#

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

Amendment No. 2

[ X ]

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES AND EXCHANGE ACT OF 1934

OR

[ ]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to ___________

Commission file number: 0-49974

CANADIAN SHIELD RESOURCES INC.

(Exact name of Registrant as specified in its charter)

Province of Ontario, Canada

(Jurisdiction of incorporation or organization)

151 Bloor Street West, #890, Toronto, Ontario, Canada M5S 1S4

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares, without par value

(Title of class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

NONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

7,205,218

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 12 or 15(d) of the Securities and Exchange Act of 1934 during the preceeding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety days.

Yes ___ NoXXX

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17XXX

Item 18 ____

Page 1 of 50

Page 2

CANADAIN SHIELD RESOURCES INC.

FORM 20-F REGISTRATION STATEMENT

AMENDMENT NO. 2

TABLE OF CONTENTS

PART I

Page

Item 1.

Identity of Directors, Senior Management and Advisors

3

Item 2.

Offer Statistics and Expected Timetable

3

Item 3.

Key Information

4

Item 4.

Information on the Company

7

Item 5.

Operating and Financial Review and Prospects

14

Item 6.

Directors, Senior Management and Employees

17

Item 7.

Major Shareholders and Related Party Transactions

22

Item 8.

Financial Information

23

Item 9.

The offer and Listing

24

Item 10.

Additional Information

27

Item 11.

Quantitive and Qualitative Disclosures About Market Risk

33

Item 12.

Description of Securities Other Than Equity Securities

33

PART II

Item 13.

Default, Dividend Arrearages and Delinquencies

33

Item 14.

Material Modifications to the Rights of Security Holders

and Use of Proceeds

33

Item 15.

Controls and Procedures

33

Item 16.

Reserved

33

PART III

Item 17.

Financial Statements

34

Item 18

Finanical Statements

34

Item 19.

Exhibits

35

Geological Glossary Terms

36

Conversion Table

37

Financial Statements for the Years Ended December 31, 2001, 2000 and 1999

38

Financial Statements for the Nine Months Ended September 30, 2002

44

Signature Page

50

Exhibit 1 – Joint Venture Agreement with Asia Now Resources Ltd.,. dated 8/9/2002

Exhibit 2 – Joint Venture Agreement with Planet Exploration Inc., dated 8/26/2002

Exhibit 3 – Joint Venture Agreement with Planet Exploration Inc., dated 2/5/2003

Exhibit 4 – Consent of Auditors, KPMG LLP, dated 8/21/2002

Page 3

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

1.A.1. DIRECTORS

Table No. 1 lists as of 2/28/2003 the names of the Directors of the Company. The business address for all Directors is care-of the Company.

Table No. 1

Directors

Name | Age | Date First Elected/Appointed |

Lynda B. Bloom (1)(2) | 46 | December 1996 |

Bernard L. Kraft (1)(2) | 72 | April 1996 |

Michael P. Kraft (1)(2) | 39 | April 1997 |

(1)

Member of Audit Committee

(2)

Resident/Citizen of Canada

1.A.2. Senior Management

Table No. 2 lists, as of 2/28/2003, the names of the Senior Management of the Company. The Senior Management serves at the pleasure of the Board of Directors.

Table No. 2

Senior Management

Name | Position | Age | Date of First Appointment |

Lynda B. Bloom (1) | President/CEO | 46 | December 1996 |

Khurram R. Qureshi (2) | Chief Financial Officer | 40 | April 1998 |

Imran Atique (3) | Secretary Treasurer | 26 | September 2001 |

(1)

She spends one-third of her time on the affairs of the Company.

(2)

He spends about 10% of his time on the affairs of the Company.

(3)

He spends about 20% of his time on the affairs of the Company.

(4)

All Business Addresses: c/o Canadian Shield Resources Inc.

151 Bloor Street West

Toronto, Ontario, Canada M5S 1S4

Lynda B. Bloom’s business functions, as President and CEO of the Company, include management of all exploration projects, strategic planning, business development, operations and reporting to the Board of Directors.

Khurram R. Qureshi’s business functions, as Chief Financial Officer of the Company, include financial administration, accounting, and providing support to the President and CEO in all financial issues.

Imran Atique’s business functions, as Corporate Secretary and Treasurer of the Company include assisting the Chief Financial Officer and the President in all financial matters and assisting the Board of directors in carrying out their duties.

1.B. Advisors

--- No Disclosure Necessary ---

1.C. Auditors

The Company’s auditors for its financial statements for each of the preceding three years was KPMG LLP, Chartered Accountants, Commerce Court West, Suite 3300, P.O. Box 31, Stn. Commerce Court, Toronto, Ontario, Canada M5L 1B2. They are members of the Ontario Institute of Chartered Accountants.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

--- No Disclosure Necessary ---

Page 4

ITEM 3. KEY INFORMATION

3.A.1. Selected Financial Data

3.A.2. Selected Financial Data

The Company's financial statements are stated in Canadian Dollars (CDN$) and are prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP), the application of which, in the case of the Company, conforms in all material respects for the periods presented with US GAAP, except as discussed in footnotes to the financial statements.

The selected financial data in Table No. 3 of the Company for Fiscal 2001, Fiscal 2000 and Fiscal 1999 ended December 31st was derived from the financial statements of the Company which have been audited by KPMG LLP, Chartered Accountants, as indicated in their audit report which is included elsewhere in this Registration Statement. The selected financial data set forth for Fiscal 1998 and Fiscal 1997 ended December 31st are derived from the Company's audited financial statements, not included herein.

The selected financial data in Table No. 3 as at and for the nine-month period ended 9/30/2002 and 9/30/2001 have been derived from the unaudited financial statements of the Company, included herein and, in the opinion of management include all adjustments (consisting solely of normally recurring adjustments) necessary to present fairly the information set forth therein.

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in the Registration Statement.

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain future earnings for use in its operations and the expansion of its business.

Table No. 3

Selected Financial Data

(CDN$ in 000, except per share data)

| | Unaudited Nine Month | |

| |

Ended 9/30/02 |

Ended 9/30/01 | Year Ended 12/31/01 | Year Ended 12/31/00 | Year Ended 12/31/99 | Year Ended 12/31/98 | Year Ended 12/31/97 |

| | | | | | | | |

CANDAIAN GAAP | | | | | | | |

Sales Revenue | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

Loss From Operations | $ (171) | $ (74) | $ (311) | $ (197) | $ (74) | $ (51) | $ 0 |

Loss for the Period | $ (171) | $ (74) | $ (311) | $ (197) | $ (74) | $ (51) | $ 0 |

Basic Loss Per Share | $ (0.03) | $ (0.01) | $ (0.02) | $ (0.01) | $ (0.02) | $ (0.02) | $ 0.00 |

Dividends Per Share | $ 0.00 | $ 0.00 | $ 0.00 | $ 0.00 | $ 0.00 | $ 0.00 | $ 0.00 |

| | | | | | | | |

Wtg. Avg. Shares (000) | 6802 | 5970 | 6027 | 4908 | 3909 | 3400 | 351 |

Period-end Shares O/S | 9339 | 7205 | 7205 | 6984 | 5900 | 3400 | 3400 |

| | | | | | | | |

Working Capital | $ (6) | | $ (10) | $ 72 | $ 101 | $ 179 | $ 326 |

Mineral Properties | 673 | | 642 | 621 | 446 | 91 | 0 |

Long-term Debt | 0 | | 0 | 0 | 0 | 0 | 0 |

Capital Stock | 999 | | 793 | 771 | 670 | 320 | 326 |

Shareholders’ Equity | 517 | | 482 | 574 | 546 | 270 | 326 |

Total Assets | 752 | | 682 | 770 | 595 | 277 | 327 |

| | | | | | | | |

US GAAP | | | | | | | |

Net Loss | $ (202) | $ (68) | $ (147) | $ (125) | $ (451) | | |

Loss Per Share | $ (0.03) | $ (0.01) | $ (0.02) | $ (0.03) | $ (0.12) | | |

Wtg. Avg. Shares (000) | 6802 | 5970 | 6027 | 4908 | 3909 | | |

| | | | | | | | |

Mineral Properties | $ 0 | | $ 0 | $ 0 | $ 0 | | |

Shareholders’ Equity | $ (6) | | $ (10) | $ 115 | $ 101 | | |

Total Assets | $ 74 | | $ 40 | $ 149 | $ 150 | | |

(1)

Cumulative Net Loss since incorporation through 9/30/2002 under US GAAP was $(1,065,649).

(2)

a) Under U.S. GAAP, options granted to non-employees as compensation for services provided are fair valued and an expense recorded

b) Under US GAAP, all costs related to exploration-stage properties are expensed in the period incurred.

3.A.3. Exchange Rates

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CDN$) or “$”. The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

Table No. 4 sets forth the rate of exchange for the Canadian Dollar at the end of the five most recent fiscal periods ended December 31st, the average rates for the period, and the range of high and low rates for the period. The data for the nine-month periods ended 9/30/2002 and 9/30/2001 is provided. The data for each month during the previous twelve months is also provided.

For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

Table No. 4

U.S. Dollar/Canadian Dollar

| | Average | High | Low | Close |

| | | | | |

February 2003 | | 1.53 | 1.49 | 1.49 |

January 2003 | | 1.57 | 1.52 | 1.52 |

December 2002 | | 1.58 | 1.55 | 1.58 |

November 2002 | | 1.59 | 1.55 | 1.56 |

October 2002 | | 1.59 | 1.56 | 1.56 |

September 2002 | | 1.59 | 1.55 | 1.59 |

August 2002 | | 1.60 | 1.55 | 1.56 |

July 2002 | | 1.59 | 1.51 | 1.59 |

June 2002 | | 1.55 | 1.51 | 1.52 |

May 2002 | | 1.57 | 1.53 | 1.53 |

April 2002 | | 1.60 | 1.56 | 1.57 |

March 2002 | | 1.60 | 1.58 | 1.60 |

February 2002 | | 1.61 | 1.59 | 1.60 |

January 2002 | | 1.61 | 1.59 | 1.59 |

| | | | | |

Fiscal Year Ended 12/31/2002 | 1.57 | 1.61 | 1.51 | 1.58 |

Fiscal Year Ended 12/31/2001 | 1.55 | 1.60 | 1.49 | 1.59 |

Fiscal Year Ended 12/31/2000 | 1.50 | 1.56 | 1.44 | 1.50 |

Fiscal Year Ended 12/31/1999 | 1.49 | 1.53 | 1.44 | 1.44 |

Fiscal Year Ended 12/31/1998 | 1.49 | 1.57 | 1.41 | 1.54 |

Fiscal Year Ended 12/31/1997 | 1.39 | 1.44 | 1.34 | 1.43 |

| | | | | |

Page 5

3.B. Capitalization and Indebtedness

Table No. 5 sets forth the capitalization and indebtedness of the Company as of 9/30/2002,since which there have been no material changes other than the exercise of 362,500 warrants at $0.10 per share.

Table No. 5

Capitalization and Indebtedness

September 30, 2002

Long-Term Portion of Capital Leases | $ nil |

Long-Term Portion of Long-Term Debt | $ nil |

| | |

Shareholders’ equity: | |

Common shares, no par value; | |

Unlimited Number of shares authorized, | |

9,339,058 shares issued and outstanding | $ 998,802 |

| | |

Retained Earnings (deficit) | $ (482,108) |

| | |

Net Stockholders’ Equity | $ 516,694 |

| | |

TOTAL CAPITALIZATION | $ 516,694 |

| | |

Stock Options Outstanding: 899,000 | |

Warrants Outstanding: 2,525,000 | |

3.C. Reasons For The Offer And Use Of Proceeds

--- No Disclosure Necessary ---

3.D. Risk Factors

The Company is subject to a number of significant uncertainties and risks including those described below and those described elsewhere in this Registration Statement, are the only known material risk factors, which may ultimately affect the Company in a manner and to a degree that cannot be foreseen at this time.

Financing Risks

If the Company’s exploration programs are successful, additional financing will be required to develop the mineral properties identified and to place them into commercial production. The development of the Company’s mineral properties is, therefore, dependent upon the Company’s ability to obtain financing through the joint venturing of projects, debt financing, equity financing or other means. Failure to obtain such financing may result in delay or indefinite postponement of development work on the Company’s mineral properties, as well as the possible loss of such properties.

Dependence Upon Key Management Employees

While engaged in the business of exploiting mineral properties, the nature of the Company’s business, its ability to continue its exploration of potential development projects, and to develop a competitive edge in the marketplace, depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there is a possibility that the Company will not be able to attract and retain such personnel. The Company’s development will depend, on the efforts of its key management employees. Loss of any of these people could have a material adverse effect on the Company.

Conflicts of Interest

Certain of the directors and officers of the Company are also directors and/or officers and/or shareholders of other natural resource companies. As the Company is engaged in the business of exploiting mineral properties, such associations may give rise to conflicts of interest from time to time. If a conflict of interest arises at a meeting of the board of directors, any director in a conflict must disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at the time.

Management of Growth

Company’s inability to manage the expansion of its business, may have a material adverse effect on the Company’s operating results.

Doing Business in Mongolia

The Company’s business in Mongolia may be harmed if the country fails to complete its transition from state socialism and a planned economy to political democracy and a free market economy. Since 1990, Mongolia has been in transition from state socialism and a planned economy to a political democracy and a free market economy. Much progress has been made in this transition but much progress remains to be made, particularly with respect to the rule of law. Many laws have been enacted, but in many instances, they are neither understood nor enforced. For decades, Mongolians have looked to politicians and bureaucrats as the sources of the “law”. This has changed in theory, but often not in practice. With respect to most day-to-day activities in Mongolia government civil servants interpret, and often effectively make, the law. This situ ation is gradually changing but at a relatively slow pace. Laws may be applied in an inconsistent, arbitrary and unfair manner and legal remedies may be uncertain, delayed or unavailable.

Future amendments to Mongolian laws could weaken, shorten or curtail the Group’s mineral exploration rights or make it more difficult or expensive to obtain mining rights and carry out mining. Mongolia’s Minerals Law was drafted with the assistance of Western legal experts and is regarded as one of the most logical, internally consistent and effective pieces of mining legislation among all of the developing countries of Asia. However, future amendments to the Minerals Law or new legislation covering ostensibly unrelated matters could affect the existing tenure regime under the Minerals Law and harm the Company’s ability to carry on business in Mongolia. Mongolian government civil servants have, in the past, unsuccessfully attempted to introduce amendments to the Minerals Law that would, from the perspective of the international mining industry, be regarde d as counterproductive. Future amendments to the Minerals Law or new legislation, if implemented, could vary or abrogate key provisions of the Minerals Law in a manner that impairs the Company’s ability to conduct exploration and mining in Mongolia.

Lack of infrastructure in proximity to the Company’s project could adversely affect mining feasibility. The Company’s project is located in an extremely remote area which lacks basic infrastructure, including sources of power, water, housing, food and transport. The availability of such sources may adversely affect mining feasibility and will, in any event, require the Company to arrange significant financing, locate adequate supplies and obtain necessary approvals from national, provincial and regional governments, none of which can be assured.

Page 6

The Company’s exploration licenses could expire before the Group is ready or able to obtain a mining license. The exploration licenses for the Company’s project are valid for an initial three years, and can then be renewed twice for an extension of two years each renewal, allowing for a maximum period of seven years. Prior to such expiry, the Company will have to convert the exploration licenses to mining licenses or risk losing its rights to the project. The Company may not be ready to commence mining activities when the exploration licenses expire. Early in 2002, a law on Licenses for Business Activities was enacted which has been interpreted by Mongolian bureaucrats as requiring aimag (provincial) government level approval as a condition to the grant of exploration and mining licenses. There can be no assurance that the Company will be ab le to obtain such approval on acceptable terms or at all when applying for mining licenses and exploration licenses in the future.

For further information about the securities laws of Mongolia go to:

www.mse.mn/law/law4.htm.

Risks Relating to an Investment in the Securities of the Company

Dilution Through Employee/Director/Consultant Options. Because the success of the Company is highly dependent upon its respective employees, the Company may in the future grant to some or all of its key employees, directors and consultants options to purchase shares of its Common Stock as non-cash incentives. Those options may be granted at exercise prices below those for the common stock prevailing in the public trading market at the time or may be granted at exercise prices equal to market prices at times when the public market is depressed. To the extent that significant numbers of such options may be granted and exercised, the interests of the other stockholders of the Company may be diluted.

Dividends. The Company intends to invest all available funds to finance the growth of the Company’s business and therefore investors cannot expect to receive a dividend on the common shares of the Company in the foreseeable future. Even were the Company to determine a dividend could be declared, the Company could be precluded from paying dividends by restrictive provisions of loans, leases or other financing documents or by legal prohibitions under applicable corporate law.

Stock Market Price and Volume Volatility. The market for the common stock of the Company may be highly volatile for reasons both related to the performance of the Company or events pertaining to the industry as well as factors unrelated to the Company or its industry. The Company’s common shares can be expected to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding the Company’s business, and changes in estimates and evaluations by securities analysts or other events or factors. In recent years the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies such as the Company, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, the Company’s common shares can also be expected to be subject to volatility resulting from purely market forces over which the Company will have no control. Further, despite the existence of a market for trading the Company’s common shares in the United States and Canada, stockholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the price of the stock.

Dependence on Key Personnel; Involvement of Key Personnel in other Businesses. The Company’s future success depends in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there is a possibility that the Company will be able to attract and retain such personnel. The Company’s development to date has depended, and in the future will continue to depend, on the efforts of its key management employees, such as Lynda B. Bloom. Loss of any of these people could have a material adverse effect on the Company.

Company is Incorporated in Canada

The articles/by-laws and the laws of the Province of Ontario are different that those typical in the United States. However, the typical rights of investors in Canadian companies differ only modestly from those in the United States; refer to the relevant sections which are discussed in Section 9.A.5 and Section 10.B of this Registration Statement.

Control by Principal Stockholders, Officers and Directors Could Adversely Affect the Company’s Stockholders. The Company’s officers, directors and greater-than-five-percent stockholders (and their affiliates), acting together, have the ability to control substantially all matters submitted to the Company’s stockholders for approval (including the election and removal of directors and any merger, consolidation or sale of all or substantially all of the Company’s assets) and to control the Company’s management and affairs. Accordingly, this concentration of ownership may have the effect of delaying, deferring or preventing a change in control of the Company, impeding a merger, consolidation, takeover or other business combination involving the Company or discouraging a potential acquirer from making a tender offer or otherwise attem pting to obtain control of the Company, which in turn could materially adversely affect the market price of the Company’s stock.

History of Losses. The Company has had a history of lossesThe Company will require significant additional funding to meet its business objectives. Capital will need to be available to help maintain and to expand development on the Company’s principal exploration property. The Company may not be able to obtain additional financing on reasonable terms, or at all. If equity financing is required, as expected, then such financings could result in significant dilution to existing shareholders.

Broker-Dealers May Be Discouraged From Effecting Transactions In Our Common Shares Because They Are Considered Penny Stocks And Are Subject To The Penny Stock Rules. Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on NASD broker-dealers who make a market in "a penny stock". A penny stock generally includes any non-NASDAQ equity security that has a market price of less than US$5.00 per share. Our shares are quoted on the TSX Venture Exchange, and the price of our shares ranged from CDN$0.02 (low) to CDN$0.30 (high) during the period from 1/1/2001 to 2/28/2003. The closing price of our shares on 2/28/2003 was CDN$0.06. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effec ting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or "accredited investor" (generally, an individual with net worth in excess of US$1,000,000 or an annual income exceeding US$200,000, or US$300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser's written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt.

In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the US Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

U.S. Investors May Not Be Able to Enforce Their Civil Liabilities Against Us or Our Directors, Controlling Persons and Officers

It may be difficult to bring and enforce suits against the Company. The Company is a corporation incorporated in the province of Ontario under the Business Corporation Act (Ontario). A majority of the Company's directors must be residents of Canada, and all or a substantial portion of their assets is located outside of the United States. In addition, all of the Company's assets are located in Canada. As a result, it may be difficult for U.S. holders of our common shares to effect service of process on these persons within the United States or to realize in the United States upon judgments rendered against them. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against us or such persons predicated upon the U.S. federal securities laws or other laws of the United States.

A judgment obtained in a U.S. court may not be recognized by a Canadian court, for example:

a) where the U.S. court where the judgment was rendered had no jurisdiction according to applicable Canadian law;

b) judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state;

c) the judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure;

d) a dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided

in a third country and the judgment meets the necessary conditions for

recognition in a Canadian court;

e) the outcome of the judgment of the U.S. court was inconsistent with Canadian public policy;

f) the judgment enforces obligations arising from foreign penal laws or laws that deal with taxation or the taking of property by a foreign government; or

g) there has not been compliance with applicable Canadian law dealing with the limitation of actions.

Page 7

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Introduction

Canadian Shield Resources Inc. and its subsidiaries are collectively hereinafter referred to as the “Company”.

The Company is engaged in the business of locating, acquiring, exploring, and, if warranted, developing and exploiting, mineral properties. The Company’s only mineral properties are two groups of Mongolian Property Licenses and the Erichsen Lake Property in northwestern Ontario, Canada.

The Company is not an extractive enterprise. The Company is a natural resource exploration company but has not made expenditures related to plant and equipment. The Company’s rights to explore on mineral exploration properties such properties were derived from joint venture agreements and acquisitions.

The Company’s executive office is located at:

151 Bloor Street West, #890

Toronto, Ontario, Canada M5S 1S4

Telephone: (416) 927-7000

Facsimile: (416) 927-1222.

e-mail: mailto:iatique@canadianshieldresources.com

The Company’s registered office is located at:

151 Bloor Street West, #890

Toronto, Ontario, Canada M5S 1S4

Telephone: (416) 927-7000

Facsimile: (416) 927-1222.

The contact person is:

Imran Atique, Corporate Secretary/Treasurer.

The Company's fiscal year ends December 31st.

The Company's common shares trade on the TSX Venture Exchange under the symbol “CSP.V”.

The Company has an unlimited number of no-par common shares authorized. At 12/31/2001, the end of the Company's most recent fiscal year, there were 7,205,218 common shares issued and outstanding. At 2/28/2003, there were 9,339,058 shares issued and outstanding.

The Company is an “exploration stage company” and may be there is no commercially viable mineral deposit on any of its properties and further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

History and Growth

Incorporation and Name Changes. The Company was incorporated under the name Catalyst Minerals Ltd. pursuant to the laws of the Province of Ontario by Articles of Incorporation on 4/24/1996. The name was changed to Catalyst Resources Inc. on 12/18/1996 and subsequently to Canadian Shield Resources Inc. on 8/13/1997.

Acquisition of Synergy Exploration Ltd.

Effective 2/25/1998, the Company entered into an agreement with Synergy Exploration Ltd. (“Synergy”), whereby the Company acquired all of the issued and outstanding shares of Synergy (the "Major Transaction"), a private Ontario company controlled by three of the Directors of the Company. The Company at that time was a junior capital pool company trading on the Alberta Stock Exchange. The Major Transaction is summarized as follows: the Company entered into a share purchase agreement with each shareholder of Synergy, whereby the Company agreed to acquire all of the outstanding shares of Synergy in exchange for 2,000,000 common shares of the Company (deemed value = fair market value = $300,000), which represented 33.8% of the issued and outstanding shares of the Company at 8/5/1999. The purchase cost, including expenses was approximately $318,000, with $329,733 assigned to the mineral properties of Synergy. The official completion date for the Major Transaction was 8/5/1999.

Synergy was incorporated pursuant to the laws of the Province of Ontario, Canada on 3/24/1997.

In view of the fact Lynda B. Bloom, Michael P. Kraft and Bernard Kraft were directors, officers, shareholders or otherwise associated with Synergy, an independent review of the Major Transaction was conducted by Mr. Gregory R. Harris, the remaining independent Director at that time. In considering the Major Transaction, the Company’s independent Director reviewed the financial statements of the Company and Synergy, the prospects and opportunities available to the Company and Synergy, the pro forma consolidated balance sheet of the Company, and the trading history of the Company's common shares. The Company’s independent Director held discussions with management of the Company and Synergy. The Company’s independent Director concluded that the Major Transaction is in the best interests of the Company and its shareholders.

The primary asset of Synergy was a joint venture agreement with Tulsa Resources Ltd. regarding the Strike Point Base Metal Property in Manitoba.

Existing Joint Venture Agreements

1.

8/9/2002 joint-venture agreement with Asia Now Resources Limited regarding the Erichsen Lake Property

2.

8/26/2002 letter agreement with Planet Exploration Inc. regarding the Mongolian Property Licenses

Financings

The Company has financed its operations through borrowings and/or private issuance of common shares (gross proceeds):

1997: | Private Placement, | 1,400,000 shares, | $ 105,000 |

1997: | Initial Public Offering, | 2,000,000 shares, | $ 300,000 |

1999: | Private Placement, | 500,000 units | $ 50,000 |

2000: | Shares for Debt, | 358,728 shares, | $ 36,949 |

| | Private Placement, | 725,000 shares, | $ 72,500 |

2001: | Shares for Debt, | 221,490 shares, | $ 22,149 |

2002-to-date: | Shares for Debt, | 338,840 shares, | $ 33,884 |

| | Private Placement, | 1,800,000 unites, | $ 180,000 |

| | Warrant Exercise, | 362,500 shares, | $ 36,250 |

Caital Expenditures

1998: | $ 68,177 | Strike Point Property exploration costs |

1999: | $ 333,633 | acquisition of Synergy Explorations Ltd. |

| | $ 44,861 | Strike Point Property exploration costs |

| | $ 3,900 | Sioux Lookout Property exploration costs |

2000: | $ 25,977 | Strike Point Property exploration costs |

2001: | $ 20,891 | Strike Point Property exploration costs |

2002-to-9/30/2002: | $ 27,423 | on Strike Point/Mongolia/Erichsen Lake |

Page 8

4.B. BUSINESS OVERVIEW

Incorporation

The Company was incorporated in April 1996 as a Junior Capital Pool Corporation, a method created by the Alberta Stock Exchange to enable experienced management in organizing a company and raising initial funds to facilitate acquiring an operating business in a “Major Transaction”.

Financings

In January 1997, the Company completed a private placement of 1,400,000 common shares, raising $105,000. In October 1997, the Company completed its initial public offering, raising $300,000 (gross) through the sale of 2,000,000 common shares. In June 1999, the Company completed a $50,000 private placement of 500,000 units of common shares and warrants. In June 2002, the Company completed a $180,000 private placement of 1,800,000 units of common shares and warrants.

Major Transaction

In February 1998, the Company entered into an acquisition agreement for Synergy Explorations Ltd., a private Ontario company with the Strike Point mining property in Manitoba, Canada. Synergy was controlled by three of the Company’s directors: Lynda B. Bloom, Bernard L. Kraft, and Michael P. Kraft; who collectively, directly/indirectly controlled 39% of the equity of Synergy. This acquisition (the “Major Transaction”) was completed in August 1999 mainly through the issuance of 2,000,000 common shares.

The Company was in the mineral exploration business through a joint venture agreement with Tulsa Resources Ltd. The joint venture agreement (as amended) committed the Company (through its subsidiary, Synergy) to expending up to $275,000 by July 2003 on exploration to fully earn it 81% interest in the Strike Point Base Metal Property. Of that amount, $75,000 was required to be expended by 7/4/2001 and it was. The amended joint venture agreement required a minimum of $10,000 more in exploration expenditures on the property prior to 10/31/2002, $90,000 prior to 12/31/2003, and another $100,000 prior to 7/4/2004. The agreement was terminated in December 2002.

Strike Point Base Metal Property

During 1998, Synergy re-established a grid on the northern portion of the Strike Point Base Metal Property, oriented in a different direction than the grid previously established by Teck Exploration Limited (“Teck”), in order to optimize geophysical responses. Synergy completed 23 kilometers of electromagnetic and magnetic surveys on closer line spacings than the previous geophysical surveys. Geophysical conductors were confirmed and the locations indicate that the drill holes completed by Teck may not have fully tested the known conductors.

During 1999, rock sample collection and analysis were completed. Plans were also developed to drill test base metal showings identified by previous exploration efforts. In November 2000, Synergy completed 824 feet of drilling at three drill hole sites. The principal focus of the drilling was to test reports of base metal mineralization in literature from the 1920’s. Some alteration and zinc mineralization were confirmed but no significant mineralization was encountered. In 2001, efforts were focused on researching the historical drill data to better define the orientation of the zinc mineralization encountered in the 1952 drilling. This has resulted in a model that explains why zinc mineralization was missed by drilling completed during 1992-1994.

An additional claim was staked on the property to cover ground where geophysical conductors and alteration were identified.

The joint-venture with Tulsa Resources Ltd. was terminated in December 2002.

Sioux Lookout Property

In 1998, the Company entered into an option and joint venture agreement between Synergy, its wholly owned subsidiary, and Stuarton Resources Ltd. (“Stuarton”), the owner of the property. Pursuant to the agreement, the Company had the right to earn a 100% undivided interest in two claims in the Patricia Mining District, near Sioux Lookout, Ontario. Synergy paid Stuarton $10,500 upon signing of the purchase agreement and made commitments to spend a maximum of $40,400 over two years on exploration to maintain the agreement in good standing. Synergy had the option to purchase a 100% interest in the Properties, upon payment of $78,000 before 7/31/2000. After completing due diligence on the property, the Company determined that Sioux Lookout did not merit additional exploration and the agreement was terminated on 8/7/2000.

Target Europe Inc.

Pursuant to a letter of intent of 7/19/2000 between the Company and Target Europe Inc. (“Target”), the Company made an offer to acquire all of the issued and outstanding shares of Target. Target is a private Alberta incorporated company with mineral exploration licences in Spain and Portugal. The purchase price for the acquisition was negotiated as 1,450,000 common shares. Target shareholders would also hold a 1% Net Smelter Return payable on the first property in the existing Target portfolio to be brought to commercial production. Subsequently the agreement was amended to acquire only the European subsidiary of Target, Target Europe (Spain) Inc., under the same terms. The Company advanced $42,824 to Target in anticipation of consummation of the acquisition. The advance is treated as a promissory note and is personally guaranteed by Peter Ho lmes, President/CEO/Director of Target Europe Inc.; even if the acquisition was not consummated. After further due diligence, the agreement was terminated on 2/23/2001.

PXI Mongolia Property Exploration License

Pursuant to a joint-venture agreement dated 8/26/2002, the Company entered into an agreement with Planet Exploration Inc. (“PXI”) to earn up to a 50% interest in three mineral property exploration licenses comprising 142,059 hectares in Mongolia’s South Gobi desert for the sum of $10,000 (paid) and 150,000 common shares issuable upon regulatory approval. The Company agreed to undertake a US$50,000 Phase I exploration program, planned for completion in 2002. Upon the completion of the Phase I exploration program and issuance of an additional 150,000 common shares, the Company will earn a 25% interest in the three mineral exploration licenses. The Company will have the option of maintaining its interest in the properties by contributing its proportionate share of exploration costs or it can earn an additional 25% interest by completing a Phase II program of US$50,000 by 8/31/2003, the payment of an additional US$25,000, and the issuance of an additional 200,000 common shares. The transaction is subject to due diligence and regulatory approval. The Company has spent $8,773 on this property exploration through 9/30/2002.

Erichsen Lake Property

On 8/9/2002, the Company entered into an agreement to form a 50/50 joint venture with Asia Now Resources Limited, a private Ontario company to explore mining claims in northwestern Ontario. Under the terms of a letter agreement, the Company has acquired a 50% interest in the Erichsen Lake Property by funding the staking expenditures for the mining claims at a cost of up to $17,000. The transaction is subject to due diligence and regulatory approval. The Company has spent $16,264 on this property exploration through 9/30/2002. Effective October 2002, Asia Now Resources Limited transferred its joint-venture interest to an affiliate, Millennium Minerals Limited.

United States vs. Foreign Sales/Assets

During Fiscal 2002-to-date and 2001/2000/1999, the Company generated no revenue from operations. At 12/31/2001 and 12/31/2000: all assets were located in Canada.

Seasonality. No Disclosure Necessary

Sources/Availability of Raw Materials - No Disclosure Necessary -

Material Effects of Government Regulations

--- No Disclosure Necessary ---

Dependency upon Patents/Licenses/Contracts/Processes

--- No Disclosure Necessary ---

Page 9

4.C. Organization Structure

The Company has two wholly-owned subsidiaries:

Canadian Shield Exploration Ltd.

(formerly Synergy Exploration Ltd.)

CS Resources (Mongolia) Ltd.

Refer to ITEM 4. “Information on the Company, 4.A. History and Growth of the Company, History and Development” for more information. Refer to ITEM 10.I “Subsidiary Information” for more information.

4.D. Property, Plant and Equipment

The Company’s executive offices are located in shared, rented premises of approximately 1,674 sq. ft. at 151 Bloor Street West, #890, Toronto, Ontario, Canada M5S 1S4. The Company began occupying these facilities in January 2000. Monthly rent is approximately $500. The Company believes these facilities are adequate for its needs for the foreseeable future.

Mongolia Mineral Property Exploration Licenses

PXI Mongolia Property Acquisition Details

Pursuant to a joint-venture agreement dated 8/26/2002, the Company entered into an agreement with Planet Exploration Inc. to earn up to a 50% interest in three mineral property exploration licenses comprising 142,059 hectares in Mongolia’s South Gobi desert for the sum of $10,000 (paid) and 150,000 common shares issuable upon regulatory approval (pending). The Company agreed to undertake a US$50,000 Phase I exploration program, planned for completion in 2002. Upon the completion of the Phase I exploration program and issuance of an additional 150,000 common shares, the Company will earn a 25% interest in the three mineral exploration licenses. The Company will have the option of maintaining its interest in the properties by contributing its proportionate share of exploration costs or it can earn an additional 25% interest by completing a Phase II program of US$50,0 00 by 8/31/2003, the payment of an additional US$25,000, and the issuance of an additional 200,000 common shares.

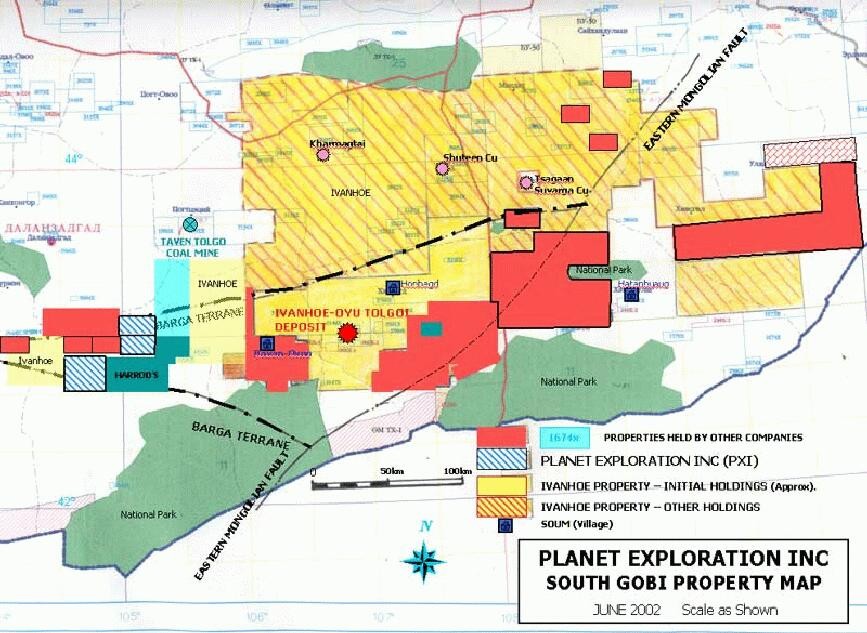

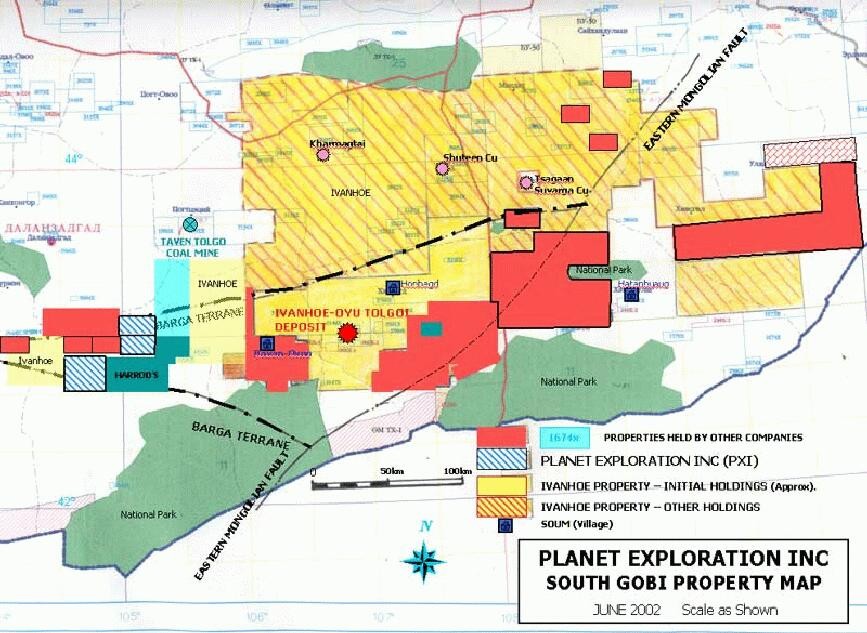

PXI Mongolia Property Description

The three mineral exploration properties comprise license numbers 5938x (Property 22) and 5945x (Property 23A and 23B) and cover 142,059 ha in three blocks. These properties are collectively referred to as the “Nomgon Properties”, based on the location of the soum (village) of Nomgon on the south central portion of Property 23B.

Summary of Licenses – South Gobi Properties

Property # | Property Name | License Number | Size Ha | Aimag Province | Soum District Village |

Property 22 | Huts Uul | 5938 x | 51,455 | Omno govi | Han hongor |

Property 23A | Nombon | 5945 x | 30,340 | Omno govi | Nomgon |

Property 23B | Nombon | 5945 x | 60,264 | Omno govi | Nomgon |

Total | | | 142,059 | | |

The Nomgon properties are located from 520-to-570 air kilometres south-south-west, of Ulaan Bator the capital city of Mongolia. The properties are accessible by 4x4 motor vehicle via a network of unimproved desert roads. The geological setting is viewed favorably for a wide range of metal deposits, especially porphyry-style copper-gold deposits.

Property 22 is located approximately 60 km ESE of the town of Dalanzadgad, which can be reached via air service or gravel roads from the capital, Ulaan Baator. The soum (village) of Nomgon is located in the southern portion of Property 23B.

Page 10

Figure 1

Mongolia Mineral Property Licenses

Location Map

Page 11

The Nomgon Properties are not subject to any land alienation for parks or special management zones according to information obtained from our in-country consultants, Mine-Info Mineral Consulting Company (“Mine Info”). Property 23A and Property 23B are approximately 30 kilometers northwest and north respectively of a National park. Based on discussions with Mine Info there are no restrictions on licenses located near these areas. There is a one- kilometer zone of limited activities along the China-Mongolia border, however none of the principal properties are located in this restricted area. Based on the author’s investigation and experience, it is the view of the author that the risk of being delayed as a project moves to production because of conflict arising from such issues as land claims is not substantial.

Land Status. The Nomgon Properties are held under terms of “Exploration Mineral Licenses” (“Licenses”) granted by the Mongolian government, to a private Mongolian company, Mine Info. Exploration licenses are defined by their corner co-ordinates. A minimum of 25 hectares and a maximum of 400,000 hectares are permitted within a requested License. Foreign countries and individuals are allowed to hold Licenses in their own names without forming a wholly owned subsidiary. There is no prohibition against transfer, pledge or joint venture with other parties provided a notice of transfer of a joint venture is registered.

The formal documents for the properties have been granted, and a copy of the Mongolian document and the authenticated translation has been reviewed. Licenses are valid for an initial three years, and can then be renewed twice for an extension of two years each renewal, allowing for a maximum period of seven years. Mining licenses are granted for a 60-year period and can be renewed for an additional 40 years. The initial acquisition License fee is US$0.05/ ha and an application fee of US$750-to-US$850 per application. Subsequent fees increase to $0.10/ha for years two and three, followed by a sharp rise to US$1.00/ha for years four and five, and US$1.50 for years six and seven. Mineral rights are maintained in good standing by payment of a yearly fee per hectare. These fees escalate US$0.05/ ha to US$1.00/ha over a seven-year period. The Minerals Law an d the Land Law govern surface rights. A royalty of 2.5% of the revenues from mineral products is payable to the Mongolian government.

No minimum work expenditures are in force over exploration licenses, nor are work permits necessary. The local sum (which is Nomgon) must be advised of proposed exploration plans; and an environmental management plan must be submitted. A bond consisting of 50% of the estimated cost of any necessary ground reclamation must be posted. None of the properties have been legally surveyed, and all are in an entirely natural state; no paved roads or permanent dwellings occur. The Company is unaware of any environmental liabilities occur on the properties.

Access, Climate, Physiography, Local Resources, and Infrastructure. The Nomgon properties are road accessible with 4x4 vehicles from the provincial center of Dalanzadgad. Dalanzadgad is located northwest of the properties and has regular scheduled air service from Ulaan Baator by the national carrier MIAT. The twin towns of Sainshand and Bayant-Ukhaa are located east-north-east of the Nomgon properties and are located on the Trans Siberian railroad which transects Mongolia between Russia and China.

For a site visit, a flight from Ulaan Baator to Dalanzadgad is necessary, with a connection by a truck convey. Access to Property 23A is via a network of unmaintained 4x4 desert roads and trails from the soum (village) of Bayan-Ovuu. The Nomgon properties are located near the soum of Nomgon, where shelter, fuel and supplies can be obtained.

There are no active mining operations in the area except for a small open pit coal mine at Tavan Tolgoi located approximately 100 kilometres northeast of the Nomgon Properties. The Tavan Tologoi coal deposit is mined by local Mongolian company, to feed coal generators at Dalanzadgad and neighboring soums. The Japanese government has supplied aid in the form of a small fleet of mine trucks for this operation. There is a small village at Tavan Tolgoi, which has mine offices, workshops and a vehicle depot. The nearest railroad, reached by unformed dirt tracks is at Sainshand, on the Trans-Mongolian Railway.

The Nomgon properties are located in the steppe area of the Gobi desert, in a semi-desert to desert steppe environment, at an elevation of approximately 1600 to 2000 metres above sea level. Vegetation is sparse, consisting mostly of small shrubs and grasses. Trees occur only very sporadically, in ephemeral stream-beds, which dissect the landscape. Precipitation annually is 150 mm, mainly between May-to-September. The area experiences a severe continental climate, with extremes of temperature, in July reaching 45º C and in January down to minus 35ºC. The South Gobi region experiences very high winds in the spring, which trends across China and is responsible for the “Yellow Dust” phenomena that seasonally effects air quality conditions in Korea and Japan.

The properties vary from generally flat relief to low hills and ridges 50-to-70 metres in elevation. North-east-trending, elongated low ranges alternate with broad valleys or basins that have been infilled with thick sequences of clastic sediments. The properties have topographies that vary from flat to rugged, with local relief up to 150 meters. The terrain is mostly covered by a poorly consolidated, brown to reddish, pebbly gravel, sandy silt, and sand. The terrain is readily amenable to the construction of the necessary infrastructure related to mining operations, including but not limited to, tail storage sites, heap leach pads, waste disposal and processing plant sites. The properties appear to have minimal disturbances related to historic exploration and mining activities. There is no apparent environment liabilities related to old mine and/or mi ll operations. The properties appear to have had minimal recent mineral exploration activities completed.

The area of the properties is relatively remote with a small population of nomad Mongolians tending herds of sheep, goats and camels and living in gers. There are common water springs located on the region, supplying herds of animals and ger housing. The area supports traditional subsistence economy, in which semi-nomadic herdsmen are engaged in the husbandry of sheep, goats, camel, cattle and horses.

Dalanzadgad is the closest larger towns for supplies and goods. Fuel and limited supplies can be obtained from the soum of Nomgon. It is expected that skilled, technical personnel will come from Ulaan Baator with accommodations arranged in the closest soum and/or gers. The coal deposit at Tavan Tolgoi and other known deposits in the South Gobi region represent an important source of energy and will need to be exploited if mining operations are developed.

Prior Exploration

The exploration history of the area of the properties is believed to have been limited systematic exploration prior to the 1990’s. Joint Mongolian-Russia government programs region from 1985 to 1988 completed by the Mongolian Geochemical Research Bureau included regional airborne surveys including magnetics, radiometrics (uranium, thorium, potassium), and gravity. Portions of these surveys cover parts of the properties. The resulting geochemical and metallogenic map (Map K-48-X) shows a regional soil geochemical anomaly for copper, gold and mercury over the northern half of license 23B.

Following the revision of the Mongolian Mineral Law in 1997, there was a fairly significant exploration boom led by private Mongolian companies and by international mining companies including MK Gold Company, Magna Copper Co., Uranerz Ltd. BHP, Rio Tinto, Phelps Dodge and Newmont Mining. Exploration declined following the “Bre-X Scandal”, along with depressed metal prices.

Exploration by Magna Copper Co. discovered the Oyu Tologoi deposit in 1996 as a result of a reconnaissance survey. BHP acquired Magma and continued early stage exploration programs in Mongolia. In 1996, the Central Oyu Tologoi zone was recognized as a porphyry copper leached cap, and South Oyu was identified in 1997. By the fall of 1997 six holes had been drilled with the discovery hole OT3, intersecting 2.39% Cu over 10.1 metres and 1.89% Cu over 16.9 metres, and hole OT4 from South Oyu, returned 1.65% Cu and 0.154 g/t Au over 70 metres.

Other known copper deposits north of Oyo Tologoi deposits include the Kharmagtai deposit, the Shuteen deposit, the Tsagaan Suvarga deposit, and the Mandah occurrence. The porphyry copper potential of the Kharmagtai-Shuteen region has been known for several decades.

Page 12

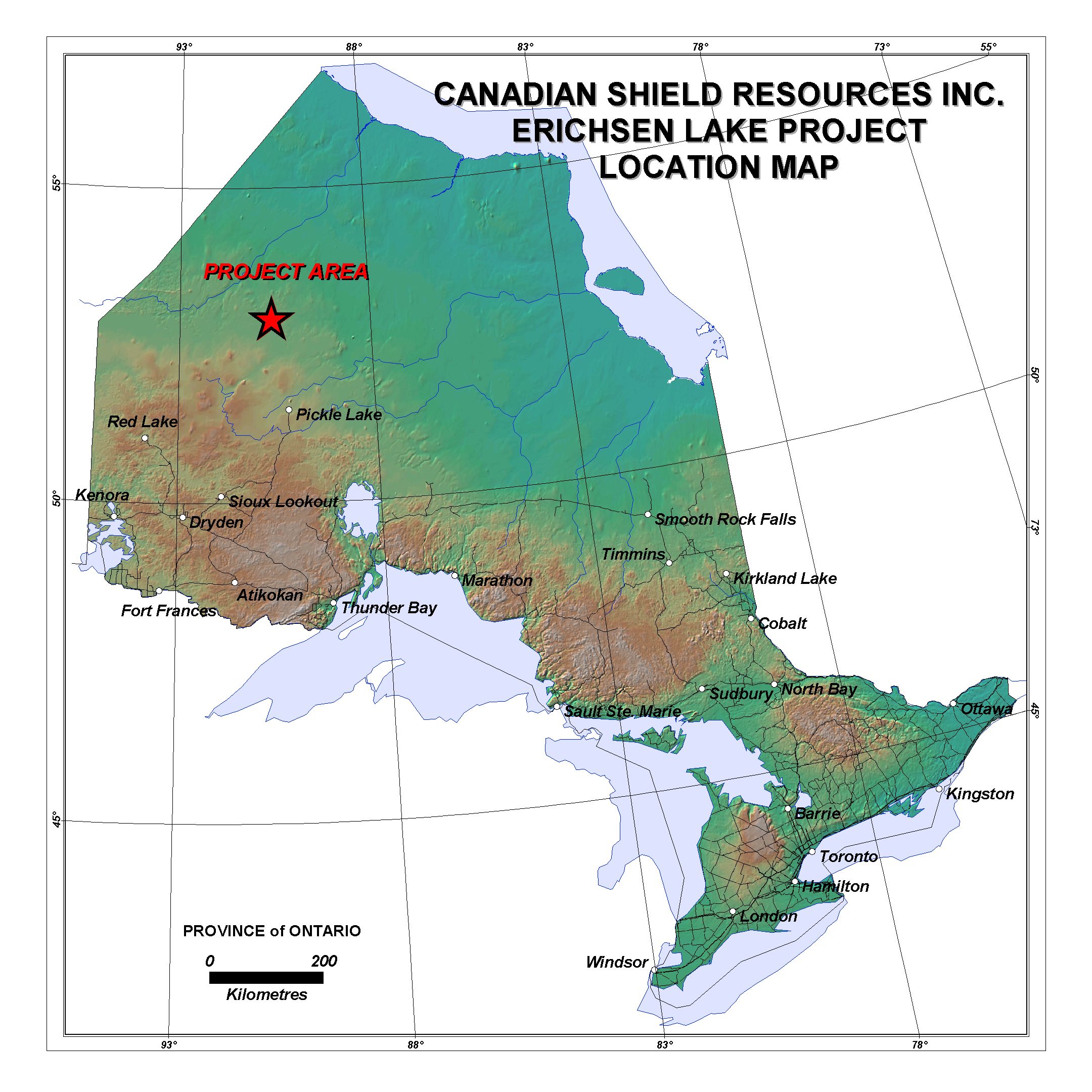

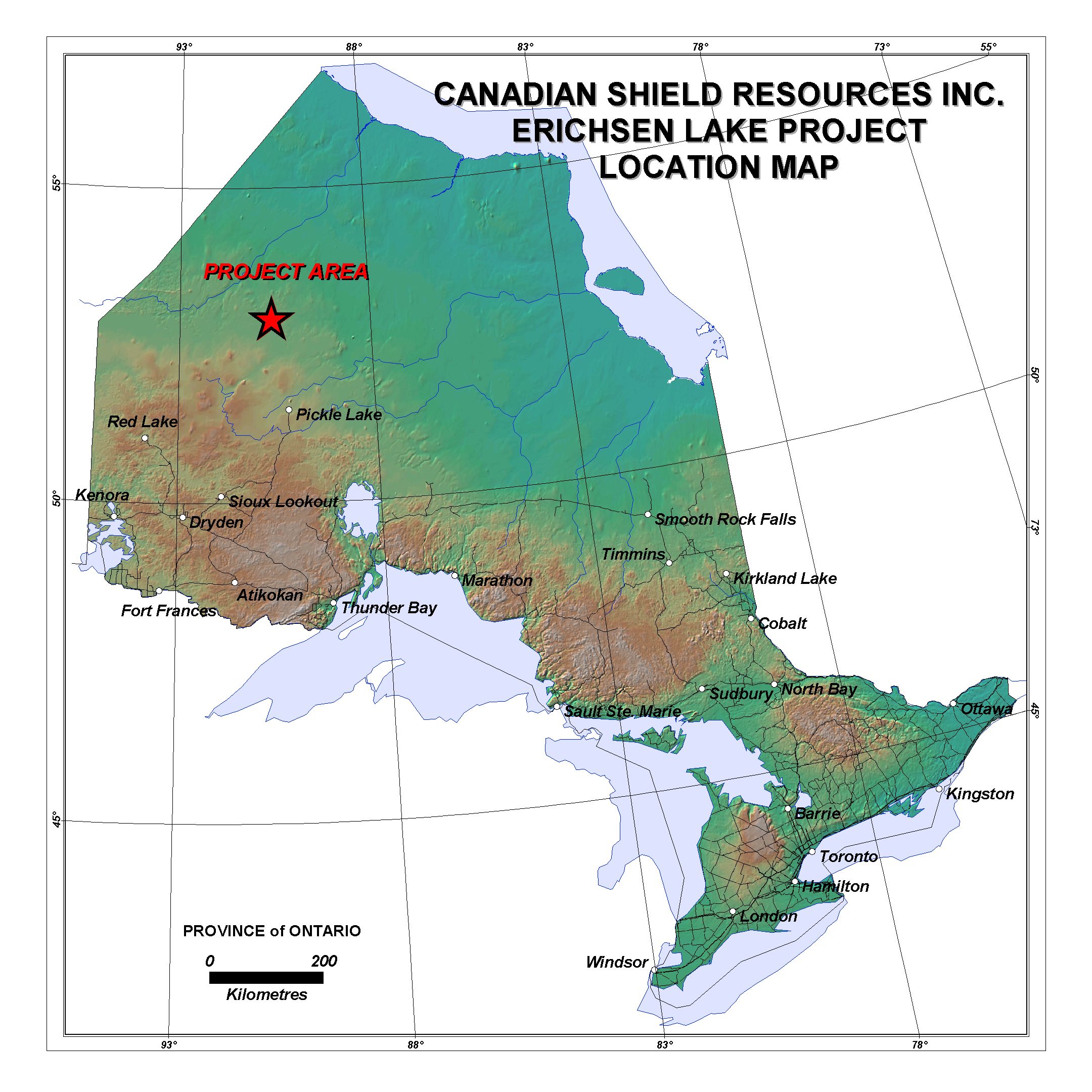

Figure 2

Erichsen Lake Property

Location Map

Page 13

Erichsen Lake Property

Northwestern Ontario, Canada

Gold Exploration

Acquisition Details

On 8/9/2002, the Company entered into an agreement to form a 50/50 joint venture with Asia Now Resources Limited, a private Ontario company to explore mining claims in northwestern Ontario. Under the terms of a letter agreement, the Company has acquired a 50% interest in the Erichsen Lake Property by funding the staking expenditures for the mining claims at a cost of up to $17,000. The transaction is subject to due diligence and regulatory approval. The Company has spent $16,264 on this property exploration through 9/30/2002. Effective October 2002, Asia Now Resources Limited transferred its joint-venture interest to an affiliate, Millennium Minerals Limited.

Property Description and Potential

Summary. The Erichsen Lake Property is an early stage gold exploration project located in Northwestern Ontario within the North Caribou Greenstone Belt. The property encompasses a belt of banded iron formation within mafic volcanic rocks situated regionally along strike with a nearby producing mine. A detailed airborne geophysical survey conducted in 1994 outlined favourable magnetic signatures and electromagnetic conductors associated with the rock units. Most of these features have never been followed-up on the surface.

Location. The Erichsen Lake Property is located in Northwestern Ontario approximately 150 km north of the town of Pickle Lake and 30 km north of the Musselwhite Mine. It consists of 14 contiguous unpatented claims covering an area of 2432 hectares. The easiest access is by float plane from Pickle Lake although much of the area is accessible by watercraft along the Eyapamikawa – North Caribou Lake System. The Musselwhite Mine is served by an all weather road from Pickle Lake.

Exploration Potential. In 1994, Placer Dome Canada staked a block of claims totalling 12,400 hectares covering the central portion of the North Caribou Greenstone Belt. The same year, that company completed a helicopter supported geophysical survey over the property at a 100-metre spacing using a DIGHEMv electromagnetic system plus magnetometer, resistivity and VLF instrumentation. The survey generated EM anomaly, total field magnetometer, calculated vertical gradient magnetometer, resistivity 7200Hz and filtered VLF-EM maps, and in the assessment report numerous geophysical targets were recommended for ground exploration. No ground follow-up work appears to have been conducted and the claims were dropped in 1997.

The primary targets are a series of variable strength EM conductors coincident with a belt of high magnetic susceptibility anomalies that outline the location of the Hatch Lake Banded Iron Formation and extend intermittently for at least ten kilometres along the length of the property. These targets were staked in July 2002 by the Canadian Shield/Asia Now Joint Venture.

In 1986-87, Milner Consolidated Silver Mines Ltd. completed geological, ground magnetometer and Horizontal Loop EM surveys over parts of the central southeastern area of the property. These were followed up by eight drill holes ranging in length from 307 to 657 feet for which some intersected pyrrhotite, pyrite, magnetite and chalcopyrite mineralization hosted in cherty grunerite garnet bearing sulphidic zones. However, these holes were discovered, based on the results of the subsequently available airborne geophysical survey data, to have missed testing any anomalies associated with the main iron formation unit. To date, no other significant private surface exploration has been conducted on the property.

The Erichsen Lake property is an early stage gold exploration project because of its similar geological setting to the highly successful nearby Musselwhite Mine, and because it is extremely under-explored in comparison to similar gold favourable volcano-sedimentary belts in Northwestern Ontario. Local structural features indicating that the iron formation units have undergone extensive deformation and possible thickening make it favorable to host a major gold orebody. Gold in iron formation has been discovered on the surface and in drill holes within the more explored and less deformed adjacent areas to the west northwest along the north shore of Eyapamikama Lake and to the south in Akow Lake. The Company’s exploration plans include the use of advanced ground geophysical and geochemical surveys to follow-up the results of the Placer Dome survey taking into account the geological setting of the recommended anomalies.

Page 14

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The following discussion for the nine months ended 9/30/2002 and 9/30/2001, and the fiscal years ended 12/31/2001, 12/31/2000, and 12/31/1999 should be read in conjunction with the consolidated financial statements of the Company and the notes thereto.

The following discussion contains forward-looking statements that are subject to significant risks and uncertainties. Readers should carefully review the risk factors described herein and in other documents the Company files from time to time with applicable securities commissions.

At the July 2001 Annual Meeting of Shareholders, the shareholders re-elected the three Directors: Lynda B. Bloom, Bernard L. Kraft and Michael P. Kraft. Shareholders also approved a new stock option plan.

Results of Operations

Fiscal 2002 To Date

During the first nine months, the Company expended $27,423 on exploration costs as compared to $26,320 last year. These expenses were incurred on the Company’s Strike Point, Mongolian and Erichson Lake properties. The Mongolia Property Licenses were acquired in July 2002 and the Erichsen Lake Property was acquired in August 2002. The Strike Point Property joint venture was terminated in December 2002.

General and administrative costs consist of expenses incurred at the corporate level including management fees, consulting fees, rent, bank charges and office and general. Such expenses increased by 215% to $93,278 from $29,632. This increase was due to the increased activity of the Company as compared to last year.

Shareholder Services for the first nine months of year 2002 were $16,171, which increased by 111.4% as compared to $7,646 last year. Professional Fees were $34,597 as compared to $15,368 the prior year, a 125% increase. The increase was due to expenses incurred to prepare and file the Company’s registration statement with the Securities and Exchange Commission in the United States.

This year the company paid $1,024 interest on shareholder loan bearing 12% interest.

The Company reported a net loss of ($171,014) or ($0.03) per share for the Nine Months Ended 9/30/2002 compared to a loss of ($73,859) or ($0.01) per share for the same period last year.

As at September 30, 2002, the Company had cash in the amount of $13,896 and advance of related party of $50,616. The Company’s ability to meet future commitments is dependent upon the ability of the Company to raise additional funds through the issue of equity and/or debt.

Fiscal 2001

The Company was inactive during Fiscal 2001 and reported no revenue from operations.

The Company expended $20,891 on exploration costs on the Strike Point Base Metal Property exploration.

General/administrative costs consist of expenses incurred at the corporate level including executive compensation, consulting fees, and administration. Such expenses increased 20% to $54,955 over the same period last year this increase was due to increased premises costs and high overhead expenses.

Shareholder services were $9,189 a 8% increase over last year. Professional services increased 85% to $25,558 because of increased public company disclosure and as the company started the process of filings is US.

The allowance for promissory notes is related to the discontinued acquisition of Target Europe Inc.: $42,824. In November 2000, the Company agreed to acquire a subsidiary of Target Europe Inc., Target Europe (Spain) Inc. During 2000, the Company advanced $42,824 to Target in anticipation of consummation of the acquisition. The advance is treated as a promissory note and is personally guaranteed by Peter Holmes, President/CEO/ Director of Target; even if the acquisition was not consummated. After further due diligence, the agreement was terminated on 2/23/2001. The Company has started the legal process of demanding the loan from the director of Target. Since the process is long and it is unlikely that the Company will be able to recover the advanced amount an allowance has been established against the entire outstanding amount.

The Company reported a net loss of ($114,099) or ($0.02) per share for Fiscal 2001 compared to a loss of ($72,892) or ($0.01) per share for Fiscal 2000.

Fiscal 2000 Ended 12/31/2000 vs. Fiscal 1999 and Fiscal 1998

The Company is involved in the exploration of mineral properties. At 12/31/2000, the Company’s only property was the Strike Point Base Metal Property located in Manitoba, Canada, where the Company is earning an 81% interest by expending up to $275,000 on exploration by July 2003. The Company’s interest in this property was acquired in the February 1998 purchase of Synergy Explorations Ltd., which was finalized in July 1999. The primary asset of Synergy was a joint-venture agreement with Tulsa Resources Inc.

During Fiscal 1998, the Company entered into agreements whereby it could acquire an interest in another mineral property, the Sioux Lookout Property in Ontario, Canada. Pursuant to the July 1998 agreement, Synergy paid Stuarton $10,500 upon signing and expended a further $3,900 on exploration in 1999. Upon further due diligence, the Company decided not to proceed and the agreement was terminated in August 2000, and all costs were expensed.

In November 2000, the Company agreed to acquire a subsidiary of Target Europe Inc., Target Europe (Spain) Inc. During 2000, the Company advanced $42,824 to Target in anticipation of consummation of the acquisition. The advance is treated as a promissory note and is personally guaranteed by Peter Holmes, President/CEO/ Director of Target; even if the acquisition was not consummated. After further due diligence, the agreement was terminated on 2/23/2001.

Expenses

Shareholder Services. Shareholder services costs consist of those costs incurred by transfer filing agents, press releases and mailings, etc. to the shareholders:

2000/1999/1998 were $8,028, $14,620, and $8,442, respectively.

General and Administrative Expenses. General and administrative costs consist of those costs incurred at the corporate level including executive compensation, consulting fees, administration, travel and business development. The expenses decreased from $42,329 in 1998 to $36,344 in 1999, and increased to $45,749 in 2000. These expenses fluctuated mainly due to the increase and decreased in the executive compensation.

Professional Fees. These fees relate to funds paid to lawyers, and accountants. These expenses were $10,068, $29,624, and $13,850, 1998, 1999 and 2000 respectively. They rose dramatically in 1999 due to higher legal fees associated with closing of the Major Transaction (acquisition of Synergy Explorations Ltd.) and private placement financings and then again decreased back in year 2000.

Interest Income. The Company has received interest income on its working capital: 2000/1999/1998 - $6,992, $6,997, and $10,322.

Loss for the Year. The Company reported a consolidated net loss of ($72,892) or ($0.01) per share for Fiscal 2000 compared to a loss of ($73,591) or ($0.02) per share for Fiscal 1999, and a loss of ($50,511) or ($0.02) for 1998.

The weighed average number of shares increased to 6,026,574 in 2000, from 4,907,920 in 1999 and from 3,908,843 in 1998, reflecting the issuance of common shares in the July 1999 acquisition of Synergy, three private placements, and shares-for-debt issuances.

Page 15

Liquidity and Capital Resources

Chronology

April 1996: Incorporation

January 1997: Private Placement, 1,400,000 shares, $105,000

January 1998: IPO, 2,000,000 shares, raising $300,000

February 1998: Agreement to acquire Synergy

July 1998: Sioux Lookout Property Agreement

June 1999: Private Placement, 500,000 units, raising $50,000

August 1999: Synergy acquisition completion, 2,000,000 shares

July 2000: Share-for-Debt settlement, 358,728 shares = $36,949

August 2000: Sioux Lookout Property agreement terminated

October 2000: Private Placement, 725,000 units, raising $72,500

November 2000: Target Europe Inc. Agreement

January 2001: Shares-for-Debt settlement, 221,490 shares = $22,149

February 2001: Target Europe Inc. agreement terminated

March 2002: Shares-for-Debt settlement, 338,834 shares = $33,384

June 2002: Private Placement, 1,800,000 units = $180,000

October 2002: Warrant Exercise, 362,500 shares = $36,250

Fiscal 2002 to Date

The Company had negative working capital of ($6,464) as at 9/30/2002.

Cash Used by Nine Month Ended 9/30/2002 Operating Activities totaled ($115,151) including the ($171,015) Net Loss. Significant adjustments included: $55,864 in net changes in non-cash working capital items.

Cash Generated by Nine Months Ended 9/30/2002 Investing Activities was $46,477, representing a ($15,449) increase in advances to related party and a ($31,028) increase in mineral properties. Advance to related party have a guaranteed interest rate of 10%.

Cash Provided by Nine Months Ended 9/30/2002 Financing Activities was $172,082 from the shares-for-debt arrangement and private placement.

As at September 30, 2002, the Company had cash in the amount of $13,896 and advance to the related party of $50,616. The Company’s ability to meet future commitments is dependent upon the ability of the Company to raise additional funds through the issue of equity and/or debt.

Fiscal 2001

The Company had negative working capital of ($9,886) as at 12/31/2001.

Cash Used by Fiscal 2001 Operating Activities totaled ($34,624) including the ($114,099) Net Loss. Significant adjustments included: ($12,000) for future income taxes; $42,824 allowance for promissory note related to Target Europe Inc.; and $48,651 in net changes in non-cash working capital items.

Cash Generated by Fiscal 2001 Investing Activities was $34,952, representing $91,010 decrease in term deposits, ($81,000) used for related party advances, $45,833 repayment of related party advances, and ($20,891) in deferred exploration expenditures on the Strike Point Property.

Cash Used by Fiscal 2001 Financing Activities was ($1,000) repayment of shareholder loan.

Supplemental Non-Cash Operating/Investing/Financing activities included the 221,490 shares issued for $22,149 in debt.

Fiscal 2000 Ended 12/31/2000 vs. Fiscal 1999 Ended 12/31/1999

The Company had a working capital of $72,131 as at 12/31/2000.

A shares-for-debt settlement of 358,728 shares for $36,949 in “debt” was completed in July 2000. A private placement of 725,000 units was completed in October 2000, raising $72,500. Each unit consisted of a common share and a warrant entitling the holder to purchase an additional common share at $0.10 until 10/4/2002. These funds were used to help pay for Strike Point Base Metal Property exploration, the aborted investment in the Sioux Lookout Property, and corporate expenses.

During Fiscal 1998, the Company entered into agreements whereby it could acquire an interest in another mineral property, the Sioux Lookout Property in Ontario, Canada. Pursuant to the July 1998 agreement, the Synergy paid Stuarton $10,500 upon signing and expended a further $3,900 in 1999 on exploration. Upon further due diligence, the Company decided not to proceed and the agreement was terminated in August 2000, and all costs were expensed.

In November 2000, the Company agreed to acquire a subsidiary of Target, Target Europe (Spain) Inc. During 2000, the Company advanced $42,824 to Target in anticipation of consummation of the acquisition. The advance is treated as a promissory note and is personally guaranteed by the Peter Holmes, President/CEO/Director of Target; even if the acquisition was not consummated. After further due diligence, the agreement was terminated on 2/23/2001.

Cash Used by Fiscal 2000 Ended 12/31/2000 Operating Activities totaled ($50,926), including the ($72,892) Net Loss. Significant adjustments included: $4,400 writedown of the Sioux Lookout Property acquisition cost and $17,566 in net changes in non-cash working capital items. Cash Used in Fiscal 2000 ended 12/31/2000 Investing Activities was ($151,954), representing: ($18,120) in deferred exploration costs for the Strike Point Base Metal Property and ($42,824) for a promissory note from Target related to advances in anticipation of acquisition of a Spanish subsidiary and ($91,010) in term deposits. Cash Provided by Fiscal 2000 Ended 12/31/2000 Financing Activities was $63,993, representing the net proceeds of the October 2000 private placement.

Fiscal 1999 Ended 12/31/1999 vs. Fiscal 1998 Ended 12/31/1998

The Company had a working capital of $100,625 as at 12/31/1999.

The Company had a working capital of $179,201 as at 12/31/1998.

A private placement of 500,000 units was completed in June 1999, raising $50,000. Each unit consisted of a common share and a warrant entitling the holder to purchase an additional common share at $0.10 until 6/24/2001. The warrants expired unexercised.

In February 1998, the Company entered into an acquisition agreement for Synergy Explorations Ltd., a private Ontario company with a mineral property in Manitoba, Canada. Synergy was controlled by three of the Company’s directors: Lynda B. Bloom, Bernard L. Kraft, and Michael P. Kraft; who collectively, directly/indirectly controlled 43% of the equity of Synergy. This acquisition (the “Major Transaction”) was completed in August 1999 mainly though issuance of 2,000,000 common shares.

The Company was in the mining exploration business through a joint venture agreement with Tulsa Resources Ltd. The joint venture agreement (as amended) committed the Company (through its subsidiary, Synergy) to expending up to $275,000 by July 2003 on exploration to fully earn it 81% interest in the Strike Point Base Metal Property, with $75,000 required by 7/4/2001 (spent).

Cash Provided by Fiscal 1999 Ended 12/31/1999 Operating Activities totaled ($44,601), including the ($73,591) Net Loss. Significant adjustments included $28,990 in net changes in non-cash working capital items.

Cash Used in Fiscal 1999 ended 12/31/1999 Investing Activities was ($48,264), including: ($44,861) in deferred development costs on the Strike Point Base Metal Property; and ($3,900) for Stuarton Sioux Lookout Property.

Cash Provided by Fiscal 1999 Ended 12/31/1999 Financing Activities was $50,000, representing the June 1999 private placement.

Page 16

Reconciliation of Canadian and United States

Generally Accepted Accounting Principles ("GAAP"):

Property Exploration Costs

Under US GAAP, property exploration costs are expensed as incurred.

Options to Consultants

Under Canadian GAAP, the Company did not recognize compensation expense when stock or stock options are issued to consultants until 12/31/2001. Starting 1/1/2002, the Company will record compensation expense based on the fair value for stock or stock options granted in exchange for services from consultants. Any consideration paid on exercise of stock options or purchase of stock is credited to share capital. Under US GAAP, the Company records compensation expense based on the fair value for stock or stock options granted in exchange for services from consultants.

Stock-based compensation disclosure

The Company measures compensation expense relating to employee stock option plans for United States GAAP purposes using the intrinsic value method specified by APB Opinion No. 25, which in the Company’s circumstances would not be materially different from compensation expense as determined under Canadian GAAP.

Calculation of Loss For the Year

The consolidated financial statements are prepared in accordance with generally accepted accounting principles ("GAAP") as applied in Canada. In the following respects, GAAP as applied in the United States differs from that applied in Canada.

If United States GAAP were employed, the loss in each year would be adjusted as follows:

| | 2001 | 2000 | 1999 |

| | | | |

Loss for the year, Canadian GAAP | $ (114,099) | $ (72,892) | $ (73,591) |

| | | | |

Impact of U.S. GAAP and adjustments: | | | |

Exploration costs | $ (20,891) | $ (18,120) | $ (377,342) |

Reversal of write-down of mineral costs | - | $ 4,400 | - |

Options granted to non-employees | - | $ (38,026) | - |

Tax effect on above | $ (12,000) | - | - |

| | | | |

Loss for the year, US GAAP | $ (146,990) | $ (124,638) | $ (450,933) |

Research and Development, Patents, Trademarks, and Licenses, Etc.

--- No Disclosure Necessary ---

Recent Accounting Pronouncements Applicable to Us

In June 2001, the FASB issued SFAS No. 143, Accounting for Asset Retirement Obligations ("SFAS No. 143"). SFAS No. 143 requires the Company to record the fair value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that result from the acquisition, construction, development and/or normal use of the assets. The Company also records a corresponding asset which is depreciated over the life of the asset. Subsequent to the initial measurement of the asset retirement obligation, the obligation will be adjusted at the end of each period to reflect the passage of time and changes in the estimated future cash flows underlying the obligation. The Company is required to adopt SFAS No. 143 on January 1, 2003 and has not yet quantified the impact of adoption on its financial state ments.

In July 2001, the Financial Accounting Standards Board, or FASB, issued Statement of Financial Accounting Standards, or SFAS, No. 141 “Business Combinations,” or SFAS 141, and SFAS No. 142, “Goodwill and Other Intangible Assets,” or SFAS 142. SFAS 141 requires all business combinations initiated after June 30, 2001 to be accounted for using the purchase method of accounting. Under SFAS 142, goodwill and intangible assets with indefinite lives are no longer amortized but are reviewed for impairment annually, or more frequently if impairment indicators arise. All other intangible assets will continue to be amortized over their estimated useful lives. The amortization provisions of SFAS 142 apply to goodwill and intangible assets acquired after June 30, 2001. With respect to goodwill and intangible assets acquired prior to July 1, 2001, we a re required to adopt SFAS 142 effective July 1, 2002. The adoption of SFAS 141 and SFAS 142 is not expected to have a material impact on our financial position or results of operations.