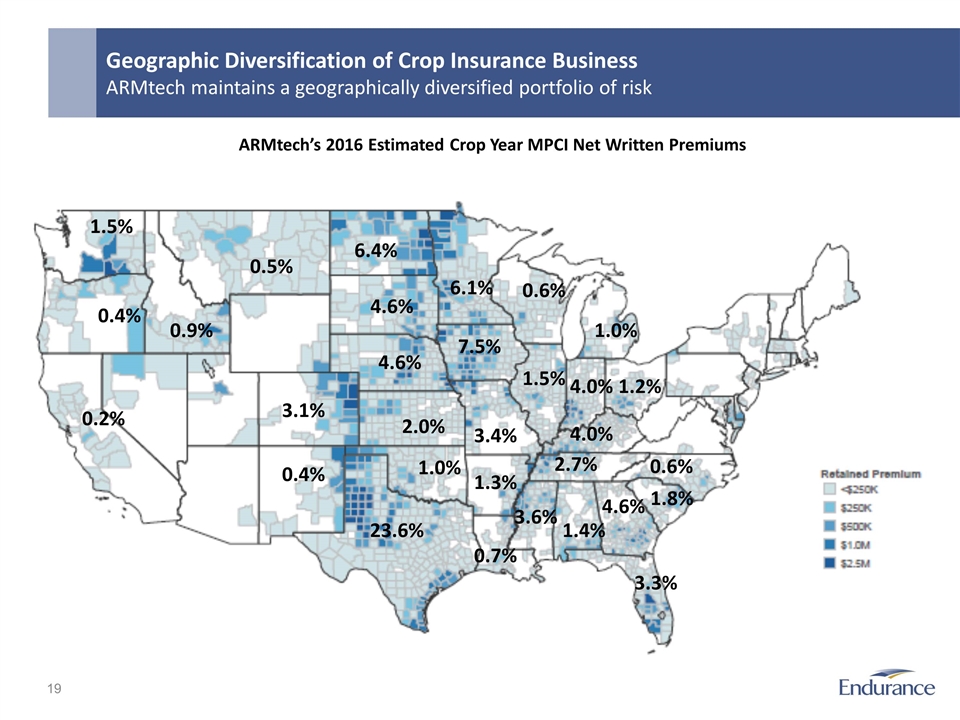

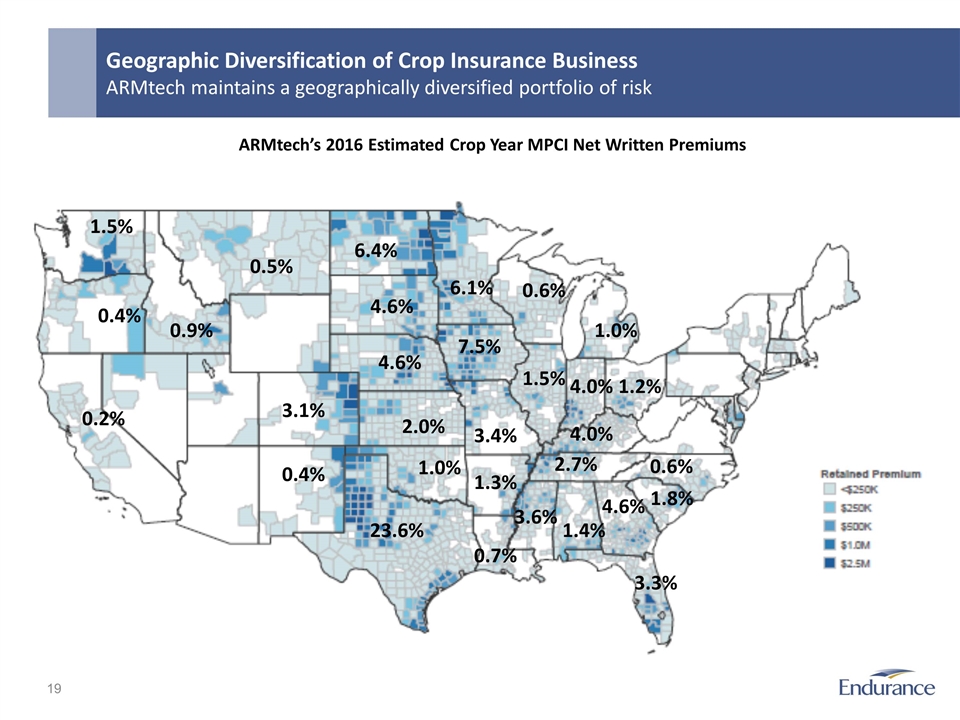

1.5% 0.2% 0.4% 0.9% 0.5% 0.4% 6.4% 4.6% 4.6% 2.0% 3.1% 23.6% 1.0% 1.3% 0.7% 3.4% 7.5% 6.1% 0.6% 1.5% 1.0% 4.0% 4.0% 1.2% 2.7% 3.6% 1.4% 4.6% 3.3% 1.8% 0.6% Geographic Diversification of Crop Insurance Business ARMtech maintains a geographically diversified portfolio of risk ARMtech’s 2016 Estimated Crop Year MPCI Net Written Premiums

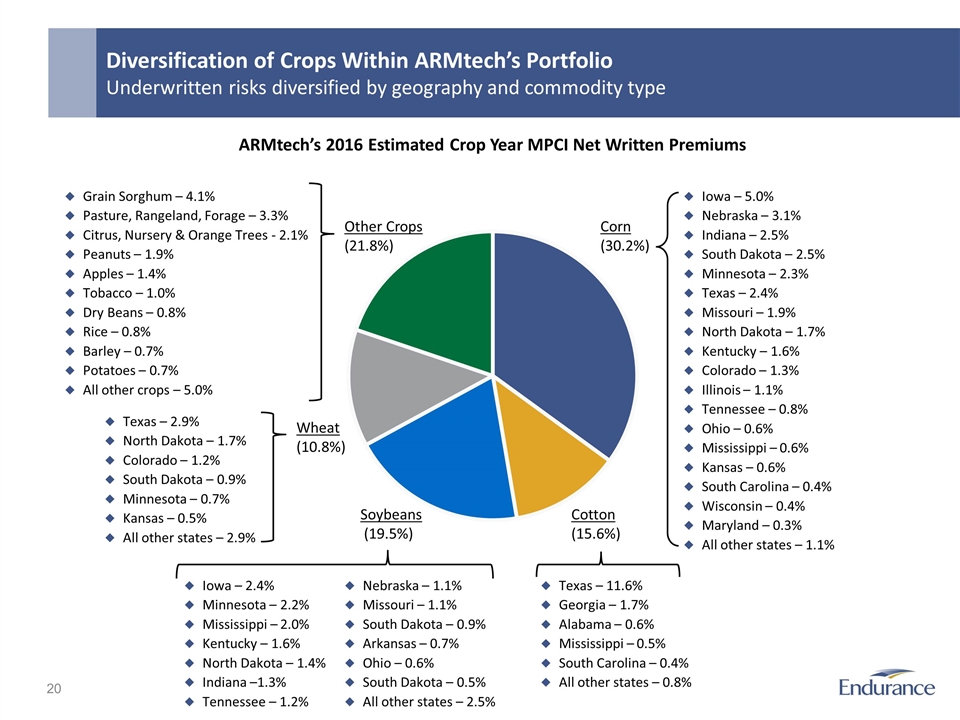

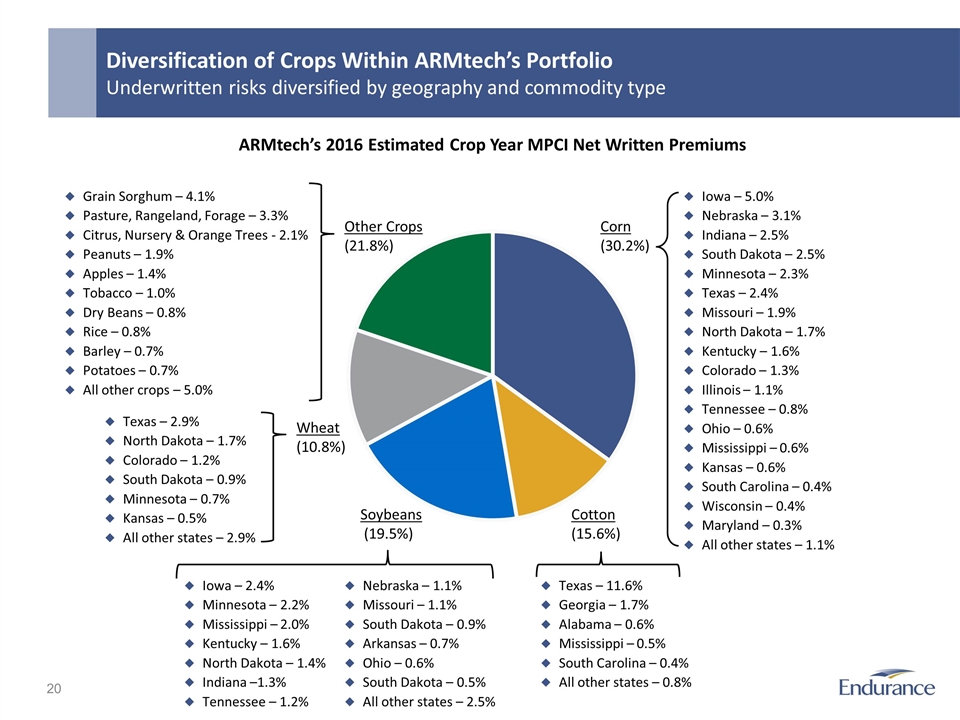

Diversification of Crops Within ARMtech’s Portfolio Underwritten risks diversified by geography and commodity type ARMtech’s 2016 Estimated Crop Year MPCI Net Written Premiums Iowa – 5.0% Nebraska – 3.1% Indiana – 2.5% South Dakota – 2.5% Minnesota – 2.3% Texas – 2.4% Missouri – 1.9% North Dakota – 1.7% Kentucky – 1.6% Colorado – 1.3% Illinois – 1.1% Tennessee – 0.8% Ohio – 0.6% Mississippi – 0.6% Kansas – 0.6% South Carolina – 0.4% Wisconsin – 0.4% Maryland – 0.3% All other states – 1.1% Corn (30.2%) Texas – 11.6% Georgia – 1.7% Alabama – 0.6% Mississippi – 0.5% South Carolina – 0.4% All other states – 0.8% Cotton (15.6%) Iowa – 2.4% Minnesota – 2.2% Mississippi – 2.0% Kentucky – 1.6% North Dakota – 1.4% Indiana –1.3% Tennessee – 1.2% Nebraska – 1.1% Missouri – 1.1% South Dakota – 0.9% Arkansas – 0.7% Ohio – 0.6% South Dakota – 0.5% All other states – 2.5% Soybeans (19.5%) Other Crops (21.8%) Wheat (10.8%) Texas – 2.9% North Dakota – 1.7% Colorado – 1.2% South Dakota – 0.9% Minnesota – 0.7% Kansas – 0.5% All other states – 2.9% Grain Sorghum – 4.1% Pasture, Rangeland, Forage – 3.3% Citrus, Nursery & Orange Trees - 2.1% Peanuts – 1.9% Apples – 1.4% Tobacco – 1.0% Dry Beans – 0.8% Rice – 0.8% Barley – 0.7% Potatoes – 0.7% All other crops – 5.0%

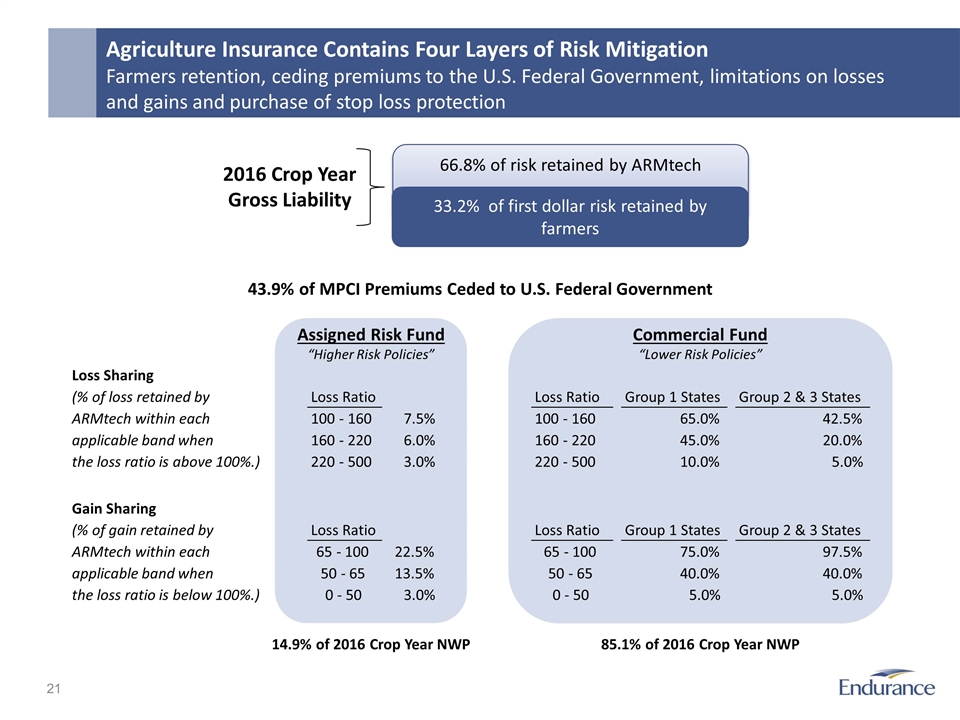

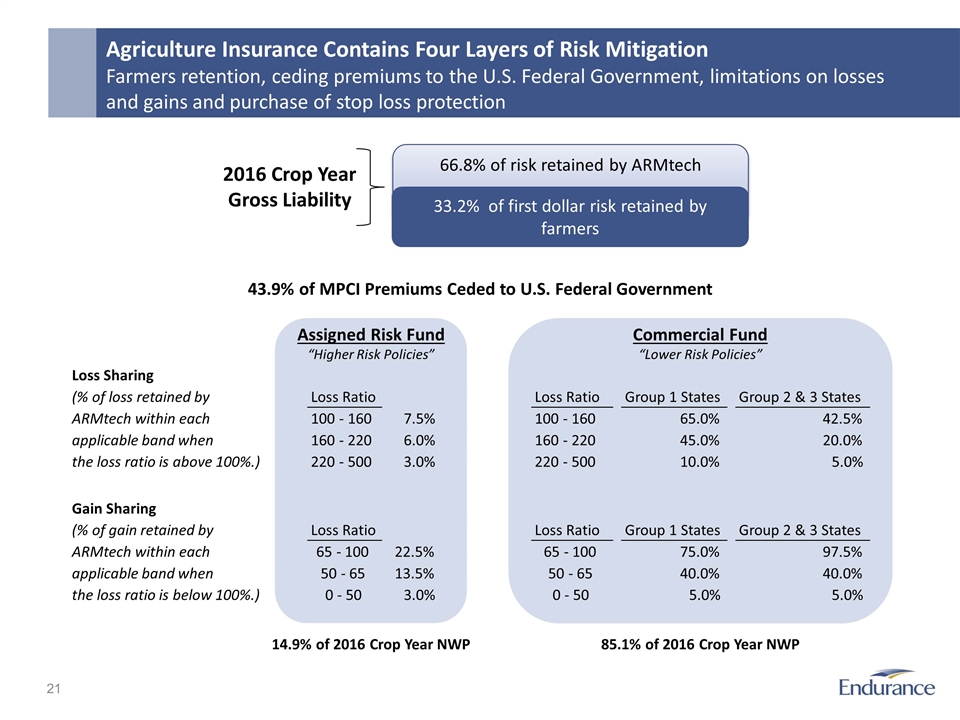

Agriculture Insurance Contains Four Layers of Risk Mitigation Farmers retention, ceding premiums to the U.S. Federal Government, limitations on losses and gains and purchase of stop loss protection 43.9% of MPCI Premiums Ceded to U.S. Federal Government Assigned Risk Fund “Higher Risk Policies” Commercial Fund “Lower Risk Policies” 2016 Crop Year Gross Liability 66.8% of risk retained by ARMtech 33.2% of first dollar risk retained by farmers 14.9% of 2016 Crop Year NWP 85.1% of 2016 Crop Year NWP Loss Sharing (% of loss retained by Loss Ratio Loss Ratio Group 1 States Group 2 & 3 States ARMtech within each 100 - 160 7.5% 100 - 160 65.0% 42.5% applicable band when 160 - 220 6.0% 160 - 220 45.0% 20.0% the loss ratio is above 100%.) 220 - 500 3.0% 220 - 500 10.0% 5.0% Gain Sharing (% of gain retained by Loss Ratio Loss Ratio Group 1 States Group 2 & 3 States ARMtech within each 65 - 100 22.5% 65 - 100 75.0% 97.5% applicable band when 50 - 65 13.5% 50 - 65 40.0% 40.0% the loss ratio is below 100%.) 0 - 50 3.0% 0 - 50 5.0% 5.0%

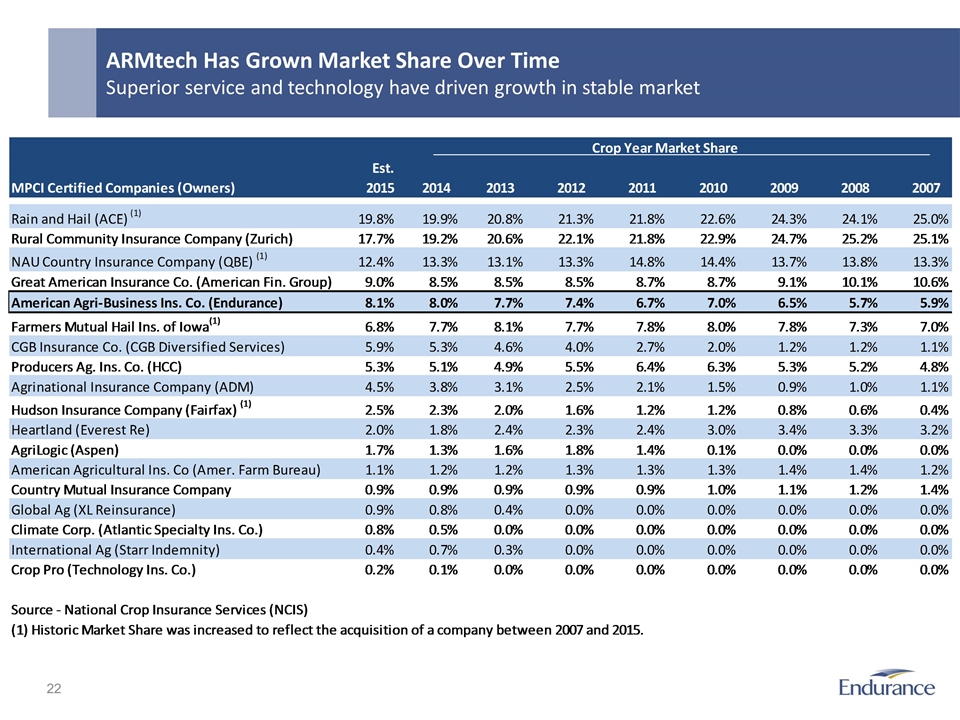

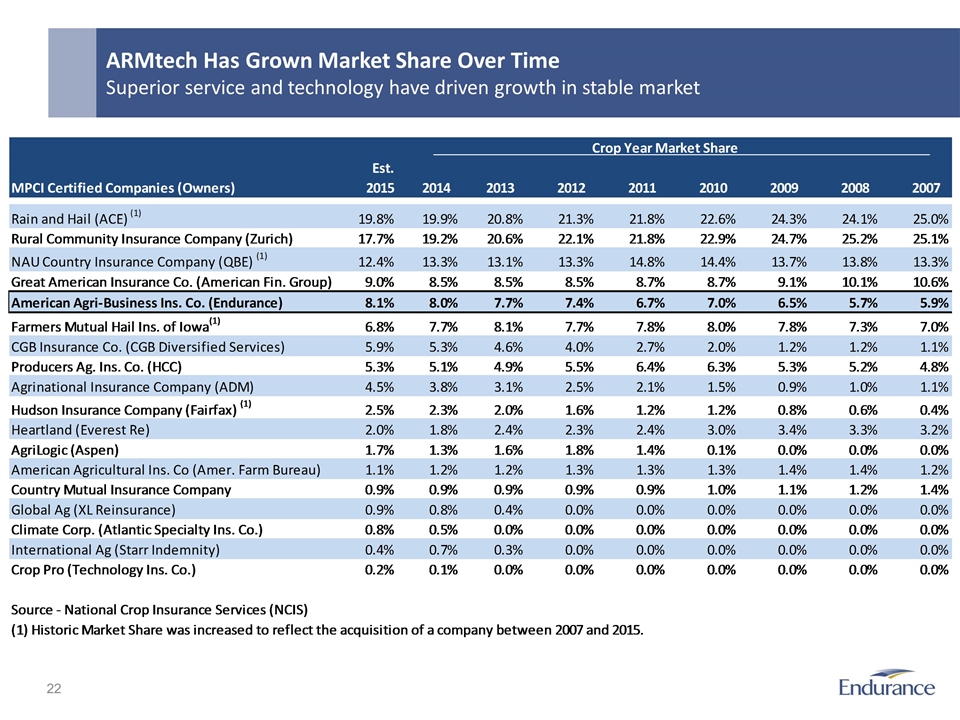

ARMtech Has Grown Market Share Over Time Superior service and technology have driven growth in stable market

Other Miscellaneous Information

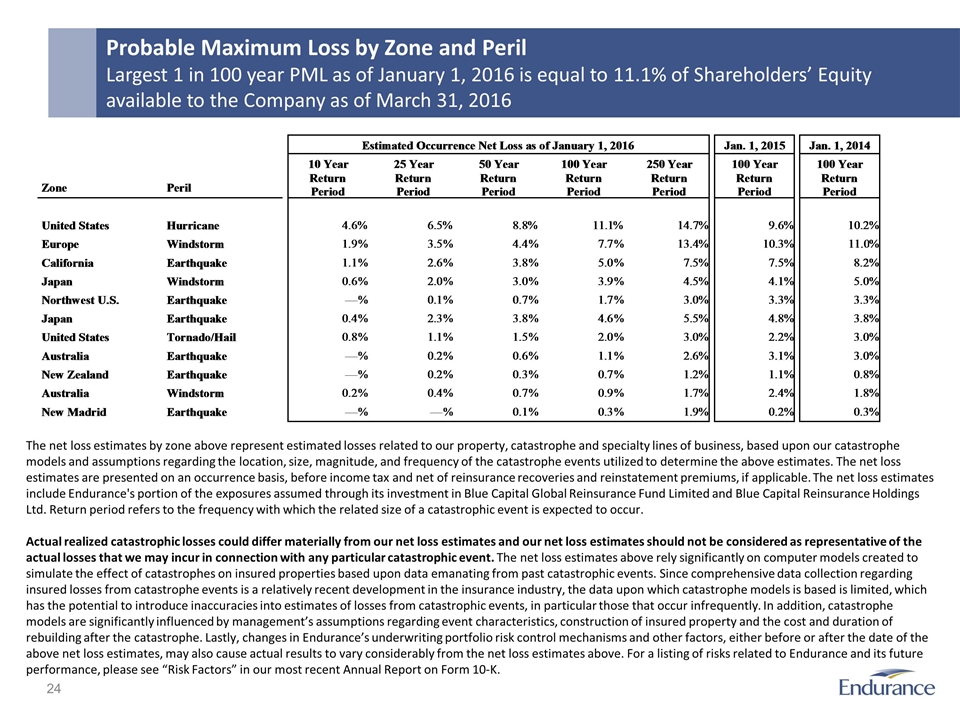

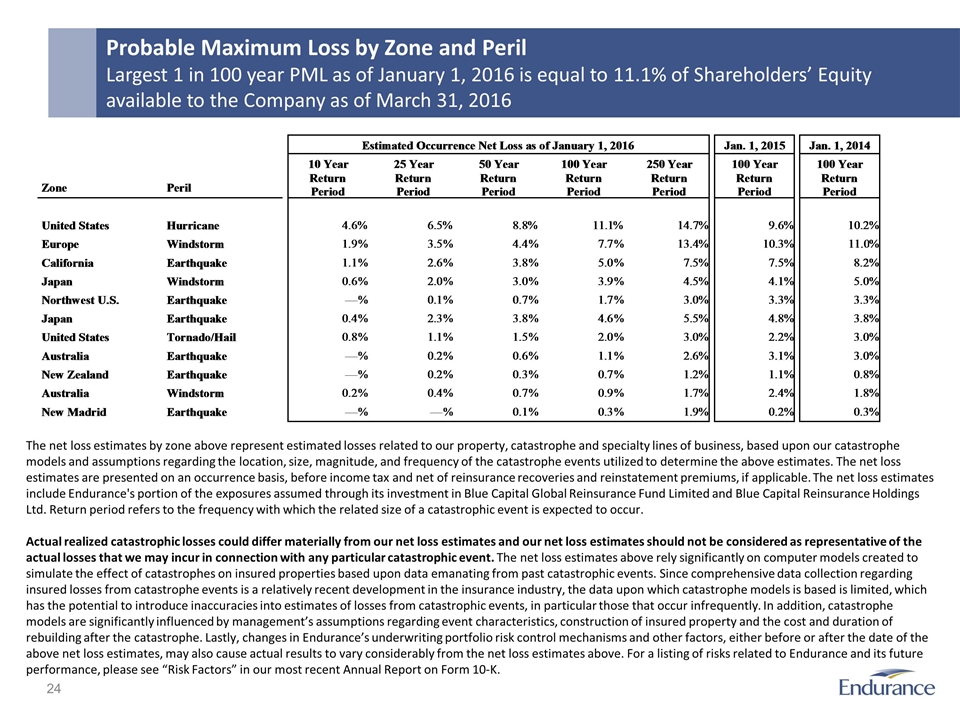

Probable Maximum Loss by Zone and Peril Largest 1 in 100 year PML as of January 1, 2016 is equal to 11.1% of Shareholders’ Equity available to the Company as of March 31, 2016 The net loss estimates by zone above represent estimated losses related to our property, catastrophe and specialty lines of business, based upon our catastrophe models and assumptions regarding the location, size, magnitude, and frequency of the catastrophe events utilized to determine the above estimates. The net loss estimates are presented on an occurrence basis, before income tax and net of reinsurance recoveries and reinstatement premiums, if applicable. The net loss estimates include Endurance's portion of the exposures assumed through its investment in Blue Capital Global Reinsurance Fund Limited and Blue Capital Reinsurance Holdings Ltd. Return period refers to the frequency with which the related size of a catastrophic event is expected to occur. Actual realized catastrophic losses could differ materially from our net loss estimates and our net loss estimates should not be considered as representative of the actual losses that we may incur in connection with any particular catastrophic event. The net loss estimates above rely significantly on computer models created to simulate the effect of catastrophes on insured properties based upon data emanating from past catastrophic events. Since comprehensive data collection regarding insured losses from catastrophe events is a relatively recent development in the insurance industry, the data upon which catastrophe models is based is limited, which has the potential to introduce inaccuracies into estimates of losses from catastrophic events, in particular those that occur infrequently. In addition, catastrophe models are significantly influenced by management’s assumptions regarding event characteristics, construction of insured property and the cost and duration of rebuilding after the catastrophe. Lastly, changes in Endurance’s underwriting portfolio risk control mechanisms and other factors, either before or after the date of the above net loss estimates, may also cause actual results to vary considerably from the net loss estimates above. For a listing of risks related to Endurance and its future performance, please see “Risk Factors” in our most recent Annual Report on Form 10-K.

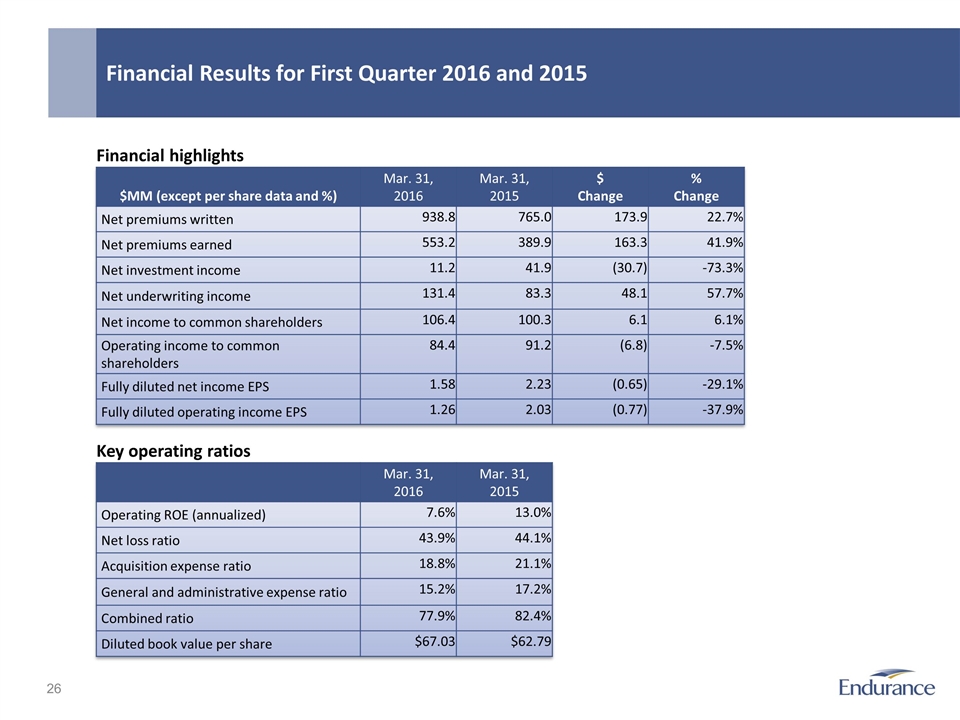

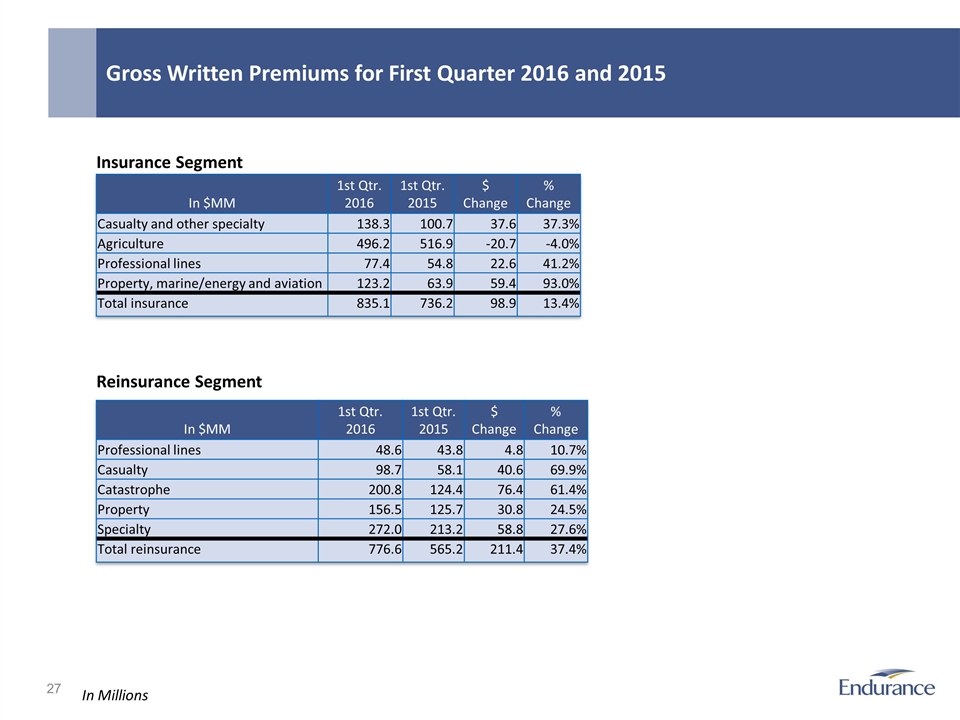

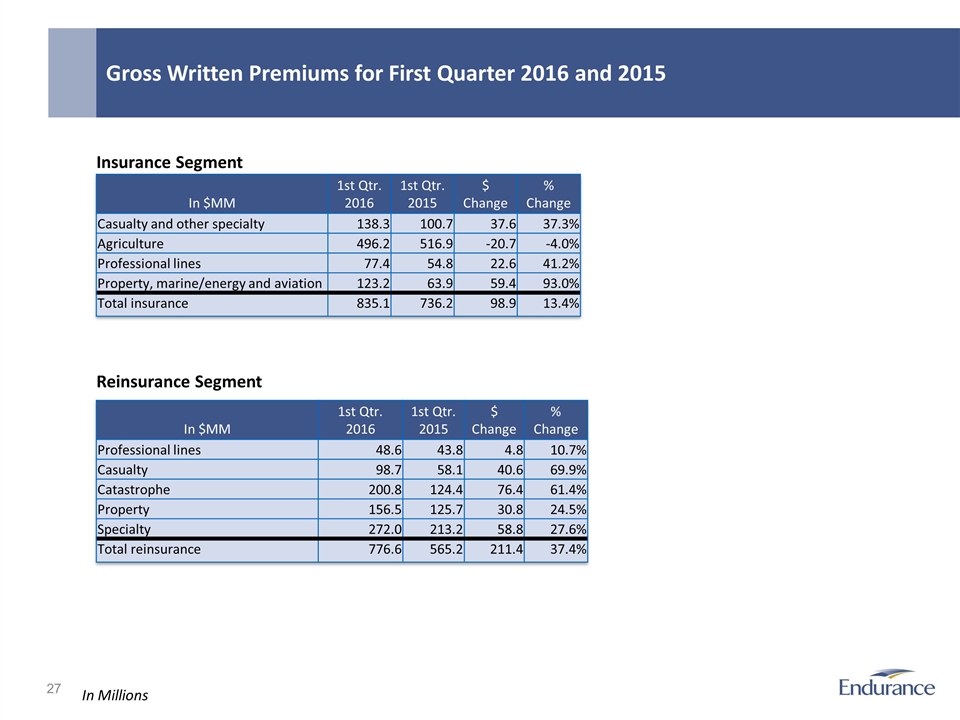

Diluted book value per common share, adjusted for dividends, grew 2.9% during first quarter 2016 Net income attributable to common shareholders of $106.4 million Improved underwriting results which included a combined ratio of 77.9% Light catastrophe activity Continued favorable reserve development Lower net investment income due to Other Investment mark to market adjustments Gross written premiums of $1.6 billion were 23.8% higher than first quarter 2015 Insurance gross written premiums of $835.1 million were 13.4% higher than first quarter 2015 Strong growth in our U.S. specialty and London operations paired with premiums written by acquired Lloyd’s operation was partially offset by reduced agriculture insurance premiums driven by lower commodity prices. Reinsurance gross written premiums of $776.6 million increased 37.4% compared to first quarter 2015 Growth across all lines of business with property and catastrophe premiums expanding due to the addition of Montpelier Net written premiums increased 22.7% compared to first quarter 2015, similar to the growth in gross premiums First Quarter 2016 Highlights Results were driven by strong underwriting margins supported by light catastrophe losses and favorable development

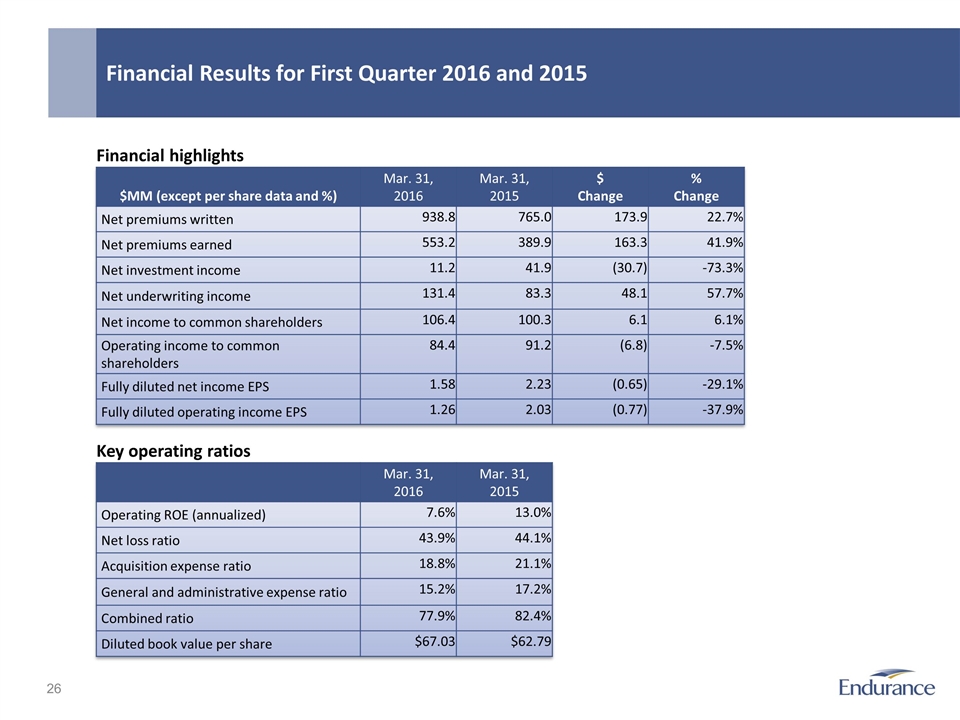

Financial Results for First Quarter 2016 and 2015 $MM (except per share data and %) Mar. 31, 2016 Mar. 31, 2015 $ Change % Change Net premiums written 938.8 765.0 173.9 22.7% Net premiums earned 553.2 389.9 163.3 41.9% Net investment income 11.2 41.9 (30.7) -73.3% Net underwriting income 131.4 83.3 48.1 57.7% Net income to common shareholders 106.4 100.3 6.1 6.1% Operating income to common shareholders 84.4 91.2 (6.8) -7.5% Fully diluted net income EPS 1.58 2.23 (0.65) -29.1% Fully diluted operating income EPS 1.26 2.03 (0.77) -37.9% Financial highlights Mar. 31, 2016 Mar. 31, 2015 Operating ROE (annualized) 7.6% 13.0% Net loss ratio 43.9% 44.1% Acquisition expense ratio 18.8% 21.1% General and administrative expense ratio 15.2% 17.2% Combined ratio 77.9% 82.4% Diluted book value per share $67.03 $62.79 Key operating ratios

Gross Written Premiums for First Quarter 2016 and 2015 In $MM 1st Qtr. 2016 1st Qtr. 2015 $ Change % Change Casualty and other specialty 138.3 100.7 37.6 37.3% Agriculture 496.2 516.9 -20.7 -4.0% Professional lines 77.4 54.8 22.6 41.2% Property, marine/energy and aviation 123.2 63.9 59.4 93.0% Total insurance 835.1 736.2 98.9 13.4% Insurance Segment Reinsurance Segment In $MM 1st Qtr. 2016 1st Qtr. 2015 $ Change % Change Professional lines 48.6 43.8 4.8 10.7% Casualty 98.7 58.1 40.6 69.9% Catastrophe 200.8 124.4 76.4 61.4% Property 156.5 125.7 30.8 24.5% Specialty 272.0 213.2 58.8 27.6% Total reinsurance 776.6 565.2 211.4 37.4% In Millions

Financial Overview: Inception to Date Financial Performance In $MM 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1Q16 Inception to date Gross prems written 799 1,602 1,711 1,669 1,790 1,781 2,246 2,021 2,053 2,467 2,549 2,665 2,894 3,321 1,612 31,180 Net prems written 765 1,598 1,697 1,619 1,586 1,575 1,784 1,606 1,764 1,980 2,029 2,049 1,934 1,950 939 24,875 Net prems earned 369 1,174 1,633 1,724 1,639 1,595 1,766 1,633 1,741 1,931 2,014 2,016 1,864 1,978 553 23,630 Net underwriting income (loss) 51 179 232 -410 304 322 111 265 195 -252 -48 195 255 450 131 1,980 Net investment income 43 71 122 180 257 281 130 284 200 147 173 166 132 114 11 2,311 Net income (loss) before preferred dividend 102 263 356 -220 498 521 100 555 365 -94 163 312 348 344 116 3,729 Net income (loss) available to common shareholders 102 263 356 -223 483 506 85 539 349 -118 130 279 316 311 106 3,484 Diluted EPS $1.73 $4.00 $5.28 ($3.60) $6.73 $7.17 $1.33 $9.00 $6.38 ($2.95) $3.00 $6.37 $7.06 $5.73 $57.23 Financial highlights from 2002 through March 31, 2016 Key Operating Ratios 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1Q16 Inception to date Combined ratio 86.2% 84.7% 85.8% 123.5% 81.5% 79.9% 93.5% 84.0% 88.7% 112.9% 102.3% 90.2% 86.0% 82.9% 77.9% 93.3% Operating ROE 7.8% 17.3% 19.9% (11.9%) 25.7% 23.8% 8.5% 22.0% 12.6% (6.3%) 2.4% 11.9% 12.3%* 12.0%** 7.6% 10.7% Book value per share $21.73 $24.03 $27.91 $23.17 $28.87 $35.05 $33.06 $44.61 $52.74 $50.56 $52.88 $55.18 $61.33 $65.48 $67.03 * Excludes $20.3 million of expenses related to the proposed acquisition of Aspen ** Excludes $76.6 million of one-time expenses related to the acquisition of Montpelier