The information in this prospectus supplement and the accompanying prospectus is not complete and may be amended. We may not sell these securities until we deliver a final prospectus supplement and accompanying prospectus. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated September 3, 2014

Prospectus Supplement

(To Prospectus Dated September 3, 2014)

GE Equipment Midticket LLC, Series 2014-1

Issuing Entity

CEF Equipment Holding, L.L.C.

Depositor

General Electric Capital Corporation

Sponsor, Administrator and Servicer

$579,100,000 Asset Backed Notes

(Approximate)

You should review carefully the factors set forth under “Risk Factors” beginning on page S-16 of this prospectus supplement and page 3 in the accompanying prospectus.

The prospectus supplement does not contain complete information about the offering of the securities. No one may use this prospectus supplement to offer and sell the securities unless it is accompanied by the prospectus. If any statements in this prospectus supplement conflict with statements in the prospectus, the statements in this prospectus supplement will control.

The securities are asset backed securities issued by the Issuing Entity. The securities are not obligations of CEF Equipment Holding, L.L.C., General Electric Capital Corporation or any of their other respective affiliates. Neither the securities nor the receivables or the related equipment are insured or guaranteed by any government agency.

Neither the SEC nor any state securities commission has approved or disapproved the securities or determined that this prospectus supplement or the prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| • | The issuing entity will issue five classes of notes. |

| • | The notes are backed by a pledge of the issuing entity’s assets. The issuing entity’s assets primarily consist of equipment loans and security interests in, or leases and ownership of, the related industrial equipment, construction equipment, transportation equipment, maritime assets, technology and telecommunications equipment, furniture and fixtures, healthcare equipment or other equipment, and a series special unit beneficial interest certificate evidencing a 100% beneficial interest in a portfolio of leases of titled transportation equipment and the related equipment. |

| • | Support for the notes includes subordination provisions, overcollateralization, excess spread and a reserve account. |

| • | Only the Class A Notes in the following table are being offered by this prospectus supplement and the accompanying prospectus. |

| • | The underwriters will purchase the Class A Notes from the issuing entity in the amounts described under “UNDERWRITING.” |

| • | There is no underwriting agreement for the Class B Notes. The Class B Notes will be initially held by an affiliate of the depositor. |

| • | Payments on the notes will be made on the 22nd day of each calendar month, or, if not a business day, the next business day, beginning with October 22, 2014. |

| | | Initial

Principal

Amount | | Interest

Rate | | Accrual

Method | | Maturity Date | | Initial

Offering

Price(1) | | | Underwriting

Discount | | | Proceeds to

Issuing

Entity(2) | |

| Class A-1 Notes | | $ | 138,600,000 | | % | | Actual/360 | | September 22, 2015 | | | % | | | | % | | | | % | |

| Class A-2 Notes | | | 190,000,000 | | % | | 30/360 | | April 24, 2017 | | | % | | | | % | | | | % | |

| Class A-3 Notes | | | 173,000,000 | | % | | 30/360 | | May 22, 2018 | | | % | | | | % | | | | % | |

| Class A-4 Notes | | | 77,500,000 | | % | | 30/360 | | August 22, 2023 | | | % | | | | % | | | | % | |

| Class B Notes | | | 10,000,000 | | % | | 30/360 | | August 22, 2023 | | | N/A | | | | N/A | | | | N/A | |

| Total | | $ | 589,100,000 | | | | | | | | $ | | | | $ | | | | $ | | |

| (1) | Plus accrued interest, if any, from September 17, 2014. |

| (2) | Before deducting expenses payable by the issuing entity, estimated to be $1,000,000. The notes will be delivered in global form only on or about September 17, 2014. |

The Series 2014-1A SUBI Certificate will be held by the issuing entity and will be pledged under the indenture to secure the notes.

Distributions on the notes and from the Series 2014-1A SUBI Certificate will be on the 22nd of each month or, if the 22nd is not a business day, on the next business day, beginning October 22, 2014.

Delivery of the notes, in book entry form only, will be made through The Depository Trust Company, Clearstream Banking, société anonyme, and/or the Euroclear System on or about September 17, 2014 against payment in immediately available funds.

Neither the SEC nor any state securities commission has approved these notes or determined that this prospectus supplement or the prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| · | We will not list the notes on any national securities exchange or on any automated quotation system of any registered securities association such as NASDAQ. |

Joint Bookrunners of the Class A Notes

| Credit Suisse | J.P. Morgan |

| | |

| The date of this prospectus supplement is September 3, 2014. |

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS

PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different information.

The information in this prospectus supplement and the accompanying prospectus is preliminary, and is subject to completion or change. This prospectus supplement is being delivered to you solely to provide you with information about the offering of these securities referred to in this prospectus supplement and to solicit an offer to purchase these securities, when, as and if issued. Any such offer to purchase made by you will not be accepted and will not constitute a contractual commitment by you to purchase any of these securities, until we have accepted your offer to purchase these securities.

These securities are being sold when, as and if issued. The issuing entity is not obligated to issue these securities or any similar security and the underwriters’ obligation to deliver these securities is subject to the terms and conditions of their underwriting agreement with the issuing entity and the availability of these securities when, as and if issued by the issuing entity. You are advised that the terms of these securities, and the characteristics of the asset pool backing them, may change (due, among other things, to the possibility that receivables owned or beneficially owned by the issuing entity may become delinquent or defaulted or may be removed or replaced and that similar or different receivables or equipment, as applicable, may be added to the pool, and that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. You are advised that these securities may not be issued that have the characteristics described in this prospectus supplement and the accompanying prospectus. The underwriters’ obligation to sell any of these securities to you is conditioned on the receivables and these securities having the characteristics described in this prospectus supplement. If for any reason the issuing entity does not deliver these securities, the underwriters will notify you, and none of the issuing entity, the depositor, the sponsor or any underwriter will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and none of the issuing entity, the depositor, the sponsor or any underwriter will be liable for any costs or damages whatsoever arising from or related to such non-delivery.

We are not offering these securities in any state where the offer is not permitted. We tell you about the securities in two separate documents that progressively provide more detail: (a) the accompanying prospectus, which provides general information, some of which may not apply to your series of securities; and (b) this prospectus supplement, which describes the specific terms of your series of securities.

We have made forward-looking statements in this prospectus supplement and the accompanying prospectus. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements are statements, other than statements of historical facts that address activities, events or developments that we expect or anticipate will or may occur in the future. Forward-looking statements also include any other statements that include words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend” and other similar expressions.

Forward-looking statements are based on certain assumptions and analyses we have made in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate. Whether actual results and developments will conform with our expectations and predictions is subject to a number of risks and uncertainties.

All of the forward-looking statements made in this prospectus supplement and the accompanying prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments we have anticipated will be realized. Even if the results and developments in our forward-looking statements are substantially realized, there is no assurance that they will have the expected consequences to or effects on us, the issuing entity, General Electric Capital Corporation, any originator or any other person or on our respective businesses or operations. The foregoing review of important factors, including those discussed in detail in this prospectus supplement and the accompanying prospectus should not be construed as exhaustive. We undertake no obligation to release the results of any future revisions we may make to forward-looking

statements to reflect events or circumstances after the date of this prospectus supplement and the accompanying prospectus or to reflect the occurrences of anticipated events.

As used in this prospectus supplement and the accompanying prospectus, all references to “dollars” and “$” are to United States dollars.

You can find a listing of the pages where capitalized terms used in this prospectus supplement are defined under the caption “Index of Terms” beginning on page S-71 in this prospectus supplement and under the caption “Index of Terms” on page 70 in the accompanying prospectus.

We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can find further related discussions. The following Table of Contents and the Table of Contents included in the accompanying prospectus provide the pages on which these captions are located.

TABLE OF CONTENTS

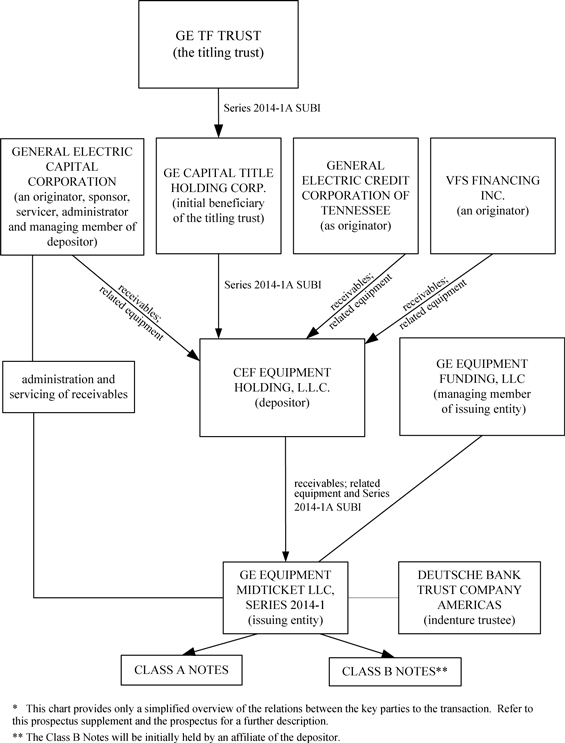

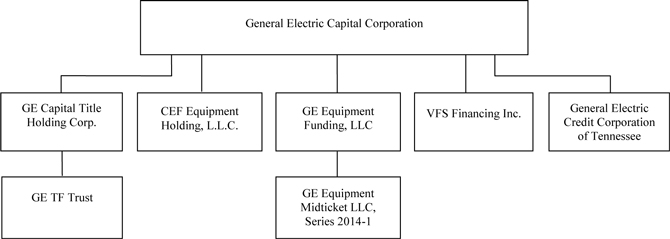

SUMMARY OF PRINCIPAL PARTIES TO THE TRANSACTION*

SUMMARY OF TERMS

The following summary contains a brief description of the notes. You will find a detailed description of the terms of the offering of the notes following this summary. You should carefully read this entire prospectus supplement and the accompanying prospectus to understand all of the terms of the offering of the notes. You should consider both documents when making your investment decision.

RELEVANT PARTIES

| Issuing Entity | GE Equipment Midticket LLC, Series 2014-1 |

| | |

| Depositor | CEF Equipment Holding, L.L.C. |

| | |

| Managing Member of Issuing | |

| Entity | GE Equipment Funding, LLC |

| | |

| Sponsor, Originator, Servicer, | |

| Administrator and Managing | |

| Member of the Depositor | General Electric Capital Corporation |

| | |

| Titling Trust | GE TF Trust |

| | |

| Originators | General Electric Capital Corporation, and its direct or indirect subsidiaries, VFS Financing, Inc. and General Electric Credit Corporation of Tennessee are the originators of 100% of the receivables to be included in the receivables pool and the titling trust is the originator of 100% of the leases of titled assets to be included in the series 2014-1A SUBI. |

| | |

| Initial Beneficiary | GE Capital Title Holding Corp., in its capacity as the initial beneficiary of the titling trust. |

| | |

| SUBI Trustee, UTI Trustee, | |

| Delaware Trustee and | |

| Administrative Trustee | Wilmington Trust Company |

| | |

| Collateral Agent | GE Title Agent LLC |

| | |

| Indenture Trustee | Deutsche Bank Trust Company Americas |

| | |

| RELEVANT AGREEMENTS | |

| | |

| Indenture | The indenture is between the issuing entity and the indenture trustee. The indenture provides for the terms relating to the notes. |

| | |

| Limited Liability Company | |

| Agreement | The limited liability company agreement governs the formation of the issuing entity by the managing member. |

| | |

| Servicing Agreement | The servicing agreement is among General Electric Capital Corporation, as servicer, the issuing entity and the titling trust. The servicing agreement governs the servicing, management and administration of the receivables (including the leases included in the series 2014-1A SUBI) and the remarketing of the equipment included in the series 2014-1A SUBI by the servicer on behalf of the issuing entity. |

| Administration Agreement | The administration agreement is between General Electric Capital Corporation, as administrator, and the issuing entity. The administration agreement governs the provision of reports by the administrator and the performance by the administrator of other administrative duties for the issuing entity. |

| | |

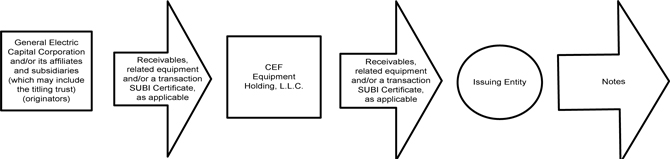

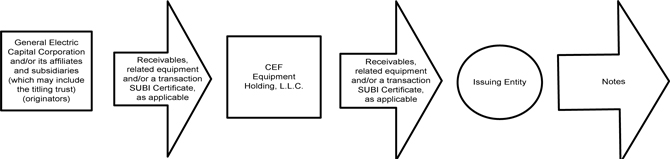

| Receivables Sale Agreement | The receivables sale agreement is among General Electric Capital Corporation, VFS Financing, Inc. and General Electric Credit Corporation of Tennessee, as sellers of loans and leases and, in the case of leases the related equipment, GE Capital Title Holding Corp., as seller of the series 2014-1A SUBI certificate, and CEF Equipment Holding, L.L.C., as purchaser. The receivables sale agreement governs the sale of the receivables, and in the case of receivables that are leases, the related equipment and the series 2014-1A SUBI certificate to the depositor. |

| | |

| Receivables Purchase and Sale | |

| Agreement | The receivables purchase and sale agreement is between the depositor, as seller, and GE Equipment Midticket LLC, Series 2014-1, as purchaser. This agreement governs the transfer of receivables, and in the case of receivables that are leases, the related equipment and the series 2014-1A SUBI certificate from the depositor to the issuing entity. |

| | |

| Limited Removal and Clean-Up | |

| Call Agreement | The limited removal and clean-up call agreement is between GE Equipment Funding, LLC, as purchaser, and the issuing entity. This agreement governs certain removals of receivables, and in the case of receivables that are leases, the related equipment and the series 2014-1A SUBI certificate from the issuing entity by GE Equipment Funding, LLC as well as the clean-up call. |

See the “—Series 2014-1A SUBI” for a description of additional relevant agreements relating to the series 2014-1A SUBI.

RELEVANT DATES

| Closing Date | September 17, 2014 |

| | |

| Cut-off Date | August 2, 2014 |

| | |

| Payment Dates | Payments on the notes will be made on the 22nd day of each calendar month, or, if not a business day, the next business day, beginning with October 22, 2014. |

| | |

| Maturity Dates | The outstanding principal amount, if any, of each class of notes will be payable in full on the date specified for each class of notes below: |

| | Class | | Maturity Date |

| | A-1 | | September 22, 2015 |

| | A-2 | | April 24, 2017 |

| | A-3 | | May 22, 2018 |

| | A-4 | | August 22, 2023 |

| | B | | August 22, 2023 |

| Record Date | So long as the securities are in global form, the issuing entity will make payments and distributions on the securities to the holders of record on the |

| | business day preceding the payment date. If the securities are issued in definitive form, the record date will be the last day of the month preceding the payment date. |

DESCRIPTION OF THE SECURITIES

| The Securities | Five classes of notes will be issued by the issuing entity pursuant to this prospectus supplement and the accompanying prospectus. |

| | Class | | Initial Principal Amount | | | Interest Rate | |

| | A-1 | | $ | 138,600,000 | | | | % | |

| | A-2 | | | 190,000,000 | | | | % | |

| | A-3 | | | 173,000,000 | | | | % | |

| | A-4 | | | 77,500,000 | | | | % | |

| | B(1) | | | 10,000,000 | | | | % | |

| | Total | | $ | 589,100,000 | | | | | |

| (1)The Class B Notes will initially be held by an affiliate of the depositor. |

| | |

| | The notes will be global securities clearing through The Depository Trust Company (in the United States) or Clearstream Banking, société anonyme or Euroclear Bank S.A./N.V. (in Europe) in minimum denominations of $1,000 and in greater whole-dollar denominations. |

| | |

| Assets of the Issuing Entity | The issuing entity will possess only the following property: |

| | • | a pool of fixed rate receivables arising under loans and leases and related collections received after the cut-off date; provided that with respect to any lease that has a split payment stream consisting of a base rent payment and a variable payment that is based on the obligor’s use of the related equipment, only the base rent component of that payment stream is included in the receivables pool (see “THE RECEIVABLES POOL” in this prospectus supplement); |

| | | |

| | • | the leased equipment with respect to the receivables arising out of leases; |

| | | |

| | • | a series special unit beneficial interest certificate evidencing a 100% beneficial interest in a portfolio of (x) TRAC leases of new or used titled transportation equipment and the related equipment and (y) other leases and the related titled equipment allocated to the series 2014-1 special unit of beneficial interest in the titling trust, including payments made under such leases, which also include, in the case of TRAC leases, payments under “terminal rental adjustment clauses” up to the related TRAC amounts; |

| | | |

| | • | agreements that give rise to loans and leases; |

| | | |

| | • | bank accounts established for the issuing entity; |

| | | |

| | • | security interests in the equipment financed with respect to the receivables that are loans, and any guarantees of the receivables; |

| | | |

| | • | any property obtained in a default situation under those security interests and proceeds from liquidation of that property; |

| | • | the reserve account and deposits therein; and |

| | | |

| | • | rights (either directly or indirectly) to proceeds from certain insurance policies covering equipment financed under the receivables or the related obligors. |

| | The depositor has not requested that any credit be given to the residual values of the equipment when determining credit enhancement. While investors will be entitled to receive any amounts received in connection with residual realizations, no particular value should be assumed with respect to such amounts. (see “THE RECEIVABLES POOL” in this prospectus supplement) |

| | |

| The Receivables | The pool consists of middle-market equipment loan and lease receivables, and in the case of leases, the related equipment, and the series 2014-1A SUBI certificate, evidencing a beneficial interest in middle-market leases of titled transportation equipment and the related equipment allocated to a special unit beneficial interest in the titling trust designated as the “series 2014-1A SUBI.” The loans and leases are made to obligors located in the United States of America and are managed by the Corporate Finance and Equipment Finance reporting categories of the Commercial Lending and Leasing division of General Electric Capital Corporation. When used in this prospectus supplement, unless explicitly provided otherwise or the context requires otherwise, the term “loans” means both loans and finance leases, the term “leases” means leases and TRAC leases and the term “receivables” means the loans and leases transferred to the issuing entity and the beneficial interests in leases that were transferred to the issuing entity, together. As of the cut-off date, by net receivable value, 52.48% of the receivables are loans, out of which 10.48% are finance leases, and 37.03% of the receivables are leases. As used in this prospectus supplement, the term “obligor” in this prospectus supplement will refer to the lessee under a lease or the borrower under a loan, as applicable. |

| | |

| | The aggregate receivable value is an amount equal to the sum of the loan value of the loans plus the lease value of the leases. The net receivable value is an amount equal to the aggregate receivable value minus the aggregate book residual value. As of the cut-off date, the allocation of the aggregate receivable value between the leases and the loans is set-out below: |

| | Collateral Type | | U.S. Dollar Amount | | | Percent of

Aggregate

Receivable Value | |

| | Aggregate loan value | | $ | 385,372,000 | | | | 55.81 | % |

| | Aggregate lease value | | $ | 305,114,852 | | | | 44.19 | % |

| | Aggregate receivable value | | $ | 690,486,852 | | | | 100.00 | % |

| | Aggregate book residual value | | $ | 78,471,046 | | | | 11.36 | % |

| | Net receivable value | | $ | 612,015,806 | | | | 88.64 | % |

| | The depositor has not requested that any credit be given to the residual values of the equipment when determining credit enhancement. While investors will be entitled to receive any amounts received in connection with residual realizations, no particular value should be assumed with respect to such amounts. (see “THE RECEIVABLES POOL” in this prospectus supplement) |

| | |

| The Receivables | The pool consists of middle-market equipment loan and lease receivables, and in the case of leases, the related equipment, and the series 2014-1A SUBI certificate, evidencing a beneficial interest in middle-market leases of titled transportation equipment and the related equipment allocated to a special unit beneficial interest in the titling trust designated as the “series 2014-1A SUBI.” The loans and leases are made to obligors located in the United States of America and are managed by the Corporate Finance and Equipment Finance reporting categories of the Commercial Lending and Leasing division of General Electric Capital Corporation. When used in this prospectus supplement, unless explicitly provided otherwise or the context requires otherwise, the term “loans” means both loans and finance leases, the term “leases” means leases and TRAC leases and the term “receivables” means the loans and leases transferred to the issuing entity and the beneficial interests in leases that were transferred to the issuing entity, together. As of the cut-off date, by net receivable value, 52.48% of the receivables are loans, out of which 10.48% are finance leases, and 37.03% of the receivables are leases. As used in this prospectus supplement, the term “obligor” in this prospectus supplement will refer to the lessee under a lease or the borrower under a loan, as applicable. |

| | |

| | The amount of notes issued by the issuing entity will be approximately equal to 96.26% of the net receivable value. See “Overcollaterization” below. |

The loan value of a loan generally is: (A) in the case of a loan accruing interest on a precomputed basis, (i) the present value of the future scheduled payments discounted monthly at the implicit rate of return of such loan plus (ii) any past due scheduled payments reflected on the servicer’s records plus (iii) the unamortized amounts of any purchase premiums minus (iv) the unamortized amounts of any purchase discounts, and (B) in the case of a loan accruing interest on a simple interest basis, (i) the balance reflected on the servicer’s records plus (ii) the unamortized amounts of any purchase premiums minus (iii) the unamortized amounts of any purchase discounts. Defaulted receivables that are loans will be deemed to have a loan value equal to the outstanding loan value at the time it became a defaulted receivable less the amount written-off as uncollectible in accordance with the credit and collection policy.

The lease value of a lease generally equals the sum of (i) the present value of the future scheduled payments payable under such lease (which, in the case of split-payment stream receivables, includes only the base rent component) discounted monthly at the implicit rate of return of such lease, as determined by the applicable originator, plus (ii) any past due scheduled payments under such lease (which, in the case of split-payment stream receivables, include only the base rent component) reflected on the servicer’s records, plus (iii) the present value of the book residual value (or, in the case of leases that are TRAC leases, the guaranteed payment), discounted monthly at the implicit rate of return of such lease, as determined by the applicable originator. Defaulted receivables that are leases will be deemed to have a lease value equal to the lease value at the time it became a defaulted receivable less the amount written-off as uncollectible in accordance with the credit and collection policy.

As of the cut-off date, the receivables had the following characteristics:

| • | number of receivables | 4,477 |

| • | average net receivable value | $136,702 |

| • | percentage of receivables that are loans (but not finance leases) by net receivable value | 52.48% |

| • | percentage of receivables that are finance leases by net receivable value | 10.48% |

| • | percentage of receivables that are leases (but not TRAC leases) by net receivable value | 34.46% |

| • | percentage of receivables that are TRAC leases by net receivable value | 2.58% |

| • | Aggregate book residual value of the equipment | $78,471,046 |

| • | percentage of receivables by net receivable value that bear interest at a fixed rate | 100.00% |

| • | weighted average remaining term to maturity (where residual realizations occur in last month of lease term) | 50.38 months |

| • | weighted average original term to maturity | 61.74 months |

| • | weighted average seasoning | 11.36 months |

| • | weighted average implicit rate of the receivables1 | 5.18% |

(1)Based on the interest rate or discount rate used by the applicable originator to allocate periodic payments between principal and interest on the receivables.

| • | distribution by type of equipment as a percentage of the net receivable value (greater than 5%): | |

| | • | industrial equipment | 33.16% |

| | • | construction equipment | 29.96% |

| | • | healthcare equipment | 15.08% |

| | • | transportation equipment | 12.54% |

The receivables and the related equipment are described in more detail in “CHARACTERISTICS OF THE RECEIVABLES” in the accompanying prospectus and “THE RECEIVABLES POOL” in this prospectus supplement.

| The Series 2014-1A SUBI | The series 2014-1A SUBI will be created by the UTI trustee’s identification and allocation of leases of titled transportation equipment and the related equipment theretofore constituting all or a portion of the undivided trust interest in the titling trust to a separate portfolio of the titling trust which the administrative trustee will designate as the “Series 2014-1A SUBI.” The series 2014-1A SUBI will be evidenced by the series 2014-1A SUBI certificate which will be issued to the initial beneficiary. The series 2014-1A SUBI certificate will be sold by the initial beneficiary to the depositor under the receivables sale agreement and will be further transferred by the depositor to the issuing entity under the receivables purchase and sale agreement. The issuing entity will grant to the indenture trustee a security interest in the series 2014-1A SUBI certificate, and the indenture trustee will become a secured party with respect to the leases of titled transportation equipment and the related equipment included in the series 2014-1A SUBI upon execution of the series 2014-1A SUBI supplement to the titling trust collateral agency agreement (see below). The leases of titled transportation equipment and the related equipment included in the series 2014-1A SUBI will be serviced by the servicer solely pursuant to the terms of the servicing agreement among the servicer, the issuing entity and the titling trust. No additional leases of titled transportation equipment, titled transportation equipment or other assets will be allocated from the undivided trust interest of the titling trust to the series 2014-1A SUBI following the closing date. In certain circumstances described in “—Removal of Receivables” below, the beneficial interest in leases of titled transportation equipment and the related equipment may be removed from the issuing entity if GE Equipment Funding, LLC purchases the beneficial interest in such leases and equipment for an amount equal to the purchase price of such assets. If the beneficial interest in any leases of the related equipment and the related equipment is purchased from the issuing entity by GE Equipment Funding, LLC, and then sold by GE Equipment Funding, LLC to the initial beneficiary, the initial beneficiary will cause the allocation of such leases and equipment from the series 2014-1A SUBI to the undivided trust interest of the titling trust. |

The titling trust agreements relevant to the series 2014-1A SUBI are as follows:

Titling Trust Agreement. The titling trust agreement is between GE Capital Title Holding Corp., as initial beneficiary and settlor and Wilmington Trust Company, as UTI trustee, administrative trustee and Delaware trustee. The titling trust agreement governs the formation and operation of the titling trust and, among other things, provides for the creation of the series 2014-1A SUBI.

The Series 2014-1A SUBI Supplement. The series 2014-1A SUBI supplement is a supplement to the titling trust agreement and is between GE Capital Title Holding Corp., as initial beneficiary and settlor and Wilmington Trust Company, as UTI trustee, administrative trustee and SUBI trustee. The series 2014-1A SUBI supplement will list the leases of titled transportation equipment and the related equipment allocated to the series 2014-1A SUBI, and will create the series 2014-1A SUBI certificate evidencing beneficial interest in 100% of the leases of titled transportation equipment and the related equipment included in the series 2014-1A SUBI.

The Series 2014-1A SUBI Servicing Supplement. The series 2014-1A SUBI servicing supplement is a supplement to the titling trust servicing agreement governing the servicing, administration and management of the leases of titled transportation equipment and the related equipment owned by the titling trust. The series 2014-1 servicing supplement will terminate the titling trust servicing agreement between the titling trust and the servicer as it pertains to the leases of titled transportation equipment and the related equipment that will be allocated to the series 2014-1A SUBI and will provide that the leases and equipment included in the series 2014-1A SUBI will be serviced, administered, managed and remarketed, as applicable, pursuant to the terms of the servicing agreement among the servicer, the issuing entity and the titling trust.

Titling Trust Collateral Agency Agreement. The titling trust collateral agency agreement is between the titling trust and GE Title Agent LLC, as collateral agent. The titling trust collateral agency agreement governs the creation and maintenance of a security interest in favor of the collateral agent and, with respect to the leases of titled transportation equipment and the related equipment included in the series 2014-1A SUBI, by operation of the series 2014-1A SUBI supplement to the titling trust collateral agent administration agreement, the indenture trustee, on behalf of the noteholders.

Titling Trust Collateral Agent Administration Agreement. The titling trust collateral agent administration agreement is between GE Title Agent, LLC, as the collateral agent and General Electric Capital Corporation, as administrator. The titling trust collateral agent administration agreement governs the performance by the administrator of certain duties of the collateral agent, including its administrative duties with respect to the series 2014-1A SUBI.

| Servicing | The servicer is General Electric Capital Corporation. The servicer will be responsible for servicing, managing and administering the receivables and related interests, and enforcing and making collections on the receivables on behalf of the issuing entity. The servicer, on behalf of the issuing entity, will also remarket or arrange for others to remarket the related equipment held or beneficially held by the issuing entity for receivables that are leases, including the equipment included in the series 2014-1A SUBI. Under the servicing agreement, as compensation for servicing, managing and administering the receivables and remarketing the related equipment, including the equipment included in the series 2014-1A SUBI, as applicable, the servicer will be entitled to a servicing fee equal to 0.35% per annum of the aggregate receivable value as of the first day of each collection period. In addition, the servicer will be entitled to collect and retain as additional servicing compensation in respect of each collection period, any late fees, prepayment charges and other administrative fees and |

expenses or similar charges collected during that period. The servicer has the option to make advances for delinquent scheduled payments only if it determines in its sole discretion that the advances will be recoverable in future periods.

| Administration | The administrator is General Electric Capital Corporation. The administrator will be responsible for performing the duties of the issuing entity under the indenture. The administrator will be entitled to an administration fee of $3,000 per annum, 1/12 of which is payable in arrears on each payment date. |

| Interest | The interest rate for each class of notes is set forth on the front cover of this prospectus supplement. The Class A-1 Notes will accrue interest on an actual/360 basis from (and including) the previous payment date to (but excluding) the related payment date, except that the first interest accrual period for those notes will be from (and including) the closing date to (but excluding) October 22, 2014. This means that the interest due for the Class A-1 Notes on each payment date will be the product of: (i) the outstanding principal balance of the Class A-1 Notes, (ii) the related interest rate and (iii) the actual number of days since the previous payment date (or, in the case of the first payment date, since the closing date) divided by 360. Interest on the notes (other than the Class A-1 Notes) will be calculated on the basis of a 360-day year of twelve 30-day months from (and including) the payment date in each calendar month to (but excluding) the payment date in the succeeding calendar month, except that the first interest accrual period for those notes will be from (and including) the closing date to (but excluding) October 22, 2014 on the basis of a 30-day month. This means that the interest due for each class of notes (other than the Class A-1 Notes) on each payment date will be the product of: (i) the outstanding principal balance of the related class of notes, (ii) the related interest rate and (iii) 30 (or, in the case of the first payment date, the number of days since the closing date on the basis of a 30-day month) divided by 360. |

Interest payments on all Class A Notes will have the same priority. Interest payments on the Class B Notes will be subordinated to interest payments (and in certain cases principal payments) on the Class A Notes.

See “Description of the Notes – Payments of Interest” for additional information.

| Principal | Prior to an event of default and acceleration of maturity of the notes, payments in respect of principal on the notes will be made, to the extent of funds available for such purpose as described under “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Priority of Payments” below, sequentially to the earliest maturing class of notes monthly on each payment date in the following order of priority: |

| • | To the Class A-1 Noteholders, until the outstanding principal balance of the Class A-1 Notes has been reduced to zero; |

| • | To the Class A-2 Noteholders, until the outstanding principal balance of the Class A-2 Notes has been reduced to zero; |

| • | To the Class A-3 Noteholders, until the outstanding principal balance of the Class A-3 Notes has been reduced to zero; |

| • | To the Class A-4 Noteholders, until the outstanding principal balance of the Class A-4 Notes has been reduced to zero; and |

| • | To the Class B Noteholders, until the outstanding principal balance of the Class B Notes has been reduced to zero. |

After an event of default and acceleration of maturity of the notes, payments of principal will be made as described under “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Priority of Payments” below.

On the applicable maturity date for each class of notes, the principal amount payable will be the amount necessary (after giving effect to the other amounts to be deposited in the note distribution account on that payment date and allocable to principal) to reduce the outstanding principal balance of the maturing class of notes to zero.

See “DESCRIPTION OF THE NOTES—Payments of Principal” in this prospectus supplement for additional details.

| Priority of Payments | Prior to the occurrence of an event of default and acceleration of the maturity of the notes, available amounts, which include all payments (which, in the case of split-payment stream receivables, includes only the base rent component) from obligors (other than late fees, extension fees, prepayment charges, if any, and any other similar charges under the applicable loan or lease that constitute part of the servicing fees), any net proceeds from any sale, re-lease, continued use or other disposition of any repossessed equipment securing a loan or, (in the case of TRAC leases, up to the related TRAC amount), any such proceeds from the sale, re-lease, continued use or other disposition of returned or repossessed leased equipment, servicer advances, proceeds from insurance policies covering the related equipment or the related obligors, the aggregate purchase price for any removed receivables and any investment earnings from funds in the issuing entity’s accounts, will be applied, together with amounts withdrawn from the reserve account, on each payment date after payment to the servicer of an amount equal to any accrued but unpaid servicing fees and reimbursement of certain unreimbursed servicer advances as follows: |

| (1) | to the indenture trustee, all accrued and unpaid trustee fees and expenses (not to exceed $75,000 per annum); |

| (2) | to the issuing entity’s administrator, all accrued and unpaid administration fees; |

| (3) | to pay ratably accrued and unpaid interest on the Class A Notes; |

| (4) | to pay principal on the notes in the priority specified above under “—Principal” in an amount equal to the excess of the outstanding principal balance of the Class A Notes over the aggregate receivable value at the end of the related collection period; |

| (5) | to pay accrued and unpaid interest on the Class B Notes; |

| (6) | to pay principal on the notes in the priority specified above under “—Principal” in an amount equal to the amount by which the outstanding principal balance of all the notes exceeds the excess of |

(x) the aggregate receivable value at the end of the related collection period over (y) the overcollateralization amount on such payment date (after giving effect to any principal payments on such payment date under clause (4) above);

| (7) | to pay 50% of the remaining available amount, after giving effect to the payments made pursuant to clauses (1) through (6) above, as principal in the priority specified above under “—Principal”; |

| (8) | to deposit in the reserve account, the amount necessary to make the amount on deposit in the reserve account equal to the required reserve account amount; |

| (9) | to the indenture trustee, any accrued and unpaid trustee fees and expenses not previously reimbursed; and |

| (10) | to the issuing entity, the remaining balance, if any. |

After the occurrence of an event of default, no cap will apply to trustee fees and expenses payable to the indenture trustee pursuant to clause (1) above, whether or not the maturity of the notes has been accelerated.

Pursuant to its limited liability company agreement, the issuing entity will distribute to its managing member the amounts available to the issuing entity pursuant to clause (10) above.

See “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Priority of Payments” for additional details and for special priority rules that would apply in a default situation.

| Events of Default | The notes are subject to events of default described under “DESCRIPTION OF THE NOTES” in the accompanying prospectus. These include: |

| · | the issuing entity fails to pay any interest on any note within five days after it becomes due and payable; provided that the failure to pay interest on the Class B Notes when due will not be an event of default if on the related payment date such failure to pay resulted from principal being paid in accordance with clause (4) under “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Priority of Payments”; |

| · | the issuing entity fails to pay any installment of the principal of any note on its due date; |

| · | bankruptcy, insolvency or similar events relating to the issuing entity; and |

| · | material breach by the issuing entity of its other covenants under the indenture, or material breach of a representation or warranty made by the issuing entity under the indenture, subject to applicable grace periods. |

If an event of default is not remedied as provided in the indenture, then the indenture trustee may, and at the direction of the noteholders will,

be required to, declare the principal of the notes to be immediately due and payable.

See “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Priority of Payments” for additional details and for special priority rules that would apply in a default situation.

| Optional Redemption | Any class of notes that remains outstanding on any payment date on which GE Equipment Funding, LLC exercises its clean-up call will be paid in whole on that payment date at a redemption price for such class equal to the outstanding principal balance of that class of notes plus accrued and unpaid interest thereon. GE Equipment Funding, LLC cannot exercise its clean-up call until the aggregate receivable value declines to 10% or less of the initial aggregate receivable value, measured on the cut-off date. |

CREDIT ENHANCEMENT

| Overcollateralization | 50% of available amounts remaining after giving effect to the payments made pursuant to clauses (1) through (6) under “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Priority of Payments” will be used to pay principal on the notes, which will cause the aggregate receivable value to increase relative to the outstanding principal balance of the notes. Any resulting overcollateralization will benefit the notes to the extent of those payments. The initial overcollateralization amount will represent approximately 3.74% of the initial net receivable value of the receivables plus 100% of the book residual value of the receivables. The depositor has not requested that any credit be given to the residual values of the equipment when determining credit enhancement. While investors will be entitled to receive any amounts received in connection with residual realizations, no particular value should be assumed with respect to such amounts. |

| Subordination | The Class B Notes will be subordinate to the Class A Notes. No interest will be paid on the Class B Notes on any payment date until the interest due on the Class A Notes on that payment date has been paid in full. No principal will be paid on the Class B Notes on any payment date until the principal payable on the Class A Notes on that payment date has been paid in full. Pursuant to the priority of payments, in certain circumstances, no interest will be paid on the Class B Notes until principal has been paid on the Class A Notes. |

The subordination of the Class B Notes to the Class A Notes as described herein will provide additional credit enhancement for the Class A Notes.

| Excess Spread | We expect interest collections on the receivables to be in excess of certain fees and expenses of the issuing entity and interest due on the notes. These amounts of excess interest are available in the collection period in which they are received to cover principal payable as a result of writedowns of the receivable pool attributable to defaults. |

| Reserve Account | On the closing date, an amount equal to 1.25% of the initial aggregate receivable value (an amount equal to $8,631,085.65) will be deposited by the issuing entity into a reserve account. On subsequent payment dates, this amount, the “Required Reserve Account Amount”, will equal the lesser of (i) the outstanding principal balance of the notes and (ii) 2.00% of the initial aggregate receivable value. The reserve account will not be fully |

funded on the closing date. On subsequent payment dates, amounts available in accordance with the priority of payments will be deposited in the reserve account until the balance of the reserve account equals the Required Reserve Account Amount. Withdrawals will be made from the reserve account, up to the amount available for such purpose, in the event there are shortfalls in available amounts to pay the amounts set forth in clauses (1) through (6) in “DESCRIPTION OF THE TRANSACTION AGREEMENTS— Priority of Payments” above or if there are shortfalls in collections to pay any accrued and unpaid servicing fees or unreimbursed servicer advances. Those withdrawals will be applied first to pay the servicer any accrued and unpaid servicing fees or unreimbursed servicer advances and then in accordance with clauses (1) through (6) under that heading. To the extent funds are withdrawn from the reserve account, the amount by which the amount on deposit therein is less than the Required Reserve Account Amount will be deposited to the reserve account from available amounts in the priority described in “Priority of Payments” above. To the extent that on any payment date, after payment of all amounts required under clauses (1) through (7) on that payment date, the balance in the reserve account is greater than the Required Reserve Account Amount, the excess will be withdrawn from the reserve account and released to the issuing entity. If on a maturity date of any class of notes, after payments are made under clauses (1) through (7), the outstanding principal balance of that class of notes is greater than zero, a withdrawal will be made from the reserve account, up to the amount available for such purpose, to pay the outstanding principal balance of that class of notes. On the maturity date of the Class B Notes or on any payment date following the occurrence of an event of default and the acceleration of the maturity of the notes, the amount on deposit in the reserve account that is available for distribution will be withdrawn from the reserve account and applied pursuant to the priority of payment rules applicable in a default situation.

| Removal of Receivables | In the event that a receivable becomes a delinquent receivable or the obligor thereon becomes subject to a bankruptcy proceeding, GE Equipment Funding, LLC, with the prior written consent of the issuing entity, has an option to purchase that receivable, and in the case of a lease, the related equipment, from the issuing entity at a price equal to the purchase amount for such receivable and, if applicable, the related equipment. In the event that a receivable that is a lease included in the series 2014-1A SUBI becomes a delinquent receivable or the obligor thereon becomes subject to a bankruptcy proceeding, GE Equipment Funding, LLC, with the prior written consent of the issuing entity, has an option to purchase the beneficial interest in such lease and the related titled equipment from the issuing entity at a price equal to the purchase amount for such lease and the related equipment. The issuing entity will require the depositor to (i) repurchase a receivable or (ii) pay the purchase amount of a lease included in the series 2014-1A SUBI that, in either case, is materially and adversely affected by a breach by the depositor of its representations and warranties under the receivables purchase and sale agreement. Following certain business events related to the originators that originated such receivables, the issuing entity may also sell to third parties (i) receivables and the related equipment, in the case of leases or (ii) in the case of leases included in the series 2014-1A SUBI, the beneficial interest in such leases and the related titled equipment, in each case, at a price equal to the greater of (i) the purchase amount and (ii) the fair market value of the affected leases and, if applicable, the related titled transportation equipment. |

See “DESCRIPTION OF THE TRANSACTION AGREEMENTS—Removal of Receivables.”

| Residual Realizations | Residual realizations are the amounts that the issuing entity will receive after lease termination on account of any sale, re-lease, continued use or other disposition of the equipment subject to leases, net of refurbishing and remarketing expenses. Such receipts will be included as available amounts and will be applied in accordance with the priority of payments except to the extent receipts on a TRAC lease exceed the applicable TRAC Amount. The total amount of residual realizations on an item of equipment will include the net proceeds from the ultimate disposition of the equipment, the net proceeds from any sale or re-lease and any rentals received under a month-to-month or other similar arrangement prior to final disposition. Any rent received under a lease (or in the case of split-payment stream receivables, the base rent received under the related lease) after its stated term has expired will be treated as a residual realization in the month received. See “Description of the Transaction Agreements—Residual Realizations” in the accompanying prospectus. |

| TAX STATUS | In the opinion of Mayer Brown LLP, tax counsel to the depositor, the Notes will be treated as debt for U.S. federal income tax purposes, and the issuing entity will not be characterized as an association (or publicly traded partnership) taxable as a corporation. See “U.S. FEDERAL INCOME TAX CONSEQUENCES” in the accompanying prospectus. |

CERTAIN ERISA

| CONSIDERATIONS | Subject to the considerations discussed in “CERTAIN ERISA CONSIDERATIONS” herein and in the accompanying prospectus, Notes may be purchased by employee benefit plans and accounts. An employee benefit plan, any other retirement plan, and any entity deemed to hold “plan assets” of any employee benefit plan or other plan should consult with its counsel before purchasing any such Notes. |

| LEGAL INVESTMENT | The Class A-1 Notes will be structured to be “eligible securities” for purchase by money market funds under paragraph (a)(12) of Rule 2a-7 under the Investment Company Act of 1940, as amended (the “Investment Company Act”). |

CERTAIN INVESTMENT

COMPANY ACT

| CONSIDERATIONS | The issuing entity is not registered or required to be registered as an investment company under the Investment Company Act. In determining whether the issuing entity is not required to be registered as an investment company, the issuing entity does not rely solely on the exemption from the definition of “investment company” set forth in Section 3(c)(1) or 3(c)(7) of the Investment Company Act. |

| RATINGS OF THE NOTES | We expect that the notes will receive credit ratings from two nationally recognized rating agencies hired by us. |

A rating is not a recommendation to purchase, hold or sell securities, inasmuch as such rating does not comment as to market price or suitability for a particular investor. The ratings of the notes address the likelihood of the timely repayment of interest on and the ultimate payment of principal of the notes pursuant to their terms. Each rating agency rating the notes will monitor the ratings using its normal surveillance procedures. Any rating

| | agency may change or withdraw an assigned rating at any time. Any rating action taken by one rating agency may not necessarily be taken by the other rating agency. None of the issuing entity, its managing member, the depositor, the sponsor, the administrator, the servicer, any originator, the titling trust, the initial beneficiary of the titling trust or the indenture trustee will be responsible for monitoring any changes to the ratings on the notes. Nationally recognized statistical rating organizations (each, an “NRSRO”) not hired to rate the transaction may provide an unsolicited rating that differs from (or is lower than) the rating provided by the rating agencies hired to rate the transaction. |

| | |

| CUSIP NUMBERS | The notes will have the following CUSIP numbers: |

| | Class | | CUSIP Number |

| | A-1 | | 36163T AA1 |

| | A-2 | | 36163T AB9 |

| | A-3 | | 36163T AC7 |

| | A-4 | | 36163T AD5 |

| | B | | 36163T AE3 |

| CEF EQUIPMENT | |

| HOLDING, L.L.C. | The mailing address of our principal executive office is 10 Riverview Drive, Danbury, CT 06810, Attention: Capital Markets Operations, and our telephone number is (203) 749-2101. |

RISK FACTORS

You should consider the following risk factors in deciding whether to purchase the notes:

Federal financial regulatory reform could have

a significant impact on the issuing entity, its

managing member, the sponsor, the originators,

the titling trust, the initial beneficiary, the

depositor or the servicer and could adversely

affect the timing and the amount of payments

on the notes. | On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted into law. Although the Dodd-Frank Act generally took effect on July 22, 2010, many provisions are yet to take effect and many provisions require implementing regulations to be issued. The Dodd-Frank Act is extensive and significant legislation that, among other things: |

| • creates a liquidation framework for the resolution of certain bank holding companies and other nonbank financial companies, defined as “covered financial companies,” in the event that a company, among other things is in default or in danger of default and the resolution of such a company under other applicable law would have serious adverse effects on financial stability in the United States, and also for the resolution of certain of their respective subsidiaries, defined as “covered subsidiaries,” in the event such a subsidiary, among other things, is in default or in danger of default and the liquidation of that subsidiary would avoid or mitigate serious adverse effects on the financial stability or economic conditions of the United States; |

| | • creates a new framework for the regulation of over-the-counter derivatives activities; |

| | • strengthens the regulatory oversight of securities and capital markets activities by the Securities and Exchange Commission (“SEC”); and |

| | • creates the Bureau of Consumer Financial Protection, a new agency responsible for administering and enforcing the laws and regulations for consumer financial products and services. |

| | |

| | The Dodd-Frank Act increases the regulation of the securitization markets. For example, it will require securitizers or originators to retain an economic interest in a portion of the credit risk for any asset that they securitize or originate. It also gives broader powers to the SEC to regulate credit rating agencies and adopt regulations governing these organizations and their activities. |

| | |

| | Compliance with the implementing regulations under the Dodd-Frank Act or the oversight of the SEC or other government entities, as applicable, may impose costs on, create operational constraints for, or place limits on pricing with respect to finance companies such as General Electric Capital Corporation (”GE Capital”) or its affiliates. Many provisions of the Dodd-Frank Act are required to be implemented through rulemaking by the appropriate federal regulatory agencies. As such, in many respects, the ultimate impact of the Dodd-Frank Act, and its effects on the financial markets and their participants, will not be fully known for an extended period of time. In particular, no assurance can be given that these new requirements imposed, or to be imposed after implementing regulations are issued, by the Dodd-Frank Act will not have a significant impact on the issuing entity, its managing member, the sponsor, any originator, the depositor or the servicer, including on the level of receivables and the related equipment owned or beneficially owned by the issuing entity, the servicing, managing and administration of the receivables and the remarketing of the related equipment, and on the regulation and supervision of GE Capital or its affiliates (including the issuing entity, the titling trust, the initial beneficiary, the managing member, the depositor or any subsidiary originator). |

| | |

| | In addition, no assurances can be given that the liquidation framework for the resolution of covered financial companies or their covered subsidiaries would not |

| | apply to GE Capital or its affiliates (including the issuing entity, its managing member, the initial beneficiary, the depositor or any subsidiary originator) or, if it were to apply, would not result in a repudiation of any of the transaction documents where further performance is required or an automatic stay or similar power preventing the indenture trustee, the securityholders or other transaction parties from exercising their rights. This repudiation power could also affect certain transfers of the receivables and the related equipment as further described under “LEGAL ASPECTS OF THE RECEIVABLES—Dodd Frank Orderly Liquidation Framework” in the accompanying prospectus. Application of this framework could materially adversely affect the timing and amount of payments of principal and interest on the notes. |

| | |

| It may not be possible to find a purchaser for your securities. | There is currently no public market for the notes and we cannot assure you that one will develop. Thus you may not be able to resell your notes at all, or may be able to do so only at a substantial discount. The underwriters may assist in resales of the notes, but they are not required to do so. We do not intend to apply for listing of the notes on any securities exchange or for the inclusion of the notes on any automated quotation system. A trading market for the notes may not develop. If a trading market does develop, it might not continue or it might not be sufficiently liquid to allow you to resell any of your notes. |

| | |

| | Recent and continuing events in the global financial markets, including the failure, acquisition or government seizure of several major financial institutions, the establishment of government bailout programs for financial institutions, problems related to subprime mortgages and other financial assets, the de-valuation of various assets in secondary markets, the forced sale of asset-backed and other securities as a result of the de-leveraging of structured investment vehicles, hedge funds, financial institutions and other entities, and the lowering of ratings on certain asset-backed securities, have caused a significant reduction in liquidity in the secondary market for asset-backed securities, including many securities backed by assets which are owned or beneficially owned by the issuing entity. This period of general market illiquidity may continue, or even worsen, and may adversely affect the value of your notes and may adversely affect your ability to locate a willing purchaser. Accordingly, you may not be able to sell your notes when you want to do so or you may be unable to obtain the price that you wish to receive for your notes and, as a result, you may suffer a loss on your investment. |

| | |

Ongoing economic developments may

adversely affect the performance and

market value of your notes. | Since the fall of 2007, general worldwide economic conditions experienced a downturn due to the effects of the deterioration in the residential housing market, the subprime lending crisis, the general credit market crisis, collateral effects on the finance and banking industries, increased commodity costs, volatile energy costs, concerns about inflation, slower economic activity, decreased consumer confidence, reduced corporate profits and capital spending, adverse business conditions and liquidity concerns and increased volatility in global financial markets due to uncertainty surrounding the level and sustainability of sovereign debt of several countries (the “Economic Crisis”). The Economic Crisis has adversely affected demand for the types of equipment that we finance, resulting in decreased sales or leases of these products, or decreased proceeds from those sales or leases, which could negatively affect our operations and result in higher losses and delinquencies on the assets. An increase in losses and delinquencies on the assets could result in reduced payments on your notes. As a result, the performance and market value of your notes may be adversely affected. See “RISK FACTORS—Defaults on the receivables may cause payment delays or losses” in the accompanying prospectus. In addition, we cannot predict the duration of the Economic Crisis, the timing or |

| | strength of a subsequent economic recovery or the extent to which the Economic Crisis will continue to negatively impact the business, financial condition and results of operations of the originators. |

| | |

Risk of downgrade of initial

ratings assigned to your notes. | The depositor expects that the notes will receive credit ratings from two NRSROs hired by the depositor (the “Hired NRSROs”). A rating is not a recommendation to purchase, hold or sell the notes, inasmuch as such rating does not comment as to market price or suitability for a particular investor. The ratings of the notes address the likelihood of the timely payment of interest on, and the ultimate repayment of principal of, the notes pursuant to their respective terms. There is no assurance that a rating will remain for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances in the future so warrant. The ratings of the notes are based primarily on the rating agencies’ analysis of the receivables, the servicer and available credit enhancement. If a rating initially assigned to any note is subsequently lowered or withdrawn for any reason, you may not be able to resell your notes without a substantial discount. |

| | |

| | The SEC rules state that the payment of fees by the sponsor, the issuing entity or an underwriter to rating agencies to issue or maintain a credit rating on asset-backed securities constitutes a conflict of interest for rating agencies. In the view of the SEC, this conflict is particularly acute because arrangers of asset-backed securities transactions provide repeat business to the rating agencies. The sponsor will pay the Hired NRSROs a fee to assign ratings on the notes. The sponsor has not hired any other NRSRO to assign ratings on the notes and is not aware that any other NRSRO has assigned ratings on the notes. However, under newly effective SEC rules, information provided to a hired rating agency for the purpose of assigning or monitoring the ratings on the notes is required to be made available to each NRSRO in order to make it possible for such non-hired NRSROs to assign unsolicited ratings on the notes. An unsolicited rating could be assigned at any time, including prior to the closing date, and none of the depositor, the issuing entity’s managing member, the sponsor, the underwriters or any of their affiliates will have any obligation to inform you of any unsolicited ratings assigned after the date of this prospectus supplement. NRSROs, including the Hired NRSROs, have different methodologies, criteria, models and requirements. If any non-hired NRSRO assigns an unsolicited rating on the notes, there can be no assurance that such rating will not be lower than the ratings provided by the Hired NRSROs, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. In addition, if the sponsor fails to make available to the non-hired NRSROs any information provided to any Hired NRSRO for the purpose of assigning or monitoring the ratings on the notes, Hired NRSROs could withdraw its ratings on the notes, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. |

| | |

| Cross-collateralization of receivables may affect your returns. | In many cases, the originators have other extensions of credit to an obligor in addition to the receivable or receivables with such obligor (or beneficial interests therein) included in the receivables pool securing the notes. In addition, after the closing date, any originator may originate additional extensions of credit to any obligor. Any originator may also sell receivables which it has retained to another issuing entity for which GE Capital may act as the servicer in the future. For purposes of this prospectus supplement, we refer to such existing or future extensions of credit by the originators, or beneficial interest that are not transferred (or in which beneficial interests are not transferred) to the issuing entity and the receivable pool, as retained receivables. |

| | |

| | In many cases, receivables sold to the issuing entity and the retained receivables |

| | are cross-defaulted and/or cross-collateralized. As a result, a retained receivable may have a lien or security interest on the equipment and other collateral securing a receivable in the receivable pool, and a receivable in the receivable pool may be secured by a lien or security interest on the collateral securing a retained receivable. In addition, the same guarantee, credit enhancement or recourse arrangement with a third party may be applicable to both a receivable or beneficial interest in receivable in the receivable pool and a retained receivable. Each originator will subordinate all rights to such cross-collateralization and will agree to obtain a similar subordination agreement from any third party securitization vehicle to which it may sell receivables or beneficial interests therein that are not owned or beneficially owned by the issuing entity. Likewise, the issuing entity will subordinate all rights to cross-collateralization that it has to the collateral for receivables held by any such originator. Certain receivables or beneficial interests therein that were previously transferred by the originators in securitization transactions or sold to third parties also contain such cross-collateralization provisions, which remain in place and have not been subordinated. |

| | |

| | Conflicts of interest involving GE Capital. GE Capital, in its capacity as servicer, will be required to make decisions, on behalf of the issuing entity, regarding the receivables owned or beneficially owned by the issuing entity which also affect its interest in the retained receivables. The servicing agreement obligates GE Capital, when acting in its capacity as the servicer, to act, on behalf of the issuing entity, in accordance with its customary servicing procedures and the credit and collection policies with respect to loan agreements, leases and other financing arrangements similar to the receivables owned or beneficially owned by the issuing entity. However, when acting in its capacity as the creditor under the retained receivables (or as the servicer for another issuing entity or lender which has purchased retained receivables or beneficial interests therein), GE Capital may make decisions and take actions to protect the creditor’s interest without regard to any effect which these decisions and actions may have on the interests of the issuing entity. Such decisions or actions by GE Capital may affect the timing and amount of the recovery by the issuing entity on receivables with the same obligor. If the obligor defaults on a receivable owned or beneficially owned by the issuing entity or a retained receivable, or an insolvency proceeding is commenced with respect to the obligor (or a third party providing a guarantee or other recourse arrangement), GE Capital, in its capacity as servicer, will be authorized to file claims (including bankruptcy claims) and commence remedial proceedings on behalf of the issuing entity, and in the same proceeding, GE Capital, in its capacity as a creditor of the obligor under a retained receivable (or as the servicer for another securitization issuer or lender which has purchased the retained receivables), may also take actions to protect its interest in the retained receivable. If a payment is made by or on behalf of an obligor (whether a scheduled payment, prepayment, liquidation or insurance proceeds or a payment by a third party under a guarantee or recourse arrangement), as servicer, GE Capital will allocate the payment between amounts due on receivables owned or beneficially owned by the issuing entity and amounts due on retained receivables in accordance with applicable law, the provisions of the receivables (and the retained receivables), the subordination provisions referred to above, if applicable and its customary practices for similar receivables. It is also the practice of the originators to accommodate obligor requests for the release of equipment or other collateral from the lien of a financing agreement or a finance lease, or the release of a third party from its guarantee (or other recourse arrangement) in respect of a receivable in appropriate circumstances. Accordingly, |

| | | GE Capital is authorized in its capacity as servicer or collateral agent, as applicable, to release the equipment or other collateral which secures a receivable and, as servicer, is also authorized to release a guarantee or other third party recourse arrangement in accordance with its customary servicing practices for similar receivables and the credit and collection policies. In such circumstances, GE Capital will, in accordance with such practices, determine whether (and in what order) to release an obligor’s collateral owned or beneficially owned by the issuing entity and/or collateral securing a retained receivable. |

| | | |

| | | Conflicts of interest involving the originators. When the servicer on behalf of the issuer sells equipment or other collateral for a receivable which has been repossessed, it may also be selling similar collateral for its own account or for an account of another party. None of the originators or the initial beneficiary is required (in a remedial proceeding, in bankruptcy, in allocation of payment or in the sale of repossessed equipment) to give priority to payments due to the issuing entity under a receivable over payments due to any such originator or the initial beneficiary under a retained receivable. Split-payment stream receivables. Only the base rent component of split-payment stream receivables will be sold to the issuing entity. In the event that an obligor does not pay the entire base rent and variable payment that is due, amounts paid to the issuing entity in respect of base rent, and to other parties in respect of variable payments, will be pro-rated on the amount of such base rent and variable payment due. |

| | | |

| Geographical concentrations of receivables may affect your investment. | | If adverse events or economic conditions were particularly severe in the geographic regions in which there is a substantial concentration of obligors, the amount of delinquent payments and defaults on the receivables may increase. As a result, the overall timing and amount of collections on the receivables owned or beneficially owned by the issuing entity, including from residual realizations, may differ from what you may have expected, and you may experience delays or reductions in payments you expected to receive. As of the cut-off date, approximately 13.25%, 9.88%, 9.46%, 5.87% and 5.58% of the net receivable value of the receivables related to obligors located in California, Illinois, Texas, North Carolina and Michigan, respectively. The receivables in those states represent 44.04% of the net receivable value of the receivables owned or beneficially owned by the issuing entity. As of the cut-off date, no other state accounts for more than 5.00% of the net receivable value of the receivables owned or beneficially owned by the issuing entity. |

| | | |

| Disproportionate concentrations of obligors in particular industries may adversely affect your investment. | | If the industries in which there is a substantial concentration of obligors experience adverse events or economic conditions, the overall timing and amount of collections on the receivables owned, or beneficially owned by the issuing entity may differ from what you may have expected. This could result in delays or reduced payments to you. As of the cut-off date, 19.36% of the net receivables value of the receivables relate to the agriculture, forestry and fishing industry, 15.08% relate to the healthcare industry, 15.03% relate to the manufacturing industry, 14.60% related to the mining and construction industry, 12.98% relate to the services industry, 8.82% relate to the distribution/wholesale industry, 6.72% relate to the printing and publishing industry and 5.06% relate to the transportation industry. Delinquencies or defaults on receivables with end-users in these industries may be adversely affected by various economic conditions including, for example, changes in interest rates and equipment inventory, and general levels of activity in the agriculture, forestry and fishing, healthcare, manufacturing, mining and construction, services, distribution/wholesale, printing and publishing, |

| | | transportation, retail, electronics, and other industries. In addition, the amounts received from the sale, re-lease or other disposition of the related equipment may also be adversely affected by these various economic conditions. Adverse developments concerning these or other conditions will tend to increase the rate of delinquencies and defaults by obligors in those industries and may also reduce residual realizations. This, in turn, could result in reductions of or delays in the collection of funds for payment of your notes. |

| | | |

Obligors may not be able to pay guaranteed payments. | | Loans and leases may require lump sum payments at the end of their term that could be materially larger than the regularly scheduled payment. These lump sum payments exist because certain of the loans require a balloon lump sum payment and certain leases included in the series 2014-1A SUBI contain a “terminal rent adjustment clause” or “TRAC.” Following the sale or other disposition of the related equipment, the TRAC requires the lessee to pay the excess, if any, of the related TRAC amount over the proceeds of such sale or other disposition. The aggregate amount of the lump sum payments attributable to balloon payments on loans and TRACs constitute 2.61% and 0.32%, respectively, of the aggregate receivable value as of the cut off date. These payments, where required, pose an additional payment risk because obligors may not be able to make such payments in full when they are due. Delays in, or shortfalls on, collections of these lump sum payments may result in delays or reduced payments to you. |

| | | |