© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . Joe Zubretsky President & Chief Executive Officer January 8, 2018 San Francisco, California J.P. Morgan Healthcare Conference The Plan: Margin Recovery and Sustainability

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 2 Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This slide presentation and our accompanying oral remarks contain “forward-looking statements” regarding, without limitation, our numerous margin and performance improvement efforts, our repositioning of revenue, re-procurements, our capital position and balance sheet, and various other matters. All of our forward-looking statements are subject to numerous risks, uncertainties, and other factors that could cause our actual results to differ materially. Anyone viewing or listening to this presentation is urged to read the risk factors and cautionary statements found under Item 1A in our annual report on Form 10-K, as well as the risk factors and cautionary statements in our quarterly reports and in our other reports and filings with the Securities and Exchange Commission and available for viewing on its website at sec.gov. Except to the extent otherwise required by federal securities laws, we do not undertake to address or update forward-looking statements in future filings or communications regarding our business or operating results. Cautionary statement

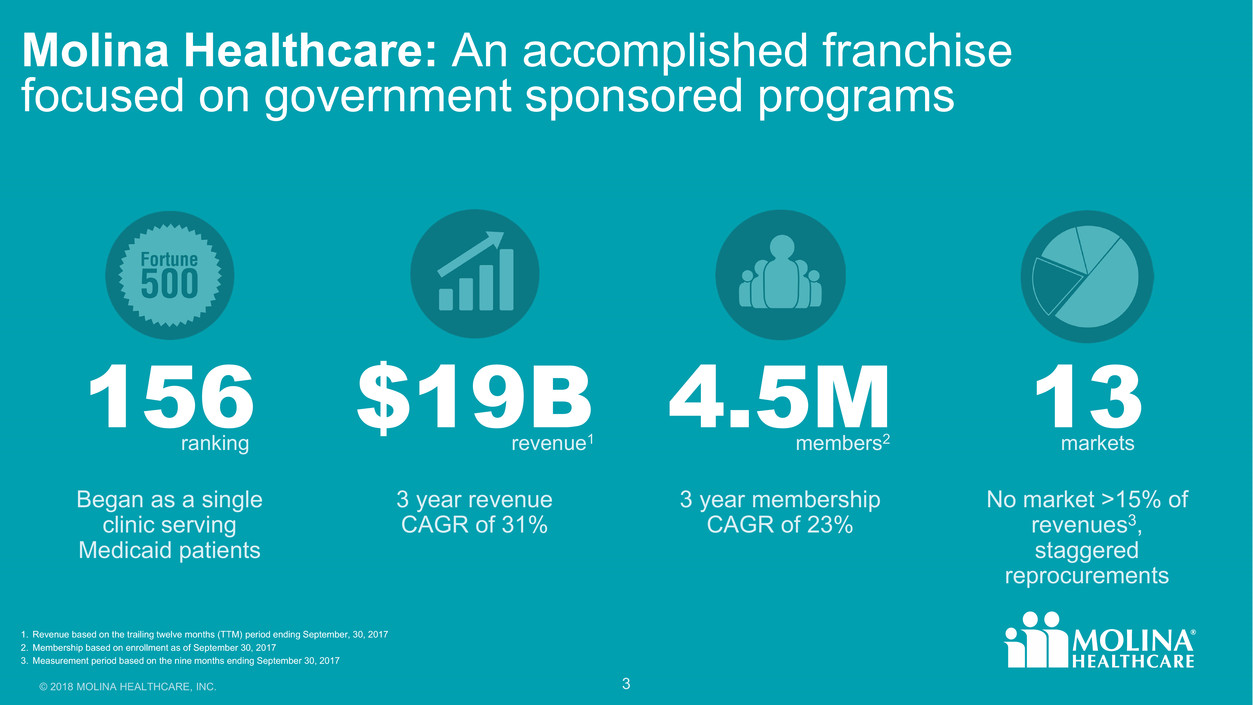

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 3 Molina Healthcare: An accomplished franchise focused on government sponsored programs 1. Revenue based on the trailing twelve months (TTM) period ending September, 30, 2017 2. Membership based on enrollment as of September 30, 2017 3. Measurement period based on the nine months ending September 30, 2017 $19B 4.5M 13 revenue1 members2 markets 156 ranking 3 year revenue CAGR of 31% 3 year membership CAGR of 23% No market >15% of revenues3, staggered reprocurements Began as a single clinic serving Medicaid patients

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 4 …but shareholder returns have been unsatisfactory Operational infrastructure and effectiveness Lack of execution on managed care fundamentals Profit drag of new growth areas including the Marketplace Challenges managing high acuity populations Capital management was not a focus ....and as a result Margins are below peers and earnings are volatile

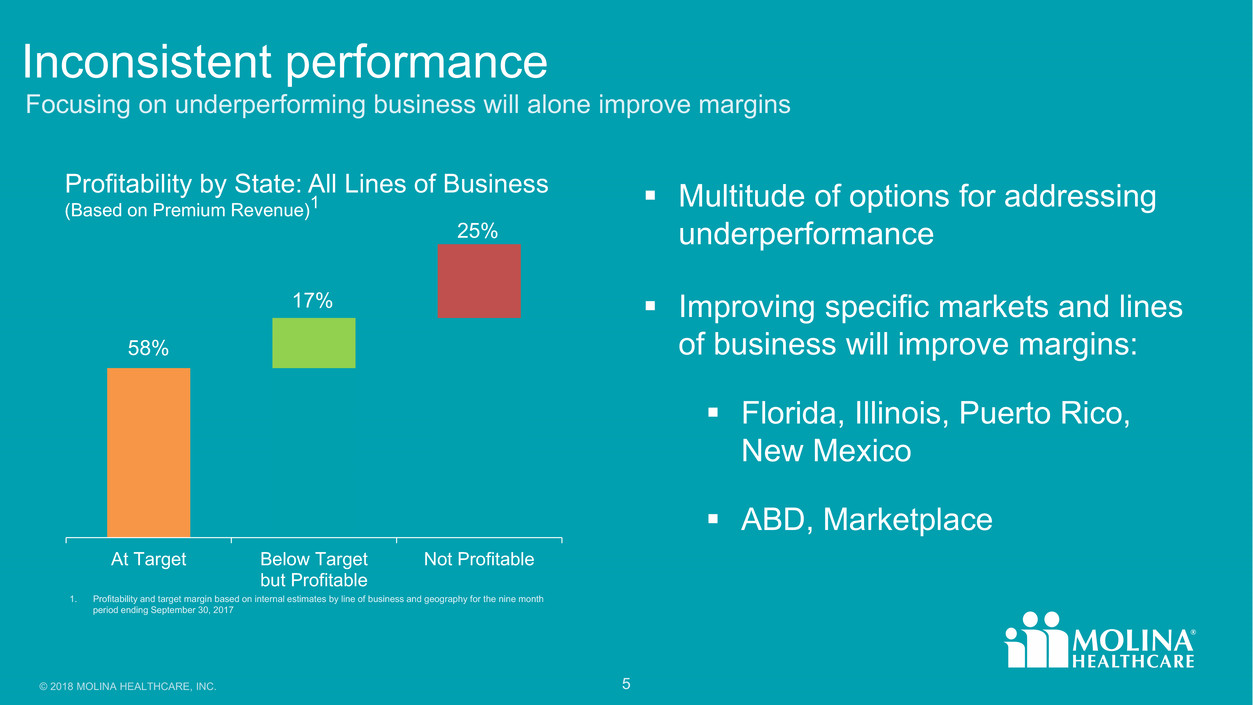

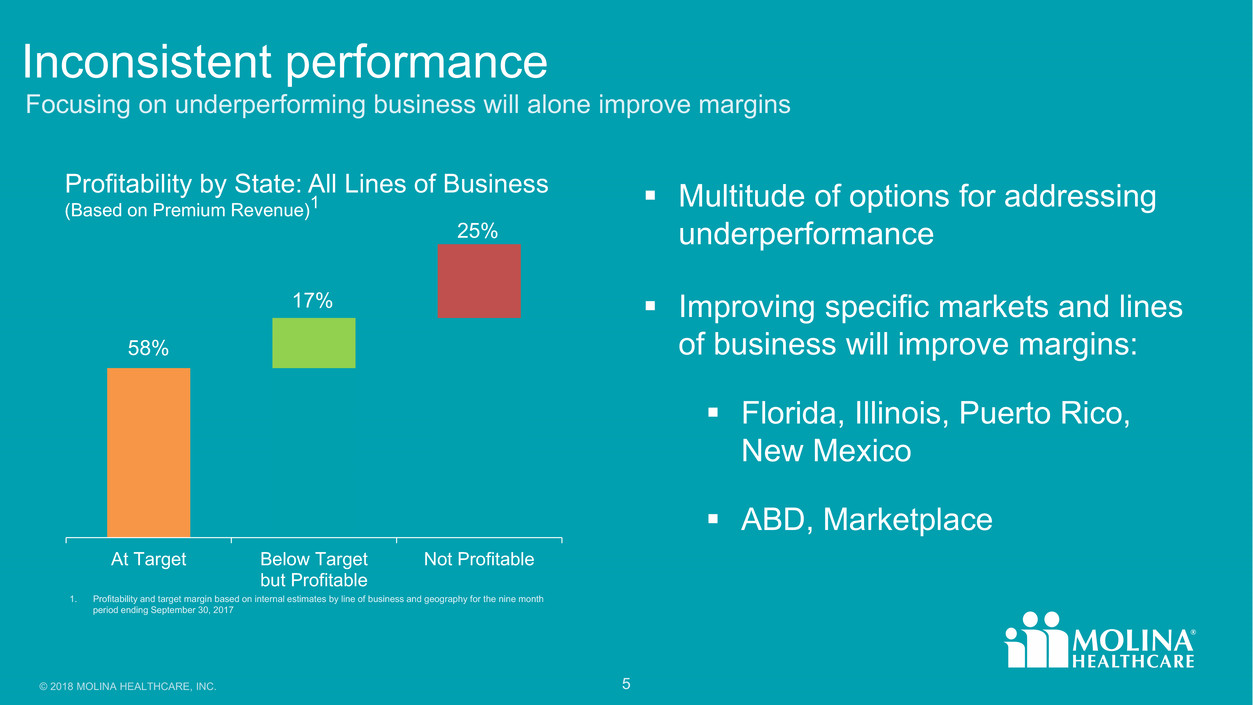

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 5 Inconsistent performance Focusing on underperforming business will alone improve margins 1. Profitability and target margin based on internal estimates by line of business and geography for the nine month period ending September 30, 2017 58% 17% 25% At Target Below Target but Profitable Not Profitable Profitability by State: All Lines of Business (Based on Premium Revenue)1 Multitude of options for addressing underperformance Improving specific markets and lines of business will improve margins: Florida, Illinois, Puerto Rico, New Mexico ABD, Marketplace

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 6 Building a plan to improve and sustain profitability What gives us the confidence that we can succeed? Based on publically available financial filings 0.0% 1.0% 2.0% 2013 2014 2015 2016 Molina Peer 1 Peer 2 After-Tax Margins MOH vs Peers Peers are profitable and growing Our portfolio is similar to our peers, same products, same geographies; different mix Molina will reestablish margins and reduce volatility before participating in growth opportunities

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 7 Molina’s Margin Recovery and Sustainability Plan: 2 3 1 Restore margins through operational improvements and managed care fundamentals Optimize revenue base for profitability and future revenue growth Enhance balance sheet and capital management discipline Goal: sustainable 1.5% - 2.0% after-tax margin in line with peers

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 8 Molina’s Margin Recovery and Sustainability Plan: 2 3 1 Restore margins through operational improvements and managed care fundamentals Optimize revenue base for profitability and future revenue growth Enhance balance sheet and capital management discipline Goal: sustainable 1.5% - 2.0% after-tax margin in line with peers

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 9 Margin recovery and sustainability Significant cost rationalization commenced and will continue: Organizational spans of control and management layers Implement salary bands and job families Eliminate or combine under-scaled operations Implement rigid productivity standards Realign field structure Open up inflight procurement contracts to reduce unit costs SG&A Network Utilization and Care Management At-Risk Revenue Risk Adjusters Claims Excellence IT and Information Management

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 10 Margin recovery and sustainability Reconfiguring the organization Reduced headcount by approximately 1,750 employees or 12% of the total workforce Reduced the number of management layers across the organization from 12 to 8 Increased average span of control from 6 to 7

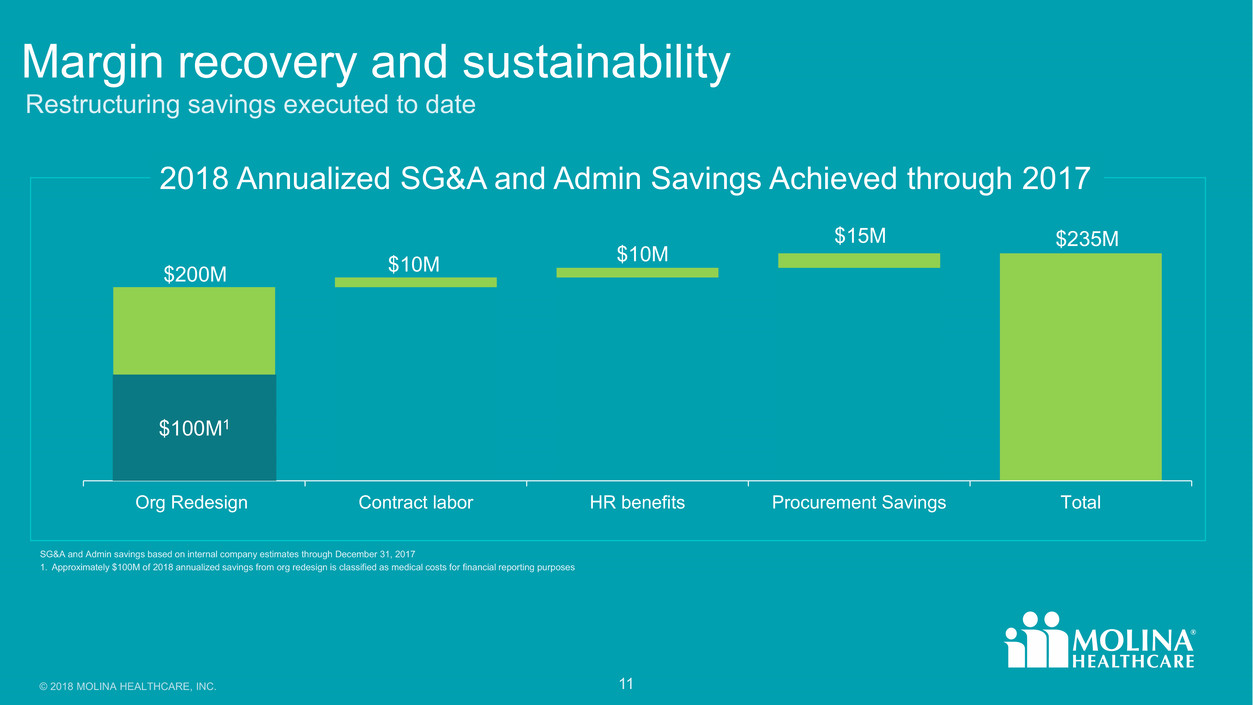

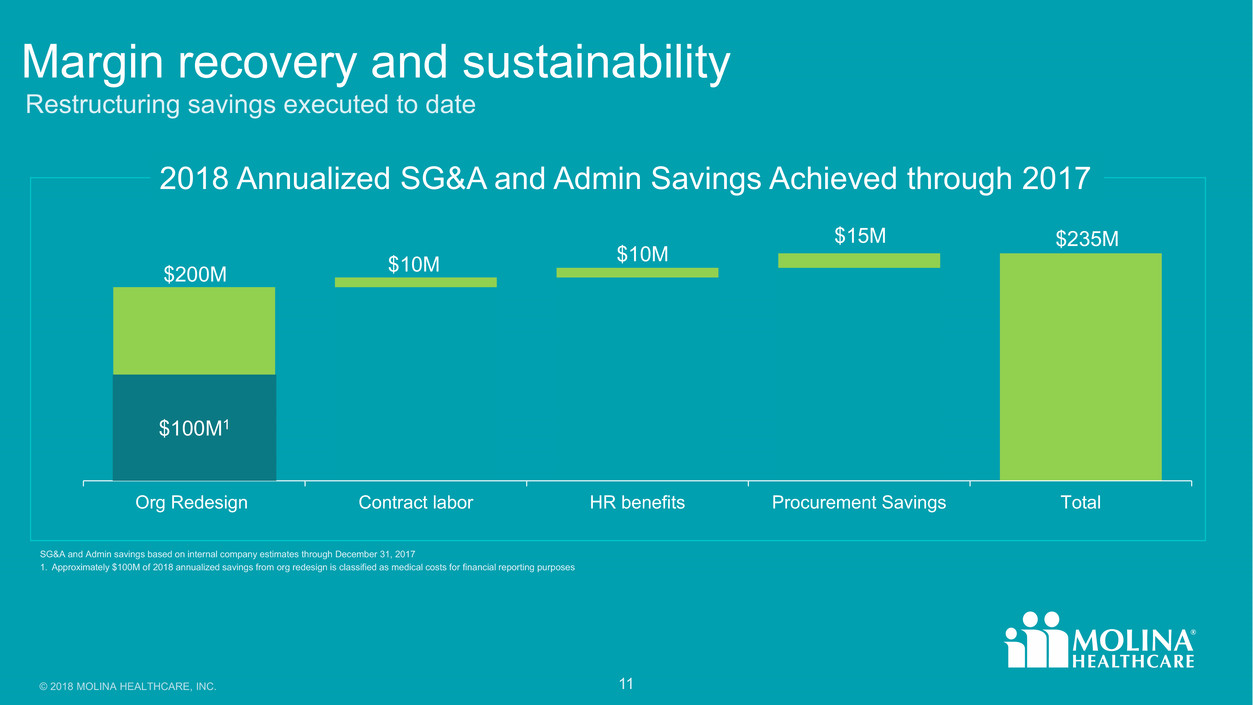

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 11 Margin recovery and sustainability Restructuring savings executed to date SG&A and Admin savings based on internal company estimates through December 31, 2017 1. Approximately $100M of 2018 annualized savings from org redesign is classified as medical costs for financial reporting purposes Org Redesign Contract labor HR benefits Procurement Savings Total 2018 Annualized SG&A and Admin Savings Achieved through 2017 $200M $10M $10M $15M $235M $100M1

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 12 Margin recovery and sustainability Opportunity to simplify networks that are too wide, too costly, and not tightly controlled Terminate or renegotiate high cost providers Narrow network in certain geographies Stop-loss thresholds and carve-outs Value-based contracting Ancillary services PBM pricing and operations Exited Direct Delivery business SG&A Network Utilization and Care Management At-Risk Revenue Risk Adjusters Claims Excellence IT and Information Management

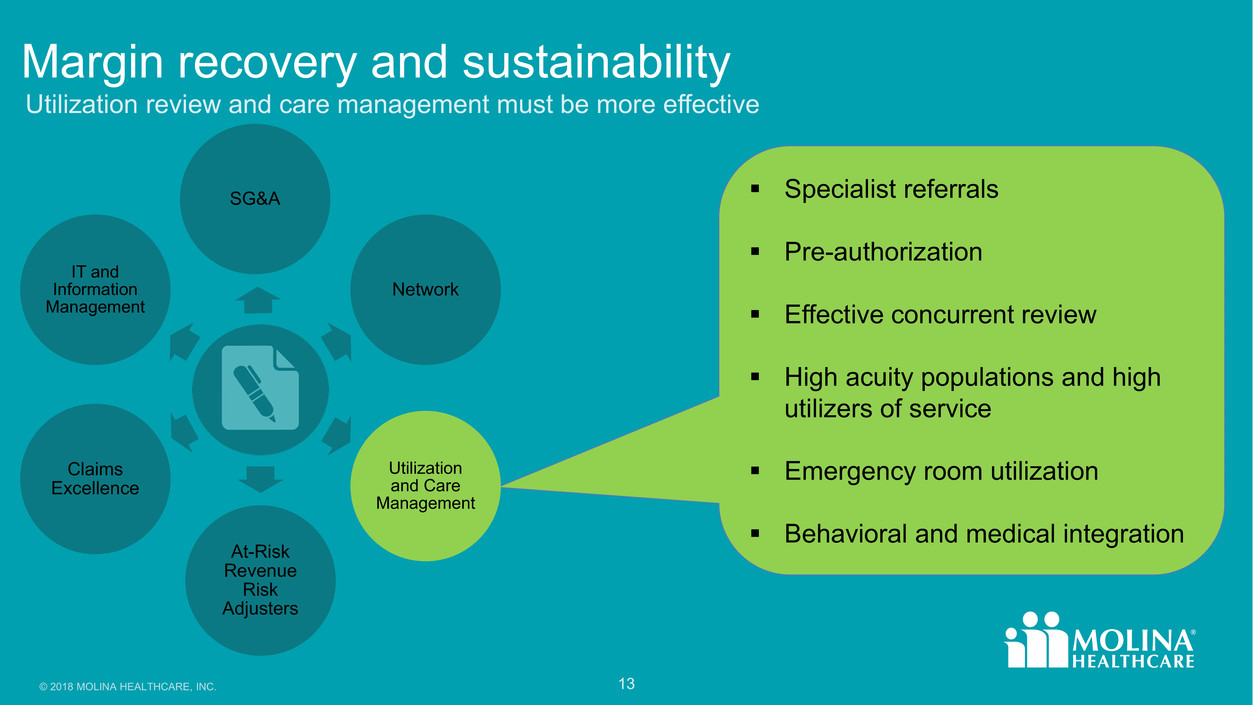

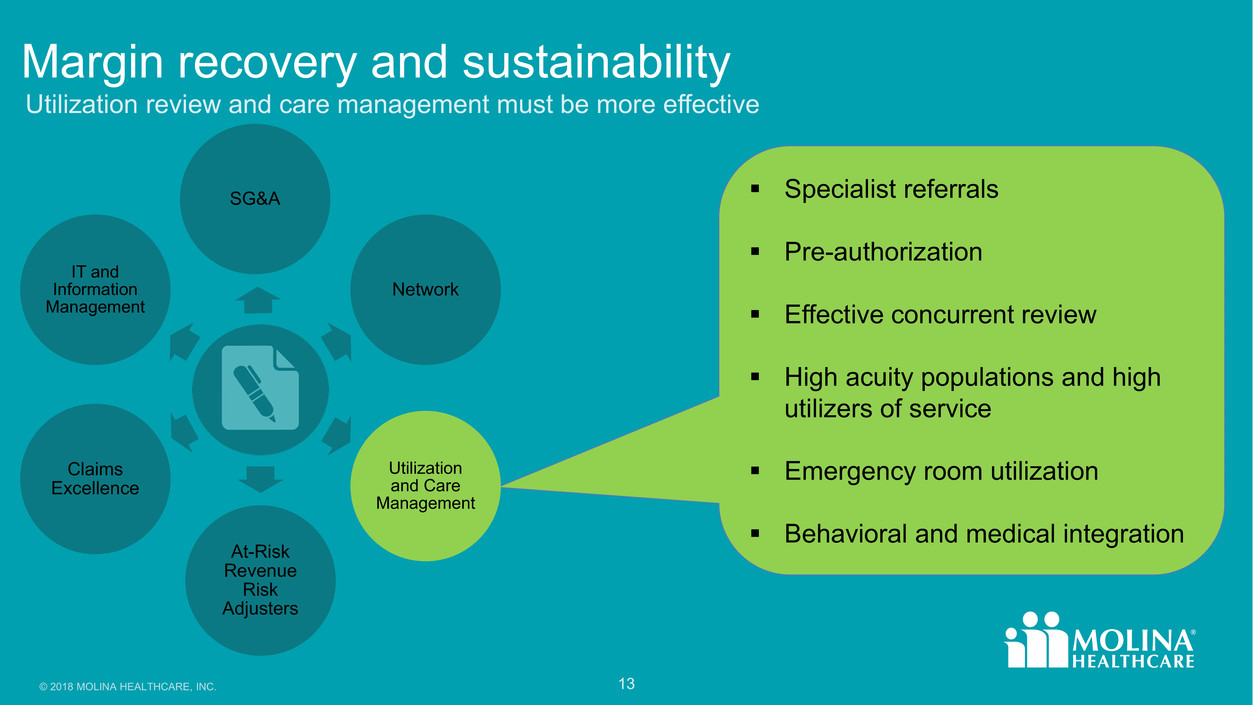

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 13 Margin recovery and sustainability Utilization review and care management must be more effective Specialist referrals Pre-authorization Effective concurrent review High acuity populations and high utilizers of service Emergency room utilization Behavioral and medical integration SG&A Network Utilization and Care Management At-Risk Revenue Risk Adjusters Claims Excellence IT and Information Management

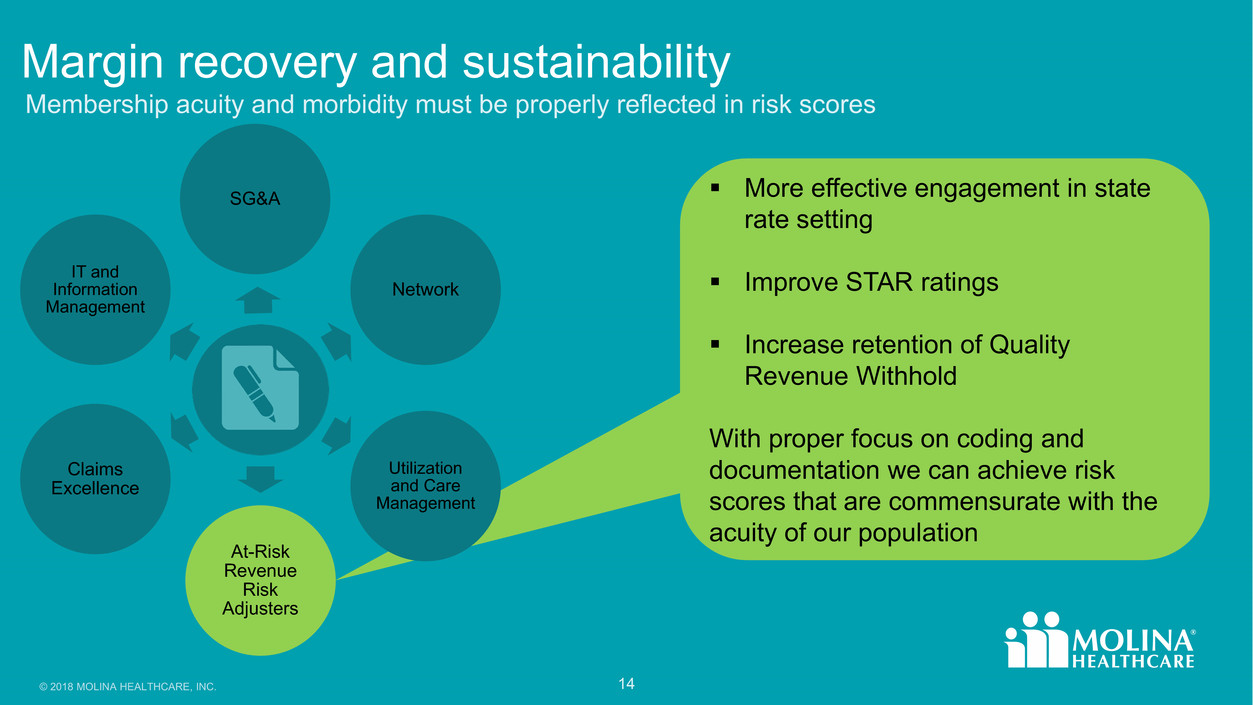

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 14 Margin recovery and sustainability Membership acuity and morbidity must be properly reflected in risk scores More effective engagement in state rate setting Improve STAR ratings Increase retention of Quality Revenue Withhold With proper focus on coding and documentation we can achieve risk scores that are commensurate with the acuity of our population SG&A Network Utilization and Care Management At-Risk Revenue Risk Adjusters Claims Excellence IT and Information Management

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 15 Margin recovery and sustainability Our claims payment function must be significantly improved Areas that can be significantly improved: Provider experience Payment accuracy Oversight of fraud waste and abuse SG&A Network Utilization and Care Management At-Risk Revenue Risk Adjusters Claims Excellence IT and Information Management

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 16 Margin recovery and sustainability All opportunities for operational efficiencies and margin improvement will be considered Standardize instances of administrative platform Streamline operations and procedures Evaluate potential co-sourcing and/or outsourcing operational components Consolidate data warehousing and data mining capabilities SG&A Network Utilization and Care Management At-Risk Revenue Risk Adjusters Claims Excellence IT and Information Management

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 17 Molina’s Margin Recovery and Sustainability Plan: 2 3 1 Restore margins through operational improvements and managed care fundamentals Optimize revenue base for profitability and future revenue growth Enhance balance sheet and capital management discipline Goal: sustainable 1.5% - 2.0% after-tax margin in line with peers

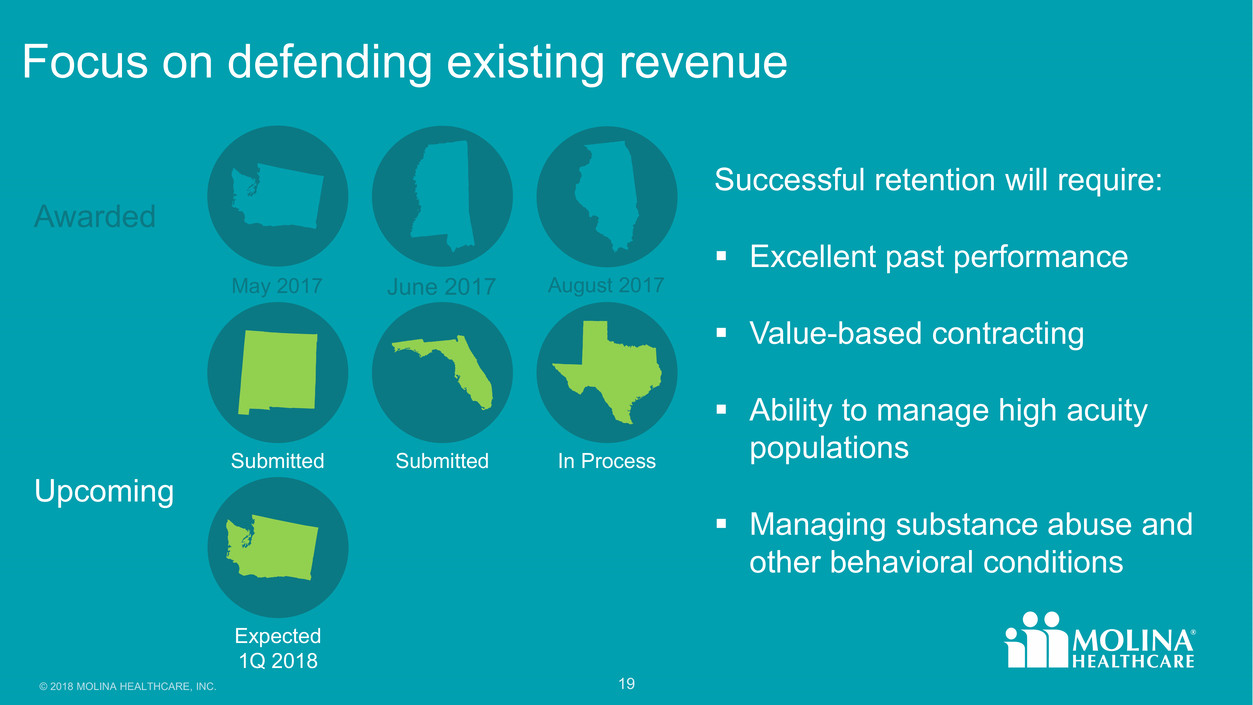

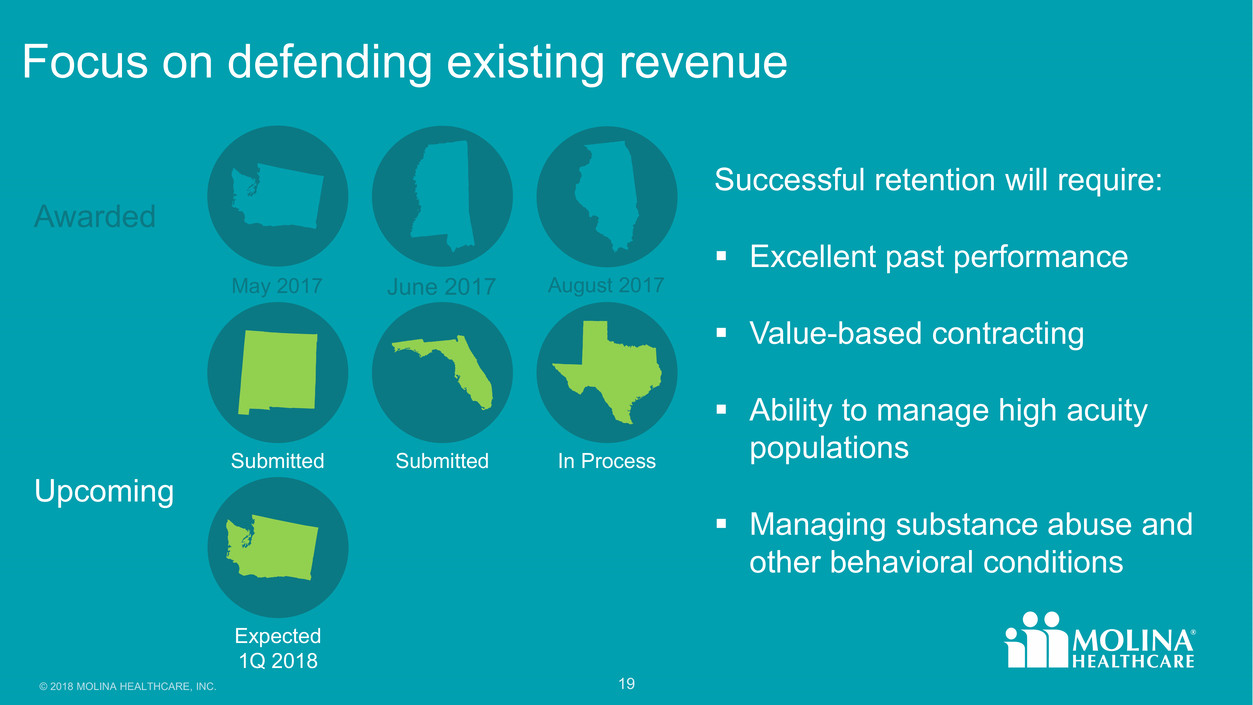

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 18 Focus on defending existing revenue May 2017 August 2017 Expected 1Q 2018 Submitted Submitted In Process June 2017 Strong track record of winning reprocurements Continue to invest in RFP team and capabilities Ensure successful launch of Mississippi TANF contract and platform Awarded Upcoming

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 19 Focus on defending existing revenue May 2017 August 2017 Awarded Upcoming Successful retention will require: Excellent past performance Value-based contracting Ability to manage high acuity populations Managing substance abuse and other behavioral conditions Expected 1Q 2018 Submitted Submitted In Process June 2017

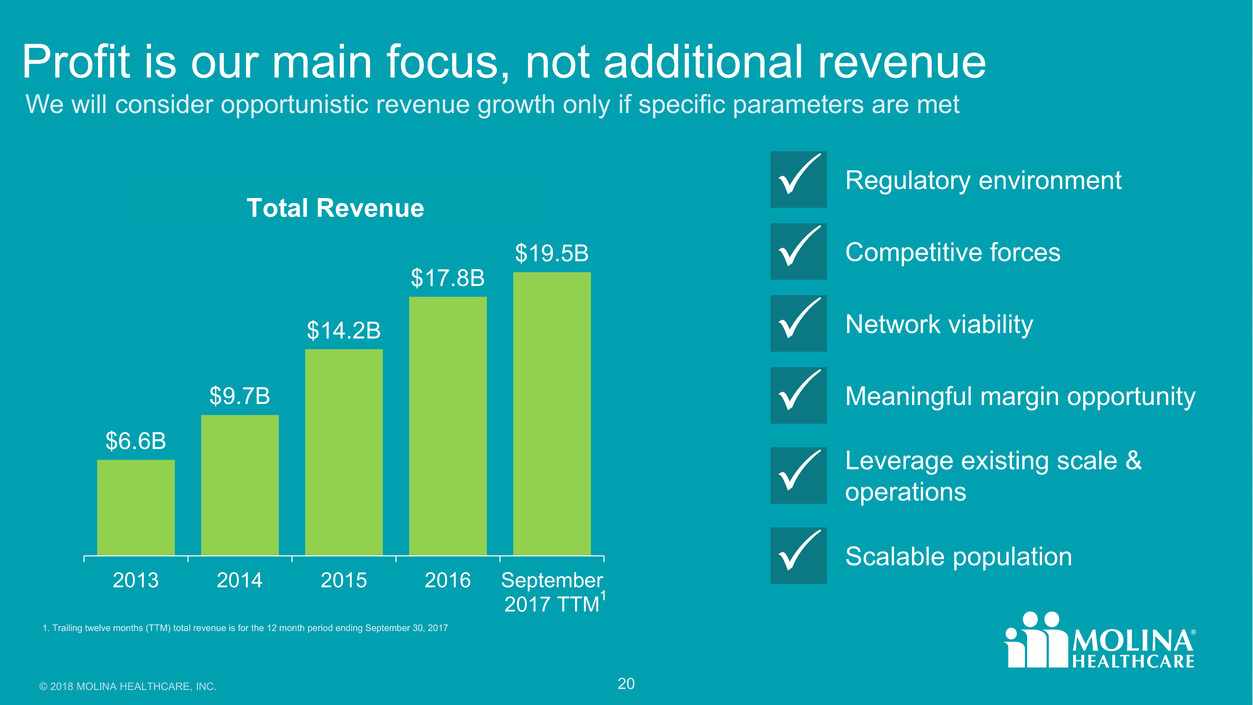

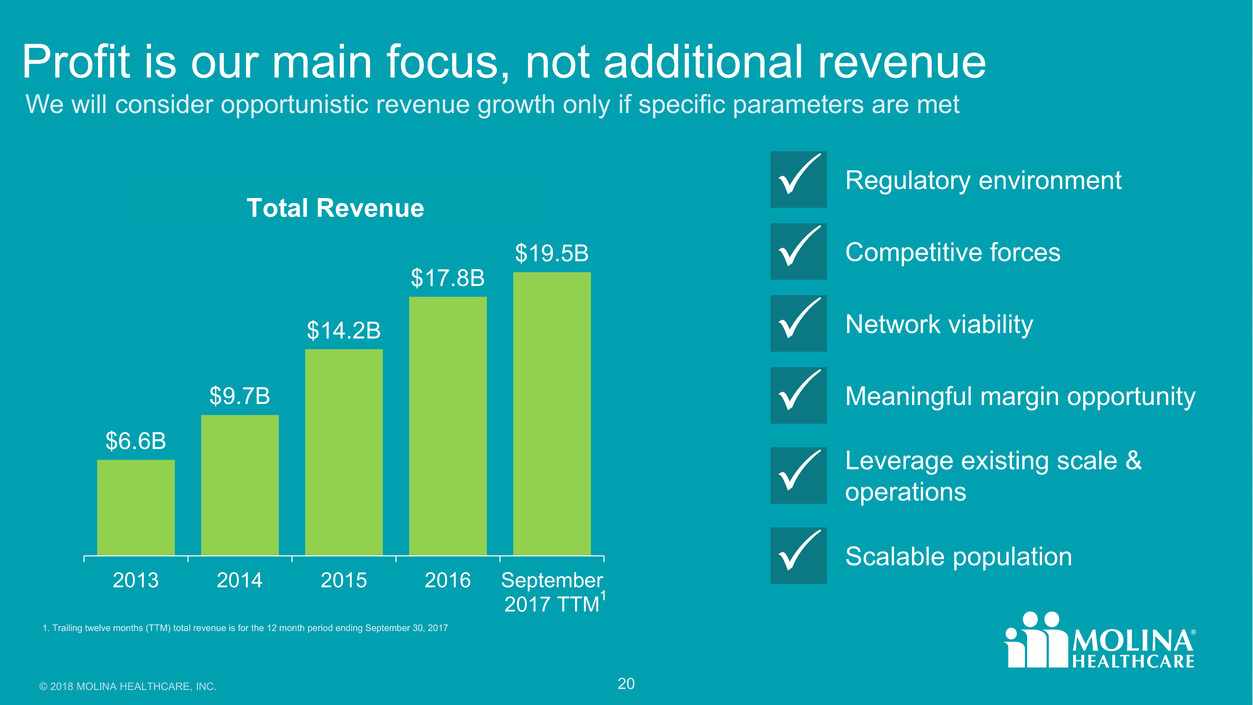

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 20 Profit is our main focus, not additional revenue We will consider opportunistic revenue growth only if specific parameters are met 1. Trailing twelve months (TTM) total revenue is for the 12 month period ending September 30, 2017 $6.6B $9.7B $14.2B $17.8B $19.5B 2013 2014 2015 2016 September 2017 TTM1 Total Revenue Regulatory environment Competitive forces Network viability Meaningful margin opportunity Leverage existing scale & operations Scalable population

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 21 Diverse revenue base with opportunity for significant performance improvement 1. Geographies and lines of business as of January 1, 2018 2. Revenue based on annualized premium revenue for the 3 months ending September 30, 2017 Geographies by Lines of Business1 Texas Washington Florida Ohio California Michigan New Mexico Puerto Rico Illinois Utah Wisconsin S. Carolina New York Medicaid ABD Expansion MMP SNP MarketplaceState ~$2.5B ~$1.5B ~$0.8B – ~$0.4B <$0.4B Revenue Identify underperforming geographies and lines of business Re-position the portfolio and allocate capital to optimize returns Each subsidiary must contribute to parent company cash flow or grow

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 22 Decisive action taken with Marketplace Reducing our Marketplace exposure and volatility 1. The 2018E average premium increase includes an increase for the removal of CSRs in 2018 2. Beginning membership and annual revenue for 2018 are estimates Molina Marketplace 2018 Operating Assumptions Average Rate Increase1 Exited Utah and Wisconsin Marketplaces in 2017 Reduced the scope of our 2018 participation in Washington In remaining Marketplace plans, increased 2018 premiums by 55% Adjusted broker commissions to market rates 900K 1Q Beginning Membership2 300K 400K 15% 55% Annualized Revenue2 $2.0B $2.4B $3.0B 2017 2018

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 23 Molina’s Margin Recovery and Sustainability Plan: 2 3 1 Restore margins through operational improvements and managed care fundamentals Optimize revenue base for profitability and future revenue growth Enhance balance sheet and capital management discipline Goal: sustainable 1.5% - 2.0% after-tax margin in line with peers

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 24 Enhance balance sheet and capital management discipline Reserving accuracy Increase tangible net equity Reduce cost of borrowing Maximize dividend capacity of subsidiaries Maximize parent company liquidity and cash flow Deploy excess capital in a balanced manner Reduce optionality in capital structure

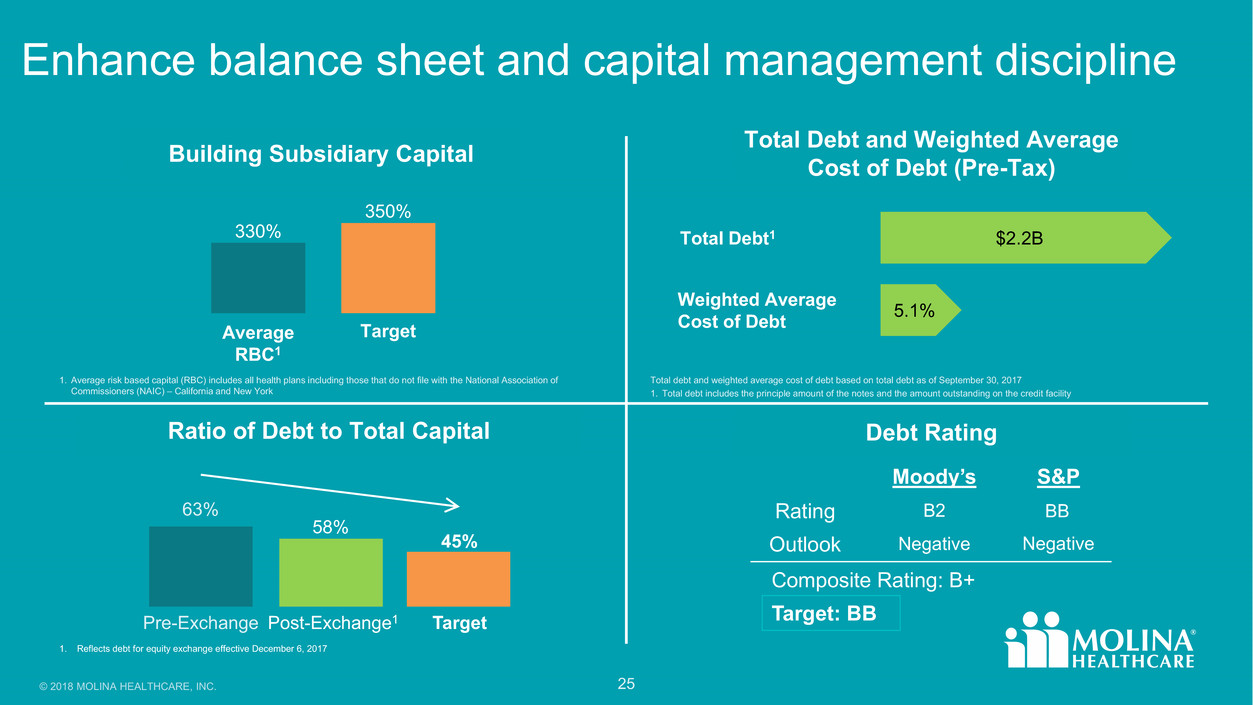

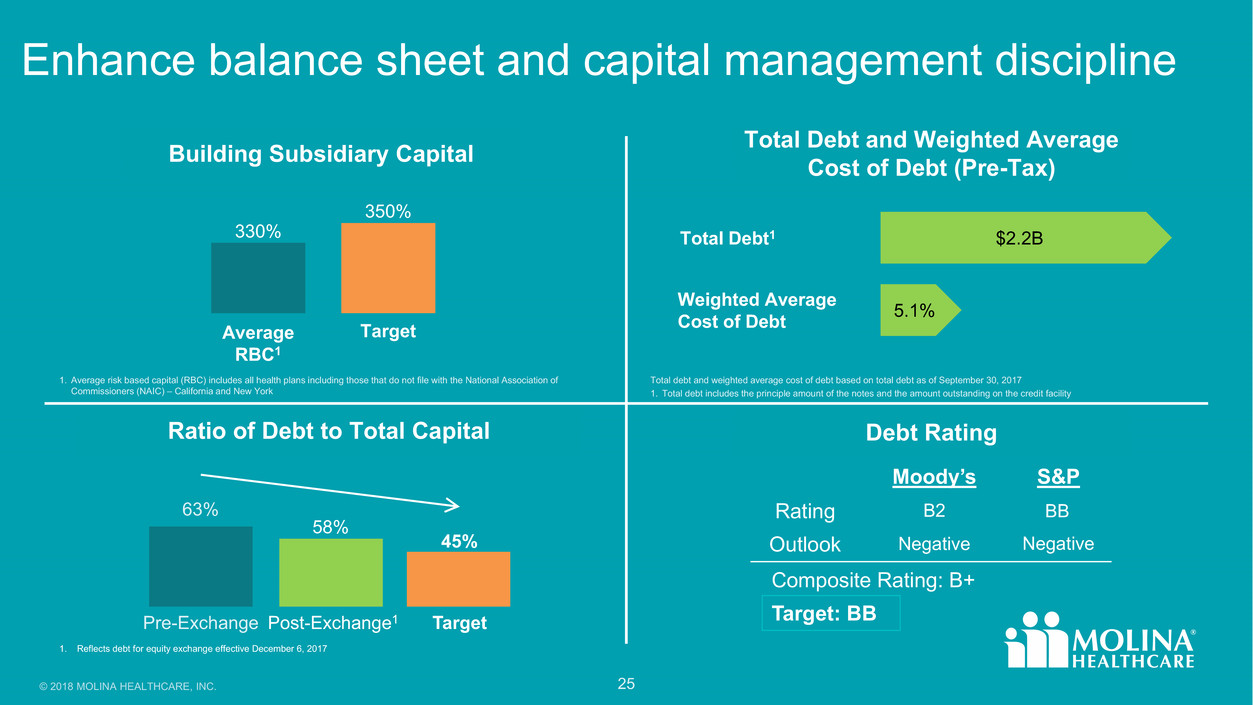

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 25 Enhance balance sheet and capital management discipline 1. Average risk based capital (RBC) includes all health plans including those that do not file with the National Association of Commissioners (NAIC) – California and New York Building Subsidiary Capital 330% 350% Average RBC1 Target Ratio of Debt to Total Capital 63% 58% Pre-Exchange Post-Exchange1 45% Target 1. Reflects debt for equity exchange effective December 6, 2017 Debt Rating S&PMoody’s Rating Outlook B2 BB Negative Negative Composite Rating: B+ Target: BB Total Debt and Weighted Average Cost of Debt (Pre-Tax) Weighted Average Cost of Debt Total Debt1 Total debt and weighted average cost of debt based on total debt as of September 30, 2017 1. Total debt includes the principle amount of the notes and the amount outstanding on the credit facility $2.2B 5.1%

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 26 What we are doing today Focus on operational improvements and SG&A levers Evaluation of all lines of business in all geographies Review balance sheet quality and capital structure Evaluation of operating model, organizational structure and talent Review non-core businesses

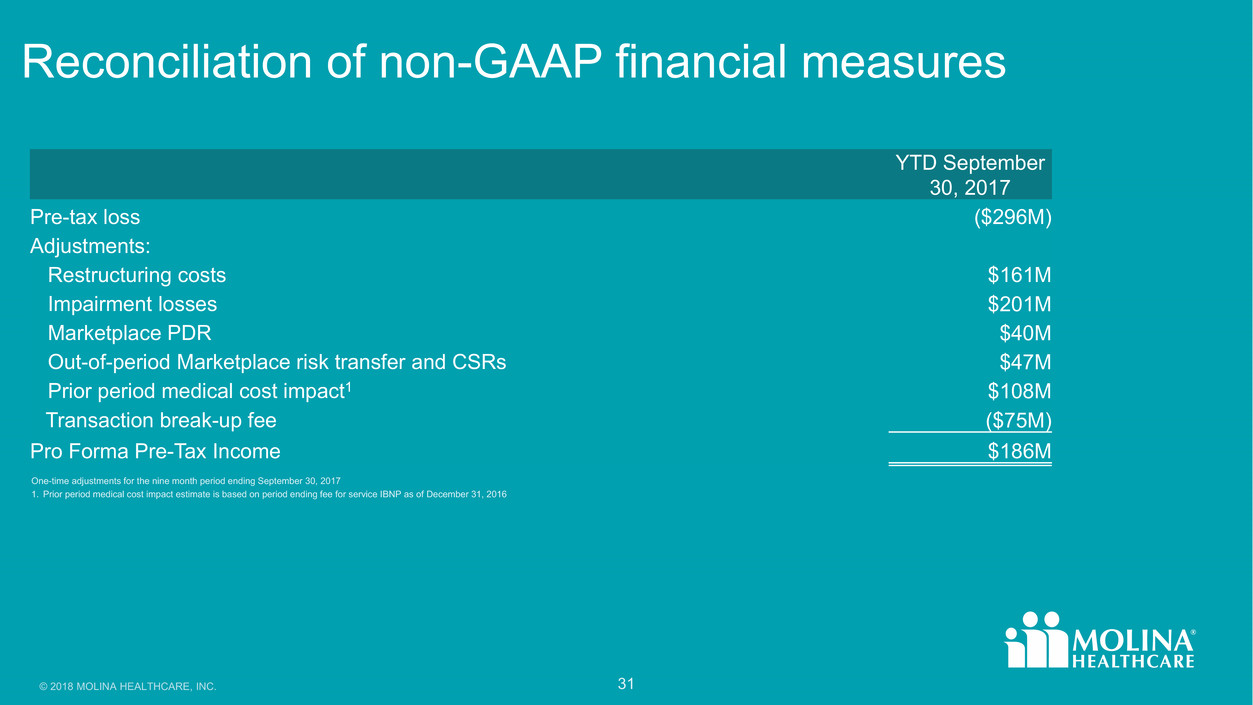

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 27 Re-baselining our business The 2018 plan will include underwriting margin and administrative cost improvements in addition to these one time items One-time adjustments for the nine month period ending September 30, 2017 1. Prior period medical cost impact estimate is based on period ending fee for service IBNP as of December 31, 2016 2. See following reconciliation of GAAP financial measures to non-GAAP financial measures ($296M) $186M September 2017 YTD Pre-Tax Loss Pro Forma September 2017 YTD Pre-Tax Income $161M Restructuring costs $201M Impairment losses $40M Marketplace PDR $47M Out-of-period Marketplace risk transfer and CSRs $108M Prior period medical cost impact1 ($75M) Transaction break-up fee

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 28 What you can expect from us Three-year high level preliminary assessment 2018 re-baseline Year 1 Year 2 Year 3 Revenue growth Reduction in Marketplace footprint Stable; implement portfolio decisions Accretive expansion in select new and existing markets Margin profile Staff rightsizing benefit; managed medical cost Improve medical and network management; nearing target margins Stable earnings, manage medical costs at target margins Capital structure Improvement to capital structure Grow capital through margin expansion Grow capital through margin expansion and redeploy excess

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 29 Molina’s Margin Recovery and Sustainability Plan: Focus on operational improvements and SG&A levers Evaluation of all lines of business in all geographies Review balance sheet quality and capital structure Evaluation of operating model, organizational structure and talent Review non-core businesses Will provide 2018 guidance in our February earnings call Details to follow at our Investor Day this spring

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 30 Thank you

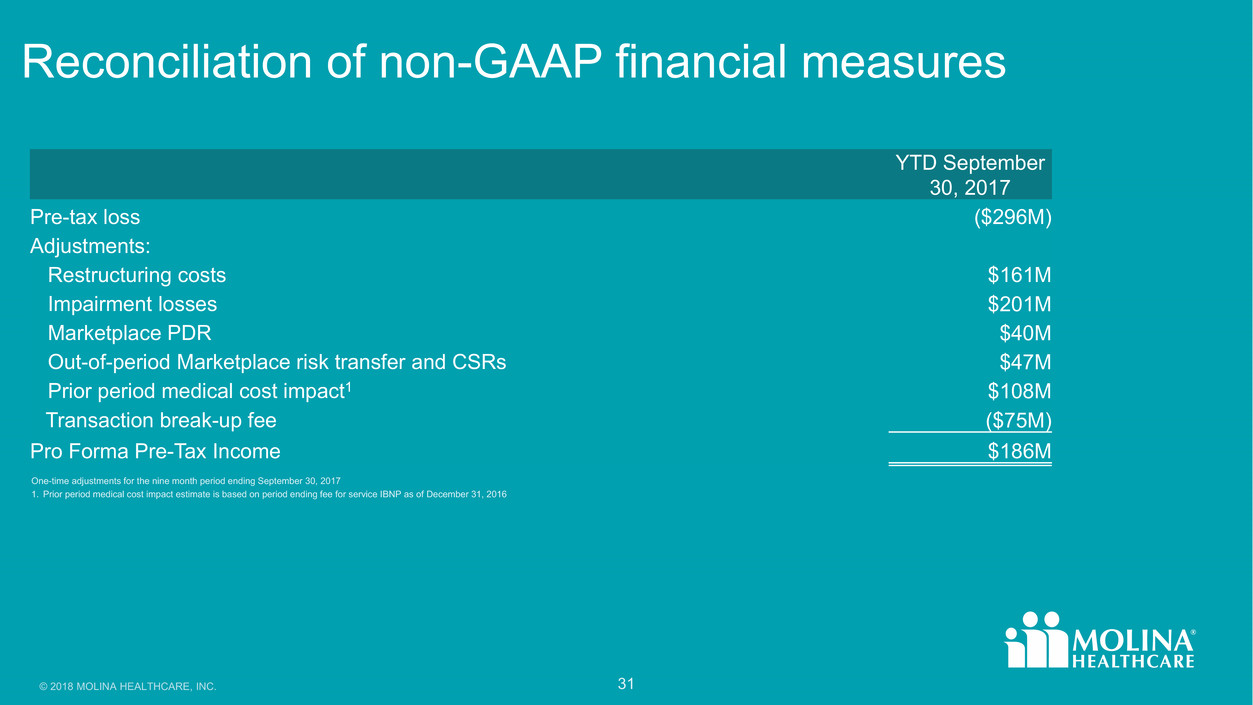

© 2018 MOLINA HEALTHCARE, INC. 2018 LI L , I . 31 Reconciliation of non-GAAP financial measures One-time adjustments for the nine month period ending September 30, 2017 1. Prior period medical cost impact estimate is based on period ending fee for service IBNP as of December 31, 2016 YTD September 30, 2017 Pre-tax loss ($296M) Adjustments: Restructuring costs $161M Impairment losses $201M Marketplace PDR $40M Out-of-period Marketplace risk transfer and CSRs $47M Prior period medical cost impact1 $108M Transaction break-up fee ($75M) Pro Forma Pre-Tax Income $186M